Summary of significant accounting policies

Dec. 31, 2022

(a)Basis of presentation

Our consolidated financial statements are expressed in United States dollars. The generally accepted accounting principles that we use are International Financial Reporting Standards as issued by the International Accounting Standards Board (IFRS-IASB).

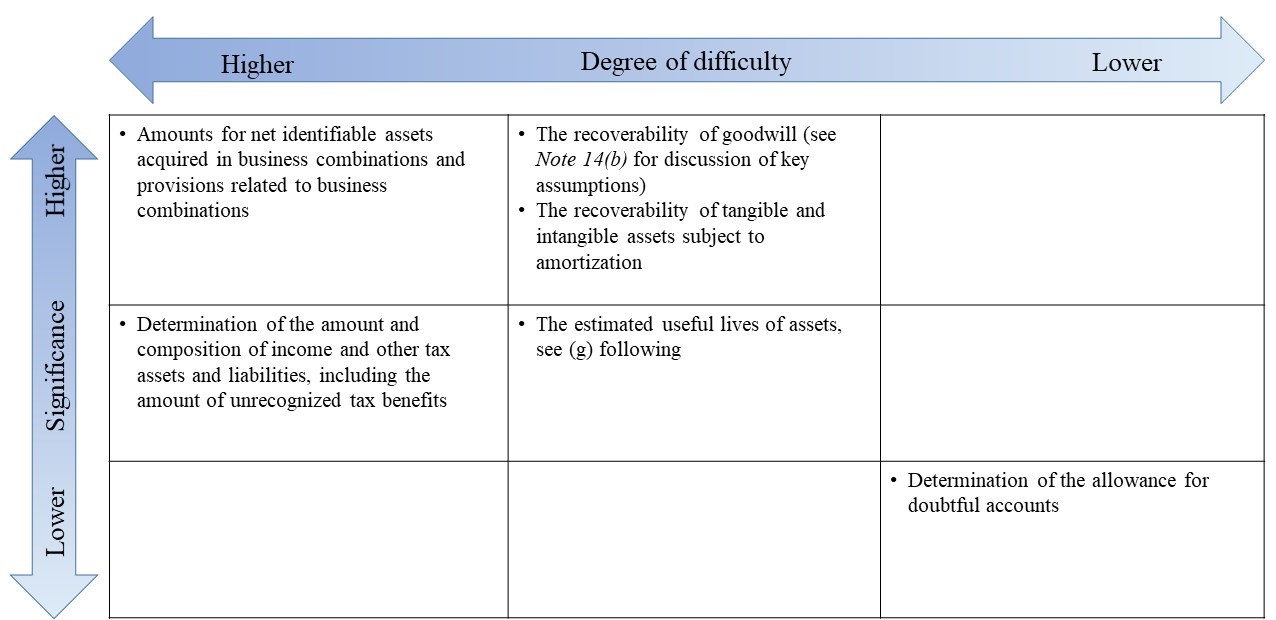

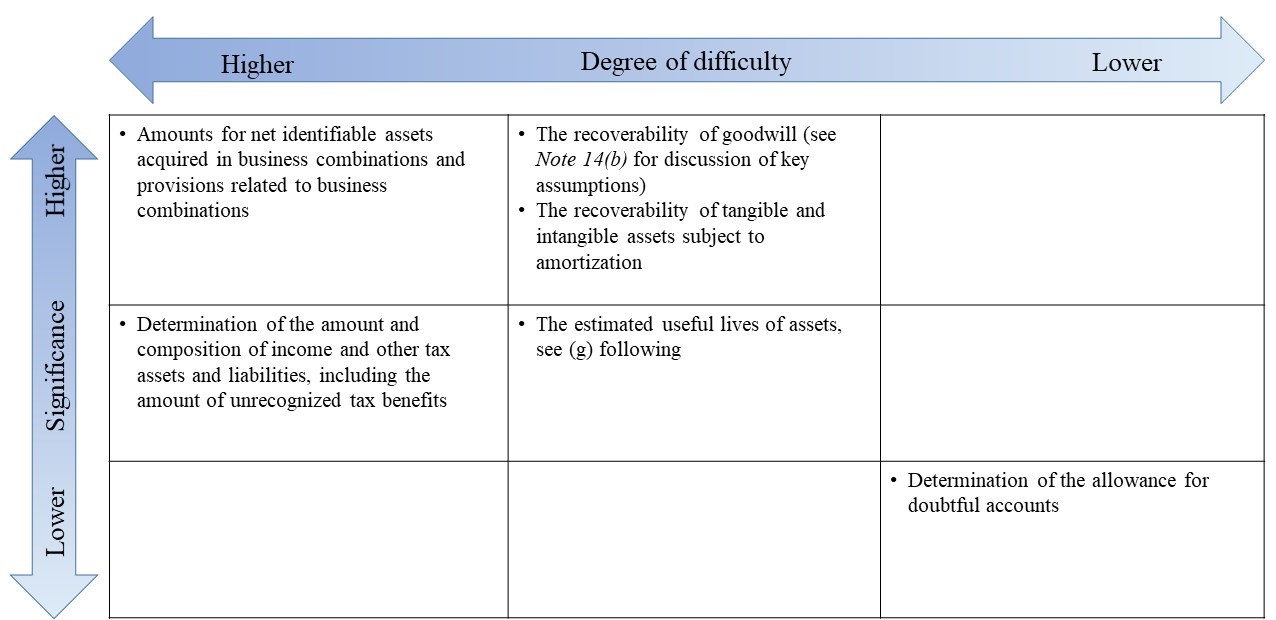

Generally accepted accounting principles require that we disclose the accounting policies we have selected in those instances where we have been obligated to choose from among various generally accepted accounting principle-compliant accounting policies. In certain other instances, including where no selection among policies is allowed, we are also required to disclose how we have applied certain accounting policies. In our assessment, all of our required accounting policy disclosures are not equally significant for us, as set out in the accompanying table; their relative significance to us will evolve over time as we do.

In the fourth quarter of 2022, the Company changed its presentation of cash interest paid on credit facilities in the consolidated statements of cash flows, which was previously included in cash flows from operating activities, and has been reclassified to cash flows from financing activities, as permitted by IAS 7, Statement of cash flows. Cash interest paid relates to interest paid on the Company’s long-term debt, which were drawn primarily to fund prior acquisitions. We believe this provides a more relevant presentation of operating cash flows, as it reflects cash flows generated by the business before deducting costs associated with servicing our long-term debt, such as interest. The table below summarizes the effect of this change in presentation, which had no impact on operating income, net income, or cash and cash equivalents.

| Years Ended December 31 (millions) | 2021 | 2020 | ||||||||||||

| Cash provided by operating activities, as previously reported | $ | 282 | $ | 263 | ||||||||||

| Add back: Interest paid | 29 | 34 | ||||||||||||

| Cash provided by operating activities | $ | 311 | $ | 297 | ||||||||||

| Cash (used in) provided by financing activities, as previously reported | $ | (206) | $ | 1,691 | ||||||||||

| Less: Interest paid | (29) | (34) | ||||||||||||

| Cash (used in) provided by financing activities | $ | (235) | $ | 1,657 | ||||||||||

In our consolidated statements of financial position, we have also reclassified certain current and non-current liabilities and grouped these amounts in Accounts payable and accrued liabilities and Other long-term liabilities, respectively, as they are not individually material to these consolidated financial statements. All amounts presented for the comparative period has been reclassified to conform with current period presentation.

These consolidated financial statements were authorized by our Board of Directors for issue on February 9, 2023.

| Accounting policy requiring a more significant choice among policies and/or a more significant application of judgment | ||||||||||||||

| Accounting policy | Yes | No | ||||||||||||

| General application | ||||||||||||||

| (a) Basis of presentation | X | |||||||||||||

| (b) Consolidation | X | |||||||||||||

| (c) Use of estimates and judgments | X | |||||||||||||

| (d) Financial instruments—recognition and measurement | X | |||||||||||||

| (e) Hedge accounting | X | |||||||||||||

| Results of operations focused | ||||||||||||||

| (f) Revenue recognition | X | |||||||||||||

| (g) Depreciation, amortization and impairment | X | |||||||||||||

| (h) Translation of foreign currencies | X | |||||||||||||

| (i) Income and other taxes | X | |||||||||||||

| (j) Share-based compensation | X | |||||||||||||

| (k) Employee future benefit plans | X | |||||||||||||

| Financial position focused | ||||||||||||||

| (l) Cash and cash equivalents | X | |||||||||||||

| (m) Property, plant and equipment; intangible assets | X | |||||||||||||

| (n) Lease liabilities | X | |||||||||||||

| (o) Business combinations | X | |||||||||||||

(b)Consolidation

As at December 31, 2022, our consolidated financial statements include our accounts and the accounts of all of our subsidiaries. Our principal subsidiaries are: TELUS International (U.S.) Corp.; Xavient Digital LLC; CallPoint New Europe EAD; TELUS International Services Limited; TELUS International Philippines Inc.; Voxpro Limited; TELUS International Germany GmbH; and TELUS International AI Inc.

Our financing arrangements and those of our subsidiaries do not impose restrictions on inter-corporate dividends, but external dividends are restricted based upon total net debt to earnings before interest, income taxes, depreciation and amortization (EBITDA) ratios, all as defined by our financing arrangements.

On a continuing basis, we review our corporate organization and effect changes as appropriate so as to enhance the value of TELUS International. This process can, and does, affect which of our subsidiaries are considered principal subsidiaries at any particular point in time.

(c)Use of estimates and judgments

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates, assumptions and judgments that affect: the reported amounts of assets and liabilities at the date of the financial statements; the disclosure of contingent assets and liabilities at the date of the financial statements; and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Estimates

Examples of the estimates and assumptions that we make and their relative significance and degree of difficulty are as follows:

Judgments

Examples of our use of judgment, apart from those involving estimation, include the following:

•Assessments about whether line items are sufficiently material to warrant separate presentation in the primary financial statements and, if not, whether they are sufficiently material to warrant separate presentation in the financial statement notes. In the normal course, we make changes to our assessments regarding presentation materiality so that they reflect current economic conditions. Due consideration is given to the view that it is reasonable to expect differing opinions of what is, and is not, material.

•In respect of revenue-generating transactions, generally we must make judgments that affect the timing of the recognition of revenue as it relates to assessing when we have satisfied our performance obligations to our customers, either at a point in time or over a period of time.

•The preparation of our financial statements in accordance with generally accepted accounting principles requires management to make judgments that affect the financial statement disclosure of information regularly reviewed by our chief operating decision maker used to make resource allocation decisions and to assess performance, as further discussed in Note 22—Segment Reporting. A significant judgment we make is that our cash flows are sufficiently indistinguishable given our global operating model, resulting in a single operating and reporting segment.

•Determination of the functional currency of each subsidiary involves significant judgment. The determination of functional currency affects the carrying value of non-current assets included in the statement of financial position and, as a consequence, the amortization of those assets, as well as the exchange gains and losses recorded in the consolidated statement of comprehensive income and the consolidated statement of equity.

•The decision to depreciate and amortize any property, plant, equipment and intangible assets that are subject to amortization on a straight-line basis, as we believe that this method reflects the consumption of resources related to the economic lifespan of those assets better than an accelerated method and is more representative of the economic substance of the underlying use of those assets.

•In connection with the annual impairment testing of goodwill, there are instances where we must exercise judgment in the determination of our cash generating unit. A significant judgment that we make is that each

geographic area in which we operate is insufficiently distinct, making it impractical to objectively distinguish the cash flows of each region. As such, each region is not an individual cash generating unit.

•In respect of claims and lawsuits, as discussed further in Note 17(b)—Contingent liabilities—Claims and lawsuits, the determination of whether an item is a contingent liability or whether an outflow of resources is probable and thus needs to be accounted for as a provision.

(d)Financial instruments—recognition and measurement

In respect of the recognition and measurement of financial instruments, we have adopted the following policies:

•Derivatives that are part of an established and documented cash flow hedging relationship are accounted for as held for hedging. We believe that classification as held for hedging results in a better matching of the change in the fair value of the derivative financial instrument with the risk exposure being hedged.

•Derivatives that are not part of a documented cash flow hedging relationship are accounted for as held for trading and thus are measured at fair value through net income.

•Transaction costs, other than in respect of items held for trading, are added to the initial fair value of the acquired financial asset or financial liability. We have selected this method as we believe that it results in a better matching of the transaction costs with the periods in which we benefit from the transaction costs.

(e)Hedge accounting

Hedge accounting

The purpose of hedge accounting, in respect of our designated hedging relationships, is to ensure that counterbalancing gains and losses are recognized in the same periods. We have chosen to apply hedge accounting as we believe that it is more representative of the economic substance of the underlying transactions.

In order to apply hedge accounting, a high correlation (which indicates effectiveness) is required in the offsetting changes in the risk-associated values of the financial instruments (the hedging items) used to establish the designated hedging relationships and all, or a part, of the asset, liability or transaction having an identified risk exposure that we have taken steps to modify (the hedged items). We assess the anticipated effectiveness of designated hedging relationships at inception and their actual effectiveness for each reporting period thereafter. We consider a designated hedging relationship to be effective if the following critical terms match between the hedging item and the hedged item: the notional amount of the hedging item and the principal amount of the hedged item; maturity dates; payment dates; and interest rate index (if, and as, applicable). Any ineffectiveness, such as would result from a difference between the notional amount of the hedging item and the principal amount of the hedged item, or from a previously effective designated hedging relationship becoming ineffective, is reflected in the consolidated statements of income and other comprehensive income as Interest expense if in respect of long-term debt, or as Goods and services purchased if in respect of future purchase commitments.

Hedging assets and liabilities

In the application of hedge accounting, an amount (the hedge value) is recorded in the consolidated statement of financial position in respect of the fair value of the hedging items. The net difference, if any, between the amounts recognized in the determination of net income and the amounts necessary to reflect the fair value of the designated cash flow hedging items recorded in the consolidated statement of financial position is recognized as a component of Other comprehensive income.

In the application of hedge accounting to the finance costs arising from interest paid on our long-term debt, the amount recognized in the determination of net income is the amount that counterbalances the difference between interest calculated at a variable interest rate, and the fixed interest rate as per our credit facility.

(f)Revenue recognition

General

Our solutions involve delivery of multiple services and products that occur at different points in time and/or over different periods of time. These arrangements may contain multiple performance obligations and the transaction price is measured and allocated among the performance obligations based upon their relative stand-alone selling price. Our relevant revenue recognition policies are then applied to the performance obligations.

Multiple contracts with a single customer are normally accounted for as separate arrangements. In instances where multiple contracts are entered into with a customer in a short period of time, the contracts are reviewed as a group to ensure that, as with multiple performance obligation arrangements, their relative stand-alone selling prices are appropriate.

Our revenues are recorded net of any value-added and/or sales taxes billed to the customer concurrent with a revenue-generating transaction. Discounts and rebates are recorded as a reduction to revenue rather than as an expense.

We recognize revenues for each accounting period as services are provided, based on fees earned per-productive hour or per transaction. Fees are invoiced to customers on a regular basis. Advance billings are recorded when a billing occurs prior to provision of the associated services; such advance billings are recognized as revenue in the period in which the services are provided.

(g)Depreciation, amortization and impairment

Depreciation and amortization

Property, plant, and equipment, including right-of-use lease assets, are depreciated on a straight-line basis over their estimated useful lives. Depreciation includes amortization of right-of-use lease assets and amortization of leasehold improvements. Leasehold improvements are normally amortized over the lesser of their expected average service life or the term of the lease. Intangible assets with finite lives are amortized on a straight-line basis over their estimated useful lives, which are reviewed at least annually and adjusted as appropriate.

Estimated useful lives for our property, plant and equipment and right-of-use assets subject to depreciation are as follows:

| Estimated useful lives | |||||

| Computer hardware and network assets | 2 to 10 years | ||||

| Buildings and leasehold improvements | 5 to 20 years | ||||

| Furniture and equipment | 3 to 7 years | ||||

| Right-of-use lease assets | 3 to 20 years | ||||

Estimated useful lives for our intangible assets subject to amortization are as follows:

| Estimated useful lives | |||||

| Customer contracts and related customer relationships | 4 to 15 years | ||||

| Software | 3 to 7 years | ||||

| Brand | 3 years | ||||

| Standard operating procedures | 5 years | ||||

| Crowdsource assets | 8 years | ||||

Impairment—general

Impairment testing compares the carrying values of the assets or cash generating units being tested with their recoverable amounts (the recoverable amount being the greater of an asset’s value-in-use or its fair value less costs to sell). Impairment losses are immediately recognized, to the extent that the carrying value of an asset exceeds its recoverable amount. Should the recoverable amounts for impaired assets subsequently increase, the impairment losses previously recognized (other than in respect of goodwill) may be reversed to the extent that the reversal is not a result of “unwinding the discount” and that the resulting carrying values do not exceed the carrying values that would have been the result if no impairment losses had been previously recognized.

Impairment—property, plant and equipment; intangible assets subject to amortization

In our assessment of estimated useful lives of assets, we consider such items as the timing of technological obsolescence, competitive pressures and future infrastructure utilization plans. These considerations could indicate that the carrying value of an asset may not be recoverable. If the carrying value of an asset were not considered recoverable, an impairment loss is recorded.

Impairment—goodwill

We assess the carrying value of goodwill each period for indicators of impairment, and an impairment test is performed when an indicator exists. At a minimum, goodwill is tested annually for impairment on October 1.

We assess our goodwill by comparing the recoverable amount of our business to its carrying value. To the extent that the carrying value exceeds its recoverable amount, the excess amount is recorded as an impairment charge in the period.

(h)Translation of foreign currencies

Trade transactions completed in foreign currencies are translated into United States dollars at the rates of exchange prevailing at the time of the transactions. Monetary assets and liabilities denominated in foreign currencies are translated into United States dollars at the rate of exchange in effect at the statement of financial position date, with any resulting gain or loss recorded to Foreign exchange in the consolidated statement of income and other comprehensive income.

We have foreign subsidiaries that do not have the United States dollar as their functional currency. Foreign exchange gains and losses arising from the translation of these foreign subsidiaries’ accounts into United States dollars are reported as a component of other comprehensive income.

(i)Income and other taxes

We follow the liability method of accounting for income taxes. Under this method, current income taxes are recognized for the estimated income taxes payable for the current year. Deferred income tax assets and liabilities are recognized for temporary differences between the tax and accounting bases of assets and liabilities, and also for the benefit of losses available to be carried forward to future years for tax purposes that are more likely than not to be realized. The amounts recognized in respect of deferred income tax assets and liabilities are based upon the expected timing of the reversal of temporary differences or usage of tax losses and application of the substantively enacted tax rates at the time of reversal or usage.

We account for any changes in substantively enacted income tax rates affecting deferred income tax assets and liabilities in full in the period in which the changes are substantively enacted. We account for changes in the estimates of tax balances for prior years as estimate revisions in the period in which the changes in estimates arise; we have selected this approach as its emphasis on the statement of financial position is more consistent with the liability method of accounting for income taxes.

Our operations are complex and the related domestic and foreign tax interpretations, regulations, legislation and jurisprudence are continually changing. As a result, there are usually some tax matters in question that result in uncertain tax positions. We recognize the income tax benefit of an uncertain tax position when it is more likely than not that the ultimate determination of the tax treatment of the position will result in that benefit being realized; however, this does not mean that tax authorities cannot challenge these positions. We accrue an amount for interest charges on current tax liabilities that have not been funded, which would include interest and penalties arising from uncertain tax positions. We include such charges in the consolidated statement of income and other comprehensive income as a component of income tax expense.

(j)Share-based compensation

General

Share-based compensation awards issued to certain of our employees include phantom and equity restricted share units, and phantom and equity share options. We recognize a share-based compensation expense in respect of these plans based on the fair value of the awards. Generally, the compensation expense of the award is recognized on a straight-line basis over the vesting of the award subject to continued service with us through the vesting date. A compensation expense is recognized for awards containing performance conditions only to the extent that it is probable that those performance conditions will be met and based on the expected achievement factor. Adjustments are made to reflect expected and actual forfeitures during the vesting period due to failure to satisfy service conditions or performance conditions against the original compensation expense recognized.

Restricted share units

Restricted share units are accounted for as equity instruments if they will be equity-settled, or liability instruments if they will be cash-settled.

For equity-accounted awards, we recognize and measure compensation expense based on the grant date fair value, which is determined to be equal to the market price of one TELUS International subordinate voting share or TELUS Corporation common share. Fair value is not subsequently re-measured unless the conditions on which the award was granted are modified. For liability-accounted awards, we accrue a liability equal to the product of the number of vesting restricted share units multiplied by the market price of one TELUS International subordinate voting share at the end of the reporting period. A mark-to-market adjustment is recorded each period based on changes in the market price of shares.

Share option awards

Share option awards are accounted for as equity instruments if they will be equity-settled, or liability instruments if they are cash-settled.

For equity-accounted awards, we recognize and measure compensation expense based on the grant date fair value, which is determined using the Black-Scholes option pricing model. Fair value is not subsequently re-measured unless the conditions on which the award was granted are modified. Proceeds arising from the exercise of equity-accounted share option awards are recognized as an increase to share capital, as are the recognized grant-date fair values of the exercised share option awards. For liability-accounted awards, we recognize and measure compensation expense based on the fair value of the award at the end of each reporting period, which is determined using the Black-Scholes option pricing model.

The Black-Scholes option pricing model requires the input of certain assumptions, some of which are highly subjective, including the expected volatility of the price of our common shares, the expected term of the option and the expected dividend yield of our shares. These estimates involve inherent uncertainties and the application of management’s judgment. If factors change and different assumptions are used, our share-based compensation expense could be materially different in future periods.

(k)Employee future benefit plans

The Company records annual amounts relating to its defined benefit plan based on calculations that incorporate various actuarial and other assumptions, including discount rates, mortality, compensation increase and turnover rates. When the defined benefit plan’s key assumptions fluctuate relative to their immediately preceding year-end values, such actuarial gains or losses are recognized in other comprehensive income.

We participate in defined benefit pension plans that share risks between TELUS Corporation and its subsidiaries as well as unfunded, non-contributory retirement plans of TELUS International and its subsidiaries. TELUS Corporation’s policy is to charge us our participant-based net defined benefit pension cost, as measured in accordance with IAS 19, Employee Benefits, which are actuarially determined using the accrued benefit method pro-rated on service and management’s best estimates of salary escalation and the retirement ages of employees. In the determination of net income, net interest for each plan, which is the product of the plan’s surplus (deficit) multiplied by the discount rate, is included as a component of Interest expense.

Contributions to defined contribution plans are charged to the consolidated statements of income in the period in which services are rendered by the covered employees.

(l)Cash and cash equivalents

Cash and cash equivalents includes short-term investments in money market funds and other highly liquid, low-risk instruments with maturities of less than three months. Cash and cash equivalents are presented net of outstanding items, including cheques written but not cleared by the related banks as at the statement of financial position date.

(m)Property, plant and equipment; intangible assets

Property, plant and equipment (excluding right-of-use assets) are recorded at historical cost. Self-constructed property, plant and equipment assets includes materials, direct labour and applicable overhead costs. Right-of-use assets, which are included in property, plant and equipment, are initially measured at cost, which includes the amount of lease liabilities recognized at the inception of the lease, initial direct costs incurred, and lease payments made at or before the lease commencement date less any lease incentives received. Subsequent to the initial recognition, right-of-use assets may be adjusted for any re-measurement of the corresponding lease liabilities.

Intangible assets are recorded at historical cost. For internally-developed internal-use software, the historical cost recorded includes materials, direct labour and direct labour-related costs.

(n)Lease liabilities

Lease liabilities are initially measured at the present value of lease payments to be made over the expected lease term. Lease payments include fixed payments, less any lease incentives or discounts. The expected lease term is the non-cancellable term of the lease, together with any periods covered by an option to extend the lease if it is reasonably certain to be exercised, considering all relevant factors and terms of the lease arrangement. In calculating the present value of lease payments, we use the interest rate implicit in the lease, if that rate can be readily determined, otherwise we use our incremental borrowing rate based on a similar security, term and economic environment.

Subsequent to the initial recognition, we monitor for significant events or changes in circumstances that would require a change in the expected lease term, including a modification to the lease, and adjust the lease liability accordingly based on the change in present value of lease payments.

(o)Business combinations

We use the acquisition method to account for business combinations, under which we allocate the excess of the purchase price of business acquisitions over the fair value of identifiable net assets acquired to goodwill. The purchase price is determined as the fair value of assets transferred, liabilities assumed, or equity instruments issued on the date of exchange, which may include contingent considerations that are initially measured at fair value at the acquisition date. Subsequent changes to the fair value of any contingent considerations are recognized through profit or loss. Acquisition-related costs are expensed as incurred.

For intangible assets acquired, the fair value is generally derived from a valuation analysis prepared by management or third-party experts as needed, based on appropriate valuation techniques using a forecast of the total expected future net cash flows and closely linked to the assumptions made by management regarding the future performance of the assets concerned and the discount rate applied. Where other markets or market participants are readily observable, these are considered in the determination of fair value.

If the fair values of the assets, liabilities and contingent liabilities can only be calculated on a provisional basis, the business combination is recognized initially using provisional values. Any adjustments resulting from the completion of the measurement process are recognized within twelve months of the date of acquisition.

Business transfers from related parties are accounted for as common control transactions using the predecessor accounting method wherein no assets or liabilities acquired are restated to their fair values and the results of operations include the transferred businesses’ results only from the date of our acquisition of them. No goodwill, except to the extent transferred as part of the transaction, is recognized on such transactions, and any excess purchase price is recorded as an adjustment to owners’ equity.