Shareholder Report

|

1 Months Ended |

12 Months Ended |

95 Months Ended |

106 Months Ended |

118 Months Ended |

|

Sep. 30, 2024

USD ($)

Holding

|

Sep. 30, 2024

USD ($)

Holding

|

Sep. 30, 2024

USD ($)

Holding

|

Sep. 30, 2024

USD ($)

Holding

|

Sep. 30, 2024

USD ($)

Holding

|

| Shareholder Report [Line Items] |

|

|

|

|

|

| Document Type |

|

N-CSR

|

|

|

|

| Amendment Flag |

|

false

|

|

|

|

| Registrant Name |

|

SPDR INDEX SHARES FUNDS

|

|

|

|

| Entity Central Index Key |

|

0001168164

|

|

|

|

| Entity Investment Company Type |

|

N-1A

|

|

|

|

| Document Period End Date |

|

Sep. 30, 2024

|

|

|

|

| C000038340 |

|

|

|

|

|

| Shareholder Report [Line Items] |

|

|

|

|

|

| Fund Name |

|

SPDR S&P Global Infrastructure ETF

|

|

|

|

| Trading Symbol |

|

GII

|

|

|

|

| Security Exchange Name |

|

NYSE

|

|

|

|

| Annual or Semi-Annual Statement [Text Block] |

|

This annual shareholder report contains important information about the SPDR S&P Global Infrastructure ETF (the "Fund") for the period of October 1, 2023 to September 30, 2024.

|

|

|

|

| Shareholder Report Annual or Semi-Annual |

|

Annual Shareholder Report

|

|

|

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund, including the Prospectus, Statement of Additional Information, financial statements and other information at www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs. You can also request this information about the Fund by contacting us at 1-866-787-2257.

|

|

|

|

| Additional Information Phone Number |

|

1-866-787-2257

|

|

|

|

| Additional Information Website |

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left;">www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs</span>

|

|

|

|

| Expenses [Text Block] |

|

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment)

Fund Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

SPDR S&P Global Infrastructure ETF |

$46 |

0.40% | |

|

|

|

| Expenses Paid, Amount |

|

$ 46

|

|

|

|

| Expense Ratio, Percent |

|

0.40%

|

|

|

|

| Factors Affecting Performance [Text Block] |

|

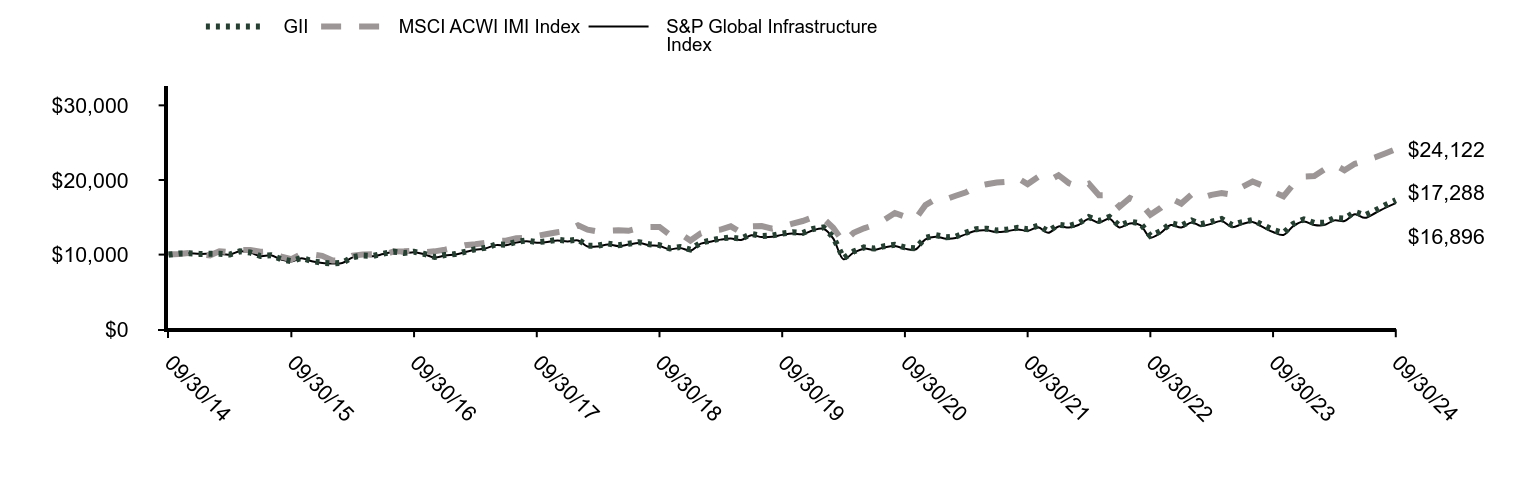

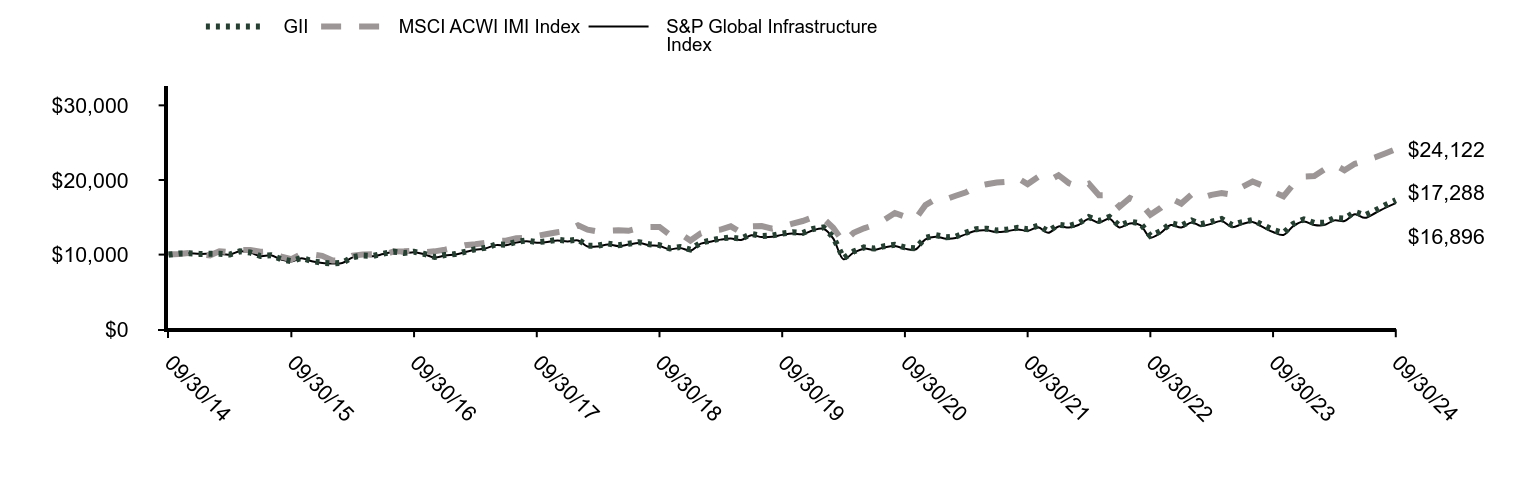

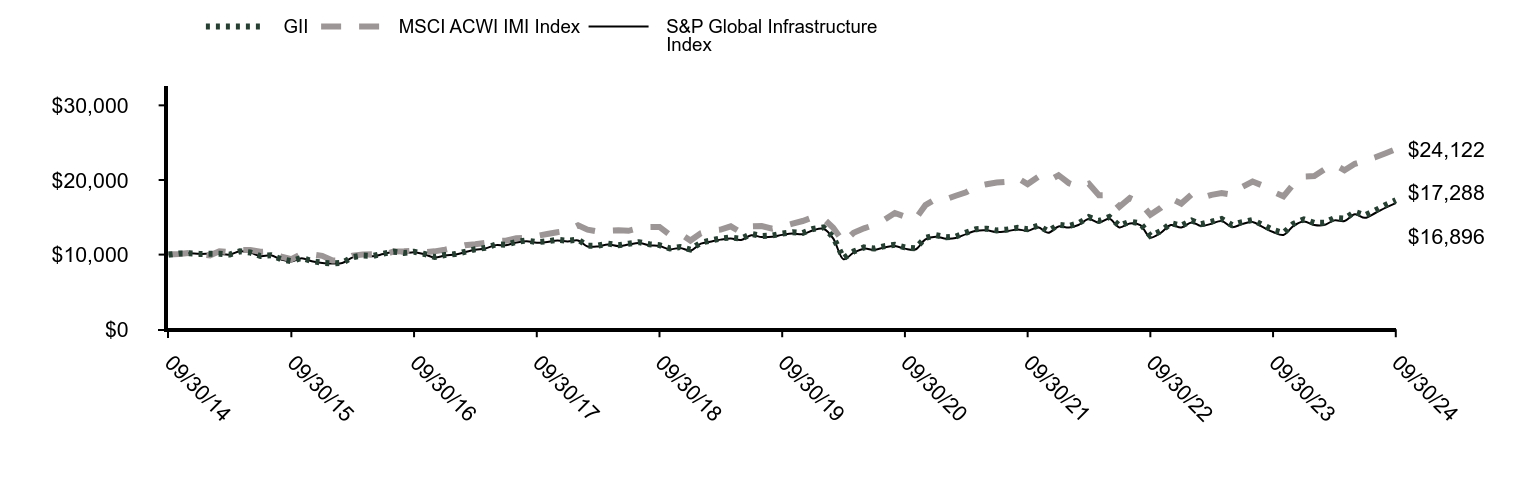

How did the Fund perform last year and what affected its performance?The reporting period’s market environment was largely driven by speculation about inflation and when and by how much the U.S. Federal Reserve (“the Fed”) and other central banks would begin cutting rates. Alongside this interest rate story was the continuing prospect of an artificial intelligence boom, driving up the values of A.I.-related tech and semiconductor companies. And even though markets moved sideways in Q3 2024 as investors rotated out of growth and tech stocks and back into value and small cap securities, they could not undo the reporting period’s significant influence driven by those mega-cap high-flyers. With the Fed finally cutting rates in September and by 50 bps, the year-long speculation about the timing of the Fed’s directional shift was finally put to rest, and markets ended the year-long period with significant gains and at the highest levels. On the sector front, Industrials and Utilities were leaders with positive performance coupled with large weights within the fund. |

|

|

|

| Performance Past Does Not Indicate Future [Text] |

|

<p style="box-sizing: border-box; color: rgb(0, 0, 0); display: block; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left;"><span style="font-weight: 700; box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left;">The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. Updated performance information is available by calling <span style="font-weight: 700; box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left;">1-866-787-2257</span> or visiting our website at <span style="font-weight: 700; box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left;">www.ssga.com</span>.</span></p>

|

|

|

|

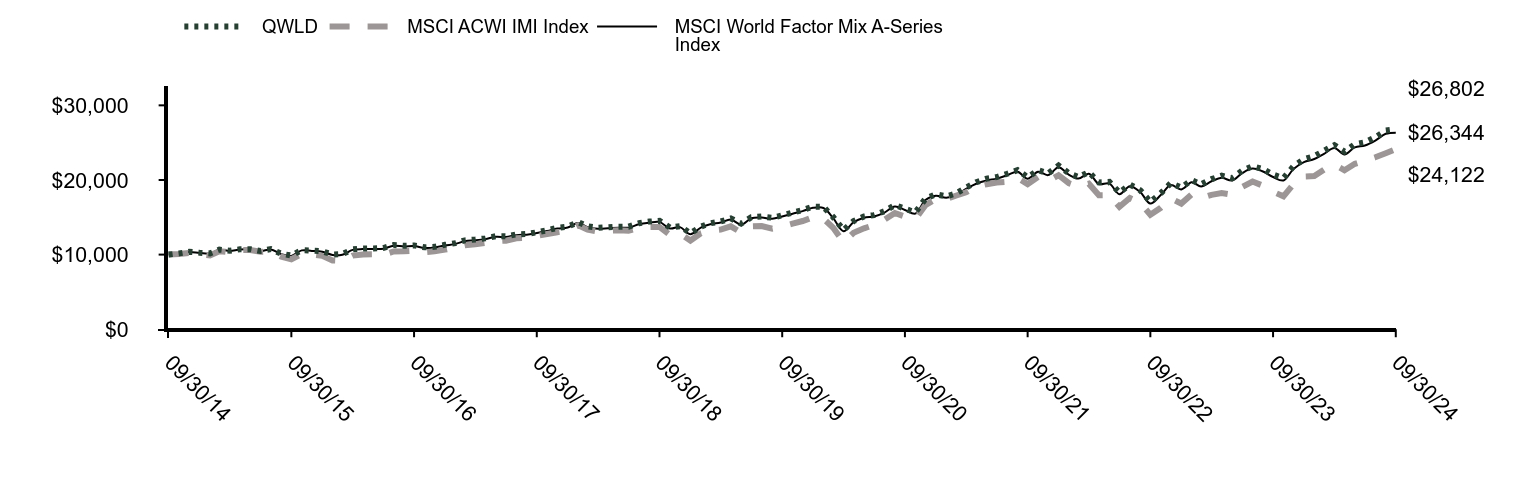

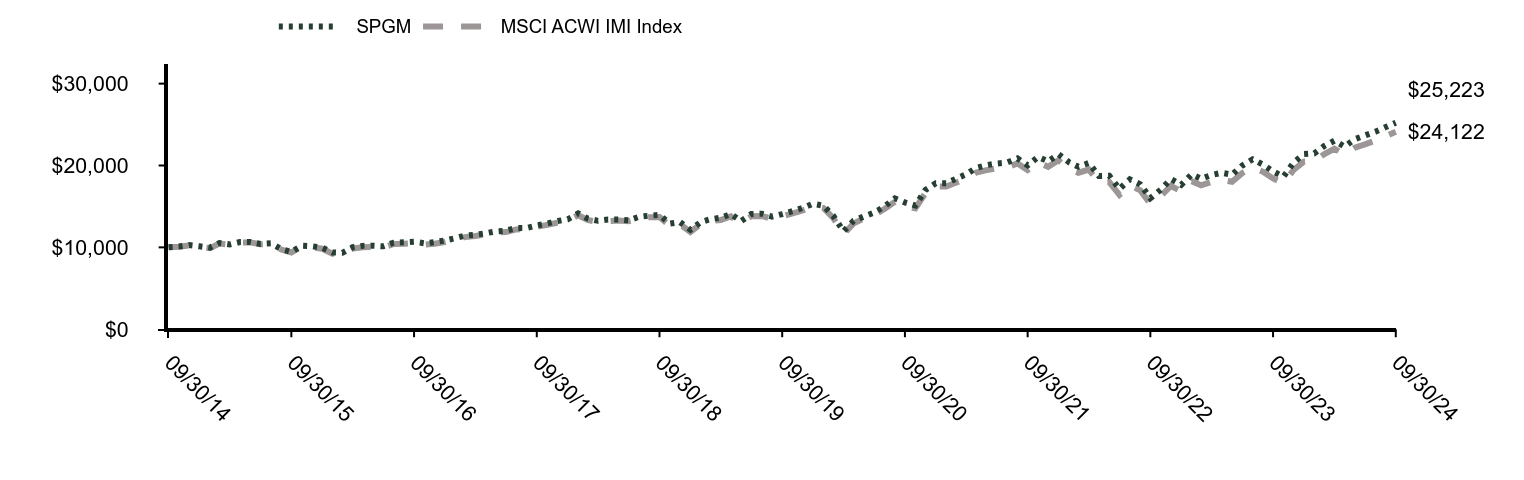

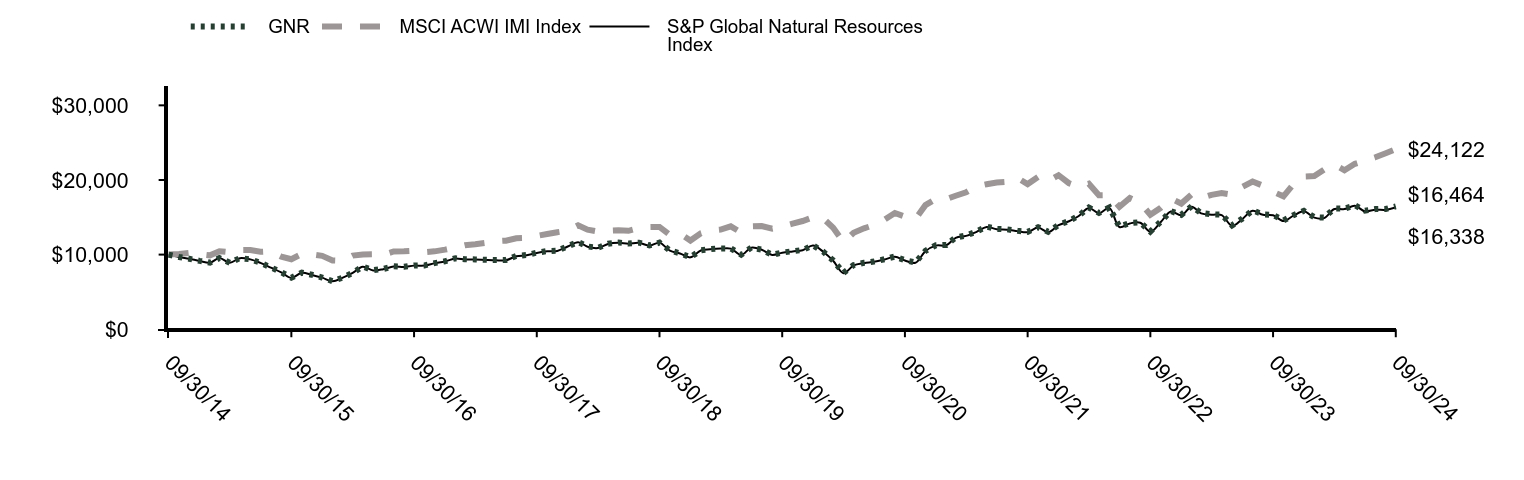

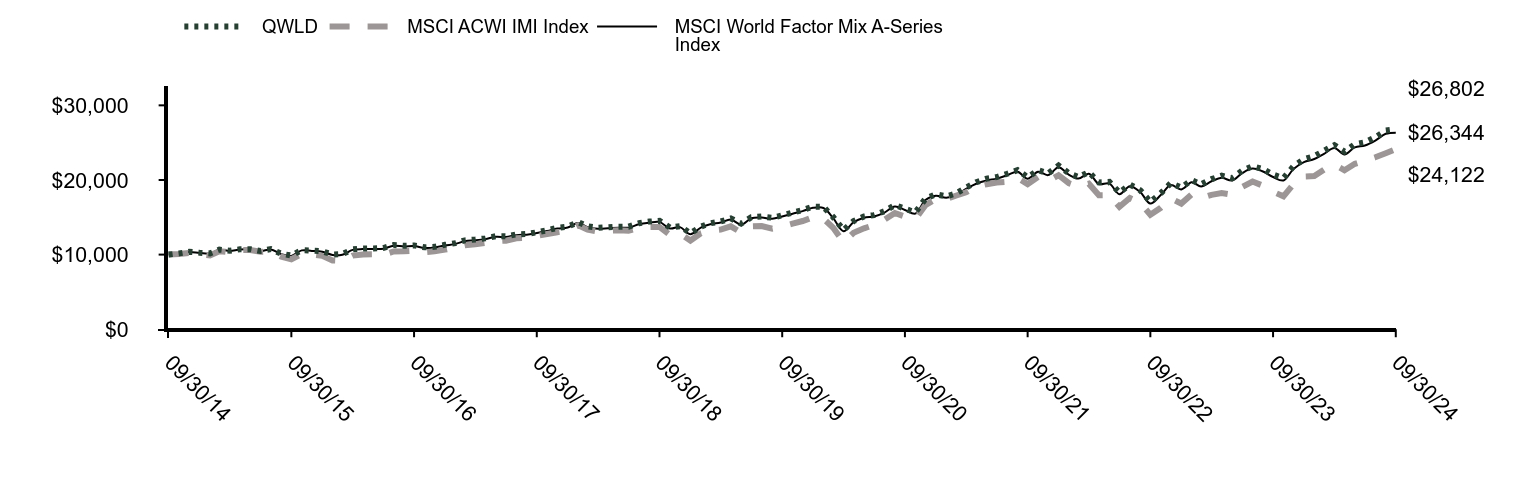

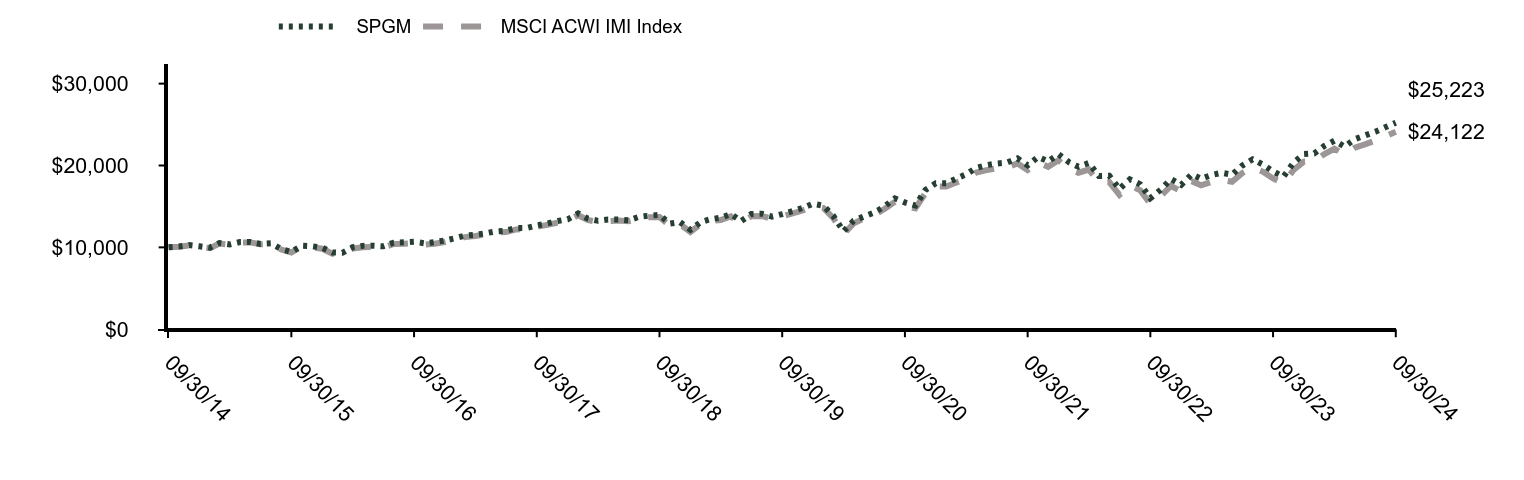

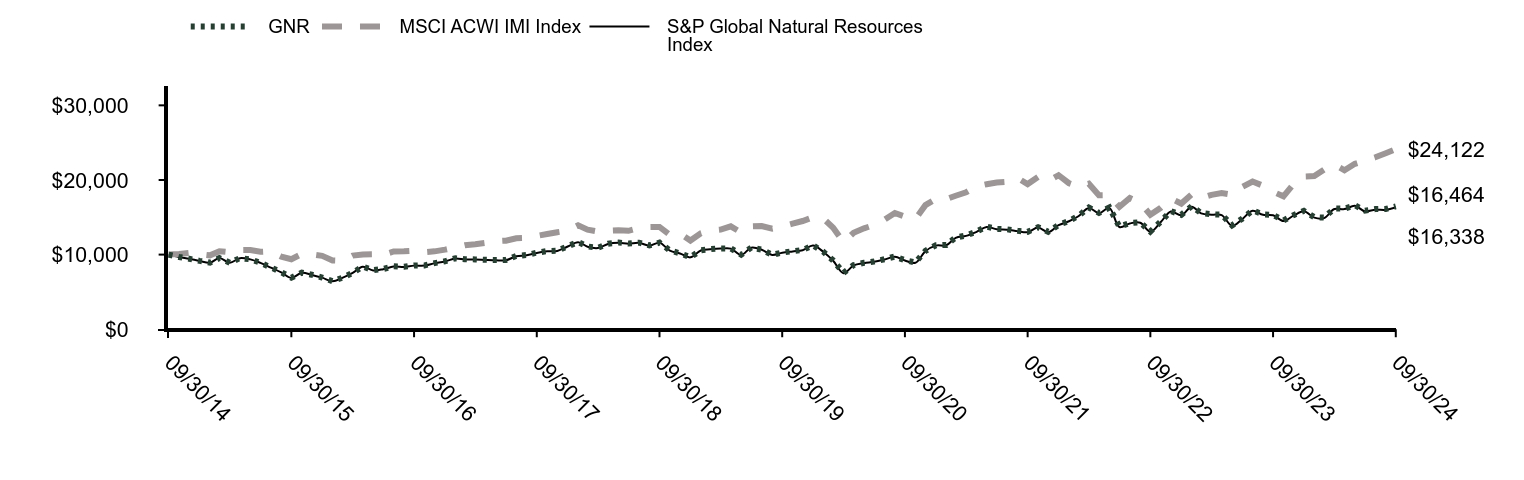

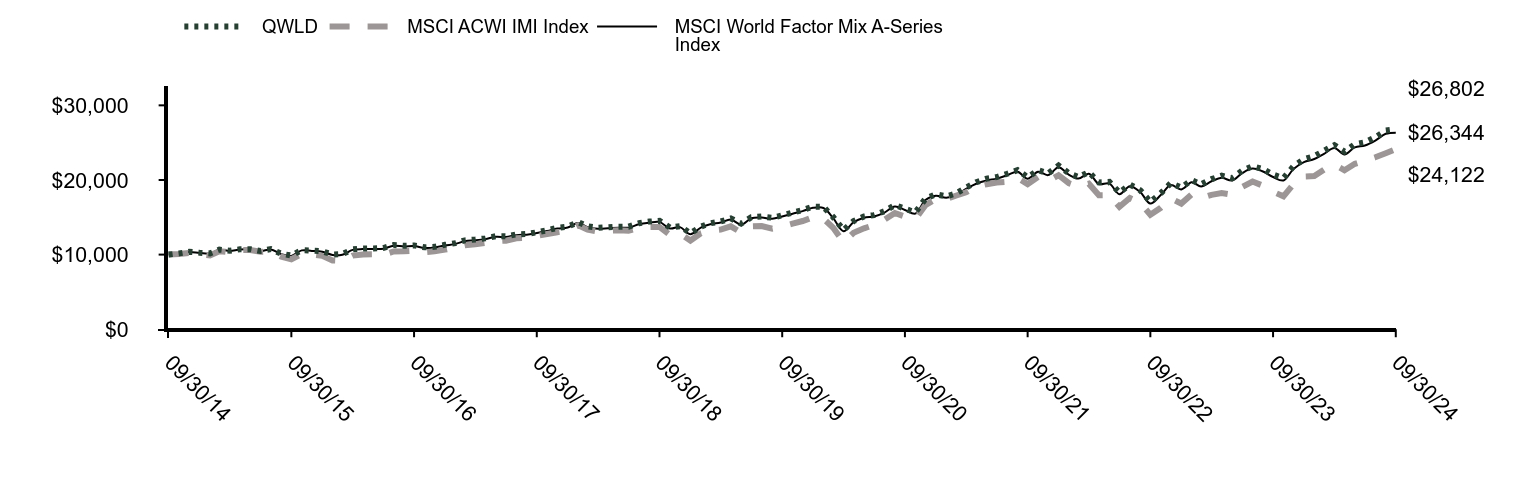

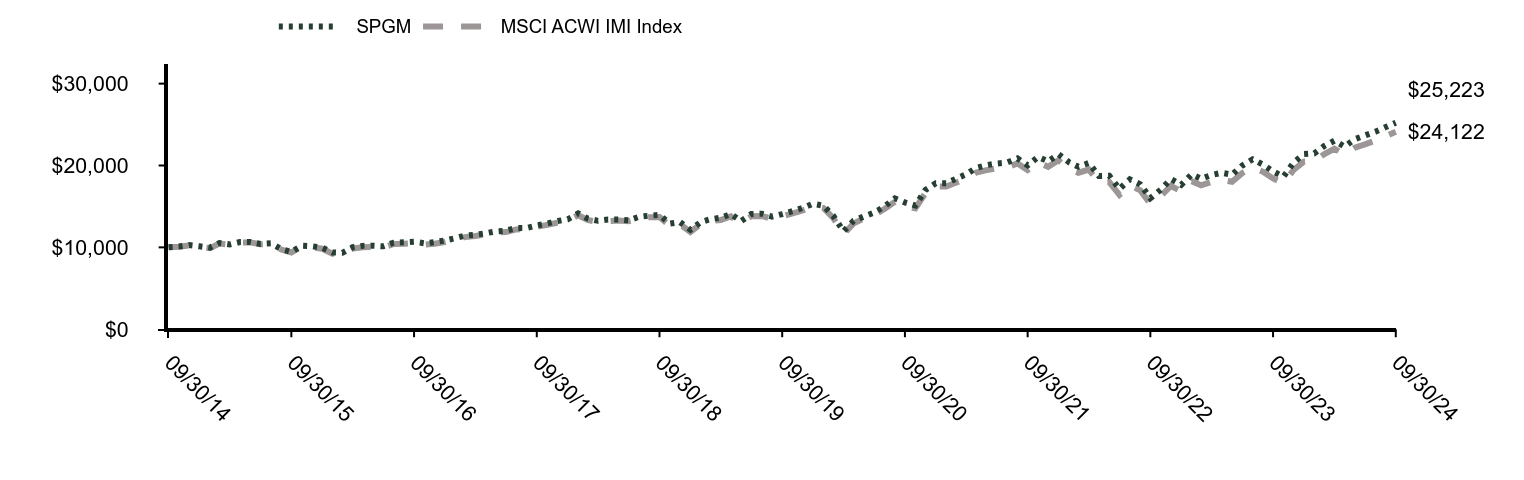

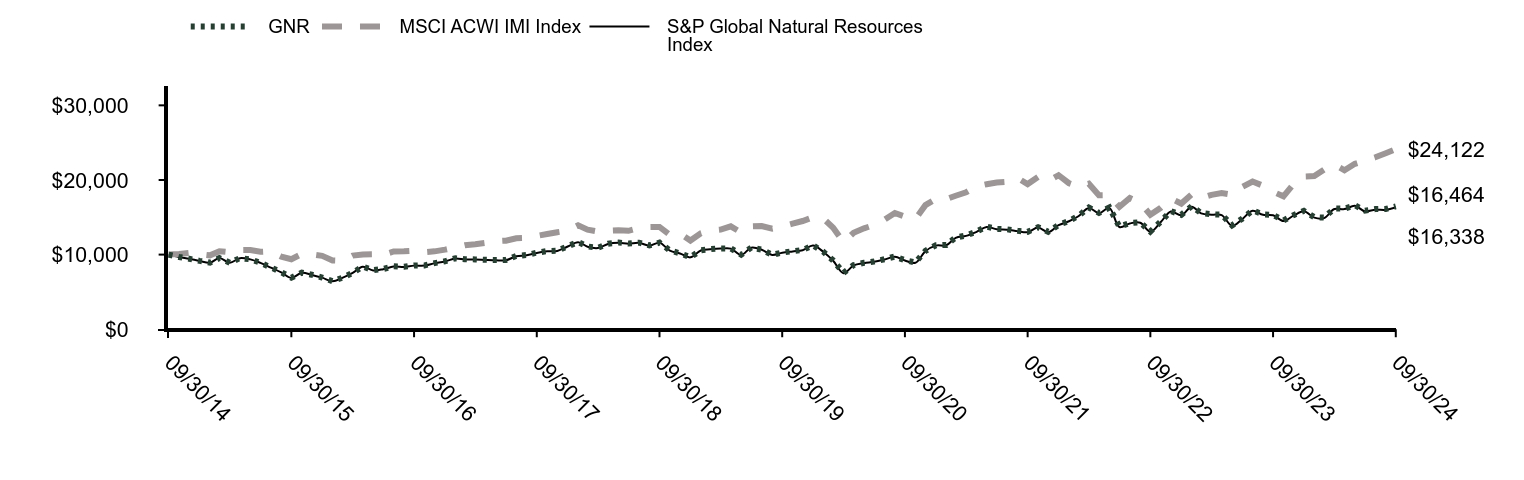

| Line Graph [Table Text Block] |

|

|

GII |

MSCI ACWI IMI Index |

S&P Global Infrastructure Index |

09/30/14 |

$10,000 |

$10,000 |

$10,000 |

10/31/14 |

$10,161 |

$10,079 |

$10,164 |

11/30/14 |

$10,166 |

$10,228 |

$10,166 |

12/31/14 |

$10,096 |

$10,059 |

$10,098 |

01/31/15 |

$10,101 |

$9,903 |

$10,107 |

02/28/15 |

$10,100 |

$10,457 |

$10,096 |

03/31/15 |

$10,010 |

$10,319 |

$10,005 |

04/30/15 |

$10,445 |

$10,602 |

$10,440 |

05/31/15 |

$10,280 |

$10,609 |

$10,269 |

06/30/15 |

$9,814 |

$10,374 |

$9,795 |

07/31/15 |

$9,917 |

$10,435 |

$9,900 |

08/31/15 |

$9,375 |

$9,735 |

$9,349 |

09/30/15 |

$9,123 |

$9,379 |

$9,091 |

10/31/15 |

$9,556 |

$10,089 |

$9,524 |

11/30/15 |

$9,146 |

$10,026 |

$9,112 |

12/31/15 |

$8,903 |

$9,839 |

$8,869 |

01/31/16 |

$8,831 |

$9,223 |

$8,799 |

02/29/16 |

$8,917 |

$9,175 |

$8,877 |

03/31/16 |

$9,665 |

$9,869 |

$9,622 |

04/30/16 |

$9,884 |

$10,025 |

$9,842 |

05/31/16 |

$9,831 |

$10,045 |

$9,782 |

06/30/16 |

$10,116 |

$9,973 |

$10,069 |

07/31/16 |

$10,395 |

$10,417 |

$10,347 |

08/31/16 |

$10,208 |

$10,452 |

$10,149 |

09/30/16 |

$10,387 |

$10,528 |

$10,326 |

10/31/16 |

$10,087 |

$10,325 |

$10,033 |

11/30/16 |

$9,676 |

$10,437 |

$9,616 |

12/31/16 |

$9,940 |

$10,662 |

$9,884 |

01/31/17 |

$10,072 |

$10,951 |

$10,015 |

02/28/17 |

$10,373 |

$11,252 |

$10,307 |

03/31/17 |

$10,721 |

$11,386 |

$10,651 |

04/30/17 |

$10,899 |

$11,569 |

$10,828 |

05/31/17 |

$11,350 |

$11,800 |

$11,269 |

06/30/17 |

$11,327 |

$11,869 |

$11,250 |

07/31/17 |

$11,699 |

$12,195 |

$11,621 |

08/31/17 |

$11,888 |

$12,238 |

$11,800 |

09/30/17 |

$11,670 |

$12,500 |

$11,582 |

10/31/17 |

$11,773 |

$12,753 |

$11,689 |

11/30/17 |

$11,980 |

$13,003 |

$11,883 |

12/31/17 |

$11,864 |

$13,215 |

$11,769 |

01/31/18 |

$11,999 |

$13,928 |

$11,902 |

02/28/18 |

$11,200 |

$13,346 |

$11,096 |

03/31/18 |

$11,204 |

$13,097 |

$11,098 |

04/30/18 |

$11,476 |

$13,219 |

$11,367 |

05/31/18 |

$11,259 |

$13,272 |

$11,144 |

06/30/18 |

$11,465 |

$13,192 |

$11,348 |

07/31/18 |

$11,666 |

$13,557 |

$11,547 |

08/31/18 |

$11,385 |

$13,682 |

$11,258 |

09/30/18 |

$11,270 |

$13,704 |

$11,144 |

10/31/18 |

$10,822 |

$12,632 |

$10,701 |

11/30/18 |

$11,023 |

$12,810 |

$10,896 |

12/31/18 |

$10,673 |

$11,883 |

$10,548 |

01/31/19 |

$11,599 |

$12,850 |

$11,465 |

02/28/19 |

$11,873 |

$13,208 |

$11,727 |

03/31/19 |

$12,159 |

$13,344 |

$12,008 |

04/30/19 |

$12,300 |

$13,785 |

$12,147 |

05/31/19 |

$12,124 |

$12,960 |

$11,962 |

06/30/19 |

$12,761 |

$13,793 |

$12,600 |

07/31/19 |

$12,503 |

$13,835 |

$12,346 |

08/31/19 |

$12,553 |

$13,486 |

$12,383 |

09/30/19 |

$12,820 |

$13,769 |

$12,645 |

10/31/19 |

$13,009 |

$14,148 |

$12,835 |

11/30/19 |

$12,904 |

$14,501 |

$12,725 |

12/31/19 |

$13,442 |

$15,015 |

$13,265 |

01/31/20 |

$13,653 |

$14,816 |

$13,473 |

02/29/20 |

$12,356 |

$13,604 |

$12,179 |

03/31/20 |

$9,525 |

$11,646 |

$9,377 |

04/30/20 |

$10,416 |

$12,928 |

$10,259 |

05/31/20 |

$10,962 |

$13,523 |

$10,798 |

06/30/20 |

$10,808 |

$13,955 |

$10,654 |

07/31/20 |

$11,128 |

$14,680 |

$10,968 |

08/31/20 |

$11,310 |

$15,569 |

$11,141 |

09/30/20 |

$10,966 |

$15,086 |

$10,800 |

10/31/20 |

$10,844 |

$14,760 |

$10,680 |

11/30/20 |

$12,235 |

$16,629 |

$12,051 |

12/31/20 |

$12,594 |

$17,455 |

$12,403 |

01/31/21 |

$12,325 |

$17,424 |

$12,136 |

02/28/21 |

$12,415 |

$17,888 |

$12,222 |

03/31/21 |

$12,954 |

$18,351 |

$12,751 |

04/30/21 |

$13,406 |

$19,148 |

$13,198 |

05/31/21 |

$13,476 |

$19,434 |

$13,260 |

06/30/21 |

$13,230 |

$19,668 |

$13,022 |

07/31/21 |

$13,354 |

$19,768 |

$13,142 |

08/31/21 |

$13,591 |

$20,257 |

$13,371 |

09/30/21 |

$13,409 |

$19,449 |

$13,190 |

10/31/21 |

$13,886 |

$20,395 |

$13,663 |

11/30/21 |

$13,143 |

$19,848 |

$12,925 |

12/31/21 |

$13,996 |

$20,636 |

$13,773 |

01/31/22 |

$13,850 |

$19,565 |

$13,628 |

02/28/22 |

$14,190 |

$19,117 |

$13,961 |

03/31/22 |

$15,015 |

$19,507 |

$14,774 |

04/30/22 |

$14,517 |

$17,958 |

$14,285 |

05/31/22 |

$15,039 |

$17,969 |

$14,796 |

06/30/22 |

$13,871 |

$16,419 |

$13,643 |

07/31/22 |

$14,416 |

$17,591 |

$14,180 |

08/31/22 |

$14,198 |

$16,967 |

$13,956 |

09/30/22 |

$12,520 |

$15,329 |

$12,304 |

10/31/22 |

$13,143 |

$16,272 |

$12,922 |

11/30/22 |

$14,197 |

$17,511 |

$13,955 |

12/31/22 |

$13,875 |

$16,838 |

$13,637 |

01/31/23 |

$14,566 |

$18,078 |

$14,317 |

02/28/23 |

$14,078 |

$17,576 |

$13,827 |

03/31/23 |

$14,407 |

$18,008 |

$14,145 |

04/30/23 |

$14,780 |

$18,238 |

$14,508 |

05/31/23 |

$13,952 |

$18,018 |

$13,685 |

06/30/23 |

$14,354 |

$19,068 |

$14,086 |

07/31/23 |

$14,639 |

$19,798 |

$14,363 |

08/31/23 |

$13,955 |

$19,229 |

$13,680 |

09/30/23 |

$13,300 |

$18,420 |

$13,030 |

10/31/23 |

$12,895 |

$17,806 |

$12,633 |

11/30/23 |

$14,138 |

$19,452 |

$13,849 |

12/31/23 |

$14,722 |

$20,472 |

$14,425 |

01/31/24 |

$14,254 |

$20,518 |

$13,964 |

02/29/24 |

$14,253 |

$21,376 |

$13,954 |

03/31/24 |

$14,898 |

$22,052 |

$14,587 |

04/30/24 |

$14,811 |

$21,303 |

$14,504 |

05/31/24 |

$15,728 |

$22,166 |

$15,394 |

06/30/24 |

$15,262 |

$22,577 |

$14,927 |

07/31/24 |

$15,924 |

$23,041 |

$15,576 |

08/31/24 |

$16,662 |

$23,579 |

$16,285 |

09/30/24 |

$17,288 |

$24,122 |

$16,896 |

|

|

|

|

| Average Annual Return [Table Text Block] |

|

Name |

1 Year |

5 Years |

10 Years |

GII |

29.98% |

6.16% |

5.63% |

MSCI ACWI IMI Index |

30.96% |

11.87% |

9.20% |

S&P Global Infrastructure Index |

29.68% |

5.97% |

5.38% | |

|

|

|

| AssetsNet |

$ 461,051,018

|

$ 461,051,018

|

$ 461,051,018

|

$ 461,051,018

|

$ 461,051,018

|

| Holdings Count | Holding |

77

|

77

|

77

|

77

|

77

|

| Advisory Fees Paid, Amount |

|

$ 1,638,133

|

|

|

|

| InvestmentCompanyPortfolioTurnover |

|

14.00%

|

|

|

|

| Additional Fund Statistics [Text Block] |

|

Key Fund Statistics as of 9/30/2024

Statistic |

Value |

Total Net Assets |

$461,051,018 |

Number of Portfolio Holdings |

77 |

Portfolio Turnover Rate |

14% |

Total Advisory Fees Paid |

$1,638,133 | |

|

|

|

| Holdings [Text Block] |

|

Sector |

% Value of Total Net Assets |

Utilities |

40.7% |

Industrials |

39.2% |

Energy |

19.7% | |

|

|

|

| Material Fund Change [Text Block] |

|

|

|

|

|

| C000096745 |

|

|

|

|

|

| Shareholder Report [Line Items] |

|

|

|

|

|

| Fund Name |

|

SPDR S&P Emerging Markets Dividend ETF

|

|

|

|

| Trading Symbol |

|

EDIV

|

|

|

|

| Security Exchange Name |

|

NYSE

|

|

|

|

| Annual or Semi-Annual Statement [Text Block] |

|

This annual shareholder report contains important information about the SPDR S&P Emerging Markets Dividend ETF (the "Fund") for the period of October 1, 2023 to September 30, 2024.

|

|

|

|

| Shareholder Report Annual or Semi-Annual |

|

Annual Shareholder Report

|

|

|

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund, including the Prospectus, Statement of Additional Information, financial statements and other information at www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs. You can also request this information about the Fund by contacting us at 1-866-787-2257.

|

|

|

|

| Additional Information Phone Number |

|

1-866-787-2257

|

|

|

|

| Additional Information Website |

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left;">www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs</span>

|

|

|

|

| Expenses [Text Block] |

|

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment)

Fund Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

SPDR S&P Emerging Markets Dividend ETF |

$57 |

0.49% | |

|

|

|

| Expenses Paid, Amount |

|

$ 57

|

|

|

|

| Expense Ratio, Percent |

|

0.49%

|

|

|

|

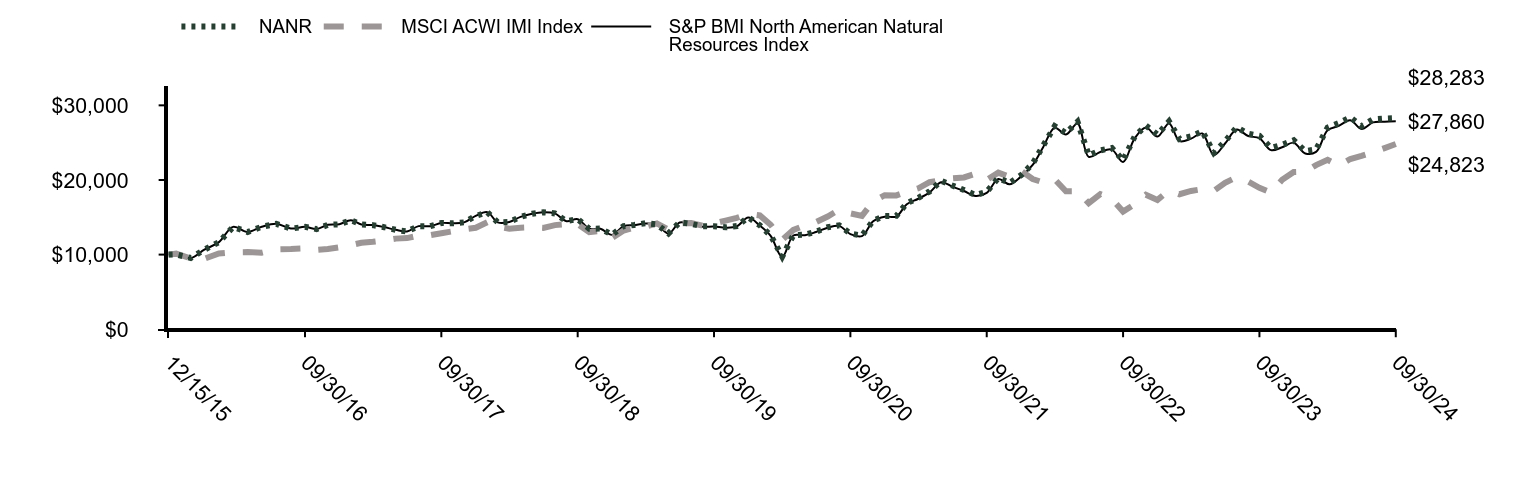

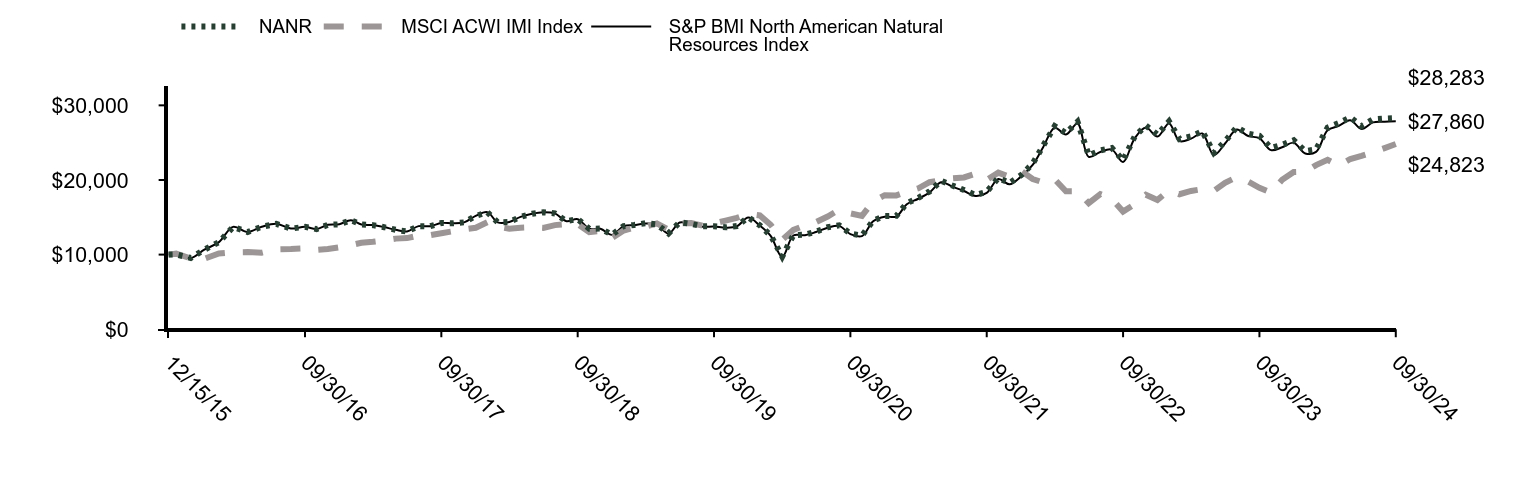

| Factors Affecting Performance [Text Block] |

|

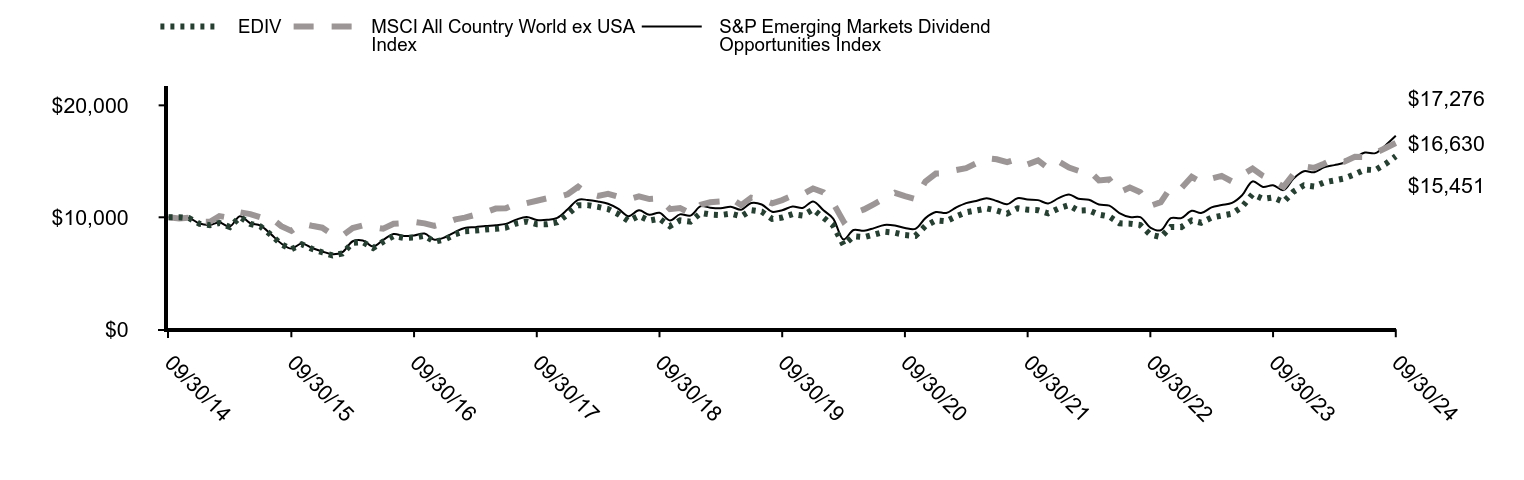

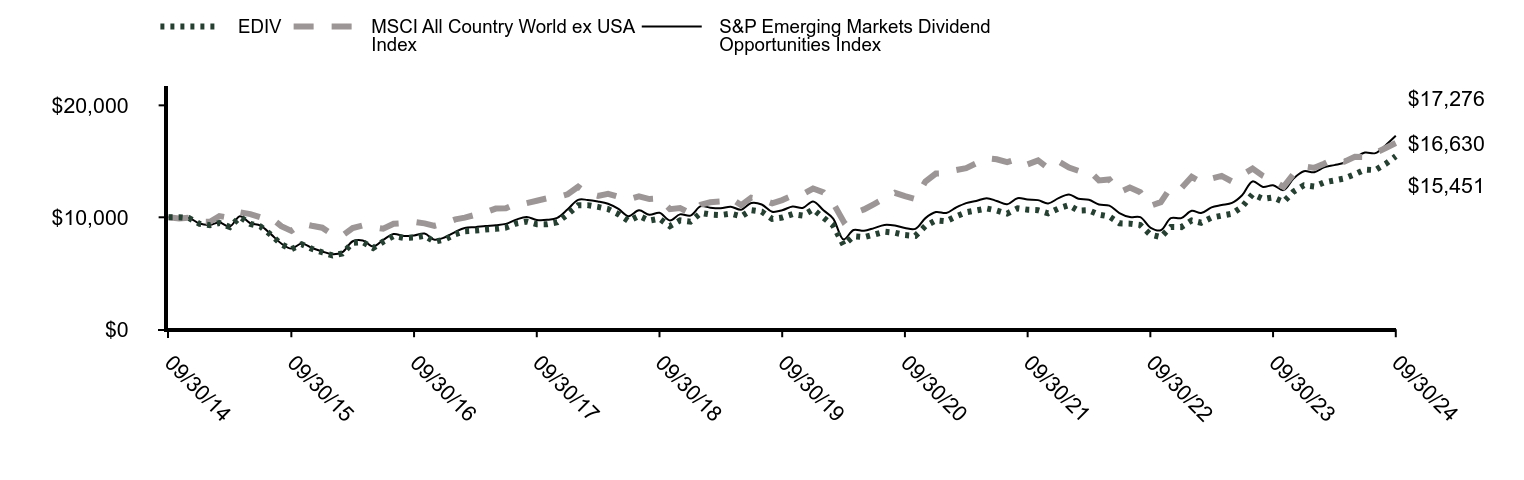

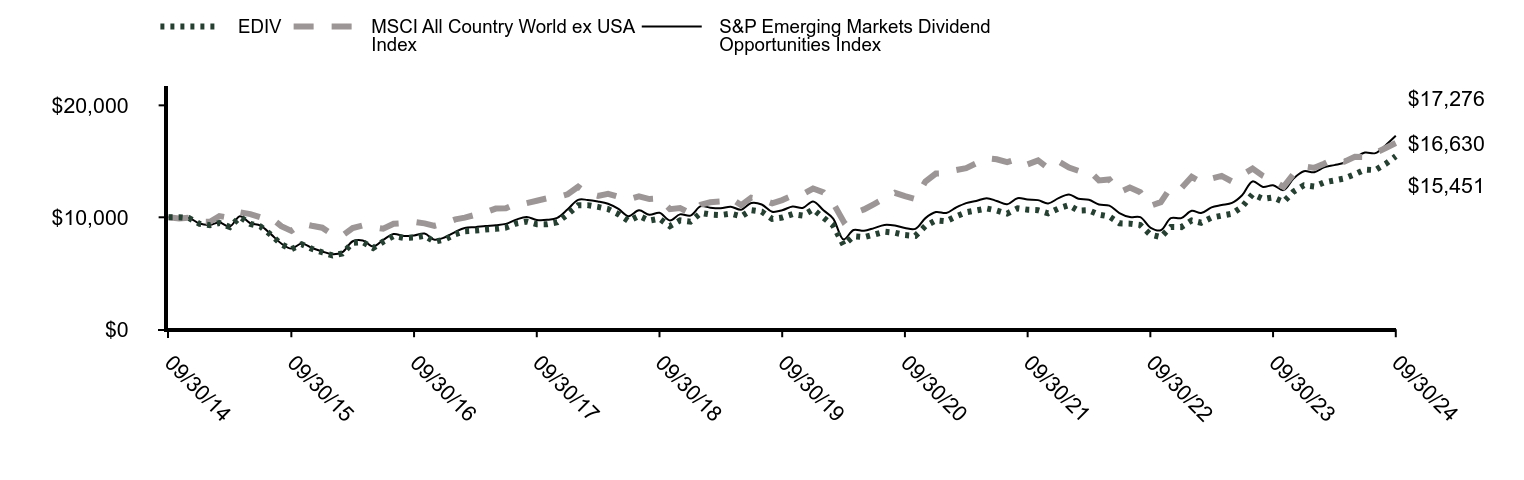

How did the Fund perform last year and what affected its performance?The reporting period’s market environment was largely driven by inflation and when and by how much the U.S. Federal Reserve and other central banks would begin cutting rates. Alongside this interest rate story was the continuing prospect of an Artificial Intelligence boom, driving up the values of A.I.-related tech and semiconductor companies. Risk assets registered positive gains despite pronounced market volatility. Developed markets (DMs) posted positive returns but underperformed emerging markets (EMs), as EM equites performed strongly, supported by the new stimulus in China. India, Taiwan and China were the top drivers of the Fund's return. Power Grid Corporation of India Ltd., NTPC Ltd., and Hero MotoCorp Ltd., were the top contributors to the Fund's performance. Yuexiu Property Company, China Resources Land, and Orbia Advance Corp. were the bottom contributors to the Fund's return. |

|

|

|

| Performance Past Does Not Indicate Future [Text] |

|

<p style="box-sizing: border-box; color: rgb(0, 0, 0); display: block; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left;"><span style="font-weight: 700; box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left;">The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. Updated performance information is available by calling <span style="font-weight: 700; box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left;">1-866-787-2257</span> or visiting our website at <span style="font-weight: 700; box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left;">www.ssga.com</span>.</span></p>

|

|

|

|

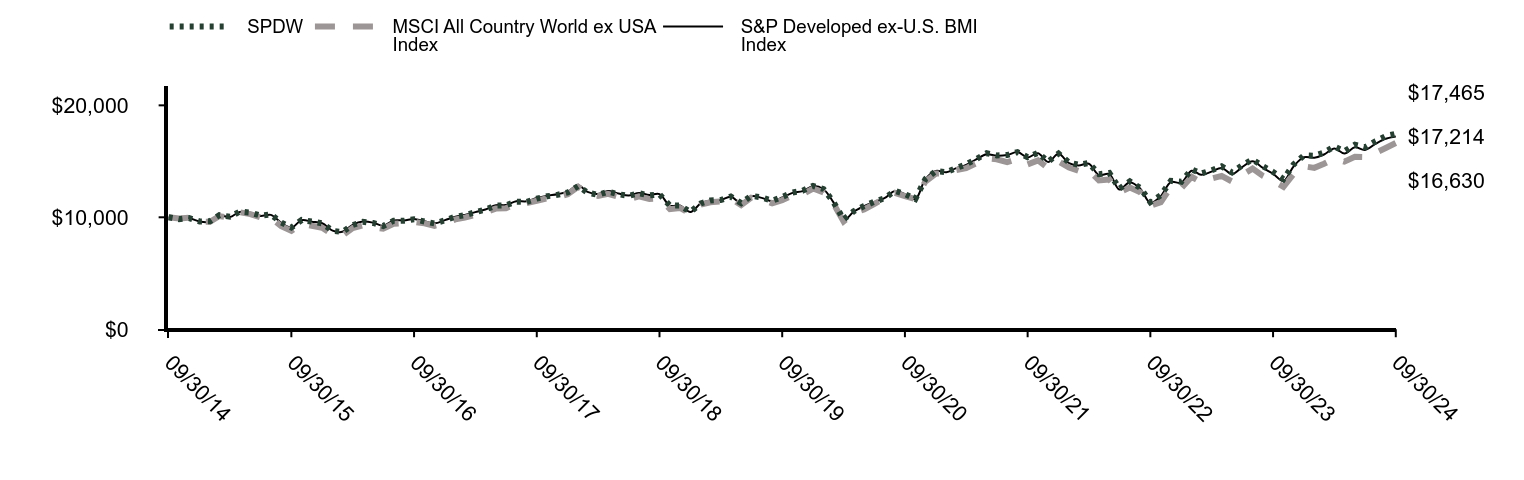

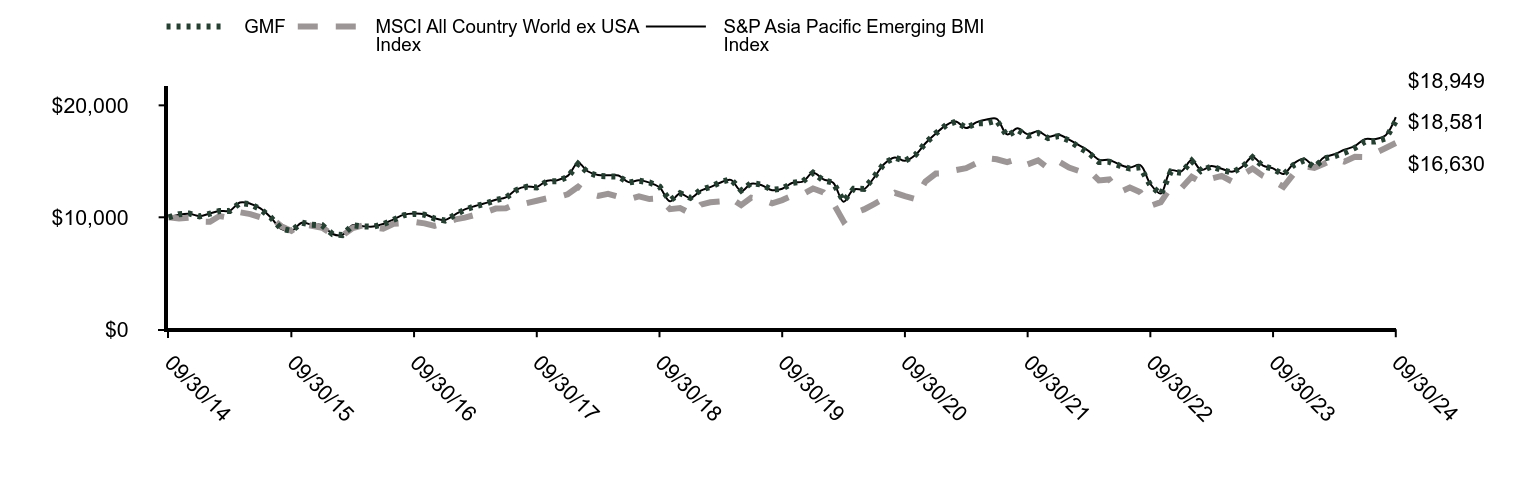

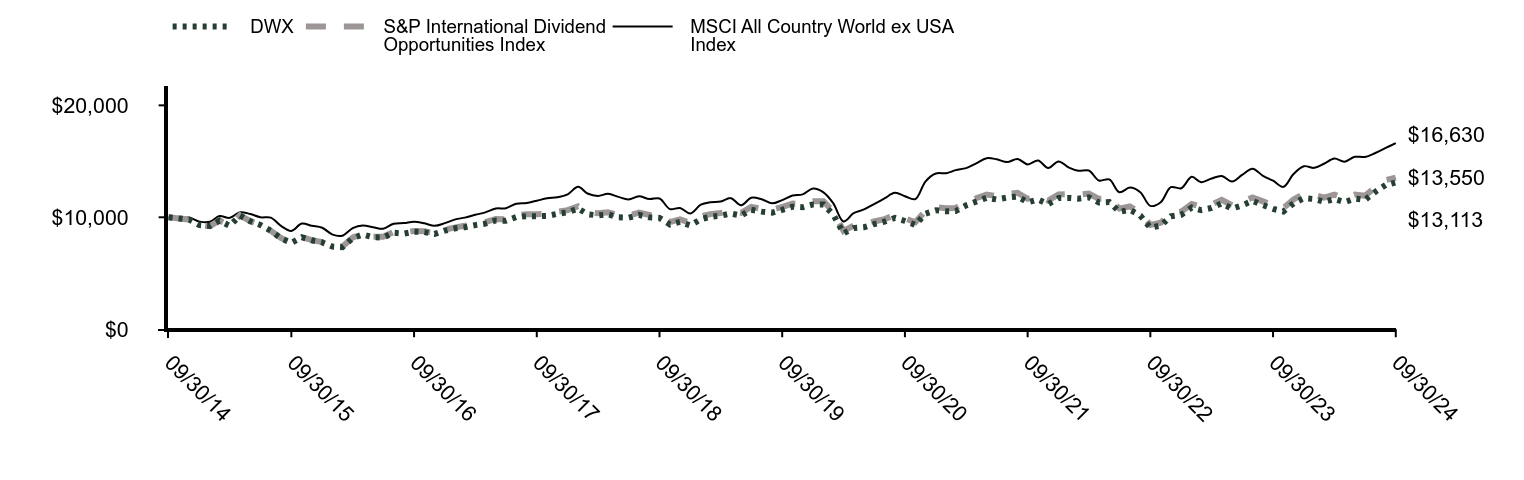

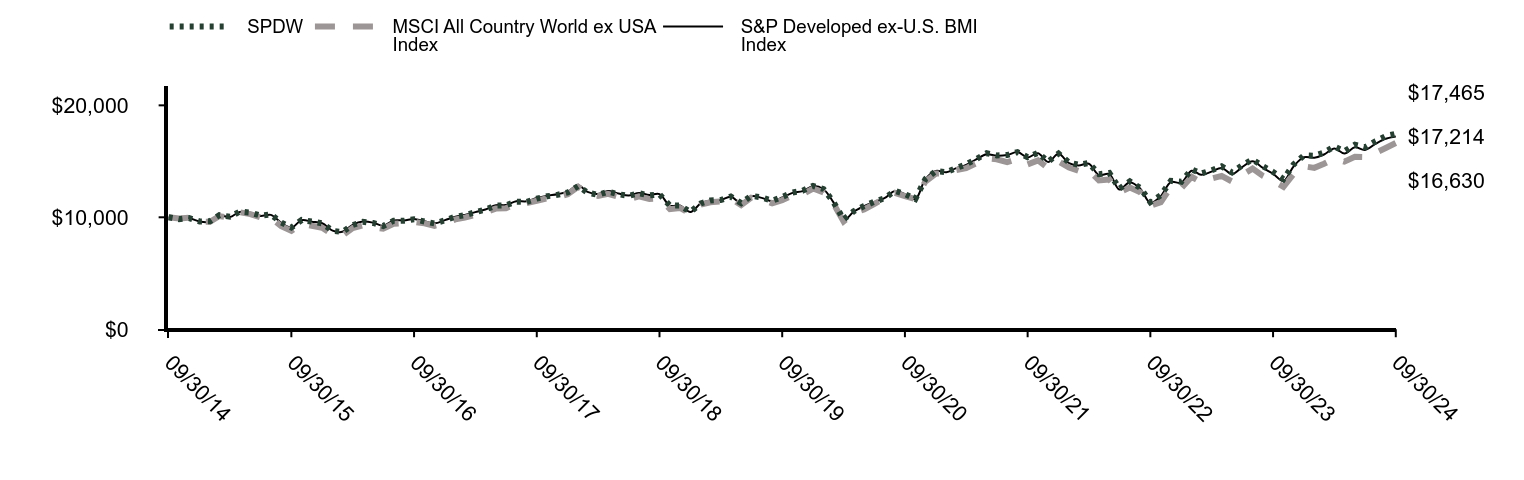

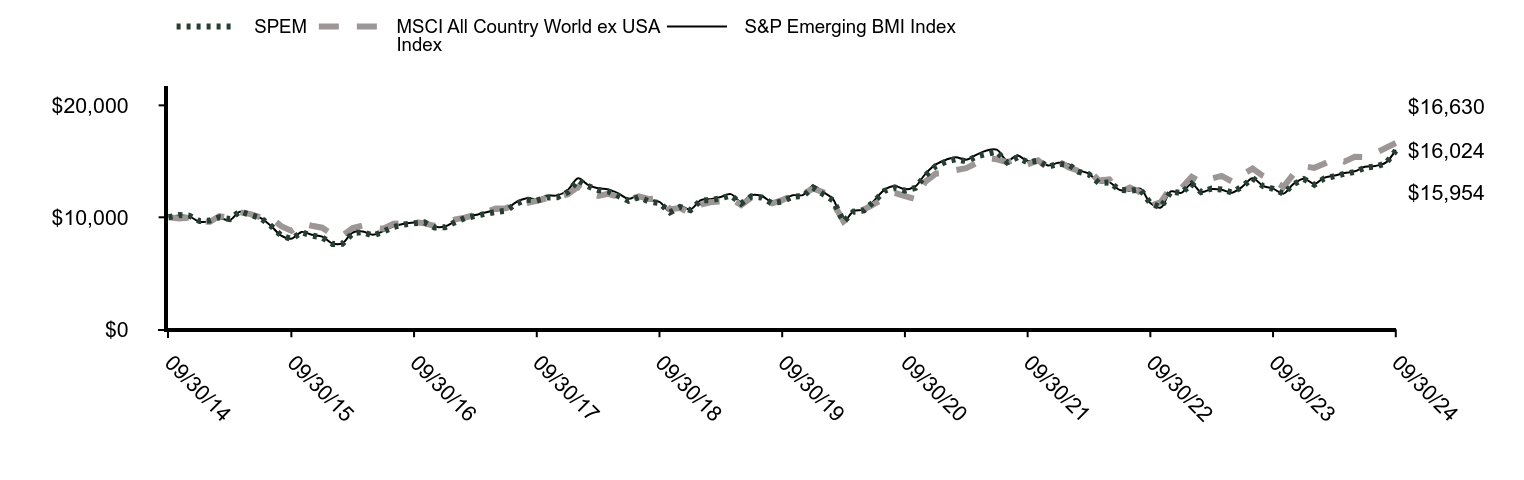

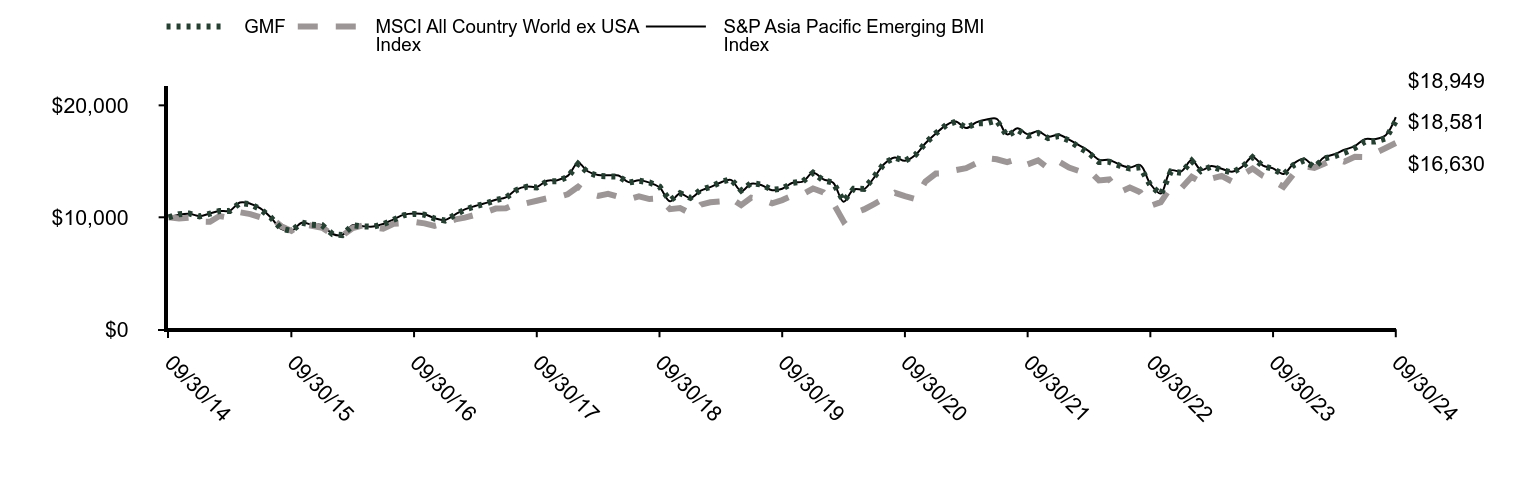

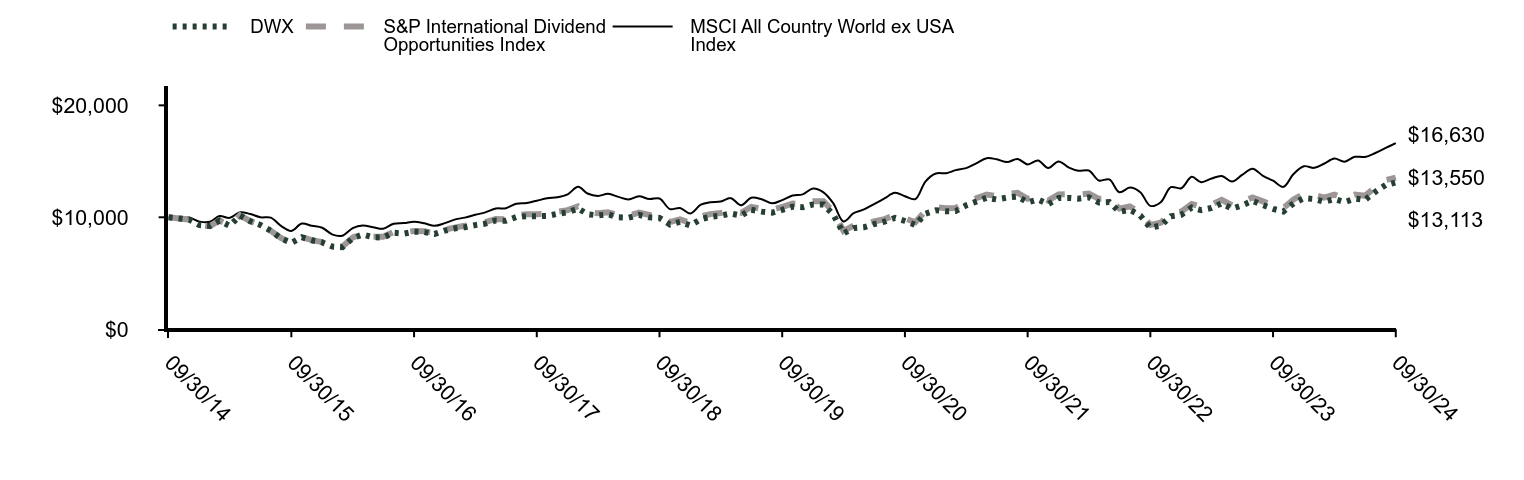

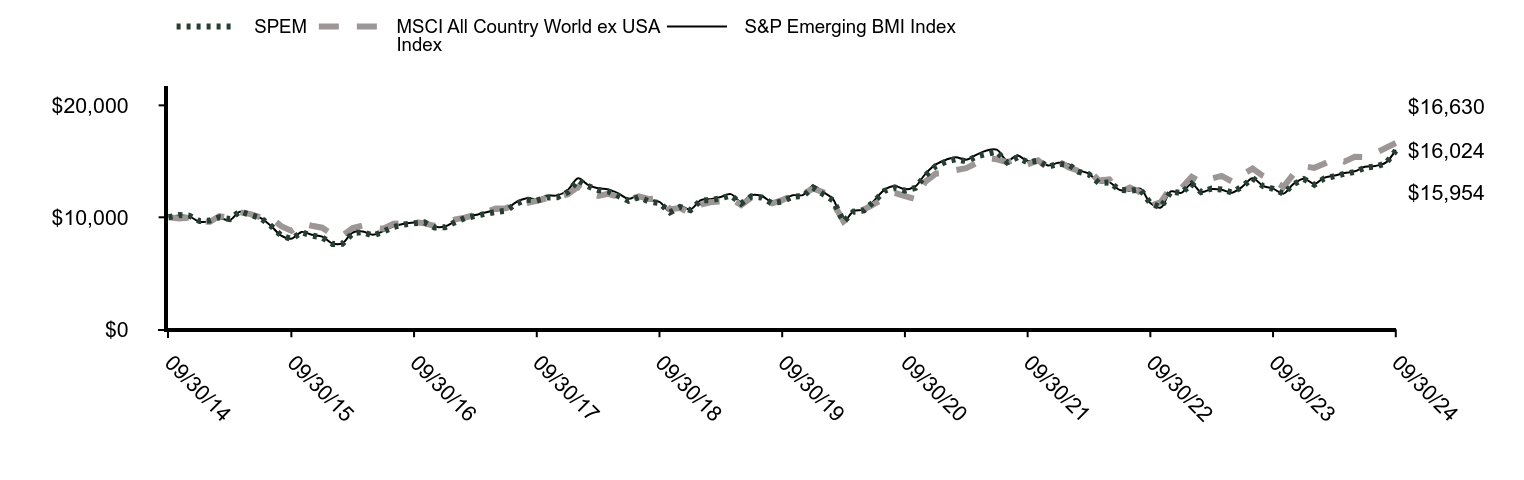

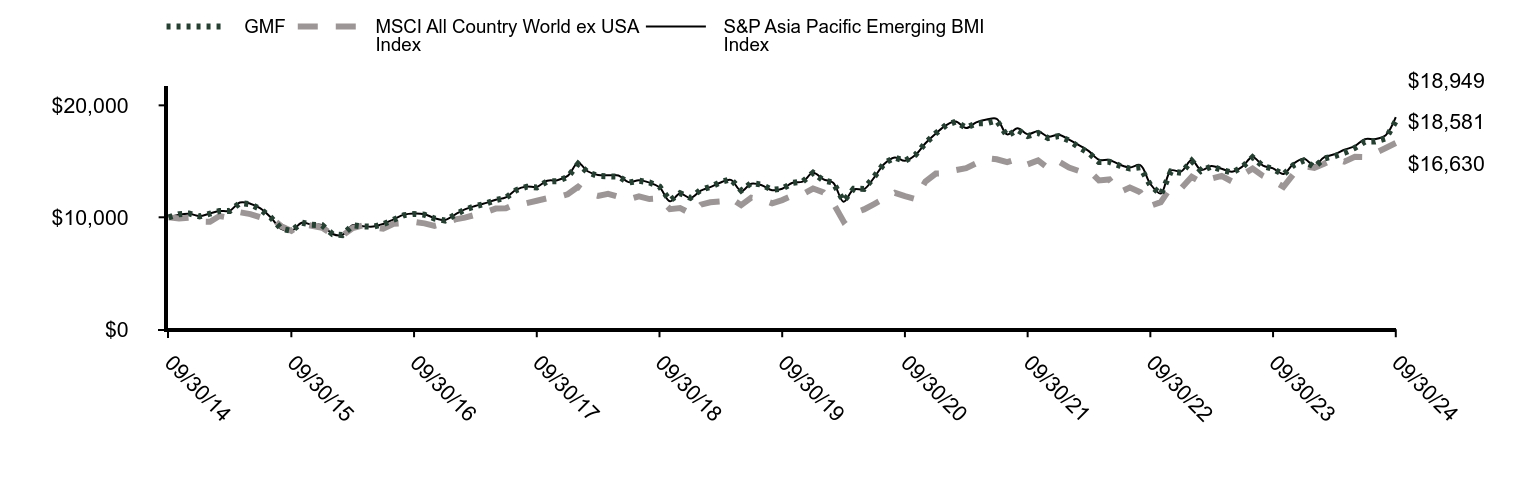

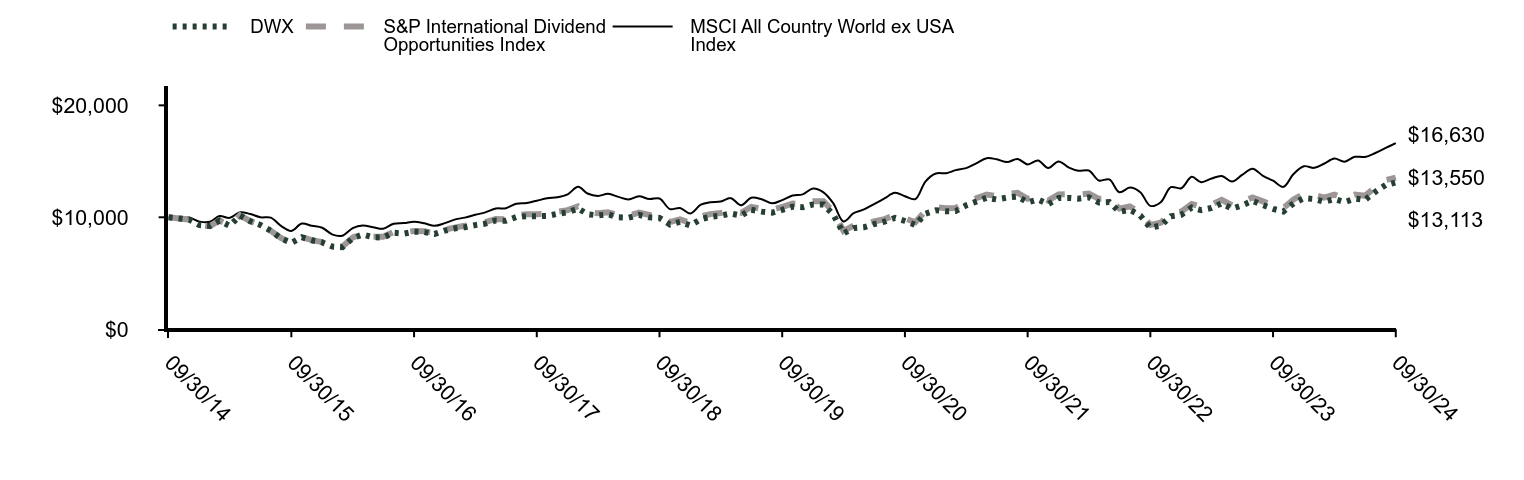

| Line Graph [Table Text Block] |

|

|

EDIV |

MSCI All Country World ex USA Index |

S&P Emerging Markets Dividend Opportunities Index |

09/30/14 |

$10,000 |

$10,000 |

$10,000 |

10/31/14 |

$10,004 |

$9,901 |

$10,017 |

11/30/14 |

$9,923 |

$9,973 |

$9,942 |

12/31/14 |

$9,413 |

$9,613 |

$9,439 |

01/31/15 |

$9,299 |

$9,599 |

$9,323 |

02/28/15 |

$9,491 |

$10,112 |

$9,539 |

03/31/15 |

$9,133 |

$9,949 |

$9,176 |

04/30/15 |

$10,027 |

$10,451 |

$10,096 |

05/31/15 |

$9,407 |

$10,288 |

$9,470 |

06/30/15 |

$9,183 |

$10,001 |

$9,251 |

07/31/15 |

$8,440 |

$9,973 |

$8,497 |

08/31/15 |

$7,589 |

$9,211 |

$7,662 |

09/30/15 |

$7,144 |

$8,784 |

$7,208 |

10/31/15 |

$7,587 |

$9,438 |

$7,662 |

11/30/15 |

$7,187 |

$9,243 |

$7,260 |

12/31/15 |

$6,876 |

$9,069 |

$6,950 |

01/31/16 |

$6,589 |

$8,452 |

$6,697 |

02/29/16 |

$6,763 |

$8,355 |

$6,882 |

03/31/16 |

$7,720 |

$9,035 |

$7,860 |

04/30/16 |

$7,782 |

$9,272 |

$7,933 |

05/31/16 |

$7,257 |

$9,116 |

$7,397 |

06/30/16 |

$7,824 |

$8,976 |

$7,979 |

07/31/16 |

$8,320 |

$9,420 |

$8,500 |

08/31/16 |

$8,152 |

$9,480 |

$8,330 |

09/30/16 |

$8,194 |

$9,597 |

$8,382 |

10/31/16 |

$8,353 |

$9,459 |

$8,546 |

11/30/16 |

$7,814 |

$9,240 |

$7,996 |

12/31/16 |

$8,027 |

$9,476 |

$8,219 |

01/31/17 |

$8,495 |

$9,812 |

$8,702 |

02/28/17 |

$8,758 |

$9,969 |

$9,045 |

03/31/17 |

$8,810 |

$10,221 |

$9,119 |

04/30/17 |

$8,904 |

$10,440 |

$9,218 |

05/31/17 |

$8,966 |

$10,779 |

$9,293 |

06/30/17 |

$9,083 |

$10,812 |

$9,409 |

07/31/17 |

$9,445 |

$11,211 |

$9,792 |

08/31/17 |

$9,620 |

$11,270 |

$10,028 |

09/30/17 |

$9,380 |

$11,479 |

$9,768 |

10/31/17 |

$9,389 |

$11,695 |

$9,778 |

11/30/17 |

$9,553 |

$11,790 |

$9,953 |

12/31/17 |

$10,272 |

$12,053 |

$10,711 |

01/31/18 |

$11,081 |

$12,725 |

$11,558 |

02/28/18 |

$11,085 |

$12,125 |

$11,552 |

03/31/18 |

$10,927 |

$11,911 |

$11,414 |

04/30/18 |

$10,741 |

$12,101 |

$11,204 |

05/31/18 |

$10,276 |

$11,821 |

$10,743 |

06/30/18 |

$9,660 |

$11,599 |

$10,101 |

07/31/18 |

$10,135 |

$11,877 |

$10,621 |

08/31/18 |

$9,699 |

$11,628 |

$10,227 |

09/30/18 |

$9,873 |

$11,681 |

$10,407 |

10/31/18 |

$9,211 |

$10,731 |

$9,721 |

11/30/18 |

$9,721 |

$10,833 |

$10,262 |

12/31/18 |

$9,611 |

$10,342 |

$10,147 |

01/31/19 |

$10,390 |

$11,124 |

$10,994 |

02/28/19 |

$10,252 |

$11,341 |

$10,855 |

03/31/19 |

$10,201 |

$11,409 |

$10,802 |

04/30/19 |

$10,322 |

$11,710 |

$10,945 |

05/31/19 |

$10,079 |

$11,081 |

$10,680 |

06/30/19 |

$10,635 |

$11,749 |

$11,273 |

07/31/19 |

$10,505 |

$11,607 |

$11,146 |

08/31/19 |

$9,850 |

$11,248 |

$10,492 |

09/30/19 |

$9,981 |

$11,538 |

$10,627 |

10/31/19 |

$10,284 |

$11,940 |

$10,962 |

11/30/19 |

$10,160 |

$12,045 |

$10,833 |

12/31/19 |

$10,705 |

$12,567 |

$11,420 |

01/31/20 |

$9,960 |

$12,229 |

$10,628 |

02/29/20 |

$9,263 |

$11,263 |

$9,890 |

03/31/20 |

$7,520 |

$9,632 |

$8,026 |

04/30/20 |

$8,300 |

$10,362 |

$8,866 |

05/31/20 |

$8,226 |

$10,701 |

$8,790 |

06/30/20 |

$8,453 |

$11,185 |

$9,035 |

07/31/20 |

$8,709 |

$11,683 |

$9,317 |

08/31/20 |

$8,613 |

$12,183 |

$9,263 |

09/30/20 |

$8,413 |

$11,884 |

$9,046 |

10/31/20 |

$8,339 |

$11,628 |

$8,970 |

11/30/20 |

$9,225 |

$13,193 |

$9,925 |

12/31/20 |

$9,728 |

$13,906 |

$10,469 |

01/31/21 |

$9,645 |

$13,936 |

$10,386 |

02/28/21 |

$10,065 |

$14,212 |

$10,852 |

03/31/21 |

$10,441 |

$14,391 |

$11,264 |

04/30/21 |

$10,614 |

$14,815 |

$11,454 |

05/31/21 |

$10,789 |

$15,278 |

$11,703 |

06/30/21 |

$10,608 |

$15,179 |

$11,456 |

07/31/21 |

$10,326 |

$14,929 |

$11,160 |

08/31/21 |

$10,802 |

$15,213 |

$11,704 |

09/30/21 |

$10,681 |

$14,726 |

$11,583 |

10/31/21 |

$10,630 |

$15,077 |

$11,532 |

11/30/21 |

$10,355 |

$14,399 |

$11,239 |

12/31/21 |

$10,785 |

$14,994 |

$11,708 |

01/31/22 |

$11,082 |

$14,441 |

$12,037 |

02/28/22 |

$10,595 |

$14,155 |

$11,658 |

03/31/22 |

$10,630 |

$14,178 |

$11,566 |

04/30/22 |

$10,240 |

$13,288 |

$11,147 |

05/31/22 |

$10,071 |

$13,383 |

$11,039 |

06/30/22 |

$9,466 |

$12,232 |

$10,382 |

07/31/22 |

$9,433 |

$12,650 |

$10,018 |

08/31/22 |

$9,309 |

$12,243 |

$10,013 |

09/30/22 |

$8,453 |

$11,020 |

$9,080 |

10/31/22 |

$8,233 |

$11,349 |

$8,838 |

11/30/22 |

$9,131 |

$12,689 |

$9,931 |

12/31/22 |

$9,121 |

$12,594 |

$9,926 |

01/31/23 |

$9,716 |

$13,615 |

$10,582 |

02/28/23 |

$9,511 |

$13,137 |

$10,375 |

03/31/23 |

$9,972 |

$13,459 |

$10,888 |

04/30/23 |

$10,147 |

$13,692 |

$11,089 |

05/31/23 |

$10,317 |

$13,195 |

$11,292 |

06/30/23 |

$10,932 |

$13,787 |

$11,972 |

07/31/23 |

$12,065 |

$14,347 |

$13,205 |

08/31/23 |

$11,646 |

$13,699 |

$12,712 |

09/30/23 |

$11,773 |

$13,266 |

$12,860 |

10/31/23 |

$11,372 |

$12,719 |

$12,429 |

11/30/23 |

$12,294 |

$13,864 |

$13,464 |

12/31/23 |

$12,857 |

$14,560 |

$14,117 |

01/31/24 |

$12,747 |

$14,416 |

$14,025 |

02/29/24 |

$13,118 |

$14,781 |

$14,461 |

03/31/24 |

$13,292 |

$15,243 |

$14,661 |

04/30/24 |

$13,472 |

$14,969 |

$14,872 |

05/31/24 |

$13,848 |

$15,404 |

$15,304 |

06/30/24 |

$14,265 |

$15,389 |

$15,786 |

07/31/24 |

$14,214 |

$15,745 |

$15,728 |

08/31/24 |

$14,774 |

$16,194 |

$16,444 |

09/30/24 |

$15,451 |

$16,630 |

$17,276 |

|

|

|

|

| Average Annual Return [Table Text Block] |

|

Name |

1 Year |

5 Years |

10 Years |

EDIV |

31.24% |

9.13% |

4.45% |

MSCI All Country World ex USA Index |

25.35% |

7.59% |

5.22% |

S&P Emerging Markets Dividend Opportunities Index |

34.34% |

10.21% |

5.62% | |

|

|

|

| AssetsNet |

$ 499,449,096

|

$ 499,449,096

|

$ 499,449,096

|

$ 499,449,096

|

$ 499,449,096

|

| Holdings Count | Holding |

109

|

109

|

109

|

109

|

109

|

| Advisory Fees Paid, Amount |

|

$ 1,883,674

|

|

|

|

| InvestmentCompanyPortfolioTurnover |

|

98.00%

|

|

|

|

| Additional Fund Statistics [Text Block] |

|

Key Fund Statistics as of 9/30/2024

Statistic |

Value |

Total Net Assets |

$499,449,096 |

Number of Portfolio Holdings |

109 |

Portfolio Turnover Rate |

98% |

Total Advisory Fees Paid |

$1,883,674 | |

|

|

|

| Holdings [Text Block] |

|

Sector |

% Value of Total Net Assets |

Financials |

30.9% |

Communication Services |

17.6% |

Utilities |

10.8% |

Consumer Staples |

9.0% |

Real Estate |

6.3% |

Consumer Discretionary |

6.1% |

Information Technology |

6.1% |

Industrials |

5.7% |

Health Care |

4.1% |

Materials |

2.1% | |

|

|

|

| Material Fund Change [Text Block] |

|

|

|

|

|

| C000038346 |

|

|

|

|

|

| Shareholder Report [Line Items] |

|

|

|

|

|

| Fund Name |

|

SPDR S&P China ETF

|

|

|

|

| Trading Symbol |

|

GXC

|

|

|

|

| Security Exchange Name |

|

NYSE

|

|

|

|

| Annual or Semi-Annual Statement [Text Block] |

|

This annual shareholder report contains important information about the SPDR S&P China ETF (the "Fund") for the period of October 1, 2023 to September 30, 2024.

|

|

|

|

| Shareholder Report Annual or Semi-Annual |

|

Annual Shareholder Report

|

|

|

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund, including the Prospectus, Statement of Additional Information, financial statements and other information at www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs. You can also request this information about the Fund by contacting us at 1-866-787-2257.

|

|

|

|

| Additional Information Phone Number |

|

1-866-787-2257

|

|

|

|

| Additional Information Website |

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left;">www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs</span>

|

|

|

|

| Expenses [Text Block] |

|

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment)

Fund Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

SPDR S&P China ETF |

$65 |

0.59% | |

|

|

|

| Expenses Paid, Amount |

|

$ 65

|

|

|

|

| Expense Ratio, Percent |

|

0.59%

|

|

|

|

| Factors Affecting Performance [Text Block] |

|

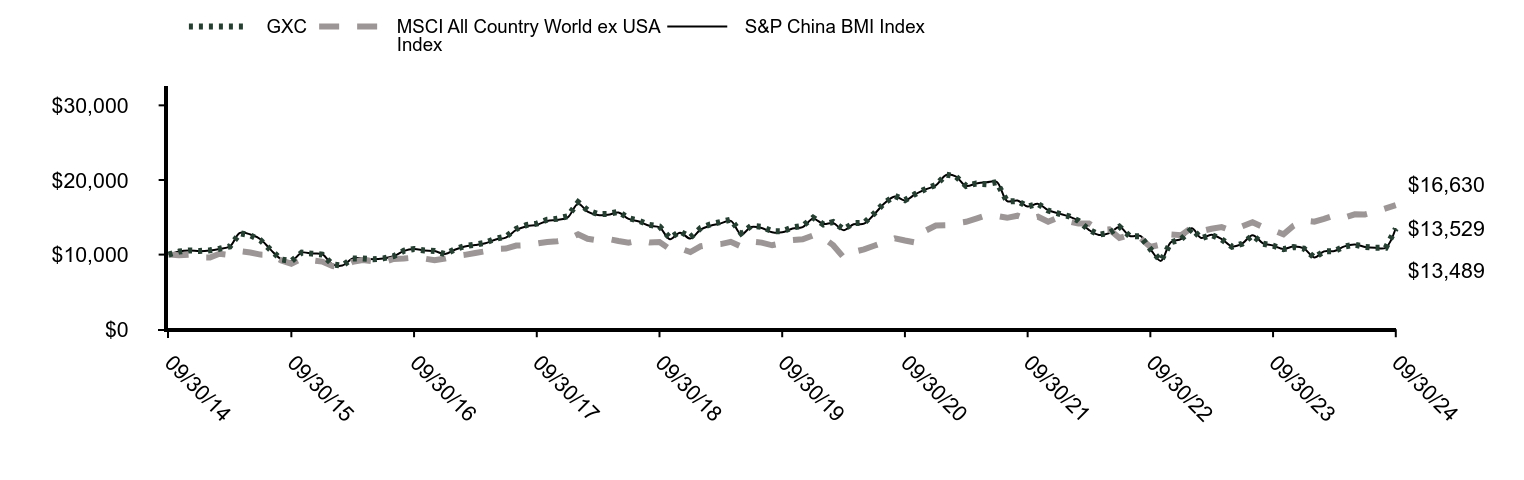

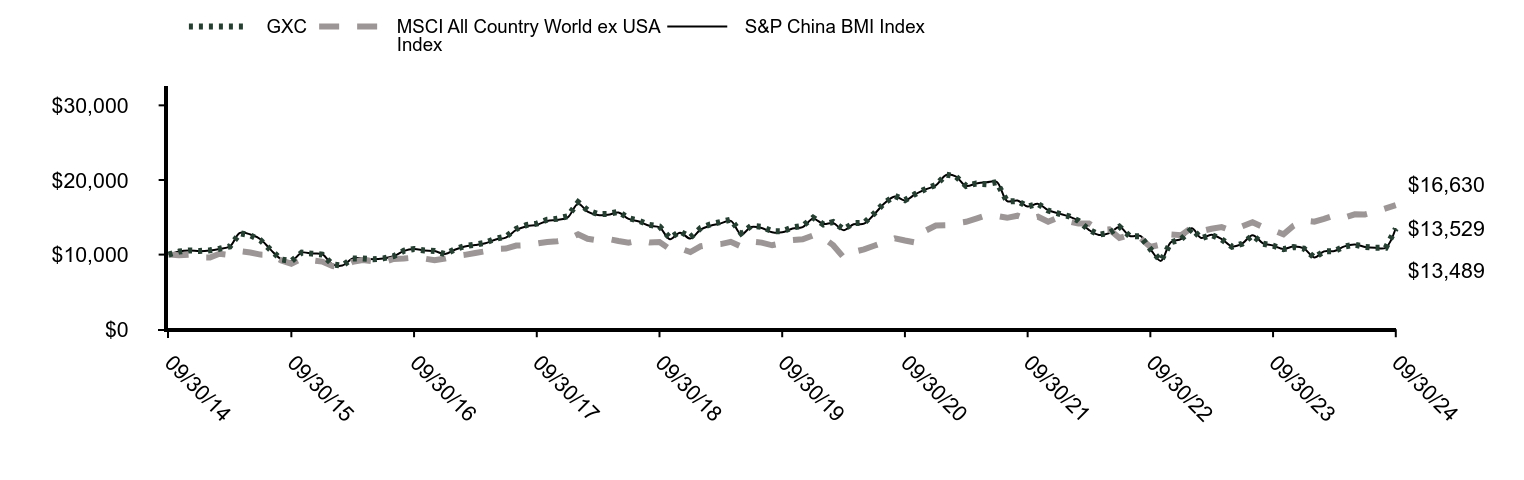

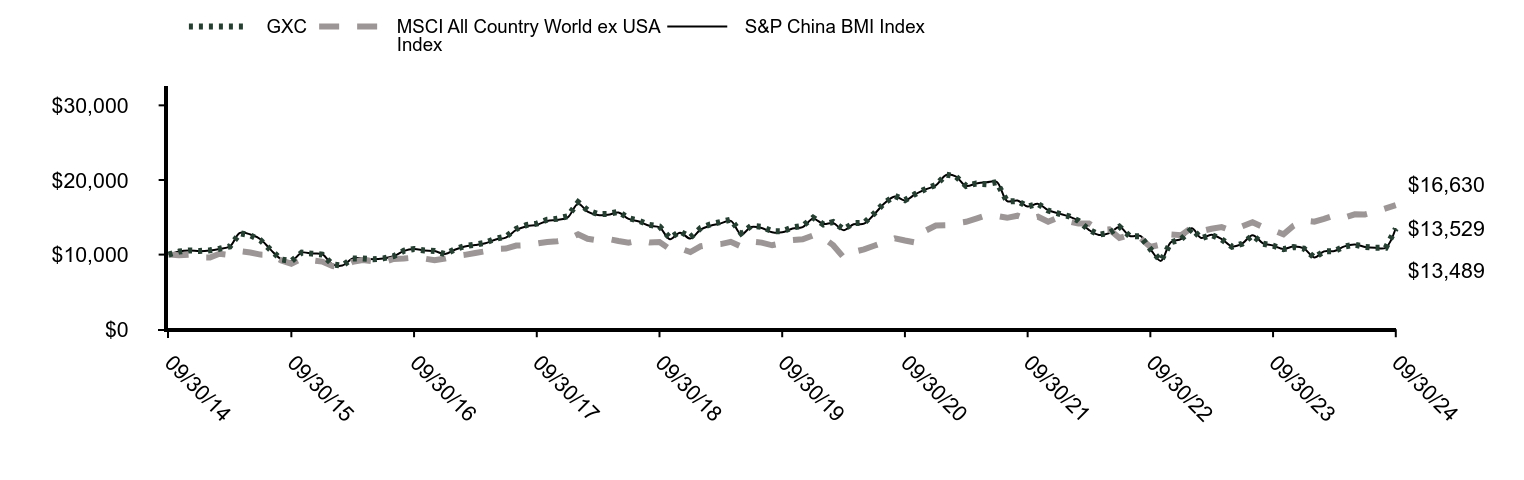

How did the Fund perform last year and what affected its performance?All markets in the Asia Pacific region had a strong fourth quarter 2023 showing, with the exception of China, where the lackluster recovery from COVID-19 restrictions as well as real estate woes soured investor sentiment. Of the major emerging markets economies, China was the only underperformer in the first quarter of 2024 as it continued to struggle without any meaningful policy stimulus. However, China did rebound from its January low as the People’s Bank of China cut the five-year loan prime rate to 3.95% from 4.20% in a move to boost economic growth. China’s economic growth stabilized in the second quarter of 2024 but remained constrained, with weak consumer sentiment and ongoing challenges in the property sector. Asia Pacific countries reported positive returns during the third quarter of 2024, with China as one of the top performers. China’s economy bounced back, increasing investor confidence in its resilience. Both onshore and offshore Chinese equities posted positive returns year to date, with Materials, Industrials, and Communication Services sectors leading the way. |

|

|

|

| Performance Past Does Not Indicate Future [Text] |

|

<p style="box-sizing: border-box; color: rgb(0, 0, 0); display: block; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left;"><span style="font-weight: 700; box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left;">The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. Updated performance information is available by calling <span style="font-weight: 700; box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left;">1-866-787-2257</span> or visiting our website at <span style="font-weight: 700; box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left;">www.ssga.com</span>.</span></p>

|

|

|

|

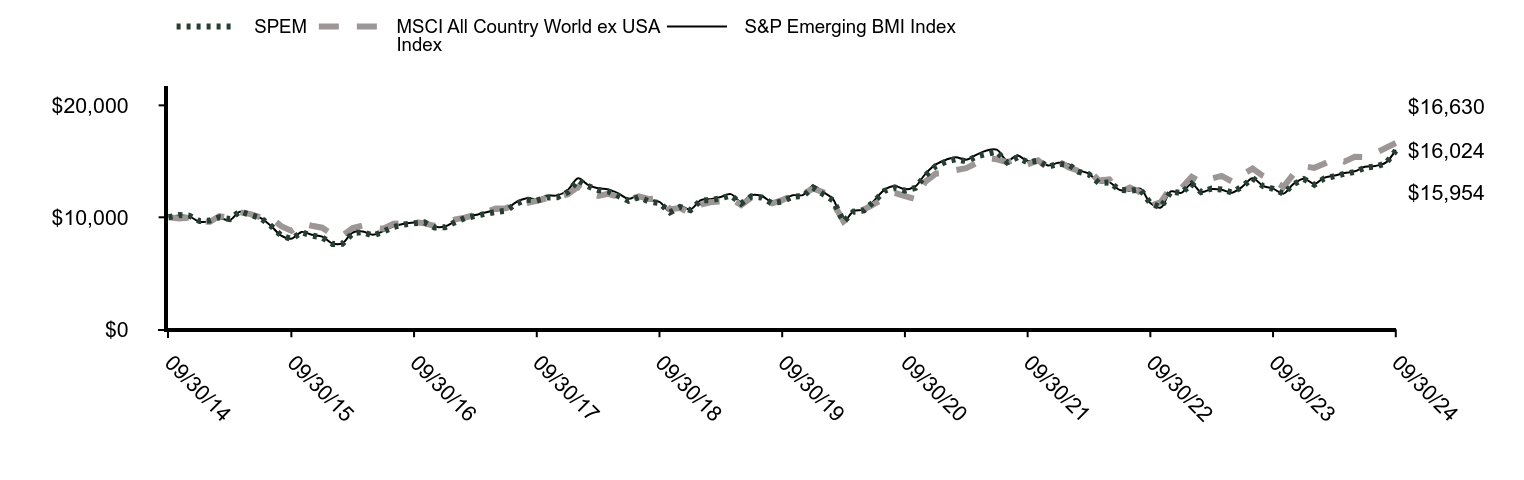

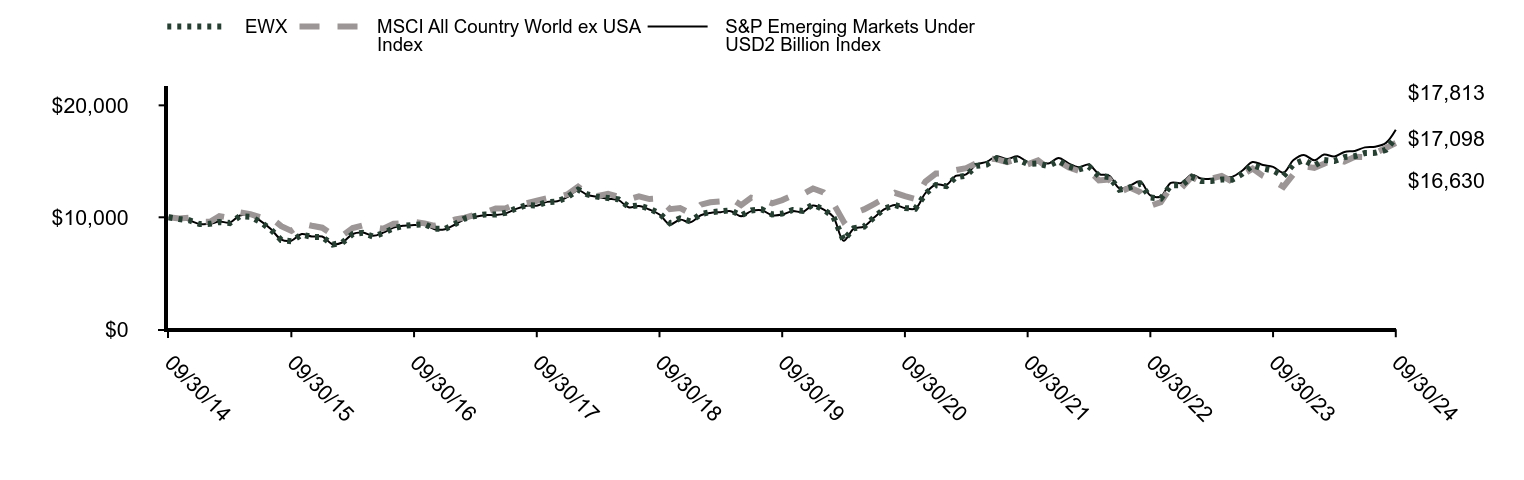

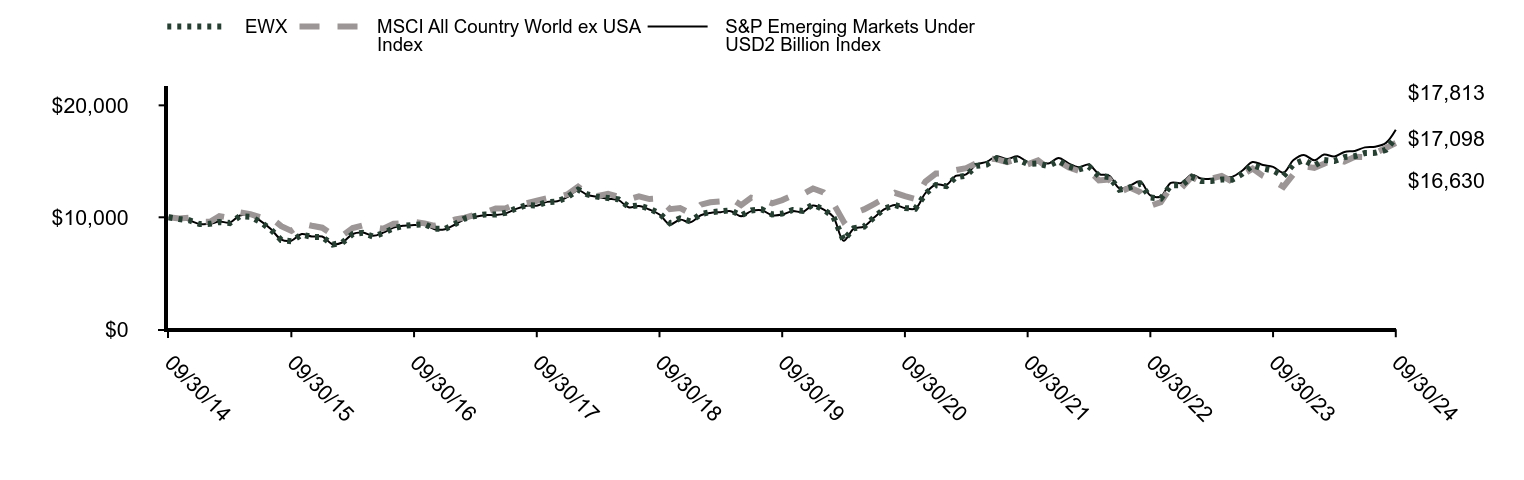

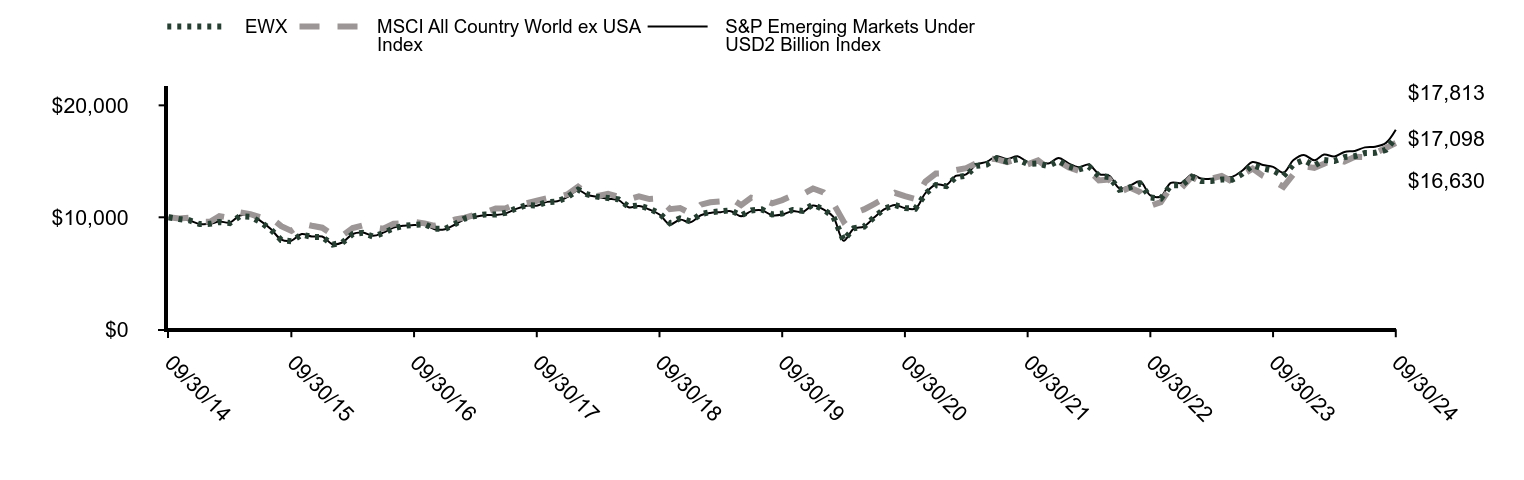

| Line Graph [Table Text Block] |

|

|

GXC |

MSCI All Country World ex USA Index |

S&P China BMI Index |

09/30/14 |

$10,000 |

$10,000 |

$10,000 |

10/31/14 |

$10,409 |

$9,901 |

$10,416 |

11/30/14 |

$10,563 |

$9,973 |

$10,557 |

12/31/14 |

$10,484 |

$9,613 |

$10,462 |

01/31/15 |

$10,579 |

$9,599 |

$10,549 |

02/28/15 |

$10,786 |

$10,112 |

$10,763 |

03/31/15 |

$11,092 |

$9,949 |

$11,087 |

04/30/15 |

$12,862 |

$10,451 |

$12,904 |

05/31/15 |

$12,581 |

$10,288 |

$12,700 |

06/30/15 |

$11,925 |

$10,001 |

$12,064 |

07/31/15 |

$10,611 |

$9,973 |

$10,632 |

08/31/15 |

$9,345 |

$9,211 |

$9,386 |

09/30/15 |

$9,131 |

$8,784 |

$9,125 |

10/31/15 |

$10,259 |

$9,438 |

$10,263 |

11/30/15 |

$10,131 |

$9,243 |

$10,144 |

12/31/15 |

$10,005 |

$9,069 |

$10,043 |

01/31/16 |

$8,674 |

$8,452 |

$8,690 |

02/29/16 |

$8,522 |

$8,355 |

$8,534 |

03/31/16 |

$9,488 |

$9,035 |

$9,487 |

04/30/16 |

$9,478 |

$9,272 |

$9,493 |

05/31/16 |

$9,380 |

$9,116 |

$9,393 |

06/30/16 |

$9,493 |

$8,976 |

$9,485 |

07/31/16 |

$9,787 |

$9,420 |

$9,776 |

08/31/16 |

$10,517 |

$9,480 |

$10,506 |

09/30/16 |

$10,758 |

$9,597 |

$10,745 |

10/31/16 |

$10,556 |

$9,459 |

$10,554 |

11/30/16 |

$10,474 |

$9,240 |

$10,476 |

12/31/16 |

$10,068 |

$9,476 |

$10,072 |

01/31/17 |

$10,728 |

$9,812 |

$10,691 |

02/28/17 |

$11,137 |

$9,969 |

$11,086 |

03/31/17 |

$11,344 |

$10,221 |

$11,273 |

04/30/17 |

$11,591 |

$10,440 |

$11,517 |

05/31/17 |

$12,140 |

$10,779 |

$12,024 |

06/30/17 |

$12,405 |

$10,812 |

$12,277 |

07/31/17 |

$13,445 |

$11,211 |

$13,299 |

08/31/17 |

$13,962 |

$11,270 |

$13,806 |

09/30/17 |

$14,146 |

$11,479 |

$13,985 |

10/31/17 |

$14,667 |

$11,695 |

$14,504 |

11/30/17 |

$14,804 |

$11,790 |

$14,643 |

12/31/17 |

$15,143 |

$12,053 |

$14,985 |

01/31/18 |

$17,016 |

$12,725 |

$16,812 |

02/28/18 |

$15,945 |

$12,125 |

$15,769 |

03/31/18 |

$15,432 |

$11,911 |

$15,300 |

04/30/18 |

$15,458 |

$12,101 |

$15,330 |

05/31/18 |

$15,733 |

$11,821 |

$15,630 |

06/30/18 |

$14,895 |

$11,599 |

$14,787 |

07/31/18 |

$14,545 |

$11,877 |

$14,431 |

08/31/18 |

$13,981 |

$11,628 |

$13,865 |

09/30/18 |

$13,773 |

$11,681 |

$13,633 |

10/31/18 |

$12,221 |

$10,731 |

$12,072 |

11/30/18 |

$13,109 |

$10,833 |

$12,941 |

12/31/18 |

$12,315 |

$10,342 |

$12,151 |

01/31/19 |

$13,583 |

$11,124 |

$13,376 |

02/28/19 |

$14,054 |

$11,341 |

$13,874 |

03/31/19 |

$14,362 |

$11,409 |

$14,185 |

04/30/19 |

$14,688 |

$11,710 |

$14,515 |

05/31/19 |

$12,865 |

$11,081 |

$12,718 |

06/30/19 |

$13,857 |

$11,749 |

$13,709 |

07/31/19 |

$13,721 |

$11,607 |

$13,564 |

08/31/19 |

$13,143 |

$11,248 |

$12,994 |

09/30/19 |

$13,121 |

$11,538 |

$12,982 |

10/31/19 |

$13,641 |

$11,940 |

$13,497 |

11/30/19 |

$13,844 |

$12,045 |

$13,692 |

12/31/19 |

$14,956 |

$12,567 |

$14,801 |

01/31/20 |

$14,026 |

$12,229 |

$14,098 |

02/29/20 |

$14,359 |

$11,263 |

$14,223 |

03/31/20 |

$13,391 |

$9,632 |

$13,280 |

04/30/20 |

$14,217 |

$10,362 |

$14,058 |

05/31/20 |

$14,241 |

$10,701 |

$14,144 |

06/30/20 |

$15,495 |

$11,185 |

$15,385 |

07/31/20 |

$16,962 |

$11,683 |

$16,871 |

08/31/20 |

$17,856 |

$12,183 |

$17,793 |

09/30/20 |

$17,306 |

$11,884 |

$17,264 |

10/31/20 |

$18,121 |

$11,628 |

$18,095 |

11/30/20 |

$18,772 |

$13,193 |

$18,718 |

12/31/20 |

$19,333 |

$13,906 |

$19,275 |

01/31/21 |

$20,713 |

$13,936 |

$20,667 |

02/28/21 |

$20,493 |

$14,212 |

$20,487 |

03/31/21 |

$19,202 |

$14,391 |

$19,197 |

04/30/21 |

$19,525 |

$14,815 |

$19,526 |

05/31/21 |

$19,440 |

$15,278 |

$19,682 |

06/30/21 |

$19,705 |

$15,179 |

$19,746 |

07/31/21 |

$17,115 |

$14,929 |

$17,182 |

08/31/21 |

$17,183 |

$15,213 |

$17,250 |

09/30/21 |

$16,434 |

$14,726 |

$16,439 |

10/31/21 |

$16,792 |

$15,077 |

$16,798 |

11/30/21 |

$15,903 |

$14,399 |

$15,960 |

12/31/21 |

$15,504 |

$14,994 |

$15,524 |

01/31/22 |

$15,128 |

$14,441 |

$15,109 |

02/28/22 |

$14,537 |

$14,155 |

$14,528 |

03/31/22 |

$13,329 |

$14,178 |

$13,317 |

04/30/22 |

$12,676 |

$13,288 |

$12,639 |

05/31/22 |

$12,887 |

$13,383 |

$12,872 |

06/30/22 |

$13,744 |

$12,232 |

$13,703 |

07/31/22 |

$12,456 |

$12,650 |

$12,493 |

08/31/22 |

$12,476 |

$12,243 |

$12,499 |

09/30/22 |

$10,748 |

$11,020 |

$10,743 |

10/31/22 |

$9,141 |

$11,349 |

$9,160 |

11/30/22 |

$11,640 |

$12,689 |

$11,667 |

12/31/22 |

$12,082 |

$12,594 |

$12,118 |

01/31/23 |

$13,471 |

$13,615 |

$13,517 |

02/28/23 |

$12,181 |

$13,137 |

$12,237 |

03/31/23 |

$12,635 |

$13,459 |

$12,668 |

04/30/23 |

$12,045 |

$13,692 |

$12,082 |

05/31/23 |

$11,049 |

$13,195 |

$11,100 |

06/30/23 |

$11,445 |

$13,787 |

$11,474 |

07/31/23 |

$12,564 |

$14,347 |

$12,608 |

08/31/23 |

$11,469 |

$13,699 |

$11,513 |

09/30/23 |

$11,187 |

$13,266 |

$11,209 |

10/31/23 |

$10,729 |

$12,719 |

$10,758 |

11/30/23 |

$11,024 |

$13,864 |

$11,076 |

12/31/23 |

$10,798 |

$14,560 |

$10,835 |

01/31/24 |

$9,605 |

$14,416 |

$9,624 |

02/29/24 |

$10,432 |

$14,781 |

$10,433 |

03/31/24 |

$10,470 |

$15,243 |

$10,484 |

04/30/24 |

$11,094 |

$14,969 |

$11,105 |

05/31/24 |

$11,329 |

$15,404 |

$11,344 |

06/30/24 |

$11,027 |

$15,389 |

$11,028 |

07/31/24 |

$10,902 |

$15,745 |

$10,905 |

08/31/24 |

$10,904 |

$16,194 |

$10,921 |

09/30/24 |

$13,489 |

$16,630 |

$13,529 |

|

|

|

|

| Average Annual Return [Table Text Block] |

|

Name |

1 Year |

5 Years |

10 Years |

GXC |

20.58% |

0.56% |

3.04% |

MSCI All Country World ex USA Index |

25.35% |

7.59% |

5.22% |

S&P China BMI Index |

20.70% |

0.83% |

3.07% | |

|

|

|

| AssetsNet |

$ 478,924,997

|

$ 478,924,997

|

$ 478,924,997

|

$ 478,924,997

|

$ 478,924,997

|

| Holdings Count | Holding |

1,167

|

1,167

|

1,167

|

1,167

|

1,167

|

| Advisory Fees Paid, Amount |

|

$ 3,349,074

|

|

|

|

| InvestmentCompanyPortfolioTurnover |

|

24.00%

|

|

|

|

| Additional Fund Statistics [Text Block] |

|

Key Fund Statistics as of 9/30/2024

Statistic |

Value |

Total Net Assets |

$478,924,997 |

Number of Portfolio Holdings |

1,167 |

Portfolio Turnover Rate |

24% |

Total Advisory Fees Paid |

$3,349,074 | |

|

|

|

| Holdings [Text Block] |

|

Industry |

% Value of Total Net Assets |

Interactive Media & Services |

14.2% |

Broadline Retail |

13.2% |

Banks |

9.7% |

Hotels, Restaurants & Leisure |

6.5% |

Automobiles |

3.9% |

Insurance |

3.4% |

Oil, Gas & Consumable Fuels |

2.9% |

Real Estate Management & Development |

2.7% |

Metals & Mining |

2.5% |

Beverages |

2.5% | |

|

|

|

| Material Fund Change [Text Block] |

|

|

|

|

|

| S000036082 |

|

|

|

|

|

| Shareholder Report [Line Items] |

|

|

|

|

|

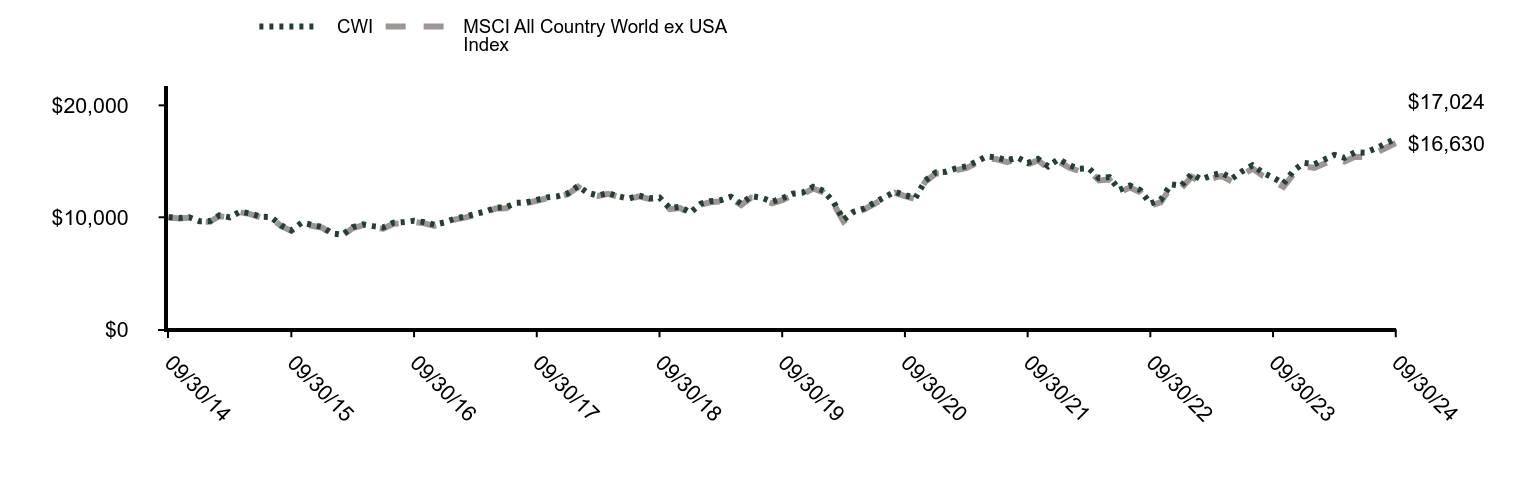

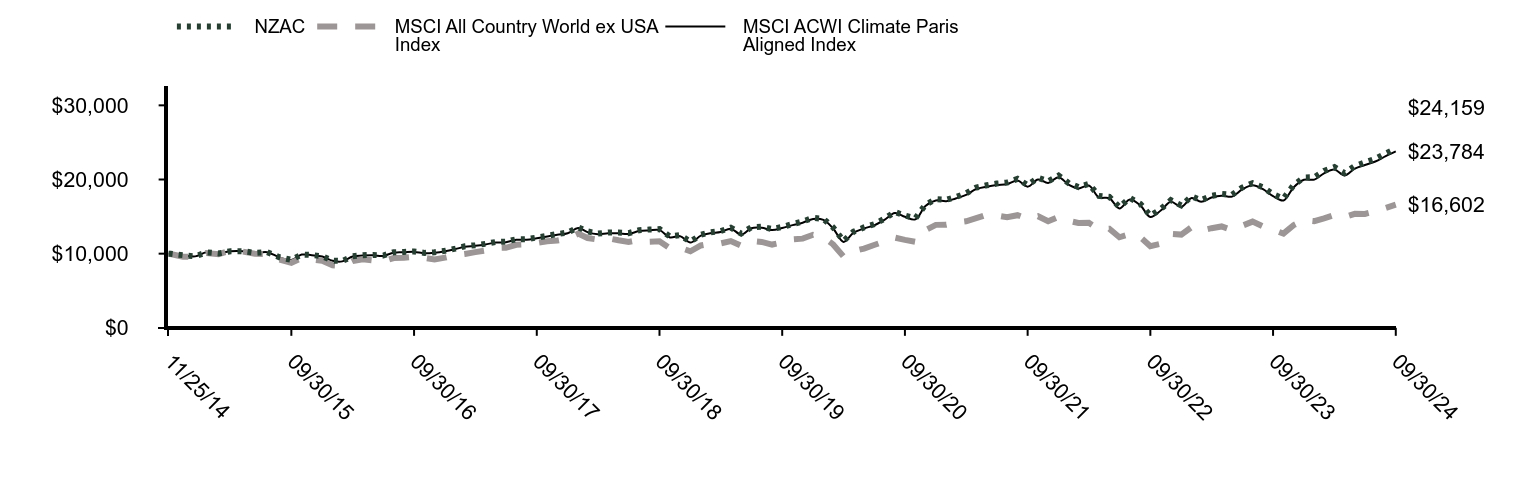

| Fund Name |

SPDR S&P Emerging Markets ex-China ETF

|

|

|

|

|

| Trading Symbol |

XCNY

|

|

|

|

|

| Security Exchange Name |

NASDAQ

|

|

|

|

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

|

|

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment)

Fund Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

SPDR S&P Emerging Markets ex-China ETF |

$1 |

0.15% | The dollar amounts above reflect expenses paid since the commencement of operations. Expenses for the full reporting period would be higher. |

|

|

|

|

| Expenses Paid, Amount |

$ 1

|

|

|

|

|

| Expense Ratio, Percent |

0.15%

|

|

|

|

|

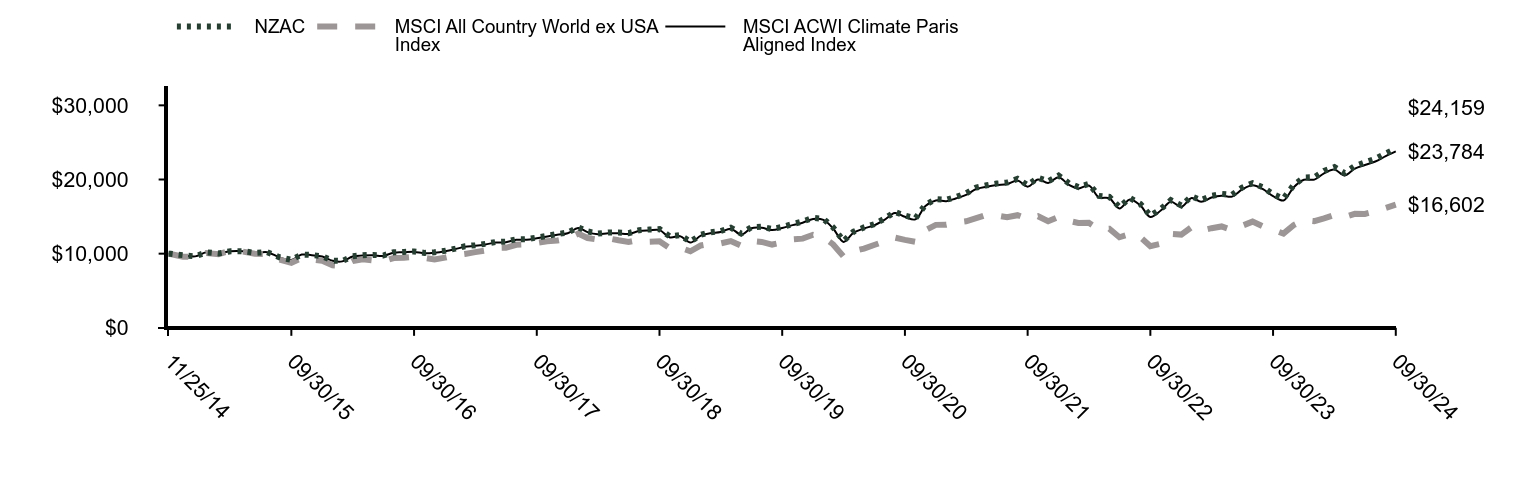

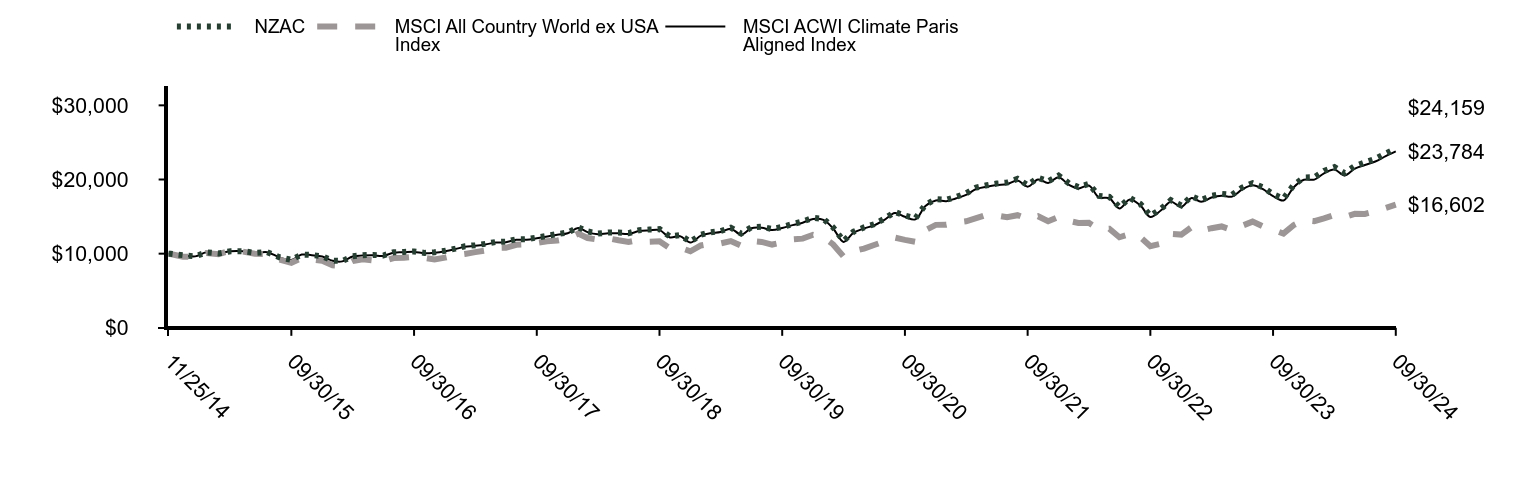

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year and what affected its performance? Performance information is not provided since the Fund has less than six months of operations. |

|

|

|

|

| AssetsNet |

$ 5,184,387

|

$ 5,184,387

|

$ 5,184,387

|

$ 5,184,387

|

$ 5,184,387

|

| Holdings Count | Holding |

964

|

964

|

964

|

964

|

964

|

| Advisory Fees Paid, Amount |

$ 564

|

|

|

|

|

| InvestmentCompanyPortfolioTurnover |

1.00%

|

|

|

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of 9/30/2024

Statistic |

Value |

Total Net Assets |

$5,184,387 |

Number of Portfolio Holdings |

964 |

Portfolio Turnover Rate |

1% |

Total Advisory Fees Paid |

$564 | |

|

|

|

|

| Holdings [Text Block] |

Sector |

% Value of Total Net Assets |

Information Technology |

19.8% |

Financials |

16.3% |

Materials |

5.8% |

Industrials |

5.1% |

Consumer Staples |

3.9% |

Consumer Discretionary |

3.3% |

Energy |

2.9% |

Communication Services |

2.8% |

Utilities |

2.3% |

Real Estate |

2.1% | |

|

|

|

|

| Exposure Basis Explanation [Text Block] |

Country |

% Value of Total Net Assets |

Taiwan |

27.2% |

Brazil |

6.6% |

Saudi Arabia |

5.4% |

South Africa |

4.3% |

Malaysia |

3.0% |

Mexico |

2.9% |

Indonesia |

2.7% |

Thailand |

2.6% |

United Arab Emirates |

2.1% |

Turkey |

1.4% | |

|

|

|

|

| Material Fund Change [Text Block] |

|

|

|

|

|

| C000062489 |

|

|

|

|

|

| Shareholder Report [Line Items] |

|

|

|

|

|

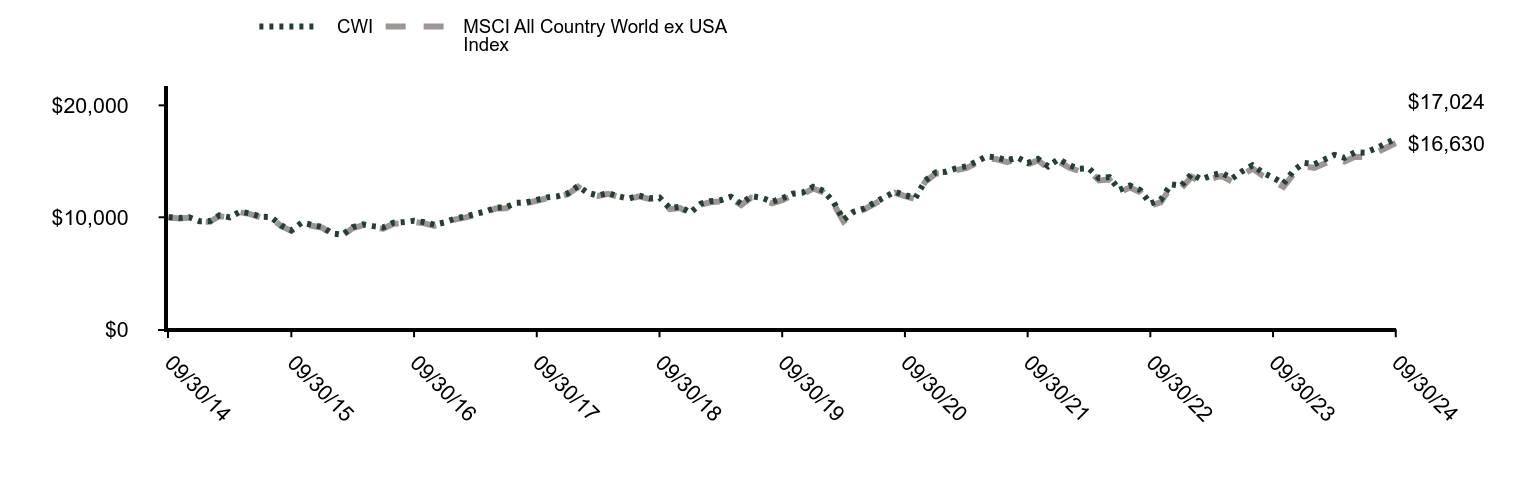

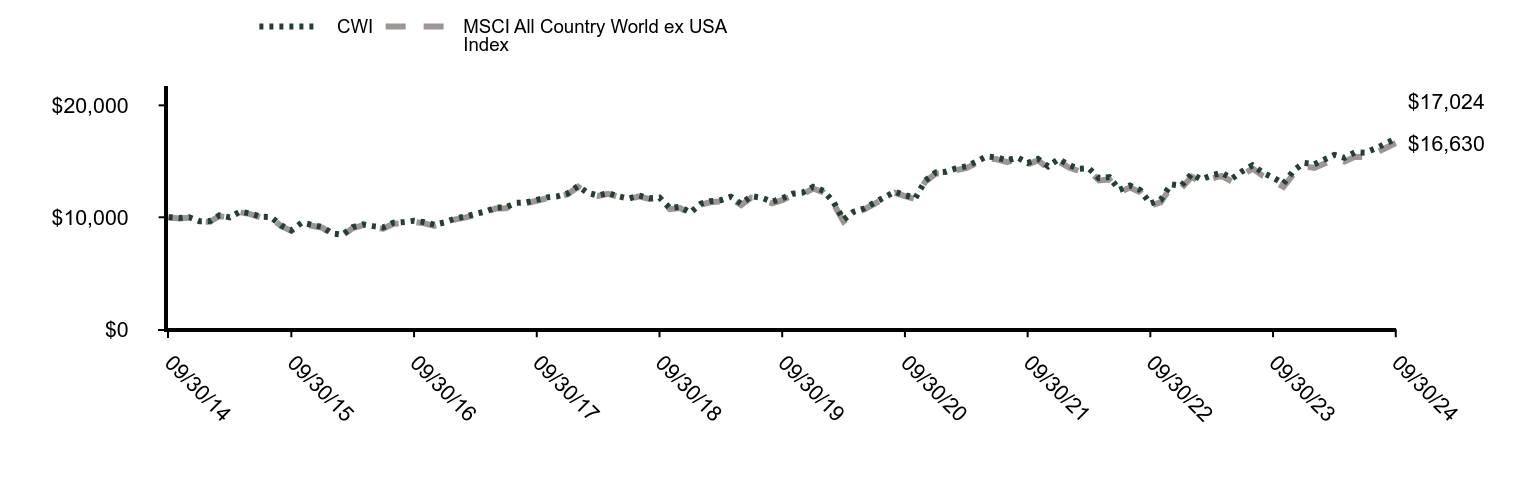

| Fund Name |

|

SPDR Dow Jones Global Real Estate ETF

|

|

|

|

| Trading Symbol |

|

RWO

|

|

|

|

| Security Exchange Name |

|

NYSE

|

|

|

|

| Annual or Semi-Annual Statement [Text Block] |

|

This annual shareholder report contains important information about the SPDR Dow Jones Global Real Estate ETF (the "Fund") for the period of October 1, 2023 to September 30, 2024.

|

|

|

|

| Shareholder Report Annual or Semi-Annual |

|

Annual Shareholder Report

|

|

|

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund, including the Prospectus, Statement of Additional Information, financial statements and other information at www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs. You can also request this information about the Fund by contacting us at 1-866-787-2257.

|

|

|

|

| Additional Information Phone Number |

|

1-866-787-2257

|

|

|

|

| Additional Information Website |

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left;">www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs</span>

|

|

|

|

| Expenses [Text Block] |

|

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment)

Fund Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

SPDR Dow Jones Global Real Estate ETF |

$57 |

0.50% | |

|

|

|

| Expenses Paid, Amount |

|

$ 57

|

|

|

|

| Expense Ratio, Percent |

|

0.50%

|

|

|

|

| Factors Affecting Performance [Text Block] |

|

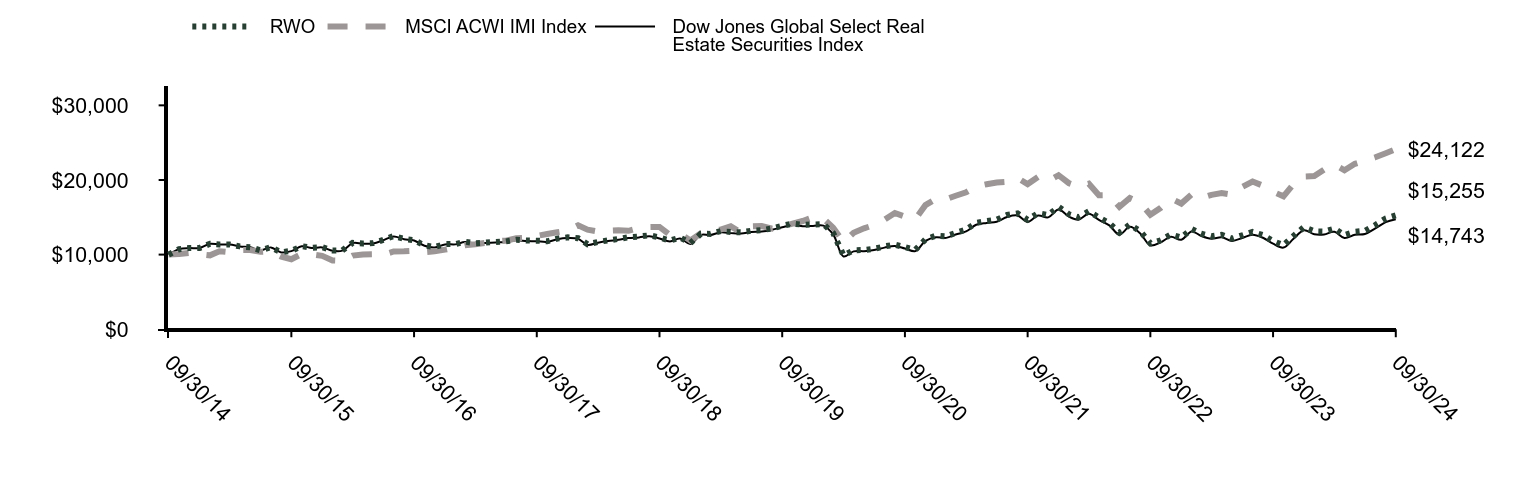

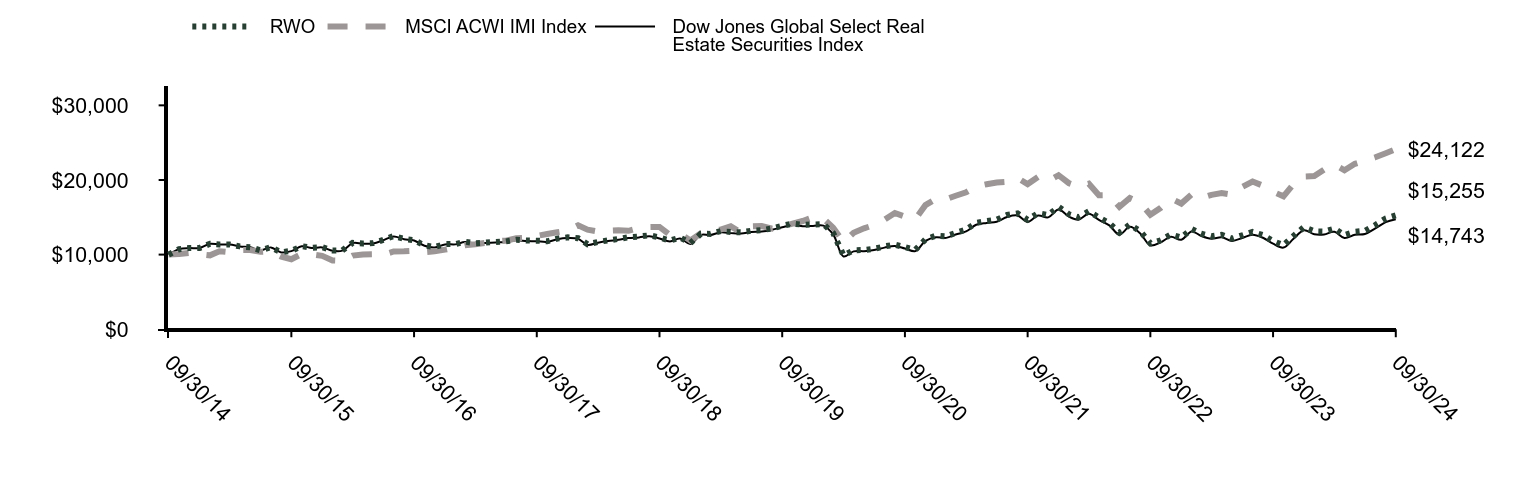

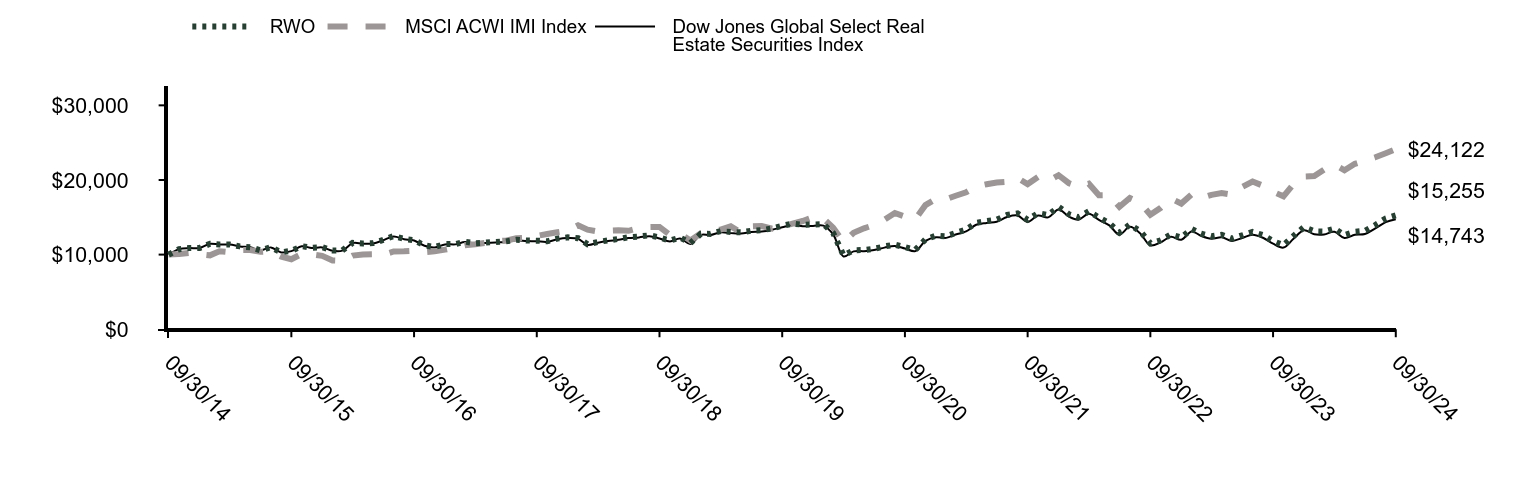

How did the Fund perform last year and what affected its performance?The reporting period’s market environment was largely driven by speculation about inflation and when and by how much the U.S. Federal Reserve ("the Fed") and other central banks would begin cutting rates. REIT performance during the period can be summed up by simply understanding that the asset class is interest rate sensitive and historically a safe haven for investors looking for alternative income streams. Treasury yields declined during the first fiscal quarter and REITs gained over 15% during that period. Then, as the Fed did not pull the trigger on a speculated rate cut in either of the next two quarters, REITs lost value coinciding with those decisions. Finally, as the fiscal year was coming to a close, the Fed finally cut rates in September by 50 basis points and the sector gained another 15%. |

|

|

|

| Performance Past Does Not Indicate Future [Text] |

|

<p style="box-sizing: border-box; color: rgb(0, 0, 0); display: block; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left;"><span style="font-weight: 700; box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left;">The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. Updated performance information is available by calling <span style="font-weight: 700; box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left;">1-866-787-2257</span> or visiting our website at <span style="font-weight: 700; box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left;">www.ssga.com</span>.</span></p>

|

|

|

|

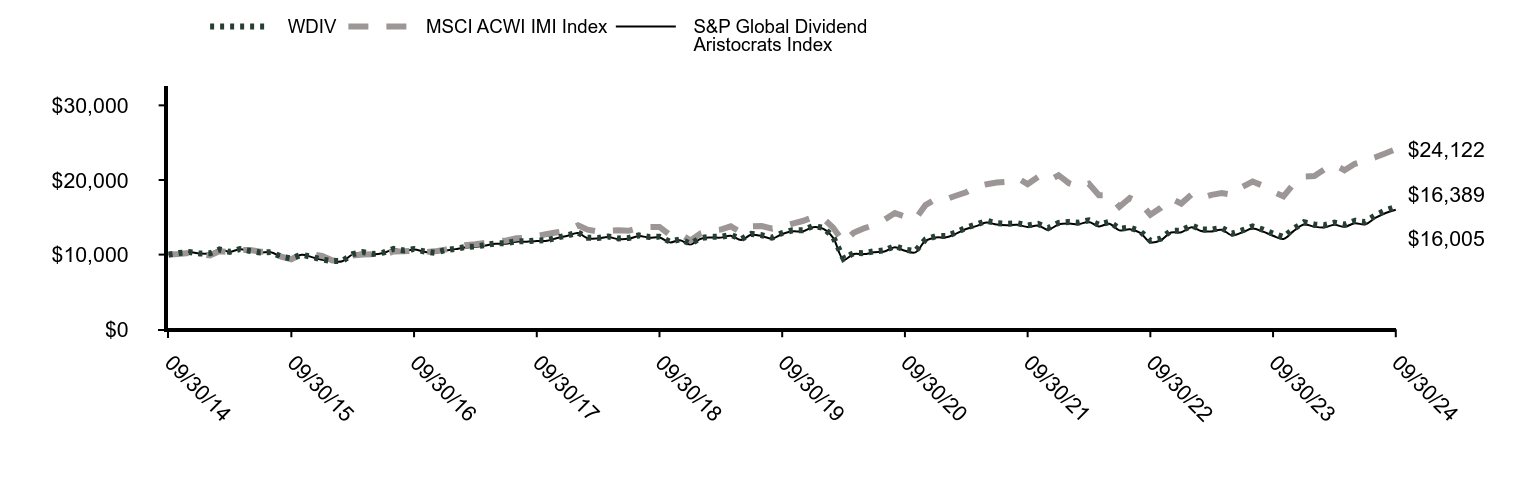

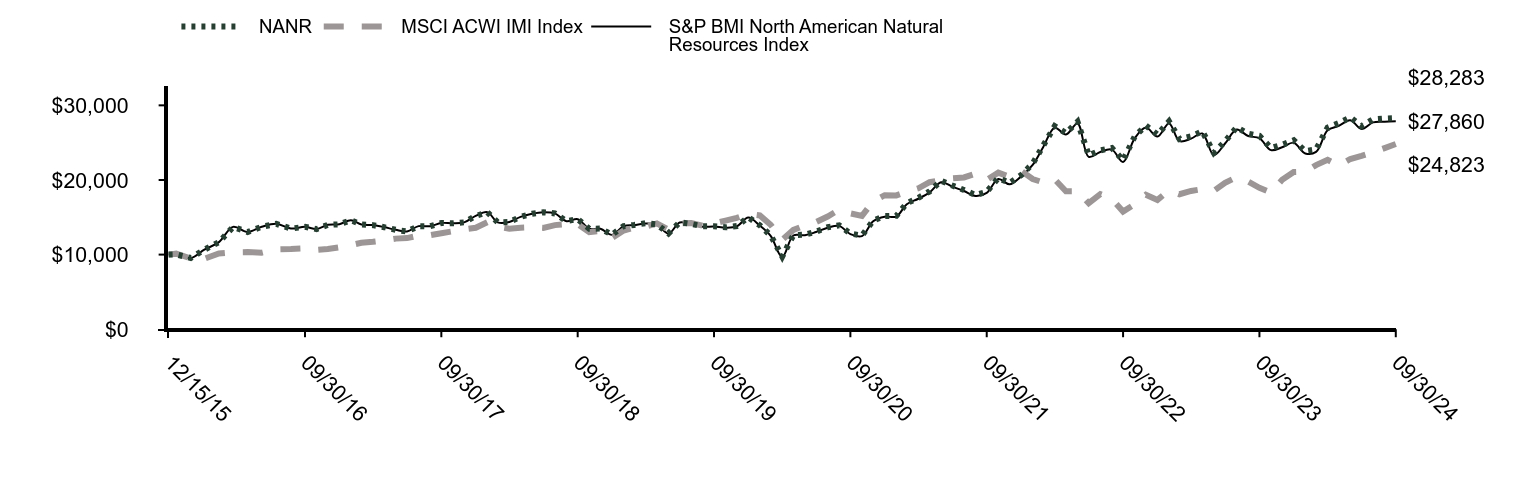

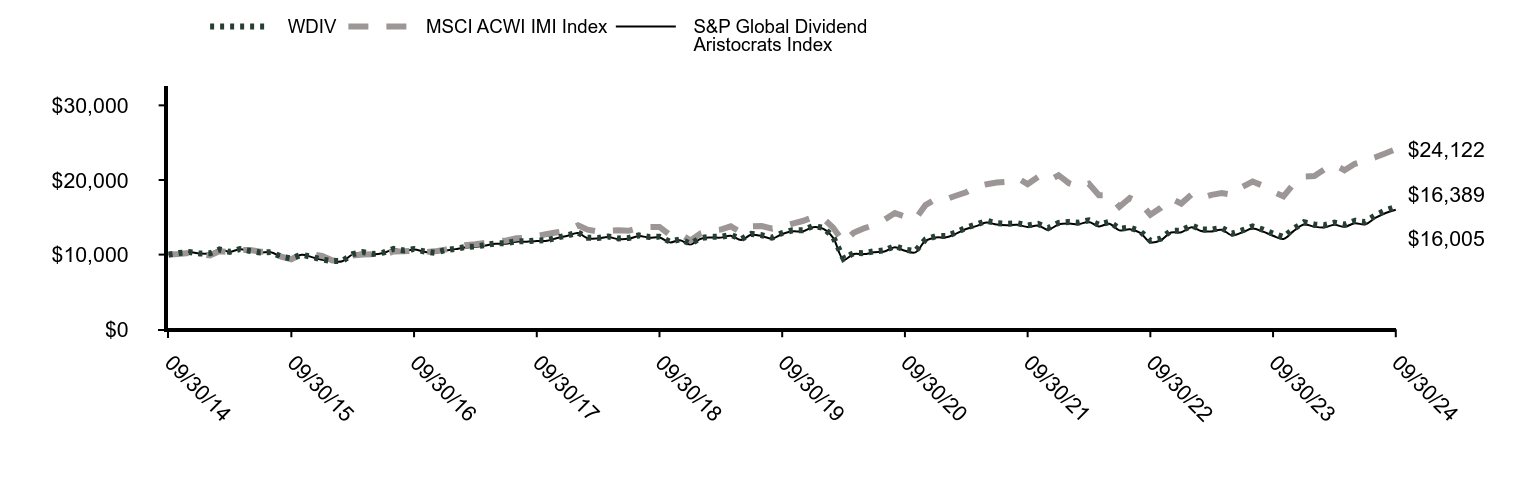

| Line Graph [Table Text Block] |

|

|

RWO |

MSCI ACWI IMI Index |

Dow Jones Global Select Real Estate Securities Index |

09/30/14 |

$10,000 |

$10,000 |

$10,000 |

10/31/14 |

$10,730 |

$10,079 |

$10,733 |

11/30/14 |

$10,870 |

$10,228 |

$10,872 |

12/31/14 |

$10,886 |

$10,059 |

$10,883 |

01/31/15 |

$11,451 |

$9,903 |

$11,452 |

02/28/15 |

$11,346 |

$10,457 |

$11,345 |

03/31/15 |

$11,358 |

$10,319 |

$11,348 |

04/30/15 |

$11,104 |

$10,602 |

$11,096 |

05/31/15 |

$10,984 |

$10,609 |

$10,974 |

06/30/15 |

$10,574 |

$10,374 |

$10,557 |

07/31/15 |

$10,983 |

$10,435 |

$10,967 |

08/31/15 |

$10,312 |

$9,735 |

$10,293 |

09/30/15 |

$10,496 |

$9,379 |

$10,470 |

10/31/15 |

$11,130 |

$10,089 |

$11,106 |

11/30/15 |

$10,908 |

$10,026 |

$10,884 |

12/31/15 |

$10,989 |

$9,839 |

$10,961 |

01/31/16 |

$10,541 |

$9,223 |

$10,514 |

02/29/16 |

$10,561 |

$9,175 |

$10,530 |

03/31/16 |

$11,574 |

$9,869 |

$11,536 |

04/30/16 |

$11,499 |

$10,025 |

$11,461 |

05/31/16 |

$11,537 |

$10,045 |

$11,497 |

06/30/16 |

$11,965 |

$9,973 |

$11,926 |

07/31/16 |

$12,479 |

$10,417 |

$12,439 |

08/31/16 |

$12,110 |

$10,452 |

$12,069 |

09/30/16 |

$11,935 |

$10,528 |

$11,889 |

10/31/16 |

$11,239 |

$10,325 |

$11,195 |

11/30/16 |

$11,004 |

$10,437 |

$10,958 |

12/31/16 |

$11,416 |

$10,662 |

$11,368 |

01/31/17 |

$11,416 |

$10,951 |

$11,370 |

02/28/17 |

$11,731 |

$11,252 |

$11,682 |

03/31/17 |

$11,529 |

$11,386 |

$11,473 |

04/30/17 |

$11,602 |

$11,569 |

$11,546 |

05/31/17 |

$11,687 |

$11,800 |

$11,628 |

06/30/17 |

$11,766 |

$11,869 |

$11,700 |

07/31/17 |

$11,976 |

$12,195 |

$11,909 |

08/31/17 |

$11,892 |

$12,238 |

$11,819 |

09/30/17 |

$11,869 |

$12,500 |

$11,788 |

10/31/17 |

$11,780 |

$12,753 |

$11,701 |

11/30/17 |

$12,144 |

$13,003 |

$12,061 |

12/31/17 |

$12,308 |

$13,215 |

$12,219 |

01/31/18 |

$12,197 |

$13,928 |

$12,110 |

02/28/18 |

$11,391 |

$13,346 |

$11,300 |

03/31/18 |

$11,691 |

$13,097 |

$11,593 |

04/30/18 |

$11,915 |

$13,219 |

$11,810 |

05/31/18 |

$12,094 |

$13,272 |

$11,984 |

06/30/18 |

$12,324 |

$13,192 |

$12,212 |

07/31/18 |

$12,418 |

$13,557 |

$12,306 |

08/31/18 |

$12,585 |

$13,682 |

$12,466 |

09/30/18 |

$12,296 |

$13,704 |

$12,169 |

10/31/18 |

$11,879 |

$12,632 |

$11,758 |

11/30/18 |

$12,287 |

$12,810 |

$12,159 |

12/31/18 |

$11,558 |

$11,883 |

$11,425 |

01/31/19 |

$12,783 |

$12,850 |

$12,640 |

02/28/19 |

$12,777 |

$13,208 |

$12,631 |

03/31/19 |

$13,142 |

$13,344 |

$12,983 |

04/30/19 |

$13,036 |

$13,785 |

$12,878 |

05/31/19 |

$12,978 |

$12,960 |

$12,817 |

06/30/19 |

$13,202 |

$13,793 |

$13,030 |

07/31/19 |

$13,270 |

$13,835 |

$13,094 |

08/31/19 |

$13,517 |

$13,486 |

$13,334 |

09/30/19 |

$13,855 |

$13,769 |

$13,665 |

10/31/19 |

$14,152 |

$14,148 |

$13,961 |

11/30/19 |

$14,007 |

$14,501 |

$13,815 |

12/31/19 |

$14,031 |

$15,015 |

$13,835 |

01/31/20 |

$14,083 |

$14,816 |

$13,888 |

02/29/20 |

$12,883 |

$13,604 |

$12,699 |

03/31/20 |

$9,892 |

$11,646 |

$9,750 |

04/30/20 |

$10,584 |

$12,928 |

$10,432 |

05/31/20 |

$10,615 |

$13,523 |

$10,462 |

06/30/20 |

$10,779 |

$13,955 |

$10,617 |

07/31/20 |

$11,102 |

$14,680 |

$10,934 |

08/31/20 |

$11,330 |

$15,569 |

$11,156 |

09/30/20 |

$10,994 |

$15,086 |

$10,813 |

10/31/20 |

$10,642 |

$14,760 |

$10,465 |

11/30/20 |

$12,036 |

$16,629 |

$11,835 |

12/31/20 |

$12,540 |

$17,455 |

$12,325 |

01/31/21 |

$12,454 |

$17,424 |

$12,242 |

02/28/21 |

$12,912 |

$17,888 |

$12,692 |

03/31/21 |

$13,346 |

$18,351 |

$13,108 |

04/30/21 |

$14,253 |

$19,148 |

$13,997 |

05/31/21 |

$14,506 |

$19,434 |

$14,248 |

06/30/21 |

$14,679 |

$19,668 |

$14,408 |

07/31/21 |

$15,317 |

$19,768 |

$15,036 |

08/31/21 |

$15,523 |

$20,257 |

$15,239 |

09/30/21 |

$14,662 |

$19,449 |

$14,386 |

10/31/21 |

$15,553 |

$20,395 |

$15,234 |

11/30/21 |

$15,300 |

$19,848 |

$14,987 |

12/31/21 |

$16,391 |

$20,636 |

$16,048 |

01/31/22 |

$15,397 |

$19,565 |

$15,079 |

02/28/22 |

$14,993 |

$19,117 |

$14,682 |

03/31/22 |

$15,800 |

$19,507 |

$15,461 |

04/30/22 |

$14,966 |

$17,958 |

$14,647 |

05/31/22 |

$14,215 |

$17,969 |

$13,909 |

06/30/22 |

$12,960 |

$16,419 |

$12,676 |

07/31/22 |

$14,024 |

$17,591 |

$13,718 |

08/31/22 |

$13,127 |

$16,967 |

$12,838 |

09/30/22 |

$11,506 |

$15,329 |

$11,237 |

10/31/22 |

$11,921 |

$16,272 |

$11,644 |

11/30/22 |

$12,692 |

$17,511 |

$12,397 |

12/31/22 |

$12,286 |

$16,838 |

$11,987 |

01/31/23 |

$13,434 |

$18,078 |

$13,108 |

02/28/23 |

$12,817 |

$17,576 |

$12,508 |

03/31/23 |

$12,455 |

$18,008 |

$12,133 |

04/30/23 |

$12,655 |

$18,238 |

$12,329 |

05/31/23 |

$12,150 |

$18,018 |

$11,837 |

06/30/23 |

$12,572 |

$19,068 |

$12,226 |

07/31/23 |

$13,032 |

$19,798 |

$12,674 |

08/31/23 |

$12,604 |

$19,229 |

$12,258 |

09/30/23 |

$11,806 |

$18,420 |

$11,465 |

10/31/23 |

$11,267 |

$17,806 |

$10,940 |

11/30/23 |

$12,482 |

$19,452 |

$12,119 |

12/31/23 |

$13,680 |

$20,472 |

$13,268 |

01/31/24 |

$13,118 |

$20,518 |

$12,726 |

02/29/24 |

$13,096 |

$21,376 |

$12,703 |

03/31/24 |

$13,475 |

$22,052 |

$13,057 |

04/30/24 |

$12,613 |

$21,303 |

$12,222 |

05/31/24 |

$13,058 |

$22,166 |

$12,649 |

06/30/24 |

$13,179 |

$22,577 |

$12,752 |

07/31/24 |

$13,960 |

$23,041 |

$13,506 |

08/31/24 |

$14,843 |

$23,579 |

$14,359 |

09/30/24 |

$15,255 |

$24,122 |

$14,743 |

|

|

|

|

| Average Annual Return [Table Text Block] |

|

Name |

1 Year |

5 Years |

10 Years |

RWO |

29.21% |

1.94% |

4.31% |

MSCI ACWI IMI Index |

30.96% |

11.87% |

9.20% |

Dow Jones Global Select Real Estate Securities Index |

28.59% |

1.53% |

3.96% | |

|

|

|

| AssetsNet |

$ 1,315,150,326

|

$ 1,315,150,326

|

$ 1,315,150,326

|

$ 1,315,150,326

|

$ 1,315,150,326

|

| Holdings Count | Holding |

229

|

229

|

229

|

229

|

229

|

| Advisory Fees Paid, Amount |

|

$ 5,998,739

|

|

|

|

| InvestmentCompanyPortfolioTurnover |

|

6.00%

|

|

|

|

| Additional Fund Statistics [Text Block] |

|

Key Fund Statistics as of 9/30/2024

Statistic |

Value |

Total Net Assets |

$1,315,150,326 |

Number of Portfolio Holdings |

229 |

Portfolio Turnover Rate |

6% |

Total Advisory Fees Paid |

$5,998,739 | |

|

|

|

| Holdings [Text Block] |

|

Holdings |

% Value of Total Net Assets |

Prologis, Inc. |

7.5% |

Equinix, Inc. |

5.4% |

Welltower, Inc. |

4.8% |

Public Storage |

3.7% |

Realty Income Corp. |

3.6% |

Simon Property Group, Inc. |

3.3% |

Digital Realty Trust, Inc. |

3.2% |

Extra Space Storage, Inc. |

2.5% |

AvalonBay Communities, Inc. |

2.1% |

Ventas, Inc. |

1.7% | |

|

|

|

| Material Fund Change [Text Block] |

|

|

|

|

|

| C000038339 |

|

|

|

|

|

| Shareholder Report [Line Items] |

|

|

|

|

|

| Fund Name |

|

SPDR Dow Jones International Real Estate ETF

|

|

|

|

| Trading Symbol |

|

RWX

|

|

|

|

| Security Exchange Name |

|

NYSE

|

|

|

|

| Annual or Semi-Annual Statement [Text Block] |

|

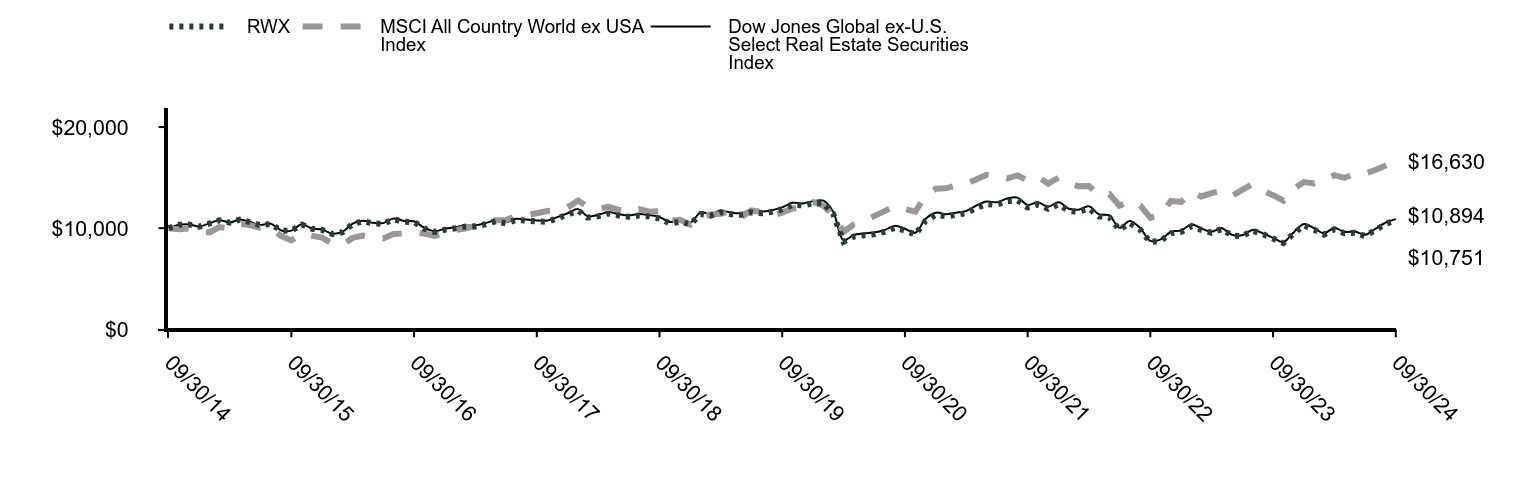

This annual shareholder report contains important information about the SPDR Dow Jones International Real Estate ETF (the "Fund") for the period of October 1, 2023 to September 30, 2024.

|

|

|

|

| Shareholder Report Annual or Semi-Annual |

|

Annual Shareholder Report

|

|

|

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund, including the Prospectus, Statement of Additional Information, financial statements and other information at www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs. You can also request this information about the Fund by contacting us at 1-866-787-2257.

|

|

|

|

| Additional Information Phone Number |

|

1-866-787-2257

|

|

|

|

| Additional Information Website |

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left;">www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs</span>

|

|

|

|

| Expenses [Text Block] |

|

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment)

Fund Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

SPDR Dow Jones International Real Estate ETF |

$65 |

0.59% | |

|

|

|

| Expenses Paid, Amount |

|

$ 65

|

|

|

|

| Expense Ratio, Percent |

|

0.59%

|

|

|

|

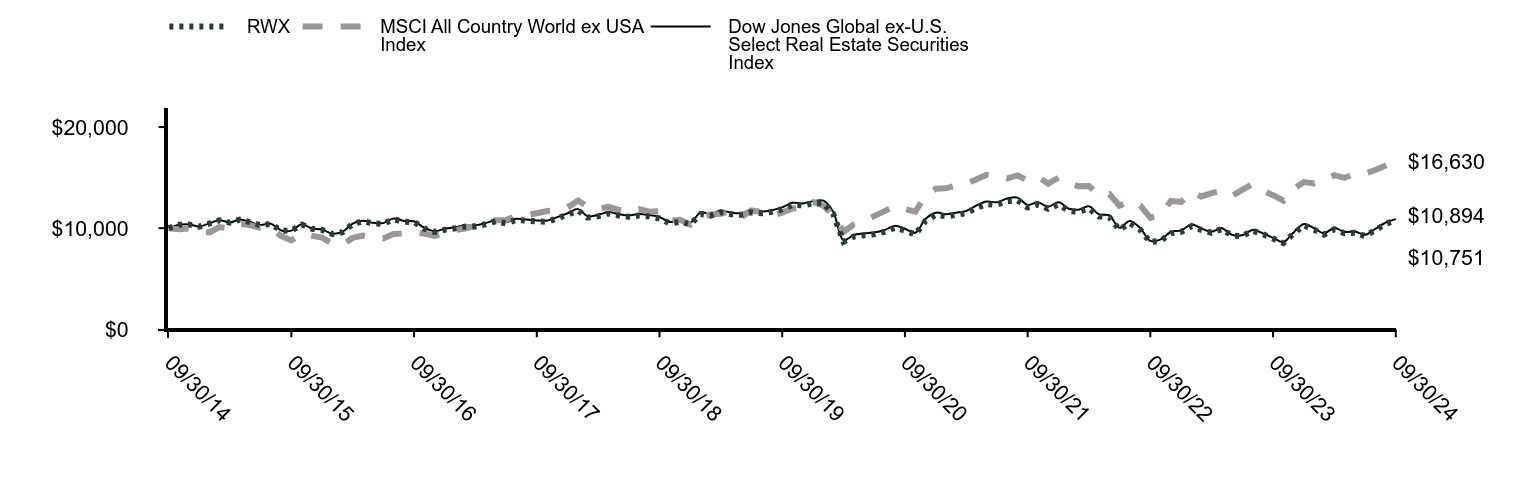

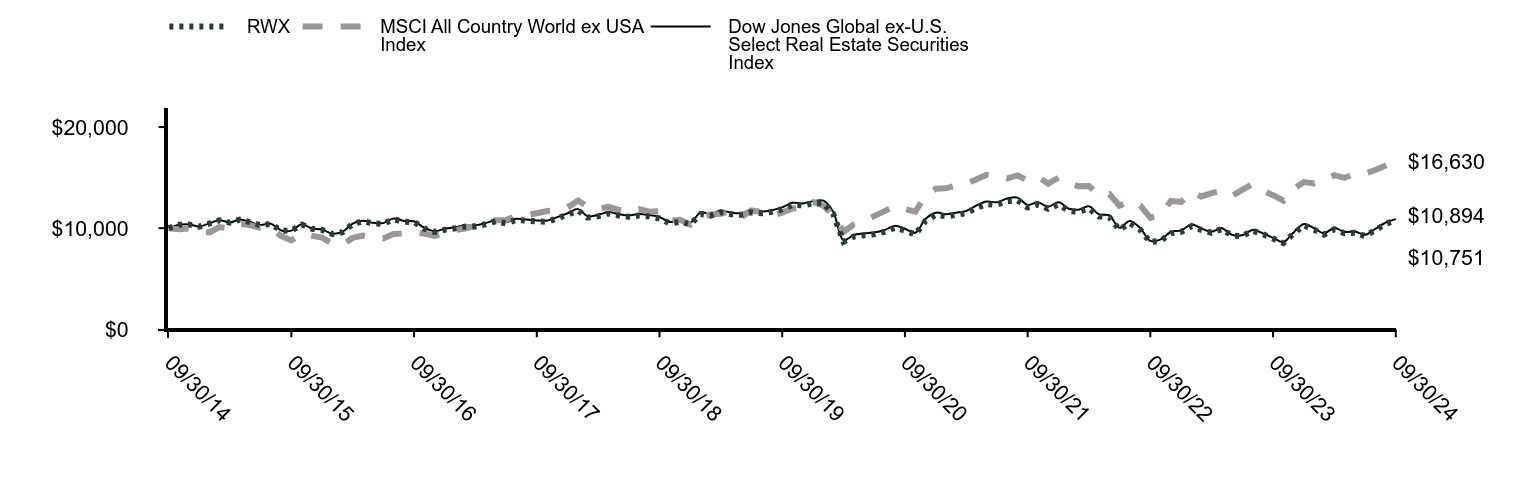

| Factors Affecting Performance [Text Block] |

|

How did the Fund perform last year and what affected its performance?The reporting period’s market environment was largely driven by speculation about inflation and when and by how much the U.S. Federal Reserve (“the Fed”) and other central banks would begin cutting rates. REIT performance during the period can be summed up by simply understanding that the asset class is interest rate sensitive and historically a safe haven for investors looking for alternative income streams. Treasury yields declined during the first fiscal quarter and REITs gained over 15% during that period. Then, as the Fed and other countries such as the Bank of England did not pull the trigger on speculated rate cuts in either of the next two quarters, REITs lost value coinciding with those decisions. Finally, as the fiscal year was coming to a close, the Fed finally cut rates in September by 50 basis points. This action followed rate cuts in many developed countries during the period and the sector gained another 16% as a result. |

|

|

|

| Performance Past Does Not Indicate Future [Text] |

|

<p style="box-sizing: border-box; color: rgb(0, 0, 0); display: block; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left;"><span style="font-weight: 700; box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left;">The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. Updated performance information is available by calling <span style="font-weight: 700; box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left;">1-866-787-2257</span> or visiting our website at <span style="font-weight: 700; box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left;">www.ssga.com</span>.</span></p>

|

|

|

|

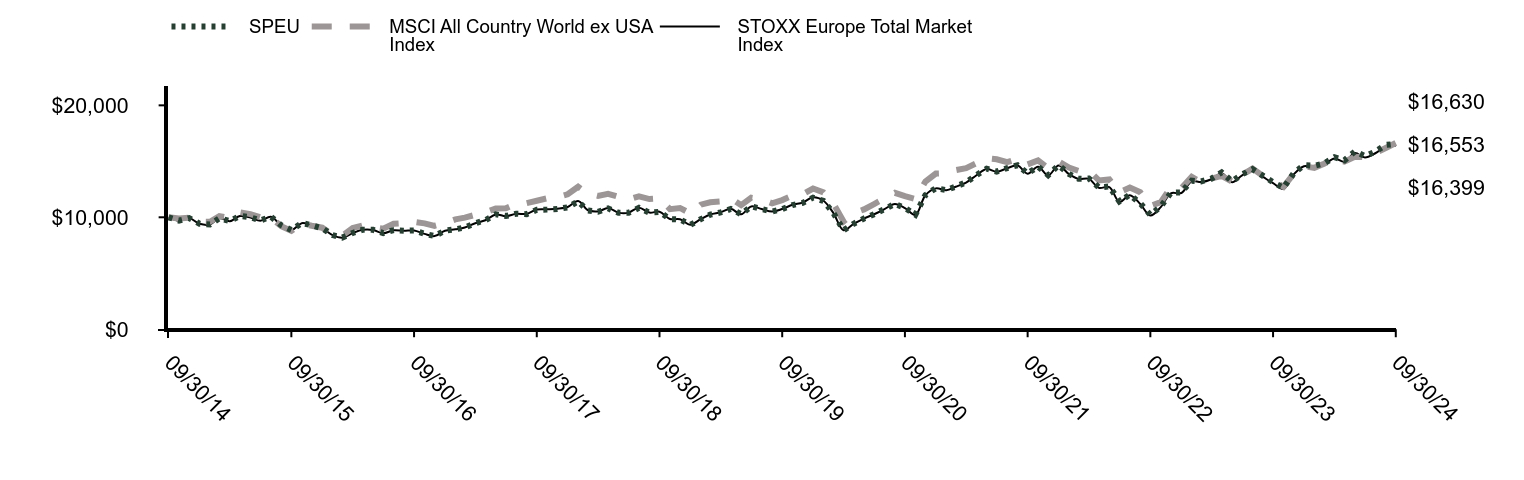

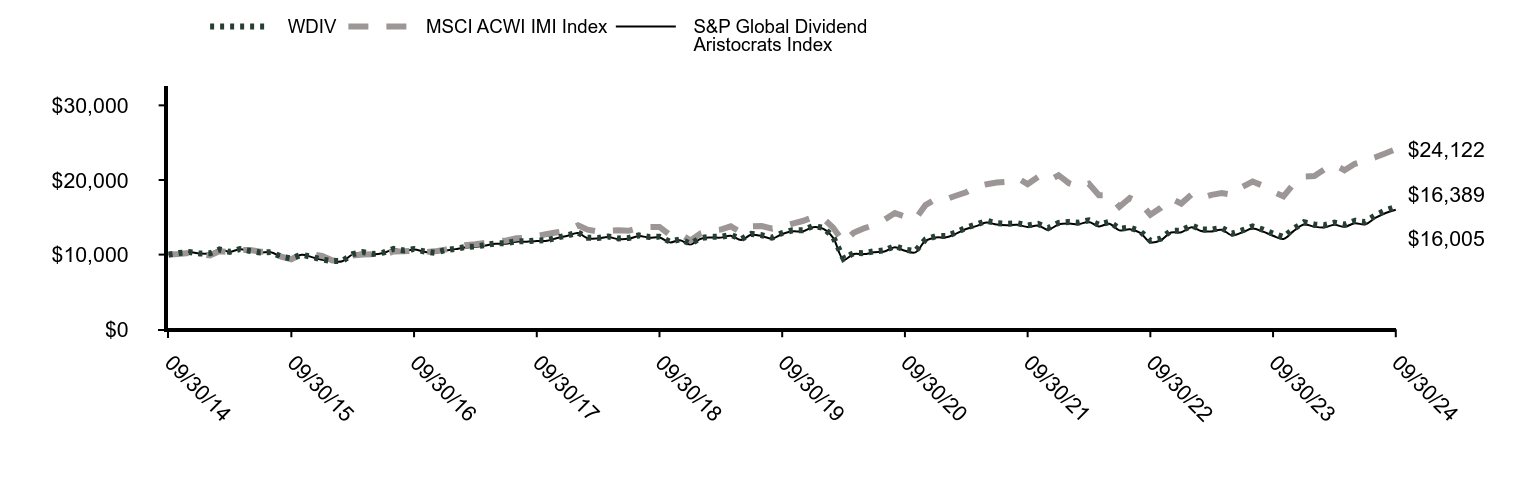

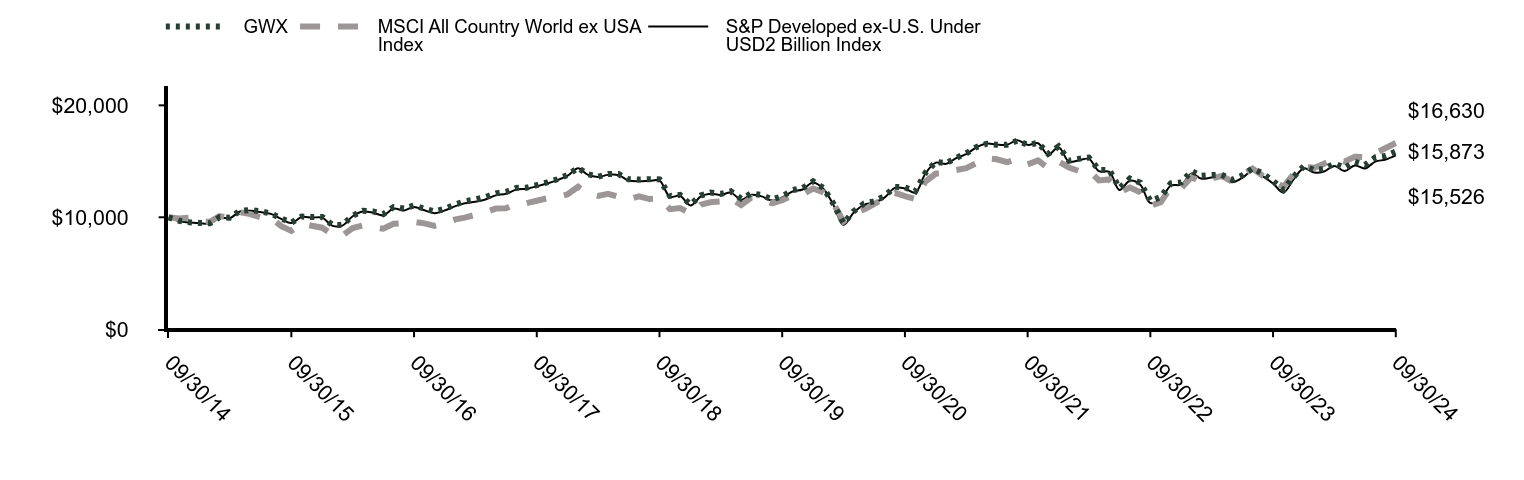

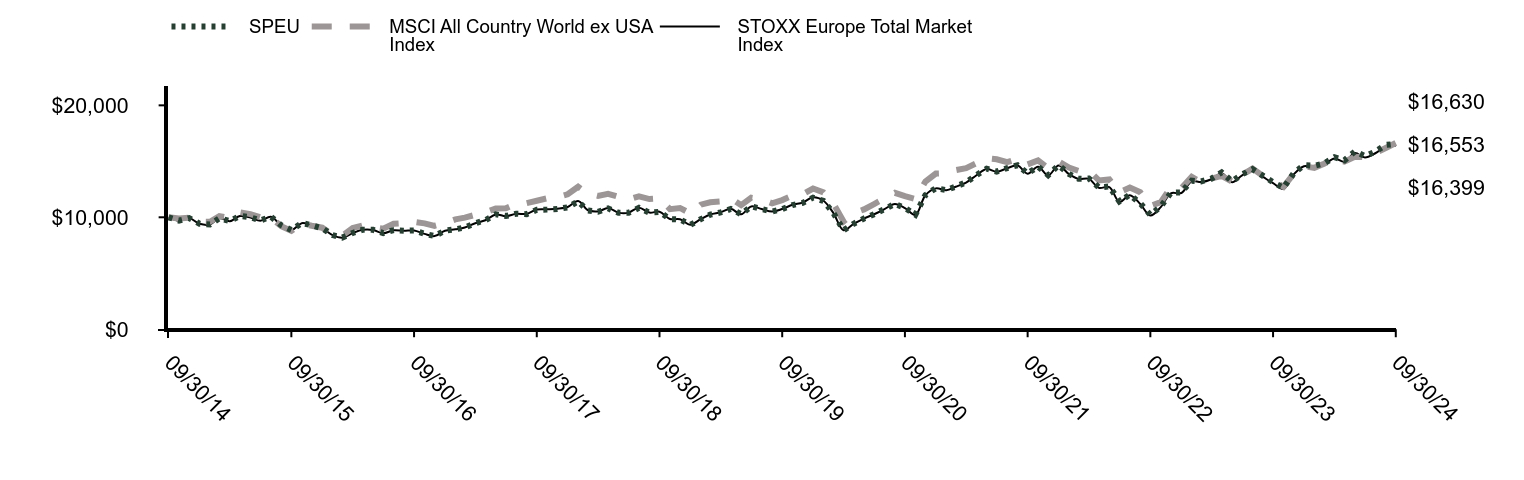

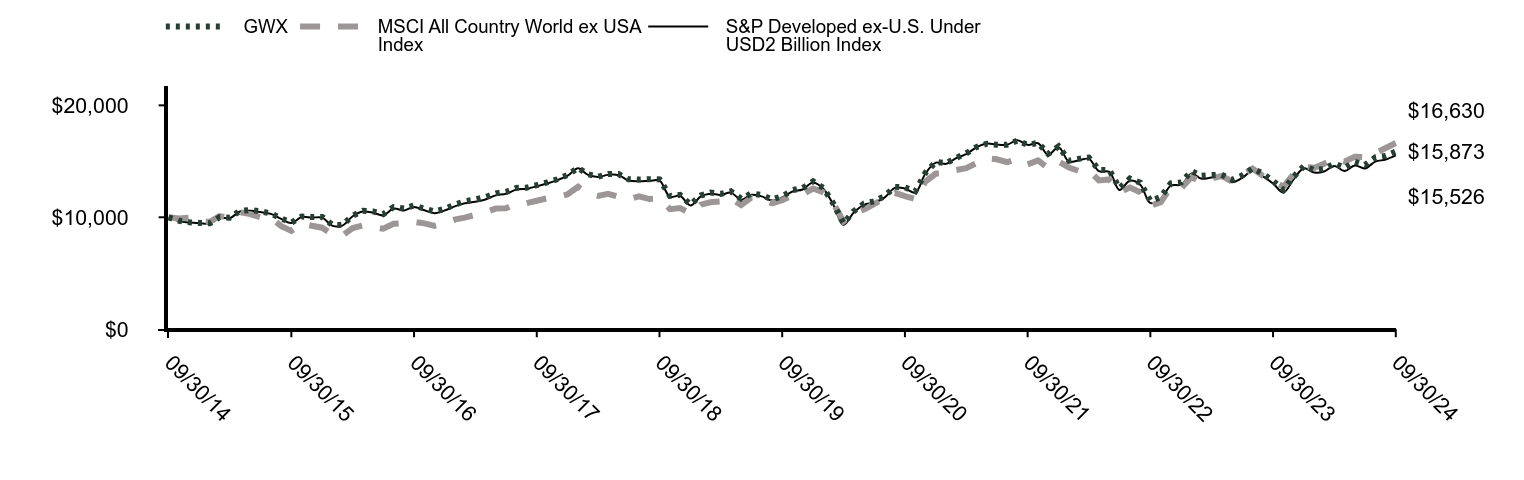

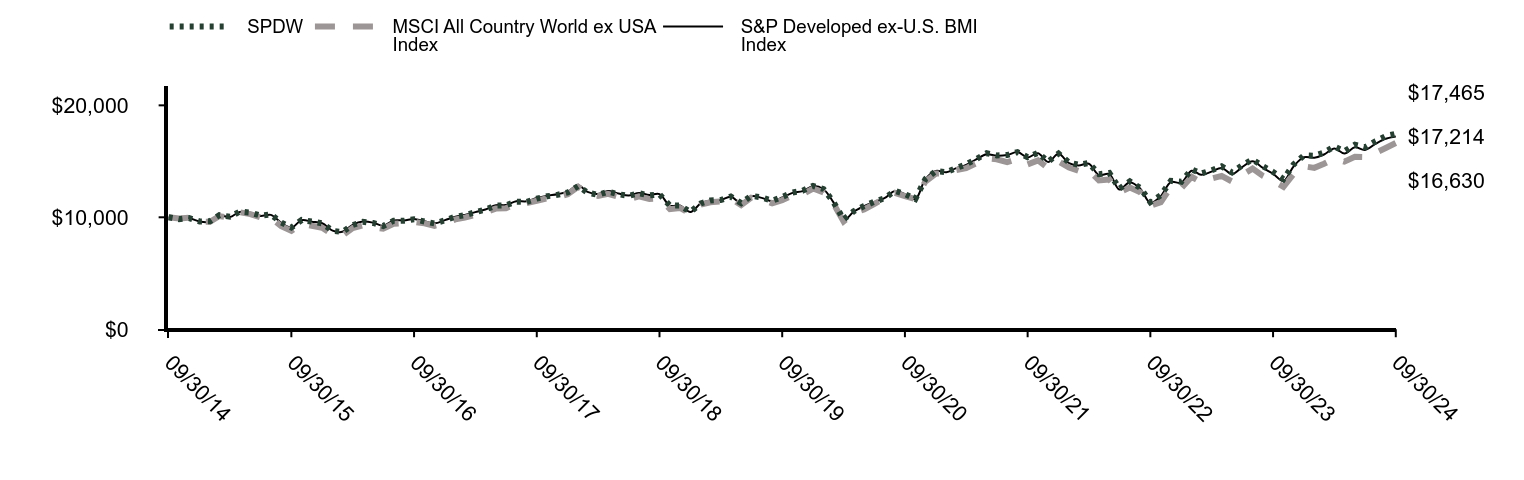

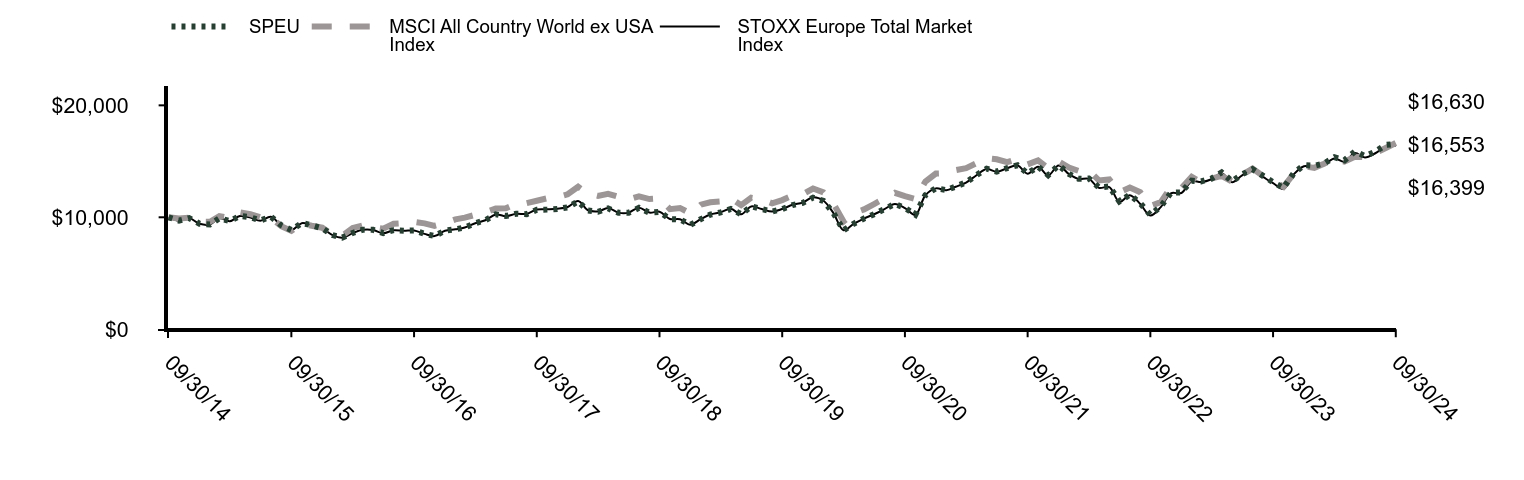

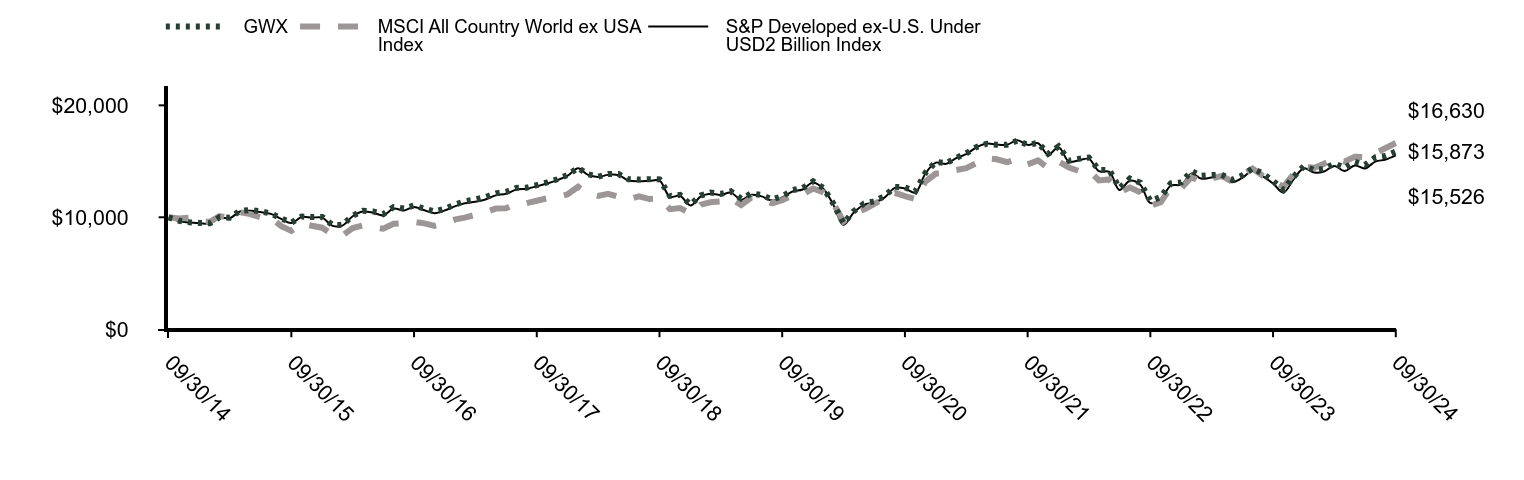

| Line Graph [Table Text Block] |

|

|

RWX |

MSCI All Country World ex USA Index |

Dow Jones Global ex-U.S. Select Real Estate Securities Index |

09/30/14 |

$10,000 |

$10,000 |

$10,000 |

10/31/14 |

$10,327 |

$9,901 |

$10,331 |

11/30/14 |

$10,358 |

$9,973 |

$10,367 |

12/31/14 |

$10,152 |

$9,613 |

$10,167 |

01/31/15 |

$10,480 |

$9,599 |

$10,495 |

02/28/15 |

$10,775 |

$10,112 |

$10,791 |

03/31/15 |

$10,549 |

$9,949 |

$10,562 |

04/30/15 |

$10,839 |

$10,451 |

$10,855 |

05/31/15 |

$10,585 |

$10,288 |

$10,604 |

06/30/15 |

$10,284 |

$10,001 |

$10,306 |

07/31/15 |

$10,419 |

$9,973 |

$10,443 |

08/31/15 |

$9,753 |

$9,211 |

$9,774 |

09/30/15 |

$9,734 |

$8,784 |

$9,756 |

10/31/15 |

$10,355 |

$9,438 |

$10,385 |

11/30/15 |

$9,940 |

$9,243 |

$9,975 |

12/31/15 |

$9,819 |

$9,069 |

$9,858 |

01/31/16 |

$9,406 |

$8,452 |

$9,449 |

02/29/16 |

$9,588 |

$8,355 |

$9,629 |

03/31/16 |

$10,395 |

$9,035 |

$10,439 |

04/30/16 |

$10,681 |

$9,272 |

$10,729 |

05/31/16 |

$10,472 |

$9,116 |

$10,522 |

06/30/16 |

$10,431 |

$8,976 |

$10,498 |

07/31/16 |

$10,873 |

$9,420 |

$10,945 |

08/31/16 |

$10,635 |

$9,480 |

$10,708 |

09/30/16 |

$10,604 |

$9,597 |

$10,675 |

10/31/16 |

$9,951 |

$9,459 |

$10,023 |

11/30/16 |

$9,625 |

$9,240 |

$9,697 |

12/31/16 |

$9,834 |

$9,476 |

$9,931 |

01/31/17 |

$9,987 |

$9,812 |

$10,089 |

02/28/17 |

$10,149 |

$9,969 |

$10,249 |

03/31/17 |

$10,171 |

$10,221 |

$10,274 |

04/30/17 |

$10,381 |

$10,440 |

$10,487 |

05/31/17 |

$10,671 |

$10,779 |

$10,782 |

06/30/17 |

$10,470 |

$10,812 |

$10,582 |

07/31/17 |

$10,800 |

$11,211 |

$10,919 |

08/31/17 |

$10,748 |

$11,270 |

$10,856 |

09/30/17 |

$10,654 |

$11,479 |

$10,764 |

10/31/17 |

$10,636 |

$11,695 |

$10,749 |

11/30/17 |

$10,971 |

$11,790 |

$11,094 |

12/31/17 |

$11,339 |

$12,053 |

$11,476 |

01/31/18 |

$11,735 |

$12,725 |

$11,882 |

02/28/18 |

$11,053 |

$12,125 |

$11,181 |

03/31/18 |

$11,165 |

$11,911 |

$11,310 |

04/30/18 |

$11,451 |

$12,101 |

$11,588 |

05/31/18 |

$11,256 |

$11,821 |

$11,390 |

06/30/18 |

$11,119 |

$11,599 |

$11,267 |

07/31/18 |

$11,243 |

$11,877 |

$11,396 |

08/31/18 |

$11,144 |

$11,628 |

$11,291 |

09/30/18 |

$10,960 |

$11,681 |

$11,101 |

10/31/18 |

$10,464 |

$10,731 |

$10,604 |

11/30/18 |

$10,621 |

$10,833 |

$10,766 |

12/31/18 |

$10,390 |

$10,342 |

$10,542 |

01/31/19 |

$11,392 |

$11,124 |

$11,562 |

02/28/19 |

$11,237 |

$11,341 |

$11,404 |

03/31/19 |

$11,563 |

$11,409 |

$11,734 |

04/30/19 |

$11,378 |

$11,710 |

$11,547 |

05/31/19 |

$11,316 |

$11,081 |

$11,485 |

06/30/19 |

$11,568 |

$11,749 |

$11,748 |

07/31/19 |

$11,468 |

$11,607 |

$11,635 |

08/31/19 |

$11,607 |

$11,248 |

$11,777 |

09/30/19 |

$11,871 |

$11,538 |

$12,057 |

10/31/19 |

$12,310 |

$11,940 |

$12,508 |

11/30/19 |

$12,244 |

$12,045 |

$12,443 |

12/31/19 |

$12,446 |

$12,567 |

$12,669 |

01/31/20 |

$12,491 |

$12,229 |

$12,719 |

02/29/20 |

$11,409 |

$11,263 |

$11,614 |

03/31/20 |

$8,640 |

$9,632 |

$8,796 |

04/30/20 |

$9,157 |

$10,362 |

$9,318 |

05/31/20 |

$9,305 |

$10,701 |

$9,473 |

06/30/20 |

$9,396 |

$11,185 |

$9,568 |

07/31/20 |

$9,633 |

$11,683 |

$9,812 |

08/31/20 |

$10,041 |

$12,183 |

$10,224 |

09/30/20 |

$9,762 |

$11,884 |

$9,941 |

10/31/20 |

$9,370 |

$11,628 |

$9,537 |

11/30/20 |

$10,715 |

$13,193 |

$10,909 |

12/31/20 |

$11,315 |

$13,906 |

$11,531 |

01/31/21 |

$11,164 |

$13,936 |

$11,380 |

02/28/21 |

$11,310 |

$14,212 |

$11,532 |

03/31/21 |

$11,475 |

$14,391 |

$11,697 |

04/30/21 |

$11,989 |

$14,815 |

$12,227 |

05/31/21 |

$12,379 |

$15,278 |

$12,632 |

06/30/21 |

$12,315 |

$15,179 |

$12,565 |

07/31/21 |

$12,661 |

$14,929 |

$12,924 |

08/31/21 |

$12,751 |

$15,213 |

$13,018 |

09/30/21 |

$12,052 |

$14,726 |

$12,302 |

10/31/21 |

$12,340 |

$15,077 |

$12,553 |

11/30/21 |

$11,910 |

$14,399 |

$12,118 |

12/31/21 |

$12,337 |

$14,994 |

$12,559 |

01/31/22 |

$11,704 |

$14,441 |

$11,916 |

02/28/22 |

$11,617 |

$14,155 |

$11,824 |

03/31/22 |

$11,939 |

$14,178 |

$12,161 |

04/30/22 |

$11,162 |

$13,288 |

$11,369 |

05/31/22 |

$11,063 |

$13,383 |

$11,266 |

06/30/22 |

$9,856 |

$12,232 |

$10,032 |

07/31/22 |

$10,508 |

$12,650 |

$10,704 |

08/31/22 |

$9,830 |

$12,243 |

$9,987 |

09/30/22 |

$8,612 |

$11,020 |

$8,741 |

10/31/22 |

$8,757 |

$11,349 |

$8,892 |

11/30/22 |

$9,480 |

$12,689 |

$9,615 |

12/31/22 |

$9,641 |

$12,594 |

$9,782 |

01/31/23 |

$10,197 |

$13,615 |

$10,352 |

02/28/23 |

$9,827 |

$13,137 |

$9,973 |

03/31/23 |

$9,543 |

$13,459 |

$9,635 |

04/30/23 |

$9,906 |

$13,692 |

$10,001 |

05/31/23 |

$9,257 |

$13,195 |

$9,342 |

06/30/23 |

$9,217 |

$13,787 |

$9,296 |

07/31/23 |

$9,737 |

$14,347 |

$9,826 |

08/31/23 |

$9,402 |

$13,699 |

$9,488 |

09/30/23 |

$8,964 |

$13,266 |

$9,039 |

10/31/23 |

$8,527 |

$12,719 |

$8,626 |

11/30/23 |

$9,452 |

$13,864 |

$9,570 |

12/31/23 |

$10,274 |

$14,560 |

$10,415 |

01/31/24 |

$9,841 |

$14,416 |

$9,977 |

02/29/24 |

$9,366 |

$14,781 |

$9,492 |

03/31/24 |

$9,877 |

$15,243 |

$10,019 |

04/30/24 |

$9,489 |

$14,969 |

$9,617 |

05/31/24 |

$9,550 |

$15,404 |

$9,669 |

06/30/24 |

$9,228 |

$15,389 |

$9,342 |

07/31/24 |

$9,795 |

$15,745 |

$9,921 |

08/31/24 |

$10,423 |

$16,194 |

$10,561 |

09/30/24 |

$10,751 |

$16,630 |

$10,894 |

|

|

|

|

| Average Annual Return [Table Text Block] |

|

Name |

1 Year |

5 Years |

10 Years |

RWX |

19.94% |

(1.96%) |

0.73% |

MSCI All Country World ex USA Index |

25.35% |

7.59% |

5.22% |

Dow Jones Global ex-U.S. Select Real Estate Securities Index |

20.53% |

(2.01%) |

0.86% | |

|

|

|

| AssetsNet |

$ 304,540,046

|

$ 304,540,046

|

$ 304,540,046

|

$ 304,540,046

|

$ 304,540,046

|

| Holdings Count | Holding |

124

|

124

|

124

|

124

|

124

|

| Advisory Fees Paid, Amount |

|

$ 1,753,161

|

|

|

|

| InvestmentCompanyPortfolioTurnover |

|

7.00%

|

|

|

|

| Additional Fund Statistics [Text Block] |

|

Key Fund Statistics as of 9/30/2024

Statistic |

Value |

Total Net Assets |

$304,540,046 |

Number of Portfolio Holdings |

124 |

Portfolio Turnover Rate |

7% |

Total Advisory Fees Paid |

$1,753,161 | |

|

|

|

| Holdings [Text Block] |

|

Holdings |

% Value of Total Net Assets |

Mitsui Fudosan Co. Ltd. |

6.0% |

Segro PLC |

3.6% |

Scentre Group |

3.0% |

Link REIT |

3.0% |

CapitaLand Integrated Commercial Trust |

2.0% |

Unibail-Rodamco-Westfield |

2.0% |

Swiss Prime Site AG |

2.0% |

CapitaLand Ascendas REIT |

1.8% |

Nippon Building Fund, Inc. |

1.8% |

LEG Immobilien SE |

1.8% | |

|

|

|

| Material Fund Change [Text Block] |

|

|

|

|

|

| C000017550 |

|

|

|

|

|

| Shareholder Report [Line Items] |

|

|

|

|

|

| Fund Name |

|

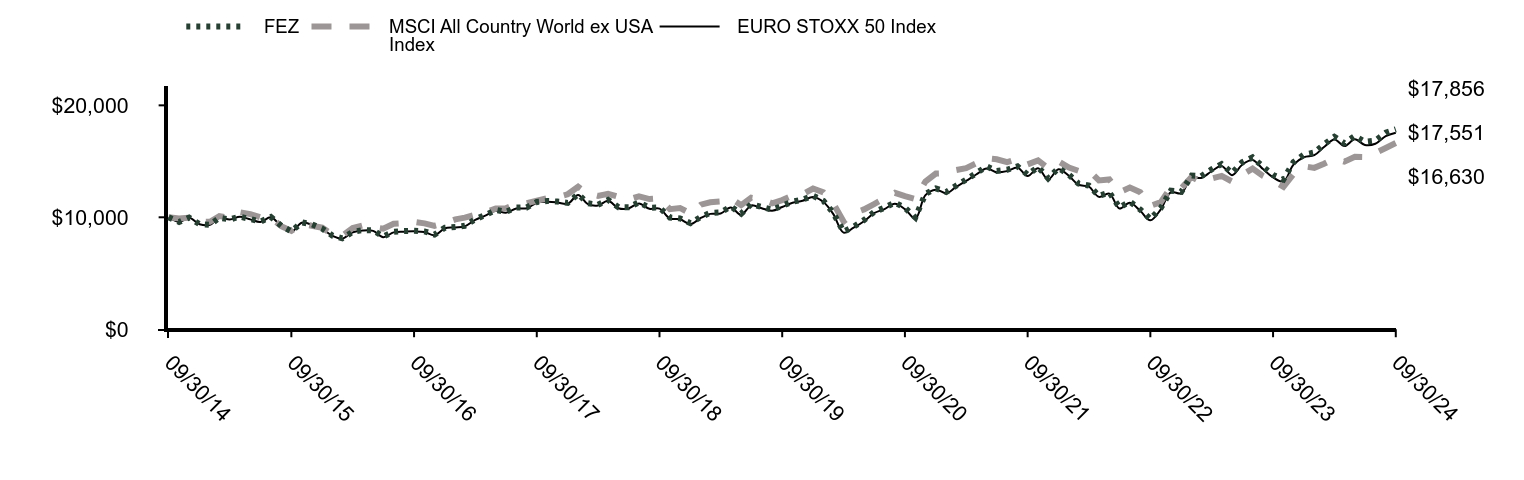

SPDR EURO STOXX 50 ETF

|

|

|

|

| Trading Symbol |

|

FEZ

|

|

|

|

| Security Exchange Name |

|

NYSE

|

|

|

|

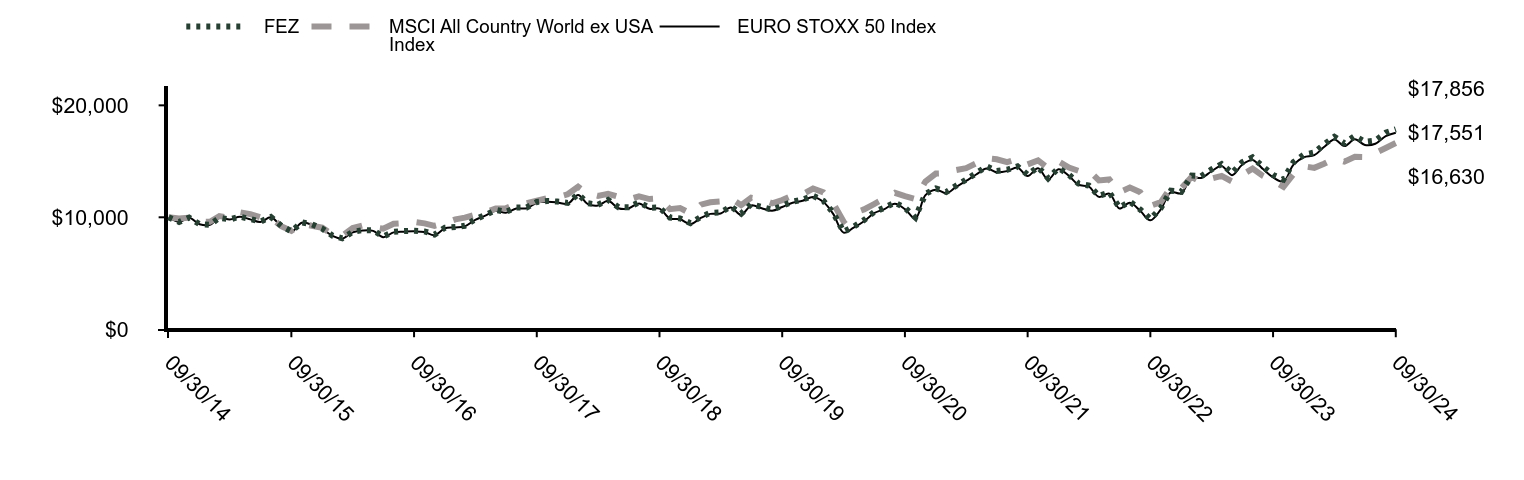

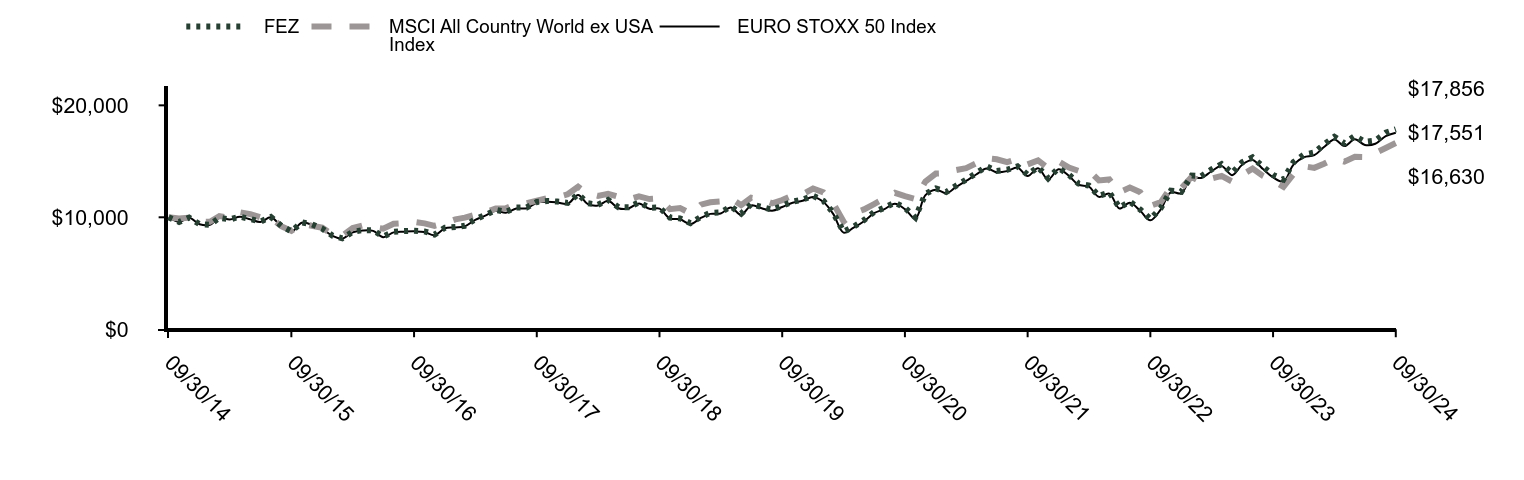

| Annual or Semi-Annual Statement [Text Block] |

|

This annual shareholder report contains important information about the SPDR EURO STOXX 50 ETF (the "Fund") for the period of October 1, 2023 to September 30, 2024.

|

|

|

|

| Shareholder Report Annual or Semi-Annual |

|

Annual Shareholder Report

|

|

|