|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

Exhibit 99.2

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

Exhibit 99.2

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

DEUTSCHE BANK AKTIENGESELLSCHAFT

Frankfurt am Main

– ISIN DE 0005140008 –

Notice of the Annual General Meeting 2023

We take pleasure in inviting our shareholders to the

Annual General Meeting

convened for

Wednesday, May 17, 2023, 10:00 Central European Summer Time (CEST)

as a virtual general meeting without physical presence of the shareholders or their authorized representatives at the place of the General Meeting.

Unique identifier of the event: 320f15089e98ed11813e005056888925

I. Agenda

The Supervisory Board has already approved the Annual Financial Statements and Consolidated Financial Statements prepared by the Management Board; the Annual Financial Statements are thus established. Therefore, in accordance with the statutory provisions, a resolution is not provided for on this Agenda Item.

2

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

Management Board and Supervisory Board propose that the distributable profit of the 2022 financial year amounting to € 3,568,548,051.09 shall be used as follows:

|

Payment of a dividend of €0.30 per share on up to 2,040,242,959 shares eligible for the payment of a dividend for the 2022 financial year

|

up to €612,072,887.70 |

|

Allocation to retained earnings

|

€2,500,000,000.00 |

|

Carry-forward to new account |

at least €456,475,163.39 |

The proposals will be finalized by the specific amounts for the dividend payments and the amount carried forward to new account when the number of own shares are determined and thus also the number of shares that are ineligible for the payment of a dividend at the time of the General Meeting.

Pursuant to § 58 (4) sentence 2 Stock Corporation Act, the claim to payment of the dividend is due on the third business day following the resolution of the General Meeting, i.e., on May 22, 2023.

3

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

Management Board and Supervisory Board propose that the acts of management of the members of the Management Board in office during the 2022 financial year be ratified for this period. The actions shall be ratified on an individual basis, i.e., a separate resolution shall be passed for each member of the Management Board.

The actions of the following Management Board members in office in the 2022 financial year shall be ratified:

4

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

Management Board and Supervisory Board propose that the acts of management of the members of the Supervisory Board in office during the 2022 financial year be ratified for this period. The actions shall be ratified on an individual basis, i.e., a separate resolution shall be passed for each member of the Supervisory Board.

The actions of the following members of the Supervisory Board in office in the 2022 financial year shall be ratified:

5

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

6

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

The Supervisory Board, based on the recommendation of its Audit Committee, proposes the following resolution:

Ernst & Young GmbH Wirtschaftsprüfungsgesellschaft, Stuttgart, (EY), is to be appointed as the auditor of the Annual Financial Statements and as the auditor of the Consolidated Financial Statements for the 2023 financial year.

Ernst & Young GmbH Wirtschaftsprüfungsgesellschaft, Stuttgart, (EY), is also to be appointed for the limited review of the condensed consolidated interim financial statements as of June 30, 2023 (§ 115 (5), § 117 No. 2 Securities Trading Act), and of the consolidated interim financial statements and consolidated interim management reports (§ 340i (4) German Commercial Code, § 115 (7) Securities Trading Act) – if any – prepared before the Ordinary General Meeting in 2024.

The Audit Committee has declared that its recommendation is free of undue third-party influence and, in particular, that no clause within the meaning of Article 16 (6) of the EU-Regulation 537/2014 (EU-Statutory Auditor Regulation) was imposed on it that limited its selection to specific auditors.

7

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

Pursuant to § 162 Stock Corporation Act, Management Board and Supervisory Board have prepared a report on the compensation awarded and due in the 2022 financial year to each current or former member of the Management Board and the Supervisory Board of the company. Pursuant to § 120a (4) Stock Corporation Act, the General Meeting resolves on the approval of the Compensation Report.

The Compensation Report was audited by the auditor in accordance with § 162 (3) Stock Corporation Act. Within the framework of a formal audit, the auditor examined whether all of the information required pursuant to § 162 (1) and (2) Stock Corporation Act was provided in the Compensation Report. Beyond these requirements prescribed by law, the auditor also performed a review of the contents. The audit opinion on the audit of the Compensation Report was issued by the auditor and is attached to the Compensation Report.

The Compensation Report for the 2022 financial year and the audit opinion of the auditor are set out in the section II. 1. and are accessible starting from the convocation of this General Meeting on the company’s website at agm.db.com . They will also be accessible there during the General Meeting.

Management Board and Supervisory Board propose that the Compensation Report produced and audited pursuant to § 162 Stock Corporation Act for the 2022 financial year be approved.

8

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

Management Board and Supervisory Board propose the following resolution:

9

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

Furthermore, the Management Board is authorized, with the exclusion of shareholders’ pre-emptive rights, to sell such own shares to third parties against cash payment if the purchase price is not substantially lower than the price of the shares on the stock exchange at the time of sale. Use may only be made of this authorization if it has been ensured that the number of shares sold on the basis of this authorization does not exceed 10% of the company’s share capital at the time this authorization becomes effective or – if the amount is lower – at the time this authorization is exercised. Shares that are issued or sold during the validity of this authorization with the exclusion of pre-emptive rights, in direct or analogous application of § 186 (3) sentence 4 Stock Corporation Act, are to be included in the maximum limit of 10% of the share capital. Also to be included are shares that are to be issued to service option and/or conversion rights from convertible bonds, bonds with warrants, convertible participatory rights or participatory rights, if these bonds or participatory rights are issued during the validity of this authorization with the exclusion of pre-emptive rights in corresponding application of § 186 (3) sentence 4 Stock Corporation Act.

The Report of the Management Board to the General Meeting pursuant to § 71 (1) No. 8 in conjunction with § 186 (4) Stock Corporation Act is set out in the section II. 2. and is accessible starting from the convocation of this General Meeting on the company’s website at agm.db.com . It will also be accessible there during the General Meeting.

10

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

In supplementing the authorization to be resolved on under Item 7 of this Agenda to acquire own shares pursuant to § 71 (1) No. 8 Stock Corporation Act, the company is also to be authorized to acquire own shares with the use of derivatives.

Management Board and Supervisory Board propose the following resolution:

The purchase of shares subject to the authorization to acquire own shares to be resolved under Agenda Item 7 may be executed, apart from in the ways described there, with the use of put and call options or forward purchase contracts. The company may sell to third parties put options based on physical delivery and buy call options from third parties if it is ensured by the option conditions that these options are fulfilled only with shares which themselves were acquired subject to compliance with the principle of equal treatment. All share purchases based on put or call options are limited to shares in a maximum volume of 5% of the actual share capital at the time of the resolution by the General Meeting on this authorization. The term of the options must be selected such that the share purchase upon exercising the option is carried out at the latest on April 30, 2028.

The purchase price to be paid per share upon exercise of the put options or upon the maturity of the forward purchase may not exceed by more than 10% or fall below 10% of the average of the share prices (closing auction prices of the Deutsche Bank share in Xetra trading and/or in a comparable successor system on the Frankfurt Stock Exchange) on the last three stock exchange trading days before conclusion of the respective transaction in each case excluding ancillary purchase costs but taking into account the option premium received. The call options may only be exercised if the purchase price to be paid does not exceed by more than 10% or fall below 10% of the average of the share prices (closing auction prices of the Deutsche Bank share in Xetra trading and/or in a comparable successor system on the Frankfurt Stock Exchange) on the last three stock exchange trading days before the acquisition of the shares. The rules specified under Item 7 of this Agenda apply to the sale and cancellation of shares acquired with the use of derivatives.

Own shares may continue to be purchased using existing derivatives that were agreed on the basis and during the existence of previous authorizations.

The Report of the Management Board to the General Meeting pursuant to § 71 (1) No. 8 in conjunction with § 186 (4) Stock Corporation Act is set out in the section II. 2. and is accessible starting from the convocation of this General Meeting on the company’s website at agm.db.com . It will also be accessible there during the General Meeting.

11

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

The term of office of Ms. Mayree Clark, Mr. John Alexander Thain, Ms. Michele Trogni and Professor Dr. Norbert Winkeljohann ends as scheduled with the conclusion of the Ordinary General Meeting on May 17, 2023, which means that in total four shareholder representatives are to be newly elected.

Pursuant to § 96 (1) and (2) and § 101 (1) Stock Corporation Act as well as § 7 (1) sentence 1 No. 3 Act Concerning Co-Determination by Employees dated May 4, 1976, the Supervisory Board consists of ten members for the shareholders and ten members for the employees.

The Terms of Reference for the Supervisory Board do not contain any specification regarding joint or separate fulfillment of the gender quotas to fulfill the statutory requirements. Until now neither the shareholder representatives’ side nor the employee representatives’ side has objected to joint fulfillment of the quotas pursuant to § 96 (2) sentence 3 Stock Corporation Act. Therefore, the Supervisory Board is to have overall at least six women and at least six men in order to fulfill the minimum quota requirements pursuant to § 96 (2) sentence 1 Stock Corporation Act.

For many years now, at least 30% of the Supervisory Board members have been women; currently, six of its members are women, i.e., 30%. Since 2013, the shareholder representatives’ side has been comprised to at least 30% of women, which would also be the case following the election of the proposed candidates. The minimum quota requirement is therefore fulfilled, and it would also be fulfilled following the election of the proposed candidates – given unchanged fulfillment on the employee representatives’ side.

Pursuant to § 4 (2) of the Terms of Reference for the Supervisory Board, shareholder representatives are proposed to the General Meeting for election for a term of office until the conclusion of the General Meeting which adopts the resolutions concerning the ratification of the acts of management for the third financial year following the beginning of the term of office, whereby the financial year in which the term of office begins is not taken into account.

The Supervisory Board proposes, based on the recommendations of the shareholder representatives of its Nomination Committee, that the following persons be elected as shareholder representatives to the Supervisory Board, pursuant to § 9 (1) sentences 2 and 3 of the Articles of Association, for the period until the end of the General Meeting that resolves on the ratification of the acts of management for the 2026 financial year:

a. Ms. Mayree Clark, Supervisory Board member, New Canaan, USA

b. Mr. John Alexander Thain, Supervisory Board member, Rye, USA

c. Ms. Michele Trogni, Chief Executive Officer of Zinnia Corporate Holdings LLC and Operating Partner at Eldridge Industries LLC, Riverside, USA

d. Professor Dr. Norbert Winkeljohann, Supervisory Board member and Self-employed corporate Consultant, Osnabrück, Germany.

12

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

In addition to her work on the Supervisory Board of Deutsche Bank Aktiengesellschaft, Ms. Clark is a member of the following foreign supervisory bodies comparable to a supervisory board: (1) Ally Financial, Inc. – Member of the Board of Directors and (2) Allvue Systems Holdings, Inc. – Member of the Board of Directors.

There are permanent business relationships between the companies Ally Financial, Inc. and Allvue Systems Holdings, Inc. and Deutsche Bank Group. The business relationships are carried out on market terms and without involvement of Ms. Clark as member of the Board of Directors. There are no personal or business relationships between Ms. Clark and Deutsche Bank Aktiengesellschaft, its Group companies, members of their corporate bodies or a major shareholder.

In addition to his work on the Supervisory Board of Deutsche Bank Aktiengesellschaft, Mr. Thain is a member of the following foreign supervisory bodies comparable to a supervisory board: (1) Aperture Investors LLC – Member of the Board of Directors; (2) Uber Technologies, Inc. – Member of the Board of Directors; (3) Pine Island Capital Partners LLC – Chairman.

There are permanent business relationships between the company Uber Technologies, Inc. and Deutsche Bank Group. The business relationships are carried out on market terms and without involvement of Mr. Thain as member of the Board of Directors. There are no personal or business relationships between Mr. Thain and Deutsche Bank Aktiengesellschaft, its Group companies, members of their corporate bodies or a major shareholder.

In addition to her work on the Supervisory Board of Deutsche Bank Aktiengesellschaft, Ms. Trogni is a member of the following foreign supervisory bodies comparable to a supervisory board: Zinnia Corporate Holdings, LLC – Chief Executive Officer and Chairperson of the Board of Directors.

Ms. Trogni is Operating Partner at Eldridge Industries LLC. There are permanent business relationships between the company Eldridge Industries LLC and Deutsche Bank Group. The business relationships are carried out on market terms and without involvement of Ms. Trogni as Operating Partner. There are no personal or business relationships between Ms. Trogni and Deutsche Bank Aktiengesellschaft, its Group companies, members of their corporate bodies or a major shareholder.

In addition to his work on the Supervisory Board of Deutsche Bank Aktiengesellschaft, Professor Dr. Norbert Winkeljohann is a member of the following supervisory boards to be formed by law: (1) Bayer AG – Chairman of the Supervisory Board; (2) Georgsmarienhütte Holding GmbH; (3) Sievert SE – Chairman of the Supervisory Board; and (4) Bohnenkamp AG – Chairman of the Supervisory Board.

13

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

There are permanent business relationships between the companies Bayer AG and Georgsmarienhütte Holding GmbH and Deutsche Bank Group. The business relationships are carried out on market terms and without involvement of Professor Dr. Norbert Winkeljohann as Chair of the Supervisory Board or as Supervisory Board member. There are no personal or business relationships between Professor Dr. Norbert Winkeljohann and Deutsche Bank Aktiengesellschaft, its Group companies, members of their corporate bodies or a major shareholder.

The election proposals reflect the objectives resolved by the Supervisory Board for its composition and are intended to fulfill as comprehensively as possible the profile of requirements adopted by the Supervisory Board.

As of the time of the conclusion of the General Meeting that resolves on the ratification of the acts of management for the 2026 financial year, i.e., at the end of the new term of office, Ms. Clark and Mr. Thain will have turned the age of 70 and thus have reached the age limit defined by the Supervisory Board (Ms. Clark) or exceeded it by up to two years (Mr. Thain). Based on their special qualifications and experience, the Supervisory Board considers the prerequisites to be met in each case for Ms. Clark and Mr. Thain for a deviation from this general specification in accordance with § 4 (3) sentence 2 of the Terms of Reference for the Supervisory Board.

The Supervisory Board expects – also based on discussions with the candidates and based on experience from the current term of office – that all four candidates can devote the expected amount of time to their Supervisory Board work.

The candidates’ resumes are presented in the section II. 3.

Through the Act on the Introduction of Virtual General Meetings of Stock Corporations and Amendment to Cooperative, Insolvency and Restructuring Regulations from July 20, 2022 (published in the Federal Gazette Part I of July 26, 2022, p. 1166 et seqq. ), lawmakers created a permanent legal basis in the Stock Corporation Act for holding virtual general meetings, which brings in particular the level for exercising shareholder rights substantially up to that of a meeting with physical attendance, while taking into account the special circumstances of communicating using electronic means. Pursuant to § 118a (1) sentence 1 Stock Corporation Act, the Articles of Association may allow for, or authorize the Management Board to allow for, the General Meeting to be held as a virtual General Meeting without physical presence of the shareholders or their authorized representatives at the place of the General Meeting. The proposed amendment to the Articles of Association shall grant such an authorization to the Management Board.

14

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

Within the framework of the authorization pursuant to the statutory provision, in consideration of the circumstances of each individual case, the Management Board is to decide if use is to be made of such authorization and – if so – in what ways the General Meeting is to be specifically conducted. The decision is to be made while taking into account the rights and interests of the shareholders and of the company within the framework of the existing statutory requirements and provisions of the Articles of Association. Unless otherwise stipulated as mandatory by law or explicitly specified differently by the company’s Articles of Association, the provisions of the Articles of Association relating to General Meetings will also apply to the company’s virtual General Meetings. This also applies to the authority to chair the General Meeting and to the other authorities of the Chair of the General Meeting pursuant to § 19 (2) sentences 1 and 2 of the Articles of Association. The Management Board’s authorization is to be issued only for General Meetings that take place on or before August 31, 2025, and not for the maximum period allowed by law of five years pursuant to § 118a (5) No. 2 Stock Corporation Act. If the Management Board decides to make use of the proposed authorization and to hold a General Meeting as a virtual General Meeting, key aspects to be taken into account for holding and structuring the General Meeting – besides sustainability considerations, workload and expenses as well as, possibly, aspects related to protecting participants’ health – will be safeguarding shareholder rights and the possibilities for shareholder interaction and participation. The fact that safeguarding shareholder rights and providing possibilities for shareholders to interact and participate are important to the company has been shown again and again in past General Meetings and will also be evident at the forthcoming General Meeting on May 17, 2023. The Management Board will keep an eye on the new format and the related ongoing developments as put into practice in the future and will react as called for depending on the situation. To preserve the greatest possible flexibility in the future, further provisions do not appear appropriate beyond these now proposed amendments to the Articles of Association.

Furthermore, through a change in the wording, it is to be made clear that the previous provision in § 19 (2) sentence 3 of the Articles of Association, according to which the Management Board is to determine whether and to what extent the General Meeting or parts of the General Meeting shall be transmitted via electronic media, applies only to General Meetings with physical attendance. In addition, in the directly following sentence 4 of § 19 (2) of the Articles of Association, according to which the transmission may also take place in a form to which the public has unrestricted access, a change in the wording shall clarify that this provision applies to every General Meeting format.

15

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

Furthermore, use is to be made of the possibility created in § 118 (3) sentence 2 Stock Corporation Act (possibly in conjunction with § 118a (2) sentence 2 Stock Corporation Act) for the Articles of Association to provide for certain cases in which the members of the Supervisory Board may participate in the General Meeting by means of audio and video transmission instead of physical attendance. This is intended to enable a participation in situations in which a physical attendance at the place of the General Meeting would not be possible or only possible with significant effort. In this context, in accordance with the legal rationale, the different General Meeting formats should not be handled differently.

Finally, the provision in § 67 (1) Stock Corporation Act on the information to be entered for registered shares in the share register will be changed with effect from January 1, 2024, by the Act to Modernize the Law on Partnerships ( MoPeG ) from August 10, 2021 (published in the Federal Gazette Part I of August 17, 2021, p. 3436 et seqq. ). For this reason, § 5 (1) sentence 2 of the Articles of Association is to be amended with a dynamic reference to the information required by law. § 5 (1) sentence 3 of the Articles of Association thus becomes unnecessary and can be deleted without replacement.

Accordingly, Management Board and Supervisory Board propose the following resolution:

“(6) The Management Board is authorized, for each individual General Meeting of the Company that takes place on or before August 31, 2025, to provide that the General Meeting will be held without physical presence of the shareholders or their authorized representatives at the place of the General Meeting (virtual General Meeting).”

“For General Meetings with physical presence, the Management Board is authorized to determine whether and to what extent the General Meeting or parts of the General Meeting shall be transmitted via electronic media. The transmission may also take place in any case in a form to which the public has unlimited access.”

16

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

“(3) Following prior consultation with the Chairman of the Supervisory Board, members of the Supervisory Board may participate in the General Meeting by means of audio and video transmission in cases in which their physical presence at the place of the General Meeting would not be possible, or only possible with significant effort, due to their presence abroad, their required presence in another place in the country or due to an inordinate amount of travel time.”

“Shareholders must notify the Company, for registration in the share register, of the personal information specified in § 67 (1) Stock Corporation Act as well as the number of shares they hold.”

§ 5 (1) sentence 3 shall be deleted without replacement.

The currently applicable Articles of Association are accessible on the company’s website at agm.db.com and will also be accessible there during the General Meeting.

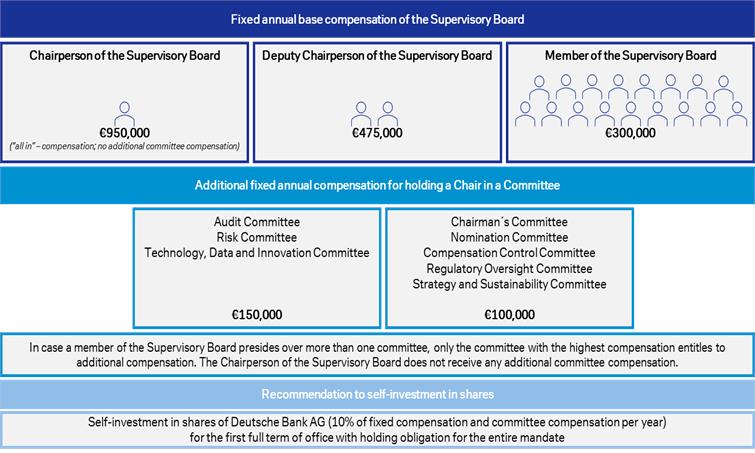

The provisions of § 14 of the Articles of Association on Supervisory Board compensation are to be amended. Intended are a simplification of the compensation structure, removal of the share-based compensation component and a slight increase in the total compensation of the Supervisory Board. In light of the intended changes to the compensation provisions, overall Supervisory Board compensation and its underlying compensation system are being presented to the General Meeting this year for a resolution to be taken in accordance with § 113 (3) Stock Corporation Act, whereby it is proposed that the compensation be adjusted as described above and the so amended Supervisory Board compensation and its underlying compensation system are to be approved. The details on the compensation as well as the other components – including those unchanged in the amended provisions of the Articles of Association – such as the reimbursement of expenses and coverage through a financial liability insurance policy are contained in the section “II. Reports, Annexes and Additional Information on the Agenda Items” under the heading “4. Compensation of members of the Supervisory Board (Item 11)”. This section also contains a more detailed description of the compensation system underpinning the regulation in the Articles of Association in corresponding application of § 87a (1) sentence 2 Stock Corporation Act.

17

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

Accordingly, Management Board and Supervisory Board propose the following resolution:

§ 14 of the Articles of Association is re-worded to read as follows:

“(1) The members of the Supervisory Board receive a fixed annual compensation (“Supervisory Board Compensation”). The amount of the annual base compensation for each Supervisory Board member is €300,000, for the Supervisory Board Chairman €950,000, and for each Deputy Chairperson €475,000.

(2) Chairs of the Committees of the Supervisory Board are paid additional fixed annual compensation amounts as follows:

a) For the Chair of the Audit Committee, the Risk Committee as well as the Technology, Data and Innovation Committee: €150,000.

b) For the Chair of the Chairman’s Committee, the Nomination Committee, the Compensation Control Committee, the Regulatory Oversight Committee as well as the Strategy and Sustainability Committee: €100,000.

18

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

If a Supervisory Board member is chair of more than one committee, compensation is only paid for the committee entitled to the highest amount. The Chairman of the Supervisory Board does not receive any additional compensation for chairing of the committees. Members of the committees also do not receive additional compensation.

(3) If the amount of the Supervisory Board Compensation according to paragraphs 1 and 2 does not exceed the Supervisory Board Compensation previously paid in the individual case (calculated compensation for the 2023 financial year based on the previous regulation in the Articles of Association), a member of the Supervisory Board whose current term of office began before May 17, 2023, will receive a compensating payment in the form of a cash payment in the amount of the difference between the previously granted Supervisory Board Compensation and the Supervisory Board Compensation pursuant to paragraphs 1 and 2. In the event of a re-election as member of the Supervisory Board, the provisions of these Articles of Association apply.

Members of the Supervisory Board whose current term of office began before May 17, 2023, will receive the virtual shares cumulatively earned during the current term of office paid out in February 2024 on the basis of the average closing price during the last 10 trading days of the Frankfurt Stock Exchange (Xetra or successor system) of the preceding January.

(4) The compensation determined according to paragraphs 1 and 2 will be paid to the respective member of the Supervisory Board by, at the latest, two months after submitting invoices and as a rule within the first three months of the following year.

19

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

(5) In case of a change in Supervisory Board membership during the year, compensation for the financial year will be paid on a pro rata basis, rounded up/down to full months.

(6) The company reimburses the Supervisory Board members for the cash expenses they incur in the performance of their office, including any value added tax (VAT) on their compensation and reimbursements of expenses. Furthermore, any employer contributions to social security schemes that may be applicable under foreign law to the performance of their Supervisory Board work shall be paid for each Supervisory Board member affected. Finally, the Supervisory Board Chairman will be reimbursed appropriately for travel expenses incurred in performing representative tasks due to his function and reimbursed for costs for the security measures required based on his function.

(7) In the interest of the company, the members of the Supervisory Board will be included in an appropriate amount in any financial liability insurance policy held by the company. The premiums for this are paid by the company. A deductible does not have to be specified for the members of the Supervisory Board.

(8) The new provisions become effective with the registration of the amendment to the Articles of Association in the Commercial Register retroactively from the end of the Annual General Meeting on May 17, 2023.”

20

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

The compensation of the Supervisory Board members pursuant to the re-worded § 14 of the Articles of Association of Deutsche Bank Aktiengesellschaft is approved, along with its underlying compensation system, which is described in more detail in the invitation to the Annual General Meeting on May 17, 2023, in the section “II. Reports, Annexes and Additional Information on the Agenda Items” under the heading “4. Compensation of members of the Supervisory Board (Item 11)”.

The currently applicable Articles of Association are accessible on the company’s website at

agm.db.com

and will also be accessible there during the General Meeting.

21

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

II. Reports, Annexes and Additional Information on the Agenda Items

1. Compensation Report (ad Item 6)

Compensation Report

Introduction

Compensation Report for the Management Board and the Supervisory Board

Employee Compensation Report (not shown below)

Compensation of the Management Board

Principles for Management Board Compensation

Responsibility and procedures for setting and reviewing Management Board compensation

Guiding principle: Alignment of Management Board compensation to corporate strategy

Compensation principles

Compensation-related developments in 2022

Development of business and alignment of Management Board compensation to corporate strategy in 2022

Management Board Changes and Compensation Decisions in 2022

Approval of the Compensation Report 2021 by the Annual General Meeting 2022

Improvements compared to the Compensation Report 2021

Principles governing the determination of compensation

Structure of the Management Board compensation system

Composition of the target total compensation and maximum compensation

Application of the compensation system in the financial year

Fixed compensation

Variable compensation

Appropriateness of Management Board compensation and compliance with the set maximum compensation

Deferrals and holding periods

Backtesting, malus and clawback

Information on shares and fulfilling the share ownership obligation (Shareholding Guidelines)

Benefits as of the end of the mandate

Benefits upon early termination

Other service contract provisions

Deviations from the compensation system

Management Board compensation 2022

Current Management Board members

Former members of the Management Board

Outlook for the 2023 financial year

Total target compensation and maximum compensation

2023 objective structure and targets

Compensation of members of the Supervisory Board

Supervisory Board Compensation for the 2022 and 2021 financial years

Comparative presentation of compensation and earnings trends

Independent auditor’s report

Responsibilities of the executive directors and the supervisory board

Auditor’s responsibility

Opinion

Other matter – formal audit of the remuneration report

Limitation of liability

22

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

Introduction

The Compensation Report for the year 2022 provides detailed information on compensation in Deutsche Bank Group.

Compensation Report for the Management Board and the Supervisory Board

The Compensation Report for the Management Board and the Supervisory Board for the 2022 financial year was prepared jointly by the Management Board and the Supervisory Board of Deutsche Bank Aktiengesellschaft (hereinafter: Deutsche Bank AG or the bank) in accordance with Section 162 of the German Stock Corporation Act. The Compensation Report describes the fundamental features of the compensation systems for Deutsche Bank’s Management Board and Supervisory Board and provides information on the compensation granted and owed by Deutsche Bank in the 2022 financial year to each incumbent or former member of the Management Board and Supervisory Board.

The Compensation Report fulfills the current legal and regulatory requirements, in particular of Section 162 of the German Stock Corporation Act and the Remuneration Ordinance for Institutions (InstitutsVergV) and takes into account the recommendations set out in the German Corporate Governance Code (GCGC). It is also in compliance with the applicable requirements of the accounting rules for capital market-oriented companies (German Commercial Code (HGB), International Financial Reporting Standards (IFRS)) as well as the guidelines issued by the working group Guidelines for Sustainable Management Board Remuneration Systems.

Employee Compensation Report

This part of the compensation report discloses information with regard to the compensation system and structure that applies to the employees in Deutsche Bank Group. The report provides details on the Group Compensation Framework and it outlines the decisions on Variable Compensation for 2022. Furthermore, this part contains quantitative disclosures specific to employees identified as Material Risk Takers (MRTs) in accordance with the Remuneration Ordinance for Institutions ( Institutsvergütungsverordnung – InstVV).

23

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

Compensation of the Management Board

Principles for Management Board Compensation

Responsibility and procedures for setting and reviewing Management Board compensation

The Supervisory Board as a whole is responsible for the decisions on the design of the compensation system as well as for setting the individual compensation amounts and procedures for awarding the compensation. The Compensation Control Committee supports the Supervisory Board in its tasks of designing and monitoring the implementation of the system and prepares proposals for resolutions for the Supervisory Board. As necessary, the Compensation Control Committee issues recommendations for the Supervisory Board to make adjustments to the system. In the case of significant changes, but at least every four years, the compensation system for the Management Board is submitted to the General Meeting for approval in accordance with Section 120a (1) of the German Stock Corporation Act. The compensation system was last approved by the General Meeting 2021 by a majority of 97.76%.

On the basis of the approved compensation system, the Supervisory Board sets the target total compensation for each Management Board member for the respective financial year, while taking into account the scope and complexity of the respective Management Board member’s functional responsibilities, the length of service of the Management Board member on the Management Board as well as the company’s financial situation. In the process, the Supervisory Board also considers the customary market compensation, also based on both horizontal and vertical comparisons, and sets the upper limit for total compensation (maximum compensation) (additional information is provided in the section “Appropriateness of Management Board compensation and compliance with the set maximum compensation”).

Guiding principle: Alignment of Management Board compensation to corporate strategy

Deutsche Bank aims to make a positive contribution to its clients, employees, investors and society in general by fostering economic growth and social progress. Deutsche Bank would like to offer its clients solutions and provide an active contribution to foster the creation of value by its clients. This approach is also intended to ensure that Deutsche Bank is competitive and profitable and can operate on the basis of a strong capital and liquidity position. Deutsche Bank is committed to a corporate culture that appropriately aligns risks and revenues.

24

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

Building on a stable and promising foundation with a balanced business model, prudent risk management and a strong balance sheet, Deutsche Bank has outlined its strategy for the Group for the period up to 2025 at the Investor Deep Dive in March 2022 aiming for sustainable profitable growth. The aim is an average annual revenue growth of 3.5 to 4.5%. At the same time, there is a commitment to remain disciplined on costs to free up capacity for investments and improving the operational leverage. The aim is to push the cost/income ratio below 62.5% by 2025 while at the same time generating an attractive return on tangible equity above 10%. The capital distribution objectives are to be achieved through a combination of dividends and share repurchases, with a payout ratio of 50% from 2025 onwards. The bank will continue to focus on conduct and controls and follow a clear management agenda to change the way of working, to become even more innovative and to remain an employer of choice.

In the interests of the shareholders, the Management Board compensation system is aligned to the business strategy as well as the sustainable and long-term development of Deutsche Bank and provides suitable incentives for a consistent achievement of the set targets. Through the composition of total compensation comprising fixed and variable compensation components, through the assessment of performance across short-term and long-term periods and through the consideration of relevant, challenging performance parameters, the implementation of the Group strategy and the alignment with the sustainable and long-term performance of the Group are rewarded in a clear and understandable manner. The structure of the targets and objectives therefore comprises a balanced mix of both financial and non-financial parameters and indicators.

Through the structuring of the compensation system, the members of the Management Board are motivated to achieve the targets and objectives linked to Deutsche Bank’s strategy, to work individually and as a team continually towards the long-term positive development of Deutsche Bank, without taking on disproportionately high risks. The Supervisory Board thus ensures there is always a strong link between compensation and performance in line with shareholder interests (“pay for performance connection”).

Compensation principles

The design of the compensation system and thus the assessment of individual compensation amounts are based on the compensation principles outlined below. The Supervisory Board takes them into consideration when adopting its resolutions in this context:

25

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

|

|

|

|

|

|

Corporate strategy |

|

The compensation system for the Management Board members is closely linked to Deutsche Bank’s strategy, thereby focusing their work on its implementation and the long-term positive development of the Group, without taking disproportionate risks. |

|

|

Shareholders’ interests |

|

The interests of shareholders are always taken into account when designing the specific structure of the compensation system, determining individual compensation amounts and structuring the means of compensation allocation and delivery. |

|

|

Individual and collective objectives |

|

Setting individual, divisional and collective objectives fosters not only the sustainable and long-term development of each of the business divisions, infrastructure areas or regions the Management Board members are responsible for, but also the performance of the Management Board as a collective management body. |

|

|

Long-term perspective |

|

A long-term link to Deutsche Bank’s performance is secured by setting a greater percentage of long-term objectives in comparison to short-term objectives and by granting variable compensation exclusively in deferred form and mostly as share-based compensation with vesting and holding periods of up to seven years. |

|

|

Sustainability |

|

Objectives in accordance with Deutsche Bank’s Environmental, Social and Governance (ESG) strategy provide incentives for acting responsibly, also in the context of sustainability, and thus make an important contribution to Deutsche Bank`s long-term performance. |

|

|

Appropriateness and upper limits (caps) |

|

The appropriateness of the compensation amounts is ensured through the review of the compensation based on a horizontal comparison with peers and a vertical comparison with the workforce as well as suitable compensation caps on the achievable variable compensation and maximum compensation. |

|

|

Transparency |

|

By avoiding unnecessary complexity in the structures and through clear and understandable reporting, the transparency of the compensation system is increased in accordance with the expectations of investors and the public as well as the regulatory requirements. |

|

|

Governance |

|

The structuring of the compensation system and the assessment to determine the individual compensation take place within the framework of the statutory and regulatory requirements. |

|

|

|

|

|

|

Compensation-related developments in 2022

Development of business and alignment of Management Board compensation to corporate strategy in 2022

Management Board compensation is closely aligned to Deutsche Bank’s strategic targets. All the individual and collective objectives agreed with the Management Board members as well as their assessment parameters for the 2022 financial year were discussed by the Compensation Control Committee at the beginning of the year and subsequently resolved on by the Supervisory Board. The objectives serve overall in fostering the strategic transformation of the Group. The achievement levels determined for the objectives for the 2022 financial year at the beginning of the year 2023 reflect the extent to which the individual objectives were achieved and thus contributed to the Bank’s performance.

Over the past three and a half years Deutsche Bank has managed to transform itself under the management team. By refocusing the business around core strengths, the bank has become significantly more profitable, better balanced and more cost-efficient. Thanks to disciplined execution of the strategy, the bank has been able to support its clients through highly challenging conditions, proving its resilience with strong risk discipline and sound capital management.

Profit before tax amounted to € 5.6 billion at the end of 2022. This is an increase of 65% over the previous year and the highest result for fifteen years. Post-tax return on tangible equity rose to 9.4%. Revenues increased by 7% to € 27.2 billion on the back of increased client business. At the same time, Deutsche Bank has further reduced costs by 5% to € 20.4 billion. The cost/income ratio fell from 85 to 75% for the full year.

26

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

Reflecting the profitability of all business segments in 2022, the Corporate Bank and the Private Bank were the most important growth drivers with revenue increases of 23% and 11% respectively. Both divisions also achieved record profits. Corporate Bank net revenues were € 6.3 billion in 2022, up 23% year on year, with 39% growth in net interest income and 7% growth in commission and fee income. Private Bank net revenues were € 9.2 billion, up 11% year on year. The Investment Bank's continued success in Fixed Income and Currencies more than compensated for the slowdown in Origination & Advisory last year, and revenues increased by 4%. In Asset Management, revenues fell by 4% to € 2.6 billion, less sharply than in almost all major markets.

The 2022 results demonstrate the benefits of Deutsche Bank’s transformation efforts. The bank delivered revenue growth in its core businesses and continued cost reductions. The risk provisions are in line with guidance, despite challenging conditions. Focused de-risking of the balance sheet has contributed to the solid capital ratio and the completion of the Capital Release Unit’s journey marks a major milestone in its transformation execution.

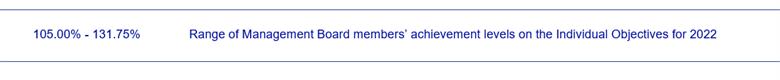

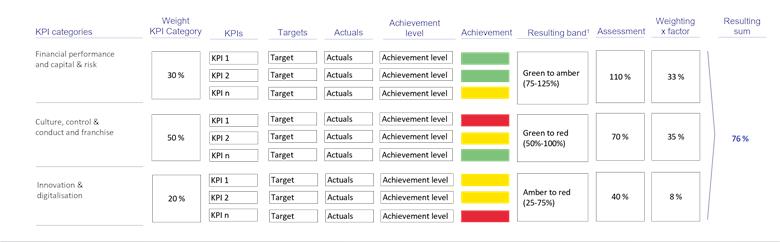

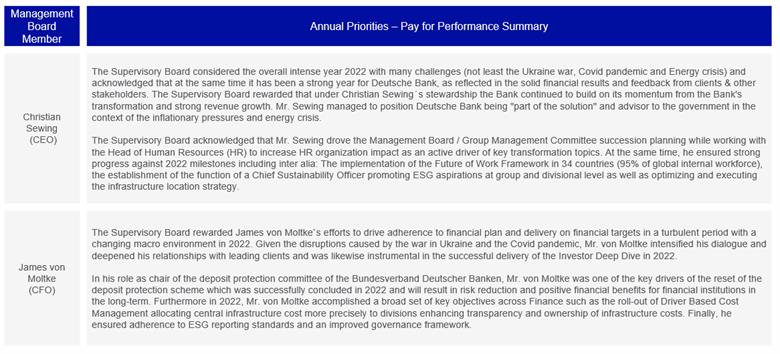

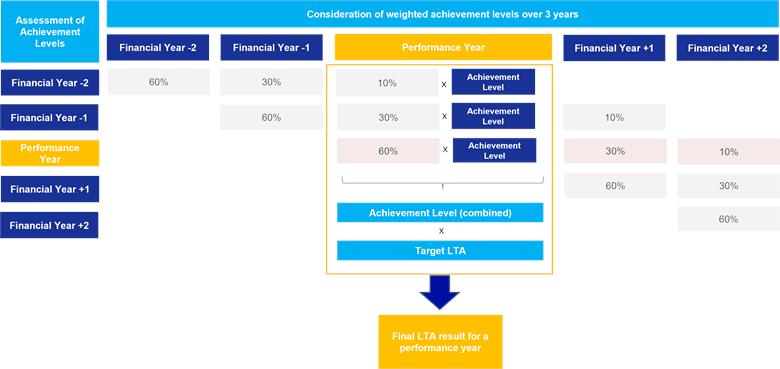

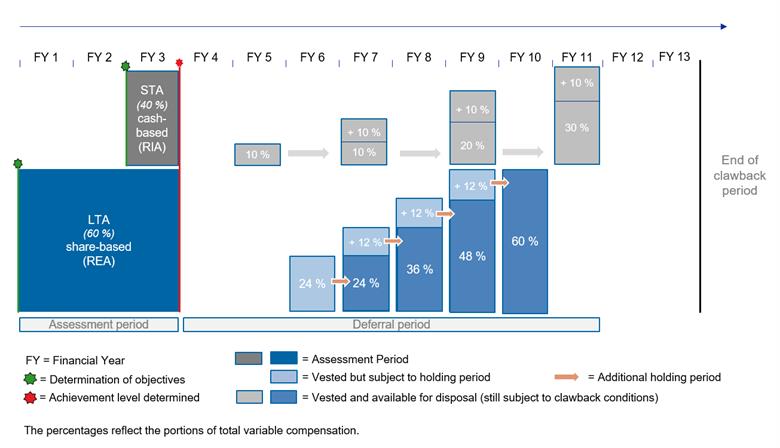

The individual objectives are bundled in the short-term component (Short-Term Award (STA)) and account for a share of 40% of the target total variable compensation. The Supervisory Board determined an achievement level for these components for the 2022 financial year of between 105.69% and 127.54%. The performance of the Management Board as a collective body is reflected in the long-term component (Long-Term Award (LTA)), which accounts for a share of 60% of the target total variable compensation. Overall, the achievement level of the collective objectives based solely on the 2022 financial year was 86.29%. This achievement level accounts for 60% of the Long-Term Award to be granted for the 2022 financial year. 30% will be for the 2023 financial year and 10% for the 2024 financial year. As achievement levels for prior years (at 30% from 2021 and 10% from 2020) also affected the Long-Term Award for the 2022 financial year, the achievement level of this component for the 2022 financial year was 79.60% based on the weighted achievement levels of the three financial years. Details on the individual achievement levels are presented as an overview in this report under the heading “Application of the compensation system in the financial year”.

27

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

Management Board Changes and Compensation Decisions in 2022

Stuart Lewis resigned as member of the Management Board and Chief Risk Officer with effect from the day of the General Meeting on May 19, 2022. The appointment of his successor, Olivier Vigneron, took place with effect from May 20, 2022. Olivier Vigneron initially worked for Deutsche Bank as Senior Group Director (Generalbevollmächtigter), starting as of March 1, 2022. As a result, a smooth transition of tasks and responsibilities of the Chief Risk Officer could be ensured.

The Management Board comprised 10 members throughout 2022 with a proportion of women of 20%.

The Supervisory Board reviews the compensation levels of the members of the Management Board annually and regularly engages external compensation advisors to support the review, while assuring that these advisors are independent from the Management Board and Deutsche Bank. In 2022, the Supervisory Board conducted a review of the compensation levels taking into account comparable companies (peer groups) with the support of the external compensation advisor. On the basis of the results of this review and taking into account other aspects such as the duration of membership in the Management Board or changes in the area of responsibility within the Management Board, the Supervisory Board has taken the following compensation decisions in 2022:

The overall target compensation for Olivier Vigneron in his capacity as member of the Management Board and Chief Risk Officer was set at the level of compensation of other Management Board members with responsibly for an infrastructure area or a region. This corresponds to a target value of € 6.5 million p.a. The total target compensation is therefore 7.14% below the total target compensation of his predecessor.

In March 2022, James von Moltke was appointed ´President´ of Deutsche Bank AG in addition to his duties as Chief Financial Officer (CFO). This appointment leads to an extension in his area of responsibility within the Management Board and additional tasks. Taking into account the extended area of responsibility and his senior membership in the Management Board already in the sixth year, the Supervisory Board decided to increase his total target compensation by € 400k p.a. to € 7.4 million p.a. with effect from 1 July 2022. This represents an increase of 5.71%.

28

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

Fabrizio Campelli successfully took over responsibility for the Corporate Bank and the Investment Bank from Christian Sewing on 1 May 2021 in a smooth takeover. The review of the compensation levels by the external compensation advisor showed that his positioning within the two peer groups of the International and European Banks with an overall target compensation of € 6.5 million p.a. is lower compared to the positioning of the other Management Board members. In addition, his appointment as a member of the Management Board was extended for a further three years. For these reasons, the Supervisory Board decided to increase the total target compensation to € 7 million p.a. which represents an increase of 7.69%. The increase took effect at the same time as the extension of his appointment with effect from 1 November 2022.

In 2022 the Management Board acknowledged that the use of non-authorized communication channels among staff represents a cultural shortcoming at Deutsche Bank. Therefore, the Management Board wanted so set a cultural signal and proposed to the Supervisory Board that, as part of performance management, this should have an impact on individual compensation. Thus, all Management Board members active on 31 December 2021 agreed to reduce variable compensation for the financial year 2021 by each EUR 75,000. The reduction will be achieved through the reduction of the Restricted Incentive Awards due on 1 March 2023 in the amount above.

When determining the variable compensation for the financial year 2022, the Supervisory Board took positive account of the financial milestones achieved and the contributions of the individual members of the Management Board to this success in their performance evaluation. In addition, the Management Board has continued its remediation activities with strong commitment and with various measures taken to meet the high expectations of the regulators; however, despite recent progress, the Supervisory Board believes that the overall extended timeline on which the remediation has taken place and the re-planning and/or missed milestones in certain areas need to be recognized in the Management Board's compensation. For this reason, the Supervisory Board, acting on a proposal from the Compensation Control Committee, reduced the individual achievement level with regards to the Short-Term Award calculated on the basis of the individual performances by 5% for all members of the Management Board active in the financial year. Details on how to calculate the Short-Term Award are presented in this report under the heading “Application of the compensation system in the financial year”.

29

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

Approval of the Compensation Report 2021 by the Annual General Meeting 2022

The Compensation Report 2021 for members of the Management Board and Supervisory Board of Deutsche Bank as published on March 11, 2022, was submitted to the ordinary General Meeting on May 19, 2022, for approval in accordance with Section 120a (4) of the German Stock Corporation Act. The General Meeting approved the Compensation Report with a majority of 88.03%.

Improvements compared to the Compensation Report 2021

While last year’s Compensation Report was in principle well received by shareholders, we constantly strive to improve the quality of the Group’s reporting. In the interests of our shareholders, the bank provides more information this year and thus increases transparency by

30

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

Principles governing the determination of compensation

Structure of the Management Board compensation system

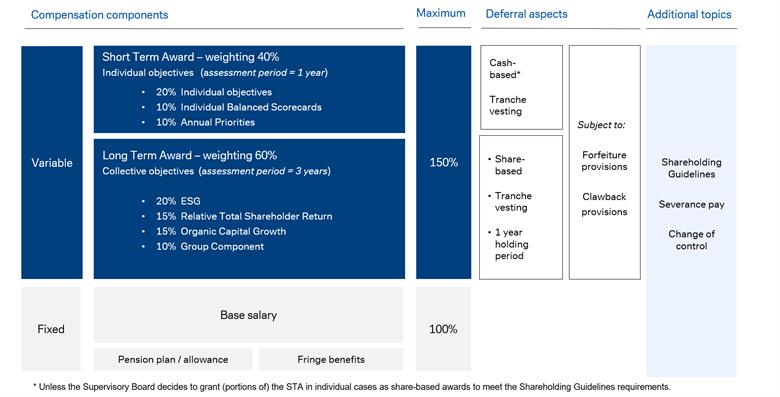

The compensation system consists of fixed and variable compensation components. The fixed compensation and variable compensation together form the total compensation for a Management Board member. The Supervisory Board defines target and maximum amounts (caps) for all compensation components.

Management Board Compensation System 2022

|

Components |

|

Objective |

|

Implementation |

||

|

Fixed Compensation |

||||||

|

Base salary |

|

The base salary rewards the Management Board member for performing the respective role and responsibilities. The fixed compensation is intended to ensure a fair and market-oriented income and to ensure that undue risks are avoided. In addition, Management Board members are granted recurrent, fringe benefits and contributions for pension benefits. |

|

- |

|

Monthly payment; Annual base salary of between € 2.4 million and € 3.6 million |

|

Fringe benefits |

|

|

- |

|

Company car and driver services as well, if applicable moving expenses, housing allowance, insurance premiums and reimbursement of business representation expenses |

|

|

Pension |

|

|

- |

|

A single and contractually agreed annually pension plan contribution or allowance of € 650,000 for adequate pension provision |

|

|

|

||||||

|

Variable Compensation |

||||||

|

Short Term Award (STA) |

|

The STA rewards the individual value contribution of each member of the Management Board to achieving short- and medium-term objectives in accordance with the corporate strategy. It consists of three elements, which are tailored to the role and responsibilities of the Management Board member and can be individually influenced by the level of achievement by the Management Board member. |

|

- |

|

40% of the total variable compensation with 3 elements related to individual performance |

|

|

|

|

- |

|

Maximum target level 150% |

|

|

|

|

|

- |

|

Assessment period 1 year |

|

|

|

|

|

- |

|

Earliest possible disbursement in 4 tranches in Restricted Incentive Awards (cash-based) - 1, 3, 5 and 7 years after being granted |

|

|

|

|

|

- |

|

Target amount for 100% achievement level: Between € 1.640 million and € 2.160 million |

|

|

|

||||||

|

Long Term Award (LTA) |

|

Within the determination of the variable compensation, the focus is on achieving long-term objectives linked to the strategy. To underline this, the Supervisory Board has set the focus on this component with a share of the LTA of 60% of the total variable target compensation. For the LTA, the Supervisory Board sets collective objectives for the members of the Management Board. An important part of the LTA is the ESG factor. Since its implementation in 2021 and further development, Deutsche Bank’s sustainability strategy has been systematically linked to the Management Board compensation |

|

- |

|

60% of total variable compensation with 4 group targets |

|

|

|

|

- |

|

Maximum target level 150% |

|

|

|

|

|

- |

|

Assessment period of 3 years with weightings of 60% (Financial Year (FY)), 30% (FY+1), 10% (FY+2) |

|

|

|

|

|

- |

|

Disbursement in 4 tranches exclusively in Restricted Equity Awards (share-based) – earliest possible delivery after 2, 3, 4, 5 years plus a holding period in each case of 1 year after grant |

|

|

|

|

|

- |

|

Target amount for 100% Achievement level: Between € 2.460 million and € 3.240 million |

|

|

|

|

|

|

|

|

|

31

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

Overview

Detailed information on the compensation system for members of the Management Board of Deutsche Bank AG is available on the company’s website: Compensation system for the Management Board Members from January 2021 onwards.

Composition of the target total compensation and maximum compensation

The Supervisory Board determines for each Management Board member a target (reference) total compensation on the basis of the compensation system approved by the General Meeting. It also determines, in accordance with the recommendation of the German Corporate Governance Code, what relative proportions the fixed compensation on the one hand and short-term and long-term variable compensation on the other hand have in the target total compensation. In this context, the Supervisory Board ensures in particular that the variable compensation linked to achieving long-term objectives exceeds the portion of variable compensation linked to short-term objectives.

When setting the target total compensation for each member of the Management Board, the Supervisory Board takes into account the scope and complexity of the respective Management Board member’s functional responsibility as well as the experience and length of service of the member on the Management Board. Furthermore, the compensation amounts are reviewed for their appropriateness on the basis of market data for suitable peer groups. On the basis of these criteria, the Supervisory Board set the relative percentages for the compensation components within the target total compensation as follows:

32

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

Relative shares of the total annual target compensation allocated to the different compensation components (%)

|

Compensation components |

|

Relative share of total compensation in % |

|

Base Salary |

|

~ 33-37% |

|

Regular fringe benefits |

|

~ 1% |

|

Pension service costs / pension allowance |

|

~ 7-9% |

|

Short-Term Award |

|

~ 22-23% |

|

Long-Term Award |

|

~ 33-34% |

|

Reference total compensation |

|

100% |

|

|

|

|

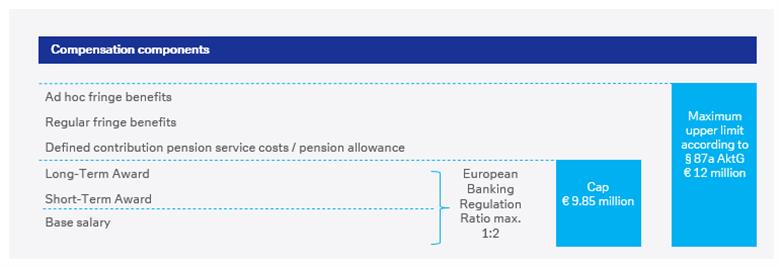

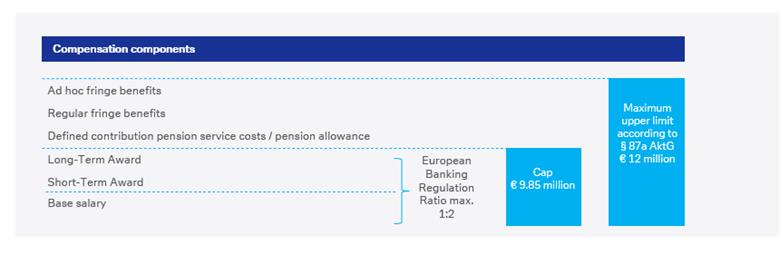

The compensation of the Management Board members is limited (capped) in several ways (maximum compensation).

Pursuant to Section 25a (5) of the German Banking Act (Kreditwesengesetz – KWG), the ratio of fixed to variable compensation is generally limited to 1:1 (cap regulation), i.e. the amount of variable compensation must not exceed that of fixed compensation, unless the shareholders of a bank resolve to increase the ratio of fixed to variable compensation to up to 1:2. The General Meeting in May 2014 made use of this possibility and increased the ratio to 1:2.

The Supervisory Board additionally limited the maximum possible achievement levels for the short-term objectives (STA) and long-term objectives (LTA) consistently to 150% of the target variable compensation. Furthermore, it specified an additional amount limit (cap) for the aggregate amount of base salary, STA and LTA of € 9.85 million. This means that even with target achievement levels that would lead to higher compensation amounts, compensation is capped at a maximum of € 9.85 million. After the target achievement level is assessed, if the calculation should result in variable compensation or total compensation that exceeds one of the specified caps, the variable compensation is to be reduced. This is to take place through a pro rata reduction of the STA and LTA.

Target and maximum amounts of base salary and variable compensation

|

|

|

2022 |

|

2021 |

||||||

|

in € |

|

Base |

|

Short-Term |

|

Long-Term |

|

Total |

|

Total |

|

CEO |

|

|

|

|

|

|

|

|

|

|

|

Target value |

|

3,600,000 |

|

2,160,000 |

|

3,240,000 |

|

9,000,000 |

|

9,000,000 |

|

Maximum value |

|

3,600,000 |

|

3,240,000 |

|

4,860,000 |

|

9,850,000 |

|

9,850,000 |

|

Presidents2, 3 |

|

|

|

|

|

|

|

|

|

|

|

Target value |

|

3,000,000 |

|

1,760,000 |

|

2,640,000 |

|

7,400,000 |

|

7,400,000 |

|

Maximum value |

|

3,000,000 |

|

2,640,000 |

|

3,960,000 |

|

9,600,000 |

|

9,600,000 |

|

Ordinary Board Member responsible for Corporate Bank and Investment Bank (CB & IB)3 |

|

|

|

|

|

|

|

|

|

|

|

Target value |

|

2,800,000 |

|

1,680,000 |

|

2,520,000 |

|

7,000,000 |

|

6,500,000 |

|

Maximum value |

|

2,800,000 |

|

2,520,000 |

|

3,780,000 |

|

9,100,000 |

|

8,550,000 |

|

All other Ordinary Board Members3 |

|

|

|

|

|

|

|

|

|

|

|

Target value |

|

2,400,000 |

|

1,640,000 |

|

2,460,000 |

|

6,500,000 |

|

6,500,000 |

|

Maximum value |

|

2,400,000 |

|

2,460,000 |

|

3,690,000 |

|

8,550,000 |

|

8,550,000 |

|

|

|

|

|

|

|

|

|

|

|

|

1 Limit the maximum total amount of basic salary and variable compensation to the upper limit set by the Supervisory Board.

2 Presidents and Ordinary Board members responsible for Private Bank (PB)/ Asset Management (AM) and Finance (CFO).

3 For further details on compensation decision, please refer to chapter "Management Board Changes and Compensation Decisions in 2022" in this report.

33

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

In addition, in accordance with Section 87a (1) sentence 2 No. 1 of the German Stock Corporation Act, the Supervisory Board also set an upper limit for the maximum total compensation of € 12 million for each Management Board member (Maximum Compensation). The Maximum Compensation is set consistently for all Management Board members. The Maximum Compensation corresponds to the sum of all compensation components for any financial year. This comprises not only the base salary, STA and LTA, but also the fringe benefits and service costs for the company pension plan or pension allowances.

Application of the compensation system in the financial year

Fixed compensation

The fixed compensation components in the form of base salary, fringe benefits and contributions to the pension plan or pension allowances were granted in the financial year as fixed compensation and in accordance with the individual agreements in the service contracts. Due to the requirements of Section 25a (5) of the German Banking Act and in accordance with the decision of the Annual General Meeting in May 2014, the ratio of fixed to variable compensation is generally limited to 1:2 (cap rule). Therefore, when determining the amount of base salary as part of the target compensation, it must be taken into account that the variable compensation may not exceed the maximum value of 200% of the fixed compensation.

The expenses for fringe benefits and pension service costs vary in their annual amounts. Although the contribution to Deutsche Bank’s pension plan is defined consistently for all Management Board members, the amounts to be contributed by Deutsche Bank during the year in the form of pension service cost accruals vary, however, based on the length of service on the Management Board within the financial year, the age of the Management Board member and actuarial figures (additional information is provided in the section “Benefits upon regular contract termination”).

34

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

Variable compensation

The Supervisory Board, based on the proposal of the Compensation Control Committee, determined the variable compensation for the Management Board members for the 2022 financial year. Variable compensation comprises two components, a short-term component (Short-Term Award (STA)) with a weighting of 40% and a long-term component (Long-Term Award (LTA)) with a weighting of 60% in relation to the target variable compensation.

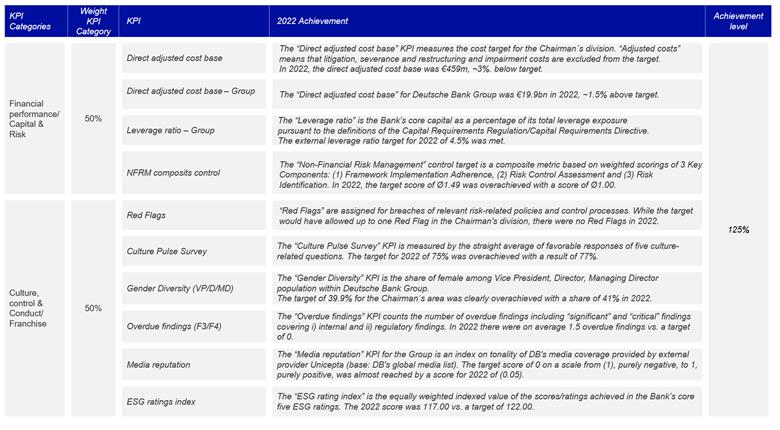

All objectives, measurements and assessment criteria that were used for the assessment of performance for the 2022 financial year are derived from Deutsche Bank’s strategy and are in line with the compensation system approved by the General Meeting. The objectives were selected to set suitable incentives for the Management Board members, to promote the development of Deutsche Bank’s earnings and the alignment to the interests of shareholders as well as to fulfill Deutsche Bank’s social responsibility through the inclusion of sustainability aspects and climate protection. The challenging objectives reflect the Bank’s ambitions. If the objectives are not achieved, the variable compensation can be zero; in the case of over-achievement, the maximum achievement level is limited to 150% of the target value.

Balance of financial and non-financial objectives

Financial and non-financial objectives are considered in a balanced way when setting the objectives. In relation to the total variable compensation, there was a greater focus on financial objectives in the 2022 financial year, with a weighting of around 68%. Both the financial and non-financial objectives were chosen in such a way that they are quantitatively or qualitatively measurable at the end of the financial year. Around 75% of the targets are quantitatively measurable and a portion of around 25% is measured qualitatively.

Short-Term Award (STA)

The amount of the Short-Term Award for the 2022 financial year is based on the achievement level during the assessment period of the short-term individual and divisional objectives. The assessment period coincides with the financial year and is one year.

The Short-Term Award comprises the following three elements with different weightings:

35

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

For each of these components, the Supervisory Board determines the achievement level based on a clearly structured year-end assessment process at the beginning of the following year. The achievement of the three components determines the overall achievement level for each Management Board member which in turn determines the amount of the short-term component for the preceding financial year.

Determination of the cash value of the Short-Term Award

|

|

|

Short-Term Award (40%) |

||||

|

|

|

Individual Objectives (50%) |

|

Balanced Scorecard (25%) |

|

Annual Priorities (25%) |

|

Target Amount1 |

|

820,000 - 1,080,000 |

|

410,000 - 540,000 |

|

410,000 - 540,000 |

|

Target Achievement Level |

|

0% - 150% |

|

0% - 150% |

|

0% - 150% |

|

|

|

|

|

|

|

|

|

Overall Target Amount per STA component |

|

0 - 1,620,000 |

|

0 - 810,000 |

|

0 - 810,000 |

|

Overall Target Amount STA |

|

|

|

0 - 3,240,000 |

|

|

|

|

|

|

|

|

|

|

1 Target amount differs depending on the Management Board member’s functional responsibility. On the basis of 100%. Pro rata temporis upon joining or leaving during the year.

Individual objectives

The Supervisory Board sets personal and divisional objectives (Individual Objectives) for each member of the Management Board at the beginning of the year. The weightings of each of these objectives as well as relevant quantitatively or qualitatively measurable performance criteria for their assessment are defined as well. The objectives are chosen so that they are challenging, ambitious and sufficiently concrete in order to ensure there is an appropriate alignment of performance and compensation and that the “pay-for-performance” principle is taken into account.

The Individual Objectives are derived from the corporate strategy and foster its implementation. They are set for each Management Board member in consideration of her or his respective area of functional responsibility and the contribution of this area of functional responsibility to advancing Deutsche Bank’s overall strategy. ESG objectives such as the further development of the sustainability strategy or the promotion of measures to improve regulatory remediation are also included as individual objectives. Individual Objectives can also be defined as project or regional targets. Besides operational measures, the implementation of strategic projects and initiatives can be agreed as objectives as well, if they are directly instrumental in the implementation of the strategy, by contributing to, for example, the structure, organization and sustainable development of Deutsche Bank.

At the beginning of the 2022 financial year, between 4 and 7 Individual Objectives were set with different weightings for each Management Board member. For these objectives, the Supervisory Board has assigned clear expectations and financial and/or non-financial performance criteria at the beginning of the year, such as financial Key Performance Indicators (KPIs), achievements of milestones, Chief Executive Officer (CEO) and/or Supervisory Board feedback, stakeholder Feedback and qualitative assessments. These enable the Supervisory Board to objectively assess the performance contribution of the respective Management Board member towards the concrete execution of the objectives.

36

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

At year-end, the determination of the achievement levels follows a pre-defined process. In a first step, all members of the Management Board perform an initial self-assessment of the achievement levels of their objectives. The self-assessed achievement levels are then discussed in conversations with the Chief Executive Officer (CEO) and the Chairman of the Compensation Control Committee. Based on the feedback from these conversations, the Compensation Control Committee prepares a proposal for the Supervisory Board for its decision. For this purpose the achievement levels are combined into an average for each Management Board member according to pre-defined weightings.

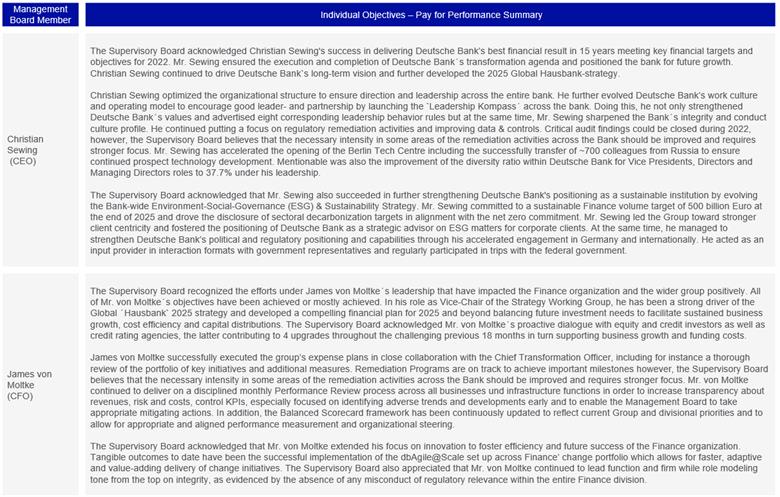

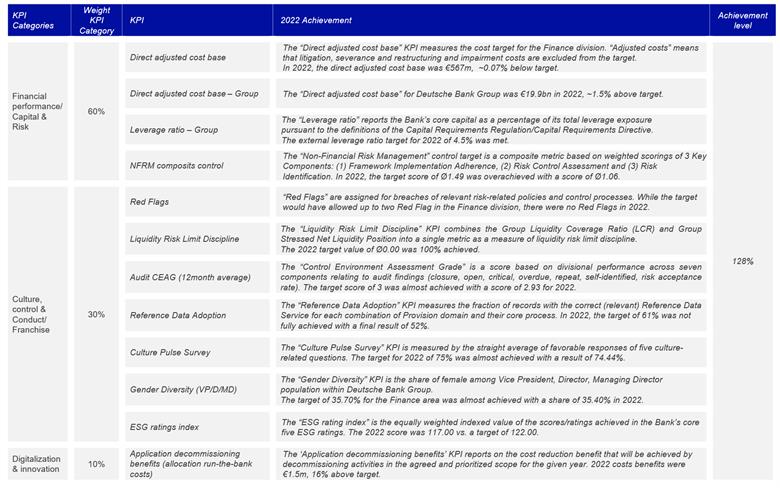

The following overview shows the objectives as well as the achievement levels as resolved on by the Supervisory Board for each Management Board member.

37

|

Deutsche Bank |

Notice |

|

General Meeting 2023

|

|

|

Management Board Member |

|

Weighting |

|

Individual objectives |

|

Achievement |

|

|

|

|

||||

|

|

||||||

|

Christian Sewing |

|

25% |

|

Further develop Deutsche Bank´s long-term vision & positioning |

|

131.50% |

|

|

|

20% |

|

Deliver on Deutsche Bank Group short-term strategy execution and milestones |

|

|

|

|

|

15% |

|

Further evolve Deutsche Bank culture |

|

|

|

|

|

15% |

|

Provide oversight to Human Resources transformation including Real Estate |

|

|

|

|

|

15% |

|

Further develop Bank-wide ESG & Sustainable Banking Strategy |

|

|

|

|

|

10% |

|

Strengthen positioning with key political stakeholders |

|

|

|

|

||||||

|

|

||||||

|

James von Moltke |

|

30% |

|

Ensure execution of Group financial plan through Group Performance Management |

|

126.75% |

|

|

|

15% |

|

Drive development of new strategy |

|

|

|

|

|

15% |

|

Drive investor and Rating Agencies engagement |

|

|

|

|

|

10% |

|

Deliver Balance Sheet & Liquidity Optimization |

|

|

|

|

|

10% |

|

Deliver Liquidity Remediation Program |

|

|

|

|

|

10% |

|

Execute Group Finance strategy, incl. Financial & Analytics enhancement |

|

|

|

|

|

10% |

|

Support CEO in further evolution of DB culture, with a focus on integrity and conduct. |

|

|

|

|

||||||

|

|

||||||

|

Karl von Rohr |

|

30% |

|

Deliver on strategy execution for the division Private Bank incl. efficiency, growth and sustainable profitability |

|

131.75% |

|

|

|

10% |

|

Support CEO in developing new strategy and achieving Group financial targets |

|

|

|

|

|

15% |

|

Ensure delivery on critical remediation activities within the area of financial crime |

|

|

|

|

|

20% |

|

Support DWS strategy through oversight role |

|

|

|

|

|

15% |

|

Provide oversight for Regions Germany & EMEA |

|

|

|

|

|

10% |

|

Support CEO in further evolution of DB culture, with a focus on integrity and conduct |

|

|

|

|

||||||

|

|

||||||

|

Fabrizio Campelli |

|

30% |

|

Deliver on strategy execution and sustainable profitability for the divisions Corporate Bank and Investment Bank |

|

130.00% |

|

|

|

20% |

|

Improve controls and demonstrate their effectiveness to regulators for Corporate Bank and Investment Bank |

|

|

|

|

|

20% |

|

Drive development of new strategy for Corporate Bank and Investment Bank |

|

|

|

|

|

10% |

|

Drive stronger F2B alignment for Corporate Bank and Investment Bank |

|

|

|

|

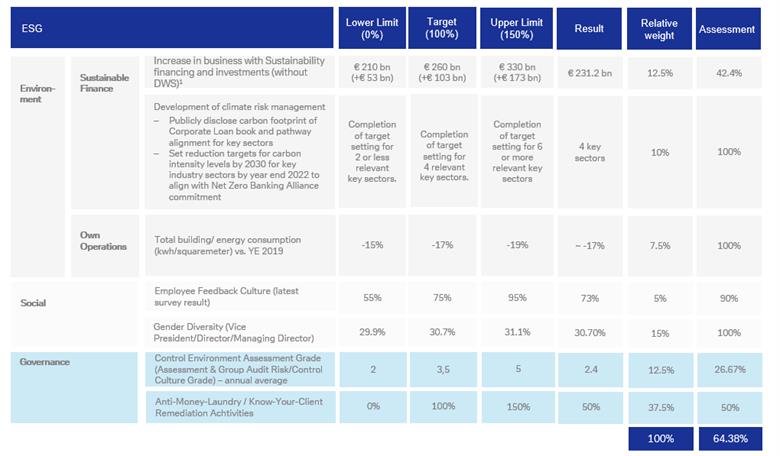

|