The Fund's investment objective is long-term capital growth.

The following table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

Shareholder Fees |

Kirr, Marbach Partners Value Fund

Kirr, Marbach Partners Value Fund

USD ($)

|

|---|---|

| Redemption Fee on Shares held less than 30 days (as a % of amount redeemed) | 1.00% |

| Exchange Fee | $ 5 |

Annual Fund Operating Expenses |

Kirr, Marbach Partners Value Fund

Kirr, Marbach Partners Value Fund

|

|

|---|---|---|

| Management Fees | 1.00% | |

| Distribution and Service (12b-1) Fees | 0.08% | |

| Other Expenses | 0.58% | |

| Total Annual Fund Operating Expenses | 1.66% | |

| Fee Waivers and/or Expense Reimbursements | (0.21%) | [1] |

| Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements | 1.45% | [1] |

| [1] | Until February 28, 2024, the Adviser has contractually agreed to waive its management fee and/or reimburse the Fund's other expenses to the extent necessary to ensure that the total annual operating expenses do not exceed 1.45% of its average net assets. After such date, the total operating expense limitations may be terminated or revised at any time. Any fee waiver or expense reimbursement is subject to later adjustment to allow the Adviser to recoup amounts waived or reimbursed to the extent actual fees and expenses for a period are less than the expense limitation cap, provided, however, that the Adviser shall only be entitled to recoup such amounts for a period of thirty-six months following the date on which such fee waiver or expense reimbursement was made. For additional information, see "Fund Management." |

The following Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. Please note that the one-year number is based on the Fund's net expenses resulting from the expense cap agreement described above. The three-, five- and ten-year numbers are based on the Fund's expenses before any waiver or reimbursements. Although your actual costs may be higher or lower, based on these assumptions your costs would be as follows:

Expense Example |

1 Year |

3 Years |

5 Years |

10 Years |

|---|---|---|---|---|

| Kirr, Marbach Partners Value Fund | Kirr, Marbach Partners Value Fund | USD ($) | 148 | 503 | 882 | 1,948 |

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 14% of the average value of its portfolio.

The Fund seeks to achieve its investment objective by investing in common stocks of companies with small-capitalizations (less than $1 billion), medium-capitalizations ($1-$15 billion) and large-capitalizations (more than $15 billion). Under normal circumstances, at least 65% of the Fund's total assets will consist of common stocks or other equity securities. The Adviser generally follows a value approach to investing for the Fund. Accordingly, the Fund will focus on securities of companies that the Adviser believes are undervalued relative to their intrinsic worth and possess certain characteristics that the Adviser believes will lead to a higher market price over time.

Stock Market Risk. Equity Funds like the Fund are subject to stock market risks and significant fluctuations in value. If the stock market declines in value, the Fund is likely to decline in value.

Stock Selection Risk. The stocks selected by the Adviser may decline in value or not increase in value when the stock market in general is rising.

Mid-Cap/Small-Cap Risk. Medium capitalization and small capitalization companies may not have the size, resources or other assets of large capitalization companies. The securities of medium capitalization and small capitalization companies may fluctuate more than those of large capitalization companies. Small-capitalization stocks often are very sensitive to changing economic conditions and market downturns because small-capitalization issuers typically have narrower markets for their products or services, fewer product lines, and more limited managerial and financial resources than other issuers. Accordingly, the stocks of small-capitalization companies may be more volatile than those of larger issuers. Additionally, the securities of medium capitalization and small capitalization companies may be less liquid than those of large capitalization companies, meaning the Fund might have greater difficulty selling such securities at a time and price that the Fund would like.

Foreign Investment Risk. The Fund's foreign investments may increase or decrease in value depending on foreign exchange rates, foreign political and economic developments and U.S. and foreign laws relating to foreign investments. Many foreign securities are less liquid and their prices are more volatile than comparable U.S. securities. From time to time foreign securities may be difficult to liquidate rapidly without adverse price effects. The costs of foreign investing also tend to be higher than the costs of investing in domestic securities.

Investment Risk. You should be aware that you may lose money by investing in the Fund. Because of the Fund's focus on value investing, it may not be a complete investment program for the equity portion of your portfolio.

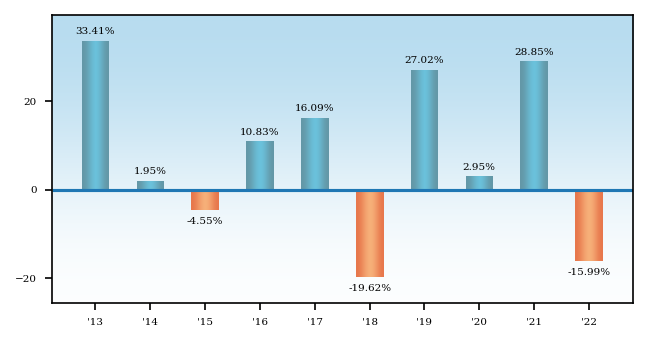

The performance information that follows gives some indication of the risks of an investment in the Fund by showing changes in the Fund's performance from year to year and by comparing the Fund's performance with a broad measure of market performance. Please remember that the Fund's past performance (before and after taxes) does not reflect how the Fund may perform in the future. You may obtain performance information current to the most recent month-end by calling 1-800-870-8039.

The Fund's year-to-date total return as of December 31, 2022 is –15.99%.

Best and Worst Quarterly Returns

| BEST |

WORST |

||||||

| December 31, 2020 |

March 31, 2020 |

||||||

| 21.81% |

–33.16% |

||||||

| (4th quarter, 2020) |

(1st quarter, 2020) |

||||||

Average Annual Returns - Kirr, Marbach Partners Value Fund |

Average Annual Returns, 1 Year |

Average Annual Returns, 5 Years |

Average Annual Returns, 10 Years |

|---|---|---|---|

| Kirr, Marbach Partners Value Fund | (15.99%) | 2.62% | 6.63% |

| After Taxes on Distributions | Kirr, Marbach Partners Value Fund | (16.68%) | 1.66% | 5.83% |

| After Taxes on Distributions and Sale of Fund Shares | Kirr, Marbach Partners Value Fund | (8.97%) | 1.91% | 5.26% |

| S&P 500 Index | (18.11%) | 9.42% | 12.56% |

(The index presented reflects no deduction for fees, expenses, or taxes)

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns shown are not relevant to investors who hold their Fund shares through tax deferred arrangements, such as 401(k) plans or individual retirement accounts.