STATEMENT OF EXECUTIVE COMPENSATION

FOR THE YEAR-ENDED

APRIL 30, 2023

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

Set out below are particulars of compensation paid to the following persons (the "Named Executive Officers" or "NEOs") as follows for Vizsla Silver Corp. ("Vizsla" or the "Company"):

a) a Chief Executive Officer ("CEO");

b) a Chief Financial Officer ("CFO");

c) each of the three most highly compensated executive officers of the company, including any of its subsidiaries, or the three most highly compensated individuals acting in a similar capacity, other than the CEO and CFO, at the end of the most recently completed financial year whose total compensation was, individually, more than $150,000 for that financial year; and

d) each individual who would be an NEO but for the fact that the individual was neither an executive officer of the company or its subsidiaries, nor acting in a similar capacity, at the end of that financial year.

In respect of the Company's year ended April 30, 2023, the Company is naming five NEOs.

| Name | Position |

| Michael Konnert | President, CEO and Director |

| Mahesh Liyanage | CFO |

| Martin Dupuis | Chief Operating Officer ("COO") |

| Michael Pettingell | SVP, Business Development and Strategy |

| Jesus Velador | VP, Exploration |

Compensation Governance

The Company has a fully-independent Compensation Committee comprised of three members (Simon Cmrlec - Chair, Harry Pokrandt and David Cobbold). All Compensation Committee members are current or former directors and officers of various publicly traded companies during the course of which they have reviewed and analyzed compensation levels and structures for both the Company's board of directors ("Board") and management. This provides them with the necessary experience to enable them to make decisions on the suitability of the Company's compensation practices and policies during the most recent fiscal year.

The Compensation Committee main duties and responsibilities are to review and approve compensation packages for senior executive officers, review the corporate goals and objectives relevant to senior executive officers and evaluate the performance of senior executive officers. Complete details of the Compensation Committee's duties and responsibilities can be read in the Compensation Committee Charter located on the corporate governance page of our website.

Executive Compensation Philosophy & Objectives

The goal of the executive compensation philosophy at Vizsla is to attract, motivate, retain, and reward a knowledgeable and driven management team and to encourage them to attain and exceed performance expectations.

Vizsla's compensation practices are based on a pay-for-performance philosophy in which assessment of performance is based on the company's financial and operational performance as well as individual contributions.

The following key principles guide the Company's overall compensation philosophy:

• Attract, retain, motivate and engage high caliber talent whose expertise, skills and performance are critical to the Company's success;

• Align employee interests with the business objectives of the Company;

• Focus employees on the key business factors that will drive shareholder value;

• Align compensation with Vizsla's corporate strategy and financial interests as well as the long-term interests of Vizsla shareholders; and

• Compensation should be fair and reasonable to shareholders and be set with reference to the local market and similar positions in comparable companies.

Since 2021, the Company, through the Compensation Committee, has engaged Global Governance Advisors ("GGA"), a leading independent compensation advisor with significant global executive and director compensation experience, to evaluate and provide recommendations on formalizing Vizsla's executive and director compensation programs to ensure competitiveness against a defined "Peer Group" (as detailed below) and within the overall mining marketplace. This included the analysis and development of the Company's Peer Group and evaluation of total direct compensation (Base Salary plus Short-Term Incentive and Long-Term Incentive) levels along with Short and Long-Term Incentive design practices relative to the competitive market. The Company's Peer Group will be reviewed periodically to generally ensure it remains aligned with the current size and scope of the Company's operations and is based on companies that generally meet the following criteria:

• Companies with a similar Market Cap range between 0.25x and 4x the size of Vizsla;

• Companies operating within the same industry segment as Vizsla (i.e., Silver, Gold or other precious metals);

• Companies who are in the exploration and/or construction phase looking to secure additional financing;

• Companies with a similar business strategy and scope of operations to Vizsla; and

• Publicly traded companies on major Canadian exchanges.

The Company's current Peer Group consists of the following companies:

| AbraSilver Resource Corp. | Bear Creek Mining Corp. | GoGold Resources Inc. | Prime Mining Corp. |

| Americas Gold and Silver Corporation | Bluestone Resources Inc. | New Pacific Metals Corp. | Probe Metals Inc. |

| Ascot Resources Ltd. | Discovery Silver Corp. | Orezon Gold Corp. | Silvercrest Metals Inc. |

| Aya Gold & Silver Inc. | Foran Mining Corp. | Perpetua Resources Corp. | Skeena Resources Ltd. |

The companies, Alexco Resource Corp., Anaconda Mining Inc., Aurcana Silver Corp., Great Panther Mining Ltd., and Integra Resources Corp., were removed from the 2023 peer group either due to the size of the organization no longer being relevant or due to their having been acquired and the companies, AbraSilver Resource Corp. Aya Gold & Silver Inc., Bear Creek Mining Corp., Foran Mining Corp., New Pacific Metals Corp., and Orezone Gold Corp. were added to the 2023 peer group.

The Compensation Committee is required to pre-approve any compensation related engagements by GGA. Although management of the Company may work with GGA on compensation specifics, GGA reports directly to the Compensation Committee in all engagements undertaken. The Company incurred the following fees for GGA's work over the past two years:

| FY Ended April 30, 2023 | FY Ended April 30, 2022 | |

| Executive Compensation-Related Fees | $41,526 | $35,394 |

| All Other Fees | - | - |

| TOTAL | $41,526 | $35,394 |

The compensation program is designed to reward each executive based on corporate and individual performance and is also designed to incent such executives to drive the organization's growth in a sustainable and prudent way.

EXECUTIVE COMPENSATION

Elements of Executive Compensation Program

During the fiscal year ended April 30, 2023, the Company's executive compensation program was comprised of four (4) components:

a. Base Salary;

b. Performance Bonuses (Short-Term Incentive);

c. Long-Term Incentive (Stock Options & Restricted Share Units); and

d. Employee Benefits.

| Compensation Component |

Description | Form of Compensation |

| Base salary or consulting fee | This is an annual fixed fee paid to each individual. The criteria for determining the amount is based on, first and foremost, attracting and retaining highly talented and experienced individuals. The second is based on the market for similar jobs in similar locations and thirdly, the experience and skills and responsibility of each individual is considered. | Fixed (Paid in Cash) |

| Performance Bonuses | Bonuses are a variable component of compensation and are designed to award NEO's for maximizing performance against corporate and individual objectives. Bonus opportunity levels will vary by employee level, role and responsibilities and be reflective of market practice for similar roles at organizations of a similar size, scope and complexity. The bonus is reflective of each individual's performance and determined by the Compensation Committee and approved by the Board with payouts typically made in cash on annual basis. | Variable (Paid in Cash) |

| Long-Term Incentive - LTIP (Stock Options & Restricted Share Units) |

Long-Term Incentive is a variable component of compensation and links pay to the longer-term performance of Company shares. LTIP is intended to be granted annually with the ability realize long-term value when superior share price performance is achieved for the Company's shareholders. LTIP grant levels will vary by employee level, role and responsibilities and be reflective of market practice for similar roles at organizations of a similar size, scope and complexity. Stock Options are granted to executives to reward and incentivize them to continue to achieve success and create shareholder value for the Company as they only are of value if the Company's underlying share price appreciates above the exercise price they are granted at. When stock options are granted, they have an expiry term of no more than five years with vesting terms typically of two years or more. Restricted Share Units ("RSUs") are also granted to executives to reward and incentivize them to continue to achieve success and create shareholder value for the Company. The RSUs start to vest after one year and fully vest over a period of three years. |

Variable (Settled in Equity) |

| Employee Benefits | Participation in the Company's employee group benefits plans is provided to each executive, where needed, but excludes any formal pension plan. The primary purposes of providing benefits to executives is to attract and retain the talent required to operate and manage the Company. Overall, employee benefits are designed to not make-up a large portion of an executive's total compensation package but be competitive overall with equivalent positions in the mining industry of similar size and scope. |

Fixed (Settled as part of payroll) |

Base Salary

In determining the annual base salary, the Board, with the recommendation of the Compensation Committee, considered the following factors:

• Current competitive market and economic conditions;

• Compensation levels within the peer group;

• Company performance as compared with the peer group; and

• Particular skills of each NEO, such as leadership ability, management effectiveness, experience, technical skill and knowledge, responsibility and proven or expected performance of the particular individual.

The annual base salaries for NEOS were as follows:

| Named Executive Officer and Position | 2023 Base Salary |

2022 Base Salary |

% Change Year- over-Year 1 |

| Michael Konnert, President, CEO & Director | $350,000 | $350,000 | 0.00% |

| Mahesh Liyanage, CFO | $220,000 | $220,000 | 0.00% |

| Martin Dupuis, COO 2 | $250,000 | $250,000 | 0.00% |

| Michael Pettingell, SVP Business Development and Strategy 3 | $195,000 | $180,000 | 8.33% |

| Jesus Velador, VP, Exploration 4 | $227,500 | $227,500 | 0.00% |

1 Year-over-year change reflects the underlying peer group salary data for comparable roles, the material increase of the Company's market capitalization, the desire to retain the team responsible for the operational advances that were largely responsible for the increase in the Company's market capitalization, as well as to reflect the significant achievements in advancing the Panuco-Copala Project between 2022 and 2023.

2 Martin Dupuis was VP of Technical Services from January 28, 2021 and was promoted to COO May 1, 2022.

3 Michael Pettingell was appointed VP of Business Development and Strategy on July 27, 2021 and was promoted to SVP of Business Development and Strategy January 27, 2023.

4 Jesus Velador was appointed VP, Exploration May 1, 2022.

Performance Bonuses

The performance bonuses are payable in cash, and the amount payable is based on the Compensation Committee's assessment of performance against pre-established objectives and targets. While the objectives are largely tied to Company results, the specific metrics and performance expectations are tailored to each executive to ensure an appropriate line-of-sight between the results achieved and the performance bonus payout earned.

The table below summarizes the performance bonus as a percentage of the base salary established by the Compensation Committee after May 1st of every year. The bonuses are arrived at based on the overall performance of the Company, the individuals performance, the increase of the market capitalization, the success of the drilling programs and the significant achievements in advancing the Panuco-Copala Project between 2022 and 2023.

| Named Executive Officer and Position | Actual Performance Bonus (% of Base Salary) |

Actual Performance Bonus |

| Michael Konnert, President, CEO & Director | 85.71% | $300,000 |

| Mahesh Liyanage, CFO | 68.18% | $150,000 |

| Martin Dupuis, COO | 84.20% | $210,500 |

| Michael Pettingell, SVP Business Development and Strategy | 76.92% | $150,000 |

| Jesus Velador, VP, Exploration | 33.04% | $75,000 |

Long-Term Incentives

The Company has been providing for equity participation in the Company through its Omnibus Equity Incentive Plan (the "Equity Plan") which was adopted by the Board on September 7, 2022 and approved by Shareholders on December 8, 2022. The Equity Plan replaced the existing Stock Option Plan that was in place since 2018. The Equity Plan includes a rolling 10% stock option plan to issue stock options ("Stock Options") and a fixed 8% other equity plan. Other equity available to issue are Restricted Share Units ("RSUs"), Performance Share Units ("PSUs") and Deferred Share Units ("DSUs") (together "Awards"). The Equity Plan can be found on the Company's Corporate Governance page on the website or under the Company's profile on SEDAR or EDGAR.

The purpose of the Equity Plan is to incentivize officers, directors, employees, consultants and advisors of the Company to achieve objectives of the Company and to attract, motivate and retain the critical employees to drive the business success of the Company.

As of April 30, 2023, there were 207,938,329 Shares issued and outstanding, an aggregate of 15,926,972 stock options outstanding and an aggregate of 1,133,572 RSUs issued. There were 4,866,861 stock options available to issue and an aggregate of 11,256,428 RSUs, PSUs or DSUs available to issue.

Terms of the Equity Plan

The Equity Plan is a "rolling up to 10% and fixed up to 8%" Security Based Compensation Plan, as defined in Policy 4.4 - Security Based Compensation of the TSX Venture Exchange (the "TSXV"). The Equity Plan is a: (a) "rolling" plan pursuant to which the number of Shares that are issuable pursuant to the exercise of Options granted hereunder, and under the Prior Stock Option Plan, shall not exceed 10% of the Issued Shares of the Company as at the date of any Stock Option grant, and (b) "fixed" plan under which the number of Shares of the Company that are issuable pursuant to all Awards other than Stock Options granted hereunder and under any other Security Based Compensation Plan of the Company, in aggregate is a maximum of 8% of the Issued Shares of the Company which is 154,875,802 issued shares, therefore a total of up to 12,390,000 may be issued under the 8% fixed plan.

Unless the Company has obtained the requisite disinterested shareholder approval, the maximum aggregate number of Shares of the Company that are issuable pursuant to all Stock Options and Awards granted or issued in any 12 month period to any one Person must not exceed 5% of the Issued Shares of the Company, calculated as at the date any Stock Option or Award is granted or issued to the Person.

The Equity Plan is subject to the following provisions:

Additional Terms for Stock Options

The Stock Option Price for each grant of a Stock Option under this Equity Plan shall be determined by the Compensation Committee and shall be specified in the Award Agreement. The minimum exercise price of an Option shall not be less than the Discounted Market Price (as defined in the policies of the TSXV), provided that, if the Company does not issue a news release to announce the grant and the exercise price of a Stock Option, the Discounted Market Price is the last closing price of the Shares before the date of grant of the Stock Option less the applicable discount. A minimum exercise price cannot be established unless the Options are allocated to particular Persons.

The following provisions apply to all Stock Option grants:

Additional Terms for RSUs

The Compensation Committee, at any time and from time to time, may grant RSUs to participants in such amounts and upon such terms as the Compensation Committee shall determine.

When and if RSUs become vested, such RSUs ("Vested RSUs") shall be settled as soon as reasonably practicable following the vesting Date and, in any event, notwithstanding any other provision of the Equity Plan, no payment, whether in cash or Shares, shall be made in respect of the settlement of any Vested RSU on a date that is later than December 31 of the calendar year which is three years following the end of the year (or first of the years) in which the participant performed the services to which the award agreement relates. Unless the award agreement specifies otherwise, the Company shall settle each Vested RSU then being settled by means of either a cash payment equal to the FMV on the Vesting Date of a Share or the issuance of a Share from treasury or a combination of both subject to any tax withholding obligations.

Additional Terms for DSUs

The Compensation Committee, at any time and from time to time, may (i) designate participants who may receive DSUs under the Equity Plan, (ii) fix the number of DSUs, if any, which may be granted to a particular participant, and (iii) determine any other terms and conditions applicable to the grant of DSUs.

The Committee shall only designate participants who are directors, officers or employees of the Company or a corporation related to the Company and as soon as reasonably practicable after designating a participant as eligible to receive DSUs, the Compensation Committee shall provide such designated participant notice in writing of the designation.

At least ten (10) days prior to the commencement of a particular year, a designated participant may enter into an agreement (a "DSU Agreement") with the Company in respect of such upcoming year to cause the participant to receive a portion of their cash remuneration payable for services to be provided during the particular year in the form of DSUs.

A DSU Agreement made with the Company in respect to a particular year is irrevocable, except if a designated participant has entered into a prior DSU Agreement in respect of an upcoming year (which has not yet commenced) and the designated participant and the Company enter into a subsequent DSU Agreement in respect of the upcoming year in the form, in which case, the prior DSU Agreement shall be rescinded in respect of the upcoming year (or years) only and such upcoming year (or years) shall instead be subject to the subsequent DSU Agreement.

DSUs elected to be received by a designated participant shall be credited as of the applicable conversion Date. The number of DSUs (including fractional DSUs) to be credited to a designated participant shall be determined by dividing the relevant portion of that designated participant's cash remuneration for the applicable period to be satisfied by DSUs by the Fair Market Value of a Share on the particular Conversion Date.

No amount may be received in respect of a DSU until after the termination date of the participant. "Termination Date" means the earliest to occur of the following dates (each a "Termination Event"):

a. the date of the Participant's death;

b. the date on which a Participant ceases to hold any position as a director, officer or Employee with the Corporation or any related entity, and, for greater certainty, shall not be before the time of the Participant's retirement from, or loss of, such office or employment with the Corporation or any related entity under applicable law.

Termination Event for Cause - If the Termination Date of a participant occurs as a result of a termination of a participant for Cause, all outstanding DSUs, whether vested or not vested, shall be forfeited and cancelled immediately, and the participant shall have no entitlement to receive any payment in respect of such forfeited DSUs, by way of damages, pay in lieu of notice or otherwise.

Termination Event otherwise than for Cause - If the Termination Date of a participant occurs as a result of the death of a participant, all DSUs at such time that have not yet vested shall be deemed to vest in the moment immediately prior to the participant's death. As soon as reasonably practicable after the Termination Date of a participant for a reason other than Cause, or as the participant may elect, and in any event, no later than December 15 of the first calendar year commencing after the Termination Date the Company shall redeem and fully settle each DSU in respect of which all vesting and other conditions to redemption and settlement have been met, deemed to have been met or waived by the Compensation Committee on or before the Termination Date (such settlement date being a "Redemption Date").

If the Termination Date of a participant occurs for a reason other than Cause after the Termination Date, the participant (or their estate) may elect up to three separate Redemption Dates as of which either a portion (specified in whole percentages) or all of the value of the participant's DSUs shall be redeemed and settled, by filing with the Company, following such participant's Termination Date, in the form and manner specified by the Compensation Committee up to three irrevocable written elections, provided that the elected Redemption Dates are no later than December 15 of the first calendar year commencing after the participant's Termination Date.

Additional Terms for PSUs

The Compensation Committee, at any time and from time to time, may grant PSUs to participants in such amounts and upon such terms as the Compensation Committee shall determine, provided that, no PSUs shall vest earlier than one year after the date of grant or later than three years after the date of grant, except that the Compensation Committee may in its sole discretion accelerate the vesting who dies or who ceases to be an eligible participant under the plan in connection with a Change of Control.

Each PSU shall give the participant the right to receive a Share or a cash payment in an amount equal to the FMV of a Share at the end of the applicable Performance Period, subject to the terms, vesting criteria and Performance Goals of the relevant PSU as established by the Compensation Committee and set forth in the Award Agreement. The Compensation Committee shall have the sole discretion to decide whether a PSUs are settled in cash, Shares or a combination thereof.

If PSUs become vested and the applicable Performance Goals have been met on or before the end of the Performance Period, such Performance Share Units ("Vested PSUs") shall be settled as soon as reasonably practicable following the end of the applicable Performance Period and no payment, whether in cash or Shares, shall be made in respect of the settlement of any Vested PSU on a date that is later than December 31 of the calendar year which is three years following the end of the year (or first of the years) in which the participant performed the services to which the award agreement relates. Unless the award agreement specifies otherwise, the Company shall settle each Vested PSU then being settled by means of a cash payment equal to the FMV on the Vesting Date of a Share or the issuance of a Share from treasury or a combination of cash and Shares as determined by the Compensation Committee at its sole discretion and subject to any tax withholding.

If a participant dies while an Employee, Director of, or Consultant to, the Company, the number of PSUs held by the participant that have not vested shall be adjusted as set out in the applicable award agreement. Any Deemed Awards shall be deemed to vest in the moment immediately prior to the death of the participant. The Performance Period in respect of any Performance Share Units held by the Participant that have vested at the time of shall be deemed to end immediately upon the Death of the Participant and shall be paid to the participant's estate in accordance with the award agreement and any settlement or redemption of any PSUs shall occur within one year following the Termination Date. Such participant's eligibility to receive further grants of PSUs under the Equity Plan ceases as of the Termination Date.

Termination other than Death - Unless determined otherwise by the Compensation Committee, or as may otherwise be set out in a participant's employment agreement, where a participant's employment or term of office or engagement terminates for any reason other than death (whether such termination occurs with or without any or adequate notice or reasonable notice, or with or without any or adequate compensation in lieu of such notice), then the Performance Period in respect of any PSUs held by the participant that have vested before the Termination Date shall be deemed to end immediately upon the Termination Date of the participant and shall be paid to the participant in accordance with the terms of the Equity Plan and award agreement, and any PSUs held by the participant that are not yet vested at the Termination Date will be immediately cancelled and forfeited to the Company on the Termination Date. The eligibility of a participant to receive further grants under the Equity Plan ceases as of the date that the Company provides notice and any PSUs shall occur within one year following the Termination Date.

Long-Term Incentive Grants in Fiscal Year Ended April 30, 2023

The following table outlines each of the equity incentive grants made to NEOs in 2023. These grants were arrived at based on the overall performance of the Company, the individuals performance, the increase of the market capitalization, the success of the drilling programs and the significant achievements in advancing the Panuco-Copala Project between 2022 and 2023.

| Named Executive Officer and Position | Stock Options (Options) |

Restricted Share Units (RSU's) |

||||

| Date of Grant |

Number of Options Granted |

Exercise Price |

Date of Grant | Number of RSUs Granted |

Price of RSUs |

|

| Michael Konnert President, CEO & Director |

10-Feb-20231 |

500,000 |

$1.60 | 10-Feb-20233 |

159,091 | $1.60 |

| Mahesh Liyanage CFO |

10-Feb-20231 |

325,000 |

$1.60 | 10-Feb-20233 | 46,667 | $1.60 |

| Martin Dupuis COO |

02-Jun-20222 10-Feb-20231 |

75,000 325,000 |

$1.74 $1.60 |

10-Feb-20233 | 121,212 | $1.60 |

| Michael Pettingell SVP Business Development and Strategy |

02-Jun-20222 10-Feb-20231 |

50,000 325,000 |

$1.74 $1.60 |

10-Feb-20233 | 74,848 | $1.60 |

| Jesus Velador VP, Exploration |

02-Jun-20222 10-Feb-20231 |

200,000 125,000 |

$1.74 $1.60 |

10-Feb-20233 | 110,985 | $1.60 |

1 These options will expire February 10, 2028, and vest over 24 months.

2 These options will expire June 2, 2027, and vest over 24 months.

3 These RSUs vest over 36 months with the first vesting to occur after 12 months from date of grant.

The Board has adopted a Timely Disclosure, Confidentiality & Insider Trading Policy which includes the prohibition of hedging and derivative trading for members of the Board and senior management of the Company. During 2023, no NEO or Director, directly or indirectly, purchased any financial instruments or employed a strategy to hedge or offset a decrease in market value of equity securities granted as compensation or held.

The Compensation Committee considered the implications of the risks associated with the Company's compensation policies and practices and concluded that, given the nature of the Company's business and the role of the Compensation Committee in overseeing the Company's executive compensation practices, the compensation policies and practices do not serve to encourage any Named Executive Officer to take inappropriate or excessive risks, and no risks were identified arising from the Company's compensation policies and practices that are reasonably likely to have a material adverse effect on the Company.

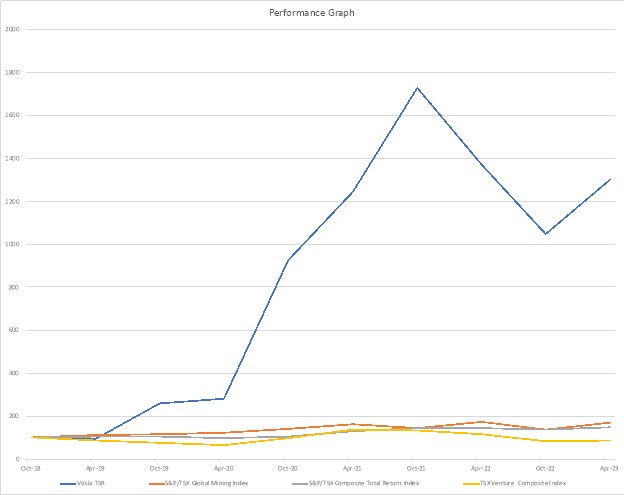

Performance Graph

The following graph compares the Company's cumulative total Shareholder return ("TSR") over the five most recently completed financial years ending April 30, 2023. It portrays the five-year growth of $100 invested in the common shares of Vizsla from October 4, 2018 to April 30, 2023, compared to $100 invested in the S&P/TSX Composite Total Return Index, and S&P/TSX Global Mining Index for the same period.

| Date | TSR | S&P/TSX Global Mining Index |

S&P/TSX Composite Total Return Index |

TSX Venture Composite Index |

| Oct-2018 | 100 | 100 | 100 | 100 |

| Apr-2019 | 93 | 111 | 106 | 87 |

| Oct-2019 | 260 | 114 | 107 | 77 |

| Apr-2020 | 280 | 122 | 97 | 67 |

| Oct-2020 | 927 | 140 | 104 | 97 |

| Apr-2021 | 1,247 | 161 | 130 | 136 |

| Oct-2021 | 1,727 | 146 | 144 | 135 |

| Apr-2022 | 1,373 | 174 | 144 | 116 |

| Oct-2022 | 1,047 | 137 | 137 | 85 |

| Apr-2023 | 1,300 | 171 | 148 | 87 |

From the time that the Company was listed on the TSXV on September 26, 2017, Vizsla's share price increased 1,300% outperforming the S&P/TSX Global Mining Index, and the S&P/TSX Composite Total Return Index. This exceptional share-price performance demonstrates the strategic value and commitment by the Executives in creating long-term shareholder value while advancing the Panuco-Copala Project in an optimal manner.

The Company's executive compensation is based on several factors including, but not limited to, the demand for and supply of skilled professionals in the resource industry generally, individual performance, the Company's performance, and other factors. The trading price of the common shares on the TSXV and the NYSE is subject to fluctuation based on several factors, many of which are beyond the control of the Company and its Executives. These include, among other things, market perception of the Company's ability to achieve planned growth or results, trading volume in the Company's common shares, and changes in general conditions in the economy and financial markets. That being said, a significant portion of the NEO's total compensation has been tied to equity-based awards through stock options which are considered at-risk and long-term performance-based. It also means that the compensation realized by NEOs is greatly tied to the performance of Vizsla shares for Company shareholders.

Summary Compensation Table for NEOs

The following table is a summary of compensation paid to the Named Executive Officers in respect of the Company's financial years ended April 30, 2023, 2022, and 2021.

| Name and Position | Year | Salary, consulting fee, retainer or commission ($) |

Bonus 8 ($) |

Share based awards 9 ($) |

Pension value ($) |

Option based awards 7 ($) |

Value of all other compensation ($) |

Total compensation ($) |

| Michael Konnert1 President, CEO & Director |

2023 | 350,000 | 300,000 | 33,650 | - | 610,650 | - | 1,294,300 |

| 2022 | 350,000 | 350,000 | - | - | 2,880,117 | - | 3,580,117 | |

| 2021 | 336,667 | 350,000 | - | - | 363,935 | - | 1,050,602 | |

| Mahesh Liyanage2 CFO |

2023 | 219,996 | 150,000 | 9,871 | - | 396,923 | - | 776,789 |

| 2022 | 131,500 | 127,500 | - | - | 966,300 | - | 1,225,300 | |

| 2021 | 48,750 | 10,700 | - | - | 133,581 | - | 193,031 | |

| Martin Dupuis3 COO |

2023 | 250,000 | 210,500 | 25,638 | - | 506,858 | - | 992,996 |

| 2022 | 211,000 | 158,400 | - | - | 600,070 | - | 969,470 | |

| 2021 | 122,850 | 7,000 | - | - | 60,646 | - | 190,496 |

| Name and Position | Year | Salary, consulting fee, retainer or commission ($) |

Bonus 8 ($) |

Share based awards 9 ($) |

Pension value ($) |

Option based awards 7 ($) |

Value of all other compensation ($) |

Total compensation ($) |

| Charles Funk4 Director (Former VP of Exploration) |

2023 | 13,038 | N/A | N/A | N/A | N/A | N/A | N/A |

| 2022 | N/A | N/A | N/A | N/A | N/A | N/A | N/A | |

| 2021 | 116,580 | 250,000 | - | - | 74,672 | - | 501,898 | |

| Michael Pettingell5 SVP Business Development and Strategy |

2023 | 191,250 | 150,000 | 15,831 | - | 470,213 | - | 827,294 |

| 2022 | 180,123 | 100,800 | - | - | 490,310 | - | 771,233 | |

| 2021 | N/A | N/A | N/A | N/A | N/A | N/A | N/A | |

| Jesus Velador6 VP, Exploration |

2023 | 283,441 | 75,000 | 23,475 | - | 445,823 | 17,000 | 844,738 |

| 2022 | N/A | N/A | N/A | N/A | N/A | N/A | N/A | |

| 2021 | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

1. Michael Konnert was appointed President and CEO and elected as a Director on September 26, 2017, the date of Incorporation. He receives no form of Director compensation given his role as an officer of the Company.

2. Mahesh Liyanage was appointed CFO on December 1, 2020.

3. Martin Dupuis was appointed VP of Technical Services on January 28, 2021 and promoted to COO on May 1, 2022.

4. Charles Funk was appointed VP of Exploration on June 1, 2019 and resigned on January 28, 2021. He was then elected as a director on January 28, 2021. The compensation reflected in this table relates only to his former role as VP Exploration and excludes any compensation paid to him in his role as a Director following January 28, 2021. His compensation relating to his role as a Director can be found in the Summary Compensation Table for Directors.

5. Michael Pettingell is not considered a NEO but earned more than $150,000 during the year ended April 30, 2023. He was appointed VP of Business Development and Strategy on July 27, 2021 and was promoted to SVP of Business Development and Strategy on January 27, 2023.

6. Jesus Velador is not considered a NEO but earned more than $150,000 during the year ended April 30, 2023. He was appointed VP Exploration on May 1, 2022.

7. Option-based awards are valued using the Black-Scholes option pricing model, which is in accordance with IFRS, for consistency with the accounting valuation. For option-based awards, the fair value of the of the awards at the grant date reflects the number of options awarded multiplied by the accounting fair value price.

The 2022 option award included the incremental share-based compensation amount recognized from the Arrangement with Vizsla Copper on September 20, 2021. The Black-Scholes value is calculated as part of a requirement by IFRS to fair value the options at the time of the grant. It is not the determining factor when granting stock options. The stock options are granted based on the performance and retention of key individuals.

| 2023 | 2022 | 2021 | |

| Exercise price | $1.60 to $1.74 | $2.22 to $2.25 | $0.76 to $1.44 |

| Risk free rate | 2.89% to 3.31% | 0.79% to 1.65% | 0.32% to 0.58% |

| Volatility estimate | 101.32% | 100% to 104% | 93.7% to 103.9% |

| Expected life | 5 years | 5 years | 5 years |

| Dividend rate | - | - | - |

| Per option value | $1.22 to $1.47 | $1.67 to $1.86 | $1.30 to $2.08 |

8. For Non-Equity incentive plans described, the Company only provided Annual incentive plans in the forms of cash bonuses. The Company did not have any Long-term non-equity compensation.

9. Share Based Awards displays the fair value, recognized at April 30, 2023, of the RSU's that were awarded in February 2023.

Outstanding Share-Based Awards and Option-Based Awards

The following table displays all awards outstanding for each NEO at the end of April 30, 2023.

| Name | Option-Based Awards | Share-Based Awards | |||||

| # of securities underlying unexercised options |

Option exercise price |

Option expiry date |

Value of unexercised in- the-money options 1 |

# of shares or units that have not vested |

Market or payout value of share- based awards that have not vested 2 |

Market or payout value of vested share- based awards not paid out or distributed |

|

| Michael Konnert President, CEO & Director |

450,000 450,000 350,000 323,000 1,000,000 500,000 500,000 |

$0.66 $0.76 $2.07 $1.44 $2.22 $2.25 $1.60 |

30-Dec-2024 29-Jun-2025 6-Aug-2025 17-Feb-2026 22-Jun-2026 24-Sep-2026 10-Feb-2028 |

$580,500 $535,500 - $164,730 - - $175,000 |

- - - - - - 159,091 |

- - - - - - $262,500 |

- - - - - - - |

| Mahesh Liyanage CFO |

100,000 200,000 225,000 240,000 325,000 |

$1.40 $1.44 $2.22 $2.25 $1.60 |

1-Dec-2025 17-Feb-2026 22-Jun-2026 24-Sep-2026 10-Feb-2028 |

$41,250 $102,000 - - $22,750 |

- - - - 46,667 |

- - - - $77,001 |

- - - - - |

| Martin Dupuis COO |

75,000 140,000 185,000 120,000 75,000 325,000 |

$1.69 $1.44 $2.22 $2.25 $1.74 $1.60 |

27-Aug-2025 17-Feb-2026 22-Jun-2026 24-Sep-2026 02-Jun-2027 10-Feb-2028 |

$19,500 $71,400 - - $6,300 $22,750 |

- - - - - 121,212 |

- - - - - $200,000 |

- - - - - - |

| Michael Pettingell SVP Business Development and Strategy |

220,000 120,000 50,000 325,000 |

$2.34 $2.25 $1.74 $1.60 |

12-Jul-2026 24-Sep-2026 02-Jun-2027 10-Feb-2028 |

- - $4,200 $22,750 |

- - - 74,848 |

- - - $123,499 |

- - - - |

| Jesus Velador VP, Exploration |

200,000 125,000 |

$1.74 $1.60 |

02-Jun-2027 10-Feb-2028 |

$16,800 $8,750 |

- 110,985 |

- $183,125 |

- - |

1 Represents the difference between the market value of the Common Shares underlying the options on April 30, 2023 (based on $1.95 closing price of the Common Shares on the TSX-V on that date).

2 Represents the price of $1.65 per RSU used at the time of the grant.

Value Vested or Earned During the Year Ended April 30, 2023

| Name | Option-Based Awards - Value vested during the year1 |

Share-Based Awards - Value vested during the year |

Non-Equity Incentive Plan Compensation - Value earned during the year |

| Michael Konnert President, CEO & Director |

$8,883 | - | - |

| Mahesh Liyanage CFO |

$10,500 | - | - |

| Martin Dupuis COO |

$6,250 | - | - |

| Michael Pettingell SVP Business Development and Strategy |

$1,600 | - | - |

| Jesus Velador VP, Exploration |

$6,400 | - | - |

1. Represents the dollar value, by which the value of Common Shares exceeded the exercise price on the day the options vested, that would have been realized if the options had been exercised on the vesting date based on the closing price of the Common Shares on the TSXV less the exercise price of the options.

No stock options were exercised during the year ended April 30, 2023.

Termination and Change of Control Benefits

In the event that any NEO is terminated for cause, they are not entitled to any additional payments.

In the event that any NEO is terminated by Vizsla without cause, the executive resigns with Good Cause, or if the Executive's employment is terminated following a Change of Control, the Executive may be eligible for certain entitlements as described below.

On termination without cause, resignation for Good Cause, or following a Change of Control, each NEO shall be paid severance consisting of a specified number of months of:

current salary

continuation of health benefits, and

highest monthly short term incentive amount from the three preceding years;

The NEO shall also be entitled to receive the highest monthly short term incentive amount received in the three preceding years, prorated for months worked during the year up to the termination date.

In the event of a Change of Control, Options that are outstanding at the time of the occurrence of such event shall become immediately vested and fully exercisable. In the case of equity issued through RSUs, all RSUs at the time of termination following a Change of Control shall become vested RSUs and each participant shall be entitled to payouts in accordance with the terms of the Equity Plan.

For clarity:

"Good Cause" means the resignation, other than on a purely voluntary basis, as a result of the occurrence of one or more of the following events without the NEO's consent: constructive dismissal, a significant reduction of compensation, title, or role, relocation of more than 100 kilometers, or a material reduction in the NEO's responsibilities.

"Change of Control" means a) the acquisition of 50% of Vizsla's common shares by a person or a group of persons acting jointly or in concert, b) the removal, or failure to elect 50% or more of the members of the Board who were nominated by the Company's Board at the nearest Annual General Meeting, or c) the sale of substantially all the assets of the Company.

| Name | Without Cause or For Good Cause |

Following a Change of Control |

| Michael Konnert President, CEO & Director |

18 months | 36 months |

| Mahesh Liyanage CFO |

12 months | 24 months |

| Martin Dupuis COO |

12 months | 24 months |

| Michael Pettingell SVP Business Development and Strategy |

3 months | 12 months |

| Jesus Velador, VP, Exploration | 1 month | - |

The table below summarizes the estimated incremental payments related to termination scenarios under each Senior Executive Agreement assuming the events occurred on April 30, 2023.

| Name | Type of Termination |

Base Salary ($) |

Performance Bonus ($) 1 |

Other ($) |

Total ($) |

| Michael Konnert President, CEO & Director | Without Cause or for Good Cause | 525,000 | 525,000 | - | 1,050,000 |

| Following a Change of Control | 1,050,000 | 1,050,000 | - | 2,100,000 | |

| Mahesh Liyanage CFO |

Without Cause or for Good Cause | 220,000 | N/A | - | 220,000 |

| Following a Change of Control | 440,000 | N/A | - | 440,000 |

| Name | Type of Termination |

Base Salary ($) |

Performance Bonus ($) 1 |

Other ($) |

Total ($) |

| Martin Dupuis COO |

Without Cause or for Good Cause | 250,000 | N/A | - | 250,000 |

| Following a Change of Control | 500,000 | N/A | - | 500,000 | |

| Michael Pettingell SVP Business Development and Strategy |

Without Cause or for Good Cause | 48,750 | N/A | - | 48,750 |

| Following a Change of Control | 195,000 | N/A | - | 195,000 | |

| Jesus Velador, VP, Exploration | Without Cause or for Good Cause | 18,958 | N/A | - | 18,958 |

| Following a Change of Control | - | - | - | - |

1. NEOs are entitled to receive a short-term incentive amount, prorated for months worked during the year up to the termination date. As this amount would vary depending on the time of year that the termination of employment was to occur, an estimate of that amount it is not included in the above figure.

DIRECTOR COMPENSATION

Cash Retainers

Outlined in the table below is a summary of the cash retainers approved by the Board for 2022 and 2023. Considering the results of benchmarking analysis by GGA, the Board approved adjustments for 2023 to position director compensation more competitively within the peer group and reflect the evolution of Vizsla as a company which has increased the roles and responsibilities of Board members. Cash retainers are payable in cash on a quarterly basis.

| Director Compensation | 2023 | 2022 | ||

| Chair Annual Retainer |

Member Annual Retainer |

Chair Annual Retainer |

Member Annual Retainer |

|

| Board of Directors | $100,000 | $50,000 | $100,000 | $50,000 |

| Audit Committee | - | - | - | - |

| Compensation Committee | - | - | - | - |

| Technical Committee | - | - | - | - |

| Corporate Governance & Nominating | - | - | - | - |

Equity Compensation

The Non-Executive Directors of the Company are primarily compensated by way of stock options, RSUs and directors' fees.

The following table outlines the value of equity compensation granted to Non-Executive Directors in the form of stock options during the Fiscal Year Ended April 30, 2023.

| Director | Date of Grant |

Number of Options Granted |

Exercise Price |

| Craig Parry | - | - | - |

| Simon Cmrlec | - | - | - |

| Harry Pokrandt | 02-Jun-20221 | 50,000 | $1.74 |

| David Cobbold | 10-Feb-20232 | 100,000 | $1.60 |

| Charles Funk (former) 3 | - | - | - |

1. These options expire on June 2, 2027 and vest over 24 months.

2. These options expire on February 10, 2023 and vest over 24 months.

3. Charles Funk resigned as a director as of January 27, 2023 and was appointed as an advisor of the Company.

Summary Compensation Table for Directors

The following table sets forth all amounts of compensation provided to the directors of the Company (other than directors who are Named Executive Officers) during 2023. For directors who are Named Executive Officers, see "Summary Compensation Table for NEOs" above.

| Name | Year | Salary, consulting fee, retainer or commission ($) |

Bonus 8 ($) |

Committee or meeting fees ($) |

Pension value ($) |

Option based awards7 ($) |

Share based awards9 ($) |

Value of all other compensation ($) |

Total compensation ($) |

| Charles Funk1 | 2023 | - | - | 36,962 | - | - | - | - | 36,962 |

| Craig Parry2 | 2023 | - | - | 152,179 | - | - | 9,614 | - | 161,794 |

| Simon Cmrlec3 | 2023 | - | - | 50,000 | - | - | 6,410 | - | 56,410 |

| Stuart Smith4 | 2023 | - | - | 12,500 | - | - | - | - | 12,500 |

| Harry Pokrandt5 | 2023 | - | - | 50,692 | - | 73,290 | 6,410 | - | 130,391 |

| David Cobbold6 | 2023 | - | - | 21,525 | - | 122,130 | 6,410 | - | 150,065 |

1. Charles Funk was VP of Exploration from June 1, 2019, to January 28, 2021 and he was a director from January 28, 2021 to January 27, 2023. He is now an advisor to the Company. The compensation reflected in this table relates only to his role as a Director and excludes any compensation paid to him in his former role as VP of Exploration. His compensation relating to his former role as VP of Exploration can be found in the Summary Compensation Table for NEOs.

2. Craig Parry has been the Chairman since December 18, 2018.

3. Simon Cmrlec has been an independent director since February 21, 2019

4. Stuart Smith was a director from Feb 22, 2019, to July 6, 2022.

5. Harry Pokrandt has been an independent director since November 23, 2021.

6. David Cobbold has been an independent director since December 8, 2022.

7. Option-based awards are valued using the Black-Scholes option pricing model, which is in accordance with IFRS, for consistency with the accounting valuation. For option-based awards, the fair value of the of the awards at the grant date reflects the number of options awarded multiplied by the accounting fair value price.

The 2022 option award included the incremental share-based compensation amount recognized from the Arrangement with Vizsla Copper on September 20, 2021. The Black-Scholes value is calculated as part of a requirement by IFRS to fair value the options at the time of the grant. It is not the determining factor when granting stock options. The stock options are granted based on the performance and retention of key individuals.

| 2023 | 2022 | 2021 | |

| Exercise price | $1.60 to $1.74 | $2.22 to $2.25 | $0.76 to $1.44 |

| Risk free rate | 2.89% to 3.31% | 0.79% to 1.65% | 0.32% to 0.58% |

| Volatility estimate | 101.32% | 100% to 104% | 93.7% to 103.9% |

| Expected life | 5 years | 5 years | 5 years |

| Dividend rate | - | - | - |

| Per option value | $1.22 to $1.47 | $1.67 to $1.86 | $1.30 to $2.08 |

8. For Non-Equity incentive plans described, the Company only provided Annual incentive plans in the form of cash bonuses. The Company did not have any Long-term non-equity compensation.

9. Share Based Awards displays the value of the RSU's that were awarded in February 2023 priced at $1.65.

Outstanding Share-Based Awards and Option-Based Awards

The following table displays all awards outstanding for each Director at the end of April 30, 2023.

| Name | Option-Based Awards | Share-Based Awards | |||||

| # of securities underlying unexercised options |

Option exercise price |

Option expiry date |

Value of unexercised in-the-money options 1 |

# of shares or units that have not vested |

Market or payout value of share-based awards that have not vested |

Market or payout value of vested share-based awards not paid out or distributed |

|

| Craig Parry | 325,000 250,000 325,000 310,000 240,000 200,000 600,000 240,000 |

$0.14 $0.16 $0.66 $0.76 $2.07 $1.44 $2.22 $2.25 |

26-Feb-2029 12-Jun-2024 30-Dec-2024 29-Jun-2025 06-Aug-2025 17-Feb-2026 22-Jun-2026 24-Sep-2026 |

$588,250 $447,500 $419,250 $368,900 - $102,000 - - |

45,455 | $75,001 | - |

| Simon Cmrlec | 125,000 100,000 100,000 100,000 100,000 125,000 200,000 100,000 |

$0.14 $0.16 $0.66 $0.76 $2.07 $1.44 $2.22 $2.25 |

26-Feb-2029 12-Jun-2024 30-Dec-2024 29-Jun-2025 06-Aug-2025 17-Feb-2026 22-Jun-2026 24-Sep-2026 |

$226,250 $179,000 $129,000 $119,000 - $63,750 - - |

30,303 | $50,000 | - |

| Harry Pokrandt 2 | 200,000 50,000 |

$2.45 $1.74 |

01-Feb-2027 02-Jun-2027 |

- $4,200 |

30,303 | $50,000 | - |

| David Cobbold | 100,000 | $1.60 | 10-Feb-2023 | $7,000 | 30,303 | $50,000 | - |

1. Represents the difference between the market value of the Common Shares underlying the options on April 30, 2023 (based on $1.95 closing price of the Common Shares on the TSXV on that date).

2. The Share-based Awards displays the value of the RSU's that were awarded in February 2023 priced at $1.65.

Value Vested or Earned During the Year Ended April 30, 2023

| Name | Option-Based Awards - Value vested during the year1 $ |

Share-Based Awards - Value vested during the year $ |

Non-Equity Incentive Plan Compensation - Value earned during the year $ |

| Craig Parry | 5,500 | - | - |

| Simon Cmrlec | 3,438 | - | - |

| Harry Pokrandt | 1,600 | - | - |

| David Cobbold | - | - | - |

1. Represents the dollar value, by which the value of Common Shares exceeded the exercise price on the day the options vested, that would have been realized if the options had been exercised on the vesting date based on the closing price of the Common Shares on the TSX Venture Exchange less the exercise price of the options.

No stock options were exercised during the year ended April 30, 2023, by the current Directors.

PENSION PLAN BENEFITS

The Company does not have any pension, retirement, defined benefit, defined contribution, or deferred compensation plans that provides for payments or benefits to its Directors and NEOs in connection with retirement and none are proposed at this time.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The following table sets out information on the Company's equity compensation plans under which Common Shares are authorized for issuance as at April 30, 2023, at which time there were 207,938,329 Common Shares issued and outstanding.

| Equity Incentive Compensation Plan Categories 1 |

Number of Securities to be issued upon exercise of outstanding options, warrants and rights (#) |

Weighted average exercise price of outstanding options, warrants and rights ($) |

Number of securities remaining available for future issuance under equity compensation plans (#) |

| Stock Options2 (approved by shareholders) |

15,926,972 | $1.69 | 4,866,861 |

| RSUs, DSUs and PSUs3 (approved by shareholders) |

1,133,572 | - | 11,256,428 |

| Equity compensation plans not approved by securityholders | - | - | - |

| Total | 17,060,544 | $1.69 | 16,123,289 |

1. The Equity Incentive Compensation Plan was approved by shareholders on December 8, 2022 authorizing the Company to issued stock options, restricted share units, deferred share units and performance share units.

2. The Company is authorized to issue stock options up to 10% of the issued and outstanding Common Shares.

3. The Company is authorized to issue, in aggregate, a maximum of 8% fixed (12,390,000) RSUs, DSU's and/or PSU's.