Fourth Quarter 2022 Earnings February 9, 2023 DieboldNixdorf.com

Use of non-GAAP Financial Information To supplement its condensed consolidated financial statements

presented in accordance with GAAP, the company considers certain financial measures that are not prepared in accordance with GAAP, including non-GAAP results, adjusted diluted earnings per share, free cash flow/(use), net debt, EBITDA, adjusted

EBITDA and constant currency results. The company calculates constant currency by translating the prior year results at current year exchange rates. The company uses these non-GAAP financial measures, in addition to GAAP financial measures, to

evaluate its operating and financial performance and to compare such performance to that of prior periods and to the performance of its competitors. Also, the company uses these non-GAAP financial measures in making operational and financial

decisions and in establishing operational goals. The company also believes providing these non-GAAP financial measures to investors, as a supplement to GAAP financial measures, helps investors evaluate its operating and financial performance

and trends in its business, consistent with how management evaluates such performance and trends. The company also believes these non-GAAP financial measures may be useful to investors in comparing its performance to the performance of other

companies, although its non-GAAP financial measures are specific to the company and the non-GAAP financial measures of other companies may not be calculated in the same manner. The company provides EBITDA and adjusted EBITDA because it believes

that investors and securities analysts will find EBITDA and adjusted EBITDA to be useful measures for evaluating its operating performance and comparing its operating performance with that of similar companies that have different capital

structures and for evaluating its ability to meet its future debt service, capital expenditures and working capital requirements. The company is also providing EBITDA and adjusted EBITDA in light of its credit agreement and the issuance of its

secured and unsecured senior notes. For more information on non-GAAP Financial Measures, please refer to the “Supplemental Slides.”

Forward-looking Statements This document and the exhibits hereto may contain statements that are not

historical information and are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements give current expectations or forecasts of future events and are not guarantees of

future performance. These forward-looking statements includ,e, but are not limited to, projections, statements regarding the Company's expected future performance (including expected results of operations and financial guidance), future

financial condition, potential impact of the ongoing coronavirus (COVID-19) pandemic, anticipated operating results, strategy plans, future liquidity and financial position. Statements can generally be identified as forward looking because they

include words such as “believes,” “anticipates,” “expects,” “intends,” “plans,” “will,” “believes,” “estimates,” “potential,” “target,” “predict,” “project,” “seek,” and variations thereof or “could,” “should” or words of similar meaning.

Statements that describe the Company's future plans, objectives or goals are also forward-looking statements. Forward-looking statements reflect the current views of the Company with respect to future events and are subject to assumptions,

risks and uncertainties that could cause actual results to differ materially. Although the Company believes that these forward-looking statements are based upon reasonable assumptions regarding, among other things, the economy, its knowledge of

its business, and key performance indicators that impact the Company, these forward-looking statements involve risks, uncertainties and other factors that may cause actual results to differ materially from those expressed in or implied by the

forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The factors that may affect the Company's results include, among others: the overall

impact of the global supply chain complexities on the Company and its business, including delays in sourcing key components as well as longer transport times, especially for container ships and U.S. trucking, given the Company’s reliance on

suppliers, subcontractors and availability of raw materials and other components; our ability to successfully convert our backlog into sales, including our ability to overcome supply chain and liquidity challenges; the ultimate impact of the

ongoing COVID-19 pandemic and other public health emergencies, including further adverse effects to the Company’s supply chain, maintenance of increased order backlog, and the effects of any COVID-19 related cancellations; the Company's ability

to successfully meet its cost-reduction goals and continue to achieve benefits from its cost-reduction initiatives and other strategic initiatives, such as the current $150 million plus cost savings plan; the success of the Company’s new

products, including its DN Series line and EASY family of retail checkout solutions, and electronic vehicle charging service business; the impact of a cybersecurity breach or operational failure on the Company's business; the Company's ability

to generate sufficient cash to service its debt or to comply with the covenants contained in the agreements governing its debt, if applicable and to successfully refinance its debt in the future; the Company’s ability to attract, retain and

motivate key employees; the Company’s reliance on suppliers, subcontractors and availability of raw materials and other components; changes in the Company's intention to further repatriate cash and cash equivalents and short-term investments

residing in international tax jurisdictions, which could negatively impact foreign and domestic taxes; the ability of the Company to raise necessary equity capital to pay the legacy 2024 senior secured notes at maturity if there is insufficient

participation in the registered exchange offer; the Company's success in divesting, reorganizing or exiting non-core and/or non-accretive businesses and its ability to successfully manage acquisitions, divestitures, and alliances; the ultimate

outcome of the appraisal proceedings initiated in connection with the implementation of the Domination and Profit Loss Transfer Agreement with the former Diebold Nixdorf AG (which was dismissed in the Company’s favor at the lower court level in

May 2022) and the merger/squeeze-out; the impact of market and economic conditions, including the bankruptcies, restructuring or consolidations of financial institutions, which could reduce the Company’s customer base and/or adversely affect

its customers' ability to make capital expenditures, as well as adversely impact the availability and cost of credit; the impact of competitive pressures, including pricing pressures and technological developments; changes in political,

economic or other factors such as currency exchange rates, inflation rates (including the impact of possible currency devaluations in countries experiencing high inflation rates), recessionary or expansive trends, hostilities or conflicts

(including the conflict between Russia and Ukraine), disruption in energy supply, taxes and regulations and laws affecting the worldwide business in each of the Company's operations; the Company's ability to maintain effective internal

controls; unanticipated litigation, claims or assessments, as well as the outcome/impact of any current/pending litigation, claims or assessments; the effect of changes in law and regulations or the manner of enforcement in the U.S. and

internationally and the Company’s ability to comply with applicable laws and regulations; and other factors included in the Company’s filings with the SEC, including its Annual Report on Form 10-K for the year ended December 31, 2021, its

Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2022, its Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2022, its quarterly period ended September 30, 2022, and in other documents the company files

with the SEC. Except to the extent required by applicable law or regulation, the Company undertakes no obligation to update these forward-looking statements to reflect future events or circumstances or to reflect the occurrence of unanticipated

events. You should consider these factors carefully in evaluating forward-looking statements and are cautioned not to place undue reliance on such statements.

FY 2022 Highlights Closed TSA Solid demand evidenced by $1.4B backlog which provides strong revenue

coverage for 2023 Continued shift to DN Series cash recyclers Growth of 30% in connected devices for our DN AllConnectSM Data Engine Positive results from our customer survey resulting in 92% of our banking customers planning to maintain or

expand their business with DN Awarded Best Banking Technology Solutions Provider Europe 2022 and Next 100 Global Awards 2022 – Technology Solutions Provider by Global Banking & Review® Implemented and achieved target of $150M in cost

savings restructuring plan

2023 Operating Priorities Grow Recurring Revenue Stabilize and grow our core and what we do

best 2 Celebrate Being a DN Employee Reinvigorate our culture 3 Deliver Units 1 Deliver our products and maintain operational excellence 60,000 ATMs 35,000 SCOs 134,000 EPOS In 2023, we will focus on deleveraging and free cash

flow conversion through our shared focus on the following priorities:

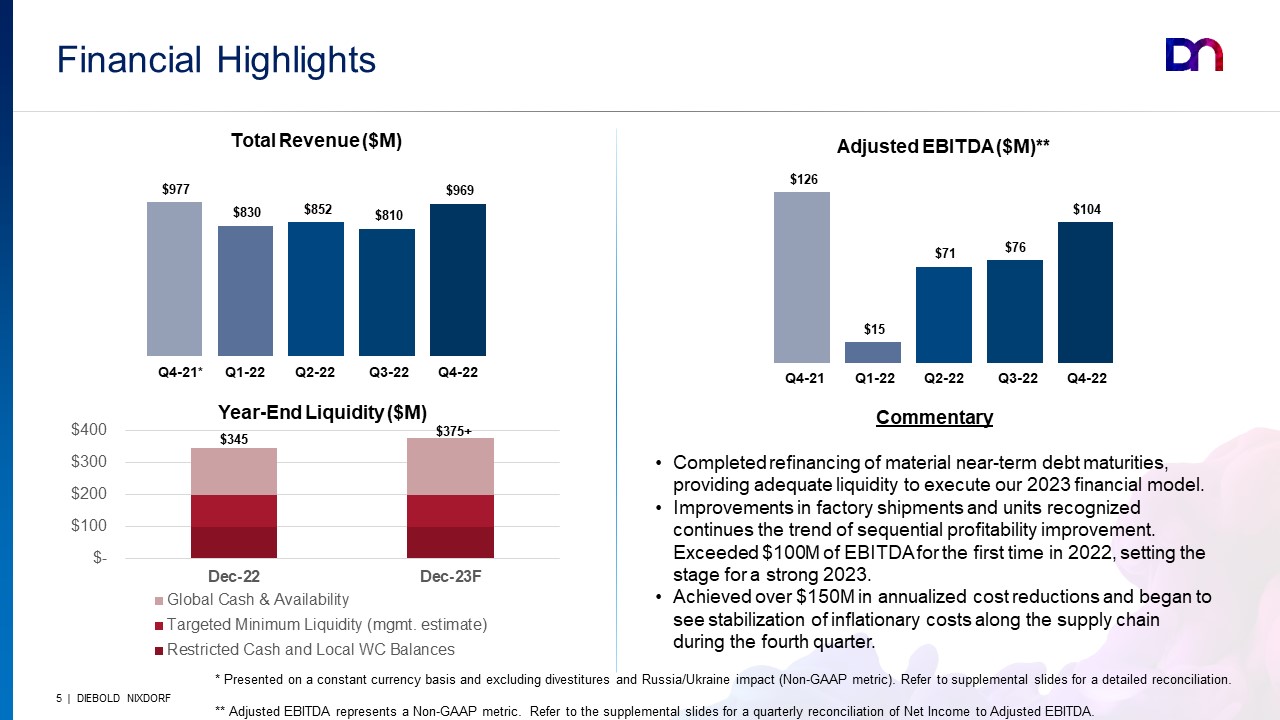

Financial Highlights 18.9% 26.7% 22.3% Q4-21* Q1-22 Q2-22 Q3-22 Q4-22 * Presented on a constant

currency basis and excluding divestitures and Russia/Ukraine impact (Non-GAAP metric). Refer to supplemental slides for a detailed reconciliation. ** Adjusted EBITDA represents a Non-GAAP metric. Refer to the supplemental slides for a

quarterly reconciliation of Net Income to Adjusted EBITDA. Q4-21 Q1-22 Q2-22 Q3-22 Q4-22 Commentary Completed refinancing of material near-term debt maturities, providing adequate liquidity to execute our 2023 financial model. Improvements

in factory shipments and units recognized continues the trend of sequential profitability improvement. Exceeded $100M of EBITDA for the first time in 2022, setting the stage for a strong 2023. Achieved over $150M in annualized cost reductions

and began to see stabilization of inflationary costs along the supply chain during the fourth quarter. Year-End Liquidity ($M)

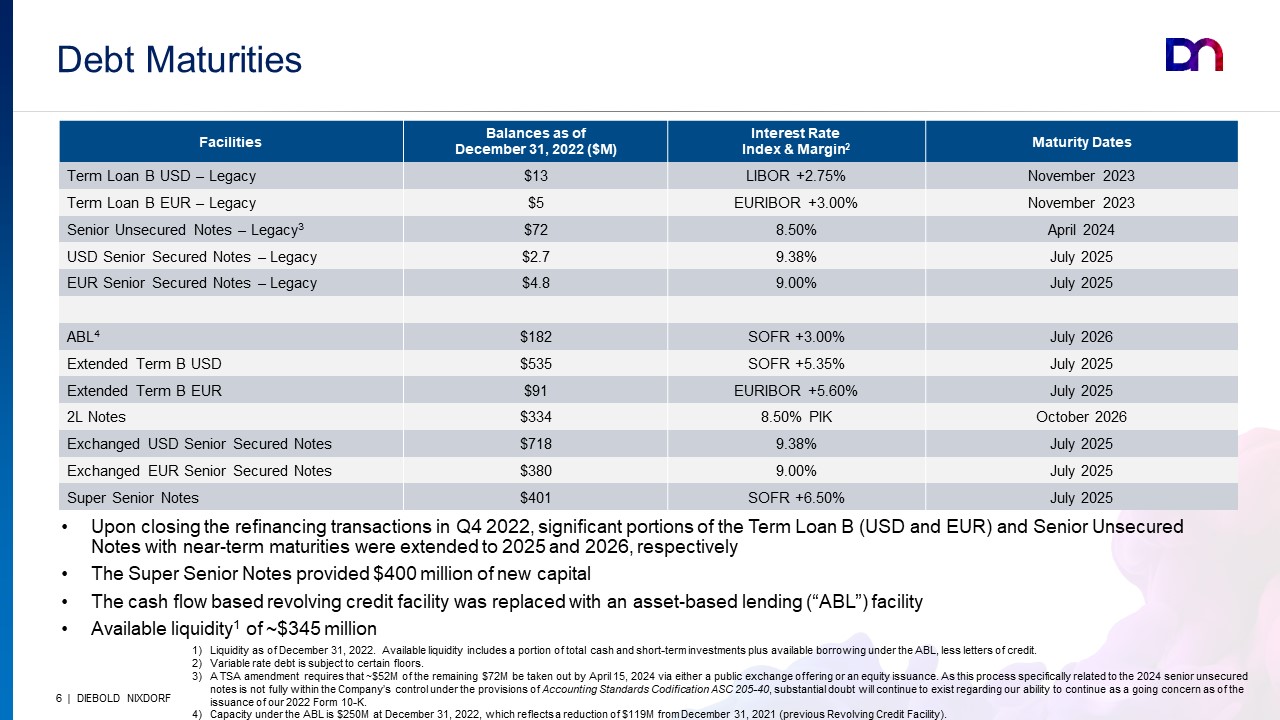

Debt Maturities Liquidity as of December 31, 2022. Available liquidity includes a portion of total cash

and short-term investments plus available borrowing under the ABL, less letters of credit. Variable rate debt is subject to certain floors. A TSA amendment requires that ~$52M of the remaining $72M be taken out by April 15, 2024 via either

a public exchange offering or an equity issuance. As this process specifically related to the 2024 senior unsecured notes is not fully within the Company’s control under the provisions of Accounting Standards Codification ASC 205-40,

substantial doubt will continue to exist regarding our ability to continue as a going concern as of the issuance of our 2022 Form 10-K. Capacity under the ABL is $250M at December 31, 2022, which reflects a reduction of $119M from December

31, 2021 (previous Revolving Credit Facility). Upon closing the refinancing transactions in Q4 2022, significant portions of the Term Loan B (USD and EUR) and Senior Unsecured Notes with near-term maturities were extended to 2025 and 2026,

respectively The Super Senior Notes provided $400 million of new capital The cash flow based revolving credit facility was replaced with an asset-based lending (“ABL”) facility Available liquidity1 of ~$345 million Facilities Balances as

of December 31, 2022 ($M) Interest Rate Index & Margin2 Maturity Dates Term Loan B USD – Legacy $13 LIBOR +2.75% November 2023 Term Loan B EUR – Legacy $5 EURIBOR +3.00% November 2023 Senior Unsecured Notes –

Legacy3 $72 8.50% April 2024 USD Senior Secured Notes – Legacy $2.7 9.38% July 2025 EUR Senior Secured Notes – Legacy $4.8 9.00% July 2025 ABL4 $182 SOFR +3.00% July 2026 Extended Term B USD $535 SOFR +5.35% July

2025 Extended Term B EUR $91 EURIBOR +5.60% July 2025 2L Notes $334 8.50% PIK October 2026 Exchanged USD Senior Secured Notes $718 9.38% July 2025 Exchanged EUR Senior Secured Notes $380 9.00% July 2025 Super Senior

Notes $401 SOFR +6.50% July 2025

Q4 2022 Banking Highlights Continued shift to DN Series™ cash recycling ATMs in North America, as

financial institutions increasingly focus on their branch transformations Secured an ~$11 million deal with a European entity’s France location for DN Series cash recyclers, bringing their total fleet of DN devices to ~75% New competitive

win of a ~$5 million deal with a top-five financial institution in Turkey for our DN Series ATMs, positioning us for additional growth in the region

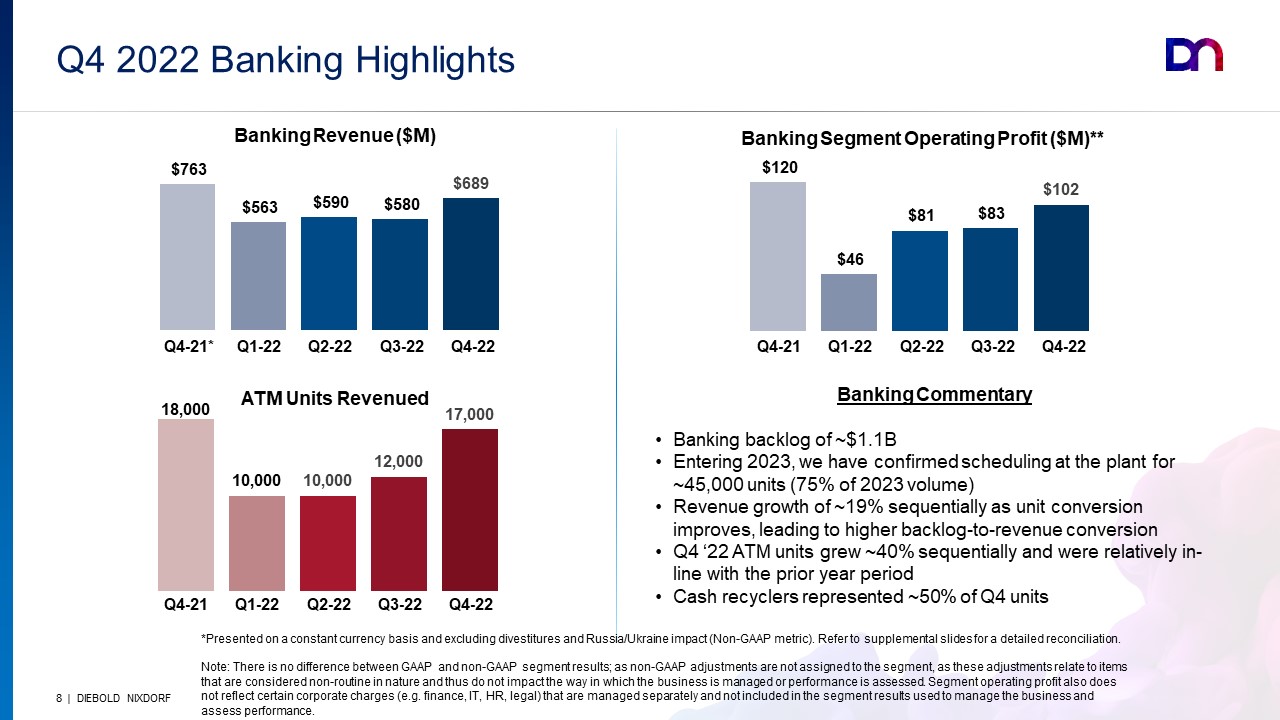

18.9% 26.7% 27.7% 24.8% 22.3% Q4-21* Q1-22 Q2-22 Q3-22 Q4-22 *Presented on a constant currency

basis and excluding divestitures and Russia/Ukraine impact (Non-GAAP metric). Refer to supplemental slides for a detailed reconciliation. Note: There is no difference between GAAP and non-GAAP segment results; as non-GAAP adjustments are not

assigned to the segment, as these adjustments relate to items that are considered non-routine in nature and thus do not impact the way in which the business is managed or performance is assessed. Segment operating profit also does not reflect

certain corporate charges (e.g. finance, IT, HR, legal) that are managed separately and not included in the segment results used to manage the business and assess performance. 25.7% 25.7% 24.7% 22.7% Banking Commentary Banking backlog of

~$1.1B Entering 2023, we have confirmed scheduling at the plant for ~45,000 units (75% of 2023 volume) Revenue growth of ~19% sequentially as unit conversion improves, leading to higher backlog-to-revenue conversion Q4 ‘22 ATM units grew

~40% sequentially and were relatively in-line with the prior year period Cash recyclers represented ~50% of Q4 units Banking Revenue ($M) Banking Segment Operating Profit ($M)** Q4-21 Q1-22 Q2-22 Q3-22 Q4-22 ATM Units Revenued Q4 2022

Banking Highlights

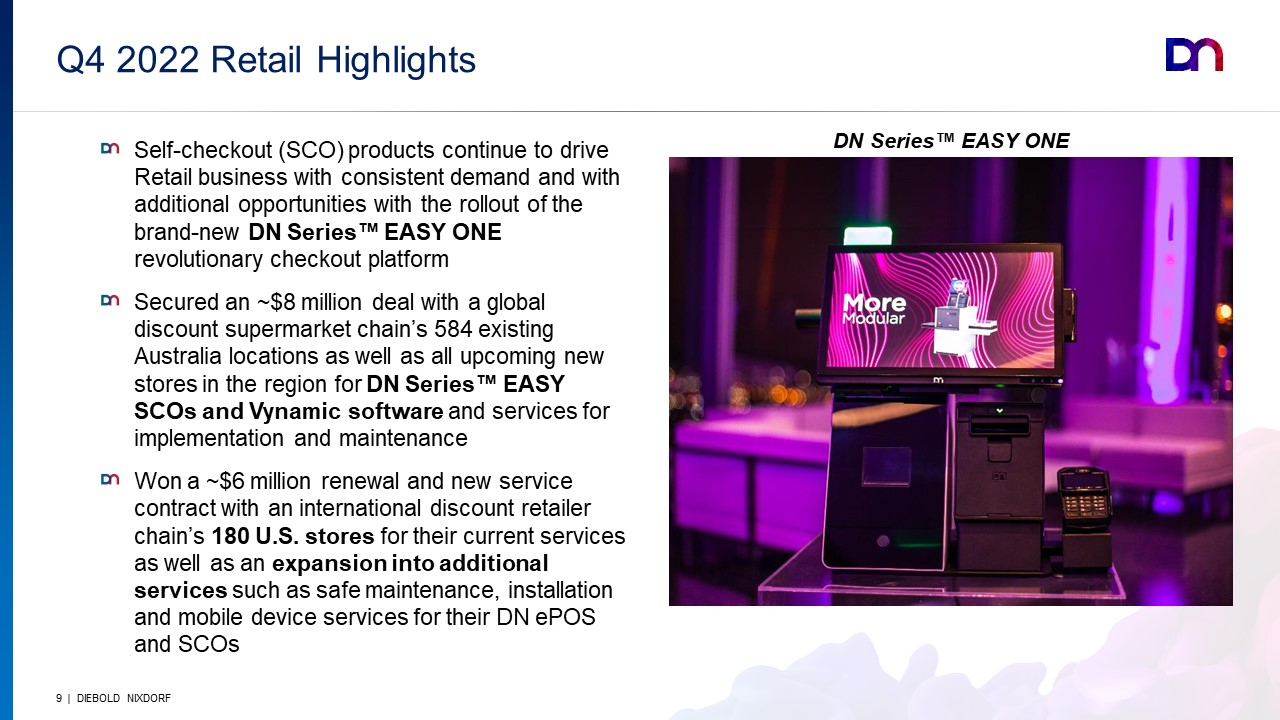

Q4 2022 Retail Highlights Self-checkout (SCO) products continue to drive Retail business with

consistent demand and with additional opportunities with the rollout of the brand-new DN Series™ EASY ONE revolutionary checkout platform Secured an ~$8 million deal with a global discount supermarket chain’s 584 existing Australia locations

as well as all upcoming new stores in the region for DN Series™ EASY SCOs and Vynamic software and services for implementation and maintenance Won a ~$6 million renewal and new service contract with an international discount retailer chain’s

180 U.S. stores for their current services as well as an expansion into additional services such as safe maintenance, installation and mobile device services for their DN ePOS and SCOs DN Series™ EASY ONE

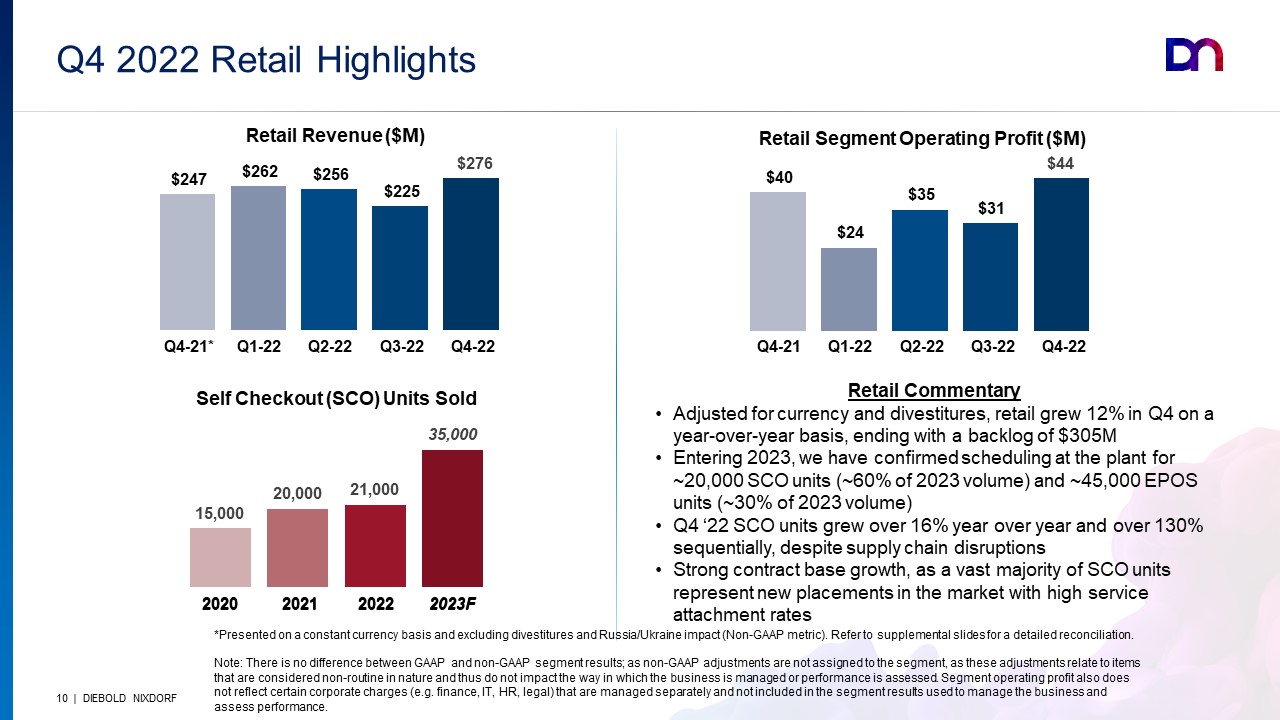

18.9% 26.7% 27.7% 24.8% 22.3% Q4-21* Q1-22 Q2-22 Q3-22 Q4-22 25.7% 25.7% 24.7% 22.7% Retail

Commentary Adjusted for currency and divestitures, retail grew 12% in Q4 on a year-over-year basis, ending with a backlog of $305M Entering 2023, we have confirmed scheduling at the plant for ~20,000 SCO units (~60% of 2023 volume) and

~45,000 EPOS units (~30% of 2023 volume) Q4 ‘22 SCO units grew over 16% year over year and over 130% sequentially, despite supply chain disruptions Strong contract base growth, as a vast majority of SCO units represent new placements in the

market with high service attachment rates Retail Revenue ($M) Retail Segment Operating Profit ($M) Q4-21 Q1-22 Q2-22 Q3-22 Q4-22 Self Checkout (SCO) Units Sold 2020 2021 2022 2023F Q4 2022 Retail Highlights *Presented on a constant

currency basis and excluding divestitures and Russia/Ukraine impact (Non-GAAP metric). Refer to supplemental slides for a detailed reconciliation. Note: There is no difference between GAAP and non-GAAP segment results; as non-GAAP adjustments

are not assigned to the segment, as these adjustments relate to items that are considered non-routine in nature and thus do not impact the way in which the business is managed or performance is assessed. Segment operating profit also does not

reflect certain corporate charges (e.g. finance, IT, HR, legal) that are managed separately and not included in the segment results used to manage the business and assess performance. 2020 2021 2022 2023F

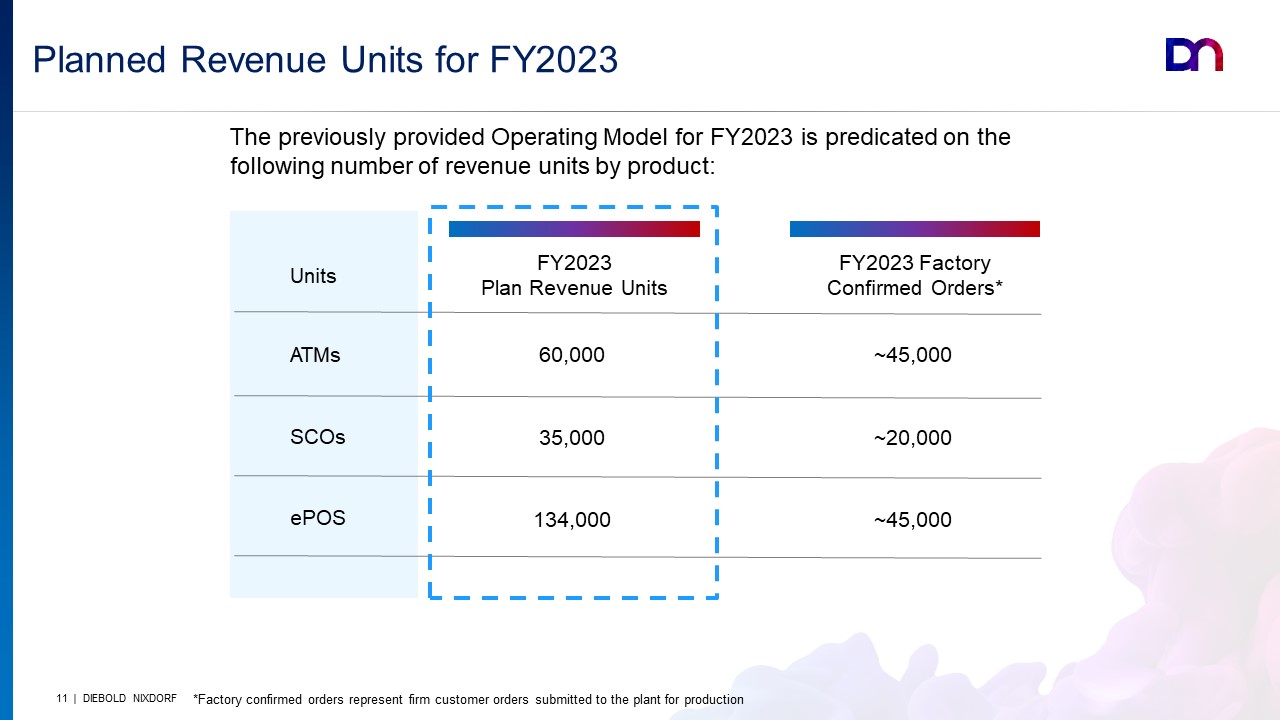

Planned Revenue Units for FY2023 ATMs SCOs 60,000 35,000 ePOS 134,000 FY2023 Plan Revenue

Units Units FY2023 Factory Confirmed Orders* The previously provided Operating Model for FY2023 is predicated on the following number of revenue units by product: ~45,000 ~20,000 ~45,000 *Factory confirmed orders represent firm customer

orders submitted to the plant for production

ESG and DEI Initiatives Key Highlights from Q4 2022 Released our new employee engagement platform

called our “DN ESG Impact Map” allowing employees to find volunteer opportunities & report on sustainability activities to support our commitments for the ESG program The French Ministry of the Environment renewed its agreement with DN for

the sustainable management of our electrical and electronic equipment (WEEE) waste from components inside our ATMs & SCOs Continued our focus on philanthropic giving through the DN Foundation with donations to Habitat for Humanity,

Cleveland Rape Crisis Center, and Physicians for Human Rights Launched new Diversity, Equity and Inclusion courses in Percipio for employees Diebold Nixdorf’s ESG program focuses on connecting commerce in ways that protect, care for and

minimize harm to the environment, caring social citizenship by creating and maintaining a diverse and safe workplace and giving back to our communities, while ensuring best practices in governance for all our stakeholders.

Supplemental Slides

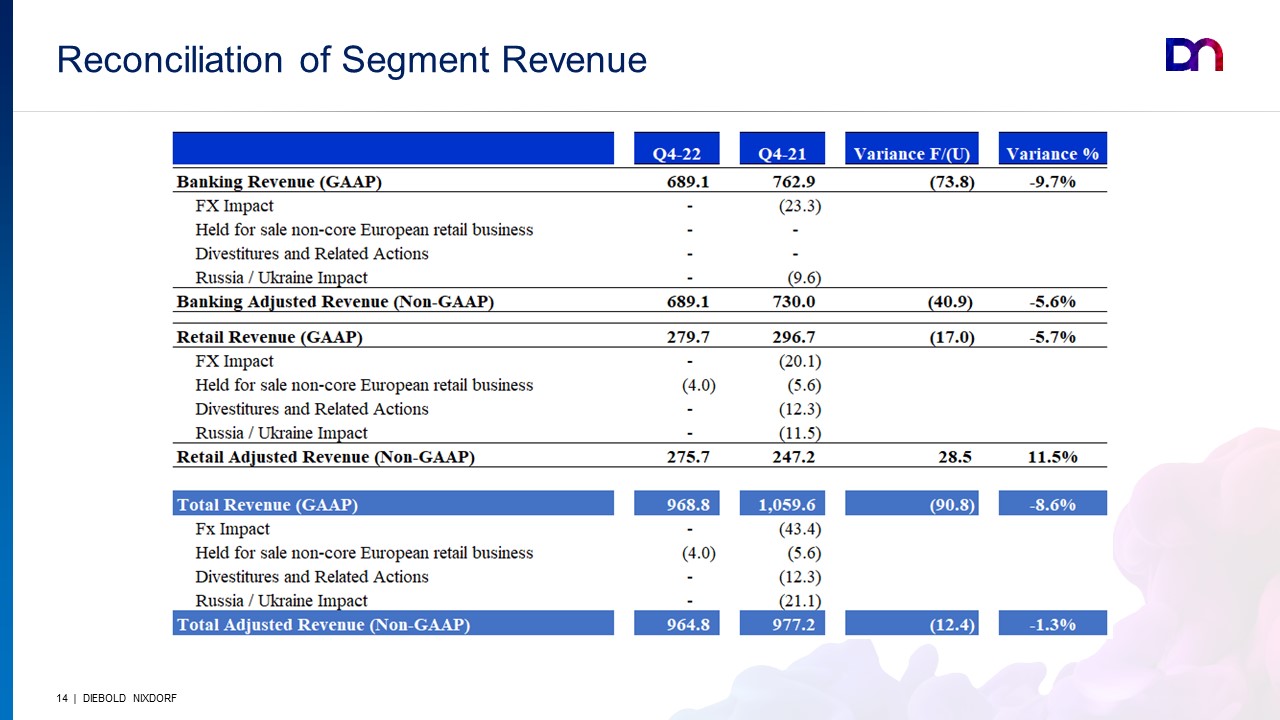

Reconciliation of Segment Revenue

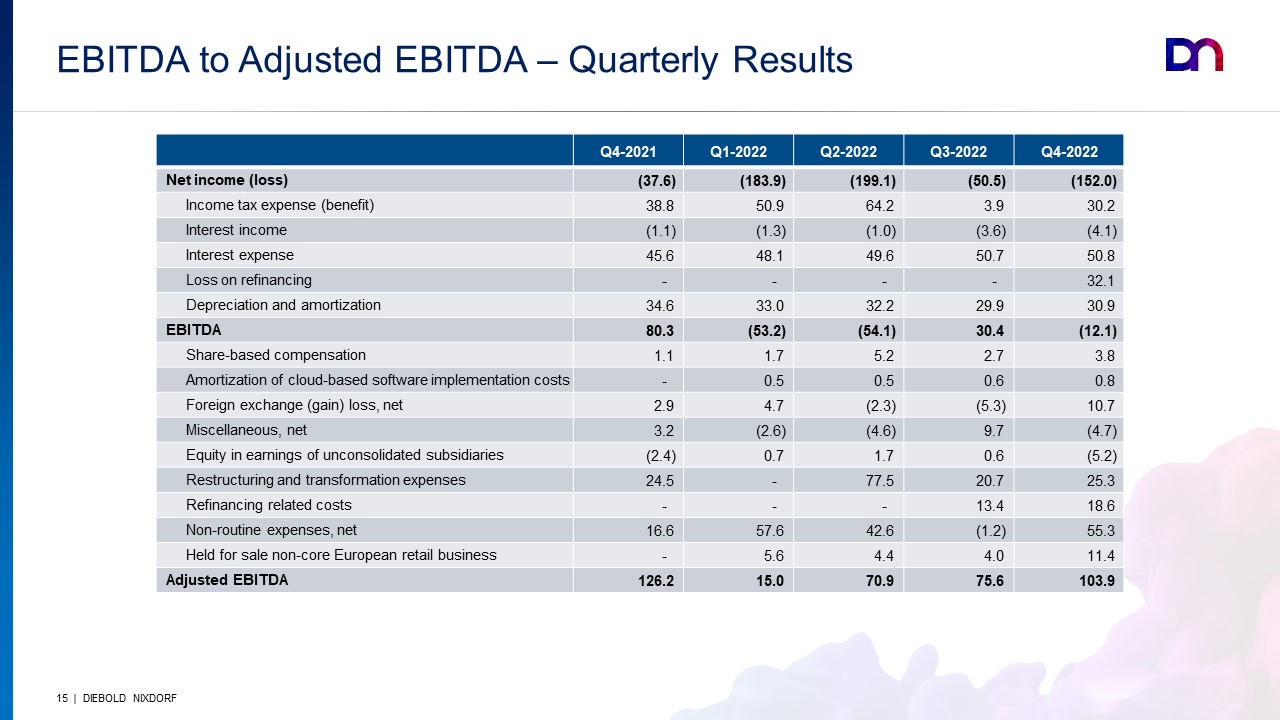

EBITDA to Adjusted EBITDA – Quarterly Results Q4-2021 Q1-2022 Q2-2022 Q3-2022 Q4-2022 Net income

(loss) (37.6) (183.9) (199.1) (50.5) (152.0) Income tax expense (benefit) 38.8 50.9 64.2 3.9 30.2 Interest income (1.1) (1.3) (1.0) (3.6) (4.1) Interest expense 45.6 48.1 49.6 50.7 50.8 Loss

on refinancing - - - - 32.1 Depreciation and amortization 34.6 33.0 32.2 29.9 30.9 EBITDA 80.3 (53.2) (54.1) 30.4 (12.1) Share-based compensation 1.1 1.7 5.2 2.7 3.8 Amortization of

cloud-based software implementation costs - 0.5 0.5 0.6 0.8 Foreign exchange (gain) loss, net 2.9 4.7 (2.3) (5.3) 10.7 Miscellaneous, net 3.2 (2.6) (4.6) 9.7 (4.7) Equity in earnings of unconsolidated

subsidiaries (2.4) 0.7 1.7 0.6 (5.2) Restructuring and transformation expenses 24.5 - 77.5 20.7 25.3 Refinancing related costs - - - 13.4 18.6 Non-routine expenses, net 16.6 57.6 42.6

(1.2) 55.3 Held for sale non-core European retail business - 5.6 4.4 4.0 11.4 Adjusted EBITDA 126.2 15.0 70.9 75.6 103.9