BALLARD POWER SYSTEMS INC.

ANNUAL INFORMATION FORM

For the year ended December 31, 2022

Dated March 16, 2023

TABLE OF CONTENTS

| | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Composition of the Audit Committee | |

| |

| |

| |

| |

| |

| |

This Annual Information Form and the documents incorporated by reference herein contain forward-looking statements that are based on the beliefs of management and reflect our current expectations as contemplated under the safe harbor provisions of Section 21E of the United States Securities Exchange Act of 1934, as amended. When used in this Annual Information Form, the words “estimate”, “project”, “believe”, “anticipate”, “intend”, “expect”, “plan”, “predict”, “may”, “could”, “should”, “will”, the negatives of these words or other variations thereof and comparable terminology are intended to identify forward-looking statements. Such statements include, but are not limited to, statements with respect to our objectives, goals, liquidity, sources and uses of capital, outlook, strategy, order backlog, order book of expected deliveries, future product roadmap costs and selling prices, future product sales, future production capacities and volumes, the markets for our products, expenses / costs, contributions and cash requirements to and from joint venture operations and research and development activities, as well as statements with respect to our beliefs, plans, objectives, expectations, anticipations, estimates and intentions. These statements are not guarantees of future performance and involve assumptions, risks and uncertainties that are difficult to predict. In particular, these forward-looking statements are based on certain factors and assumptions relating to our expectations with respect to new and existing customer and partner relationships, the generation of new sales, producing, delivering, and selling the expected product and service volumes at the expected prices and controlling our costs. They are also based on a variety of general factors and assumptions including, but not limited to, our expectations regarding technology and product development efforts, manufacturing capacity and cost, product and service pricing, market demand, and the availability and prices of raw materials, labour, and supplies. These assumptions have been derived from information available to the Company including information obtained by the Company from third parties. These assumptions may prove to be incorrect in whole or in part. In addition, actual results may differ materially from those expressed, implied, or forecasted in such forward-looking statements. Factors that could cause our actual results or outcomes to differ materially from the results expressed, implied or forecasted in such forward-looking statements include, but are not limited to: challenges or delays in our technology, manufacturing and product development activities; our ability to extract value from joint venture operations; changes in the availability or price of raw materials, labour, supplies and shipping; costs of integration, and the integration failing to achieve the expected benefits of transactions; our ability to attract and retain business partners, suppliers, employees and customers; challenges or delays in our technology and product development activities; our ability to extract value from joint venture operations; changes in the availability or price of raw materials, labour, supplies and shipping; costs of integration, and the integration failing to achieve the expected benefits of the transaction; our ability to attract and retain business partners, suppliers, employees and customers; global economic trends and geopolitical risks (such as the conflict between Russia and Ukraine), including changes in the rates of investment, inflation or economic growth in our key markets, or an escalation of trade tensions such as those between the U.S. and China; the relative strength of the value proposition that we offer our customers with our products or services; changes in competitive technologies, including battery and fuel cell technologies; product safety, liability or warranty issues; changes in our customers’ requirements, the competitive environment and/or related market conditions; potential merger and acquisition activities, including risks related to integration, loss of key personnel and disruptions to

operations; warranty claims, product performance guarantees, or indemnification claims; changes in product or service pricing or cost; market developments or customer actions (including developments and actions arising from epidemics and pandemic) that may affect levels of demand and/or the financial performance of the major industries and customers we serve, such as secular, cyclical and competitive pressures in the bus, truck, rail and marine sectors; the rate of mass adoption of our products or related ecosystem, including the availability of cost-effective hydrogen; cybersecurity threat; our ability to protect our intellectual property; the severity, magnitude and duration of the on-going COVID-19 pandemic, including impacts of the pandemic and of businesses’ and governments’ responses to the pandemic on our operations, personnel and joint venture operations, and on commercial activity and demand across our and our customers’, partners’ and joint venture businesses, and on global supply chains; climate risk; changing government or environmental regulations, including subsidies or incentives associated with the adoption of clean energy products, including hydrogen and fuel cells; currency fluctuations, including the magnitude of the rate of change of the Canadian dollar versus the U.S. dollar; our access to funding and our ability to provide the capital required for product development, operations and marketing efforts, working capital requirements, and joint venture capital contributions; and the general assumption that none of the risks noted in the “Risk Factors” section of this Annual Information Form will materialize.

The forward-looking statements contained in this Annual Information Form speak only as of the date of this Annual Information Form. Except as required by applicable legislation, Ballard does not undertake any obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after the date of this Annual Information Form, including the occurrence of unanticipated events.

In this Annual Information Form, references to “Corporation”, “Company”, “Ballard”, “we”, “us” and “our” refers to Ballard Power Systems Inc. and, as applicable, its subsidiaries. All dollar amounts are in United States dollars unless otherwise indicated. Canadian dollars are indicated by the symbol “C$”, and euros by the symbol “€”.

Except where otherwise indicated, all information presented is as of December 31, 2022.

CORPORATE STRUCTURE

Name, Address and Incorporation

Ballard was incorporated on November 12, 2008 under the Canada Business Corporations Act (Canada), under the name “7076991 Canada Inc.” Ballard changed its name to “Ballard Power Systems Inc.” on December 31, 2008. On August 24, 2016, Ballard continued into British Columbia under the Business Corporations Act (British Columbia). Ballard’s head office is located at 9000 Glenlyon Parkway, Burnaby, British Columbia, Canada V5J 5J8, and its registered office is located at Suite 1700, 666 Burrard Street, Vancouver, British Columbia, Canada V6C 2X8.

Previously, Ballard Power Systems Inc. was a British Columbia company incorporated on May 30, 1989. The original predecessor to Ballard was founded in 1979 under the name Ballard Research Inc. to conduct research and development on high-energy lithium batteries. In the course of investigating environmentally clean energy systems with commercial potential, we began to develop fuel cells and have been developing fuel cell products since 1983.

Our Vision, Mission and Values

Our vision is to deliver fuel cell power for a sustainable planet. Our mission is to use our fuel cell expertise to deliver valuable and innovative solutions to our customers globally, create rewarding opportunities for our team, provide extraordinary value to our shareholders and power the hydrogen society.

Our values represent our core beliefs and underpin how we carry on our business. In addition to our value pillars of safety and innovation, we have five key cultural values:

•Listen and Deliver – We listen to our customers, understand their business and deliver innovative and valuable solutions for lasting partnerships;

•Quality Always – We deliver quality in everything we do;

•Inspire Excellence – We live with integrity, passion, urgency, agility and humility;

•Row Together – We achieve success through respect, trust and collaboration; and

•Own It – We step up, take ownership for our results and trust others to do the same.

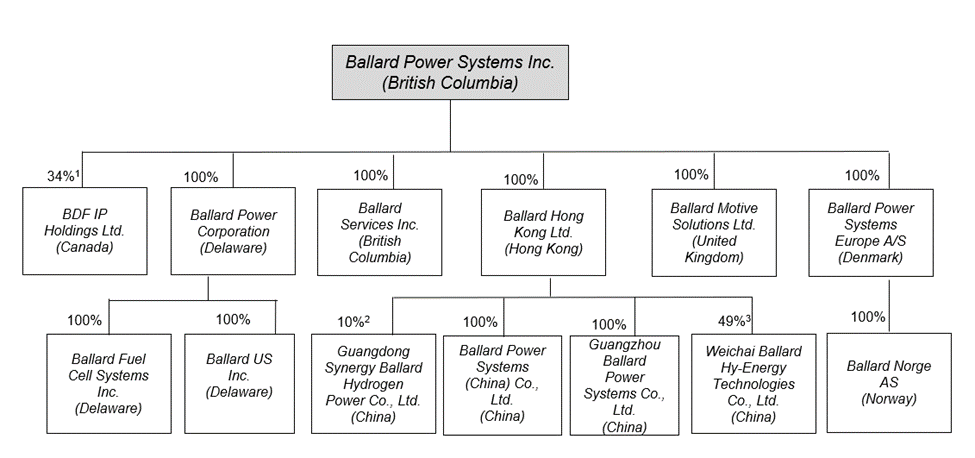

Intercorporate Relationships

We have eleven subsidiaries and affiliates: (i) Ballard Power Corporation, a Delaware corporation that is a holding company; (ii) Ballard Fuel Cell Systems, Inc., a Delaware corporation that does certain development and manufacturing work, and provides certain services to customers; (iii) Ballard US Inc. (formerly Ballard Unmanned Systems Inc.), a Delaware corporation that is a dormant holding company; (iv) Ballard Power Systems Europe A/S (formerly Dantherm Power A/S) (“Ballard Denmark”), a Danish corporation that provides certain sales, assembly, manufacturing, commissioning, research and development, engineering services and after-sales service; (v) Ballard Norge AS, a Norwegian company that provides certain sales and after-sales services; (vi) BDF IP Holdings Ltd., a Canadian corporation that holds certain intellectual property assets; (vii) Ballard Services Inc., a British Columbia company that provides certain engineering services; (viii) Ballard Hong Kong Limited, a holding company

for certain assets in China; (ix) Guangzhou Ballard Power Systems Co., Ltd., a Chinese wholly foreign-owned entity, that provides certain sales, quality, supply chain and after-sales services; (x) Ballard Power Systems (China) Co. Ltd., a Chinese wholly foreign-owned entity that is a holding company; and (xi) Ballard Motive Solutions Ltd. (formerly Arcola Energy Ltd.) (“BMS”), a United Kingdom company which provides certain engineering consulting services relating to fuel cell systems and powertrain integration.

We have a non-controlling 49% interest in Weichai Ballard Hy-Energy Technologies Co., Ltd. (“Weichai-Ballard JV”), located in Weifang, Shandong Province, China, with Weichai Power Co., Ltd. (“Weichai”) holding a 51% interest. The Weichai-Ballard JV’s business is to manufacture Ballard’s FCgen®-LCS fuel cell bipolar plates, stacks and power modules for bus, commercial truck and forklift applications with certain exclusive rights in China.

We also have a non-controlling 10% interest in Guangdong Synergy Ballard Hydrogen Power Co., Ltd. (“Synergy-Ballard JV”), located in Yunfu, Guangdong Province, China, with Sino-Synergy Hydrogen Energy Technology (Jiaxing) Co., Ltd. (previously known as Guangdong Nation Synergy Hydrogen Power Technology Co. Ltd.) (“Sino-Synergy”) holding a 90% interest. The Synergy-Ballard JV’s business is to manufacture fuel cell products utilizing our FCvelocity®-9SSL fuel cell stack technology for use primarily in fuel cell engines assembled and sold in China.

The following chart shows these subsidiaries and affiliates, their respective jurisdictions of incorporation and our percentage of share ownership in each of them, all as of March 16, 2023:

Notes:

1. Ballard holds 100% of the non-voting, participating shares of BDF IP Holdings Ltd. and 34% of the voting, non-participating shares, along with each of Mercedes-Benz AG (33%) and Ford Motor Company (33%).

2. Ballard indirectly holds a 10% interest in Guangdong Synergy Ballard Hydrogen Power Co., Ltd. together with Sino-Synergy Hydrogen Energy Technology (Jiaxing) Co. Ltd. (90%).

3. Ballard indirectly holds a 49% interest in Weichai Ballard Hy-Energy Technologies Co., Ltd. together with Weichai Power Co., Ltd. (51%).

Recent History

Over the past three years, we have continued to focus on building and commercializing our proton exchange membrane (“PEM”) fuel cell business for a variety of mobility and stationary power applications. The following are key developments during that period:

COVID-19 Response

We continue to assess, monitor and deal with the impact of COVID-19 on our business and share information across the Company. We continue to adjust our operations and take actions to protect the health of our employees, customers, suppliers and visitors.

During 2022, we continued to incur COVID-19 administration costs and experienced certain COVID-19 supply chain disruptions. In our Technology Solutions business, there were deferrals of development work on certain of our programs in China as a result of ongoing work, travel and other restrictions related to COVID-19.

We continue to actively monitor the situation and adjust our plans in accordance with governmental orders and legal requirements in each of the markets in which we operate. We may take further actions with respect to production, where required by law or determined by us to be in the best interests of our employees, customers, suppliers or other applicable stakeholders.

Order from First Mode for 30 additional hydrogen fuels for diesel-free mining trucks

On March 1, 2023, we announced a purchase order to supply First Mode with 30 hydrogen fuel cell modules – totaling 3 megawatts – to power several hybrid hydrogen and battery ultra-class mining haul trucks. This is the equivalent of approximately 4,000 horsepower.

The 30 Ballard hydrogen fuel cell modules are to be integrated into clean energy powerplants built in Seattle, Washington and installed into ultra-class haul trucks to be operated at First Mode’s Proving Grounds in Centralia, Washington. These trucks are estimated to save 2,600 tons of diesel fuel each year.

Order from CrossWind for Stationary Power Project

On January 23, 2023, we announced on order for a fuel cell system to CrossWind, a joint venture between Shell and Eneco. The Ballard fuel cell system will be integrated in the Hollandse Kust Noord offshore wind project. The Hollandse Kust Noord offshore wind project, located off the coast of the Netherlands, will have a capacity of 759 MW to generate at least 3.3 TWh per year. Ballard will supply a containerized fuel cell power solution with a peak power capacity of 1 MW, with delivery expected in 2024.

Global manufacturing strategy update including plan to invest $130 million in MEA manufacturing facility and R&D center in Shanghai, China

On September 30, 2022, we announced our strategy ‘local for local’ where we plan to deepen our global manufacturing footprint in Europe, the United States, and China to support expected global market demand growth through 2030. As part of this strategy, we have entered into an investment agreement with the Government of Anting in Shanghai’s Jiading District to establish our new China headquarters, membrane electrode assembly (“MEA”) manufacturing facility, and a research and development (“R&D”) center, at a site strategically located at the Jiading Hydrogen Port, located in one of China’s leading automotive industry clusters.

Ballard plans to invest approximately $130 million over the next three years ($2.1 million was invested in fiscal 2022), which will enable annual production capacity at the new MEA production facility of approximately 13 million MEAs, which will supply approximately 20,000 engines. Ballard expects to be able to achieve significant capacity expansion of this facility in future phases with much lower capital requirements. The facility will also include space to assemble approximately 600 engines annually to support the production and sale of Ballard engines in the rail, marine, off-road and stationary markets in China, as well as for certain export markets.

During 2021, we completed our MEA manufacturing expansion in Canada, which is critical as the MEA is the core technology and limiting factor for Ballard’s global fuel cell engine production capabilities. With the new MEA capacity coming online in China, we now expect our global MEA capacity to support total demand requirements through the second half of the decade.

This investment is expected to reduce MEA manufacturing costs, align with China’s fuel cell value chain localization policy, and position Ballard more strongly in the hydrogen fuel cell demonstration cluster regions and for the post-subsidy market.

The facility is planned to be in operation in 2025 to meet expected market demand in China, including from the Weichai-Ballard JV for the bus, truck and forklift markets, as well as other opportunities in China outside the Weichai-Ballard JV scope and also to support Ballard’s global development requirements.

We also expect to set up an R&D and innovation center at the same site. The center will be focused on MEA research to achieve key corporate technical advancements, support cost reduction initiatives, and engage the emerging China local supply chain for fuel cell materials and components.

We also announced the signing of a non-binding memorandum of understanding with Weichai whereby Weichai plans to make an equity investment for 2% of Ballard’s new MEA manufacturing company.

Ballard signs contract with Stadler to supply fuel cell engines to power first hydrogen train in United States

On September 26, 2022, we announced an order from Stadler Rail AG (“Stadler”), a leading manufacturer of rolling stock, for the supply of six 100 kW FCmoveTM-HD+ fuel cell engines to power the first hydrogen train in the United States.

The contract to provide the hydrogen-powered train was awarded to Stadler by San Bernardino County Transportation Authority (SBCTA), with the option of additional trains in the future. The train is expected to be in service in San Bernardino, California in 2024 and is expected to seat over 100 passengers.

Ballard to power India’s first hydrogen trains

On September 6, 2022, we announced a fuel cell module order from Medha Servo Drives (“Medha”), a leading rail system integrator, who has been contracted by Indian Railways to develop India’s first hydrogen powered trains. The two retrofitted diesel-electric commuter trains will integrate 8 units of 100 kW FCmoveTM-HD+, Ballard’s latest fuel cell technology,

which offers improved efficiency and power density than previous module generations. The contract to provide the hydrogen-powered trains was awarded to Medha as a first step in Indian Railways’ path to achieve their net zero ambitions. The fuel cell modules are expected to be shipped in 2023, with trains scheduled to go into service in 2024, with potential for additional retrofits following the initial deployment.

Ballard partners with Wisdom Motor Company

On May 9, 2022, we announced a strategic collaboration with Wisdom (Fujian) Motor Company Limited (“Wisdom”), Templewater Group (“Templewater”), and Bravo Transport Services Limited (“Bravo”) to accelerate the adoption of commercial fuel cell electric vehicles (“FCEVs”) in Hong Kong.

Templewater, an alternative asset management firm and parent company of Bravo, Hong Kong island’s largest transit operator, together with Ballard, co-invested in a Series A funding for Wisdom, a technology company that designs and manufactures zero emission commercial vehicles. The Series A funds (including Ballard’s $10.0 million, 7% equity ownership contribution in the second quarter of 2022) will support Wisdom’s organizational growth, R&D, and manufacturing platforms, including the expansion and development of its hydrogen zero emission fuel cell truck, bus, and specialty vehicle offerings for international markets.

Wisdom’s hydrogen vehicle product lines are expected to exclusively deploy Ballard’s world leading PEM fuel cell technology, with modules supplied by the Weichai-Ballard JV in China. Ballard intends to enter into a joint development agreement with Wisdom to advance the integration and optimization of its fuel cell electric powertrain designs and control strategies.

Ballard granted Type Approval by DNV for the FCwaveTM marine fuel cell module

On April 6, 2022, we announced the receipt of Europe’s industry first Type Approval by DNV, one of the world’s leading classification and certification bodies, for our marine fuel cell module FCwaveTM. The Type Approval marks an important step in commercializing Ballard’s fuel cell technology for marine applications and is key to including fuel cells as part of zero- emission solutions for the marine industry. The Type Approval process is extensive, involving a series of simulations and tests which were carried out at Ballard’s global Marine Center of Excellence in Hobro, Denmark, where the FCwave™ is developed and manufactured.

The International Maritime Organization has set ambitious targets to cut greenhouse gas (“GHG”) emissions from ships by at least 50% by 2050. The high-power FCwaveTM module is a flexible solution that can support the energy needs of various vessel types as well as onshore power. The scalable 200kW power module offers a plug-and-play replacement for conventional diesel engines. The Type Approval certification confirms the design meets certain safety, functional, design and documentation requirements necessary for global marine commercialization.

Project with Adani for Hydrogen Fuel Cells in India

On February 22, 2022, we announced the signing of a non-binding Memorandum of Understanding (“MOU”) with the Adani Group (“Adani Group”) to evaluate a joint investment case for the commercialization of fuel cells in various mobility and industrial applications in India.

On January 17, 2023, we announced the signing of an agreement to launch a pilot project to develop a hydrogen fuel cell electric truck (“FCET”) for mining logistics and transportation with Adani Enterprises Limited (“AEL”), part of the diversified Adani portfolio of companies, and Ashok Leyland.

This collaboration marks Asia’s first planned hydrogen powered mining truck. The demonstration project will be led by AEL, a company focused on both mining operations and developing green hydrogen projects for sourcing, transporting, and building out hydrogen refueling infrastructure. Ballard, an industry leading PEM fuel cell engine manufacturer, will supply the FCmoveTM fuel cell engine for the hydrogen truck and Ashok Leyland, one of the largest manufacturers of buses in the world, will provide the vehicle platform and technical support. The FCET is scheduled to be launched in India in 2023.

Ballard fuel cells installed onboard the world’s first liquid hydrogen-powered ferry

On February 2, 2022, we announced the delivery of two, 200 kilowatt (kW) FCwaveTM modules to Norled A/S, one of Norway’s largest ferry and express boat operators. The fuel cell modules are intended to power the world’s first liquid hydrogen-powered ferry, the MF Hydra.

Orders for 31 fuel cell engines to a leading global construction, electric power & off-road equipment manufacturer

On January 13, 2022, we announced orders for 31 modules, totaling 3 MW of hydrogen fuel cell power, to a leading global construction, electric power, and off-road equipment manufacturer for testing and deployment in a variety of end-use applications. The modules are expected to be delivered in 2022 and 2023 to match planned integration, testing, and deployment schedules.

Acquisition of Arcola

On November 11, 2021, we announced the acquisition of Arcola Energy Ltd. (“Arcola”) (now BMS), a UK-based systems engineering company with approximately 90 employees, specializing in hydrogen fuel cell powertrain and vehicle systems integration. Ballard acquired Arcola for total consideration of up to US$40 million, including 337,353 Ballard shares (with an approximate valuation of US$6 million at acquisition) that vest over two years, and up to US$34 million in upfront and earn-out cash consideration based on the achievement of certain performance conditions over a two-year period.

During the fourth quarter of 2022, we completed a post-acquisition restructuring of the operations at BMS and recognized impairment charges on intangible assets of approximately $13 million and restructuring related operating expenses of approximately $5 million which included contract exit and modification costs, grant adjustment charges, personnel change costs, and legal and advisory costs, net of expected recoveries. Pursuant to this restructuring of operations, it was agreed to reduce the earn-out consideration by approximately $10 million which resulted in a corresponding recovery on settlement of contingent consideration payable.

Infrastructure Funds

In 2021, we invested in two hydrogen infrastructure and growth equity funds whereby we acquired a 12% interest in the HyCap Fund I SCSP (“HyCap”), a special limited partnership

registered in Luxembourg; and a 1% interest in the Clean H2 Infra Fund (“Clean H2”), a special limited partnership registered in France.

HyCap is a newly created hydrogen infrastructure and growth equity fund. HyCap is to invest in a combination of hydrogen infrastructure projects and investments in companies along the hydrogen value chain. We have committed to investing £25.0 million (including £7.2 million invested as of December 31, 2022) into HyCap.

Clean H2 is another newly created hydrogen infrastructure and growth equity fund. Clean H2 is to invest in a combination of hydrogen infrastructure projects and investments in companies along the hydrogen value chain. We have committed to investing €30.0 million (including €1.0 million invested as of December 31, 2022) into Clean H2.

Ballard and Forsee Power SA (“Forsee Power”) enter Long-Term Strategic Partnership to Develop & Commercialize Integrated Fuel Cell and Battery Solutions for Heavy-Duty Hydrogen Mobility

On October 18, 2021, we announced the signing of an MOU for a strategic partnership with Forsee Power to develop fully integrated fuel cell and battery solutions, optimized for performance, cost and installation for heavy-duty hydrogen mobility applications. Ballard will supply the fuel cell system and related controls, and Forsee Power will supply the battery system and related battery management system, cooling system and high voltage DC/DC conversion system. The parties will jointly develop the software EMS to optimize the hybrid fuel cell and battery system architecture.

As part of the strategic relationship, in October 2021 Ballard participated as a cornerstone lead investor in Forsee Power’s initial public offering on Euronext in Paris, France. We made a contribution of €37.7 million (approximately $43.8 million), resulting in an ownership interest of 9.77% in Forsee Power. In connection with our investment, Ballard has the right to appoint a nominee to the Forsee Power board of directors. Ballard appointed a nominee effective as of the closing of the initial public offering.

The MOU was superseded by a Collaboration Agreement between the parties, dated December 14, 2022, pursuant to which the parties agreed to jointly approach new and existing customers with an integrated fuel cell and battery solution, integrate fuel cell and battery systems with software, develop and specific power electronics components for the integrated fuel cell and battery solution, and develop the integrated fuel cell and battery into a turn-key solution for customers.

Ballard and Quantron AG Announce a Strategic Partnership for the Development of Hydrogen Fuel Cell Electric Trucks

On September 7, 2021, we announced a strategic partnership with Quantron AG (“Quantron”) expected to accelerate deployment and market adoption of fuel cell technologies. Initial collaboration will focus on the integration of Ballard’s FCmove™ family of heavy-duty fuel cell power modules into Quantron’s electric drivetrain and vehicles.

On September 19, 2022, we announced a minority equity investment in Quantron. As part of Quantron’s financing round of up to 50 million Euros, Ballard’s investment proceeds (5 million Euros was contributed in the fourth quarter of 2022, resulting in an ownership interest of

1.89% in Quantron) are to be used by Quantron to develop their truck fuel cell vehicle platforms, under the terms of a Joint Development Agreement. Ballard is to be the exclusive fuel cell supplier to Quantron for these platforms.

In connection with our investment, Ballard has the right to appoint (and has appointed) a nominee to the Quantron AG board of directors.

As part of the strategic partnership, Quantron committed to purchase 140 FCmove™ modules totaling approximately 17MW, with an option to purchase an additional 50 units. The fuel cell modules are expected to be delivered in 2023 and 2024. Subsequent to the initial order, Quantron committed to purchase an additional 72 FCmove™ modules totaling approximately 3MW for delivery in 2023 and 2024. The zero-emission fuel cell electric vehicle platforms developed by Quantron are to integrate Ballard fuel cell products for various truck applications in Europe and the US.

Ballard and Linamar Form Strategic Alliance to Develop Fuel Cell Solutions for Light-Duty Vehicles

On May 3, 2021, we announced the formation of a strategic alliance with Linamar Corporation (“Linamar”) for the co-development and sale of fuel cell powertrains and components for class 1 and 2 vehicles, weighing up to 5 tons, initially in North America and Europe.

On May 9, 2022, Ballard announced with Linamar the unveiling of its concept hydrogen fuel cell powered class 2 truck chassis. The technology demonstration platform was showcased at the ACT Expo displayed in a RAM 2500 truck chassis. Testing on the new platform is underway and will continue in 2023.

Ballard Fuel Cells to Power CP Hydrogen Locomotive Program

On March 9, 2021, we announced that Canadian Pacific (“CP”) will employ Ballard fuel cell modules for CP’s pioneering Hydrogen Locomotive Program to develop North America’s first hydrogen-powered line-haul freight locomotive by retrofitting a formerly diesel-powered locomotive with Ballard’s 200 kW hydrogen fuel cell modules.

On January 19, 2022, we announced receipt of an order for six of an additional eight fuel cell modules to support CP’s expansion of the Hydrogen Locomotive Program. In total, Ballard will provide a total of 14 fuel cell modules, each module with a rated power output of 200 kW, to support this program.

Orders for Fuel Cell Modules to Power Buses

On November 4, 2021, we announced orders for a total of 40 FCmoveTM-HD (70kW) modules for planned deployment in hydrogen fuel cell electric buses (“FCEBs”) across Europe in 2022. As of March 2023, the announced FCmoveTM-HD sales have been deployed in FCEBs across Europe.

On June 22, 2021, we announced a follow-on purchase order from New Flyer for 20 fuel cell modules to power 20 New Flyer Xcelsior® model FCEBs, planned for deployment with Alameda-Contra Costa Transit District (AC Transit) in Oakland, California.

On March 9, 2021, we announced follow-on purchase orders from Wrightbus for a total of 50 fuel cell modules to power FCEBs planned for deployment in a number of UK cities.

February 2021 Bought Deal Offering of Common Shares

On February 23, 2021, we announced the closing of a bought deal offering of 14,870,000 common shares of Ballard at a price of $37.00 per common share for gross proceeds of $550,190,000.

November 2020 Bought Deal Offering of Common Shares

On November 27, 2020, we announced the closing of a bought deal offering of 20,909,300 common shares of Ballard at a price of $19.25 per common share for gross proceeds of $402,504,025. The bought deal offering included the exercise in full by the underwriters of their over-allotment option to purchase up to an additional 2,727,300 common shares at the offering price.

Ballard and AUDI Sign Agreements Regarding Use of the High-Power Density Fuel Cell Stack for Vehicle Propulsion

As part of the planned completion of the AUDI program, on October 29, 2020, we announced that we had signed definitive agreements – in the form of an amendment to the existing Technology Development Agreement and a Patent License Agreement – with AUDI AG (“AUDI”) expanding Ballard’s right to use the FCgen®-HPS product, a high-performance, zero-emission, PEM fuel cell stack in all applications, including commercial trucks and passenger cars. The amendments allowed AUDI to reduce the size of the remaining Technology Solutions program to the lower end of the range previously disclosed, and in return Ballard acquired expanded rights to use the FCgen®-HPS product, subject to certain royalty obligations.

The FCgen®-HPS fuel cell stack provides propulsion for a range of Light-, Medium- and Heavy-Duty vehicles with a high volumetric power density of 4.3 kilowatts per liter (4.3 kW/L). This marks another power density milestone for Ballard over our decades of PEM fuel cell product innovation. The FCgen®-HPS was fully designed and developed by Ballard to stringent automotive standards in the company’s Technology Solutions program with AUDI.

Ballard Sells UAV Business to Honeywell

On October 15, 2020, we announced that we had sold our Unmanned Aerial Vehicle (“UAV”) business assets of Ballard Unmanned Systems Inc. to Honeywell International Inc. (“Honeywell”). All employees of Ballard Unmanned Systems Inc. transitioned to Honeywell Aerospace on the closing. In 2022, Ballard Unmanned Systems Inc. changed its name to Ballard US Inc., which is now a dormant holding company.

Ballard and MAHLE to Collaborate on Fuel Cell Propulsion Systems for Heavy- and Medium-Duty Trucks

On September 28, 2020, we announced an agreement to collaborate with MAHLE International GmbH (“MAHLE”), a leading international development partner and Tier 1 supplier to the commercial vehicle and automotive industry, on the development and commercialization of zero-emission fuel cell systems to provide primary propulsion power in

various classes of commercial trucks. The definitive agreement defining the collaboration was entered in October 2020.

During the initial development phase, Ballard has prime responsibility for system design and the fuel cell stack sub-system, while MAHLE’s scope of responsibility includes balance-of-plant components, thermal management and power electronics for the complete fuel cell system, as well as system assembly.

Solaris Bus & Coach S.A. Orders

On April 27, 2020, we announced a purchase order from Solaris Bus & Coach S.A. (“Solaris”), a leading European bus and trolleybus manufacturer headquartered in Bolechowo, Poland, for 20 of Ballard’s new 70 kW heavy-duty FCmove™-HD fuel cell modules. These modules will power 20 Solaris Urbino 12 hydrogen buses planned for deployment The Netherlands, under the Joint Initiative For Hydrogen Vehicles Across Europe (“JIVE 2”) funding program. The buses will be operated by Connexxion, which provides transport services for South Holland province.

On March 12, 2020, we announced a purchase order from Solaris for 25 70 kW heavy-duty FCmove™-HD fuel cell modules. These 25 modules will power 15 Solaris Urbino 12 hydrogen buses planned for deployment in Cologne, Germany and 10 Urbino 12 hydrogen buses planned for deployment in Wuppertal, Germany, all under the JIVE 2 funding program.

On November 17, 2022 we announced another purchase order from Solaris for a further 25 70 kW heavy-duty FCmove™-HD fuel cell modules. These modules will be installed in Solaris’ Urbino 12 hydrogen buses for deployment to Polish public transport operator MPK Poznań and are expected to be delivered in the second half of 2023. The buses are to be partially funded by the National Fund for Environmental Protection and Water Management’s Green Public Transport program. MPK Poznań requires 30% of its fleet to be zero-emission by 2028. These 25 hydrogen fuel cell buses will increase its zero-emission fleet from 18% to 25%.

At-The-Market Equity Distributions

On March 10, 2020, we entered into an at-the-market Equity Distribution Agreement (the “March EDA”) with BMO Capital Markets Corp. (“BMO US”) as lead agent and CIBC World Markets Corp. (“CIBC US”), Cormark Securities Inc. (“Cormark US), and TD Securities (USA) LLC (“TD US”) (together with BMO, the “March Agents”), thereby establishing an at-the-market equity program (the “March ATM Program”).

The Company issued $66,673,000 of common shares under the March ATM Program for net proceeds of $64,867,000. The common shares were issued from treasury to the public in March and April 2020. Shares issued in April resulted from transactions initiated in the last days of March that were settled in April 2020.

The common shares sold under the March ATM Program were sold at the prevailing market price at the time of sale, when sold through the Nasdaq stock exchange (“Nasdaq”) or any other existing trading market for the Common Shares in the United States.

On September 1, 2020, we entered into an at-the-market Equity Distribution Agreement (the “September EDA”) with BMO Nesbitt Burns Inc., Raymond James Ltd. and TD Securities Inc., as lead Canadian agents, and CIBC World Markets Inc., Cormark Securities Inc., National

Bank Financial Inc. (collectively, the “Canadian Agents”), and BMO US, Raymond James & Associates, Inc. and TD US, as lead US agents, and CIBC US, H.C. Wainwright & Co., LLC, Cormark Securities (USA) Limited, Lake Street Capital Markets, LLC, National Bank of Canada Financial Inc., and Roth Capital Partners (collectively, the “US Agents” and together with the Canadian Agents, the “September Agents”), thereby establishing an at-the-market equity program (the “September ATM Program”).

The Company issued $250 million of common shares under the September ATM Program for net proceeds of approximately $245 million. The common shares were issued from treasury to the public in September and October 2020. Shares issued in October resulted from transactions initiated in the last days of September that were settled in October 2020.

The common shares sold under the September ATM Program were sold at the prevailing market price at the time of sale, when sold through the Toronto Stock Exchange (the “TSX”), Nasdaq, or other existing trading markets for the Common Shares in Canada and the United States.

Under the March EDA and September EDA, sales of common shares were made through “at-the-market distributions” as defined in National Instrument 44-102 – Shelf Distributions.

Ballard paid the March Agents and September Agents a commission rate of 2.0% of the aggregate gross proceeds from each sale of common shares under the March EDA and the September EDA, respectively, and provided the March Agents and September Agents with customary indemnification and contribution rights. Ballard reimbursed the March Agents and September Agents for certain specified expenses in connection with entering into the March EDA and September EDA, respectively.

Ballard and HDF Energy Sign Development Agreement for Multi-Megawatt Fuel Cell Systems

On December 9, 2019, we signed a Product Development Agreement with Hydrogène de France (“HDF Energy”) for the development and integration of a multi-megawatt (“MW”) scale PEM fuel cell system into HDF Energy’s Renewstable® power plant designed for stationary power applications.

HDF Energy’s Renewstable® power plant is a multi-MW baseload system enabling large-scale storage of intermittent renewable wind or solar energy in the form of hydrogen – through the process of electrolysis – as well as electricity generation using that hydrogen feedstock together with a fuel cell system.

Subject to certain conditions, the collaboration contemplates a future technology transfer of Ballard’s new MW-scale containerized PEM fuel cell system to HDF Energy with an exclusive royalty-bearing, non-transferable, multi-year global license for the manufacture and sale of MW-scale fuel cell systems for Renewstable® power plant systems. The collaboration also contemplates Ballard supplying FCgen®-LCS fuel cell stacks for these systems based on an exclusive long-term supply agreement.

The initial HDF Energy project is an installation planned in French Guiana, an overseas region of France located off the northern Atlantic coast of South America, under the Centrale Electricité de l’Ouest Guyanais (“CEOG”) project.

The transaction remains subject to completion of definitive agreements and is reliant in part on the CEOG project, which is subject to customary conditions for multi-year programs of this scope, including but not limited to permitting and regulatory approvals, financings and project execution activities.

Strategic Collaboration with Weichai

On November 13, 2018, we closed a strategic collaboration transaction with Weichai. The strategic collaboration included an equity investment by Weichai in Ballard, formation of a joint venture company and a development program.

Weichai and Ballard established the Weichai-Ballard JV on November 26, 2018 in Shandong Province to support China’s fuel cell electric vehicle market. Ballard holds a 49% ownership position and Weichai holds a 51% ownership position. Weichai holds three of five Weichai-Ballard JV board seats and Ballard holds two, with Ballard having certain minority shareholder protections.

The Weichai-Ballard JV develops and manufactures fuel cell modules and components including Ballard’s LCS bipolar plates, fuel cell stacks and FCgen®-LCS-based power modules for bus, commercial truck, and forklift applications with exclusive rights (subject to certain conditions) in China and is to pay Ballard a total of $90 million under a Research and Development Agreement to develop and transfer technology to Weichai-Ballard JV in order to enable these manufacturing activities. Ballard retains an exclusive right to the developed technologies outside China, subject to certain restrictions on sublicensing outside China. The Weichai-Ballard JV will also purchase MEAs for FCgen®-LCS fuel cell stacks exclusively from Ballard under a long-term supply agreement.

The Weichai-Ballard JV operation, located in Weifang, Shandong Province, China, has commenced production activities of LCS bipolar plates, LCS fuel cell stacks and LCS-based modules to power bus and truck FCEVs for the China market. After recent production automation projects, the Weichai-Ballard JV is expected to have annual production capacity of 40,000 fuel cell stacks which equates to approximately 20,000 engines.

Ballard and AUDI Sign Extension to Long-Term Program for Fuel Cell Passenger Cars

On June 11, 2018, we announced that we had signed a 3.5-year extension to our current Technology Solutions contract with AUDI, part of the Volkswagen Group, extending the HyMotion program. The amendment to the Technology Development Agreement entered into in October 2020 (and discussed above) allowed AUDI to reduce the size of the remaining Technology Solutions program to the lower end of the range previously disclosed, and in return Ballard acquired expanded rights to use the FCgen®-HPS product, subject to certain royalty obligations. This program has now been completed.

Ballard Receives Orders to Power Siemens Mireo Plus H Passenger Trains and signs LOI for up to an additional 200 modules over the next six years

On July 15, 2021, we announced a purchase order for two of our 200 kW fuel cell modules from Siemens Mobility GmbH to power a 2-car Mireo Plus H passenger train through a trial operation in Bavaria, Germany.

On September 22, 2022, we announced an order for 14 x 200 kW fuel cell modules from Siemens Mobility GmbH, to power a fleet of seven Mireo Plus H passenger trains. Delivery of the 14 fuel cell modules is expected to start in 2023 with the fleet planned to be in service in Berlin-Brandenburg region in late 2024.

In addition to the initial order of 14 fuel cell modules, Siemens Mobility also signed a letter of intent with Ballard for the supply of 200 fuel cell modules totaling 40 MW over the next six years, including a firm commitment on 100 of the fuel cell modules totaling 20MW. The modules will be used for Siemen’s Mireo Plus H trains.

OUR BUSINESS

At Ballard, our vision is to deliver fuel cell power for a sustainable planet. We are recognized as a world leader in PEM fuel cell and power system development and commercialization.

Our principal business is the design, development, manufacture, sale and service of PEM fuel cell products for a variety of applications, focusing on our power product markets of Heavy-Duty Motive (consisting of bus, truck, rail and marine applications), Material Handling, and Stationary Power Generation, as well as the delivery of Technology Solutions, including engineering services, product and systems integration services, and related technology transfer for a variety of PEM fuel cell applications. With the acquisition of Arcola (now BMS) in 2021, Ballard now offers hydrogen fuel cell powertrain integration solutions.

A fuel cell is an environmentally clean electrochemical device that combines hydrogen fuel with oxygen (from the air) to produce electricity. The hydrogen fuel can be obtained from natural gas, kerosene, methanol or other hydrocarbon fuels, or from water through electrolysis. Ballard’s PEM fuel cell products feature high fuel efficiency, low operating temperature, low noise and vibration, compact size, quick response to changes in electrical demand and modular design. Embedded in each Ballard PEM fuel cell product lies a stack of unit cells designed with Ballard’s proprietary technology, which include membrane electrode assemblies, catalysts, plates, and other key components, and which draw on intellectual property from our patent portfolio together with our extensive experience and know-how, in key areas of PEM fuel cell stack design, operation, production processes and system integration.

Strategy

We strive to build value for our shareholders by developing, manufacturing, selling and servicing zero-emission, industry-leading PEM fuel cell technology products and services to meet the needs of our customers in select target markets. More specifically, our business plan is to leverage our core competencies of PEM fuel cell stack technology and engine development and manufacturing, our investments in advanced manufacturing and production capacity, and our product portfolio by marketing our products and services across select large and attractive addressable market applications and select geographic regions.

We typically select our target market applications based on use cases where the comparative user value proposition for PEM fuel cells powered by hydrogen are strongest – such as where operators value low emission vehicles that require high utilization, long driving range, heavy payload, fast refueling, and similar user experiences to legacy diesel vehicles – and where

the barriers to entry for hydrogen refueling infrastructure are lowest – such as use cases where fuel cell vehicles typically return to a depot or hydrogen hub for centralized refueling and don’t require a distributed hydrogen refueling network. Our current target markets include certain medium- and heavy-duty mobility applications of bus, truck, rail and marine, along with certain off-road mobility and stationary power applications.

We select our target geographic markets based on a variety of factors, including addressable market sizes of the target market applications in the geographic markets, historic deployments and expected market adoption rates for hydrogen and fuel cells, supportive government policies, existing and potential partner, customer, and end user relationships, and competitive dynamics. Our current target markets are the geographic regions of China, Europe, and North America.

While we recognize addressing multiple market applications and geographic markets in parallel increases our near-term cost structure and investments, we believe offering the same core PEM fuel cell technologies and substantially similar derivative PEM fuel cell products across multiple mobility and power market applications and select geographic regions will significantly expand and strengthen our long-term business prospects by increasing volume scaling in our operations, enabling lower product and production costs for the benefit of all markets, improving our competitive positioning and market share, enabling richly diversified revenue streams and profit pools, and improving our return on investment in our technology and product development programs and our investments in manufacturing.

Our strategy is built on 5 key themes:

1.Double down in fuel cell stack & module: invest in leading technology and products to provide leading value to our customers and end users based on a total cost of ownership basis.

2.Selectively expand across value chain: extend across the value chain to capture control points, reduce technology adoption barriers, simplify, and optimize our customer offering, and accelerate fuel cell deployments.

3.Develop new routes to market: creatively explore partnerships and demonstration programs to accelerate hydrogen and fuel cell market adoption and grow volume for product sales.

4.Win in key regions: build a competitive platform in each of North America, Europe and China.

5.Here for Life: deliver a compelling environmental, social and governance (“ESG” proposition for our stakeholders

In 2020 and 2021, we materially strengthened our financial position through equity financings, thereby providing additional flexibility to fund our growth strategy. Following these financings, given strong indicators of long-term market adoption of hydrogen and zero-emission mobility, given growing customer interest in our fuel cell products, given a growing opportunity set, and given an increasingly competitive environment, we strategically decided to significantly increase and accelerate our investments ahead of the adoption curve, including investments in our 5 key themes. As a result, we have increased and accelerated our investments in technology and product innovation, production capacity expansion and localization, strategic pricing for

select customer demonstration programs, customer experience, and corporate development investments. Our increased investments include significant investment in next generation products and technology, including our proprietary MEAs, bipolar plates, stacks, modules, and powertrain systems integration, including our acquisition of BMS; advanced manufacturing processes, technologies, equipment, and production localization activities in China, Europe, and the United States; and technology and product cost reduction.

Revenues from Market Segments

We report our results in the single operating segment of Fuel Cell Products and Services. Our Fuel Cell Products and Services segment consists of the sale and service of PEM fuel cell products for our power product markets of Heavy-Duty Motive (consisting of bus, truck, rail and marine applications), Material Handling and Stationary Power Generation, as well as the delivery of Technology Solutions, including engineering services, technology transfer and the license and sale of our extensive intellectual property portfolio and fundamental knowledge for a variety of fuel cell applications.

The results of BMS are included in our Technology Solutions and Heavy Duty Motive markets. For 2023, we anticipate reclassifying the results of our Fuel Cell Products and Services operating segment into certain power product market applications as well as the delivery of services.

The following chart shows the percentage of total revenues which arises from sales to investees and sales of products and services to other customers, for the years 2022 and 2021: | | | | | | | | |

| 2022 | 2021 |

Revenues from Fuel Cell Products and Services | | |

Percentage of total revenues | 100% | 100% |

Portion representing sales to investees (1) | 10.0% | 37.0% |

Portion representing sales to customers other than investees | 90.0% | 63.0% |

Notes:

1. In this table, “investees” means Guangdong Synergy Ballard Hydrogen Power Co., Ltd., a joint venture formed in China of which we hold a 10% equity interest and Weichai Ballard Hy-Energy Technologies Co., Ltd., a joint venture formed in China, of which we hold a 49% equity interest.

Our Markets, Products and Services

Product & Service Overview

Ballard’s product offering provides for a cost effective and flexible set of fuel cell power solutions. Ballard provides products in five distinct product classes:

1.MEAs: We provide our proprietary MEAs to the Synergy-Ballard JV and the Weichai-Ballard JV that use the MEAs to produce our proprietary FCveloCity®-9SSL fuel cell stacks and FCgen®-LCS fuel cell stacks, respectively.

2.Fuel cell stacks: We provide our proprietary FCgen® and FCveloCity® fuel cell stacks to

OEM customers and system integrators that use the stacks to produce fuel cell systems for power solutions. As the fuel cell stack provider, we are the power inside the system.

3.Fuel cell modules: We design and build, including specifying and procuring balance of plant components, self-contained FCveloCity® and FCmoveTM motive modules using our fuel cell stacks that are plug-and-play into commercial vehicle powertrains. We also design and build self-contained FCwave™ modules designed for marine applications and FCrail™ for rail applications. As a fuel cell module provider, we make it easier for OEMs and system integrators to create fuel cell powertrains.

4.Fuel cell systems: We also build complete fuel cell systems, FCgen®-H2PM and CleargenTM products, for stationary power markets that are designed to solve certain power needs of our customers, including back-up for critical infrastructure and MW distributed power generation.

5.Energy system and powertrain integration: We provide complete energy system (fuel cell + battery + controller + high and low voltage distribution), powertrain design and integration services, and vehicle integration services, to support our customer fuel cell vehicle development programs.

6.Technology Solutions: We offer engineering services to our customers for special fuel cell product development.

7.After Sales Services: We offer our customers after sales services including in and out of warranty support, service contracts, spare part management, fleet monitoring and training.

The following table lists the key fuel cell and non-fuel cell products we currently produce, offer for sale, have under development or are testing:

| | | | | | | | |

Motive Power Product Family: |

Product Name | Application | Status |

FCgen®-LCS MEA | Fuel cell stacks for buses, commercial vehicles, light rail, and material handling | Sales to licensee (Weichai-Ballard JV) |

FCveloCity®-9SSL MEA | Fuel cell stacks for buses, commercial vehicles, light rail, and material handling | Sales to licensee (Synergy-Ballard JV) |

FCgen®-HPS stacks | Light-duty and heavy-duty commercial vehicles and passenger car | Sales to OEMs and system integrators |

FCgen®-LCS stacks | Buses, commercial vehicles, light rail, and material handling | Sales to OEMs and system integrators |

FCveloCity®-9SSL stacks | Buses, commercial vehicles, light rail, and material handling | Sales to OEMs and system integrators |

FCgen®-1020ACS stacks | Material handling and backup power | Sales to OEMs and system integrators |

FCveloCity® modules | Buses, commercial vehicles, and light rail | Sales to OEMs and system integrators |

FCmove™ modules | Buses, commercial vehicles, and light rail (legacy product range) | Sales to OEMs and system integrators |

FCwave™ modules | Marine, rail (freight locomotives) and stationary | Sales to OEMs and system integrators |

| FCrail™ | Passenger rail application | Sales to OEMs and system integrators |

| Energy system controller and powertrain integration services | Energy system for bus and truck | Sales to demonstration projects in the UK and engineering services globally |

| | | | | | | | |

Stationary Power Product Family: |

Product Name | Application | Status |

FCgen®-1020ACS | Backup power | Sales to OEMs and system integrators |

FCgen®-H2PM | Backup power systems | Sales to customers |

ClearGen® | Distributed generation systems | Sales to customers and Integrators |

| FCgen®-200 | Power generation | Sales to customers |

Fuel Cell Products and Services

Power Products Markets

Heavy-Duty Motive

We provide fuel cell modules for public transit systems, including buses and light rail, and for commercial trucks. Fuel cell electric vehicles in these applications rely on centralized

fueling depots that simplify the hydrogen infrastructure requirements and are typically government-subsidized, thus enabling the purchase of pre-commercial fleets.

We design and manufacture the fuel cell module products capable of delivering 50 kW to 200 kW of power for use in the Heavy-Duty Motive market. We supply the fuel cell modules to hybrid drive, bus, truck, light rail and marine propulsion system OEMs and integrators that deliver zero-emission fuel cell-powered vehicles to fleet operators. The demand for zero-emission vehicles is driven in many jurisdictions by the requirement to reduce greenhouse gases and other harmful emissions.

The FCveloCity® power module platform, which was initially launched in 2015, is available in various configurations ranging in power from 50 kW to 100 kW to address different levels of battery/fuel cell hybridization and a variety of applications. In 2022, sales of the FCveloCity®-HD module were limited to some of our existing customers mainly for fuel cell electric bus applications.

In 2019, we launched our eighth-generation high-performance fuel cell module, the FCmove™-HD. The FCmove™ family of products is designed to power medium- and heavy-duty commercial vehicles such as buses and trucks. The FCmove™-HD 70kW version is being delivered to customers in China and Europe and has been integrated in vehicles. The FCmove™-HD+ 100kW version was launched in 2021 and we are starting delivery of the first modules to customers for integration into their new vehicle platforms. We presented at IAA Show in September 2022 the concept unit for FCmoveTM-XD (120/240kW) product which is being developed for heavy duty trucks (>19t and class 6-8).

In 2020, we introduced the FCwaveTM, a fuel cell module designed for certain marine applications. The FCwaveTM fuel cell module is a 200 kW modular unit that can be scaled in series up to the multi-megawatt (MW) power level. The FCwaveTM product provides primary propulsion power for marine vessels – such as passenger and car ferries, river push boats, and fishing boats – as well as stationary electrical power to support hotel and auxiliary loads on cruise ships and other vessels while docked at port (also known as ‘cold ironing’). In 2021, we also started to sell FCwave™ products for stationary and rail applications.

Supported by Technology Solution program, we have developed for Siemens Mobility the 200kW FCrail™ product which has been integrated in the new Mireo Plus H2 regional passenger train.

By the end of 2022, fuel cell electric vehicles in commercial heavy-duty and medium-duty motive applications powered by Ballard technology surpassed an estimated total of 150 million kilometers.

Competition

Diesel-powered buses and commercial trucks currently dominate the market today. Compressed natural gas (“CNG”) and diesel electric hybrid powertrains are lower-emission alternatives to diesel engines but are in limited service today. Other variants available today include gasoline hybrid buses and CNG hybrid buses. Electric trolley buses provide a zero-emission alternative; however, their purchase price is high and the overhead catenary power infrastructure is expensive to maintain and is considered aesthetically undesirable in many urban

centres. The recent developments in battery-powered powertrain vehicles have created a zero-emission alternative to fuel cell buses in the form of battery electric buses and commercial trucks, as well as electrified trains and battery-powered marine vessels. These battery-powered heavy-duty vehicles will continue to offer a competitive zero emission mobility solution for zero-emission mobility applications.

We believe that fuel cell electric vehicles are the best zero-emission alternative for medium-duty and heavy-duty applications in certain use cases in bus, truck, train and marine. In comparison to battery electric vehicles, we believe fuel cell electric vehicles in medium-duty and heavy-duty applications: are able to operate over a longer range and on more demanding routes; offer higher energy density to maximize payload; and are capable of refueling quickly, ensuring the vehicle is on the road generating revenue for the fleet operator. We also believe that in certain cases hydrogen refueling infrastructure has certain scaling cost and logistics advantages compared to battery recharging for large fleets.

Companies developing fuel cell systems for heavy-duty applications include Beijing Sinohytec Co. Ltd., cellcentric GmbH & Co. KG (a joint venture of Daimler Truck AG and the Volvo Group), Cummins Inc., EKPO Fuel Cell Technologies GmbH (a joint venture of ElringKlinger and Plastic Omnium), Hyzon Fuel Cell Technologies Pte. Ltd., Hyundai Motor Company, Nikola Motor Company, Plug Power, Inc. (“Plug Power”), Powercell Sweden AB, Robert Bosch GmbH, Shanghai Re-Fire Technology Co., Ltd., Symbio SAS (a joint venture of Michelin and Faurecia), Toyota Motor Corporation and Loop Energy Inc.

We are also seeing the emergence of product offerings for hydrogen internal combustion engines developed by companies like Cummins Inc. and J C Bamford Excavators Ltd. This technology is seen as a bridge between internal combustion engines and hydrogen mobility. Through modification of existing diesel engines, it allows the use of hydrogen as a fuel leading to CO2 emission reduction. However, the fact it does not meet zero emission requirements (NOx emissions) and lower efficiency compared to fuel cells (-15%) will likely be a serious handicap for long term viability.

We believe that we are well positioned to compete with our competitors based on our talented workforce, intellectual property portfolio, technology, number of product offerings, manufacturing capabilities, vertical integration, customers, partners, brand, financial strength, and extensive operating hours in real world heavy-duty operations.

Material Handling

The material handling market includes industrial vehicles such as forklifts, automated guided vehicles and ground support equipment. Our initial focus is on battery-powered Class 1 counterbalance lift trucks, Class 2 reach trucks and Class 3 pallet forklifts. Our products for the material handling market are the FCveloCity®-9SSL stack, which is applicable to Class 1, Class 2 and Class 3 forklift truck solutions, the FCveloCity®-1020ACS stack for Class 3 material handling applications, and the FCgen®-LCS stack which is expected to be applicable to Class 1, Class 2 and Class 3 forklift truck solutions.

Ballard is currently supplying fuel cell stacks to a limited number of system integrators in North America and Europe.

Competition

Class 2 and Class 3 forklift trucks are currently dominated by battery-powered solutions, as are Class 1 forklift trucks intended for indoor applications. Internal combustion engine power is typically seen as the solution for forklift trucks in Class 1 for outdoor applications. Compared to batteries, fuel cell systems in Class 1, Class 2 and Class 3 forklift trucks can provide extended run time without frequent and lengthy battery replacement and recharging cycles. For high-throughput, multi-shift warehouse or manufacturing operations, fuel cell powered forklift trucks can provide a lower life-cycle cost when compared with battery solutions.

Plug Power is the only company currently offering a full suite of Class 1, 2 and 3 forklift solutions to the material handling market. We currently sell and supply fuel cell stacks to Plug Power on a limited basis. Plug Power has developed its own air-cooled and liquid-cooled fuel cell stacks to vertically integrate into their material handling solutions. Plug Power’s own fuel cell stacks compete with our fuel cell stacks for supply in Plug Power’s business. Ballard is also engaged with other companies to increase potential sales beyond Plug Power for the forklift market.

Other companies developing fuel cell systems for material handling applications include certain systems integrators, like Infintium, and certain forklift manufacturers, like Hyster-Yale, KION, and Toyota.

Advanced battery technology continues to make progress in the material handling market. However, the high up-front cost of advanced batteries continues to be a barrier to broad market adoption. Furthermore, advanced battery technologies still require significant time for recharging and, in many cases, cannot meet desired run times without requiring spare batteries and substantial space for battery charging and storage.

Stationary Power Generation

PEM fuel cell systems have market opportunities for zero emission power generation applications requiring intermittent power generation with fast response such as backup power of critical infrastructure, peak shaving, hybrid renewable off-grid sites and electric charging applications such as shore power.

The backup power market includes stationary applications for telecommunications equipment and other critical infrastructure such as data centers. We also sell fuel cell stacks to certain companies developing PEM fuel cell-based backup power systems and other stationary power systems.

We supply the backup power market through the sale of our hydrogen backup power product, the FCgen®-H2PM, manufactured by Ballard Denmark.

We provide fuel cell systems to backup critical communication infrastructure with a focus on fibre optics network backbones, critical hub sites and emergency communication networks (police, fire, ambulance and other emergency response services) in Europe with our FCgen®-H2PM product. Several Scandinavian countries have passed regulations to impose extended backup time (typically more than 12 hours) for critical infrastructure.

Fuel cell technology provides an alternative power solution to ensure site power availability during unexpected and extended power outages to harden critical infrastructure including data centres.

We also intend to provide fuel cell power generation solutions from 200kW to multiple MW using our FCwave and ClearGen platforms. We recently announced a demonstration program for backup generation for data centers with Caterpillar Inc. at a Microsoft data center in the US as well as distributed power generation project with HDF Energy.

Competition

The stationary power generation market is currently dominated by diesel generators and batteries. Advanced battery technology continues to make modest progress in the backup power generation market. However, advanced battery technologies still require lengthy recharging and, in many cases, cannot meet desired run times without requiring substantial space. We believe that PEM fuel cell products are superior to batteries in some applications, because of their ability to provide extended run time without frequent or lengthy recharging, as well as their ability to offer lower life cycle costs, given that batteries require periodic replacement.

For certain applications and markets we believe fuel cell power generators offer a value proposition against diesel generators with lower operating cost, extended run time, low emission and noise, and less risk of theft.

Hydrogen internal combustion engines (“H-ICEs”) and hydrogen fueled gas turbines are also being developed and could be an alternative to diesel generators. Compared with fuel cell systems, however, H-ICEs and gas turbines produce nitrous oxide emissions and are considered to be less power efficient.

Companies developing PEM fuel cell systems for stationary power generation applications include Altergy, CHEM, Plug Power, SFC Energy, Powercell, and Nedstack. We seek to gain competitive advantage through fuel cell designs that provide zero emissions, superior performance, reliability, durability and cost.

Technology Solutions

This business platform was established in 2011 to leverage our expertise in fuel cell design, prototyping, manufacturing and servicing. The mandate of the Technology Solutions business platform is to help customers solve difficult technical and business challenges in their PEM fuel cell programs or address new business opportunities. We offer customized, bundled technology solutions, including specialized PEM fuel cell engineering services, access to our intellectual property portfolio and know-how, as well as the supply of technology components.

Our current Technology Solutions efforts are predominantly in support of automotive and heavy-duty motive research and product development programs. In 2022, we also executed on programs in rail, marine and stationary.

As noted in the Recent History section above, in 2018 we signed a 3.5-year extension to the then-current Technology Development Agreement with AUDI, part of the Volkswagen Group. In 2020 we amended the Technology Development Agreement with AUDI relating to certain program reductions through 2022. This program has now been completed.

In 2022, we continued to execute on the development of a 200 kW fuel cell engine zero-emission fuel cell engine to power Siemens’ Mireo light rail train pursuant to the Development Agreement entered into with Siemens in 2017. We also continued the execution of the Research and Development Agreement to develop and transfer technology to the Weichai-Ballard JV in order to enable manufacturing of Ballard’s FCgen®-LCS fuel cell stack and FCgen®-LCS-based power modules for bus, commercial truck and forklift applications with exclusive rights in China.

Competition

Our main competition in the automotive sector for engineering services is the automakers’ ‘in-house’ capabilities, specialized automotive engineering companies, or fuel cell development companies, like AVL List, FEV Group GmbH, Intelligent Energy, Bosch, and Ricardo offer competing fuel cell development programs.

Impact of Regulations and Public Policy

In the course of carrying on our business we believe we have become aware of government regulation and public policies that may be supportive of our business, the fuel cell industry in general or zero-emission vehicles. The statements below in this section are based on our understanding of the regulations and public policies in place in the particular jurisdiction as of the date of this Annual Information Form that we believe to be correct. While we believe the statements below in this section to be correct, regulation and public policy may change without notice and our understanding regulations and public policies may be incorrect.

Approximately 75 countries have announced targets to achieve net-zero emissions strategies for 2050 or pledged to be carbon neutral by 2050. Also, over 50 countries representing approximately 90% of global GDP have specific hydrogen strategies. The main drivers of such policies include GHG emission reduction goals, the integration of renewables, as well as the opportunity for economic growth and green recovery plans. Interest and investment in hydrogen is increasing globally, as governments across the globe continue to adopt national hydrogen strategies. The Hydrogen Council reported in 2022 that 684 large-scale project proposals worth $240 billion have been announced.

On November 15, 2021, President Biden signed into law the Infrastructure Investment and Jobs Act. The bill allocates over $62 billion to the Department of Energy to advance clean energy technologies, including: (1) $8 billion to support the development of at least four clean hydrogen hubs across the United States in order to further development with respect to the production, processing, delivery, storage, and end-use of clean hydrogen; and (2) $1 billion to support the demonstration, commercialization, and deployment of electrolyzer systems, in order to decrease the cost of clean hydrogen production.

In 2022, more than $1.6 billion was allocated through the Federal Transit Administration’s (the “FTA”) Low and No Emission Grants and the Bus and Bus Facilities Grants; this funding supported investment in 150 transit fleets and facilities throughout the United States with more than 1,100 vehicles being zero-emission.

The Inflation Reduction Act was signed into law by President Biden in August 2022, and represents a $369 billion investment in the modernization of the American energy system.

Among other things, the broad bill includes a hydrogen production tax credit (up to $3/kg of hydrogen produced at a given facility, based on the carbon intensity of production ) It is intended to make technologies, like green hydrogen and carbon capture, profitable in large scale improving business case for hydrogen mobility and deployment of fuel cell applications.

The California Air and Resource Board (“CARB”) Low Carbon Transportation and Air Quality Improvement Program programs provide mobile source incentives to reduce GHG emissions, criteria pollutants, and air toxics through the development of advanced technology and clean transportation in California. The ICT Regulation was adopted in December 2018 and requires all public transit agencies to gradually transition to a 100 percent zero‑emission bus (“ZEB”) fleet. Beginning in 2029, all new transit bus purchases by California transit agencies must be ZEBs, with a goal for full transition by 2040. In 2020, the CARB unanimously adopted the world’s first zero-emission commercial truck requirement, the Advanced Clean Trucks rule. Beginning in 2024, truck manufacturers must increase their zero-emission truck sales to between 30-50 percent by 2030 and 40-75 percent by 2035 depending on the class of truck. The CARB requirements are expected to be key drivers of the growing demand in California for fuel cell trucks and buses.

In 2020, multiple countries in Europe announced ambitious hydrogen strategies supported by significant funding (for example, €9 billion in Germany and €7 billion in France).

The European Commission’s “Fit for 55 package, announced in July 2021, includes a number of proposals that could support growth in the European Union’s hydrogen economy, as the bloc seeks to reach its climate goals. Europe has a binding legal target of a 55% GHG emissions reduction by 2030 and a goal of a net-zero economy by 2050. The revised Alternative Fuels Infrastructure Directive calls for hydrogen refueling stations at least every 150 km on highways for compressed hydrogen and every 450 km for liquid hydrogen by 2030. Furthermore, it establishes new sub-targets for the use of Renewable Fuels of Non-Biological Origin (RFNBOs) by 2030. Overall, this totals five million tonnes of green hydrogen per year for industry, alongside a further five million tonnes for transport.

In December 2021, the European Commission announced the launch of the Clean Hydrogen Partnership, which will take over the activities of existing FCH JU. The EU will support the Clean Hydrogen JU with €1 billion of funding for the period 2021-2027, complemented by at least an equivalent amount of private investment (from the private members of the partnership). The Clean Hydrogen Partnership will accelerate the development and deployment of the European value chain for clean hydrogen technologies, contributing to sustainable, decarbonized and fully integrated energy systems. Together with the Hydrogen Alliance, it will contribute to the achievement of the European Union’s objectives put forward in the EU hydrogen strategy for a climate-neutral Europe.

Within those European Union policies, hydrogen is identified as one of the key technologies to achieve decarbonization and European energy security as part of the REPowerEU plan published in 2022. The plan sets targets of 10Mt of locally produced renewable hydrogen and 10Mt of imports by 2030. In addition, through the REPowerEU plan, the European Commission allocated an additional €200 million to the Clean Hydrogen Partnership to double the number of Hydrogen Valleys in Europe by 2025. Other recent EU

legislative initiatives include the Renewable Energy Directive revision, the new Fuel EU Maritime, and the Alternative Fuel Infrastructure Regulation.

In December 2020, Canada announced its Hydrogen Strategy setting an ambitious framework to cement hydrogen as a key part of Canada’s path to net-zero carbon emissions by 2050 and make Canada a global leader in hydrogen technologies. In 2021, Natural Resources Canada set up a framework for the execution of Canadian Hydrogen Strategy including development of hydrogen hubs and have released first call for proposal for production at scale of green hydrogen to be used for fuel for zero emission vehicles. In August 2021, the Canadian government announced the creation of the Zero Emission Transit Fund, which will allocate $2.75 billion to ZEBs over five years with a goal of deploying 5,000 ZEBs.

In September 2020, the Government of China announced a new 4-year policy framework replacing existing subsidy programs with awards. While previous policies in China to support zero-emission vehicle makers (sometimes referred to as new-energy vehicles) had offered subsidies on sales, the new policy framework will require local governments and companies to build a more mature supply chain and business model for the new-energy vehicle industry. The Government of China is expected to provide financial incentives to demonstration regions that meet requirements based on:

•Completeness of industry base with leading enterprises;

•Competitive hydrogen energy supply and economics;