|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

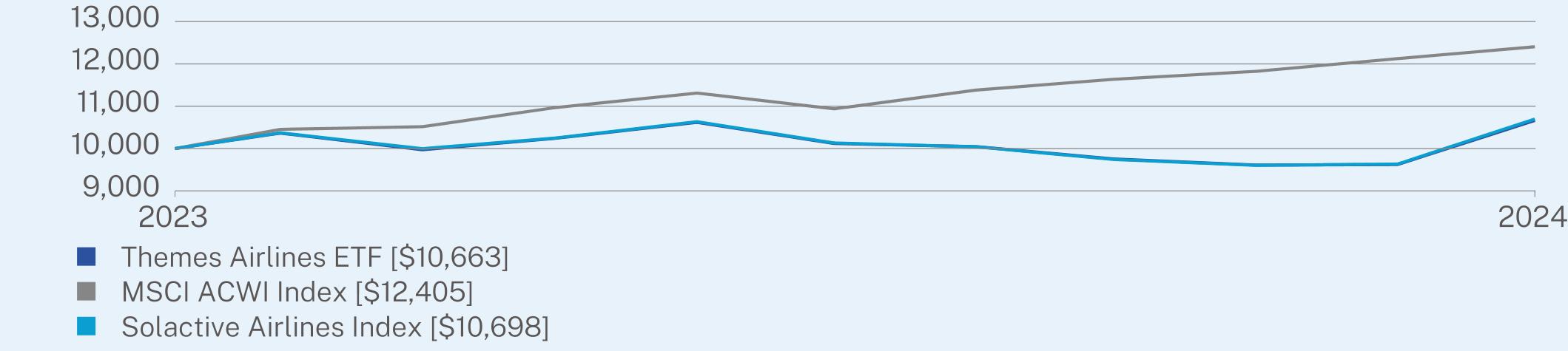

Themes Airlines ETF

|

$29*

|

0.35%**

|

|

|

Since Inception

(12/08/2023) |

|

Themes Airlines ETF

|

6.63

|

|

MSCI ACWI Index

|

24.05

|

|

Solactive Airlines Index

|

6.98

|

|

Net Assets

|

$799,707

|

|

Number of Holdings

|

30

|

|

Net Advisory Fee

|

$1,592

|

|

Portfolio Turnover

|

27%

|

|

Top 10 Issuers

|

(% of net assets)

|

|

Alaska Air Group, Inc.

|

5.2%

|

|

International Consolidated Airlines Group SA

|

5.1%

|

|

Qantas Airways Ltd.

|

5.1%

|

|

United Airlines Holdings, Inc.

|

5.1%

|

|

Deutsche Lufthansa AG

|

4.8%

|

|

ANA Holdings, Inc.

|

4.8%

|

|

easyJet PLC

|

4.8%

|

|

Japan Airlines Co. Ltd.

|

4.6%

|

|

Southwest Airlines Co.

|

4.5%

|

|

Delta Air Lines, Inc.

|

4.5%

|

|

Top Sectors

|

(% of net assets)

|

|

Industrials

|

99.3%

|

|

Cash & Other

|

0.7%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

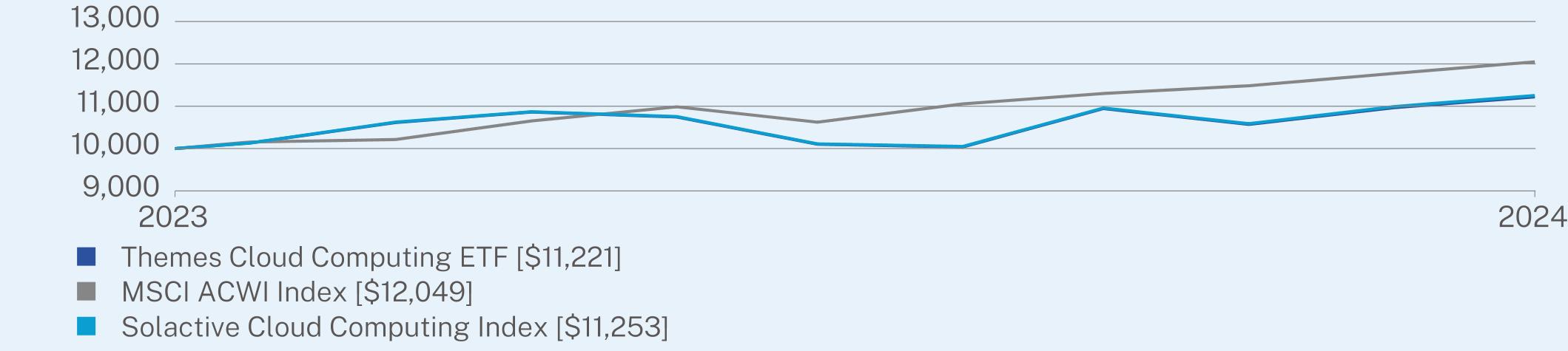

Themes Cloud Computing ETF

|

$29*

|

0.35%**

|

|

|

Since Inception

(12/15/2023) |

|

Themes Cloud Computing ETF

|

12.21

|

|

MSCI ACWI Index

|

20.49

|

|

Solactive Cloud Computing Index

|

12.53

|

|

Net Assets

|

$1,402,619

|

|

Number of Holdings

|

51

|

|

Net Advisory Fee

|

$3,076

|

|

Portfolio Turnover

|

11%

|

|

Top 10 Issuers

|

(% of net assets)

|

|

ServiceNow, Inc.

|

5.2%

|

|

Oracle Corp.

|

5.2%

|

|

MercadoLibre, Inc.

|

5.0%

|

|

SAP SE

|

4.9%

|

|

Salesforce, Inc.

|

4.7%

|

|

Palo Alto Networks, Inc.

|

4.4%

|

|

Intuit, Inc.

|

4.3%

|

|

Amazon.com, Inc.

|

4.1%

|

|

Microsoft Corp.

|

4.0%

|

|

Adobe, Inc.

|

4.0%

|

|

Top Sectors

|

(% of net assets)

|

|

Technology

|

79.8%

|

|

Communications

|

10.4%

|

|

Consumer Discretionary

|

9.0%

|

|

Cash & Other

|

0.8%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

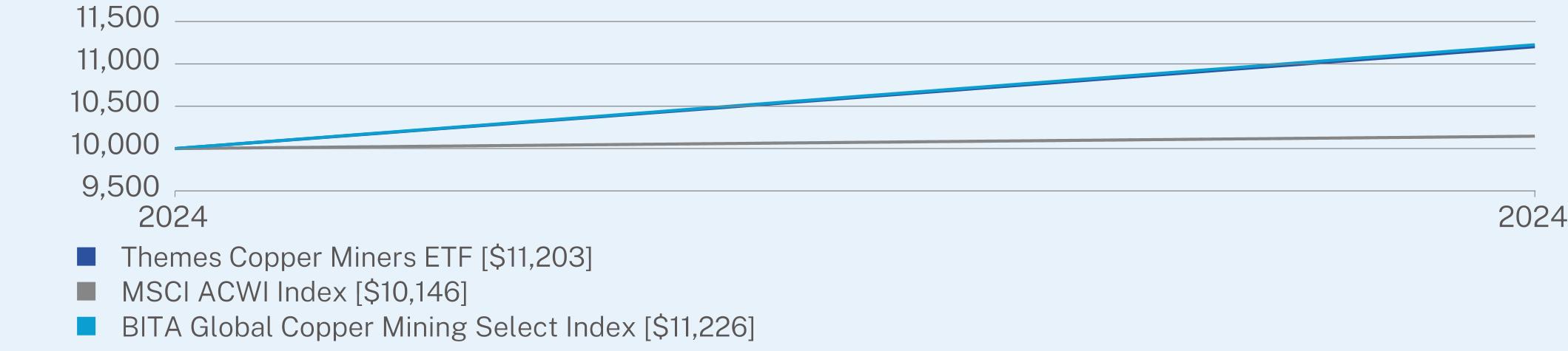

Themes Copper Miners ETF

|

$1*

|

0.35%**

|

|

|

Since Inception

(09/24/2024) |

|

Themes Copper Miners ETF

|

12.03

|

|

MSCI ACWI Index

|

1.46

|

|

BITA Global Copper Mining Select Index

|

12.26

|

|

Net Assets

|

$560,610

|

|

Number of Holdings

|

47

|

|

Net Advisory Fee

|

$31

|

|

Portfolio Turnover

|

0%

|

|

Top 10 Issuers

|

(% of net assets)

|

|

Freeport-McMoRan, Inc.

|

10.0%

|

|

First Quantum Minerals Ltd.

|

4.8%

|

|

BHP Group Ltd.

|

4.7%

|

|

Capstone Copper Corp.

|

4.5%

|

|

Jiujiang Defu Technology Co. Ltd.

|

4.5%

|

|

Glencore PLC

|

4.4%

|

|

Southern Copper Corp.

|

4.2%

|

|

Antofagasta PLC

|

4.2%

|

|

China Nonferrous Mining Corp. Ltd.

|

4.0%

|

|

Jiangxi Copper Co. Ltd.

|

3.5%

|

|

Top Sectors

|

(% of net assets)

|

|

Materials

|

99.7%

|

|

Cash & Other

|

0.3%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

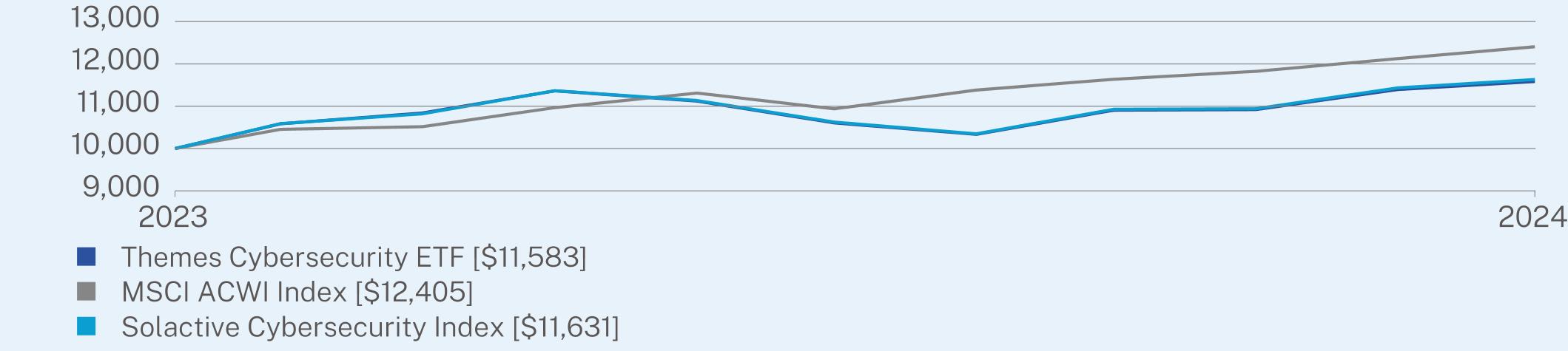

Themes Cybersecurity ETF

|

$31*

|

0.36%**

|

|

|

Since Inception

(12/08/2023) |

|

Themes Cybersecurity ETF

|

15.83

|

|

MSCI ACWI Index

|

24.05

|

|

Solactive Cybersecurity Index

|

16.31

|

|

Net Assets

|

$1,737,515

|

|

Number of Holdings

|

34

|

|

Net Advisory Fee

|

$3,582

|

|

Portfolio Turnover

|

24%

|

|

Top 10 Issuers

|

(% of net assets)

|

|

Trend Micro, Inc.

|

5.8%

|

|

Fortinet, Inc.

|

5.7%

|

|

Clear Secure, Inc.

|

5.2%

|

|

Varonis Systems, Inc.

|

5.1%

|

|

SentinelOne, Inc.

|

5.0%

|

|

CACI International, Inc.

|

4.9%

|

|

Check Point Software Technologies Ltd.

|

4.7%

|

|

CyberArk Software Ltd.

|

4.5%

|

|

Booz Allen Hamilton Holding Corp.

|

4.4%

|

|

Darktrace PLC

|

4.3%

|

|

Top Sectors

|

(% of net assets)

|

|

Technology

|

90.4%

|

|

Communications

|

5.7%

|

|

Industrials

|

3.6%

|

|

Financials

|

0.1%

|

|

Cash & Other

|

0.2%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

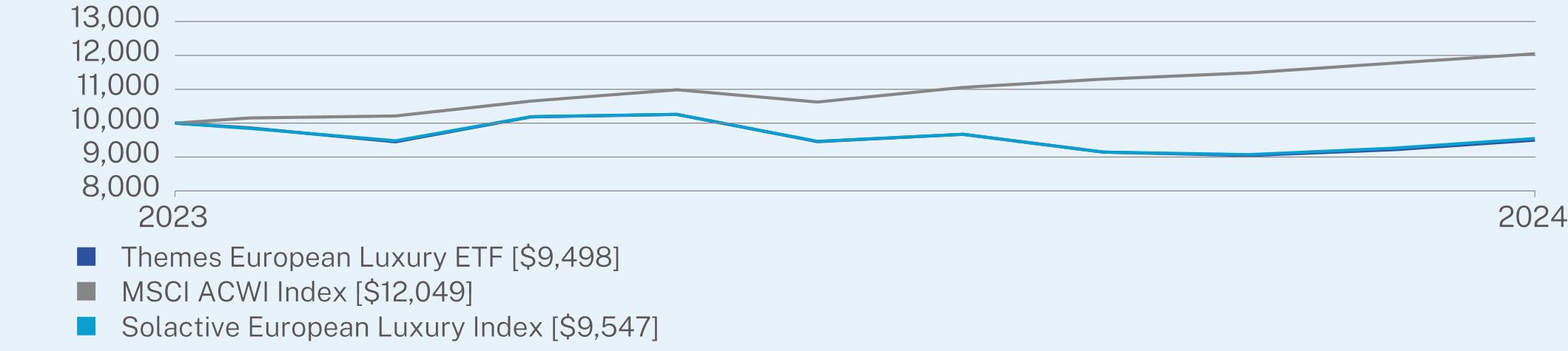

Themes European Luxury ETF

|

$27*

|

0.35%**

|

|

|

Since Inception

(12/15/2023) |

|

Themes European Luxury ETF

|

-5.02

|

|

MSCI ACWI Index

|

20.49

|

|

Solactive European Luxury Index

|

-4.53

|

|

Net Assets

|

$712,362

|

|

Number of Holdings

|

26

|

|

Net Advisory Fee

|

$1,412

|

|

Portfolio Turnover

|

47%

|

|

Top 10 Issuers

|

(% of net assets)

|

|

Capri Holdings Ltd.

|

4.7%

|

|

Watches of Switzerland Group PLC

|

4.7%

|

|

Interparfums SA

|

4.6%

|

|

Coats Group PLC

|

4.6%

|

|

Prada SpA

|

4.4%

|

|

Givaudan SA

|

4.4%

|

|

Brunello Cucinelli SpA

|

4.3%

|

|

Hugo Boss AG

|

4.3%

|

|

Ferrari NV

|

4.2%

|

|

Swatch Group AG

|

4.2%

|

|

Top Sectors

|

(% of net assets)

|

|

Consumer Discretionary

|

90.6%

|

|

Consumer Staples

|

4.6%

|

|

Materials

|

4.4%

|

|

Cash & Other

|

0.4%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

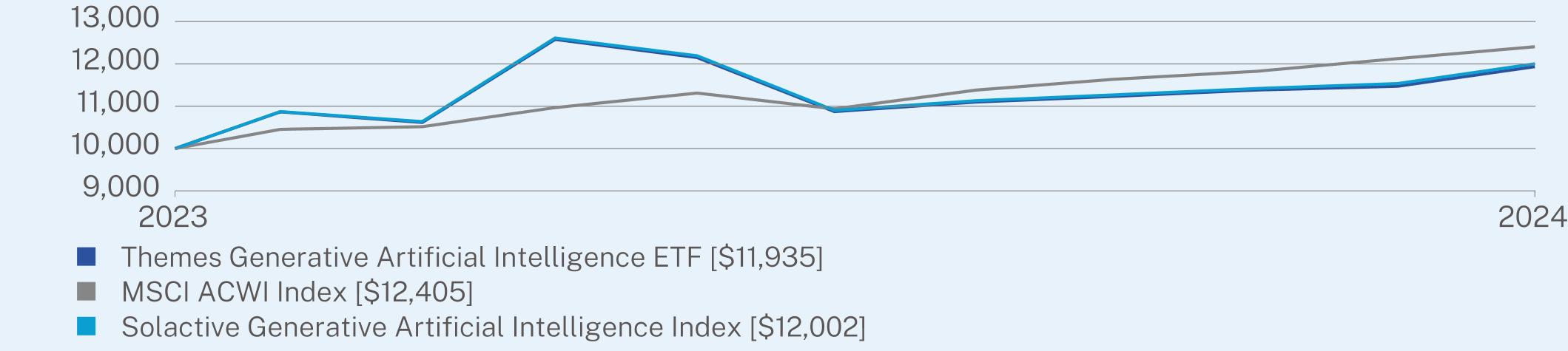

Themes Generative Artificial Intelligence ETF

|

$31*

|

0.35%**

|

|

|

Since Inception

(12/08/2023) |

|

Themes Generative Artificial Intelligence ETF

|

19.35

|

|

MSCI ACWI Index

|

24.05

|

|

Solactive Generative Artificial Intelligence Index

|

20.02

|

|

Net Assets

|

$13,128,895

|

|

Number of Holdings

|

41

|

|

Net Advisory Fee

|

$37,541

|

|

Portfolio Turnover

|

58%

|

|

Top 10 Issuers

|

(% of net assets)

|

|

Advanced Micro Devices, Inc.

|

5.0%

|

|

Microsoft Corp.

|

4.8%

|

|

Intel Corp.

|

4.8%

|

|

Amazon.com, Inc.

|

4.6%

|

|

NVIDIA Corp.

|

4.5%

|

|

UiPath, Inc.

|

4.2%

|

|

Alphabet, Inc.

|

4.1%

|

|

Oracle Corp.

|

3.9%

|

|

Broadcom, Inc.

|

3.6%

|

|

PKSHA Technology, Inc.

|

3.6%

|

|

Top Sectors

|

(% of net assets)

|

|

Technology

|

81.5%

|

|

Communications

|

9.0%

|

|

Consumer Discretionary

|

6.4%

|

|

Financials

|

2.5%

|

|

Health Care

|

0.2%

|

|

Cash & Other

|

0.4%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

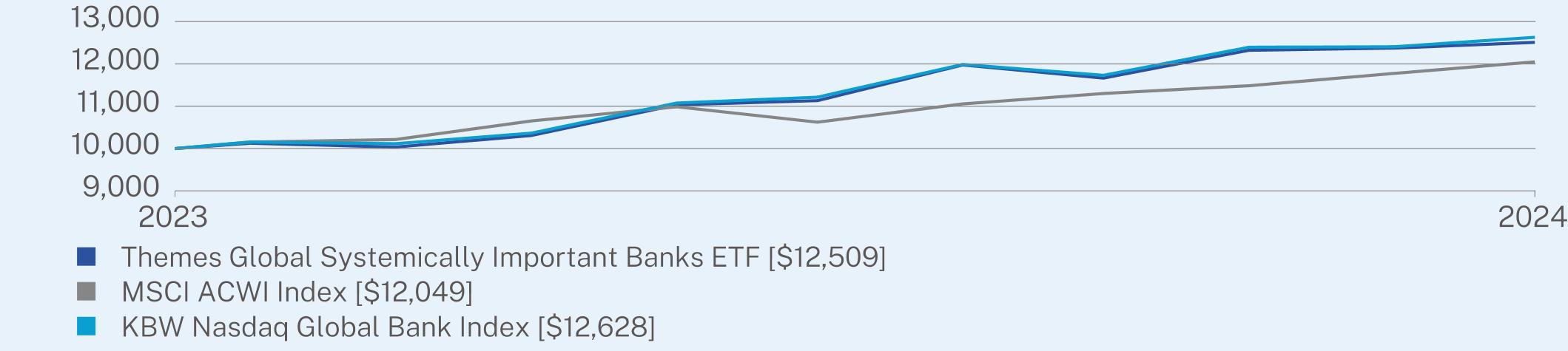

Themes Global Systemically Important Banks ETF

|

$31*

|

0.35%**

|

|

|

Since Inception

(12/15/2023) |

|

Themes Global Systemically Important Banks ETF

|

25.09

|

|

MSCI ACWI Index

|

20.49

|

|

KBW Nasdaq Global Bank Index

|

26.28

|

|

Net Assets

|

$2,189,148

|

|

Number of Holdings

|

29

|

|

Net Advisory Fee

|

$3,211

|

|

Portfolio Turnover

|

28%

|

|

Top 10 Issuers

|

(% of net assets)

|

|

Bank of New York Mellon Corp.

|

4.0%

|

|

State Street Corp.

|

4.0%

|

|

Royal Bank of Canada

|

4.0%

|

|

Bank of Communications Co. Ltd.

|

3.8%

|

|

Bank of China Ltd.

|

3.6%

|

|

Industrial & Commercial Bank of China Ltd.

|

3.6%

|

|

Mizuho Financial Group, Inc.

|

3.6%

|

|

China Construction Bank Corp.

|

3.6%

|

|

Credit Agricole SA

|

3.6%

|

|

Citigroup, Inc.

|

3.6%

|

|

Top Sectors

|

(% of net assets)

|

|

Financials

|

99.9%

|

|

Cash & Other

|

0.1%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

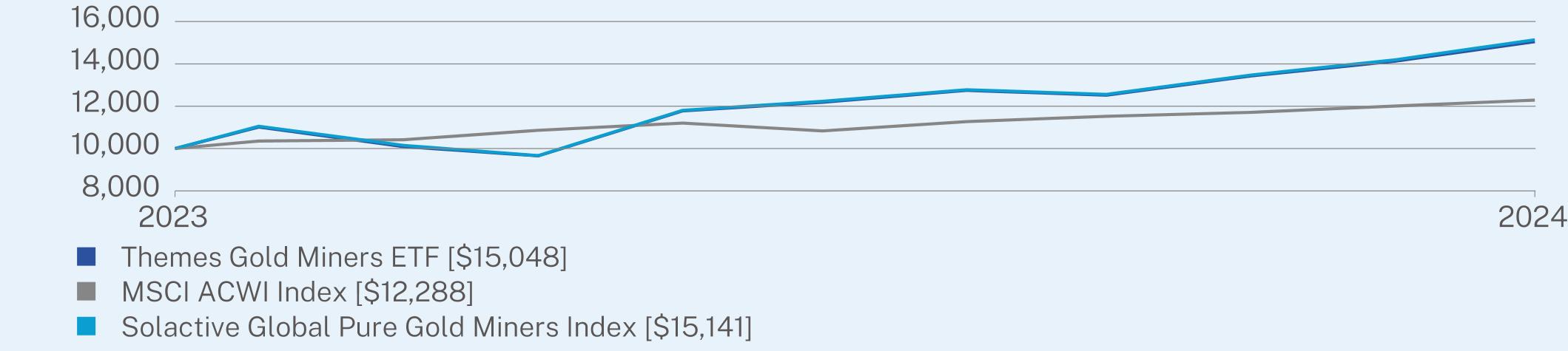

Themes Gold Miners ETF

|

$35*

|

0.35%**

|

|

|

Since Inception

(12/13/2023) |

|

Themes Gold Miners ETF

|

50.48

|

|

MSCI ACWI Index

|

22.88

|

|

Solactive Global Pure Gold Miners Index

|

51.41

|

|

Net Assets

|

$2,257,169

|

|

Number of Holdings

|

23

|

|

Net Advisory Fee

|

$4,252

|

|

Portfolio Turnover

|

14%

|

|

Top 10 Issuers

|

(% of net assets)

|

|

Centamin PLC

|

5.3%

|

|

De Grey Mining Ltd.

|

5.3%

|

|

Endeavour Mining PLC

|

5.0%

|

|

B2Gold Corp.

|

4.9%

|

|

Northern Star Resources Ltd.

|

4.9%

|

|

Ramelius Resources Ltd.

|

4.9%

|

|

OceanaGold Corp.

|

4.8%

|

|

Lundin Gold, Inc.

|

4.8%

|

|

Gold Fields Ltd.

|

4.8%

|

|

Perseus Mining Ltd.

|

4.7%

|

|

Top Sectors

|

(% of net assets)

|

|

Materials

|

99.2%

|

|

Cash & Other

|

0.8%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

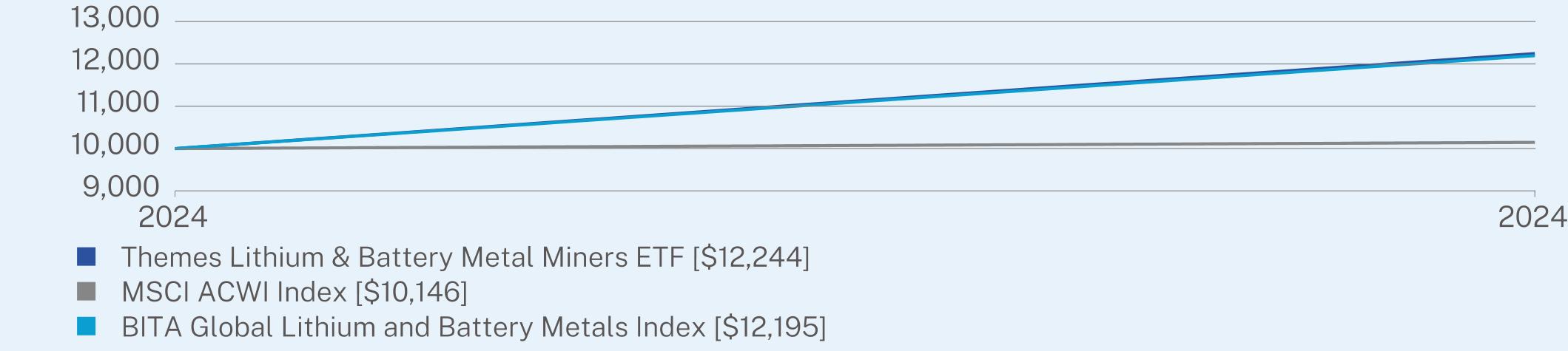

Themes Lithium & Battery Metal Miners ETF

|

$1*

|

0.35%**

|

|

|

Since Inception

(09/24/2024) |

|

Themes Lithium & Battery Metal Miners ETF

|

22.44

|

|

MSCI ACWI Index

|

1.46

|

|

BITA Global Lithium and Battery Metals Index

|

21.95

|

|

Net Assets

|

$615,118

|

|

Number of Holdings

|

48

|

|

Net Advisory Fee

|

$32

|

|

Portfolio Turnover

|

0%

|

|

Top 10 Issuers

|

(% of net assets)

|

|

Pilbara Minerals Ltd.

|

4.3%

|

|

Albemarle Corp.

|

4.0%

|

|

Tianqi Lithium Corp.

|

3.9%

|

|

Guangzhou Tinci Materials Technology Co. Ltd.

|

3.4%

|

|

Core Lithium Ltd.

|

3.3%

|

|

Sayona Mining Ltd.

|

3.3%

|

|

Beijing Easpring Material Technology Co. Ltd.

|

3.2%

|

|

Arcadium Lithium PLC

|

3.2%

|

|

Lithium Americas Argentina Corp.

|

3.0%

|

|

GEM Co. Ltd.

|

2.9%

|

|

Top Sectors

|

(% of net assets)

|

|

Materials

|

99.9%

|

|

Cash & Other

|

0.1%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

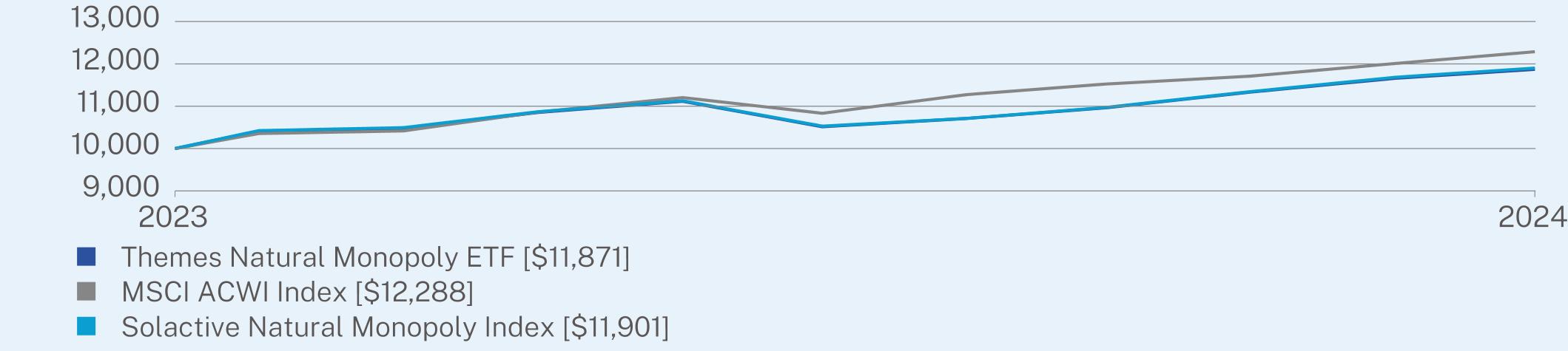

Themes Natural Monopoly ETF

|

$31*

|

0.35%**

|

|

|

Since Inception

(12/13/2023) |

|

Themes Natural Monopoly ETF

|

18.71

|

|

MSCI ACWI Index

|

22.88

|

|

Solactive Natural Monopoly Index

|

19.01

|

|

Net Assets

|

$1,483,837

|

|

Number of Holdings

|

96

|

|

Net Advisory Fee

|

$2,419

|

|

Portfolio Turnover

|

113%

|

|

Top 10 Issuers

|

(% of net assets)

|

|

Legrand SA

|

3.8%

|

|

Cisco Systems, Inc.

|

3.6%

|

|

Meta Platforms, Inc.

|

3.5%

|

|

Singapore Exchange Ltd.

|

3.5%

|

|

Fortive Corp.

|

3.5%

|

|

Open Text Corp.

|

3.4%

|

|

BlackRock, Inc.

|

3.3%

|

|

Analog Devices, Inc.

|

3.3%

|

|

Dassault Systemes SE

|

3.2%

|

|

American Express Co.

|

3.2%

|

|

Top Sectors

|

(% of net assets)

|

|

Technology

|

19.9%

|

|

Industrials

|

19.2%

|

|

Financials

|

17.9%

|

|

Consumer Staples

|

11.8%

|

|

Health Care

|

11.0%

|

|

Communications

|

6.8%

|

|

Consumer Discretionary

|

3.8%

|

|

Materials

|

3.6%

|

|

Energy

|

3.0%

|

|

Cash & Other

|

3.0%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

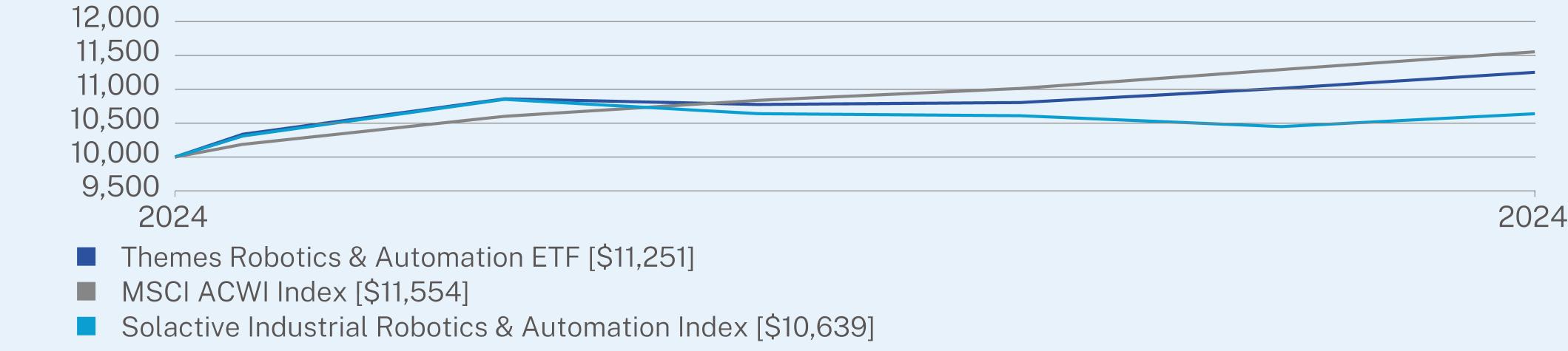

Themes Robotics & Automation ETF

|

$16*

|

0.35%**

|

|

|

Since Inception

(04/22/2024) |

|

Themes Robotics & Automation ETF

|

12.51

|

|

MSCI ACWI Index

|

15.54

|

|

Solactive Industrial Robotics & Automation Index

|

6.39

|

|

Net Assets

|

$562,547

|

|

Number of Holdings

|

30

|

|

Net Advisory Fee

|

$822

|

|

Portfolio Turnover

|

46%

|

|

Top 10 Issuers

|

(% of net assets)

|

|

Japan Steel Works Ltd.

|

4.3%

|

|

Impinj, Inc.

|

4.3%

|

|

Konecranes Oyj

|

4.3%

|

|

Semtech Corp.

|

4.2%

|

|

Cargotec Oyj

|

4.1%

|

|

ANDRITZ AG

|

3.8%

|

|

Haitian International Holdings Ltd.

|

3.8%

|

|

Esab Corp.

|

3.8%

|

|

GEA Group AG

|

3.7%

|

|

Valmet Oyj

|

3.6%

|

|

Top Sectors

|

(% of net assets)

|

|

Industrials

|

57.7%

|

|

Technology

|

38.9%

|

|

Consumer Discretionary

|

2.7%

|

|

Cash & Other

|

0.7%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

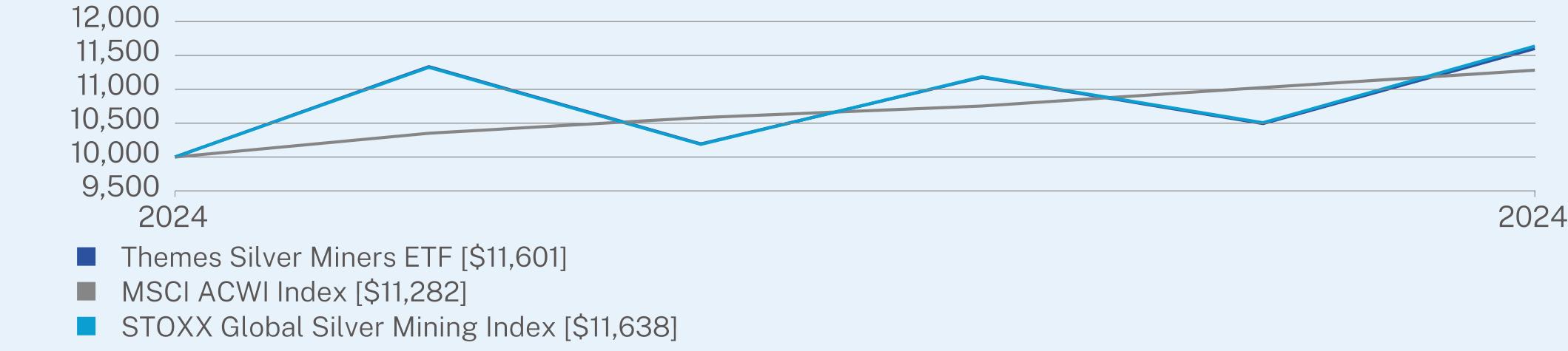

Themes Silver Miners ETF

|

$15*

|

0.35%**

|

|

|

Since Inception

(05/03/2024) |

|

Themes Silver Miners ETF

|

16.01

|

|

MSCI ACWI Index

|

12.82

|

|

STOXX Global Silver Mining Index

|

16.38

|

|

Net Assets

|

$580,070

|

|

Number of Holdings

|

26

|

|

Net Advisory Fee

|

$770

|

|

Portfolio Turnover

|

38%

|

|

Top 10 Issuers

|

(% of net assets)

|

|

Pan American Silver Corp.

|

9.3%

|

|

Industrias Penoles SAB de CV

|

9.2%

|

|

Wheaton Precious Metals Corp.

|

9.1%

|

|

Southern Copper Corp.

|

8.2%

|

|

First Majestic Silver Corp.

|

6.6%

|

|

Jiangxi Copper Co. Ltd.

|

5.4%

|

|

KGHM Polska Miedz SA

|

4.9%

|

|

Silvercorp Metals, Inc.

|

4.8%

|

|

Fresnillo PLC

|

4.8%

|

|

Aya Gold & Silver, Inc.

|

4.7%

|

|

Top Sectors

|

(% of net assets)

|

|

Materials

|

99.6%

|

|

Cash & Other

|

0.4%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

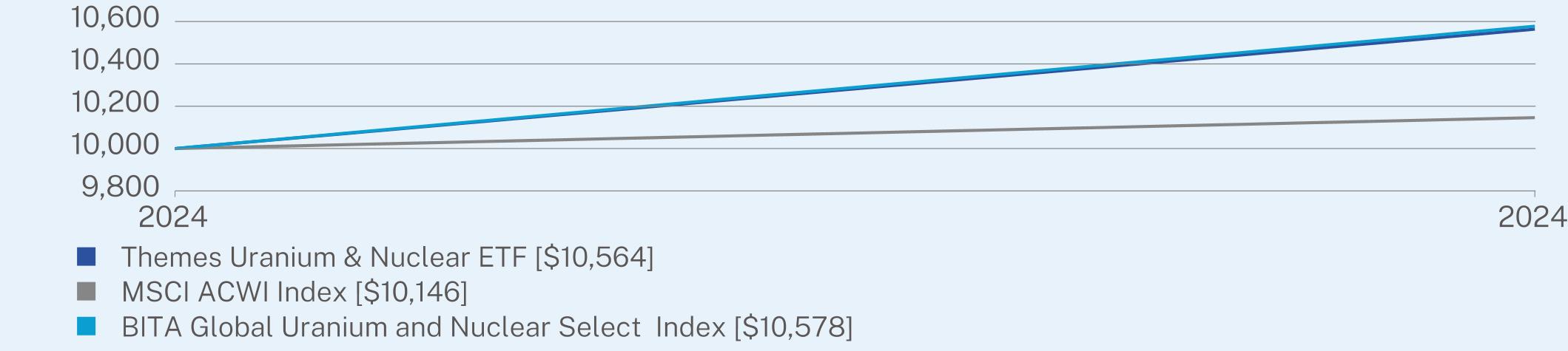

Themes Uranium & Nuclear ETF

|

$1*

|

0.35%**

|

|

|

Since Inception

(09/24/2024) |

|

Themes Uranium & Nuclear ETF

|

5.64

|

|

MSCI ACWI Index

|

1.46

|

|

BITA Global Uranium and Nuclear Select Index

|

5.78

|

|

Net Assets

|

$558,203

|

|

Number of Holdings

|

34

|

|

Net Advisory Fee

|

$32

|

|

Portfolio Turnover

|

0%

|

|

Top 10 Issuers

|

(% of net assets)

|

|

Constellation Energy Corp.

|

11.0%

|

|

Cameco Corp.

|

8.5%

|

|

NuScale Power Corp.

|

5.8%

|

|

Uranium Energy Corp.

|

5.2%

|

|

PG&E Corp.

|

5.1%

|

|

Paladin Energy Ltd.

|

5.1%

|

|

China National Nuclear Power Co. Ltd.

|

4.6%

|

|

NexGen Energy Ltd.

|

4.5%

|

|

Centrus Energy Corp.

|

4.5%

|

|

Yellow Cake PLC

|

4.1%

|

|

Top Sectors

|

(% of net assets)

|

|

Materials

|

53.1%

|

|

Utilities

|

30.5%

|

|

Industrials

|

14.6%

|

|

Technology

|

1.6%

|

|

Cash & Other

|

0.2%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

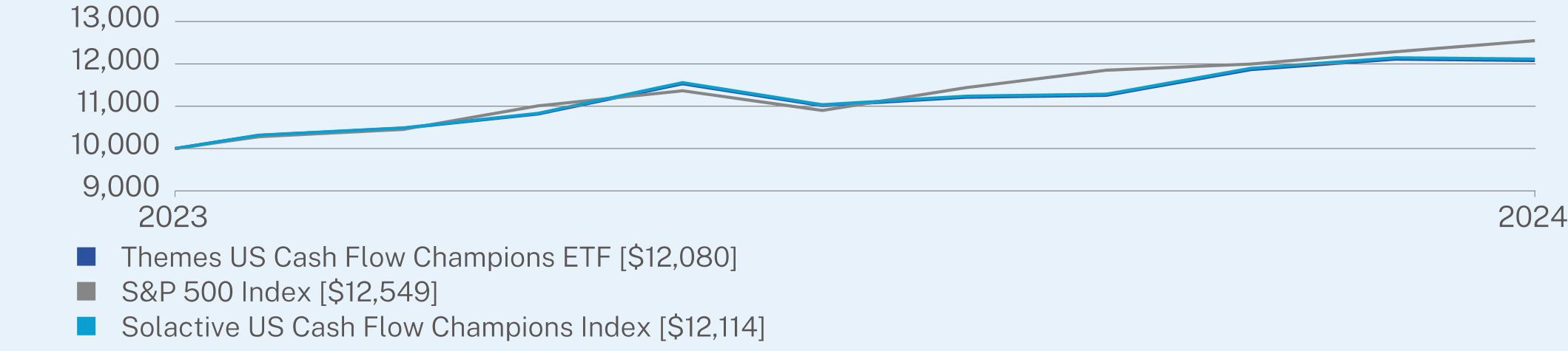

Themes US Cash Flow Champions ETF

|

$26*

|

0.30%**

|

|

|

Since Inception

(12/13/2023) |

|

Themes US Cash Flow Champions ETF

|

20.80

|

|

S&P 500 Index

|

25.49

|

|

Solactive US Cash Flow Champions Index

|

21.14

|

|

Net Assets

|

$905,969

|

|

Number of Holdings

|

76

|

|

Net Advisory Fee

|

$1,486

|

|

Portfolio Turnover

|

20%

|

|

Top 10 Issuers

|

(% of net assets)

|

|

AbbVie, Inc.

|

5.4%

|

|

Broadcom, Inc.

|

5.0%

|

|

JPMorgan Chase & Co.

|

4.9%

|

|

Exxon Mobil Corp.

|

4.8%

|

|

Wells Fargo & Co.

|

4.4%

|

|

Chevron Corp.

|

4.4%

|

|

Pfizer, Inc.

|

3.7%

|

|

American Express Co.

|

3.6%

|

|

Progressive Corp.

|

3.4%

|

|

ConocoPhillips

|

2.9%

|

|

Top Sectors

|

(% of net assets)

|

|

Financials

|

39.3%

|

|

Energy

|

20.8%

|

|

Health Care

|

19.8%

|

|

Technology

|

7.7%

|

|

Consumer Discretionary

|

4.2%

|

|

Consumer Staples

|

3.9%

|

|

Materials

|

2.2%

|

|

Communications

|

1.1%

|

|

Industrials

|

0.3%

|

|

Cash & Other

|

0.7%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

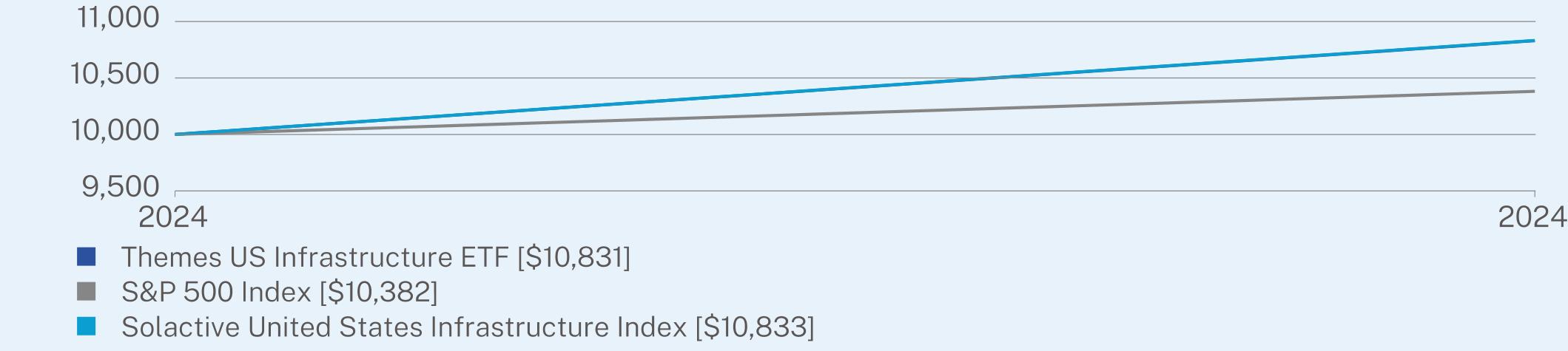

Themes US Infrastructure ETF

|

$1*

|

0.29%**

|

|

|

Since Inception

(09/12/2024) |

|

Themes US Infrastructure ETF

|

8.31

|

|

S&P 500 Index

|

3.82

|

|

Solactive United States Infrastructure Index

|

8.33

|

|

Net Assets

|

$541,571

|

|

Number of Holdings

|

102

|

|

Net Advisory Fee

|

$75

|

|

Portfolio Turnover

|

0%

|

|

Top 10 Issuers

|

(% of net assets)

|

|

Caterpillar, Inc.

|

4.7%

|

|

Union Pacific Corp.

|

4.6%

|

|

Deere & Co.

|

4.5%

|

|

Norfolk Southern Corp.

|

4.5%

|

|

United Rentals, Inc.

|

4.3%

|

|

Emerson Electric Co.

|

4.3%

|

|

CSX Corp.

|

4.3%

|

|

Quanta Services, Inc.

|

3.4%

|

|

WW Grainger, Inc.

|

3.3%

|

|

Fastenal Co.

|

3.3%

|

|

Top Sectors

|

(% of net assets)

|

|

Industrials

|

71.6%

|

|

Materials

|

23.0%

|

|

Consumer Discretionary

|

4.3%

|

|

Energy

|

0.4%

|

|

Utilities

|

0.3%

|

|

Technology

|

0.3%

|

|

Cash & Other

|

0.1%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

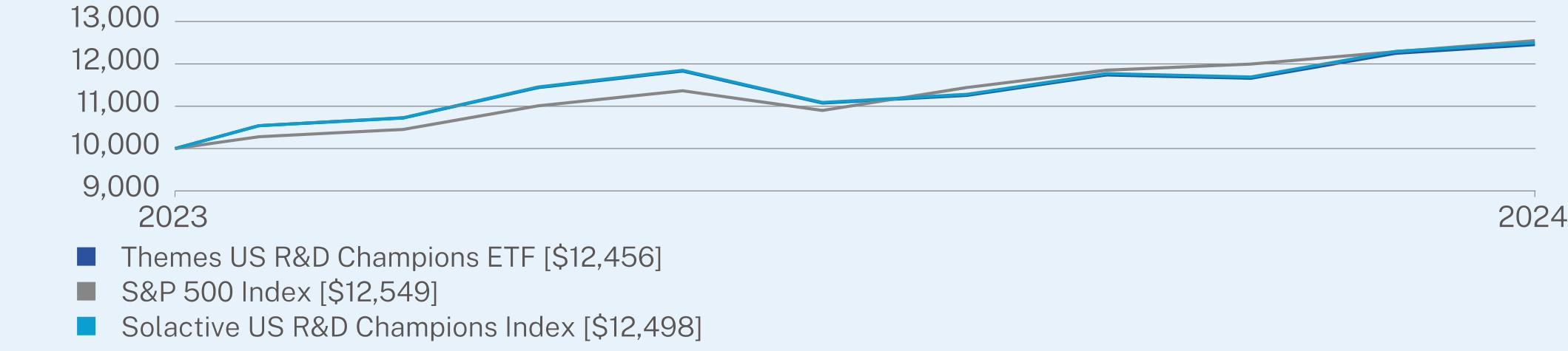

Themes US R&D Champions ETF

|

$26*

|

0.29%**

|

|

|

Since Inception

(12/13/2023) |

|

Themes US R&D Champions ETF

|

24.56

|

|

S&P 500 Index

|

25.49

|

|

Solactive US R&D Champions Index

|

24.98

|

|

Net Assets

|

$1,245,571

|

|

Number of Holdings

|

51

|

|

Net Advisory Fee

|

$1,898

|

|

Portfolio Turnover

|

34%

|

|

Top 10 Issuers

|

(% of net assets)

|

|

Oracle Corp.

|

2.4%

|

|

Keysight Technologies, Inc.

|

2.4%

|

|

Expedia Group, Inc.

|

2.3%

|

|

Carrier Global Corp.

|

2.3%

|

|

Trade Desk, Inc.

|

2.3%

|

|

Zoom Video Communications, Inc.

|

2.3%

|

|

Advanced Micro Devices, Inc.

|

2.2%

|

|

Trimble, Inc.

|

2.2%

|

|

Hewlett Packard Enterprise Co.

|

2.2%

|

|

Align Technology, Inc.

|

2.1%

|

|

Top Sectors

|

(% of net assets)

|

|

Technology

|

47.7%

|

|

Health Care

|

19.3%

|

|

Industrials

|

10.8%

|

|

Communications

|

10.2%

|

|

Consumer Discretionary

|

5.8%

|

|

Materials

|

2.1%

|

|

Energy

|

1.9%

|

|

Real Estate

|

1.9%

|

|

Cash & Other

|

0.3%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

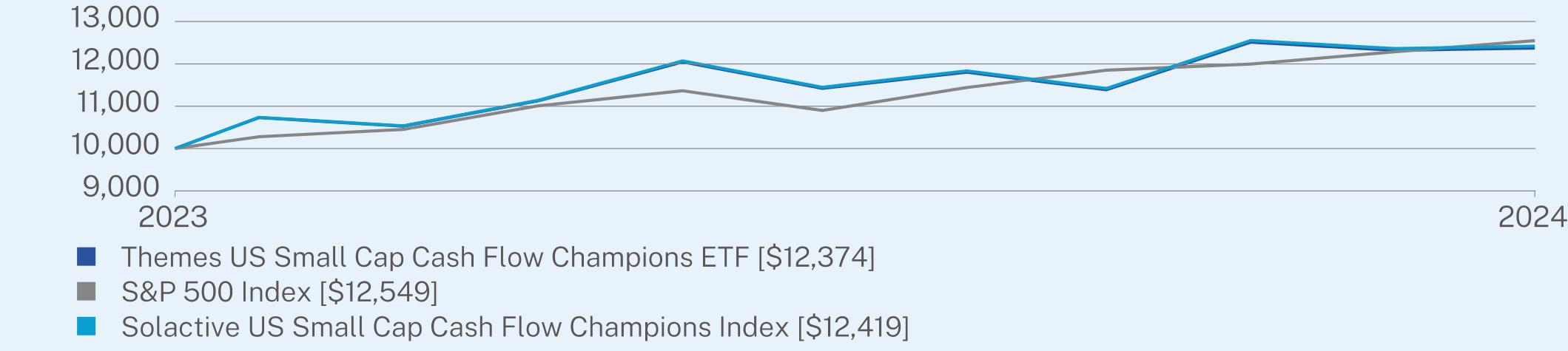

Themes US Small Cap Cash Flow Champions ETF

|

$26*

|

0.29%**

|

|

|

Since Inception

(12/13/2023) |

|

Themes US Small Cap Cash Flow Champions ETF

|

23.74

|

|

S&P 500 Index

|

25.49

|

|

Solactive US Small Cap Cash Flow Champions Index

|

24.19

|

|

Net Assets

|

$928,022

|

|

Number of Holdings

|

75

|

|

Net Advisory Fee

|

$1,637

|

|

Portfolio Turnover

|

46%

|

|

Top 10 Issuers

|

(% of net assets)

|

|

Builders FirstSource, Inc.

|

5.8%

|

|

Molina Healthcare, Inc.

|

4.9%

|

|

Williams-Sonoma, Inc.

|

4.8%

|

|

Marathon Oil Corp.

|

4.4%

|

|

CF Industries Holdings, Inc.

|

4.2%

|

|

Toll Brothers, Inc.

|

4.1%

|

|

Reinsurance Group of America, Inc.

|

3.7%

|

|

Flex Ltd.

|

3.5%

|

|

East West Bancorp, Inc.

|

3.0%

|

|

Stifel Financial Corp.

|

2.4%

|

|

Top Sectors

|

(% of net assets)

|

|

Financials

|

38.0%

|

|

Consumer Discretionary

|

17.5%

|

|

Energy

|

17.2%

|

|

Materials

|

10.0%

|

|

Industrials

|

5.5%

|

|

Health Care

|

5.0%

|

|

Technology

|

4.3%

|

|

Consumer Staples

|

0.8%

|

|

Real Estate

|

0.6%

|

|

Cash & Other

|

1.1%

|

| [1] |

|

||

| [2] |

|

||

| [3] |

|

||

| [4] |

|

||

| [5] |

|

||

| [6] |

|

||

| [7] |

|

||

| [8] |

|

||

| [9] |

|

||

| [10] |

|

||

| [11] |

|

||

| [12] |

|

||

| [13] |

|

||

| [14] |

|

||

| [15] |

|

||

| [16] |

|

||

| [17] |

|

||

| [18] |

|

||

| [19] |

|

||

| [20] |

|

||

| [21] |

|

||

| [22] |

|

||

| [23] |

|

||

| [24] |

|

||

| [25] |

|

||

| [26] |

|

||

| [27] |

|

||

| [28] |

|

||

| [29] |

|

||

| [30] |

|

||

| [31] |

|

||

| [32] |

|

||

| [33] |

|

||

| [34] |

|