Year | Summary Compensation Table Total for Current PEO(1) | Summary Compensation Table Total for Former PEO(2) | Compensation Actually Paid to Current PEO(3) | Compensation Actually Paid to Former PEO(3) | Average Summary Compensation Table Total for Non-PEO Named Executive Officers(4) | Average Compensation Actually Paid to Non-PEO Named Executive Officers(3) | Value of initial fixed $100 investment based on: | ||||||||||||||||||||||

Total Shareholder Return(5) | Peer Group Total Shareholder Return(6) | Net Income (Loss)(7)(8) | |||||||||||||||||||||||||||

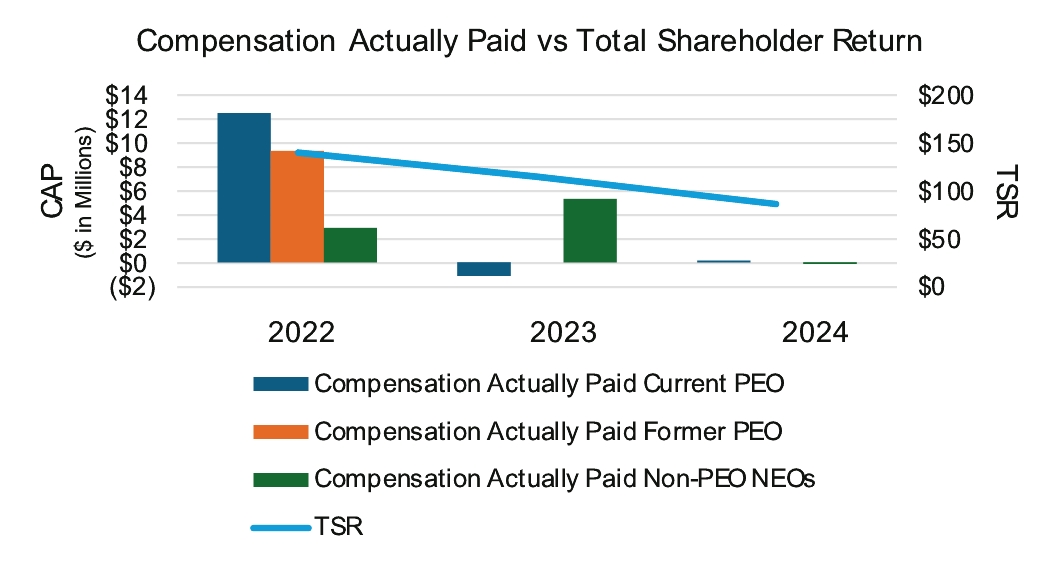

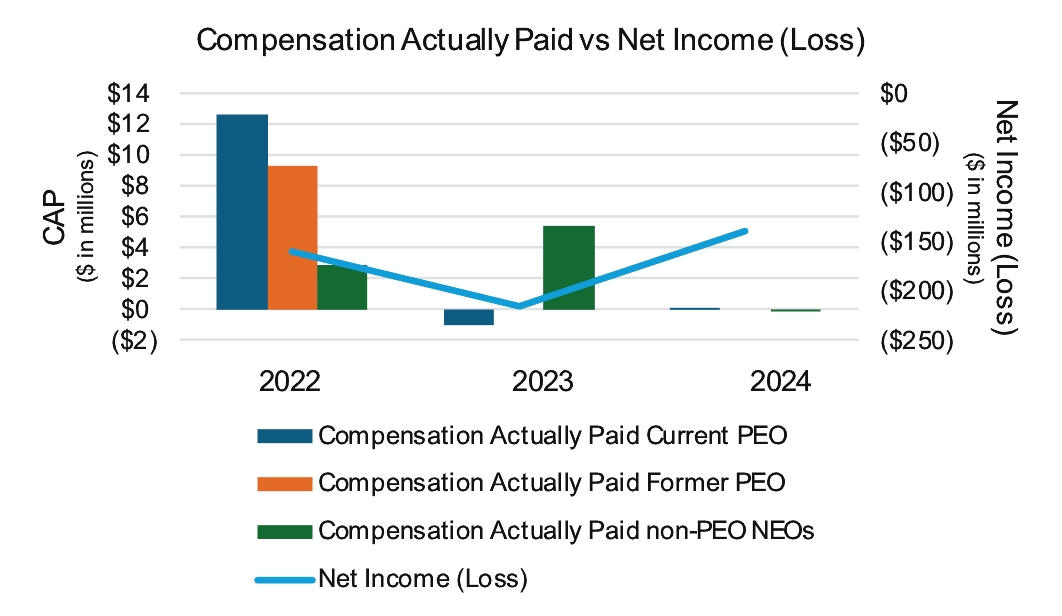

2024 | $1,995,245 | $— | $71,043 | $— | $1,494,211 | ($60,371) | $86.78 | $112.12 | ($140,181,000) | ||||||||||||||||||||

2023 | $971,879 | $— | ($1,090,621) | $— | $7,030,149 | $5,371,399 | $115.86 | $118.61 | ($216,075,000) | ||||||||||||||||||||

2022 | $10,083,718 | $3,103,477 | $12,566,218 | $9,302,368 | $2,181,633 | $2,862,386 | $139.66 | $117.43 | ($160,221,000) | ||||||||||||||||||||

(1) | The dollar amounts reported for the current PEO are the amounts reported for our CEO, Mr. Melvin (the Company’s President and Chief Executive Officer since November 21, 2022), for each corresponding year in the “Total” column of the Fiscal Year 2024 Summary Compensation Table. |

(2) | The dollar amounts reported for the former PEO are the amounts reported for our former CEO, Mr. Friedland (the Company’s Executive Chairman) for each corresponding year in the “Total” column of the Summary Compensation Table of the Proxy Statement dated April 28, 2023. |

(3) | Deductions from, and additions to, total compensation in the Fiscal Year 2024 Summary Compensation Table (SCT) by year to calculate Compensation Actually Paid (“CAP”) include: |

PEO | Former PEO | Average Non- PEO NEOs | ||||||||||||||||||||||||

2024 | 2023 | 2022 | 2022 | 2024 | 2023 | 2022 | ||||||||||||||||||||

Summary Compensation Total | $1,995,245 | $971,879 | $10,083,718 | $3,103,477 | $1,494,211 | $7,030,149 | $2,181,633 | |||||||||||||||||||

Adjustments for Equity Awards | ||||||||||||||||||||||||||

Deduct: | Grant date values in SCT | ($999,904) | — | ($10,026,668) | ($3,103,477) | ($989,854) | ($6,362,084) | ($2,036,581) | ||||||||||||||||||

Add: | Year-end fair value of unvested awards granted in the current year | $551,538 | — | $12,509,168 | $3,962,783 | $480,587 | $4,703,334 | $2,717,334 | ||||||||||||||||||

Add: | Year-over-year difference of year-end fair values for unvested awards granted in prior years | ($1,110,837) | ($1,961,668) | — | $3,989,797 | ($853,182) | — | — | ||||||||||||||||||

Add: | Difference in fair values between prior year-end fair values and vest date fair values for awards granted in prior years and vested at prior year end or during current year | ($364,999) | ($100,832) | — | $1,349,788 | ($192,135) | — | — | ||||||||||||||||||

Total Adjustments for Equity Awards | ($1,924,202) | ($2,062,500) | $2,482,500 | $6,198,891 | ($1,554,584) | ($1,658,749) | $680,753 | |||||||||||||||||||

Compensation Actually Paid | $71,043 | ($1,090,621) | $12,566,218 | $9,302,368 | ($60,371) | $5,371,399 | $2,862,386 | |||||||||||||||||||

(4) | The dollar amounts reported for the non- PEO Named Executive Officers for 2024 are the average of the amounts reported for the other NEOs, Jordan Neeser, Robert Friedland, Quentin Markin and Cassandra Joseph, for the corresponding year in the “Total” column of the Fiscal Year 2024 Summary Compensation Table for 2024, the amounts reported for the non- PEO Named Executive Officers for 2023 are the average of the amounts reported for the other NEOs, Quentin Markin and Cassandra Joseph, for the corresponding year in the “Total” column of the Summary Compensation Table of the Proxy Statement dated April 24, 2023, and the amounts reported for 2022 are the amounts reported for the other NEOs, Jordan Neeser and Glen Kuntz, in the “Total” column of the Summary Compensation Table of the Proxy Statement dated April 28, 2023. |

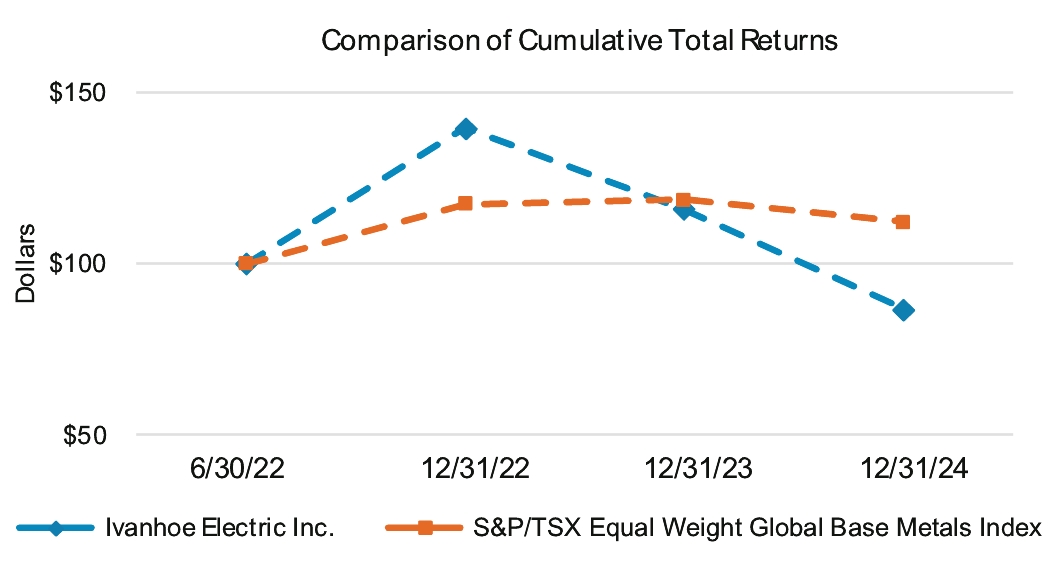

(5) | Total Shareholder Return assumes the investment of $100 in our common stock beginning on June 30, 2022, which is when our common stock began trading |

(6) | Peer group return is based on the S&P/TSX Equal Weight Global Base Metals Index. |

(7) | The Company’s net loss is reflected in the Company’s audited financial statements. |

(8) | For 2024, the Company did not use any financial reporting measures to link compensation actually paid to the Company’s NEOs for fiscal year 2024 to company performance. As discussed under “Compensation Discussion & Analysis-Short Term Incentive Awards,” the Company focused on health, safety and the environment; operational performance; and corporate development in linking compensation to company performance for 2024. |

(1) | The dollar amounts reported for the current PEO are the amounts reported for our CEO, Mr. Melvin (the Company’s President and Chief Executive Officer since November 21, 2022), for each corresponding year in the “Total” column of the Fiscal Year 2024 Summary Compensation Table. |

(2) | The dollar amounts reported for the former PEO are the amounts reported for our former CEO, Mr. Friedland (the Company’s Executive Chairman) for each corresponding year in the “Total” column of the Summary Compensation Table of the Proxy Statement dated April 28, 2023. |

(4) | The dollar amounts reported for the non- PEO Named Executive Officers for 2024 are the average of the amounts reported for the other NEOs, Jordan Neeser, Robert Friedland, Quentin Markin and Cassandra Joseph, for the corresponding year in the “Total” column of the Fiscal Year 2024 Summary Compensation Table for 2024, the amounts reported for the non- PEO Named Executive Officers for 2023 are the average of the amounts reported for the other NEOs, Quentin Markin and Cassandra Joseph, for the corresponding year in the “Total” column of the Summary Compensation Table of the Proxy Statement dated April 24, 2023, and the amounts reported for 2022 are the amounts reported for the other NEOs, Jordan Neeser and Glen Kuntz, in the “Total” column of the Summary Compensation Table of the Proxy Statement dated April 28, 2023. |

(6) | Peer group return is based on the S&P/TSX Equal Weight Global Base Metals Index. |

(3) | Deductions from, and additions to, total compensation in the Fiscal Year 2024 Summary Compensation Table (SCT) by year to calculate Compensation Actually Paid (“CAP”) include: |

PEO | Former PEO | Average Non- PEO NEOs | ||||||||||||||||||||||||

2024 | 2023 | 2022 | 2022 | 2024 | 2023 | 2022 | ||||||||||||||||||||

Summary Compensation Total | $1,995,245 | $971,879 | $10,083,718 | $3,103,477 | $1,494,211 | $7,030,149 | $2,181,633 | |||||||||||||||||||

Adjustments for Equity Awards | ||||||||||||||||||||||||||

Deduct: | Grant date values in SCT | ($999,904) | — | ($10,026,668) | ($3,103,477) | ($989,854) | ($6,362,084) | ($2,036,581) | ||||||||||||||||||

Add: | Year-end fair value of unvested awards granted in the current year | $551,538 | — | $12,509,168 | $3,962,783 | $480,587 | $4,703,334 | $2,717,334 | ||||||||||||||||||

Add: | Year-over-year difference of year-end fair values for unvested awards granted in prior years | ($1,110,837) | ($1,961,668) | — | $3,989,797 | ($853,182) | — | — | ||||||||||||||||||

Add: | Difference in fair values between prior year-end fair values and vest date fair values for awards granted in prior years and vested at prior year end or during current year | ($364,999) | ($100,832) | — | $1,349,788 | ($192,135) | — | — | ||||||||||||||||||

Total Adjustments for Equity Awards | ($1,924,202) | ($2,062,500) | $2,482,500 | $6,198,891 | ($1,554,584) | ($1,658,749) | $680,753 | |||||||||||||||||||

Compensation Actually Paid | $71,043 | ($1,090,621) | $12,566,218 | $9,302,368 | ($60,371) | $5,371,399 | $2,862,386 | |||||||||||||||||||

(3) | Deductions from, and additions to, total compensation in the Fiscal Year 2024 Summary Compensation Table (SCT) by year to calculate Compensation Actually Paid (“CAP”) include: |

PEO | Former PEO | Average Non- PEO NEOs | ||||||||||||||||||||||||

2024 | 2023 | 2022 | 2022 | 2024 | 2023 | 2022 | ||||||||||||||||||||

Summary Compensation Total | $1,995,245 | $971,879 | $10,083,718 | $3,103,477 | $1,494,211 | $7,030,149 | $2,181,633 | |||||||||||||||||||

Adjustments for Equity Awards | ||||||||||||||||||||||||||

Deduct: | Grant date values in SCT | ($999,904) | — | ($10,026,668) | ($3,103,477) | ($989,854) | ($6,362,084) | ($2,036,581) | ||||||||||||||||||

Add: | Year-end fair value of unvested awards granted in the current year | $551,538 | — | $12,509,168 | $3,962,783 | $480,587 | $4,703,334 | $2,717,334 | ||||||||||||||||||

Add: | Year-over-year difference of year-end fair values for unvested awards granted in prior years | ($1,110,837) | ($1,961,668) | — | $3,989,797 | ($853,182) | — | — | ||||||||||||||||||

Add: | Difference in fair values between prior year-end fair values and vest date fair values for awards granted in prior years and vested at prior year end or during current year | ($364,999) | ($100,832) | — | $1,349,788 | ($192,135) | — | — | ||||||||||||||||||

Total Adjustments for Equity Awards | ($1,924,202) | ($2,062,500) | $2,482,500 | $6,198,891 | ($1,554,584) | ($1,658,749) | $680,753 | |||||||||||||||||||

Compensation Actually Paid | $71,043 | ($1,090,621) | $12,566,218 | $9,302,368 | ($60,371) | $5,371,399 | $2,862,386 | |||||||||||||||||||