| Investor presentation FEB RUARY 2023 |

| 2 THIS PRESENTATION AND ITS CONTENTS ARE CONFIDENTIAL AND ARE NOT FOR RELEASE, REPRODUCTION, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, TO ANY OTHER PERSON OR IN OR INTO OR FROM ANY JURISDICTION WHERE SUCH RELEASE, REPRODUCTION, PUBLICATION OR DISTRIBUTION IS UNLAWFUL .. PERSONS INTO WHOSE POSSESSION THIS PRESENTATION COMES SHOULD INFORM THEMSELVES ABOUT, AND OBSERVE, ANY SUCH RESTRICTIONS .. THIS PRESENTATION IS NOT AN OFFER OR AN INVITATION TO BUY, SELL OR SUBSCRIBE FOR SECURITIES .. About this Presentation This Presentation has been prepared by L Catterton Asia Acquisition Corp (“SPAC” or “ L CAA”) and Lotus Technology Inc .. (the “Company” or “Lotus Technology”) in connection with a potential business combination involving SPAC and the Company (the “Transaction”) .. This Presentation is preliminary in nature and solely for information and discussion purposes and must not be relied upon for any other purpose .. For the purpose of this notice, “Presentation” shall mean and include the slides that follow, the oral presentation of the slides by members of SPAC or the Company or any person on their behalf, the question - and - answer session that follows that oral presentation, copies of this document and any materials distributed at, or in connection with, that presentation .. By accepting this Presentation, participating in the meeting, or by reading the Presentation slides, you will be deemed to have (i) acknowledged and agreed to the following conditions, limitations and notifications and made the following undertakings, and (ii) acknowledged that you understand the legal and regulatory sanctions attached to the misuse, disclosure or improper circulation of this Presentation .. This Presentation does not constitute (i) an offer or invitation for the sale or purchase of the securities, assets or business described herein or a commitment of the Company or SPAC with respect to any of the foregoing, or (ii) a solicitation of proxy, consent or authorisation with respect to any securities or in respect of the Transaction, and this Presentation shall not form the basis of any contract, commitment or investment decision and does not constitute either advice or recommendation regarding any securities .. The Company and SPAC expressly reserve the right, at any time and in any respect, to amend or terminate this process, to terminate discussions with any or all potential investors, to accept or reject any proposals and to negotiate with, or cease negotiations with, any party regarding a transaction involving the Company and SPAC .. Any offer to sell securities will be made only pursuant to a definitive subscription agreement and will be made in reliance on an exemption from registration under the Securities Act of 1933 , as amended, and the rules and regulations promulgated thereunder (collectively, the “Securities Act”), for offers and sales of securities that do not involve a public offering .. Furthermore, all or a portion of the information contained in this Presentation may constitute material non - public information of the Company, SPAC and their respective affiliates, and other parties that may be referred to in the context of those discussions .. By your receipt of this Presentation, you acknowledge that applicable securities laws restrict a person from purchasing or selling securities of a person with tradeable securities from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities .. Except where otherwise indicated, this Presentation speaks as of the date hereof .. The information contained in this Presentation replaces and supersedes, in its entirety, information of all prior versions of similar presentations .. This Presentation does not purport to contain all information that may be required for or relevant to an evaluation of the Transaction .. Further, this Presentation should not be construed as legal, tax, investment or other advice, and should not be relied upon to form the basis of, or be relied on in connection with, any contract or commitment or investment decision whatsoever .. You will be responsible for conducting any investigations and analysis that is deemed appropriate and should consult your own legal, regulatory, tax, business, financial and accounting advisors to the extent you deem necessary, and must make your own investment decision and perform your own independent investigation and analysis with respect to the Transaction, any investment in SPAC and the transactions contemplated in this Presentation .. SPAC and the Company reserve the right to amend or replace this Presentation at any time but none of SPAC and the Company, their respective subsidiaries, affiliates, legal advisors, financial advisors or agents shall have any obligation to update or supplement any content set forth in this Presentation or otherwise provide any additional information to you in connection with the Transaction should circumstances, management’s estimates or opinions change or any information provided in this Presentation become inaccurate .. Confidential Information The information contained in this Presentation is confidential and being provided to you solely for the purpose of assisting you in familiarizing yourself with SPAC and the Company in connection with the Transaction .. This Presentation shall remain the property of the Company and the Company reserves the right to require the return of this Presentation (together with any copies or extracts thereof) at any time .. Neither this Presentation nor any of its contents may be disclosed or used for any purposes other than information and discussion purposes without the prior written consent of SPAC and the Company .. You agree that you will not copy, reproduce or distribute this Presentation, in whole or in part, to other persons or entities at any time without the prior written consent of SPAC and the Company .. Any unauthorised distribution or reproduction of any part of this Presentation may result in a violation of the Securities Act .. Forward - Looking Statements Certain statements included in this Presentation are forward - looking statements .. All statements other than statements of historical fact contained in this Presentation, including statements as to future results of operations and financial position, planned products and services, business strategy and plans, objectives of management for future operations of the Company, market size and growth opportunities, competitive position and technological and market trends, are forward - looking statements .. Some of these forward - looking statements can be identified by the use of forward - looking words, including “anticipate,” “expect,” “suggests,” “plan,” “believe,” “intend,” “estimates,” “targets,” “projects,” “should,” “could,” “would,” “may,” “will,” “forecast” or other similar expressions .. All forward - looking statements are based upon current estimates and forecasts and reflect the views, assumptions, expectations, and opinions of SPAC and the Company as of the date of this Presentation, and are therefore subject to a number of factors, risks and uncertainties, some of which are not currently known to SPAC or the Company .. Some of these factors include, but are not limited to : the company’s success in the highly competitive automotive market, the Company’s reliance on Geely , the Company’s ability to maintain the “Lotus” brand, the Company’s limited number of orders, the Company’s limited number of models, the Company’s dependency on consumers’ demand and willingness for electronic vehicles and passenger vehicles, unforeseen changes of the Company’s industry and technology, the Company’s dependency of suppliers, cost increases or disruptions of raw materials and other components , and the global shortage in the supply of semiconductor chips .. The foregoing list of factors is not exhaustive .. You should carefully consider the risks and uncertainties described in the “Risk Factors” section of this Presentation and the “Risk Factors” section of the proxy statement/prospectus on Form F - 4 relating to the Transaction which is expected to be filed with the U .. S .. Securities and Exchange Commission (“SEC”), and other documents filed from time to time with the SEC .. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward - looking statements .. In light of these factors, risks and uncertainties, the forward - looking events and circumstances discussed in this Presentation may not occur, and any estimates, assumptions, expectations, forecasts, views or opinions set forth in this Presentation should be regarded as preliminary and for illustrative purposes only and accordingly, undue reliance should not be placed upon the forward - looking statements .. SPAC and the Company assume no obligation and do not intend to update or revise these forward - looking statements, whether as a result of new information, future events, or otherwise, except as required by law .. Moreover, the Company operates in a very competitive and rapidly changing environment, and new risks may emerge from time to time .. It is not possible to predict all risks, nor assess the impact of all factors on the Company’s business or the extent to which any factor, or combination of factors, may cause the Company’s actual results, performance or financial condition to be materially different from the expected future results, performance of financial condition .. In addition, the analyses of SPAC and the Company contained herein are not, and do not purport to be, appraisals of the securities, assets or business of the Company, SPAC or any other entity .. There may be additional risks that neither SPAC nor the Company presently knows or that SPAC and the Company currently believe are immaterial that could also cause actual results to differ from those contained in the forward - looking statements .. These forward - looking statements should not be relied upon as representing the Company’s or SPAC’s assessment as of any date subsequent to the date of this Presentation .. More generally, SPAC and the Company caution you against relying on these forward - looking statements, and SPAC and the Company qualify all of our forward - looking statements by these cautionary statements .. DISCLAIMER (1/2) |

| 3 Industry and Market Data This Presentation also contains information, estimates and other statistical data derived from third party sources including Oliver Wyman, LLC .. Such information involves a number of assumptions and limitations, and due to the nature of the techniques and methodologies used in market research, Oliver Wyman, LLC cannot guarantee the accuracy of such information .. You are cautioned not to give undue weight to such estimates .. Neither SPAC nor the Company has independently verified such third party information, and makes no representation, express or implied, as to the accuracy, completeness, timeliness, reliability or availability of, such third party information .. SPAC and the Company may have supplemented such information where necessary, taking into account publicly available information about other industry participants .. Presentation of Financial Data The financial information and data contained in this Presentation has not been audited in accordance with the standards of the Public Company Oversight Board (“PCAOB”) or prepared in accordance with Regulation S - X promulgated under the Securities Act (“Regulation S - X”) .. Accordingly, such information and data may not be included in, may be adjusted in, or may be presented differently in, any proxy statement, prospectus or other report or document filed or to be filed or furnished by the Company or SPAC with the SEC .. Neither SPAC nor the Company can assure you that, had the financial information and data included in this Presentation been compliant with Regulation S - X and audited in accordance with PCAOB standards, there would not be differences, which differences could be material .. This Presentation includes certain financial information of the Company that has not been audited or reviewed by the Company's independent auditor .. In addition, certain projections or forecasts for the Company included in this Presentation are based on such unaudited and unreviewed financial information .. Upon completion of the Company auditor's review or audit of the financial information included in this Presentation, it is possible that changes to the financial information and/or projections or forecasts included in this Presentation may be necessary .. Therefore, undue reliance should not be placed on such financial information, projections or forecasts .. Use of Projections This Presentation contains financial forecasts for the Company with respect to certain of its financial results for the fiscal years 2023 - 2025 for illustrative purposes .. Neither SPAC’s nor the Company’s independent auditors have audited, studied, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this Presentation, and accordingly, they did not express any opinion or provide any other form of assurance with respect thereto for the purpose of this Presentation .. These projections are forward - looking statements and should not be relied upon as being necessarily indicative of future results .. The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information .. While such information and projections are necessarily speculative, SPAC and the Company believe that the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection extends from the date of preparation .. Accordingly, there can be no assurance that the prospective results are indicative of the future performance of the Company or that actual results will not differ materially from those presented in the prospective financial information .. The inclusion of prospective financial information in this Presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved .. All subsequent written and oral forward - looking statements concerning the Company or SPAC, the Transaction or other matters and attributable to the Company or SPAC or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above .. Non - GAAP Financial Measures This Presentation also includes non - GAAP financial measures, such as EBITDA .. Such non - GAAP measures should be considered only as supplemental to, and not as superior to, financial measures prepared in accordance with GAAP .. SPAC and the Company believe these non - GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to the Company’s financial condition and results of operations .. SPAC and the Company believe that the use of these non - GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends in and in comparing the Company’s financial measures with other similar companies, many of which present similar non - GAAP financial measures to investors .. Management does not consider these non - GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP .. These non - GAAP financial measures are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non - GAAP financial measures .. Additionally, to the extent that forward - looking non - GAAP financial measures are provided, they are presented on a non - GAAP basis without reconciliations of such forward - looking non - GAAP measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation .. Additional Information In connection with the Transaction, the SPAC will be required to file a preliminary and definitive proxy statement, which may include a registration statement, and other relevant documents with the SEC .. You are urged to read the proxy statement/prospectus and any other relevant documents filed with the SEC when they become available because, among other things, they will contain updates to the financial, industry and other information herein as well as important information about SPAC, the Company and the Transaction .. Shareholders of SPAC will be able to obtain a free copy of the proxy statement when filed, as well as other filings containing information about SPAC, the Company and the Transaction, without charge, at the SEC’s website located at www .. sec .. gov .. Participants in the Solicitation SPAC and the Company, and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from SPAC’s shareholders in connection with the Transaction .. A list of the names of such directors and executive officers and information regarding their interests in the Transaction will be contained in the proxy statement .. You may obtain free copies of these documents as described in the preceding paragraph .. The definitive proxy statement will be mailed to shareholders of SPAC as of a record date to be established for voting on the Transaction when it becomes available .. Participants in Solicitation SPAC, the Company and their respective directors, executive officers, other members of management, and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies from SPAC' shareholders in connection with the Transaction .. You can find information about SPAC' directors and executive officers and their interest in SPAC can be found in SPAC' Annual Report on Form 10 - K for the fiscal year ended 31 December 2021 , which was originally filed with the SEC on March 28 , 2022 .. A list of the names of the directors, executive officers, other members of management and employees of SPAC and the Company, as well as information regarding their interests in the Transaction, will be contained in the Registration Statement on Form F - 4 to be filed with the SEC by the Company .. Additional information regarding the interests of such potential participants in the solicitation process may also be included in other relevant documents when they are filed with the SEC .. You may obtain free copies of these documents from the sources indicated above .. No Offer or Solicitation This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction .. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, or an exemption therefrom .. Trademarks This Presentation may contain trademarks, service marks, trade names and copyrights of third parties, which are the property of their respective owners .. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this Presentation may be listed without the TM, SM © or ® symbols, but such references are not intended to indicate, in any way, that SPAC, the Company or the third - parties will not assert, to the fullest extent under applicable law, their rights or the right of the applicable owners or licensors to these trademarks, service marks, trade names and copyrights .. Neither SPAC, the Company, nor any of their respective directors, officers, employees, affiliates, advisors, representatives or agents, makes any representation or warranty of any kind, express or implied, as to the value that may be realised in connection with the Transaction, the legal, regulatory, tax, financial, accounting or other effects of the Transaction or the timeliness, accuracy or completeness of the information contained in this Presentation, and none of them shall have any liability based on or arising from, in whole or in part, any information contained in, or omitted from, this Presentation or for any other written or oral communication transmitted to any person or entity in the course of its evaluation of the Transaction, and they expressly disclaim any responsibility or liability for direct, indirect, incidental, exemplary, compensatory, punitive, special, or consequential damages, costs, expenses, legal fees, or losses (including lost income or profits and opportunity costs) in connection with the use of the information herein .. DISCLAIMER (2/2) |

| 4 Risks Relating to Lotus Tech's Business and Industry 1. The automotive market is highly competitive, and we may not be successful in competing in this industry .. 2. Our reliance on a variety of arrangements with Geely could subject us to risks .. 3. We may not succeed in continuing to maintain and strengthen our brand, and our brand and reputation could be harmed by negative publicity with respect to us, our directors, officers, employees, shareholders, peers, business partners, or our industry in general .. 4. We have a limited operating history and our ability to develop, manufacture, and deliver automobiles of high quality and appeal to customers, on schedule, and on a large scale is unproven and still evolving .. 5. We have received a limited number of orders for Eletre , all of which may be cancelled by customers despite their deposit payment and online confirmation .. 6. We currently depend on revenues generated from a limited number of model of vehicles and expect this to continue in the foreseeable future .. 7. Our future growth is dependent on the demand for, and upon consumers’ willingness to adopt electric vehicles .. 8. Our future growth is dependent on the consumer demand for passenger vehicles, the prospects of which are subject to many uncertainties .. 9. Our industry and its technology are rapidly evolving and may be subject to unforeseen changes .. Developments in alternative technologies or improvements in internal combustion engine technology may materially and adversely affect the demand for our electric vehicles .. 10. We are dependent on our suppliers, many of whom are our single source suppliers for the components they supply .. 11. We could experience cost increases or disruptions in supply of raw materials or other components used in our vehicles .. 12. The global shortage in the supply of semiconductor chips may disrupt our operations and adversely affect our business, results of operations, and financial condition .. 13. Our forecasts and projections are based upon assumptions, analyses and internal estimates developed by our management .. If these assumptions, analyses or estimates prove to be incorrect or inaccurate, our actual operating results may differ materially and adversely f orecasted or projected .. 14. We have not been profitable and had negative net cash flows from operations, and there can be no assurance that this will change in the future .. 15. If we fail to effectively manage our inventory, our results of operations and financial condition may be materially and adversely affected .. 16. We may be unable to adequately control the costs associated with our operations .. 17. If we fail to manage our growth effectively, we may not be able to market and sell our vehicles successfully .. 18. Our business plans require a significant amount of capital .. In addition, our future capital needs may require us to obtain additional equity or debt financing that may dilute our shareholders or introduce covenants that may restrict our operations or our ability to pay dividends .. 19. If our suppliers fail to use ethical business practices and comply with applicable laws and regulations, our brand image could be harmed due to negative publicity .. 20. Any delays in the manufacturing and launch of the commercial production vehicles in our pipeline could have a material adverse effect on our business .. 21. We may not be able to expand our physical sales network cost - efficiently .. Our distribution model is different from the currently predominant distribution model for automakers, and its long - term viability is unproven .. 22. Our vehicles may not perform in line with customer expectations and may contain defects .. Risks Relating to Doing Business in China 1. The PRC government has significant oversight and discretion over our business operations, and it may influence or intervene in our operations as part of its efforts to enforce PRC law, which could result in a material adverse change in our operations and the value of our securities .. 2. Uncertainties in the PRC legal system and the interpretation and enforcement of PRC laws and regulations could limit the legal protections available to you and us, hinder our ability and the ability of any holder of our securities to offer or continue to offer such securities, result in a material adverse change to our business operations, and damage our reputation, which would materially and adversely affect our financial condition and results of operations and may cause our securities to significantly decline in value or become worthless .. 3. We may be adversely affected by the complexity, uncertainties and changes in PRC regulations on automotive as well as internet - related businesses and companies .. 4. The approval of and filing with the CSRC or other PRC government authorities may be required in connection with this offering under PRC law, and, if so required, we cannot predict whether or when we will be able to obtain such approval or complete such filing, and even if we obtain such approval, it could be rescinded .. Any failure to or delay in obtaining such approval or complying with such filing requirements in relation to offering, or a rescission of such approval, could subject us to sanctions imposed by the CSRC or other PRC government authorities .. 5. The PCAOB had historically been unable to inspect our auditor in relation to their audit work performed for our financial statements and the inability of the PCAOB to conduct inspections over our auditor in the past had deprived our investors with the benefits of such inspections .. 6. Our securities may be prohibited from trading in the United States under the Holding Foreign Companies Accountable Act, or the HFCAA, if the PCAOB is unable to inspect or investigate completely auditors located in China .. The delisting of our securities, or the threat of their being delisted, may materially and adversely affect the value of your investment .. 7. Additional disclosure requirements to be adopted by and regulatory scrutiny from the SEC in response to risks related to companies with substantial operations in China, which could increase our compliance costs, subject us to additional disclosure requirements, and/or suspend or terminate our future securities offerings, making capital - raising more difficult .. 8. China’s M&A Rules and certain other PRC regulations establish complex procedures for certain acquisitions of PRC companies by foreign investors, which could make it more difficult for us to pursue growth through acquisitions in China .. 9. Substantial uncertainties exist with respect to the interpretation and implementation of newly enacted 2019 PRC Foreign Investment Law and its Implementation Rules .. 10. PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may delay or prevent us from making loans to or make additional capital contributions to our PRC subsidiaries, which could materially and adversely affect our liquidity and our ability to fund and expand our business .. 11. We may rely on dividends and other distributions on equity paid by our PRC subsidiaries to fund any cash and financing requirements we may have, and any limitation on the ability of our PRC subsidiaries to make payments to us could have a material and adverse effect on our ability to conduct our business .. RISK FACTORS (1/2) |

| 5 Risks Relating to Intellectual Property and Legal Proceedings 1. We may need to defend ourselves against intellectual property right infringement, misappropriation, or other claims, which may be time - consuming and would cause us to incur substantial costs .. 2. We may not be able to prevent others from unauthorised use of our intellectual property, which could harm our business and competitive position .. 3. We may not be able to adequately obtain or maintain our proprietary and intellectual property rights in our data or technology .. 4. As our patents may expire and may not be extended, our patent applications may not be granted, and our patent rights may be contested, circumvented, invalidated, or limited in scope, our patent rights may not protect us effectively .. In particular, we may not be able to prevent others from developing or exploiting competing technologies, which could materially and adversely affect our business, financial condition, and results of operations .. 5. In addition to patented technologies, we rely on our unpatented proprietary technologies, trade secrets, processes, and know - how .. Risks Relating to L CAA and the Business Combination 1. L CAA’s current directors’ and executive officers’ affiliates own L CAA Shares that will be worthless if the Business Combination is not approved .. Such interests may have influenced their decision to approve the Business Combination .. 2. The process of taking a company public by means of a business combination with a special purpose acquisition company is different from taking a company public through a traditional initial public offering and may create risks for L CAA’s unaffiliated investors 3. L CAA’s current directors and officers and their affiliates have interests that are different than, or in addition to (and which may conflict with), the interests of its shareholders, and therefore potential conflicts of interests exist in recommending that shareholders vote in favour of approval of the Business Combination .. Such conflicts of interests include that the Sponsor as well as L CAA’s directors and officers are expected to lose their entire investment in L CAA if the Business Combination is not completed .. 4. The exercise of L CAA directors’ discretion in agreeing to changes or waivers in the terms of the Business Combination may result in a conflict of interests when determining whether such changes to the terms of the Business Combination or waivers of conditions are appropriate and in L CAA’s best interest .. 5. L CAA may be forced to close the Business Combination even if L CAA determines it is no longer in L CAA shareholders’ best interest .. The foregoing summarizes certain of the general risks related to Lotus Tech and L CAA, and such list is not exhaustive .. The foregoing list has been prepared solely for purpose of assisting interested parties in making their own evaluation with respect to the Business Combination and not for any other purpose .. You should carefully consider these risks and uncertainties together with the other available information and should carry out your own diligence and consult with your own financial and legal advisors .. A more expansive description of the key risk factors will be filed with the SEC as part of the Form F - 4 registration statement referred to above and in subsequent filings with the SEC, and such risk factors will be more extensive than, and may differ significantly from, the above summary .. RISK FACTORS (2/2) |

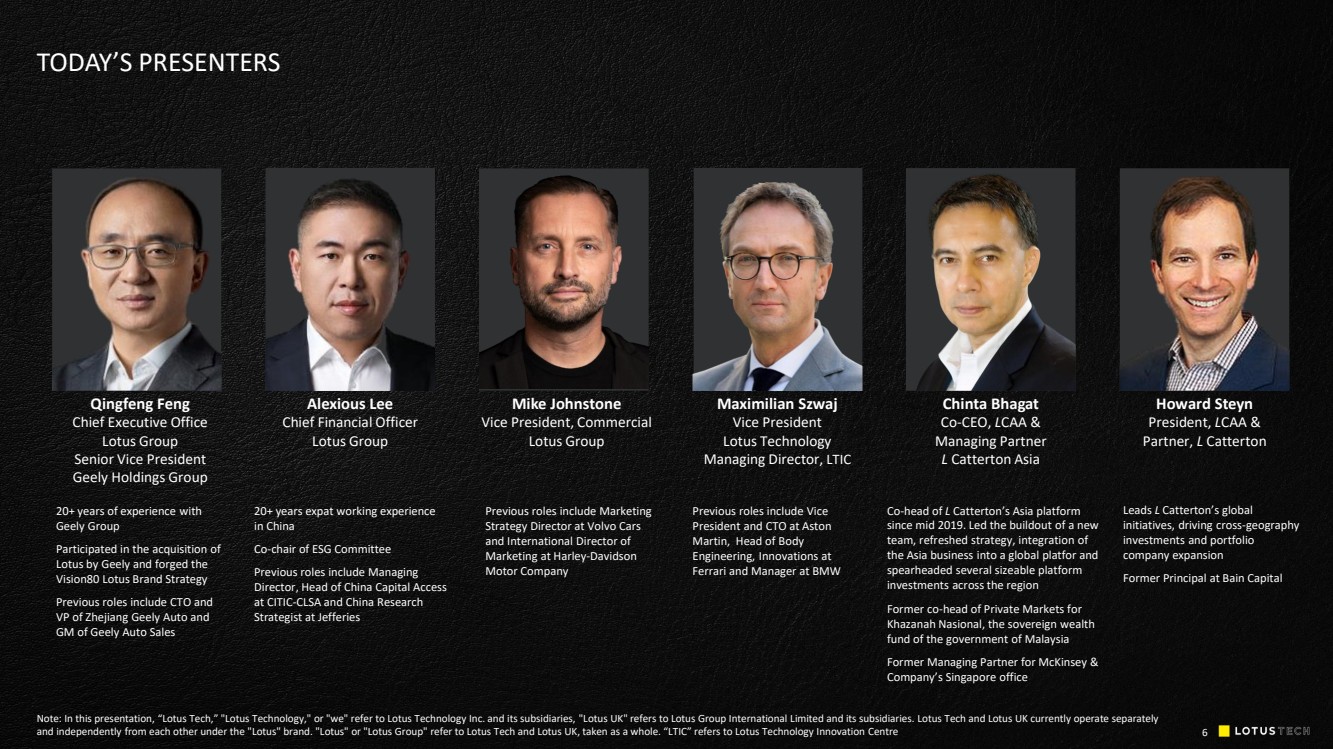

| 6 TODAY’S PRESENTERS Note: In this presentation, “Lotus Tech,” "Lotus Technology," or "we" refer to Lotus Technology Inc. and its subsidiaries, "L otu s UK" refers to Lotus Group International Limited and its subsidiaries. Lotus Tech and Lotus UK currently operate separately and independently from each other under the "Lotus" brand. "Lotus" or "Lotus Group" refer to Lotus Tech and Lotus UK, taken a s a whole. “LTIC” refers to Lotus Technology Innovation Centre Howard Steyn President, L CAA & Partner, L Catterton Alexious Lee Chief Financial Officer Lotus Group 20+ years expat working experience in China Co - chair of ESG Committee Previous roles include Managing Director, Head of China Capital Access at CITIC - CLSA and China Research Strategist at Jefferies Mike Johnstone Vice President, Commercial Lotus Group Previous roles include Marketing Strategy Director at Volvo C ars and International Director of Marketing at Harley - Davidson Motor Company Maximilian Szwaj Vice President Lotus Technology Managing Director, LTIC Previous roles include Vice President and CTO at Aston Martin, Head of Body Engineering, Innovations at Ferrari and Manager at BMW Chinta Bhagat Co - CEO, L CAA & Managing Partner L Catterton Asia Co - head of L Catterton’s Asia platform since mid 2019. Led the buildout of a new team, refreshed strategy, integration of the Asia business into a global platfor and spearheaded several sizeable platform investments across the region Former co - head of Private Markets for Khazanah Nasional , the sovereign wealth fund of the government of Malaysia Former Managing Partner for McKinsey & Company’s Singapore office Leads L Catterton’s global initiatives, driving cross - geography investments and portfolio company expansion Former Principal at Bain Capital 20+ years of experience with Geely Group Participated in the acquisition of Lotus by Geely and forged the Vision80 Lotus Brand Strategy Previous roles include CTO and VP of Zhejiang Geely Auto and GM of Geely Auto Sales Qingfeng Feng Chief Executive Office Lotus Group Senior Vice President Geely Holdings Group |

| Source: Public sources 1. The list of L Catterton portfolio companies includes historical and current investments L CATTERTON – TRUSTED PARTNER TO VISIONARY ENTREPRENEURS AND LEADING CONSUMER BUSINESSES Selected L Catterton Portfolio Companies 1 • A leading global consumer - focused investment firm with more than US$30bn of equity capital under management, investments in over 250 consumer companies and more than 200 investment and operating professionals across 17 offices • Focused exclusively on building iconic and enduring consumer brands since founding in 1989 • Strategic relationship with LVMH, the world’s largest luxury conglomerate with 75+ distinguished brands • Leveraging deep consumer insights and extensive operating capabilities to help build iconic brands and create significant shareholder value 1989 F ounded >US $30 bn Equity capital under management 250+ Investments 17 Offices globally 7 |

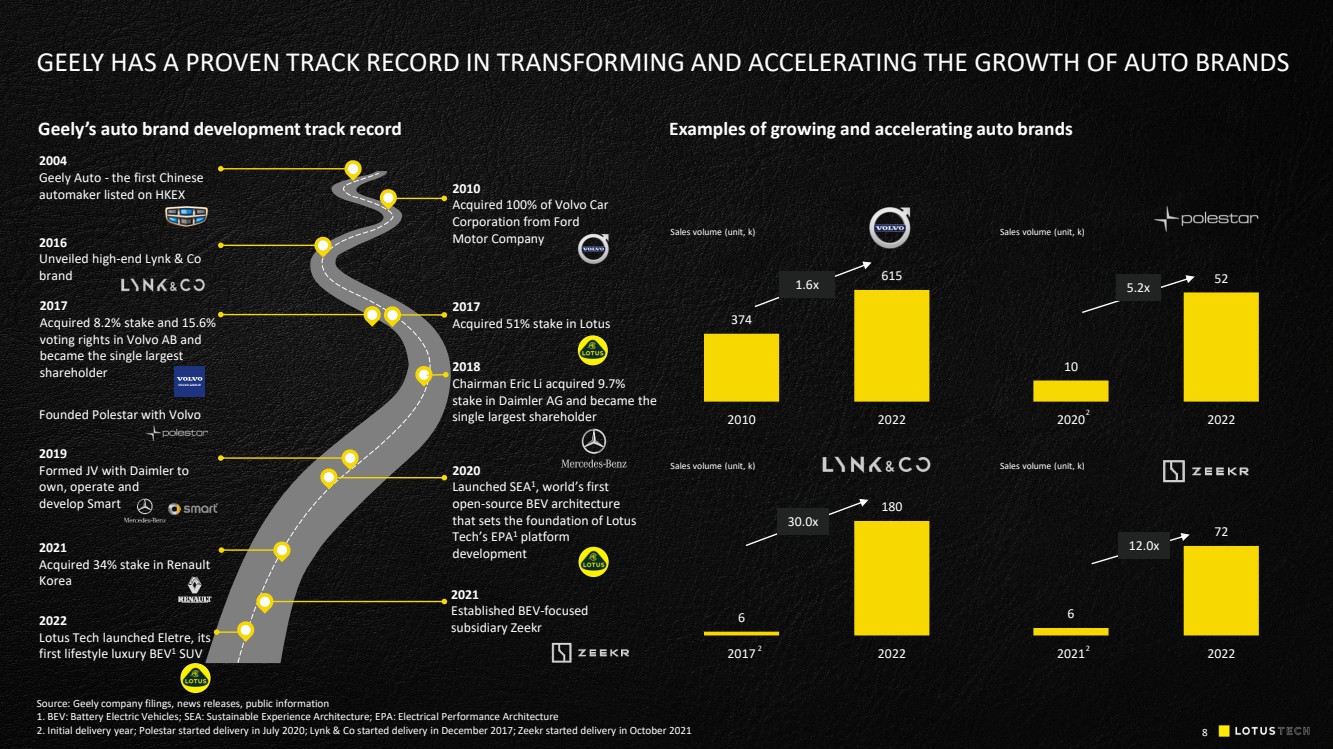

| Source: Geely company filings, news releases, public information 1. BEV: Battery Electric Vehicles; SEA: Sustainable Experience Architecture; EPA: Electrical Performance Architecture 2. Initial delivery year; Polestar started delivery in July 2020; Lynk & Co started delivery in December 2017; Zeekr started delivery in October 2021 8 GEELY HAS A PROVEN TRACK RECORD IN TRANSFORMING AND ACCELERATING THE GROWTH OF AUTO BRANDS Geely’s auto brand development track record Examples of growing and accelerating auto brands 374 615 2010 2022 Sales volume (unit, k) 6 72 2021 2022 Sales volume (unit, k) 6 180 2017 2022 Sales volume (unit, k) 10 52 2020 2022 Sales volume (unit, k) 1.6x 30.0x 12.0x 5.2x 2 2 2004 Geely Auto - the first Chinese automaker listed on HKEX 2016 Unveiled high - end Lynk & Co brand 2017 Acquired 8.2% stake and 15.6% voting rights in Volvo AB and became the single largest shareholder Founded Polestar with Volvo 2019 Formed JV with Daimler to own, operate and develop S mart 2021 Acquired 34% stake in Renault Korea 2022 Lotus Tech launched Eletre , its first lifestyle luxury BEV 1 SUV 2010 Acquired 100% of Volvo Car Corporation from Ford Motor Company 2017 Acquired 51% stake in Lotus 2018 Chairman Eric Li acquired 9.7% stake in Daimler AG and became the single largest shareholder 2020 Launched SEA 1 , world’s first open - source BEV architecture that sets the foundation of Lotus Tech’s EPA 1 platform development 2021 Established BEV - focused subsidiary Zeekr 2 |

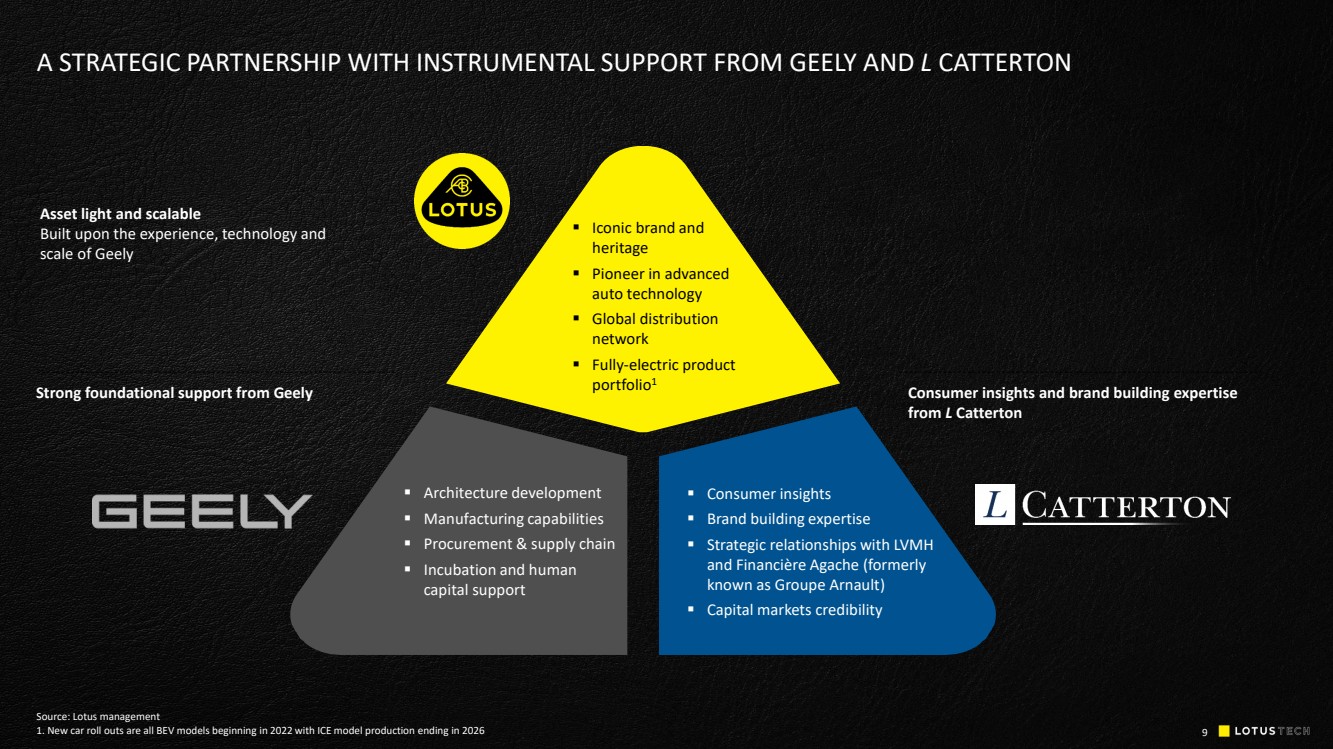

| 9 ▪ Iconic brand and heritage ▪ Pioneer in advanced auto technology ▪ Global distribution network ▪ Fully - electric product portfolio 1 ▪ Architecture development ▪ Manufacturing capabilities ▪ Procurement & supply chain ▪ Incubation and human capital support ▪ Consumer insights ▪ Brand building expertise ▪ S trategic relationships with LVMH and Financière Agache (formerly known as Groupe Arnault ) ▪ Capital markets credibility Strong foundational support from Geely Asset light and scalable Built upon the experience, technology and scale of Geely Consumer insights and brand building expertise from L Catterton A STRATEGIC PARTNERSHIP WITH INSTRUMENTAL SUPPORT FROM GEELY AND L CATTERTON Source: Lotus management 1. New car roll outs are all BEV models beginning in 2022 with ICE model production ending in 2026 |

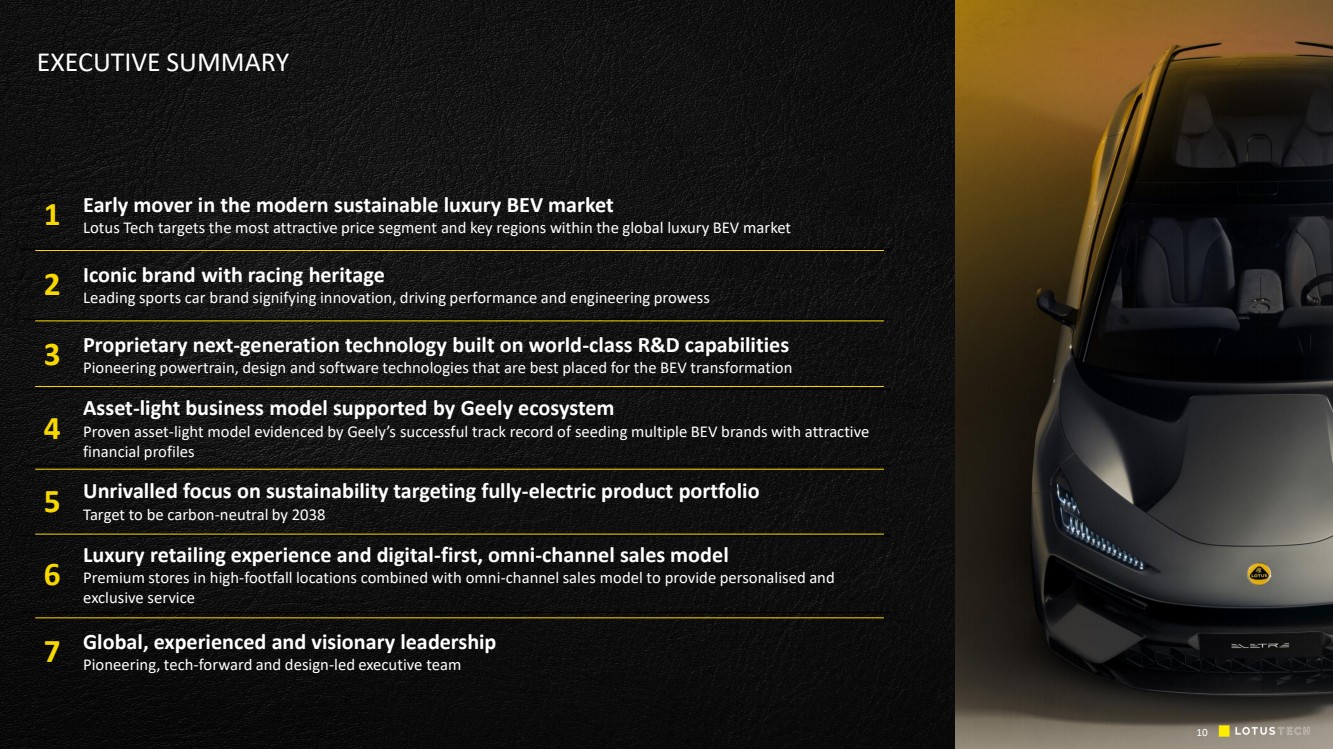

| 10 1 Early mover in the modern sustainable luxury BEV market Lotus Tech targets the most attractive price segment and key regions within the global luxury BEV market 2 Iconic brand with racing heritage Leading sports car brand signifying innovation, driving performance and engineering prowess 3 Proprietary next - generation technology built on world - class R&D capabilities Pioneering powertrain, design and software technologies that are best placed for the BEV transformation 4 Asset - light business model supported by Geely ecosystem Proven asset - light model evidenced by Geely’s successful track record of seeding multiple BEV brands with attractive financial profiles 5 U nrivalled focus on sustainability targeting fully - electric product portfolio Target to be carbon - neutral by 2038 6 Luxury retailing experience and digital - first, omni - channel sales model Premium stores in high - footfall locations combined with omni - channel sales model to provide personalised and exclusive service 7 Global, experienced and visionary leadership Pioneering, tech - forward and design - led executive team Darker picture EXECUTIVE SUMMARY 10 |

| BUSINESS OVERVIEW |

| MODERN SUSTAINABLE LUXURY BEV PERFORMANCE DESIGN ENGINEERING ICONIC BRAND & HERITAGE ‒ ESTABLISHED BRITISH BRAND ‒ RACING HERITAGE WITH SUPERIOR AERODYNAMICS ‒ PIONEER IN LIGHTWEIGHT TECHNOLOGY ‒ EARLY MOVER IN THE LUXURY LIFESTYLE BEV SEGMENT ‒ LEADER IN ADVANCED TECHNOLOGY ‒ FULLY - ELECTRIC PORTFOLIO 1 1. New car roll outs are all BEV models beginning in 2022 with ICE model production ending in 2026 TRANSFORMATION OF THE ICONIC LOTUS BRAND 12 |

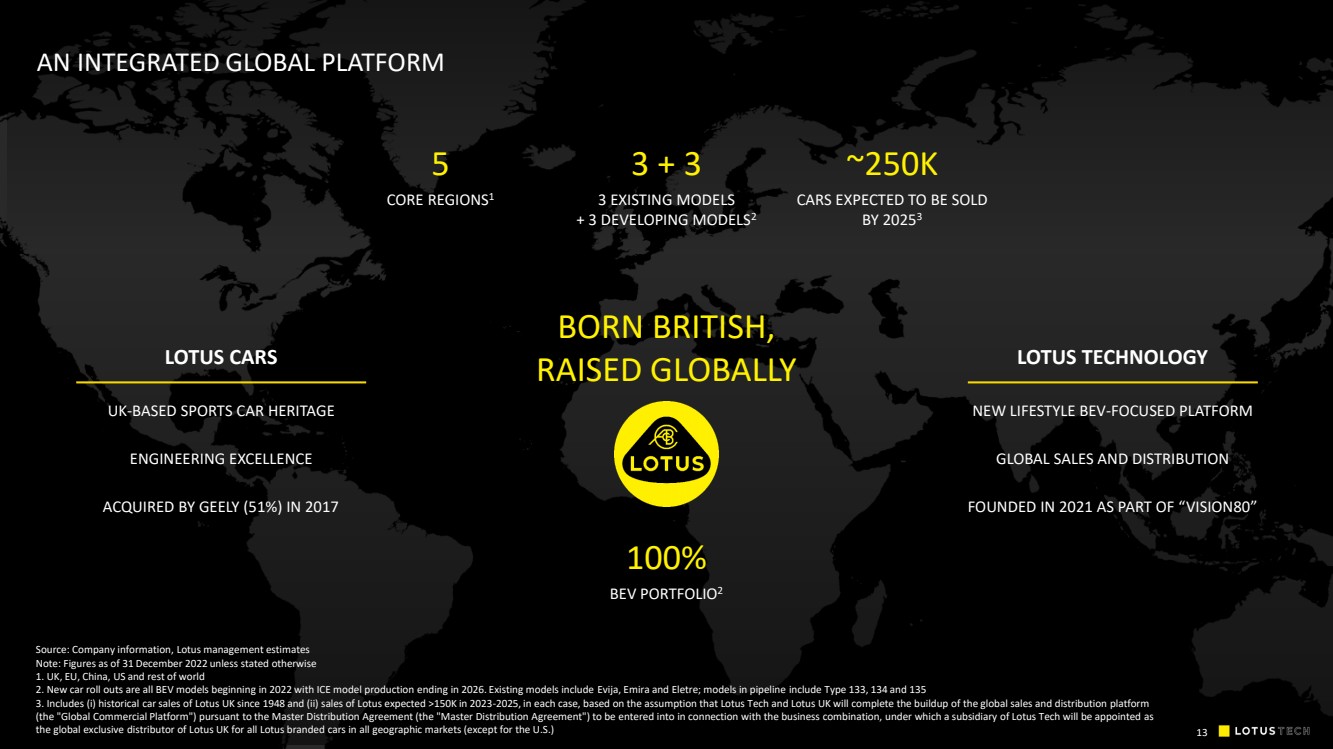

| LOTUS CARS UK - BASED SPORTS CAR HERITAGE ENGINEERING EXCELLENCE ACQUIRED BY GEELY (51%) IN 2017 LOTUS TECHNOLOGY NEW LIFESTYLE BEV - FOCUSED PLATFORM GLOBAL SALES AND DISTRIBUTION FOUNDED IN 2021 AS PART OF “VISION80” 13 100% BEV PORTFOLIO 2 BORN BRITISH, RAISED GLOBALLY 3 + 3 3 EXISTING MODELS + 3 DEVELOPING MODELS 2 ~250K CARS EXPECTED TO BE SOLD BY 2025 3 5 CORE REGIONS 1 Source: Company information, Lotus management estimates Note: Figures as of 31 December 2022 unless stated otherwise 1. UK, EU, China, US and rest of world 2. New car roll outs are all BEV models beginning in 2022 with ICE model production ending in 2026. Existing models include Evija , Emira and Eletre ; models in pipeline include Type 133, 134 and 135 3. Includes ( i ) historical car sales of Lotus UK since 1948 and (ii) sales of Lotus expected >150K in 2023 - 2025, in each case, based on the as sumption that Lotus Tech and Lotus UK will complete the buildup of the global sales and distribution platform (the "Global Commercial Platform") pursuant to the Master Distribution Agreement (the "Master Distribution Agreement") to be ent ered into in connection with the business combination, under which a subsidiary of Lotus Tech will be appointed as the global exclusive distributor of Lotus UK for all Lotus branded cars in all geographic markets (except for the U.S.) AN INTEGRATED GLOBAL PLATFORM 13 |

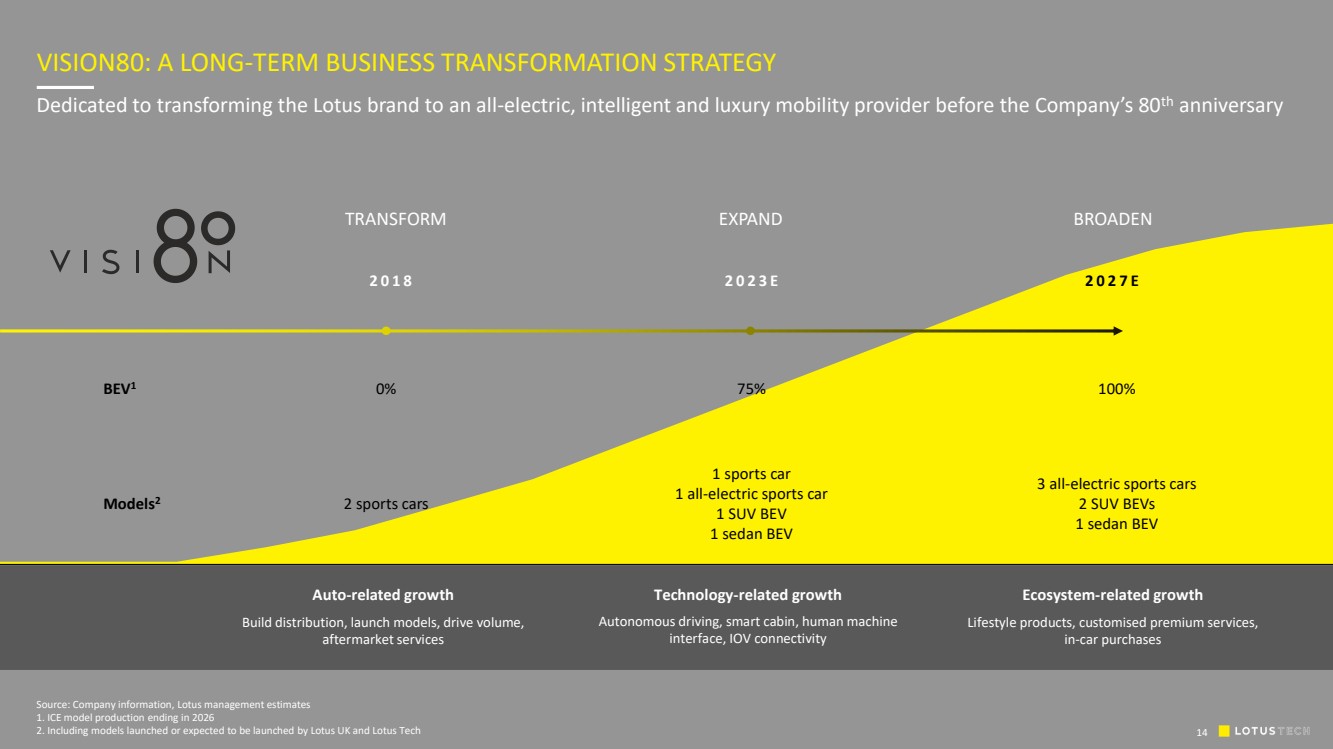

| 14 Technology - related growth Autonomous driving, smart cabin, human machine interface, IOV connectivity Auto - related growth Build distribution, launch models, drive volume, aftermarket services Ecosystem - related growth Lifestyle products, customised premium services, in - car purchases VISION80: A LONG - TERM BUSINESS TRANSFORMATION STRATEGY Source: Company information, Lotus management estimates 1. ICE model production ending in 2026 2. Including models launched or expected to be launched by Lotus UK and Lotus Tech 2018 2023E 2027E BEV 1 0% 75% 100% Models 2 2 sports cars 1 sports car 1 all - electric sports car 1 SUV BEV 1 sedan BEV 3 all - electric sports car s 2 SUV BEVs 1 sedan BEV Dedicated to transforming the Lotus brand to an all - electric, intelligent and luxury mobility provider before the Company’s 80 th anniversary 14 TRANSFORM EXPAND BROADEN |

| Source: Company information, Lotus management estimates 1. Average Manufacturer’s Suggested Retail Price (MSRP) 2. Forecasted annual sales volume in years when production level and sales volume are relatively stable: Evija (~2023 onwards), Emira (~2024 onwards), Eletre (~2026 onwards), Type 133 (~2027 onwards), Type 134 (~2027 onwards), Type 135 (~2029 onwards) 3. Developed and launched by Lotus UK 4. Originally released as the last ICE car by Lotus UK, the Emira is expected to be converted to BEV from 2027 onwards 15 Evija 3 (BEV Sports car) Emira 4 (ICE Sports car) Eletre (BEV SUV) Type 133 (BEV Sedan) Type 135 (BEV Sports car) Type 134 (BEV SUV) PRODUCT PORTFOLIO LEADING THE MODERN SUSTAINABLE LUXURY BEV MARK ET 2019 / 2023 2021 / 2022 2022 / Q1 2023 2023 / 2024 2024 / 2026 2025 / 2027 Launch / delivery year 2,200,000+ 85,000+ 100,000+ 100,000+ 70,000+ 95,000+ MSRP (US$) 1 25 5k - 6k 40k - 50k 30k - 40k 80k - 90k 10k - 15k Exp. annual sales volume 2 All new models after 2022 are BEVs |

| <20 min CHARGING SPEED (10 - 80% CHARGE) 905 hp 1 675KW 2.95 s 1 0 - 100 KM/H 0 - 62 MPH 600 km 2 TARGET RANGE (WLTP 3 COMBINED CYCLE) ~US$100K STARTING MSRP Reader Award, 2022 Electric Car of the Year We’re most curious to drive, The Electric Awards 2022 Finalist, Car Design Award 2022 1. Figure for Eletre R models 2. Figure for Eletre S models 3. WLTP: Worldwide Harmonised Light Vehicle Test Procedure THE WORLD’S FIRST ALL - ELECTRIC HYPER - SUV 16 |

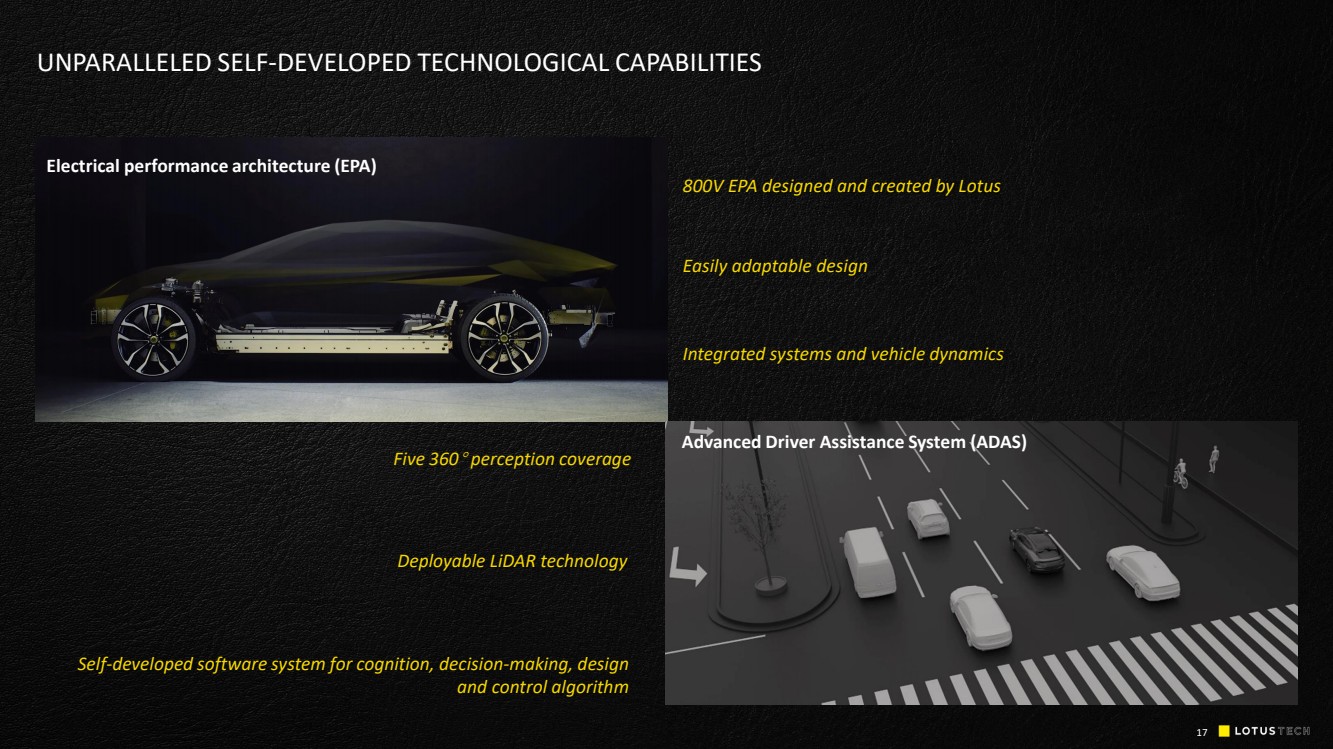

| 17 800V EPA designed and created by Lotus Self - developed software system for cognition, decision - making, design and control algorithm Deployable LiDAR technology Five 360 ° perception coverage Easily adaptable design UNPARALLELED SELF - DEVELOPED TECHNOLOGICAL CAPABILITIES Advanced Driver Assistance System (ADAS) Electrical performance architecture (EPA) Integrated systems and vehicle dynamics |

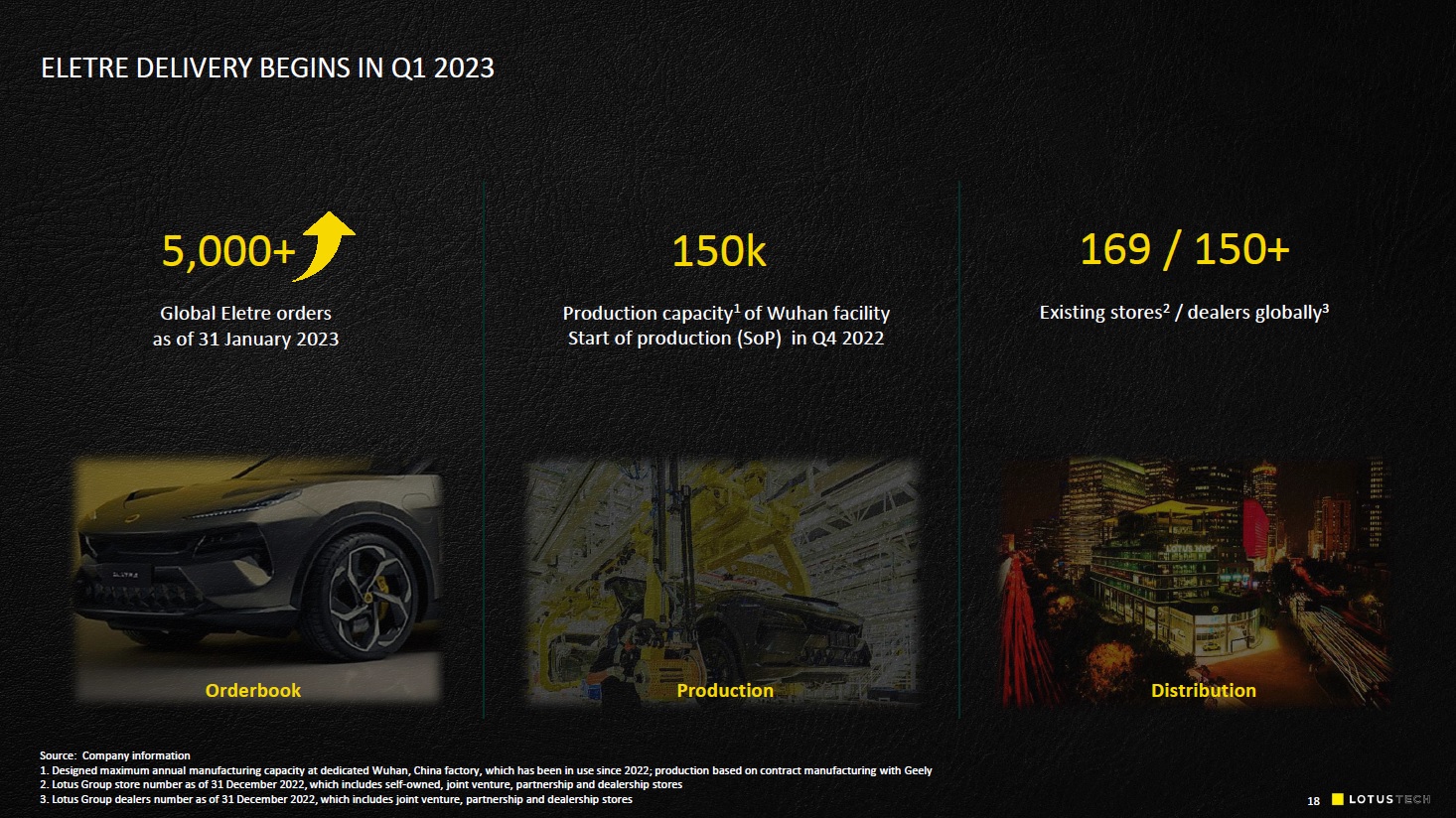

| Source: Company information 1. Designed maximum annual manufacturing capacity at dedicated Wuhan, China factory, which has been in use since 2022; produc tio n based on contract manufacturing with Geely 2. Lotus Group store / dealer number as of 31 December 2022; store number including self - owned, joint venture, partnership and dealership stores 18 ELETRE DELIVERY BEGINS IN Q1 2023 G lobal Eletre orders as of 31 January 2023 150 k Production capacity 1 of Wuhan facility Start of production ( SoP ) in Q4 2022 Existing stores / dealers globally 2 169 / 150+ Orderbook Production Distribution 5,000+ |

| INVESTMENT HIGHLIGHTS |

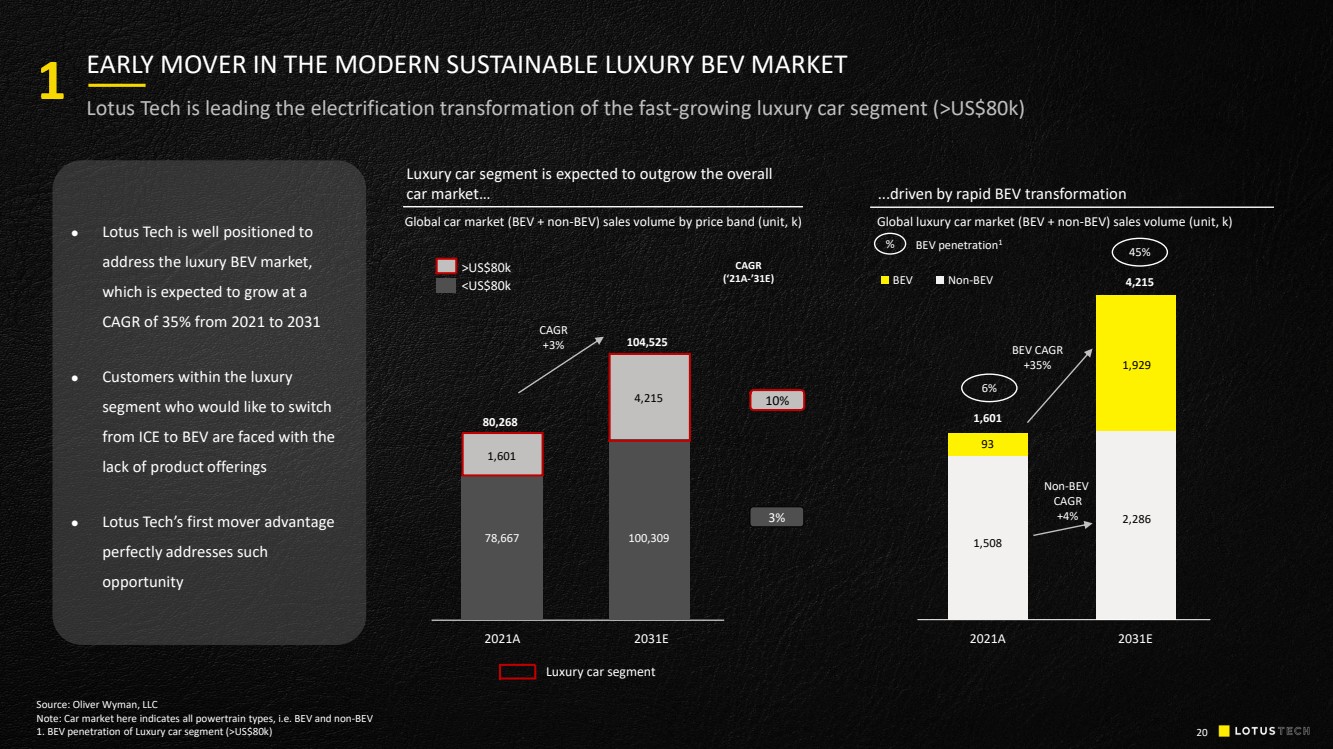

| Source: Oliver Wyman, LLC Note: Car market here indicates all powertrain types, i.e. BEV and non - BEV 1. BEV penetration of Luxury car segment (>US$80k) 20 ....driven by rapid BEV transformation EARLY MOVER IN THE MODERN SUSTAINABLE LUXURY BEV MARKET 1 Lotus Tech is leading the electrification transformation of the fast - growing luxury car segment (>US$80k) % 45% BEV penetration 1 6% Non - BEV CAGR +4% BEV CAGR +35% Global car market (BEV + non - BEV ) sales volume by price band (unit , k) 10% 3% >US$80k CAGR (‘21A - ’31E) Luxury car segment Luxury car segment is expected to outgrow the overall car market… Global luxury car market ( BEV + non - BEV) sales volume (u nit, k) CAGR +3% 2031E 2021A 4,266 2021A 78,667 1,601 80,268 4,266 100,309 4,215 104 ,525 2031E 2,286 1,929 93 1,508 1,601 4,215 BEV Non - BEV ⚫ Lotus Tech is well positioned to address the luxury BEV market, which is expected to grow at a CAGR of 35% from 2021 to 2031 ⚫ Customers within the luxury segment who would like to switch from ICE to BEV are faced with the lack of product offerings ⚫ Lotus Tech’s first mover advantage perfectly addresses such opportunity <US$80k |

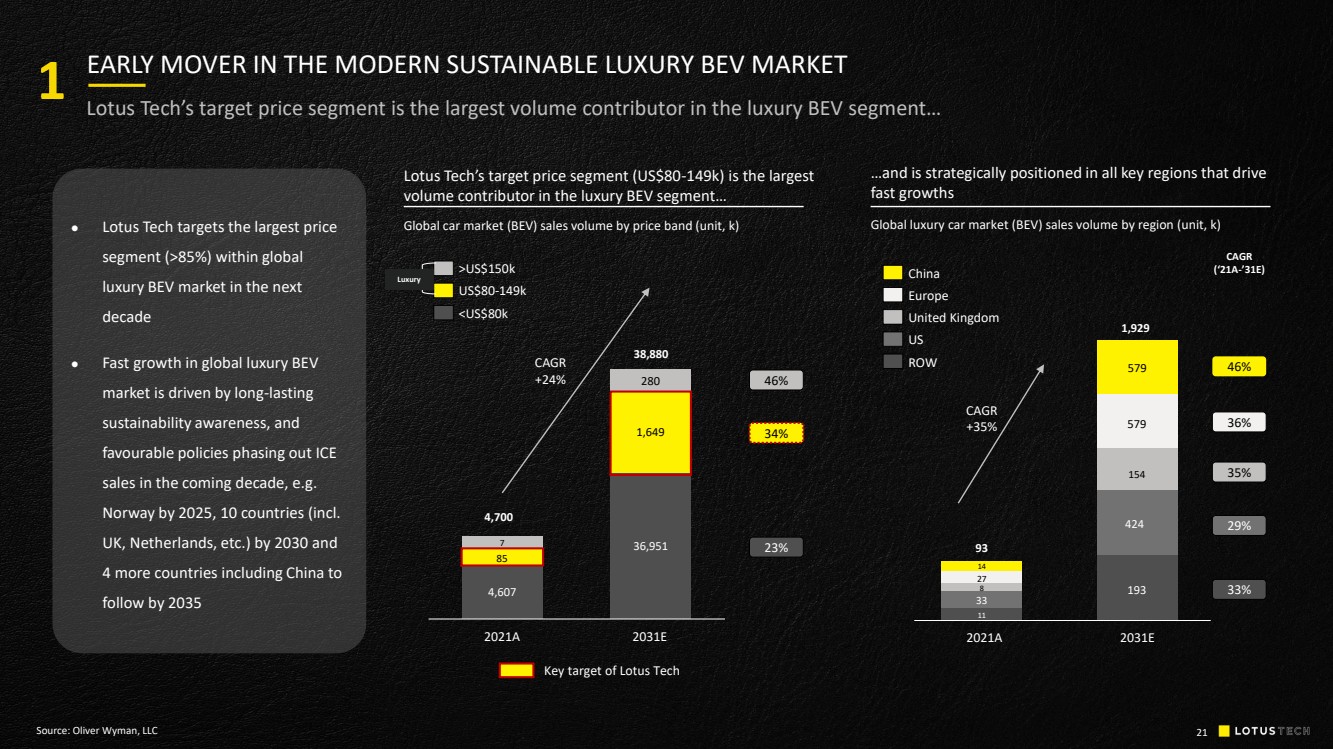

| 21 EARLY MOVER IN THE MODERN SUSTAINABLE LUXURY BEV MARKET 1 Lotus Tech’s target price segment is the largest volume contributor in the luxury BEV segment… Global luxury car market ( BEV ) sales volume by region (unit, k) CAGR (‘21A - ’31E) Global car market (BEV) sales volume by price band (unit, k) 46% 33% 35% 36% 29% Lotus Tech’s target price segment (US$80 - 149k) is the largest volume contributor in the luxury BEV segment… …and is strategically positioned in all key regions that drive fast growths 2021A 2031E 1,929 ROW China Europe United Kingdom US 14 11 33 8 27 93 35,867 579 579 193 424 154 ⚫ Lotus Tech targets the largest price segment (>85%) within global luxury BEV market in the next decade ⚫ Fast growth in global luxury BEV market is driven by long - lasting sustainability awareness, and favourable policies phasing out ICE sales in the coming decade, e.g. Norway by 2025, 10 countries (incl. UK, Netherlands, etc.) by 2030 and 4 more countries including China to follow by 2035 CAGR +35% Source: Oliver Wyman, LLC 34% 46% 23% 4,266 4,700 2021A 35,867 2031E CAGR +24% >US$150k <US$80k 4,607 85 7 280 1,649 36,951 38,880 Key target of Lotus Tech Luxury US$80 - 149k |

| 22 EARLY MOVER IN THE MODERN SUSTAINABLE LUXURY BEV MARKET 1 …however, the global luxury BEV market is currently underserved due to limited competitive models Comparison of global luxury vehicle models Source: Oliver Wyman , LLC Note: The charts cover a representative list of vehicle models and are not exhaustive BEV models: c.10 ICE models: 100+ VS Model X, S EQE, EQS Eletre iX e - tron Taycan … X6, X7, 7 - Series, 8 - Series Q8, A8 Cayenne (Coupe), Panamera, 911 DBX, Vantage Roma, 488, F8 GLE (Coupe), GLS, S - Class Levante, Quattroporte Range Rover (Sport) Urus, Huracan … |

| 23 FULLY - ELECTRIC PRODUCT PORTFOLIO 1 Transformation to fully - electric portfolio Brand heritage and luxury positioning 1 Heading the electrification wave among all global luxury automakers Source: Oliver Wyman , LLC 1. New car roll outs are all BEV models beginning in 2022 with ICE model production ending in 2026 |

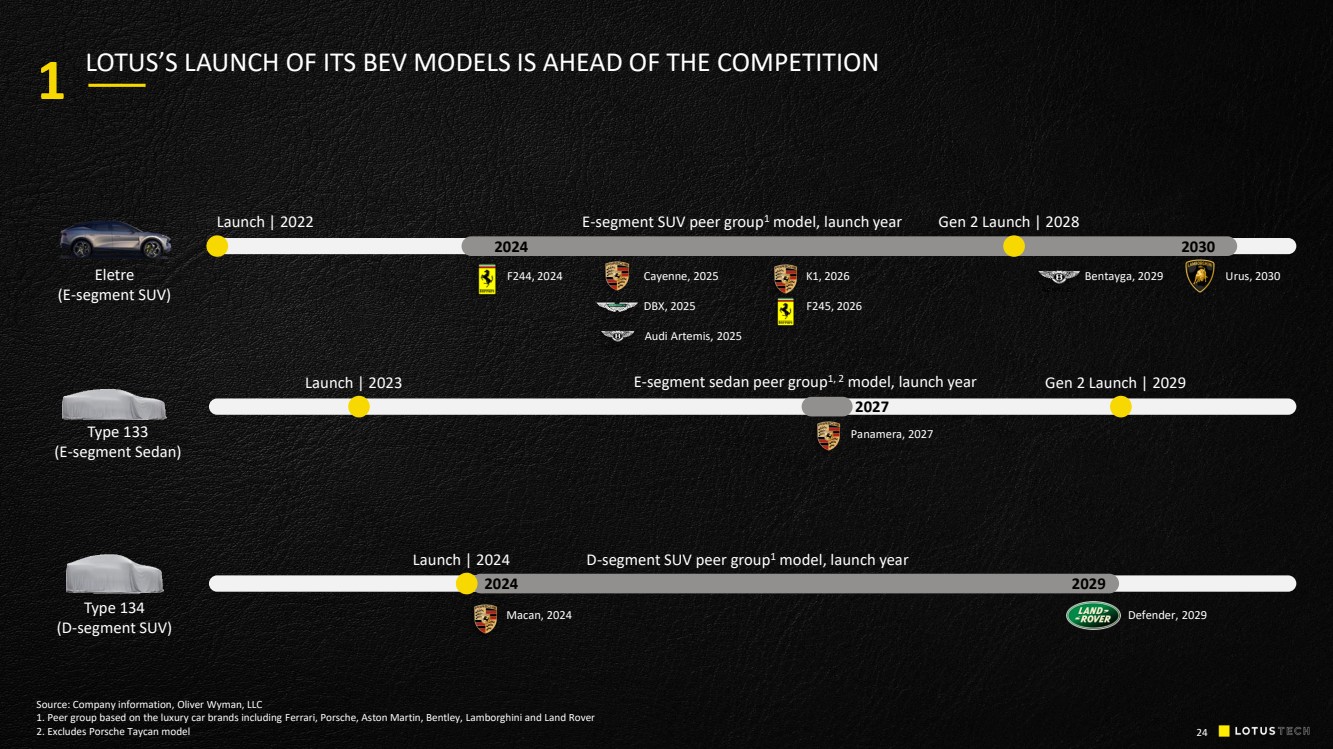

| Source: Company information, Oliver Wyman , LLC 1. Peer group based on the luxury car brands including Ferrari, Porsche, Aston Martin, Bentley, Lamborghini and Land Rover 2. Excludes Porsche Taycan model 24 LOTUS’S LAUNCH OF ITS BEV MODELS IS AHEAD OF THE COMPETITION 1 Type 134 (D - segment SUV) Launch | 2024 D - segment SUV peer group 1 model, launch year Type 133 (E - segment Sedan) Launch | 2023 Eletre (E - segment SUV) Launch | 2022 Gen 2 Launch | 2028 E - segment sedan peer group 1, 2 model, launch year 2027 E - segment SUV peer group 1 model, launch year 2030 2024 2029 2024 Gen 2 Launch | 2029 F244, 2024 DBX, 2025 Audi Artemis, 2025 K1, 2026 F245, 2026 Bentayga , 2029 Urus, 2030 Cayenne, 2025 Panamera, 2027 Macan, 2024 D efender , 2029 |

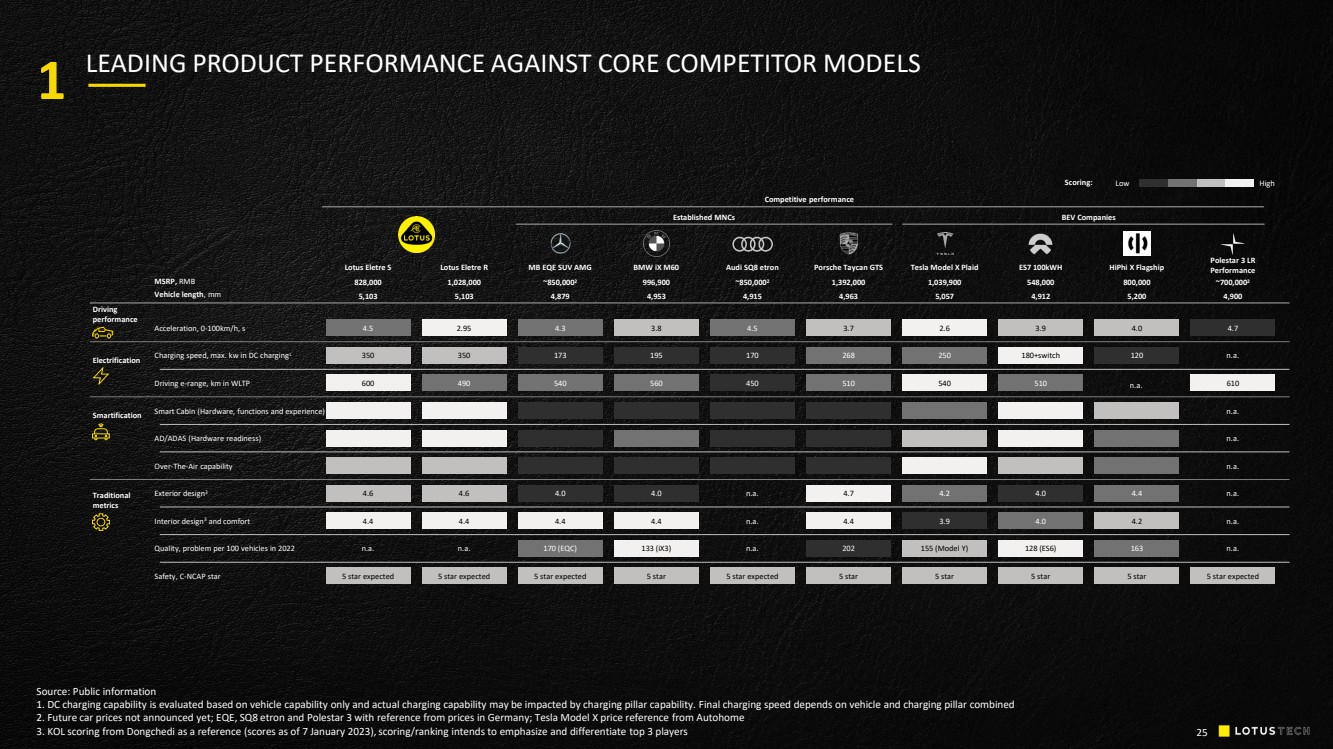

| 25 5 star expected 5 star expected 5 star expected 5 star 5 star expected 5 star LEADING PRODUCT PERFORMANCE AGAINST CORE COMPETITOR MODELS Scoring: High Low BEV Companies Competitive performance Established MNCs MSRP, RMB Vehicle length , mm ES7 100kWH 548,000 4,912 Audi SQ8 etron ~850,000 2 4,915 Tesla Model X Plaid 1,039,900 5,057 Lotus Eletre S 828,000 5,103 Porsche Taycan GTS 1,392,000 4,963 Polestar 3 LR Performance ~700,000 2 4,900 HiPhi X Flagship 800,000 5,200 BMW iX M60 996,900 4,953 MB EQE SUV AMG ~850,000 2 4, 879 Lotus Eletre R 1,028,000 5,103 Acceleration, 0 - 100km/h, s Driving performance 3.9 4.5 2.6 4.5 3.7 4.7 4.0 3.8 4.3 2.95 Electrification Driving e - range, km in WLTP Charging speed, max. kw in DC charging 1 180+switch 510 170 450 250 540 350 600 510 268 610 120 195 560 173 540 350 490 Smartification Smart Cabin ( Hardware, functions and experience ) AD/ADAS (Hardware readiness) Over - The - Air capability n.a. n.a. n.a. Traditional metrics Quality , problem per 100 vehicles in 2022 Safety , C - NCAP star Exterior design 3 Interior design 3 and comfort 128 (ES6) 5 star 4.0 4.0 n.a. n.a. n.a. 155 (Model Y) 4.2 3.9 n. a .. 4.6 4.4 202 5 star 4.7 4.4 5 star expected n.a. n.a. 163 5 star 4.4 4.2 133 (iX3) 4.0 4.4 170 (EQC) 4.0 4.4 n.a. 4.6 4.4 1 n.a. n.a. Source: Public information 1. DC charging capability is evaluated based on vehicle capability only and actual charging capability may be impacted by cha rgi ng pillar capability. Final charging speed depends on vehicle and charging pillar combined 2. Future car prices not announced yet; EQE, SQ8 etron and Polestar 3 with reference from prices in Germany; Tesla Model X price reference from Autohome 3. KOL scoring from Dongchedi as a reference (scores as of 7 January 2023), scoring/ranking intends to emphasize and differentiate top 3 players n.a. |

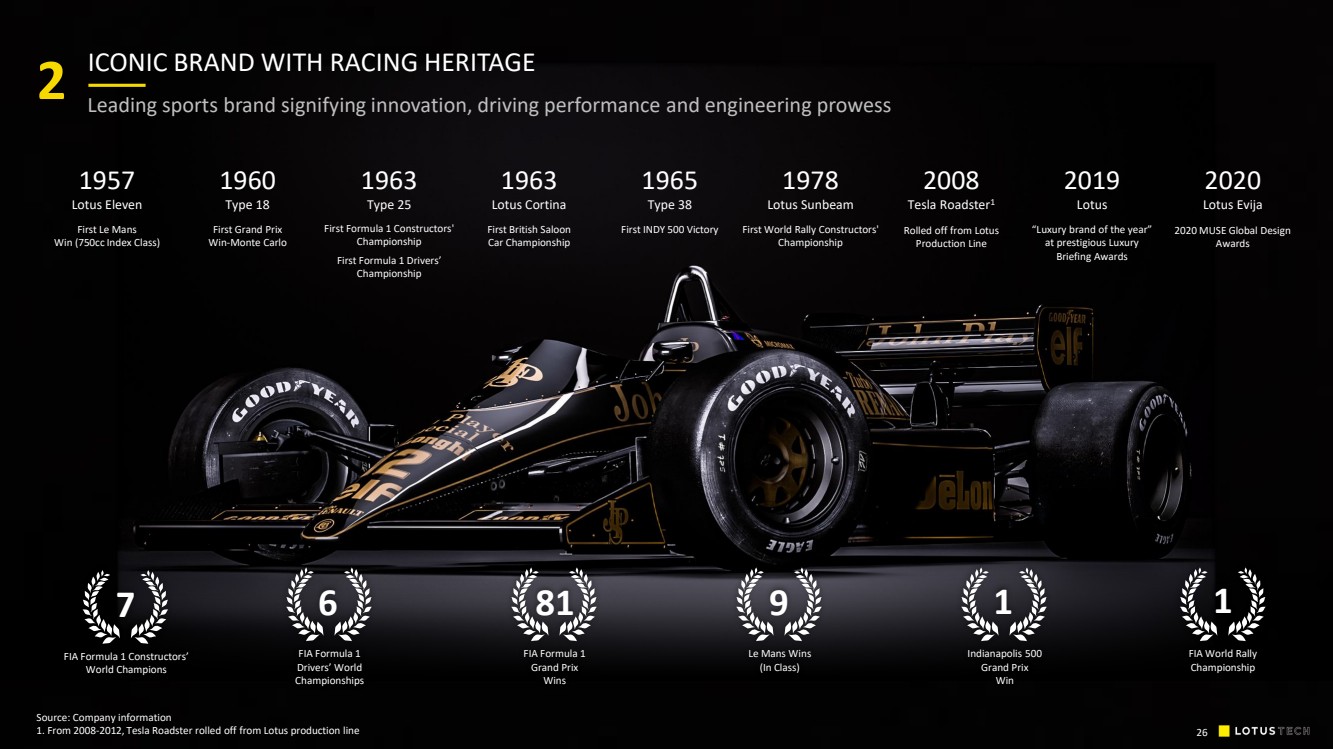

| Source: Company information 1. From 2008 - 2012, Tesla Roadster rolled off from Lotus production line 26 ICONIC BRAND WITH RACING HERITAGE 6 FIA Formula 1 Drivers’ World Championships 81 FIA Formula 1 Grand Prix Wins 9 Le Mans W ins (In Class) 1 Indianapolis 500 Grand Prix Win 1 FIA World Rally Championship 2 Le ading sports brand signifying innovation, driving performance and engineering prowess 1957 Lotus Eleven First Le Mans Win (750cc Index Class) 1963 Type 25 First Formula 1 Constructors ' Championship First Formula 1 Driver s ’ Championship 1960 Type 18 First Grand Prix Win - Monte Carlo First World Rally Constructors ' Championship 1963 Lotus Cortina First British Saloon Car Championship 1965 Type 38 First INDY 500 Victory 1978 Lotus Sunbeam 2008 Tesla Roadster 1 2019 Lotus 2020 Lotus Evija Rolled off from Lotus Production Line “Luxury brand of the year” at prestigious Luxury Briefing Awards 2020 MUSE Global Design Awards 7 FIA F ormula 1 Constructors’ W orld Champion s |

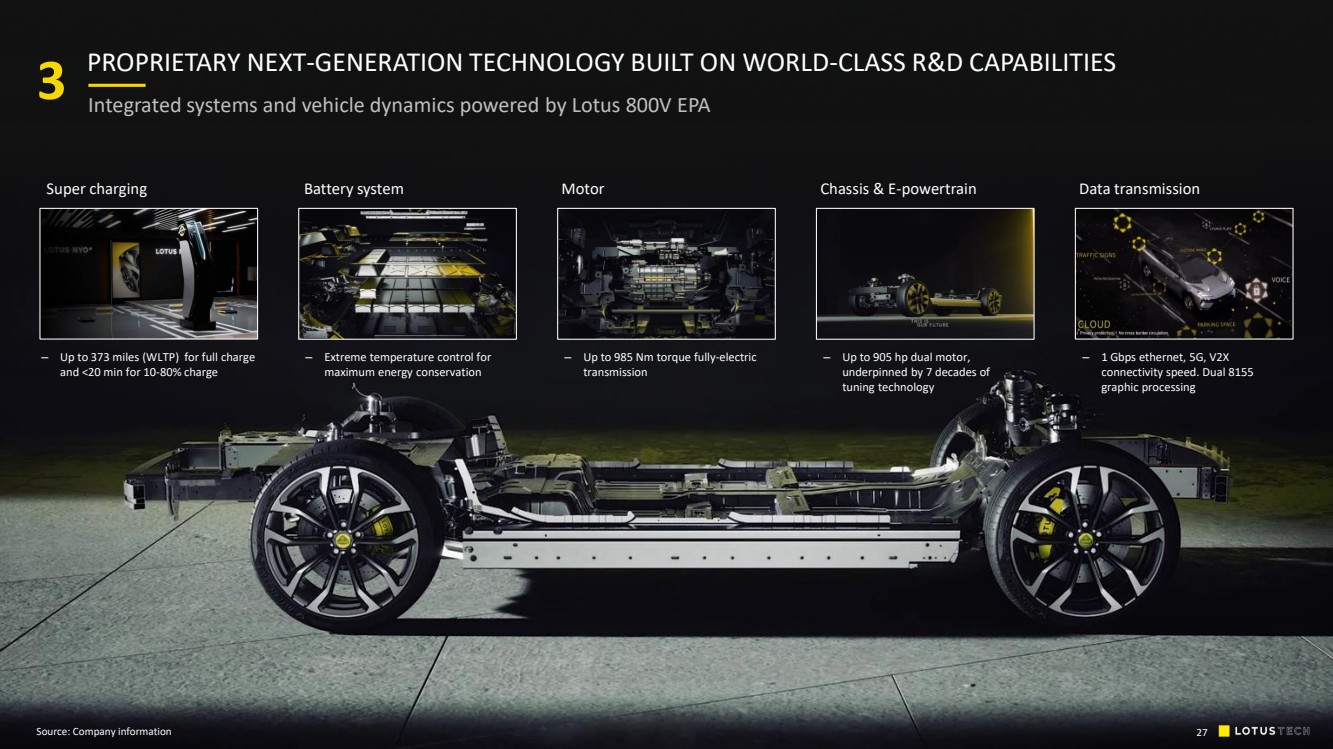

| ‒ Extreme temperature control for maximum energy conservation ‒ Up to 985 Nm torque fully - electric transmission ‒ U p to 373 miles (WLTP) for full charge and <20 min for 10 - 80% charge ‒ Up to 905 hp dual motor, underpinned by 7 decades of tuning technology ‒ 1 Gbps ethernet, 5G, V2X connectivity speed. Dual 8155 graphic processing PROPRIETARY NEXT - GENERATION TECHNOLOGY BUILT ON WORLD - CLASS R&D CAPABILITIES 3 In tegrated systems and vehicle dynamics powered by Lotus 800V EPA Source: Company information Battery system Motor Super charging Chassis & E - powertrain Data transmission 27 |

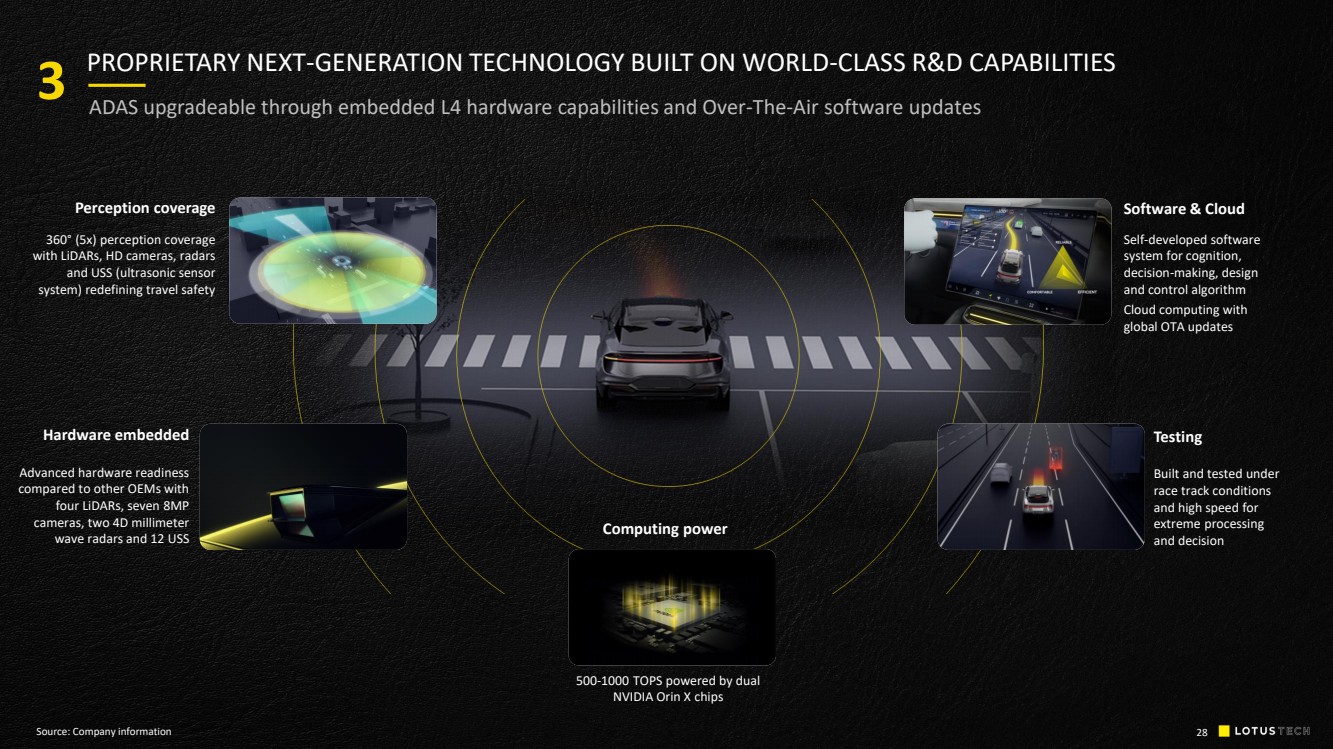

| 28 PROPRIETARY NEXT - GENERATION TECHNOLOGY BUILT ON WORLD - CLASS R&D CAPABILITIES 3 ADAS upgradeable through embedded L4 hardware capabilities and Over - The - Air software updates 360 ° (5x) perception coverage with LiDARs , HD cameras, radars and USS ( ultrasonic sensor system) redefining travel safety Perception c overage Hardware e mbedded Advanced hardware readiness compared to other OEMs with four LiDARs , seven 8MP cameras, two 4D millimeter wave radars and 12 USS 500 - 1000 TOPS powered by dual NVIDIA Orin X chips Computing power Testing Built and tested under race track conditions and high speed for extreme processing and decision Self - developed software system for cognition, decision - making, design and control algorithm Cloud computing with global OTA updates Software & Cloud Source: Company information |

| 29 ‒ Lotus Hyper OS from ECARX (advanced, proven and tested from Emira) ‒ Dual Qualcomm 8155 chips to power next - generation real - time 3D digital mapping and graphing experience ‒ Premium experience through KEF speakers and OLED touchscreen ‒ Voice control enabled ‒ Up - to - date OTA software PROPRIETARY NEXT - GENERATION TECHNOLOGY BUILT ON WORLD - CLASS R&D CAPABILITIES 3 World - class, intuitive and seamless connected experience through Lotus’s intelligent cabin infotainment system Source: Company information |

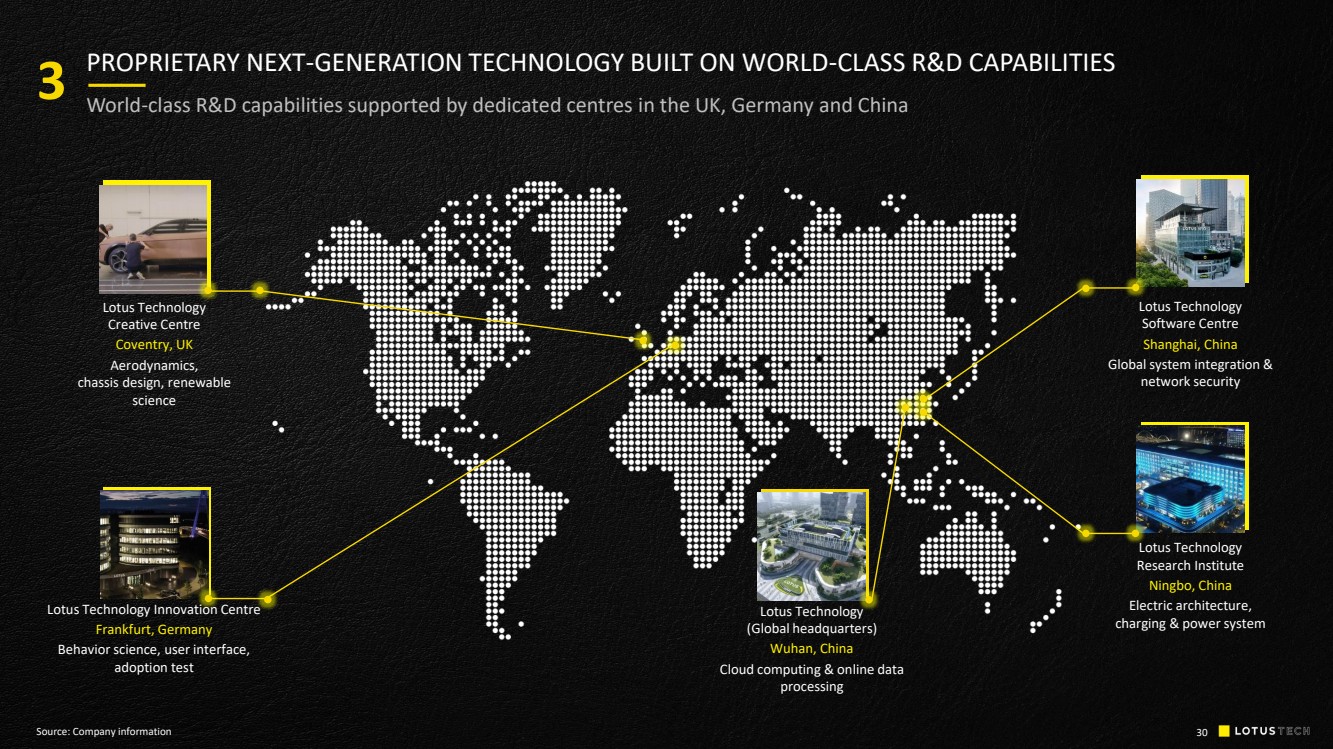

| PROPRIETARY NEXT - GENERATION TECHNOLOGY BUILT ON WORLD - CLASS R&D CAPABILITIES 3 World - class R&D capabilities supported by dedicated centres in the UK, Germany and China Lotus Technology (Global headquarters) Wuhan, China Cloud computing & online data processing Lotus Technology Software Centre Shanghai, China Global system integration & network security Lotus Technology Creative Centre Coventry, UK Aerodynamics, chassis design, renewable science Lotus Technology Research Institute Ningbo, China Electric architecture, charging & power system Lotus Technology Innovation Centre Frankfurt, Germany Behavior science, user interface, adoption test 30 Source: Company information |

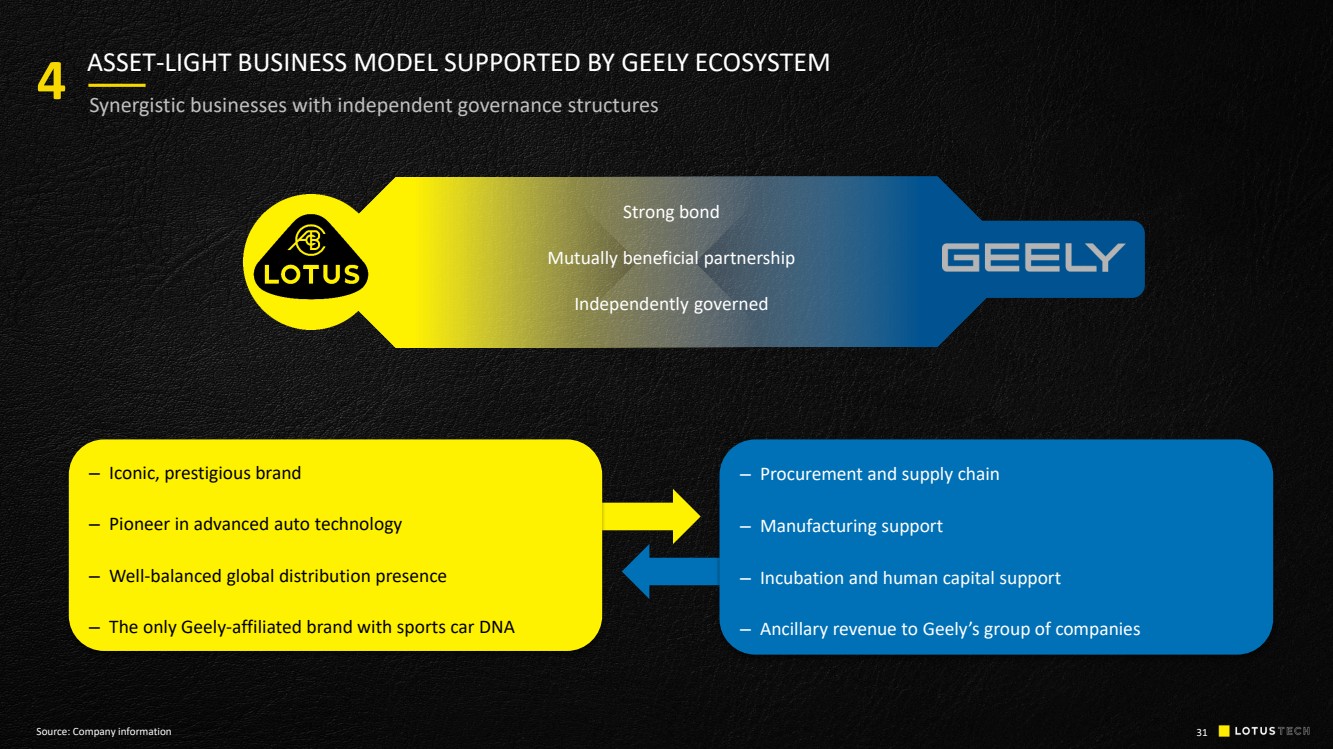

| 31 4 Synergistic businesses with independent governance structures S trong bond Mutually beneficial partnership Independently governed ‒ Procurement and supply chain ‒ Manufacturing support ‒ Incubation and human capital support ‒ Ancillary revenue to Geely ’s group of companies ‒ Iconic, prestigious brand ‒ Pioneer in advanced auto technology ‒ Well - balanced global distribution presence ‒ The only Geely - affiliated brand with sports car DNA ASSET - LIGHT BUSINESS MODEL SUPPORTED BY GEELY ECOSYSTEM Source: Company information |

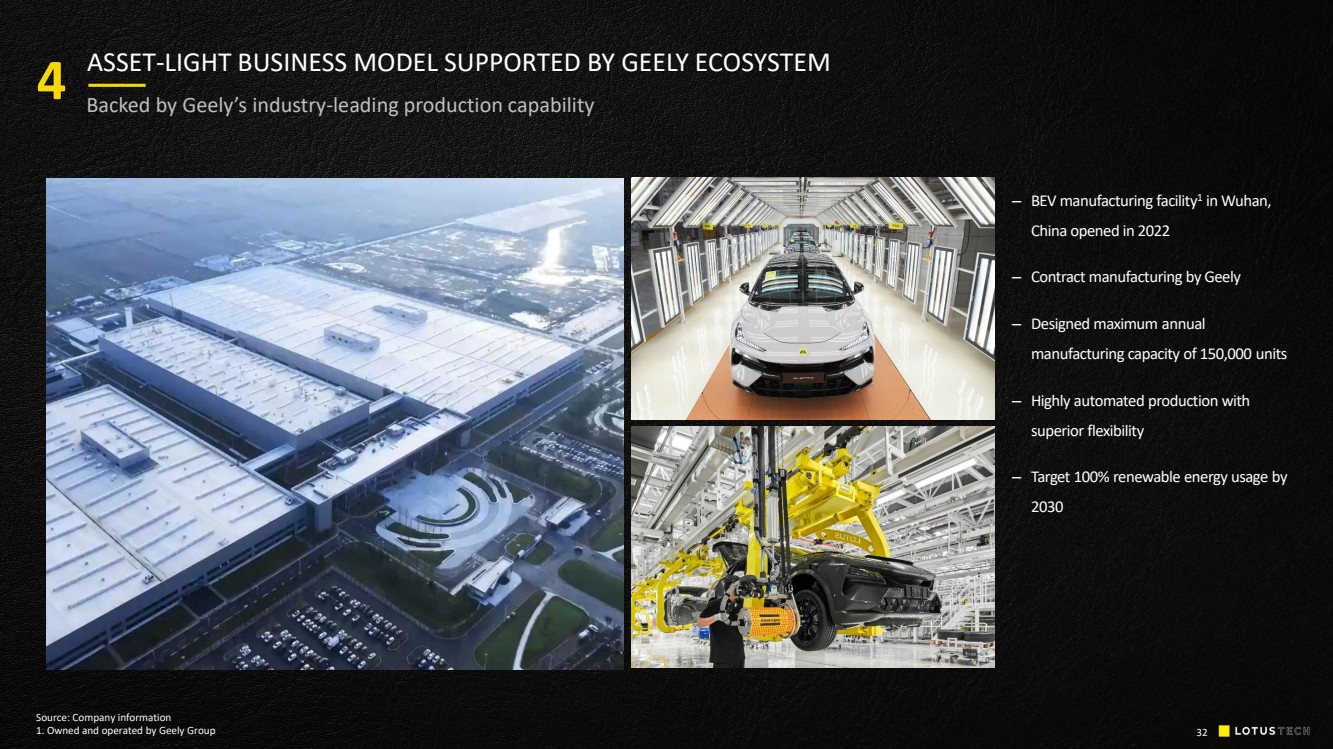

| 32 ASSET - LIGHT BUSINESS MODEL SUPPORTED BY GEELY ECOSYSTEM 4 Backed by Geely’s industry - leading production capability ‒ BEV manufacturing facility 1 in Wuhan, China opened in 2022 ‒ Contract manufacturing by Geely ‒ Designed maximum annual manufacturing capacity of 150,000 units ‒ Highly automated production with superior flexibility ‒ Target 100% renewable energy usage by 2030 Source: Company information 1. Owned and operated by Geely Group |

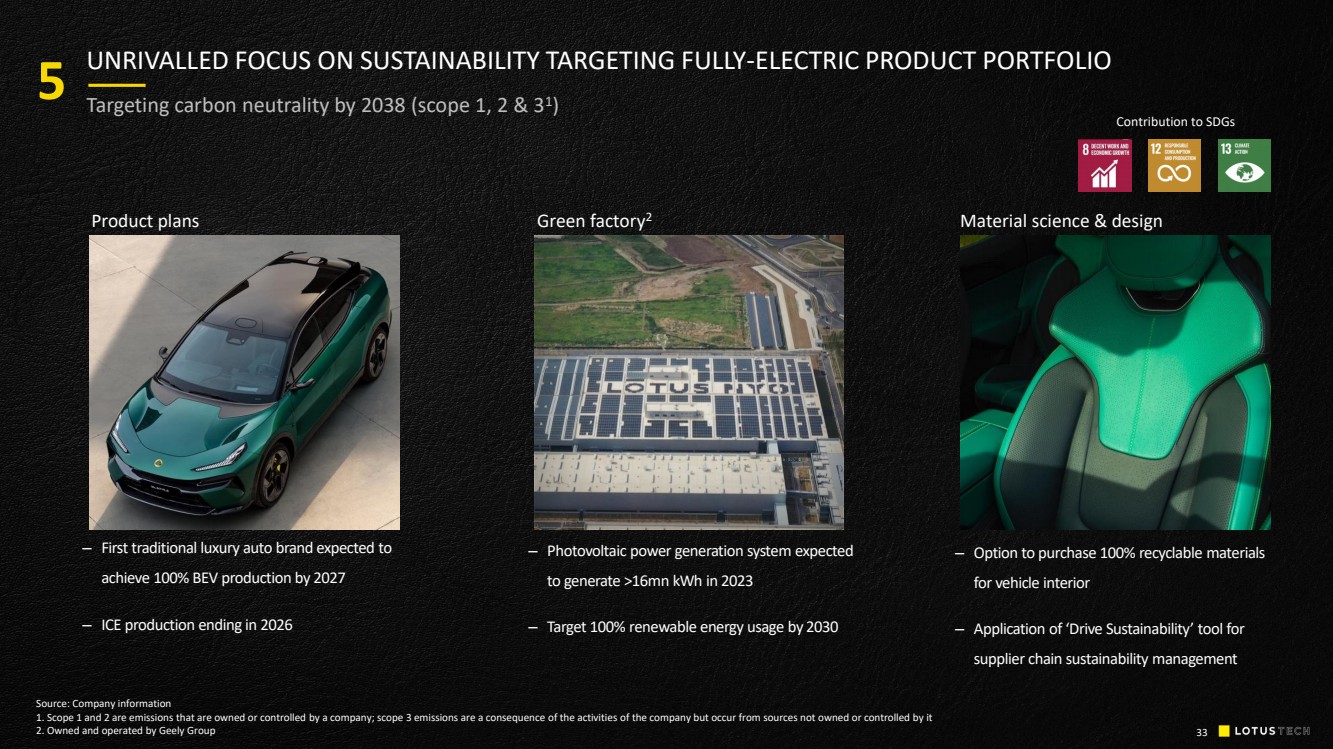

| 33 UNRIVALLED FOCUS ON SUSTAINABILITY TARGETING FULLY - ELECTRIC PROD UCT PORTFOLIO Material science & design 5 Targeting carbon neutrality by 2038 (scope 1, 2 & 3 1 ) ‒ Option to purchase 100% recyclable materials for vehicle interior ‒ Application of ‘Drive Sustainability’ tool for supplier chain sustainability management ‒ First traditional luxury auto brand expected to achieve 100% BEV production by 2027 ‒ ICE production ending in 2026 G reen factory 2 ‒ Photovoltaic power generation system expected to generate >16mn kWh in 2023 ‒ Target 100% renewable energy usage by 2030 Contribution to SDGs Product plans Source: Company information 1. Scope 1 and 2 are emissions that are owned or controlled by a company; scope 3 emissions are a consequence of the activiti es of the company but occur from sources not owned or controlled by it 2. Owned and operated by Geely Group |

| Source: Company information, ST Green Finance, as of Q3 2022 1. CSR: Corporate Social Responsibility 2. ST Green Finance ESG rating awarded to Wuhan Lotus Cars Technology Co., Ltd. in Jan 2023. Comprehensive governance level a nd overall ESG risk are evaluated based on the ESG rating methodology of non - listed companies 3. Number of non - listed companies rated is not public 34 Lotus launched its new CSR 1 programme ‘Driving Change’ in 2021 aligned to its Vision80 strategy Social Governance ADHERENCE TO INTERNATIONAL ESG STANDARDS 5 Contribution to SDGs ‒ US LOT - the global Lotus colleagues - at the heart of global sustainable growth ‒ Safety and inclusion of customers and communities ‒ Advancement of equal education and automobility technology through college sponsorship and R&D project partnership ‒ Adherence to the highest standards of corporate governance ‒ Commitment to being an ethical and transparent company ‒ Dedicated Directors and ESG Management Committee A - ESG Rating 2 5,514 listed companies rated 3 7% awarded A - rating or above |

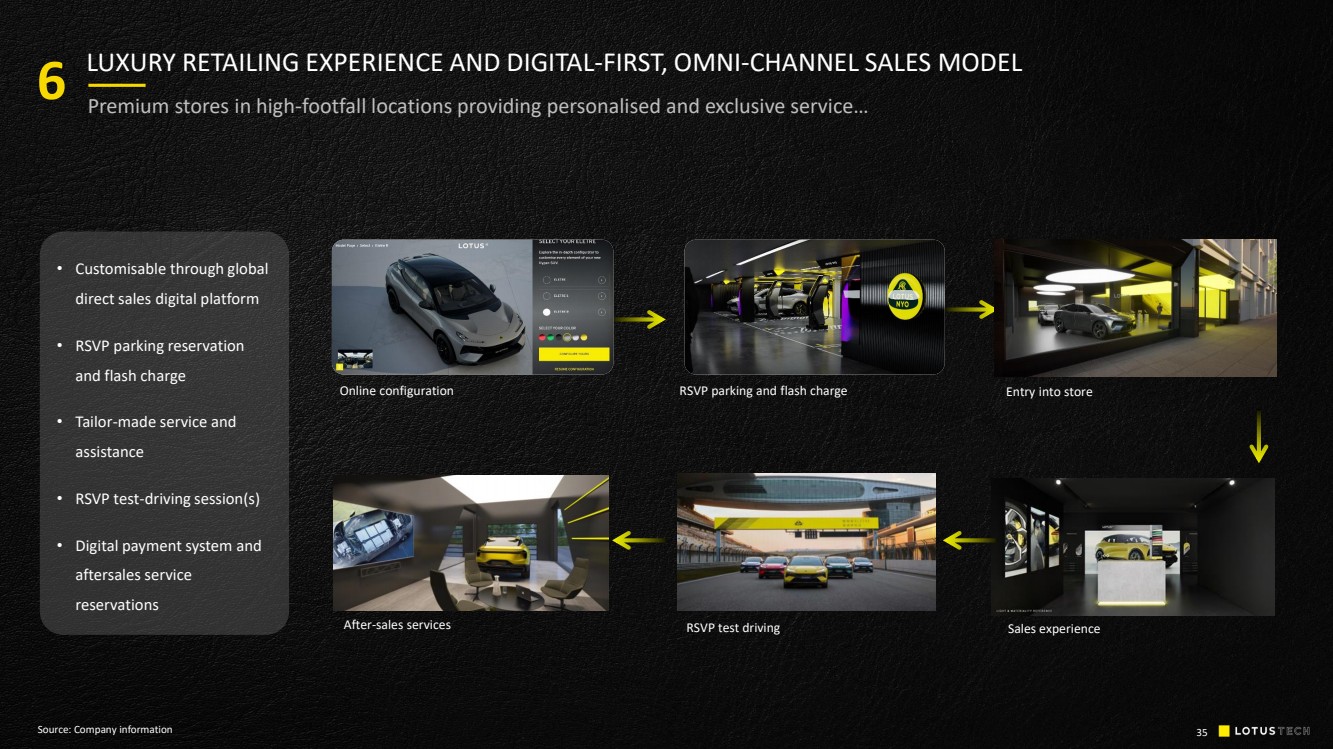

| Source: Company information 35 LUXURY RETAILING EXPERIENCE AND DIGITAL - FIRST, OMNI - CHANNEL SALES MODEL 6 Premium stores in high - footfall locations providing personalised and exclusive service… • Customisable through global direct sales digital platform • RSVP parking reservation and flash charge • Tailor - made service and assistance • RSVP test - driving session(s) • Digital payment system and aftersales service reservations RSVP parking and flash charge Sales experience After - sales services Entry into store Online configuration RSVP test driving |

| 36 CUSTOMISATION CO - BRANDING AFTERMARKET CO - DEVELOPMENT CO - MARKETING RSVP SOFTWARE PURCHASE & TRADE - IN MOTORSPORTS PRIME FAST CHARGE RENTALS EVENTS LUXURY RETAILING EXPERIENCE AND DIGITAL - FIRST, OMNI - CHANNEL SALE S MODEL Car - related b usiness L ifestyle - related business 6 Lotus’s retail strategy will be supported by an omni - channel model Digital - centric, immensely flexible and scalable in response to individual market and customer requirements … enabled by digital - first, omni - channel sales model… |

| Source: Lotus management estimates Note: Stores currently owned by Lotus UK will be transferred to Lotus Tech after signing of the Master Distribution Agreement 1. Consists of dealership model only 2. Consists of direct - to - customer (DTC) model only, which includes self - owned, joint venture stores and partnership stores 3. North America includes US and Canada; EU store number includes stores in Switzerland; ROW includes rest of Asia, Australia an d New Zealand, most of the Middle East and parts of South America, and excludes non - EU states ( e.g. Turkey, Monaco), South Africa, Lebanon, Panama and Guatemala 37 LUXURY RETAILING EXPERIENCE AND DIGITAL - FIRST, OMNI - CHANNEL SALE S MODEL 6 …to cover prime locations globally with existing and newly - built hybrid model China 2 • 41 existing stores • 130 stores by 2025 ROW 1, 3 • 33 existing stores • 35 stores by 2025 North America 1, 3 • 41 existing stores • 50 stores by 2025 UK 2 • 15 existing stores • 35 stores by 2025 EU 2, 3 • 39 existing stores • 60 stores by 2025 |

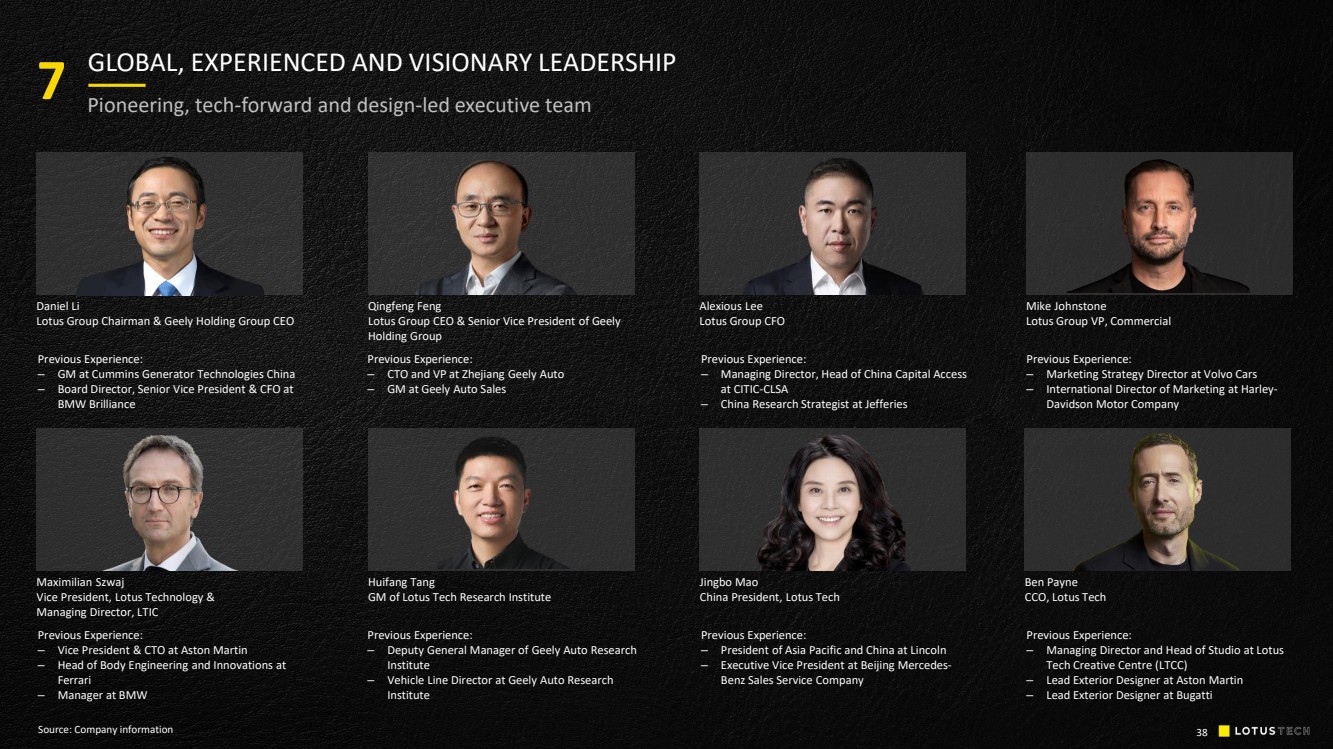

| Source: Company information 38 Mike Johnstone Lotus Group VP, Commercial Alexious Lee Lotus Group CFO Huifang Tang GM of Lotus Tech Research Institute Jingbo Mao China President, Lotus Tech Maximilian Szwaj Vice President, Lotus Technology & Managing Director, LTIC Qingfeng Feng Lotus Group CEO & Senior Vice President of Geely Holding Group Ben Payne CCO, Lotus Tech GLOBAL, EXPERIENCED AND VISIONARY LEADERSHIP 7 Pioneering, tech - forward and design - led executive team Daniel Li Lotus Group Chairman & Geely Holding Group CEO Previous Experience: – GM at Cummins Generator Technologies China – Board Director, Senior Vice President & CFO at BMW Brilliance Previous Experience: – CTO and VP at Zhejiang Geely Auto – GM at Geely Auto Sales Previous Experience: – Managing Director, Head of China Capital Access at CITIC - CLSA – China Research Strategist at Jefferies Previous Experience: – Marketing Strategy Director at Volvo Cars – International Director of Marketing at Harley - Davidson Motor Company Previous Experience: – Managing Director and Head of Studio at Lotus Tech Creative Centre (LTCC) – Lead Exterior Designer at Aston Martin – Lead Exterior Designer at Bugatti Previous Experience: – President of Asia Pacific and China at Lincoln – Executive Vice President at Beijing Mercedes - Benz Sales Service Company Previous Experience: – Deputy General Manager of Geely Auto Research Institute – Vehicle Line Director at Geely Auto Research Institute Previous Experience: – Vice President & CTO at Aston Martin – Head of Body Engineering and Innovations at Ferrari – Manager at BMW |

| FINANCIAL OVERVIEW |

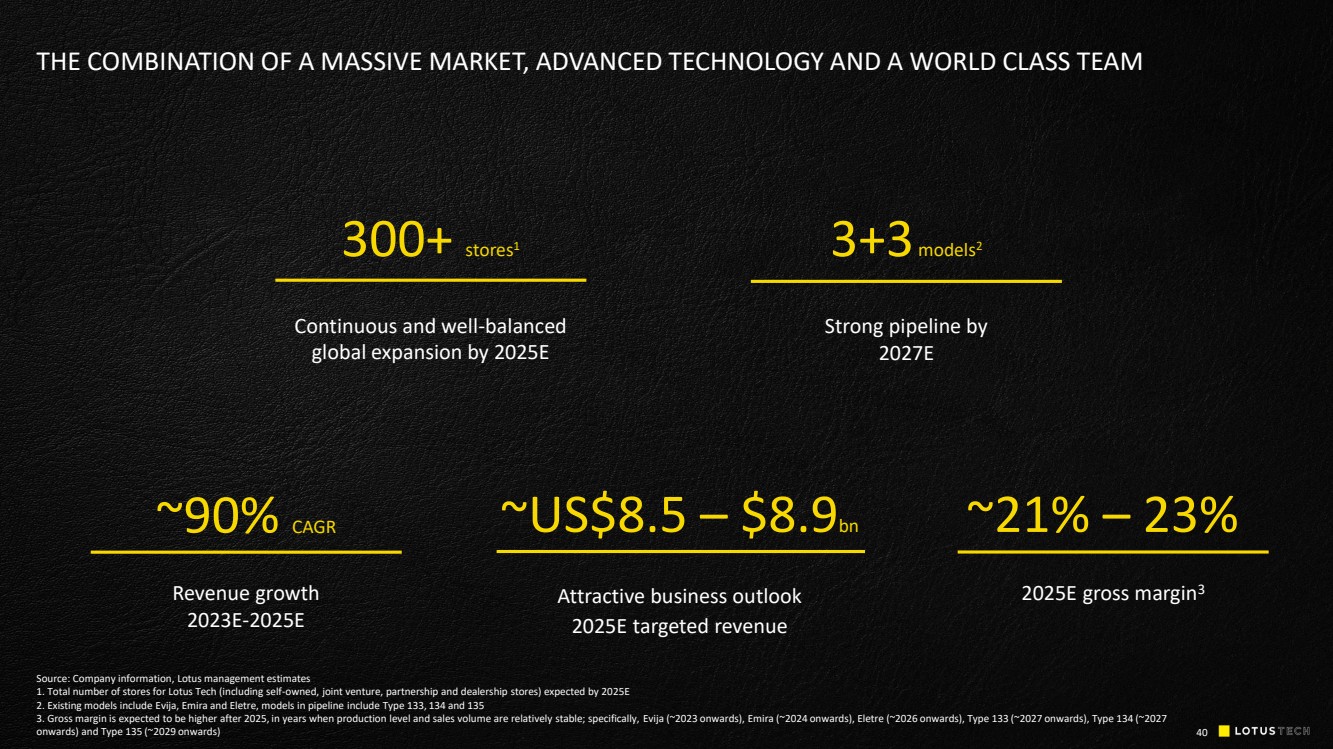

| Source: Company information, Lotus management estimates 1. Total number of stores for Lotus Tech (including self - owned, joint venture, partnership and dealership stores) expected by 20 25E 2. Existing models include Evija , Emira and Eletre , models in pipeline include Type 133, 134 and 135 3. Gross margin is expected to be higher after 2025, in years when production level and sales volume are relatively stable; s pec ifically, Evija (~2023 onwards), Emira (~2024 onwards), Eletre (~2026 onwards), Type 133 (~2027 onwards), Type 134 (~2027 onwards) and Type 135 (~2029 onwards) 40 THE COMBINATION OF A MASSIVE MARKET, ADVANCED TECHNOLOGY AND A WORLD CLASS TEAM Revenue growth 2023E - 2025E Attractive business outlook 2025E gross margin 3 ~90 % CAGR 3+3 models 2 2025E targeted r evenue ~US$8.5 – $8.9 bn ~21% – 23% Continuous and well - balanced global expansion by 2025E 300+ stores 1 Strong pipeline by 2027E |

| Source: Company information, Lotus management estimates 1. The sales volume is based on the assumption that Lotus Tech and Lotus UK will complete the buildup of the Global Commercia l P latform pursuant to the Master Distribution Agreement; currently assume only 50% of 2023E sales and profits to reflect the dealer transition process 2. ’24E – ’25E YoY growth 3. ROW includes rest of Asia, Australia, most of the Middle East and parts of South America, and excludes non - EU states (e.g. Turke y, Monaco), South Africa, Lebanon, Panama and Guatemala Four models expected to power 88% CAGR volume growth 1 .... ....with China market contributing ~45% and other global markets contributing to the rest 88% CAGR +88% +34% 2 +50% +31% CAGR ‘23 – ’25E +88% +59% +82% + 59 % +266% +491% CAGR ‘23 – ’25E STRONG TOP - LINE GROWTH DRIVEN BY MODEL PIPELINE AND INTERNATIONA L EXPANSION 18 3 22 2023E 2024E 2025E 2023E 2024E 2025E 28 6 22 56 41 6 29 76 10 5 6 1 0 10 24 5 13 22 56 12 33 9 16 76 Eletre Type 133 Emira Evija China UK EU US ROW 41 Unit, k Unit, k 7 3 3 |

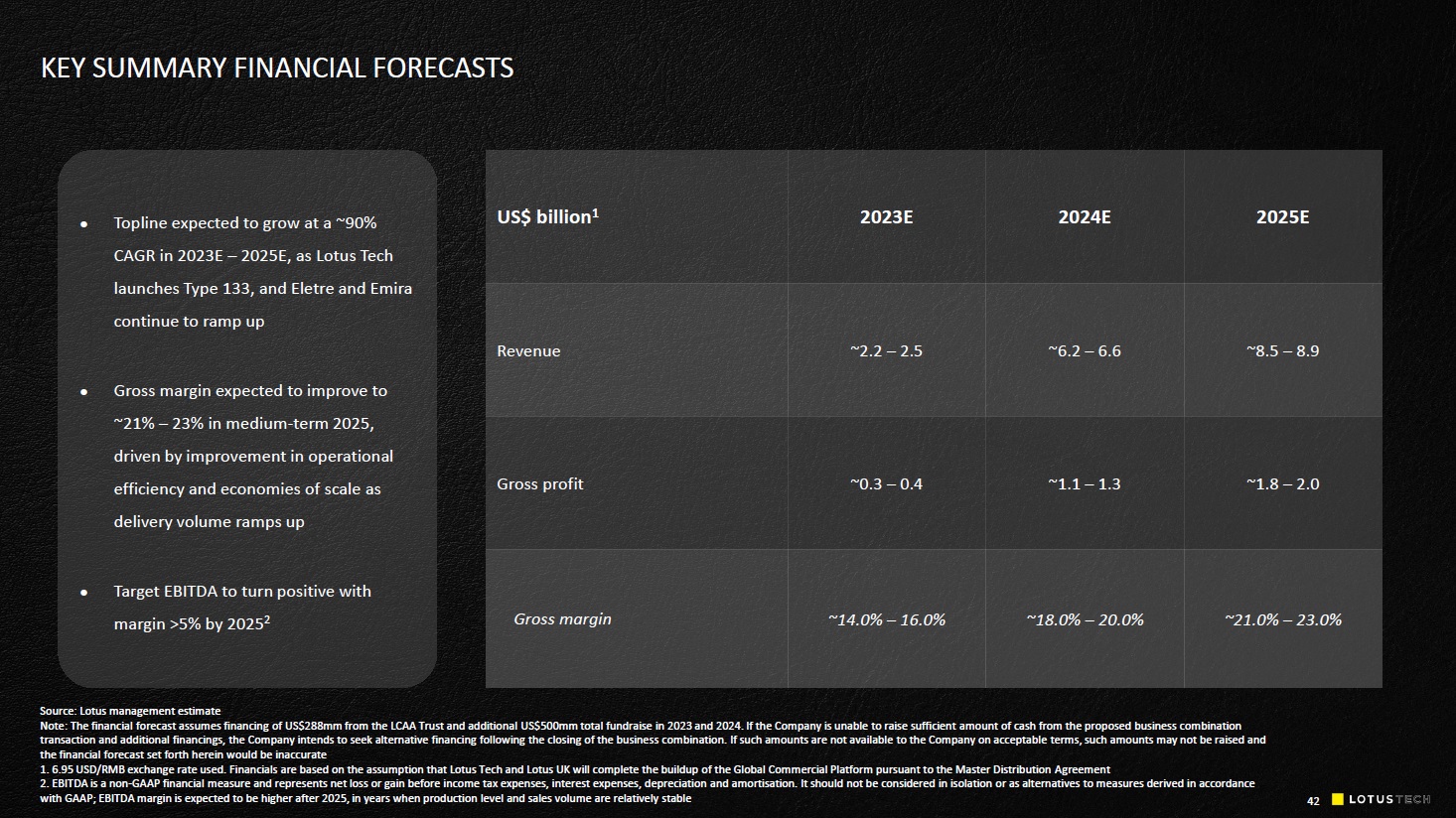

| 42 ⚫ Topline expected to grow at a ~ 90 % CAGR in 2023E – 2025E, as Lotus Tech launches Type 133, and Eletre and Emira continue to ramp up ⚫ Gross margin expected to improve to ~21% – 23% in medium - term 2025, driven by improvement in operational efficiency and economies of scale as delivery volume ramps up ⚫ Target EBITDA to turn positive with margin >5% by 2025 2 KEY SUMMARY FINANCIAL FORECASTS US$ billion 1 2023E 2024E 2025E Revenue ~2.2 – 2.5 ~6.2 – 6.6 ~8.5 – 8.9 Gross profit ~0.3 – 0.4 ~1.1 – 1.3 ~1.8 – 2.0 Gross margin ~14.0% – 16.0% ~18 ..0% – 20 ..0% ~21.0% – 23.0% Source: Lotus management estimate Note: The financial forecast assumes financing of US$288mm from the LCAA Trust and additional US$500mm total fundraise in 202 3 a nd 2024. If the Company is unable to raise sufficient amount of cash from the proposed business combination transaction and additional financings, the Company intends to seek alternative financing following the closing of the busines s c ombination. If such amounts are not available to the Company on acceptable terms, such amounts may not be raised and the financial forecast set forth herein would be inaccurate 1. 6.95 USD/RMB exchange rate used. Financials are based on the assumption that Lotus Tech and Lotus UK will complete the buildup of the Global Commercial Platform pursuant to the Master Distribution Ag reement 2. EBITDA is a non - GAAP financial measure and represents net loss or gain before income tax expenses, interest expenses, depreci ation and amortisation .. It should not be considered in isolation or as alternatives to measures derived in accordance with GAAP; EBITDA margin is expected to be higher after 2025, in years when production level and sales volume are relatively stable |

| TRANSACTION OVERVIEW AND VALUATION |

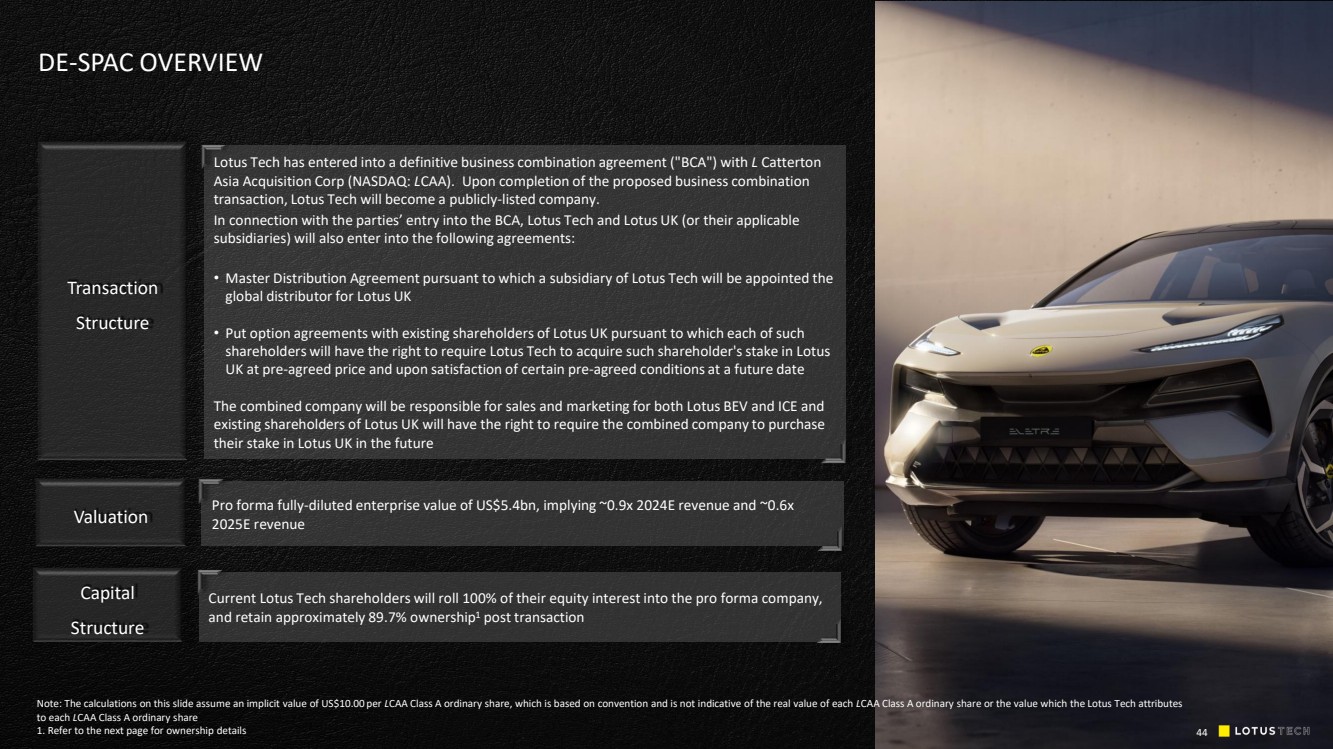

| 44 DE - SPAC OVERVIEW Transaction Structure Lotus Tech has entered into a definitive business combination agreement ("BCA") with L Catterton Asia Acquisition Corp (NASDAQ: L CAA). Upon completion of the proposed business combination transaction, Lotus Tech will become a publicly - listed company. In connection with the parties’ entry into the BCA, Lotus Tech and Lotus UK (or their applicable subsidiaries) will also enter into the following agreements: • Master Distribution Agreement pursuant to which a subsidiary of Lotus Tech will be appointed the global distributor for Lotus UK • Put option agreements with existing shareholders of Lotus UK pursuant to which each of such shareholders will have the right to require Lotus Tech to acquire such shareholder's stake in Lotus UK at pre - agreed price and upon satisfaction of certain pre - agreed conditions at a future date The combined company will be responsible for sales and marketing for both Lotus BEV and ICE and existing shareholders of Lotus UK will have the right to require the combined company to purchase their stake in Lotus UK in the future Valuation Pro forma fully - diluted enterprise value of US$5.4bn, implying ~0.9x 2024E revenue and ~0.6x 2025E revenue Capital Structure Current Lotus Tech shareholders will roll 100% of their equity interest into the pro forma company, and retain approximately 89.7% ownership 1 post transaction Note: The calculations on this slide assume an implicit value of US$10.00 per L CAA Class A ordinary share, which is based on convention and is not indicative of the real value of each L CAA Class A ordinary share or the value which the Lotus Tech attributes to each L CAA Class A ordinary share 1. Refer to the next page for ownership details |

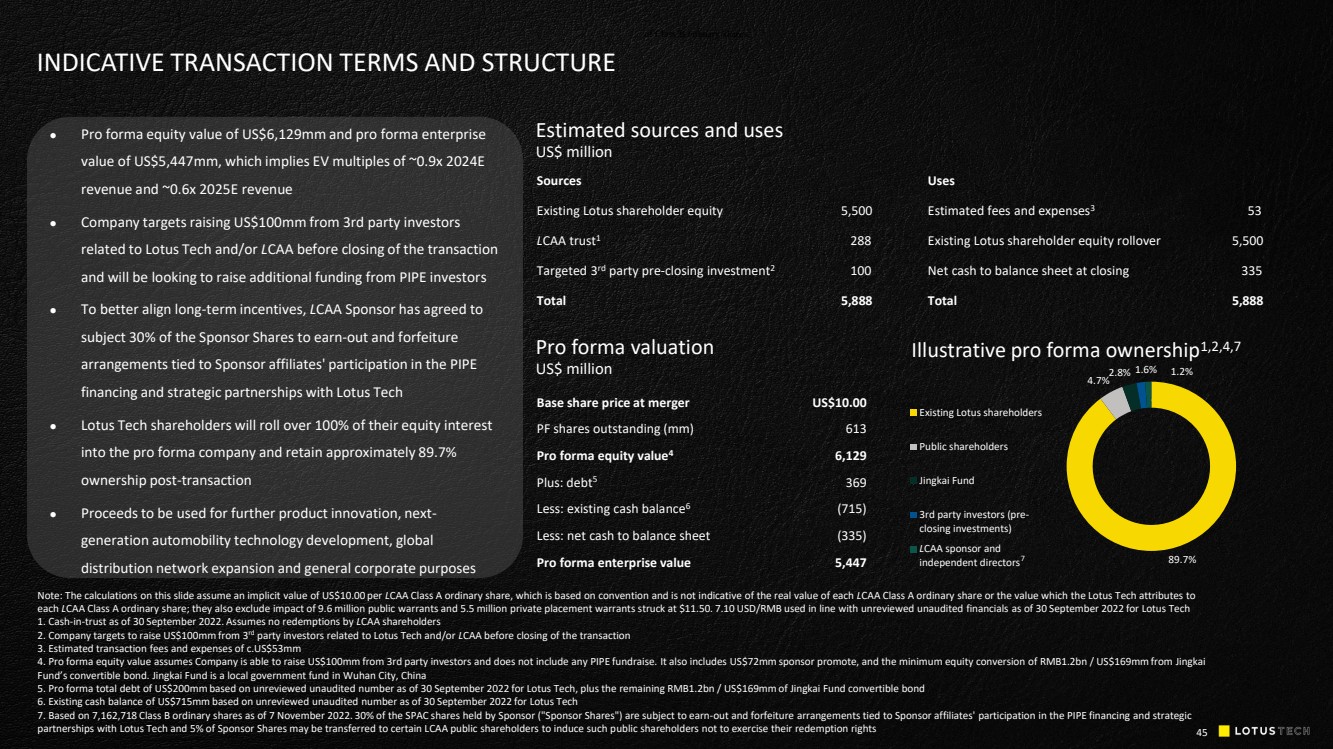

| 45 Estimated sources and uses US$ million Pro forma valuation US$ million Sources Existing Lotus shareholder equity 5,500 L CAA trust 1 288 Targeted 3 rd party pre - closing investment 2 100 Total 5,888 Base share price at merger US$10.00 PF shares outstanding (mm) 613 Pro forma equity value 4 6,129 Plus: debt 5 369 Less: existing cash balance 6 (715) Less: net cash to balance sheet (335) Pro forma enterprise value 5,447 Illustrative pro forma ownership 1,2,4,7 INDICATIVE TRANSACTION TERMS AND STRUCTURE ⚫ Pro forma equity value of US$6,129mm and pro forma enterprise value of US$5,447mm, which implies EV multiples of ~0.9x 2024E revenue and ~0.6x 2025E revenue ⚫ Company targets raising US$100mm from 3rd party investors related to Lotus Tech and/or L CAA before closing of the transaction and will be looking to raise additional funding from PIPE investors ⚫ To better align long - term incentives, L CAA S ponsor has agreed to subject 30% of the Sponsor Shares to earn - out and forfeiture arrangements tied to Sponsor affiliates' participation in the PIPE financing and strategic partnerships with Lotus Tech ⚫ Lotus Tech shareholders will roll over 100% of their equity interest into the pro forma company and retain approximately 89.7% ownership post - transaction ⚫ Proceeds to be used for further product innovation, next - generation automobility technology development, global distribution network expansion and general corporate purposes Note: The calculations on this slide assume an implicit value of US$10.00 per L CAA Class A ordinary share, which is based on convention and is not indicative of the real value of each L CAA Class A ordinary share or the value which the Lotus Tech attributes to each L CAA Class A ordinary share; they also exclude impact of 9.6 million public warrants and 5.5 million private placement warrant s s truck at $11.50. 7.10 USD/RMB used in line with un reviewed unaudited financials as of 30 September 2022 for Lotus Tech 1. Cash - in - trust as of 30 September 2022. Assumes no redemptions by L CAA shareholders 2. Company targets to raise US$100mm from 3 rd party investors related to Lotus Tech and/or L CAA before closing of the transaction 3. Estimated transaction fees and expenses of c.US$53mm 4. Pro forma equity value assumes Company is able to raise US$100mm from 3rd party investors and does not include any PIPE fundraise. It also includes US$72mm sponsor promote, and the minimum equity conversion of RMB1.2bn / US$169mm from Jingkai Fund’s convertible bond. Jingkai Fund is a local government fund in Wuhan City, China 5. Pro forma total debt of US$200mm based on un reviewed unaudited number as of 30 September 2022 for Lotus Tech, plus the remaining RMB1.2bn / US$169mm of Jingkai Fund convertible bond 6. Existing cash balance of US$715mm based on un reviewed unaudited number as of 30 September 2022 for Lotus Tech 7. Based on 7,162,718 Class B ordinary shares as of 7 November 2022. 30% of the SPAC shares held by Sponsor ("Sponsor Shares") are subject to earn - out and forfeiture arrangements tied to Sponsor af filiates' participation in the PIPE financing and strategic partnerships with Lotus Tech and 5% of Sponsor Shares may be transferred to certain LCAA public shareholders to induce such p ubl ic shareholders not to exercise their redemption rights of Class B ordinary shares, 89.7% 4.7% 2.8% 1.6% 1.2% Existing Lotus shareholders Public shareholders Jingkai Fund 3rd party investors (pre- closing investments) LCAA sponsor and independent directors L 7 Uses Estimated fees and expenses 3 53 Existing Lotus shareholder equity rollover 5,500 Net cash to balance sheet at closing 335 Total 5,888 |

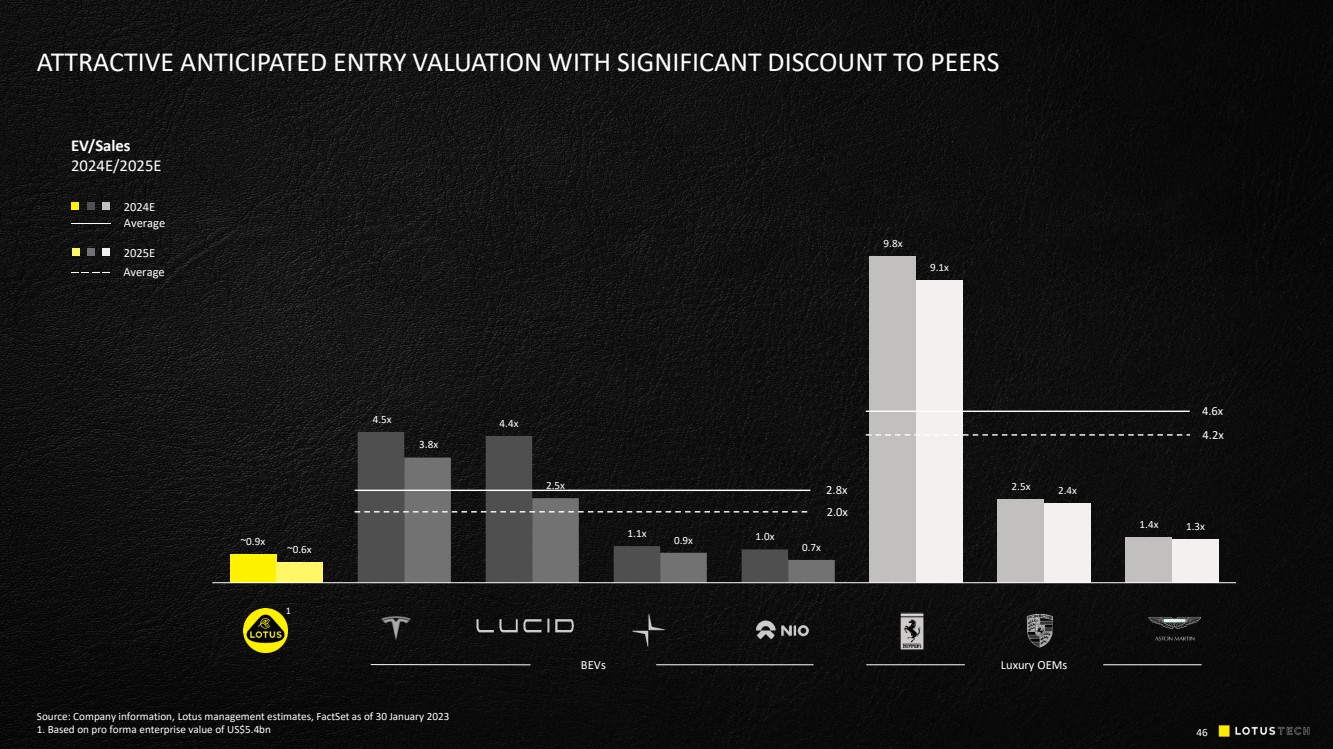

| ~0.9x 4.5x 4.4x 1.1x 1.0x 9.8x 2.5x 1.4x ~0.6x 3.8x 2.5x 0.9x 0.7x 9.1x 2.4x 1.3x Source: Company information, Lotus management estimates, FactSet as of 30 January 2023 1. Based on pro forma enterprise value of US$5.4bn 46 ATTRACTIVE ANTICIPATED ENTRY VALUATION WITH SIGNIFICANT DISCOUNT TO PEERS EV/Sales 2024E/2025E 2025E Average Average 2024E 1 B EVs Luxury OEMs 2.8 x 2.0 x 4 ..6x 4.2x |

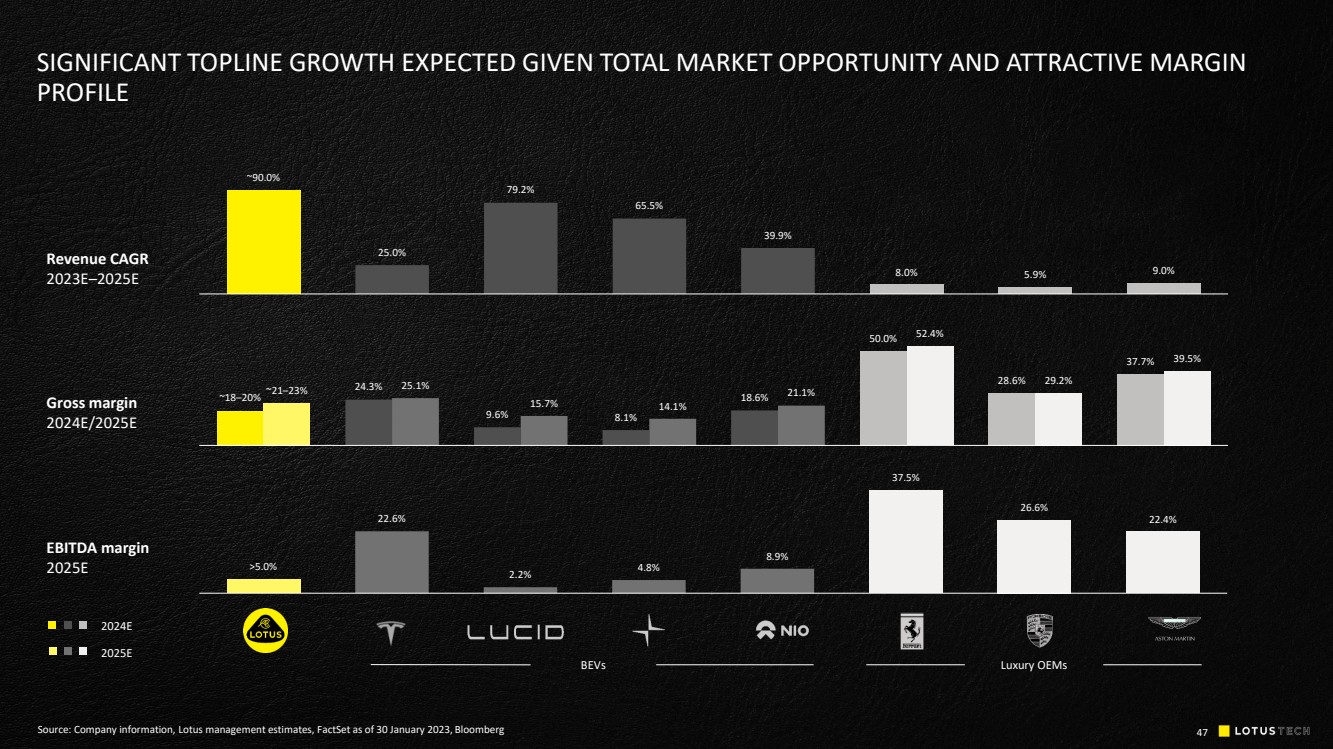

| Source: Company information, Lotus management estimates, FactSet as of 30 January 2023, Bloomberg Gross margin 2024E/2025E EBITDA margin 2025E SIGNIFICANT TOPLINE GROWTH EXPECTED GIVEN TOTAL MARKET OPPORTUNI TY AND ATTRACTIVE MARGIN PROFILE 2025E 2024E Revenue CAGR 2023E – 2025E 47 B EVs Luxury OEMs ~90.0% 25.0% 79.2% 65.5% 39.9% 8.0% 5.9% 9.0% ~18 – 20% 24.3% 9.6% 8.1% 18.6% 50.0% 28.6% 37.7% ~21 – 23% 25.1% 15.7% 14.1% 21.1% 52.4% 29.2% 39.5% >5.0% 22.6% 2.2% 4.8% 8.9% 37.5% 26.6% 22.4% |

| APPENDIX |

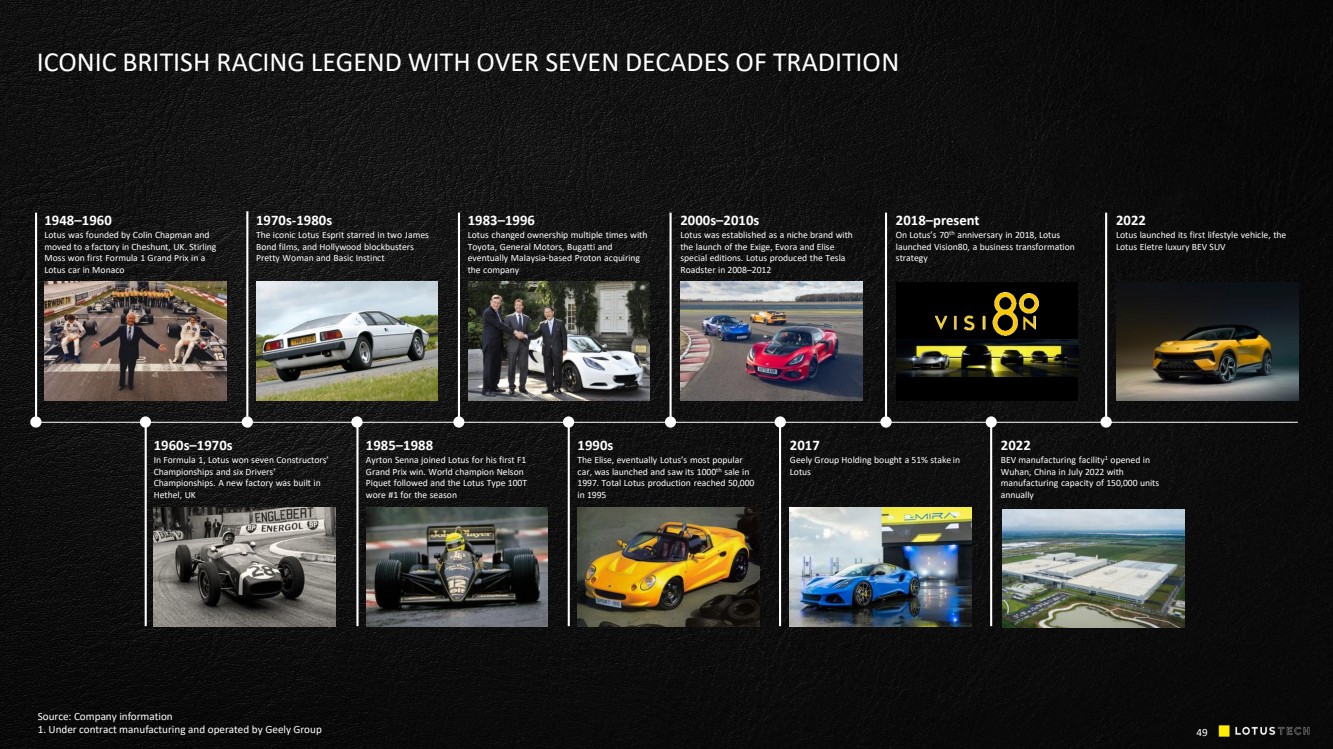

| Source: Company information 1. Under contract manufacturing and operated by Geely Group 49 1948 – 1960 Lotus was founded by Colin Chapman and moved to a factory in Cheshunt, UK. Stirling Moss won first Formula 1 Grand Prix in a Lotus car in Monaco 2000s – 2010s Lotus was established as a niche brand with the launch of the Exige, Evora and Elise special editions. Lotus produced the Tesla Roadster in 2008 – 2012 1983 – 1996 Lotus changed ownership multiple times with Toyota, General Motors, Bugatti and eventually Malaysia - based Proton acquiring the company 1970s - 1980s The iconic Lotus Esprit starred in two James Bond films, and Hollywood blockbusters Pretty Woman and Basic Instinct 2018 – present On Lotus’s 70 th anniversary in 2018, Lotus launched Vision80, a business transformation strategy 1960s – 1970s In Formula 1, Lotus won seven Constructors’ Championships and six Drivers’ Championships. A new factory was built in Hethel, UK 1985 – 1988 Ayrton Senna joined Lotus for his first F1 Grand Prix win. World champion Nelson Piquet followed and the Lotus Type 100T wore #1 for the season 1990s The Elise, eventually Lotus’s most popular car, was launched and saw its 1000 th sale in 1997. Total Lotus production reached 50,000 in 1995 2017 Geely Group Holding bought a 51% stake in Lotus 2022 Lotus launched its first lifestyle vehicle, the Lotus Eletre luxury BEV SUV 2022 BEV manufacturing facility 1 opened in Wuhan, China in July 2022 with manufacturing capacity of 150,000 units annually ICONIC BRITISH RACING LEGEND WITH OVER SEVEN DECADES OF TRADITIO N |

| SPORTS CAR STYLE SUV COMFORT AERODYNAMIC DESIGN The all - new and all - electric Lotus Eletre takes the core principles and Lotus DNA from 75 years of sports car design and engineering The Evija - derived aerodynamics guide air over and through its body for extra downforce and speed The Eletre takes Lotus comfort to an unprecedented new level. The performance - oriented and technical design is visually lightweight, using ultra - premium materials to deliver an exceptional customer experience 50 |

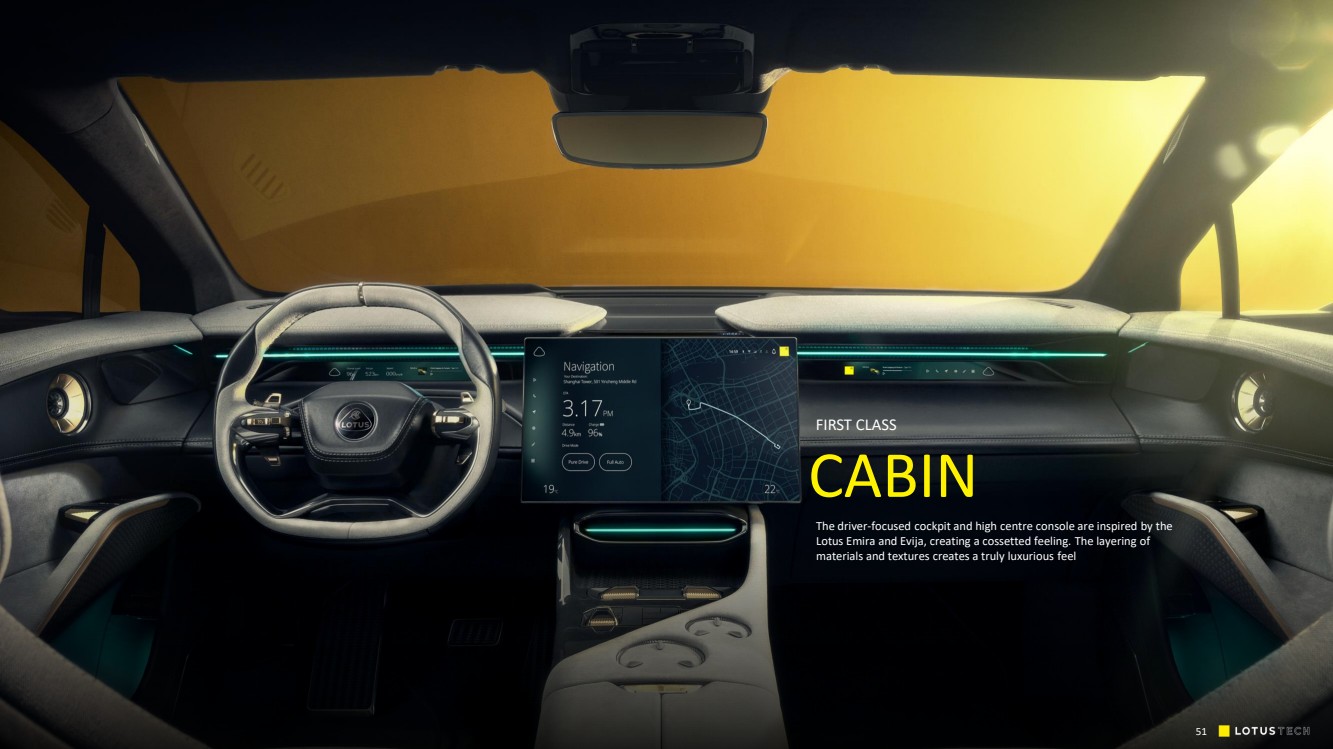

| FIRST CLASS CABIN The driver - focused cockpit and high centre console are inspired by the Lotus Emira and Evija , creating a cossetted feeling. The layering of materials and textures creates a truly luxurious feel 51 |

| REFINED ELEGANCE Eletre’s interior is as comfortable as it is beautiful, combining highly durable materials and immersive infotainment The High Definition OLED central screen works in tandem with the digital passenger display The Eletre operating system is future - proof by design, updatable wirelessly 52 |

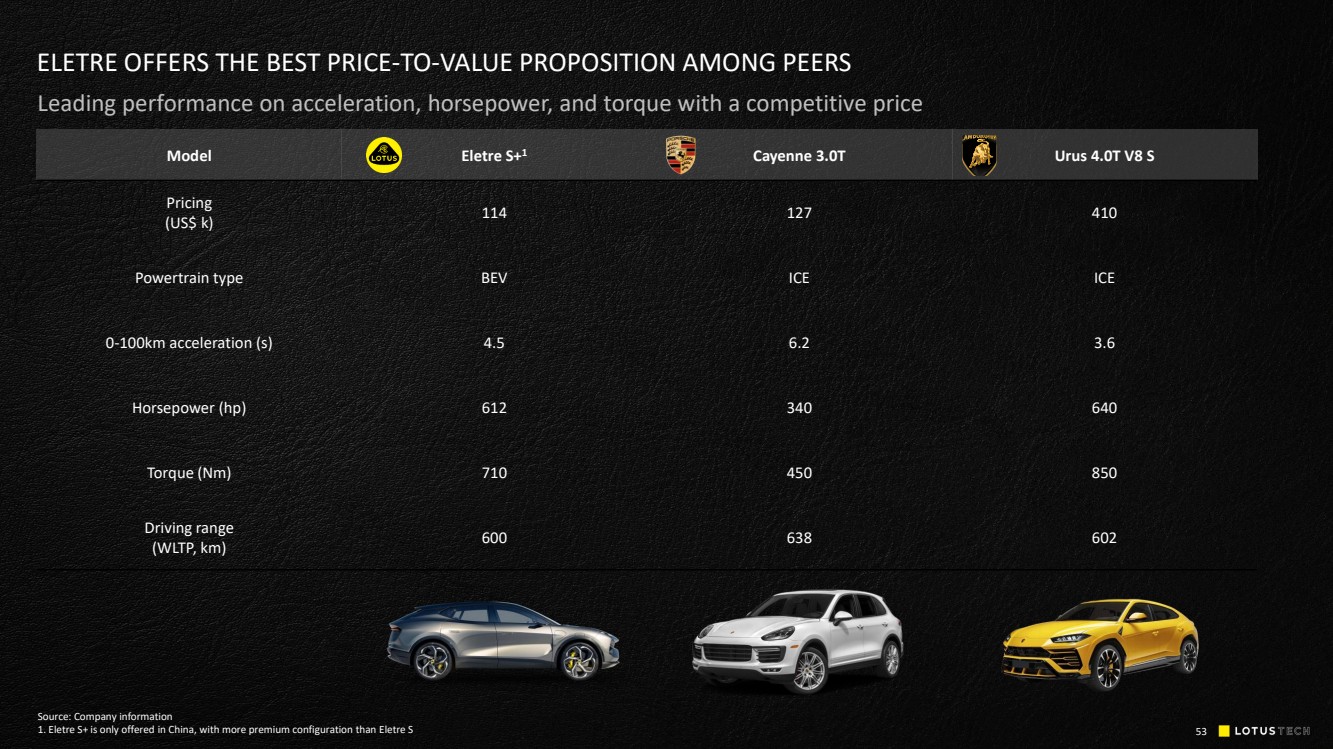

| ELETRE OFFERS THE BEST PRICE - TO - VALUE PROPOSITION AMONG PEERS Model Eletre S+ 1 Cayenne 3.0T Urus 4.0T V8 S Pricing (US$ k) 114 127 410 Powertrain type BEV ICE ICE 0 - 100km acceleration (s) 4.5 6.2 3.6 Horsepower (hp) 612 340 640 Torque (Nm) 710 450 850 Driving range (WLTP, km ) 600 638 602 Leading performance on acceleration, horsepower, and torque with a competitive price 53 Source: Company information 1. Eletre S+ is only offered in China, with more premium configuration than Eletre S |

| The One to Watch , 2021 Electric Awards Product Design of the Year , 2021 Overall Automotive Transportation , 2020 Global Design Awards 2,000 hp 1,500KW DELIVERED THROUGH 4 MOTORS 9.1 s 0 - 186 MPH 0 - 300 KM/H 200 mph (320 KM/H) MAX SPEED 1,680 kg LIGHTWEIGHT BEV 1,700 Nm TORQUE (WITH TORQUE VECTORING) 1,800 kg DOWNPOWER Note: Evija was launched and manufactured by Lotus UK 54 THE WORLD’S FIRST PURE ELECTRIC BRITISH HYPERCAR |

| 55 L CATTERTON HAS AN INCREDIBLE TRACK RECORD OF CONNECTING ICONIC BRANDS GENTLE FENDI Source: Public information The two brands came together to create an extraordinary capsule collection inspired by Gentle Monster’s innovative designs and Fendi’s exquisite craftsmanship x • L Catterton’s strategic relationship with LVMH enabled it to facilitate the collaboration between Gentle Monster and Fendi • L Catterton played a crucial role in enacting the collaboration between Birkenstock and Dior Combining functionality and elegance, the debut collection subtly pays tribute to Monsieur Dior’s passion for gardening x DIOR BY BIRKENSTOCK |

| www.group - lotus.com All contents contained in this document are owned by Lotus. © Lotus 2023 |