PAY VS. PERFORMANCE |

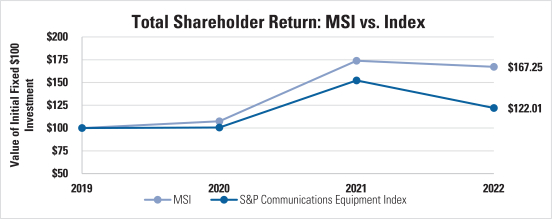

Value of Initial Fixed $100 Investment Based On: |

||||||||||||||||||||||||||||||||

Year (a) |

Summary Compensation Table Total for PEO ($) (b) (1) |

Compensation Actually Paid to PEO ($) (c) (1)(2) |

Average Summary Compensation Table Total for Non-PEO NEOs ($) (d) (3) |

Average Compensation Actually Paid to Non-PEO NEOs ($) (e) (3)(4) |

Total Shareholder Return ($) (f) (5) |

Peer Group Total Shareholder Return ($) (g) (5)(6) |

Net Income ($ millions) (h) (7) |

One-Year Relative Total Shareholder Return Percentile Rank (%) (i) (8) |

||||||||||||||||||||||||

2022 |

$21,016,481 | $19,817,153 | $5,745,113 | $6,254,463 | $167.25 | $122.01 | $1,363 | 65.4 | % | |||||||||||||||||||||||

2021 |

$19,980,639 | $86,440,713 | $4,923,478 | $13,731,315 | $173.87 | $152.27 | $1,245 | 89.8 | % | |||||||||||||||||||||||

2020 |

$23,100,854 | $24,335,560 | $4,089,772 | $4,567,727 | $107.39 | $100.63 | $949 | 48.9 | % | |||||||||||||||||||||||

| (1) | Gregory Q. Brown served as our PEO for the full year for each of 2022, 2021, and 2020. The amounts in columns (b) and (c) include Mr. Brown’s compensation for 2020-2022. |

| (2) | The dollar amounts shown in column (c) reflect “compensation actually paid” to Mr. Brown, calculated in accordance with SEC rules. As required, the dollar amounts include (among other items) unpaid amounts of equity compensation that may be realizable in future periods, and as such, the dollar amounts shown do not fully represent the actual final amount of compensation earned or actually paid to Mr. Brown during the applicable years. The amounts deducted and added to the PEO’s Summary Compensation Table total in order to determine the PEO’s CAP are as follows: |

PEO – Reconciliation of SCT Total to CAP Total (column (c)) |

2020 |

2021 |

2022 |

|||||||||

SCT Total |

23,100,854 | 19,980,639 | 21,016,481 | |||||||||

Less SCT Change in Present Value of Pension Plan (a) |

(21,004 | ) | (1,273 | ) | 0 | |||||||

Less SCT Stock Awards (b) |

(9,399,711 | ) | (10,501,466 | ) | (10,956,744 | ) | ||||||

Less SCT Option Awards (b) |

(4,699,939 | ) | (4,916,617 | ) | (5,162,429 | ) | ||||||

Plus Pension Programs Service Cost (c) |

0 | 0 | 0 | |||||||||

Plus Pension Programs Prior Service Cost (c) |

0 | 0 | 0 | |||||||||

Plus Value of New Stock and Option Awards Granted in Current Year and Unvested as of Year End (d) |

13,785,275 | 37,662,758 | 24,606,376 | |||||||||

Plus Change in Value of Stock and Option Awards Granted in Prior Years and Unvested as of Year End (d) |

(598,442 | ) | 41,901,428 | 1,629,246 | ||||||||

Plus New Stock and Option Award Grants Value as of Vesting Date (d) |

0 | 0 | 0 | |||||||||

Plus Change in Value of Stock and Option Awards Granted in Prior Years as of Vesting Date (d) |

2,168,527 | 2,315,244 | (11,315,777 | ) | ||||||||

Less Prior Year Value of Stock and Option Awards Forfeited or Cancelled (d) |

0 | 0 | 0 | |||||||||

Compensation Actually Paid |

24,335,560 |

86,440,713 |

19,817,153 |

|||||||||

| (a) | Represents the aggregate change in actuarial present value of the PEO’s benefits under all pension plans for each year, as previously reported in the applicable SCT. |

| (b) | Represents the aggregate grant date fair value of equity-based awards granted each year as computed in accordance with ASC Topic 718, as previously reported in the applicable SCT. |

| (c) | There was no service cost or prior service cost for our defined benefit pension plans because our executives who participate in those plans ceased accruing service credit under those plans when they were frozen in early 2009. |

| (d) | Reflects the fair value or change in fair value of equity-based awards, calculated in accordance with Regulation S-K Item 402(v)(2)(iii)(C). |

| (3) | For 2020, our Non-PEO NEOs included Messrs. Winkler, Molloy, and Hacker, and former executives Kelly Mark and Gino Bonanotte. For 2021, our Non-PEO NEOs included Messrs. Winkler, Molloy, Hacker, and Mark and Dr. Saptharishi. For 2022, our Non-PEO NEOs included Messrs. Winkler, Molloy, and Hacker and Dr. Saptharishi. |

| (4) | The dollar amounts shown in column (e) reflect average CAP to our Non-PEO NEOs, calculated in accordance with SEC rules. As required, the dollar amounts include (among other items) unpaid amounts of equity compensation that may be realizable in future periods, and as such, the dollar amounts shown do not fully represent the actual final amount of compensation earned or actually paid to our Non-PEO NEOs during the applicable years. The amounts deducted and added to the Non-PEO NEOs’ SCT total in order to determine the Non-PEO NEOs’ CAP are as follows: |

Non-PEO NEOs (Average) – Reconciliation of SCT Total to CAP Total (column (e)) |

2020 Average |

2021 Average |

2022 Average |

|||||||||

SCT Total |

4,089,772 |

4,923,478 |

5,745,113 |

|||||||||

Less SCT Change in Present Value of Pension Plan (a) |

(57,797 | ) | 0 | 0 | ||||||||

Less SCT Stock Awards (b) |

(1,129,136 | ) | (1,873,248 | ) | (2,219,488 | ) | ||||||

Less SCT Option Awards (b) |

(689,411 | ) | (907,398 | ) | (1,045,801 | ) | ||||||

Plus Pension Programs Service Cost (c) |

0 | 0 | 0 | |||||||||

Plus Pension Programs Prior Service Cost (c) |

0 | 0 | 0 | |||||||||

Plus Value of New Stock and Option Awards Granted in Current Year and Unvested as of Year End (d) |

2,172,356 | 6,577,679 | 4,984,568 | |||||||||

Plus Change in Value of Stock and Option Awards Granted in Prior Years and Unvested as of Year End (d) |

(55,582 |

) |

4,736,906 |

186,564 |

||||||||

Plus New Stock and Option Award Grants Value as of Vesting Date (d) |

0 | 0 | 0 | |||||||||

Plus Change in Value of Stock and Option Awards Granted in Prior Years as of Vesting Date (d) |

237,525 |

273,898 |

(1,396,493 |

) | ||||||||

Less Prior Year Value of Stock and Option Awards Forfeited or Cancelled (d) |

0 | 0 | 0 | |||||||||

Compensation Actually Paid |

4,567,727 |

13,731,315 |

6,254,463 |

|||||||||

| (a) | Represents the aggregate change in actuarial present value of the Non-PEO NEOs’ benefits under all pension plans for each year, as previously reported in the applicable SCT. |

| (b) | Represents the aggregate grant date fair value of equity-based awards granted each year as computed in accordance with ASC Topic 718, as previously reported in the applicable SCT. |

| (c) | There was no service cost or prior service cost for our defined benefit pension plans because our executives who participate in those plans ceased accruing service credit under those plans when they were frozen in early 2009. |

| (d) | Reflects the fair value or change in fair value of equity-based awards, calculated in accordance with Regulation S-K Item 402(v)(2)(iii)(C). |

| (5) | Pursuant to SEC rules, the TSR figures assume an initial investment of $100 on December 31, 2019. For 2022, reflects the cumulative total shareholder return from December 31, 2019-December 31, 2022. For 2021, reflects the cumulative total shareholder return from December 31, 2019-December 31, 2021. For 2020, reflects the cumulative total shareholder return from December 31, 2019-December 31, 2020. |

| (6) | Reflects the market cap weighted total shareholder return of the S&P Communications Equipment Index. As permitted by SEC rules, the peer group referenced for purpose of the TSR comparison is the group of companies included in the S&P Communications Equipment Index, which is the industry peer group used for purposes of Item 201(e) of Regulation S-K. For a description of the separate peer group used by the Compensation and Leadership Committee, for purposes of determining compensation paid to our executive officers, refer to the section of this Proxy Statement on page 57 titled “Comparative Market Data – 2022 Peer Group.” |

| (7) | Reflects after-tax net income attributable to shareholders prepared in accordance with GAAP for each of the years shown. We do not use net income in our compensation programs. |

| (8) | Reflects the Company’s percentile rank based on one-year TSR relative to the S&P 500, which, for 2022, represents, in the Company’s assessment, the most important financial performance measure used to link NEO compensation actually paid to company performance for the most recently completed fiscal year. We have included one-year relative TSR in the table in accordance with applicable SEC guidance. However, percentile rank based on three-year TSR relative to the S&P 500 is the measure actually used in the Company’s compensation programs. The Company’s three-year percentile rank was 78th for 2022, 79th for 2021 and 88th for 2020. This three-year measure represented 52% of 2022 target total compensation for Mr. Brown and an average of 42% of 2022 target total compensation for other NEOs. For additional detail regarding the calculation of this three-year measure, refer to the section of this Proxy Statement on page 56 titled “2022 Annual Compensation Elements – Long-Term Incentives – LTI Components.” |

| (2) | The dollar amounts shown in column (c) reflect “compensation actually paid” to Mr. Brown, calculated in accordance with SEC rules. As required, the dollar amounts include (among other items) unpaid amounts of equity compensation that may be realizable in future periods, and as such, the dollar amounts shown do not fully represent the actual final amount of compensation earned or actually paid to Mr. Brown during the applicable years. The amounts deducted and added to the PEO’s Summary Compensation Table total in order to determine the PEO’s CAP are as follows: |

PEO – Reconciliation of SCT Total to CAP Total (column (c)) |

2020 |

2021 |

2022 |

|||||||||

SCT Total |

23,100,854 | 19,980,639 | 21,016,481 | |||||||||

Less SCT Change in Present Value of Pension Plan (a) |

(21,004 | ) | (1,273 | ) | 0 | |||||||

Less SCT Stock Awards (b) |

(9,399,711 | ) | (10,501,466 | ) | (10,956,744 | ) | ||||||

Less SCT Option Awards (b) |

(4,699,939 | ) | (4,916,617 | ) | (5,162,429 | ) | ||||||

Plus Pension Programs Service Cost (c) |

0 | 0 | 0 | |||||||||

Plus Pension Programs Prior Service Cost (c) |

0 | 0 | 0 | |||||||||

Plus Value of New Stock and Option Awards Granted in Current Year and Unvested as of Year End (d) |

13,785,275 | 37,662,758 | 24,606,376 | |||||||||

Plus Change in Value of Stock and Option Awards Granted in Prior Years and Unvested as of Year End (d) |

(598,442 | ) | 41,901,428 | 1,629,246 | ||||||||

Plus New Stock and Option Award Grants Value as of Vesting Date (d) |

0 | 0 | 0 | |||||||||

Plus Change in Value of Stock and Option Awards Granted in Prior Years as of Vesting Date (d) |

2,168,527 | 2,315,244 | (11,315,777 | ) | ||||||||

Less Prior Year Value of Stock and Option Awards Forfeited or Cancelled (d) |

0 | 0 | 0 | |||||||||

Compensation Actually Paid |

24,335,560 |

86,440,713 |

19,817,153 |

|||||||||

| (a) | Represents the aggregate change in actuarial present value of the PEO’s benefits under all pension plans for each year, as previously reported in the applicable SCT. |

| (b) | Represents the aggregate grant date fair value of equity-based awards granted each year as computed in accordance with ASC Topic 718, as previously reported in the applicable SCT. |

| (c) | There was no service cost or prior service cost for our defined benefit pension plans because our executives who participate in those plans ceased accruing service credit under those plans when they were frozen in early 2009. |

| (d) | Reflects the fair value or change in fair value of equity-based awards, calculated in accordance with Regulation S-K Item 402(v)(2)(iii)(C). |

| (4) | The dollar amounts shown in column (e) reflect average CAP to our Non-PEO NEOs, calculated in accordance with SEC rules. As required, the dollar amounts include (among other items) unpaid amounts of equity compensation that may be realizable in future periods, and as such, the dollar amounts shown do not fully represent the actual final amount of compensation earned or actually paid to our Non-PEO NEOs during the applicable years. The amounts deducted and added to the Non-PEO NEOs’ SCT total in order to determine the Non-PEO NEOs’ CAP are as follows: |

Non-PEO NEOs (Average) – Reconciliation of SCT Total to CAP Total (column (e)) |

2020 Average |

2021 Average |

2022 Average |

|||||||||

SCT Total |

4,089,772 |

4,923,478 |

5,745,113 |

|||||||||

Less SCT Change in Present Value of Pension Plan (a) |

(57,797 | ) | 0 | 0 | ||||||||

Less SCT Stock Awards (b) |

(1,129,136 | ) | (1,873,248 | ) | (2,219,488 | ) | ||||||

Less SCT Option Awards (b) |

(689,411 | ) | (907,398 | ) | (1,045,801 | ) | ||||||

Plus Pension Programs Service Cost (c) |

0 | 0 | 0 | |||||||||

Plus Pension Programs Prior Service Cost (c) |

0 | 0 | 0 | |||||||||

Plus Value of New Stock and Option Awards Granted in Current Year and Unvested as of Year End (d) |

2,172,356 | 6,577,679 | 4,984,568 | |||||||||

Plus Change in Value of Stock and Option Awards Granted in Prior Years and Unvested as of Year End (d) |

(55,582 |

) |

4,736,906 |

186,564 |

||||||||

Plus New Stock and Option Award Grants Value as of Vesting Date (d) |

0 | 0 | 0 | |||||||||

Plus Change in Value of Stock and Option Awards Granted in Prior Years as of Vesting Date (d) |

237,525 |

273,898 |

(1,396,493 |

) | ||||||||

Less Prior Year Value of Stock and Option Awards Forfeited or Cancelled (d) |

0 | 0 | 0 | |||||||||

Compensation Actually Paid |

4,567,727 |

13,731,315 |

6,254,463 |

|||||||||

| (a) | Represents the aggregate change in actuarial present value of the Non-PEO NEOs’ benefits under all pension plans for each year, as previously reported in the applicable SCT. |

| (b) | Represents the aggregate grant date fair value of equity-based awards granted each year as computed in accordance with ASC Topic 718, as previously reported in the applicable SCT. |

| (c) | There was no service cost or prior service cost for our defined benefit pension plans because our executives who participate in those plans ceased accruing service credit under those plans when they were frozen in early 2009. |

| (d) | Reflects the fair value or change in fair value of equity-based awards, calculated in accordance with Regulation S-K Item 402(v)(2)(iii)(C). |

• |

From 2021 to 2022, compensation actually paid to the CEO decreased by $66.6 million or 77%. Over this same period, the Company’s TSR decreased by 4%, net income increased by 9.5%, and one-year relative TSR percentile rank decreased by 27% (from 89.8 th percentile rank to 65.4th percentile rank). |

• |

From 2020 to 2021, compensation actually paid to the CEO increased by $62.1 million or 255%. Over this same period, the Company’s TSR increased by 62%, net income increased by 31%, and one-year relative TSR percentile rank increased by 84% (from 48.9 th percentile rank to 89.8th percentile rank). |

• |

From 2021 to 2022, compensation actually paid to the Non-PEO NEOs decreased by $7.5 million or 54%. Over this same period, the Company’s TSR decreased by 4%, net income increased by 9.5%, and one-year relative TSR percentile rank decreased by 27% (from 89.8 th percentile rank to 65.4th percentile rank). |

• |

From 2020 to 2021, compensation actually paid to the Non-PEO NEOs increased by $9.2 million or 201%. Over this same period, the Company’s TSR increased by 62%, net income increased by 31%, and one-year relative TSR percentile rank increased by 84% (from 48.9 th percentile rank to 89.8th percentile rank). |

2022 Most Important Performance Measures |

• Relative TSR Percentile Rank |

• Stock Price |

• Non-GAAP Operating Earnings |