Shareholder Report

|

6 Months Ended |

|

Sep. 30, 2024

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSRS

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

TIAA-CREF Funds

|

|

| Entity Central Index Key |

0001084380

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Sep. 30, 2024

|

|

| C000162546 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Real Estate Securities Select Fund (Formerly known as TIAA-CREF Real Estate Securities Fund)

|

|

| Class Name |

Class I Shares (Formerly known as Advisor Class Shares)

|

|

| Trading Symbol |

TIRHX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Class I Shares of the Nuveen Real Estate Securities Select Fund for the period of April 1, 2024 to September 30, 2024.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class I Shares |

|

$33 |

|

0.61% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 33

|

|

| Expense Ratio, Percent |

0.61%

|

[1] |

| Net Assets |

$ 3,066,748,727

|

|

| Holdings Count | Holding |

40

|

|

| Investment Company Portfolio Turnover |

11.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of September 30, 2024)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

3,066,748,727 |

|

|

|

| Total number of portfolio holdings |

|

|

40 |

|

|

|

| Portfolio turnover (%) |

|

|

11% |

|

|

|

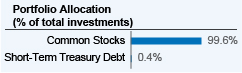

| Holdings [Text Block] |

|

|

| C000014629 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Real Estate Securities Select Fund (Formerly known as TIAA-CREF Real Estate Securities Fund)

|

|

| Class Name |

Class A Shares (Formerly known as Retail Class Shares)

|

|

| Trading Symbol |

TCREX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Class A Shares of the Nuveen Real Estate Securities Select Fund for the period of April 1, 2024 to September 30, 2024.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class A Shares |

|

$42 |

|

0.78% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 42

|

|

| Expense Ratio, Percent |

0.78%

|

[2] |

| Net Assets |

$ 3,066,748,727

|

|

| Holdings Count | Holding |

40

|

|

| Investment Company Portfolio Turnover |

11.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of September 30, 2024)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

3,066,748,727 |

|

|

|

| Total number of portfolio holdings |

|

|

40 |

|

|

|

| Portfolio turnover (%) |

|

|

11% |

|

|

|

| Holdings [Text Block] |

|

|

| C000079553 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Real Estate Securities Select Fund (Formerly known as TIAA-CREF Real Estate Securities Fund)

|

|

| Class Name |

Premier Class Shares

|

|

| Trading Symbol |

TRRPX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Premier Class Shares of the Nuveen Real Estate Securities Select Fund for the period of April 1, 2024 to September 30, 2024.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Premier Class Shares |

|

$34 |

|

0.64% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 34

|

|

| Expense Ratio, Percent |

0.64%

|

[3] |

| Net Assets |

$ 3,066,748,727

|

|

| Holdings Count | Holding |

40

|

|

| Investment Company Portfolio Turnover |

11.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of September 30, 2024)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

3,066,748,727 |

|

|

|

| Total number of portfolio holdings |

|

|

40 |

|

|

|

| Portfolio turnover (%) |

|

|

11% |

|

|

|

| Holdings [Text Block] |

|

|

| C000014630 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Real Estate Securities Select Fund (Formerly known as TIAA-CREF Real Estate Securities Fund)

|

|

| Class Name |

Retirement Class Shares

|

|

| Trading Symbol |

TRRSX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Retirement Class Shares of the Nuveen Real Estate Securities Select Fund for the period of April 1, 2024 to September 30, 2024.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Retirement Class Shares |

|

$40 |

|

0.74% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 40

|

|

| Expense Ratio, Percent |

0.74%

|

[4] |

| Net Assets |

$ 3,066,748,727

|

|

| Holdings Count | Holding |

40

|

|

| Investment Company Portfolio Turnover |

11.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of September 30, 2024)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

3,066,748,727 |

|

|

|

| Total number of portfolio holdings |

|

|

40 |

|

|

|

| Portfolio turnover (%) |

|

|

11% |

|

|

|

| Holdings [Text Block] |

|

|

| C000014628 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Real Estate Securities Select Fund (Formerly known as TIAA-CREF Real Estate Securities Fund)

|

|

| Class Name |

Class R6 Shares (Formerly known as Institutional Class Shares)

|

|

| Trading Symbol |

TIREX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Class R6 Shares of the Nuveen Real Estate Securities Select Fund for the period of April 1, 2024 to September 30, 2024.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class R6 Shares |

|

$26 |

|

0.49% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 26

|

|

| Expense Ratio, Percent |

0.49%

|

[5] |

| Net Assets |

$ 3,066,748,727

|

|

| Holdings Count | Holding |

40

|

|

| Investment Company Portfolio Turnover |

11.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of September 30, 2024)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

3,066,748,727 |

|

|

|

| Total number of portfolio holdings |

|

|

40 |

|

|

|

| Portfolio turnover (%) |

|

|

11% |

|

|

|

| Holdings [Text Block] |

|

|

| C000162549 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Core Bond Fund (Formerly known as TIAA-CREF Core Bond Fund)

|

|

| Class Name |

Class I Shares (Formerly known as Advisor Class Shares)

|

|

| Trading Symbol |

TIBHX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Class I Shares of the Nuveen Core Bond Fund for the period of April 1, 2024 to September 30, 2024.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class I Shares |

|

$22 |

|

0.42% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 22

|

|

| Expense Ratio, Percent |

0.42%

|

[6] |

| Net Assets |

$ 10,810,418,759

|

|

| Holdings Count | Holding |

2,038

|

|

| Investment Company Portfolio Turnover |

36.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of September 30, 2024)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

10,810,418,759 |

|

|

|

| Total number of portfolio holdings |

|

|

2,038 |

|

|

|

| Portfolio turnover (%) |

|

|

36% |

|

|

|

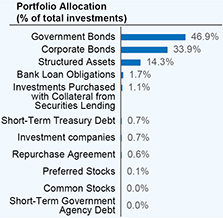

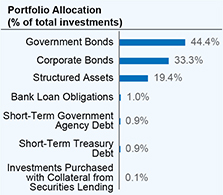

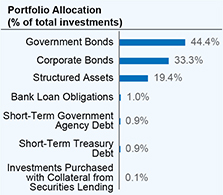

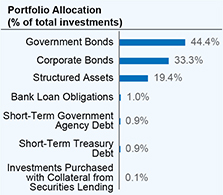

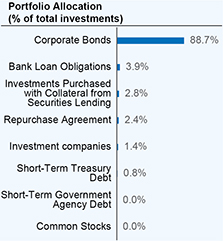

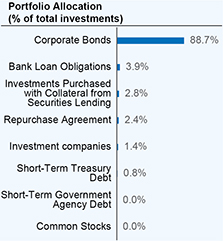

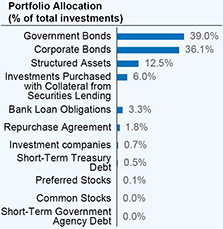

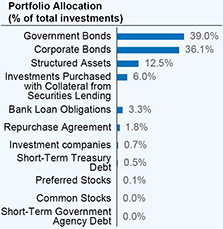

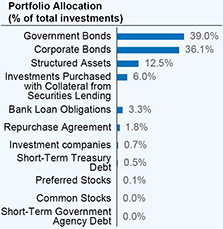

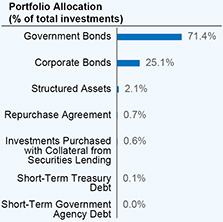

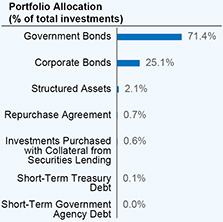

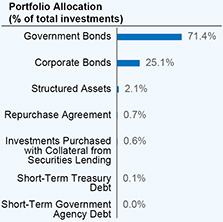

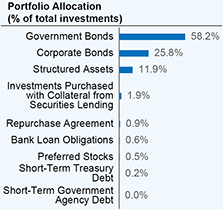

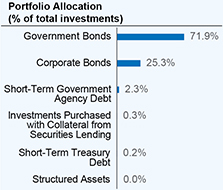

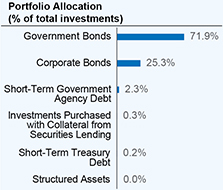

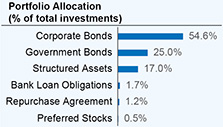

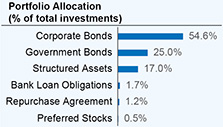

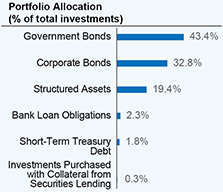

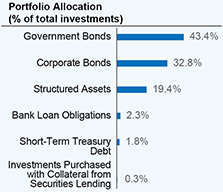

| Holdings [Text Block] |

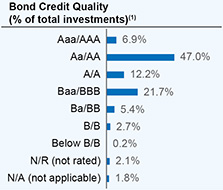

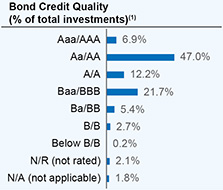

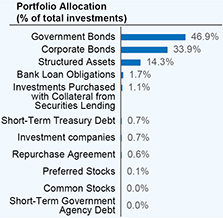

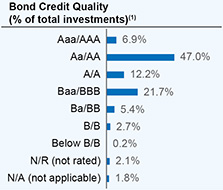

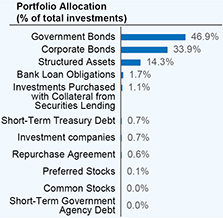

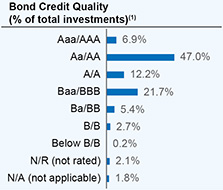

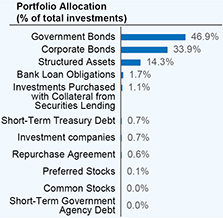

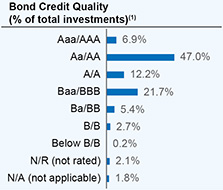

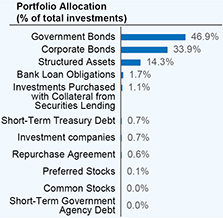

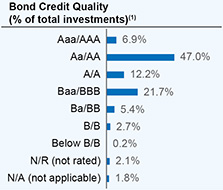

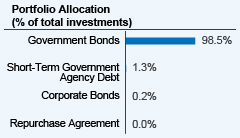

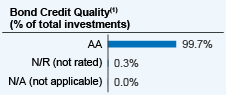

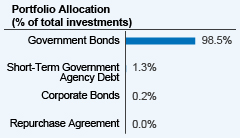

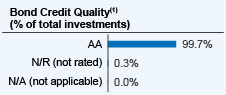

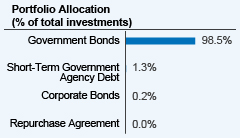

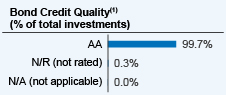

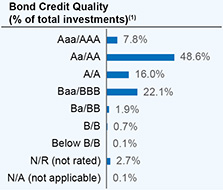

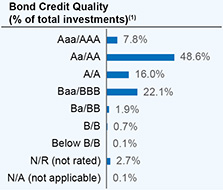

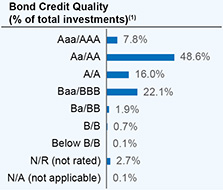

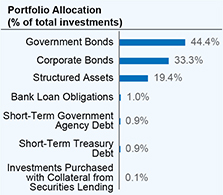

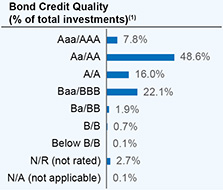

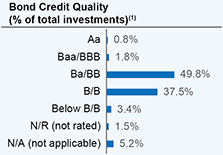

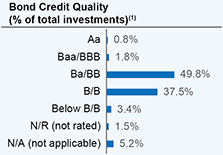

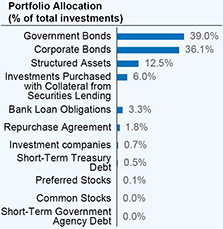

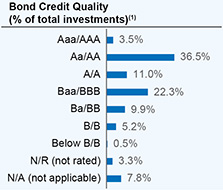

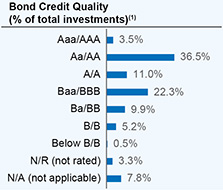

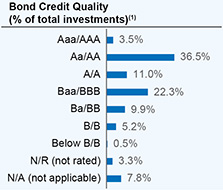

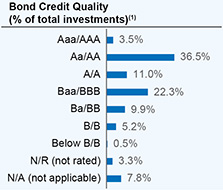

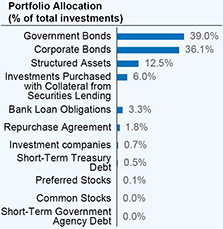

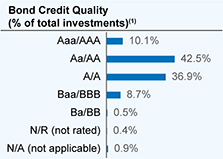

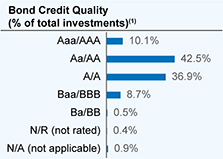

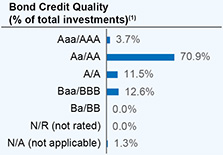

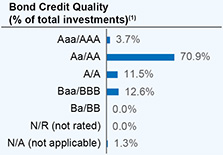

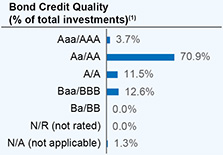

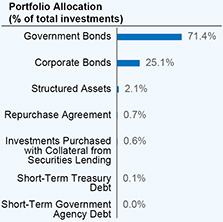

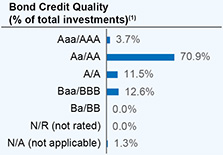

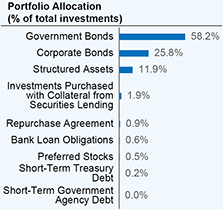

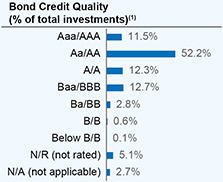

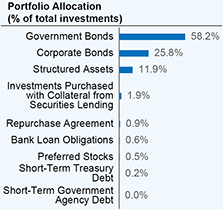

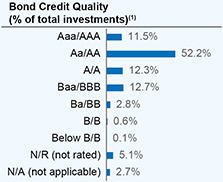

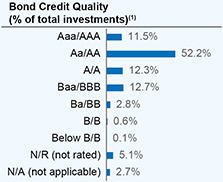

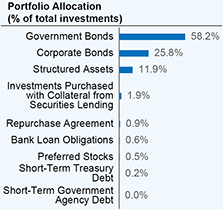

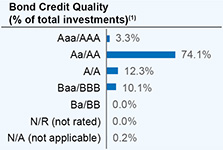

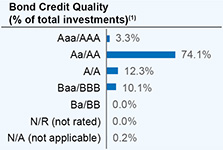

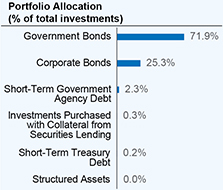

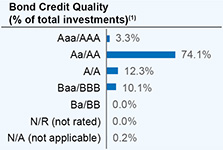

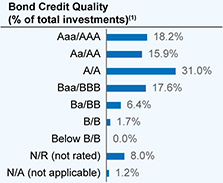

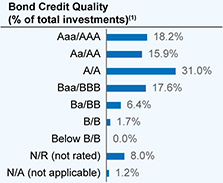

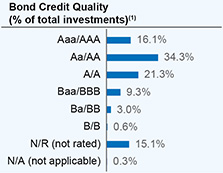

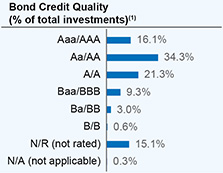

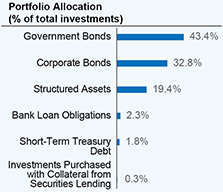

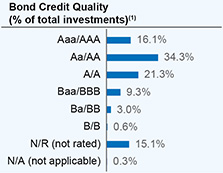

(1) Credit quality ratings are based on the Bloomberg Barclays methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that one is used. These ratings are subject to change without notice.

|

|

| Credit Ratings Selection [Text Block] |

Credit quality ratings are based on the Bloomberg Barclays methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that one is used. These ratings are subject to change without notice.

|

|

| C000033992 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Core Bond Fund (Formerly known as TIAA-CREF Core Bond Fund)

|

|

| Class Name |

Class A Shares (Formerly known as Retail Class Shares)

|

|

| Trading Symbol |

TIORX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Class A Shares of the Nuveen Core Bond Fund for the period of April 1, 2024 to September 30, 2024.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class A Shares |

|

$30 |

|

0.59% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 30

|

|

| Expense Ratio, Percent |

0.59%

|

[7] |

| Net Assets |

$ 10,810,418,759

|

|

| Holdings Count | Holding |

2,038

|

|

| Investment Company Portfolio Turnover |

36.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of September 30, 2024)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

10,810,418,759 |

|

|

|

| Total number of portfolio holdings |

|

|

2,038 |

|

|

|

| Portfolio turnover (%) |

|

|

36% |

|

|

|

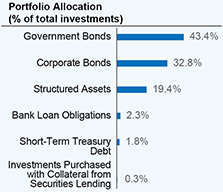

| Holdings [Text Block] |

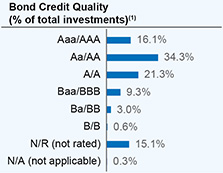

(1) Credit quality ratings are based on the Bloomberg Barclays methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that one is used. These ratings are subject to change without notice.

|

|

| Credit Ratings Selection [Text Block] |

Credit quality ratings are based on the Bloomberg Barclays methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that one is used. These ratings are subject to change without notice.

|

|

| C000079556 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Core Bond Fund (Formerly known as TIAA-CREF Core Bond Fund)

|

|

| Class Name |

Premier Class Shares

|

|

| Trading Symbol |

TIDPX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Premier Class Shares of the Nuveen Core Bond Fund for the period of April 1, 2024 to September 30, 2024.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Premier Class Shares |

|

$23 |

|

0.44% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 23

|

|

| Expense Ratio, Percent |

0.44%

|

[8] |

| Net Assets |

$ 10,810,418,759

|

|

| Holdings Count | Holding |

2,038

|

|

| Investment Company Portfolio Turnover |

36.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of September 30, 2024)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

10,810,418,759 |

|

|

|

| Total number of portfolio holdings |

|

|

2,038 |

|

|

|

| Portfolio turnover (%) |

|

|

36% |

|

|

|

| Holdings [Text Block] |

(1) Credit quality ratings are based on the Bloomberg Barclays methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that one is used. These ratings are subject to change without notice.

|

|

| Credit Ratings Selection [Text Block] |

Credit quality ratings are based on the Bloomberg Barclays methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that one is used. These ratings are subject to change without notice.

|

|

| C000033991 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Core Bond Fund (Formerly known as TIAA-CREF Core Bond Fund)

|

|

| Class Name |

Retirement Class Shares

|

|

| Trading Symbol |

TIDRX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Retirement Class Shares of the Nuveen Core Bond Fund for the period of April 1, 2024 to September 30, 2024.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Retirement Class Shares |

|

$27 |

|

0.53% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 27

|

|

| Expense Ratio, Percent |

0.53%

|

[9] |

| Net Assets |

$ 10,810,418,759

|

|

| Holdings Count | Holding |

2,038

|

|

| Investment Company Portfolio Turnover |

36.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of September 30, 2024)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

10,810,418,759 |

|

|

|

| Total number of portfolio holdings |

|

|

2,038 |

|

|

|

| Portfolio turnover (%) |

|

|

36% |

|

|

|

| Holdings [Text Block] |

(1) Credit quality ratings are based on the Bloomberg Barclays methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that one is used. These ratings are subject to change without notice.

|

|

| Credit Ratings Selection [Text Block] |

Credit quality ratings are based on the Bloomberg Barclays methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that one is used. These ratings are subject to change without notice.

|

|

| C000014635 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Core Bond Fund (Formerly known as TIAA-CREF Core Bond Fund)

|

|

| Class Name |

Class R6 Shares (Formerly known as Institutional Class Shares)

|

|

| Trading Symbol |

TIBDX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Class R6 Shares of the Nuveen Core Bond Fund for the period of April 1, 2024 to September 30, 2024.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class R6 Shares |

|

$15 |

|

0.29% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 15

|

|

| Expense Ratio, Percent |

0.29%

|

[10] |

| Net Assets |

$ 10,810,418,759

|

|

| Holdings Count | Holding |

2,038

|

|

| Investment Company Portfolio Turnover |

36.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of September 30, 2024)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

10,810,418,759 |

|

|

|

| Total number of portfolio holdings |

|

|

2,038 |

|

|

|

| Portfolio turnover (%) |

|

|

36% |

|

|

|

| Holdings [Text Block] |

(1) Credit quality ratings are based on the Bloomberg Barclays methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that one is used. These ratings are subject to change without notice.

|

|

| Credit Ratings Selection [Text Block] |

Credit quality ratings are based on the Bloomberg Barclays methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that one is used. These ratings are subject to change without notice.

|

|

| C000202747 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Core Bond Fund (Formerly known as TIAA-CREF Core Bond Fund)

|

|

| Class Name |

Class W Shares

|

|

| Trading Symbol |

TBBWX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Class W Shares of the Nuveen Core Bond Fund for the period of April 1, 2024 to September 30, 2024.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class W Shares |

|

$– |

|

0.00% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

|

|

| Expense Ratio, Percent |

0.00%

|

[11] |

| Net Assets |

$ 10,810,418,759

|

|

| Holdings Count | Holding |

2,038

|

|

| Investment Company Portfolio Turnover |

36.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of September 30, 2024)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

10,810,418,759 |

|

|

|

| Total number of portfolio holdings |

|

|

2,038 |

|

|

|

| Portfolio turnover (%) |

|

|

36% |

|

|

|

| Holdings [Text Block] |

(1) Credit quality ratings are based on the Bloomberg Barclays methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that one is used. These ratings are subject to change without notice.

|

|

| Credit Ratings Selection [Text Block] |

Credit quality ratings are based on the Bloomberg Barclays methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that one is used. These ratings are subject to change without notice.

|

|

| C000162550 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Inflation Linked Bond Fund (Formerly known as TIAA-CREF Inflation-Linked Bond Fund)

|

|

| Class Name |

Class I Shares (Formerly known as Advisor Class Shares)

|

|

| Trading Symbol |

TIIHX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Class I Shares of the Nuveen Inflation Linked Bond Fund for the period of April 1, 2024 to September 30, 2024.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class I Shares |

|

$18 |

|

0.36% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 18

|

|

| Expense Ratio, Percent |

0.36%

|

[12] |

| Net Assets |

$ 2,983,887,668

|

|

| Holdings Count | Holding |

54

|

|

| Investment Company Portfolio Turnover |

17.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of September 30, 2024)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

2,983,887,668 |

|

|

|

| Total number of portfolio holdings |

|

|

54 |

|

|

|

| Portfolio turnover (%) |

|

|

17% |

|

|

|

| Holdings [Text Block] |

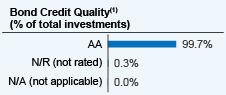

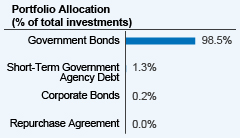

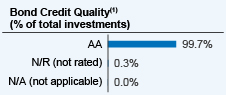

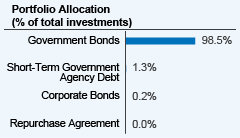

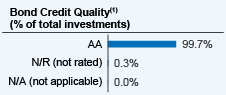

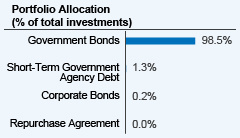

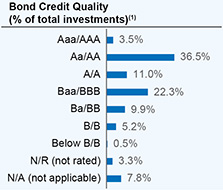

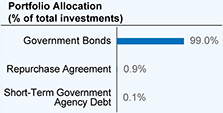

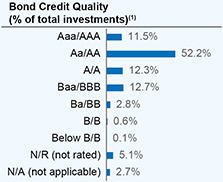

(1) Credit quality ratings are based on the Bloomberg Barclays methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that one is used. These ratings are subject to change without notice.

|

|

| Credit Ratings Selection [Text Block] |

Credit quality ratings are based on the Bloomberg Barclays methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that one is used. These ratings are subject to change without notice.

|

|

| C000014637 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Inflation Linked Bond Fund (Formerly known as TIAA-CREF Inflation-Linked Bond Fund)

|

|

| Class Name |

Class A Shares (Formerly known as Retail Class Shares)

|

|

| Trading Symbol |

TCILX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Class A Shares of the Nuveen Inflation Linked Bond Fund for the period of April 1, 2024 to September 30, 2024.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class A Shares |

|

$29 |

|

0.56% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 29

|

|

| Expense Ratio, Percent |

0.56%

|

[13] |

| Net Assets |

$ 2,983,887,668

|

|

| Holdings Count | Holding |

54

|

|

| Investment Company Portfolio Turnover |

17.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of September 30, 2024)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

2,983,887,668 |

|

|

|

| Total number of portfolio holdings |

|

|

54 |

|

|

|

| Portfolio turnover (%) |

|

|

17% |

|

|

|

| Holdings [Text Block] |

(1) Credit quality ratings are based on the Bloomberg Barclays methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that one is used. These ratings are subject to change without notice.

|

|

| Credit Ratings Selection [Text Block] |

Credit quality ratings are based on the Bloomberg Barclays methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that one is used. These ratings are subject to change without notice.

|

|

| C000079557 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Inflation Linked Bond Fund (Formerly known as TIAA-CREF Inflation-Linked Bond Fund)

|

|

| Class Name |

Premier Class Shares

|

|

| Trading Symbol |

TIKPX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Premier Class Shares of the Nuveen Inflation Linked Bond Fund for the period of April 1, 2024 to September 30, 2024.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Premier Class Shares |

|

$21 |

|

0.41% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 21

|

|

| Expense Ratio, Percent |

0.41%

|

[14] |

| Net Assets |

$ 2,983,887,668

|

|

| Holdings Count | Holding |

54

|

|

| Investment Company Portfolio Turnover |

17.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of September 30, 2024)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

2,983,887,668 |

|

|

|

| Total number of portfolio holdings |

|

|

54 |

|

|

|

| Portfolio turnover (%) |

|

|

17% |

|

|

|

| Holdings [Text Block] |

(1) Credit quality ratings are based on the Bloomberg Barclays methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that one is used. These ratings are subject to change without notice.

|

|

| Credit Ratings Selection [Text Block] |

Credit quality ratings are based on the Bloomberg Barclays methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that one is used. These ratings are subject to change without notice.

|

|

| C000033993 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Inflation Linked Bond Fund (Formerly known as TIAA-CREF Inflation-Linked Bond Fund)

|

|

| Class Name |

Retirement Class Shares

|

|

| Trading Symbol |

TIKRX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Retirement Class Shares of the Nuveen Inflation Linked Bond Fund for the period of April 1, 2024 to September 30, 2024.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Retirement Class Shares |

|

$26 |

|

0.50% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 26

|

|

| Expense Ratio, Percent |

0.50%

|

[15] |

| Net Assets |

$ 2,983,887,668

|

|

| Holdings Count | Holding |

54

|

|

| Investment Company Portfolio Turnover |

17.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of September 30, 2024)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

2,983,887,668 |

|

|

|

| Total number of portfolio holdings |

|

|

54 |

|

|

|

| Portfolio turnover (%) |

|

|

17% |

|

|

|

| Holdings [Text Block] |

(1) Credit quality ratings are based on the Bloomberg Barclays methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that oneis used. These ratings are subject to change without notice.

|

|

| Credit Ratings Selection [Text Block] |

Credit quality ratings are based on the Bloomberg Barclays methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that oneis used. These ratings are subject to change without notice.

|

|

| C000014636 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Inflation Linked Bond Fund (Formerly known as TIAA-CREF Inflation-Linked Bond Fund)

|

|

| Class Name |

Class R6 Shares (Formerly known as Institutional Class Shares)

|

|

| Trading Symbol |

TIILX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Class R6 Shares of the Nuveen Inflation Linked Bond Fund for the period of April 1, 2024 to September 30, 2024.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class R6 Shares |

|

$13 |

|

0.25% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 13

|

|

| Expense Ratio, Percent |

0.25%

|

[16] |

| Net Assets |

$ 2,983,887,668

|

|

| Holdings Count | Holding |

54

|

|

| Investment Company Portfolio Turnover |

17.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of September 30, 2024)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

2,983,887,668 |

|

|

|

| Total number of portfolio holdings |

|

|

54 |

|

|

|

| Portfolio turnover (%) |

|

|

17% |

|

|

|

| Holdings [Text Block] |

(1) Credit quality ratings are based on the Bloomberg Barclays methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that one is used. These ratings are subject to change without notice.

|

|

| Credit Ratings Selection [Text Block] |

Credit quality ratings are based on the Bloomberg Barclays methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that one is used. These ratings are subject to change without notice.

|

|

| C000202748 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Inflation Linked Bond Fund (Formerly known as TIAA-CREF Inflation-Linked Bond Fund)

|

|

| Class Name |

Class W Shares

|

|

| Trading Symbol |

TIIWX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Class W Shares of the Nuveen Inflation Linked Bond Fund for the period of April 1, 2024 to September 30, 2024.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class W Shares |

|

$– |

|

0.00% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

|

|

| Expense Ratio, Percent |

0.00%

|

[17] |

| Net Assets |

$ 2,983,887,668

|

|

| Holdings Count | Holding |

54

|

|

| Investment Company Portfolio Turnover |

17.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of September 30, 2024)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

2,983,887,668 |

|

|

|

| Total number of portfolio holdings |

|

|

54 |

|

|

|

| Portfolio turnover (%) |

|

|

17% |

|

|

|

| Holdings [Text Block] |

(1) Credit quality ratings are based on the Bloomberg Barclays methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that one is used. These ratings are subject to change without notice.

|

|

| Credit Ratings Selection [Text Block] |

Credit quality ratings are based on the Bloomberg Barclays methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that one is used. These ratings are subject to change without notice.

|

|

| C000162551 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Money Market Fund (Formerly known as TIAA-CREF Money Market Fund)

|

|

| Class Name |

Class I Shares (Formerly known as Advisor Class Shares)

|

|

| Trading Symbol |

TMHXX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Class I Shares of the Nuveen Money Market Fund for the period of April 1, 2024 to September 30, 2024.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of $10,000 investment* |

| |

|

|

| Class I Shares |

|

$8 |

|

0.16% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 8

|

|

| Expense Ratio, Percent |

0.16%

|

[18] |

| Net Assets |

$ 2,101,093,971

|

|

| Holdings Count | Holding |

86

|

|

| Investment Company Portfolio Turnover |

0.00%

|

|

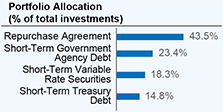

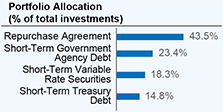

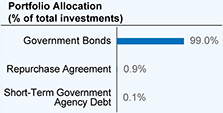

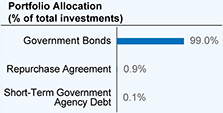

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of September 30, 2024)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

2,101,093,971 |

|

|

|

| Total number of portfolio holdings |

|

|

86 |

|

|

|

| Portfolio turnover (%) |

|

|

0% |

|

|

|

| Holdings [Text Block] |

|

|

| C000033995 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Money Market Fund (Formerly known as TIAA-CREF Money Market Fund)

|

|

| Class Name |

Class A Shares (Formerly known as Retail Class Shares)

|

|

| Trading Symbol |

TIRXX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Class A Shares of the Nuveen Money Market Fund for the period of April 1, 2024 to September 30, 2024.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class A Shares |

|

$23 |

|

0.46% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 23

|

|

| Expense Ratio, Percent |

0.46%

|

[19] |

| Net Assets |

$ 2,101,093,971

|

|

| Holdings Count | Holding |

86

|

|

| Investment Company Portfolio Turnover |

0.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of September 30, 2024)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

2,101,093,971 |

|

|

|

| Total number of portfolio holdings |

|

|

86 |

|

|

|

| Portfolio turnover (%) |

|

|

0% |

|

|

|

| Holdings [Text Block] |

|

|

| C000079558 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Money Market Fund (Formerly known as TIAA-CREF Money Market Fund)

|

|

| Class Name |

Premier Class Shares

|

|

| Trading Symbol |

TPPXX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Premier Class Shares of the Nuveen Money Market Fund for the period of April 1, 2024 to September 30, 2024.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Premier Class Shares |

|

$14 |

|

0.27% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 14

|

|

| Expense Ratio, Percent |

0.27%

|

[20] |

| Net Assets |

$ 2,101,093,971

|

|

| Holdings Count | Holding |

86

|

|

| Investment Company Portfolio Turnover |

0.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of September 30, 2024)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

2,101,093,971 |

|

|

|

| Total number of portfolio holdings |

|

|

86 |

|

|

|

| Portfolio turnover (%) |

|

|

0% |

|

|

|

| Holdings [Text Block] |

|

|

| C000033994 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Money Market Fund (Formerly known as TIAA-CREF Money Market Fund)

|

|

| Class Name |

Retirement Class Shares

|

|

| Trading Symbol |

TIEXX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Retirement Class Shares of the Nuveen Money Market Fund for the period of April 1, 2024 to September 30, 2024.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Retirement Class Shares |

|

$19 |

|

0.37% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 19

|

|

| Expense Ratio, Percent |

0.37%

|

[21] |

| Net Assets |

$ 2,101,093,971

|

|

| Holdings Count | Holding |

86

|

|

| Investment Company Portfolio Turnover |

0.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of September 30, 2024)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

2,101,093,971 |

|

|

|

| Total number of portfolio holdings |

|

|

86 |

|

|

|

| Portfolio turnover (%) |

|

|

0% |

|

|

|

| Holdings [Text Block] |

|

|

| C000014638 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Money Market Fund (Formerly known as TIAA-CREF Money Market Fund)

|

|

| Class Name |

Class R6 Shares (Formerly known as Institutional Class Shares)

|

|

| Trading Symbol |

TCIXX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Class R6 Shares of the Nuveen Money Market Fund for the period of April 1, 2024 to September 30, 2024.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class R6 Shares |

|

$6 |

|

0.12% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 6

|

|

| Expense Ratio, Percent |

0.12%

|

[22] |

| Net Assets |

$ 2,101,093,971

|

|

| Holdings Count | Holding |

86

|

|

| Investment Company Portfolio Turnover |

0.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of September 30, 2024)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

2,101,093,971 |

|

|

|

| Total number of portfolio holdings |

|

|

86 |

|

|

|

| Portfolio turnover (%) |

|

|

0% |

|

|

|

| Holdings [Text Block] |

|

|

| C000162566 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Short Term Bond Fund (Formerly known as TIAA-CREF Short-Term Bond Fund)

|

|

| Class Name |

Class I Shares (Formerly known as Advisor Class Shares)

|

|

| Trading Symbol |

TCTHX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Class I Shares of the Nuveen Short Term Bond Fund for the period of April 1, 2024 to September 30, 2024.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class I Shares |

|

$18 |

|

0.36% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 18

|

|

| Expense Ratio, Percent |

0.36%

|

[23] |

| Net Assets |

$ 1,866,831,987

|

|

| Holdings Count | Holding |

305

|

|

| Investment Company Portfolio Turnover |

88.00%

|

|

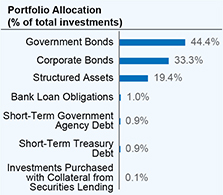

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of September 30, 2024)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

1,866,831,987 |

|

|

|

| Total number of portfolio holdings |

|

|

305 |

|

|

|

| Portfolio turnover (%) |

|

|

88% |

|

|

|

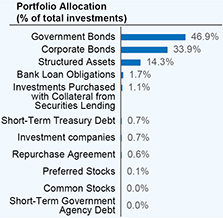

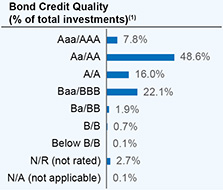

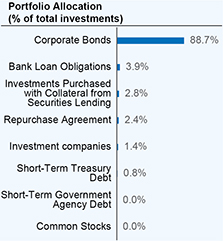

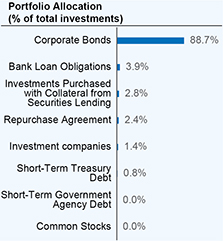

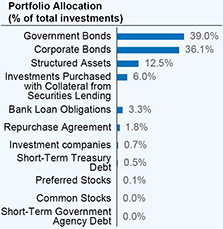

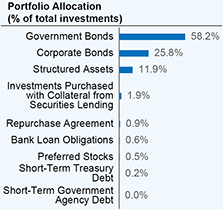

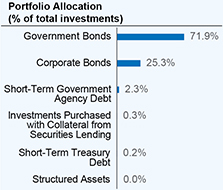

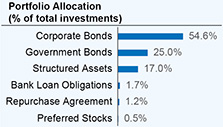

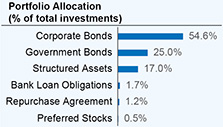

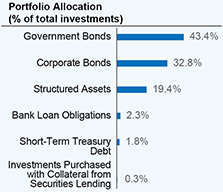

| Holdings [Text Block] |

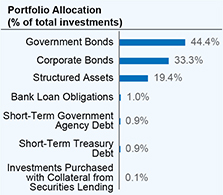

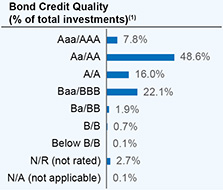

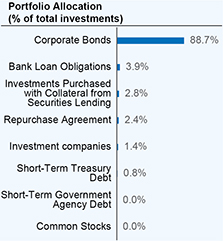

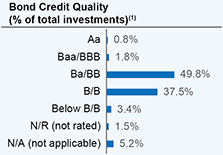

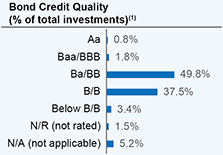

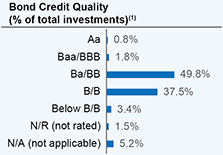

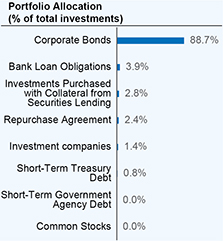

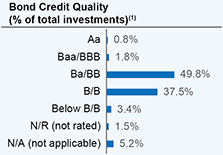

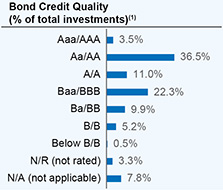

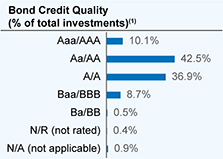

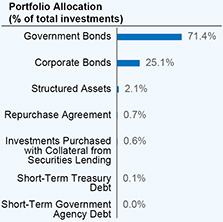

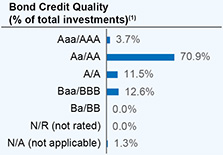

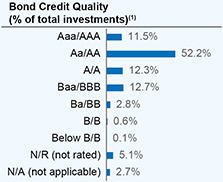

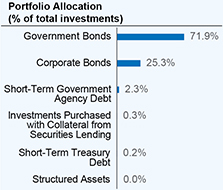

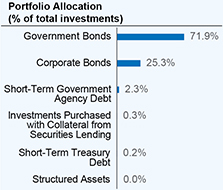

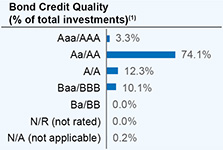

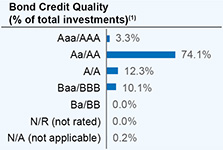

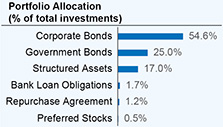

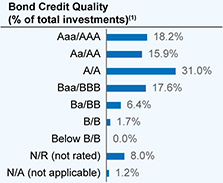

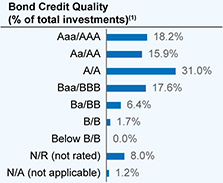

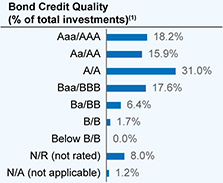

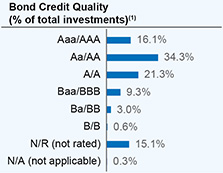

(1) Credit quality ratings are based on the Bloomberg Barclays methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that one is used. These ratings are subject to change without notice.

|

|

| Credit Ratings Selection [Text Block] |

Credit quality ratings are based on the Bloomberg Barclays methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that one is used. These ratings are subject to change without notice.

|

|

| C000033274 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Short Term Bond Fund (Formerly known as TIAA-CREF Short-Term Bond Fund)

|

|

| Class Name |

Class A Shares (Formerly known as Retail Class Shares)

|

|

| Trading Symbol |

TCTRX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Class A Shares of the Nuveen Short Term Bond Fund for the period of April 1, 2024 to September 30, 2024.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class A Shares |

|

$30 |

|

0.58% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 30

|

|

| Expense Ratio, Percent |

0.58%

|

[24] |

| Net Assets |

$ 1,866,831,987

|

|

| Holdings Count | Holding |

305

|

|

| Investment Company Portfolio Turnover |

88.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of September 30, 2024)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

1,866,831,987 |

|

|

|

| Total number of portfolio holdings |

|

|

305 |

|

|

|

| Portfolio turnover (%) |

|

|

88% |

|

|

|

| Holdings [Text Block] |

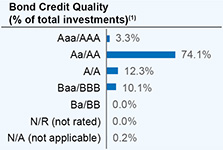

(1) Credit quality ratings are based on the Bloomberg Barclays methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that one is used. These ratings are subject to change without notice.

|

|

| Credit Ratings Selection [Text Block] |

Credit quality ratings are based on the Bloomberg Barclays methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that one is used. These ratings are subject to change without notice.

|

|

| C000079571 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Short Term Bond Fund (Formerly known as TIAA-CREF Short-Term Bond Fund)

|

|

| Class Name |

Premier Class Shares

|

|

| Trading Symbol |

TSTPX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Premier Class Shares of the Nuveen Short Term Bond Fund for the period of April 1, 2024 to September 30, 2024.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Premier Class Shares |

|

$21 |

|

0.42% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 21

|

|

| Expense Ratio, Percent |

0.42%

|

[25] |

| Net Assets |

$ 1,866,831,987

|

|

| Holdings Count | Holding |

305

|

|

| Investment Company Portfolio Turnover |

88.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of September 30, 2024)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

1,866,831,987 |

|

|

|

| Total number of portfolio holdings |

|

|

305 |

|

|

|

| Portfolio turnover (%) |

|

|

88% |

|

|

|

| Holdings [Text Block] |

(1) Credit quality ratings are based on the Bloomberg Barclays methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that one is used. These ratings are subject to change without notice.

|

|

| Credit Ratings Selection [Text Block] |

Credit quality ratings are based on the Bloomberg Barclays methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that one is used. These ratings are subject to change without notice.

|

|

| C000033275 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Short Term Bond Fund (Formerly known as TIAA-CREF Short-Term Bond Fund)

|

|

| Class Name |

Retirement Class Shares

|

|

| Trading Symbol |

TISRX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Retirement Class Shares of the Nuveen Short Term Bond Fund for the period of April 1, 2024 to September 30, 2024.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Retirement Class Shares |

|

$26 |

|

0.51% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 26

|

|

| Expense Ratio, Percent |

0.51%

|

[26] |

| Net Assets |

$ 1,866,831,987

|

|

| Holdings Count | Holding |

305

|

|

| Investment Company Portfolio Turnover |

88.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of September 30, 2024)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

1,866,831,987 |

|

|

|

| Total number of portfolio holdings |

|

|

305 |

|

|

|

| Portfolio turnover (%) |

|

|

88% |

|

|

|

| Holdings [Text Block] |

(1) Credit quality ratings are based on the Bloomberg Barclays methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that one is used. These ratings are subject to change without notice.

|

|

| Credit Ratings Selection [Text Block] |

Credit quality ratings are based on the Bloomberg Barclays methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that one is used. These ratings are subject to change without notice.

|

|

| C000033276 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Short Term Bond Fund (Formerly known as TIAA-CREF Short-Term Bond Fund)

|

|

| Class Name |

Class R6 Shares (Formerly known as Institutional Class Shares)

|

|

| Trading Symbol |

TISIX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Class R6 Shares of the Nuveen Short Term Bond Fund for the period of April 1, 2024 to September 30, 2024.

|

|