Pay vs Performance Disclosure

|

12 Months Ended |

|

Dec. 31, 2024

USD ($)

|

Dec. 31, 2023

USD ($)

|

Dec. 31, 2022

USD ($)

|

Dec. 31, 2021

USD ($)

|

Dec. 31, 2020

USD ($)

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Pay vs Performance Disclosure, Table |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Value of Initial Fixed $100 Investment Based On: | | | Year(1) | Summary Compensation Table Total for PEO ($) (1,2) | Summary Compensation Table Total for PEO ($) (1,3) | Compensation Actually Paid to PEO ($) (1,2 ) | Compensation Actually Paid to PEO ($) (1,3) | Average Summary Compensation Table Total for Non-PEO NEO ($) (1) | Average Compensation Actually Paid to Non-PEO NEO ($) (1) | Total Shareholder Return ($)(4) | Peer Group Total Shareholder Return ($)(5) | Net Income Attributable to Common Stockholders (In thousands) ($) (6) | Normalized FFO per diluted share ($) (7) | | 2024 | 20,200,824 | | — | | 106,628,885 | | — | | 5,767,430 | | 30,904,176 | | 180.71 | | 114.71 | | 951,680 | | 4.32 | | | 2023 | 17,250,363 | | — | | 40,809,501 | | — | | 5,038,923 | | 10,743,501 | | 126.31 | | 113.36 | | 340,094 | | 3.64 | | | 2022 | 14,317,407 | | — | | 5,970,149 | | — | | 4,121,683 | | 2,497,577 | | 89.10 | | 99.68 | | 141,214 | | 3.35 | | | 2021 | 12,787,358 | | — | | 22,858,790 | | — | | 3,096,543 | | 4,768,476 | | 113.03 | | 131.78 | | 336,138 | | 3.21 | | | 2020 | 9,557,434 | | 14,589,584 | | 5,290,290 | | (7,391,356) | | 2,590,052 | | 1,401,426 | | 82.51 | | 92.00 | | 978,844 | | 3.56 | |

|

|

|

|

|

| Company Selected Measure Name |

normalized FFO

|

|

|

|

|

| Named Executive Officers, Footnote |

Amounts represent compensation actually paid to our PEO(s) and the average compensation actually paid to our remaining NEOs for the relevant fiscal year, as determined in accordance with SEC rules, which includes the individuals listed in the table below for each fiscal year. | | | | | | | | | | Year | PEO | Non-PEO NEOS | | 2024 | Shankh Mitra | Timothy G. McHugh, John F. Burkart, Matthew G. McQueen, and Nikhil Chaudhri | | 2021-2023 | Shankh Mitra | Timothy G. McHugh, John F. Burkart, Matthew G. McQueen, and Ayesha Menon | | 2020 | Thomas J. DeRosa and Shankh Mitra | Timothy G. McHugh, Matthew G. McQueen, and Ayesha Menon |

|

|

|

|

|

| Peer Group Issuers, Footnote |

Peer group TSR is based on the FTSE NAREIT Equity Health Care Index to which we compare our performance in our Form 10-K Stockholder Return Performance Presentation in Item 5.

|

|

|

|

|

| PEO Total Compensation Amount |

$ 20,200,824

|

$ 17,250,363

|

$ 14,317,407

|

$ 12,787,358

|

$ 9,557,434

|

| PEO Actually Paid Compensation Amount |

$ 106,628,885

|

40,809,501

|

5,970,149

|

22,858,790

|

5,290,290

|

| Adjustment To PEO Compensation, Footnote |

| | | | | | | | | | | | | | | | | | | Shankh Mitra, CEO | 2024 | 2023 | 2022 | 2021 | 2020 | | SCT Total | $ | 20,200,824 | $ | 17,250,363 | $ | 14,317,407 | $ | 12,787,358 | $ | 9,557,434 | | Less: Fair Value of Awards Reported in the SCT | (13,532,489) | (11,653,191) | (10,454,249) | (7,500,075) | (6,528,373) | | Plus: Fair Value of Awards Granted in Year and Outstanding and Unvested at Year-End | 30,189,488 | 19,380,298 | 7,822,060 | 14,018,154 | 4,703,812 | | Plus: Change in Fair Value from Prior Year-End to Current Year-End of Awards Granted Prior to Year that were Outstanding and Unvested as of Year-End | 59,995,952 | 11,237,147 | (5,103,585) | 2,964,149 | (1,337,571) | | Plus: Change in Fair Value from Prior Year-End to Vesting Date of Awards Granted Prior to Year that Vested During Year | 9,775,110 | 4,594,884 | (611,484) | 589,204 | (1,105,012) | | Total Compensation Actually Paid | $ | 106,628,885 | | $ | 40,809,501 | | $ | 5,970,149 | | $ | 22,858,790 | | $ | 5,290,290 | | | | | | | | | Thomas J. DeRosa, Former CEO | 2024 | 2023 | 2022 | 2021 | 2020 | | SCT Total | | | | | $ | 14,589,584 | | Less: Fair Value of Awards Reported in the SCT | | | | | (10,501,359) | | Plus: Fair Value of Awards Granted in Year and Outstanding and Unvested at Year-End | | | | | — | | Plus: Change in Fair Value from Prior Year-End to Current Year-End of Awards Granted Prior to Year that were Outstanding and Unvested as of Year-End | | | | | — | | Plus: Value of Awards Granted and Vested in the Year | | | | | 2,533,763 | | Plus: Change in Fair Value from Prior Year-End to Vesting Date of Awards Granted Prior to Year that Vested During Year | | | | | (14,013,344) | | Total Compensation Actually Paid | | | | | $ | (7,391,356) | | | | | | | | Average of Other NEOs | 2024 | 2023 | 2022 | 2021 | 2020 | | SCT Total | $ | 5,767,430 | $ | 5,038,923 | $ | 4,121,683 | $ | 3,096,543 | $ | 2,590,052 | | Less: Fair Value of Awards Reported in the SCT | (3,239,296) | (3,047,939) | (2,634,005) | (1,475,967) | (1,365,328) | | Plus: Fair Value of Awards Granted in Year and Outstanding and Unvested at Year-End | 8,149,325 | 5,046,550 | 2,018,683 | 2,563,124 | 846,041 | | Plus: Change in Fair Value from Prior Year-End to Current Year-End of Awards Granted Prior to Year that were Outstanding and Unvested as of Year-End | 17,904,140 | 2,819,526 | (930,824) | 427,784 | (498,132) | | Plus: Change in Fair Value from Prior Year-End to Vesting Date of Awards Granted Prior to Year that Vested During Year | 2,322,577 | 886,441 | (77,960) | 156,992 | (171,207) | | Total Average Compensation Actually Paid | $ | 30,904,176 | | $ | 10,743,501 | | $ | 2,497,577 | | $ | 4,768,476 | | $ | 1,401,426 | |

|

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

$ 5,767,430

|

5,038,923

|

4,121,683

|

3,096,543

|

2,590,052

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

$ 30,904,176

|

10,743,501

|

2,497,577

|

4,768,476

|

1,401,426

|

| Adjustment to Non-PEO NEO Compensation Footnote |

| | | | | | | | | | | | | | | | | | | Shankh Mitra, CEO | 2024 | 2023 | 2022 | 2021 | 2020 | | SCT Total | $ | 20,200,824 | $ | 17,250,363 | $ | 14,317,407 | $ | 12,787,358 | $ | 9,557,434 | | Less: Fair Value of Awards Reported in the SCT | (13,532,489) | (11,653,191) | (10,454,249) | (7,500,075) | (6,528,373) | | Plus: Fair Value of Awards Granted in Year and Outstanding and Unvested at Year-End | 30,189,488 | 19,380,298 | 7,822,060 | 14,018,154 | 4,703,812 | | Plus: Change in Fair Value from Prior Year-End to Current Year-End of Awards Granted Prior to Year that were Outstanding and Unvested as of Year-End | 59,995,952 | 11,237,147 | (5,103,585) | 2,964,149 | (1,337,571) | | Plus: Change in Fair Value from Prior Year-End to Vesting Date of Awards Granted Prior to Year that Vested During Year | 9,775,110 | 4,594,884 | (611,484) | 589,204 | (1,105,012) | | Total Compensation Actually Paid | $ | 106,628,885 | | $ | 40,809,501 | | $ | 5,970,149 | | $ | 22,858,790 | | $ | 5,290,290 | | | | | | | | | Thomas J. DeRosa, Former CEO | 2024 | 2023 | 2022 | 2021 | 2020 | | SCT Total | | | | | $ | 14,589,584 | | Less: Fair Value of Awards Reported in the SCT | | | | | (10,501,359) | | Plus: Fair Value of Awards Granted in Year and Outstanding and Unvested at Year-End | | | | | — | | Plus: Change in Fair Value from Prior Year-End to Current Year-End of Awards Granted Prior to Year that were Outstanding and Unvested as of Year-End | | | | | — | | Plus: Value of Awards Granted and Vested in the Year | | | | | 2,533,763 | | Plus: Change in Fair Value from Prior Year-End to Vesting Date of Awards Granted Prior to Year that Vested During Year | | | | | (14,013,344) | | Total Compensation Actually Paid | | | | | $ | (7,391,356) | | | | | | | | Average of Other NEOs | 2024 | 2023 | 2022 | 2021 | 2020 | | SCT Total | $ | 5,767,430 | $ | 5,038,923 | $ | 4,121,683 | $ | 3,096,543 | $ | 2,590,052 | | Less: Fair Value of Awards Reported in the SCT | (3,239,296) | (3,047,939) | (2,634,005) | (1,475,967) | (1,365,328) | | Plus: Fair Value of Awards Granted in Year and Outstanding and Unvested at Year-End | 8,149,325 | 5,046,550 | 2,018,683 | 2,563,124 | 846,041 | | Plus: Change in Fair Value from Prior Year-End to Current Year-End of Awards Granted Prior to Year that were Outstanding and Unvested as of Year-End | 17,904,140 | 2,819,526 | (930,824) | 427,784 | (498,132) | | Plus: Change in Fair Value from Prior Year-End to Vesting Date of Awards Granted Prior to Year that Vested During Year | 2,322,577 | 886,441 | (77,960) | 156,992 | (171,207) | | Total Average Compensation Actually Paid | $ | 30,904,176 | | $ | 10,743,501 | | $ | 2,497,577 | | $ | 4,768,476 | | $ | 1,401,426 | |

|

|

|

|

|

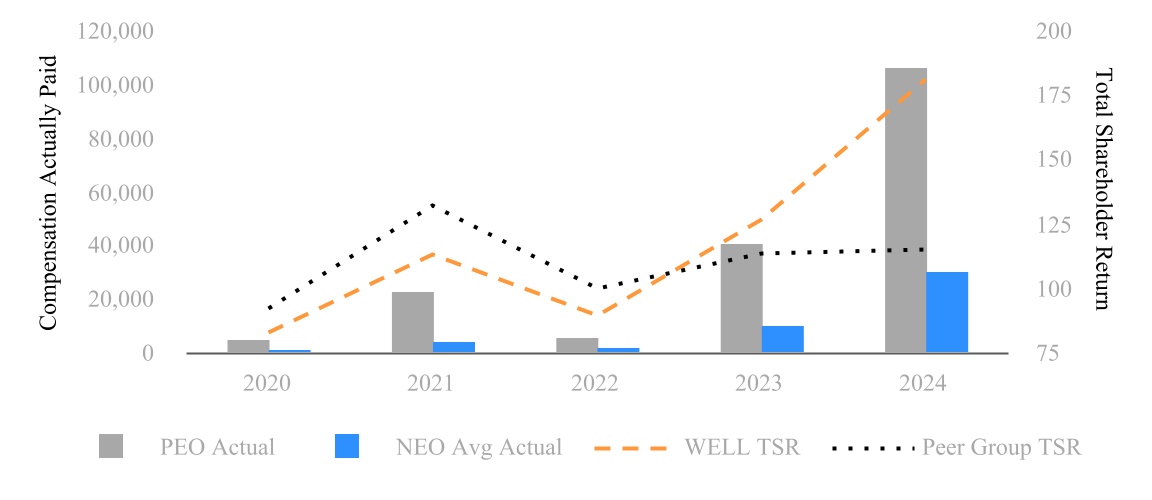

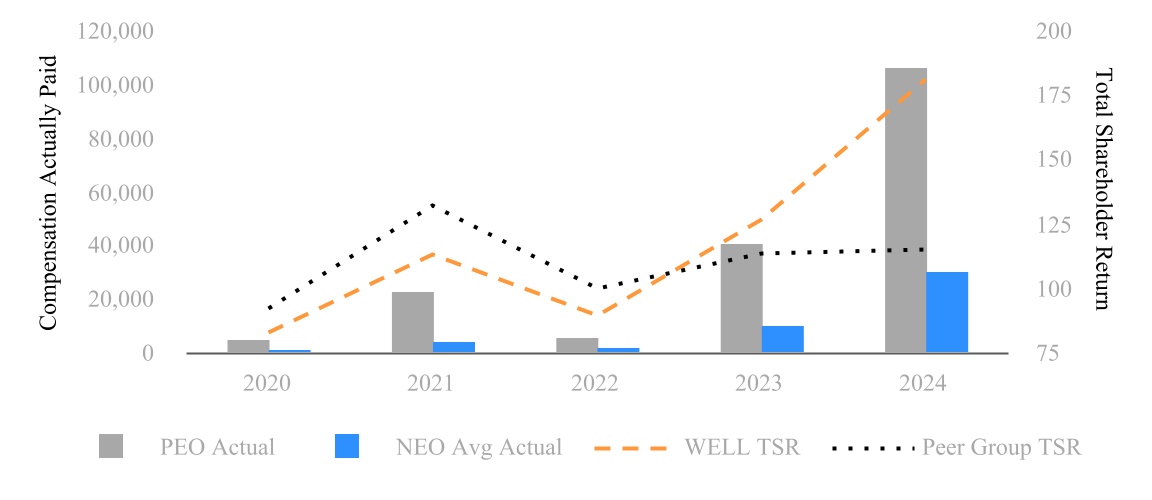

| Compensation Actually Paid vs. Total Shareholder Return |

The NEOs’ pay, particularly the PEO’s, closely tracks with our TSR since, in any year, generally more than 70 percent of the NEOs’ compensation is comprised of equity awards. The chart below shows Mr. Mitra’s and the average of our other NEOs’ pay compared to our annual TSR performance and the Peer Group’s TSR performance (in thousands, except TSR data):

|

|

|

|

|

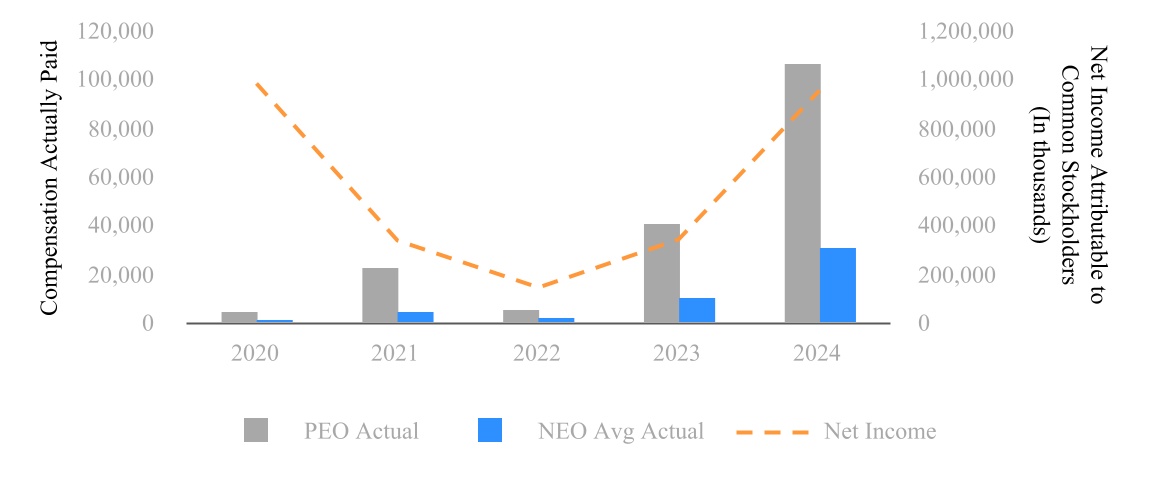

| Compensation Actually Paid vs. Net Income |

The chart below shows Mr. Mitra’s and the average of our other NEOs’ average pay compared to our net income attributable to common stockholders (in thousands):

|

|

|

|

|

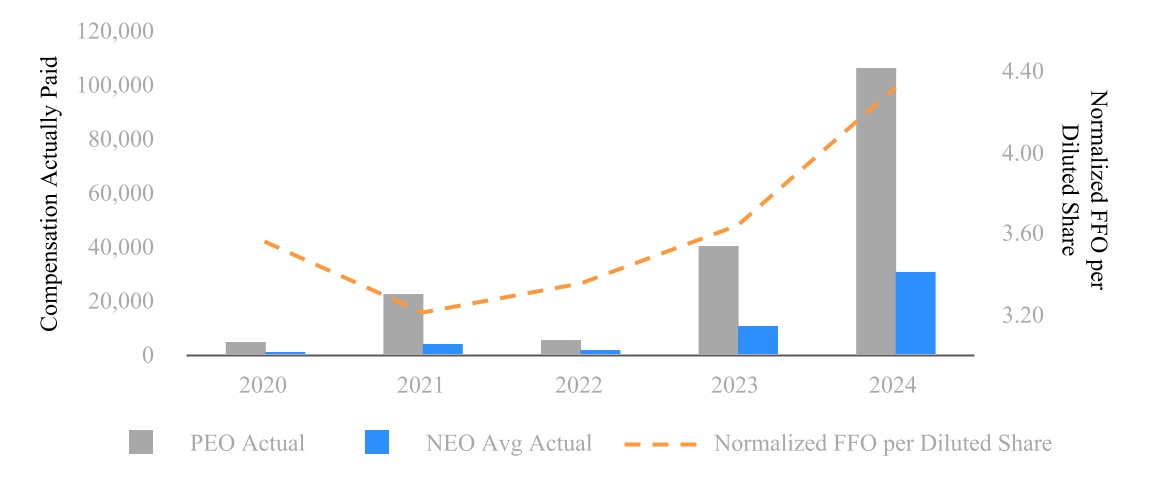

| Compensation Actually Paid vs. Company Selected Measure |

The chart below shows Mr. Mitra’s and the average of our other NEOs’ pay compared to our normalized FFO per diluted share performance (in thousands, except per share data):

|

|

|

|

|

| Total Shareholder Return Vs Peer Group |

The NEOs’ pay, particularly the PEO’s, closely tracks with our TSR since, in any year, generally more than 70 percent of the NEOs’ compensation is comprised of equity awards. The chart below shows Mr. Mitra’s and the average of our other NEOs’ pay compared to our annual TSR performance and the Peer Group’s TSR performance (in thousands, except TSR data):

|

|

|

|

|

| Tabular List, Table |

The following table lists the most important financial performance measures used to link compensation actually paid to our NEOs to company performance. | | | | Important Financial Performance Measures | | Relative Total Shareholder Return | | Normalized FFO per Diluted Share | | Adjusted Fixed Charge Coverage | | General and Administrative Expense Controls | | (Net Debt + Preferred) / Annualized Adjusted EBITDA |

|

|

|

|

|

| Total Shareholder Return Amount |

$ 180.71

|

126.31

|

89.10

|

113.03

|

82.51

|

| Peer Group Total Shareholder Return Amount |

114.71

|

113.36

|

99.68

|

131.78

|

92.00

|

| Net Income (Loss) |

$ 951,680,000

|

$ 340,094,000

|

$ 141,214,000

|

$ 336,138,000

|

$ 978,844,000

|

| Company Selected Measure Amount |

4.32

|

3.64

|

3.35

|

3.21

|

3.56

|

| Additional 402(v) Disclosure |

TSR is calculated by dividing (a) the sum of (i) the cumulative amount of dividends for the measurement period, assuming dividend reinvestment, and (ii) the difference between Welltower’s share price at the end of each fiscal year shown and the beginning of the measurement period by (b) Welltower’s share price at the beginning of the measurement period. The beginning of the measurement period for each year in the table is December 31, 2019. The dollar amounts reported represent the amount of net income (or loss) attributable to common stockholders reflected in Welltower’s audited financial statements for the applicable year.

|

|

|

|

|

| Measure:: 1 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Relative Total Shareholder Return

|

|

|

|

|

| Measure:: 2 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Normalized FFO per Diluted Share

|

|

|

|

|

| Non-GAAP Measure Description |

See Appendix A for a discussion and reconciliation of non-GAAP measures.

|

|

|

|

|

| Measure:: 3 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Adjusted Fixed Charge Coverage

|

|

|

|

|

| Measure:: 4 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

General and Administrative Expense Controls

|

|

|

|

|

| Measure:: 5 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

(Net Debt + Preferred) / Annualized Adjusted EBITDA

|

|

|

|

|

| Thomas J. DeRosa [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| PEO Total Compensation Amount |

|

|

|

|

$ 14,589,584

|

| PEO Actually Paid Compensation Amount |

|

|

|

|

$ (7,391,356)

|

| PEO Name |

|

|

|

|

Thomas J. DeRosa

|

| Shankh Mitra [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| PEO Name |

Shankh Mitra

|

Shankh Mitra

|

Shankh Mitra

|

Shankh Mitra

|

Shankh Mitra

|

| PEO | Thomas J. DeRosa [Member] | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

|

$ (10,501,359)

|

| PEO | Thomas J. DeRosa [Member] | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

|

0

|

| PEO | Thomas J. DeRosa [Member] | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

|

0

|

| PEO | Thomas J. DeRosa [Member] | Vesting Date Fair Value of Equity Awards Granted and Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

|

2,533,763

|

| PEO | Thomas J. DeRosa [Member] | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

|

(14,013,344)

|

| PEO | Shankh Mitra [Member] | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

$ (13,532,489)

|

$ (11,653,191)

|

$ (10,454,249)

|

$ (7,500,075)

|

(6,528,373)

|

| PEO | Shankh Mitra [Member] | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

30,189,488

|

19,380,298

|

7,822,060

|

14,018,154

|

4,703,812

|

| PEO | Shankh Mitra [Member] | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

59,995,952

|

11,237,147

|

(5,103,585)

|

2,964,149

|

(1,337,571)

|

| PEO | Shankh Mitra [Member] | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

9,775,110

|

4,594,884

|

(611,484)

|

589,204

|

(1,105,012)

|

| Non-PEO NEO | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(3,239,296)

|

(3,047,939)

|

(2,634,005)

|

(1,475,967)

|

(1,365,328)

|

| Non-PEO NEO | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

8,149,325

|

5,046,550

|

2,018,683

|

2,563,124

|

846,041

|

| Non-PEO NEO | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

17,904,140

|

2,819,526

|

(930,824)

|

427,784

|

(498,132)

|

| Non-PEO NEO | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

$ 2,322,577

|

$ 886,441

|

$ (77,960)

|

$ 156,992

|

$ (171,207)

|