The fund’s investment objective is to provide long-term growth of capital while providing current income.

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below. For example, in addition to the fees and expenses described below, you may also be required to pay brokerage commissions on purchases and sales of Class F-2, F-3, 529-F-2 or 529-F-3 shares of the fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $25,000 in American Funds. More information about these and other discounts is available from your financial professional, in the “Sales charge reductions and waivers” sections on page 37 of the prospectus and on page 76 of the fund’s statement of additional information, and in the sales charge waiver appendix to the prospectus.

Shareholder Fees - AMERICAN FUNDS DEVELOPING WORLD GROWTH & INCOME FUND |

Class A |

Class 529-A |

Class C |

Class 529-C |

Class 529-E |

Class 529-T |

Class T |

Class 529-F-1 |

Class F-1 |

Class F-2 |

Class F-3 |

Class 529-F-2 |

Class 529-F-3 |

Class R-1 |

Class R-2 |

Class R-3 |

Class R-4 |

Class R-5 |

Class R-6 |

Class R-2E |

Class R-5E |

||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | 5.75% | 3.50% | none | none | none | 2.50% | 2.50% | none | none | none | none | none | none | none | none | none | none | none | none | none | none | ||

| Maximum deferred sales charge (load) (as a percentage of the amount redeemed) | 1.00% | [1] | 1.00% | [1] | 1.00% | 1.00% | none | none | none | none | none | none | none | none | none | none | none | none | none | none | none | none | none |

| Maximum sales charge (load) imposed on reinvested dividends | none | none | none | none | none | none | none | none | none | none | none | none | none | none | none | none | none | none | none | none | none | ||

| Redemption or exchange fees | none | none | none | none | none | none | none | none | none | none | none | none | none | none | none | none | none | none | none | none | none | ||

| [1] | A contingent deferred sales charge of 1.00% applies on certain redemptions made within 18 months following purchases of $1 million or more made without an initial sales charge. Contingent deferred sales charge is calculated based on the lesser of the offering price and market value of shares being sold. |

Annual Fund Operating Expenses - AMERICAN FUNDS DEVELOPING WORLD GROWTH & INCOME FUND |

Class A |

Class C |

Class T |

Class F-1 |

Class F-2 |

Class F-3 |

Class 529-A |

Class 529-C |

Class 529-E |

Class 529-T |

Class 529-F-1 |

Class 529-F-2 |

Class 529-F-3 |

Class R-1 |

Class R-2 |

Class R-2E |

Class R-3 |

Class R-4 |

Class R-5E |

Class R-5 |

Class R-6 |

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Management fees | [1] | 0.65% | 0.65% | 0.65% | 0.65% | 0.65% | 0.65% | 0.65% | 0.65% | 0.65% | 0.65% | 0.65% | 0.65% | 0.65% | 0.65% | 0.65% | 0.65% | 0.65% | 0.65% | 0.65% | 0.65% | 0.65% |

| Distribution and/or service (12b-1) fees | 0.24% | 1.00% | 0.25% | 0.25% | none | none | 0.22% | 1.00% | 0.50% | 0.25% | 0.25% | none | none | 1.00% | 0.75% | 0.60% | 0.50% | 0.25% | none | none | none | |

| Other expenses | [1] | 0.32% | 0.32% | 0.31% | 0.26% | 0.23% | 0.11% | 0.36% | 0.37% | 0.24% | 0.36% | 0.32% | 0.23% | 0.18% | 0.20% | 0.52% | 0.34% | 0.27% | 0.22% | 0.28% | 0.17% | 0.11% |

| Total annual fund operating expenses | 1.21% | 1.97% | 1.21% | 1.16% | 0.88% | 0.76% | 1.23% | 2.02% | 1.39% | 1.26% | 1.22% | 0.88% | 0.83% | 1.85% | 1.92% | 1.59% | 1.42% | 1.12% | 0.93% | 0.82% | 0.76% | |

| [1] | Restated to reflect current fees. |

This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds.

The example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the fund’s operating expenses remain the same. You may be required to pay brokerage commissions on your purchases and sales of Class F-2, F-3, 529-F-2 or 529-F-3 shares of the fund, which are not reflected in the example.

Expense Example - AMERICAN FUNDS DEVELOPING WORLD GROWTH & INCOME FUND - USD ($) |

Class A |

Class C |

Class T |

Class F-1 |

Class F-2 |

Class F-3 |

Class 529-A |

Class 529-C |

Class 529-E |

Class 529-T |

Class 529-F-1 |

Class 529-F-2 |

Class 529-F-3 |

Class R-1 |

Class R-2 |

Class R-2E |

Class R-3 |

Class R-4 |

Class R-5E |

Class R-5 |

Class R-6 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 year | $ 691 | $ 300 | $ 370 | $ 118 | $ 90 | $ 78 | $ 471 | $ 305 | $ 142 | $ 375 | $ 124 | $ 90 | $ 85 | $ 188 | $ 195 | $ 162 | $ 145 | $ 114 | $ 95 | $ 84 | $ 78 |

| 3 years | 937 | 618 | 624 | 368 | 281 | 243 | 727 | 634 | 440 | 640 | 387 | 281 | 265 | 582 | 603 | 502 | 449 | 356 | 296 | 262 | 243 |

| 5 years | 1,202 | 1,062 | 898 | 638 | 488 | 422 | 1,002 | 1,088 | 761 | 924 | 670 | 488 | 460 | 1,001 | 1,037 | 866 | 776 | 617 | 515 | 455 | 422 |

| 10 years | $ 1,957 | $ 2,099 | $ 1,679 | $ 1,409 | $ 1,084 | $ 942 | $ 1,787 | $ 1,870 | $ 1,669 | $ 1,735 | $ 1,477 | $ 1,084 | $ 1,025 | $ 2,169 | $ 2,243 | $ 1,889 | $ 1,702 | $ 1,363 | $ 1,143 | $ 1,014 | $ 942 |

Expense Example No Redemption - AMERICAN FUNDS DEVELOPING WORLD GROWTH & INCOME FUND - USD ($) |

Class C |

Class 529-C |

|---|---|---|

| 1 year | $ 200 | $ 205 |

| 3 years | 618 | 634 |

| 5 years | 1,062 | 1,088 |

| 10 years | $ 2,099 | $ 1,870 |

The fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the fund’s investment results. During the most recent fiscal year, the fund’s portfolio turnover rate was 45% of the average value of its portfolio.

Under normal market conditions, the fund will invest at least 80% of its assets in securities that are (1) issued by companies in developing countries; (2) principally traded in the securities markets of developing countries; (3) denominated in developing country currencies; or (4) issued by companies deemed to be suitable for investment by the fund because they have significant economic exposure to developing countries. In determining whether a country is a developing country, the fund’s investment adviser will consider, among other things, whether the country is generally considered to be a developing country by the international financial community, the country’s per capita gross domestic product, the percentage of the country’s economy that is industrialized, market capital as a percentage of the country’s gross domestic product, and the overall regulatory environment of the country, including the presence of government regulation limiting or banning foreign ownership and restrictions on repatriation of initial capital, dividends, interest and/or capital gains. For example, the investment adviser currently expects that most countries included in any one of the Morgan Stanley Capital Index (MSCI) emerging markets indices will be treated as developing countries.

The fund may invest in securities of any company, regardless of where it is domiciled, if the fund’s investment adviser determines that the company has significant economic exposure to a developing country. An issuer will be deemed to have significant economic exposure to a developing country if at least 50% of its assets are located in a developing country or at least 50% of its total revenues or profits are derived, or, in the opinion of the investment adviser, are expected to be derived, from goods or services produced or sold in a developing country.

The fund may have significant exposure to one or more developing countries. For example, as of December 31, 2022, the fund held more than 25% of its assets in securities of issuers domiciled in China. See the paragraphs captioned “Investing outside the United States,” “Investing in emerging markets” and “Exposure to country, region, industry or sector” under “Principal risks” below for a description of the risks associated with such investments. More current portfolio holdings information for the fund is available on our website at capitalgroup.com.

The fund is designed for investors seeking both capital appreciation and income. As a general matter, the fund may invest in a broad range of securities, including both growth- and income-oriented stocks and debt securities. In pursuing its objective, however, the fund focuses on stocks of companies that have the potential for growth and the capacity to pay dividends. The investment adviser believes that these stocks will be more resistant to market declines than stocks of companies that do not, or do not have the capacity to, pay dividends. The fund may also invest in securities of foreign issuers in the form of depositary receipts or other instruments by which the fund may obtain exposure to equity investments in local markets.

The investment adviser uses a system of multiple portfolio managers in managing the fund’s assets. Under this approach, the portfolio of the fund is divided into segments managed by individual managers.

The fund relies on the professional judgment of its investment adviser to make decisions about the fund’s portfolio investments. The basic investment philosophy of the investment adviser is to seek to invest in attractively valued companies that, in its opinion, represent good, long-term investment opportunities. Securities may be sold

when the investment adviser believes that they no longer represent relatively attractive investment opportunities.

This section describes the principal risks associated with investing in the fund. You may lose money by investing in the fund. The likelihood of loss may be greater if you invest for a shorter period of time. Investors in the fund should have a long-term perspective and be able to tolerate potentially sharp declines in value.

Market conditions — The prices of, and the income generated by, the common stocks and other securities held by the fund may decline – sometimes rapidly or unpredictably – due to various factors, including events or conditions affecting the general economy or particular industries or companies; overall market changes; local, regional or global political, social or economic instability; governmental, governmental agency or central bank responses to economic conditions; and currency exchange rate, interest rate and commodity price fluctuations.

Economies and financial markets throughout the world are highly interconnected. Economic, financial or political events, trading and tariff arrangements, wars, terrorism, cybersecurity events, natural disasters, public health emergencies (such as the spread of infectious disease) and other circumstances in one country or region, including actions taken by governmental or quasi-governmental authorities in response to any of the foregoing, could have impacts on global economies or markets. As a result, whether or not the fund invests in securities of issuers located in or with significant exposure to the countries affected, the value and liquidity of the fund’s investments may be negatively affected by developments in other countries and regions.

Issuer risks — The prices of, and the income generated by, securities held by the fund may decline in response to various factors directly related to the issuers of such securities, including reduced demand for an issuer’s goods or services, poor management performance, major litigation, investigations or other controversies related to the issuer, changes in financial condition or credit rating, changes in government regulations affecting the issuer or its competitive environment and strategic initiatives such as mergers, acquisitions or dispositions and the market response to any such initiatives.

Investing outside the United States — Securities of issuers domiciled outside the United States, or with significant operations or revenues outside the United States, may lose value because of adverse political, social, economic or market developments (including social instability, regional conflicts, terrorism and war) in the countries or regions in which the issuers operate or generate revenue. These securities may also lose value due to changes in foreign currency exchange rates against the U.S. dollar and/or currencies of other countries. Issuers of these securities may be more susceptible to actions of foreign governments, such as nationalization, currency blockage or the imposition of price controls, sanctions, or punitive taxes, each of which could adversely impact the value of these securities. Securities markets in certain countries may be more volatile and/or less liquid than those in the United States. Investments outside the United States may also be subject to different regulatory, legal, accounting, auditing, financial reporting and recordkeeping requirements, and may be more difficult to value, than those in the United States. In addition, the value of investments outside the United States may be reduced by foreign taxes, including foreign withholding taxes on interest and dividends. Further, there may be increased risks of delayed settlement of securities

purchased or sold by the fund, which could impact the liquidity of the fund’s portfolio. The risks of investing outside the United States may be heightened in connection with investments in emerging markets.

Investing in emerging markets — Investing in emerging markets may involve risks in addition to and greater than those generally associated with investing in the securities markets of developed countries. For instance, emerging market countries tend to have less developed political, economic and legal systems than those in developed countries. Accordingly, the governments of these countries may be less stable and more likely to intervene in the market economy, for example, by imposing capital controls, nationalizing a company or industry, placing restrictions on foreign ownership and on withdrawing sale proceeds of securities from the country, and/or imposing punitive taxes that could adversely affect the prices of securities. Information regarding issuers in emerging markets may be limited, incomplete or inaccurate, and such issuers may not be subject to regulatory, accounting, auditing, and financial reporting and recordkeeping standards comparable to those to which issuers in more developed markets are subject. The fund’s rights with respect to its investments in emerging markets, if any, will generally be governed by local law, which may make it difficult or impossible for the fund to pursue legal remedies or to obtain and enforce judgments in local courts. In addition, the economies of these countries may be dependent on relatively few industries, may have limited access to capital and may be more susceptible to changes in local and global trade conditions and downturns in the world economy. Securities markets in these countries can also be relatively small and have substantially lower trading volumes. As a result, securities issued in these countries may be more volatile and less liquid, and may be more difficult to value, than securities issued in countries with more developed economies and/or markets. Less certainty with respect to security valuations may lead to additional challenges and risks in calculating the fund’s net asset value. Additionally, emerging markets are more likely to experience problems with the clearing and settling of trades and the holding of securities by banks, agents and depositories that are less established than those in developed countries.

Exposure to country, region, industry or sector — Subject to the investment limitations, the fund may have significant exposure to a particular country, region, industry or sector. Such exposure may cause the fund to be more impacted by risks relating to and developments affecting the country, region, industry or sector, and thus its net asset value may be more volatile, than a fund without such levels of exposure. For example, if the fund has significant exposure in a particular country, then social, economic, regulatory or other issues that negatively affect that country may have a greater impact on the fund than on a fund that is more geographically diversified.

Investing in growth-oriented stocks — Growth-oriented common stocks and other equity-type securities (such as preferred stocks, convertible preferred stocks and convertible bonds) may involve larger price swings and greater potential for loss than other types of investments. These risks may be even greater in the case of smaller capitalization stocks.

Investing in income-oriented stocks — The value of the fund’s securities and income provided by the fund may be reduced by changes in the dividend policies of, and the capital resources available for dividend payments at, the companies in which the fund invests.

Investing in small companies — Investing in smaller companies may pose additional risks. For example, it is often more difficult to value or dispose of small company stocks and more difficult to obtain information about smaller companies than about larger companies. Furthermore, smaller companies often have limited product lines, operating histories, markets and/or financial resources, may be dependent on one or a few key persons for management, and can be more susceptible to losses. Moreover, the prices of their stocks may be more volatile than stocks of larger, more established companies, particularly during times of market turmoil.

Investing in depositary receipts — Depositary receipts are securities that evidence ownership interests in, and represent the right to receive, a security or a pool of securities that have been deposited with a bank or trust depository. Such securities may be less liquid or may trade at a lower price than the underlying securities of the issuer. Additionally, receipt of corporate information about the underlying issuer and proxy disclosure may not be timely and there may not be a correlation between such information and the market value of the depositary receipts.

Management — The investment adviser to the fund actively manages the fund’s investments. Consequently, the fund is subject to the risk that the methods and analyses, including models, tools and data, employed by the investment adviser in this process may be flawed or incorrect and may not produce the desired results. This could cause the fund to lose value or its investment results to lag relevant benchmarks or other funds with similar objectives.

Your investment in the fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency, entity or person. You should consider how this fund fits into your overall investment program.

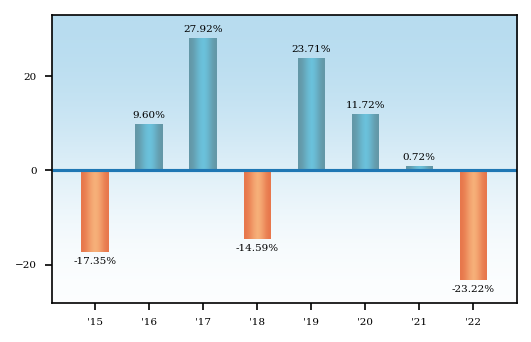

The following bar chart shows how the fund’s investment results have varied from year to year, and the following table shows how the fund’s average annual total returns for various periods compare with a broad measure of securities market results. This information provides some indication of the risks of investing in the fund. Past investment results (before and after taxes) are not predictive of future investment results. Prior to October 30, 2020, certain fees, such as 12b-1 fees, were not charged on Class 529-F-1 shares. If these expenses had been deducted, results would have been lower. Updated information on the fund’s investment results can be obtained by visiting capitalgroup.com.

The following bar chart shows how the fund’s investment results have varied from year to year, and the following table shows how the fund’s average annual total returns for various periods compare with a broad measure of securities market results.

Highest/Lowest quarterly results during this period were:

Highest 19.32% (quarter ended June 30, 2020)

Lowest -25.85% (quarter ended March 31, 2020)

Average Annual Returns - AMERICAN FUNDS DEVELOPING WORLD GROWTH & INCOME FUND |

Average Annual Returns, 1 Year |

Average Annual Returns, 5 Years |

Average Annual Returns, Since Inception |

Average Annual Returns, Inception Date |

|---|---|---|---|---|

| Class F-2 | (23.22%) | (1.81%) | 1.24% | Feb. 03, 2014 |

| Class A | (27.88%) | (3.26%) | 0.28% | Feb. 03, 2014 |

| Class C | (24.89%) | (2.86%) | 0.25% | Feb. 03, 2014 |

| Class F-1 | (23.51%) | (2.09%) | 0.97% | Feb. 03, 2014 |

| Class F-3 | (23.15%) | (1.72%) | 1.91% | Jan. 27, 2017 |

| Class 529-A | (26.18%) | (2.83%) | 0.52% | Feb. 03, 2014 |

| Class 529-C | (24.90%) | (2.89%) | 0.47% | Feb. 03, 2014 |

| Class 529-E | (23.57%) | (2.29%) | 0.75% | Feb. 03, 2014 |

| Class 529-F-1 | (23.30%) | (1.90%) | 1.13% | Feb. 03, 2014 |

| Class 529-F-2 | (23.21%) | (3.99%) | Oct. 30, 2020 | |

| Class 529-F-3 | (23.25%) | (3.97%) | Oct. 30, 2020 | |

| Class R-1 | (24.00%) | (2.79%) | 0.24% | Feb. 03, 2014 |

| Class R-2 | (24.05%) | (2.78%) | 0.22% | Feb. 03, 2014 |

| Class R-2E | (23.79%) | (2.50%) | (1.23%) | Aug. 29, 2014 |

| Class R-3 | (23.63%) | (2.34%) | 0.70% | Feb. 03, 2014 |

| Class R-4 | (23.43%) | (2.05%) | 1.00% | Feb. 03, 2014 |

| Class R-5E | (23.29%) | (1.85%) | 2.64% | Nov. 20, 2015 |

| Class R-5 | (23.17%) | (1.75%) | 1.30% | Feb. 03, 2014 |

| Class R-6 | (23.13%) | (1.69%) | 1.35% | Feb. 03, 2014 |

| After Taxes on Distributions | Class F-2 | (23.15%) | (1.97%) | 1.00% | |

| After Taxes on Distributions and Sale of Fund Shares | Class F-2 | (13.23%) | (1.10%) | 1.17% | |

| MSCI Emerging Markets Index (reflects no deductions for sales charges, account fees, expenses or U.S. federal income taxes) | (20.09%) | (1.40%) | 2.81% | Feb. 03, 2014 |

After-tax returns are shown only for Class F-2 shares; after-tax returns for other share classes will vary. After-tax returns are calculated using the highest individual federal income tax rates in effect during each year of the periods shown and do not reflect the impact of state and local taxes. Your actual after-tax returns depend on your individual tax situation and likely will differ from the results shown above. In addition, after-tax returns are not relevant if you hold your fund shares through a tax-favored arrangement, such as a 401(k) plan, individual retirement account (IRA) or 529 college savings plan.