Forward Looking Statement This presentation contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements include all statements that are not historical statements of fact and those regarding our intent, belief, or expectations, including, but not limited to, the statements in this document regarding our future plans and goals, including our pipeline investments and projects, our plans to eliminate certain near term debt maturities, our estimated value creation and potential, our timing, scheduling and budgeting, projections regarding lease growth, our plans to form joint ventures, our plans for new acquisitions or dispositions, our strategic partnerships and value added therefrom, and changes to our corporate governance. We caution investors not to place undue reliance on any such forward-looking statements. Words such as “anticipate(s),” “expect(s),” “intend(s),” “plan(s),” “believe(s),” “may,” “will,” “would,” “could,” “should,” “seek(s)” and similar expressions, or the negative of these terms, are intended to identify such forward-looking statements. These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside the control of Aimco that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statement. Important factors, among others, that may affect actual results or outcomes include, but are not limited to: (i) the risk that the 2023 plans and goals may not be completed, as expected, in a timely manner or at all, (ii) the inability to recognize the anticipated benefits of the pipeline investments and projects, and (iii) changes in general economic conditions, including, increases in interest rates and other force-majeure events. Although we believe that the assumptions underlying the forward-looking statements are reasonable, we can give no assurance that our expectations will be attained. Readers should carefully review Aimco’s financial statements and the notes thereto, as well as the section entitled “Risk Factors” in Item 1A of Aimco’s Annual Report on Form 10-K for the year ended December 31, 2022, and subsequent Quarterly Reports on Form 10-Q and other documents Aimco files from time to time with the SEC. These filings identify and address important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. These forward-looking statements reflect management’s judgment and expectations as of this date, and Aimco assumes no (and disclaims any) obligation to revise or update them to reflect future events or circumstances. Certain financial and operating measures found herein are used by management and are not defined under accounting principles generally accepted in the United States, or GAAP. These measures are reconciled to the most comparable GAAP measures at the end of this presentation. Definitions can be found in Aimco’s Earnings Release and Supplemental Schedules for the quarter ended March 31, 2023.

Key takeaways from the following presentation: Aimco offers significant growth opportunities through the combination of its geographically diversified portfolio of multifamily properties, its high-quality development pipeline and its strategic approach to investment management. Aimco is committed to practicing disciplined capital allocation and maintaining a rock-solid balance sheet. Aimco represents a compelling value proposition given the intrinsic value of its assets and platform, relative to the current share price. Aimco is an excellent corporate citizen, focused on sustainability and social responsibility, and committed to best-in-class corporate governance. PRESENTATION OVERVIEW

Balance Sheet Near Term Capital Allocation Governance Ample liquidity with access to $336 million of cash on hand and capacity on its revolving credit facility Complete Active Projects Highly regarded and reconstituted Board with an average tenure of only two years Limited near-term maturities with only $3.5M of debt maturing in 2023 and $75M over next 36 months (including extensions) Advance pipeline and prepare for new starts Committed to best-in-class governance 98% of Aimco total debt is either fixed-rate or has in place hedges mitigating floating rate exposure Share Repurchases – In place authorization for 12M shares at YE 2022 Aimco’s Board has implemented shareholder friendly policies Favorable mark-to-market on leverage, inclusive of interest hedges of ~$80M Debt Reduction - $60M of floating rate property debt prepayable at par later in 2023 Inaugural Reporting to TCFD in 2022 AIMCO OVERVIEW NYSE: AIV Active Development Projects Future Development Pipeline Stabilized Portfolio # of Residential Units 1,315 Potential Residential Units ~ 6,500 US Markets / Residential Units 8 / 5,600 Commercial Space 114K sf Potential Commercial Space ~ 1.7M sf 1Q 2023 Annualized NOI $102M Total Direct Costs of Projects Underway $815M Total Potential Cost > $5B Avg Revenue per Apartment $2,227 2023 Direct Costs of Projects Underway $165M - $185M Total AIV Equity Investment $500M – $800M New Customer Rent/Inc Ratio 19.5% 2023 AIV Equity Funding ~$45M Avg Annual Projects Underway (target) $1B - $2B 2023 Revenue Guidance +5% - 7% NOI at Stabilization $55M NOI Yield Spreads Above Expected Cap Rates 150 – 200 bps 2023 NOI Guidance +5% - 7% SE FL 20% / CO Front Range 9% / DC Metro 65% Other 7% SE FL 80% / CO Front Range 17% / DC Metro 3% Northeast 49% / Southeast 21% / Central 28% West Coast 2% Total Shareholder Return Year-to-date 13.9% One Year 29.4% Since Spin-off 48.5% *As of May 31, 2023 Aimco is a diversified real estate investment company with a 28+ year history of growth and innovation in the multifamily sector. Aimco targets a balanced allocation of investments including value add and opportunistic multifamily real estate, primarily located in Southeast Florida, the Washington D.C. Metro Area, and Colorado’s Front Range, plus investment in a geographically diversified portfolio of stabilized apartment communities.

AIMCO MISSION To make real estate investments, primarily focused on the multifamily sector within targeted U.S. markets, where outcomes are enhanced through our human capital and substantial value is created for investors, teammates, and the communities in which we operate. WHAT WE INVEST IN: Real estate assets and related businesses. Primarily focused on Value-Add investments in the Multifamily Sector. WHERE WE INVEST: Select U.S. Markets where barriers to entry are high, where target customers can be clearly defined, and where Aimco has a Comparative Advantage over others in the market; which may include local market knowledge from regional investment teams. HOW WE INVEST: Primarily through Direct Investment In The General Partner Position with occasional direct limited partner and indirect investments.

AIMCO INVESTMENTS Aimco couples outsized growth prospects from opportunistic investments with the safety of a stable multifamily portfolio resulting in a nimble platform that can move the needle quickly. 7 Current Allocation Investment in Value Add and Opportunistic Real Estate Provides outsized growth opportunities compared to a primarily stabilized apartment portfolio Aimco invests where it has the local knowledge and expertise that provides a comparative advantage over other developers and mitigates execution risk Maintain a portfolio of Core and Core Plus Real Estate Provides stability and safety compared to a pure development portfolio Aimco’s diversified portfolio of apartments in major U.S. markets provides additional certainty of performance through local economic cycles Select Alternative Investments Aimco plans to significantly reduce capital allocated to these investments

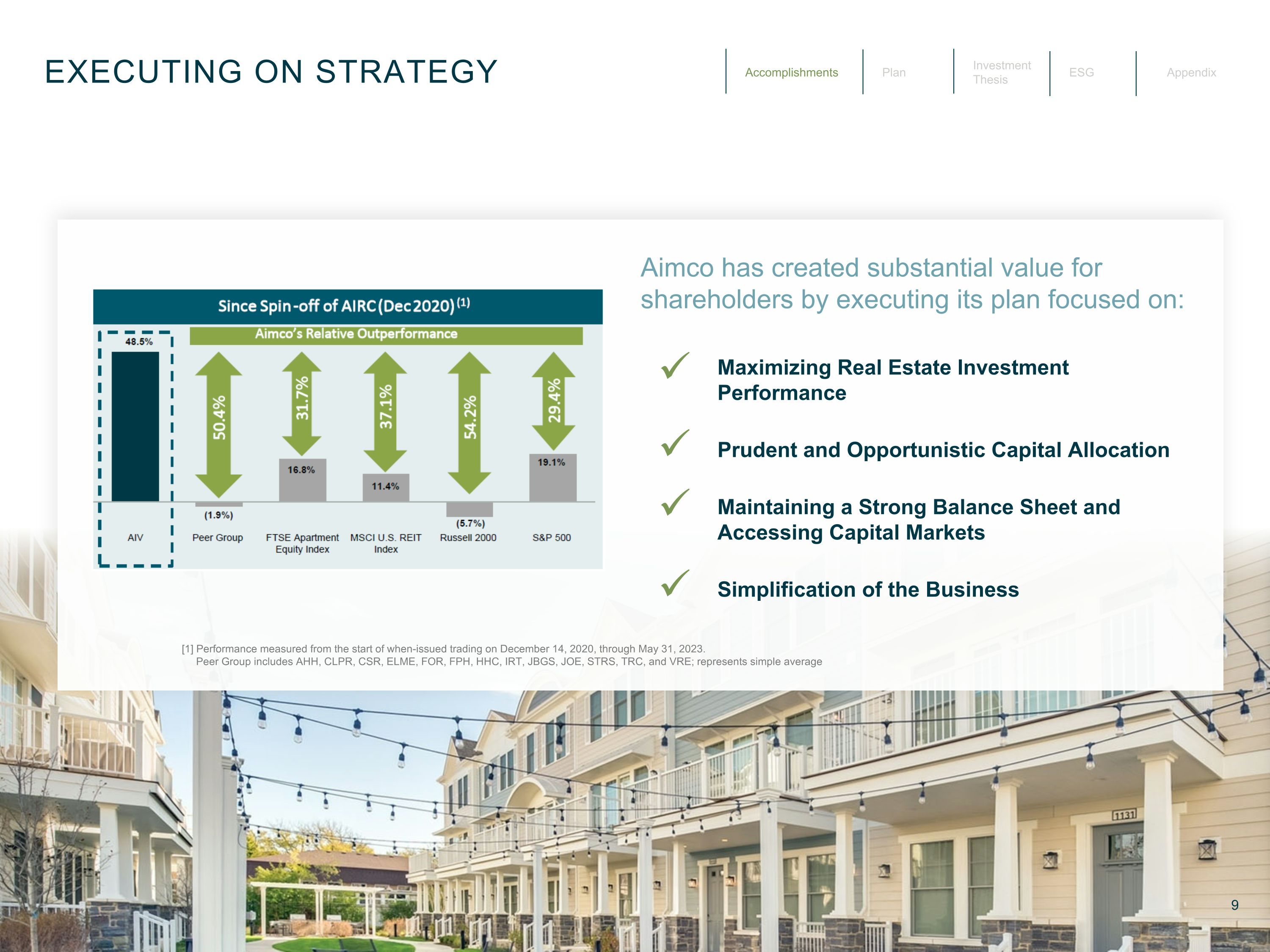

Maximizing Real Estate Investment Performance Prudent and Opportunistic Capital Allocation Maintaining a Strong Balance Sheet and Accessing Capital Markets Simplification of the Business EXECUTING ON STRATEGY [1] Performance measured from the start of when-issued trading on December 14, 2020, through May 31, 2023. Peer Group includes AHH, CLPR, CSR, ELME, FOR, FPH, HHC, IRT, JBGS, JOE, STRS, TRC, and VRE; represents simple average Aimco has created substantial value for shareholders by executing its plan focused on:

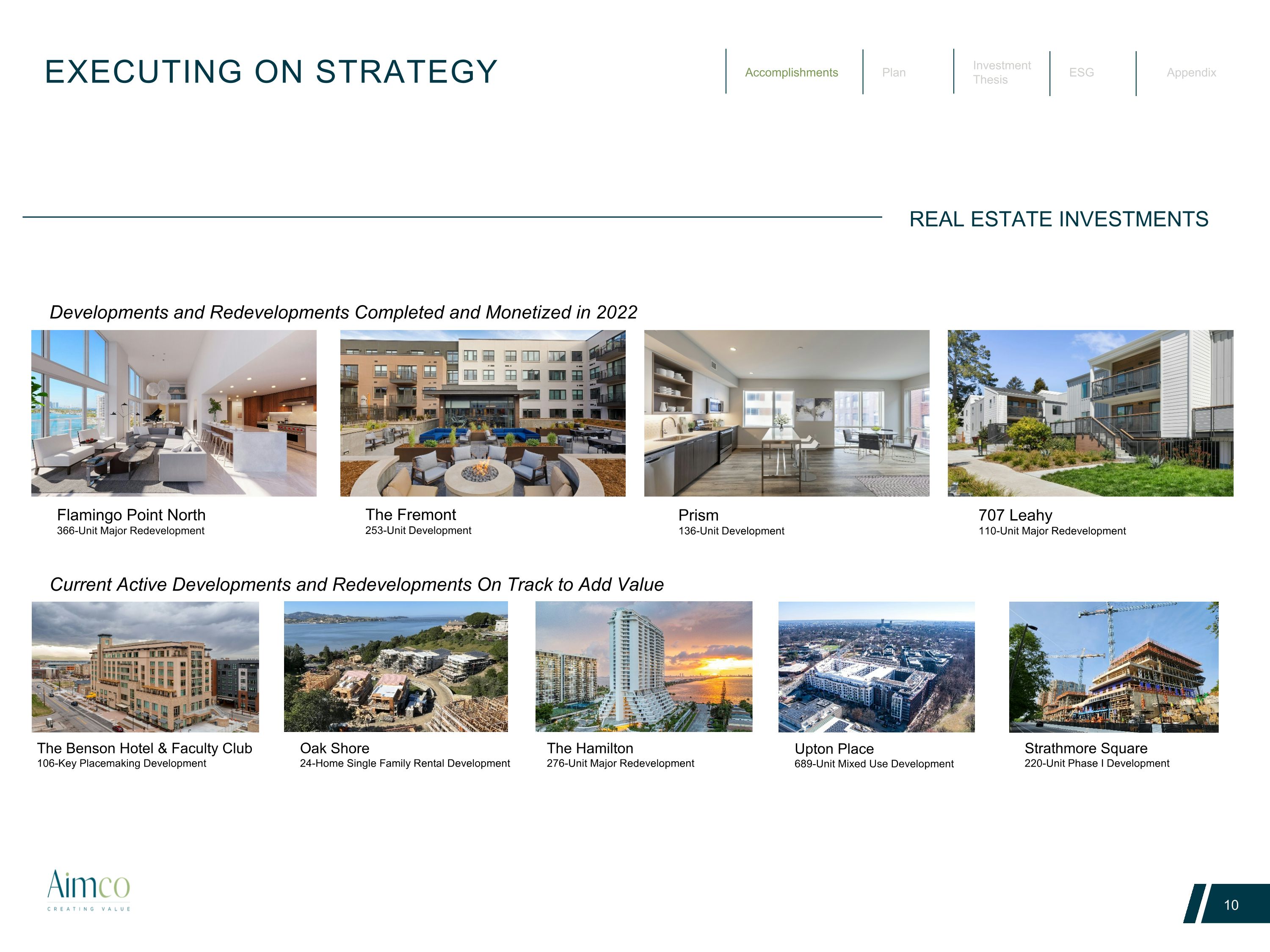

EXECUTING ON STRATEGY The Fremont 253-Unit Development 707 Leahy 110-Unit Major Redevelopment Prism 136-Unit Development Flamingo Point North 366-Unit Major Redevelopment The Benson Hotel & Faculty Club 106-Key Placemaking Development Oak Shore 24-Home Single Family Rental Development The Hamilton 276-Unit Major Redevelopment Upton Place 689-Unit Mixed Use Development Strathmore Square 220-Unit Phase I Development Developments and Redevelopments Completed and Monetized in 2022 Current Active Developments and Redevelopments On Track to Add Value REAL ESTATE INVESTMENTS

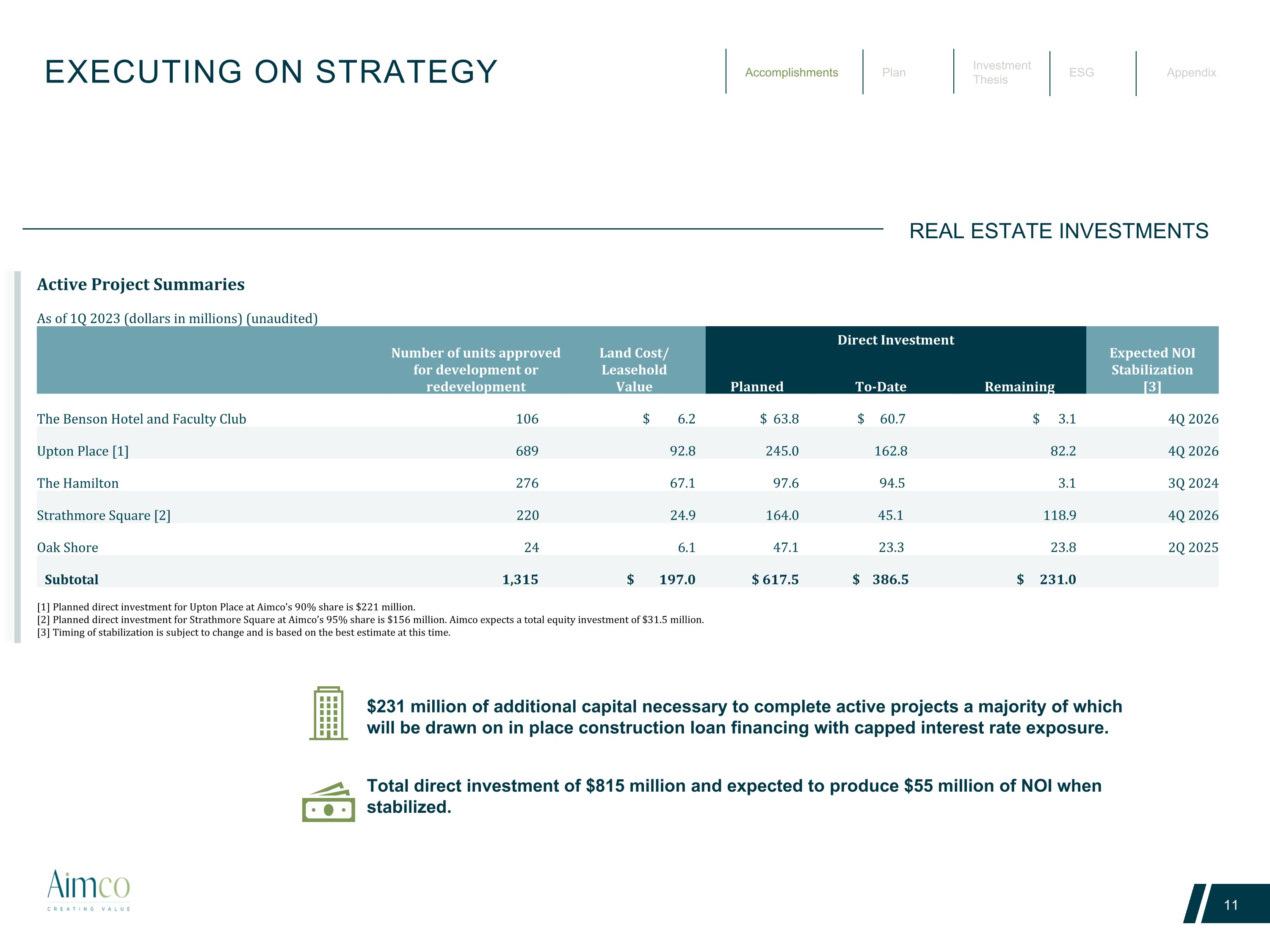

EXECUTING ON STRATEGY REAL ESTATE INVESTMENTS Active Project Summaries As of 1Q 2023 (dollars in millions) (unaudited) Number of units approved for development or redevelopment Land Cost/ Leasehold Value Direct Investment Expected NOI Stabilization [2] Expected NOI Stabilization [3] Planned To-Date To-Date Remaining Remaining Remaining The Benson Hotel and Faculty Club 106 $ 6.2 $ 63.8 $ 48.8 $ 60.7 $ 15.0 $ 3.1 $ 15.0 4Q 2026 Upton Place [1] 689 92.8 245.0 128.8 162.8 131.2 82.2 131.2 4Q 2026 The Hamilton 276 67.1 97.6 85.3 94.5 12.3 3.1 12.3 3Q 2024 Strathmore Square [2] 220 24.9 164.0 45.1 118.9 4Q 2026 Oak Shore 24 6.1 47.1 15.9 23.3 31.2 23.8 31.2 2Q 2025 Subtotal 1,315 $ 197.0 $ 617.5 $ 278.8 $ 386.5 $ 189.7 $ 231.0 $ 189.7 [1] Planned direct investment for Upton Place at Aimco's 90% share is $221 million. [2] Planned direct investment for Strathmore Square at Aimco’s 95% share is $156 million. Aimco expects a total equity investment of $31.5 million. [3] Timing of stabilization is subject to change and is based on the best estimate at this time. $231 million of additional capital necessary to complete active projects a majority of which will be drawn on in place construction loan financing with capped interest rate exposure. Total direct investment of $815 million and expected to produce $55 million of NOI when stabilized.

EXECUTING ON STRATEGY REAL ESTATE INVESTMENTS Royal Crest Estates (Nashua) 902 Units – Nashua, NH Select Stabilized Operating Communities Plantation Gardens 372 Units – Plantation, FL Evanston Place 190 Units – Evanston, IL The Milan 42 Units – New York, NY Wexford Village 264 Units – Worcester, MA Hyde Park Tower 155 Units – Chicago, IL Exposure to West Coast markets reduced by 85% since 2021 Percent of Stabilized Operating NOI BY MARKET

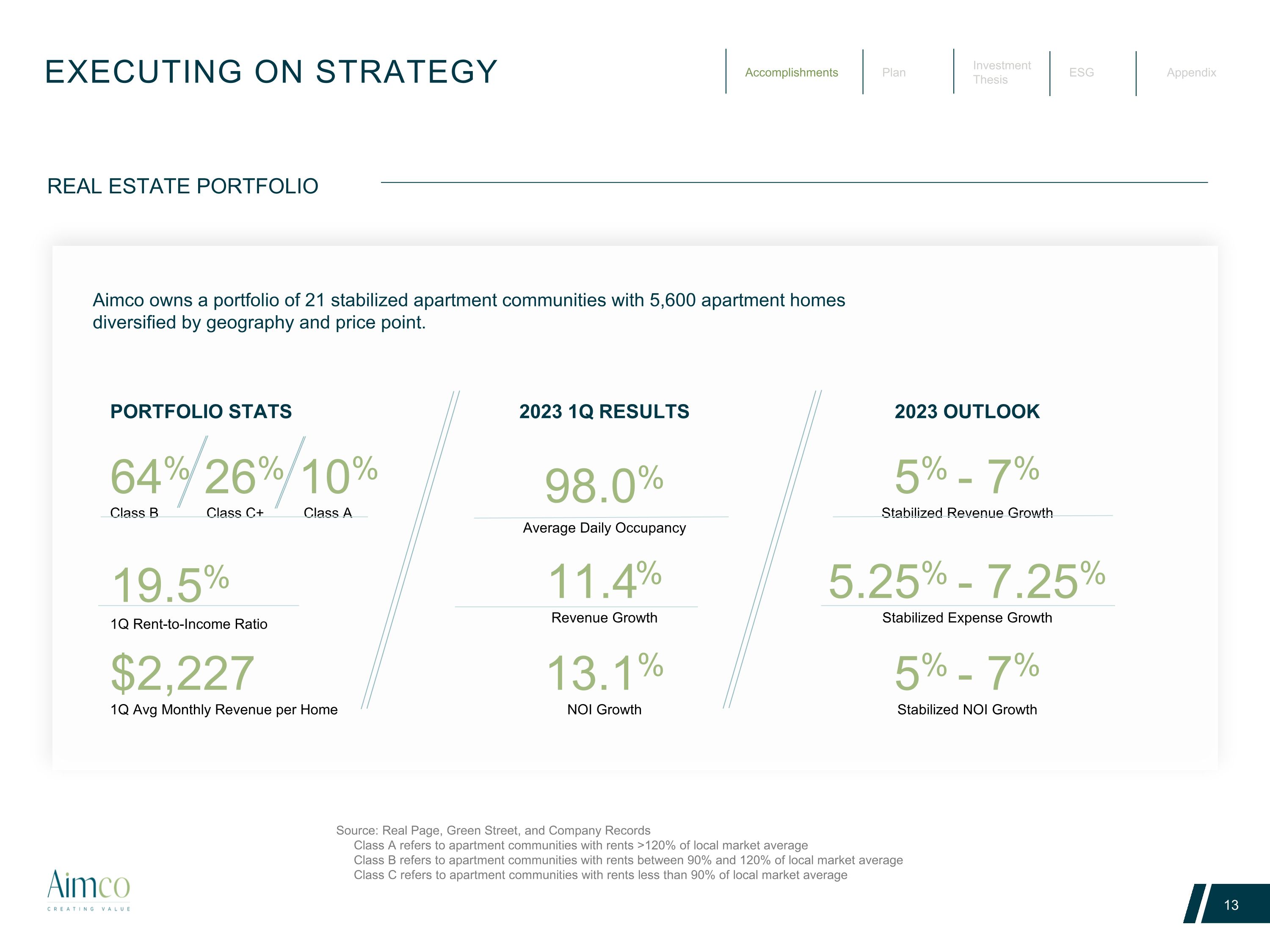

PORTFOLIO STATS 2023 1Q RESULTS 2023 OUTLOOK 64% 26% 10% Class B Class C+ Class A 98.0% Average Daily Occupancy 5% - 7% Stabilized Revenue Growth 19.5% 1Q Rent-to-Income Ratio 11.4% Revenue Growth 5.25% - 7.25% Stabilized Expense Growth $2,227 1Q Avg Monthly Revenue per Home 13.1% NOI Growth 5% - 7% Stabilized NOI Growth 13 EXECUTING ON STRATEGY REAL ESTATE PORTFOLIO Aimco owns a portfolio of 21 stabilized apartment communities with 5,600 apartment homes diversified by geography and price point. Source: Real Page, Green Street, and Company Records Class A refers to apartment communities with rents >120% of local market average Class B refers to apartment communities with rents between 90% and 120% of local market average Class C refers to apartment communities with rents less than 90% of local market average

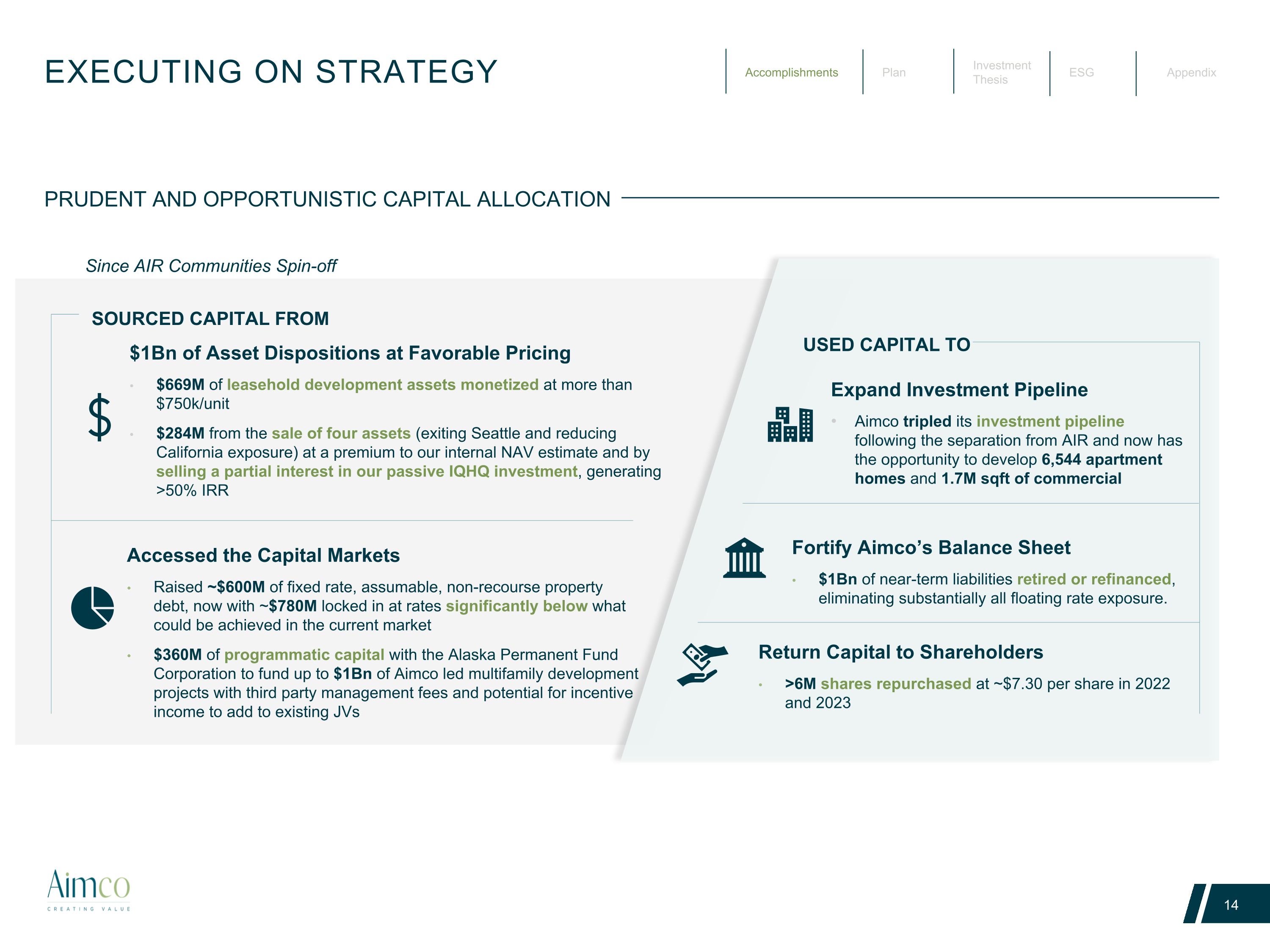

$1Bn of Asset Dispositions at Favorable Pricing $669M of leasehold development assets monetized at more than $750k/unit $284M from the sale of four assets (exiting Seattle and reducing California exposure) at a premium to our internal NAV estimate and by selling a partial interest in our passive IQHQ investment, generating >50% IRR Expand Investment Pipeline Aimco tripled its investment pipeline following the separation from AIR and now has the opportunity to develop 6,544 apartment homes and 1.7M sqft of commercial EXECUTING ON STRATEGY PRUDENT AND OPPORTUNISTIC CAPITAL ALLOCATION USED CAPITAL TO SOURCED CAPITAL FROM Fortify Aimco’s Balance Sheet $1Bn of near-term liabilities retired or refinanced, eliminating substantially all floating rate exposure. Return Capital to Shareholders >6M shares repurchased at ~$7.30 per share in 2022 and 2023 Accessed the Capital Markets Raised ~$600M of fixed rate, assumable, non-recourse property debt, now with ~$780M locked in at rates significantly below what could be achieved in the current market $360M of programmatic capital with the Alaska Permanent Fund Corporation to fund up to $1Bn of Aimco led multifamily development projects with third party management fees and potential for incentive income to add to existing JVs Since AIR Communities Spin-off

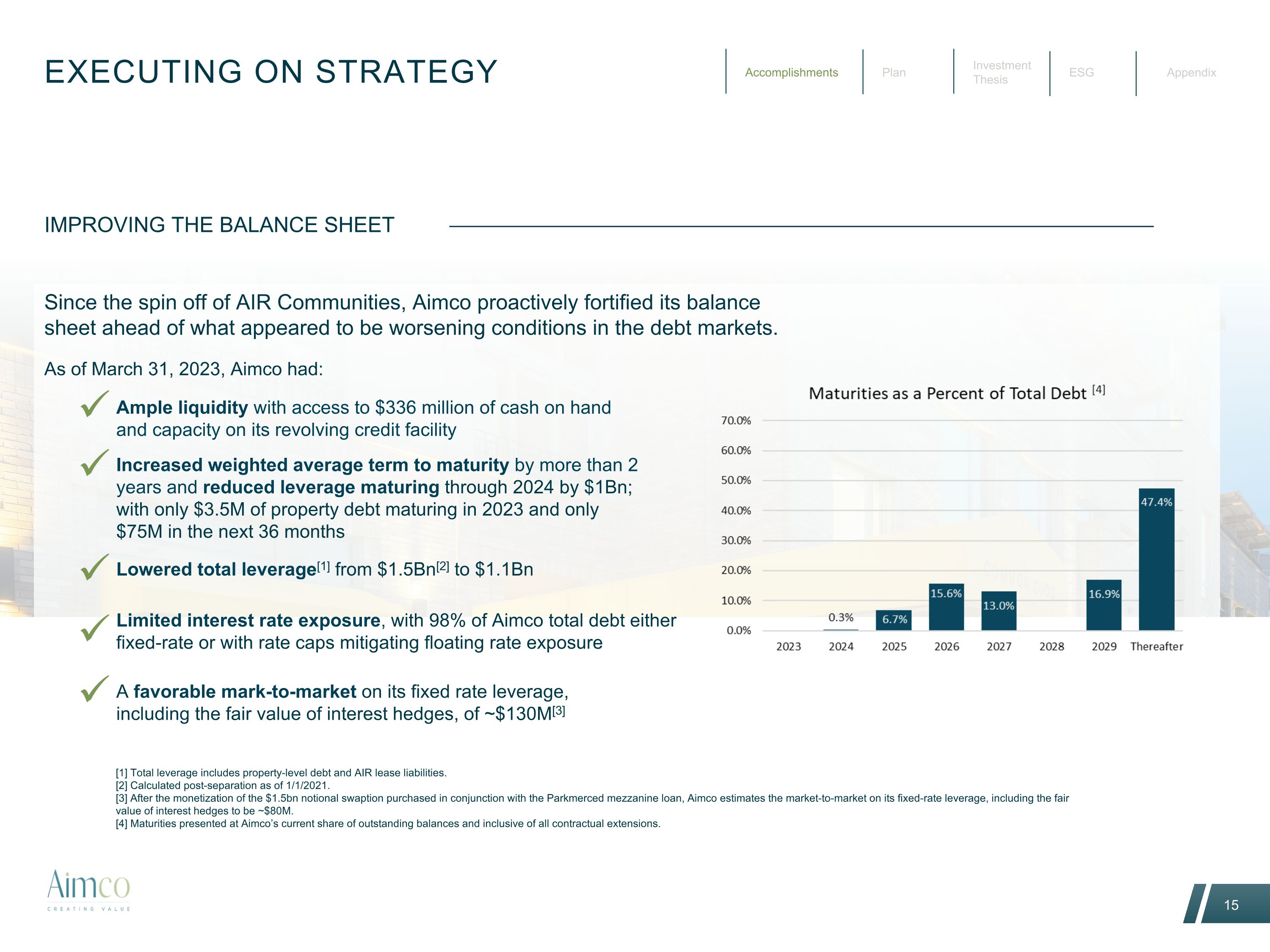

EXECUTING ON STRATEGY IMPROVING THE BALANCE SHEET Since the spin off of AIR Communities, Aimco proactively fortified its balance sheet ahead of what appeared to be worsening conditions in the debt markets. As of March 31, 2023, Aimco had: Lowered total leverage[1] from $1.5Bn[2] to $1.1Bn Limited interest rate exposure, with 98% of Aimco total debt either fixed-rate or with rate caps mitigating floating rate exposure Increased weighted average term to maturity by more than 2 years and reduced leverage maturing through 2024 by $1Bn; with only $3.5M of property debt maturing in 2023 and only $75M in the next 36 months A favorable mark-to-market on its fixed rate leverage, including the fair value of interest hedges, of ~$130M[3] Ample liquidity with access to $336 million of cash on hand and capacity on its revolving credit facility [1] Total leverage includes property-level debt and AIR lease liabilities. [2] Calculated post-separation as of 1/1/2021. [3] After the monetization of the $1.5bn notional swaption purchased in conjunction with the Parkmerced mezzanine loan, Aimco estimates the market-to-market on its fixed-rate leverage, including the fair value of interest hedges to be ~$80M. [4] Maturities presented at Aimco’s current share of outstanding balances and inclusive of all contractual extensions.

EXECUTING ON STRATEGY ALTERNATIVE INVESTMENTS Parkmerced Loan Sale Agreement Update In February 2023, Aimco entered into an agreement to sell the Parkmerced mezzanine loan for $167.5 million. The initial $5 million deposit received by the purchaser became nonrefundable in April 2023. On May 30, 2023, the buyer exercised its contractual right to extend closing to June 22, 2023, by increasing its non-refundable deposit to $7 million. Parkmerced Loan Status & Collateral Update The borrower on Aimco’s mezzanine loan remains current on its obligated payments to the senior lender through May 2023. Property operations are improving. The trajectory of rents and income generated by the rental properties is better … yet still lagging pre-Covid operations. Occupancy was 82% as of April 30, 2023, up from ~72% in April 2022 April average executed rents are $3.30/sf ($3,292) Aimco’s current alternative investments are primarily those investments originated prior to the separation from AIR Communities and include a mezzanine loan secured by a stabilized multifamily property with an option to participate in future multifamily development, as well as three passive equity investments. Over time, we plan to significantly reduce capital allocated to these investments.

ALLOCATE AIMCO CAPITAL ACCRETIVELY OPTIMIZING GROWTH DEVELOPMENT FUNDING selectively advance pipeline projects RETURN OF CAPITAL TO SHAREHOLDERS share repurchases and dividend payments DEBT REDUCTION providing reduced costs and optionality INVEST CAPITAL PRUDENTLY balancing growth and return of capital, while maintaining balance sheet stability

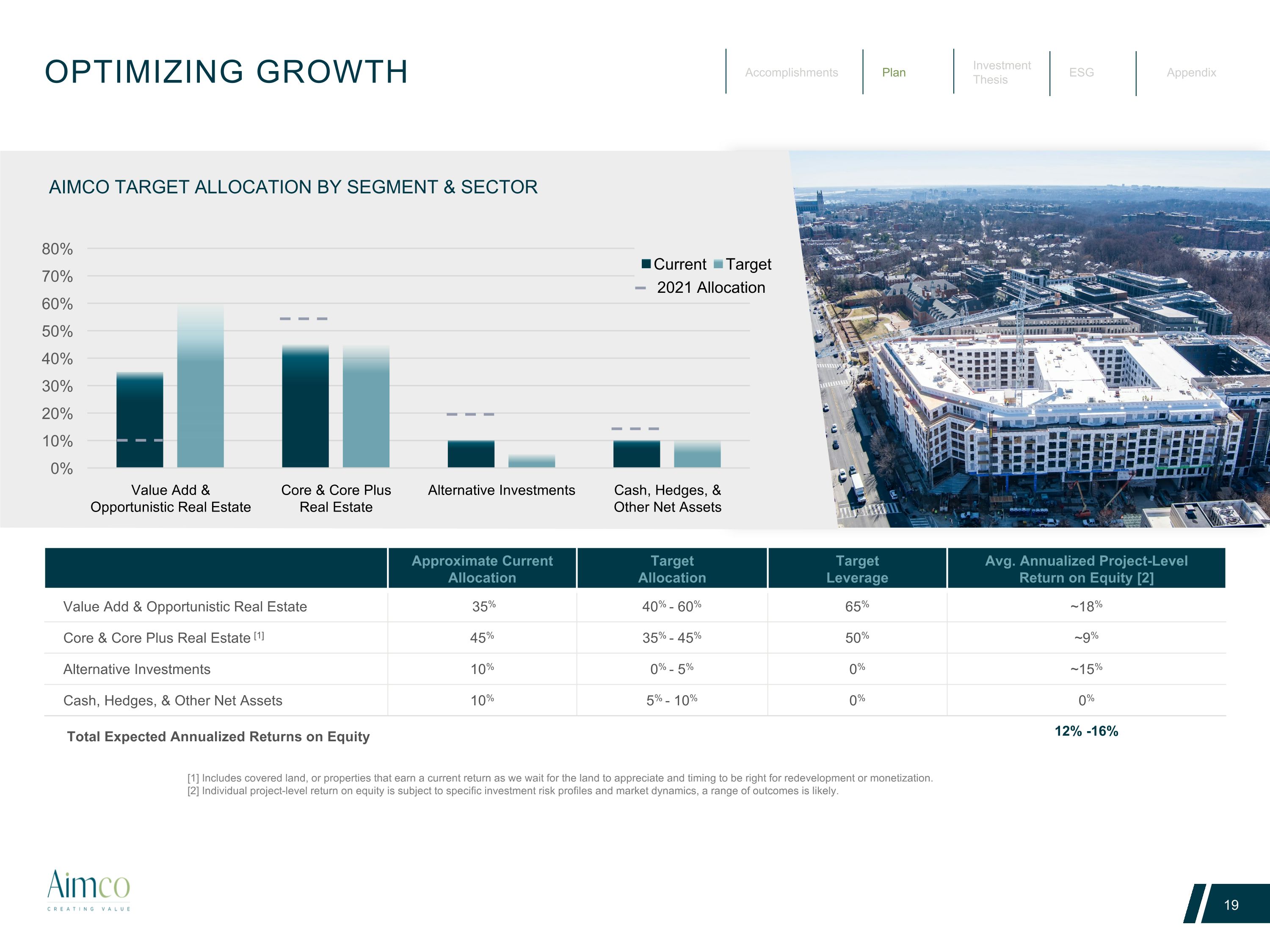

OPTIMIZING GROWTH 2021 Allocation AIMCO TARGET ALLOCATION BY SEGMENT & SECTOR Approximate Current Allocation Target Allocation Target Leverage Avg. Annualized Project-Level Return on Equity [2] Value Add & Opportunistic Real Estate 35% 40% - 60% 65% ~18% Core & Core Plus Real Estate [1] 45% 35% - 45% 50% ~9% Alternative Investments 10% 0% - 5% 0% ~15% Cash, Hedges, & Other Net Assets 10% 5% - 10% 0% 0% [1] Includes covered land, or properties that earn a current return as we wait for the land to appreciate and timing to be right for redevelopment or monetization. [2] Individual project-level return on equity is subject to specific investment risk profiles and market dynamics, a range of outcomes is likely. Total Expected Annualized Returns on Equity 12% -16%

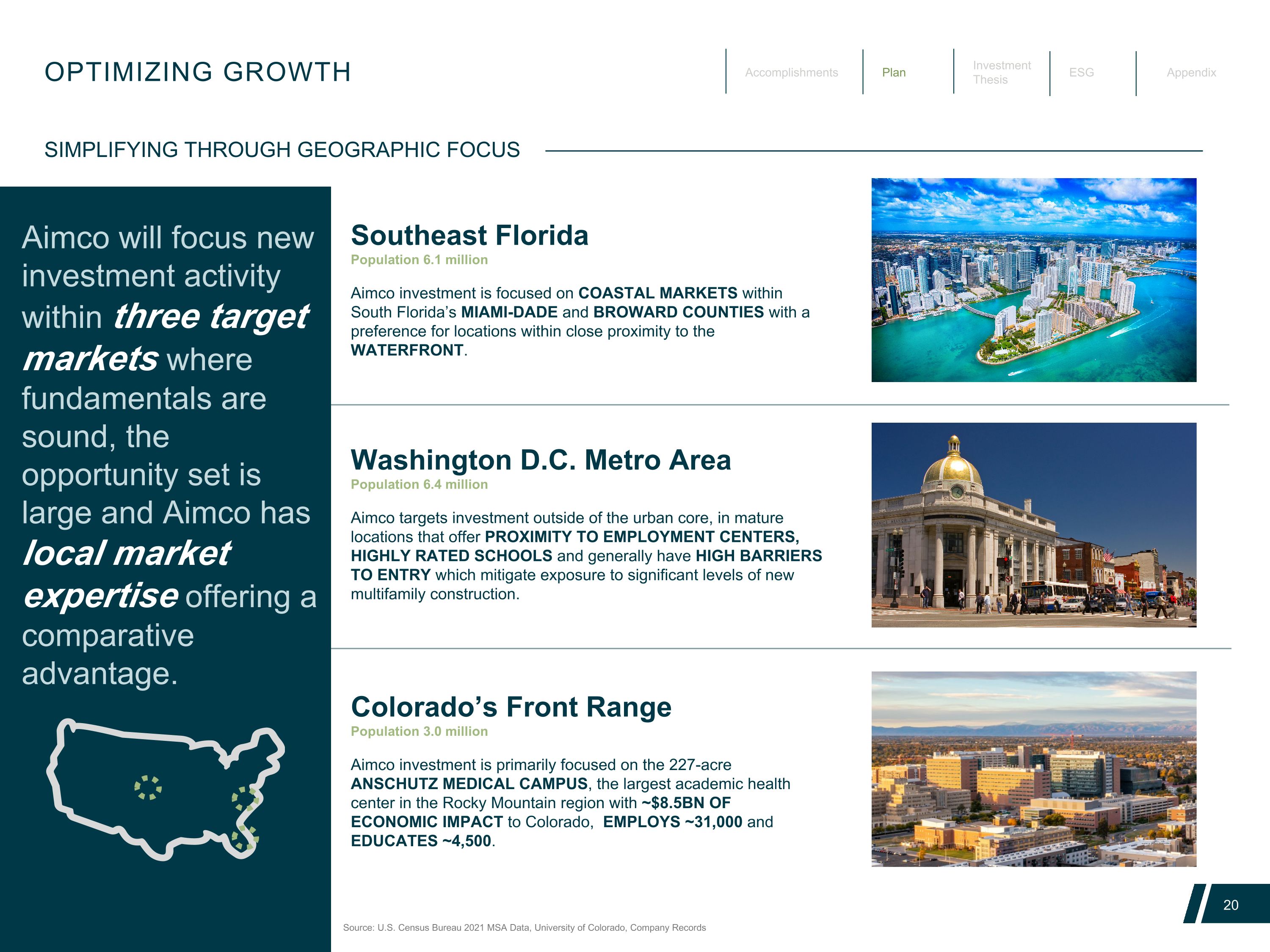

OPTIMIZING GROWTH SIMPLIFYING THROUGH GEOGRAPHIC FOCUS Aimco will focus new investment activity within three target markets where fundamentals are sound, the opportunity set is large and Aimco has local market expertise offering a comparative advantage. Source: U.S. Census Bureau 2021 MSA Data, University of Colorado, Company Records Washington D.C. Metro Area Population 6.4 million Aimco targets investment outside of the urban core, in mature locations that offer PROXIMITY TO EMPLOYMENT CENTERS, HIGHLY RATED SCHOOLS and generally have HIGH BARRIERS TO ENTRY which mitigate exposure to significant levels of new multifamily construction. Southeast Florida Population 6.1 million Aimco investment is focused on COASTAL MARKETS within South Florida’s MIAMI-DADE and BROWARD COUNTIES with a preference for locations within close proximity to the WATERFRONT. Colorado’s Front Range Population 3.0 million Aimco investment is primarily focused on the 227-acre ANSCHUTZ MEDICAL CAMPUS, the largest academic health center in the Rocky Mountain region with ~$8.5BN OF ECONOMIC IMPACT to Colorado, EMPLOYS ~31,000 and EDUCATES ~4,500.

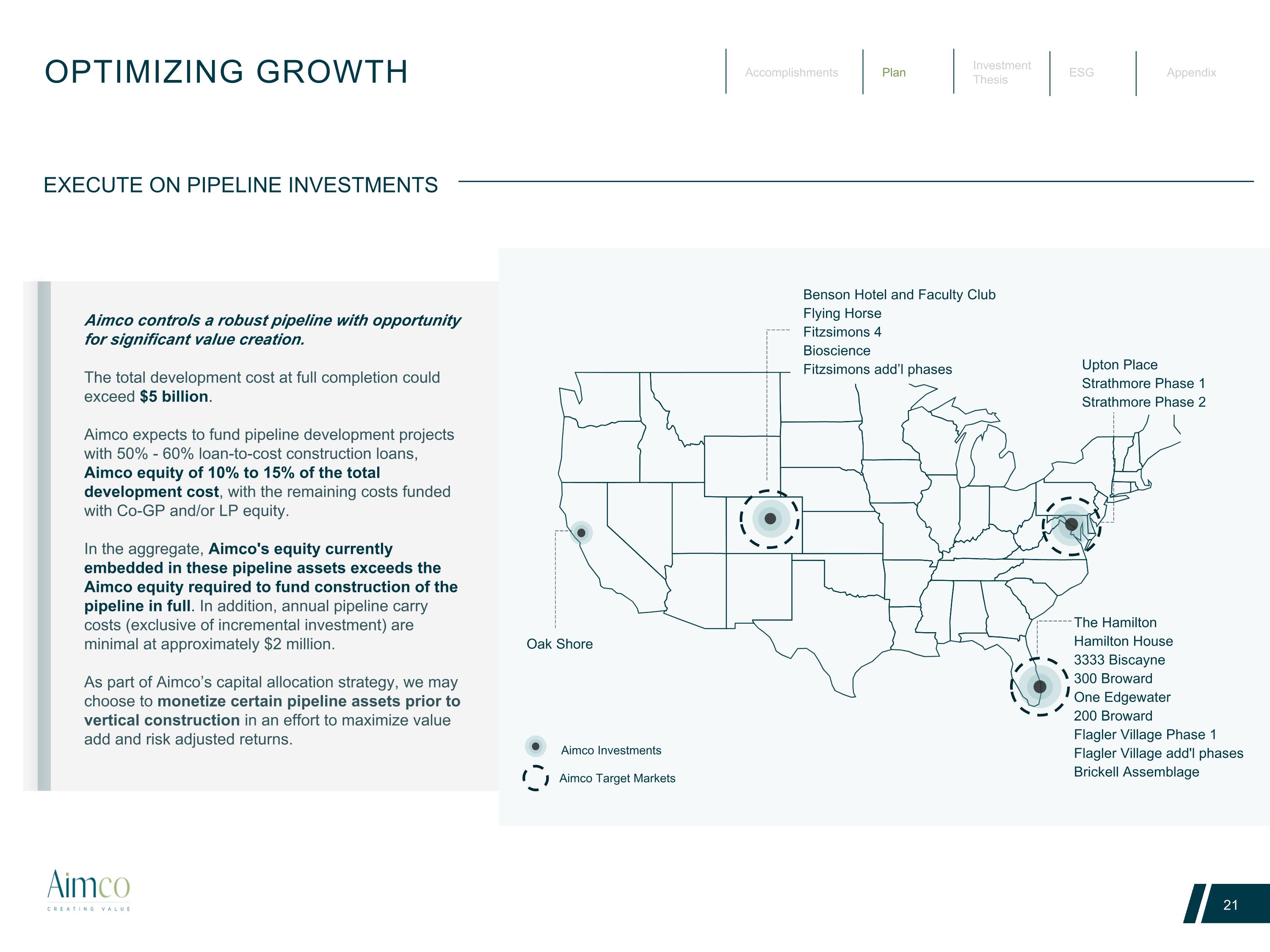

Benson Hotel and Faculty Club Flying Horse Fitzsimons 4 Bioscience Fitzsimons add’l phases Oak Shore Upton Place Strathmore Phase 1 Strathmore Phase 2 The Hamilton Hamilton House 3333 Biscayne 300 Broward One Edgewater 200 Broward Flagler Village Phase 1 Flagler Village add'l phases Brickell Assemblage OPTIMIZING GROWTH Aimco Investments Aimco Target Markets EXECUTE ON PIPELINE INVESTMENTS Aimco controls a robust pipeline with opportunity for significant value creation. The total development cost at full completion could exceed $5 billion. Aimco expects to fund pipeline development projects with 50% - 60% loan-to-cost construction loans, Aimco equity of 10% to 15% of the total development cost, with the remaining costs funded with Co-GP and/or LP equity. In the aggregate, Aimco's equity currently embedded in these pipeline assets exceeds the Aimco equity required to fund construction of the pipeline in full. In addition, annual pipeline carry costs (exclusive of incremental investment) are minimal at approximately $2 million. As part of Aimco’s capital allocation strategy, we may choose to monetize certain pipeline assets prior to vertical construction in an effort to maximize value add and risk adjusted returns.

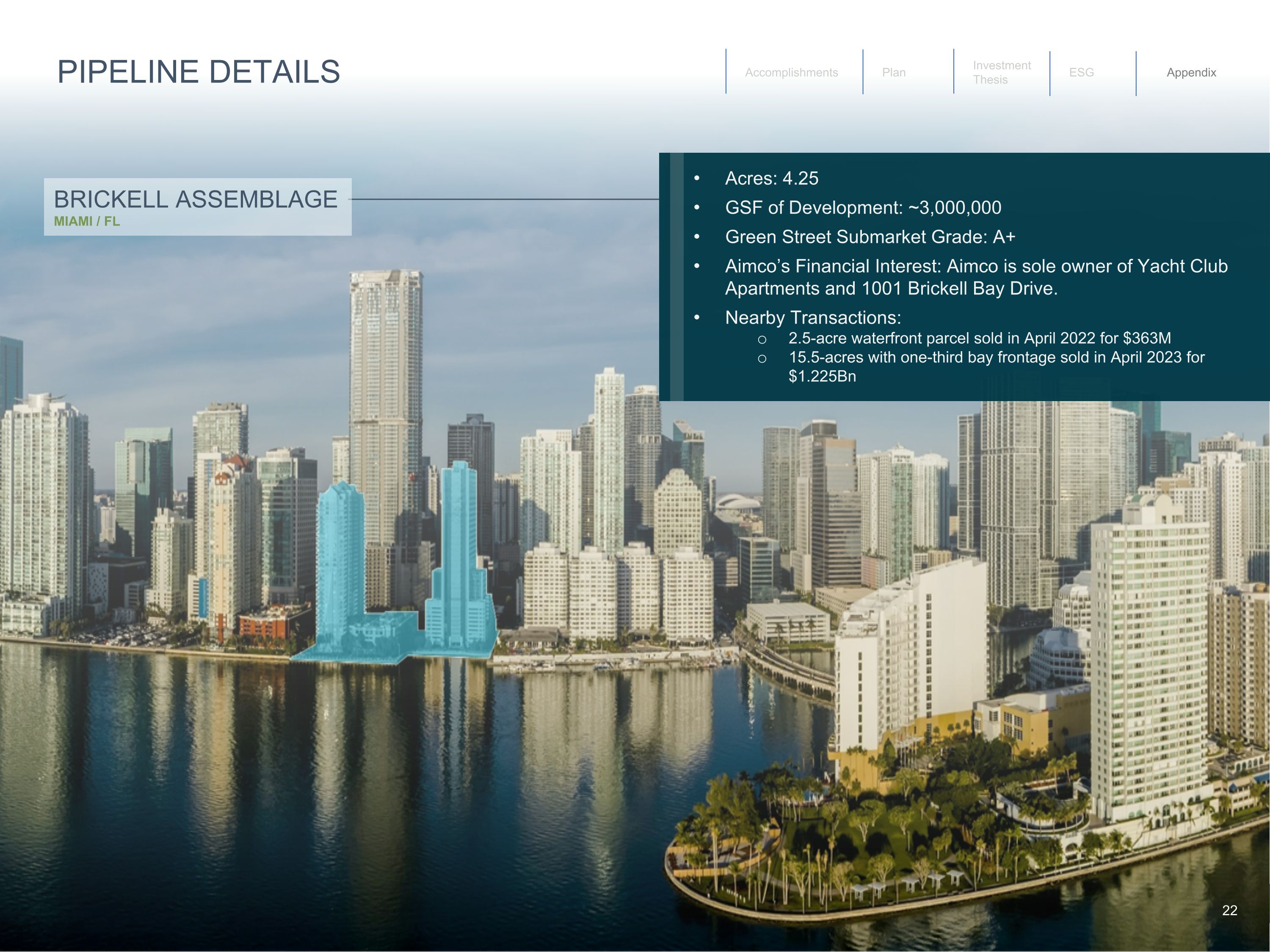

PIPELINE DETAILS BRICKELL ASSEMBLAGE MIAMI / FL Acres: 4.25 GSF of Development: ~3,000,000 Green Street Submarket Grade: A+ Aimco’s Financial Interest: Aimco is sole owner of Yacht Club Apartments and 1001 Brickell Bay Drive. Nearby Transactions: 2.5-acre waterfront parcel sold in April 2022 for $363M 15.5-acres with one-third bay frontage sold in April 2023 for $1.225Bn 22

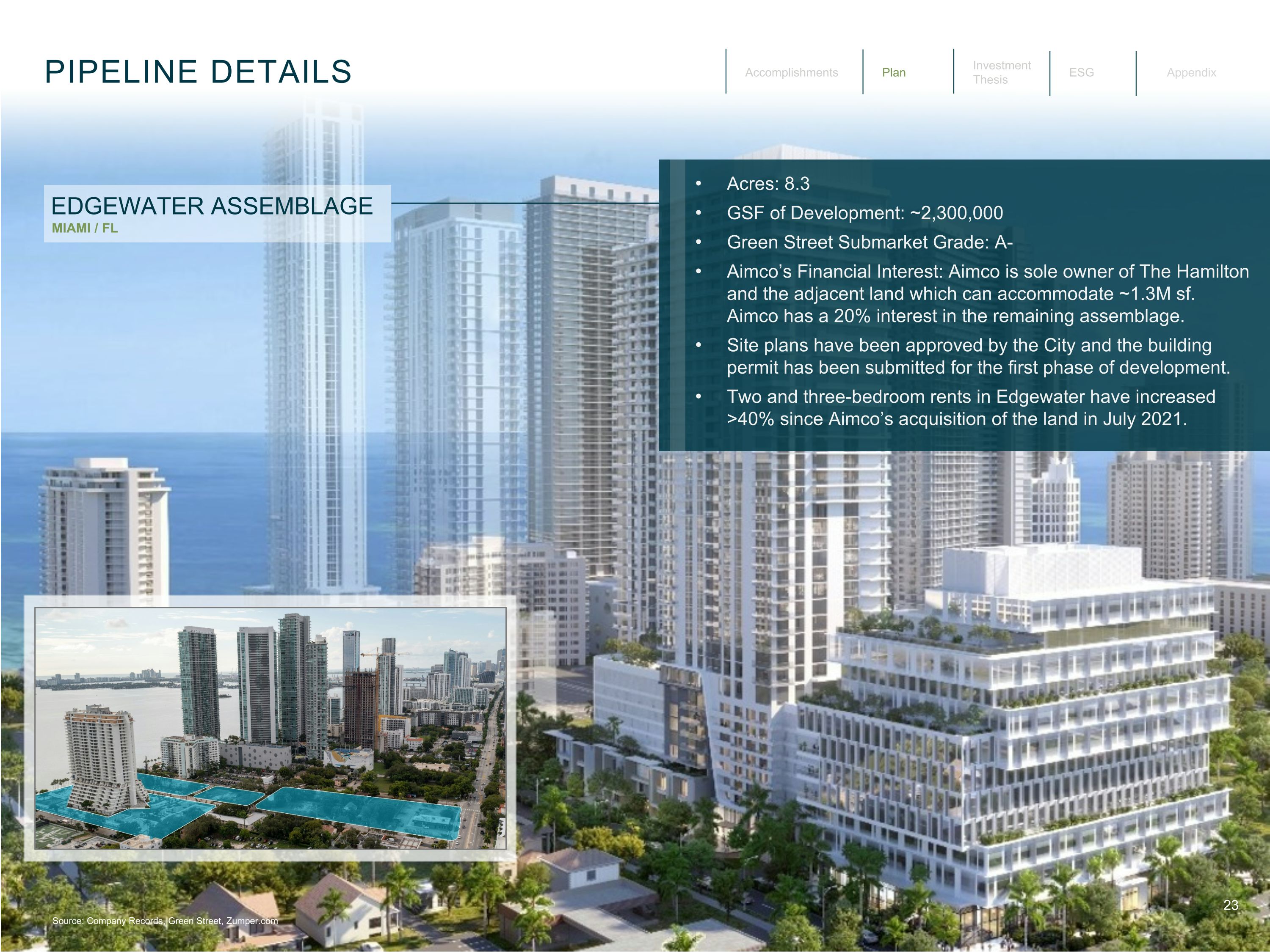

PIPELINE DETAILS EDGEWATER ASSEMBLAGE MIAMI / FL Acres: 8.3 GSF of Development: ~2,300,000 Green Street Submarket Grade: A- Aimco’s Financial Interest: Aimco is sole owner of The Hamilton and the adjacent land which can accommodate ~1.3M sf. Aimco has a 20% interest in the remaining assemblage. Site plans have been approved by the City and the building permit has been submitted for the first phase of development. Two and three-bedroom rents in Edgewater have increased >40% since Aimco’s acquisition of the land in July 2021. Source: Company Records, Green Street, Zumper.com

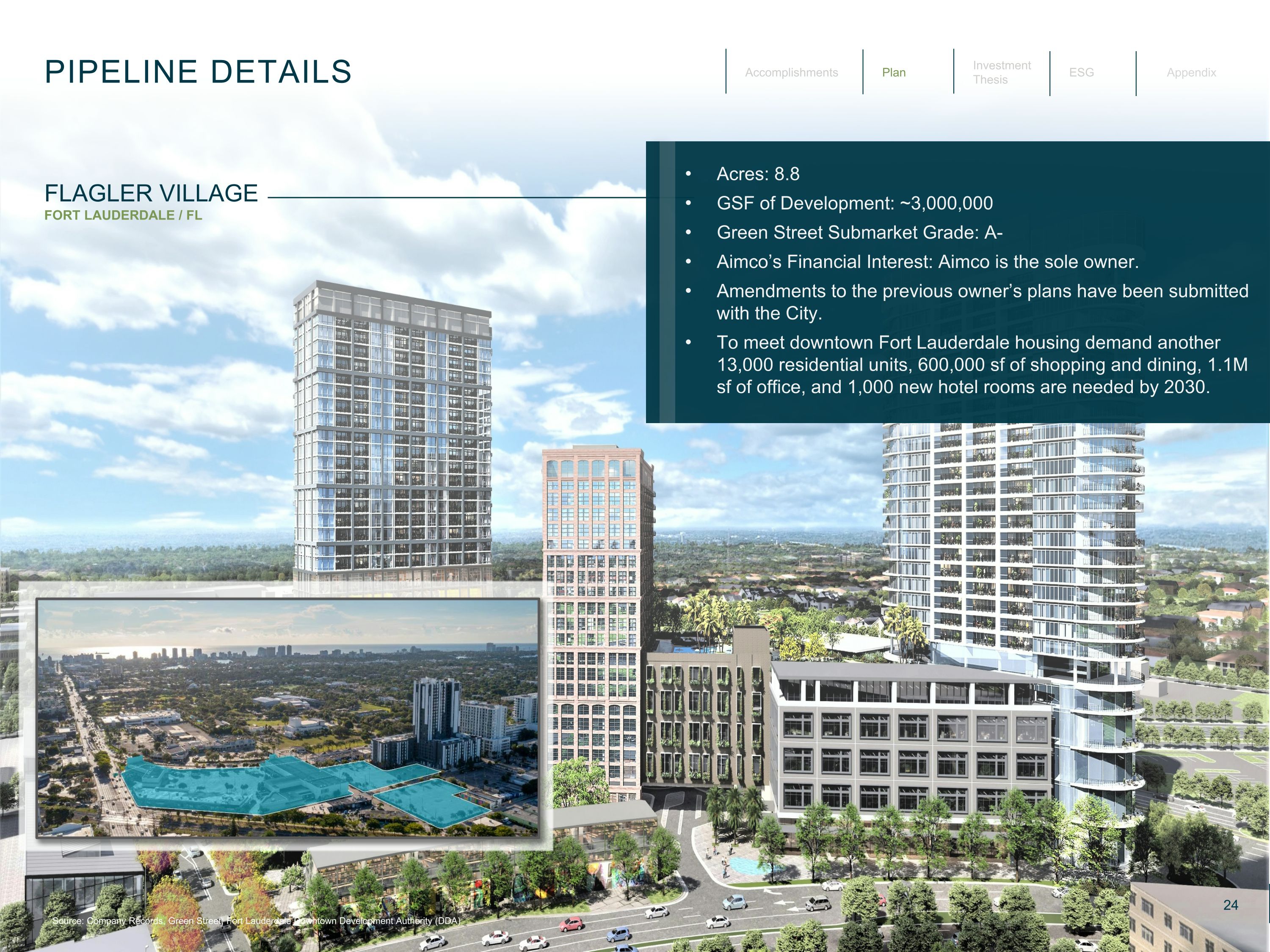

PIPELINE DETAILS FLAGLER VILLAGE FORT LAUDERDALE / FL Acres: 8.8 GSF of Development: ~3,000,000 Green Street Submarket Grade: A- Aimco’s Financial Interest: Aimco is the sole owner. Amendments to the previous owner’s plans have been submitted with the City. To meet downtown Fort Lauderdale housing demand another 13,000 residential units, 600,000 sf of shopping and dining, 1.1M sf of office, and 1,000 new hotel rooms are needed by 2030. Source: Company Records, Green Street, Fort Lauderdale Downtown Development Authority (DDA)

PIPELINE DETAILS BROWARD FORT LAUDERDALE / FL Acres: 3.4 GSF of Development: ~2,100,000 Green Street Submarket Grade: A- Aimco’s Financial Interest: Aimco owns 51% of the venture. The joint venture’s development plans are in final certification, and it expects to be ready to file for a building permit later in 2023. Located two blocks from the Brightline Fort Lauderdale Station, since 2018 home prices located near the Brightline have appreciated by twice as much as those located further away. SOLD Dec 2022 Source: Company Records, Green Street

PIPELINE DETAILS STRATHMORE SQUARE BETHESDA / MD Acres: 1.4 GSF of Development: 525,000 Green Street Submarket Grade: A++ Aimco’s Financial Interest: Aimco has a 50% interest in the first two of six phases of development with options to increase participation. Located at the Grosvenor-Strathmore stop on the Metrorail Red Line, on the campus shuttle bus route of the National Institutes of Health Construction of the first phase is on plan with initial occupancy expected in 3Q 2024 Source: Company Records, Green Street

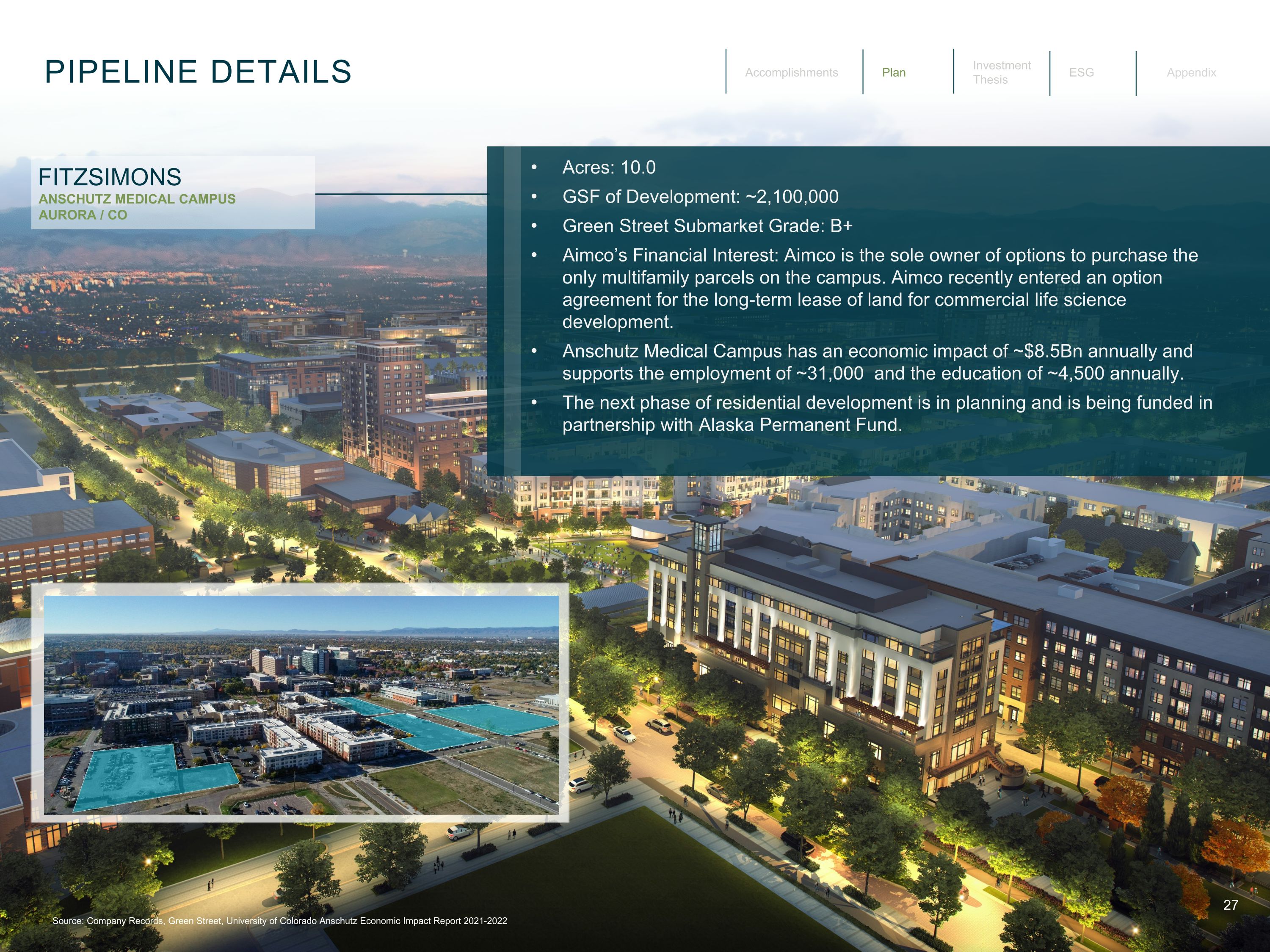

PIPELINE DETAILS FITZSIMONS ANSCHUTZ MEDICAL CAMPUS AURORA / CO Acres: 10.0 GSF of Development: ~2,100,000 Green Street Submarket Grade: B+ Aimco’s Financial Interest: Aimco is the sole owner of options to purchase the only multifamily parcels on the campus. Aimco recently entered an option agreement for the long-term lease of land for commercial life science development. Anschutz Medical Campus has an economic impact of ~$8.5Bn annually and supports the employment of ~31,000 and the education of ~4,500 annually. The next phase of residential development is in planning and is being funded in partnership with Alaska Permanent Fund. Source: Company Records, Green Street, University of Colorado Anschutz Economic Impact Report 2021-2022

UTILIZING 3rd PARTY EQUITY TO FUND PROJECTS AND SCALE OPTIMIZING GROWTH Hypothetical Project Example Aimco 100% of Development Equity Aimco 20% GP with 80% LP Capital Uses Aimco Land Basis $35 $35 Development Costs $180 $180 Development Fee (3%) $5 $5 Closing Costs (2%) $4 $4 Accrued Interest $16 $16 Total Development Cost $240 $240 Sources Construction Debt (50% LTC) $120 $120 Aimco Equity $120 $24 3rd Party Equity N/A $96 Total Sources $240 $240 Return on Equity NOI During Hold Period $14 $14 Stabilized Value $307 $307 Construction Debt Payoff ($121) ($121) Total Proceeds / Equity Value $201 $201 LP Partner Value / Proceeds N/A $146 LP Partner Multiple on Equity N/A 1.5x LP Levered IRR N/A 18.0% Aimco Pro Rata Development Fee N/A $4 Aimco Pro Rata Return Distribution N/A $40 Aimco Promoted Distribution N/A $9 Aimco Total Proceeds $201 $53 Multiple on Aimco Equity 1.6x 2.2x Levered IRR to Aimco 20.9% 35.1% BALANCE INCREMENTAL FINANCIAL LEVERAGE WITH DIVERSIFICATION OF AIMCO CAPITAL Aimco plans to diversify its capital invested and limit the incremental amount of Aimco capital needed, by using 3rd party equity sourced from JV partners and construction debt to fund the build out of its investment pipeline when conditions are right. Aimco expects to monetize certain developments when prudent and retain ownership of phased developments.

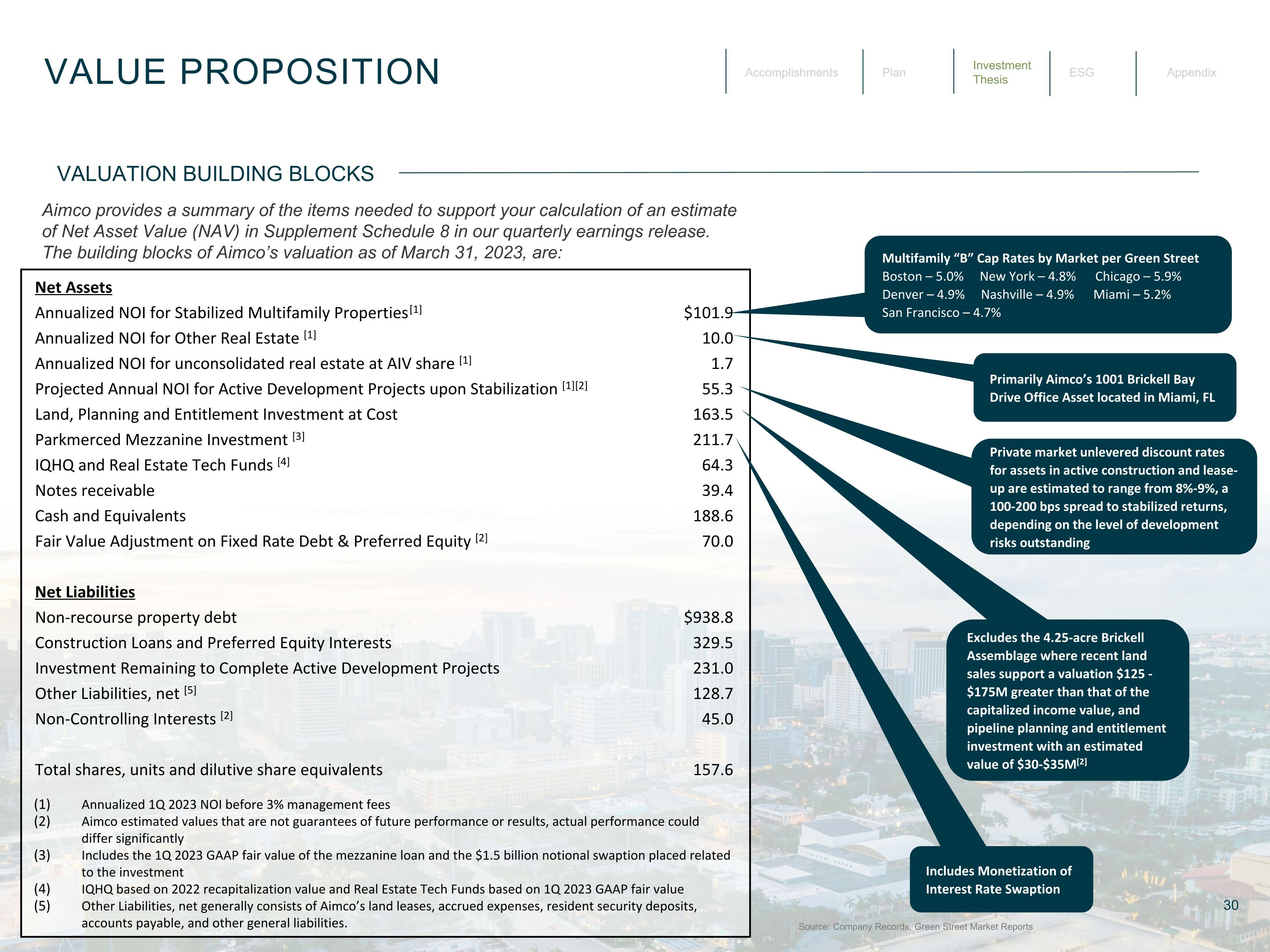

VALUE PROPOSITION VALUATION BUILDING BLOCKS Aimco provides a summary of the items needed to support your calculation of an estimate of Net Asset Value (NAV) in Supplement Schedule 8 in our quarterly earnings release. The building blocks of Aimco’s valuation as of March 31, 2023, are: Source: Company Records, Green Street Market Reports Net Assets Annualized NOI for Stabilized Multifamily Properties [1] $101.9 Annualized NOI for Other Real Estate [1] 10.0 Annualized NOI for unconsolidated real estate at AIV share [1] 1.7 Projected Annual NOI for Active Development Projects upon Stabilization [1][2] 55.3 Land, Planning and Entitlement Investment at Cost 163.5 Parkmerced Mezzanine Investment [3] 211.7 IQHQ and Real Estate Tech Funds [4] 64.3 Notes receivable 39.4 Cash and Equivalents 188.6 Fair Value Adjustment on Fixed Rate Debt & Preferred Equity [2] 70.0 Net Liabilities Non-recourse property debt $938.8 Construction Loans and Preferred Equity Interests 329.5 Investment Remaining to Complete Active Development Projects 231.0 Other Liabilities, net [5] 128.7 Non-Controlling Interests [2] 45.0 Total shares, units and dilutive share equivalents 157.6 Annualized 1Q 2023 NOI before 3% management fees Aimco estimated values that are not guarantees of future performance or results, actual performance could differ significantly Includes the 1Q 2023 GAAP fair value of the mezzanine loan and the $1.5 billion notional swaption placed related to the investment IQHQ based on 2022 recapitalization value and Real Estate Tech Funds based on 1Q 2023 GAAP fair value Other Liabilities, net generally consists of Aimco’s land leases, accrued expenses, resident security deposits, accounts payable, and other general liabilities. Multifamily “B” Cap Rates by Market per Green Street Boston – 5.0% New York – 4.8% Chicago – 5.9% Denver – 4.9% Nashville – 4.9% Miami – 5.2% San Francisco – 4.7% Primarily Aimco’s 1001 Brickell Bay Drive Office Asset located in Miami, FL Private market unlevered discount rates for assets in active construction and lease-up are estimated to range from 8%-9%, a 100-200 bps spread to stabilized returns, depending on the level of development risks outstanding Excludes the 4.25-acre Brickell Assemblage where recent land sales support a valuation $125 - $175M greater than that of the capitalized income value, and pipeline planning and entitlement investment with an estimated value of $30-$35M[2] Includes Monetization of Interest Rate Swaption

VALUE PROPOSITION COMMITTED TO MAXIMIZING AND UNLOCKING SHAREHOLDER VALUE There can be no assurance that the ongoing review will result in any particular transaction or transactions or other strategic changes or outcomes and the timing of any such event is similarly uncertain. The Company does not intend to disclose or comment on developments related to the foregoing unless or until it determines that further disclosure is appropriate or required. The Aimco Board of Directors, in consultation with management and its corporate advisory team, is continuing to oversee the review of a broad range of options to further enhance and unlock value for Aimco shareholders. Aimco is well positioned for long term growth as a result of its high-quality development pipeline and investment platform, diversified portfolio of core and opportunistic multifamily assets, and long-duration, low-cost, balance sheet. As such, the timing of any actions that may result from the Board’s review will take into consideration a host of factors, including the health and stability of both the financial and capital markets as well as the continued advancement of Aimco’s previously defined strategic plan.

EXCELLENT CORPORATE CITIZENSHIP Jennifer Johnson EVP, CHIEF ADMINISTRATIVE OFFICER, GENERAL COUNSEL Wes Powell PRESIDENT & CHIEF EXECUTIVE OFFICER Lynn Stanfield EVP & CHIEF FINANCIAL OFFICER Lee Hodges SENIOR VICE PRESIDENT SOUTHEAST REGION 7 Years with Aimco Previously with: Peebles Development The Related Group Matt Konrad SENIOR VICE PRESIDENT NATIONAL TRANSACTIONS 5 Years with Aimco Previously with: Brandywine Realty Akridge Tom Marchant SENIOR VICE PRESIDENT ACCOUNTING, TAX, & FP&A 8 Years with Aimco Previously with: Extra Space Storage Deloitte Derek Ullian SENIOR VICE PRESIDENT DEVELOPMENT 6 Years with Aimco Previously with: Benchmark RE Group Hellmuth, Obata + Kassabaum John Nicholson SENIOR VICE PRESIDENT DEBT & CAPITAL MARKETS 18 Years with Aimco Previously with: Tuchenhagen N.A,. Elizabeth (Tizzie) Likovich SENIOR VICE PRESIDENT CENTRAL REGION 2 Years with Aimco Previously with: UDR Wells Fargo Kellie Dreyer SENIOR VICE PRESIDENT CHIEF ACCOUNTING OFFICER 1 Year with Aimco Previously with: Ernst & Young Matt Hopkins SENIOR VICE PRESIDENT MID-ATLANTIC REGION 7 Years with Aimco Previously with: Streetsense DNC Architects COHESIVE AND EXPERIENCED SENIOR LEADERSHIP TEAM

James P. Sullivan FORMER PRESIDENT, GREEN STREET ADVISORY GROUP Appointed 2022 Wesley Powell PRESIDENT, CHIEF EXECUTIVE OFFICER Appointed 2020 Deborah Smith CO-FOUNDER AND CEO, THE CENTERCAP GROUP Appointed 2021 Jay Paul Leupp CO-FOUNDER, MANAGING PARTNER AND SENIOR PORTFOLIO MANAGER, REAL ESTATE SECURITIES, TERRA FIRMA ASSET MANAGEMENT Appointed 2020 Kirk A. Sykes CO-MANAGING PARTNER, ACCORDIA PARTNERS, LLC Appointed 2020 Patricia L. Gibson FOUNDING PRINCIPAL AND CEO, BANNER OAK CAPITAL PARTNERS Appointed 2020 Quincy L. Allen CO-FOUNDER AND MANAGING PARTNER, ARC CAPITAL PARTNERS Appointed 2020 R. Dary Stone PRESIDENT & CEO, R. D. STONE INTERESTS Appointed 2020 AIMCO DIRECTORS An average tenure of two years Eight of nine are independent EXCELLENT CORPORATE CITIZENSHIP STRONG GOVERNANCE: HIGHLY REGARDED AND RECONSTITUTED BOARD Sherry L. Rexroad FORMER CFO, STORE CAPITAL Appointed 2023

EXCELLENT CORPORATE CITIZENSHIP COMMITTED TO BEST-IN-CLASS GOVERNANCE Aimco’s Board of Directors is committed to shareholder friendly governance. Aimco’s Board has taken actions to: Opt Out of MUTA (Maryland Unsolicited Takeover Act) including those that would otherwise allow it to re-classify the Board without the approval of shareholders. Declassify the Board in 2023 Transition Timing of the Annual Meeting Date: The Board will move the date of the Company’s annual meeting so the 2024 annual meeting will be held by the end of the second quarter of 2024. The Board has set the 2023 annual meeting for September 29, 2023. Amend Aimco’s Bylaws to Lower Threshold for Shareholders to Call a Special Meeting to 15% and also allow shareholders to amend the Bylaws to set the size or range of the size of the Board (but to no fewer than three directors). At the 2023 annual meeting, Aimco's Board will ask shareholders to: Approve Certain Charter Amendments to Eliminate Super-Majority Requirements and Expand Shareholder Rights to Replace Directors: Lower the threshold required for shareholders to amend all portions of Aimco’s Charter and Bylaws to a simple majority of shares outstanding; and Lower the threshold for shareholders to remove directors to a simple majority of shares outstanding, eliminate the requirement that such removal be for “cause”, and allow shareholders to appoint directors to fill vacancies arising out of removals by shareholders.

EXCELLENT CORPORATE CITIZENSHIP HIGHLY ENGAGED TEAM Record 4.52 (out of 5 stars) team engagement for 2022: 92% employee response rate SUPPORTING OUR COMMUNITIES WITH PARTNERSHIPS, OPPORTUNITIES FOR TEAMMATES TO VOLUNTEER Providing teammates with 15 hours of paid volunteer hours through Aimco Cares Partnership with Camillus House in 2022, pledging $1M over four years for expansion of Camillus House’s workforce development programs SOCIAL RESPONSIBILITY: COMMITMENT TO OUR TEAMMATES, CUSTOMERS & COMMUNITIES INVESTMENTS IN TEAMMATES & COMPANY CULTURE… Workplace flexibility Parental leave – 16 weeks paid leave Healthy work environments …SHOWING TANGIBLE RESULTS A WORKFORCE RICH WITH DIVERSE BACKGROUNDS, PERSPECTIVES LEADS TO IMPROVED OUTCOMES 67% Women in executive management 43% Women and racial/ethnic minorities in senior leadership positions (all officers) 53% Women and racial/ethnic minorities company-wide AIMCO’S HUMAN CAPITAL COMPOSITION AT A GLANCE HIGHLY ENGAGED TEAM

EXCELLENT CORPORATE CITIZENSHIP BUILDING COMMUNITIES THROUGH DESIGN AND PLANNING ENVIRONMENTAL STEWARDSHIP: COMMITMENT TO CONSERVATION & SUSTAINABILITY Inaugural Reporting to Task Force on Climate-Related Financial Disclosures (TCFD) in 2022 Corporate Responsibility Report In 2022, Aimco conducted climate-risk assessments for each of its assets and land and building acquisitions. Every development and redevelopment project is built with conservation, sustainability, resilience, and climate-related risks and opportunities in mind. Further, we have implemented a number of measures throughout our portfolio to reduce our environmental footprint, including innovative technologies. KEYLESS ENTRY LED LIGHTING RESIDENT & OFFICE RECYCLING SMART THERMOSTATS WATER SENSORS Upton Place, Washington D.C.

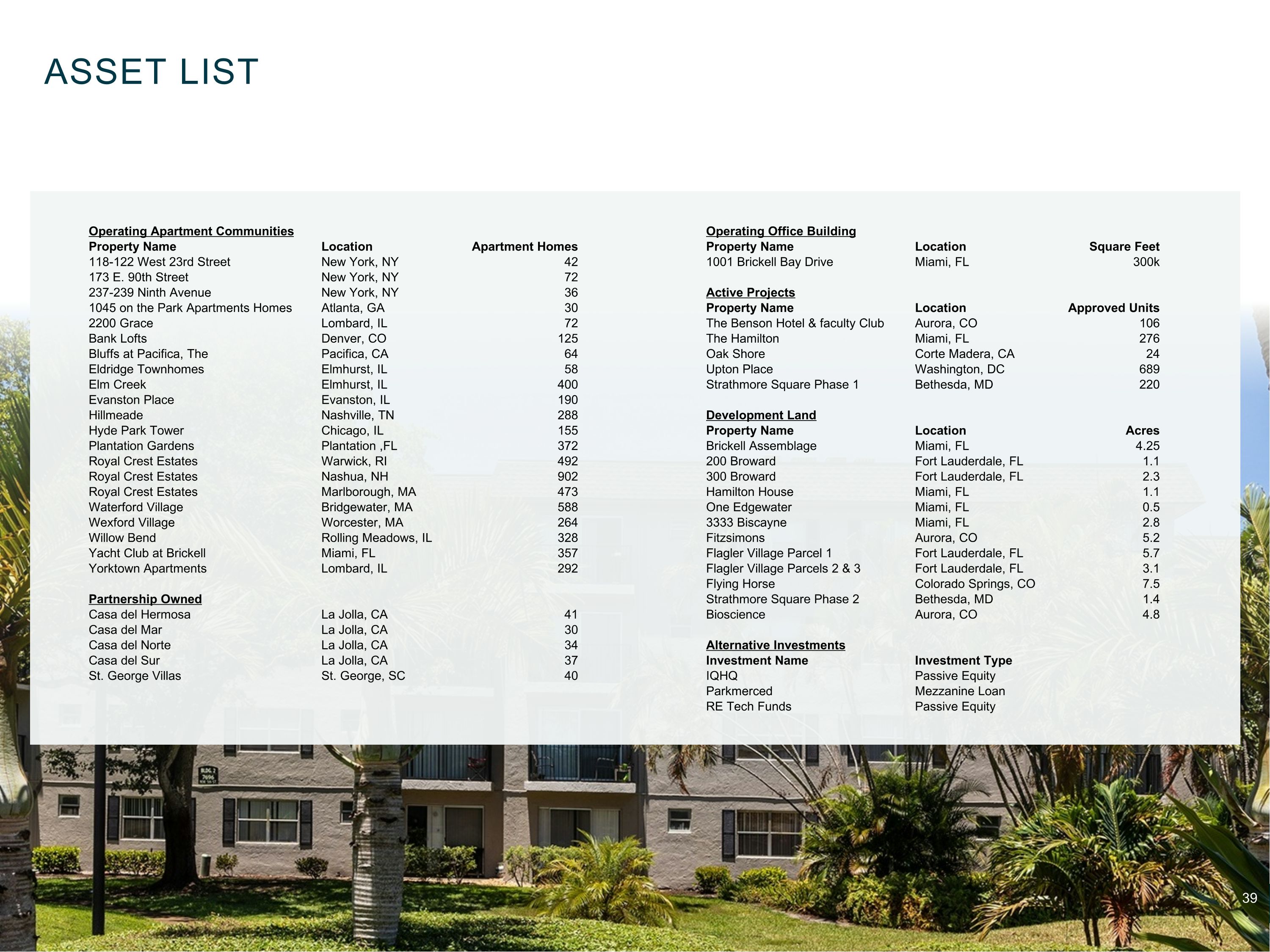

ASSET LIST Operating Apartment Communities Operating Office Building Property Name Location Apartment Homes Property Name Location Square Feet 118-122 West 23rd Street New York, NY 42 1001 Brickell Bay Drive Miami, FL 300k 173 E. 90th Street New York, NY 72 237-239 Ninth Avenue New York, NY 36 Active Projects 1045 on the Park Apartments Homes Atlanta, GA 30 Property Name Location Approved Units 2200 Grace Lombard, IL 72 The Benson Hotel & faculty Club Aurora, CO 106 Bank Lofts Denver, CO 125 The Hamilton Miami, FL 276 Bluffs at Pacifica, The Pacifica, CA 64 Oak Shore Corte Madera, CA 24 Eldridge Townhomes Elmhurst, IL 58 Upton Place Washington, DC 689 Elm Creek Elmhurst, IL 400 Strathmore Square Phase 1 Bethesda, MD 220 Evanston Place Evanston, IL 190 Hillmeade Nashville, TN 288 Development Land Hyde Park Tower Chicago, IL 155 Property Name Location Acres Plantation Gardens Plantation ,FL 372 Brickell Assemblage Miami, FL 4.25 Royal Crest Estates Warwick, RI 492 200 Broward Fort Lauderdale, FL 1.1 Royal Crest Estates Nashua, NH 902 300 Broward Fort Lauderdale, FL 2.3 Royal Crest Estates Marlborough, MA 473 Hamilton House Miami, FL 1.1 Waterford Village Bridgewater, MA 588 One Edgewater Miami, FL 0.5 Wexford Village Worcester, MA 264 3333 Biscayne Miami, FL 2.8 Willow Bend Rolling Meadows, IL 328 Fitzsimons Aurora, CO 5.2 Yacht Club at Brickell Miami, FL 357 Flagler Village Parcel 1 Fort Lauderdale, FL 5.7 Yorktown Apartments Lombard, IL 292 Flagler Village Parcels 2 & 3 Fort Lauderdale, FL 3.1 Flying Horse Colorado Springs, CO 7.5 Partnership Owned Strathmore Square Phase 2 Bethesda, MD 1.4 Casa del Hermosa La Jolla, CA 41 Bioscience Aurora, CO 4.8 Casa del Mar La Jolla, CA 30 Casa del Norte La Jolla, CA 34 Alternative Investments Casa del Sur La Jolla, CA 37 Investment Name Investment Type St. George Villas St. George, SC 40 IQHQ Passive Equity Parkmerced Mezzanine Loan RE Tech Funds Passive Equity

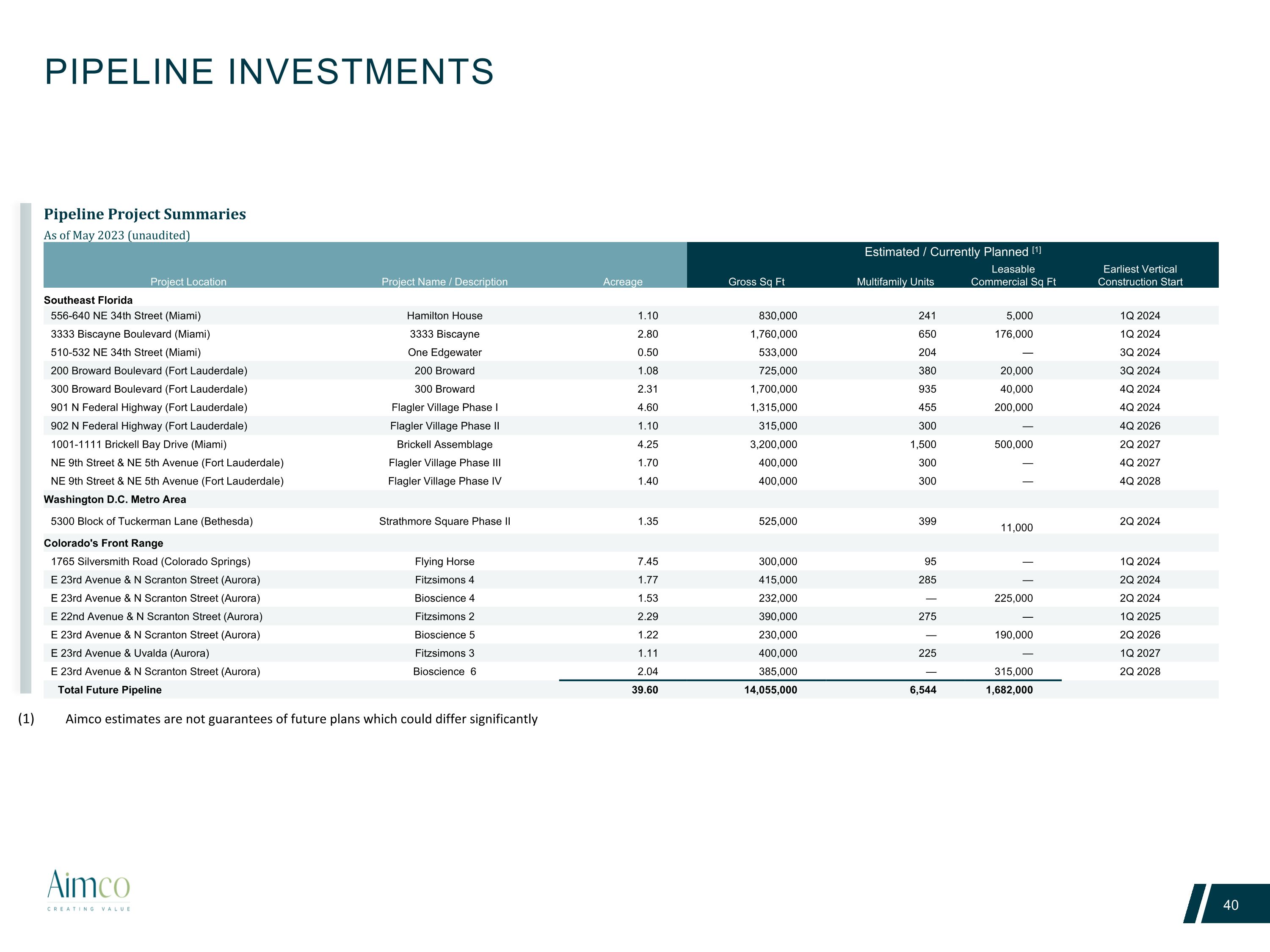

PIPELINE INVESTMENTS Pipeline Project Summaries As of May 2023 (unaudited) Project Location Project Name / Description Estimated / Currently Planned [1] Acreage Gross Sq Ft Multifamily Units Leasable Commercial Sq Ft Earliest Vertical Construction Start Southeast Florida 556-640 NE 34th Street (Miami) Hamilton House 1.10 830,000 241 5,000 1Q 2024 3333 Biscayne Boulevard (Miami) 3333 Biscayne 2.80 1,760,000 650 176,000 1Q 2024 510-532 NE 34th Street (Miami) One Edgewater 0.50 533,000 204 — 3Q 2024 200 Broward Boulevard (Fort Lauderdale) 200 Broward 1.08 725,000 380 20,000 3Q 2024 300 Broward Boulevard (Fort Lauderdale) 300 Broward 2.31 1,700,000 935 40,000 4Q 2024 901 N Federal Highway (Fort Lauderdale) Flagler Village Phase I 4.60 1,315,000 455 200,000 4Q 2024 902 N Federal Highway (Fort Lauderdale) Flagler Village Phase II 1.10 315,000 300 — 4Q 2026 1001-1111 Brickell Bay Drive (Miami) Brickell Assemblage 4.25 3,200,000 1,500 500,000 2Q 2027 NE 9th Street & NE 5th Avenue (Fort Lauderdale) Flagler Village Phase III 1.70 400,000 300 — 4Q 2027 NE 9th Street & NE 5th Avenue (Fort Lauderdale) Flagler Village Phase IV 1.40 400,000 300 — 4Q 2028 Washington D.C. Metro Area 5300 Block of Tuckerman Lane (Bethesda) Strathmore Square Phase II 1.35 525,000 399 11,000 2Q 2024 Colorado's Front Range 1765 Silversmith Road (Colorado Springs) Flying Horse 7.45 300,000 95 — 1Q 2024 E 23rd Avenue & N Scranton Street (Aurora) Fitzsimons 4 1.77 415,000 285 — 2Q 2024 E 23rd Avenue & N Scranton Street (Aurora) Bioscience 4 1.53 232,000 — 225,000 2Q 2024 E 22nd Avenue & N Scranton Street (Aurora) Fitzsimons 2 2.29 390,000 275 — 1Q 2025 E 23rd Avenue & N Scranton Street (Aurora) Bioscience 5 1.22 230,000 — 190,000 2Q 2026 E 23rd Avenue & Uvalda (Aurora) Fitzsimons 3 1.11 400,000 225 — 1Q 2027 E 23rd Avenue & N Scranton Street (Aurora) Bioscience 6 2.04 385,000 — 315,000 2Q 2028 Total Future Pipeline 39.60 14,055,000 6,544 1,682,000 Aimco estimates are not guarantees of future plans which could differ significantly

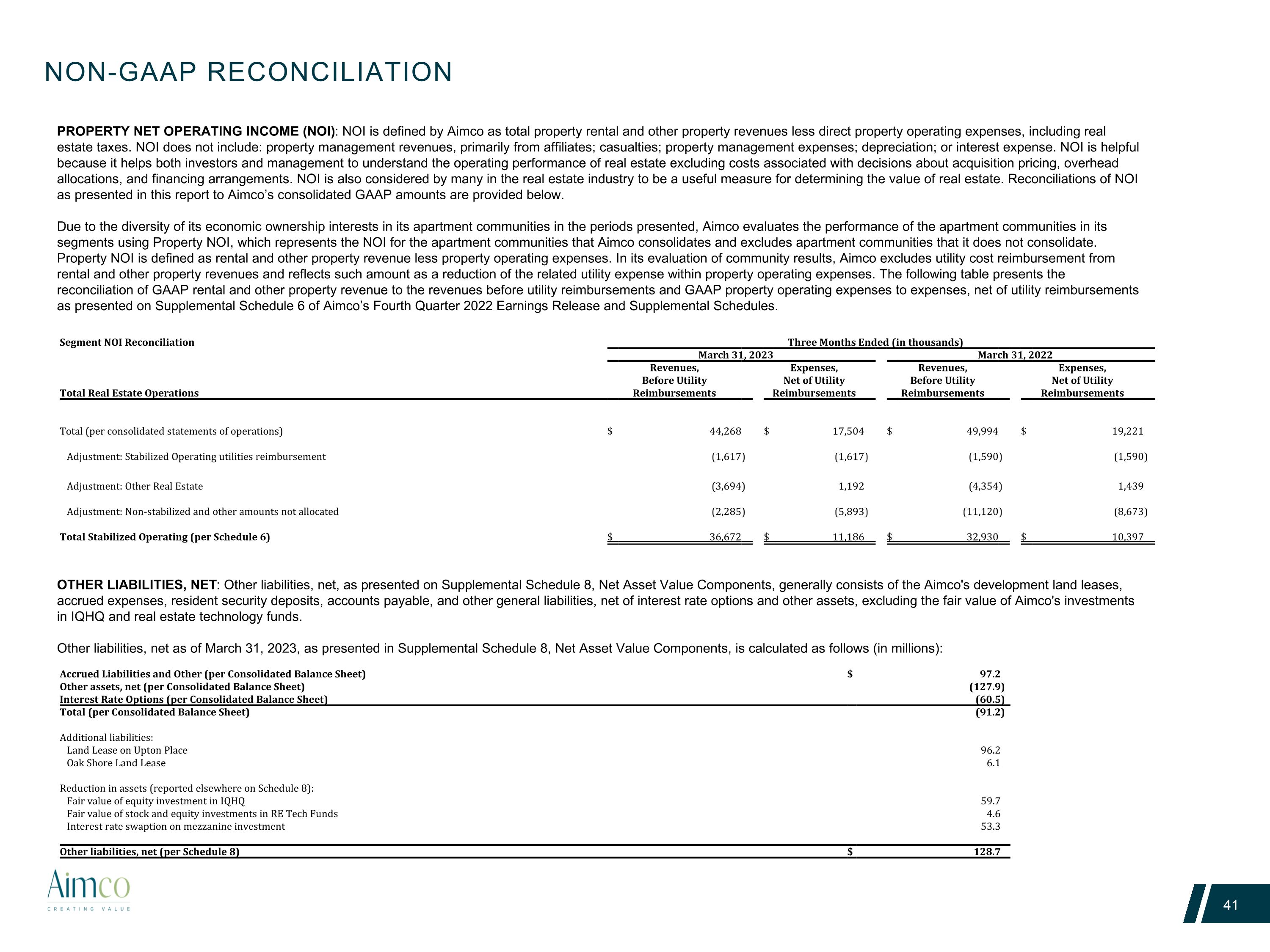

NON-GAAP RECONCILIATION PROPERTY NET OPERATING INCOME (NOI): NOI is defined by Aimco as total property rental and other property revenues less direct property operating expenses, including real estate taxes. NOI does not include: property management revenues, primarily from affiliates; casualties; property management expenses; depreciation; or interest expense. NOI is helpful because it helps both investors and management to understand the operating performance of real estate excluding costs associated with decisions about acquisition pricing, overhead allocations, and financing arrangements. NOI is also considered by many in the real estate industry to be a useful measure for determining the value of real estate. Reconciliations of NOI as presented in this report to Aimco’s consolidated GAAP amounts are provided below. Due to the diversity of its economic ownership interests in its apartment communities in the periods presented, Aimco evaluates the performance of the apartment communities in its segments using Property NOI, which represents the NOI for the apartment communities that Aimco consolidates and excludes apartment communities that it does not consolidate. Property NOI is defined as rental and other property revenue less property operating expenses. In its evaluation of community results, Aimco excludes utility cost reimbursement from rental and other property revenues and reflects such amount as a reduction of the related utility expense within property operating expenses. The following table presents the reconciliation of GAAP rental and other property revenue to the revenues before utility reimbursements and GAAP property operating expenses to expenses, net of utility reimbursements as presented on Supplemental Schedule 6 of Aimco’s Fourth Quarter 2022 Earnings Release and Supplemental Schedules. Segment NOI Reconciliation Three Months Ended (in thousands) March 31, 2023 March 31, 2022 Total Real Estate Operations Revenues, Before Utility Reimbursements Expenses, Net of Utility Reimbursements Revenues, Before Utility Reimbursements Expenses, Net of Utility Reimbursements Total (per consolidated statements of operations) $ 44,268 $ 17,504 $ 49,994 $ 19,221 Adjustment: Stabilized Operating utilities reimbursement (1,617 ) (1,617 ) (1,590 ) (1,590 ) Adjustment: Other Real Estate (3,694 ) 1,192 (4,354 ) 1,439 Adjustment: Non-stabilized and other amounts not allocated (2,285 ) (5,893 ) (11,120 ) (8,673 ) Total Stabilized Operating (per Schedule 6) $ 36,672 $ 11,186 $ 32,930 $ 10,397 OTHER LIABILITIES, NET: Other liabilities, net, as presented on Supplemental Schedule 8, Net Asset Value Components, generally consists of the Aimco's development land leases, accrued expenses, resident security deposits, accounts payable, and other general liabilities, net of interest rate options and other assets, excluding the fair value of Aimco's investments in IQHQ and real estate technology funds. Other liabilities, net as of March 31, 2023, as presented in Supplemental Schedule 8, Net Asset Value Components, is calculated as follows (in millions): Accrued Liabilities and Other (per Consolidated Balance Sheet) $ 97.2 Other assets, net (per Consolidated Balance Sheet) (127.9 ) Interest Rate Options (per Consolidated Balance Sheet) (60.5 ) Total (per Consolidated Balance Sheet) (91.2 ) Additional liabilities: Land Lease on Upton Place 96.2 Oak Shore Land Lease 6.1 Reduction in assets (reported elsewhere on Schedule 8): Fair value of equity investment in IQHQ 59.7 Fair value of stock and equity investments in RE Tech Funds 4.6 Interest rate swaption on mezzanine investment 53.3 Other liabilities, net (per Schedule 8) $ 128.7