| |

|

| |

|

| |

|

| |

|

| |

|

| |

Value of Initial Fixed

$100 Investment Based

On:

|

| |

|

| |

|

| |

|

| |||

| |

Year

|

| |

Summary

Compensation

Table Total for

PEO(1)

|

| |

Compensation

Actually Paid

to PEO(2)

|

| |

Average

Summary

Compensation

Table Total for

Non-PEO

NEOs(3)

|

| |

Average

Compensation

Actually Paid

to Non-PEO

NEOs(2)

|

| |

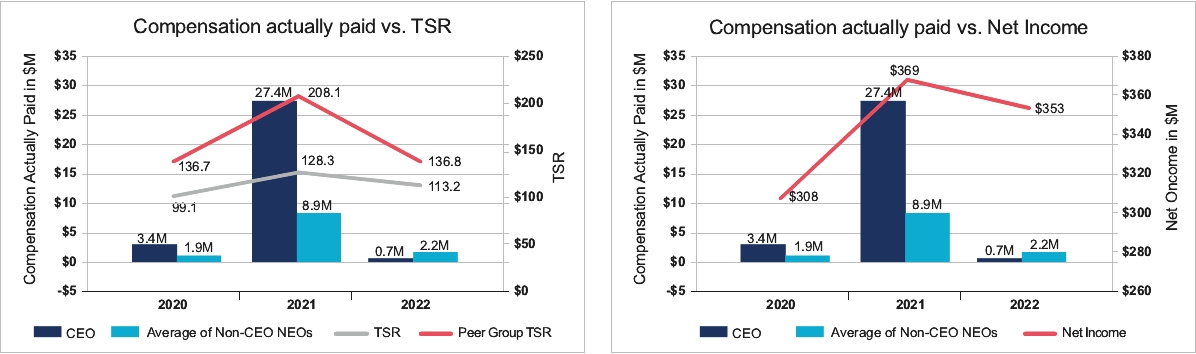

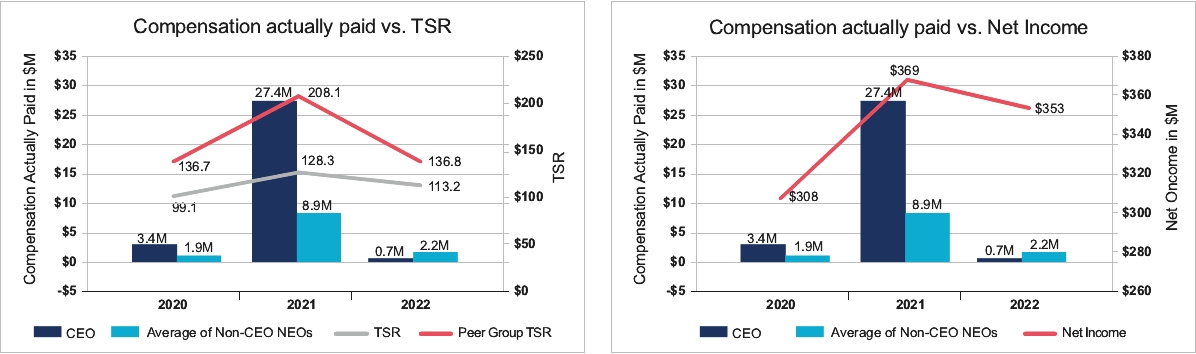

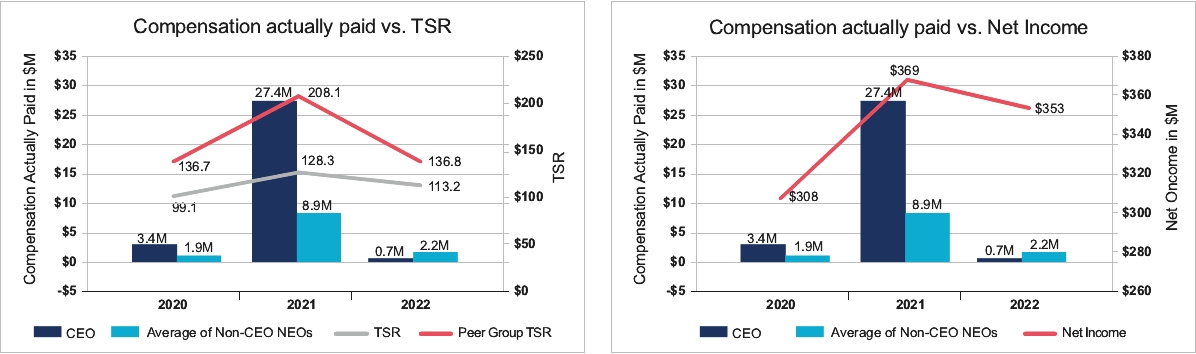

TSR(4)

|

| |

Peer Group

TSR(4)

|

| |

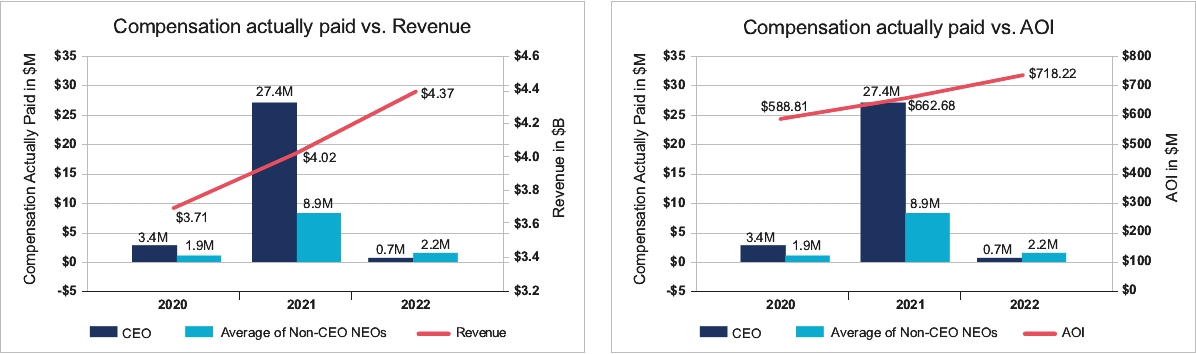

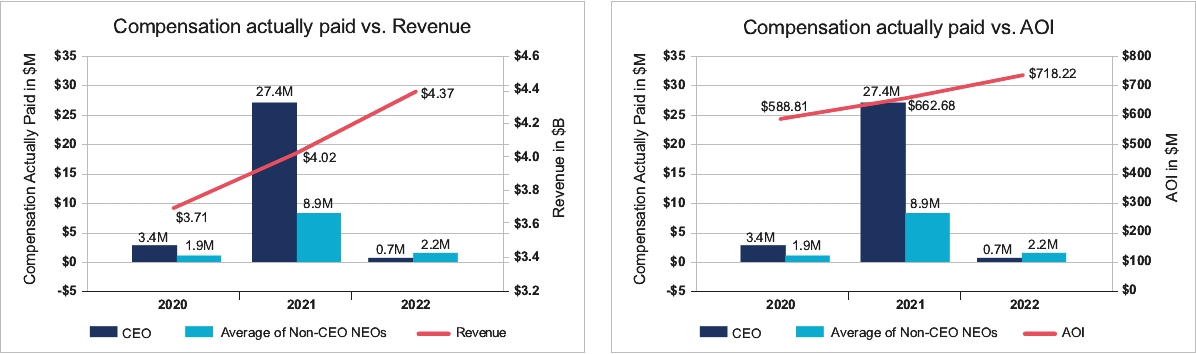

Net Income

(in $ '000)

|

| |

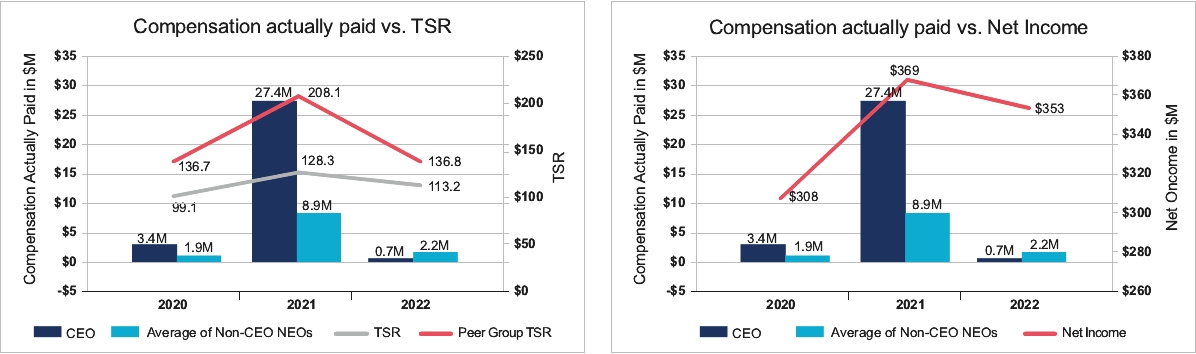

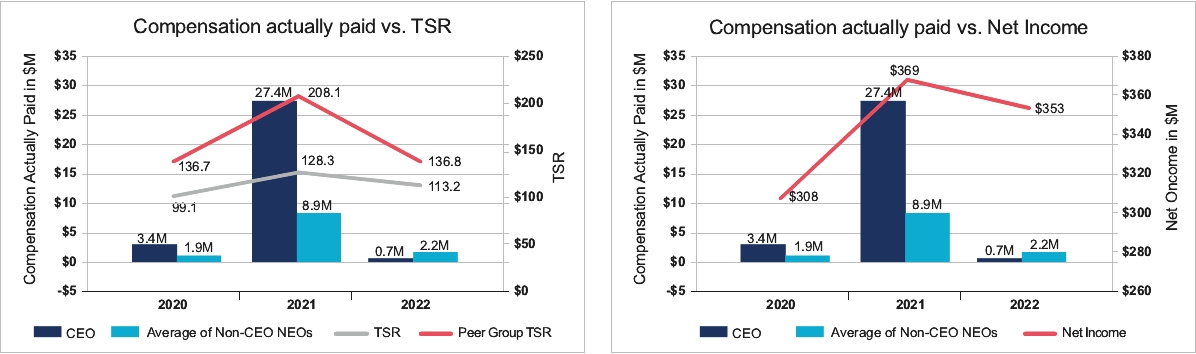

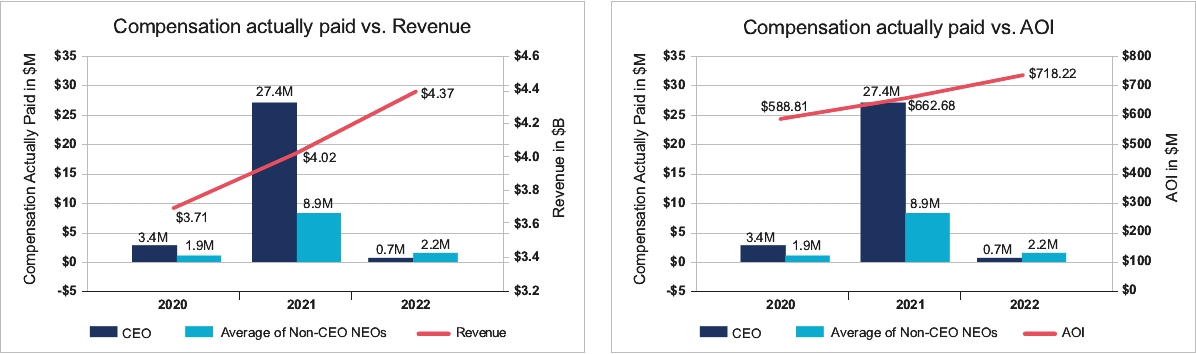

Revenue

(in $ '000)

|

| |

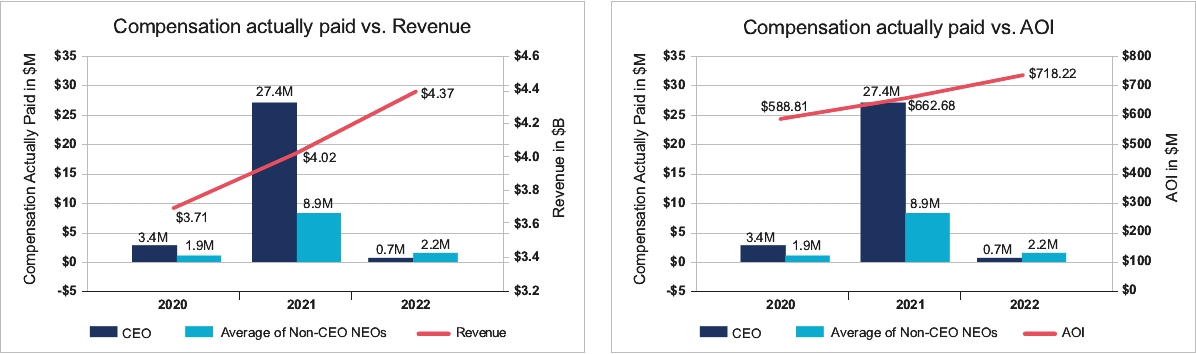

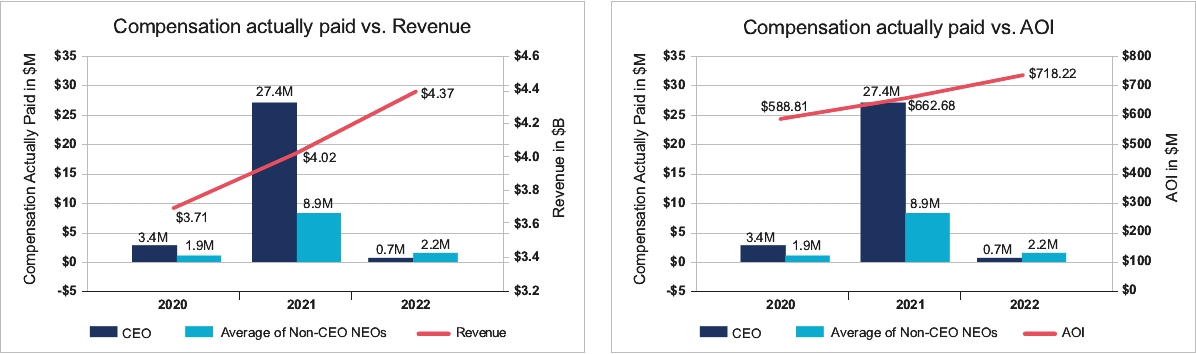

AOI

(in $ '000)

|

|

| |

2022

|

| |

4,166,783

|

| |

694,298

|

| |

2,976,115

|

| |

2,224,062

|

| |

113

|

| |

137

|

| |

353,404

|

| |

4,371,172

|

| |

718,219

|

|

| |

2021

|

| |

6,646,011

|

| |

27,436,323

|

| |

4,275,935

|

| |

8,907,805

|

| |

128

|

| |

208

|

| |

369,448

|

| |

4,022,211

|

| |

662,680

|

|

| |

2020

|

| |

5,294,702

|

| |

3,358,666

|

| |

2,535,069

|

| |

1,876,240

|

| |

99

|

| |

137

|

| |

308,276

|

| |

3,709,377

|

| |

588,808

|

|

|

(1)

|

Represents the total compensation of our PEO, N.V. Tyagarajan, as reported in the Summary Compensation Table for each year reported in the table.

|

|

(2)

|

SEC rules require certain adjustments be made to the Summary Compensation Table totals to determine “compensation actually paid” as

reported in the Pay versus Performance Table above. The following table details the applicable adjustments that were made to determine “compensation actually paid” to our PEO and, on average, our non-PEO NEOs for each year reported in

the table:

|

| |

|

| |

Executive(s)

|

| |

Summary

Compensation

Table Total

($)

|

| |

Subtract:

Reported

value of

equity

awards

granted

during the

year

($)

|

| |

Add: Year-end

fair value of

unvested equity

awards granted

during the

year ($)

|

| |

Add: Change in

fair value of

outstanding and

unvested

equity

awards granted in

prior years ($)

|

| |

Add: Change in

fair value of

equity

awards granted in

prior years that

vested during the

year

($)

|

| |

Compensation

actually paid ($)

|

|

| |

2022

|

| |

PEO

Non-PEO NEOs

|

| |

4,166,783

2,976,115

|

| |

2,252,530

1,812,167

|

| |

4,229,564

2,525,815

|

| |

(5,251,707)

(1,336,522)

|

| |

(197,812)

(129,179)

|

| |

694,298

2,224,062

|

|

| |

2021

|

| |

PEO

Non-PEO NEOs

|

| |

6,646,011

4,275,935

|

| |

4,080,420

2,979,374

|

| |

6,001,454

4,237,676

|

| |

13,782,911

3,332,710

|

| |

5,086,367

40,858

|

| |

27,436,323

8,907,805

|

|

| |

2020

|

| |

PEO

Non-PEO NEOs

|

| |

5,294,702

2,535,069

|

| |

3,366,017

1,386,350

|

| |

2,233,927

1,056,272

|

| |

(943,743)

(331,050)

|

| |

139,797

2,299

|

| |

3,358,666

1,876,240

|

|

|

(3)

|

Represents the average of the total compensation of each of our non-PEO NEOs as reported in the Summary Compensation Table for each

year indicated. The non-PEO NEOs included in this calculation for each reported year are as follows:

|

|

•

|

2022: Michael Weiner, Balkrishan Kalra, Darren Saumur and Kathryn Stein;

|

|

•

|

2021: Michael Weiner, Edward Fitzpatrick, Balkrishan Kalra, Darren Saumur and Kathryn Stein; and

|

|

•

|

2020: Edward Fitzpatrick, Balkrishan Kalra, Darren Saumur and Kathryn Stein.

|

|

(4)

|

TSR was determined assuming an initial fixed investment of $100 on December 31, 2019. The peer group TSR represents the TSR of the

peer group disclosed in our Annual Report on Form 10-K in accordance with Item 201(e) of Regulation S-K and consists of Accenture plc, Cognizant Technology Solutions Corp., ExlService Holdings, Inc., Infosys Technologies Limited, Wipro

Technologies Limited, and WNS (Holdings) Limited.

|

|

(3)

|

Represents the average of the total compensation of each of our non-PEO NEOs as reported in the Summary Compensation Table for each

year indicated. The non-PEO NEOs included in this calculation for each reported year are as follows:

|

|

•

|

2022: Michael Weiner, Balkrishan Kalra, Darren Saumur and Kathryn Stein;

|

|

•

|

2021: Michael Weiner, Edward Fitzpatrick, Balkrishan Kalra, Darren Saumur and Kathryn Stein; and

|

|

•

|

2020: Edward Fitzpatrick, Balkrishan Kalra, Darren Saumur and Kathryn Stein.

|

|

(4)

|

TSR was determined assuming an initial fixed investment of $100 on December 31, 2019. The peer group TSR represents the TSR of the

peer group disclosed in our Annual Report on Form 10-K in accordance with Item 201(e) of Regulation S-K and consists of Accenture plc, Cognizant Technology Solutions Corp., ExlService Holdings, Inc., Infosys Technologies Limited, Wipro

Technologies Limited, and WNS (Holdings) Limited.

|

|

(2)

|

SEC rules require certain adjustments be made to the Summary Compensation Table totals to determine “compensation actually paid” as

reported in the Pay versus Performance Table above. The following table details the applicable adjustments that were made to determine “compensation actually paid” to our PEO and, on average, our non-PEO NEOs for each year reported in

the table:

|

| |

|

| |

Executive(s)

|

| |

Summary

Compensation

Table Total

($)

|

| |

Subtract:

Reported

value of

equity

awards

granted

during the

year

($)

|

| |

Add: Year-end

fair value of

unvested equity

awards granted

during the

year ($)

|

| |

Add: Change in

fair value of

outstanding and

unvested

equity

awards granted in

prior years ($)

|

| |

Add: Change in

fair value of

equity

awards granted in

prior years that

vested during the

year

($)

|

| |

Compensation

actually paid ($)

|

|

| |

2022

|

| |

PEO

Non-PEO NEOs

|

| |

4,166,783

2,976,115

|

| |

2,252,530

1,812,167

|

| |

4,229,564

2,525,815

|

| |

(5,251,707)

(1,336,522)

|

| |

(197,812)

(129,179)

|

| |

694,298

2,224,062

|

|

| |

2021

|

| |

PEO

Non-PEO NEOs

|

| |

6,646,011

4,275,935

|

| |

4,080,420

2,979,374

|

| |

6,001,454

4,237,676

|

| |

13,782,911

3,332,710

|

| |

5,086,367

40,858

|

| |

27,436,323

8,907,805

|

|

| |

2020

|

| |

PEO

Non-PEO NEOs

|

| |

5,294,702

2,535,069

|

| |

3,366,017

1,386,350

|

| |

2,233,927

1,056,272

|

| |

(943,743)

(331,050)

|

| |

139,797

2,299

|

| |

3,358,666

1,876,240

|

|

|

(2)

|

SEC rules require certain adjustments be made to the Summary Compensation Table totals to determine “compensation actually paid” as

reported in the Pay versus Performance Table above. The following table details the applicable adjustments that were made to determine “compensation actually paid” to our PEO and, on average, our non-PEO NEOs for each year reported in

the table:

|

| |

|

| |

Executive(s)

|

| |

Summary

Compensation

Table Total

($)

|

| |

Subtract:

Reported

value of

equity

awards

granted

during the

year

($)

|

| |

Add: Year-end

fair value of

unvested equity

awards granted

during the

year ($)

|

| |

Add: Change in

fair value of

outstanding and

unvested

equity

awards granted in

prior years ($)

|

| |

Add: Change in

fair value of

equity

awards granted in

prior years that

vested during the

year

($)

|

| |

Compensation

actually paid ($)

|

|

| |

2022

|

| |

PEO

Non-PEO NEOs

|

| |

4,166,783

2,976,115

|

| |

2,252,530

1,812,167

|

| |

4,229,564

2,525,815

|

| |

(5,251,707)

(1,336,522)

|

| |

(197,812)

(129,179)

|

| |

694,298

2,224,062

|

|

| |

2021

|

| |

PEO

Non-PEO NEOs

|

| |

6,646,011

4,275,935

|

| |

4,080,420

2,979,374

|

| |

6,001,454

4,237,676

|

| |

13,782,911

3,332,710

|

| |

5,086,367

40,858

|

| |

27,436,323

8,907,805

|

|

| |

2020

|

| |

PEO

Non-PEO NEOs

|

| |

5,294,702

2,535,069

|

| |

3,366,017

1,386,350

|

| |

2,233,927

1,056,272

|

| |

(943,743)

(331,050)

|

| |

139,797

2,299

|

| |

3,358,666

1,876,240

|

|

| |

2022 Most Important Measures (Unranked)

|

| |||

| |

• AOI($)

|

| |

• Transformation services bookings

|

|

| |

• AOI margin

|

| |

• Renewal bookings

|

|

| |

• Net bookings

|

| |

• Revenue

|

|

| |

• Employee engagement score

|

| |

|

|