Unit_pure in Thousands

Pay Versus Performance |

||||||||||||||||||||||||||||||||

Value of $100 Initial Investment Based On: |

||||||||||||||||||||||||||||||||

Year |

Summary Compensation Table Total for CEO ($) |

Compensation Actually Paid to CEO ($)(1) |

Average Summary Compensation Table Total for Non-CEO Named Executive Officers ($)(2) |

Average Compensation Actually Paid to Non-CEO Named Executive Officers ($)(3) |

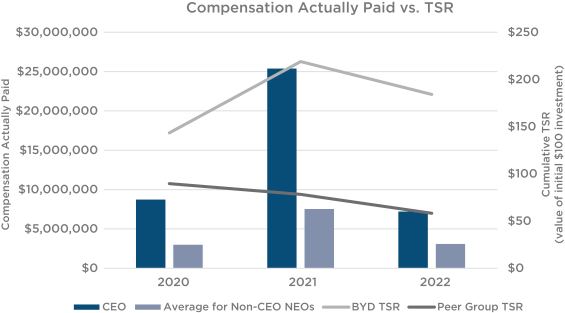

Total Shareholder Return ($)(4) |

Peer Group Total Shareholder Return ($)(5) |

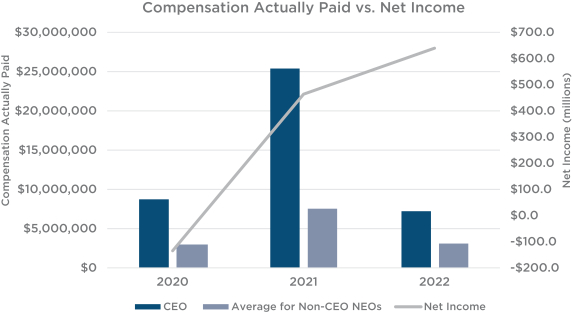

Net Income (Loss) (in thousands) ($) |

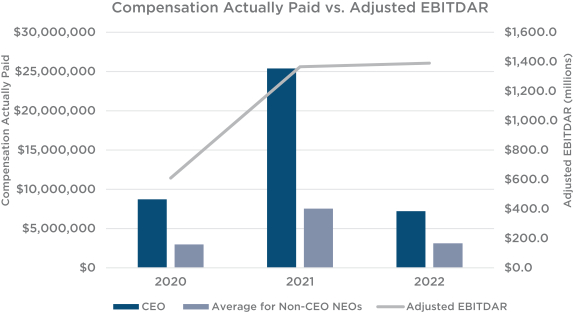

Adjusted EBITDAR (in thousands) ($) |

||||||||||||||||||||||||

2022 |

10,369,721 |

7,120,582 |

3,431,198 |

2,958,368 |

184.16 |

58.28 |

639,377 |

1,390,509 |

||||||||||||||||||||||||

2021 |

14,740,782 |

25,387,421 |

4,531,494 |

7,532,905 |

219.00 |

78.17 |

463,846 |

1,365,985 |

||||||||||||||||||||||||

2020 |

2,973,606 |

8,720,802 |

1,331,123 |

2,975,201 |

143.35 |

89.66 |

(134,700 |

) |

609,894 |

|||||||||||||||||||||||

| (1) | Compensation actually paid to Mr. Smith for each of the fiscal years reported is calculated as follows: |

2022($) |

2021($) |

2020($) |

||||||||||

Total compensation reported in Summary Compensation Table |

10,369,721 |

14,740,782 |

2,973,606 |

|||||||||

Less: |

6,430,512 |

8,940,265 |

213,746 |

|||||||||

Plus: |

||||||||||||

Fair value as of December 31 of awards granted during and outstanding at the end of the fiscal year |

4,952,415 |

10,841,081 |

— |

|||||||||

Change in fair value of outstanding awards granted in prior fiscal years(b) |

(2,628,668 |

) |

6,743,562 |

6,085,478 |

||||||||

Vesting date fair value of equity awards granted and vested during the fiscal year |

217,516 |

213,759 |

213,746 |

|||||||||

Change in fair value of awards granted in prior fiscal years and vested during the covered fiscal year(c) |

640,110 |

1,788,502 |

(338,282 |

) | ||||||||

Earnings paid on unvested awards for dividends or other earnings |

— |

— |

— |

|||||||||

Less: |

— |

— |

— |

|||||||||

Compensation actually paid(d) |

7,120,582 |

25,387,421 |

8,720,802 |

|||||||||

| (a) | Includes time-based restricted shares and performance-based restricted shares, which do not vest during the fiscal year awarded, and career shares, which vest 100% when granted. |

| (b) | Change in fair value from December 31 of the covered fiscal year compared to December 31 of the prior fiscal year. Each performance share included as part of the calculation represents a contingent right to receive up to a maximum of two shares of common stock, subject to satisfaction of certain performance metrics. Amounts reported assume the performance metrics will be achieved at the target performance level, which is the most probable outcome as of the end of the fiscal year, unless otherwise noted. Interim values based on assumption of the most probable outcome may not ultimately reflect actual payouts. |

| (c) | Change in fair value from vesting date compared to December 31 of the prior fiscal year. |

| (d) | The valuation assumptions used to calculate fair values did not materially differ from those disclosed at the time of grant. |

| (2) | Named Executive Officers included in the calculation for each of 2022, 2021 and 2020 are William S. Boyd, Josh Hirsberg, Stephen Thompson, and Theodore Bogich. |

| (3) | Average compensation actually paid to non-CEO named executive officers (“NEOs”) reported on an average basis is calculated as follows: |

2022($) |

2021($) |

2020($) |

||||||||||

Total compensation reported in Summary Compensation Table |

3,431,198 |

4,531,494 |

1,331,123 |

|||||||||

Less: (a) |

1,751,000 |

2,350,193 |

110,058 |

|||||||||

Plus: |

||||||||||||

Fair value as of December 31 of awards granted during and outstanding at the end of the fiscal year |

1,457,644 |

2,826,067 |

42,043 |

|||||||||

Change in fair value of outstanding awards granted in prior fiscal years (b) |

(432,994 |

) |

2,023,149 |

1,676,692 |

||||||||

Vesting date fair value of equity awards granted and vested during the fiscal year |

94,075 |

94,086 |

91,872 |

|||||||||

Change in fair value of awards granted in prior fiscal years and vested during the covered fiscal year (c) |

159,445 |

408,302 |

(56,471 |

) | ||||||||

Earnings paid on unvested awards for dividends or other earnings |

— |

— |

— |

|||||||||

Less: |

— |

— |

— |

|||||||||

Compensation actually paid (d) |

2,958,368 |

7,532,905 |

2,975,201 |

|||||||||

| (a) | Includes time-based restricted shares and performance-based restricted shares, which do not vest during the fiscal year awarded, and career shares, which vest 100% when granted. |

| (b) | Change in fair value from December 31 of the covered fiscal year compared to December 31 of the prior fiscal year. Each performance share included as part of the calculation represents a contingent right to receive up to a maximum of two shares of common stock, subject to satisfaction of certain performance metrics. Amounts reported assume the performance metrics will be achieved at the target performance level, which is the most probable outcome as of the end of the fiscal year, unless otherwise noted. Interim values based on assumption of the most probable outcome may not ultimately reflect actual payouts. |

| (c) | Change in fair value from vesting date compared to December 31 of the prior fiscal year. |

| (d) | The valuation assumptions used to calculate fair values did not materially differ from those disclosed at the time of grant. |

| (4) | Assumes $100 was invested on December 31, 2019. |

| (5) | Represents the cumulative total return of the Dow Jones U.S. Gambling Index and assumes $100 was invested on December 31, 2019. |

2022($) |

2021($) |

2020($) |

||||||||||

Total compensation reported in Summary Compensation Table |

10,369,721 |

14,740,782 |

2,973,606 |

|||||||||

Less: |

6,430,512 |

8,940,265 |

213,746 |

|||||||||

Plus: |

||||||||||||

Fair value as of December 31 of awards granted during and outstanding at the end of the fiscal year |

4,952,415 |

10,841,081 |

— |

|||||||||

Change in fair value of outstanding awards granted in prior fiscal years(b) |

(2,628,668 |

) |

6,743,562 |

6,085,478 |

||||||||

Vesting date fair value of equity awards granted and vested during the fiscal year |

217,516 |

213,759 |

213,746 |

|||||||||

Change in fair value of awards granted in prior fiscal years and vested during the covered fiscal year(c) |

640,110 |

1,788,502 |

(338,282 |

) | ||||||||

Earnings paid on unvested awards for dividends or other earnings |

— |

— |

— |

|||||||||

Less: |

— |

— |

— |

|||||||||

Compensation actually paid(d) |

7,120,582 |

25,387,421 |

8,720,802 |

|||||||||

| (a) | Includes time-based restricted shares and performance-based restricted shares, which do not vest during the fiscal year awarded, and career shares, which vest 100% when granted. |

| (b) | Change in fair value from December 31 of the covered fiscal year compared to December 31 of the prior fiscal year. Each performance share included as part of the calculation represents a contingent right to receive up to a maximum of two shares of common stock, subject to satisfaction of certain performance metrics. Amounts reported assume the performance metrics will be achieved at the target performance level, which is the most probable outcome as of the end of the fiscal year, unless otherwise noted. Interim values based on assumption of the most probable outcome may not ultimately reflect actual payouts. |

| (c) | Change in fair value from vesting date compared to December 31 of the prior fiscal year. |

| (d) | The valuation assumptions used to calculate fair values did not materially differ from those disclosed at the time of grant. |

2022($) |

2021($) |

2020($) |

||||||||||

Total compensation reported in Summary Compensation Table |

3,431,198 |

4,531,494 |

1,331,123 |

|||||||||

Less: (a) |

1,751,000 |

2,350,193 |

110,058 |

|||||||||

Plus: |

||||||||||||

Fair value as of December 31 of awards granted during and outstanding at the end of the fiscal year |

1,457,644 |

2,826,067 |

42,043 |

|||||||||

Change in fair value of outstanding awards granted in prior fiscal years (b) |

(432,994 |

) |

2,023,149 |

1,676,692 |

||||||||

Vesting date fair value of equity awards granted and vested during the fiscal year |

94,075 |

94,086 |

91,872 |

|||||||||

Change in fair value of awards granted in prior fiscal years and vested during the covered fiscal year (c) |

159,445 |

408,302 |

(56,471 |

) | ||||||||

Earnings paid on unvested awards for dividends or other earnings |

— |

— |

— |

|||||||||

Less: |

— |

— |

— |

|||||||||

Compensation actually paid (d) |

2,958,368 |

7,532,905 |

2,975,201 |

|||||||||

| (a) | Includes time-based restricted shares and performance-based restricted shares, which do not vest during the fiscal year awarded, and career shares, which vest 100% when granted. |

| (b) | Change in fair value from December 31 of the covered fiscal year compared to December 31 of the prior fiscal year. Each performance share included as part of the calculation represents a contingent right to receive up to a maximum of two shares of common stock, subject to satisfaction of certain performance metrics. Amounts reported assume the performance metrics will be achieved at the target performance level, which is the most probable outcome as of the end of the fiscal year, unless otherwise noted. Interim values based on assumption of the most probable outcome may not ultimately reflect actual payouts. |

| (c) | Change in fair value from vesting date compared to December 31 of the prior fiscal year. |

| (d) | The valuation assumptions used to calculate fair values did not materially differ from those disclosed at the time of grant. |

| • | Adjusted EBITDAR; |

| • | Adjusted EBITDAR Growth; and |

| • | Net Revenue Growth. |