Pay vs Performance Disclosure - USD ($)

|

12 Months Ended |

Dec. 31, 2024 |

Dec. 31, 2023 |

Dec. 31, 2022 |

Dec. 31, 2021 |

Dec. 31, 2020 |

| Pay vs Performance Disclosure |

|

|

|

|

|

| Pay vs Performance Disclosure, Table |

As required by Item 402(v) of Regulation S-K, we are providing the following disclosure regarding executive compensation paid to our CEO and principal executive officer (“PEO”), Kevin Sayer, and our NEOs other than our CEO (the “Other NEOs”), and company performance for the fiscal years listed below. Our Compensation Committee did not consider the pay versus performance disclosure below in making its pay decisions for any of the years shown. For further information concerning our pay-for-performance philosophy and how we structure our executive compensation to drive and reward performance, refer to “Executive Compensation—Compensation Discussion and Analysis.” The amounts shown below are calculated in accordance with Item 402(v) of Regulation S-K. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Value of Initial Fixed $100 Investment Based On: | | | | | Year | Summary Compensation Table Total for PEO $(1) | Compensation Actually Paid to PEO $(1)(4)(5) | Average Summary Compensation Table Total for Other NEOs $(2) | Average Compensation Actually Paid to Other NEOs $(2)(4)(5) | | Total Shareholder Return $(6) | Peer Group Total Shareholder Return $(6) | Net Income (in millions) $(7) | Company Selected Measure: Revenue (in millions) $(8) | | | 2024 | 15,828,797 | (8,689,910) | | 5,619,919 | 532,201 | | 142.21 | 105.04 | 576.2 | | 4,034.6 | | | | 2023 | 15,712,244 | 22,999,097 | 5,015,577 | 6,071,441 | | 226.92 | 99.63 | 541.5 | | 3,608.6 | | (9) | | 2022 | 15,435,652 | 5,735,702 | 4,440,975 | 3,929,405 | | 207.08 | 105.61 | 341.2 | | 2,964.9 | | (10) | | 2021 | 11,985,324 | 36,052,076 | 4,962,060 | 6,403,115 | | 245.47 | 137.80 | 216.9 | | 2,422.5 | | (11) | | 2020 | 13,804,156 | 45,122,463 | 5,707,750 | 10,335,589 | (3) | 169.02 | 133.15 | 549.7 | | 1,926.7 | | (12) |

(1)Kevin Sayer was our PEO for all years presented. (2)For the applicable fiscal year, other NEOs include: 2024: Jereme M. Sylvain, Michael J. Brown, Jacob S. Leach, Sadie M. Stern, and Teri L. Lawver; 2023: Jereme M. Sylvain, Michael J. Brown, Teri L. Lawver, and Jacob S. Leach; 2022: Jereme M. Sylvain, Michael J. Brown, Girish Naganathan, and Jacob S. Leach; 2021: Jereme M. Sylvain, Paul Flynn, Jacob S. Leach, Chad Patterson, and Quentin Blackford; 2020: Quentin Blackford, Richard Doubleday, Jacob S. Leach, and Jeffrey Moy. (3)Mr. Moy and Mr. Doubleday received acceleration of time-based vesting for outstanding equity awards pursuant to Mr. Moy’s retention incentive agreement dated April 2020 and Mr. Doubleday’s transition and consulting agreement dated December 2020. The modifications of the RSUs are reflected above as of the modification date of April 28, 2020 for Mr. Moy and December 10, 2020 for Mr. Doubleday.

|

|

|

|

|

| Named Executive Officers, Footnote |

Kevin Sayer was our PEO for all years presented. (2)For the applicable fiscal year, other NEOs include: 2024: Jereme M. Sylvain, Michael J. Brown, Jacob S. Leach, Sadie M. Stern, and Teri L. Lawver; 2023: Jereme M. Sylvain, Michael J. Brown, Teri L. Lawver, and Jacob S. Leach; 2022: Jereme M. Sylvain, Michael J. Brown, Girish Naganathan, and Jacob S. Leach; 2021: Jereme M. Sylvain, Paul Flynn, Jacob S. Leach, Chad Patterson, and Quentin Blackford; 2020: Quentin Blackford, Richard Doubleday, Jacob S. Leach, and Jeffrey Moy.

|

|

|

|

|

| PEO Total Compensation Amount |

$ 15,828,797

|

$ 15,712,244

|

$ 15,435,652

|

$ 11,985,324

|

$ 13,804,156

|

| PEO Actually Paid Compensation Amount |

$ (8,689,910)

|

22,999,097

|

5,735,702

|

36,052,076

|

45,122,463

|

| Adjustment To PEO Compensation, Footnote |

The 2024 Summary Compensation Table (“SCT”) totals reported for the PEO and the average of the Other NEOs for fiscal 2024 were subject to the following adjustments per Item 402(v)(2)(iii) of Regulation S-K to calculate “compensation actually paid” or CAP: | | | | | | | | | | | | | | | | | | | | | | | 2024 | | | | | | | | | PEO ($) | Average for Other NEOs ($) | | | | | | | | | | | Summary Compensation Table | | 15,828,797 | 5,619,919 | | | | | | | | | | | | Adjustments for Grant Date Fair Value | | | | | | | | | | | | | | Deductions for equity awards reported in Summary Compensation Table | | (14,536,111) | | (4,880,561) | | | | | | | | | | | | Adjustments for Changes in Equity Fair Value | | | | | | | | | | | | | | Year-end Fair Value of Equity Awards Granted During the Year that Remained Unvested as of the End of the Covered Year | | 3,768,624 | | 1,891,071 | | | | | | | | | | | | Vesting Date Fair Value for Awards Granted and Vested in the Same Fiscal Year | | — | | — | | | | | | | | | | | | Change in Year-end Fair Value of Equity Awards Granted During Prior Years that Remained Unvested as of the End of the Covered Year | | (14,679,150) | | (2,151,712) | | | | | | | | | | | | Change in Fair Value from Prior Year-end to Vesting Date for Awards Granted in Prior Years that Vested in Covered Fiscal Year | | 927,930 | | 53,484 | | | | | | | | | | | | Prior Year-End Fair Value for Awards Granted in Prior Years that are forfeited during the Covered Year | | — | | — | | | | | | | | | | | Net Decreases for the Inclusion of Rule 402(v) Equity Values | | (9,982,596) | | (207,157) | | | | | | | | | | | | Compensation Actually Paid | | (8,689,910) | | 532,201 | | | | | | | | | | |

(5)The SCT totals reported for the PEO and the average for the Other NEOs for each other year were subject to the adjustments as required by Regulation S-K Item 402(v) (2)(iii) to calculate “compensation actually paid. Equity values are calculated in accordance with ASC Topic 718, and the valuation assumptions used to calculate fair values did not materially differ from those disclosed at the time of the grant. (6)$100 invested on December 31, 2019 in Dexcom common stock or the S&P Health Care Equipment Select Industry index, including reinvestment of any dividends. (7)We adopted ASU 2020-06 as of January 1, 2020 on a full retrospective basis and have reflected the adoption in the table above. (8)We have identified 2024 Adjusted Revenue as described in the Compensation Discussion and Analysis, as the most important financial performance measure used to link compensation actually paid to the PEO and Other NEOs for 2024 to the Company’s performance. We may determine a different financial performance measure to be the most important financial performance measure in future years. A reconciliation of this Non-GAAP financial measure to its nearest GAAP comparable financial measure is included in Annex A. (9)For a description of 2023 revenue, please refer to our 2024 Proxy Statement. (10)For a description of 2022 revenue, please refer to our 2023 Proxy Statement. (11)For a description of 2021 revenue, please refer to our 2022 Proxy Statement. (12)For a description of 2020 revenue, please refer to our 2021 Proxy Statement.

|

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

$ 5,619,919

|

5,015,577

|

4,440,975

|

4,962,060

|

5,707,750

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

$ 532,201

|

6,071,441

|

3,929,405

|

6,403,115

|

10,335,589

|

| Compensation Actually Paid vs. Total Shareholder Return |

Total compensation for the PEO and Other NEOs, as disclosed in the Summary Compensation Table, is comprised of salaries, annual cash incentives, and equity awards. The CAP calculation for each year includes changes in fair market value adjustments on vesting and outstanding equity awards during the year. The CAP adjustment fluctuates due to changes in the Company’s stock price in each of the years presented. The following graph shows the relationship between the CAP to our PEO, average CAP to our Other NEOs, and Dexcom’s cumulative total shareholder return, or TSR, and the peer group’s cumulative TSR (S&P Health Care Equipment Select Industry index) for the fiscal years ended December 31, 2024, 2023, 2022, 2021, and 2020.

|

|

|

|

|

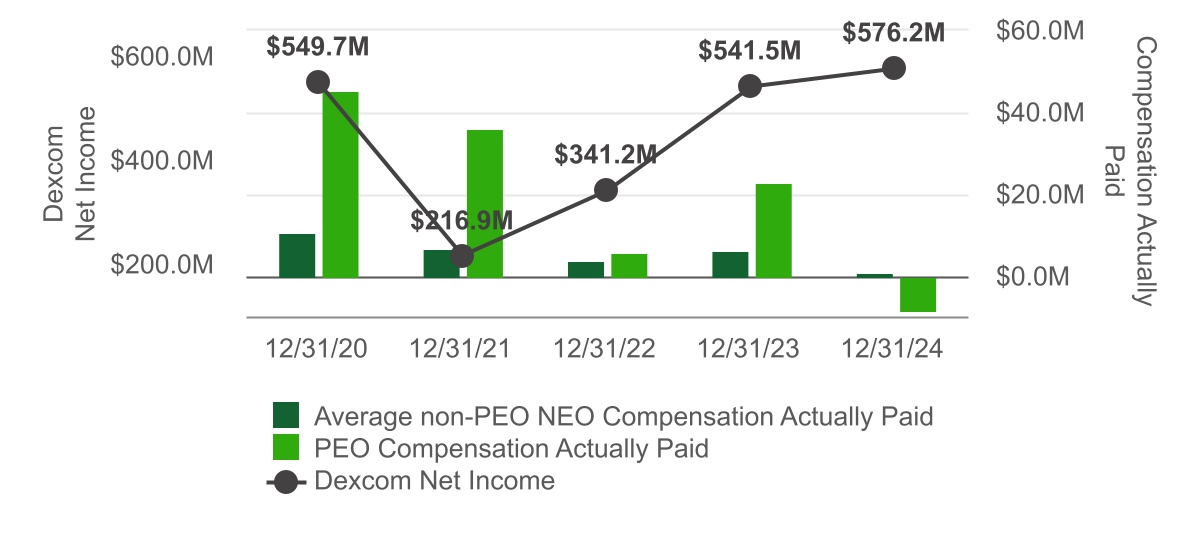

| Compensation Actually Paid vs. Net Income |

The following graph shows the relationship between the CAP to our PEO, the average CAP to our Other NEOs, and the Company’s net income for the fiscal years ended December 31, 2024, 2023, 2022, 2021, and 2020.

|

|

|

|

|

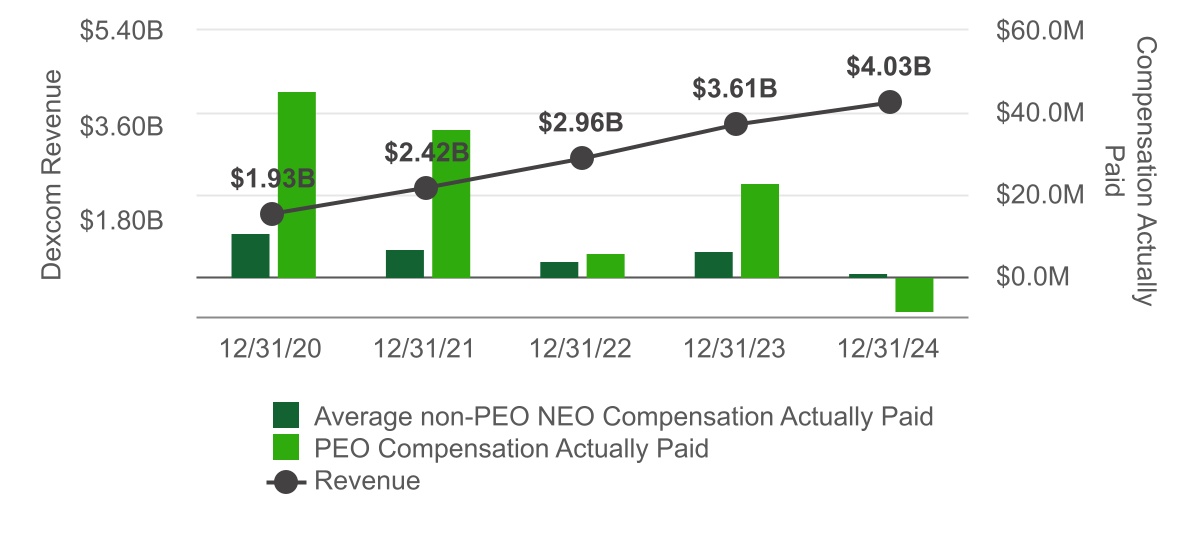

| Compensation Actually Paid vs. Company Selected Measure |

The following graph shows the relationship between the CAP to our PEO, the average CAP to our Other NEOs, and the Company’s Revenue for the fiscal years ended December 31, 2024, 2023, 2022, 2021, and 2020.

|

|

|

|

|

| Tabular List, Table |

Tabular List of Financial Performance Measures Dexcom considers the following to be the most important financial performance measures it used to link compensation actually paid to its NEOs, for 2024, to Company performance: | | | | | | | | | 2024 Adjusted Revenue | Non-GAAP Operating Margin | Relative Total Shareholder Return |

|

|

|

|

|

| Total Shareholder Return Amount |

$ 142.21

|

226.92

|

207.08

|

245.47

|

169.02

|

| Peer Group Total Shareholder Return Amount |

105.04

|

99.63

|

105.61

|

137.80

|

133.15

|

| Net Income (Loss) |

$ 576,200,000

|

$ 541,500,000

|

$ 341,200,000

|

$ 216,900,000

|

$ 549,700,000

|

| Company Selected Measure Amount |

4,034,600,000

|

3,608,600,000

|

2,964,900,000

|

2,422,500,000

|

1,926,700,000

|

| PEO Name |

Kevin Sayer

|

Kevin Sayer

|

Kevin Sayer

|

Kevin Sayer

|

Kevin Sayer

|

| Measure:: 1 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

2024 Adjusted Revenue

|

|

|

|

|

| Measure:: 2 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Non-GAAP Operating Margin

|

|

|

|

|

| Measure:: 3 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Relative Total Shareholder Return

|

|

|

|

|

| PEO | Deductions for amounts reported under the “Stock Awards” column in the Summary Compensation Table [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

$ (14,536,111)

|

|

|

|

|

| PEO | Year-end Fair Value of Equity Awards Granted During the Year that Remained Unvested as of the End of the Covered Year [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

3,768,624

|

|

|

|

|

| PEO | Vesting Date Fair Value for Awards Granted and Vested in the Same Fiscal Year [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

|

|

|

|

| PEO | Change in Year-end Fair Value of Equity Awards Granted During Prior Years that Remained Unvested as of the End of the Covered Year [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(14,679,150)

|

|

|

|

|

| PEO | Change in Fair Value from Prior Year-end to Vesting Date for Awards Granted in Prior Years that Vested in Covered Fiscal Year [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

927,930

|

|

|

|

|

| PEO | Prior Year-End Fair Value for Awards Granted in Prior Years that are forfeited during the Covered Year [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

|

|

|

|

| Non-PEO NEO | Deductions for amounts reported under the “Stock Awards” column in the Summary Compensation Table [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(4,880,561)

|

|

|

|

|

| Non-PEO NEO | Year-end Fair Value of Equity Awards Granted During the Year that Remained Unvested as of the End of the Covered Year [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

1,891,071

|

|

|

|

|

| Non-PEO NEO | Vesting Date Fair Value for Awards Granted and Vested in the Same Fiscal Year [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

|

|

|

|

| Non-PEO NEO | Change in Year-end Fair Value of Equity Awards Granted During Prior Years that Remained Unvested as of the End of the Covered Year [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(2,151,712)

|

|

|

|

|

| Non-PEO NEO | Change in Fair Value from Prior Year-end to Vesting Date for Awards Granted in Prior Years that Vested in Covered Fiscal Year [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

53,484

|

|

|

|

|

| Non-PEO NEO | Prior Year-End Fair Value for Awards Granted in Prior Years that are forfeited during the Covered Year [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

$ 0

|

|

|

|

|