Pay vs Performance Disclosure - USD ($)

|

12 Months Ended |

Dec. 31, 2022 |

Dec. 31, 2021 |

Dec. 31, 2020 |

| Pay vs Performance Disclosure [Table] |

|

|

|

| Pay vs Performance [Table Text Block] |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Summary Compensation Table Total for Non-PEO Named Executive

|

|

|

Average

Compensation

Actually Paid to

|

|

|

|

|

|

|

|

| |

|

|

|

Peer Group

Total

Shareholder

|

|

| |

|

|

|

|

|

|

|

2022 |

|

$ |

8,031,975 |

|

|

$ |

8,031,975 |

|

|

$ |

6,460,948 |

|

|

$ |

5,982,322 |

|

|

$ |

144 |

|

|

$ |

98 |

|

|

$ |

1,098 |

|

| |

|

|

|

|

|

|

|

2021 |

|

|

5,629,478 |

|

|

|

5,686,151 |

|

|

|

2,868,125 |

|

|

|

2,901,866 |

|

|

|

157 |

|

|

|

124 |

|

|

|

547 |

|

| |

|

|

|

|

|

|

|

2020 |

|

|

4,436,450 |

|

|

|

3,938,276 |

|

|

|

2,397,694 |

|

|

|

2,119,384 |

|

|

|

109 |

|

|

|

90 |

|

|

|

492 |

|

|

For each year, reflects the total compensation amount reported for our Chief Executive Officer (our “PEO”), Frank B. Holding, Jr., in the “Total” column of our Summary Compensation Table that appears under the heading “E XECUTIVE C OMPENSATION .” |

|

For each year, reflects the amount of “Compensation Actually Paid” to our Chief Executive Officer, Frank B. Holding, Jr., as computed in accordance with Item 402(v) of Regulation S-K. “Compensation Actually Paid” is calculated solely for purposes of required disclosures under Item 402(v) and does not reflect the actual amount of compensation earned by or paid to Mr. Holding for each year. In accordance with Item 402(v), the following adjustments were made to Mr. Holding’s total compensation as presented in the Summary Compensation Table for each year to calculate “Compensation Actually Paid.” No equity awards have been granted to Mr. Holding and, as a result, the table below reflects no equity award adjustments. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reported Summary

Compensation Table

|

|

|

Reported Change in

Actuarial

|

|

|

|

|

|

|

|

2022 |

|

$ |

8,031,975 |

|

|

$ |

|

|

|

$ |

|

|

|

$ |

8,031,975 |

|

2021 |

|

|

5,629,478 |

|

|

|

(60,063 |

) |

|

|

116,736 |

|

|

|

5,686,151 |

|

2020 |

|

|

4,436,450 |

|

|

|

(581,100 |

) |

|

|

82,926 |

|

|

|

3,938,276 |

|

| |

|

Reflects subtraction of the aggregate change in the actuarial present value of Mr. Holding’s accumulated benefits under all defined benefit and actuarial pension plans as reported for him in the “Change in Pension Value and Nonqualified Deferred Compensation Earnings” column of the Summary Compensation Table for each year. |

| |

|

Reflects addition of annual “service cost,” which is the actuarially determined present value of Mr. Holding’s benefit under all defined benefit and actuarial pension plans attributable to services he rendered during each year. There are no adjustments related to service costs for prior years resulting from amendments to defined benefit or actuarial plans. |

|

|

|

| Named Executive Officers, Footnote [Text Block] |

For each year, reflects the total compensation amount reported for our Chief Executive Officer (our “PEO”), Frank B. Holding, Jr., in the “Total” column of our Summary Compensation Table that appears under the heading “E XECUTIVE COMPENSATION .”

|

|

|

| Peer Group Issuers, Footnote [Text Block] |

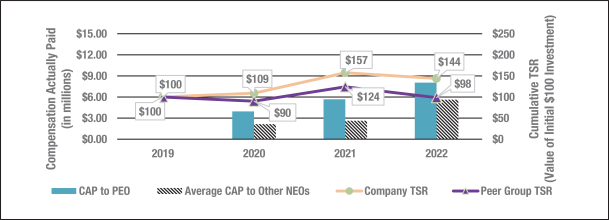

“Peer Group Total Shareholder Return” (“Peer Group TSR”) represents the cumulative total stockholder return during each measurement period for the KBW Nasdaq Bank Total Return Index, which is an industry index composed of the largest banking companies, including all regional and money center banks. Each amount assumes that $100 was invested on December 31, 2019, and dividends were reinvested for additional shares. |

|

|

| PEO Total Compensation Amount |

$ 8,031,975

|

$ 5,629,478

|

$ 4,436,450

|

| PEO Actually Paid Compensation Amount |

$ 8,031,975

|

5,686,151

|

3,938,276

|

| Adjustment To PEO Compensation, Footnote [Text Block] |

For each year, reflects the amount of “Compensation Actually Paid” to our Chief Executive Officer, Frank B. Holding, Jr., as computed in accordance with Item 402(v) of Regulation S-K. “Compensation Actually Paid” is calculated solely for purposes of required disclosures under Item 402(v) and does not reflect the actual amount of compensation earned by or paid to Mr. Holding for each year. In accordance with Item 402(v), the following adjustments were made to Mr. Holding’s total compensation as presented in the Summary Compensation Table for each year to calculate “Compensation Actually Paid.” No equity awards have been granted to Mr. Holding and, as a result, the table below reflects no equity award adjustments.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reported Summary

Compensation Table

|

|

|

Reported Change in

Actuarial

|

|

|

|

|

|

|

|

2022 |

|

$ |

8,031,975 |

|

|

$ |

|

|

|

$ |

|

|

|

$ |

8,031,975 |

|

2021 |

|

|

5,629,478 |

|

|

|

(60,063 |

) |

|

|

116,736 |

|

|

|

5,686,151 |

|

2020 |

|

|

4,436,450 |

|

|

|

(581,100 |

) |

|

|

82,926 |

|

|

|

3,938,276 |

|

| |

|

Reflects subtraction of the aggregate change in the actuarial present value of Mr. Holding’s accumulated benefits under all defined benefit and actuarial pension plans as reported for him in the “Change in Pension Value and Nonqualified Deferred Compensation Earnings” column of the Summary Compensation Table for each year. |

| |

|

Reflects addition of annual “service cost,” which is the actuarially determined present value of Mr. Holding’s benefit under all defined benefit and actuarial pension plans attributable to services he rendered during each year. There are no adjustments related to service costs for prior years resulting from amendments to defined benefit or actuarial plans. |

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

$ 6,460,948

|

2,868,125

|

2,397,694

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

$ 5,982,322

|

2,901,866

|

2,119,384

|

| Adjustment to Non-PEO NEO Compensation Footnote [Text Block] |

For each year, reflects the average of the amounts of “Compensation Actually Paid” to the other NEOs as a group (excluding Mr. Holding), as computed in accordance with Item 402(v) of Regulation S-K. The names of each of the other NEOs included for purposes of calculating the average amount for each year are: Craig L. Nix, Hope H. Bryant, and Peter M. Bristow. In addition, our NEOs included Ellen R. Alemany for 2022, Lorie K. Rupp for 2021, and Jeffery L. Ward for 2020. “Compensation Actually Paid” is calculated using the same methodology described in Footnote 2. The average “Compensation Actually Paid” to our other NEOs for 2022 was higher than in 2021 and 2020, primarily as a result of the compensation paid to Mrs. Alemany as described in Footnote 3 above. In accordance with the requirements of Item 402(v), the following adjustments were made to average total compensation of the other NEOs as a group for each year to determine the “Compensation Actually Paid.”

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average

Reported

Summary

Compensation

Table Total for

|

|

|

|

|

|

Average

Equity Award

Adjustments (b) |

|

|

Average

Reported

Change in

Actuarial

|

|

|

|

|

|

Actually Paid to Non-PEO NEOs |

|

2022 |

|

$ |

6,460,948 |

|

|

|

$ (659,436 |

) |

|

$ |

148,923 |

|

|

$ |

|

|

|

$ |

31,887 |

|

|

$ |

5,982,322 |

|

2021 |

|

|

2,868,125 |

|

|

|

-0- |

|

|

|

-0- |

|

|

|

( 21,516 |

) |

|

|

55,257 |

|

|

|

2,901,866 |

|

2020 |

|

|

2,397,694 |

|

|

|

-0- |

|

|

|

-0- |

|

|

|

(323,938 |

) |

|

|

45,628 |

|

|

|

2,119,384 |

|

| |

|

For 2022, reflects subtraction of the average for our NEOs as a group (excluding Mr. Holding) of the fair value, computed in accordance with FASB ASC Topic 718, of equity awards granted during that year. The RSUs deemed to have been granted to Mrs. Alemany during 2022 upon conversion of an equity award previously granted to her by CIT, as described above under the Grants of Plan-Based Awards table, is the only equity award that is deemed to have been granted to any of our NEOs during 2022, 2021 or 2020. |

| |

|

Reflects the addition of a net average amount of equity award adjustments for 2022, which was the only year in which equity awards were outstanding. The amounts added or subtracted in calculating the total average equity award adjustments for 2022 are listed in the following table. As described in footnotes to the table, Mrs. Alemany is the only NEO who held any equity awards during any year shown in the table. Amounts listed are averages for our four NEOs as a group, excluding Mr. Holding, based on equity awards held only by Mrs. Alemany. |

|

|

|

| Compensation Actually Paid vs. Net Income [Text Block] |

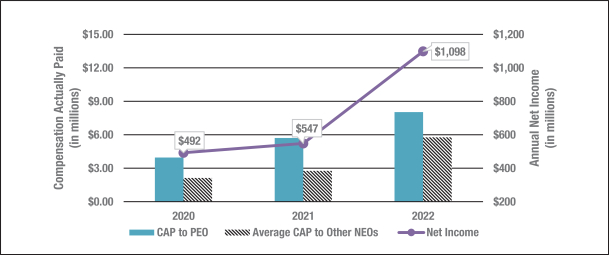

The following graph compares, for each of 2022, 2021 and 2020, the “Compensation Actually Paid” to our Chief Executive Officer, and the average “Compensation Actually Paid” to our other NEOs for each of those years to our net income as reported in our audited financial statements for each year. We do not use net income alone as a performance measure in the overall executive compensation program. However, net income is a substantial component of annual increases in tangible book value and, accordingly, it is a factor in our TBV+D Growth Rate. As illustrated by the following table, the amount of “Compensation Actually Paid” to Mr. Holding and the average amount of “Compensation Actually Paid” to our other NEOs as a group (excluding Mr. Holding) for each year are generally aligned with our net income over the three years presented in the table. C OMPENSATION A CTUALLY P AID (CAP) VS . N ET I NCOME

|

|

|

| Total Shareholder Return Vs Peer Group [Text Block] |

The following graph compares, for each of 2022, 2021 and 2020, the “Compensation Actually Paid” to our Chief Executive Officer and the average “Compensation Actually Paid” to our other NEOs for each of those years to the Company TSR and Peer Group TSR over those years. As illustrated by the graph, the amount of “Compensation Actually Paid” to Mr. Holding and the average amount of “Compensation Actually Paid” to our other NEOs as a group (excluding Mr. Holding) for each year are generally aligned with our Company TSR over the three years presented in the table, and our Company TSR compares favorably to the Peer Group TSR over that period. However, both our Company TSR and the Peer Group TSR for 2022 were negatively affected by the general market decline in stock prices during 2022. C OMPENSATION A CTUALLY P AID (CAP) VS . C OMPANY TSR AND P EER G ROUP TSR

|

|

|

| Total Shareholder Return Amount |

$ 144

|

157

|

109

|

| Peer Group Total Shareholder Return Amount |

98

|

124

|

90

|

| Net Income (Loss) |

$ 1,098,000,000

|

547,000,000

|

492,000,000

|

| PEO Name |

Frank B. Holding, Jr.

|

|

|

| PEO [Member] | Reported Change in Actuarial Present Value of Pension Benefits [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

$ 0

|

(60,063)

|

(581,100)

|

| PEO [Member] | Pension Benefit Adjustments [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

0

|

116,736

|

82,926

|

| Non-PEO NEO [Member] | Average Reported Value of Equity Awards [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

(659,436)

|

0

|

0

|

| Non-PEO NEO [Member] | Average Equity Award Adjustments [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

148,923

|

0

|

0

|

| Non-PEO NEO [Member] | Average Reported Change in Actuarial Present Value of Pension Benefits [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

0

|

(21,516)

|

(323,938)

|

| Non-PEO NEO [Member] | Average Pension Benefit Adjustments [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

$ 31,887

|

$ 55,257

|

$ 45,628

|