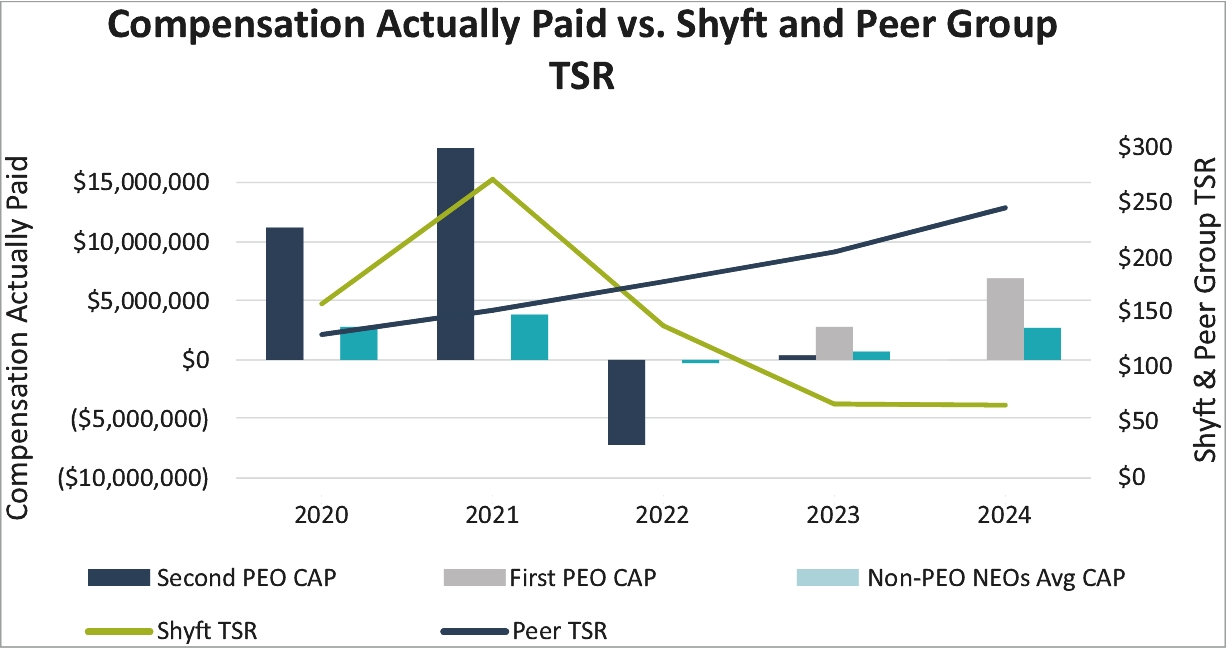

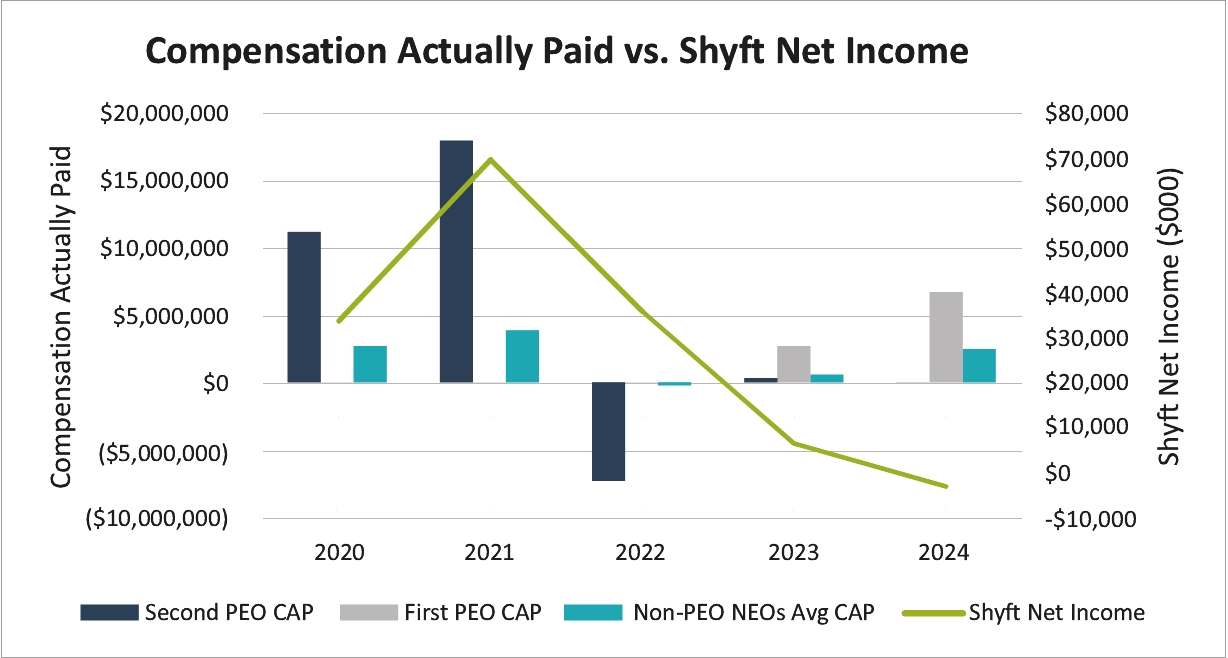

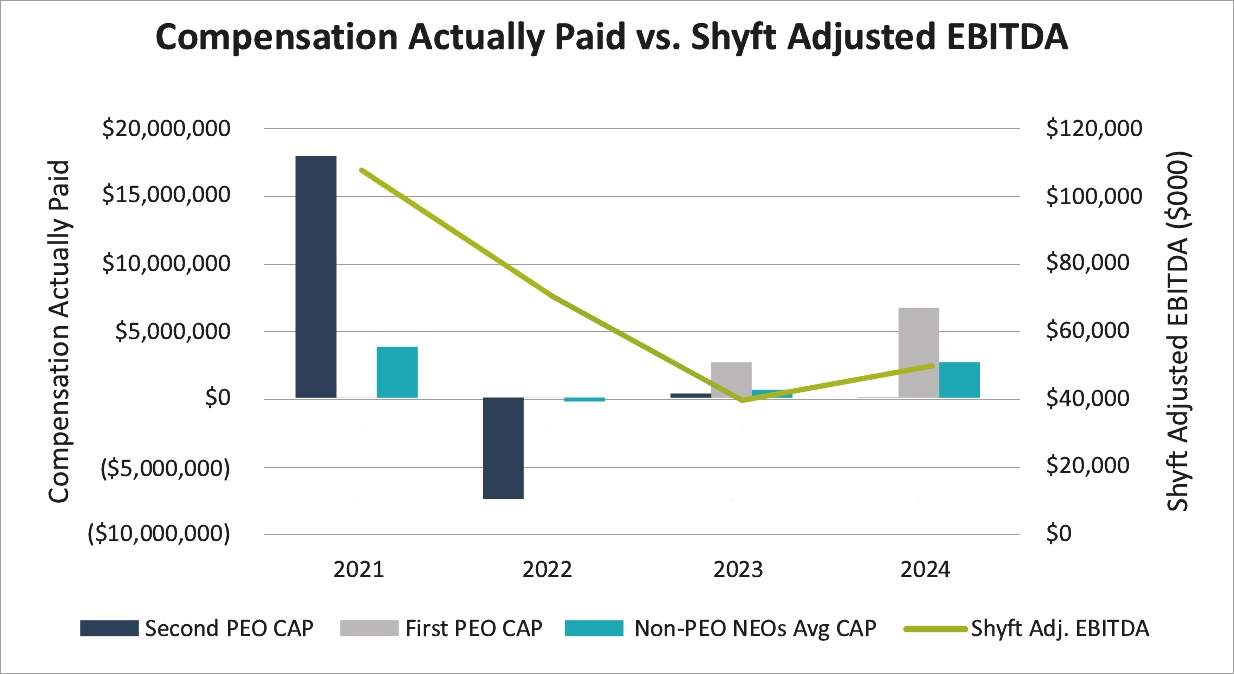

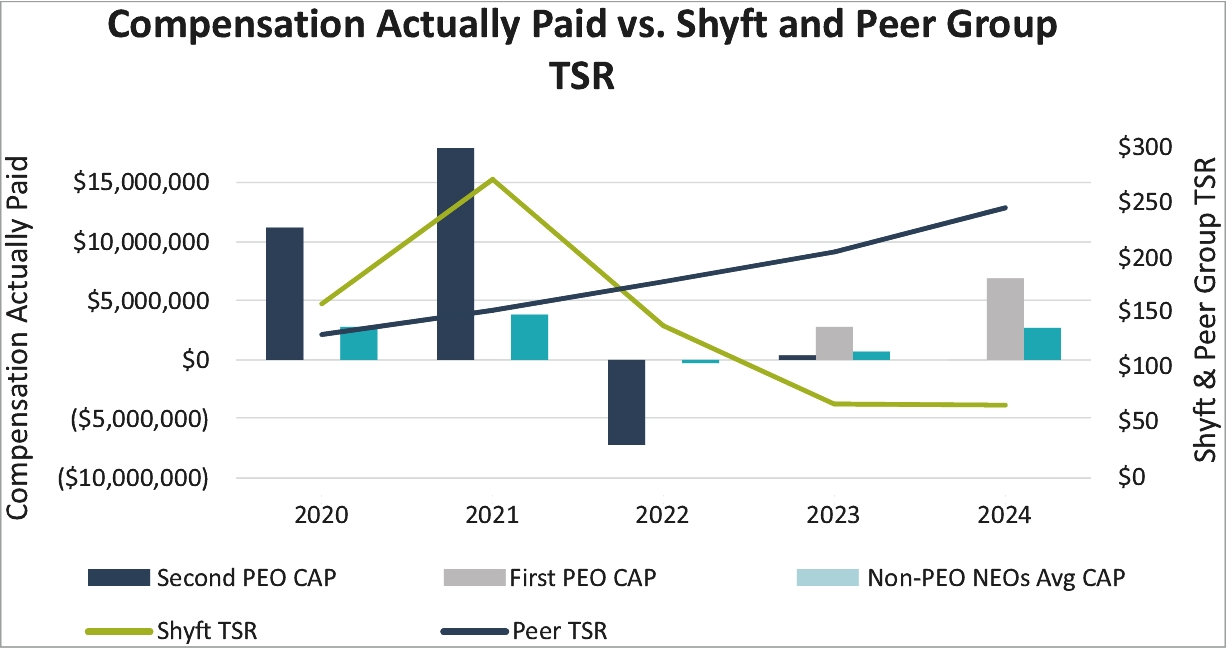

Value of initial fixed $100 investment based on: | ||||||||||||||||||||||||||||||||

Year (a) | Summary Compensation Table Total for First PEO (b1) | Summary Compensation Table Total for Second PEO (b2) | Compensation Actually Paid to First PEO (c1) | Compensation Actually Paid to Second PEO (c2) | Average Summary Compensation Table Total for non-PEO NEOs (d) | Average Compensation Actually Paid to non-PEO NEOs (e) | Total Shareholder Return (f) | Peer Group Total Shareholder Return (g) | Net Income (000s) (h) | Shyft Adjusted EBITDA (000s) (i) | ||||||||||||||||||||||

2024 | $6,704,927 | — | $6,824,031 | — | $3,068,125 | $2,552,066 | $64.93 | $244.65 | $(2,795) | $48,848 | ||||||||||||||||||||||

2023 | 3,402,383 | $3,755,905 | 2,706,203 | $263,813 | 1,131,628 | 541,211 | 67.59 | 204.99 | 6,464 | 39,968 | ||||||||||||||||||||||

2022 | — | 3,417,703 | — | (7,264,177) | 1,295,458 | (151,088) | 137.50 | 177.95 | 36,558 | 70,793 | ||||||||||||||||||||||

2021 | — | 5,147,927 | — | 17,936,324 | 1,423,191 | 3,782,664 | 271.74 | 151.52 | 70,155 | 108,066 | ||||||||||||||||||||||

2020 | — | 4,495,767 | — | 11,205,332 | 1,274,709 | 2,655,111 | 156.97 | 128.80 | 33,166 | 76,346 | ||||||||||||||||||||||

First PEO (Dunn) | Second PEO (Adams) | |||||||||||||||||||

Compensation Actually Paid to PEO | 2024 | 2023 | 2023 | 2022 | 2021 | 2020 | ||||||||||||||

SCT Total Compensation ($) | 6,704,927 | 3,402,383 | 3,755,905 | 3,417,703 | 5,147,927 | 4,495,767 | ||||||||||||||

Less: Stock and Option Award Values Reported in SCT for the Covered Year ($) | (4,983,273) | (2,230,214) | (2,567,922) | (2,211,760) | (2,554,773) | (1,978,913) | ||||||||||||||

Plus: Covered Year-End Fair Value for Stock and Option Awards Granted in and Outstanding at the End of the Covered Year ($) | 4,142,312 | 1,534,034 | 627,261 | 1,053,484 | 4,349,758 | 6,021,187 | ||||||||||||||

Plus/Minus: Change in Fair Value (From Prior Year-End to Covered Year-End) of Outstanding Unvested Stock and Option Awards Granted Prior to the Covered Year ($) | (302,657) | — | (847,981) | (3,172,834) | 5,666,217 | 3,547,420 | ||||||||||||||

Plus/Minus: Change in Fair Value (From Prior Year-End to Vesting Date) of Stock and Option Awards Granted Prior to the Covered Year that Vested in the Covered Year ($) | 1,262,722 | — | (703,450) | (6,350,770) | 5,327,195 | (880,130) | ||||||||||||||

Compensation Actually Paid ($) | 6,824,031 | 2,706,203 | 263,813 | (7,264,177) | 17,936,324 | 11,205,332 | ||||||||||||||

Average Compensation Actually Paid to Non-PEO NEOs | 2024 | 2023 | 2022 | 2021 | 2020 | ||||||||||||

SCT Total Compensation ($) | 3,068,125 | 1,131,628 | 1,295,458 | 1,423,191 | 1,274,709 | ||||||||||||

Less: Stock and Option Award Values Reported in SCT for the Covered Year ($) | (1,885,322) | (560,801) | (670,736) | (663,829) | (526,733) | ||||||||||||

Plus: Covered Year-End Fair Value for Stock and Option Awards Granted in and Outstanding at the End of the Covered Year ($) | 1,033,505 | 317,112 | 507,847 | 1,086,806 | 1,630,064 | ||||||||||||

Plus/Minus: Change in Fair Value (From Prior Year-End to Covered Year-End) of Outstanding Unvested Stock and Option Awards Granted Prior to the Covered Year ($) | (214,741) | (258,504) | (605,195) | 1,550,824 | 354,922 | ||||||||||||

Plus/Minus: Change in Fair Value (From Prior Year-End to Vesting Date) of Stock and Option Awards Granted Prior to the Covered Year that Vested in the Covered Year ($) | 550,499 | (88,225) | (678,462) | 385,671 | (77,851) | ||||||||||||

Compensation Actually Paid ($) | 2,552,066 | 541,211 | (151,088) | 3,782,664 | 2,655,111 | ||||||||||||

First PEO (Dunn) | Second PEO (Adams) | |||||||||||||||||||

Compensation Actually Paid to PEO | 2024 | 2023 | 2023 | 2022 | 2021 | 2020 | ||||||||||||||

SCT Total Compensation ($) | 6,704,927 | 3,402,383 | 3,755,905 | 3,417,703 | 5,147,927 | 4,495,767 | ||||||||||||||

Less: Stock and Option Award Values Reported in SCT for the Covered Year ($) | (4,983,273) | (2,230,214) | (2,567,922) | (2,211,760) | (2,554,773) | (1,978,913) | ||||||||||||||

Plus: Covered Year-End Fair Value for Stock and Option Awards Granted in and Outstanding at the End of the Covered Year ($) | 4,142,312 | 1,534,034 | 627,261 | 1,053,484 | 4,349,758 | 6,021,187 | ||||||||||||||

Plus/Minus: Change in Fair Value (From Prior Year-End to Covered Year-End) of Outstanding Unvested Stock and Option Awards Granted Prior to the Covered Year ($) | (302,657) | — | (847,981) | (3,172,834) | 5,666,217 | 3,547,420 | ||||||||||||||

Plus/Minus: Change in Fair Value (From Prior Year-End to Vesting Date) of Stock and Option Awards Granted Prior to the Covered Year that Vested in the Covered Year ($) | 1,262,722 | — | (703,450) | (6,350,770) | 5,327,195 | (880,130) | ||||||||||||||

Compensation Actually Paid ($) | 6,824,031 | 2,706,203 | 263,813 | (7,264,177) | 17,936,324 | 11,205,332 | ||||||||||||||

Average Compensation Actually Paid to Non-PEO NEOs | 2024 | 2023 | 2022 | 2021 | 2020 | ||||||||||||

SCT Total Compensation ($) | 3,068,125 | 1,131,628 | 1,295,458 | 1,423,191 | 1,274,709 | ||||||||||||

Less: Stock and Option Award Values Reported in SCT for the Covered Year ($) | (1,885,322) | (560,801) | (670,736) | (663,829) | (526,733) | ||||||||||||

Plus: Covered Year-End Fair Value for Stock and Option Awards Granted in and Outstanding at the End of the Covered Year ($) | 1,033,505 | 317,112 | 507,847 | 1,086,806 | 1,630,064 | ||||||||||||

Plus/Minus: Change in Fair Value (From Prior Year-End to Covered Year-End) of Outstanding Unvested Stock and Option Awards Granted Prior to the Covered Year ($) | (214,741) | (258,504) | (605,195) | 1,550,824 | 354,922 | ||||||||||||

Plus/Minus: Change in Fair Value (From Prior Year-End to Vesting Date) of Stock and Option Awards Granted Prior to the Covered Year that Vested in the Covered Year ($) | 550,499 | (88,225) | (678,462) | 385,671 | (77,851) | ||||||||||||

Compensation Actually Paid ($) | 2,552,066 | 541,211 | (151,088) | 3,782,664 | 2,655,111 | ||||||||||||

Financial Performance Measures | ||||||||

Adjusted EBITDA (Company and segment) | Net Income | Relative TSR | ||||||

Free Cash Flow Conversion | ||||||||