Exhibit 99.1

|

FOURTH QUARTER 2024 | |

|

EARNINGS RELEASE |

| ROYAL BANK OF CANADA REPORTS FOURTH QUARTER AND 2024 RESULTS |

All amounts are in Canadian dollars and are based on our audited Annual and unaudited Interim Consolidated Financial Statements for the year and quarter ended October 31, 2024 and related notes prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board, unless otherwise noted. Effective November 1, 2023, we adopted IFRS 17 Insurance Contracts (IFRS 17). Comparative amounts have been restated from those previously presented. Our 2024 Annual Report (which includes our audited Annual Consolidated Financial Statements and accompanying Management’s Discussion & Analysis), our 2024 Annual Information Form and our Supplementary Financial Information are available on our website at http://www.rbc.com/investorrelations and on https://www.sedarplus.com.

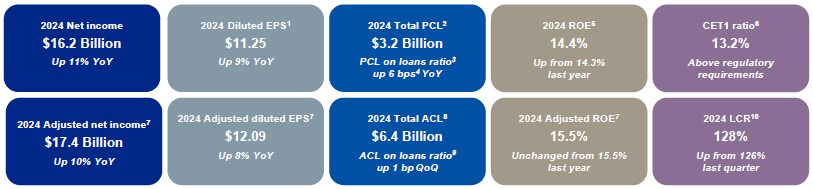

TORONTO, December 4, 2024 – Royal Bank of Canada11 (RY on TSX and NYSE) today reported net income of $16.2 billion for the year ended October 31, 2024, up $1.6 billion or 11% from the prior year. Diluted EPS was $11.25, up 9% over the prior year reflecting growth across each of our business segments. The inclusion of HSBC Bank Canada (HSBC Canada) results12 increased net income by $453 million. Adjusted net income7 and adjusted diluted EPS7 of $17.4 billion and $12.09 were up 10% and 8%, respectively, from the prior year.

Our consolidated results include higher provisions on impaired loans, largely in Commercial Banking and Personal Banking. The PCL on impaired loans ratio13 was 28 bps, up 7 bps from the prior year.

Pre-provision, pre-tax earnings7 of $23.1 billion were up 12% from last year. The inclusion of HSBC Canada results increased pre-provision, pre-tax earnings7 by $995 million. Excluding HSBC Canada results, pre-provision, pre-tax earnings7 increased 7% from last year, mainly due to higher net interest income reflecting solid average volume growth and higher spreads in both Personal Banking and Commercial Banking. Higher fee-based revenue in Wealth Management reflecting market appreciation and net sales, and higher Corporate & Investment Banking revenue in Capital Markets, also contributed to the increase. These factors were partially offset by higher expenses driven by higher variable compensation on improved results and continued investments across our businesses.

Our capital position remained robust with a CET1 ratio6 of 13.2% supporting solid volume growth. In addition, this year we returned $8.1 billion to our shareholders through common dividends and share buybacks. Today, we declared a quarterly dividend of $1.48 per share reflecting an increase of $0.06 or 4%.

|

“In 2024, RBC relentlessly pursued our ambition to stay ahead of evolving client expectations and create unparalleled value.

As our results exemplify, our premium franchises delivered diversified revenue growth, underpinned by a strong balance sheet and prudent risk management. One of our year’s defining moments was the acquisition of HSBC Bank Canada, which marked a pivotal milestone in our client-driven growth story and strengthened our position as a competitive global financial institution. We also elevated a new generation of leaders across the bank to continue delivering trusted advice and experiences to rival the best in any industry.

As we enter 2025 from a position of strength, I’m fully confident in Team RBC’s ability to continue going above-and-beyond to support those we serve, each and every day.” – Dave McKay, President and Chief Executive Officer of Royal Bank of Canada

|

| 1 | Earnings per share (EPS). |

| 2 | Provision for credit losses (PCL). |

| 3 | PCL on loans ratio is calculated as PCL on loans as a percentage of average net loans and acceptances. |

| 4 | Basis points (bps). |

| 5 | Return on equity (ROE). For further information, refer to the Key performance and non-GAAP measures section on pages 12 to 15 of this Earnings Release. |

| 6 | This ratio is calculated by dividing Common Equity Tier 1 (CET1) by risk-weighted assets (RWA), in accordance with the Office of the Superintendent of Financial Institutions’ (OSFI) Basel III Capital Adequacy Requirements (CAR) guideline. |

| 7 | These are non-GAAP measures. For further information, including a reconciliation, refer to the Key performance and non-GAAP measures section on pages 12 to 15 of this Earnings Release. |

| 8 | Allowance for credit losses (ACL). |

| 9 | ACL on loans ratio is calculated as ACL on loans as a percentage of total loans and acceptances. |

| 10 | The liquidity coverage ratio (LCR) is calculated in accordance with OSFI’s Liquidity Adequacy Requirements (LAR) guideline. For further details, refer to the Liquidity and funding risk section of our 2024 Annual Report. |

| 11 | When we say “we”, “us”, “our”, “the bank” or “RBC”, we mean Royal Bank of Canada and its subsidiaries, as applicable. |

| 12 | On March 28, 2024, we completed the acquisition of HSBC Canada (HSBC Canada transaction). HSBC Canada results reflect revenue, PCL, non-interest expenses and income taxes associated with the acquired operations and clients, which include the acquired assets, assumed liabilities and employees with the exception of assets and liabilities relating to treasury and liquidity management activities. For further details, refer to the Key corporate events section of our 2024 Annual Report. |

| 13 | PCL on impaired loans ratio is calculated as PCL on impaired loans as a percentage of average net loans and acceptances. |

- 1 -