Year |

Summary Compensation Table Total for PEO – Wernikoff ($) (1) |

Summary Compensation Table Total for PEO – Stibel ($) (1) |

Compensation Actually Paid to PEO – Wernikoff ($) (2) |

Compensation Actually Paid to PEO – Stibel ($) (2) |

Average Summary Compensation Table Total For Non-PEO Named Executive Officers ($) (1) |

Average Compensation Actually Paid to Non-PEO Named Executive Officers ($) (2) |

Value of Initial Fixed $100 Investment Based On: |

Net Income (Loss) ($) (4) |

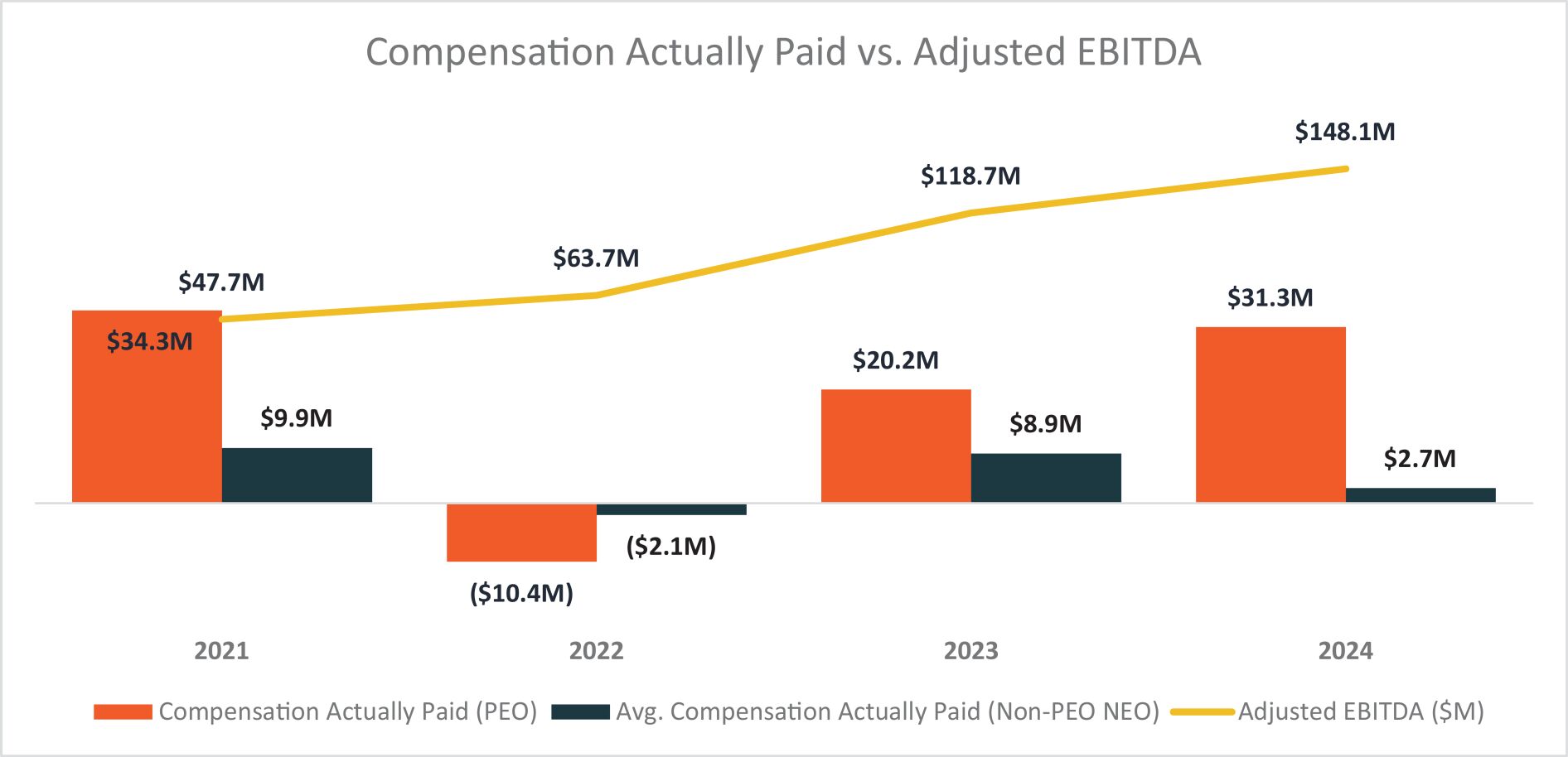

Adjusted EBITDA ($) (5) | |||||||||||

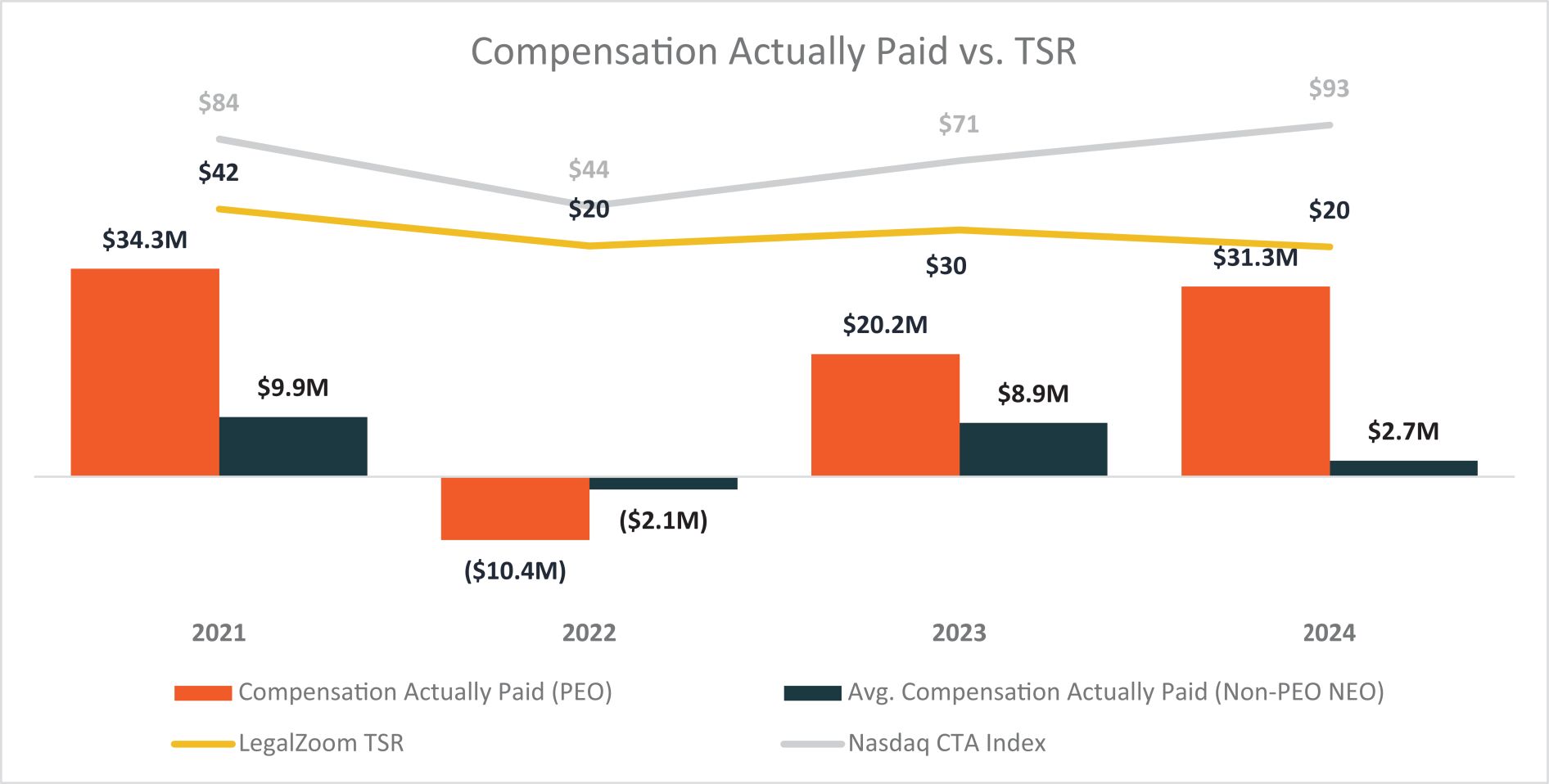

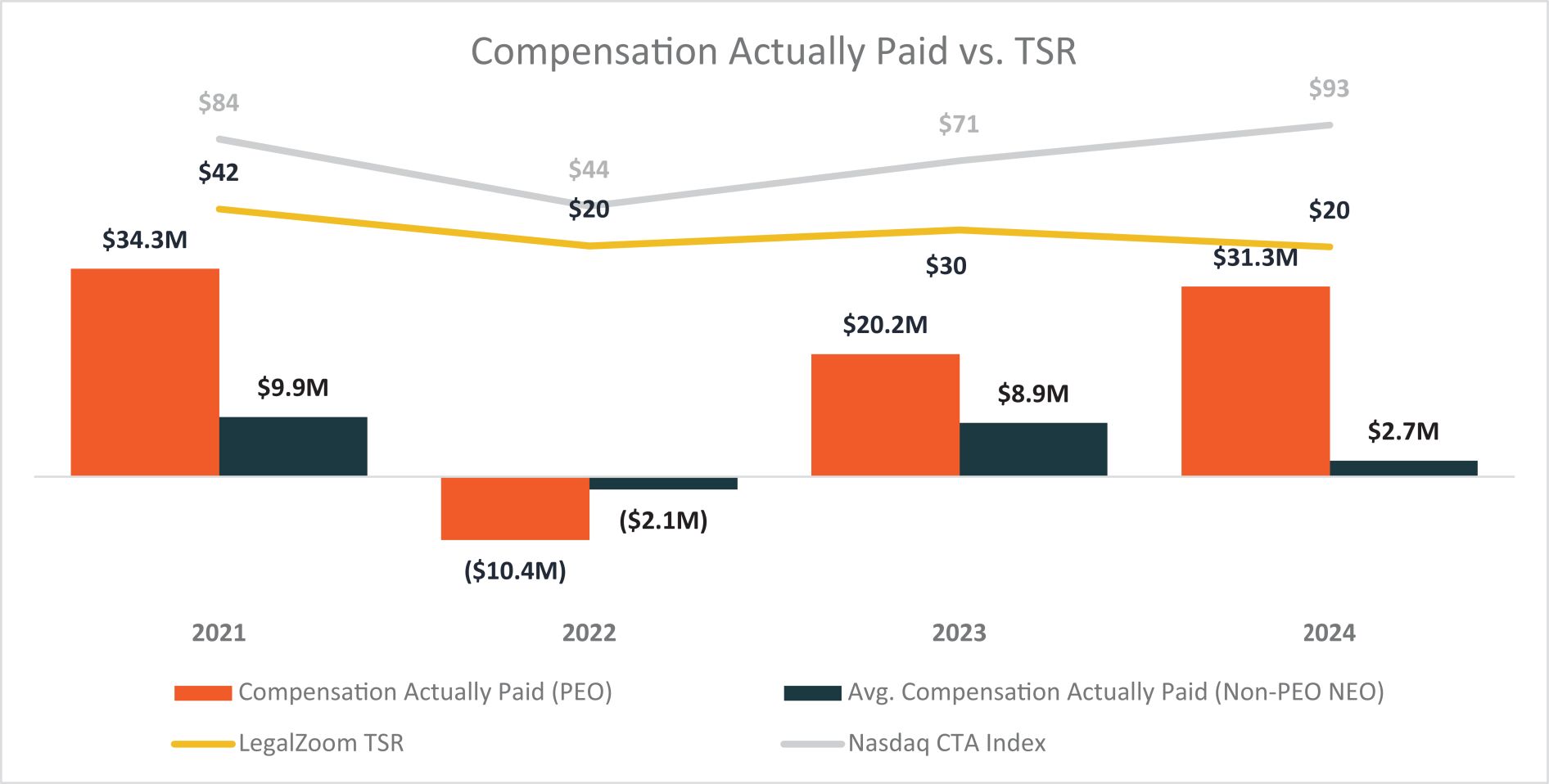

Total Shareholder Return ($) (3) |

Peer Group Total Shareholder Return ($) (3) | |||||||||||||||||||

2024 |

12,441,053 | 61,184,704 | (12,431,614) | 43,778,341 | 11,781,128 | 2,715,864 | 19.84 | 92.64 | 29,962,519 | 148,113,727 | ||||||||||

2023 |

15,952,976 | — | 20,239,579 | — | 6,480,194 | 8,875,106 | 29.85 | 71.27 | 13,953,160 | 118,691,151 | ||||||||||

2022 |

10,398,594 | — | (10,419,083) | — | 5,676,307 | (2,068,778) | 20.45 | 44.15 | (48,733,016) | 63,704,963 | ||||||||||

| (1) | For the fiscal years ended December 31, 2024, 2023 and 2022, our PEO and remaining non-PEO named executive officers were as set forth below. For 2024, Mr. Wernikoff served as PEO from January 1, 2024 to July 9, 2024 and Mr. Stibel served as PEO from July 9, 2024 to December 31, 2024. |

Year |

PEOs |

Non-PEO Named Executive Officers |

||||||

2024 |

Mr. Stibel and Mr. Wernikoff | Messrs. Watson, Preece and Radhakrishna and Ms. Miller | ||||||

2023 |

Mr. Wernikoff | Messrs. Watson, Preece and Radhakrishna and Ms. Miller | ||||||

2022 |

Mr. Wernikoff | Messrs. Watson, Preece and Radhakrishna and Ms. Miller | ||||||

| (2) | The following table reflects the adjustments used to calculate compensation actually paid from the summary compensation table amounts for 2024. The summary compensation table amounts and the compensation actually paid amounts do not reflect the actual amount of compensation earned by or paid to our executive officers during the applicable year, but rather are amounts determined in accordance with Item 402 of Regulation S-K under the Exchange Act. For information regarding the decisions made by our Compensation Committee in regards to our executive officers’ compensation for 2024, see the “Compensation Discussion and Analysis |

2024 | ||||||

PEO - Wernikoff |

PEO - Stibel |

Average for Non- PEO Named Executive Officers | ||||

Total Reported in Summary Compensation Table |

12,441,053 |

61,184,704 |

11,781,128 | |||

(Minus): Reported SCT Value of Equity Awards (a) |

(11,237,638) | (60,700,819) | (11,126,042) | |||

Plus/(Minus): Equity Award Adjustments (b) |

(13,635,029) | 43,294,455 | 2,060,778 | |||

Compensation Actually Paid |

(12,431,614) | 43,778,341 | 2,715,864 | |||

| (a) | The amounts included in this column are the amounts reported in the “Stock Awards” and “Option Awards” columns of the Summary Compensation Table for each applicable year. |

| (b) | The equity award adjustments for each applicable year were calculated in accordance with the methodology required by Item 402(v) of Regulation S-K. The amounts deducted or added in calculating the equity award adjustments are provided in the table below: |

Year End Fair Value of Outstanding and Unvested Awards Granted in the Year |

Year-Over-Year Change in Fair Value of Outstanding and Unvested Equity Awards Granted in Prior Years |

Fair Value at Vesting of Equity Awards Granted and Vested in the Fiscal Year |

Year-Over-Year Change in Fair Value of Equity Awards Granted in Prior Years That Vested During the Year |

Fair Value as of Prior Fiscal Year End of Equity Awards Granted in Prior Fiscal Years that Failed to Meet Vesting Conditions in the Fiscal Year |

Total Equity Award Adjustments | |||||||

PEO - Wernikoff |

— | — | 216,989 | (178,808) | (13,673,210) | (13,635,029) | ||||||

PEO - Stibel |

43,035,972 | — | 258,483 | — | — | 43,294,455 | ||||||

Non-PEO |

6,595,039 | (701,759) | 214,926 | (594,252) | (3,453,176) | 2,060,778 | ||||||

| (3) | Peer group total shareholder return reflects the Company’s peer group (Nasdaq CTA Internet Index) as reflected in our Annual Report on Form 10-K for the year ended December 31, 2024 and filed with the SEC on February 26, 2025. Each year reflects what the cumulative value of $100 would be, including the reinvestment of dividends, if such amount were invested on June 29, 2021, the date of our IPO. |

| (4) | Represents net income (loss) reported in our audited financial statements for the applicable year. |

| (5) | The Company’s most important financial performance measure is Adjusted EBITDA, a non-GAAP measure. Adjusted EBITDA is defined as set forth in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024, which was filed with the SEC on February 26, 2025. |

| (2) | The following table reflects the adjustments used to calculate compensation actually paid from the summary compensation table amounts for 2024. The summary compensation table amounts and the compensation actually paid amounts do not reflect the actual amount of compensation earned by or paid to our executive officers during the applicable year, but rather are amounts determined in accordance with Item 402 of Regulation S-K under the Exchange Act. For information regarding the decisions made by our Compensation Committee in regards to our executive officers’ compensation for 2024, see the “Compensation Discussion and Analysis |

2024 | ||||||

PEO - Wernikoff |

PEO - Stibel |

Average for Non- PEO Named Executive Officers | ||||

Total Reported in Summary Compensation Table |

12,441,053 |

61,184,704 |

11,781,128 | |||

(Minus): Reported SCT Value of Equity Awards (a) |

(11,237,638) | (60,700,819) | (11,126,042) | |||

Plus/(Minus): Equity Award Adjustments (b) |

(13,635,029) | 43,294,455 | 2,060,778 | |||

Compensation Actually Paid |

(12,431,614) | 43,778,341 | 2,715,864 | |||

| (a) | The amounts included in this column are the amounts reported in the “Stock Awards” and “Option Awards” columns of the Summary Compensation Table for each applicable year. |

| (b) | The equity award adjustments for each applicable year were calculated in accordance with the methodology required by Item 402(v) of Regulation S-K. The amounts deducted or added in calculating the equity award adjustments are provided in the table below: |

Year End Fair Value of Outstanding and Unvested Awards Granted in the Year |

Year-Over-Year Change in Fair Value of Outstanding and Unvested Equity Awards Granted in Prior Years |

Fair Value at Vesting of Equity Awards Granted and Vested in the Fiscal Year |

Year-Over-Year Change in Fair Value of Equity Awards Granted in Prior Years That Vested During the Year |

Fair Value as of Prior Fiscal Year End of Equity Awards Granted in Prior Fiscal Years that Failed to Meet Vesting Conditions in the Fiscal Year |

Total Equity Award Adjustments | |||||||

PEO - Wernikoff |

— | — | 216,989 | (178,808) | (13,673,210) | (13,635,029) | ||||||

PEO - Stibel |

43,035,972 | — | 258,483 | — | — | 43,294,455 | ||||||

Non-PEO |

6,595,039 | (701,759) | 214,926 | (594,252) | (3,453,176) | 2,060,778 | ||||||

| (2) | The following table reflects the adjustments used to calculate compensation actually paid from the summary compensation table amounts for 2024. The summary compensation table amounts and the compensation actually paid amounts do not reflect the actual amount of compensation earned by or paid to our executive officers during the applicable year, but rather are amounts determined in accordance with Item 402 of Regulation S-K under the Exchange Act. For information regarding the decisions made by our Compensation Committee in regards to our executive officers’ compensation for 2024, see the “Compensation Discussion and Analysis |

2024 | ||||||

PEO - Wernikoff |

PEO - Stibel |

Average for Non- PEO Named Executive Officers | ||||

Total Reported in Summary Compensation Table |

12,441,053 |

61,184,704 |

11,781,128 | |||

(Minus): Reported SCT Value of Equity Awards (a) |

(11,237,638) | (60,700,819) | (11,126,042) | |||

Plus/(Minus): Equity Award Adjustments (b) |

(13,635,029) | 43,294,455 | 2,060,778 | |||

Compensation Actually Paid |

(12,431,614) | 43,778,341 | 2,715,864 | |||

| (a) | The amounts included in this column are the amounts reported in the “Stock Awards” and “Option Awards” columns of the Summary Compensation Table for each applicable year. |

| (b) | The equity award adjustments for each applicable year were calculated in accordance with the methodology required by Item 402(v) of Regulation S-K. The amounts deducted or added in calculating the equity award adjustments are provided in the table below: |

Year End Fair Value of Outstanding and Unvested Awards Granted in the Year |

Year-Over-Year Change in Fair Value of Outstanding and Unvested Equity Awards Granted in Prior Years |

Fair Value at Vesting of Equity Awards Granted and Vested in the Fiscal Year |

Year-Over-Year Change in Fair Value of Equity Awards Granted in Prior Years That Vested During the Year |

Fair Value as of Prior Fiscal Year End of Equity Awards Granted in Prior Fiscal Years that Failed to Meet Vesting Conditions in the Fiscal Year |

Total Equity Award Adjustments | |||||||

PEO - Wernikoff |

— | — | 216,989 | (178,808) | (13,673,210) | (13,635,029) | ||||||

PEO - Stibel |

43,035,972 | — | 258,483 | — | — | 43,294,455 | ||||||

Non-PEO |

6,595,039 | (701,759) | 214,926 | (594,252) | (3,453,176) | 2,060,778 | ||||||

Most Important Performance Measures |

Adjusted EBITDA Revenue |