What were the Fund costs for the period?

(based on a hypothetical $10,000 investment)

|

Fund Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

|---|---|---|

|

Laffer|Tengler Equity Income ETF |

$50 |

0.95%¹ |

| ¹ | Annualized. |

Key Fund Statistics

(as of January 31, 2025)

|

Fund Net Assets |

$14,242,410 |

|

Number of Holdings |

29 |

|

Total Advisory Fee Paid |

$63,947 |

|

Portfolio Turnover Rate |

4.36% |

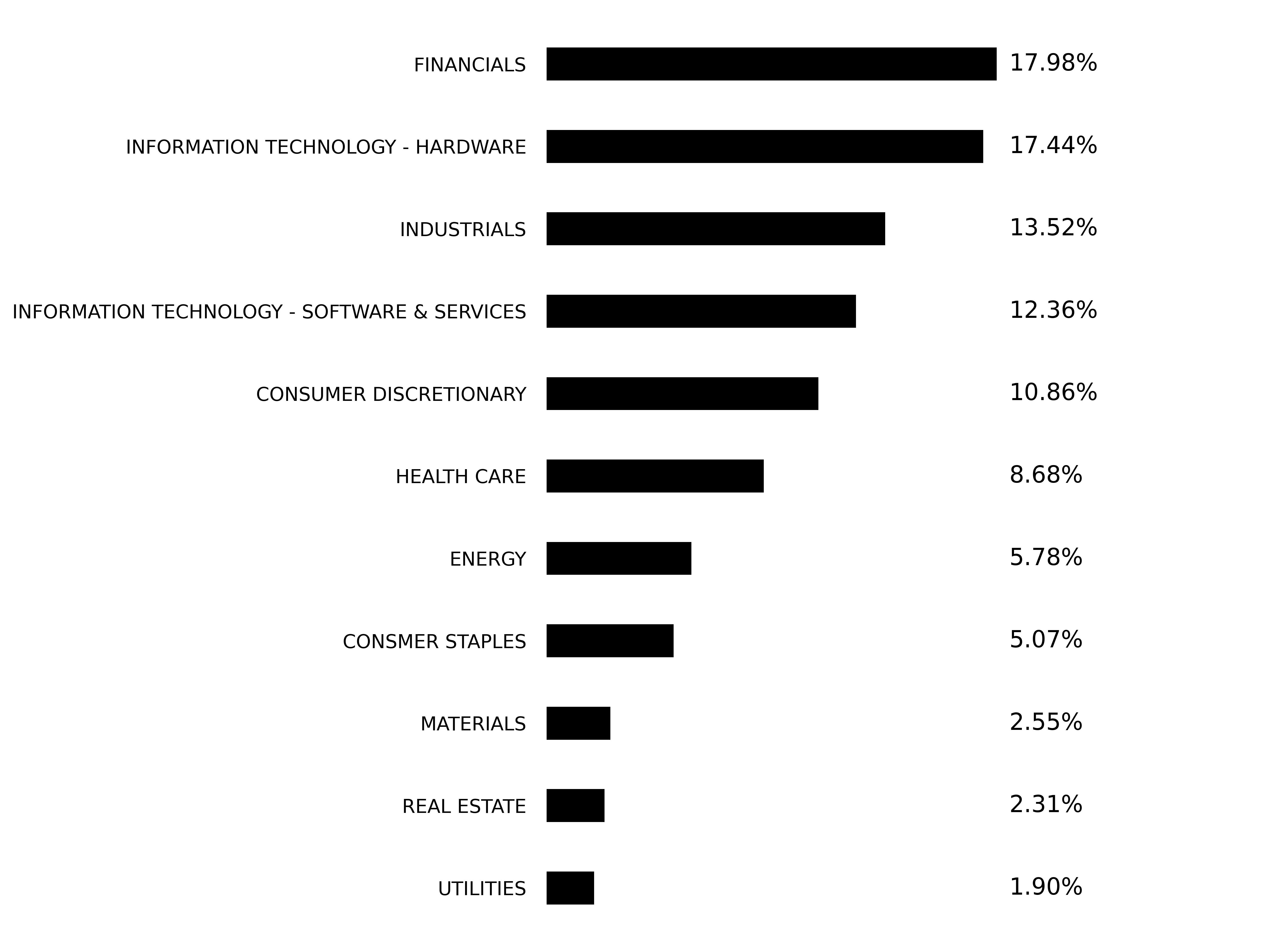

Sector Breakdown

|

Top Ten Holdings |

|

|---|---|

|

Broadcom, Inc. |

|

|

American Express Co. |

|

|

Walmart, Inc. |

|

|

JPMorgan Chase & Co. |

|

|

Oracle Corp. |

|

|

Microsoft Corp. |

|

|

RTX Corp. |

|

|

Goldman Sachs Group, Inc. |

|

|

Home Depot, Inc. |

|

|

Abbvie, Inc. |

| [1] | Annualized. |