Value of Initial Fixed $100 Investment Based On: |

||||||||||||||||||||||||||||||||

Year (1) |

Summary Compensation Table Total for Principal Executive Officer (PEO) |

Compensation Actually Paid to PEO (2)(3) |

Average Summary Compensation Table Total for non-PEO NEOs |

Average Compensation Actually Paid to non-PEO NEOs (2)(3) |

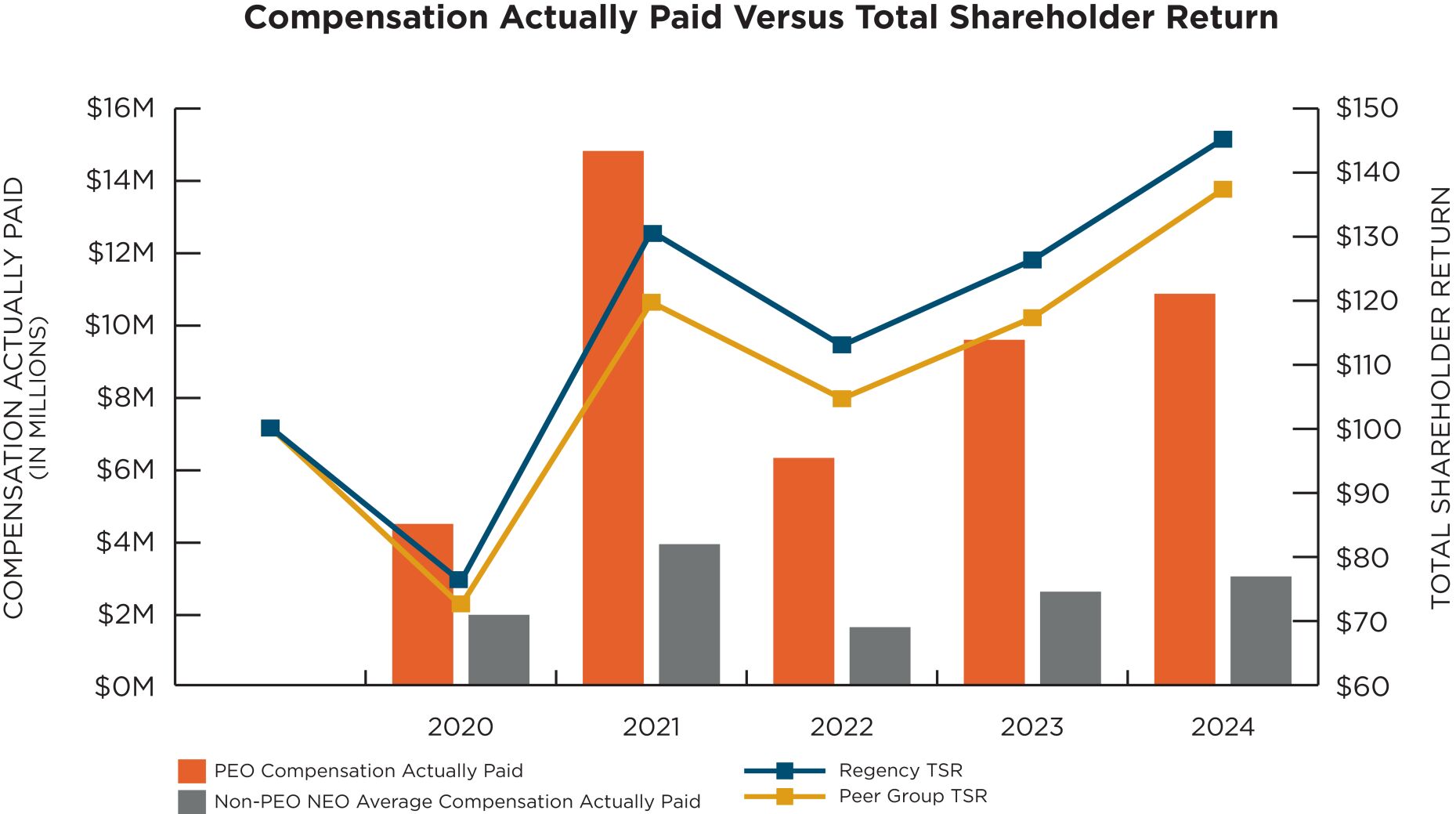

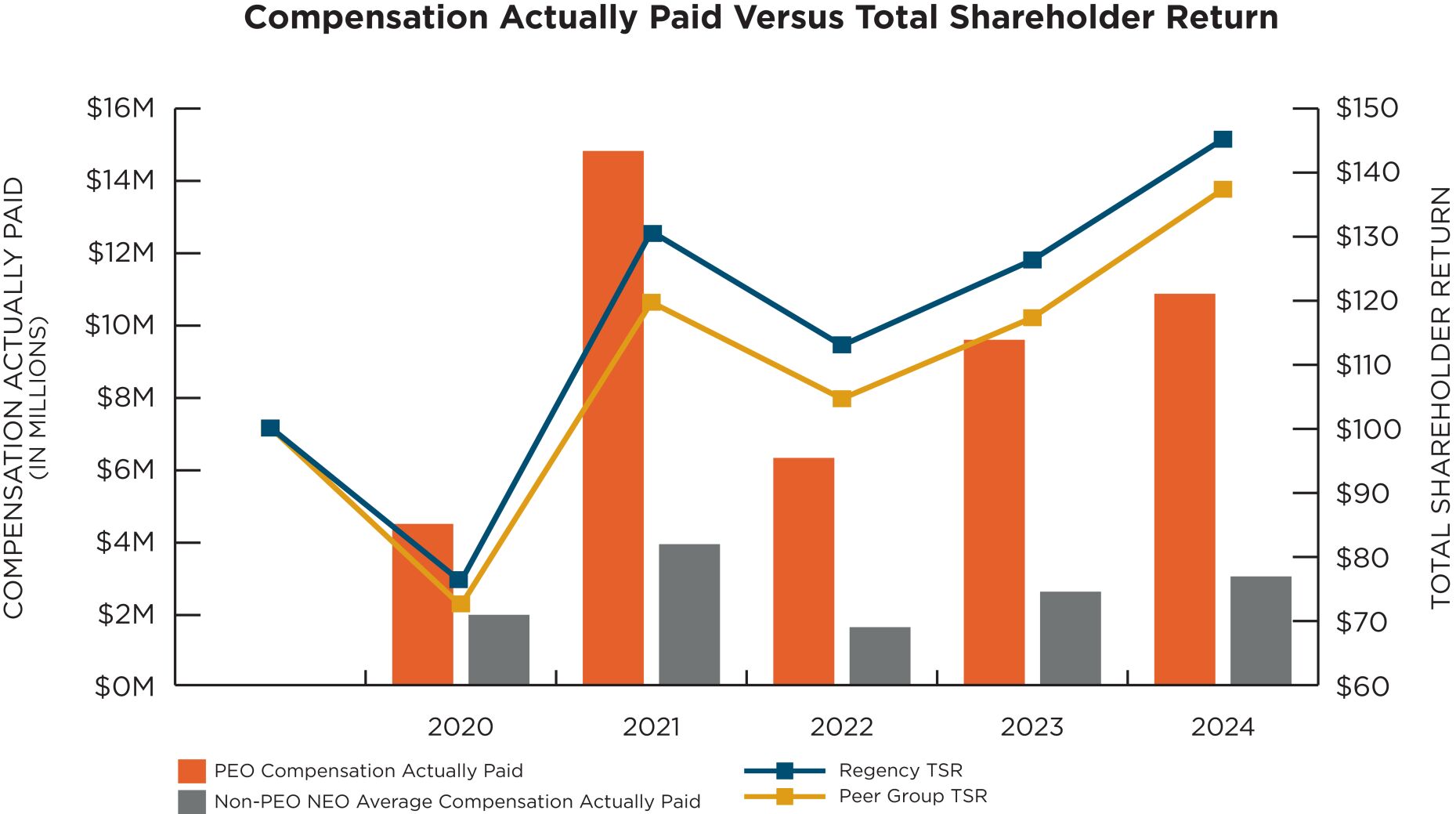

Total Shareholder Return (9) |

Peer Group Total Shareholder Return (9) |

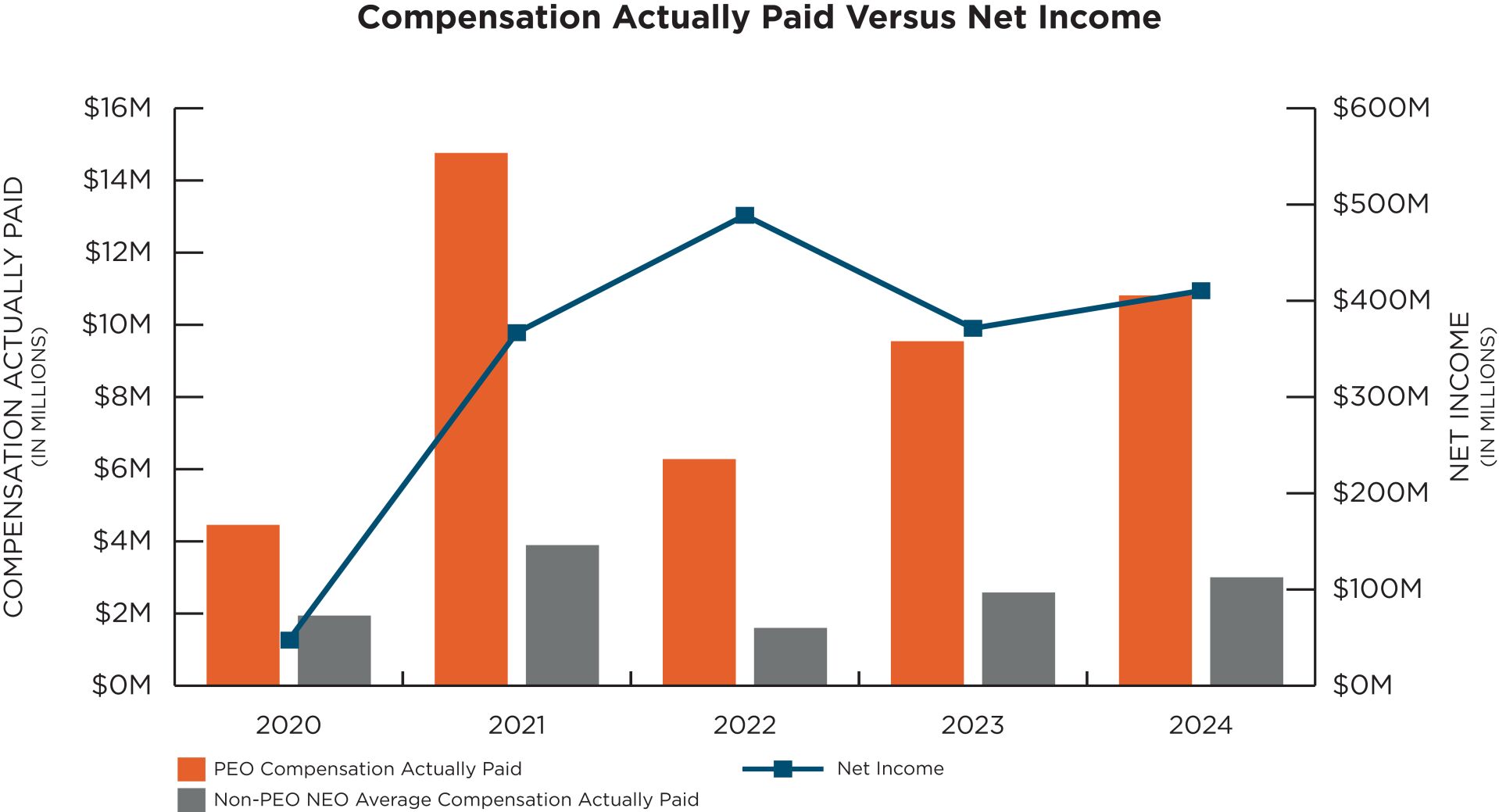

Net Income (in thousands) |

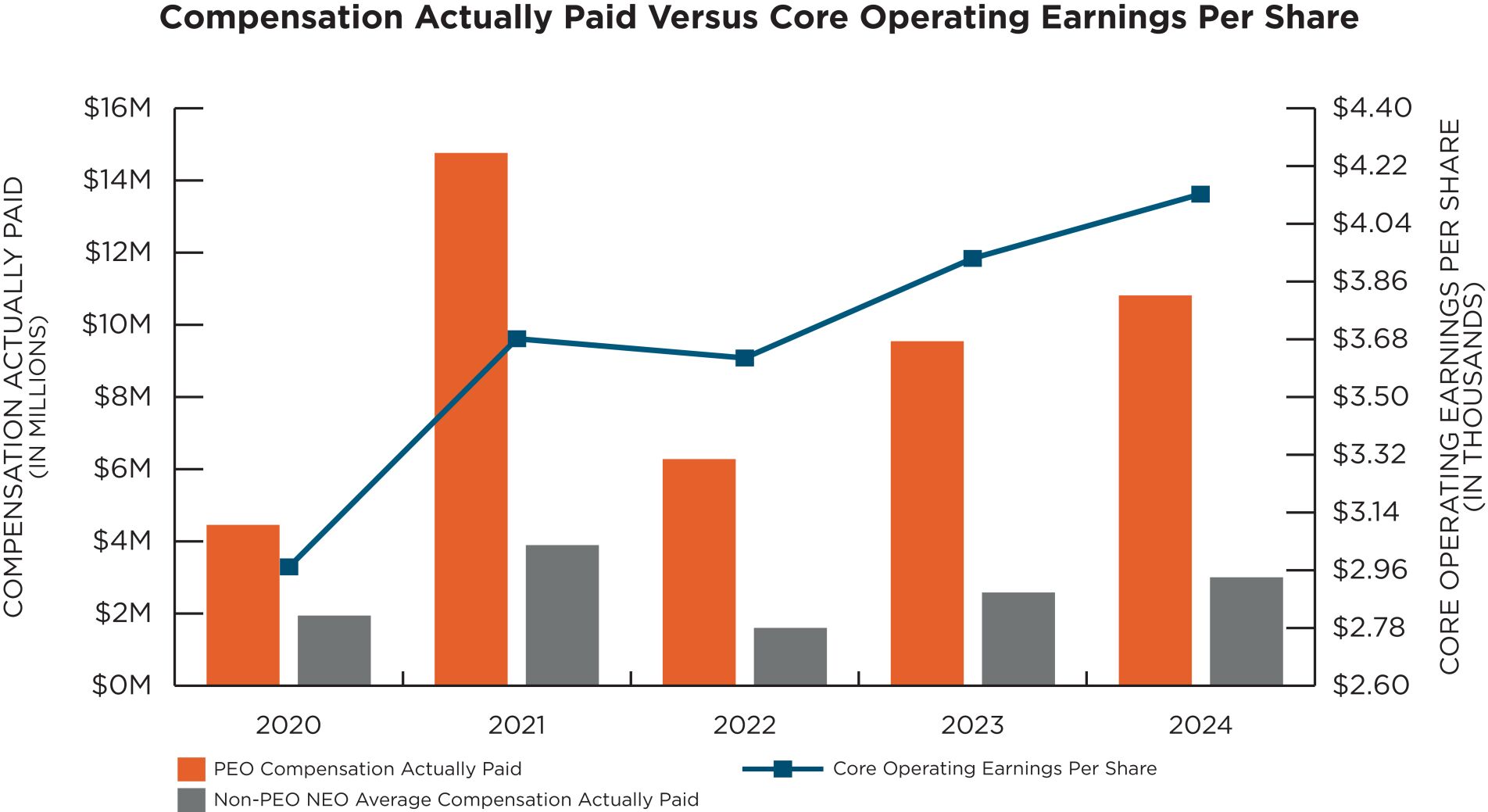

Core Operating Earnings Per Share (10) |

||||||||||||||||||||||||

2024 |

$9,559,263 | $10,808,053 | (4) |

$2,713,582 | $3,048,249 | (4) |

$144.74 | $136.97 | $409,840 | $4.13 | ||||||||||||||||||||||

2023 |

$9,269,035 | $9,530,042 | (5) |

$2,479,595 | $2,586,810 | (5) |

$125.99 | $117.03 | $370,867 | $3.93 (11) |

||||||||||||||||||||||

2022 |

$8,649,788 | $6,276,760 | (6) |

$2,291,627 | $1,608,823 | (6) |

$112.72 | $104.46 | $488,035 | $3.62 (11) |

||||||||||||||||||||||

2021 |

$7,026,315 | $14,742,502 | (7) |

$2,374,789 | $3,894,473 | (7) |

$130.41 | $119.43 | $366,288 | $3.68 | ||||||||||||||||||||||

2020 |

$4,944,744 | $4,451,284 | (8) |

$2,138,002 | $1,942,653 | (8) |

$76.09 | $72.36 | $47,317 | $2.97 | ||||||||||||||||||||||

Year |

PEO |

Non-PEOs | ||||||

2024 |

Ms. Palmer |

Mr. Stein, Mr. Mas, Mr. Roth and Mr. Wibbenmeyer | ||||||

2023 |

Ms. Palmer |

Mr. Stein, Mr. Mas, Mr. Roth and Mr. Wibbenmeyer | ||||||

2022 |

Ms. Palmer |

Mr. Stein, Mr. Mas, Mr. James D. Thompson, and Mr. Roth | ||||||

2021 |

Ms. Palmer |

Mr. Stein, Mr. Mas, Mr. James D. Thompson, and Mr. Dan M. Chandler | ||||||

2020 |

Ms. Palmer |

Mr. Stein, Mr. Mas, Mr. James D. Thompson, and Mr. Dan M. Chandler | ||||||

PEO |

Average Non-PEO |

|||||||

Total Reported in 2024 Summary Compensation Table (SCT) |

$9,559,263 |

$2,713,582 |

||||||

Less, value of Stock Awards reported in SCT |

($5,702,941 | ) | ($1,295,055 | ) | ||||

Plus, Year-End value of Awards Granted in Fiscal Year that are Unvested and Outstanding |

$7,340,943 | $1,667,006 | ||||||

Plus, Change in Fair Value of Prior Year awards that are Outstanding and Unvested |

$185,673 | $52,457 | ||||||

Plus, FMV of Awards Granted this Year and that Vested this Year |

$0 | $0 | ||||||

Plus, Change in Fair Value (from prior year-end) of Prior Year awards that Vested this year |

($574,885 | ) | ($89,740 | ) | ||||

Less Prior Year Fair Value of Prior Year awards that Failed to vest this year |

$0 | $0 | ||||||

Total Adjustments |

$1,248,790 | $334,667 | ||||||

Compensation Actually Paid for Fiscal Year 2024 |

$10,808,053 |

$3,048,249 |

||||||

PEO |

Average Non-PEO |

|||||||

Total Reported in 2023 Summary Compensation Table (SCT) |

$9,269,035 |

$2,479,595 |

||||||

Less, value of Stock Awards reported in SCT |

($5,536,918 | ) | ($1,265,942 | ) | ||||

Plus, Year-End value of Awards Granted in Fiscal Year that are Unvested and Outstanding |

$5,517,908 | $1,263,196 | ||||||

Plus, Change in Fair Value of Prior Year awards that are Outstanding and Unvested |

$216,704 | $72,835 | ||||||

Plus, FMV of Awards Granted this Year and that Vested this Year |

$0 | $0 | ||||||

Plus, Change in Fair Value (from prior year-end) of Prior Year awards that Vested this year |

$63,313 | $37,126 | ||||||

Less Prior Year Fair Value of Prior Year awards that Failed to vest this year |

$0 | $0 | ||||||

Total Adjustments |

$261,007 | $107,215 | ||||||

Compensation Actually Paid for Fiscal Year 2023 |

$9,530,042 |

$2,586,810 |

||||||

PEO |

Average Non-PEO |

|||||||

Total Reported in 2022 Summary Compensation Table (SCT) |

$8,649,788 |

$2,291,627 |

||||||

Less, value of Stock Awards reported in SCT |

($5,184,152 | ) | ($1,212,490 | ) | ||||

Plus, Year-End value of Awards Granted in Fiscal Year that are Unvested and Outstanding |

$4,567,311 | $1,085,215 | ||||||

Plus, Change in Fair Value of Prior Year awards that are Outstanding and Unvested |

($1,288,996 | ) | ($384,424 | ) | ||||

Plus, FMV of Awards Granted this Year and that Vested this Year |

$0 | $0 | ||||||

Plus, Change in Fair Value (from prior year-end) of Prior Year awards that Vested this year |

($467,191 | ) | ($171,104 | ) | ||||

Less Prior Year Fair Value of Prior Year awards that Failed to vest this year |

$0 | $0 | ||||||

Total Adjustments |

($2,373,028 | ) | ($682,803 | ) | ||||

Compensation Actually Paid for Fiscal Year 2022 |

$6,276,760 |

$1,608,823 |

||||||

PEO |

Average Non-PEO |

|||||||

Total Reported in 2021 Summary Compensation Table (SCT) |

$7,026,315 |

$2,374,789 |

||||||

Less, value of Stock Awards reported in SCT |

($3,950,257 | ) | ($1,420,337 | ) | ||||

Plus, Year-End value of Awards Granted in Fiscal Year that are Unvested and Outstanding |

$7,830,287 | $2,153,181 | ||||||

Plus, Change in Fair Value of Prior Year awards that are Outstanding and Unvested |

$2,664,658 | $790,463 | ||||||

Plus, FMV of Awards Granted this Year and that Vested this Year |

$0 | $0 | ||||||

Plus, Change in Fair Value (from prior year-end) of Prior Year awards that Vested this year |

$1,171,500 | $608,353 | ||||||

Less Prior Year Fair Value of Prior Year awards that Failed to vest this year |

$0 | ($611,977 | ) | |||||

Total Adjustments |

$7,716,187 | $1,519,684 | ||||||

Compensation Actually Paid for Fiscal Year 2021 |

$14,742,502 |

$3,894,473 |

||||||

PEO |

Average Non-PEO |

|||||||

Total Reported in 2020 Summary Compensation Table (SCT) |

$4,944,744 |

$2,138,002 |

||||||

Less, value of Stock Awards reported in SCT |

($3,588,410 | ) | ($1,332,018 | ) | ||||

Plus, Year-End value of Awards Granted in Fiscal Year that are Unvested and Outstanding |

$2,811,435 | $1,043,604 | ||||||

Plus, Change in Fair Value of Prior Year awards that are Outstanding and Unvested |

$56,637 | ($40,231 | ) | |||||

Plus, FMV of Awards Granted this Year and that Vested this Year |

$0 | $0 | ||||||

Plus, Change in Fair Value (from prior year-end) of Prior Year awards that Vested this year |

$226,878 | $133,297 | ||||||

Less Prior Year Fair Value of Prior Year awards that Failed to vest this year |

$0 | $0 | ||||||

Total Adjustments |

($493,460 | ) | ($195,349 | ) | ||||

Compensation Actually Paid for Fiscal Year 2020 |

$4,451,284 |

$1,942,653 |

||||||

Year |

PEO |

Non-PEOs | ||||||

2024 |

Ms. Palmer |

Mr. Stein, Mr. Mas, Mr. Roth and Mr. Wibbenmeyer | ||||||

2023 |

Ms. Palmer |

Mr. Stein, Mr. Mas, Mr. Roth and Mr. Wibbenmeyer | ||||||

2022 |

Ms. Palmer |

Mr. Stein, Mr. Mas, Mr. James D. Thompson, and Mr. Roth | ||||||

2021 |

Ms. Palmer |

Mr. Stein, Mr. Mas, Mr. James D. Thompson, and Mr. Dan M. Chandler | ||||||

2020 |

Ms. Palmer |

Mr. Stein, Mr. Mas, Mr. James D. Thompson, and Mr. Dan M. Chandler | ||||||

PEO |

Average Non-PEO |

|||||||

Total Reported in 2024 Summary Compensation Table (SCT) |

$9,559,263 |

$2,713,582 |

||||||

Less, value of Stock Awards reported in SCT |

($5,702,941 | ) | ($1,295,055 | ) | ||||

Plus, Year-End value of Awards Granted in Fiscal Year that are Unvested and Outstanding |

$7,340,943 | $1,667,006 | ||||||

Plus, Change in Fair Value of Prior Year awards that are Outstanding and Unvested |

$185,673 | $52,457 | ||||||

Plus, FMV of Awards Granted this Year and that Vested this Year |

$0 | $0 | ||||||

Plus, Change in Fair Value (from prior year-end) of Prior Year awards that Vested this year |

($574,885 | ) | ($89,740 | ) | ||||

Less Prior Year Fair Value of Prior Year awards that Failed to vest this year |

$0 | $0 | ||||||

Total Adjustments |

$1,248,790 | $334,667 | ||||||

Compensation Actually Paid for Fiscal Year 2024 |

$10,808,053 |

$3,048,249 |

||||||

PEO |

Average Non-PEO |

|||||||

Total Reported in 2023 Summary Compensation Table (SCT) |

$9,269,035 |

$2,479,595 |

||||||

Less, value of Stock Awards reported in SCT |

($5,536,918 | ) | ($1,265,942 | ) | ||||

Plus, Year-End value of Awards Granted in Fiscal Year that are Unvested and Outstanding |

$5,517,908 | $1,263,196 | ||||||

Plus, Change in Fair Value of Prior Year awards that are Outstanding and Unvested |

$216,704 | $72,835 | ||||||

Plus, FMV of Awards Granted this Year and that Vested this Year |

$0 | $0 | ||||||

Plus, Change in Fair Value (from prior year-end) of Prior Year awards that Vested this year |

$63,313 | $37,126 | ||||||

Less Prior Year Fair Value of Prior Year awards that Failed to vest this year |

$0 | $0 | ||||||

Total Adjustments |

$261,007 | $107,215 | ||||||

Compensation Actually Paid for Fiscal Year 2023 |

$9,530,042 |

$2,586,810 |

||||||

PEO |

Average Non-PEO |

|||||||

Total Reported in 2022 Summary Compensation Table (SCT) |

$8,649,788 |

$2,291,627 |

||||||

Less, value of Stock Awards reported in SCT |

($5,184,152 | ) | ($1,212,490 | ) | ||||

Plus, Year-End value of Awards Granted in Fiscal Year that are Unvested and Outstanding |

$4,567,311 | $1,085,215 | ||||||

Plus, Change in Fair Value of Prior Year awards that are Outstanding and Unvested |

($1,288,996 | ) | ($384,424 | ) | ||||

Plus, FMV of Awards Granted this Year and that Vested this Year |

$0 | $0 | ||||||

Plus, Change in Fair Value (from prior year-end) of Prior Year awards that Vested this year |

($467,191 | ) | ($171,104 | ) | ||||

Less Prior Year Fair Value of Prior Year awards that Failed to vest this year |

$0 | $0 | ||||||

Total Adjustments |

($2,373,028 | ) | ($682,803 | ) | ||||

Compensation Actually Paid for Fiscal Year 2022 |

$6,276,760 |

$1,608,823 |

||||||

PEO |

Average Non-PEO |

|||||||

Total Reported in 2021 Summary Compensation Table (SCT) |

$7,026,315 |

$2,374,789 |

||||||

Less, value of Stock Awards reported in SCT |

($3,950,257 | ) | ($1,420,337 | ) | ||||

Plus, Year-End value of Awards Granted in Fiscal Year that are Unvested and Outstanding |

$7,830,287 | $2,153,181 | ||||||

Plus, Change in Fair Value of Prior Year awards that are Outstanding and Unvested |

$2,664,658 | $790,463 | ||||||

Plus, FMV of Awards Granted this Year and that Vested this Year |

$0 | $0 | ||||||

Plus, Change in Fair Value (from prior year-end) of Prior Year awards that Vested this year |

$1,171,500 | $608,353 | ||||||

Less Prior Year Fair Value of Prior Year awards that Failed to vest this year |

$0 | ($611,977 | ) | |||||

Total Adjustments |

$7,716,187 | $1,519,684 | ||||||

Compensation Actually Paid for Fiscal Year 2021 |

$14,742,502 |

$3,894,473 |

||||||

PEO |

Average Non-PEO |

|||||||

Total Reported in 2020 Summary Compensation Table (SCT) |

$4,944,744 |

$2,138,002 |

||||||

Less, value of Stock Awards reported in SCT |

($3,588,410 | ) | ($1,332,018 | ) | ||||

Plus, Year-End value of Awards Granted in Fiscal Year that are Unvested and Outstanding |

$2,811,435 | $1,043,604 | ||||||

Plus, Change in Fair Value of Prior Year awards that are Outstanding and Unvested |

$56,637 | ($40,231 | ) | |||||

Plus, FMV of Awards Granted this Year and that Vested this Year |

$0 | $0 | ||||||

Plus, Change in Fair Value (from prior year-end) of Prior Year awards that Vested this year |

$226,878 | $133,297 | ||||||

Less Prior Year Fair Value of Prior Year awards that Failed to vest this year |

$0 | $0 | ||||||

Total Adjustments |

($493,460 | ) | ($195,349 | ) | ||||

Compensation Actually Paid for Fiscal Year 2020 |

$4,451,284 |

$1,942,653 |

||||||

PEO |

Average Non-PEO |

|||||||

Total Reported in 2024 Summary Compensation Table (SCT) |

$9,559,263 |

$2,713,582 |

||||||

Less, value of Stock Awards reported in SCT |

($5,702,941 | ) | ($1,295,055 | ) | ||||

Plus, Year-End value of Awards Granted in Fiscal Year that are Unvested and Outstanding |

$7,340,943 | $1,667,006 | ||||||

Plus, Change in Fair Value of Prior Year awards that are Outstanding and Unvested |

$185,673 | $52,457 | ||||||

Plus, FMV of Awards Granted this Year and that Vested this Year |

$0 | $0 | ||||||

Plus, Change in Fair Value (from prior year-end) of Prior Year awards that Vested this year |

($574,885 | ) | ($89,740 | ) | ||||

Less Prior Year Fair Value of Prior Year awards that Failed to vest this year |

$0 | $0 | ||||||

Total Adjustments |

$1,248,790 | $334,667 | ||||||

Compensation Actually Paid for Fiscal Year 2024 |

$10,808,053 |

$3,048,249 |

||||||

PEO |

Average Non-PEO |

|||||||

Total Reported in 2023 Summary Compensation Table (SCT) |

$9,269,035 |

$2,479,595 |

||||||

Less, value of Stock Awards reported in SCT |

($5,536,918 | ) | ($1,265,942 | ) | ||||

Plus, Year-End value of Awards Granted in Fiscal Year that are Unvested and Outstanding |

$5,517,908 | $1,263,196 | ||||||

Plus, Change in Fair Value of Prior Year awards that are Outstanding and Unvested |

$216,704 | $72,835 | ||||||

Plus, FMV of Awards Granted this Year and that Vested this Year |

$0 | $0 | ||||||

Plus, Change in Fair Value (from prior year-end) of Prior Year awards that Vested this year |

$63,313 | $37,126 | ||||||

Less Prior Year Fair Value of Prior Year awards that Failed to vest this year |

$0 | $0 | ||||||

Total Adjustments |

$261,007 | $107,215 | ||||||

Compensation Actually Paid for Fiscal Year 2023 |

$9,530,042 |

$2,586,810 |

||||||

PEO |

Average Non-PEO |

|||||||

Total Reported in 2022 Summary Compensation Table (SCT) |

$8,649,788 |

$2,291,627 |

||||||

Less, value of Stock Awards reported in SCT |

($5,184,152 | ) | ($1,212,490 | ) | ||||

Plus, Year-End value of Awards Granted in Fiscal Year that are Unvested and Outstanding |

$4,567,311 | $1,085,215 | ||||||

Plus, Change in Fair Value of Prior Year awards that are Outstanding and Unvested |

($1,288,996 | ) | ($384,424 | ) | ||||

Plus, FMV of Awards Granted this Year and that Vested this Year |

$0 | $0 | ||||||

Plus, Change in Fair Value (from prior year-end) of Prior Year awards that Vested this year |

($467,191 | ) | ($171,104 | ) | ||||

Less Prior Year Fair Value of Prior Year awards that Failed to vest this year |

$0 | $0 | ||||||

Total Adjustments |

($2,373,028 | ) | ($682,803 | ) | ||||

Compensation Actually Paid for Fiscal Year 2022 |

$6,276,760 |

$1,608,823 |

||||||

PEO |

Average Non-PEO |

|||||||

Total Reported in 2021 Summary Compensation Table (SCT) |

$7,026,315 |

$2,374,789 |

||||||

Less, value of Stock Awards reported in SCT |

($3,950,257 | ) | ($1,420,337 | ) | ||||

Plus, Year-End value of Awards Granted in Fiscal Year that are Unvested and Outstanding |

$7,830,287 | $2,153,181 | ||||||

Plus, Change in Fair Value of Prior Year awards that are Outstanding and Unvested |

$2,664,658 | $790,463 | ||||||

Plus, FMV of Awards Granted this Year and that Vested this Year |

$0 | $0 | ||||||

Plus, Change in Fair Value (from prior year-end) of Prior Year awards that Vested this year |

$1,171,500 | $608,353 | ||||||

Less Prior Year Fair Value of Prior Year awards that Failed to vest this year |

$0 | ($611,977 | ) | |||||

Total Adjustments |

$7,716,187 | $1,519,684 | ||||||

Compensation Actually Paid for Fiscal Year 2021 |

$14,742,502 |

$3,894,473 |

||||||

PEO |

Average Non-PEO |

|||||||

Total Reported in 2020 Summary Compensation Table (SCT) |

$4,944,744 |

$2,138,002 |

||||||

Less, value of Stock Awards reported in SCT |

($3,588,410 | ) | ($1,332,018 | ) | ||||

Plus, Year-End value of Awards Granted in Fiscal Year that are Unvested and Outstanding |

$2,811,435 | $1,043,604 | ||||||

Plus, Change in Fair Value of Prior Year awards that are Outstanding and Unvested |

$56,637 | ($40,231 | ) | |||||

Plus, FMV of Awards Granted this Year and that Vested this Year |

$0 | $0 | ||||||

Plus, Change in Fair Value (from prior year-end) of Prior Year awards that Vested this year |

$226,878 | $133,297 | ||||||

Less Prior Year Fair Value of Prior Year awards that Failed to vest this year |

$0 | $0 | ||||||

Total Adjustments |

($493,460 | ) | ($195,349 | ) | ||||

Compensation Actually Paid for Fiscal Year 2020 |

$4,451,284 |

$1,942,653 |

||||||

Core Operating Earnings Per Share (Company-Selected Measure) |

Corporate Responsibility Objectives |

Relative Total Shareholder Return |