FIRST QUARTER SUMMARY FINANCIALS | ||||||||||||||

| Moody’s Corporation (MCO) Revenue | Moody’s Analytics (MA) Revenue | Moody’s Investors Service (MIS) Revenue | ||||||||||||

1Q 2025 | 1Q 2025 | 1Q 2025 | ||||||||||||

$1.9 billion ⇑ 8% | $859 million ⇑ 8% | $1.1 billion ⇑ 8% | ||||||||||||

| MCO Diluted EPS | MCO Adjusted Diluted EPS1 | MCO FY 2025 Projected2 | ||||||||||||

1Q 2025 | 1Q 2025 | Diluted EPS | ||||||||||||

$3.46 ⇑ 10% | $3.83 ⇑ 14% | $12.00 to $12.75 | ||||||||||||

Adjusted Diluted EPS1 | ||||||||||||||

$13.25 to $14.00 | ||||||||||||||

“Moody’s delivered a very strong quarter across both our businesses, including a record quarter for our Ratings franchise. It is in times of uncertainty when the clarity and transparency we provide matter the most. Though we are facing a period of increased volatility, we run our business across market cycles, harnessing the strength and breadth of our portfolio to deliver value to our stakeholders over the long-term.” | |||||

| Rob Fauber President and Chief Executive Officer | |||||

“We are proud of Moody’s record first quarter results, with revenue of $1.9 billion up 8% year-on-year, on the back of solid growth in the first quarter of 2024. Considering market volatility, we are updating and widening our full year guidance range. We now expect to deliver Adjusted Diluted EPS1 between $13.25 to $14.002, representing 9% year-over-year growth at the mid-point. We believe our financial strength allows us to continue investing to meet the needs of our customers to help drive durable growth.” | |||||

| Noémie Heuland Chief Financial Officer | |||||

1 Refer to the tables at the end of this press release for reconciliations of adjusted measures to U.S. GAAP. 2 Guidance as of April 22, 2025. Refer to Table 12 - “2025 Outlook” for table of all items for which the Company provides guidance and page 7 for disclosure regarding the assumptions used by the Company with respect to its guidance. | |||||

| REVENUE | ||

| Moody’s Corporation (MCO) | ||

First Quarter 2025 | ||

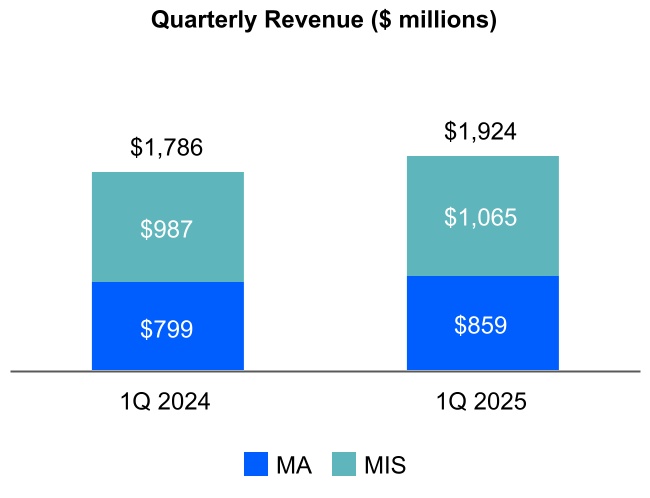

•MCO revenue was $1.9 billion, an 8% increase from the prior-year period. •Foreign currency translation unfavorably impacted MCO revenue by 1%. •Both MA and MIS revenue increased 8% from the prior-year period. | ||

| Moody’s Analytics (MA) | ||

First Quarter 2025 | ||

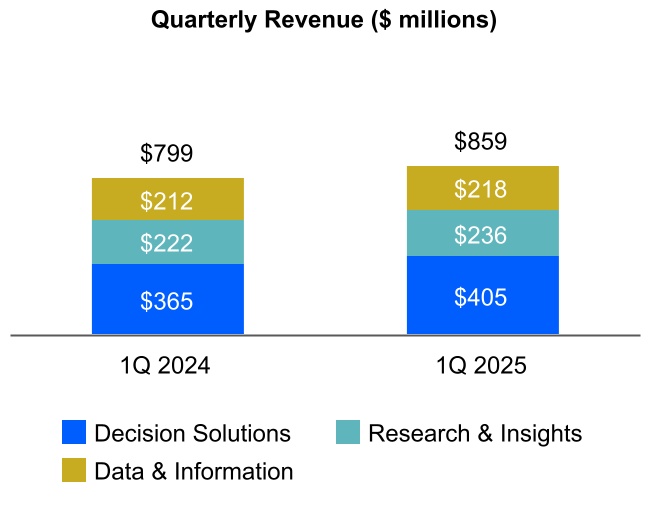

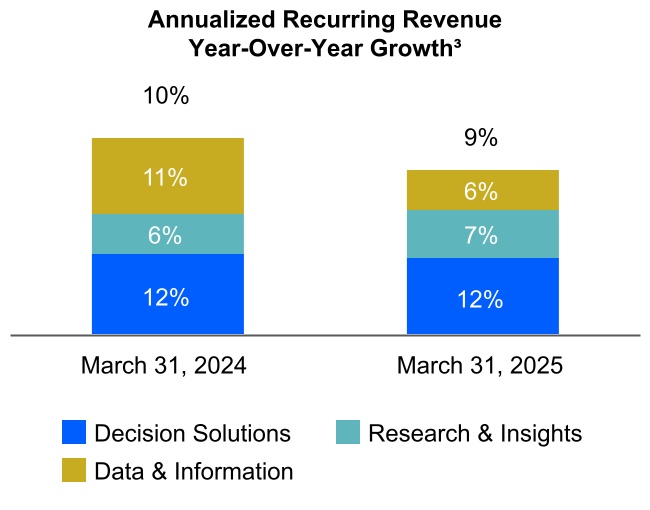

•Revenue grew 8% versus the prior-year period, including 11% growth in Decision Solutions, followed by Research and Insights growth of 6% and Data & Information with 3% growth. •Recurring revenue, comprising 96% of total MA revenue, grew 9% on both a reported and organic constant currency basis. •ARR3 of $3.3 billion increased by $260 million during the first quarter, representing 9% growth versus March 31, 2024. •Transaction revenue declined by 21%, reflecting MA’s ongoing strategic shift towards subscription-based solutions. •Foreign currency translation unfavorably impacted MA revenue by 1%. | ||

3 Refer to Table 10 at the end of this press release for the definition of and further information on the Annualized Recurring Revenue (ARR) metric. | |||||

| Moody’s Investors Service (MIS) | ||

First Quarter 2025 | ||

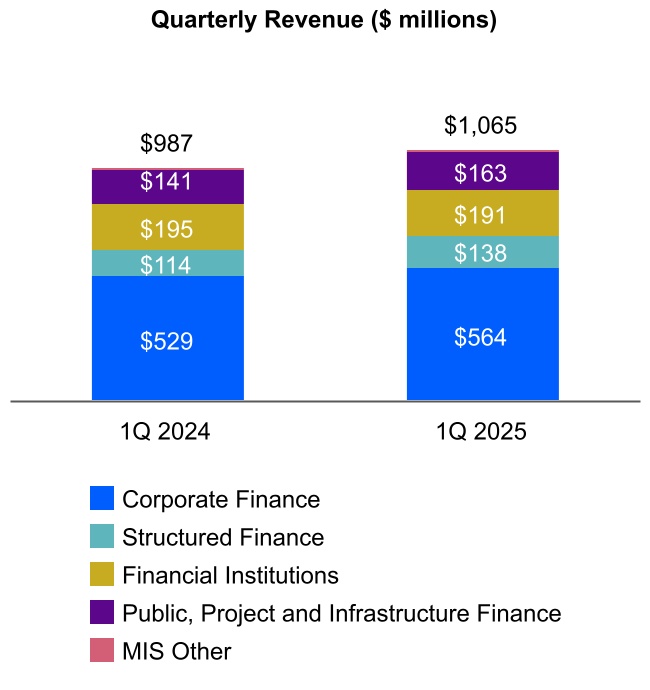

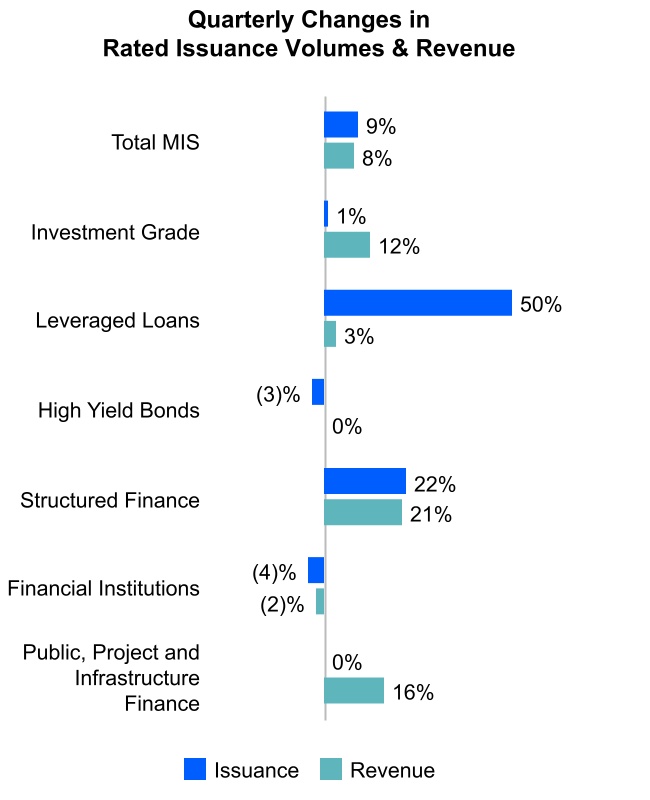

•Highest quarterly revenue on record, with $1.1 billion reflecting 8% growth compared to the prior-year period. •Corporate Finance revenue growth was primarily driven by Investment Grade issuers given strong demand for high-quality credits. •Transactional revenue grew 8% from the prior-year period. •Structured Finance revenue growth was driven by refinancing activity in CLOs and CMBS, given the attractive spread environment. •Financial Institutions revenue declined compared to the prior-year period, primarily due to a lower volume of infrequent Insurance issuance, partially offset by higher issuance activity within the Banking sector. •Foreign currency translation unfavorably impacted MIS revenue by 1%. | ||

| OPERATING EXPENSES AND MARGIN | ||

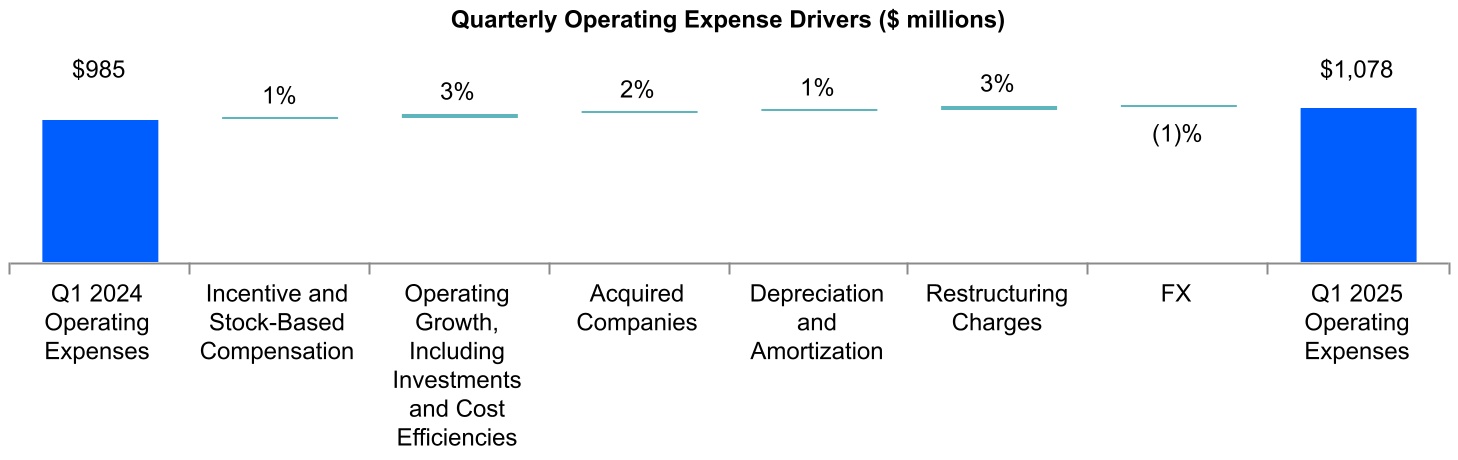

MCO Operating Expenses | ||

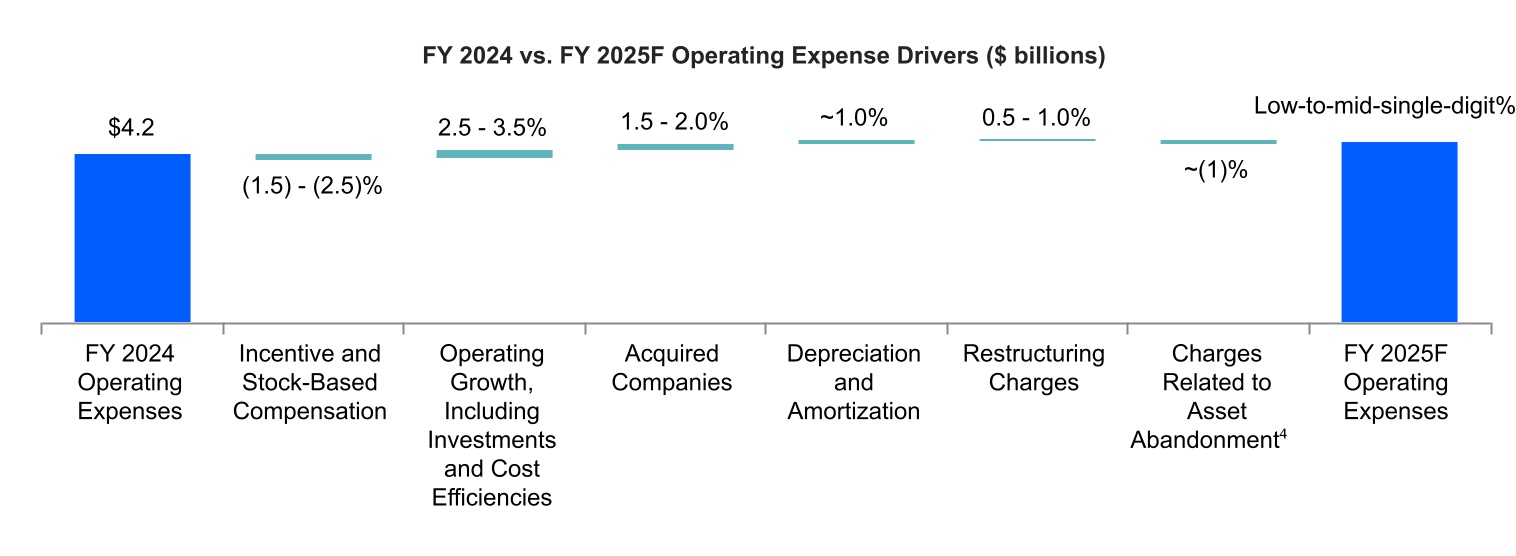

| First Quarter 2025 | Full Year 2025 Forecast2 | |||||||

•Operating expenses grew 9% compared to the prior-year period, including 3% from investments and operational costs, 3% from restructuring charges and 2% related to M&A. •Operating expenses include $33 million in charges related to the Strategic and Operational Efficiency Restructuring Program announced in Q4 2024. •Foreign currency favorably impacted operating expenses by 1%. | •Operating expenses projected to increase in the low-to-mid-single-digit percent range in 2025. •Operating expense growth primarily reflects annual compensation increases, organic investments and M&A, partially offset by the reset of incentive compensation accruals and savings associated with cost efficiencies. •Foreign currency translation expected to have an immaterial impact on operating growth. | |||||||

4 Refer to Table 5 - “Financial Information by Segment (Unaudited)” for more information regarding the “Charges Related to Asset Abandonment” category. | |||||

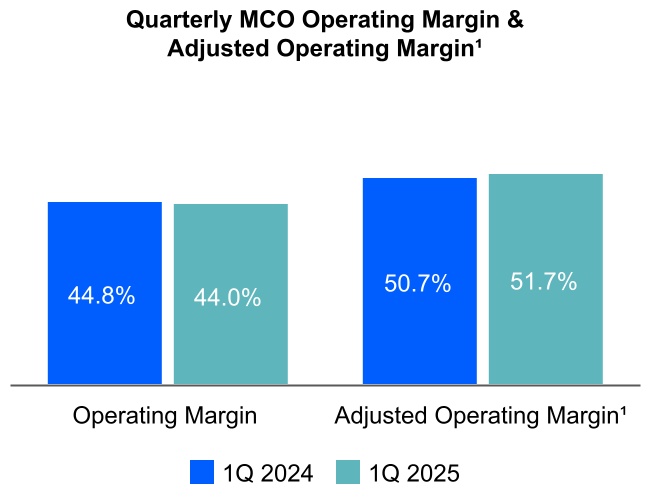

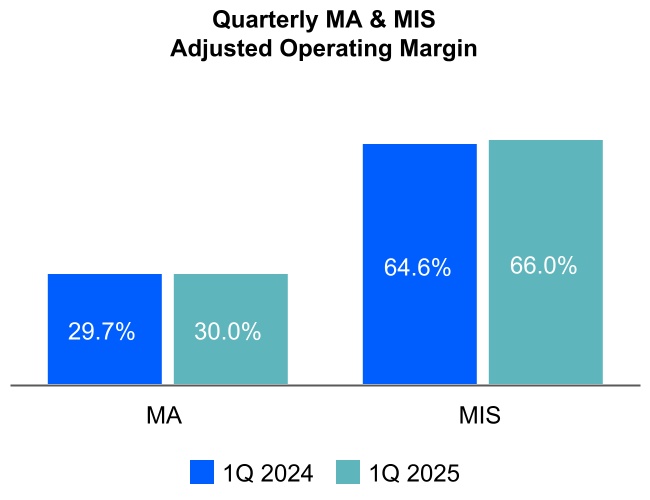

Operating Margin and Adjusted Operating Margin1 | ||

First Quarter 2025 | ||

•MCO’s operating margin was 44.0%. MCO’s adjusted operating margin1 was 51.7%, up 100 basis points from the prior-year period. •MA’s adjusted operating margin was 30.0%, up 30 basis points from the prior-year period, as we balance ongoing strategic investments and operating efficiency initiatives. •MIS’s adjusted operating margin was 66.0%, up 140 basis points from the prior-year period, demonstrating the operational leverage of the business and a disciplined approach to expense management. •Foreign currency translation had an immaterial impact on both operating and adjusted operating margins1. | ||

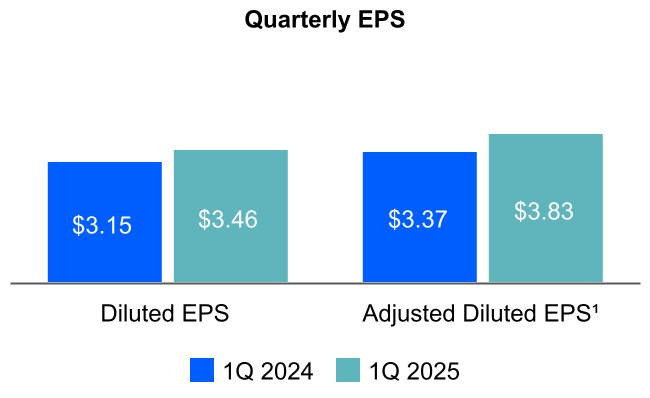

| EARNINGS PER SHARE (EPS) | ||

Diluted EPS and Adjusted Diluted EPS1 | ||

First Quarter 2025 | ||

•Diluted EPS and Adjusted Diluted EPS1 grew 10% and 14%, respectively, from the prior-year period, primarily attributable to an increase in net income derived from strong revenue growth across both segments. •The Effective Tax Rate (ETR) was 22.3%, lower than the 23.3% reported in the prior-year period, primarily due to the increase in excess tax benefits from stock-based compensation. | ||

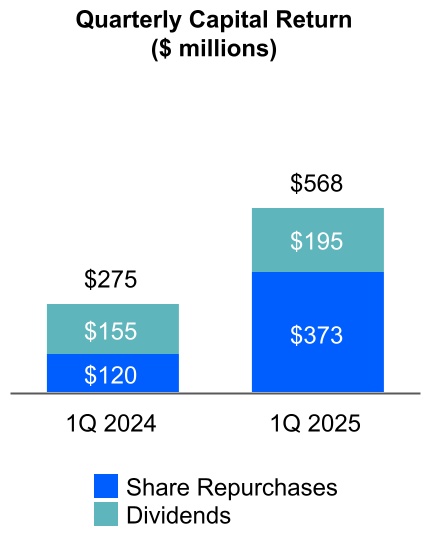

| CAPITAL ALLOCATION AND LIQUIDITY | ||

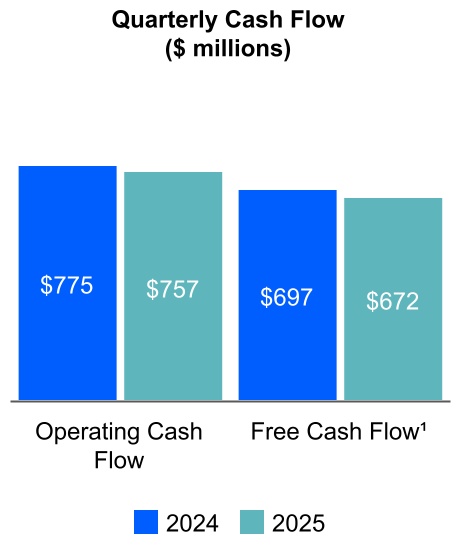

Capital Returned to Shareholders & Free Cash Flow1 | ||

•Cash flow from operations was $757 million and free cash flow1 was $672 million. •The decrease in both operating cash flow and free cash flow1 was primarily driven by higher incentive compensation payments versus the prior-year period. •On April 21, 2025, the Board of Directors declared a regular quarterly dividend of $0.94 per share of MCO Common Stock, an 11% increase from the prior year’s quarterly dividend of $0.85 per share. The dividend will be payable on June 6, 2025, to stockholders of record at the close of business on May 16, 2025. •During the first quarter of 2025, Moody’s repurchased 0.8 million shares at an average cost of $481.77 per share and issued net 0.4 million shares as part of its employee stock-based compensation programs. The net amount included shares withheld for employee payroll taxes. •As of March 31, 2025, Moody’s had 179.9 million shares outstanding, with approximately $1.2 billion of share repurchase authority remaining. There is no established expiration date for the remaining authorizations. •As of March 31, 2025, Moody's had $6.8 billion of outstanding debt and an undrawn $1.25 billion revolving credit facility. | ||

| ASSUMPTIONS AND OUTLOOK | ||

| Forecasted Item | Last Publicly Disclosed Assumption | Current Assumption | ||||||

U.S. GDP (1) growth | 1.5% - 2.5% | 0.0% - 1.0% | ||||||

Euro area GDP (1) growth | 0.5% - 1.5% | 0.0% - 1.0% | ||||||

Global GDP (1) growth | 2.0% - 3.0% | 1.0% - 2.0% | ||||||

| Global policy rates | To continue to normalize throughout 2025, including two cuts by the U.S. Fed | Expecting two cuts from the U.S. Fed in 2H25. Other Central Banks to maintain easing bias. | ||||||

| U.S. high yield spreads | To widen to around 430 bps by year-end, below historical average of around 500 bps | To widen to around 460 bps over the next 12 months, close to historical average of around 500 bps | ||||||

| U.S. inflation rate | To average around 2.0% - 2.5% | 3.5% - 4.5% | ||||||

| Euro area inflation rate | To average around 2.0% through 2025 | 2.0% - 2.5% | ||||||

| U.S. unemployment rate | To average around 4.2% - 4.5% over the next 12 months | 4.0% - 5.0% during 2025 | ||||||

| Global high yield default rate | To decline below 3.0% in 2025 | To decline to 3.1% by year-end | ||||||

| Global MIS rated issuance | Increase in the low-single-digit percent range | Decrease in the low-single-digit to high-single-digit percent range | ||||||

| GBP/USD exchange rate | $1.25 for the full year | $1.29 for the remainder of the year | ||||||

| EUR/USD exchange rate | $1.04 for the full year | $1.08 for the remainder of the year | ||||||

Note: All current assumptions are as of April 22, 2025. (1) GDP growth represents real GDP. | ||||||||

| TELECONFERENCE DETAILS | ||

| Date and Time | April 22, 2025, at 9:00 a.m. Eastern Time (ET). | |||||||

| Webcast | The webcast and its replay can be accessed through Moody’s Investor Relations website, ir.moodys.com, within “Events & Presentations.” | |||||||

| Dial In | U.S. and Canada | ‘+1-888-596-4144 | ||||||

Other callers | ‘+1-646-968-2525 | |||||||

| Passcode | 515 6491 | |||||||

| Dial In Replay | A replay will be available immediately after the call on April 22, 2025 and until April 29, 2025. | |||||||

U.S. and Canada | ‘+1-800-770-2030 | |||||||

Other callers | ‘+1-609-800-9909 | |||||||

| Passcode | 515 6491 | |||||||

| ABOUT MOODY’S CORPORATION | ||

| “SAFE HARBOR” STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 | ||

Three Months Ended March 31, | |||||||||||

| Amounts in millions, except per share amounts | 2025 | 2024 | |||||||||

| Revenue | $ | 1,924 | $ | 1,786 | |||||||

| Expenses: | |||||||||||

| Operating | 491 | 467 | |||||||||

Selling, general and administrative | 439 | 413 | |||||||||

| Depreciation and amortization | 113 | 100 | |||||||||

| Restructuring | 33 | 5 | |||||||||

| Charges related to asset abandonment | 2 | — | |||||||||

| Total expenses | 1,078 | 985 | |||||||||

| Operating income | 846 | 801 | |||||||||

| Non-operating (expense) income, net | |||||||||||

| Interest expense, net | (61) | (62) | |||||||||

Other non-operating income, net | 19 | 13 | |||||||||

| Total non-operating (expense) income, net | (42) | (49) | |||||||||

| Income before provision for income taxes | 804 | 752 | |||||||||

| Provision for income taxes | 179 | 175 | |||||||||

Net income attributable to Moody's | $ | 625 | $ | 577 | |||||||

| Earnings per share attributable to Moody's common shareholders | |||||||||||

| Basic | $ | 3.47 | $ | 3.16 | |||||||

| Diluted | $ | 3.46 | $ | 3.15 | |||||||

| Weighted average number of shares outstanding | |||||||||||

| Basic | 180.0 | 182.6 | |||||||||

| Diluted | 180.7 | 183.4 | |||||||||

| Amounts in millions | March 31, 2025 | December 31, 2024 | |||||||||

| ASSETS | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | 2,139 | $ | 2,408 | |||||||

| Short-term investments | 62 | 566 | |||||||||

Accounts receivable, net of allowance for credit losses of $34 in 2025 and $32 in 2024 | 1,850 | 1,801 | |||||||||

| Other current assets | 514 | 515 | |||||||||

| Total current assets | 4,565 | 5,290 | |||||||||

Property and equipment, net of accumulated depreciation of $1,511 in 2025 and $1,453 in 2024 | 671 | 656 | |||||||||

| Operating lease right-of-use assets | 217 | 216 | |||||||||

| Goodwill | 6,237 | 5,994 | |||||||||

| Intangible assets, net | 1,978 | 1,890 | |||||||||

| Deferred tax assets, net | 292 | 293 | |||||||||

| Other assets | 1,136 | 1,166 | |||||||||

| Total assets | $ | 15,096 | $ | 15,505 | |||||||

| LIABILITIES AND SHAREHOLDERS' EQUITY | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable and accrued liabilities | $ | 1,049 | $ | 1,344 | |||||||

| Current portion of operating lease liabilities | 103 | 102 | |||||||||

| Current portion of long-term debt | — | 697 | |||||||||

| Deferred revenue | 1,765 | 1,454 | |||||||||

| Total current liabilities | 2,917 | 3,597 | |||||||||

| Non-current portion of deferred revenue | 57 | 57 | |||||||||

| Long-term debt | 6,823 | 6,731 | |||||||||

| Deferred tax liabilities, net | 439 | 449 | |||||||||

| Uncertain tax positions | 218 | 211 | |||||||||

| Operating lease liabilities | 210 | 216 | |||||||||

| Other liabilities | 574 | 517 | |||||||||

| Total liabilities | 11,238 | 11,778 | |||||||||

| Total Moody's shareholders' equity | 3,700 | 3,565 | |||||||||

| Noncontrolling interests | 158 | 162 | |||||||||

| Total shareholders' equity | 3,858 | 3,727 | |||||||||

Total liabilities, noncontrolling interests and shareholders' equity | $ | 15,096 | $ | 15,505 | |||||||

| Three Months Ended March 31, | |||||||||||

| Amounts in millions | 2025 | 2024 | |||||||||

Cash flows from operating activities | |||||||||||

| Net income | $ | 625 | $ | 577 | |||||||

Reconciliation of net income to net cash provided by operating activities: | |||||||||||

| Depreciation and amortization | 113 | 100 | |||||||||

| Stock-based compensation | 56 | 53 | |||||||||

| Deferred income taxes | 18 | 25 | |||||||||

| Non-cash restructuring charges | 3 | — | |||||||||

Provision for credit losses on accounts receivable | 5 | 4 | |||||||||

Net changes in other operating assets and liabilities | (63) | 16 | |||||||||

| Net cash provided by operating activities | 757 | 775 | |||||||||

Cash flows from investing activities | |||||||||||

| Capital additions | (85) | (78) | |||||||||

| Purchases of investments | (41) | (50) | |||||||||

| Sales and maturities of investments | 551 | 46 | |||||||||

Purchases of investments in non-consolidated affiliates | (10) | (2) | |||||||||

| Receipts from settlement of net investment hedges | 32 | — | |||||||||

| Cash paid for acquisitions, net of cash acquired | (223) | (12) | |||||||||

| Net cash provided by (used in) investing activities | 224 | (96) | |||||||||

Cash flows from financing activities | |||||||||||

| Repayment of notes | (700) | — | |||||||||

Proceeds from stock-based compensation plans | 23 | 20 | |||||||||

Repurchase of shares related to stock-based compensation | (53) | (53) | |||||||||

Treasury shares | (373) | (120) | |||||||||

Dividends | (195) | (155) | |||||||||

| Net cash used in financing activities | (1,298) | (308) | |||||||||

Effect of exchange rate changes on cash and cash equivalents | 48 | (25) | |||||||||

| (Decrease) increase in cash and cash equivalents | (269) | 346 | |||||||||

Cash and cash equivalents, beginning of period | 2,408 | 2,130 | |||||||||

Cash and cash equivalents, end of period | $ | 2,139 | $ | 2,476 | |||||||

Three Months Ended March 31, | |||||||||||

| Amounts in millions | 2025 | 2024 | |||||||||

| Interest: | |||||||||||

| Income | $ | 24 | $ | 22 | |||||||

Expense on borrowings(1) | (72) | (74) | |||||||||

Expense on UTPs and other tax related liabilities | (6) | (4) | |||||||||

| Net periodic pension costs - interest component | (7) | (6) | |||||||||

Interest expense, net | $ | (61) | $ | (62) | |||||||

Other non-operating income, net: | |||||||||||

FX loss | $ | (5) | $ | (3) | |||||||

| Net periodic pension income - non-service and non-interest cost components | 9 | 8 | |||||||||

Income from investments in non-consolidated affiliates | 11 | — | |||||||||

| Gain on investments | 3 | 3 | |||||||||

Other | 1 | 5 | |||||||||

Other non-operating income, net | $ | 19 | $ | 13 | |||||||

| Total non-operating (expense) income, net | $ | (42) | $ | (49) | |||||||

(1) Expense on borrowings includes interest on long-term debt and realized gains/losses related to interest rate swaps and cross currency swaps. | ||

Three Months Ended March 31, | |||||||||||||||||||||||||||||||||||||||||||||||

| 2025 | 2024 | ||||||||||||||||||||||||||||||||||||||||||||||

| Amounts in millions | MA | MIS | Eliminations | Consolidated | MA | MIS | Eliminations | Consolidated | |||||||||||||||||||||||||||||||||||||||

| Total external revenue | $ | 859 | $ | 1,065 | $ | — | $ | 1,924 | $ | 799 | $ | 987 | $ | — | $ | 1,786 | |||||||||||||||||||||||||||||||

| Intersegment revenue | 3 | 49 | (52) | — | 3 | 47 | (50) | — | |||||||||||||||||||||||||||||||||||||||

| Total revenue | 862 | 1,114 | (52) | 1,924 | 802 | 1,034 | (50) | 1,786 | |||||||||||||||||||||||||||||||||||||||

Compensation expense | 362 | 280 | — | 642 | 337 | 272 | — | 609 | |||||||||||||||||||||||||||||||||||||||

Non-compensation expense | 192 | 96 | — | 288 | 180 | 91 | — | 271 | |||||||||||||||||||||||||||||||||||||||

Intersegment expense | 49 | 3 | (52) | — | 47 | 3 | (50) | — | |||||||||||||||||||||||||||||||||||||||

| Operating, SG&A | 603 | 379 | (52) | 930 | 564 | 366 | (50) | 880 | |||||||||||||||||||||||||||||||||||||||

| Adjusted Operating Income | $ | 259 | $ | 735 | $ | — | $ | 994 | $ | 238 | $ | 668 | $ | — | $ | 906 | |||||||||||||||||||||||||||||||

| Adjusted Operating Margin | 30.0 | % | 66.0 | % | 51.7 | % | 29.7 | % | 64.6 | % | 50.7 | % | |||||||||||||||||||||||||||||||||||

| Depreciation and amortization | 94 | 19 | — | 113 | 82 | 18 | — | 100 | |||||||||||||||||||||||||||||||||||||||

| Restructuring | 26 | 7 | — | 33 | 2 | 3 | — | 5 | |||||||||||||||||||||||||||||||||||||||

Charges related to asset abandonment (1) | 2 | — | — | 2 | — | — | — | — | |||||||||||||||||||||||||||||||||||||||

| Operating income | $ | 846 | $ | 801 | |||||||||||||||||||||||||||||||||||||||||||

| Operating margin | 44.0 | % | 44.8 | % | |||||||||||||||||||||||||||||||||||||||||||

Three Months Ended March 31, | |||||||||||||||||||||||||||||||||||

| 2025 | 2024 | ||||||||||||||||||||||||||||||||||

| Amounts in millions | Transaction | Recurring | Total | Transaction | Recurring | Total | |||||||||||||||||||||||||||||

Decision Solutions | |||||||||||||||||||||||||||||||||||

Banking | $ | 26 | $ | 115 | $ | 141 | $ | 29 | $ | 105 | $ | 134 | |||||||||||||||||||||||

| 18 | % | 82 | % | 100 | % | 22 | % | 78 | % | 100 | % | ||||||||||||||||||||||||

Insurance | $ | 6 | $ | 157 | $ | 163 | $ | 10 | $ | 134 | $ | 144 | |||||||||||||||||||||||

| 4 | % | 96 | % | 100 | % | 7 | % | 93 | % | 100 | % | ||||||||||||||||||||||||

KYC | $ | — | $ | 101 | $ | 101 | $ | 2 | $ | 85 | $ | 87 | |||||||||||||||||||||||

| — | % | 100 | % | 100 | % | 2 | % | 98 | % | 100 | % | ||||||||||||||||||||||||

Total Decision Solutions | $ | 32 | $ | 373 | $ | 405 | $ | 41 | $ | 324 | $ | 365 | |||||||||||||||||||||||

| 8 | % | 92 | % | 100 | % | 11 | % | 89 | % | 100 | % | ||||||||||||||||||||||||

| Research & Insights | $ | 3 | $ | 233 | $ | 236 | $ | 3 | $ | 219 | $ | 222 | |||||||||||||||||||||||

| 1 | % | 99 | % | 100 | % | 1 | % | 99 | % | 100 | % | ||||||||||||||||||||||||

| Data & Information | $ | 2 | $ | 216 | $ | 218 | $ | 3 | $ | 209 | $ | 212 | |||||||||||||||||||||||

| 1 | % | 99 | % | 100 | % | 1 | % | 99 | % | 100 | % | ||||||||||||||||||||||||

| Total MA | $ | 37 | $ | 822 | $ | 859 | $ | 47 | $ | 752 | $ | 799 | |||||||||||||||||||||||

| 4 | % | 96 | % | 100 | % | 6 | % | 94 | % | 100 | % | ||||||||||||||||||||||||

| Corporate Finance | $ | 427 | $ | 137 | $ | 564 | $ | 399 | $ | 130 | $ | 529 | |||||||||||||||||||||||

| 76 | % | 24 | % | 100 | % | 75 | % | 25 | % | 100 | % | ||||||||||||||||||||||||

| Structured Finance | $ | 78 | $ | 60 | $ | 138 | $ | 59 | $ | 55 | $ | 114 | |||||||||||||||||||||||

| 57 | % | 43 | % | 100 | % | 52 | % | 48 | % | 100 | % | ||||||||||||||||||||||||

| Financial Institutions | $ | 109 | $ | 82 | $ | 191 | $ | 122 | $ | 73 | $ | 195 | |||||||||||||||||||||||

| 57 | % | 43 | % | 100 | % | 63 | % | 37 | % | 100 | % | ||||||||||||||||||||||||

| Public, Project and Infrastructure Finance | $ | 116 | $ | 47 | $ | 163 | $ | 96 | $ | 45 | $ | 141 | |||||||||||||||||||||||

| 71 | % | 29 | % | 100 | % | 68 | % | 32 | % | 100 | % | ||||||||||||||||||||||||

| MIS Other | $ | 2 | $ | 7 | $ | 9 | $ | 1 | $ | 7 | $ | 8 | |||||||||||||||||||||||

| 22 | % | 78 | % | 100 | % | 12 | % | 88 | % | 100 | % | ||||||||||||||||||||||||

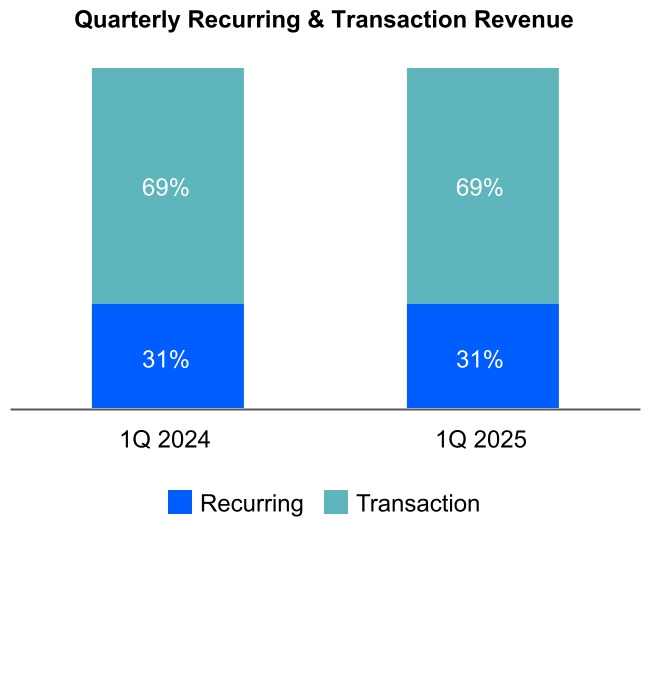

| Total MIS | $ | 732 | $ | 333 | $ | 1,065 | $ | 677 | $ | 310 | $ | 987 | |||||||||||||||||||||||

| 69 | % | 31 | % | 100 | % | 69 | % | 31 | % | 100 | % | ||||||||||||||||||||||||

| Total Moody's Corporation | $ | 769 | $ | 1,155 | $ | 1,924 | $ | 724 | $ | 1,062 | $ | 1,786 | |||||||||||||||||||||||

| 40 | % | 60 | % | 100 | % | 41 | % | 59 | % | 100 | % | ||||||||||||||||||||||||

Three Months Ended March 31, | |||||||||||

| Amounts in millions | 2025 | 2024 | |||||||||

| Operating income | $ | 846 | $ | 801 | |||||||

| Depreciation and amortization | 113 | 100 | |||||||||

| Restructuring | 33 | 5 | |||||||||

| Charges related to asset abandonment | 2 | — | |||||||||

| Adjusted Operating Income | $ | 994 | $ | 906 | |||||||

| Operating margin | 44.0 | % | 44.8 | % | |||||||

| Adjusted Operating Margin | 51.7 | % | 50.7 | % | |||||||

| Three Months Ended March 31, | |||||||||||

| Amounts in millions | 2025 | 2024 | |||||||||

| Net cash provided by operating activities | $ | 757 | $ | 775 | |||||||

| Capital additions | (85) | (78) | |||||||||

| Free Cash Flow | $ | 672 | $ | 697 | |||||||

| Net cash provided by (used in) investing activities | $ | 224 | $ | (96) | |||||||

| Net cash used in financing activities | $ | (1,298) | $ | (308) | |||||||

Three Months Ended March 31, | ||||||||||||||||||||||||||

| Amounts in millions | 2025 | 2024 | Change | Growth | ||||||||||||||||||||||

| MCO revenue | $ | 1,924 | $ | 1,786 | $ | 138 | 8% | |||||||||||||||||||

| FX impact | 14 | — | 14 | |||||||||||||||||||||||

| Inorganic revenue from acquisitions | (15) | — | (15) | |||||||||||||||||||||||

Organic constant currency MCO revenue | $ | 1,923 | $ | 1,786 | $ | 137 | 8% | |||||||||||||||||||

| MA revenue | $ | 859 | $ | 799 | $ | 60 | 8% | |||||||||||||||||||

| FX impact | 8 | — | 8 | |||||||||||||||||||||||

| Inorganic revenue from acquisitions | (11) | — | (11) | |||||||||||||||||||||||

Organic constant currency MA revenue | $ | 856 | $ | 799 | $ | 57 | 7% | |||||||||||||||||||

| Decision Solutions revenue | $ | 405 | $ | 365 | $ | 40 | 11% | |||||||||||||||||||

| FX impact | 3 | — | 3 | |||||||||||||||||||||||

| Inorganic revenue from acquisitions | (11) | — | (11) | |||||||||||||||||||||||

Organic constant currency Decision Solutions revenue | $ | 397 | $ | 365 | $ | 32 | 9% | |||||||||||||||||||

| Research and Insights revenue | $ | 236 | $ | 222 | $ | 14 | 6% | |||||||||||||||||||

| FX impact | 1 | — | 1 | |||||||||||||||||||||||

Constant currency Research and Insights revenue | $ | 237 | $ | 222 | $ | 15 | 7% | |||||||||||||||||||

| Data and Information revenue | $ | 218 | $ | 212 | $ | 6 | 3% | |||||||||||||||||||

| FX impact | 4 | — | 4 | |||||||||||||||||||||||

Constant currency Data and Information revenue | $ | 222 | $ | 212 | $ | 10 | 5% | |||||||||||||||||||

| MA recurring revenue | $ | 822 | $ | 752 | $ | 70 | 9% | |||||||||||||||||||

| FX impact | 7 | — | 7 | |||||||||||||||||||||||

| Inorganic recurring revenue from acquisitions | (11) | — | (11) | |||||||||||||||||||||||

Organic constant currency MA recurring revenue | $ | 818 | $ | 752 | $ | 66 | 9% | |||||||||||||||||||

| MIS revenue | $ | 1,065 | $ | 987 | $ | 78 | 8% | |||||||||||||||||||

| FX impact | 6 | — | 6 | |||||||||||||||||||||||

| Inorganic revenue from acquisitions | (4) | — | (4) | |||||||||||||||||||||||

Organic constant currency MIS revenue | $ | 1,067 | $ | 987 | $ | 80 | 8% | |||||||||||||||||||

| Amounts in millions | March 31, 2025 | March 31, 2024 | Change | Growth | |||||||||||||||||||

| MA ARR | |||||||||||||||||||||||

| Decision Solutions | |||||||||||||||||||||||

| Banking | $ | 453 | $ | 421 | $ | 32 | 8% | ||||||||||||||||

| Insurance | 609 | 548 | 61 | 11% | |||||||||||||||||||

| KYC | 393 | 335 | 58 | 17% | |||||||||||||||||||

Total Decision Solutions | $ | 1,455 | $ | 1,304 | $ | 151 | 12% | ||||||||||||||||

| Research and Insights | 945 | 884 | 61 | 7% | |||||||||||||||||||

| Data and Information | 866 | 818 | 48 | 6% | |||||||||||||||||||

| Total MA ARR | $ | 3,266 | $ | 3,006 | $ | 260 | 9% | ||||||||||||||||

Three Months Ended March 31, | |||||||||||||||||

| Amounts in millions | 2025 | 2024 | |||||||||||||||

| Net Income attributable to Moody's common shareholders | $ | 625 | $ | 577 | |||||||||||||

| Pre-tax Acquisition-Related Intangible Amortization Expenses | $ | 53 | $ | 49 | |||||||||||||

| Tax on Acquisition-Related Intangible Amortization Expenses | (13) | (12) | |||||||||||||||

| Net Acquisition-Related Intangible Amortization Expenses | 40 | 37 | |||||||||||||||

| Pre-tax restructuring | $ | 33 | $ | 5 | |||||||||||||

| Tax on restructuring | (8) | (1) | |||||||||||||||

| Net restructuring | 25 | 4 | |||||||||||||||

| Pre-tax charges related to asset abandonment | $ | 2 | $ | — | |||||||||||||

| Tax on charges related to asset abandonment | — | — | |||||||||||||||

| Net charges related to asset abandonment | 2 | — | |||||||||||||||

| Adjusted Net Income | $ | 692 | $ | 618 | |||||||||||||

Three Months Ended March 31, | |||||||||||||||||

| 2025 | 2024 | ||||||||||||||||

| Diluted earnings per share attributable to Moody's common shareholders | $ | 3.46 | $ | 3.15 | |||||||||||||

| Pre-tax Acquisition-Related Intangible Amortization Expenses | $ | 0.29 | $ | 0.27 | |||||||||||||

| Tax on Acquisition-Related Intangible Amortization Expenses | (0.07) | (0.07) | |||||||||||||||

| Net Acquisition-Related Intangible Amortization Expenses | 0.22 | 0.20 | |||||||||||||||

| Pre-tax restructuring | $ | 0.18 | $ | 0.03 | |||||||||||||

| Tax on restructuring | (0.04) | (0.01) | |||||||||||||||

| Net restructuring | 0.14 | 0.02 | |||||||||||||||

| Pre-tax charges related to asset abandonment | $ | 0.01 | $ | — | |||||||||||||

| Tax on charges related to asset abandonment | — | — | |||||||||||||||

| Net charges related to asset abandonment | 0.01 | — | |||||||||||||||

| Adjusted Diluted EPS | $ | 3.83 | $ | 3.37 | |||||||||||||

| Note: The tax impacts in the tables above were calculated using tax rates in effect in the jurisdiction for which the item relates. | ||

Full Year 2025 Moody's Corporation Guidance as of April 22, 2025 | ||||||||

Moody's Corporation (MCO) | Last Publicly Disclosed Guidance | Current Guidance | ||||||

| Revenue | Increase in the high-single-digit percent range | Increase in the mid-single-digit percent range | ||||||

Operating Expenses | Increase in the low-to-mid-single-digit percent range | NC | ||||||

Operating Margin | Approximately 43% | 42% to 43% | ||||||

Adjusted Operating Margin (1) | Approximately 50% | 49% to 50% | ||||||

Interest Expense, Net | $220 million to $240 million | NC | ||||||

Effective Tax Rate | 23% to 25% | NC | ||||||

Diluted EPS | $12.75 to $13.25 | $12.00 to $12.75 | ||||||

Adjusted Diluted EPS (1) | $14.00 to $14.50 | $13.25 to $14.00 | ||||||

Operating Cash Flow | $2.75 to $2.95 billion | $2.65 to $2.85 billion | ||||||

Free Cash Flow (1) | $2.40 to $2.60 billion | $2.30 to $2.50 billion | ||||||

Share Repurchases | At least $1.3 billion (subject to available cash, market conditions, M&A opportunities and other ongoing capital allocation decisions) | NC | ||||||

| Moody's Analytics (MA) | Last Publicly Disclosed Guidance | Current Guidance | ||||||

MA Revenue | Increase in the high-single-digit percent range | NC | ||||||

ARR (2) | Increase in the high-single-digit to low-double-digit percent range | Increase in the high-single-digit percent range | ||||||

| MA Adjusted Operating Margin | 32% to 33% | NC | ||||||

| Moody's Investors Service (MIS) | Last Publicly Disclosed Guidance | Current Guidance | ||||||

MIS Revenue | Increase in the mid-to-high-single-digit percent range | Flat to increase in the mid-single-digit percent range | ||||||

| MIS Adjusted Operating Margin | 62% to 63% | 61% to 62% | ||||||

NC - There is no difference between the Company’s current guidance and the last publicly disclosed guidance for this item. Note: All current guidance as of April 22, 2025. (1) These metrics are adjusted measures. See below for reconciliation of these measures to their comparable U.S. GAAP measure. (2) Refer to Table 10 within this earnings release for the definition of and further information on the ARR metric. | ||||||||

Projected for the Year Ended December 31, 2025 | |||||

| Operating margin guidance | 42% to 43% | ||||

| Depreciation and amortization | Approximately 6% | ||||

| Restructuring | Approximately 1% | ||||

Charges Related to Asset Abandonment | Negligible | ||||

| Adjusted Operating Margin guidance | 49% to 50% | ||||

| Projected for the Year Ended December 31, 2025 | |||||

| Operating cash flow guidance | $2.65 to $2.85 billion | ||||

| Less: Capital expenditures | Approximately $350 million | ||||

| Free Cash Flow guidance | $2.30 to $2.50 billion | ||||

| Projected for the Year Ended December 31, 2025 | |||||

| Diluted EPS guidance | $12.00 to $12.75 | ||||

| Acquisition-Related Intangible Amortization | Approximately $0.90 | ||||

| Restructuring | Approximately $0.35 | ||||

Charges Related to Asset Abandonment | Negligible | ||||

| Adjusted Diluted EPS guidance | $13.25 to $14.00 | ||||