Pay vs Performance Disclosure - USD ($)

|

12 Months Ended |

Dec. 31, 2024 |

Dec. 31, 2023 |

Dec. 31, 2022 |

Dec. 31, 2021 |

Dec. 31, 2020 |

| Pay vs Performance Disclosure |

|

|

|

|

|

| Pay vs Performance Disclosure, Table |

As required by Section 953(a) of the Dodd-Frank Act and Item 402(v) of Regulation S-K (the PvP Rule), we provide the following disclosure regarding executive “compensation actually paid” (CAP), calculated in accordance with SEC rules, and certain Company performance for the fiscal years listed below. This disclosure was prepared in accordance with the requirements of the PvP Rule and does not necessarily reflect the value actually realized by our executives, how our executives’ compensation relates to Company performance, or how the MD&C Committee evaluates compensation decisions in light of Company or individual performance. For example, the MD&C Committee does not use CAP as a basis for making compensation decisions, nor does it use net income (as reflected below) for purposes of determining our executives’ incentive compensation. Please refer to our Compensation Discussion and Analysis for a complete description of how executive compensation relates to Company performance and how the MD&C Committee makes its compensation decisions. The information provided under this Pay versus Performance section will not be deemed to be incorporated by reference into any filing made by the Company under the Securities Act or the Securities Exchange Act of 1934, as amended (the Exchange Act), except to the extent the Company specifically incorporates it by reference.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Summary Compensation Table Total for PEO (1) |

|

|

Compensation Actually Paid to PEO (2)(3) |

|

|

Average Summary Compensation Table Total for Non-PEO Named Executive Officers (1) |

|

|

Average Compensation Actually Paid to Non-PEO Named Executive Officers (2)(4) |

|

|

Value of Initial Fixed $100

Investment Based On: |

|

|

|

|

|

|

|

| |

|

|

|

Peer Group Total Shareholder Return (5) |

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

11,440,709 |

|

|

|

6,216,553 |

|

|

|

4,099,763 |

|

|

|

1,549,100 |

|

|

|

99.33 |

|

|

|

186.27 |

|

|

|

804 |

|

|

|

841 |

|

|

|

|

|

|

|

|

|

|

2023 |

|

|

13,763,441 |

|

|

|

3,438,692 |

|

|

|

5,142,656 |

|

|

|

1,481,677 |

|

|

|

149.23 |

|

|

|

189.15 |

|

|

|

2,855 |

|

|

|

965 |

|

|

|

|

|

|

|

|

|

|

2022 |

|

|

13,802,119 |

|

|

|

37,002,785 |

|

|

|

5,258,220 |

|

|

|

12,358,523 |

|

|

|

189.47 |

|

|

|

180.98 |

|

|

|

3,674 |

|

|

|

2,458 |

|

|

|

|

|

|

|

|

|

|

2021 |

|

|

15,040,707 |

|

|

|

27,948,348 |

|

|

|

5,318,503 |

|

|

|

9,347,083 |

|

|

|

107.38 |

|

|

|

113.41 |

|

|

|

973 |

|

|

|

1,823 |

|

|

|

|

|

|

|

|

|

|

2020 |

|

|

14,321,225 |

|

|

|

4,161,792 |

|

|

|

5,049,645 |

|

|

|

2,445,197 |

|

|

|

56.29 |

|

|

|

66.35 |

|

|

|

(4,860 |

) |

|

|

182 |

|

(1) |

The dollar amounts reported in columns (b) and (d) are the amounts of total compensation reported for the PEO and the average of the amounts reported for the Company’s non-PEO NEOs as a group, respectively, for each corresponding year in the “Total” column of the Summary Compensation Table (SCT). The individuals included in the table are: |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Stephen J. Riney, D. Clay Bretches, Tracey K. Henderson, Mark D. Maddox, P. Anthony Lannie, and David A. Pursell |

|

|

|

|

Stephen J. Riney, David A. Pursell, D. Clay Bretches, and Tracey K. Henderson |

|

|

|

|

Stephen J. Riney, P. Anthony Lannie, David A. Pursell, and D. Clay Bretches |

(2) |

The dollar amounts reported in columns (c) and (e) represent the amount of CAP to the PEO and the non-PEO NEOs as a group, respectively, as computed in accordance with the PvP Rule. The dollar amounts do not reflect the actual amount of compensation earned by or paid to these individuals during the applicable year. In accordance with the requirements of the PvP Rule, the adjustments in the tables in the following footnotes below were made to the total compensation of the PEO and the average compensation paid to the non-PEO NEOs as a group, as reported in the SCT for the most recent year, and the addition (or subtraction, as applicable) of the amounts shown in the table for equity award adjustments, as required by the PVP Rule, to determine the CAP. Similar adjustments were made for prior years shown in the table above. No pension benefit adjustments were made, as the Company does not have any defined benefit or actuarial pension plans applicable to our U.S. employees, including our NEOs. The grant date fair value of equity awards represents the total (or average, as applicable) of the amounts reported in the “Stock Awards” and “Option Awards” columns in the SCT for the applicable year. The valuation assumptions used to calculate fair values did not materially differ from those disclosed at the time of grant. |

(3) |

Adjustments made to the total compensation of the PEO for the most recent year were as follows: |

|

|

|

|

|

Calculation of CAP for PEO |

|

|

|

|

|

|

|

|

Reported value of equity awards ($) |

|

|

|

|

Fair value as of the end of the covered fiscal year of equity awards granted during the covered fiscal year that are outstanding and unvested as of the end of the covered fiscal year ($) |

|

|

|

|

Change as of the end of the covered fiscal year (from the end of the prior fiscal year) in fair value of equity awards granted in prior fiscal years that are outstanding and unvested as of the end of the covered fiscal year ($) |

|

|

|

|

Fair value as of vesting date of equity awards granted and vested in the covered fiscal year ($) |

|

|

|

|

Change as of the vesting date (from the end of the prior fiscal year) in fair value of equity awards granted in prior fiscal years that vested in the covered fiscal year ($) |

|

|

|

|

Fair value at the end of the prior fiscal year of equity awards granted in prior fiscal years that failed to meet applicable vesting conditions in the covered fiscal year ($) |

|

|

|

|

Value of dividends or other earnings paid on stock or option awards in the covered fiscal year prior to the vesting date that are not otherwise included in total compensation for the covered fiscal year ($) |

|

|

|

|

|

|

|

|

|

| |

* |

Individual amounts above and the totals are rounded to the nearest dollar. |

(4) |

Adjustments made to the average compensation of the non-PEO NEOs as a group for the most recent year were as follows: |

|

|

|

|

|

Calculation of Average CAP for Non-PEO NEOs as a Group |

|

|

|

|

|

|

|

|

Reported value of equity awards ($) |

|

|

|

|

Fair value as of the end of the covered fiscal year of equity awards granted during the covered fiscal year that are outstanding and unvested as of the end of the covered fiscal year ($) |

|

|

|

|

Change as of the end of the covered fiscal year (from the end of the prior fiscal year) in fair value of equity awards granted in prior fiscal years that are outstanding and unvested as of the end of the covered fiscal year ($) |

|

|

|

|

Fair value as of vesting date of equity awards granted and vested in the covered fiscal year ($) |

|

|

|

|

Change as of the vesting date (from the end of the prior fiscal year) in fair value of equity awards granted in prior fiscal years that vested in the covered fiscal year ($) |

|

|

|

|

Fair value at the end of the prior fiscal year of equity awards granted in prior fiscal years that failed to meet applicable vesting conditions in the covered fiscal year ($) |

|

|

|

|

Value of dividends or other earnings paid on stock or option awards in the covered fiscal year prior to the vesting date that are not otherwise included in total compensation for the covered fiscal year ($) |

|

|

|

|

|

|

|

|

|

| |

* |

Individual amounts above and the totals are rounded to the nearest dollar. |

(5) |

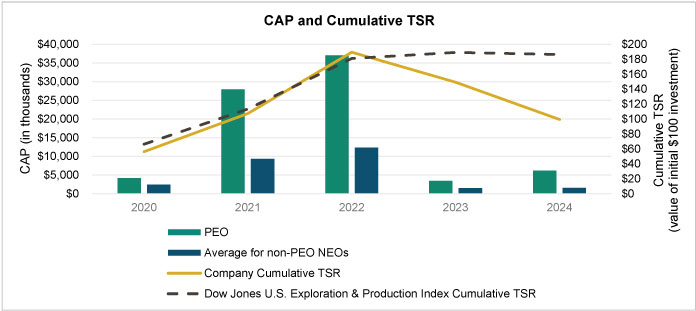

Represents the weighted peer group cumulative TSR, weighted according to the respective companies’ stock market capitalization at the beginning of each period for which a return is indicated. The peer group used for this purpose is the Dow Jones U.S. Exploration & Production Index, which is the same published industry index the Company uses for purposes of Item 201(e)(1)(ii) of Regulation S-K. |

(6) |

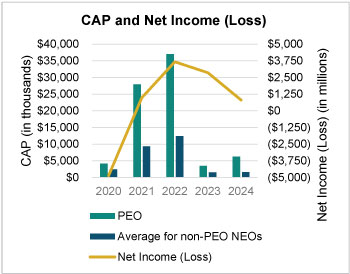

The dollar amounts reported represent the amount of net income (loss) previously disclosed in the Company’s audited GAAP financial statements for the applicable year, as required by Regulation S-X. |

(7) |

Free Cash Flow for purposes of this Pay versus Performance table is calculated by taking cash flows from operations before changes in operating assets and liabilities, including Sinopec’s noncontrolling interest, and subtracts upstream capital investment and distributions to Sinopec’s noncontrolling interest. This is a different formulation of Free Cash Flow as compared to what is used in the Company’s goal metrics, as described in the Compensation Discussion and Analysis section. |

|

|

|

|

|

| Company Selected Measure Name |

Free Cash Flow

|

|

|

|

|

| Named Executive Officers, Footnote |

(1) |

The dollar amounts reported in columns (b) and (d) are the amounts of total compensation reported for the PEO and the average of the amounts reported for the Company’s non-PEO NEOs as a group, respectively, for each corresponding year in the “Total” column of the Summary Compensation Table (SCT). The individuals included in the table are: |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Stephen J. Riney, D. Clay Bretches, Tracey K. Henderson, Mark D. Maddox, P. Anthony Lannie, and David A. Pursell |

|

|

|

|

Stephen J. Riney, David A. Pursell, D. Clay Bretches, and Tracey K. Henderson |

|

|

|

|

Stephen J. Riney, P. Anthony Lannie, David A. Pursell, and D. Clay Bretches |

|

|

|

|

|

| Peer Group Issuers, Footnote |

Represents the weighted peer group cumulative TSR, weighted according to the respective companies’ stock market capitalization at the beginning of each period for which a return is indicated. The peer group used for this purpose is the Dow Jones U.S. Exploration & Production Index, which is the same published industry index the Company uses for purposes of Item 201(e)(1)(ii) of Regulation S-K.

|

|

|

|

|

| PEO Total Compensation Amount |

$ 11,440,709

|

$ 13,763,441

|

$ 13,802,119

|

$ 15,040,707

|

$ 14,321,225

|

| PEO Actually Paid Compensation Amount |

$ 6,216,553

|

3,438,692

|

37,002,785

|

27,948,348

|

4,161,792

|

| Adjustment To PEO Compensation, Footnote |

(2) |

The dollar amounts reported in columns (c) and (e) represent the amount of CAP to the PEO and the non-PEO NEOs as a group, respectively, as computed in accordance with the PvP Rule. The dollar amounts do not reflect the actual amount of compensation earned by or paid to these individuals during the applicable year. In accordance with the requirements of the PvP Rule, the adjustments in the tables in the following footnotes below were made to the total compensation of the PEO and the average compensation paid to the non-PEO NEOs as a group, as reported in the SCT for the most recent year, and the addition (or subtraction, as applicable) of the amounts shown in the table for equity award adjustments, as required by the PVP Rule, to determine the CAP. Similar adjustments were made for prior years shown in the table above. No pension benefit adjustments were made, as the Company does not have any defined benefit or actuarial pension plans applicable to our U.S. employees, including our NEOs. The grant date fair value of equity awards represents the total (or average, as applicable) of the amounts reported in the “Stock Awards” and “Option Awards” columns in the SCT for the applicable year. The valuation assumptions used to calculate fair values did not materially differ from those disclosed at the time of grant. |

(3) |

Adjustments made to the total compensation of the PEO for the most recent year were as follows: |

|

|

|

|

|

Calculation of CAP for PEO |

|

|

|

|

|

|

|

|

Reported value of equity awards ($) |

|

|

|

|

Fair value as of the end of the covered fiscal year of equity awards granted during the covered fiscal year that are outstanding and unvested as of the end of the covered fiscal year ($) |

|

|

|

|

Change as of the end of the covered fiscal year (from the end of the prior fiscal year) in fair value of equity awards granted in prior fiscal years that are outstanding and unvested as of the end of the covered fiscal year ($) |

|

|

|

|

Fair value as of vesting date of equity awards granted and vested in the covered fiscal year ($) |

|

|

|

|

Change as of the vesting date (from the end of the prior fiscal year) in fair value of equity awards granted in prior fiscal years that vested in the covered fiscal year ($) |

|

|

|

|

Fair value at the end of the prior fiscal year of equity awards granted in prior fiscal years that failed to meet applicable vesting conditions in the covered fiscal year ($) |

|

|

|

|

Value of dividends or other earnings paid on stock or option awards in the covered fiscal year prior to the vesting date that are not otherwise included in total compensation for the covered fiscal year ($) |

|

|

|

|

|

|

|

|

|

| |

* |

Individual amounts above and the totals are rounded to the nearest dollar. |

|

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

$ 4,099,763

|

5,142,656

|

5,258,220

|

5,318,503

|

5,049,645

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

$ 1,549,100

|

1,481,677

|

12,358,523

|

9,347,083

|

2,445,197

|

| Adjustment to Non-PEO NEO Compensation Footnote |

(4) |

Adjustments made to the average compensation of the non-PEO NEOs as a group for the most recent year were as follows: |

|

|

|

|

|

Calculation of Average CAP for Non-PEO NEOs as a Group |

|

|

|

|

|

|

|

|

Reported value of equity awards ($) |

|

|

|

|

Fair value as of the end of the covered fiscal year of equity awards granted during the covered fiscal year that are outstanding and unvested as of the end of the covered fiscal year ($) |

|

|

|

|

Change as of the end of the covered fiscal year (from the end of the prior fiscal year) in fair value of equity awards granted in prior fiscal years that are outstanding and unvested as of the end of the covered fiscal year ($) |

|

|

|

|

Fair value as of vesting date of equity awards granted and vested in the covered fiscal year ($) |

|

|

|

|

Change as of the vesting date (from the end of the prior fiscal year) in fair value of equity awards granted in prior fiscal years that vested in the covered fiscal year ($) |

|

|

|

|

Fair value at the end of the prior fiscal year of equity awards granted in prior fiscal years that failed to meet applicable vesting conditions in the covered fiscal year ($) |

|

|

|

|

Value of dividends or other earnings paid on stock or option awards in the covered fiscal year prior to the vesting date that are not otherwise included in total compensation for the covered fiscal year ($) |

|

|

|

|

|

|

|

|

|

| |

* |

Individual amounts above and the totals are rounded to the nearest dollar. |

|

|

|

|

|

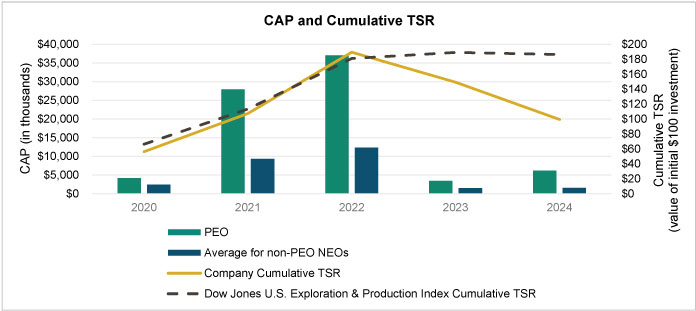

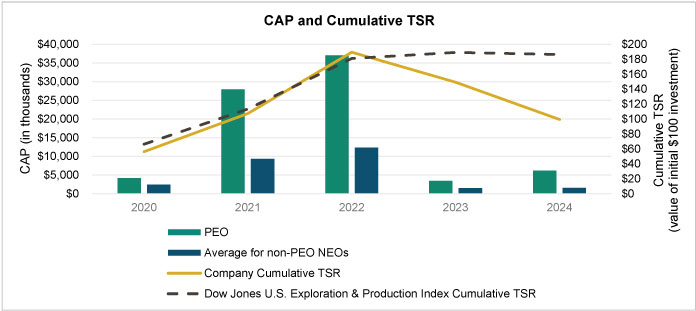

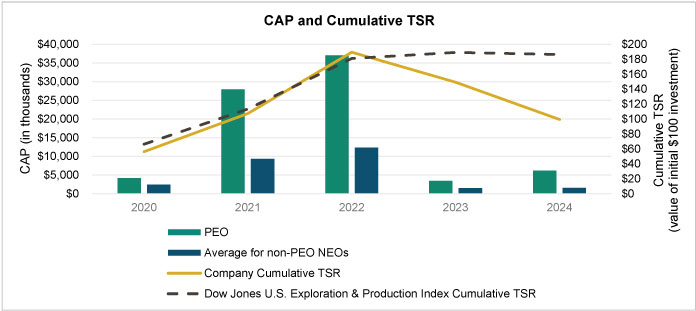

| Compensation Actually Paid vs. Total Shareholder Return |

|

|

|

|

|

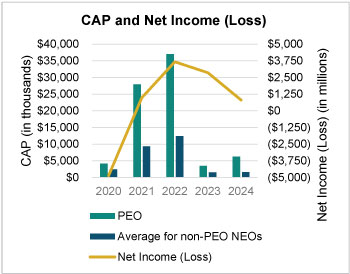

| Compensation Actually Paid vs. Net Income |

|

|

|

|

|

| Compensation Actually Paid vs. Company Selected Measure |

|

|

|

|

|

| Total Shareholder Return Vs Peer Group |

|

|

|

|

|

| Tabular List, Table |

Financial Performance Measures In our assessment, the most important financial performance measures used to link CAP (as calculated in accordance with the SEC rules) to our NEOs in 2024 to our performance were:

| |

• |

|

Cash Return on Invested Capital |

| |

• |

|

Cash Costs per BOE ($/BOE) |

| |

• |

|

All-in Finding and Development ($/BOE) |

|

|

|

|

|

| Total Shareholder Return Amount |

$ 99.33

|

149.23

|

189.47

|

107.38

|

56.29

|

| Peer Group Total Shareholder Return Amount |

186.27

|

189.15

|

180.98

|

113.41

|

66.35

|

| Net Income (Loss) |

$ 804,000,000

|

$ 2,855,000,000

|

$ 3,674,000,000

|

$ 973,000,000

|

$ (4,860,000,000)

|

| Company Selected Measure Amount |

841,000,000

|

965,000,000

|

2,458,000,000

|

1,823,000,000

|

182,000,000

|

| PEO Name |

John J. Christmann IV

|

|

|

|

|

| Measure:: 1 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Free Cash Flow

|

|

|

|

|

| Non-GAAP Measure Description |

Free Cash Flow for purposes of this Pay versus Performance table is calculated by taking cash flows from operations before changes in operating assets and liabilities, including Sinopec’s noncontrolling interest, and subtracts upstream capital investment and distributions to Sinopec’s noncontrolling interest. This is a different formulation of Free Cash Flow as compared to what is used in the Company’s goal metrics, as described in the Compensation Discussion and Analysis |

|

|

|

|

| Measure:: 2 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Cash Return on Invested Capital

|

|

|

|

|

| Measure:: 3 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Cash Costs per BOE ($/BOE)

|

|

|

|

|

| Measure:: 4 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

All-in Finding and Development ($/BOE)

|

|

|

|

|

| PEO | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

$ (7,555,373)

|

|

|

|

|

| PEO | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

6,091,918

|

|

|

|

|

| PEO | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(8,359,619)

|

|

|

|

|

| PEO | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

3,761,435

|

|

|

|

|

| PEO | Dividends or Other Earnings Paid on Equity Awards not Otherwise Reflected in Total Compensation for Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

837,482

|

|

|

|

|

| Non-PEO NEO | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(2,269,443)

|

|

|

|

|

| Non-PEO NEO | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

1,354,071

|

|

|

|

|

| Non-PEO NEO | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(2,548,922)

|

|

|

|

|

| Non-PEO NEO | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

896,072

|

|

|

|

|

| Non-PEO NEO | Prior Year End Fair Value of Equity Awards Granted in Any Prior Year that Fail to Meet Applicable Vesting Conditions During Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(203,709)

|

|

|

|

|

| Non-PEO NEO | Dividends or Other Earnings Paid on Equity Awards not Otherwise Reflected in Total Compensation for Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

$ 221,268

|

|

|

|

|