The Fund’s investment objective is long-term capital appreciation.

The following table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

Shareholder Fees |

The Biondo Focus Fund

The Biondo Focus Fund Investor Class

|

|---|---|

| Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) | none |

| Maximum Deferred Sales Charge (Load) (as a % of original purchase price) | none |

| Maximum Sales Charge (Load) Imposed on Reinvested Dividends and other Distributions | none |

| Redemption Fee (as a % of amount redeemed, if sold before 30 days) | 2.00% |

Annual Fund Operating Expenses |

The Biondo Focus Fund

The Biondo Focus Fund Investor Class

|

|

|---|---|---|

| Management Fees | 1.00% | |

| Distribution and Service (12b-1) Fees | 0.25% | |

| Other Expenses | 0.55% | |

| Total Annual Fund Operating Expenses | 1.80% | |

| Fee Waiver and Reimbursement | (0.30%) | [1] |

| Total Annual Fund Operating Expenses After Fee Waiver and Reimbursement | 1.50% | |

| [1] | The Fund’s adviser has contractually agreed to reduce its fees and to reimburse expenses, at least until April 30, 2026, to ensure that total annual fund operating expenses after fee waiver and/or reimbursement excluding any front-end or contingent deferred loads, brokerage fees and commissions, acquired fund fees and expenses, fees and expenses associated with instruments in other collective investment vehicles or derivative instruments (including, for example, options and swap fees and expenses), borrowing costs (such as interest and dividend expense on securities sold short), taxes, and extraordinary expenses, such as litigation expenses (which may include indemnification of Fund officers and Trustees and contractual indemnification of Fund service providers (other than the adviser)) will not exceed 1.50% of average daily net assets attributable to the Investor Class. These fee waivers and expense reimbursements are subject to possible recoupment from the Fund in future years on a rolling three-year basis (within the three years after fees have been waived or expenses have been reimbursed) if such recoupment can be achieved within the foregoing expense limits. This agreement may be terminated only by the Board of Trustees on 60 days’ written notice to the adviser. |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

Expense Example |

Expense Example, with Redemption, 1 Year |

Expense Example, with Redemption, 3 Years |

Expense Example, with Redemption, 5 Years |

Expense Example, with Redemption, 10 Years |

|---|---|---|---|---|

| The Biondo Focus Fund | The Biondo Focus Fund Investor Class | USD ($) | 153 | 537 | 947 | 2,091 |

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. During the most recent fiscal period, the Fund’s portfolio turnover was 14% of the average value of its portfolio.

The Fund’s adviser seeks to achieve the Fund’s investment objective by investing primarily in a combination of long positions in (1) common stock of U.S. companies of any capitalization; (2) American depositary receipts (“ADRs”) representing common stock of foreign companies; (3) investment grade fixed income securities; (4) exchange-traded funds (“ETFs”) that invest primarily in (i) common stocks of U.S. companies, (ii) ADRs or (iii) investment grade fixed income securities; and (5) options on common stock, ADRs and ETFs. The Fund defines investment grade fixed income securities as those rated Baa3 or higher by Moody’s, or BBB- or higher by S&P, or if not rated, determined by the adviser to be of comparable quality.

The Fund’s adviser anticipates focusing, from time to time, more than 25% of the Fund’s portfolio in the securities of companies in one or more of the following sectors: (1) technology, (2) financial services and (3) healthcare. The adviser defines technology companies as those principally engaged in research, development or manufacturing of computer related products including hardware, software and computer services; communications related products and services including telephony, satellite or wireless communications; or manufacturing related products that rely upon scientific innovation. The adviser defines financial service companies as those principally engaged in commercial or retail banking, specialty finance, brokerage, investment banking, investment management or insurance. The adviser defines healthcare companies as those principally engaged in the discovery, development, manufacture or delivery of biotechnology, medical devices, pharmaceuticals, or health care supplies. The adviser selects securities based on fundamental, bottom-up research. The adviser looks for some or all of the following characteristics in a company:

| ○ | Exceptional growth prospects |

| ○ | Quality management |

| ○ | Niche business segment |

| ○ | High barriers to entry |

The Fund may also employ leverage including bank borrowing of up to 33% of the Fund’s assets (defined as net assets plus borrowing for investment purposes). The Fund may also engage in covered call writing against its portfolio of common stocks, ADRs or ETFs. Additionally, the Fund may purchase call options as a temporary substitute for common stocks, ADRs or ETFs. The adviser anticipates investing in fixed income securities that it believes are undervalued and have the potential for capital appreciation in addition to providing income. In general, the adviser anticipates investing up to 20% of Fund assets in fixed income securities.

The Fund is non-diversified, which means that it can invest a greater percentage of its assets in any one issuer than a diversified fund. The Fund will typically have fewer than 30 investments at any time. In general, the adviser buys securities that it believes are undervalued and sells a security if its price target is achieved, if the fundamentals have deteriorated or if, in the opinion of the adviser, the security is no longer attractive for investment purposes. The Fund’s adviser may engage in active and frequent trading of the Fund’s portfolio securities to achieve the Fund’s investment objective.

Due to the focused nature of the adviser’s strategy, the Fund may concentrate its portfolio in a limited number of issuers. In order to comply with certain Internal Revenue Code requirements for investment companies, the Fund sells securities of concentrated issuers at the end of each quarter of the Fund’s fiscal year if necessary to comply with these tax requirements and then can repurchase those securities shortly after quarter end.

As with all mutual funds, there is the risk that you could lose money through your investment in the Fund. Many factors affect the Fund’s net asset value (“NAV”) and performance.

| ○ | Concentration Risk. The Fund may focus its investments in securities to a particular sector or type of securities. Economic, legislative or regulatory developments may occur that significantly affect the sector. |

| ○ | ETF Risk. ETFs are subject to investment advisory fees and other expenses, which will be indirectly paid by the Fund. As a result, your cost of investing in the Fund will be higher than the cost of investing directly in ETFs and may be higher than other mutual funds that invest directly in stocks and bonds. Each ETF is subject to specific risks, depending on its investments. |

| ○ | Fixed Income Risk. When the Fund invests in fixed income securities directly or indirectly by investing in mutual funds that invest primarily in fixed income securities, the value of the Fund will fluctuate with changes in interest rates. Defaults by fixed income issuers in which the Fund invests will also harm performance. |

| ○ | Foreign Investment Risk. Foreign investing, including through ADRs, involves risks not typically associated with U.S. investments, including adverse fluctuations in foreign currency values, adverse political, social and economic developments, less liquidity, greater volatility, less developed or less efficient trading markets, political instability and differing auditing and legal standards. |

| ○ | Issuer-Specific Risk. The value of a specific security can be more volatile than the market as a whole and may perform worse than the market as a whole. |

| ○ | Large Capitalization Stock Risk. Large capitalization companies may be less able than smaller capitalization companies to adapt to changing market conditions. Large capitalization companies may be more mature and subject to more limited growth potential compared with smaller capitalization companies. During different market cycles, the performance of large capitalization companies has trailed the overall performance of the broader securities markets. |

| ○ | Leveraging Risk. The use of leverage, such as borrowing money to purchase securities, will cause the Fund to incur additional expenses and magnify the Fund’s gains or losses. |

| ○ | Management Risk. The adviser’s judgments about the attractiveness, value and potential appreciation of a particular security derivative or asset in which the Fund invests or sells short may prove to be incorrect and may not produce the desired results. As a result of the adviser’s trading strategy, the Fund often engages in portfolio transactions at the end of each fiscal quarter in order to comply with the requirements of the Internal Revenue Code for investment companies. These portfolio transactions result in additional brokerage expenses and the potential for the Fund to incur short-term capital gains. |

| ○ | Market and Geopolitical Risk. The increasing interconnectivity between global economies and financial markets increases the likelihood that events or conditions in one region or financial market may adversely impact issuers in a different country, region or financial market. Securities in the Fund may underperform due to inflation (or expectations for inflation), interest rates, global demand for particular products or resources, natural disasters, climate change or climate-related events, pandemics, epidemics, terrorism, international conflicts, regulatory events and governmental or quasi-governmental actions. The occurrence of global events similar to those in recent years, such as a worldwide pandemic, terrorist attacks, natural disasters, social and political discord or debt crises and downgrades, among others, may result in market volatility and may have long term effects on both the U.S. and global financial markets. It is difficult to predict when similar events affecting the U.S. or global financial markets may occur, the effects that such events may have and the duration of those effects. Any such event(s) could have a significant adverse impact on the value and risk profile of the Fund. For example, the COVID-19 global pandemic had negative impacts, and in many cases severe negative impacts, on markets worldwide. It is not known how long any future impacts of the significant events described above would last, but there could be a prolonged period of global economic slowdown, which may impact your investment. Therefore, the Fund could lose money over short periods due to short-term market movements and over longer periods during more prolonged market downturns. During a general market downturn, multiple asset classes may be negatively affected. Changes in market conditions and interest rates can have the same impact on all types of securities and instruments. In times of severe market disruptions, you could experience significant loss in such times. |

| ○ | Non-Diversification Risk. The Fund has a greater potential to realize losses upon the occurrence of adverse events affecting a particular issuer. Accordingly, the Fund’s performance may be more volatile than other funds. |

| ○ | Sector Risk. The value of securities from a specific sector can be more volatile than the market as a whole and may be subject to economic or regulatory risks different than the economy as a whole. The technology sector may be subject to rapid obsolescence, the financial services sector may be subject to unfavorable changes in government regulation or funding costs, and the healthcare sector may be subject to expiration of patent rights and unfavorable changes in government regulation. |

| ○ | Small and Medium Capitalization Stock Risk. Stocks of small and medium capitalization companies may be subject to more abrupt or erratic market movements than those of larger, more established companies or the market averages in general. |

| ○ | Stock Market Risk. Stock prices can fall rapidly in response to developments affecting a specific company or sector, or to changing economic, political or market conditions. |

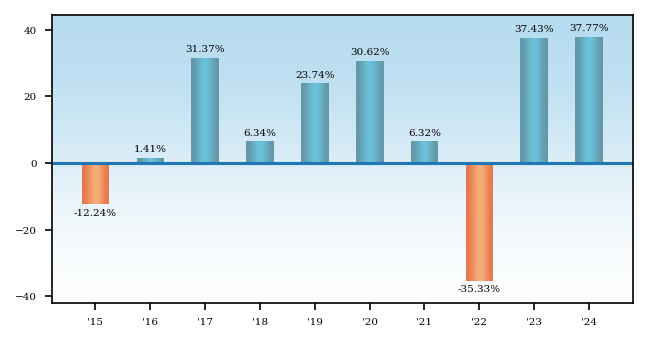

The bar chart and performance table below show the variability of the Fund’s returns, which is some indication of the risks of investing in the Fund. The bar chart shows the performance of the Fund’s Investor shares for the full calendar year for the past ten years. The performance table compares the performance of the Fund’s Investor shares is over time to the performance of a broad-based securities market index. You should be aware that the Fund’s past performance (before and after taxes) may not be an indication of how the Fund will perform in the future. Updated performance information is available at no cost by calling 1-800-672-9152.

| Best Quarter: | 2nd Quarter 2020 | 27.37% |

| Worst Quarter: | 2nd Quarter 2022 | (32.77)% |

Average Annual Total Returns - The Biondo Focus Fund |

Label |

1 Year |

5 Years |

10 Years |

|---|---|---|---|---|

| The Biondo Focus Fund Investor Class | Return before taxes | 37.77% | 11.20% | 10.09% |

| The Biondo Focus Fund Investor Class | Return after taxes on distributions | 32.94% | 9.12% | 8.37% | |

| The Biondo Focus Fund Investor Class | Return after taxes on distributions and sale of Fund shares | 26.20% | 8.63% | 7.90% | |

| S&P 500 Total Return Index | 25.02% | 14.53% | 13.10% |

The S&P 500® Total Return Index is an unmanaged market capitalization-weighted index of 500 of the largest capitalized U.S. domiciled companies. Index returns assume reinvestment of dividends. Unlike the Fund’s returns, however, index returns do not reflect any fees or expenses. An investor cannot invest directly in an index.

After-tax returns are calculated using the highest historical individual federal marginal income tax rate and do not reflect the impact of state and local taxes. Actual after-tax returns depend on a shareholder’s tax situation and may differ from those shown. The after-tax returns are not relevant if you hold your Fund shares in tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRA”).

| ○ | Concentration Risk. The Fund may focus its investments in securities to a particular sector or type of securities. Economic, legislative or regulatory developments may occur that significantly affect the sector. |

| ○ | ETF Risk. ETFs are subject to investment advisory fees and other expenses, which will be indirectly paid by the Fund. As a result, your cost of investing in the Fund will be higher than the cost of investing directly in ETFs and may be higher than other mutual funds that invest directly in stocks and bonds. Each ETF is subject to specific risks, depending on its investments. |

| ○ | Fixed Income Risk. When the Fund invests in fixed income securities directly or indirectly by investing in mutual funds that invest primarily in fixed income securities, the value of the Fund will fluctuate with changes in interest rates. Defaults by fixed income issuers in which the Fund invests will also harm performance. |

| ○ | Foreign Investment Risk. Foreign investing, including through ADRs, involves risks not typically associated with U.S. investments, including adverse fluctuations in foreign currency values, adverse political, social and economic developments, less liquidity, greater volatility, less developed or less efficient trading markets, political instability and differing auditing and legal standards. |

| ○ | Issuer-Specific Risk. The value of a specific security can be more volatile than the market as a whole and may perform worse than the market as a whole. |

| ○ | Large Capitalization Stock Risk. Large capitalization companies may be less able than smaller capitalization companies to adapt to changing market conditions. Large capitalization companies may be more mature and subject to more limited growth potential compared with smaller capitalization companies. During different market cycles, the performance of large capitalization companies has trailed the overall performance of the broader securities markets. |

| ○ | Leveraging Risk. The use of leverage, such as borrowing money to purchase securities, will cause the Fund to incur additional expenses and magnify the Fund’s gains or losses. |

| ○ | Management Risk. The adviser’s judgments about the attractiveness, value and potential appreciation of a particular security derivative or asset in which the Fund invests or sells short may prove to be incorrect and may not produce the desired results. As a result of the adviser’s trading strategy, the Fund often engages in portfolio transactions at the end of each fiscal quarter in order to comply with the requirements of the Internal Revenue Code for investment companies. These portfolio transactions result in additional brokerage expenses and the potential for the Fund to incur short-term capital gains. |

| ○ | Market and Geopolitical Risk. The increasing interconnectivity between global economies and financial markets increases the likelihood that events or conditions in one region or financial market may adversely impact issuers in a different country, region or financial market. Securities in the Fund may underperform due to inflation (or expectations for inflation), interest rates, global demand for particular products or resources, natural disasters, climate change or climate-related events, pandemics, epidemics, terrorism, international conflicts, regulatory events and governmental or quasi-governmental actions. The occurrence of global events similar to those in recent years, such as a worldwide pandemic, terrorist attacks, natural disasters, social and political discord or debt crises and downgrades, among others, may result in market volatility and may have long term effects on both the U.S. and global financial markets. It is difficult to predict when similar events affecting the U.S. or global financial markets may occur, the effects that such events may have and the duration of those effects. Any such event(s) could have a significant adverse impact on the value and risk profile of the Fund. For example, the COVID-19 global pandemic had negative impacts, and in many cases severe negative impacts, on markets worldwide. It is not known how long any future impacts of the significant events described above would last, but there could be a prolonged period of global economic slowdown, which may impact your investment. Therefore, the Fund could lose money over short periods due to short-term market movements and over longer periods during more prolonged market downturns. During a general market downturn, multiple asset classes may be negatively affected. Changes in market conditions and interest rates can have the same impact on all types of securities and instruments. In times of severe market disruptions, you could experience significant loss in such times. |

| ○ | Non-Diversification Risk. The Fund has a greater potential to realize losses upon the occurrence of adverse events affecting a particular issuer. Accordingly, the Fund’s performance may be more volatile than other funds. |

| ○ | Sector Risk. The value of securities from a specific sector can be more volatile than the market as a whole and may be subject to economic or regulatory risks different than the economy as a whole. The technology sector may be subject to rapid obsolescence, the financial services sector may be subject to unfavorable changes in government regulation or funding costs, and the healthcare sector may be subject to expiration of patent rights and unfavorable changes in government regulation. |

| ○ | Small and Medium Capitalization Stock Risk. Stocks of small and medium capitalization companies may be subject to more abrupt or erratic market movements than those of larger, more established companies or the market averages in general. |

| ○ | Stock Market Risk. Stock prices can fall rapidly in response to developments affecting a specific company or sector, or to changing economic, political or market conditions. |