First Eagle Overseas Variable Fund (the “Fund”) seeks long-term growth of capital by investing primarily in equities, including common and preferred stocks, warrants or other similar rights, and convertible securities, issued by non-U.S. companies.

The following information describes the fees and expenses you may pay if you buy, hold and sell shares of the Fund. The expenses shown do not reflect charges imposed by variable annuity contracts and variable life insurance policies (collectively “Variable Contracts”) issued by the life insurance companies through which the Fund is offered.

|

|

| |||||

Annual Fund Operating Expenses | |||||||

Management Fees* |

|

| 0.75 | ||||

| |||||||

Distribution and Service (12b-1) Fees |

|

| 0.25 | ||||

| |||||||

Other Expenses** |

| 0.54 | |||||

| Total Annual Operating Expenses | 1.54 | ||||||

| Fee Waiver and/or Expense Reimbursement* | -0.33 | ||||||

| Total Annual Operating Expenses After Fee Waiver and/or Expense Reimbursement | 1.21 | ||||||

* | First Eagle Investment Management, LLC (the “Adviser”) has contractually agreed to waive and/or reimburse certain fees and expenses so that the total annual operating expenses (excluding interest, taxes, brokerage commissions, acquired fund fees and expenses, dividend and interest expenses relating to short sales, and extraordinary expenses, if any) (“annual operating expenses”) are limited to 1.21% of average net assets. This undertaking lasts until April 29, 2026 and may not be terminated during its term without the consent of the Board of Trustees. The Fund has agreed that it will repay the Adviser for fees and expenses waived or reimbursed provided that repayment does not cause annual operating expenses (after the repayment is taken into account) to exceed the lesser of: (1) 1.21% the Fund’s average net assets; or (2) if applicable, the then-current expense limitation. Any such repayment must be made within three years after the year in which the Adviser incurred the expense. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

** | “Other Expenses” shown generally reflect actual expenses for the Fund for fiscal year ended December 31, 2024. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The following example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. This hypothetical example assumes that you invest $10,000 in the Fund for the time periods indicated and then either redeem or do not redeem all of your shares at the end of those periods. The example also assumes that the average annual return is 5% and operating expenses remain the same. The example does not reflect charges imposed by the Variable Contracts and the costs shown in the example would be higher if those charges were reflected.

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

1 Year |

3 Years |

5 Years |

10 Years |

|||||||||||||||||||||||||

Sold or Held |

|

|

$123 |

|

$454 |

|

|

$808 |

|

|

$1,806 |

|||||||||||||||||

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

1 Year |

3 Years |

5 Years |

10 Years |

|||||||||||||||||||||||||

Sold or Held |

|

|

$123 |

|

$454 |

|

|

$808 |

|

|

$1,806 |

|||||||||||||||||

|

||||||||||||||||||||||||||||

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account (which would typically not be the case for a Variable Contract). These costs, which are not reflected in Annual Fund Operating Expenses or in the Example above, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 21.99% of the average value of its portfolio.

To achieve its objective, under normal circumstances the Fund will invest primarily in equities, including common and preferred stocks, warrants or other similar rights to purchase a company’s securities, and convertible securities, issued by non-U.S. companies. The Fund may invest in securities traded in mature markets (for example, Canada, Japan, Germany and France) and in countries whose economies are still developing (sometimes called “emerging markets”). The Fund particularly seeks companies that have financial strength and stability, strong management and fundamental value (“fundamental value” is a term commonly used by value investors to refer to their estimate of the value an educated buyer would place on a company as a whole). Normally, the Fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in foreign securities (including American Depositary Receipts, Global Depositary Receipts and European Depositary Receipts) and “counts” relevant derivative positions towards this “80% of assets” allocation, and in doing so, values each position at the price at which it is held on the Fund’s books (generally market price, but anticipates valuing each such position for purposes of assessing compliance with this test at notional value in connection with new rules requiring that treatment). The Fund may invest up to 20% of its total assets in debt instruments (e.g., notes and bonds). Investment decisions for the Fund are made without regard to the capitalization (size) of the companies in which it invests. The Fund may invest in any size company, including large, medium and smaller companies. The Fund may invest in debt instruments (without regard to credit rating or time to maturity), including short-term debt instruments, gold and other precious metals, and futures contracts related to precious metals.

The Fund may make certain investments through one or more special purpose trading subsidiaries (each, a “Subsidiary”). Any Subsidiary will be a wholly-owned and controlled subsidiary of the Fund. Generally, any Subsidiary will invest in commodities and related instruments (primarily gold bullion and other precious metals and related futures contracts).

Although the Fund shares a similar name and investment objective to First Eagle Overseas Fund (a portfolio of the First Eagle Funds family), the two do not apply identical investment strategies.

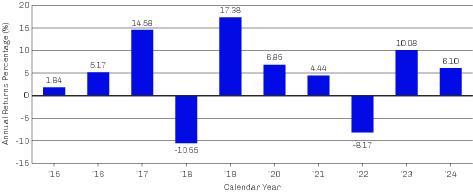

The following information provides an indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year, and by showing how the Fund’s average annual returns for the periods shown compare with those of one or more broad measures of market performance, which have characteristics relevant to the Fund’s investment strategy. The index is described in the Fund Index section. As with all mutual funds, past performance is not an indication of future performance (before or after taxes).

The following information discloses returns on a before-tax basis. After-tax returns depend on an individual investor’s tax situation and are generally not relevant for investors who hold shares in tax-deferred arrangements, including most Variable Contracts.

Updated performance information is available by calling 800.747.2008.

The following bar chart and table assume reinvestment of dividends and distributions and do not reflect any sales charges. If sales charges were included, the returns would be lower.

* | For the period presented in the bar chart above. |

|

|

|

|

|

|

|

|

|

Best Quarter* |

|

| Worst Quarter* | |||||

Second Quarter 2020 | 12.54% |

|

| First Quarter 2020 | -17.90% | |||

|

|

|

|

| ||||

|

|

|

|

|

| ||||||||||||||||

1 Year | 5 Years | 10 Years | |||||||||||||||||||

| |||||||||||||||||||||

First Eagle Overseas Variable Fund* |

| 6.10 | % |

|

| 3.66 | % |

|

| 4.43 | % |

| |||||||||

| |||||||||||||||||||||

MSCI EAFE Index |

| 3.82 | % |

|

| 4.73 | % |

|

| 5.20 | % |

| |||||||||

| |||||||||||||||||||||

* | Performance data quoted herein does not reflect charges imposed by Variable Contracts issued by the life insurance companies through which the Fund is offered. If those account-level fees and expenses were reflected, performance would be lower. |