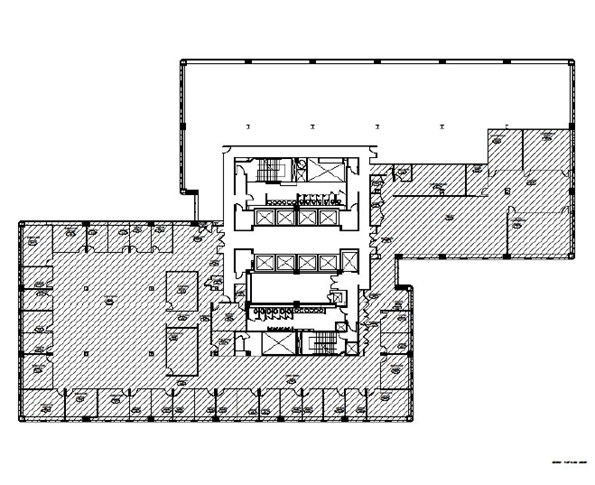

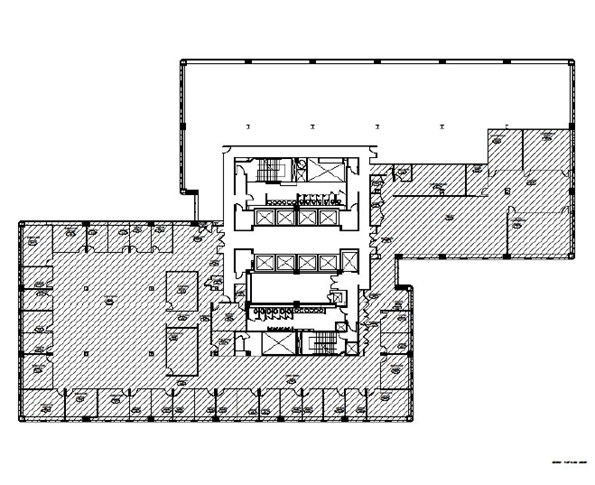

EXHIBIT A

The Premises

A-1

Exhibit 10.1

EXECUTION

AGREEMENT OF LEASE

Between

400 ATLANTIC JOINT VENTURE LLC AND

SLJ ATLANTIC STAMFORD LLC (tenants-in-common)

as Landlord

- and -

CARA THERAPEUTICS, INC.,

as Tenant

400 ATLANTIC STREET,

STAMFORD, CONNECTICUT

Dated as of May 11, 2023

TABLE OF CONTENTS

| Page | |

| ||

ARTICLE 1 | DEFINITIONS | 1 |

ARTICLE 2 | DEMISE; PREMISES; TERM; RENEWAL OPTION | 4 |

ARTICLE 3 | AS-IS CONDITION OF THE PREMISES | 6 |

ARTICLE 4 | RENT | 9 |

ARTICLE 5 | USE | 10 |

ARTICLE 6 | ESCALATIONS | 13 |

ARTICLE 7 | INSURANCE | 22 |

ARTICLE 8 | COMPLIANCE WITH LAWS | 25 |

ARTICLE 9 | ALTERATIONS; IMPROVEMENTS | 25 |

ARTICLE 10 | REPAIRS | 29 |

ARTICLE 11 | UTILITIES AND SERVICES | 30 |

ARTICLE 12 | DAMAGE TO OR DESTRUCTION OF THE PREMISES | 35 |

ARTICLE 13 | EMINENT DOMAIN | 37 |

ARTICLE 14 | DEFAULT | 38 |

ARTICLE 15 | LANDLORD REMEDIES | 40 |

ARTICLE 16 | CURING TENANT’S DEFAULTS; FEES AND EXPENSES | 42 |

ARTICLE 17 | NON-LIABILITY AND INDEMNIFICATION | 42 |

ARTICLE 18 | SURRENDER | 44 |

ARTICLE 19 | ASSIGNMENT, MORTGAGING AND SUBLETTING | 45 |

ARTICLE 20 | SUBORDINATION AND ATTORNMENT | 49 |

ARTICLE 21 | ACCESS; CHANGE IN FACILITIES | 51 |

ARTICLE 22 | INABILITY TO PERFORM | 52 |

ARTICLE 23 | WAIVER | 53 |

ARTICLE 24 | NO OTHER WAIVER | 53 |

ARTICLE 25 | ARBITRATION | 54 |

ARTICLE 26 | QUIET ENJOYMENT | 54 |

ARTICLE 27 | RULES AND REGULATIONS | 54 |

ARTICLE 28 | SHORING | 55 |

ARTICLE 29 | NOTICE OF ACCIDENTS | 55 |

ARTICLE 30 | BROKERAGE | 56 |

-i-

ARTICLE 31 | WINDOW CLEANING | 56 |

ARTICLE 32 | NOTICES | 56 |

ARTICLE 33 | ESTOPPEL CERTIFICATE; MEMORANDUM | 57 |

ARTICLE 34 | SECURITY DEPOSIT | 57 |

ARTICLE 35 | PARTIES BOUND | 59 |

ARTICLE 36 | RIGHT OF FIRST OFFER | 60 |

ARTICLE 37 | AMENITIES | 61 |

ARTICLE 38 | ENTIRE AGREEMENT; NO OTHER REPRESENTATIONS; GOVERNING LAW; SEPARABILITY | 61 |

ARTICLE 39 | TENANT ROOF RIGHTS | 62 |

ARTICLE 40 | TENANT’S OPTION TO TERMINATE | 64 |

ARTICLE 41 | NO RELOCATION | 65 |

ARTICLE 42 | CONFIDENTIALITY | 65 |

ARTICLE 43 | LOBBY AND ACCESS WORK | 66 |

EXHIBITS

EXHIBIT A | The Premises |

EXHIBIT B | The Land |

EXHIBIT C | Rules and Regulations |

EXHIBIT D | Cleaning Specifications |

EXHIBIT E | HVAC Specifications |

EXHIBIT F | Landlord's Base Building Work |

EXHIBIT G | Tenant's Work Letter |

EXHIBIT H | Intentionally Omitted |

EXHIBIT I | Form of Letter of Credit |

-ii-

THIS AGREEMENT OF LEASE (this “Lease”), is dated as of May 11, 2023 (“Effective Date”), between 400 ATLANTIC JOINT VENTURE LLC AND SLJ ATLANTIC STAMFORD LLC (tenants-in-common), each a Delaware limited liability company, with an office at c/o George Comfort & Sons, Inc., 200 Madison Avenue, New York, New York 10016 (“Landlord”), and CARA THERAPEUTICS, INC., a Delaware corporation, with an office at 4 Stamford Plaza, 107 Elm Street, 9th Floor, Stamford, Connecticut 06902 (“Tenant”).

WI T N E S S E T H:

Landlord and Tenant hereby covenant and agree as follows:

ARTICLE 1

Definitions

Section 1.01.Definitions. For the purposes of this Lease, unless the context otherwise requires:

(a)“Alterations” shall mean alterations, installments, improvements, additions or other changes (other than temporary partition walls and decorations), in the Premises (hereinafter defined), or, to the extent expressly permitted pursuant to the terms of this Lease, outside of the Premises, including, without limitation, Tenant’s Alterations (hereinafter defined).

(b)“Building” shall mean, collectively, the building(s) and improvements constituting the office complex located at and known as 400 Atlantic Street, Stamford, Connecticut.

(c)“Building Common Areas” shall mean all of the non-rentable areas in the interior and exterior of the Building designated by Landlord as available in common for or for the common benefit of, the tenants of the Building, including, without limitation, restrooms on multitenant floors, fire stairs, common space on the ground floor of the Building (the “Plaza”), any common loading docks, and the Garage.

(d)“Building Systems” shall mean the base Building mechanical, gas, electrical, sanitary, heating, air-conditioning, ventilating, elevator, plumbing, life-safety, roof and balcony drainage and other service systems of the Building (other than any horizontal distribution of the Building Systems within and exclusively serving the Premises following the main point of connection thereof).

(e)“City” shall mean Stamford, Connecticut.

(f)“Complex” shall mean the office building(s) and the related facilities, parking areas, interconnected garages, terraces and roadways and any other improvements constructed on the Land and currently known as and having an address at 400 Atlantic Street, Stamford, Connecticut. Landlord and Tenant have agreed that for the purpose of this Lease, as of the date hereof, the rentable square footage of the Complex is deemed to be 491,420 rentable square feet. Said Complex rentable square footage shall be subject to change, from time to time, based solely on any actual, physical additions or deletions of rentable square footage to the Complex, or pursuant to the terms of this Lease.

1

(g)“Complex Common Areas” shall mean all of the areas in and around the building(s) comprising the Complex which are designated by Landlord as being available for common use by or the common benefit of all tenants of the Complex, subject to such commercially reasonable access restrictions which Landlord may impose, including, without limitation, the Complex Garages (hereinafter defined); any exterior parking areas located at and being a part of the Complex; any Complex common parking spaces; any Complex annexes and/or common terraces; landscaped areas of the Land; any Complex common loading and unloading areas; any common facilities which are designated for the use of tenants of the Complex; and the Land and the roadways and sidewalks located adjacent to the building(s) in the Complex.

(h)“Complex Garages” shall mean all of the motor vehicle parking garages which are located adjacent to the building(s) comprising the Complex.

(i)“Control” shall mean ownership of more than fifty percent (50%) of the outstanding voting stock of a corporation or other majority equity and/or control interest if not a corporation and/or the possession of power to direct or cause the direction of the management and policy of such corporation or other entity, whether through the ownership of voting securities or interests or by statute.

(j)“Environmental Laws” shall mean all applicable Federal, state, county, and local statutes, laws, regulations, rules, ordinances, codes, standards, guidelines, orders, licenses and permits of any Governmental Authorities relating to environmental, health or safety matters, including by way of illustration and not by way of limitation, the Clean Air Act, the Federal Water Pollution Control Act of 1972, the Solid Waste Disposal Act of 1970, the Comprehensive Environmental Response, Compensation and Liability Act of 1980, the Resource Conservation and Recovery Act of 1970, the Comprehensive Environmental Response, Compensation and Liability Act of 1980, the Toxic Substances Control Act and any state and local equivalents of all for the preceding laws, including, but not limited to Connecticut General Statutes §22a-1 et seq., including any amendments or extensions thereof and all future similar statutes, laws, rules, regulations, and directives and any rules, regulations, standards or guidelines issued pursuant to any of said Environmental Laws.

(k)“Garage” shall mean that portion of the Complex Garages located directly under and around the Building.

(l)“Governmental Authorities” or a “Governmental Authority” shall mean any federal, state, county, municipal or local government or any quasi-governmental authority, now or hereafter created and all departments, commissions, boards, bureaus and offices thereof having or claiming jurisdiction over the Building or Complex or any portion thereof.

(m)“Hazardous Materials” shall mean any hazardous or toxic chemical, waste, byproduct, pollutant, contaminant, compound, product or substance, including, without limitation, asbestos, polychlorinated biphenyl’s, lead, petroleum (including crude oil or any fraction thereof), and any material the exposure to, or manufacture, possession, presence, use, generation, storage, transportation, treatment, release, disposal, abatement, cleanup, removal, remediation or handling of which is now, or may in the future be, prohibited, controlled or regulated by any of the Environmental Laws.

2

(n)“Land” shall mean the parcel or parcels of land situated in the County of Fairfield, State of Connecticut and the City upon which the Complex stands.

(o)“Lease Year” shall mean every period of twelve (12) consecutive months during the Term of this Lease commencing on the Rent Commencement Date (as hereinafter defined), provided that if the Rent Commencement Date does not occur on the first day of a month, then the first Lease Year shall commence on the Rent Commencement Date and end on the last day of the month in which shall occur the day immediately preceding the first anniversary of the Rent Commencement Date and provided further that the last Lease Year shall end on the Expiration Date (as hereinafter defined).

(p)“Requirements” shall mean all present and future laws, rules, orders, ordinances, regulations, statutes, requirements, codes and executive orders, extraordinary as well as ordinary, of all Governmental Authorities now existing or hereafter created, and of any and all of their departments and bureaus affecting the Complex or any portion thereof, or any street, avenue or sidewalk comprising a part of or in front thereof.

(q)“Superior Lease” shall mean any and all ground or underlying leases of the Land, Complex or the Building and all renewals, extensions, supplements, amendments and modifications thereof.

(r)“Superior Mortgages” shall mean any trust indenture or mortgage which may now or hereafter affect the Land, the Complex or the Building or any Superior Lease and the leasehold interest created thereby or any condominium declaration or similar common interest ownership structure, and all renewals, extensions, supplements, amendments, modifications, consolidations and replacements thereof or thereto, substitutions therefor and advances made thereunder.

(s)“Tenant’s Alterations” shall mean the fit-up improvements and Alterations made by Tenant to the Premises, excluding Tenant’s Property, during the Term of this Lease, including, without limitation, improvements to the First Offer Space (as hereinafter defined), if any.

(t)“Tenant’s Property” shall mean Tenant’s (i) moveable trade fixtures and partitions, (ii) telephones, computers, printers and other business office machines, and (iii) furniture, furnishings, work stations, decorations and other items of moveable personal property.

(u)“Unavoidable Delays” shall mean any and all delays beyond the reasonable control of a party, including, without limitation, delays caused by the other party hereto, governmental restrictions, governmental regulations, governmental controls, order of civil, military or naval authority, governmental preemption, governmental mandated pandemic shut-downs, strikes, labor disputes, lock-outs, shortage of labor materials, inability to obtain materials or reasonable substitutes therefor, default of any building or construction contractor or subcontractor, Acts of God, pandemics, epidemics, fire, earthquake, floods, explosions, actions of the elements, extreme weather conditions, enemy action, civil commotion, riot or insurrection, fire or other unavoidable casualty or any other cause beyond such party’s reasonable control. Notwithstanding the foregoing, (i) lack of funds shall not be deemed a cause beyond either party’s

3

reasonable control, and (ii) the provisions of this Section 1.01(u) shall not excuse Tenant from its obligation to pay Fixed Rent and/or Additional Rent as and when due hereunder, nor Landlord from its obligation to reimburse Tenant any funds or make any other payments due hereunder.

ARTICLE 2

Demise; Premises; Term; Renewal Option

Section 2.01.Demise; Premises; Term. Landlord hereby leases to Tenant, and Tenant hereby hires from Landlord, the interior rentable area located on the fifth (5th) floor of the Building, as more particularly outlined on Exhibit A attached hereto and made a part hereof (the “Premises”), in the Building situated on a portion of the Land as more particularly described on Exhibit B attached hereto and made a part hereof, for the Term hereinafter stated, and for the rents, covenants and conditions (including limitations, restrictions and reservations) hereinafter provided.

Section 2.02.Rentable Area. Landlord and Tenant hereby stipulate that, as of the date hereof, the rentable square footage of the Premises shall be deemed to be 26,374 rentable square feet (“Tenant’s Area”). Such Premises rentable area shall be subject to change, from time to time, based solely on any actual, physical additions or deletions of rentable square footage to the Premises pursuant to the terms of this Lease (including Articles 12, 13, or 36) or by written agreement between the parties.

Section 2.03.Term. The Premises are leased for a term (the “Term”) of approximately eleven (11) years, commencing on the earlier to occur of (a) the date that Tenant first occupies the Premises for the regular conduct of its business therein, and (b) the date Landlord delivers the Premises to Tenant in the condition required hereunder with Landlord’s Critical Path Work substantially completed, provided that such date shall be no sooner than November 1, 2023 (the “Commencement Date”), and expiring at 11:59 p.m. (Eastern Time) on the last day of the calendar month in which occurs the tenth (10th) anniversary of the Rent Commencement Date (the “Expiration Date”), unless the Term shall sooner terminate pursuant to any of the terms, covenants or conditions of this Lease or pursuant to law. If Tenant validly exercises any option to renew pursuant to the terms of this Lease, the Term shall include any such exercised renewal period. Upon substantial completion of Landlord’s Critical Path Work, the Premises shall be turned over to Tenant in the following condition (the “Delivery Condition”): vacant, broom-clean condition, ready for Tenant to commence Tenant’s Work, fully demised, utilities separately metered, with all construction debris removed.

Section 2.04.Inability to Deliver Premises. If Landlord fails to substantially complete Landlord’s Critical Path Work on or prior to any target substantial completion date, this Lease shall not be void or voidable, nor shall Landlord be liable for any damages or penalties in connection therewith, except as expressly set forth herein. Notwithstanding the foregoing and provided that Tenant has received all permits necessary to begin construction of Tenant’s Work on or before the date Landlord actually substantially competes Landlord’s Critical Path Work: (i) subject to any Tenant Delays and Unavoidable Delays, if Landlord does not substantially complete Landlord’s Critical Path Work on or before June 30, 2023, then Tenant shall be entitled to a credit, in the amount of one and one-half (1.5) days of Base Rent for every day after such date that Landlord has not so substantially completed Landlord’s Critical Path Work, and, subject to any

4

Tenant Delays and Unavoidable Delays, if Landlord does not substantially complete Landlord’s Critical Path Work on or before August 31, 2023, then Tenant shall have the right to terminate the Lease by providing ten (10) Business Days’ prior written notice of termination within ten (10) Business Days after such date (time being of the essence), provided that if Landlord substantially completes Landlord’s Critical Path Work prior to the expiration of such ten (10) Business Day period, then such termination notice shall be deemed null and void and of no further force or effect, and (ii) subject to any Tenant Delays and Unavoidable Delays, if Landlord does not substantially complete Landlord’s Base Building Work on or before October 31, 2023, then Tenant shall be entitled to a credit, in the amount of one and one half (1.5) days of Base Rent for every day after such date that Landlord has not so substantially completed Landlord’s Base Building Work.

Section 2.05.Option to Renew. Landlord hereby grants to Tenant and Tenant shall have the option (the “Option”) to extend the Term of this Lease for one (1) five (5) year period (the “Extended Term”) after the Expiration Date, subject to and in accordance with all of the following terms and conditions:

(a)Tenant shall exercise the Option by giving written notice to Landlord at least twelve (12) months prior to the Expiration Date, time being of the essence;

(b)The Extended Term shall be under the then applicable terms and conditions contained in this Lease, except that the annual Fixed Rent shall be at the annual fair market rental rate (as hereinafter defined) of the Premises as of the Expiration Date;

(c)Tenant shall not be in default of any terms and/or conditions of this Lease beyond any applicable notice and cure periods;

(d)Tenant’s failure to give Landlord written notice exercising the Option to extend within the stipulated time shall result in the automatic forfeiture of the Option. Landlord shall have no obligation to solicit such notice, or to remind Tenant of its obligations hereunder;

(e)Except as modified herein, all terms and conditions applicable as of the Expiration Date of this Lease shall be in full force and effect during the Extended Term without any further options to extend; and

(f)The Option to extend is offered exclusively to the named Tenant herein (i.e., Cara Therapeutics, Inc.) and may not be assigned, pledged or otherwise transferred (except pursuant to a permitted assignment of the Tenant’s leasehold to related or affiliated companies as defined in and pursuant to Article 19 of this Lease).

(g)The “annual fair market rental rate” for the Extended Term shall be determined as follows: Upon Landlord’s receipt of Tenant’s timely notice of Tenant’s exercise of the Option, and commencing on or about the date which is eleven (11) months before the end of the Lease Term, Landlord shall deliver to Tenant, in writing, Landlord’s good faith determination of the then annual fair market rental rate of the Premises as of the Expiration Date, which shall be based on the annual fair market rental rate for comparable, first-class commercial office space (including any available in the Complex) on comparable renewal terms and conditions in the Complex or in the Stamford, Connecticut commercial office rental market. Tenant shall have ten (10) Business Days following receipt of Landlord’s determination to either accept or reject same,

5

by written notice given to Landlord, time being of the essence. If the parties are unable to so agree on the annual fair market rental rate for the Extended Term, then such figure shall be determined as follows: Each party shall, within ten (10) Business Days after the expiration of such ten (10) Business Day period, appoint a reputable, independent, commercial MAI appraiser, commercial real estate broker, commercial real estate appraiser or commercial real estate consultant, which, as to any such selected party, has had not less than ten (10) years’ experience appraising and/or leasing comparable, first-class commercial premises in the Stamford, Connecticut, area (an “advisor”). The advisor shall not have the power to add to, modify or change any of the provisions of this Lease. On the failure of either party to appoint such advisor within ten (10) days after notification of the appointment by the other party, the person appointed as an advisor shall appoint an advisor to represent the party who has not so appointed an advisor. The two (2) advisors appointed in either manner above provided shall then proceed to act to determine such figure equaling such annual fair market rental rate as of such applicable date, in accordance with the above definition. In the event of their inability to reach an agreement between them within ten (10) days, they shall, within ten (10) days, appoint a third similarly qualified advisor who has had not less than ten (10) years’ experience appraising comparable, first-class commercial premises in the Stamford, Connecticut, area. If the three (3) advisors are then unable to reach an agreement within ten (10) days thereafter, the decision of the third advisor shall determine such figure equaling such annual fair market rental rate, in accordance with the above definition (which decision shall be made by the third advisor picking one of the two such submitted figures by the other advisor(s)). The final decision of the advisors shall be delivered to the parties in writing not later than nine (9) months before the expiration of the Lease Term (the “Decision Date”), time being of the essence. Landlord and Tenant agree to each pay the expenses and fees of their own advisor and one-half (1/2) the expenses and fees of any third advisor and to be bound by their final decision.

(h)If for any reason by the commencement of the Extended Term, the annual Fixed Rent for such period shall not have been finally determined, Tenant shall, until such determination, pay the annual Fixed Rent at the last applicable annual Fixed Rent rate per rentable square foot of the Premises during the Lease Term. Upon such final determination, Tenant shall thereafter pay such annual Fixed Rent at a rate which is based upon the annual Fixed Rent for the Extended Term as so determined and shall pay Landlord the balance, if any, which shall be owing for the period preceding such determination. Whenever the annual Fixed Rent for the Extended Term shall have been determined, the parties hereto, on request of either of them, shall enter into a stipulation with respect to the annual Fixed Rent rate for the Extended Term.

ARTICLE 3

As-is Condition of the Premises

Section 3.01.As-is Condition. Except as hereinafter specifically provided, Tenant hereby acknowledges that it shall take the Premises, the Building and the Complex in their “AS-IS,” “WHERE-IS” condition as of the date of this Lease, and (except as expressly specified pursuant to the terms of this Lease) Landlord shall have no obligation to alter, repair or perform any work to prepare the Premises, the Building, the Complex or any portion thereof for Tenant’s occupancy. Notwithstanding the foregoing, Tenant shall, at its sole cost and expense (subject to the Tenant Improvement Allowance), be responsible for the completion of the work identified in Exhibit G hereto (collectively, “Tenant’s Work”). In addition, Landlord shall cause Landlord’s Base Building Work to be substantially completed, subject to the terms of this Lease and Exhibit

6

F (collectively, “Landlord’s Base Building Work”). Notwithstanding the foregoing, Landlord hereby warrants to Tenant that, as of the Commencement Date, the roof and all structural elements of the Building, as well as all Building Systems (including, without limitation, HVAC, mechanical, electrical, lighting, plumbing and life safety systems) serving the Premises shall be delivered in good working order, and the Premises, the Building and Common Areas (and paths of travel to and from the Building) shall be in compliance with applicable Requirements (including, without limitation, applicable zoning regulations (including, for the Permitted Use), environmental laws and ADA).

Section 3.02.Tenant Improvement Allowance. Landlord has agreed to contribute a one-time tenant improvement allowance (the “Tenant Improvement Allowance”) in the amount of up to $2,901,140.00 (based on a rate of $110.00/rentable square foot of the Premises) to reimburse Tenant for (a) the actual hard and soft costs (but subject to the last sentence of this Section 3.02) of completing, constructing or installing the Tenant’s Work to the Premises, (b) government permit fees relating to such Tenant’s Work, and (c) Tenant’s actual costs for computer cabling, furniture, fixtures and equipment in connection with Tenant’s Work. The Tenant Improvement Allowance, or a portion thereof, will be disbursed by Landlord to Tenant no less frequently than monthly (the “Monthly Draws”) within twenty (20) days (such period, the “Disbursement Date”) after Tenant submits all of the following to Landlord: (i) a written certification from Tenant’s architect stating that the improvements (to the extent completed during the period covered by the Monthly Draw) were completed in accordance with the Landlord-approved plans and specifications therefor, (ii) partial lien releases from all contractors and materialmen providing services or supplies, through the date of the pertinent Monthly Draw, in connection with the improvements covered by such Monthly Draw, (iii) invoices or other reasonable evidence of the costs incurred in connection with the improvements covered by the Monthly Draw, through the date of the pertinent Monthly Draw, and (iv) a certificate of completion or certificate of occupancy (but, only with respect to the final Monthly Draw, or sooner, if the pertinent improvements are completed sooner than the month of the final Monthly Draw) for the Premises (if required by applicable Requirements and if necessary pursuant to such Requirements, Landlord shall reasonably cooperate, at no expense to Landlord, with respect thereto). If Tenant timely submits to Landlord each of the foregoing and Landlord fails to disburse the applicable portion of the Tenant Improvement Allowance when due and payable hereunder, then Landlord shall pay interest on the undisbursed portion of any such due and unpaid portion of the Tenant Improvement Allowance at the Default Rate, until paid by Landlord. If Landlord in good faith disputes any Monthly Draw request and/or asserts that the required supporting documentation for such Monthly Draw was not duly submitted, it shall pay any undisputed portion of the Monthly Draw and provide, in writing, to Tenant the basis for not paying the balance within the above-referenced thirty (30) day timeframe for payment, with Tenant entitled to interest at the Default Rate hereunder only with respect to unpaid portions of the Tenant Improvement Allowance to the extent Landlord’s non-payment continues after same is due and payable hereunder. Tenant shall be solely responsible for any and all costs of designing and constructing improvements to the Premises in excess of the Tenant Improvement Allowance. Tenant shall have until the date which is the last day of the month in which the second (2nd) anniversary of the Commencement Date occurs to perform work in the Premises that is reimbursed by the Tenant Improvement Allowance. In the event that Tenant does not use the entire Tenant Improvement Allowance on or before second (2nd) anniversary of the Commencement Date, the unused portion of the Tenant Improvement Allowance (up to twenty percent (20%), or $580,228.00, of the Tenant Improvement

7

Allowance) shall be applied as a credit against Fixed Rent next coming due and payable under this Lease. Notwithstanding anything contained herein to the contrary, up to $580,228.00 (or twenty percent (20%)) of the Tenant Improvement Allowance may be used to reimburse Tenant’s reasonable, out-of-pocket architectural and engineering costs incurred for Tenant’s Work, pursuant to Monthly Draw requirements, accompanied with Tenant’s relevant invoices and paid receipts.

Section 3.03.Tenant shall cause to be performed, at Tenant’s sole cost and expense (except for the Tenant Improvement Allowance due and payable hereunder), subject to and in accordance with the provisions of the Work Letter attached hereto as Exhibit G, any and all alterations to the Premises necessary for Tenant to conduct its business in the Premises (collectively, the “Tenant’s Work” or “Initial Alterations”). Subject to Landlord’s reasonable prior approval (which approval shall not be unreasonably withheld, conditioned or delayed) and Tenant’s compliance with all applicable terms, conditions and requirements of this Lease (including, without limitation, Exhibit G hereof), Tenant may, at its election and expense, include the following items as part of Tenant’s Work: (a) a commercially reasonable computer room in the Premises; (b) two (2) commercially reasonable office pantries (with associated seating) in the Premises; and (c) a commercially reasonable Supplemental HVAC system in the Premises.

Section 3.04.Tenant’s Installations. Tenant shall cause to be installed, at Tenant’s sole cost and expense, any and all furniture, fixtures, business equipment, cabling, wiring and technology installations in and to the Premises necessary (in Tenant’s discretion and otherwise in accordance with the terms of this Lease) for Tenant to conduct its business therein.

Section 3.05.If Landlord fails, after satisfaction of all required conditions under Section 3.02, to pay all or any installment of the Tenant Improvement Allowance on or before the due date therefor, and such failure continues for thirty (30) days after Tenant notifies Landlord of such failure and no monetary or material non-monetary default by Tenant shall have occurred and be continuing beyond applicable notice and cure periods, then Tenant shall have the right to deliver to Landlord a written notice (a “Second Allowance Notice”) stating that Landlord has failed to pay all or any installment of the Tenant Improvement Allowance in accordance with Section 3.02. If Landlord fails to pay all or any portion of the Tenant Improvement Allowance covered by the Second Allowance Notice within ten (10) Business Days after Tenant gives the Second Allowance Notice to Landlord, then, subject to the provisions of this Section 3.05, Tenant shall be entitled to offset such amount against the next installments of Rent coming due until fully paid. Notwithstanding anything herein to the contrary, if Landlord disputes that Tenant is entitled to the amount covered by the Second Allowance Notice by notice given to Tenant within such ten (10) Business Day period (which notice sets forth in reasonable detail the reason(s) for why Landlord believes Tenant is not entitled to the disputed amount), then Tenant shall not be entitled to offset the disputed amount unless and until Tenant obtains the determination of the Arbitrator pursuant to Article 25 that Tenant is entitled to the disputed amount. If Tenant obtains such determination, then Tenant may offset the disputed amount against the next installments of Rent coming due until fully paid, together with interest thereon from the date the disputed amount was due until the date that the disputed amount has been fully offset at the Base Rate. The obligations of Landlord and Tenant under the provisions of this Section 3.05 shall survive the expiration or earlier termination of the Term.

8

Section 3.06.Disputes. Any dispute under this Article 3 shall be determined by arbitration pursuant to Article 25 hereof initiated by either party.

ARTICLE 4

Rent

Section 4.01.Fixed and Additional Rent. Commencing on the date which is the later to occur of (a) the date which is twelve (12) months after the Commencement Date and (b) November 1, 2024 (the “Rent Commencement Date”), Tenant shall pay to Landlord, without notice or demand, in lawful money of the United States of America, at the office of Landlord or at such other place as Landlord may designate by written notice, without any set-off, offset, abatement or deduction, except as otherwise provided herein, annual fixed rent (“Fixed Rent”) as follows:

Lease Years/Period |

| Annual Fixed |

| Monthly Fixed |

| Annual Fixed |

1 | | $49.00 | | $107,693.83 | | $1,292,326.00 |

2 | | $50.23 | | $110,397.17 | | $1,324,766.02 |

3 | | $51.48 | | $113,144.46 | | $1,357,733.52 |

4 | | $52.77 | | $115,979.67 | | $1,391,755.98 |

5 | | $54.09 | | $118,880.81 | | $1,426,569.66 |

6 | | $55.44 | | $121,847.88 | | $1,462,174.56 |

7 | | $56.82 | | $124,880.89 | | $1,498,570.68 |

8 | | $58.25 | | $128,023.79 | | $1,536,285.50 |

9 | | $59.70 | | $131,210.65 | | $1,574,527.80 |

10 | | $61.19 | | $134,485.42 | | $1,613,825.06 |

payable in advance on the first day of each and every calendar month thereafter occurring during the Term, except Tenant’s first monthly installment of Fixed Rent shall be paid in advance on Tenant’s execution of this Lease; and

(a)In addition, commencing on the Commencement Date, and continuing during the Term, Tenant shall pay Landlord additional rent (“Additional Rent”) consisting of all other sums of money as shall become due and payable by Tenant under this Lease (for default in the payment of which Landlord shall have the same rights and remedies as for a default in the payment of Fixed Rent). Unless otherwise expressly set forth in this Lease, all items of Additional Rent shall be due and payable not later than twenty-five (25) days after receipt of a statement therefor. For purposes of this Lease, the term “Rent” shall mean Fixed Rent and Additional Rent.

(b)There shall be no abatement of, deduction from, counterclaim or set off against Fixed Rent or Additional Rent except as otherwise expressly provided herein.

(c)Notwithstanding anything to the contrary contained in this Lease, as long as Tenant is not in default of any of its Lease obligations beyond any applicable notice and cure periods, Tenant shall be entitled to a full Fixed Rent abatement (the “Abated Rent”) for the twelve (12)-month period from the Commencement Date through the date preceding the Rent Commencement Date (such twelve (12) month Fixed Rent abatement period, the “Abatement

9

Period”). Notwithstanding the foregoing, in the event Tenant defaults in any of its monetary or material non-monetary Lease obligations beyond any applicable notice and cure periods at any time during the Abatement Period, all of the previously Abated Rent shall become due and payable within ten (10) days after Landlord’s written demand therefor and Tenant shall not be entitled to any further rent abatement during the remainder of the Abatement Period. Payment by Tenant of any Abated Rent in the event of such default shall not limit or affect any Landlord’s rights, claims or remedies pursuant to the Lease or available at law or in equity, as a result of any such default. During the Abatement Period, only the applicable Fixed Rent specified therefor shall be abated, and except as expressly set forth herein, all Additional Rent and other costs and charges specified in this Lease shall remain due and payable pursuant to the provisions of this Lease.

Section 4.02.Interest. If Tenant shall fail to pay when due any installment of Fixed Rent or any Additional Rent more than once in any 12-month period during the Term, then Tenant shall pay interest thereon at an annual rate of interest equal to three percent (3%) above the Base Rate (said rate or the maximum rate permitted by applicable usury laws, if any, whichever is less, is referred to herein as the “Default Rate”) from the date when such installment or payment shall have become due to the date of the payment thereof, and such interest shall be deemed Additional Rent. For purposes of this Lease, the term “Base Rate” shall mean the annual rate of interest publicly announced from time to time by Citibank, N.A., or its successor, as its “prime lending rate” (or such other term as may be used by Citibank, N.A., or its successor, from time to time, for the rate presently referred to as its “prime lending rate”).

ARTICLE 5

Use

Section 5.01.Use. Tenant shall use and occupy the Premises solely for executive, general and administrative offices for Tenant’s business (and lawful related uses) (the “Permitted Use”) and for no other purpose without the prior written consent of Landlord, which consent shall be determined by Landlord within its sole discretion. Tenant shall not use or occupy or suffer or permit the use or occupancy of the Premises or any part thereof in any manner which in Landlord’s reasonable judgment shall adversely affect or interfere with any services required to be furnished by Landlord to Tenant or to any other tenant or occupant of any part of the Complex, or with the proper and economical rendition of any such service or with the use or enjoyment of any part of the Complex by any other tenant or occupant.

Section 5.02.Restrictions on Use. Tenant’s specific manner of use or occupancy of the Premises (as opposed to the general use of the Premises for the Permitted Use) shall not suffer or permit the Premises or any part thereof to be used in any manner, or anything to be done therein, or suffer or permit anything to be brought into or kept therein, which would in any way: (a) violate any applicable Requirements of any Governmental Authority; (b) make void or voidable any insurance policy then in force with respect to the Building or the Premises; (c) make unobtainable from reputable insurance companies authorized to do business in the State of Connecticut at standard rates any fire insurance with extended coverage, or liability, elevator, boiler or other insurance required to be furnished by Landlord under the terms of the Superior Mortgages or Superior Leases, if any; (d) cause, or be likely to cause, physical damage to the Building or Complex or any part thereof (except for permitted Alterations performed and/or installed in accordance with the terms and conditions of this Lease); (e) constitute a public or

10

private nuisance; (f) materially or unreasonably impair the appearance or reputation of the Building; (g) discharge noxious fumes, vapors or odors into the Building’s air conditioning system or into Building’s flues or vents or otherwise in such a manner as may unreasonably offend other occupants; (h) cause substantial or objectionable noise or vibrations; (i) violate any of the exclusive use restrictions applicable to all or any portion of the Complex in effect on the date hereof; (j) permit any uses of governmental agencies and/or excessively high density businesses, such as call centers, staffing centers, or medical offices with regular patient visitations; or (k) impair or interfere with any of the Building’s or Complex’s services or operations, including, without limitation, the furnishing of electrical energy, or the proper and economic cleaning, air conditioning or other servicing of the Building or the Premises or impair or interfere with the use of any of the other areas of the Building or the Complex, or occasion material or unreasonable discomfort, annoyance or inconvenience to Landlord or any of the other tenants or occupants of the Building or of the Complex. The provisions of this Section, and the application thereof, shall not be deemed to be limited in any way to or by the provisions of any other Section of this Article or any of the Rules and Regulations referred to in Article 27 or set forth in Exhibit C attached hereto and made a part hereof.

Section 5.03.Certificate of Occupancy. Tenant shall not at any time use or occupy, or suffer or permit to use or occupy the Premises in violation of the certificate of occupancy issued for the Premises or the Building or any applicable zoning ordinances of the City and in the event that any department of the City or State of Connecticut shall hereafter contend or declare by notice, violation, order or in any other manner whatsoever that the Premises are used for a purpose which is a violation of such certificate of occupancy, Tenant shall immediately notify Landlord and discontinue such use of the Premises. Landlord represents to Tenant, to Landlord’s actual knowledge, as of the date hereof, that Tenant’s Permitted Use of the Premises set forth in this Lease does not violate the current certificate of occupancy for the Building, and Landlord hereby agrees not to amend the certificate of occupancy to prevent the use of the Premises by Tenant for the Permitted Use.

Section 5.04.Floor Load. Tenant shall not place a load upon any floor of the Premises that exceeds the floor load per square foot that such floor was designed to carry fifty (50) pounds per square foot (live load)) and which is allowed by certificate, rule, regulation, permit or law. Subject to the terms of the next preceding sentence, if Tenant wishes to place any safes, vaults or other structural reinforcements in the Premises, it may do so at its own expense, in accordance with the provisions of Article 9 hereof. Landlord reserves the right to prescribe their weight and position. Business machines and mechanical equipment in the Premises shall be placed and maintained by Tenant, at Tenant’s expense, in such manner as shall be sufficient in Landlord’s reasonable judgment to absorb vibration and noise and prevent annoyance or inconvenience to Landlord or to any of the other tenants or occupants of the Building.

Section 5.05.Names. Neither Tenant nor any occupant of the Premises shall use the name “400 Atlantic Street”, or any combination or simulation thereof, for any purpose whatsoever including, but not limited to, or as for any corporate, firm or trade name, trademark or designation or description of merchandise or services except that the foregoing shall not prevent the use of such name as part of Tenant’s business address.

11

Section 5.06.Use of Hazardous Materials.

(a)Tenant shall not install, use, generate, store or dispose of in or about the Premises any Hazardous Materials, except for immaterial quantities of lawful Hazardous Materials customarily used in business office operations, provided Tenant uses such Hazardous Materials in accordance with all applicable Environmental Laws.

(b)Landlord shall not use, generate, store or dispose of in or about the Building any Hazardous Materials, except for immaterial quantities of Hazardous Materials customarily used in the operation or management of office buildings, provided that such Hazardous Materials are used in accordance with all applicable Environmental Laws.

(c)Landlord hereby represents to Tenant that, to Landlord’s actual knowledge, as of the date hereof, that there are no Hazardous Materials in violation of applicable Environmental Laws at the Building. If any such Hazardous Materials in violation of applicable Environmental Laws are discovered at the Building, Landlord shall remove, remediate and/or encapsulate same in compliance with applicable Environmental Laws, with commercially reasonable diligence to completion, subject to Tenant Delays and conditions beyond Landlord’s reasonable control. To the extent that any such removal (i) requires Tenant to vacate all or a portion of the Premises for a period of five (5) consecutive Business Days or more, then thereafter Fixed Rent and Tenant’s obligation to pay Tenant’s Projected Share and Tenant’s Proportionate Share of any increase in Taxes shall abate for the portion of the Premises which have thus been vacated until the earlier of completion of Landlord’s removal work or reoccupation of such part of the Premises by Tenant or (ii) causes an actual delay in the performance of Tenant’s Work, then the Rent Commencement Date shall be delayed on a per diem basis for each day of such delay, provided that such delay in the Rent Commencement Date shall not accrue until Tenant has provided written notice to Landlord of the actual delay in the performance of Tenant’s Work caused by such removal. Following the completion of such work, Landlord shall provide Tenant with an appropriate report from Landlord’s environmental consultant certifying the completion of such work.

(d)Anything herein to the contrary notwithstanding, Landlord shall indemnify, defend with counsel reasonably acceptable to Tenant, and hold harmless Tenant and shareholders, members, principals, partners, officers, directors, managers, employees, representatives, and agents (collectively, the “Tenant Parties”) from and against any and all Losses (as defined in Section 17.01 below), directly resulting from, or directly attributable to the presence or removal of Hazardous Materials from all or any portion of the Complex, to the extent such Losses are actually suffered or incurred by Tenant and/or Tenant Parties as a result of the release or presence of Hazardous Materials in, on, at, to or under all or any portion of the Complex where (i) such release or presence is actually caused by, or the direct result of, any negligent or intentional acts or omissions of Landlord, or (ii) Landlord is actually compensated by a third party for the Losses suffered or incurred by Tenant (in which case Landlord shall indemnity the Tenant Parties hereunder up to the amount of such compensation). The undertakings, covenants and obligations imposed under this Section 5.06 shall survive the termination or expiration of this Lease.

12

ARTICLE 6

Escalations

Section 6.01.Taxes; Cost of Operation and Maintenance. As used herein:

(a)The term “Taxes” shall mean all real estate taxes, assessments, special or otherwise, sewer rents, rates and charges, water rents, rates and charges, personal property taxes, or any other charge of Governmental Authority of a similar or dissimilar nature which may be levied or assessed upon or with respect to the portion of the Land on which the Building stands and/or the Building and all taxes or charges levied or assessed upon or with respect to the Fixed Rent or Additional Rent or the gross receipts from the Building, or charges levied on Landlord’s receipts from the Building which are in lieu of or a substitute for, any other tax or assessment or charge upon or with respect to the Building. Taxes shall also include the “Building’s Share” (as described in paragraph (f) below) of the Taxes, if any, assessed against any real estate shared by the Complex (such as any common landscaped terraces) with other properties. Taxes shall not be deemed to include:

(i)franchise or similar taxes of Landlord,

(ii)income, revenue or profit taxes of Landlord,

(iii)any real estate taxes or water or sewer rents exclusively chargeable to and reimbursable by another tenant,

(iv)excise, inheritance, estate, margin, capital stock, gift, gains, transfer, conveyance, capital levy or other taxes not limited to real property or the revenues therefrom, as provided above, or

(v)penalties or interest on Taxes if caused solely by Landlord’s failure to submit such Taxes on a timely basis.

(b)The term “Tax Year” shall mean the period of twelve (12) months commencing on July 1st of each year.

(c)The term “Landlord’s Statement” shall mean an instrument containing a computation of any Additional Rent due pursuant to the provisions of this Article, together with, if requested by Tenant in writing and available to Landlord, reasonable back-up data, billings and other written materials sufficient to evidence the computation of such Additional Rent.

(d)The term “Base Taxes” shall mean the Taxes for the fiscal tax year commencing on July 1, 2023 and ending on June 30, 2024 (the “Tax Base Year”).

(e)The term “Tenant’s Proportionate Share” shall be 5.37%.

(f)The term “Building’s Share” shall be 100%.

(g)Subject to the provisions of Section 6.08 hereof, the term “Cost of Operation and Maintenance” shall mean any and all actual costs incurred by Landlord with respect to the

13

operation, maintenance, replacement and repair of the Building and the improvements thereto and the Building Common Areas, including, without limitation, the cost incurred for air conditioning; mechanical ventilation; heating; cleaning of the Building; rubbish removal; window washing (interior and exterior, including inside partitions); repair and maintenance of the elevators; porter and matron service; metered or unmetered (if or to the extent not separately metered and paid directly by tenants for tenant space in the Complex) cost of electric current, oil and gas used throughout the Building Common Areas; steam; protection and security service; utility consultant’s fees; repairs; maintenance; fire, extended coverage, boiler, sprinkler, apparatus, public liability and property damage insurance; supplies, wages, salaries, disability benefits, pensions, hospitalization, retirement plans and group insurance respecting service and maintenance employees; uniforms and working clothes for such employees and the cleaning thereof; expenses imposed pursuant to any collective bargaining agreement with respect to such employees; payroll, social security, unemployment and other similar taxes with respect to such employees’ sales, use and other similar taxes; water rates; structural and/or capital repairs, improvements, alterations, additions or replacements (i) incurred or performed for the purpose of reducing or stabilizing Cost of Operation and Maintenance, or (ii) which are necessary to comply with applicable Requirements or insurance rating standards or recommendations enacted after the date hereof, to the extent such repairs, improvements, alterations, additions or replacements are capitalized under generally accepted accounting principles (provided that only the annual amortization of any such expenditure shall be included in the Cost of Operation and Maintenance or Complex Operating Expenses, as applicable (such amortization to be calculated on a straight-line basis over the useful life thereof, as reasonably determined by Landlord in accordance with generally accepted accounting principles, together with interest at the Base Rate plus three percent (3%)); all materials, supplies and equipment, purchased or hired therefor; replacement of tools and machinery and equipment which are not capital expenses; maintenance and repairs in and to Building Systems; repairing all rooftops, facades and foundations and all parts thereof (but excluding any such repairs that would be considered capital expenditures under generally accepted accounting principles, in which case same would be subject to the other terms and conditions of this Article 6); painting, whether decorative or otherwise; removal of snow, ice, trash, garbage or other refuse; extermination; sewer rents and competitive management fees not to exceed prevailing management fees then charged at comparable first-class office complexes located in the City, based on fully-occupied properties. The Cost of Operation and Maintenance shall also include the “Building’s Share” of the Complex Operating Expenses (hereinafter defined).

(h)The term “Complex Operating Expenses” shall include, but not be limited to, all costs and expenses incurred by Landlord with respect to the operation, maintenance, replacement and repair of the Complex Common Areas, including the Complex Garages, and the property manager’s office for the Complex including, without limitation, the following: maintenance and repair of grounds; all materials, supplies and equipment, purchased or hired therefor; service contracts for any of the foregoing; removal of snow, ice, trash, garbage and other refuse; all oil or gas used in connection with heating the Complex Garages; all electricity consumed by reason of the operation of the Complex Garages; the cost of lighting exterior Complex Common Areas; the cost of personnel engaged in the operation, maintenance or repair of the Complex Common Areas, including the Complex Garages, including all wages, salaries, disability benefits, pensions, hospitalization, retirement plans and group insurance(including the property manager’s telephone charges pertaining to the operation of the Complex and Complex Common Areas); the property manager’s office utilities; all taxes, charges and assessments levied or assessed against

14

the personal property of Landlord used in the operation of the Complex Common Areas, including the Complex Garages; all insurance carried by Landlord applicable to Complex Common Areas, including the Complex Garages (including, without limitation, liability insurance for Complex Common Areas, including the Complex Garages and extended coverage replacement cost property damage insurance); Complex Garage and Complex management fees (to the extent same do not include Building management fees otherwise charged to and paid for by Tenant); reasonable legal fees and accounting fees; taxes (including, without limitation, sales and use taxes); structural and/or capital repairs, improvements, alterations, additions or replacements (i) incurred or performed for the purpose of reducing or stabilizing Complex Operating Expenses, or (ii) which are necessary to comply with Requirements or insurance rating standards or recommendations enacted after the date hereof, to the extent such repairs, improvements, alterations, additions or replacements are capitalized under generally accepted accounting principles (provided that only the annual amortization of any such expenditure shall be included in Complex Operating Expenses, as applicable (such amortization to be calculated on a straight-line basis over the useful life thereof, as reasonably determined by Landlord in accordance with generally accepted accounting principles, together with interest at the Base Rate plus three percent (3%)); energy; and any systems, measures, procedures and personnel which Landlord may provide to control access to Complex Common Areas; and any other reasonable costs and expenses in connection with the operation, maintenance and repair of the Complex Common Areas; line painting; repaving; traffic systems, and traffic personnel; the costs of maintaining and repairing all private roads forming a part of the Complex and used for access through the Complex and Complex Garages and/or to and from the Building. Costs and expenses incurred in connection with the operation, maintenance and repair of Complex Common Areas, including the Complex Garages shall be included in Complex Operating Expenses notwithstanding the fact that Tenant or other Complex tenants may have the controlled or designated use of portions of same.

Anything herein to the contrary notwithstanding, there shall be excluded from the Cost of Operation and Maintenance and from Complex Operating Expenses the following:

(i)Taxes;

(ii)debt service on mortgages, deeds of trust or other encumbrances upon the Complex or any part thereof and all interest on and amortization or depreciation of any other debts of Landlord;

(iii)any cost or expense for which Landlord is reimbursed or otherwise compensated through insurance or condemnation awards (to the extent such insurance proceeds or condemnation awards are actually received by Landlord, with Landlord being obligated to use commercially reasonable, good faith efforts to collect such insurance proceeds or condemnation awards), or is otherwise compensated or reimbursed by any tenant (including Tenant) of the Complex, under a warranty or from any other source, other than through an operating expense provision such as the one contained in this Article 6;

(iv)salaries and other compensation (such as benefits and other expenses for employees of Landlord or Landlord’s affiliates) of personnel above the grade of manager of the Complex;

15

(v)any fee or expenditure paid to any person or entity which shall Control, be under the Control of, or be under common Control with Landlord, in each case in excess of the amount which would be paid in the absence of such relationship;

(vi)the cost of any other tenant improvement work in any space leased to an existing tenant or prospective tenant of the Building (including installations and other tenant improvements for tenants (including Tenant)) and all costs of obtaining new tenants or extending or renegotiating leases with existing tenants, including without limitation, brokerage commissions and other professional fees, including, without limitation, any legal, architectural and engineering fees, and relocation costs;

(vii)depreciation and amortization;

(viii)rent paid under Superior Leases (other than in the nature of rent consisting of taxes or operating expenses or other “pass-through” escalations as permitted herein);

(ix)leasing commissions, advertising, promotion costs and other fees and expenses, including, without limitation, legal fees, relating to procuring tenants to rent space in the Complex and lease takeover costs;

(x)Landlord’s advertising and promotional costs;

(xi)legal fees and arbitration expenses, together with other similar professional fees, incurred in connection with any Superior Lease, Superior Mortgage, or procuring or leasing to other tenants in the Building or Complex;

(xii)franchise, income, gains, estate, inheritance, transfer, margin, conveyance, corporate, unincorporated business, succession, gift, capital stock, mortgage recording or other taxes imposed upon Landlord except that the amount of occupancy, rent or other similar tax attributable to the offices of the management for the Complex shall be includible in the Cost of Operation and Maintenance;

(xiii)to the extent any costs that are otherwise includible in the Cost of Operation and Maintenance are incurred with respect to both the Complex and other properties (including, without limitation, salaries, fringe benefits and other compensation of Landlord’s personnel who provide services to both the Complex and such other properties), there shall be excluded from the cost of Operation and Maintenance and Complex Operating Expenses a fair and reasonable percentage thereof that is properly allocable to such other properties;

(xiv)any increased insurance costs reimbursed directly to Landlord by a tenant, including, without limitation, Tenant, pursuant to their respective leases;

(xv)any interest, late charge or penalties incurred or payable by Landlord or any increase in insurance premium resulting from Landlord’s violation of any Requirements or insurance requirement;

(xvi)all costs and expenses, and taxes and impositions, whatsoever, incurred in connection with a sale or transfer, financing or refinancing, of all or any portion of the

16

Land and/or Building, and/or the Complex, or any interest therein or in any party of whatever tier owning an interest therein;

(xvii)all costs and expenses (including, without limitation, attorneys’ fees and overtime pay) incurred in curing a default by Landlord under this Lease or any other lease at the Complex;

(xviii)the cost of performing special or exclusive services for any particular tenant (including Tenant) to the extent that such services exceed those provided or available to other tenants in the Complex;

(xix)the cost of Landlord’s Base Building Work;

(xx)charitable or political contributions;

(xxi)expenses incurred by Landlord to resolve disputes, enforce or negotiate lease terms with prospective or existing tenants or in connection with any financing, sale or syndication of the Property;

(xxii)cost of alterations, capital improvements, equipment replacement and other items which under generally accepted accounting principles are properly classified as capital expenditures, except those expressly permitted to be included under either Section 6.01(g) or (h) above;

(xxiii)cost of repairs necessitated by Landlord’s negligence or willful misconduct, or of correcting any latent defects or original design defects in the Building construction, materials, or equipment;

(xxiv)a property management fee for the Complex in excess of three percent (3%) of the gross rents of the Complex exclusive of taxes, utilities, capital expenditures, tenant reimbursements and ancillary income from other tenants (e.g., income from antennae or satellite dishes, paid parking, security deposits and interest thereon, etc.) applicable to the Complex for the relevant calendar year, based on a fully-occupied property;

(xxv)Landlord’s general corporate overhead and administrative expenses except if it is solely for the Building;

(xxvi)business interruption insurance or rental value insurance;

(xxvii)expenses incurred by Landlord in order to comply with Requirements and environmental obligations hereunder, including, without limitation, removal, remediation or other handling of Hazardous Materials, compliance with or certification under so-called “green” initiatives and/or emissions reduction efforts or requirements;

(xxviii)reserves;

(xxix)any additional operating expenses incurred by Landlord relative to any declaration of covenants or restrictions to which the Complex or Land may be subject; and

17

(xxx)the operating expenses incurred by Landlord relative to retail stores and hotels in the Complex.

(xxxi)“Operational Year” shall mean each calendar year after the calendar year 2024 (such 2024 calendar year, the “Operational Base Year”).

(i)“Tenant’s Projected Share” shall mean Tenant’s Proportionate Share multiplied by Landlord’s written estimate of the reasonable increase of Cost of Operation and Maintenance for the ensuing calendar year over the Base Expenses (as hereinafter defined), said written estimate to be delivered by Landlord to Tenant during December of each year. Tenant’s Projected Share shall be divided by twelve (12) and shall be payable on the first of each month, starting January 1 of the ensuing year, by Tenant to Landlord as Additional Rent.

(j)The term “Base Expenses” shall mean the Cost of Operation and Maintenance for the Operational Base Year (i.e., the calendar year 2024).

Section 6.02.Tax Increases; Contest.

(a)(i)Commencing on the first (1st) anniversary of the Rent Commencement Date, if Taxes payable by Landlord in any Tax Year, falling wholly or partially within the Term shall be greater than the Base Taxes, Tenant shall pay as Additional Rent for such Tax Year a sum equal to Tenant’s Proportionate Share of the amount by which the Taxes for such Tax Year (or portion thereof) exceed the Base Taxes. Promptly after receipt of a tax bill, Landlord shall submit to Tenant a copy of a bill issued by the City or other applicable Governmental Authority for Taxes, together with Landlord’s Statement consistent with the proportionate share allocation provided herein, and Tenant shall pay the Additional Rent set forth on such Statement within twenty-five (25) days after the date of receipt of such Statement by Landlord.

(i)The foregoing notwithstanding, in the event a Mortgagee (hereinafter defined) of Landlord shall require Taxes be paid in monthly installments, then Landlord shall render to Tenant a Landlord’s Statement or Statements showing (i) a comparison and/or good faith estimate of the Taxes for the Tax Year with the Base Taxes, and (ii) the amount of Tenant’s payment for the Taxes (“Tax Payment”) resulting from such comparison and/or good faith estimate. On the first day of the month following the furnishing to Tenant of a Landlord’s Statement or estimate, Tenant shall pay to Landlord a sum equal to 1/12th of the Tax Payment shown thereon to be due for such Tax Year multiplied by the number of months of the Term then elapsed since the commencement of such Tax Year. Tenant shall continue to pay to Landlord a sum equal to one-twelfth (1/12th) of the Tax Payment shown on such Statement or estimate on the first day of each succeeding month until the first day of the month following the month in which Landlord shall deliver to Tenant a new Landlord’s Statement or estimate. If Landlord furnishes a Landlord’s Statement for a new Tax Year subsequent to the commencement thereof, promptly after the new Landlord’s Statement is furnished to Tenant, Landlord shall give notice to Tenant stating whether the amount previously paid by Tenant to Landlord for the current Tax Year was greater or less than the installments of the Tax Payment for the current tax year in accordance with the Landlord’s Statement, and (a) if there shall be a deficiency, Tenant shall pay the amount thereof within twenty-five (25) days after demand therefor, or (b) if there shall have been an overpayment, Landlord shall credit the amount thereof against the next monthly installments of the Additional

18

Rent payable under this Lease (or refund to Tenant within thirty (30) days after the Expiration Date). Tax Payments shall be collectible by Landlord in the same manner as Fixed Rent. Landlord’s failure to render a Tax Statement shall not prejudice Landlord’s right to render a Landlord’s Statement during or with respect to any subsequent Tax Year, and shall not eliminate or reduce Tenant’s obligation to make Tax Payments for such Tax Year. Notwithstanding the foregoing, failure of Landlord to bill Tenant for any Tax Payment within twenty-four (24) months after the end of the Tax Year in which the same are due shall be deemed a waiver of Landlord to collect such Tax Payment from Tenant.

(ii)If as a result of any application or proceeding brought by or on behalf of Landlord, the Base Taxes actually paid by Landlord shall be decreased, Landlord’s Statement next following such decrease shall include any adjustment for prior Tax Years reflecting such decrease in the Base Taxes (less Tenant’s Proportionate Share of all reasonable out-of-pocket costs and expenses, including counsel fees, incurred by Landlord in connection with such application or proceeding). After the Term, any such net adjustment in favor of Tenant shall be paid to Tenant withing thirty (30) days after such determination by the taxing authority. If, as a result of any application or proceeding brought by or on behalf of Landlord for review of the assessed valuation of the Land or Building for any fiscal year, there shall be a decrease in the Taxes actually paid by Landlord for any Tax Year with respect to which Landlord shall have previously rendered a Landlord’s Statement and Tenant shall have paid Additional Rent hereunder, then Landlord’s Statement next following such decrease shall include an adjustment applicable to prior Tax Years. If Landlord receives a rebate of past Taxes overpaid, Tenant shall receive Tenant’s Proportionate Share of the net rebate for the period during which Tenant paid Additional Rent on account of said Taxes (less Tenant’s Proportionate Share of all reasonable out-of-pocket costs and expenses, including counsel fees, incurred by Landlord in connection with such application or proceeding). If Landlord receives a credit against future Taxes, that net credit shall be reflected in subsequent Additional Rent payments Tenant is required to make on account of such Taxes; provided with respect to any or all of the foregoing adjustments or credits benefitting Tenant, that Tenant is not in default hereunder beyond applicable notice and cure periods. If this Lease shall terminate prior to recoupment of the entire net credit due to Tenant, Landlord shall continue to make payments to Tenant as and to the extent that Landlord receives credits against future Taxes until such time as Tenant’s credit is paid in full.

(b)Any payments of Additional Rent or refunds due to Tenant hereunder for any period of less than a full Lease Year or any adjustment required due to the change in the rentable area of the Premises, shall be equitably prorated to reflect any such event.

(c)Following the expiration of this Lease in accordance with the provisions hereof (and provided Tenant is not in default hereunder beyond applicable notice and cure periods), any overpayments by Tenant of any Tax Payment known to Landlord shall be refunded to Tenant within thirty (30) days of such Lease expiration.

(d)Intentionally omitted.

Section 6.03.Operating Expense Increases.

19

(a)Commencing on the first day of the month after which the first anniversary of the Rent Commencement Date occurs, Tenant shall pay to Landlord, as Additional Rent, Tenant’s Projected Share, as set forth in Section 6.01(j) hereof. After the expiration of each Operational Year, Landlord shall furnish Tenant a written statement (in commercially reasonable detail) prepared by Landlord’s chief financial officer or Landlord’s independent certified public accountant (in accordance with sound commercial real estate management practices consistently applied in good faith), setting forth the Cost of Operation and Maintenance incurred for such Operational Year. Within twenty-five (25) days after receipt of such statement for any Operational Year setting forth Tenant’s Proportionate Share of any increase of Cost of Operation and Maintenance during such Operational Year over the amount of the Base Expenses (said increase being referred to herein as the “Cost Increase”), Tenant shall pay same (less the amount of Tenant’s Projected Share paid by Tenant on account thereof) to Landlord as Additional Rent.

(b)If Landlord’s Statement at the end of the then Operational Year shall indicate that Tenant’s Projected Share exceeded Tenant’s Proportionate Share of Cost Increase, Landlord shall permit Tenant to credit the amount of such excess against the subsequent payment(s) of Additional Rent due hereunder. If Landlord’s Statement shall indicate that Tenant’s Proportionate Share of Cost Increase exceeded Tenant’s Projected Share for the then Operational Year, Tenant shall, within twenty-five (25) days after demand therefor, pay the amount of such excess to Landlord. If said Landlord’s Statement is furnished to Tenant after the commencement of such Operational Year, there shall be promptly paid by Tenant to Landlord or vice versa, as the case may be, an amount equal to the portion of such payment or credit allocable to the part of such Operational Year which shall have elapsed prior to the first day of the calendar month next succeeding the calendar month in which said Landlord’s Statement is furnished to Tenant.

(c)Following the expiration of this Lease in accordance with the provisions hereof (and provided Tenant is not in default hereunder beyond applicable notice and cure periods), any overpayments by Tenant of any Additional Rent shall be refunded to Tenant within thirty (30) days of such Lease expiration.

Section 6.04.Apportionment. Additional Rent for the Lease Year in which the Rent Commencement Date or the Expiration Date shall occur shall be apportioned in that percentage which the number of days in the period from January 1st of such Lease Year to such date of expiration, both inclusive, shall bear to the total number of days in the calendar year in which such expiration occurs.

Section 6.05.Landlord’s Statement; Dispute.

(a)Landlord’s failure to render Landlord’s Statement with respect to any Operational Year or Tax Year or Landlord’s delay in rendering said Statement shall not prejudice Landlord’s right to render a Landlord’s Statement with respect to that Year or any subsequent Operational Year or Tax Year, except that notwithstanding the foregoing, failure of Landlord to bill Tenant for the Tenant’s Proportionate Share of Cost Increase within twenty-four (24) months after the end of the calendar year in which the same are due shall be deemed a waiver of Landlord to collect such Tenant’s Proportionate Share of Cost Increase from Tenant. The obligations of Landlord and Tenant under the provisions of this Article shall survive the expiration or earlier termination of the Term except as expressly provided for herein.

20

(b)Each Landlord’s Statement shall be conclusive and binding upon Tenant unless within sixty (60) days after receipt of such Landlord’s Statement Tenant shall notify Landlord that it disputes the correctness of Landlord’s Statement, specifying the respects in which Landlord’s Statement is claimed to be incorrect. Pending the determination of such dispute as hereinafter provided, Tenant shall timely pay Additional Rent in accordance with the applicable Landlord’s Statement, and such payment shall be without prejudice to Tenant’s position. In the event Tenant disputes Landlord’s Statement, Tenant may use, solely on a confidential basis pursuant to a confidentiality agreement in form and substance reasonably acceptable to Landlord and Tenant, Tenant’s own independent certified public accountant to reasonably inspect Landlord’s records of the material reflected on said Statement, which records shall be maintained in Fairfield County, Westchester County, or Manhattan (and which shall be made available on a confidential basis to Tenant and its certified public accountant and attorneys within a reasonable amount of time after written request by Tenant but not to exceed thirty (30) days); and in the event said independent certified public accountant determines that Landlord’s Statement was in error, the dispute shall be referred to binding arbitration as provided in Article 25 hereof. If the dispute shall be determined in Tenant’s favor, Tenant shall be entitled to a one-time credit (or prompt payment if the Term has expired) against Additional Rent thereafter payable in the amount of Tenant’s overpayment of Additional Rent resulting from compliance with Landlord’s Statement. If the arbitrator determines that the amount overcharged to Tenant exceeded the actual, total annual expenses by more than five percent (5%), then Landlord shall reimburse Tenant for its reasonable, out-of-pocket expenses incurred (including its independent certified public accountant) in connection with Tenant’s audit and the arbitration. If the arbitration determines such overcharges do not exceed such five percent (5%) threshold, Tenant shall be solely responsible for all costs incurred by Landlord and/or Tenant in connection with such audit and arbitration.

Section 6.06.Refunds. Notwithstanding anything contained herein to the contrary, in no event shall the aggregate amount of the refunds allowable to Tenant in any Operational Year pursuant to this Article 6 exceed the Additional Rent payable by Tenant pursuant to this Article 6 for such Operational Year, it being the intention of Landlord and Tenant that the Fixed Rent payable by Tenant hereunder shall not be reduced by reason of any decrease in the Taxes or Cost of Maintenance and Operation or Complex Operating Expenses; however, any portion of the aggregate refunds to Tenant not allowed in any Operating Year due to this Section 6.06 shall be carried forward and used to offset Additional Rent payable by Tenant in each subsequent Operating Year in the same manner as described in this Section 6.06 until such credits have been exhausted.

Section 6.07.Remedies. Any Additional Rent payable pursuant to Article 6 or elsewhere in this Lease shall be collectible by Landlord in the same manner as Fixed Rent and Landlord shall have the same rights and remedies for nonpayment thereof as Landlord has hereunder for non-payment of Fixed Rent.

Section 6.08.Gross-Up. In determining the amount of the Cost of Operation and Maintenance for the Operational Base Year and any Operational Year, if less than one hundred percent (100%) of the Building rentable area shall have been occupied by tenant(s) at any time during the Operational Base Year or any such Operational Year, the Costs of Operation and Maintenance which vary based upon occupancy levels in the Building shall be determined for the Operational Base Year or such Operational Year to be an amount equal to the like expenses which

21

would normally be expected to be incurred if one hundred percent (100%) of such areas had been occupied throughout such Operational Base Year or Operational Year. If less than one hundred percent (100%) of the rentable area of the Complex shall have been occupied by tenant(s) at any time during any Operational Year, Complex Operating Expenses which vary based upon occupancy levels in the Complex shall be similarly grossed up. For purposes of computing the Base Taxes or Taxes for subsequent Tax Years, if the Building or Complex is not fully assessed for real estate tax purposes as a completed Building or Complex at any time during the Tax Base Year or subsequent Tax Years, then the Taxes shall be increased to reflect what such costs would have been if they had been calculated on the basis of a fully assessed Building and Complex having a full assessment of Taxes for the entire Tax Base Year or subsequent Tax Years.

Section 6.09.Adjustments for Changes in Complex. Notwithstanding anything to the contrary contained in this Lease, Landlord may elect to separate or split portions of the Building and/or Complex into distinct ownership, condominium or operating structures. To the extent such separate structure occurs, Tenant’s Additional Rent charges under this Article 6 thereafter shall be equitably adjusted (without duplicative payments by Tenant) to reasonably reflect the percentage ratios of the then applicable rentable areas of the Premises, the Building and the Complex, based on such applicable structure. In such event, Tenant’s Proportionate Share, Tenant’s Projected Share, and the Building’s Share shall thereupon be equitably adjusted based on such new rentable areas, and Tenant shall pay its Additional Rent pursuant to Landlord’s revised statements without prejudice to Tenant’s position; however, any disputes between Landlord and Tenant in connection therewith that are not resolved in writing within sixty (60) days following notice of such dispute shall be resolved by binding arbitration pursuant to Article 25 hereof.

ARTICLE 7

Insurance

Section 7.01.Prohibited Acts; Compliance.

(a)Tenant shall not do anything, or suffer or permit anything to be done in or about the Premises, Land or Building by reason of any activity being conducted in the Premises which shall (i) subject Landlord to any liability or responsibility for injury to any person or property, (ii) cause any increase in the fire insurance rates applicable to the Building or equipment or other property located therein, or (iii) be prohibited by any license or other permit required or obtained pursuant to Section 5.03, including the certificate of occupancy for the Building. Landlord acknowledges that the Permitted Use (as opposed to Tenant’s particular manner of use of the Premises) will not cause any of the foregoing to occur.