Feb. 28, 2023 |

|---|

| Shenkman Capital Floating Rate High Income Fund

|

| Shenkman Capital Floating Rate High Income Fund

|

| Investment Objective

|

| The Floating Rate Fund seeks to generate a high level of current income.

|

| Fees and Expenses of the Fund

|

| This table describes the fees and expenses that you may pay if you buy, hold, and sell shares of the Floating Rate Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $100,000 in the Fund’s Class A shares. Certain financial intermediaries also may offer variations in Fund sales charges to their customers as described in Appendix A to the Prospectus. More information about these and other discounts is available from your financial professional and in the “Your Account with a Fund” section on page 32 of the Fund’s Prospectus, the “Class A Shares Sales Charge Reductions and Waivers” section beginning on page 34 of the Fund’s Prospectus, Appendix A to the Prospectus and the “Breakpoints/Volume Discounts and Sales Charge Waivers” section on page 47 of the Fund’s Statement of Additional Information (“SAI”). In addition to the fees and expenses described below, you may also be required to pay brokerage commissions on your purchases and sales of Institutional Class shares of the Fund by certain financial intermediaries.

|

| SHAREHOLDER FEES (fees paid directly from your investment)

|

| | | | | | | | | | | | | | | SHAREHOLDER FEES (fees paid directly from your investment) | Class A | Class C | Class F | Institutional

Class | Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | 3.00% | None | None | None | Maximum Deferred Sales Charge (Load) (as a percentage of original purchase price or redemption price, whichever is less) | None | 1.00% | None | None | Redemption Fee (as a percentage of amount redeemed on shares held for 30 days or less) | 1.00% | 1.00% | 1.00% | 1.00% |

|

| ANNUAL FUND OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment)

|

| | | | | | | | | | | | | | | | | | | | | ANNUAL FUND OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment) | | Management Fees | 0.50 | % | | 0.50% | | 0.50% | 0.50% | | Distribution and Service (Rule 12b-1) Fees | 0.25 | % | | 1.00% | | None | None | | Other Expenses (includes Shareholder Servicing Plan Fee) | 0.31 | % | (1) | 0.31% | (1) | 0.31% | 0.21% | | Shareholder Servicing Plan Fee | 0.10% | | 0.10% | | 0.10% | None | Total Annual Fund Operating Expenses(2) | 1.06 | % | | 1.81% | | 0.81% | 0.71% | Less: Fee Waiver(3) | -0.17 | % | | -0.17% | | -0.17% | -0.17% | | Total Annual Fund Operating Expenses After Fee Waiver | 0.89 | % | | 1.64% | | 0.64% | 0.54% |

|

| Example

|

| This Example is intended to help you compare the cost of investing in the Floating Rate Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same (taking into account the Expense Cap only in the first year). You may be required to pay brokerage commissions on your purchases and sales of Institutional Class shares of the Fund, which are not reflected in this Example. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

|

| (if you redeem your shares at the end of the period)

|

| | | | | | | | | | | | | | | | 1

Year | 3

Years | 5

Years | 10

Years | Class A (if you redeem your shares at the end of the period) | $388 | $611 | $851 | $1,540 | Class C (if you redeem your shares at the end of the period) | $267 | $553 | $964 | $2,113 | Class F (if you redeem your shares at the end of the period) | $65 | $242 | $433 | $986 | Institutional Class (if you redeem your shares at the end of the period) | $55 | $210 | $378 | $867 | | | | | | Class C (if you do not redeem your shares at the end of the period) | $167 | $553 | $964 | $2,113 |

|

| (if you do not redeem your shares at the end of the period)

|

| | | | | | | | | | | | | | | | 1

Year | 3

Years | 5

Years | 10

Years | Class A (if you redeem your shares at the end of the period) | $388 | $611 | $851 | $1,540 | Class C (if you redeem your shares at the end of the period) | $267 | $553 | $964 | $2,113 | Class F (if you redeem your shares at the end of the period) | $65 | $242 | $433 | $986 | Institutional Class (if you redeem your shares at the end of the period) | $55 | $210 | $378 | $867 | | | | | | Class C (if you do not redeem your shares at the end of the period) | $167 | $553 | $964 | $2,113 |

|

| Portfolio Turnover

|

| The Floating Rate Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 39% of the average value of its portfolio.

|

| Principal Investment Strategies of the Floating Rate Fund

|

Under normal market conditions, the Floating Rate Fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in a diversified portfolio of senior secured and unsecured floating rate bank loans and other floating rate instruments. The Fund seeks to provide a high level of current income through comprehensive fundamental analysis and compounding interest income. The Fund also seeks to preserve capital by avoiding defaults and minimizing both interest rate volatility and credit risk. The loans and other instruments in which the Floating Rate Fund invests include bank loans (i.e., loan assignments and participations) to corporate borrowers, traditional corporate bonds, notes, debentures, zero-coupon bonds, collateralized loan obligations (“CLOs”) and other corporate debt instruments, and obligations of the U.S. Government and government-sponsored entities. A substantial portion of the Floating Rate Fund’s net assets may be comprised of covenant lite loans. The Fund may invest in corporate fixed-income instruments and loans of any maturity or credit quality. The Fund may invest without limit in loans, bonds or other debt obligations rated lower than Baa by Moody’s Investors Service, Inc. (“Moody’s”) or BBB by S&P Global Ratings (“S&P”) (i.e., “junk” bonds and loans), and may also invest without limit in Rule 144A and restricted fixed-income securities; provided, however, that the Floating Rate Fund may only invest up to 20% of its total assets in fixed-income instruments. The Fund generally invests in high yield instruments rated Caa or better by Moody’s or CCC or better by S&P, but retains the discretion to invest in even lower-rated instruments. The Floating Rate Fund may invest up to 20% of its total assets in foreign fixed-income instruments, including those denominated in U.S. dollars, such as Yankee bonds, or other currencies, and may also invest up to 20% of its total assets in initial public offerings (“IPOs”) and other unseasoned companies. Additionally, the Fund may invest up to 15% of its total assets in convertible bonds, up to 15% of its total assets in other investment companies, including mutual funds and exchange-traded funds (“ETFs”), up to 10% of its total assets in preferred stocks, and up to 10% of its total assets in when-issued securities. The Fund may also utilize leverage of no more than 33% of the Fund’s total assets as part of the portfolio management process. Leverage is the practice of borrowing money to purchase investments, for instance, by borrowing money against a line of credit. The Fund may also create leverage by borrowing money against a margin account where the Fund’s portfolio holdings and cash serve as collateral for the loan. Additionally, the Fund may hold from time to time equity positions received as a result of a restructuring of a debt instrument held by the Fund. The Floating Rate Fund may invest up to 100% of its net assets in high-quality, short-term debt securities and money market instruments for temporary defensive purposes.

|

| Principal Investment Risks

|

Losing all or a portion of your investment is a risk of investing in the Floating Rate Fund. The success of the Fund cannot be guaranteed. There are risks associated with investments in the types of instruments in which the Fund invests. These risks include: •General Market Risk. Economies and financial markets throughout the world are becoming increasingly interconnected, which increases the likelihood that events or conditions in one country or region will adversely impact markets or issuers in other countries or regions. Securities in the Fund’s portfolio may underperform in comparison to securities in general financial markets, a particular financial market or other asset classes due to a number of factors, including: inflation (or expectations for inflation); interest rates; global demand for particular products or resources; natural disasters or events; pandemic diseases; terrorism; regulatory events; and government controls. U.S. and international markets have experienced significant periods of volatility in recent years and months due to a number of economic, political and global macro factors including the impact of COVID-19 as a global pandemic, which has resulted in a public health crisis, disruptions to business operations and supply chains, stress on the global healthcare system, growth concerns in the U.S. and overseas, staffing shortages and the inability to meet consumer demand, and widespread concern and uncertainty. The global recovery from COVID-19 is proceeding at slower than expected rates due to the emergence of variant strains and may last for an extended period of time. Continuing uncertainties regarding interest rates, rising inflation, political events, rising government debt in the U.S. and trade tensions also contribute to market volatility. As a result of continuing political tensions and armed conflicts, including the war between Ukraine and Russia, the U.S. and the European Union imposed sanctions on certain Russian individuals and companies, including certain financial institutions, and have limited certain exports and imports to and from Russia. The war has contributed to recent market volatility and may continue to do so. •Bank Loan Risk. The Floating Rate Fund’s investments in secured and unsecured assignments of (or participations in) bank loans may create substantial risk. In making investments in bank loans, which are made by banks or other financial intermediaries to borrowers, the Fund will depend primarily upon the creditworthiness of the borrower, whose financial condition may be troubled or highly leveraged, for payment of principal and interest. When the Fund is a participant in a loan, the Fund has no direct claim on the loan and would be a creditor of the lender, and not the borrower, in the event of a borrower’s insolvency or default. Transactions involving floating rate loans have significantly longer settlement periods (e.g., longer than seven days) than more traditional investments and, as a result, sale proceeds related to the sale of loans may not be available to make additional investments or to meet the Fund’s redemption obligations until potentially a substantial period after the sale of the loans. In addition, loans are not registered under the federal securities laws like stocks and bonds, so investors in loans have less protection against improper practices than investors in registered securities. •Covenant Lite Loan Risk. Some covenant lite loans tend to have fewer or no financial maintenance covenants and restrictions. A covenant lite loan typically contains fewer clauses which allow an investor to proactively enforce financial covenants or prevent undesired actions by the borrower/issuer. Covenant lite loans also generally provide fewer investor protections if certain criteria are breached. The Fund may experience losses or delays in enforcing its rights on its holdings of covenant lite loans. •LIBOR Risk. The Floating Rate Fund invests in certain debt securities or other financial instruments that utilize the London Inter-bank Offered Rate, or “LIBOR,” as a “benchmark” or “reference rate” for variable interest rate calculations. The United Kingdom’s Financial Conduct Authority, which regulates LIBOR, announced a desire to phase out the use of LIBOR by the end of 2021. On November 30, 2020, the administrator of LIBOR announced a delay in the phase out of a majority of the U.S. dollar LIBOR publications until June 30, 2023, with the remainder of LIBOR publications already phased out at the end of 2021. Although financial regulators and industry working groups have suggested alternative reference rates, global consensus is lacking and the process for amending existing contracts or instruments to transition away from LIBOR remains unclear. Uncertainty and risk also remain regarding the willingness and ability of issuers and lenders to include enhanced provisions in new and existing contracts or instruments. Consequently, the transition away from LIBOR may lead to increased volatility and illiquidity in markets that are tied to LIBOR, decreased values of LIBOR-related investments or investments in issuers that utilize LIBOR, increased difficulty in borrowing or refinancing and diminished effectiveness of hedging strategies, adversely affecting the Fund’s performance or net asset value. Uncertainty and volatility arising from the transition may result in a reduction in the value of certain LIBOR-based instruments held by the Fund or reduce the effectiveness of related transactions. Any such effects of the transition away from LIBOR, as well as other unforeseen effects, could result in losses to the Fund and may adversely affect the Fund’s performance or net asset value. •Collateralized Loan Obligation Risk. The risks of an investment in a collateralized loan obligation depend largely on the type of the collateral securities and the class of the debt obligation in which the Fund invests. Collateralized loan obligations are generally subject to credit, interest rate, valuation, liquidity, prepayment and extension risks. These securities also are subject to risk of default on the underlying asset, particularly during periods of economic downturn. Collateralized loan obligations carry additional risks including, but not limited to, (i) the possibility that distributions from collateral securities will not be adequate to make interest or other payments, (ii) the collateral may decline in value or default, (iii) the Fund may invest in obligations that are subordinate to other classes, and (iv) the complex structure of the security may not be fully understood at the time of investment and produce disputes with the issuer or unexpected investment results. •High Yield Risk. High yield debt obligations, including bonds and loans, rated below BBB by S&P or Baa by Moody’s (commonly referred to as “junk bonds”) typically carry higher coupon rates than investment grade securities, but also are described as speculative by both S&P and Moody’s and may be subject to greater market price fluctuations, less liquidity and greater risk of loss of income or principal including greater possibility of default and bankruptcy of the issuer of such instruments than more highly rated bonds and loans. •Counterparty Risk. Counterparty risk arises upon entering into borrowing arrangements and is the risk from the potential inability of counterparties to meet the terms of their contracts. •Credit Risk. The issuers of the bonds and other debt instruments held by the Floating Rate Fund may not be able to make interest or principal payments. •Impairment of Collateral Risk. The value of any collateral securing a bond or loan can decline, and may be insufficient to meet the borrower’s obligations or difficult to liquidate. In addition, the Floating Rate Fund’s access to collateral may be limited by bankruptcy or other insolvency laws. •Interest Rate Risk. The Fund’s investments in fixed-income instruments will change in value based on changes in interest rates. When interest rates decline, the value of a portfolio invested in fixed-rate obligations can be expected to rise. Conversely, when interest rates rise, the value of a portfolio investment in fixed-rate obligations can be expected to decline. Although the value of the Fund’s investments will vary, the Fund invests primarily in floating rate instruments, which should minimize fluctuations in value as a result of changes in market interest rates. However, because floating rates on loans and other instruments only reset periodically, changes in prevailing interest rates can still be expected to cause some fluctuation in the value of the Fund. •Investment Risk. The Floating Rate Fund is not a complete investment program and you may lose money by investing in the Fund. The Fund invests primarily in high yield debt obligations issued by companies that may have significant risks as a result of business, financial, market or legal uncertainties. There can be no assurance that the Advisor will correctly evaluate the nature and magnitude of the various factors that could affect the value of, and return on, the Fund’s investments. •Leverage Risk. Leverage can increase the investment returns of the Floating Rate Fund if the securities purchased increase in value in an amount exceeding the cost of the borrowing. However, if the securities decrease in value, the Fund will suffer a greater loss than would have resulted without the use of leverage. •Liquidity Risk. Low or lack of trading volume may make it difficult to sell instruments held by the Fund at quoted market prices. The Floating Rate Fund’s investments may at any time consist of significant amounts of positions that are thinly traded or for which no market exists. For example, the investments held by the Fund may not be liquid in all circumstances so that, in volatile markets, the Advisor may not be able to close out a position without incurring a loss. The foregoing risks may be accentuated when the Fund is required to liquidate positions to meet withdrawal requests. Additionally, floating rate loans generally are subject to legal or contractual restrictions on resale, may trade infrequently, and their value may be impaired when the Fund needs to liquidate such loans. High yield bonds and loans generally trade only in the over-the-counter market rather than on an organized exchange and may be more difficult to purchase or sell at a fair price, which could have a negative impact on the Fund’s performance. •Initial Public Offering (“IPO”) and Unseasoned Company Risk. The market value of IPO shares may fluctuate considerably due to factors such as the absence of a prior public market, unseasoned trading, the small number of shares available for trading and limited information about the issuer. Additionally, investments in unseasoned companies may involve greater risks, in part because they have limited product lines, markets and financial or managerial resources. In addition, less frequently-traded securities may be subject to more abrupt price movements than securities of larger capitalized companies. •Convertible Bond Risk. Convertible bonds are hybrid securities that have characteristics of both bonds and common stocks and are therefore subject to both debt security risks and equity risk. Convertible bonds are subject to equity risk especially when their conversion value is greater than the interest and principal value of the bond. The prices of equity securities may rise or fall because of economic or political changes and may decline over short or extended periods of time. •Foreign Instruments Risk. Investments in foreign instruments involve certain risks not associated with investments in U.S. companies. Foreign instruments in the Floating Rate Fund’s portfolio subject the Fund to the risks associated with investing in the particular country, including the political, regulatory, economic, social and other conditions or events occurring in the country, as well as fluctuations in its currency, foreign currency exchange controls, foreign tax issues and the risks associated with less developed custody and settlement practices. •Management Risk. The Floating Rate Fund is an actively managed portfolio. The Advisor’s management practices and investment strategies may not work to produce the desired results. The success of the Fund is largely dependent upon the ability of the Advisor to manage the Fund and implement the Fund’s investment program. If the Fund were to lose the services of the Advisor or its senior officers, the Fund may be adversely affected. Additionally, if the Fund or any of the other accounts managed by the Advisor were to incur substantial losses or were subject to an unusually high level of redemptions or withdrawals, the revenues of the Advisor may decline substantially. Such losses and/or withdrawals may impair the Advisor’s ability to retain employees and its ability to provide the same level of service to the Fund as it has in the past and continue operations. •Preferred Stock Risk. Preferred stocks may be more volatile than fixed-income securities and are more correlated with the issuer’s underlying common stock than fixed-income securities. Additionally, the dividend on a preferred stock may be changed or omitted by the issuer. •Rule 144A Securities Risk. The market for Rule 144A securities typically is less active than the market for publicly-traded securities. Rule 144A securities carry the risk that the liquidity of these securities may become impaired, making it more difficult for the Floating Rate Fund to sell these bonds. •U.S. Government Obligations Risk. Certain U.S. government securities are supported by the full faith and credit of the United States; others are supported by the right of the issuer to borrow from the U.S. Treasury; others are supported by the discretionary authority of the U.S. government to purchase the agency’s obligations; and still others are supported only by the credit of the issuing agency, instrumentality, or enterprise. Although U.S. government-sponsored enterprises such as the Federal Home Loan Mortgage Corporation (Freddie Mac) and the Federal National Mortgage Association (Fannie Mae) may be chartered or sponsored by Congress, they are not funded by Congressional appropriations, and their securities are not issued by the U.S. Treasury, are not supported by the full faith and credit of the U.S. government, and involve increased credit risks. •When-Issued Instruments Risk. The price or yield obtained in a when-issued transaction may be less favorable than the price or yield available in the market when the instruments’ delivery takes place. Additionally, failure of a party to a transaction to consummate the trade may result in a loss to the Floating Rate Fund or missing an opportunity to obtain a price considered advantageous. •Yankee Bond Risk. Yankee bonds are subject to the same risks as other debt issues, notably credit risk, market risk, currency and liquidity risk. Other risks include adverse political and economic developments; the extent and quality of government regulations of financial markets and institutions; the imposition of foreign withholding taxes; and the expropriation or nationalization of foreign issuers. •Zero Coupon Securities Risk. While interest payments are not made on such securities, holders of such securities are deemed to have received income annually, notwithstanding that cash may not be received currently. Some of these securities may be subject to substantially greater price fluctuations during periods of changing market interest rates than are comparable securities that pay interest currently. Longer term zero coupon bonds are more exposed to interest rate risk than shorter term zero coupon bonds.

|

| Performance

|

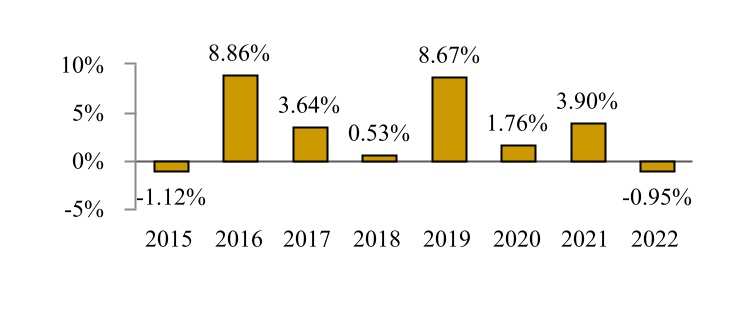

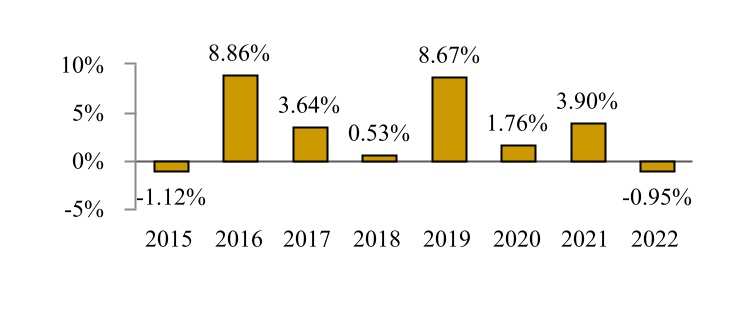

| The following information provides some indication of the risks of investing in the Floating Rate Fund. The bar chart shows the annual total returns of the Fund’s Institutional Class from year to year. The table shows how the average annual returns for the one year, five years and since inception periods for the Fund’s Institutional Class and Class F compare with those of broad measures of market performance and a more narrowly based index. As of December 31, 2022, the Fund’s Class A and C shares did not commence operations. The Class F shares commenced operations March 1, 2017. The following information shows the performance for the Institutional Class and Class F shares only. The performance for the Class A and C shares would differ only to extent that the Class A and C shares have different expenses than the Institutional Class shares, such as sales charges. If sales charges were included, the returns would be lower than those shown in the bar chart. The Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available on the Fund’s website at www.shenkmancapital.com/mutual-funds/ or by calling the Fund toll-free at 1‑855-SHENKMAN (1-855-743-6562).

|

| Calendar Year Total Returns as of December 31 – Institutional Class

|

|

| During the period of time shown in the bar chart, the Floating Rate Fund’s highest return for a calendar quarter was 8.51% (quarter ended June 30, 2020) and the Fund’s lowest return for a calendar quarter was -12.13% (quarter ended March 31, 2020).

|

| Average Annual Total Returns(for the periods ended December 31, 2022)

|

| | | | | | | | | | | | Average Annual Total Returns (for the periods ended December 31, 2022) | 1 Year | 5 Year | Since Inception (10/15/2014) | | Institutional Class | | | | | Return Before Taxes | -0.95% | 2.73% | 3.00% | | Return After Taxes on Distributions | -2.92% | 0.89% | 1.15% | | Return After Taxes on Distributions and Sale of Fund Shares | -0.58% | 1.30% | 1.47% | Class F(1) | | | | | Return Before Taxes | -0.94% | 2.73% | 2.95% | Morningstar LSTA US B- Ratings and Above Loan Index(2)

(reflects no deduction for fees, expenses or taxes) | 0.25% | 3.36% | 3.63% | Morningstar LSTA US Leveraged Loan Index(2)

(reflects no deduction for fees, expenses or taxes) | -0.61% | 3.31% | 3.60% |

|

| The after-tax returns were calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns are not relevant to investors who hold shares of the Fund through tax-deferred arrangements, such as 401(k) plans or an individual retirement account (“IRA”). The Return After Taxes on Distributions and Sale of Fund Shares is higher than other return figures when a capital loss occurs upon the redemption of Fund shares and provides an assumed tax deduction that benefits the investor.

|

| Shenkman Capital Short Duration High Income Fund

|

| Shenkman Capital Short Duration High Income Fund

|

| Investment Objective

|

| The Short Duration Fund seeks to generate a high level of current income.

|

| Fees and Expenses of the Fund

|

| This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Short Duration Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $100,000 in the Fund’s Class A shares. Certain financial intermediaries also may offer variations in Fund sales charges to their customers as described in Appendix A to the Prospectus. More information about these and other discounts is available from your financial professional and in the “Your Account with a Fund” section on page 32 of the Fund’s Prospectus, the “Class A Shares Sales Charge Reductions and Waivers” section beginning on page 34 of the Fund’s Prospectus, Appendix A to the Prospectus and the “Breakpoints/Volume Discounts and Sales Charge Waivers” section on page 47 of the Fund’s Statement of Additional Information (“SAI”). In addition to the fees and expenses described below, you may also be required to pay brokerage commissions on your purchases and sales of Institutional Class shares of the Fund by certain financial intermediaries.

|

| SHAREHOLDER FEES (fees paid directly from your investment)

|

| | | | | | | | | | | | | | | SHAREHOLDER FEES (fees paid directly from your investment) | Class A | Class C | Class F | Institutional

Class | Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | 3.00% | None | None | None | Maximum Deferred Sales Charge (Load) (as a percentage of original purchase price or redemption price, whichever is less) | None | 1.00% | None | None | Redemption Fee (as a percentage of amount redeemed on shares held for 30 days or less) | 1.00% | 1.00% | 1.00% | 1.00% |

|

| ANNUAL FUND OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment)

|

| | | | | | | | | | | | | | | ANNUAL FUND OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment) | | Management Fees | 0.55% | 0.55% | 0.55% | 0.55% | | Distribution and Service (Rule 12b-1) Fees | 0.25% | 1.00% | None | None | | Other Expenses (includes Shareholder Servicing Plan Fee) | 0.21% | 0.21% | 0.21% | 0.11% | | Shareholder Servicing Plan Fee | 0.10% | 0.10% | 0.10% | None | Total Annual Fund Operating Expenses(1) | 1.01% | 1.76% | 0.76% | 0.66% | Less: Fee Waiver(2) | -0.01% | -0.01% | -0.01% | -0.01% | | Total Annual Fund Operating Expenses After Fee Waiver | 1.00% | 1.75% | 0.75% | 0.65% |

|

| Example

|

| This Example is intended to help you compare the cost of investing in the Short Duration Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same (taking into account the Expense Cap only in the first year). You may be required to pay brokerage commissions on your purchases and sales of Institutional Class shares of the Fund, which are not reflected in this Example. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

|

| (if you redeem your shares at the end of the period)

|

| | | | | | | | | | | | | | |

| 1 Year | 3 Years | 5 Years | 10 Years | Class A (if you redeem your shares at the end of the period) | $399 | $611 | $840 | $1,498 | Class C (if you redeem your shares at the end of the period) | $278 | $553 | $953 | $2,072 | Class F (if you redeem your shares at the end of the period) | $77 | $242 | $421 | $941 | Institutional Class (if you redeem your shares at the end of the period) | $66 | $210 | $367 | $822 | | | | | | Class C (if you do not redeem your shares at the end of the period) | $178 | $553 | $953 | $2,072 |

|

| (if you do not redeem your shares at the end of the period)

|

| | | | | | | | | | | | | | |

| 1 Year | 3 Years | 5 Years | 10 Years | Class A (if you redeem your shares at the end of the period) | $399 | $611 | $840 | $1,498 | Class C (if you redeem your shares at the end of the period) | $278 | $553 | $953 | $2,072 | Class F (if you redeem your shares at the end of the period) | $77 | $242 | $421 | $941 | Institutional Class (if you redeem your shares at the end of the period) | $66 | $210 | $367 | $822 | | | | | | Class C (if you do not redeem your shares at the end of the period) | $178 | $553 | $953 | $2,072 |

|

| Portfolio Turnover

|

| The Short Duration Fund pays transaction costs when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 50% of the average value of its portfolio.

|

| Principal Investment Strategies of the Short Duration Fund

|

Under normal market conditions, the Short Duration Fund will invest at least 80% of its net assets (plus any borrowings for investment purposes) in fixed-income securities, bank loans and other instruments issued by companies that are rated below investment grade (i.e., “junk” bonds and loans). The Fund considers below investment grade instruments to include instruments with ratings lower than BBB- by S&P Global Ratings (“S&P”) or Baa3 by Moody’s Investors Service, Inc. (“Moody’s”), or that are not rated or considered by the Advisor to be equivalent to high yield instruments. The Fund generally invests in high yield instruments rated CCC or better by S&P or Caa or better by Moody’s, but retains the discretion to invest in even lower rated instruments. The fixed-income securities, bank loans and other instruments in which the Short Duration Fund invests include traditional corporate bonds, U.S. government obligations and bank loans to corporate borrowers, and may have fixed, floating or variable rates. The Fund typically focuses on instruments that have short durations (i.e., have an expected redemption through maturity, call or other corporate action within three years or less from the time of purchase). The Fund will seek to maintain a dollar-weighted average portfolio duration of approximately three years or less. Duration is a measure of a debt instrument’s price sensitivity to yield. Higher duration indicates debt instruments that are more sensitive to interest rate changes. Bonds with shorter duration are typically less sensitive to interest rate changes. Duration takes into account a debt instrument’s cash flows over time, including the possibility that a debt instrument might be prepaid by the issuer or redeemed by the holder prior to its stated maturity date. In contrast, maturity measures only the time until final payment is due. The Short Duration Fund may invest up to 20% of its total assets in foreign fixed-income instruments, including those denominated in U.S. dollars, such as Yankee bonds, or other currencies, and may also invest without limit in Rule 144A fixed-income securities. Additionally, the Fund may invest up to 15% of its total assets in convertible bonds, and up to 10% of its total assets in preferred stocks. The Fund may also utilize leverage of no more than 33% of the Fund’s total assets as part of the portfolio management process. Leverage is the practice of borrowing money to purchase investments, for instance, by borrowing money against a line of credit. The Fund may also create leverage by borrowing money against a margin account where the Fund’s portfolio holdings and cash serve as collateral for the loan. Additionally, the Fund may hold from time to time equity positions received as a result of a restructuring of a debt instrument held by the Fund. The Short Duration Fund may invest up to 100% of its net assets in high-quality, short-term debt securities and money market instruments for temporary defensive purposes.

|

| Principal Investment Risks

|

Losing all or a portion of your investment is a risk of investing in the Short Duration Fund. The success of the Fund cannot be guaranteed. There are risks associated with investments in the types of instruments in which the Fund invests. These risks include: •General Market Risk. Economies and financial markets throughout the world are becoming increasingly interconnected, which increases the likelihood that events or conditions in one country or region will adversely impact markets or issuers in other countries or regions. Securities in the Fund’s portfolio may underperform in comparison to securities in general financial markets, a particular financial market or other asset classes due to a number of factors, including: inflation (or expectations for inflation); interest rates; global demand for particular products or resources; natural disasters or events; pandemic diseases; terrorism; regulatory events; and government controls. U.S. and international markets have experienced significant periods of volatility in recent years and months due to a number of economic, political and global macro factors including the impact of COVID-19 as a global pandemic, which has resulted in a public health crisis, disruptions to business operations and supply chains, stress on the global healthcare system, growth concerns in the U.S. and overseas, staffing shortages and the inability to meet consumer demand, and widespread concern and uncertainty. The global recovery from COVID-19 is proceeding at slower than expected rates due to the emergence of variant strains and may last for an extended period of time. Continuing uncertainties regarding interest rates, rising inflation, political events, rising government debt in the U.S. and trade tensions also contribute to market volatility. As a result of continuing political tensions and armed conflicts, including the war between Ukraine and Russia, the U.S. and the European Union imposed sanctions on certain Russian individuals and companies, including certain financial institutions, and have limited certain exports and imports to and from Russia. The war has contributed to recent market volatility and may continue to do so. •High Yield Risk. High yield debt obligations, including bonds and loans, rated below BBB by S&P or Baa by Moody’s (commonly referred to as “junk bonds”) typically carry higher coupon rates than investment grade securities, but also are described as speculative by both S&P and Moody’s and may be subject to greater market price fluctuations, less liquidity and greater risk of loss of income or principal including greater possibility of default and bankruptcy of the issuer of such instruments than more highly rated bonds and loans. •Bank Loan Risk. The Short Duration Fund’s investments in secured and unsecured assignments of (or participations in) bank loans may create substantial risk. In making investments in such loans, which are made by banks or other financial intermediaries to borrowers the Fund will depend primarily upon the creditworthiness of the borrower, whose financial condition may be troubled or highly leveraged for payment of principal and interest. When the Fund is a participant in a loan, the Fund has no direct claim on the loan and would be a creditor of the lender, and not the borrower, in the event of a borrower’s insolvency or default. Transactions involving floating rate loans have significantly longer settlement periods (e.g., longer than seven days) than more traditional investments and, as a result, sale proceeds related to the sale of loans may not be available to make additional investments or to meet the Fund’s redemption obligations until potentially a substantial period after the sale of the loans. In addition, loans are not registered under the federal securities laws like stocks and bonds, so investors in loans have less protection against improper practices than investors in registered securities. •Counterparty Risk. Counterparty risk arises upon entering into borrowing arrangements or derivative transactions and is the risk from the potential inability of counterparties to meet the terms of their contracts. •Credit Risk. The issuers of the bonds and other debt securities held by the Short Duration Fund may not be able to make interest or principal payments. •Convertible Bond Risk. Convertible bonds are hybrid securities that have characteristics of both bonds and common stocks and are therefore subject to both debt security risks and equity risk. Convertible bonds are subject to equity risk especially when their conversion value is greater than the interest and principal value of the bond. The prices of equity securities may rise or fall because of economic or political changes and may decline over short or extended periods of time. •Impairment of Collateral Risk. The value of any collateral securing a bond or loan can decline, and may be insufficient to meet the borrower’s obligations or difficult to liquidate. In addition, the Short Duration Fund’s access to collateral may be limited by bankruptcy or other insolvency laws. •Interest Rate Risk. The Fund’s investments in fixed-income instruments will change in value based on changes in interest rates. When interest rates decline, the value of a portfolio invested in fixed-rate obligations can be expected to rise. Conversely, when interest rates rise, the value of a portfolio investment in fixed-rate obligations can be expected to decline. Although the value of the Fund’s investments will vary, the fluctuations in value of the Fund’s investments in floating rate instruments should be minimized as a result of changes in market interest rates. However, because floating rates on loans and other instruments only reset periodically, changes in prevailing interest rates can still be expected to cause some fluctuation in the value of the Fund. •Investment Risk. The Short Duration Fund is not a complete investment program and you may lose money by investing in the Fund. The Fund invests primarily in high yield debt obligations issued by companies that may have significant risks as a result of business, financial, market or legal uncertainties. There can be no assurance that the Advisor will correctly evaluate the nature and magnitude of the various factors that could affect the value of, and return on, the Fund’s investments. •Liquidity Risk. Low or lack of trading volume may make it difficult to sell instruments held by the Fund at quoted market prices. The Short Duration Fund’s investments may at any time consist of significant amounts of positions that are thinly traded or for which no market exists. For example, the investments held by the Fund may not be liquid in all circumstances so that, in volatile markets, the Advisor may not be able to close out a position without incurring a loss. The foregoing risks may be accentuated when the Fund is required to liquidate positions to meet withdrawal requests. Additionally, floating rate loans generally are subject to legal or contractual restrictions on resale, may trade infrequently, and their value may be impaired when the Fund needs to liquidate such loans. High yield bonds and loans generally trade only in the over-the-counter market rather than on an organized exchange and may be more difficult to purchase or sell at a fair price, which could have a negative impact on the Fund’s performance. •Leverage Risk. Leverage can increase the investment returns of the Short Duration Fund if the securities purchased increase in value in an amount exceeding the cost of the borrowing. However, if the securities decrease in value, the Fund will suffer a greater loss than would have resulted without the use of leverage. •Initial Public Offering (“IPO”) and Unseasoned Company Risk. The market value of IPO shares may fluctuate considerably due to factors such as the absence of a prior public market, unseasoned trading, the small number of shares available for trading and limited information about the issuer. Additionally, investments in unseasoned companies may involve greater risks, in part because they have limited product lines, markets and financial or managerial resources. In addition, less frequently-traded securities may be subject to more abrupt price movements than securities of larger capitalized companies. •Foreign Instruments Risk. Investments in foreign instruments involve certain risks not associated with investments in U.S. companies. Foreign instruments in the Short Duration Fund’s portfolio subject the Fund to the risks associated with investing in the particular country, including the political, regulatory, economic, social and other conditions or events occurring in the country, as well as fluctuations in its currency, foreign currency exchange controls, foreign tax issues and the risks associated with less developed custody and settlement practices. •Management Risk. The Short Duration Fund is an actively managed portfolio. The Advisor’s management practices and investment strategies might not work to produce the desired results. The success of the Fund is largely dependent upon the ability of the Advisor to manage the Fund and implement the Fund’s investment program. If the Fund were to lose the services of the Advisor or its senior officers, the Fund may be adversely affected. Additionally, if the Fund or any of the other accounts managed by the Advisor were to incur substantial losses or were subject to an unusually high level of redemptions or withdrawals, the revenues of the Advisor may decline substantially. Such losses and/or withdrawals may impair the Advisor’s ability to retain employees and its ability to provide the same level of service to the Fund as it has in the past and continue operations. •Preferred Stock Risk. Preferred stocks may be more volatile than fixed-income securities and are more correlated with the issuer’s underlying common stock than fixed-income securities. Additionally, the dividend on a preferred stock may be changed or omitted by the issuer. •Rule 144A Securities Risk. The market for Rule 144A securities typically is less active than the market for publicly-traded securities. Rule 144A securities carry the risk that the liquidity of these securities may become impaired, making it more difficult for the Short Duration Fund to sell these bonds. •When-Issued Instruments Risk. The price or yield obtained in a when-issued transaction may be less favorable than the price or yield available in the market when the instruments’ delivery takes place. Additionally, failure of a party to a transaction to consummate the trade may result in a loss to the Floating Rate Fund or missing an opportunity to obtain a price considered advantageous. •Yankee Bond Risk. Yankee bonds are subject to the same risks as other debt issues, notably credit risk, market risk, currency and liquidity risk. Other risks include adverse political and economic developments; the extent and quality of government regulations of financial markets and institutions; the imposition of foreign withholding taxes; and the expropriation or nationalization of foreign issuers. •U.S. Government Obligations Risk. Certain U.S. government securities are supported by the full faith and credit of the United States; others are supported by the right of the issuer to borrow from the U.S. Treasury; others are supported by the discretionary authority of the U.S. government to purchase the agency’s obligations; and still others are supported only by the credit of the issuing agency, instrumentality, or enterprise. Although U.S. government-sponsored enterprises such as the Federal Home Loan Mortgage Corporation (Freddie Mac) and the Federal National Mortgage Association (Fannie Mae) may be chartered or sponsored by Congress, they are not funded by Congressional appropriations, and their securities are not issued by the U.S. Treasury, are not supported by the full faith and credit of the U.S. government, and involve increased credit risks.

|

| Performance

|

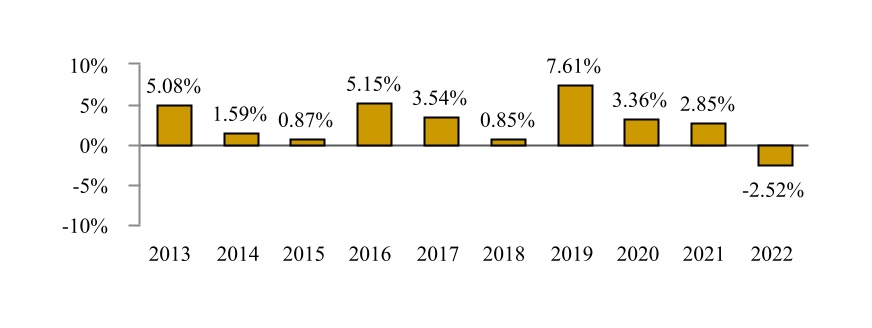

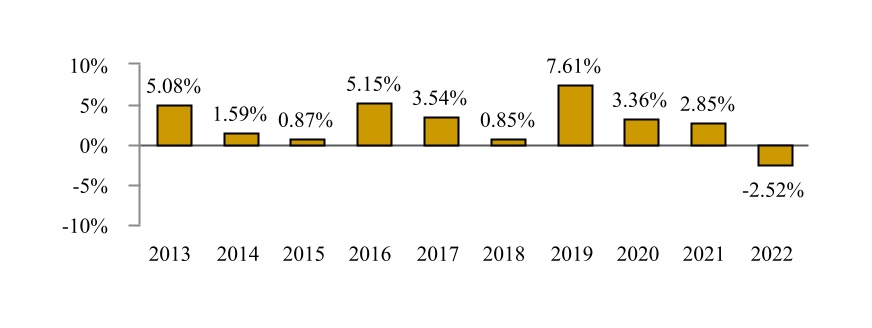

| The following information provides some indication of the risks of investing in the Short Duration Fund. The bar chart shows the annual total returns of the Fund’s Institutional Class shares from year to year and does not reflect the sales charges applicable to Class A and Class C. If sales charges were included, the returns would be lower than those shown in the bar chart. The table shows how the Fund’s Institutional Class, Class A (reflecting the sales charges), Class C (reflecting the sales charges) and Class F average annual returns for one year, five years, ten years and since inception compare with those of broad measures of market performance. The Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available on the Fund’s website at www.shenkmancapital.com/mutual-funds/ or by calling the Fund toll-free at 1‑855-SHENKMAN (1-855-743-6562).

|

| Calendar Year Total Returns as of December 31 – Institutional Class

|

|

| During the period of time shown in the bar chart, the Short Duration Fund’s highest return for a calendar quarter was 4.27% (quarter ended June 30, 2020) and the Fund’s lowest return for a calendar quarter was -5.15% (quarter ended March 31, 2020).

|

| Average Annual Total Returns(for the periods ended December 31, 2022)

|

| | | | | | | | | | | | | | | Average Annual Total Returns (for the periods ended December 31, 2022) | 1 Year | 5 Year | 10 Year | Since Inception (10/31/2012) | | Institutional Class | | | | | | Return Before Taxes | -2.52% | 2.37% | 2.80% | 2.86% | | Return After Taxes on Distributions | -4.02% | 0.92% | 1.34% | 1.41% | | Return After Taxes on Distributions and Sale of Fund Shares | -1.50% | 1.20% | 1.50% | 1.55% | | Class A | | | | | | Return Before Taxes | -5.61% | 1.44% | 2.17% | 2.23% | Class C(1) | | | | | | Return Before Taxes | -4.37% | 1.31% | 1.72% | 1.78% | Class F(2) | | | | | | Return Before Taxes | -2.60% | 2.29% | 2.70% | 2.76% | ICE BofA 0-3 Year U.S. Treasury Index (G1QA)(3) (reflects no deduction for fees, expenses or taxes) | -2.27% | 0.94% | 0.72% | 0.72% | ICE BofA 0-2 Year Duration BB-B U.S. High Yield Constrained Index (H42C)(3)

(reflects no deduction for fees, expenses or taxes) | -1.69% | 2.39% | 3.19% | 3.26% |

|

| The after-tax returns were calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns are not relevant to investors who hold shares of the Fund through tax-deferred arrangements, such as 401(k) plans or an individual retirement account (“IRA”). The after-tax returns are shown only for the Institutional Class; after-tax returns for Class A, Class C and Class F will vary to the extent each class has different expenses. The Return After Taxes on Distributions and Sale of Fund Shares is higher than other return figures when a capital loss occurs upon the redemption of Fund shares and provides an assumed tax deduction that benefits the investor.

|