Pay vs Performance Disclosure

number in Thousands |

3 Months Ended |

9 Months Ended |

12 Months Ended |

Mar. 28, 2023 |

Dec. 31, 2023 |

Dec. 31, 2024

USD ($)

|

Dec. 31, 2023

USD ($)

|

Dec. 31, 2022

USD ($)

|

Dec. 31, 2021

USD ($)

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Pay vs Performance Disclosure, Table |

|

|

The following table summarizes the total compensation of our principal executive officer (“PEO”) and the average of the total compensation of our other NEOs as reported in the Summary Compensation Table for the past four fiscal years, as well as their “compensation actually paid” as calculated pursuant to recently adopted SEC rules and certain performance measures required by the rules. Compensation actually paid, as determined under SEC requirements, does not reflect the actual amount of compensation earned by or paid to our executive officers during a covered year. For further information concerning the Company’s pay for performance philosophy and how the Company aligns executive compensation with the Company’s performance, refer to the CD&A. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Value of Initial Fixed $100 Investment Based On: | | | | | | Year | | Summary Compensation Table Total for CEO (McCann)(1) | | Summary Compensation Table Total for CEO (Bacon)(1) | | Compensation Actually Paid to CEO (McCann)(2) | | Compensation Actually Paid to CEO (Bacon)(2) | | Average Summary Compensation Table Total for Non-CEO NEOs(3) | | Average Compensation Actually Paid to Non-CEO NEOs(4) | | Total Stockholder Return(5) | | Peer Group Total Stockholder Return(6) | | GAAP Net Income (thousands) | | Non-GAAP Adjusted EBITDA (thousands)(7) | | 2024 | | $ | 2,816,315 | | | $ | — | | | $ | 9,433,359 | | | $ | — | | | $ | 1,268,558 | | | $ | 4,738,748 | | | $ | 693.76 | | | $ | 119.14 | | | $ | 30,875 | | | $ | 63,714 | | | 2023 | | $ | 2,021,840 | | | $ | 2,620,078 | | | $ | 6,707,263 | | | $ | 2,267,037 | | | $ | 1,321,349 | | | $ | 4,384,774 | | | $ | 368.78 | | | $ | 106.82 | | | $ | 20,754 | | | $ | 46,801 | | | 2022 | | $ | — | | | $ | 1,942,742 | | | $ | — | | | $ | 2,221,816 | | | $ | 1,038,156 | | | $ | 1,218,326 | | | $ | 84.43 | | | $ | 91.35 | | | $ | 6,799 | | | $ | 31,765 | | | 2021 | | $ | — | | | $ | 1,497,380 | | | $ | — | | | $ | 916,923 | | | $ | 986,220 | | | $ | 762,489 | | | $ | 72.99 | | | $ | 114.82 | | | $ | 6,714 | | | $ | 23,276 | |

|

|

|

|

| Company Selected Measure Name |

|

|

Adjusted EBITDA

|

|

|

|

| Named Executive Officers, Footnote |

|

|

During 2023, both Mr. McCann and Charles A. Bacon, III served as the PEO. Mr. Bacon served as President and Chief Executive Officer in 2021, 2022 and through March 28, 2023 and Mr. McCann served as President and Chief Executive Officer beginning on March 29, 2023. The dollar amounts reported reflect the amounts of total compensation reported for each of our PEOs.

|

|

|

|

| Peer Group Issuers, Footnote |

|

|

The amounts reported in column represent the peer group TSR under SEC rules, from December 31, 2020, the last trading day of 2020, through the last trading day for the applicable year in the table, assuming reinvestment of dividends and weighted according to the respective companies’ stock market capitalization at the beginning of each period for which a return is indicated. The peer group used for this purpose is the Russell 2000 Index.

|

|

|

|

| Adjustment To PEO Compensation, Footnote |

|

|

To calculate the amounts in the “Compensation Actually Paid to CEO” columns in the table above, the following amounts were deducted from and added to (as applicable) our CEO’s “Total” compensation as reported in the Summary Compensation Table for fiscal years 2021 through 2024: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Year | | Summary Compensation Table Total for CEO | | Reported Value of Equity Awards for CEO(1) | | Fair Value as of Year End for Awards Granted During the Year(2) | | Fair Value Year over Year Increase or Decrease in Unvested Awards Granted in Prior Years(3) | | Fair Value Increase or Decrease from Prior Year end for Awards Granted and Vested During the Year(4) | | Fair Value Increase or Decrease from Prior Year end for Awards that Vested during the Year(5) | | Awards Granted in a Fiscal Year Prior to the Covered Period Fiscal Year that Failed to Meet Applicable Vesting Conditions(6) | | Compensation Actually Paid to CEO | | 2024 (McCann) | | $ | 2,816,315 | | | $ | (1,075,138) | | | $ | 2,022,593 | | | $ | 5,535,140 | | | $ | — | | | $ | 134,449 | | | $ | — | | | $ | 9,433,359 | | | 2023 (McCann) | | $ | 2,021,840 | | | $ | (613,893) | | | $ | 2,364,804 | | | $ | 2,858,282 | | | $ | — | | | $ | 76,230 | | | $ | — | | | $ | 6,707,263 | | | 2023 (Bacon) | | $ | 2,620,078 | | | $ | (1,507,218) | | | $ | 2,065,111 | | | $ | — | | | $ | 8,011 | | | $ | 76,230 | | | $ | (995,175) | | | $ | 2,267,037 | | | 2022 (Bacon) | | $ | 1,942,742 | | | $ | (598,461) | | | $ | 800,768 | | | $ | 76,767 | | | $ | — | | | $ | — | | | $ | — | | | $ | 2,221,816 | | | 2021 (Bacon) | | $ | 1,497,380 | | | $ | (431,550) | | | $ | 315,000 | | | $ | (463,907) | | | $ | — | | | $ | — | | | $ | — | | | $ | 916,923 | |

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

|

|

$ 1,268,558

|

$ 1,321,349

|

$ 1,038,156

|

$ 986,220

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

|

|

$ 4,738,748

|

4,384,774

|

1,218,326

|

762,489

|

| Adjustment to Non-PEO NEO Compensation Footnote |

|

|

To calculate the amounts in the “Compensation Actually Paid to Non-CEO NEOs” column in the table above, the following amounts were deducted from and added to (as applicable) the average “Total” compensation of our Non-CEO NEOs as reported in the Summary Compensation Table: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Year | | Summary Compensation Table Total for Non-CEO NEOs | | Reported Value of Equity Awards for Non-CEO NEOs(1) | | Fair Value as of Year End for Awards Granted During the Year(2) | | Fair Value Year over Year Increase or Decrease in Unvested Awards Granted in Prior Years(3) | | Fair Value Increase or Decrease from Prior Year end for Awards Granted and Vested During the Year | | Fair Value Increase or Decrease from Prior Year end for Awards that Vested during the Year(4) | | Compensation Actually Paid to Non-CEO NEOs | | 2024 | | $ | 1,268,558 | | | $ | (404,486) | | | $ | 760,935 | | | $ | 3,034,350 | | | $ | — | | | $ | 79,391 | | | $ | 4,738,748 | | | 2023 | | $ | 1,321,349 | | | $ | (415,567) | | | $ | 1,581,970 | | | $ | 1,849,107 | | | $ | — | | | $ | 47,915 | | | $ | 4,384,774 | | | 2022 | | $ | 1,038,156 | | | $ | (319,322) | | | $ | 427,268 | | | $ | 70,814 | | | $ | — | | | $ | 1,410 | | | $ | 1,218,326 | | | 2021 | | $ | 986,220 | | | $ | (400,725) | | | $ | 292,500 | | | $ | (109,411) | | | $ | — | | | $ | (6,095) | | | $ | 762,489 | |

|

|

|

|

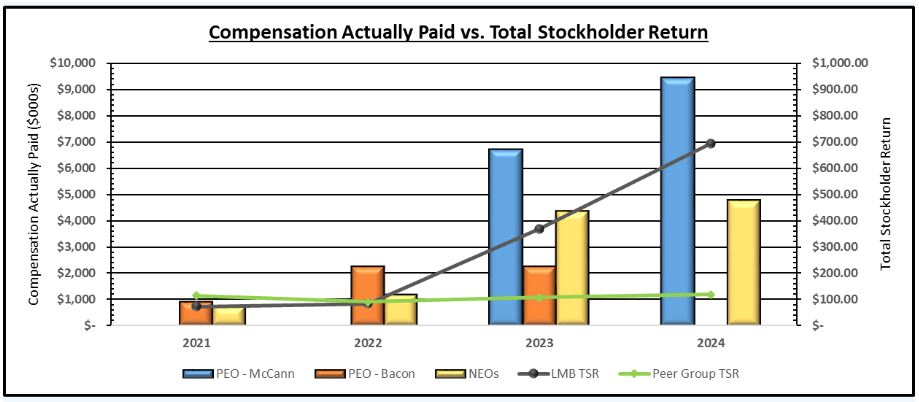

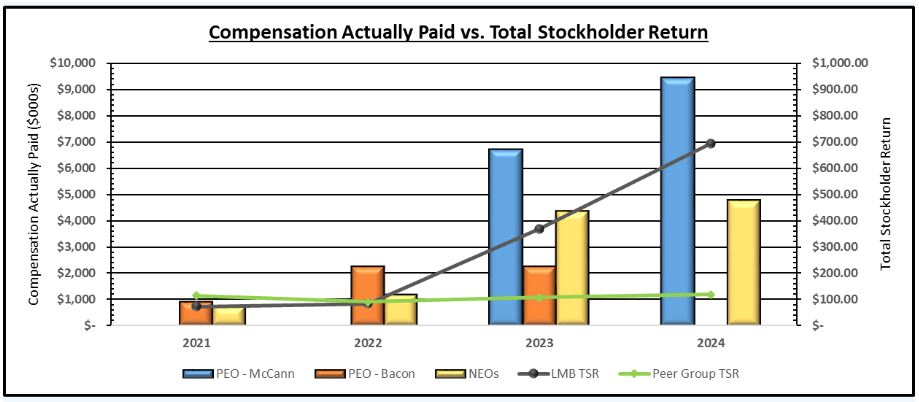

| Compensation Actually Paid vs. Total Shareholder Return |

|

|

The following chart sets forth the relationship between Compensation Actually Paid to our CEO, the average of Compensation Actually Paid to our Non-CEO NEOs, and the Company’s cumulative TSR over the four most recently completed fiscal years to that of the Peer Group over the same period.

|

|

|

|

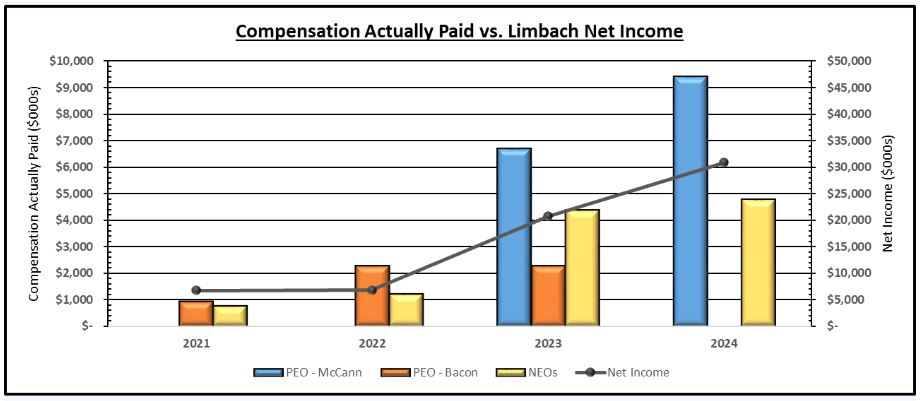

| Compensation Actually Paid vs. Net Income |

|

|

The following chart sets forth the relationship between Compensation Actually Paid to our CEO, the average of Compensation Actually Paid to our Non-CEO NEOs, and our Net Income during the four most recently completed fiscal years.

|

|

|

|

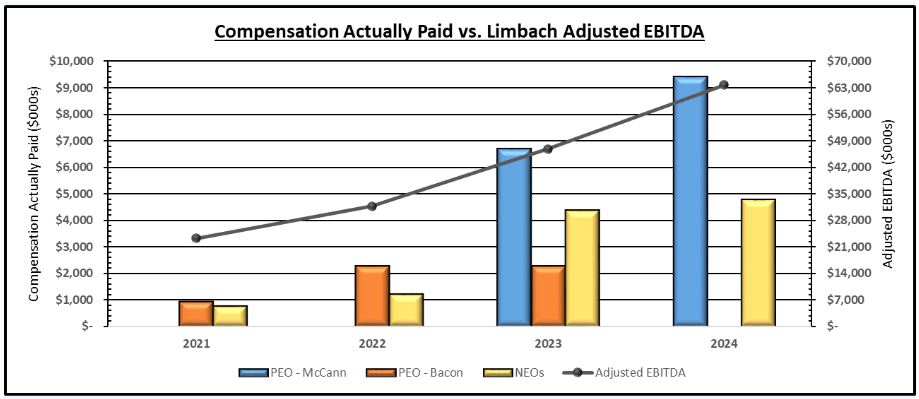

| Compensation Actually Paid vs. Company Selected Measure |

|

|

The following chart sets forth the relationship between Compensation Actually Paid to our CEO, the average of Compensation Actually Paid to our Non-CEO NEOs, and our Adjusted EBITDA during the four most recently completed fiscal years.

|

|

|

|

| Total Shareholder Return Vs Peer Group |

|

|

The following chart sets forth the relationship between Compensation Actually Paid to our CEO, the average of Compensation Actually Paid to our Non-CEO NEOs, and the Company’s cumulative TSR over the four most recently completed fiscal years to that of the Peer Group over the same period.

|

|

|

|

| Tabular List, Table |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | GAAP Net Income | | Adjusted EBITDA | | Adjusted EBITDA Margin | | |

|

|

|

|

| Total Shareholder Return Amount |

|

|

$ 693.76

|

368.78

|

84.43

|

72.99

|

| Peer Group Total Shareholder Return Amount |

|

|

119.14

|

106.82

|

91.35

|

114.82

|

| Net Income (Loss) |

|

|

$ 30,875,000

|

$ 20,754,000

|

$ 6,799,000

|

$ 6,714,000

|

| Company Selected Measure Amount |

|

|

63,714

|

46,801

|

31,765

|

23,276

|

| PEO Name |

Charles A. Bacon, III

|

Mr. McCann

|

Mr. McCann

|

|

Charles A. Bacon, III

|

Charles A. Bacon, III

|

| Additional 402(v) Disclosure |

|

|

The dollar amounts reported represent the amount of “compensation actually paid,” as computed in accordance with SEC rules. The dollar amounts reported are the amounts of total compensation reported for Mr. McCann and Mr. Bacon during the applicable years, but also include (i) the year-end value of equity awards granted during the reported year, (ii) the change in the value of equity awards that were unvested at the end of the prior year, measured through the date the awards vested, or through the end of the reported fiscal year, and (iii) the value of equity awards issued and vested during the reported fiscal year. See Table below for further information. The amount disclosed for Mr. Bacon in fiscal year 2022 has been revised from what was reported in our Definitive Proxy Statement filed in 2024 to appropriately reconcile to the calculation of “Compensation Actually Paid to CEO” as disclosed in the table below. (3) For fiscal year 2024, the dollar amounts reported are the average of the total compensation reported for our NEOs, other than our President and Chief Executive Officer, Mr. McCann. For fiscal year 2023, the dollar amounts reported are the average of the total compensation reported for our NEOs at the time, our Executive Vice President and Chief Financial Officer, Jayme L. Brooks and our Regional President, Northeast and Midwest, Jay A. Sharp. For fiscal years 2022 and 2021, the dollar amounts reported are the average of the total compensation reported for Ms. Brooks and Mr. McCann while he served in the capacity as Executive Vice President and Chief Operating Officer. (4) The dollar amounts reported represent the average amount of “compensation actually paid”, as computed in accordance with SEC rules, for our NEOs, other than Mr. McCann for fiscal years 2024 and 2023 and Mr. Bacon for fiscal years 2023 and 2022 in the Summary Compensation Table, but also include (i) the year-end value of equity awards granted during the reported year, (ii) the change in the value of equity awards that were unvested at the end of the prior year, measured through the date the awards vested, or through the end of the reported fiscal year, and (iii) value of equity awards issued and vested during the reported fiscal year. (5) The amounts reported represent cumulative TSR of the Company under SEC rules from December 31, 2020, the last trading day of 2020, through the last trading day for the applicable year in the table. TSR is calculated by dividing the sum of the cumulative amount of dividends for the measurement period and the difference between the Company’s share price at the end and the beginning of the measurement period by the Company’s share price at the beginning of the measurement period. The amounts disclosed for fiscal years 2022 and 2023 have been revised from those disclosed in the Pay vs. Performance table in our Definitive Proxy Statement filed in 2024 as the total shareholder return for those periods reflected the return over those respective fiscal years and was not indicative of the entire measurement period. Refer to Annex A for a reconciliation of the Company’s non-GAAP financial measures included in this Proxy Statement.(1) Represents the grant date fair value, and the incremental fair value where applicable, of the equity awards to our CEO, as reported in the Summary Compensation Table. In accordance with Mr. Bacon’s employment transition agreement, all unvested service-based RSUs held by Mr. Bacon as of April 30, 2023 were forfeited under the Company’s Omnibus Plan. On April 30, 2023, in accordance with Mr. Bacon’s employment transition agreement, all unvested performance-based RSUs held by Mr. Bacon at the time of his retirement were modified to permit a pro-rata portion of all such unvested performance-based RSUs to continue to vest based on actual performance through the applicable performance period, on an “as if, and when”, earned basis, resulting in an incremental fair value of $769,365. (2) Represents the average of the year-over-year change in the fair value of equity awards to our CEO. No awards vested in the year they were granted. (3) For performance-based awards granted on March 30, 2022, a performance factor of 150% was applied as a result of the level of achievement through December 31, 2024. For performance-based awards granted on January 1, 2021, a performance factor of 134.32% was applied as a result of the level of achievement through December 31, 2023. In addition, for performance-based awards granted on January 4, 2023, January 17, 2023 and July 1, 2023, a performance factor of 150% was applied based on the current presumed level of achievement. For all other performance-based awards shown in the table above, the amounts shown reflect the pay-out of performance based shares based upon achievement of a 100% level of performance. In addition, as noted above, in accordance with Mr. Bacon’s Employment Transition Agreement, all unvested service-based RSUs held by Mr. Bacon as of April 30, 2023 were forfeited under the Company’s Omnibus Plan and all unvested performance-based RSUs held by Mr. Bacon as of April 30, 2023 were modified to permit a pro-rata portion of all such unvested performance-based RSUs to continue to vest. (4) As noted within the Summary Compensation Table, Mr. Bacon was granted 1,151 service-based RSU awards on April 30, 2023 for his services as a non-employee Director, which vested on the date of the 2023 Annual Meeting. The amount disclosed above represents the fair value increase of the awards at the time of vesting. The grant date fair value of these awards were included in “All Other Compensation” within the Summary Compensation Table. (5) For 2024, the amount represents the change in fair value associated with certain performance-based RSUs that vested on March 13, 2024 based on the achievement of certain pre-established goals at above-target levels for the performance period commencing on January 1, 2021 through December 31, 2023. The performance factor during the measurement period used to determine compensation payouts was 150% of the pre-defined metric target of 100%. For 2023, the amounts represent the change in fair value associated with certain performance-based RSUs that vested on March 8, 2023 based on the achievement of certain pre-established goals at above-target levels for the performance period commencing on January 1, 2020 through December 31, 2022. The performance factor during the measurement period used to determine compensation payouts was 136.13% of the pre-defined metric target of 100%. (6) Reflects the grant date fair value of certain service-based and performance-based RSUs that were forfeited by Mr. Bacon as a result of his employment transition. 1) Represents the average of the grant date fair value of the equity awards to our Non-CEO NEOs, as reported in the Summary Compensation Table for each applicable year.(2) Represents the average of the year-over-year change in the fair value of equity awards to our Non-CEO NEOs. (3) Represents the average of the year-over-year change in the fair value of equity awards to our Non-CEO NEOs. For performance-based awards granted on January 1, 2021 and March 30, 2022, a performance factor of 134.32% and 150% was applied as a result of the level of achievement, respectively. In addition, for performance-based awards granted on January 4, 2023, January 17, 2023 and July 1, 2023, a performance factor of 150% was applied based on the current presumed level of achievement. For all other performance-based awards shown in the table above, the amounts shown reflect the pay-out of performance based shares based upon achievement of a 100% level of performance. (4) For 2024, the amount represents the change in fair value associated with certain performance-based RSUs that vested on March 13, 2024 based on the achievement of certain pre-established goals at above-target levels for the performance period commencing on January 1, 2021 through December 31, 2023. The performance factor during the measurement period used to determine compensation payouts was 150% of the pre-defined metric target of 100%. For 2023, the amount represents the change in fair value associated with certain performance-based RSUs that vested on March 8, 2023 based on the achievement of certain pre-established goals at above-target levels for the performance period commencing on January 1, 2020 through December 31, 2022. The performance factor during the measurement period used to determine compensation payouts was 136.13% of the pre-defined metric target of 100%.

|

|

|

|

| McCann [Member] |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| PEO Total Compensation Amount |

|

|

$ 2,816,315

|

$ 2,021,840

|

$ 0

|

$ 0

|

| PEO Actually Paid Compensation Amount |

|

|

9,433,359

|

6,707,263

|

0

|

0

|

| Bacon [Member] |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| PEO Total Compensation Amount |

|

|

0

|

2,620,078

|

1,942,742

|

1,497,380

|

| PEO Actually Paid Compensation Amount |

|

|

$ 0

|

2,267,037

|

2,221,816

|

916,923

|

| PEO | Measure:: 1 |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Name |

|

|

GAAP Net Income

|

|

|

|

| PEO | Measure:: 2 |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Name |

|

|

Adjusted EBITDA

|

|

|

|

| PEO | Measure:: 3 |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Name |

|

|

Adjusted EBITDA Margin

|

|

|

|

| PEO | McCann [Member] | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

$ (1,075,138)

|

(613,893)

|

|

|

| PEO | McCann [Member] | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

2,022,593

|

2,364,804

|

|

|

| PEO | McCann [Member] | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

5,535,140

|

2,858,282

|

|

|

| PEO | McCann [Member] | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

134,449

|

76,230

|

|

|

| PEO | McCann [Member] | Dividends or Other Earnings Paid on Equity Awards not Otherwise Reflected in Total Compensation for Covered Year |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

0

|

0

|

|

|

| PEO | McCann [Member] | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Granted and Vested in Covered Year [Member] |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

0

|

0

|

|

|

| PEO | Bacon [Member] | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

(1,507,218)

|

(598,461)

|

(431,550)

|

| PEO | Bacon [Member] | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

2,065,111

|

800,768

|

315,000

|

| PEO | Bacon [Member] | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

0

|

76,767

|

(463,907)

|

| PEO | Bacon [Member] | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

76,230

|

0

|

0

|

| PEO | Bacon [Member] | Dividends or Other Earnings Paid on Equity Awards not Otherwise Reflected in Total Compensation for Covered Year |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

(995,175)

|

0

|

0

|

| PEO | Bacon [Member] | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Granted and Vested in Covered Year [Member] |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

8,011

|

0

|

0

|

| Non-PEO NEO | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

(404,486)

|

(415,567)

|

(319,322)

|

(400,725)

|

| Non-PEO NEO | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

760,935

|

1,581,970

|

427,268

|

292,500

|

| Non-PEO NEO | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

3,034,350

|

1,849,107

|

70,814

|

(109,411)

|

| Non-PEO NEO | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

0

|

0

|

0

|

0

|

| Non-PEO NEO | Dividends or Other Earnings Paid on Equity Awards not Otherwise Reflected in Total Compensation for Covered Year |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

$ 79,391

|

$ 47,915

|

$ 1,410

|

$ (6,095)

|