|

Pay-versus-Performance Table

|

| | | | | | | | | | |

Value of Initial Fixed

$100 Investment Based On:

|

| | | | ||||||||||

|

Year

(a)

|

| |

Summary

Compensation

Table Total for

PEO(1)

(b)

|

| |

Compensation

Actually Paid

to PEO(2)

(c)

|

| |

Average

Summary

Compensation

Table Total

for non-PEO

NEOs(3)

(d)

|

| |

Average

Compensation

Actually

Paid to non-

PEO

NEOs(2)(3)

(e)

|

| |

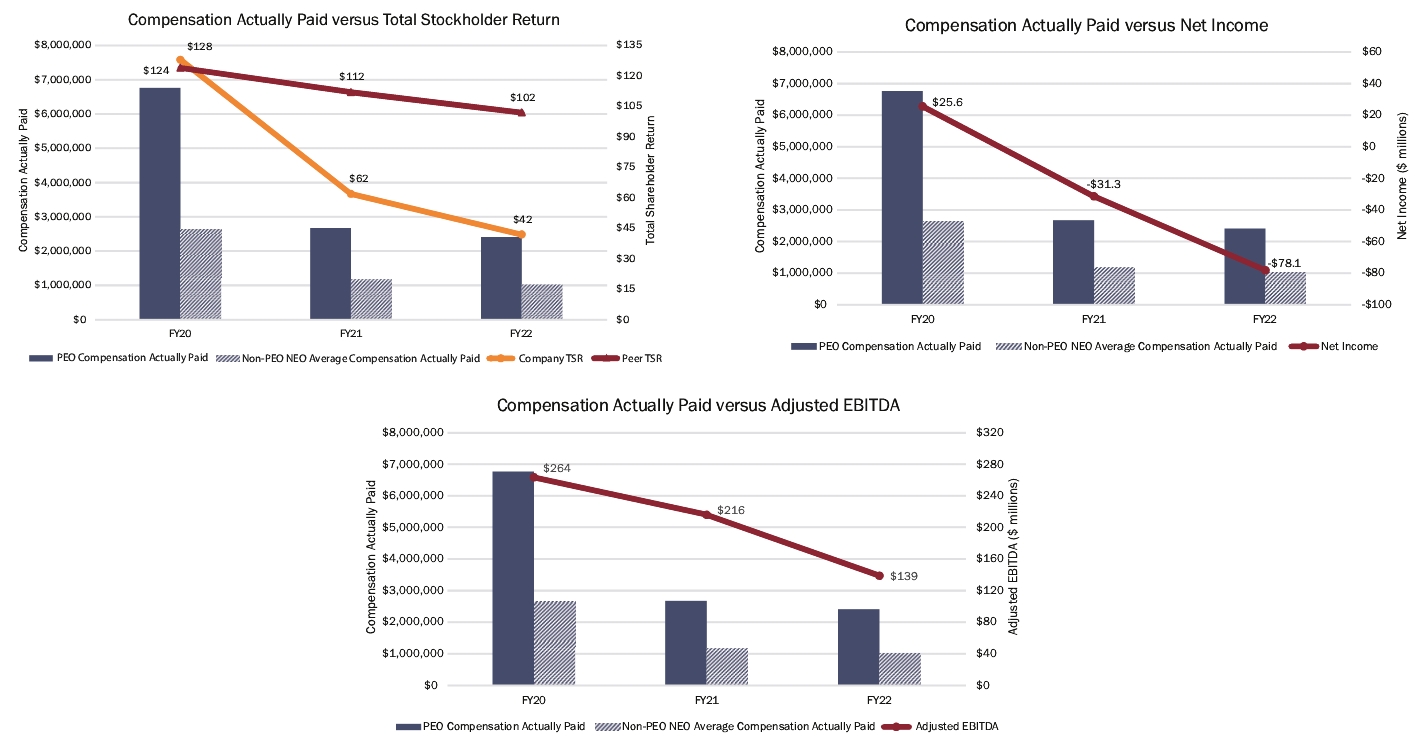

Total

Stockholder

Return(4)

(f)

|

| |

Peer

Group

Total

Stockholder

Return(4)

(g)

|

| |

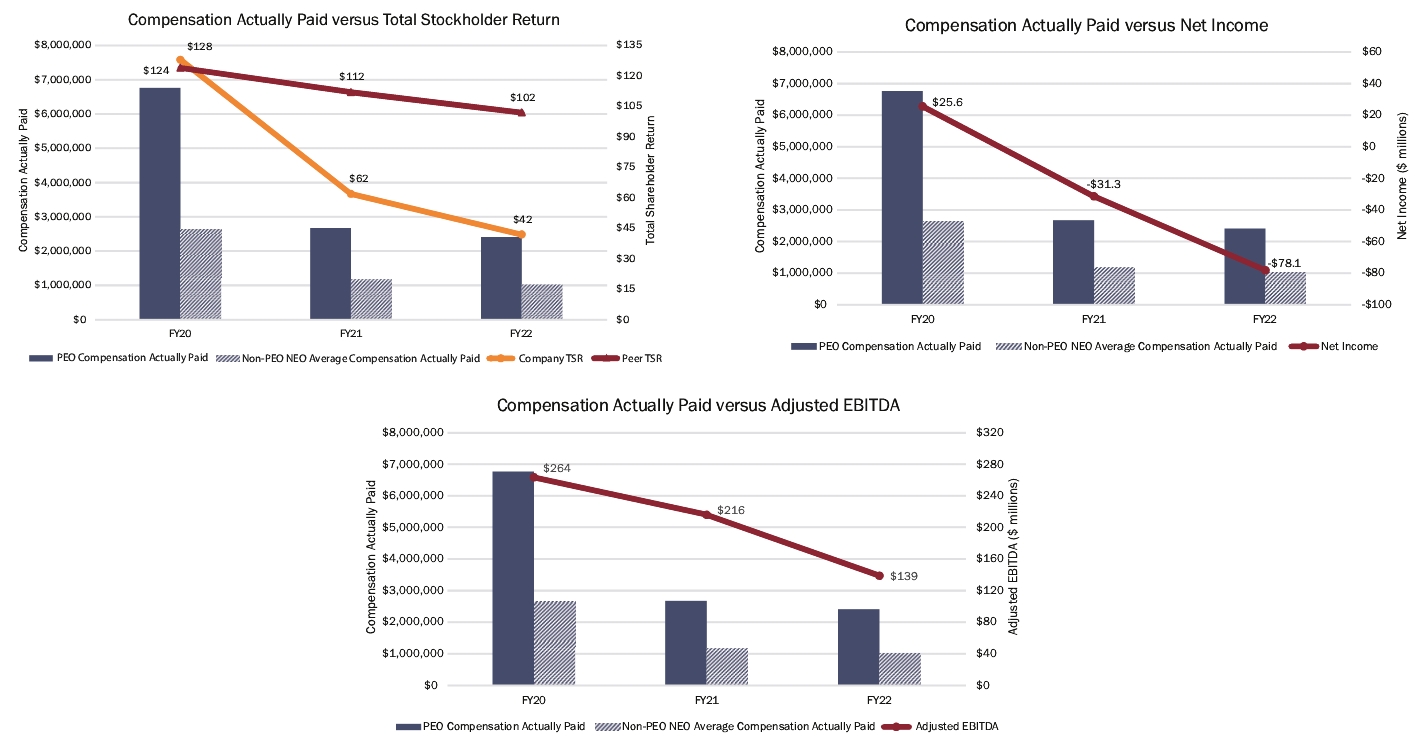

Net Income

(h)

|

| |

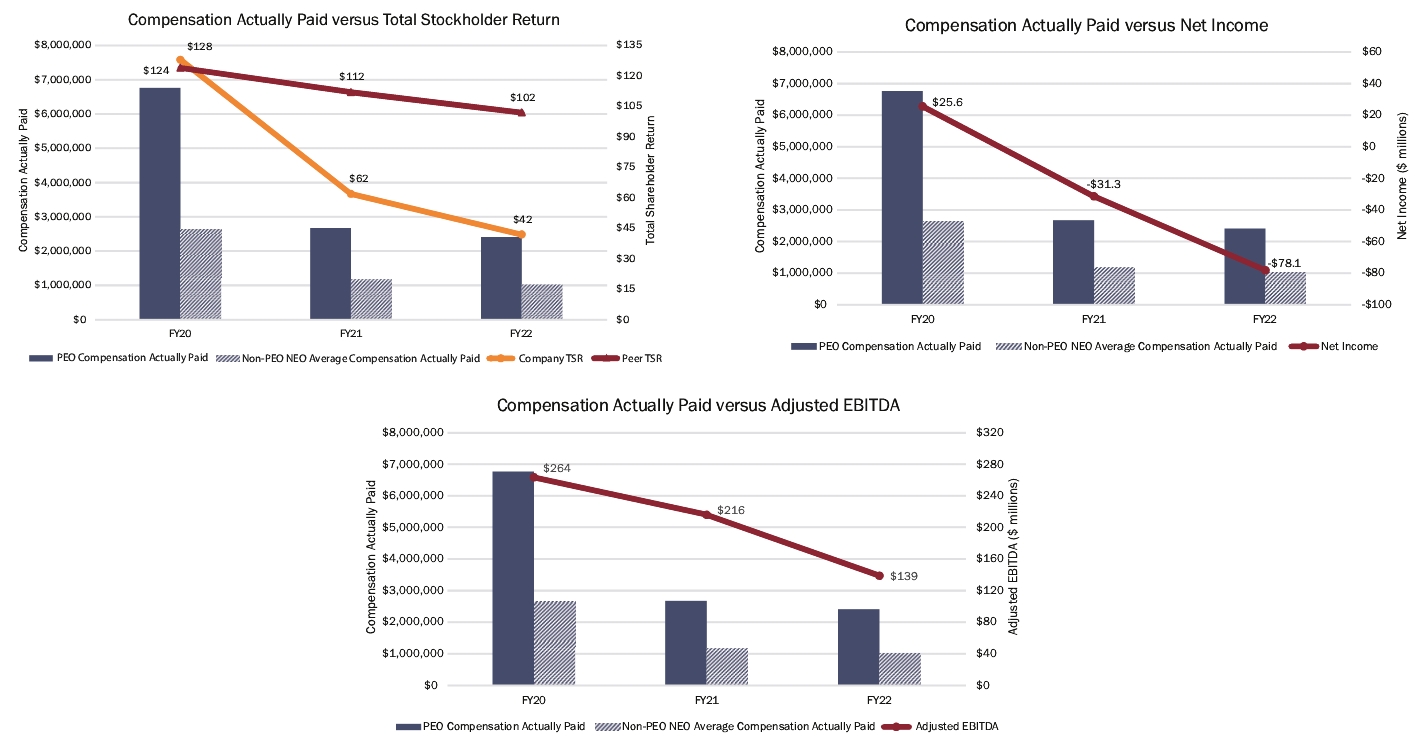

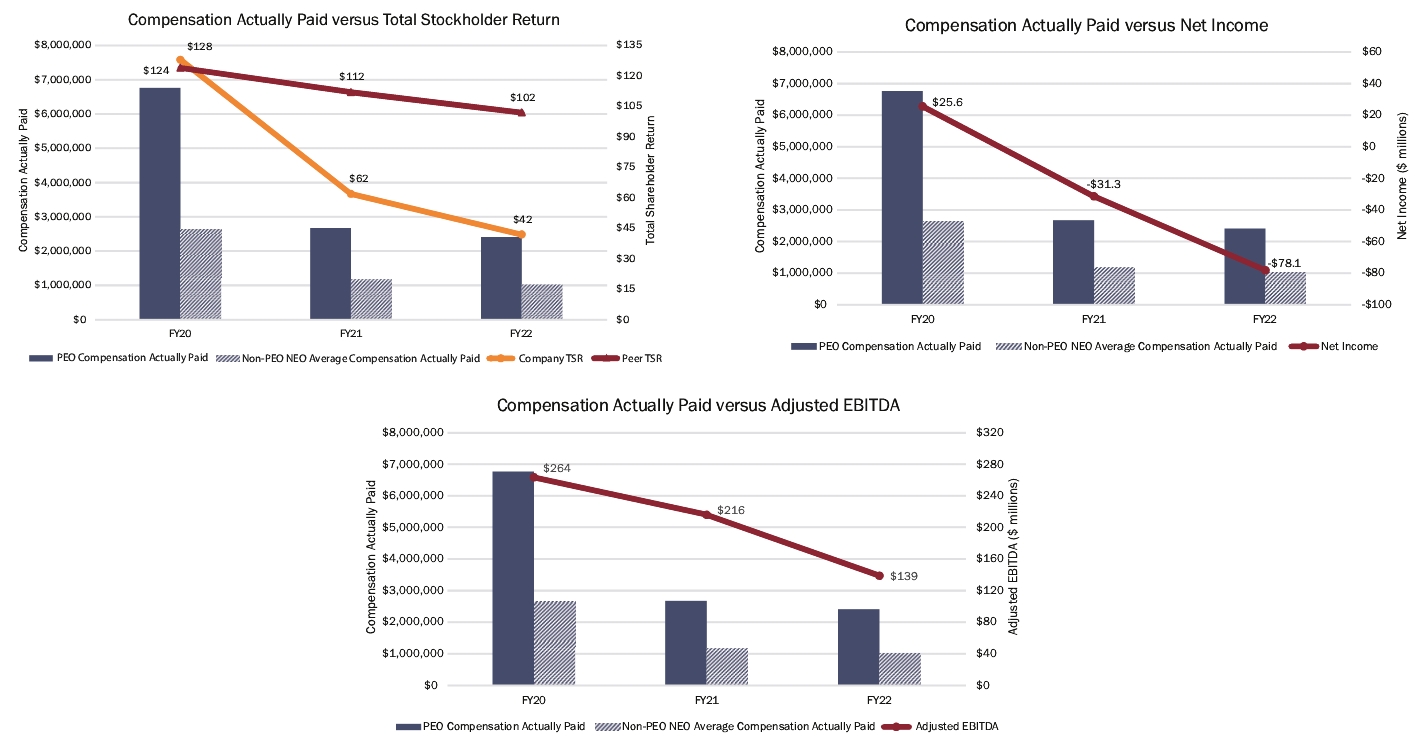

Adjusted EBITDA (Company

Selected Measure)(5)

(i)

|

|

2022

|

| |

$3,905,654

|

| |

$2,406,554

|

| |

$1,558,682

|

| |

$1,028,030

|

| |

$42

|

| |

$102

|

| |

($78,107,000)

|

| |

$138,954,000

|

|

2021

|

| |

$3,703,859

|

| |

$2,672,360

|

| |

$1,479,751

|

| |

$1,177,195

|

| |

$62

|

| |

$112

|

| |

($31,322,000)

|

| |

$216,112,000

|

|

2020

|

| |

$4,078,908

|

| |

$6,765,818

|

| |

$1,546,507

|

| |

$2,652,357

|

| |

$128

|

| |

$124

|

| |

$25,627,000

|

| |

$263,565,000

|

|

1.

|

In all the years in question, Mitchell J. Krebs was our Chief Executive Officer.

|

|

2.

|

For performance-based awards, the fair value of equity awards in the “Compensation Actually Paid” or “CAP” columns is calculated

using a Monte Carlo simulation valuation model as of the applicable year-end date(s), and in all cases based on volatility and risk free rates determined as of the revaluation date based on the expected life period and an expected

dividend rate of 0% and takes into consideration the probability of achievement as of each such date.

|

|

|

For the portion of CAP that is based on year-end stock prices, the following prices were used: 2022 $3.36, 2021 $5.04 and 2020 $10.35.

|

|

|

The following tables set forth the adjustments made during each year represented in the pay versus performance (“PVP”) table to

arrive at CAP to our NEOs during each of the years in question:

|

| | | | |

PEO

|

| |

Average

Non-PEO

|

||

|

Total Reported in 2022 Summary Compensation Table (SCT)

|

| |

$3,905,654

|

| |

$1,558,682

|

|||

|

|

| |

Less, value of Stock Awards reported in SCT

|

| |

$2,045,212

|

| |

$716,887

|

|

|

| |

Plus, Year-End value of Awards Granted in Fiscal Year that are Unvested and

Outstanding

|

| |

$1,545,292

|

| |

$541,656

|

|

|

| |

Plus, Change in Fair Value of Prior Year awards that are Outstanding and Unvested

|

| |

($969,420)

|

| |

($340,423)

|

|

|

| |

Plus, FMV of Awards Granted this Year and that Vested this Year

|

| |

—

|

| |

—

|

|

|

| |

Plus, Change in Fair Value (from prior year-end) of Prior Year awards that Vested

this year

|

| |

($29,760)

|

| |

($14,997)

|

|

|

| |

Less Prior Year Fair Value of Prior Year awards that Failed to vest this year

|

| |

—

|

| |

—

|

|

Total Adjustments

|

| |

($1,499,100)

|

| |

($530,651)

|

|||

|

Actual Compensation Paid for Fiscal Year 2022

|

| |

$2,406,554

|

| |

$1,028,030

|

|||

| | | | |

PEO

|

| |

Average

Non-PEO

|

||

|

Total Reported in 2021 Summary Compensation Table (SCT)

|

| |

$3,703,859

|

| |

$1,479,751

|

|||

|

|

| |

Less, value of Stock Awards reported in SCT

|

| |

$2,347,253

|

| |

$820,554

|

|

|

| |

Plus, Year-End value of Awards Granted in Fiscal Year that are Unvested and

Outstanding

|

| |

$1,230,965

|

| |

$429,463

|

|

|

| |

Plus, Change in Fair Value of Prior Year awards that are Outstanding and Unvested

|

| |

$102,629

|

| |

$99,832

|

|

|

| |

Plus, FMV of Awards Granted this Year and that Vested this Year

|

| |

—

|

| |

—

|

|

|

| |

Plus, Change in Fair Value (from prior year-end) of Prior Year awards that Vested

this year

|

| |

($17,841)

|

| |

($11,298)

|

|

|

| |

Less Prior Year Fair Value of Prior Year awards that Failed to vest this year

|

| |

—

|

| |

—

|

|

Total Adjustments

|

| |

($1,031,499)

|

| |

($302,556)

|

|||

|

Actual Compensation Paid for Fiscal Year 2021

|

| |

$2,672,360

|

| |

$1,177,195

|

|||

| | | | |

PEO

|

| |

Average

Non-PEO

|

||

|

Total Reported in 2020 Summary Compensation Table (SCT)

|

| |

$4,078,908

|

| |

$1,546,507

|

|||

|

|

| |

Less, value of Stock Awards reported in SCT

|

| |

$2,136,136

|

| |

$780,612

|

|

|

| |

Plus, Year-End value of Awards Granted in Fiscal Year that are Unvested and

Outstanding

|

| |

$5,515,006

|

| |

$1,997,966

|

|

|

| |

Plus, Change in Fair Value of Prior Year awards that are Outstanding and Unvested

|

| |

($418,848)

|

| |

($60,029)

|

|

|

| |

Plus, FMV of Awards Granted this Year and that Vested this Year

|

| |

—

|

| |

—

|

|

|

| |

Plus, Change in Fair Value (from prior year-end) of Prior Year awards that Vested

this year

|

| |

($273,112)

|

| |

($51,475)

|

|

|

| |

Less Prior Year Fair Value of Prior Year awards that Failed to vest this year

|

| |

—

|

| |

—

|

|

Total Adjustments

|

| |

$2,686,910

|

| |

$1,105,850

|

|||

|

Actual Compensation Paid for Fiscal Year 2020

|

| |

$6,765,818

|

| |

$2,652,357

|

|||

|

3.

|

During 2022, our non-PEO NEOs consisted of Thomas S. Whelan, Michael Routledge, Casey M. Nault and Emilie C. Schouten. During 2021,

our non-PEO NEOs consisted of Thomas S. Whelan, Michael Routledge, Casey M. Nault and Hans J. Rasmussen. During 2020, our non-PEO NEOs consisted of Thomas S. Whelan, Michael Routledge, Casey M. Nault and Hans J. Rasmussen. Mr. Rasmussen

retired from his position as Senior Vice President, Exploration, effective March 31, 2022.

|

|

4.

|

Company and peer group TSR reflects the Company’s “TSR peer group” as reflected in our 2022 Annual Report on Form 10-K pursuant to

Item 201(e) of Regulation S-K. Each year reflects what the cumulative value of $100 would be, including reinvestment of dividends, if such amount were invested on December 31, 2019.

|

|

5.

|

Adjusted EBITDA, a non-GAAP financial reporting measure, is used by the Company to evaluate operating performance of our core mining

business and allows investors and analysts to compare results of the Company to similar results of other mining companies. For a reconciliation of Adjusted EBITDA to net income, please refer to the tables in the Appendix.

|

|

3.

|

During 2022, our non-PEO NEOs consisted of Thomas S. Whelan, Michael Routledge, Casey M. Nault and Emilie C. Schouten. During 2021,

our non-PEO NEOs consisted of Thomas S. Whelan, Michael Routledge, Casey M. Nault and Hans J. Rasmussen. During 2020, our non-PEO NEOs consisted of Thomas S. Whelan, Michael Routledge, Casey M. Nault and Hans J. Rasmussen. Mr. Rasmussen

retired from his position as Senior Vice President, Exploration, effective March 31, 2022.

|

|

4.

|

Company and peer group TSR reflects the Company’s “TSR peer group” as reflected in our 2022 Annual Report on Form 10-K pursuant to

Item 201(e) of Regulation S-K. Each year reflects what the cumulative value of $100 would be, including reinvestment of dividends, if such amount were invested on December 31, 2019.

|

|

|

The following tables set forth the adjustments made during each year represented in the pay versus performance (“PVP”) table to

arrive at CAP to our NEOs during each of the years in question:

|

| | | | |

PEO

|

| |

Average

Non-PEO

|

||

|

Total Reported in 2022 Summary Compensation Table (SCT)

|

| |

$3,905,654

|

| |

$1,558,682

|

|||

|

|

| |

Less, value of Stock Awards reported in SCT

|

| |

$2,045,212

|

| |

$716,887

|

|

|

| |

Plus, Year-End value of Awards Granted in Fiscal Year that are Unvested and

Outstanding

|

| |

$1,545,292

|

| |

$541,656

|

|

|

| |

Plus, Change in Fair Value of Prior Year awards that are Outstanding and Unvested

|

| |

($969,420)

|

| |

($340,423)

|

|

|

| |

Plus, FMV of Awards Granted this Year and that Vested this Year

|

| |

—

|

| |

—

|

|

|

| |

Plus, Change in Fair Value (from prior year-end) of Prior Year awards that Vested

this year

|

| |

($29,760)

|

| |

($14,997)

|

|

|

| |

Less Prior Year Fair Value of Prior Year awards that Failed to vest this year

|

| |

—

|

| |

—

|

|

Total Adjustments

|

| |

($1,499,100)

|

| |

($530,651)

|

|||

|

Actual Compensation Paid for Fiscal Year 2022

|

| |

$2,406,554

|

| |

$1,028,030

|

|||

| | | | |

PEO

|

| |

Average

Non-PEO

|

||

|

Total Reported in 2021 Summary Compensation Table (SCT)

|

| |

$3,703,859

|

| |

$1,479,751

|

|||

|

|

| |

Less, value of Stock Awards reported in SCT

|

| |

$2,347,253

|

| |

$820,554

|

|

|

| |

Plus, Year-End value of Awards Granted in Fiscal Year that are Unvested and

Outstanding

|

| |

$1,230,965

|

| |

$429,463

|

|

|

| |

Plus, Change in Fair Value of Prior Year awards that are Outstanding and Unvested

|

| |

$102,629

|

| |

$99,832

|

|

|

| |

Plus, FMV of Awards Granted this Year and that Vested this Year

|

| |

—

|

| |

—

|

|

|

| |

Plus, Change in Fair Value (from prior year-end) of Prior Year awards that Vested

this year

|

| |

($17,841)

|

| |

($11,298)

|

|

|

| |

Less Prior Year Fair Value of Prior Year awards that Failed to vest this year

|

| |

—

|

| |

—

|

|

Total Adjustments

|

| |

($1,031,499)

|

| |

($302,556)

|

|||

|

Actual Compensation Paid for Fiscal Year 2021

|

| |

$2,672,360

|

| |

$1,177,195

|

|||

| | | | |

PEO

|

| |

Average

Non-PEO

|

||

|

Total Reported in 2020 Summary Compensation Table (SCT)

|

| |

$4,078,908

|

| |

$1,546,507

|

|||

|

|

| |

Less, value of Stock Awards reported in SCT

|

| |

$2,136,136

|

| |

$780,612

|

|

|

| |

Plus, Year-End value of Awards Granted in Fiscal Year that are Unvested and

Outstanding

|

| |

$5,515,006

|

| |

$1,997,966

|

|

|

| |

Plus, Change in Fair Value of Prior Year awards that are Outstanding and Unvested

|

| |

($418,848)

|

| |

($60,029)

|

|

|

| |

Plus, FMV of Awards Granted this Year and that Vested this Year

|

| |

—

|

| |

—

|

|

|

| |

Plus, Change in Fair Value (from prior year-end) of Prior Year awards that Vested

this year

|

| |

($273,112)

|

| |

($51,475)

|

|

|

| |

Less Prior Year Fair Value of Prior Year awards that Failed to vest this year

|

| |

—

|

| |

—

|

|

Total Adjustments

|

| |

$2,686,910

|

| |

$1,105,850

|

|||

|

Actual Compensation Paid for Fiscal Year 2020

|

| |

$6,765,818

|

| |

$2,652,357

|

|||

|

|

The following tables set forth the adjustments made during each year represented in the pay versus performance (“PVP”) table to

arrive at CAP to our NEOs during each of the years in question:

|

| | | | |

PEO

|

| |

Average

Non-PEO

|

||

|

Total Reported in 2022 Summary Compensation Table (SCT)

|

| |

$3,905,654

|

| |

$1,558,682

|

|||

|

|

| |

Less, value of Stock Awards reported in SCT

|

| |

$2,045,212

|

| |

$716,887

|

|

|

| |

Plus, Year-End value of Awards Granted in Fiscal Year that are Unvested and

Outstanding

|

| |

$1,545,292

|

| |

$541,656

|

|

|

| |

Plus, Change in Fair Value of Prior Year awards that are Outstanding and Unvested

|

| |

($969,420)

|

| |

($340,423)

|

|

|

| |

Plus, FMV of Awards Granted this Year and that Vested this Year

|

| |

—

|

| |

—

|

|

|

| |

Plus, Change in Fair Value (from prior year-end) of Prior Year awards that Vested

this year

|

| |

($29,760)

|

| |

($14,997)

|

|

|

| |

Less Prior Year Fair Value of Prior Year awards that Failed to vest this year

|

| |

—

|

| |

—

|

|

Total Adjustments

|

| |

($1,499,100)

|

| |

($530,651)

|

|||

|

Actual Compensation Paid for Fiscal Year 2022

|

| |

$2,406,554

|

| |

$1,028,030

|

|||

| | | | |

PEO

|

| |

Average

Non-PEO

|

||

|

Total Reported in 2021 Summary Compensation Table (SCT)

|

| |

$3,703,859

|

| |

$1,479,751

|

|||

|

|

| |

Less, value of Stock Awards reported in SCT

|

| |

$2,347,253

|

| |

$820,554

|

|

|

| |

Plus, Year-End value of Awards Granted in Fiscal Year that are Unvested and

Outstanding

|

| |

$1,230,965

|

| |

$429,463

|

|

|

| |

Plus, Change in Fair Value of Prior Year awards that are Outstanding and Unvested

|

| |

$102,629

|

| |

$99,832

|

|

|

| |

Plus, FMV of Awards Granted this Year and that Vested this Year

|

| |

—

|

| |

—

|

|

|

| |

Plus, Change in Fair Value (from prior year-end) of Prior Year awards that Vested

this year

|

| |

($17,841)

|

| |

($11,298)

|

|

|

| |

Less Prior Year Fair Value of Prior Year awards that Failed to vest this year

|

| |

—

|

| |

—

|

|

Total Adjustments

|

| |

($1,031,499)

|

| |

($302,556)

|

|||

|

Actual Compensation Paid for Fiscal Year 2021

|

| |

$2,672,360

|

| |

$1,177,195

|

|||

| | | | |

PEO

|

| |

Average

Non-PEO

|

||

|

Total Reported in 2020 Summary Compensation Table (SCT)

|

| |

$4,078,908

|

| |

$1,546,507

|

|||

|

|

| |

Less, value of Stock Awards reported in SCT

|

| |

$2,136,136

|

| |

$780,612

|

|

|

| |

Plus, Year-End value of Awards Granted in Fiscal Year that are Unvested and

Outstanding

|

| |

$5,515,006

|

| |

$1,997,966

|

|

|

| |

Plus, Change in Fair Value of Prior Year awards that are Outstanding and Unvested

|

| |

($418,848)

|

| |

($60,029)

|

|

|

| |

Plus, FMV of Awards Granted this Year and that Vested this Year

|

| |

—

|

| |

—

|

|

|

| |

Plus, Change in Fair Value (from prior year-end) of Prior Year awards that Vested

this year

|

| |

($273,112)

|

| |

($51,475)

|

|

|

| |

Less Prior Year Fair Value of Prior Year awards that Failed to vest this year

|

| |

—

|

| |

—

|

|

Total Adjustments

|

| |

$2,686,910

|

| |

$1,105,850

|

|||

|

Actual Compensation Paid for Fiscal Year 2020

|

| |

$6,765,818

|

| |

$2,652,357

|

|||

|

Adjusted EBITDA

|

|

ROIC

|

|

Production

|

|

Costs Applicable to Sales

|

|

Growth in Reserves and Resources

|

|

Environmental, Health and Safety Performance

|

|

rTSR

|

|

5.

|

Adjusted EBITDA, a non-GAAP financial reporting measure, is used by the Company to evaluate operating performance of our core mining

business and allows investors and analysts to compare results of the Company to similar results of other mining companies. For a reconciliation of Adjusted EBITDA to net income, please refer to the tables in the Appendix.

|