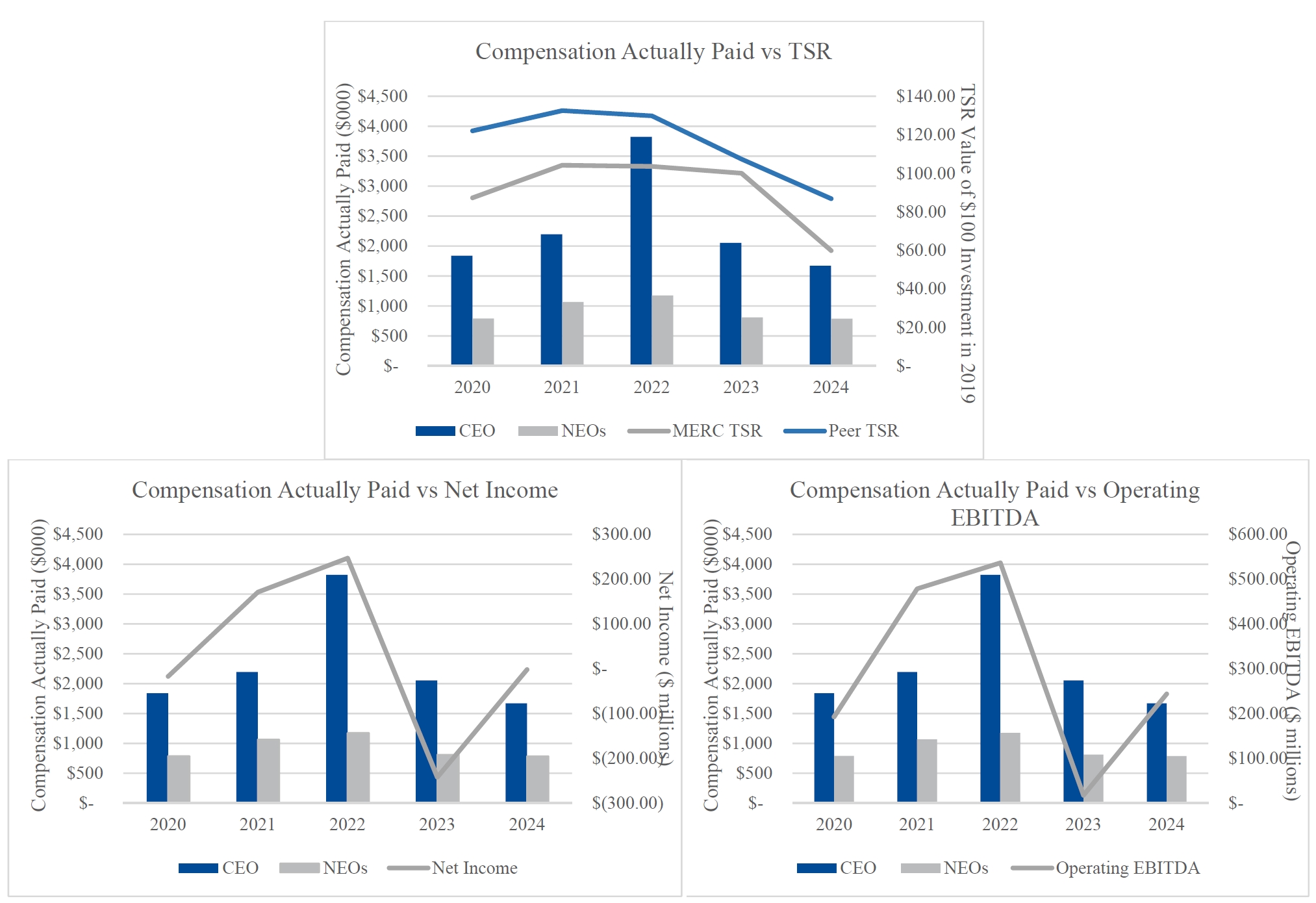

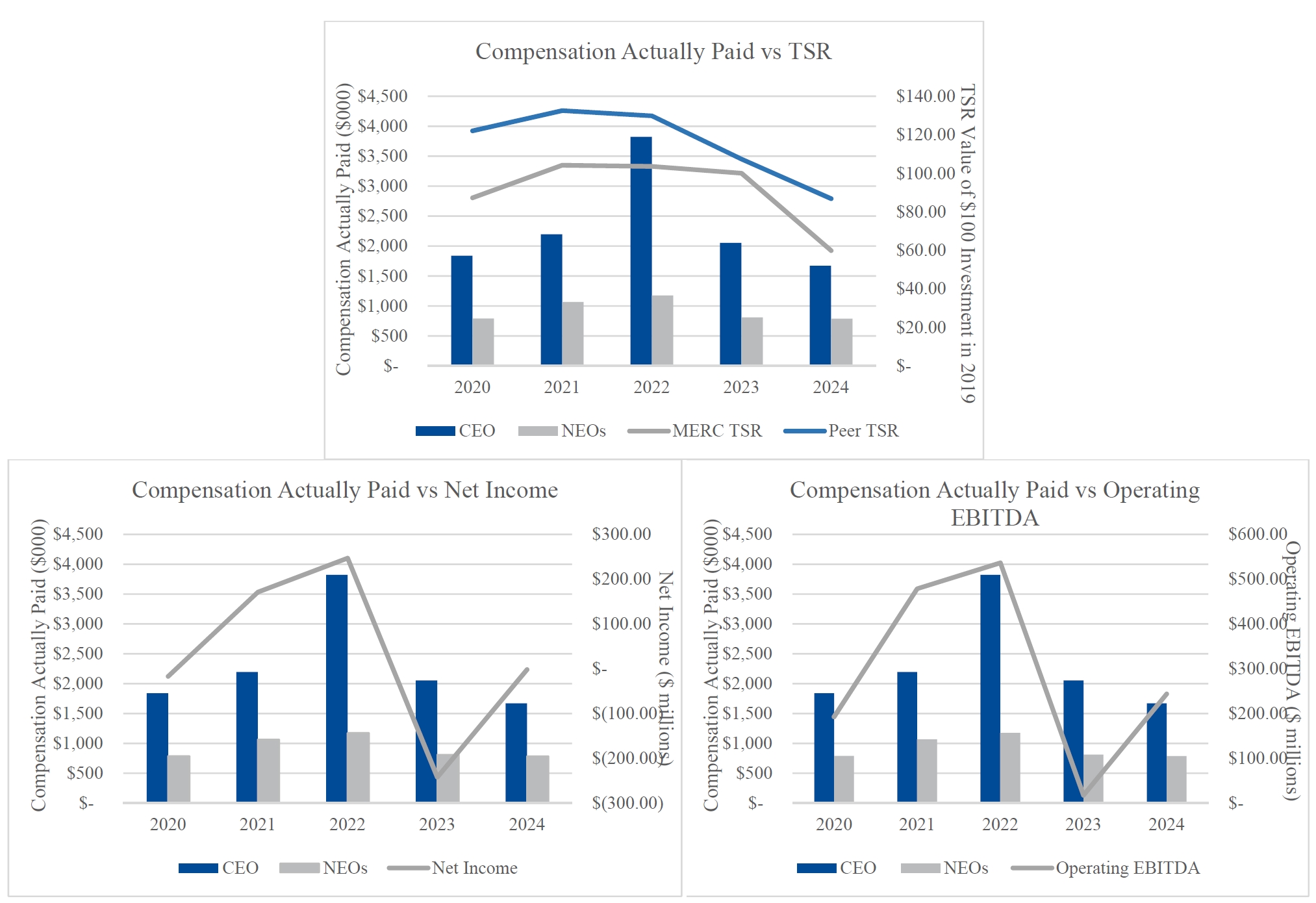

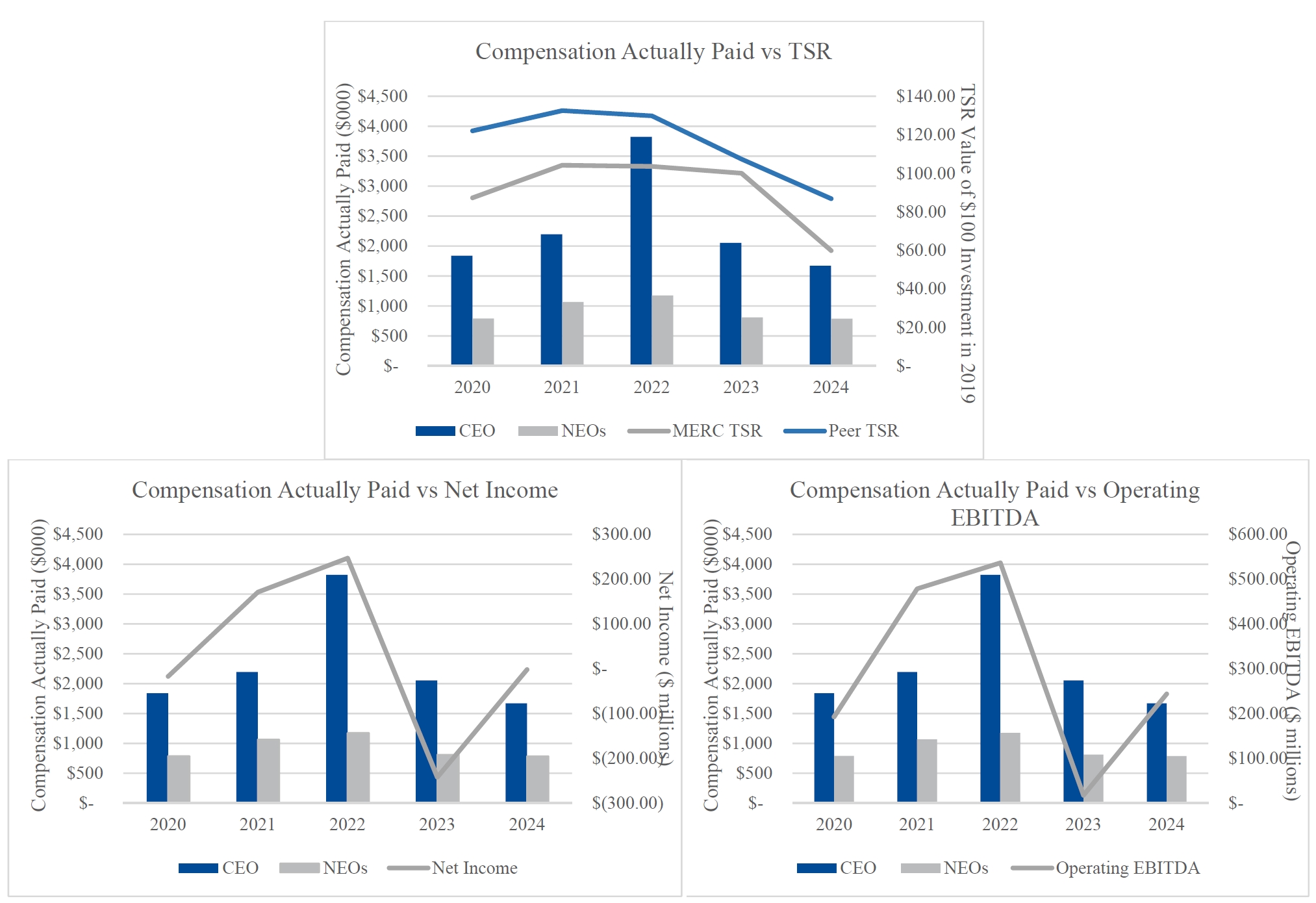

We are required by SEC rules to disclose the following information regarding compensation paid to our NEOs. The amounts set forth below under the headings "Compensation Actually Paid to CEO" and "Average Compensation Actually Paid for NEOs" have been calculated in a manner consistent with Item 402(v) of Regulation S-K. Footnote (10) below sets forth the adjustments from the Total Compensation for each NEO reported in the Summary Compensation Table above.

The following table sets forth additional compensation information of our CEO and our non-CEO NEOs along with total shareholder return, net income, and Operating EBITDA performance results for fiscal years 2020, 2021, 2022, 2023 and 2024:

Year |

Summary Compensation Table Total for CEO ($) |

Compensation Actually Paid to CEO ($) |

Average Summary Compensation Table Total for Non-CEO NEOs(2) ($) |

Average Compensation Actually Paid to Non-CEO NEOs(2) ($) |

Value of Initial Fixed $100 Investment Based On: |

Net Income (Loss) ($) |

Operating EBITDA (in 000s)(10) ($) |

|||

Juan Carlos Bueno(1) |

David Gandossi(1) |

Juan Carlos Bueno(1) |

David Gandossi(1) |

Total Shareholder Return(9) ($) |

Peer Group Total Shareholder Return(9) ($) |

|||||

(a) |

(b) |

(c) |

(d) |

(e) |

(f) |

(g) |

(h) |

(i) |

||

2024 |

2,951,587 |

N/A |

1,669,153 |

N/A |

1,045,486 |

784,586 |

59.84 |

86.62 |

(85,141) |

243,722 |

2023 |

3,174,950 |

N/A |

2,052,731 |

N/A |

1,063,027 |

809,823 |

100.06 |

107.36 |

(242,056) |

17,462 |

2022 |

4,945,342 |

1,518,538 |

3,016,641 |

806,333 |

1,449,725 |

1,174,802 |

103.55 |

129.84 |

247,039 |

536,521 |

2021 |

- |

3,152,658 |

- |

2,194,616 |

1,374,929 |

1,065,747 |

104.19 |

132.54 |

170,988 |

478,782 |

2020 |

- |

2,647,401 |

- |

1,837,807 |

1,150,286 |

791,419 |

87.24 |

122.03 |

(17,235) |

192,650 |

Year |

CEO |

NEOs |

2024 |

Juan Carlos Bueno |

Richard Short, Adolf Koppensteiner, Carsten Merforth, Wolfram Ridder |

2023 |

Juan Carlos Bueno |

Jimmy S.H. Lee, David Ure (to May 31, 2023), Richard Short (from June 1, 2023), Adolf Koppensteiner, Guy Arguin |

2022 |

David Gandossi (to May 1, 2022) Juan Carlos Bueno (from May 1, 2022) |

Jimmy S.H. Lee, David Ure, Adolf Koppensteiner, Guy Arguin |

2021 |

David Gandossi |

Jimmy S.H. Lee, David Ure, Adolf Koppensteiner, Wolfram Ridder |

2020 |

David Gandossi |

Jimmy S.H. Lee, David Ure, Adolf Koppensteiner, Wolfram Ridder |

|

2024 |

2024 |

2023 |

2023 |

2022 |

2021 |

2020 |

||||

CEO ($) |

Average of NEOs ($) |

CEO ($) |

Average of NEOs ($) |

CEO (Gandossi) ($) |

CEO (Bueno) ($) |

Average of NEOs ($) |

CEO ($) |

Average of NEOs ($) |

CEO ($) |

Average of NEOs ($) |

|

Total Reported in 2024 Summary Compensation Table (SCT) |

2,951,587 |

1,045,486 |

3,174,950 |

1,063,027 |

1,518,538 |

4,945,342 |

1,449,725 |

3,152,658 |

1,374,929 |

2,647,401 |

1,150,286 |

Less, total fair value of stock and option awards reported in SCT |

(1,493,315) |

(312,008) |

(1,441,904) |

(339,825) |

(314,028) |

(3,757,708) |

(454,575) |

(1,375,183) |

(415,925) |

(1,299,232) |

(372,768) |

Plus, fair value (at end of fiscal year) of awards granted in 2024 fiscal year that are unvested and outstanding |

784,193 |

163,846 |

704,167 |

196,417 |

159,817 |

1,829,007 |

231,345 |

702,051 |

212,336 |

990,495 |

284,187 |

Plus (less), change in fair (at end of fiscal year) value of prior year awards that are outstanding and unvested |

(207,496) |

(38,501) |

(101,532) |

(32,740) |

(34,837) |

- |

(16,581) |

(206,224) |

(59,168) |

(213,615) |

(126,039) |

Plus, fair value (at vesting date) of awards granted and vested in 2024 fiscal year |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Plus (less), change in fair value (at vesting date) of prior year awards that vested in 2024 fiscal year |

- |

- |

(365,506) |

(85,803) |

(53,421) |

- |

(15,096) |

15,556 |

9,179 |

(46,132) |

(23,167) |

Plus (less), fair value (at end of prior fiscal year) of prior year awards that failed to vest in 2024 fiscal year (i.e. forfeited) |

(365,816) |

(74,238) |

82,556 |

8,748 |

(469,736) |

- |

(20,015) |

(94,243) |

(55,603) |

(241,110) |

(121,079) |

Less, change in actuarial present value of all defined benefit and actuarial pension plans |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Plus, pension value attributable to current year's service and any change in pension value attributable to plan amendments made in the current year |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Compensation Actually Paid ($) |

1,669,153 |

784,586 |

2,052,731 |

809,823 |

806,333 |

3,016,641 |

1,174,802 |

2,194,616 |

1,065,747 |

1,837,807 |

791,419 |

|

2024 |

2024 |

2023 |

2023 |

2022 |

2021 |

2020 |

||||

CEO ($) |

Average of NEOs ($) |

CEO ($) |

Average of NEOs ($) |

CEO (Gandossi) ($) |

CEO (Bueno) ($) |

Average of NEOs ($) |

CEO ($) |

Average of NEOs ($) |

CEO ($) |

Average of NEOs ($) |

|

Total Reported in 2024 Summary Compensation Table (SCT) |

2,951,587 |

1,045,486 |

3,174,950 |

1,063,027 |

1,518,538 |

4,945,342 |

1,449,725 |

3,152,658 |

1,374,929 |

2,647,401 |

1,150,286 |

Less, total fair value of stock and option awards reported in SCT |

(1,493,315) |

(312,008) |

(1,441,904) |

(339,825) |

(314,028) |

(3,757,708) |

(454,575) |

(1,375,183) |

(415,925) |

(1,299,232) |

(372,768) |

Plus, fair value (at end of fiscal year) of awards granted in 2024 fiscal year that are unvested and outstanding |

784,193 |

163,846 |

704,167 |

196,417 |

159,817 |

1,829,007 |

231,345 |

702,051 |

212,336 |

990,495 |

284,187 |

Plus (less), change in fair (at end of fiscal year) value of prior year awards that are outstanding and unvested |

(207,496) |

(38,501) |

(101,532) |

(32,740) |

(34,837) |

- |

(16,581) |

(206,224) |

(59,168) |

(213,615) |

(126,039) |

Plus, fair value (at vesting date) of awards granted and vested in 2024 fiscal year |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Plus (less), change in fair value (at vesting date) of prior year awards that vested in 2024 fiscal year |

- |

- |

(365,506) |

(85,803) |

(53,421) |

- |

(15,096) |

15,556 |

9,179 |

(46,132) |

(23,167) |

Plus (less), fair value (at end of prior fiscal year) of prior year awards that failed to vest in 2024 fiscal year (i.e. forfeited) |

(365,816) |

(74,238) |

82,556 |

8,748 |

(469,736) |

- |

(20,015) |

(94,243) |

(55,603) |

(241,110) |

(121,079) |

Less, change in actuarial present value of all defined benefit and actuarial pension plans |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Plus, pension value attributable to current year's service and any change in pension value attributable to plan amendments made in the current year |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Compensation Actually Paid ($) |

1,669,153 |

784,586 |

2,052,731 |

809,823 |

806,333 |

3,016,641 |

1,174,802 |

2,194,616 |

1,065,747 |

1,837,807 |

791,419 |

|

2024 |

2024 |

2023 |

2023 |

2022 |

2021 |

2020 |

||||

CEO ($) |

Average of NEOs ($) |

CEO ($) |

Average of NEOs ($) |

CEO (Gandossi) ($) |

CEO (Bueno) ($) |

Average of NEOs ($) |

CEO ($) |

Average of NEOs ($) |

CEO ($) |

Average of NEOs ($) |

|

Total Reported in 2024 Summary Compensation Table (SCT) |

2,951,587 |

1,045,486 |

3,174,950 |

1,063,027 |

1,518,538 |

4,945,342 |

1,449,725 |

3,152,658 |

1,374,929 |

2,647,401 |

1,150,286 |

Less, total fair value of stock and option awards reported in SCT |

(1,493,315) |

(312,008) |

(1,441,904) |

(339,825) |

(314,028) |

(3,757,708) |

(454,575) |

(1,375,183) |

(415,925) |

(1,299,232) |

(372,768) |

Plus, fair value (at end of fiscal year) of awards granted in 2024 fiscal year that are unvested and outstanding |

784,193 |

163,846 |

704,167 |

196,417 |

159,817 |

1,829,007 |

231,345 |

702,051 |

212,336 |

990,495 |

284,187 |

Plus (less), change in fair (at end of fiscal year) value of prior year awards that are outstanding and unvested |

(207,496) |

(38,501) |

(101,532) |

(32,740) |

(34,837) |

- |

(16,581) |

(206,224) |

(59,168) |

(213,615) |

(126,039) |

Plus, fair value (at vesting date) of awards granted and vested in 2024 fiscal year |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Plus (less), change in fair value (at vesting date) of prior year awards that vested in 2024 fiscal year |

- |

- |

(365,506) |

(85,803) |

(53,421) |

- |

(15,096) |

15,556 |

9,179 |

(46,132) |

(23,167) |

Plus (less), fair value (at end of prior fiscal year) of prior year awards that failed to vest in 2024 fiscal year (i.e. forfeited) |

(365,816) |

(74,238) |

82,556 |

8,748 |

(469,736) |

- |

(20,015) |

(94,243) |

(55,603) |

(241,110) |

(121,079) |

Less, change in actuarial present value of all defined benefit and actuarial pension plans |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Plus, pension value attributable to current year's service and any change in pension value attributable to plan amendments made in the current year |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Compensation Actually Paid ($) |

1,669,153 |

784,586 |

2,052,731 |

809,823 |

806,333 |

3,016,641 |

1,174,802 |

2,194,616 |

1,065,747 |

1,837,807 |

791,419 |

Tabular List

Listed below are the financial and non-financial performance measures which we believe to be our most important measures to link compensation actually paid to our NEOs to Company performance, for fiscal 2024.

Measure |

Explanation |

Net Income |

Net income in accordance with generally accepted accounting principles in the United States ("GAAP"). |

Operating EBITDA |

A non-GAAP financial measure comprised of Net Income before Income tax provision, Interest expense, Other income and Depreciation and amortization. |

Total Recordable Incident Rate (TRIR) |

Total recordable incident rate; the rate of recordable workplace injuries per 200,000 working hours. |

Return on Average Assets (ROAA) |

Return on average assets; the ratio of Net income in accordance with GAAP to the average Total Assets of the Company in the year. |

Revenues |

Revenues for the year in accordance with GAAP. |

Other |

Other non-financial measures include advancement of strategic priorities related to acquisitions, capital expenditures, productivity, carbon emissions reduction, environmental performance, employee and community engagement and equity and diversity initiatives. |