Management Information Circular

Notice of Annual General and Special Meeting of Shareholders

NOTICE IS HEREBY GIVEN that the Annual General and Special Meeting of Shareholders (the “Meeting”) of Sandstorm Gold Ltd. (the “Company”) will be held in the Gold Boardroom at the Company’s head office located at Suite 3200, 733 Seymour Street, Vancouver, British Columbia, Canada V6B 0S6, on Friday, May 30, 2025, at the hour of 10:00 a.m. (Vancouver Time).

Important details about the Meeting, as well as further information with respect to voting by proxy are set out in the accompanying Management Information Circular (the “Circular”) and proxy materials.

| | | | | | | | | | | | | | |

| | | | |

| DATE | |

| Friday | The Meeting will be held for the following purposes: |

| May 30, 2025 | |

| 1.To receive and consider the audited consolidated financial statements of the Company for the financial year ended December 31, 2024, together with the report of the auditors thereon; 2.To fix the number of Directors of the Company at eight; 3.To elect Directors of the Company for the ensuing year; 4.To appoint PricewaterhouseCoopers LLP, Chartered Professional Accountants, as auditors of the Company for the ensuing year and to authorize the Directors to fix their remuneration; 5.To consider and, if deemed appropriate, to pass, with or without variation, an ordinary resolution to approve: (a) certain amendments to the Company's Stock Option Plan, including an amendment to convert the Stock Option Plan from a "rolling" plan to a "fixed maximum" plan with an "evergreen" feature; and (b) unallocated Stock Options under the Company's amended Stock Option Plan, all as more particularly described in the accompanying Circular; 6.To consider, if deemed appropriate, to pass, with or without variation, an ordinary resolution to approve unallocated Restricted Share Rights under the Company's amended Restricted Share Plan, all as more particularly described in the accompanying Circular; 7.To consider, if deemed appropriate, to pass, with or without variation, an ordinary resolution to approve the Company's new Performance Share Plan and the 2024 Performance Share Rights Awards under it, all as more particularly described in the accompanying Circular; and. 8.To approve a non-binding advisory resolution on the Company's approach to executive compensation. |

| TIME |

| 10:00 am |

| (Vancouver Time) |

|

| LOCATION |

| Gold Boardroom |

| Suite 3200, 733 Seymour Street |

| Vancouver, BC V6B 0S6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Sandstorm Gold Ltd. 2 2025

Management Information Circular

Shareholders of the Company (as defined below) will also transact any other business properly brought before the Meeting or any adjournment thereof. The specific details of the foregoing matters to be put before the Meeting are set forth in the Circular accompanying this notice. The audited consolidated financial statements and related management’s discussion and analysis (“MD&A”) for the Company for the financial year ended December 31, 2024, have already been mailed to those Shareholders who have previously requested to receive them. Otherwise, they are available upon request to the Company, on SEDAR+ at www.sedarplus.ca, on the United States Securities and Exchange Commission website at www.sec.gov, or the Company’s website at www.sandstormgold.com. This notice is accompanied by the Circular, either a form of proxy for registered Shareholders or a voting instruction form for beneficial Shareholders and a supplemental mailing list return card (collectively, the “Meeting Materials”).

As described in the notice and access notification mailed to Shareholders of the Company, the Company will deliver the applicable Meeting Materials to Shareholders by posting the Meeting Materials on its website. This alternative means of delivery is more environmentally friendly as it will help reduce paper use and mitigate the Company’s printing and mailing costs. The Meeting Materials will be available on the Company’s website as of April 22, 2025, and will remain on the website for one full year thereafter. The Meeting Materials will also be available under the Company’s profile on SEDAR+ at www.sedarplus.ca and on the United States Securities and Exchange Commission website at www.sec.gov as of April 22, 2025. The Company will continue to mail paper copies of the applicable Meeting Materials to those registered and beneficial Shareholders who previously elected to receive paper copies. All other Shareholders will receive a notice and access notification which will contain information on how to obtain electronic and paper copies of the Meeting Materials in advance of the Meeting. Shareholders who wish to receive paper copies of the Meeting Materials may request copies from Mark Klausen at the Company by calling toll-free in North America at 1-866-584-0234, Extension # 258, or from outside North America by calling 604-628-1164, or by email at info@sandstormgold.com. Meeting Materials will be sent to such Shareholders at no cost to them within three business days of their request, if such requests are made before the Meeting.

The Board of Directors of the Company has, by resolution, fixed the close of business on April 9, 2025, as the record date, being the date for the determination of the registered holders of common shares of the Company entitled to notice of and to vote at the Meeting and any adjournment or adjournments thereof. Proxies to be used at the Meeting must be deposited with the Company, c/o the Company's transfer agent, Computershare Investor Services Inc., Proxy Department, 100 University Avenue, 8th Floor, Toronto, Ontario, M5J 2Y1 no later than 10:00 a.m. (Vancouver Time) on May 28, 2025, or no later than 48 hours (excluding Saturdays, Sundays and statutory holidays) prior to the date on which the Meeting or any adjournment thereof is held. Non-registered Shareholders who receive these materials through their broker or other intermediary are requested to follow the instructions for voting provided by their broker or intermediary, which may include the completion and delivery of a voting instruction form.

Sandstorm Gold Ltd. 3 2025

Management Information Circular

Please review the accompanying Circular before voting as it contains important information about the Meeting. If you have any questions about the procedures required to qualify to vote at the Meeting or about obtaining and depositing the required form of proxy, you should contact Computershare by telephone (toll free) at 1-800-564-6253, by fax at 1-866-249-7775 or by e-mail at service@computershare.com.

| | | | | |

| BY ORDER OF THE BOARD OF DIRECTORS | |

| |

| Date: April 9, 2025 | /s/ Nolan Watson |

| Vancouver, British Columbia | Nolan Watson |

| Chief Executive Officer |

Sandstorm Gold Ltd. 4 2025

Management Information Circular

Table of Contents

Sandstorm Gold Ltd. 5 2025

Management Information Circular

Sandstorm Gold Ltd. 6 2025

Management Information Circular

Sandstorm Gold Ltd. 7 2025

Management Information Circular

Introduction

Information in this Circular is provided as at April 9, 2025, except as otherwise indicated.

Unless otherwise noted or the context otherwise indicates, references to the “Company”, “Sandstorm”, “Sandstorm Gold”, “us”, “our” and "we" all refer to Sandstorm Gold Ltd. (the “Company”).

Unless the context otherwise requires, when we refer in this Circular to the Company, its subsidiaries are also included. The Company will conduct its solicitation by mail and officers and employees of the Company may, without receiving special compensation, also telephone or make other personal contact. The Company will pay the cost of solicitation.

Sandstorm provides certain links to websites in this Circular, including www.sandstormgold.com. No such websites are incorporated by reference herein. Sandstorm also produces and references other materials that may be of assistance when reviewing (but which do not form part of, nor are incorporated by reference into) this Management Information Circular (the “Circular”), including the 2023 Sustainability Report (as defined and discussed below).

Sandstorm is providing this Circular and a form of proxy in connection with management’s solicitation of proxies for use at the Annual General and Special Meeting (the “Meeting”) of the Company to be held on Friday, May 30, 2025, and at any adjournments or postponements thereof, at the time and place and for the purposes set forth in the accompanying notice of annual general meeting (“Notice of Meeting”). This solicitation of proxies and voting instruction forms involves securities of a corporation located in Canada and is being effected in accordance with the applicable corporate and securities laws of Canada. The proxy solicitation rules under the United States Securities Exchange Act of 1934, as amended, are not applicable to the Company or this solicitation. Shareholders should be aware that disclosure and proxy solicitation requirements under the applicable securities laws of Canada and the Toronto Stock Exchange (“TSX”) differ from the disclosure and proxy solicitation requirements under United States securities laws.

All dollar amounts referenced herein are, unless otherwise stated, expressed in United States Dollars (being the same currency that the Company uses in its financial statements. The price of the Company’s common shares (the “Shares”) on the TSX is denoted in Canadian dollars and, in certain circumstances where appropriate in this Circular, such amounts have not been converted to United States Dollars.

Sandstorm Gold Ltd. 8 2025

Management Information Circular

Particulars of Matters to be Acted Upon

Election of Directors

The directors (“Directors”) of the Company are elected at each annual general meeting and hold office until the next annual general meeting or until their successors are appointed. The Board of Directors of the Company (the “Board”) currently consists of eight Directors and Shareholder approval will be sought at the Meeting to fix the number of Directors of the Company at eight.

At the Meeting, the eight persons named hereunder will be proposed for election as Directors of the Company (the “Nominees” and each, a “Nominee”). All of the Nominees currently serve on the Board and each has expressed his or her willingness to serve on the Board for another term.

The Board and management consider the election of each of the Nominees to be appropriate and in the best interests of the Company. Accordingly, unless otherwise indicated, the persons designated as proxyholders in the accompanying proxy will vote the Shares (as hereinafter defined in this Circular) represented by such form of proxy, properly executed, FOR the election of each of the Nominees whose names are set forth below. Management does not contemplate that any of the Nominees will be unable to serve as a Director, but if that should occur for any reason prior to the Meeting, it is intended that discretionary authority shall be exercised by the persons named in the accompanying proxy to vote the proxy for the election of any other person or persons in place of any Nominee or Nominees unable to serve. Each of the Nominees below was elected at the last annual general meeting of the Shareholders held on June 21, 2024 (the “2024 Shareholder Meeting”).

Majority Voting Policy

| | | | | | | | |

| | |

| A Majority Voting Policy is in Place | |

| | |

The Board has adopted a Majority Voting Policy stipulating that if the votes in favour of the election of a Director at a Shareholder meeting represent less than a majority (i.e. 50% + 1) of the votes cast with respect to his or her election, that Director will immediately tender his or her resignation (“Resignation”) to the Board after the Shareholder meeting. Within 90 days of the Shareholder meeting, the Board shall conclude its deliberations and will determine whether or not to accept the Resignation, however, as mandated in the TSX Company Manual, the Board shall accept the Resignation absent exceptional circumstances and the Director in question will not participate in any Board deliberations on the Resignation. The Board’s decision to accept or reject the Resignation offer will promptly be disclosed to the public by news release. If a Resignation is tendered and accepted pursuant to the Majority Voting Policy, subject to any applicable corporate law restrictions, the Board may leave the vacancy unfilled or

Sandstorm Gold Ltd. 9 2025

Management Information Circular

may appoint a new Director to fill the vacancy. The Company’s Majority Voting Policy does not apply in circumstances involving contested Director elections.

Kindly refer to the full text of the Majority Voting Policy for complete details, which may be accessed on the Company’s website at www.sandstormgold.com.

Advance Notice Policy

| | | | | | | | |

| | |

| An Advance Notice Policy is in Place | |

| | |

On April 27, 2018, the Corporate Governance & Nominating Committee recommended, and the Board adopted and approved, an Advance Notice Policy, which was subsequently approved by the Shareholders at the 2018 Shareholder Meeting. The Directors of the Company are committed to: (i) facilitating an orderly and efficient process for holding annual general and, where the need arises, special meetings of its Shareholders; (ii) ensuring that all Shareholders receive adequate advance notice of the Director nominations and sufficient information with respect to all Director nominees; and (iii) allowing Shareholders to register an informed vote for Directors of the Company after having been afforded reasonable time for appropriate deliberation. The purpose of the Advance Notice Policy is to provide Shareholders, Directors and management of the Company with a clear framework for nominating Directors of the Company. The Advance Notice Policy fixes a deadline by which Director nominations must be submitted to the Company prior to any annual or special meeting of Shareholders and sets forth the information that must be included in the notice to the Company for the notice to be in proper written form in order for any Director nominee to be eligible for election at any annual or special meeting of Shareholders. Shareholders who fail to comply with the Advance Notice Policy will not be entitled to make nominations for Directors at the Meeting. As of the date of this Circular, the Company has not received any notice of a Shareholder’s intention to nominate Directors at the Meeting pursuant to the provisions contained in the Advance Notice Policy.

Kindly refer to the full text of the Advance Notice Policy for complete details, which may be accessed on the Company’s website at www.sandstormgold.com.

Director Profiles

Each of the eight nominated Directors is profiled below, including his/her background and experience, areas of expertise, committee memberships, Share ownership and other public companies and board committees of which he/she is a member. Information concerning each such person is based upon information furnished by the individual Nominee.

Sandstorm Gold Ltd. 10 2025

Management Information Circular

| | | | | | | | | | | | | | | | | | | | | | | |

| | Non-Independent | |

| Nolan Watson |

|

| Age | 45 | | Director Since: | Committee Membership: |

| Residence | British Columbia, Canada | September 12, 2008 | N/A |

|

Primary Areas of Expertise: | | Mr. Watson has been the President and Chief Executive Officer of the Company since September 2008 and was its Chairman from January 2013 to March 2016. From May 2010 to May 2014 (when Sandstorm Metals & Energy Ltd. (“Sandstorm Metals”) was acquired by the Company), Mr. Watson was President and Chief Executive Officer of Sandstorm Metals and its Chairman from January 2013 to May 2014. From July 2008 to September 2008, Mr. Watson was an independent businessman. From April 2006 to July 2008, Mr. Watson was the Chief Financial Officer of Wheaton Precious Metals Corp. (formerly known as Silver Wheaton Corp., “Wheaton”). Mr. Watson is a Chartered Financial Analyst Charterholder, a Fellow of the Chartered Professional Accountants of British Columbia (Valedictorian), and he holds a Bachelor of Commerce degree (with honours) from the University of British Columbia. |

Executive Management |

| Finance and Capital Markets |

| Accounting/Financial Controls |

| Mergers and Acquisitions |

| ESG and Climate Change |

|

Principal Occupation: |

| President and Chief Executive Officer of the Company |

|

Other Public Company Directorships: |

| (and committee memberships) |

| Horizon Copper Corp. |

| Chairman of the Board |

|

| | | | |

| 2024 Annual Meeting Voting Results: | Number of Shares of the Company Beneficially Owned, Controlled or Directed, Directly or Indirectly(1) |

| |

| For | 99.33% | Company Shares: | 1,344,065 |

| Withheld | 0.67% | Restricted Share Rights: | 24,333 |

| Total “At-Risk” Market Value(2): | C$13,957,660 |

| (1) In addition, Mr. Watson has been awarded 180,000 Performance Share Rights, which are subject to Shareholder ratification at the Meeting. |

Sandstorm Gold Ltd. 11 2025

Management Information Circular

| | | | | | | | | | | | | | | | | | | | | | | |

| | Non-Independent | |

| David Awram |

|

| Age | 52 | | Director Since: | Committee Membership: |

| Residence | British Columbia, Canada | March 23, 2007 | N/A |

|

Primary Areas of Expertise: | | Mr. Awram was Executive Vice-President of the Company from July 2009 to January 2013 and has been its Senior Executive Vice-President since January 2013. Mr. Awram was Executive Vice-President of Sandstorm Metals from January 2010 to January 2013 and then its Senior Executive Vice-President from January 2013 to May 2014. From July 2008 to July 2009, Mr. Awram was an independent businessman. From May 2005 to July 2008, Mr. Awram was the Director of Investor Relations for Wheaton. Prior to May 2005, he was Manager, Investor Relations with Diamond Fields International Ltd. from April 2004 to April 2005. He holds a Bachelor of Science degree (Honours) in Geology from the University of British Columbia in 1996.

|

Mining and Exploration |

| Mergers and Acquisitions |

|

Principal Occupation: |

| Senior Executive Vice-President of the Company |

|

Other Public Company Directorships: |

| (and committee memberships) |

| Sun Peak Metals Corp. |

| Chairman of the Board

Audit Committee (Chair) |

|

| | | | |

| 2024 Annual Meeting Voting Results: | Number of Shares of the Company Beneficially Owned, Controlled or Directed, Directly or Indirectly(1) |

| |

| For | 94.05% | Company Shares: | 700,990 |

| Withheld | 5.95% | Restricted Share Rights: | 320,000 |

| Total “At-Risk” Market Value(2): | C$10,414,098 |

| (1) In addition, Mr. Awram has been awarded 100,000 Performance Share Rights, which are subject to Shareholder ratification at the Meeting. |

Sandstorm Gold Ltd. 12 2025

Management Information Circular

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Independent | Chairman of the Board |

| David E. De Witt |

|

| Age | 72 | | Director Since: | Committee Membership: |

| Residence | British Columbia, Canada | April 22, 2008 | • | Audit Committee (Chair) |

| | | • | Corporate Governance & Nominating Committee |

| | | • | Compensation Committee |

|

Primary Areas of Expertise: | | Since October 2004, Mr. De Witt has been a co-founder and Chairman of Pathway Capital Ltd., a Vancouver-based private venture capital company. Mr. De Witt graduated with a BComm/LLB from the University of British Columbia in 1978 and practiced corporate, securities and mining law until his retirement from the practice of law in January 1997. He has held directorships in a number of public companies involved in the natural resource field and has experience in resource projects located in Latin America, North America and Asia. |

Law |

| Mining and Exploration |

| Mergers and Acquisitions |

|

Principal Occupation: |

Independent businessman;

Chairman of Pathway Capital Ltd. |

|

Other Public Company Directorships: |

| (and committee memberships) |

| Drummond Ventures Corp. |

|

| | | | |

| 2024 Annual Meeting Voting Results: | Number of Shares of the Company Beneficially Owned, Controlled or Directed, Directly or Indirectly(1) |

| |

| For | 94.52% | Company Shares: | 974,233 |

| Withheld | 5.48% | Restricted Share Rights: | 51,999 |

| Total “At-Risk” Market Value(2): | C$10,467,566 |

| |

Sandstorm Gold Ltd. 13 2025

Management Information Circular

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Independent | | |

| Andrew T. Swarthout |

|

| Age | 73 | | Director Since: | Committee Membership: |

| Residence | Colorado, USA | March 23, 2009 | • | Audit Committee |

| | | • | Corporate Governance & Nominating Committee |

|

Primary Areas of Expertise: | | Mr. Swarthout was the Executive Chairman of Bear Creek Mining Corporation, a mining company, from October 2017 to May 2020. He was a director of Bear Creek Mining Corporation from 2003 to March 2025 and was its Chief Executive Officer from 2003 to September 2017. He was also its President until February 2011 and then again from August 2013 to September 2017. Mr. Swarthout was a director of Pucara Gold Ltd. from June 2020 to November 2024, when it wad acquired by Copper Standard Resources Inc., and he has been a director (and Chair) of Copper Standard Resources Inc. since November 2024. He was a director of Rio Cristal Resources Corporation from December 2006 to September 2013, and he was a director of Esperanza Resources Corp. from May 2012 to August 2013 (when it was acquired by Alamos Gold Inc.). Formerly he was an officer and member of the management committee of Southern Peru Copper Corporation from 1995 to 2000 where he participated in decision making during a dynamic period of corporate expansions, financing and project development. Mr. Swarthout graduated in 1974 from the University of Arizona with a Bachelor of Geosciences degree and he is a Professional Geologist. |

Mining and Exploration |

| Mergers and Acquisitions |

| Executive Management |

| Finance and Capital Markets |

|

Principal Occupation: |

| Independent Consultant |

|

Other Public Company Directorships: |

| (and committee memberships) |

| Copper Standard Resources Inc. |

| |

|

| |

|

|

| | | | |

| 2024 Annual Meeting Voting Results: | Number of Shares of the Company Beneficially Owned, Controlled or Directed, Directly or Indirectly(1) |

| |

| For | 95.94% | Company Shares: | 43,667 |

| Withheld | 4.06% | Restricted Share Rights: | 46,999 |

| Total “At-Risk” Market Value(2): | C$924,793 |

| |

Sandstorm Gold Ltd. 14 2025

Management Information Circular

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Independent | | |

| John P.A. Budreski |

|

| Age | 66 | | Director Since: | Committee Membership: |

| Residence | British Columbia, Canada | June 11, 2009 | • | Audit Committee |

| | | • | Corporate Governance & Nominating Committee |

| | | • | Compensation Committee (Chair) |

|

Primary Areas of Expertise: | | Mr. Budreski has been the Executive Chairman of Morien Resources Corp., a mining development company, since November 2018 and was its Chief Executive Officer and Chairman from November 2017 to November 2018 and its President and Chief Executive Officer from November 2012 to November 2017. He has been the Executive Chairman of EnWave Corporation, an advanced technology company, since June 2014. Mr. Budreski was a Managing Director and a Vice Chairman with Cormark Securities Inc. from 2009 to 2012. He was the President and Chief Executive Officer of Orion Securities Inc. from 2005 to 2007. During the periods from February 2012 to October 2012 and from December 2007 to February 2009, Mr. Budreski was an independent businessman. Prior to this, he filled the roles of a Managing Director of Equity Capital Markets and Head of Investment Banking for Scotia Capital Inc. from March 1998 to February 2005 after starting out as a Managing Director of US Institutional Equity Group for Scotia Capital. He also held senior roles in investment banking and equity sales and trading for RBC Dominion Securities and worked for Toronto Dominion Bank. He holds an MBA from the University of Calgary and a Bachelor of Engineering from TUNS/Dalhousie. |

Mining and Exploration |

| Banking and Finance |

| Mergers and Acquisitions |

|

Principal Occupation: |

Executive Chairman of Morien Resources Corp.

Executive Chairman of EnWave Corporation |

|

Other Public Company Directorships: |

| (and committee memberships) |

| Morien Resources Corp. |

| EnWave Corporation |

| |

| |

|

|

| | | | |

| 2024 Annual Meeting Voting Results: | Number of Shares of the Company Beneficially Owned, Controlled or Directed, Directly or Indirectly(1) |

| |

| For | 90.78% | Company Shares: | 44,334 |

| Withheld | 9.22% | Restricted Share Rights: | 138,666 |

| Total “At-Risk” Market Value(2): | C$1,866,600 |

| |

Sandstorm Gold Ltd. 15 2025

Management Information Circular

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Independent | | |

| Mary L. Little |

|

| Age | 71 | | Director Since: | Committee Membership: |

| Residence | Colorado, USA | June 25, 2014 | • | Corporate Governance & Nominating Committee (Chair) |

| | | • | Compensation Committee |

| | | • | Sustainability Committee |

|

Primary Areas of Expertise: | | Ms. Little has been an independent geological consultant since 2014. Formerly, she was the founding Chief Executive Officer, President and a director (from October 2003 to May 2014) of Mirasol Resources Ltd., a precious metals company focused on exploration in Latin America. Ms. Little was a director of Pure Energy Minerals Limited from March 2015 to October 2024. She became a director of Tinka Resources Limited in April 2016. In May 2018, Ms. Little became a director of Capella Minerals Limited (formerly known as New Dimension Resources Ltd.). Ms. Little became a director of Sable Resources Ltd. on September 5, 2024. Her industry experience includes 15 years in Latin America with major mining companies Newmont Chile, Cyprus Amax and WMC Ltd., where she held management positions including Business Development Manager and Country Manager. Ms. Little has extensive experience in the exploration and evaluation of epithermal precious metals deposits, as well as porphyry and sediment-hosted mineral environments. Ms. Little served as trustee for the Society of Economic Geologists Foundation from 2010 to 2014 and was appointed to the SEG Council from 2022 to 2024. She received the 2025 Alumni Citation award from Franklin and Marshall College for distinguished accomplishments in a profession, leadership and service to the community. She holds a M.Sc. degree in Earth Sciences from the University of California and an MBA from the University of Colorado and is a Qualified Person under National Instrument 43-101. |

Mining and Exploration |

| Mergers and Acquisitions |

| Executive Management |

|

Principal Occupation: |

| Independent Consultant |

|

Other Public Company Directorships: |

| (and committee memberships) |

| Sable Resources Ltd. |

| Audit Committee (Chair)

Compensation Committee |

| Tinka Resources Limited |

| Audit Committee

Compensation Committee |

| Capella Minerals Limited |

| Audit Committee

Compensation Committee (Chair) |

|

| | | | |

| 2024 Annual Meeting Voting Results: | Number of Shares of the Company Beneficially Owned, Controlled or Directed, Directly or Indirectly(1) |

| |

| For | 92.75% | Company Shares: | 356,128 |

| Withheld | 7.25% | Restricted Share Rights: | 97,000 |

| Total “At-Risk” Market Value(2): | C$4,621,906 |

| |

Sandstorm Gold Ltd. 16 2025

Management Information Circular

| | | | | | | | | | | | | | | | | | | | | | | |

| | Independent | |

| Vera Kobalia |

|

| Age | 43 | | Director Since: | Committee Membership: |

| Residence | British Columbia, Canada | June 15, 2018 | Sustainability Committee (Chair) |

|

Primary Areas of Expertise: | | Ms. Kobalia is the founder of Kobalia Consulting, a private consultancy advising public and private sector leaders around the world since 2013. Clients have included local and federal governments of Australia, Kazakhstan, Philippines, United Arab Emirates, Indonesia, and the United Kingdom. She is also co-founder of Olyn Inc., a blockchain based solution for asset registry. Ms. Kobalia is an AsiaGlobal Fellow at the University of Hong Kong. Formerly, she was an International Doing Business Advisor for the Australia Indonesia Partnership for Economic Governance in Jakarta, Indonesia from January 2016 to February 2018. From February to July 2015, she was the Deputy Chair of the Board for the Astana Expo 2017 National Company in Astana, Kazakhstan. From October 2012 to November 2013, Ms. Kobalia was Advisor to the President of Georgia on issues of economic and foreign policy in Tbilisi, Georgia. Prior to this appointment, she held the government position of Minister for the Ministry of Economy and Sustainable Development of Georgia in Tbilisi, Georgia for the period from June 2010 to October 2012. Ms. Kobalia is currently a visiting lecturer at the European Academy of Diplomacy (Warsaw, Poland); and a member of the Economic Development Advisory Committee for the City of New Westminster, British Columbia. Ms. Kobalia was recognized as one of Business in Vancouver’s “Top 40 Under 40” award winners in 2019 and is a frequent speaker at various international forums including the World Economic Forum, where she was a Board Member on the Global Council for Development Finance in 2018-2019. In 2024, Ms. Kobalia earned the Sustainability & ESG Designation and Certification (GCB.D) from Competent Boards. She is fluent in English, Russian and Georgian and frequently speaks on public policy issues, fighting corruption in public and private institutions, sustainable development as economic growth tool and women leadership at international conferences and forums, including the Council of Europe’s World Forum for Democracy, the World Economic Forum, the Warsaw Security Forum and the International Transport Forum. She holds a diploma in Information Technology Management from the British Columbia Institute of Technology. |

Public Policy and Government |

| Political Risk Assessment |

|

Principal Occupation: |

| Government Advisor |

|

Other Public Company Directorships: |

| (and committee memberships) |

| Arras Minerals Corp |

| Audit Committee (Chair)

Corporate Governance and Nominating Committee |

|

| |

|

| | | | |

| 2024 Annual Meeting Voting Results: | Number of Shares of the Company Beneficially Owned, Controlled or Directed, Directly or Indirectly(1) |

| |

| For | 97.85% | Company Shares: | 5,000 |

| Withheld | 2.15% | Restricted Share Rights: | 82,000 |

| Total “At-Risk” Market Value(2): | C$887,400 |

| |

Sandstorm Gold Ltd. 17 2025

Management Information Circular

| | | | | | | | | | | | | | | | | | | | | | | |

| | Non-Independent | |

| Elif Lévesque |

|

| Age | 51 | | Director Since: | Committee Membership: |

| Residence | Québec, Canada | June 9, 2023 | Sustainability Committee |

|

Primary Areas of Expertise: | | Elif Lévesque is a founder and former Chief Financial Officer of Nomad Royalty Company Ltd., a company formerly listed on the New York and TSX stock exchanges, from its inception in 2020 until its acquisition by the Company in August 2022. Between June 2014 and February 2020, she was Chief Financial Officer and Vice President Finance of Osisko Gold Royalties Ltd. Prior to this, Ms. Lévesque was Vice President and Controller of Osisko Mining Corporation and contributed to the finance function at Osisko since 2008. Ms. Lévesque has over 20 years of experience with Canadian and U.S. listed companies, including 18 years with leading intermediate gold producers (Cambior Inc. 2002-2006 and Iamgold Corporation 2006-2008). She is a Chartered Professional Accountant, holds a Bachelor's degree in Economics and an MBA from Clark University (Massachusetts, USA) and has an ICD.D designation. Ms. Lévesque was the winner in the category “Financial executive of a small or medium enterprise” in the 2018 Aces of Finance competition held by FEI Canada, Québec Section and was named as one of the “Top 100 global inspirational women in mining”, 2018 edition of Women in Mining in the UK. |

Executive Management |

| ESG and Climate Change |

| Accounting/Financial Controls |

| Mergers and Acquisitions |

| Risk Management |

|

Principal Occupation: |

| Corporate Director |

|

Other Public Company Directorships: |

| (and committee memberships) |

| Cascades Inc. |

| Audit and Finance Committee

Human Resources Committee |

| G Mining Ventures Corp. |

| Audit & Risk Committee (Chair)

Environment, Social and Governance Committee

Human Resources and Compensation Committee |

|

| | | | |

| 2024 Annual Meeting Voting Results: | Number of Shares of the Company Beneficially Owned, Controlled or Directed, Directly or Indirectly(1) |

| |

| For | 94.16% | Company Shares: | 125,361 |

| Withheld | 5.84% | Restricted Share Rights: | 32,750 |

| Total “At-Risk” Market Value(2): | C$1,612,732 |

| |

1.For details concerning Stock Options (as hereinafter defined in this Circular) held by each of the above persons and the year-end “at risk” value of their Stock Options, kindly refer to the specific disclosure contained within the “EXECUTIVE COMPENSATION” section of this Circular.

2.Based on the closing price of the Shares on the TSX on April 9, 2025, of C$10.20.

No proposed Director is to be elected under any arrangement or understanding between the proposed Director and any other person or company, except the Directors and Executive Officers of the Company acting solely in such capacity.

Sandstorm Gold Ltd. 18 2025

Management Information Circular

Cease Trade Orders, Bankruptcies, Penalties or Sanctions

To the knowledge of the Company, no proposed Director:

a)is, as at the date of this Circular, or has been, within 10 years before the date of this Circular, a Director, chief executive officer or chief financial officer of any company (including the Company) that:

i.was the subject, while the proposed Director was acting in the capacity as Director, chief executive officer or chief financial officer of such company, of a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days; or

ii.was subject to a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days, that was issued after the proposed Director ceased to be a Director, chief executive officer or chief financial officer but which resulted from an event that occurred while the proposed Director was acting in the capacity as Director, chief executive officer or chief financial officer of such company; or

b)is, as at the date of this Circular, or has been within 10 years before the date of this Circular, a Director or executive officer of any company (including the Company) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or

c)has, within the 10 years before the date of this Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed Director; or

d)has been subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or

e)has been subject to any penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable securityholder in deciding whether to vote for a proposed Director;

other than John P.A. Budreski. Mr. Budreski became a director of Colossus Minerals Inc. (“Colossus”) in late March of 2014 pursuant to the terms of, and upon the completion of, a Court supervised restructuring. Prior to Mr. Budreski joining the Board of Colossus, Colossus had failed to file its requisite disclosure materials with the applicable regulatory bodies, and, on April 29, 2014, the Ontario Securities Commission issued a cease trade order against Colossus. As of the date hereof, the cease trade order remains in effect.

Sandstorm Gold Ltd. 19 2025

Management Information Circular

Interlocking Directorships/Committee Appointments

None of the Directors serve together on other public company Boards and committees.

Meeting Attendance

The table below presents the Director attendance at Board and committee meetings held during 2024. Director attendance at the annual Shareholders’ meeting held each year is not mandatory, however, historically, a majority of the Directors have attended the Company’s annual Shareholder meetings. Non-committee member Directors also regularly attend Audit Committee meetings as guests.

Attendance Chart

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Director | Board Meetings2 | Audit Committee Meetings1 | Corporate Governance & Nominating Committee Meetings 3 | Compensation Committee Meetings | Sustainability Committee Meetings 4 |

| | | | | | | | | |

| # | % | # | % | # | % | # | % | # | % |

Nolan Watson | 5/5 | 100% | - | - | - | - | - | - | - | - |

David Awram | 5/5 | 100% | - | - | - | - | - | - | - | - |

David E. De Witt | 5/5 | 100% | 4/4 | 100% | 1/1 | 100% | 2/2 | 100% | - | - |

John P.A. Budreski | 5/5 | 100% | 4/4 | 100% | 1/1 | 100% | 2/2 | 100% | - | - |

Andrew T. Swarthout | 5/5 | 100% | 4/4 | 100% | 1/1 | 100% | - | - | - | - |

Mary L. Little | 5/5 | 100% | - | - | 1/1 | 100% | 2/2 | 100% | 1/1 | 100% |

Vera Kobalia | 5/5 | 100% | - | - | - | - | - | - | 1/1 | 100% |

Elif Lévesque | 5/5 | 100% | - | - | - | - | - | - | 1/1 | 100% |

1.The members of the Company’s Audit Committee (the “Audit Committee”) meet in camera with the Company’s auditors at each Audit Committee meeting.

2.Although the Board only met on a formal basis five times in 2024, other matters to be considered by the Board were circulated to, discussed by and approved by the Board by consent resolution throughout 2024.

3.Although the Corporate Governance & Nominating Committee only met on a formal basis once in 2024, other matters to be considered by this committee were circulated to, discussed by and approved by the Corporate Governance & Nominating Committee by consent resolution in 2024.

4.The Sustainability Committee was formed in March 2024, and although it only met on a formal basis once in 2024, other matters to be considered by this committee were circulated to and discussed by the Sustainability Committee in 2024.

Appointment of Auditors

PricewaterhouseCoopers LLP, Chartered Professional Accountants (“PwC”), are the auditors of the Company and were first appointed as auditors of the Company on June 17, 2016.

Accordingly, unless otherwise indicated, the persons designated as proxyholders in the accompanying form of proxy will vote the Shares represented by such form of proxy, properly executed, FOR the appointment of PwC as the auditors of the Company to hold office for the ensuing year at a remuneration to be fixed by the Directors.

Sandstorm Gold Ltd. 20 2025

Management Information Circular

Approval of Amendments to and Unallocated Stock Options under Stock Option Plan

Background

The terms of the Stock Option Plan ("Stock Option Plan") and additional disclosure related to the Stock Option Plan which is required by the TSX is set forth in this Circular under "SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS - Stock Option Plan".

Amendments to the Stock Option Plan

As discussed below in this Circular and also under "SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS - Stock Option Plan - 2025 Stock Option Plan Amendments", the Corporate Governance & Nominating Committee and the full Board have recently reviewed the Stock Option Plan and the Board approved certain housekeeping and other appropriate amendments to it on April 9, 2025 (further defined below as the General Housekeeping Amendments, the Conversion Amendment and the Evergreen Feature and collectively the “2025 Stock Option Plan Amendments”).

Shareholder approval is being requested below with respect to the Company's new Performance Share Plan ("Performance Share Plan") pursuant to which the Directors of the Company may, from time to time and subject to the restrictions laid out in the Performance Share Plan, grant Performance Share Rights (as defined below) to Eligible Employees under the Performance Share Plan entitling such Eligible Employees to acquire up to an aggregate maximum of 4,400,000 Shares.

On April 9, 2025, the Board approved certain general housekeeping amendments to the Stock Option Plan which would harmonize certain sections of the Stock Option Plan, including certain defined terms, to similar sections and defined terms as contained in the new Performance Share Plan (the

"General Housekeeping Amendments"). Kindly note that, while the General Housekeeping Amendments DO NOT require Shareholder approval, these General Housekeeping Amendments do require the approval of the TSX.

The Board also approved amendments to the Stock Option Plan which convert it from a "rolling" plan into a "fixed maximum" plan pursuant to which the Company may issue only up to a maximum of 14,112,417 Shares, representing the exact number of the Company's outstanding Stock Options ("Stock Options") as of December 31, 2024, upon exercise of Stock Options issued under it (the "Conversion Amendment").

In addition, as permitted pursuant to rules of the TSX, the conversion of the Stock Option Plan from a "rolling" plan into a "fixed maximum" plan now also includes provisions for the replenishment of the number of securities reserved under the Stock Option Plan when Stock Options are exercised (i.e. the maximum number of Shares reserved for issuance from treasury under the Stock Option Plan will be automatically replenished by that number of Shares which is equal to the number of Shares issued by the Company from time to time upon exercise of any Stock Options) (the "Evergreen Feature") .

Sandstorm Gold Ltd. 21 2025

Management Information Circular

It is important to note that the Conversion Amendment to the Stock Option Plan is subject to Board discretion to not proceed with such conversion in the event that Shareholder approval is not obtained at the Meeting to the Company's new Performance Share Plan as discussed below.

The Board has approved this important Conversion Amendment to the Stock Option Plan in order to reduce the number of Shares issuable in total under all of the Company's equity compensation plans. Together, the introduction of the Performance Share Plan and the Conversion Amendment to the Stock Option Plan will reflect the increased importance and weighting of Restricted Share Rights under the Company's Restricted Share Plan ("Restricted Share Plan") and/or Performance Share Rights under the Performance Share Plan and a decreased reliance by the Company on Stock Options under the Stock Option Plan as long-term incentives in the Company's compensation program.

Other than the 2025 Stock Option Plan Amendments, all of the other provisions of the Stock Option Plan shall remain substantially unchanged and in full force and effect. The Board has approved the 2025 Stock Option Plan Amendments, subject to the approval of the Shareholders (excluding the General Housekeeping Amendments) and the TSX.

A blacklined copy of the full text of the proposed form of amended Stock Option Plan containing all of the 2025 Stock Option Plan Amendments and comparing it to the form of Stock Option Plan previously approved by the Shareholders is attached to this Circular as Schedule “A”.

Approval of Unallocated Stock Options

When Stock Options are granted pursuant to the Stock Option Plan, Shares that are reserved for issuance pursuant to these outstanding unexercised Stock Options are considered “allocated” Stock Options by the TSX. As the maximum number of Shares which may be issuable under the Stock Option Plan, together with all of the Company’s other previously established or proposed share compensation arrangements (i.e. the Restricted Share Plan, and now the new Performance Share Plan as well), was previously set at 8.5% (on a rolling basis) of the Company’s issued and outstanding Shares from time to time before the Board approved the 2025 Stock Option Plan Amendments, additional Shares may be issued by the Company under the Stock Option Plan which are not the subject of current unexercised Stock Option grants, and these are considered to be “unallocated” Stock Options by the TSX.

In the case of the Company’s Stock Option Plan, amendments were last approved by Shareholders at the Annual General and Special Meeting of Shareholders held on June 3, 2022, which approval also included all unallocated Stock Options. Shareholders are being asked to approve such unallocated Stock Options at the Meeting.

Sandstorm Gold Ltd. 22 2025

Management Information Circular

Approval by Shareholders

As required by the TSX, an ordinary resolution will be placed before the Shareholders at the Meeting to approve the 2025 Stock Option Plan Amendments (excluding the General Housekeeping Amendments) which require Shareholder approval (the “Amendments Resolution”), as well as a separate second ordinary resolution to approve the unallocated Stock Options under the Stock Option Plan (the “Unallocated Options Resolution”). Shareholder approval to the Unallocated Options Resolution will be effective for three years from the date of the Meeting.

Assuming that the Shareholders and the TSX approve the conversion of the Stock Option Plan from a "rolling" plan to a "fixed maximum" plan with an Evergreen Feature, going forward the TSX will still require shareholder approval of unallocated Stock Options under the amended Stock Option Plan because the plan contains the Evergreen Feature.

With respect to the below Unallocated Options Resolution, if approval is not obtained at the Meeting, Stock Options which have not been allocated as of May 30, 2025, and Shares underlying Stock Options which are outstanding as at May 30, 2025 and are subsequently cancelled or terminated will not be available for the new grant of Stock Options under the Stock Option Plan. Previously allocated Stock Options will be unaffected by the approval or disapproval by the Shareholders of the Unallocated Options Resolution.

With respect to the Amendments Resolution, if approval is not obtained at the Meeting, the version of the Stock Option Plan which was in effect immediately prior to such 2025 Stock Option Plan Amendments shall continue in full force and effect.

The Board and management consider the approval of the Amendments Resolution and the separate approval of the Unallocated Options Resolution to be appropriate and in the best interests of the Company.

Accordingly, unless otherwise indicated, the persons designated as proxyholders in the accompanying form of proxy will vote the Shares represented by such form of proxy, properly executed, FOR the approval of the Amendments Resolution and FOR the approval of the Unallocated Options Resolution.

The text of the ordinary resolution approving the Amendments Resolution is set forth below, subject to such amendments, variations or additions as may be approved at the Meeting.

“RESOLVED, with or without amendment, that subject to receipt of regulatory approval:

1those certain amendments to the Company's Stock Option Plan, which convert the Stock Option Plan from a "rolling" plan to a "fixed maximum" plan with an "evergreen" feature, all as disclosed in the blacklined copy of the Stock Option Plan attached as Schedule "A" to the Company’s Management Information Circular dated April 9, 2025, be and are hereby ratified and approved; and

2 any Director or officer of the Company be and is hereby authorized and directed, acting for, in the name of and on behalf of the Company, to execute or cause to be executed, under the corporate seal of the Company or otherwise, and to deliver or cause to be delivered, such other documents and instruments, and to do or cause to be done all such acts and things, as may in the opinion of such Director or officer of the Company be necessary

Sandstorm Gold Ltd. 23 2025

Management Information Circular

or desirable to carry out the intent of the foregoing resolution, including the filing of all necessary documents with regulatory authorities including the Toronto Stock Exchange.”

The text of the ordinary resolution approving the Unallocated Options Resolution is set forth below, subject to such amendments, variations or additions as may be approved at the Meeting.

RESOLVED, with or without amendment, that subject to receipt of regulatory approval:

1all unallocated Stock Options under the Stock Option Plan of the Company, as amended from time to time, are hereby approved and authorized and the Company is authorized to continue granting Stock Options as may be permitted under the Stock Option Plan until May 30, 2028, which is the date that is three years from the date upon which Shareholder approval is being sought; and

2any Director or officer of the Company be and is hereby authorized and directed, acting for, in the name of and on behalf of the Company, to execute or cause to be executed, under the corporate seal of the Company or otherwise, and to deliver or cause to be delivered, such other documents and instruments, and to do or cause to be done all such acts and things, as may in the opinion of such Director or officer of the Company be necessary or desirable to carry out the intent of the foregoing resolution, including the filing of all necessary documents with regulatory authorities including the Toronto Stock Exchange.”

Approval of Unallocated Restricted Share Rights under Restricted Share Plan

Background

The terms of the Restricted Share Plan and other disclosure related to the Restricted Share Plan which is required by the TSX is set forth in detail in this Circular under “SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS – Restricted Share Plan”.

Amendments to the Restricted Share Plan

The Corporate Governance & Nominating Committee and the full Board have recently reviewed the Restricted Share Plan and the Board approved certain housekeeping amendments to it on April 9, 2025 (the “2025 Restricted Share Plan Amendments”).

The 2025 Restricted Share Plan Amendments are disclosed in the blacklined copy of the Restricted Share Plan attached as Schedule "B" to this Circular. Pursuant to the terms of the Restricted Share Plan and the policies of the TSX, these housekeeping amendments DO NOT require approval by the Shareholders. Other than the 2025 Restricted Share Plan Amendments, all of the other provisions of the Restricted Share Plan shall remain unchanged and in full force and effect. The Board has approved the 2025 Restricted Share Plan Amendments.

The Restricted Share Plan was transitioned into a fixed maximum evergreen plan in 2019. The evergreen feature of the Restricted Share Plan means that the maximum number of Shares reserved for issuance

Sandstorm Gold Ltd. 24 2025

Management Information Circular

from treasury under the Restricted Share Plan is automatically replenished by that amount of Shares which is equal to the number of Shares issued by the Company from time to time upon the vesting of any Restricted Share Rights ("Restricted Share Rights" or "RSRs"). The adoption of this Automatic Replenishment Feature in the Restricted Share Plan in 2019 made the Restricted Share Plan a fixed maximum evergreen plan under the policies of the TSX, requiring that the Shareholders approve the unallocated Restricted Share Rights under the Restricted Share Plan at least once every three years thereafter (i.e. by not later than June 3, 2025).

The Restricted Share Plan was last approved by Shareholders at the Annual and Special Meeting of Shareholders held on June 7, 2019, including all unallocated Restricted Share Rights. The Shareholders last approved solely unallocated Restricted Share Rights at the Annual and Special Shareholder meeting held on June 3, 2022.

As required by the TSX, an ordinary resolution will be placed before the Shareholders at the Meeting to approve the unallocated Restricted Share Rights under the Restricted Share Plan (“Unallocated RSRs Resolution”). This Shareholder approval will be effective for three years from the date of the Meeting.

Approval by Shareholders

If approval is not obtained at the Meeting, Restricted Share Rights which have not been allocated as of May 30, 2025, and Shares underlying Restricted Share Rights which are outstanding as at May 30, 2025 and are subsequently cancelled or terminated, will not be available for the new award of Restricted Share Rights under the Restricted Share Plan. Previously allocated Restricted Share Rights will be unaffected by the approval or disapproval by the Shareholders of the Unallocated RSRs Resolution.

The Board and management consider the approval of the Unallocated RSRs Resolution to be appropriate and in the best interests of the Company.

Accordingly, unless otherwise indicated, the persons designated as proxyholders in the accompanying form of proxy will vote the Shares represented by such form of proxy, properly executed, FOR the approval of the Unallocated RSRs Resolution.

The text of the ordinary resolution approving the Unallocated RSRs Resolution is set forth below, subject to such amendments, variations or additions as may be approved at the Meeting.

“RESOLVED, with or without amendment, that subject to receipt of regulatory approval:

1all unallocated Restricted Share Rights under the Restricted Share Plan of the Company, as amended from time to time, are hereby approved and authorized and the Company is authorized to continue awarding Restricted Share Rights under the Restricted Share Plan until May 30, 2028, which is the date that is three years from the date upon which Shareholder approval is being sought; and

2any Director or officer of the Company be and is hereby authorized and directed, acting for, in the name of and on behalf of the Company, to execute or cause to be executed, under the corporate seal of the Company or otherwise, and to deliver or cause to be delivered, such other documents and instruments, and to do or cause to be done all such acts and things, as may in the opinion of such Director or officer of the Company be necessary or desirable to carry out the intent of the foregoing resolution, including the filing of all necessary documents with regulatory authorities including the Toronto Stock Exchange.”

Sandstorm Gold Ltd. 25 2025

Management Information Circular

Approval of New Performance Share Plan and 2024 Performance Share Rights Awards

Background

At a meeting of the Compensation Committee held on November 14, 2024, the Compensation Committee approved a form of Performance Share Plan and they recommended the adoption of this new Performance Share Plan to the Board. At a meeting held on December 12, 2024, the Board approved the Performance Share Plan, subject to both Shareholder approval and approval by the TSX.

Please also see "Compensation Committee - Independent Compensation Advisor" in this Circular.

The Performance Share Plan provides a framework for the issuance of Performance Share Rights by the Company ("Performance Share Rights" or "PSRs").

Pursuant to this new Performance Share Plan, the Board may, from time to time and subject to the restrictions laid out in the Performance Share Plan, grant Performance Share Rights to "Eligible Employees" (as defined in the Performance Share Plan) entitling such Eligible Employees to acquire up to an aggregate maximum of 4,400,000 Shares.

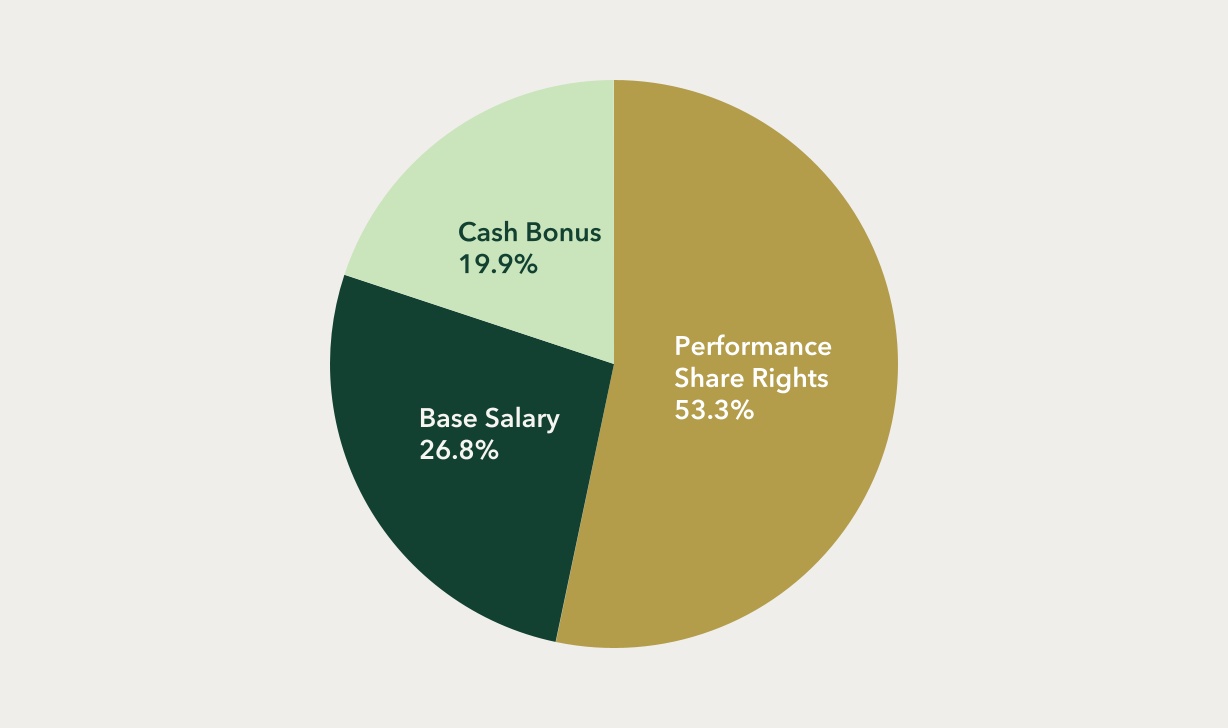

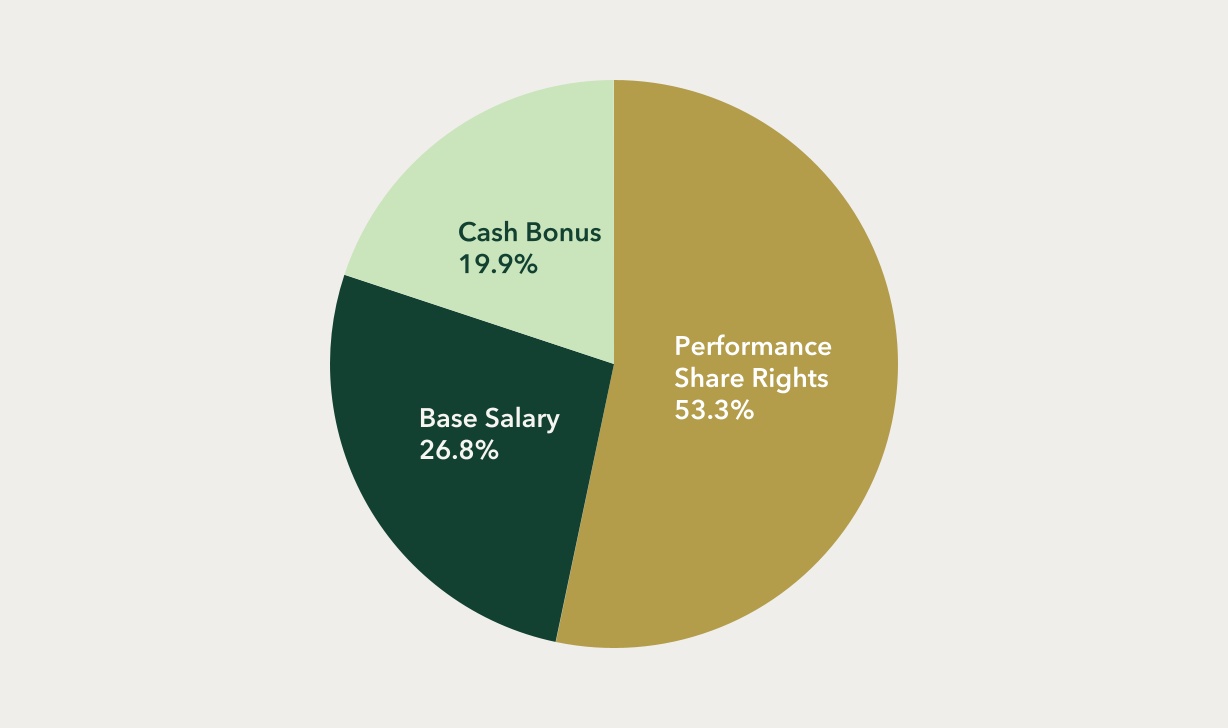

The award of Performance Share Rights is a new variable and discretionary component of compensation intended to reward the Company’s executives for accretively growing the Company and increasing the value of the Shares. Awards of Performance Share Rights seek to align the interests of management with the interests of Shareholders.

All Performance Share Rights awarded will cliff-vest after three years and the number of Shares which will be issued by the Company to each executive for each Performance Share Right held will be based upon the Company's performance during that three year performance period (the "Performance Period") against each of two benchmark groups. 50% of the Performance Share Rights granted will be tracked over the Performance Period relative to the first benchmark group and 50% of the Performance Share Rights granted will be tracked over the Performance Period relative to the second benchmark group. The first benchmark group will be comprised of seven publicly traded North American royalty companies selected by the Board as of the date of grant of Performance Share Rights, and the second benchmark group will be the GDX.

The GDX is an exchange traded fund ("ETF") and is the ticker symbol for the VanEck Vectors Gold Miners ETF, which is designed to provide investors with exposure to the gold mining industry by holding a basket of stocks of companies involved in gold mining (the "GDX"). An ETF is a type of investment fund that is traded on an exchange, like a stock, and can be bought and sold throughout a trading day.

At the end of the Performance Period, a calculation will be completed in order to determine the cumulative "under" or "out performance" of the Share price relative to each of the two selected benchmark groups. The actual number of Performance Share Rights that will vest may range from 0% to 200% of the number granted, subject to the satisfaction of these performance conditions.

Sandstorm Gold Ltd. 26 2025

Management Information Circular

The payout multiplier for each measure will be determined by the Board/Committee according to the performance criteria and may be zero if the Company does not achieve a specified level of threshold performance and will be capped at 200% for maximum performance. The extent to which each Performance Condition is met will be determined by the Board/Committee, subject to any applicable adjustments as may be determined by the Board/Committee.

The below table illustrates the number of Performance Shares which would be issued to an Eligible Employee for each Performance Share Right held, based upon the Company’s performance during the Performance Period against each of the aforementioned two (2) benchmark groups:

| | | | | | | | | | | | | | |

Calculation Table for Performance Shares to be Received by the Eligible Employee on the Vesting Date (1) |

0 (i.e. zero) X one PSR held, if the Company's performance is: | 0.5 X one PSR held, if the Company's performance is: | 1.0 X one PSR held, if the Company's performance is: | 1.5 X one PSR held, if the Company's performance is: | 2.0 X one PSR held, if the Company's performance is: |

BELOW MINUS 20% (i.e. underperformance) | BELOW MINUS 10% - to - MINUS 20% |

0% to either MINUS 10% or PLUS 10% | GREATER THAN PLUS 10% - to - PLUS 20% | GREATER THAN PLUS 20% (i.e. outperformance) |

1.For example, if an Eligible Employee was originally granted 100 PSRs on the Grant Date, then 50 of such PSRs would be benchmarked against Group 1 and 50 of such PSRs would be benchmarked against Group 2. Using this example, at the end of the Performance Period, if the Company had cumulatively outperformed Group 1 (i.e. the royalty company group) by 5%, but had underperformed Group 2 (i.e. the GDX) by 15%, then the number of Performance Shares to be issued to the Eligible Employee on the Vesting Date would be 75 (i.e. 50 x 1.0 for the Group 1 benchmark and 50 x 0.5 for the Group 2 benchmark).

Accordingly, actual vesting will range from 0% to 200% of the original number of Performance Share Rights granted to the Eligible Employee, based upon the foregoing parameters and specified performance benchmarks must be achieved in order for any performance-based share compensation to vest.

The Performance Period begins on the date of grant and ends on the third anniversary of the grant date of Performance Share Rights. For greater certainty, all Performance Share Rights granted under the Performance Share Plan to an Eligible Employee will vest on the first business day following that day which is the third anniversary of the Grant Date.

Assuming that the required Shareholder and TSX approval is granted for the Performance Share Plan, going forward, the Compensation Committee will consider, and review proposed awards of Performance Share Rights as part of its overall assessment of the Company and individual executive performance.

Together, the introduction of the Performance Share Plan and the proposed conversion of the Stock Option Plan from a "rolling" plan into a "fixed maximum" plan as discussed above in this Circular reflect the increased importance and weighting of Restricted Share Rights and/or Performance Share Rights and a decreased reliance by the Company on Stock Options as long-term incentives in the Company's compensation program.

A copy of the Performance Share Plan is attached as Schedule "C" to this Circular.

Sandstorm Gold Ltd. 27 2025

Management Information Circular

Performance Share Rights Awards

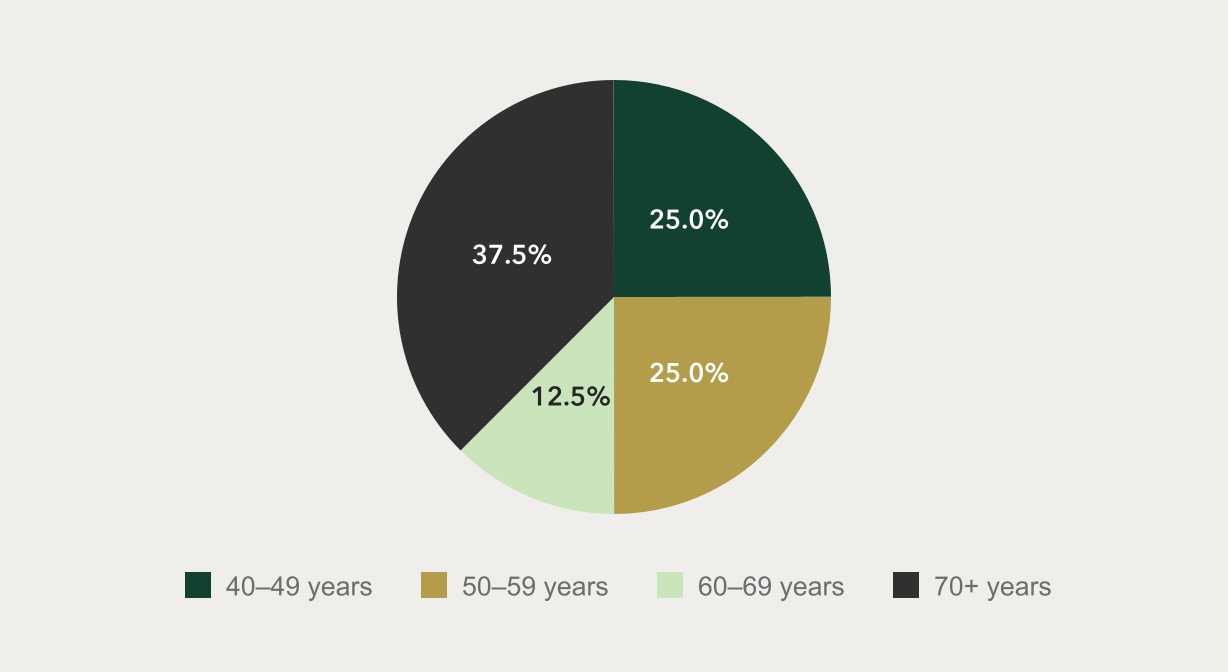

On December 12, 2024, the Board, on the recommendation of the Compensation Committee, awarded an aggregate of 550,000 Performance Share Rights to the Company's five NEOs and an aggregate of 64,500 Performance Share Rights to seven of the Company's employees, for a total grant of 614,500 Performance Share Rights awarded in 2024 (the "2024 Performance Share Rights Awards").

Because the Performance Share Plan had not as yet received either TSX or Shareholder approval as of the date of grant of these 614,500 Performance Share Rights, the TSX requires that the Company also seek Shareholder approval for these awards at the Meeting. The outstanding 614,500 Performance Share Rights represents 0.2% of the issued Shares as of December 31, 2024.

In the event that the Shareholders do not approve the Performance Share Plan at the Meeting, all Performance Share Rights awarded by the Company on December 12, 2024 will be cancelled and the Compensation Committee will re-evaluate appropriate compensation.

The Performance Share Rights awarded in 2024 are as follows:

| | | | | | | | | | | |

| Name of NEO/Eligible Employee | Title of NEO/Eligible Employee | Number of PSRs Awarded 1 | PSR Award Value 2 (C$) |

| | | |

| Nolan Watson | President & Chief Executive Officer | 180,000 | $1,072,800 |

| David Awram | Sr. Executive Vice-President | 100,000 | $596,000 |

| Erfan Kazemi | Chief Financial Officer | 100,000 | $596,000 |

| Ian Grundy | Executive Vice-President, Corporate Development | 100,000 | $596,000 |

| Tom Bruington | Executive Vice-President, Project Evaluation | 70,000 | $417,200 |

| Non-NEO Employees (7) | Internal Executives | 64,500 | $384,420 |

| Total Awards | 614,500 | |

1.These Performance Share Rights have a three year Performance Period, which commenced December 12, 2024.

2.Calculated using the Monte Carlo simulation model as the methodology to calculate the award date fair value of each PSR as of December 12, 2024 (C$5.96 or ~ $4.14 per PSR) and relied on the following key assumptions and estimates for the 2024 PSR calculations: grant date Share price of C$8.09; expected stock price volatility of 38.0%; risk free interest rate of 4.09%; and expected life of PSRs of three years. The Company chose this methodology as it is the standard for companies in Canada.

Approval by Shareholders

At the Meeting, Shareholders will be asked to consider and, if deemed appropriate, to pass, with or without variation, an ordinary resolution, in the form set out below, subject to such amendments variations or additions as may be approved at the Meeting, approving the adoption of the Performance Share Plan and approving the 2024 Performance Share Rights Awards.

This ordinary resolution must be approved by a simple majority of the votes cast at the Meeting in accordance with the rules and policies of the TSX.

The Board and management consider the approval of the Performance Share Plan and the 2024 Performance Share Rights Awards to be appropriate and in the best interests of the Company.

Sandstorm Gold Ltd. 28 2025

Management Information Circular

Accordingly, unless otherwise indicated, the persons designated as proxyholders in the accompanying form of proxy will vote the Shares represented by such form of proxy, properly executed, FOR the approval of the Performance Share Plan and the 2024 Performance Share Rights Awards.

The text of the ordinary resolution approving the Performance Share Plan and the 2024 Performance Share Rights Awards is set forth below, subject to such amendments, variations or additions as may be approved at the Meeting.

Sandstorm Gold Ltd. 29 2025

Management Information Circular

"RESOLVED, with or without amendment, that:

1 subject to receipt of the final approval of the Toronto Stock Exchange, the adoption of the Performance Share Plan by the Company, substantially in the form attached as Schedule "C" to the Information Circular of the Company dated April 9, 2025, pursuant to which the Board of Directors of the Company may, from time to time and subject to the restrictions laid out in the Performance Share Plan, grant Performance Share Rights to Eligible Employees under the Performance Share Plan, entitling such Eligible Employees to receive up to an aggregate maximum of 4,400,000 common shares of the Company, as fully paid and non-assessable, be and is hereby authorized and approved;

2 the award by the Company on December 12, 2024, of an aggregate of 550,000 Performance Share Rights to the Company's five NEOs and an aggregate of 64,600 Performance Share Rights to seven of the Company's employees, for a total grant of 614,500 Performance Share Rights awarded in 2024, all as disclosed in the Company’s Management Information Circular dated April 9, 2025, be and is hereby ratified and approved; and

3 any Director or officer of the Company be and is hereby authorized and directed, acting for, in the name of and on behalf of the Company, to execute or cause to be executed, under the corporate seal of the Company or otherwise, and to deliver or cause to be delivered, such other documents and instruments, and to do or cause to be done all such acts and things, as may in the opinion of such Director or officer of the Company be necessary or desirable to carry out the intent of the foregoing resolution, including the filing of all necessary documents with regulatory authorities including the Toronto Stock Exchange.”

Special Matters

Say on Pay Advisory Vote

The Company’s new internal policy relating to executive compensation, known as “Say on Pay”, gives Shareholders a formal opportunity to provide their views on the executive compensation plans of the Company through an annual advisory vote.

"Say on Pay" is a non-binding advisory resolution to accept the Company's approach to executive compensation. The purpose of the "Say on Pay" advisory vote is to give Shareholders a formal opportunity to provide their views on the executive compensation plans of the Company. The advisory vote is non-binding on the Company and it remains the duty of the Board to develop and implement appropriate executive compensation policies for the Company and the Board will take the voting results into account when considering the executive compensation plans and policies of the Company for future periods.

In the event that a significant number of Shareholders oppose the resolution, the Board will endeavour to consult with its Shareholders as appropriate (particularly those who are known to have voted against it) to understand their concerns and will review the Company’s approach to compensation in the context of those concerns.

Sandstorm Gold Ltd. 30 2025

Management Information Circular

The Board will consider disclosing to Shareholders as soon as is practicable, and no later than in the management information circular for its next annual shareholder meeting, a summary of any comments received from Shareholders in the engagement process and any changes to the compensation plans made or to be made by the Board (or why no changes will be made).

The Board believes that it is important to have constructive engagement with its Shareholders to allow and encourage Shareholders to express their views on governance matters directly to the Board outside of the Meeting. These discussions are intended to be an interchange of views about governance and disclosure matters that are within the public domain and will not include a discussion of undisclosed material facts or material changes.

At the Meeting, the Shareholders will be asked to consider this non-binding advisory resolution on executive compensation, known as “Say on Pay”. The Board and management recommend the adoption of the "Say on Pay" resolution. To be effective, the non-binding advisory resolution on executive compensation must be approved by not less than a majority of the votes cast by the holders of Shares present in person, or represented by proxy, at the Meeting.

Accordingly, unless otherwise indicated, the persons designated as proxyholders in the accompanying form of proxy will vote the Shares represented by such form of proxy, properly executed, FOR such "Say on Pay" resolution.

The text of the "Say on Pay" ordinary resolution is set forth below, subject to such amendments, variations or additions as may be approved at the Meeting.

“RESOLVED, with or without amendment, THAT on an advisory basis, and not to diminish the role and responsibilities of the Board of Directors of the Company ("Board"), that the Shareholders accept the Board’s approach to executive compensation disclosed under the section entitled “Statement of Executive Compensation” as contained in Company’s Management Information Circular dated April 9, 2025, and delivered to Shareholders in advance of the Meeting.”

Other Matters

Management of the Company does not intend to introduce any other business at the Meeting and is not aware of any other matter to come before the Meeting other than as set forth in the Notice of Meeting. If any other business or amendments to the matters to be considered at the Meeting are properly brought before the Meeting, it is the intention of the persons named in the enclosed form of proxy to vote the Shares represented thereby in accordance with their best judgment on such matter.

Sandstorm Gold Ltd. 31 2025

Management Information Circular

General Proxy Information

Appointment of Proxyholder

The purpose of a proxy is to designate persons who will vote the proxy on behalf of a shareholder of the Company (a “Shareholder”) in accordance with the instructions given by the Shareholder in the proxy. The persons whose names are printed in the enclosed form of proxy are officers or Directors of the Company (the “Management Proxyholders”).

A Shareholder has the right to appoint a person other than a Management Proxyholder, to represent the Shareholder at the Meeting by striking out the names of the Management Proxyholders and by inserting the desired person’s name in the blank space provided or by executing a proxy in a form similar to the enclosed form. A proxyholder need not be a Shareholder.

Voting by Proxy

Only registered Shareholders (“Registered Shareholders”) or duly appointed proxyholders are permitted to vote at the Meeting. Shares (as hereinafter defined) represented by a properly executed proxy will be voted for or against or be withheld from voting on each matter referred to in the Notice of Meeting in accordance with the instructions of the Shareholder on any ballot that may be called for and if the Shareholder specifies a choice with respect to any matter to be acted upon, the Shares will be voted accordingly.

If a Shareholder does not specify a choice and the Shareholder has appointed one of the Management Proxyholders as proxyholder, the Management Proxyholder will vote in favour of the matters specified in the Notice of Meeting and in favour of all other matters proposed by management at the Meeting.

The enclosed form of proxy also gives discretionary authority to the person named therein as proxyholder with respect to amendments or variations to matters identified in the Notice of Meeting and with respect to other matters which may properly come before the Meeting. At the date of this Circular, management of the Company knows of no such amendments, variations or other matters to come before the Meeting.

Completion and Return of Proxy

Completed forms of proxy must be deposited at the office of the Company’s registrar and transfer agent, Computershare Investor Services Inc., Proxy Department, 100 University Avenue, P.O. Box 4572, Toronto, Ontario, M5J 2Y1, not later than forty-eight (48) hours, excluding Saturdays, Sundays and holidays, prior to the time of the Meeting, unless the chairman of the Meeting elects to exercise his discretion to accept proxies received subsequently.

Sandstorm Gold Ltd. 32 2025

Management Information Circular

Non-Registered Holders

Only Registered Shareholders or the persons they appoint as their proxies are permitted to vote at the Meeting. Registered Shareholders are holders whose names appear on the Share register of the Company and are not held in the name of a brokerage firm, bank or trust company through which they purchased Shares. Whether or not you are able to attend the Meeting, Shareholders are requested to vote their proxy in accordance with the instructions on the proxy. Most Shareholders are “non-registered” Shareholders (“Non-Registered Shareholders”) because the Shares they own are not registered in their names but are instead registered in the name of the brokerage firm, bank or trust company through which they purchased the Shares. Shares beneficially owned by a Non-Registered Shareholder are registered either: (i) in the name of an intermediary (an “Intermediary”) that the Non-Registered Shareholder deals with in respect of their shares (Intermediaries include, among others, banks, trust companies, securities dealers or brokers and trustees or administrators of self-administered RRSPs, RRIFs, RESPs and similar plans); or (ii) in the name of a clearing agency (such as The Canadian Depository for Securities Limited or The Depository Trust & Clearing Corporation) of which the Intermediary is a participant.

There are two kinds of beneficial owners: those who object to their name being made known to the issuers of securities which they own (called “OBOs” for Objecting Beneficial Owners) and those who do not object (called “NOBOs” for Non-Objecting Beneficial Owners).

Issuers can request and obtain a list of their NOBOs from Intermediaries via their transfer agents, pursuant to National Instrument 54-101— Communication with Beneficial Owners of Securities of a Reporting Issuer (“NI 54-101”) and issuers can use this NOBO list for distribution of proxy-related materials directly to NOBOs. The Company has decided to take advantage of those provisions of NI 54-101 that allow it to directly deliver proxy-related materials to its NOBOs. As a result, NOBOs can expect to receive a voting instruction form from the Company’s transfer agent, Computershare Investor Services Inc. (“Computershare”). These voting instruction forms are to be completed and returned to Computershare in the envelope provided or by facsimile. Computershare will tabulate the results of the voting instruction forms received from NOBOs and will provide appropriate instructions at the Meeting with respect to the Shares represented by voting instruction forms they receive. Alternatively, NOBOs may vote following the instructions on the voting instruction form, via the internet or by phone.