| |

|

| |

|

| |

|

| |

|

| |

|

| |

Value of Initial Fixed $100

Investment Based On:

|

| |

|

| |

|

| |||

| |

Year

|

| |

Summary

Compensation

Table Total

for CEO(1)

|

| |

Compensation

Actually Paid

to CEO(2)

|

| |

Average

Summary

Compensation

Table Total for

Non-CEO

NEOs(3)

|

| |

Average

Compensation

Actually Paid

to Non-CEO

NEOs(4)

|

| |

Total

Shareholder

Return(5)

|

| |

Peer Group

Total

Shareholder

Return(6)

|

| |

Net Income

(millions)(7)

|

| |

Bonus-Adjusted EBITDA

(millions)(8)

|

|

| |

(a)

|

| |

(b)

|

| |

(c)

|

| |

(d)

|

| |

(e)

|

| |

(f)

|

| |

(g)

|

| |

(h)

|

| |

(i)

|

|

| |

2022

|

| |

$5,889,707

|

| |

$4,828,690

|

| |

$1,417,865

|

| |

$1,039,138

|

| |

$121.50

|

| |

$140.50

|

| |

$29.6

|

| |

$431.9

|

|

| |

2021

|

| |

$5,332,744

|

| |

$7,696,386

|

| |

$2,690,759

|

| |

$3,394,000

|

| |

$135.20

|

| |

$153.94

|

| |

-$3.20

|

| |

$374.7

|

|

| |

2020

|

| |

$6,999,545

|

| |

$5,874,930

|

| |

$2,010,274

|

| |

$1,924,436

|

| |

$118.58

|

| |

$128.45

|

| |

-$131.70

|

| |

$360.0

|

|

|

(1)

|

The dollar amounts reported in column (b) reflect the total compensation reported for Mr. Harrington, our CEO during the covered years, in the “Total” column in the “Summary

Compensation Table” for each corresponding year.

|

|

(2)

|

The dollar amounts reported in column (c) represent the amount of “compensation actually paid” to Mr. Harrington, by applying

the following adjustments to Mr. Harrington’s total compensation for each year, as computed in accordance with Item 402(v). The dollar amounts do not reflect the actual amount of compensation earned by or paid to Mr. Harrington during the

applicable year.

|

| |

Year

|

| |

Reported Summary

Compensation Table

Total for CEO

|

| |

Less: Reported

Value of Equity

Awards to CEO(a)

|

| |

Add: Equity Award

Adjustments to

CEO (b),(c)

|

| |

Compensation

Actually Paid to

CEO

|

|

| |

2022

|

| |

$5,889,707

|

| |

$4,000,000

|

| |

$2,938,983

|

| |

$4,828,690

|

|

| |

2021

|

| |

$5,332,744

|

| |

$3,500,000

|

| |

$5,863,642

|

| |

$7,696,386

|

|

| |

2020

|

| |

$6,999,545

|

| |

$5,426,981

|

| |

$4,302,366

|

| |

$5,874,930

|

|

|

(a)

|

The amounts in this column reflect the aggregate grant-date fair value reported in the “Stock

Awards” and “Option/SAR Awards” columns in the Summary Compensation Table for the applicable year.

|

|

(b)

|

The amounts deducted or added in calculating the total equity award adjustments are as follows:

|

| |

Year

|

| |

Year End Fair

Value of

Outstanding

and Unvested

Equity

Awards

Granted in the

Year

|

| |

Year over Year

Change in Fair

Value of Equity

Awards Granted

in Prior Years

that Vested in the

Year

|

| |

Year over Year

Change in Fair

Value of

Outstanding and

Unvested Equity

Awards Granted in

Prior Years

|

| |

Value of

Dividends or

other Earnings

Paid on Stock

or Option

Awards not

Otherwise Reflected in

Fair Value or

Total

Compensation

|

| |

Total Equity

Award

Adjustments

|

|

| |

2022

|

| |

$4,084,083

|

| |

($708,578)

|

| |

($650,162)

|

| |

$213,639

|

| |

$2,938,983

|

|

| |

2021

|

| |

$3,619,051

|

| |

$292,642

|

| |

$1,844,792

|

| |

$107,157

|

| |

$5,863,642

|

|

| |

2020

|

| |

$2,899,519

|

| |

$624,422

|

| |

$706,574

|

| |

$71,851

|

| |

$4,302,366

|

|

|

(c)

|

In accordance with Item 402(v) requirements, the fair values of unvested and outstanding equity awards to our NEOs were

remeasured as of the end of each fiscal year, and as of each vesting date for each award that vested in a covered year, during the years displayed in the table above. For options, the fair values as of each measurement date were

determined using a binomial lattice model, which considers the circumstances of the grant at the measurement date, with assumptions and methodologies regarding volatility, dividend yield, and risk-free rates that are generally consistent

with those used to estimate fair value at grant under U.S. GAAP. The range of estimates used in the fair value calculations are as follows: (i) for 2022, remaining option contractual life between 7.0 years – 8.0 years, volatility of 35%, dividend yield between 1.8%-1.9%, and risk-free rate between 3.1%-3.9%; (ii) for 2021, remaining option contractual life between 7.0 years – 9.0 years, volatility between 33%-36%, dividend yield of 1.4%, and risk-free rate between 1.2%-1.5%; (iii) for 2020, remaining option contractual life between 3.0 years – 9.9 years, volatility between 29%-35%, dividend yield between

1.5%-2.7%, and

risk-free rate between 0.5%-1.1%.

For performance-based awards, the fair values reflect the probable outcome of the performance vesting conditions as of each measurement date.

|

|

(3)

|

The dollar amounts reported in column (d) represent the average of the total compensation reported for the NEOs (excluding

Mr. Harrington) in the “Total” column of the Summary Compensation Table for each corresponding year. The NEOs (excluding Mr. Harrington) included for purposes of calculating the average amounts in

each applicable year are as follows: (i) for 2022 and 2021, Mr. Wells, Ms. Morgan Poe, Ms. Gutowski, and Ms. Melaragni; and (ii) for 2020, Mr. Wells, Ms. Morgan Poe, Ron Hinson, David Muscato, and Jamie Jamieson.

|

|

(4)

|

The dollar amounts reported in column (e) represent the average amount of “compensation actually paid” to the NEOs as a group

(excluding Mr. Harrington), by applying the following adjustments to each NEO’s total compensation for each year, as computed in accordance with Item 402(v). The dollar amounts do not reflect the actual amount of compensation earned by or

paid to each NEO during the applicable year.

|

| |

Year

|

| |

Average

Reported

Summary

Compensation

Table Total for

Non-CEO NEOs

|

| |

Less: Average

Reported

Value of Equity

Awards for Non-

CEO NEOs

|

| |

Add: Average

Equity Award

Adjustments for

Non-CEO

NEOs(a)

|

| |

Average

Compensation

Actually Paid

to Non-CEO

NEOs

|

|

| |

2022

|

| |

$1,417,865

|

| |

$356,250

|

| |

($22,477)

|

| |

$1,039,138

|

|

| |

2021

|

| |

$2,690,759

|

| |

$1,925,000

|

| |

$2,628,241

|

| |

$3,394,000

|

|

| |

2020

|

| |

$2,010,274

|

| |

$1,083,060

|

| |

$997,222

|

| |

$1,924,436

|

|

|

(a)

|

The amounts deducted or added in calculating the total average equity award adjustments are as follows:

|

| |

Year

|

| |

Year End Fair

Value of

Outstanding

and Unvested

Equity Awards

Granted in the

Year

|

| |

Year over Year

Change in Fair

Value of Equity

Awards

Granted in

Prior Years

that Vested in

the Year

|

| |

Fair Value as of

Vesting Date of

Equity Awards

Granted and

Vested in the

Year

|

| |

Year over Year

Change in Fair

Value of

Outstanding

and Unvested

Equity Awards

Granted in

Prior Years

|

| |

Value of

Dividends or

other Earnings

Paid on Stock

or Option

Awards not

Otherwise

Reflected in

Fair Value or

Total

Compensation

|

| |

Total Equity

Award

Adjustments

|

|

| |

2022

|

| |

$368,158

|

| |

($242,524)

|

| |

$0

|

| |

($199,945)

|

| |

$51,833

|

| |

($22,477)

|

|

| |

2021

|

| |

$2,084,783

|

| |

$48,829

|

| |

$159,070

|

| |

$312,561

|

| |

$22,998

|

| |

$2,628,241

|

|

| |

2020

|

| |

$512,235

|

| |

$93,935

|

| |

$0

|

| |

$369,842

|

| |

$21,210

|

| |

$997,222

|

|

|

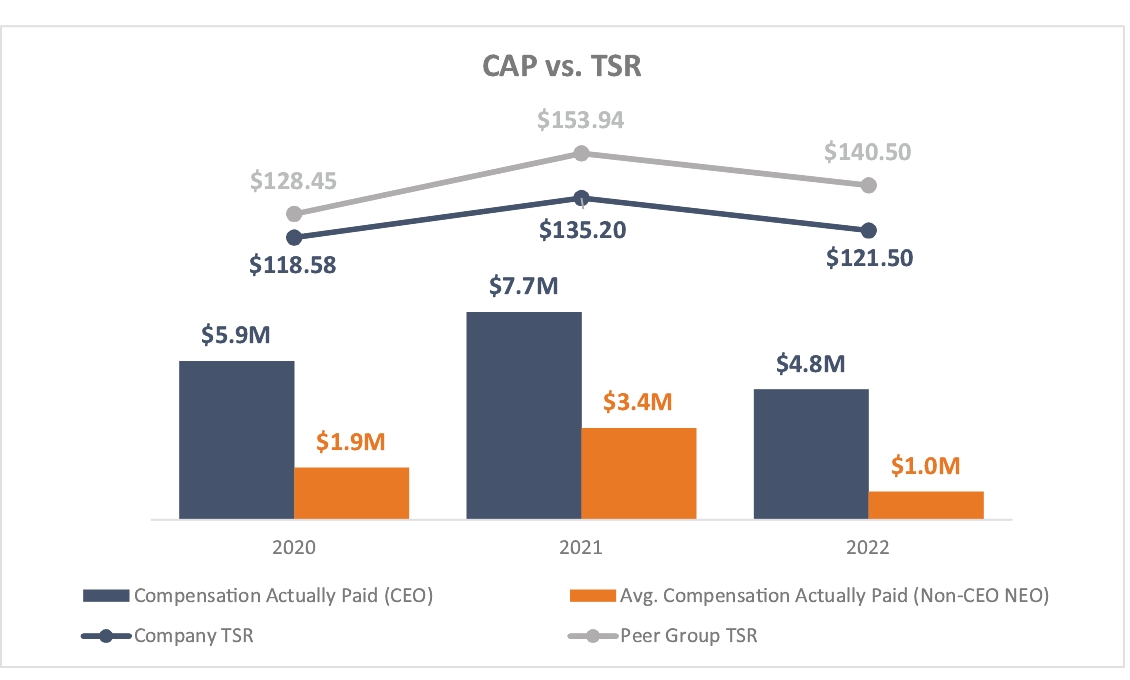

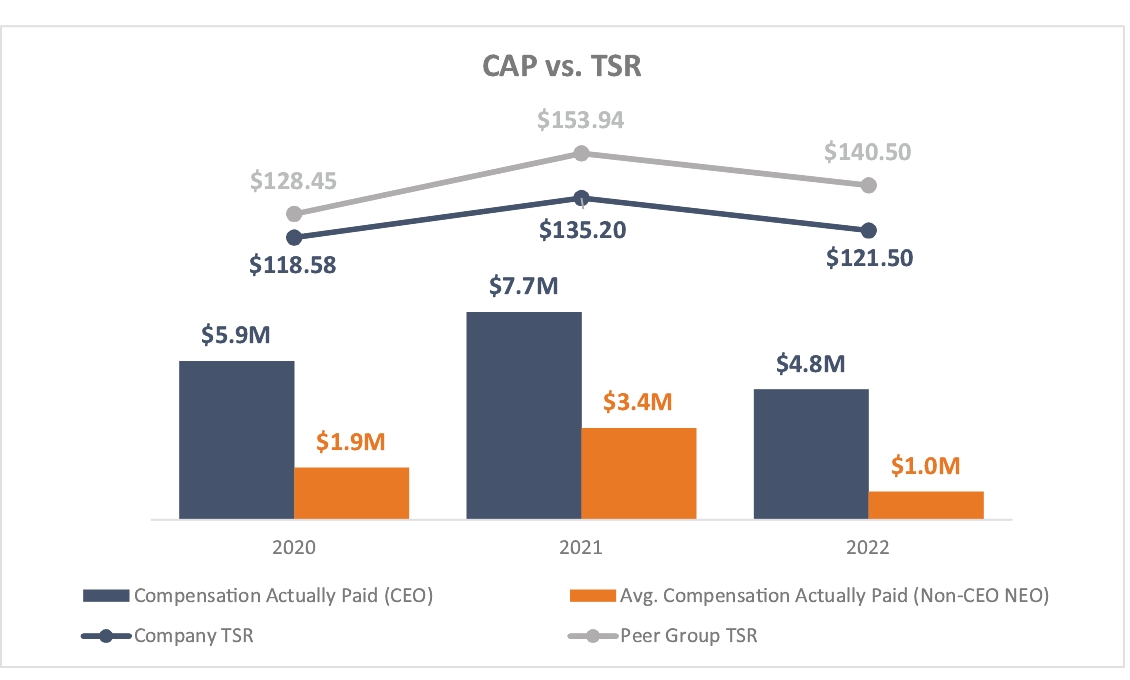

(5)

|

The amounts in column (f) show changes over our past three fiscal years in the value of $100 (assuming reinvestment of

dividends) invested in Primo Water’s common shares traded on the NYSE.

|

|

(6)

|

The amounts in column (g) show changes over our past three fiscal years in the value of $100 (assuming reinvestment of

dividends), invested in a market-capitalization weighted index of our peer group, which consists of publicly-traded companies used to determine target compensation for each fiscal year. The peer group for 2022 is comprised of ADT Inc., A.

O. Smith Corporation, The Brink’s Company, Chemed Corp., Cintas Corporation, Evoqua Water Technologies Corp, Franklin Electric Co., Inc., IDEX Corporation, Mueller Water Products, Inc., Pentair plc, Rollins, Inc., Regal Rexnord

Corporation, Stericycle Inc., Terminix, Tetra Tech, Inc., UniFirst Corp., Watts Water Technologies, and Xylem Inc. The peer group for 2021 also includes Windstream Holdings, Inc. The peer group for 2020 excludes ADT Inc., Franklin

Electric Co. Inc,, and Mueller Water Products, Inc. and includes AquaVenture Holdings Limited, Farmer Bros. Co., Frontier Communications Corporation.

|

|

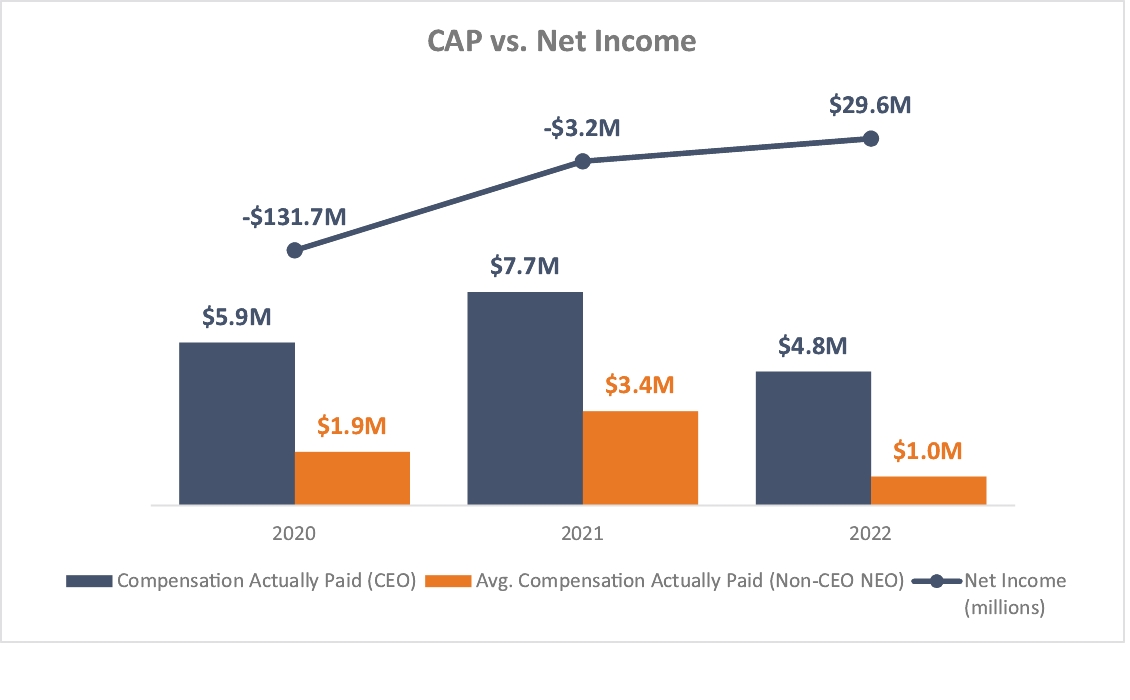

(7)

|

The dollar amounts reported represent the net income reflected in Primo Water’s audited financial statements for the applicable

year.

|

|

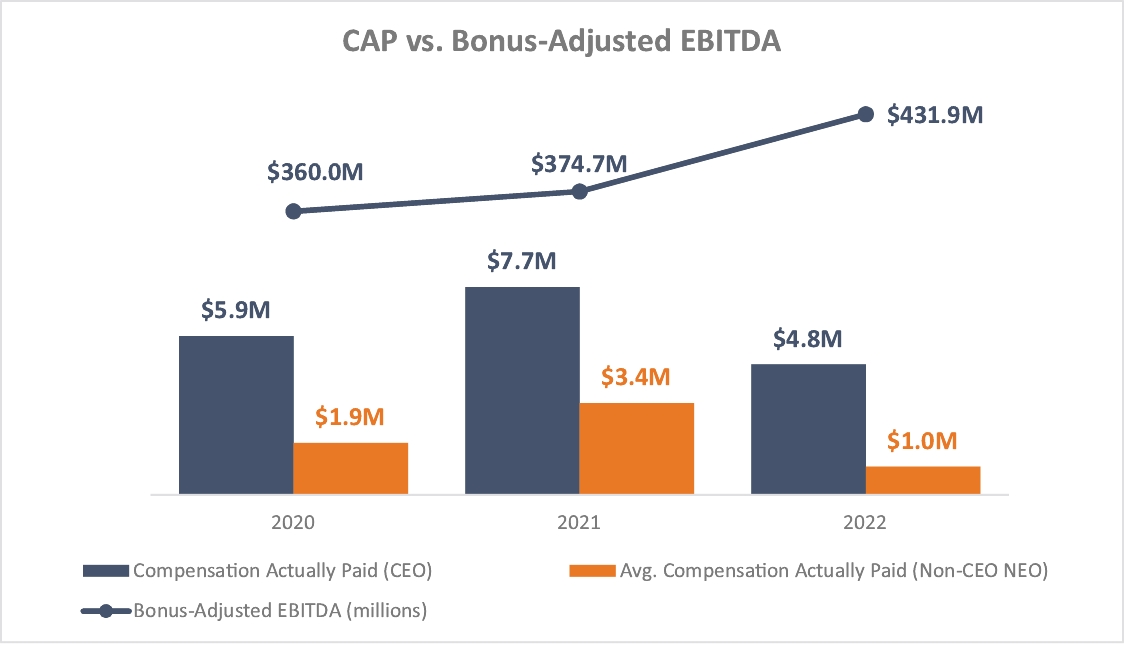

(8)

|

“Bonus-Adjusted EBITDA” is GAAP earnings before interest, taxes, depreciation, and amortization, adjusted to exclude the impact

of certain items as approved by the Compensation Committee, as more particularly set forth on Appendix E. While we use numerous financial and non-financial performance measures to evaluate performance under our compensation programs,

Bonus-Adjusted EBITDA is the financial performance measure that, in Primo Water’s assessment, represents the most important performance measure (that is not otherwise required to be disclosed in the table) used to link compensation

actually paid to NEOs, for the most recently completed fiscal year, to Company performance.

|

|

(3)

|

The dollar amounts reported in column (d) represent the average of the total compensation reported for the NEOs (excluding

Mr. Harrington) in the “Total” column of the Summary Compensation Table for each corresponding year. The NEOs (excluding Mr. Harrington) included for purposes of calculating the average amounts in

each applicable year are as follows: (i) for 2022 and 2021, Mr. Wells, Ms. Morgan Poe, Ms. Gutowski, and Ms. Melaragni; and (ii) for 2020, Mr. Wells, Ms. Morgan Poe, Ron Hinson, David Muscato, and Jamie Jamieson.

|

|

(6)

|

The amounts in column (g) show changes over our past three fiscal years in the value of $100 (assuming reinvestment of

dividends), invested in a market-capitalization weighted index of our peer group, which consists of publicly-traded companies used to determine target compensation for each fiscal year. The peer group for 2022 is comprised of ADT Inc., A.

O. Smith Corporation, The Brink’s Company, Chemed Corp., Cintas Corporation, Evoqua Water Technologies Corp, Franklin Electric Co., Inc., IDEX Corporation, Mueller Water Products, Inc., Pentair plc, Rollins, Inc., Regal Rexnord

Corporation, Stericycle Inc., Terminix, Tetra Tech, Inc., UniFirst Corp., Watts Water Technologies, and Xylem Inc. The peer group for 2021 also includes Windstream Holdings, Inc. The peer group for 2020 excludes ADT Inc., Franklin

Electric Co. Inc,, and Mueller Water Products, Inc. and includes AquaVenture Holdings Limited, Farmer Bros. Co., Frontier Communications Corporation.

|

|

(2)

|

The dollar amounts reported in column (c) represent the amount of “compensation actually paid” to Mr. Harrington, by applying

the following adjustments to Mr. Harrington’s total compensation for each year, as computed in accordance with Item 402(v). The dollar amounts do not reflect the actual amount of compensation earned by or paid to Mr. Harrington during the

applicable year.

|

| |

Year

|

| |

Reported Summary

Compensation Table

Total for CEO

|

| |

Less: Reported

Value of Equity

Awards to CEO(a)

|

| |

Add: Equity Award

Adjustments to

CEO (b),(c)

|

| |

Compensation

Actually Paid to

CEO

|

|

| |

2022

|

| |

$5,889,707

|

| |

$4,000,000

|

| |

$2,938,983

|

| |

$4,828,690

|

|

| |

2021

|

| |

$5,332,744

|

| |

$3,500,000

|

| |

$5,863,642

|

| |

$7,696,386

|

|

| |

2020

|

| |

$6,999,545

|

| |

$5,426,981

|

| |

$4,302,366

|

| |

$5,874,930

|

|

|

(a)

|

The amounts in this column reflect the aggregate grant-date fair value reported in the “Stock

Awards” and “Option/SAR Awards” columns in the Summary Compensation Table for the applicable year.

|

|

(b)

|

The amounts deducted or added in calculating the total equity award adjustments are as follows:

|

| |

Year

|

| |

Year End Fair

Value of

Outstanding

and Unvested

Equity

Awards

Granted in the

Year

|

| |

Year over Year

Change in Fair

Value of Equity

Awards Granted

in Prior Years

that Vested in the

Year

|

| |

Year over Year

Change in Fair

Value of

Outstanding and

Unvested Equity

Awards Granted in

Prior Years

|

| |

Value of

Dividends or

other Earnings

Paid on Stock

or Option

Awards not

Otherwise Reflected in

Fair Value or

Total

Compensation

|

| |

Total Equity

Award

Adjustments

|

|

| |

2022

|

| |

$4,084,083

|

| |

($708,578)

|

| |

($650,162)

|

| |

$213,639

|

| |

$2,938,983

|

|

| |

2021

|

| |

$3,619,051

|

| |

$292,642

|

| |

$1,844,792

|

| |

$107,157

|

| |

$5,863,642

|

|

| |

2020

|

| |

$2,899,519

|

| |

$624,422

|

| |

$706,574

|

| |

$71,851

|

| |

$4,302,366

|

|

|

(c)

|

In accordance with Item 402(v) requirements, the fair values of unvested and outstanding equity awards to our NEOs were

remeasured as of the end of each fiscal year, and as of each vesting date for each award that vested in a covered year, during the years displayed in the table above. For options, the fair values as of each measurement date were

determined using a binomial lattice model, which considers the circumstances of the grant at the measurement date, with assumptions and methodologies regarding volatility, dividend yield, and risk-free rates that are generally consistent

with those used to estimate fair value at grant under U.S. GAAP. The range of estimates used in the fair value calculations are as follows: (i) for 2022, remaining option contractual life between 7.0 years – 8.0 years, volatility of 35%, dividend yield between 1.8%-1.9%, and risk-free rate between 3.1%-3.9%; (ii) for 2021, remaining option contractual life between 7.0 years – 9.0 years, volatility between 33%-36%, dividend yield of 1.4%, and risk-free rate between 1.2%-1.5%; (iii) for 2020, remaining option contractual life between 3.0 years – 9.9 years, volatility between 29%-35%, dividend yield between

1.5%-2.7%, and

risk-free rate between 0.5%-1.1%.

For performance-based awards, the fair values reflect the probable outcome of the performance vesting conditions as of each measurement date.

|

|

(4)

|

The dollar amounts reported in column (e) represent the average amount of “compensation actually paid” to the NEOs as a group

(excluding Mr. Harrington), by applying the following adjustments to each NEO’s total compensation for each year, as computed in accordance with Item 402(v). The dollar amounts do not reflect the actual amount of compensation earned by or

paid to each NEO during the applicable year.

|

| |

Year

|

| |

Average

Reported

Summary

Compensation

Table Total for

Non-CEO NEOs

|

| |

Less: Average

Reported

Value of Equity

Awards for Non-

CEO NEOs

|

| |

Add: Average

Equity Award

Adjustments for

Non-CEO

NEOs(a)

|

| |

Average

Compensation

Actually Paid

to Non-CEO

NEOs

|

|

| |

2022

|

| |

$1,417,865

|

| |

$356,250

|

| |

($22,477)

|

| |

$1,039,138

|

|

| |

2021

|

| |

$2,690,759

|

| |

$1,925,000

|

| |

$2,628,241

|

| |

$3,394,000

|

|

| |

2020

|

| |

$2,010,274

|

| |

$1,083,060

|

| |

$997,222

|

| |

$1,924,436

|

|

|

(a)

|

The amounts deducted or added in calculating the total average equity award adjustments are as follows:

|

| |

Year

|

| |

Year End Fair

Value of

Outstanding

and Unvested

Equity Awards

Granted in the

Year

|

| |

Year over Year

Change in Fair

Value of Equity

Awards

Granted in

Prior Years

that Vested in

the Year

|

| |

Fair Value as of

Vesting Date of

Equity Awards

Granted and

Vested in the

Year

|

| |

Year over Year

Change in Fair

Value of

Outstanding

and Unvested

Equity Awards

Granted in

Prior Years

|

| |

Value of

Dividends or

other Earnings

Paid on Stock

or Option

Awards not

Otherwise

Reflected in

Fair Value or

Total

Compensation

|

| |

Total Equity

Award

Adjustments

|

|

| |

2022

|

| |

$368,158

|

| |

($242,524)

|

| |

$0

|

| |

($199,945)

|

| |

$51,833

|

| |

($22,477)

|

|

| |

2021

|

| |

$2,084,783

|

| |

$48,829

|

| |

$159,070

|

| |

$312,561

|

| |

$22,998

|

| |

$2,628,241

|

|

| |

2020

|

| |

$512,235

|

| |

$93,935

|

| |

$0

|

| |

$369,842

|

| |

$21,210

|

| |

$997,222

|

|

|

(c)

|

In accordance with Item 402(v) requirements, the fair values of unvested and outstanding equity awards to our NEOs were

remeasured as of the end of each fiscal year, and as of each vesting date for each award that vested in a covered year, during the years displayed in the table above. For options, the fair values as of each measurement date were

determined using a binomial lattice model, which considers the circumstances of the grant at the measurement date, with assumptions and methodologies regarding volatility, dividend yield, and risk-free rates that are generally consistent

with those used to estimate fair value at grant under U.S. GAAP. The range of estimates used in the fair value calculations are as follows: (i) for 2022, remaining option contractual life between 7.0 years – 8.0 years, volatility of 35%, dividend yield between 1.8%-1.9%, and risk-free rate between 3.1%-3.9%; (ii) for 2021, remaining option contractual life between 7.0 years – 9.0 years, volatility between 33%-36%, dividend yield of 1.4%, and risk-free rate between 1.2%-1.5%; (iii) for 2020, remaining option contractual life between 3.0 years – 9.9 years, volatility between 29%-35%, dividend yield between

1.5%-2.7%, and

risk-free rate between 0.5%-1.1%.

For performance-based awards, the fair values reflect the probable outcome of the performance vesting conditions as of each measurement date.

|

|

•

|

Bonus-Adjusted EBITDA

|

|

•

|

Bonus-Adjusted Operating Free Cash Flow

|

|

•

|

Bonus-Adjusted Revenue

|

|

•

|

Adjusted Pre-Tax Income

|