| | |

SEC Technical Report Summary Pre-Feasibility Study Salar de Atacama Región II, Chile

Effective Date: August 31, 2021 Report Date: January 28, 2022 Amended Date: December 16, 2022 |

Report Prepared for Albemarle Corporation 4350 Congress Street Suite 700 Charlotte, North Carolina 28209 |

Report Prepared by SRK Consulting (U.S.), Inc. 1125 Seventeenth Street, Suite 600 Denver, CO 80202

SRK Project Number: 515800.040 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page ii |

Table of Contents

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page iii |

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page iv |

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page v |

| | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| 210 |

| 210 |

| 211 |

| 213 |

| 217 |

| 217 |

| 218 |

| 219 |

| 220 |

| 221 |

| 224 |

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page vi |

| | | | | |

| 225 |

| 225 |

| 225 |

| 230 |

| 232 |

| 232 |

| 232 |

| 232 |

| 234 |

| 235 |

| 236 |

| 237 |

| 237 |

| 238 |

| 238 |

| 241 |

| 245 |

| 245 |

| 245 |

| 245 |

| 246 |

| 251 |

| 254 |

| 256 |

| 256 |

| 259 |

| 259 |

| 263 |

| 264 |

| 264 |

| 264 |

| 264 |

| 265 |

| 265 |

| 265 |

| 265 |

| 265 |

| 266 |

| 266 |

| 266 |

| 267 |

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page vii |

| | | | | |

| 268 |

| 268 |

| 268 |

| 268 |

| 269 |

| 269 |

| 270 |

| 274 |

| Signature Page | 275 |

List of Tables

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page viii |

| | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| 205 |

| 205 |

| 205 |

| 206 |

| 206 |

| 206 |

| |

| 209 |

| 221 |

| 222 |

| 224 |

| 227 |

| 230 |

| 234 |

| 239 |

| 241 |

| 242 |

| 243 |

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page ix |

| | | | | |

| 244 |

| 245 |

| 246 |

| 247 |

| 248 |

| 248 |

| 250 |

| 250 |

| 251 |

| 253 |

| 259 |

| 259 |

| 260 |

| 262 |

| 269 |

| 274 |

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page x |

List of Figures

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page xi |

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page xii |

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page xiii |

| | | | | |

| 212 |

| 215 |

| 236 |

| 244 |

| 246 |

| 247 |

| 248 |

| 249 |

| 249 |

| 251 |

| 254 |

| 254 |

| 257 |

| 258 |

| 258 |

| 261 |

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page xiv |

List of Abbreviations

The metric system has been used throughout this report. Tonnes are metric of 1,000 kg, or 2,204.6 lb. All currency is in U.S. dollars (US$) unless otherwise stated.

| | | | | |

| Abbreviation | Definition |

| °C | degrees Celsius |

| 2D | two dimensional |

| 3D | three dimensional |

| A/P | Accounts Payable |

| A/R | Accounts Receivable |

| ADI | Indigenous Development Area |

| Albemarle | Albemarle Corporation |

| APVC | Altiplano-Puna volcanic complex |

| BEV | battery electric vehicle |

| BG | Battery grade |

| BNEF | Bloomberg New Energy Finance |

| CoG | cut off grade |

| CONAF | National Forestry Corporation |

| DGA | General Water Directorate |

| ET | Evapotranspiration |

| EWMP | Environmental Water Monitoring Plan |

H2SO4 | sulfuric acid |

| ha | hectares |

| HCl | hydrochloric acid |

| ICE | internal combustion engine |

| ID2 | Inverse Distance Squared |

| IDW | inverse distance weighting |

| KE | kriging efficiency |

| kg | kilograms |

| kg/d | kilograms per day |

| km | kilometers |

km2 | square kilometers |

| L | liter |

| l/s | liters per second |

| LCE | lithium carbonate equivalent |

| Li | lithium |

| LiCl | lithium chloride |

| LME | lithium metal equivalent |

| LoM | life of mine |

| m | meters |

| m/d | meters per day |

| m3/y | cubic meters per year |

| Ma | mega annum |

| mamsl | meters above mean seal level |

| mg/L | milligrams per liter |

| mm | millimeters |

| mm/y | millimeters per year |

| MNT | Monturaqui-Negrillar-Tilopozo |

| MOP | muriate of potash |

| MRE | Mineral Resource Estimate |

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page xv |

| | | | | |

| Mt/y | million tonnes per year |

| NaOH | sodium hydroxide |

| NMR | Nuclear Magnetic Resonance |

| NN | nearest neighbor |

| OK | ordinary kriging |

| PAT | Early Warning Plan |

| PFS | prefeasibility study |

| PMB | Environmental Monitoring Plan |

| PPE | personal protective equipment |

| QA/QC | Quality Assurance/Quality Control |

| QP | Qualified Person |

| RAMSAR | Convention on Wetlands |

| RMSE | root mean square error |

| SCL | Chilean Society of Limited Lithium |

| SEA | Environmental Assessment Service |

| SEC | Securities and Exchange Commission |

| SEIA | Chilean Environmental Impact System |

| SEN | Sistema Eléctrico Nacional |

| SEP | Sistema de Empresas |

| SERNAGEOMIN | National Service of Geology and Mining |

| SMA | Environmental Superintendence |

| SOR | slope or regression value |

| SRK | SRK Consulting (U.S.), Inc. |

| SS | specific storage |

| Sy | specific yield |

| SYIP | Salar Yield Improvement Program |

| t | metric tonnes |

| t/y | tonnes per year |

| TG | technical grade |

| TRS | Technical Report Summary |

| VGC | Volcanic, Gypsum and clastic |

| ZOIT | Zone of Tourist Interest |

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page 16 |

1Executive Summary

This report was prepared as a prefeasibility study (PFS)-level Technical Report Summary (TRS) in accordance with the Securities and Exchange Commission (SEC) S-K regulations (Title 17, Part 229, Items 601 and 1300 until 1305) for Albemarle Corporation (Albemarle) by SRK Consulting (U.S.), Inc. (SRK). This TRS is for the portion of the Salar de Atacama lithium-rich brine deposit controlled by Albemarle and the associated brine concentration facilities and La Negra lithium processing facilities owned by Albemarle, combined referred to as the “Project ” located in Region II, Chile. The purpose of this TRS is to support public disclosure of Albemarle’s mineral resources and mineral reserves for the Salar de Atacama for Albemarle’s public disclosure purposes.

The report was amended to include additional clarifying information in December 2022. The basis of the report is unchanged. The summary of the changes and location in document are summarized in Chapter 2.1.

1.1Property Description and Ownership

The Salar de Atacama Basin is located in the commune of San Pedro de Atacama, with the operations approximately 100 kilometers (km) to the south of this commune, in the extreme east of the Antofagasta Region and close to the border with the republics of Argentina and Bolivia. In a regional context, the salar is located in a remote area with the nearest city, Calama, approximately 190 km by road to the northwest. The regional capital, Antofagasta, which also is located near the La Negra processing facilities, is located approximately 280 km, by road to the west.

Albemarle's mining properties within the Salar de Atacama include two groups of exploitation concessions, CASEME (Carlos Sáez – Eduardo Morales Echeverría) and OMA, which cover a total of 5,227 mining properties. They comprise of approximately 25 km at the widest zone in the East-West direction and 12 km in the widest North-South zone. For the purpose of the reserve estimate, the OMA concessions are those that are relevant. The CASEME concessions include 1,883 properties and the same number of hectares (ha). The OMA concessions include 3,344 mining properties of 5 ha each, which corresponds to 16,720 ha.

Albemarle owns the land on which the extraction/processing facilities at Salar de Atacama and the processing facility at La Negra operate. However, the ownership of the land at the Salar de Atacama will revert to the Chilean government once all amounts of lithium remaining under Albemarle’s contracts with the Chilean government are sold (the ownership of the land and fixed assets at La Negra will remain unchanged).

Albemarle’s mineral rights at the Salar de Atacama in Chile consist of the right to extract lithium brine, pursuant to a long-term contract with the Chilean government, originally entered into in 1980 by Foote Minerals, a predecessor of Albemarle. This contract has been subsequently amended and restated.

Albemarle’s predecessor’s initial contract with the Chilean government will remain in effect until the date on which it has produced and sold 200,000 metric tonnes (t) of lithium metal equivalent (LME), although the lithium can be produced in any of its forms, from the Salar de Atacama. As of August 31, 2021, the remaining amount of lithium from the initial contract equals approximately 78,038 t of LME. On November 25, 2016, CORFO and Albemarle entered into an annex to the initial agreement adding an additional 262,132 t LME to the total quota and setting an expiry for production of the

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page 17 |

quota of January 1, 2044 (i.e., any remaining quota after this date will be forfeited). As of August 31, 2021, the remaining amount of lithium from the second quota equals 262,132 t. Combined, as of the effective date of this TRS, August 31, 2021, Albemarle has a remaining quota of 340,170 t of LME, expiring January 1, 2044.

1.2Geology and Mineralization

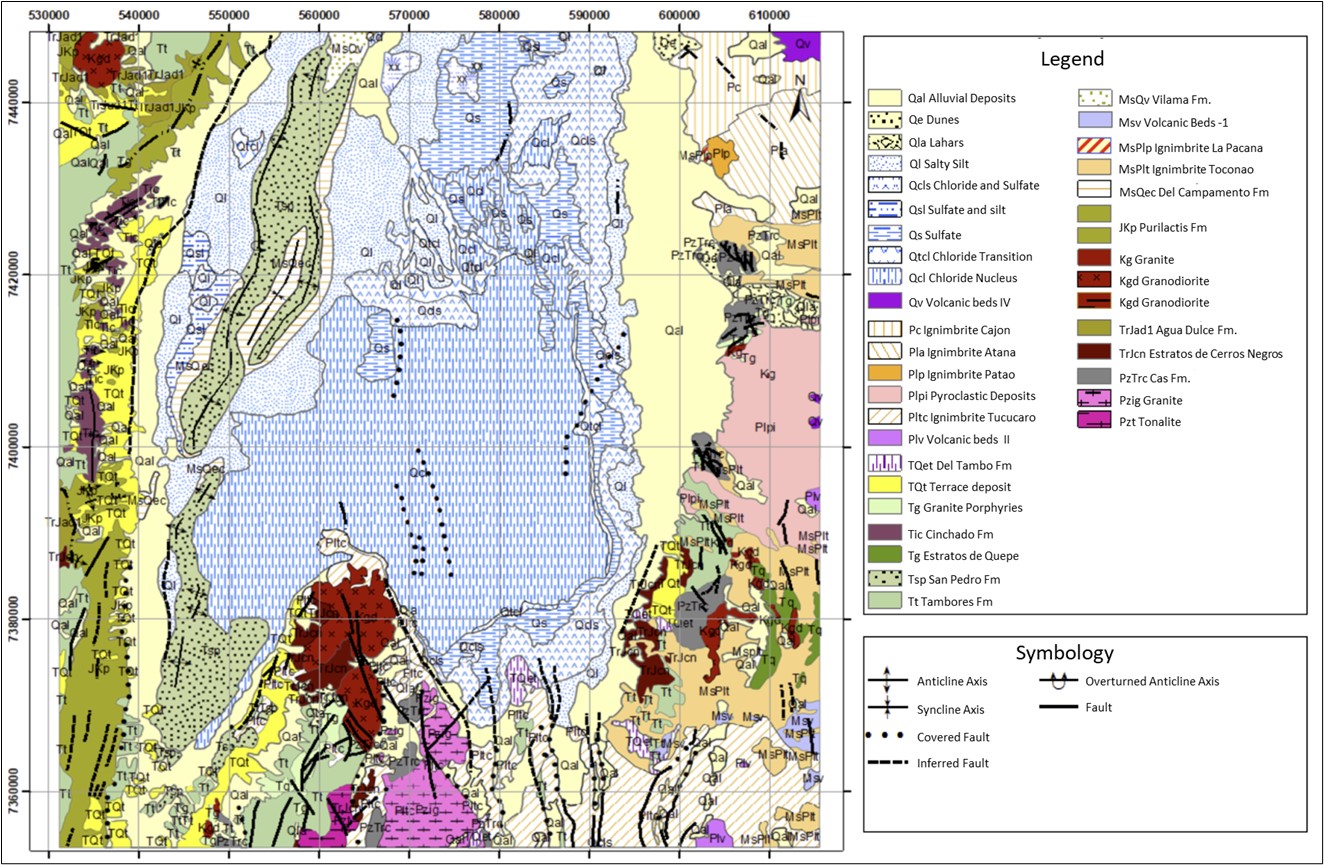

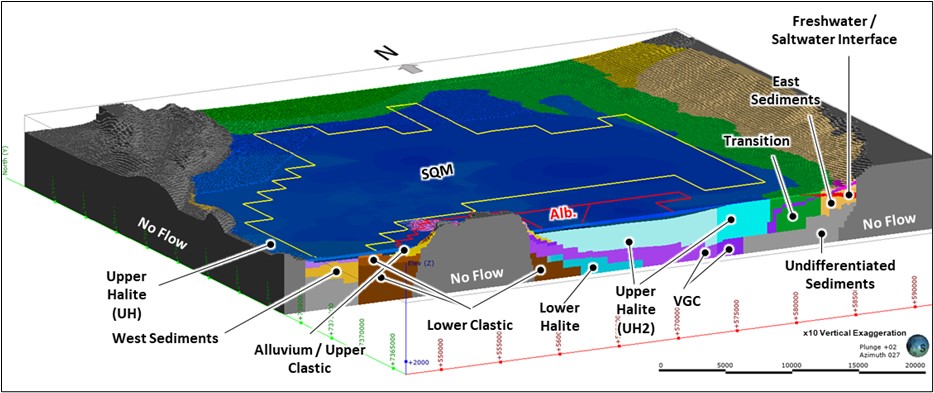

Salar de Atacama is located in the Central Andes of Chile, a region which is host to some of the most prolific lithium (Li) brine deposits in the world. The Central Andean Plateau and the Atacama Desert are two important physiographic features that contribute to the generation of Li brines in the Central Andes. In these environments, the combination of hyper-arid climate, closed basins, volcanism, and hydrothermal activity has led to extensive deposition of evaporite deposits since approximately 15 mega annum (Ma) (Alonso et al., 1991). The extreme size and longevity of these closed basins is favorable for lithium-rich brine generation, particularly where thick evaporite deposits (halite, gypsum and less commonly borates) have removed ions from solution and further concentrated lithium.

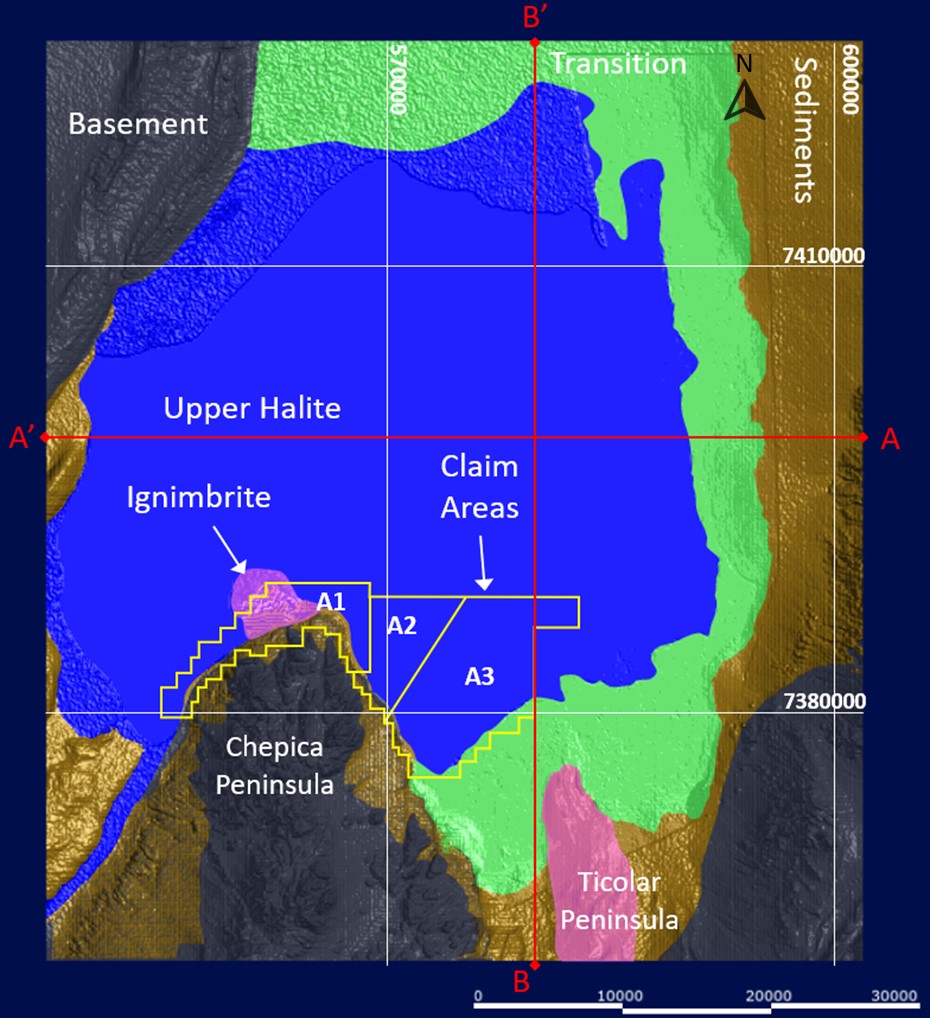

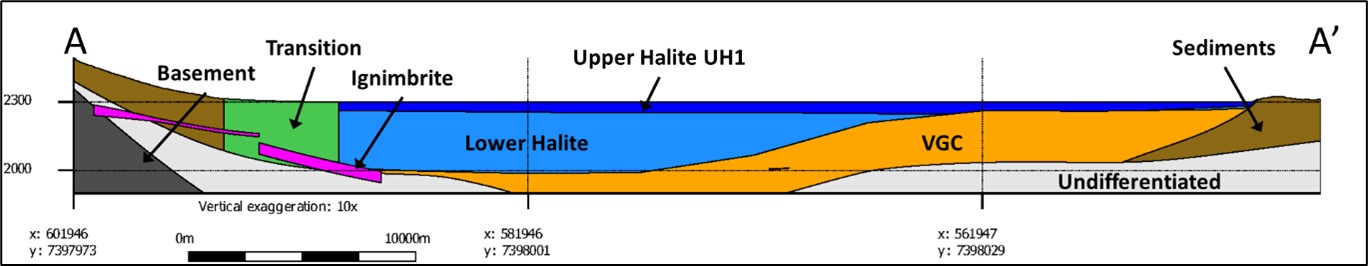

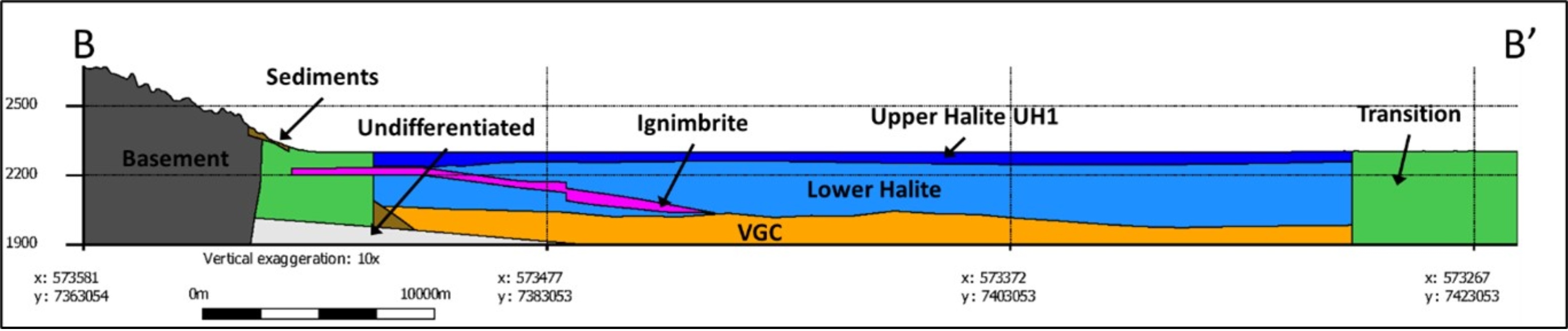

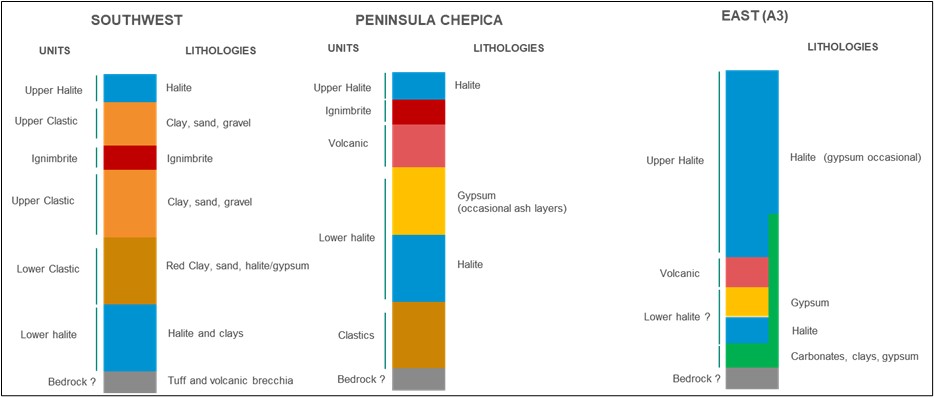

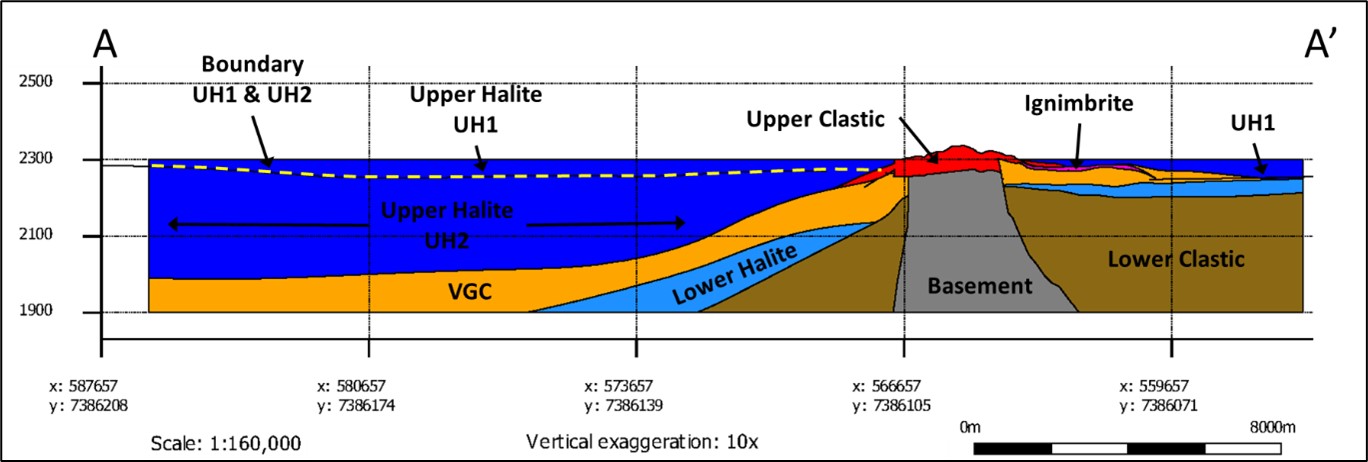

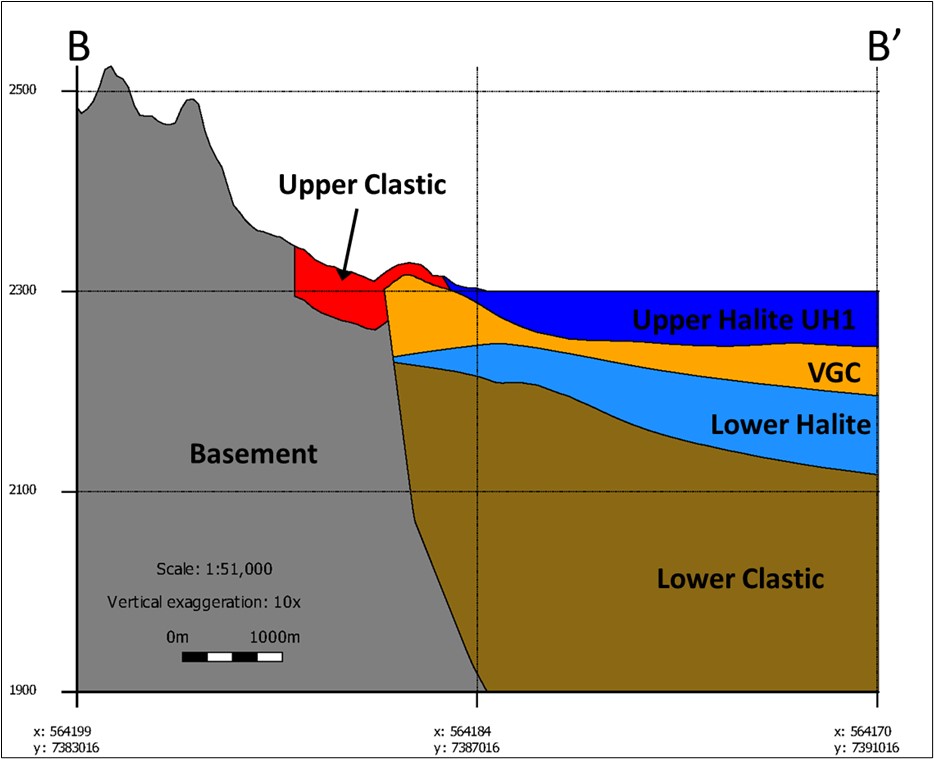

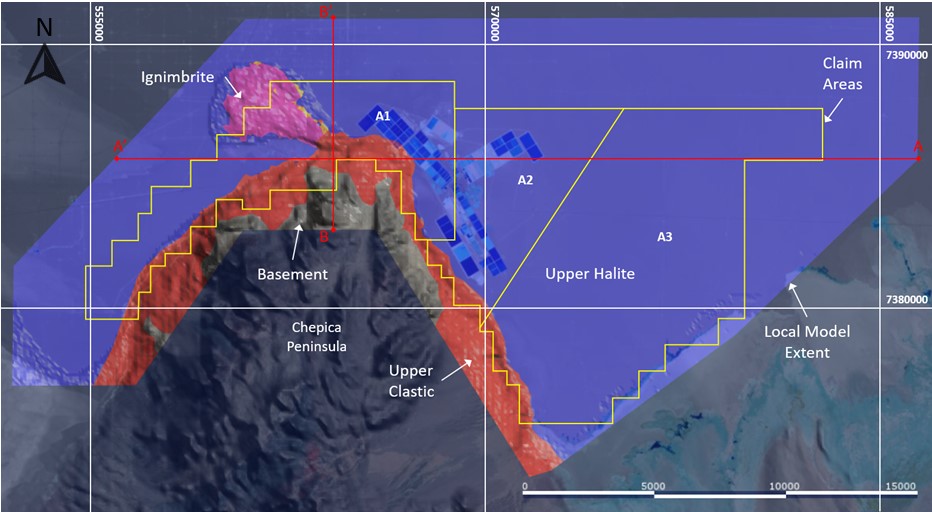

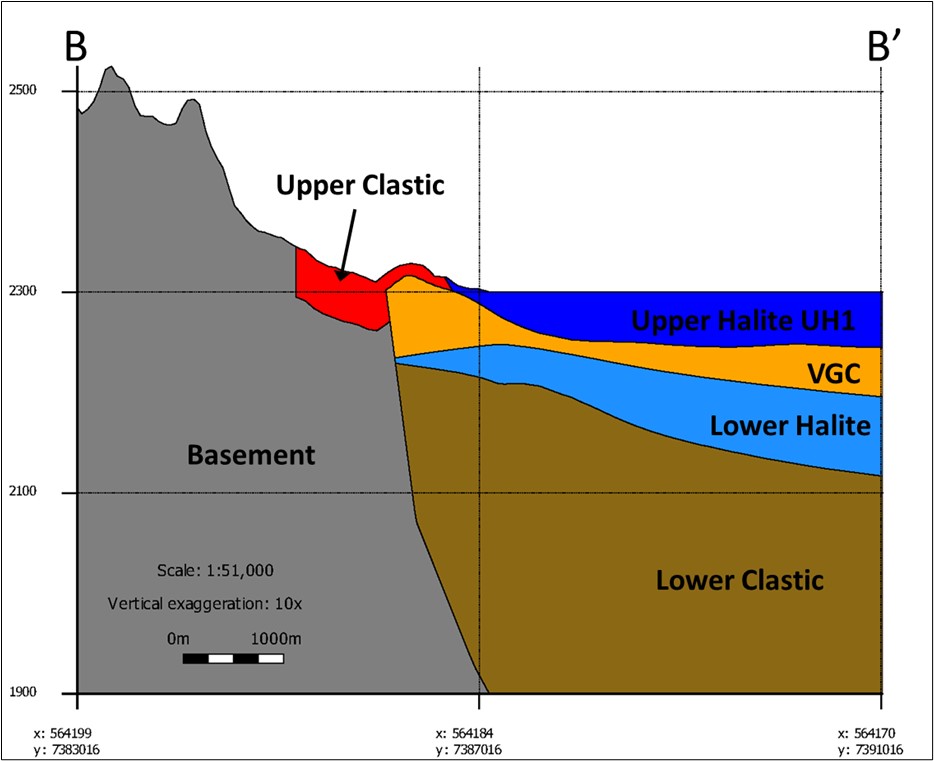

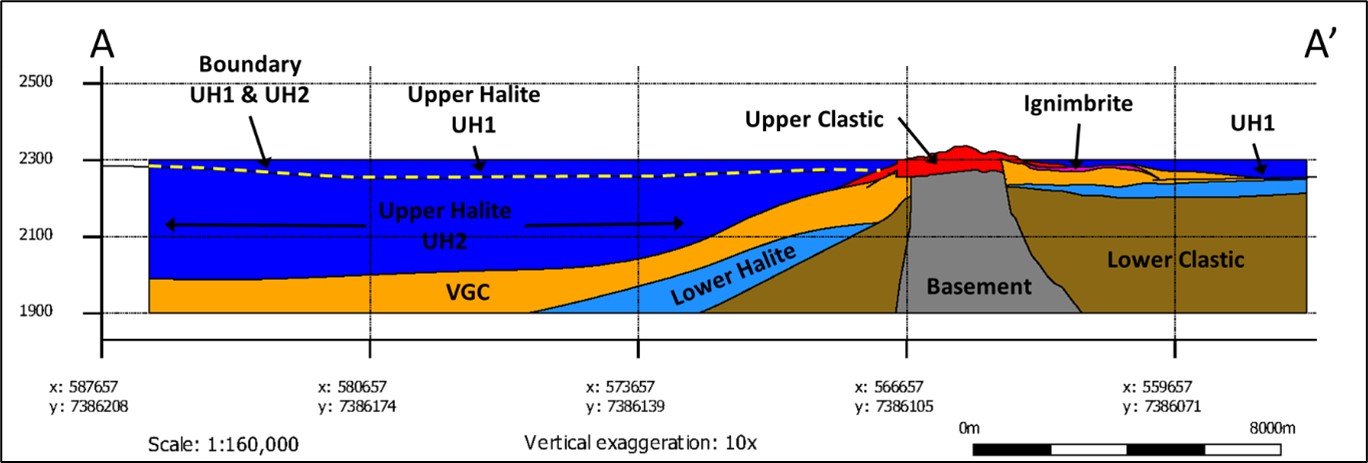

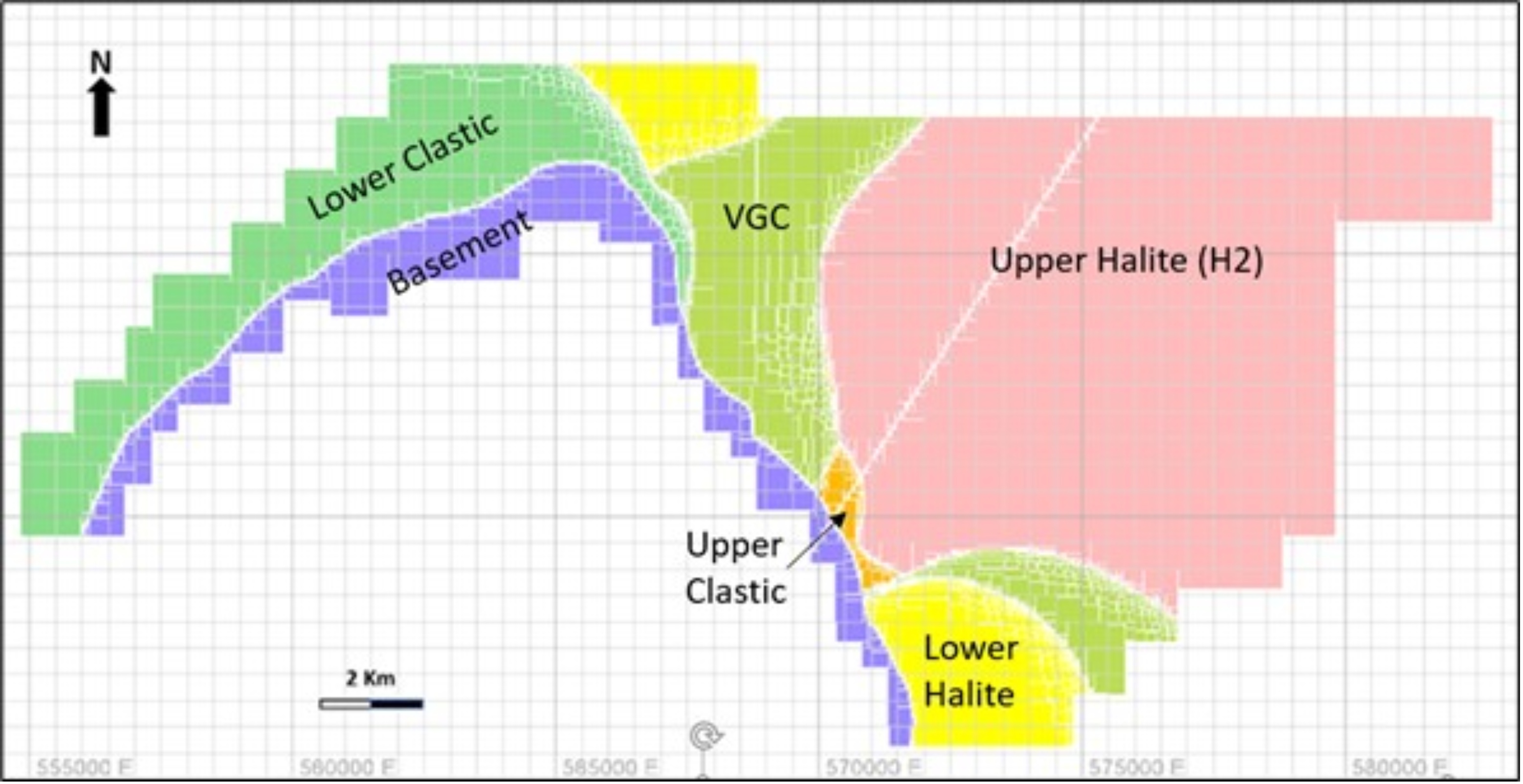

Basin fill materials at the Salar de Atacama are dominated by the Vilama Formation and modern evaporite and clastic materials currently being deposited in the basin. In the Albemarle operation area, the Vilama Formation is up to approximately 1 km thick and is host to the production aquifer system. The formation is composed of evaporite chemical sediments including intervals of carbonate, gypsum and halite punctuated by volcanic deposits of large ignimbrite sheets, volcanic ashes and minor clastic deposits. These deposits are best observed in outcrop along the salar margin and in drill cores from the Albemarle project site.

Lithium-rich brines are produced from a halite aquifer within the salar nucleus. Carbonate and sulfate flank the basin and indicate that carbonate and sulfate mineral precipitation may have played a role in producing the brine. In addition to the evaporative concentration processes, the distillation of lithium from geothermal heating of fluids may further concentrate lithium in these brines and provide prolonged replenishment of brines that are in production. Since many lithium-rich brines exist over, or in close proximity to, relatively shallow magma chambers, the late-stage magmatic fluids and vapors may have pathways through faults and fractures to migrate into the closed basin.

Waters in the Salar de Atacama basin and the adjacent Andean arc vary in lithium concentration from approximately 0.05 to 5 milligrams per liter (mg/L) Li in the Andean inflow waters, 5 to 100 mg/L Li in shallow groundwaters in the south and east flanks of the basin and in excess of 5,000 mg/L Li in brines in the nucleus (Munk et al., 2018). This indicates that the lithium-rich brine in the basin is concentrated by up to five orders of magnitude compared to water entering the basin. This is a unique hydrogeochemical circumstance to the salar compared to other lithium brine systems.

1.3Mineral Resource

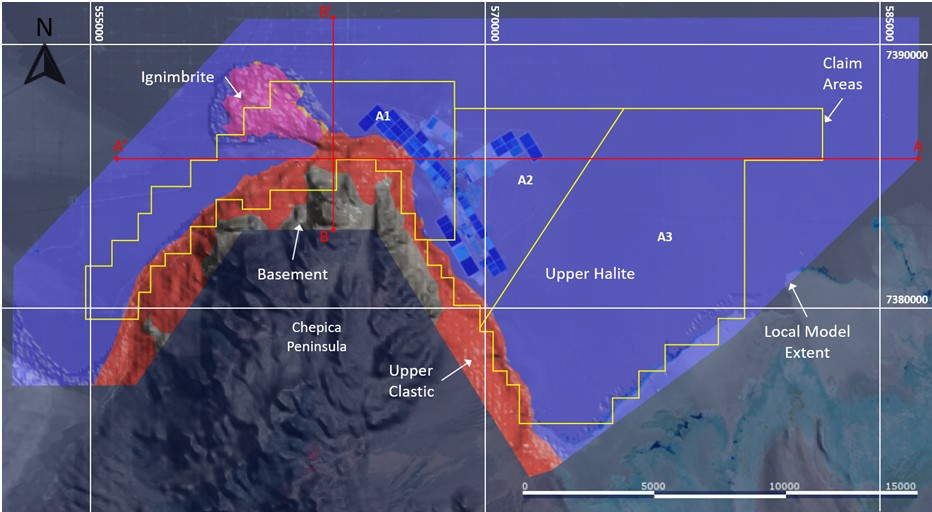

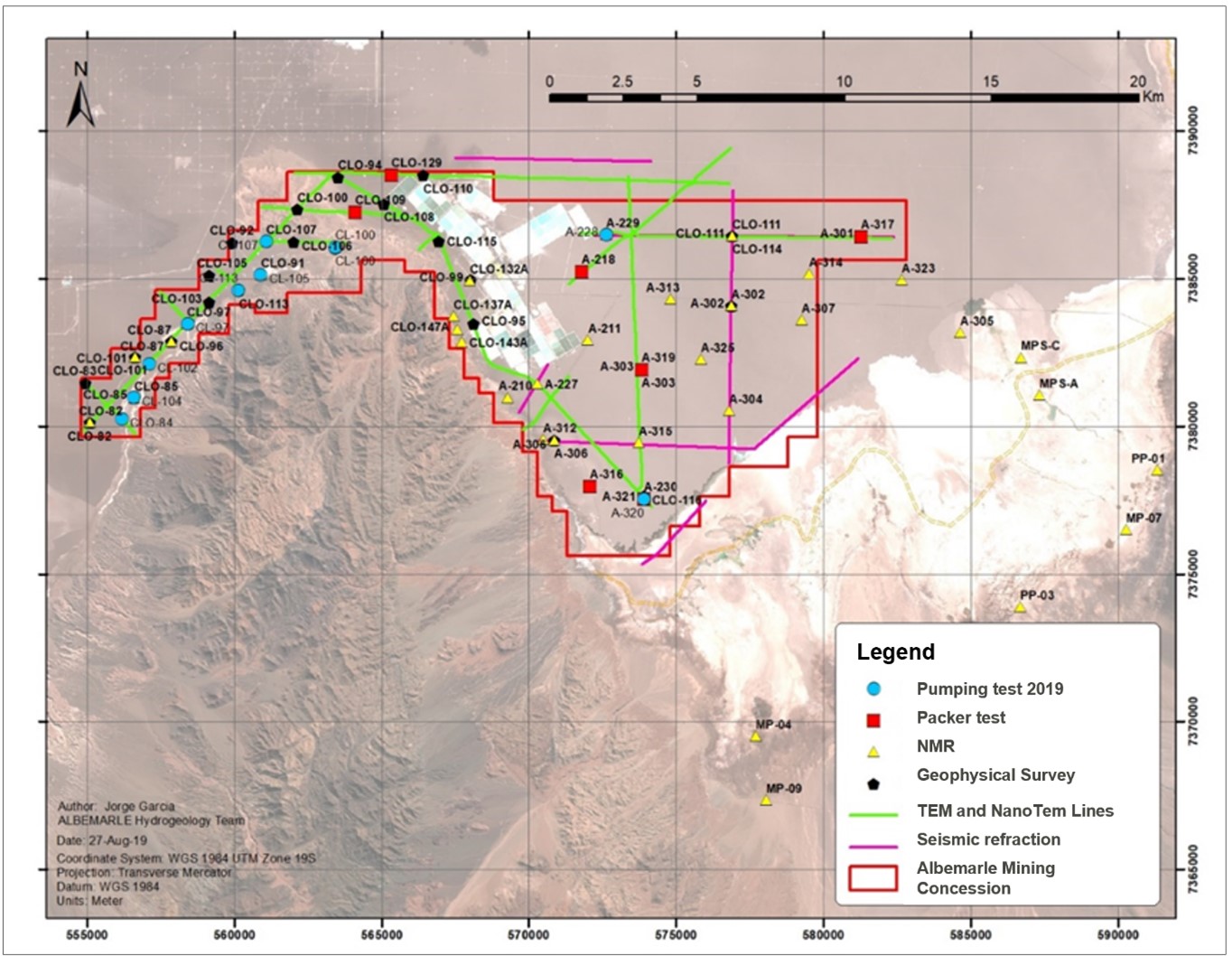

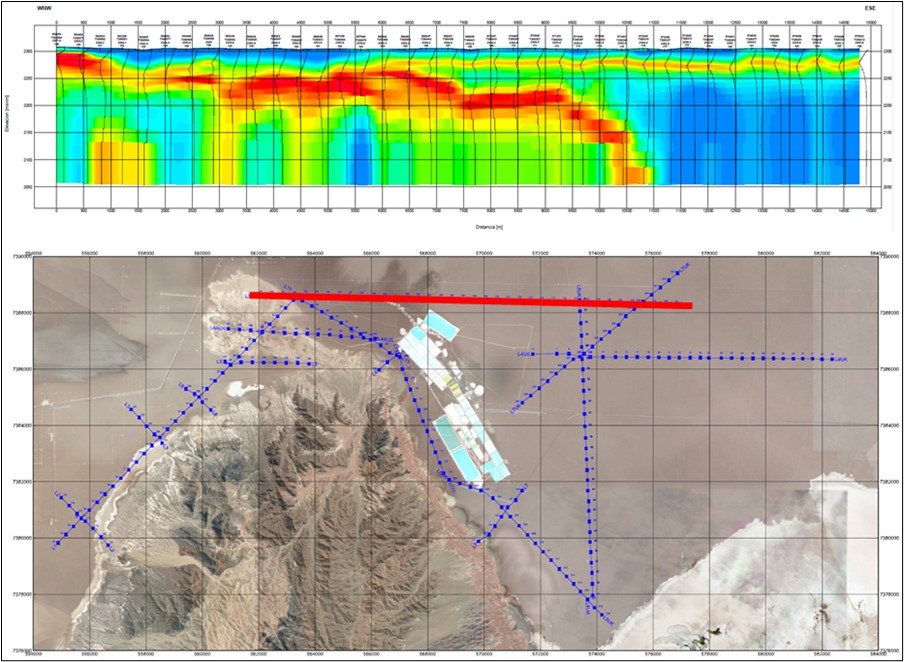

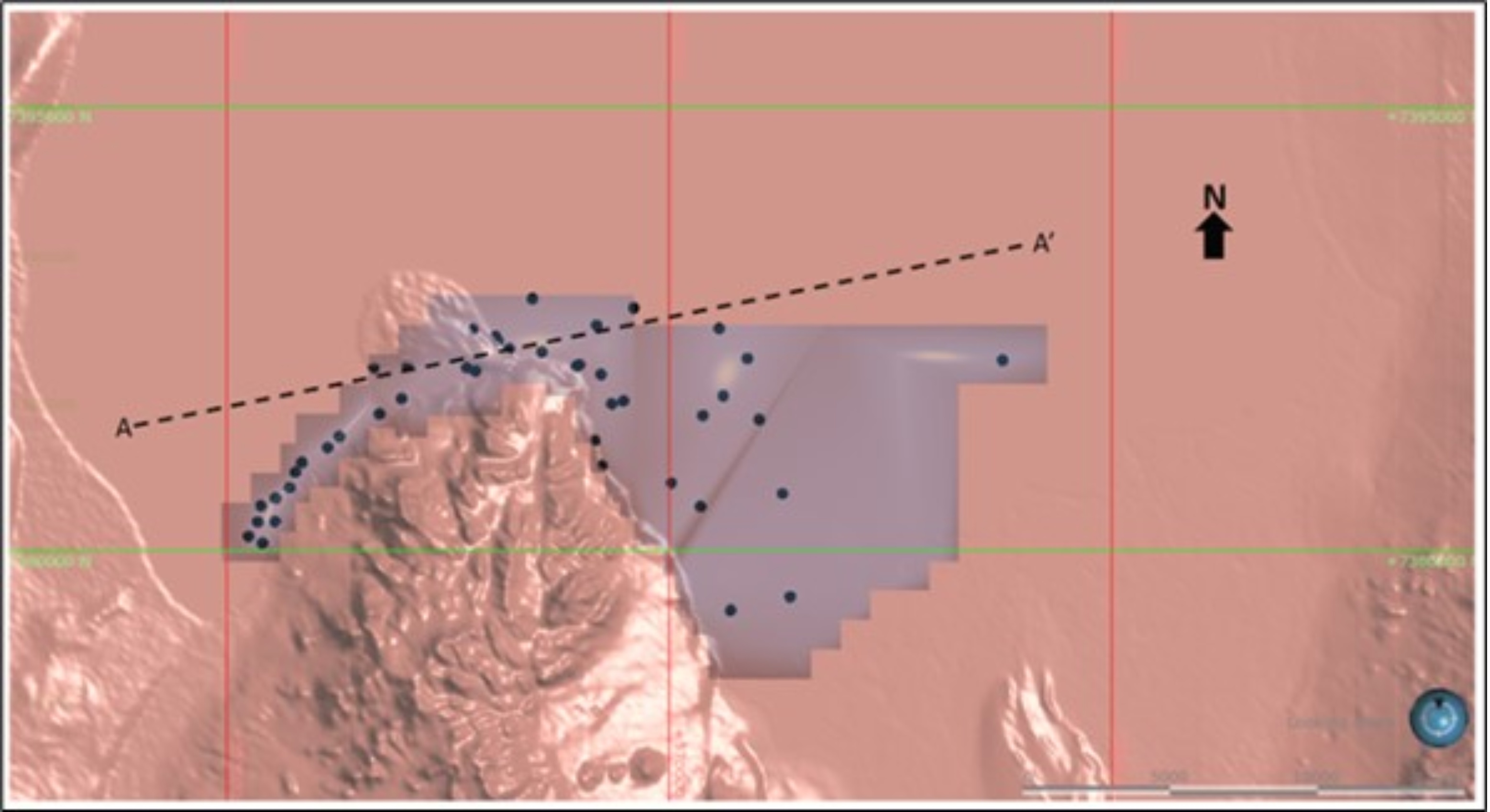

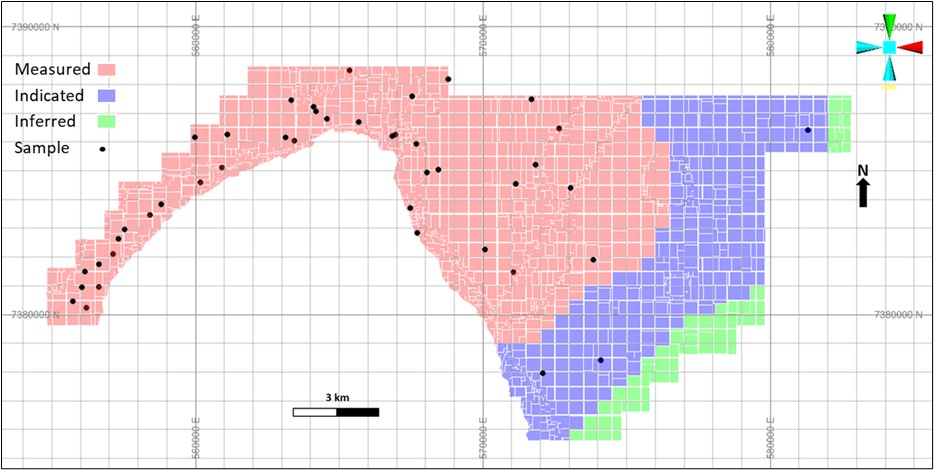

Mineral resources have been estimated by SRK. SRK generated a three dimensional (3D) geological model informed by various data types (drill hole, geophysical data, surface geologic mapping, interpreted cross sections and surface/downhole structural observations) to constrain and control the shapes of aquifers which host the lithium.

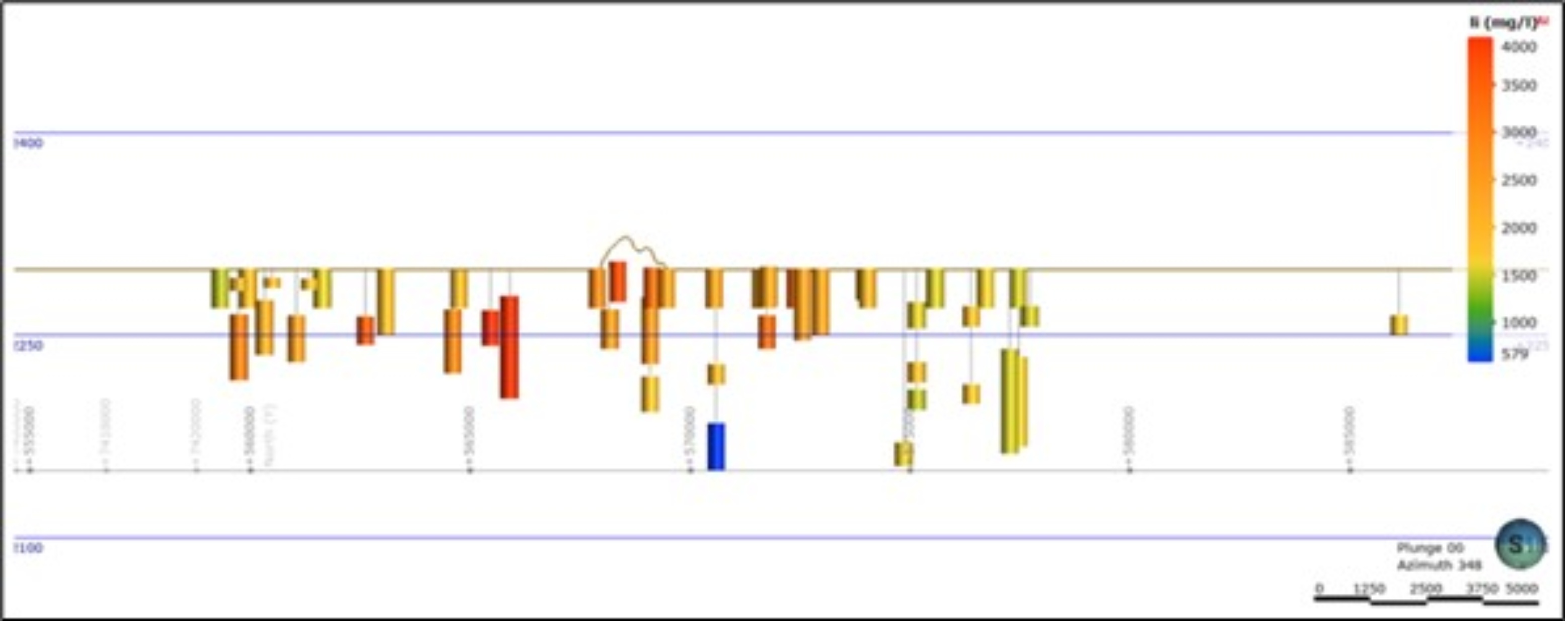

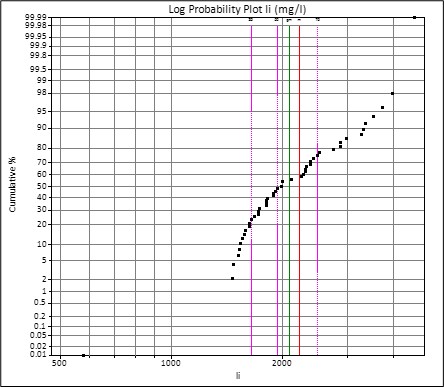

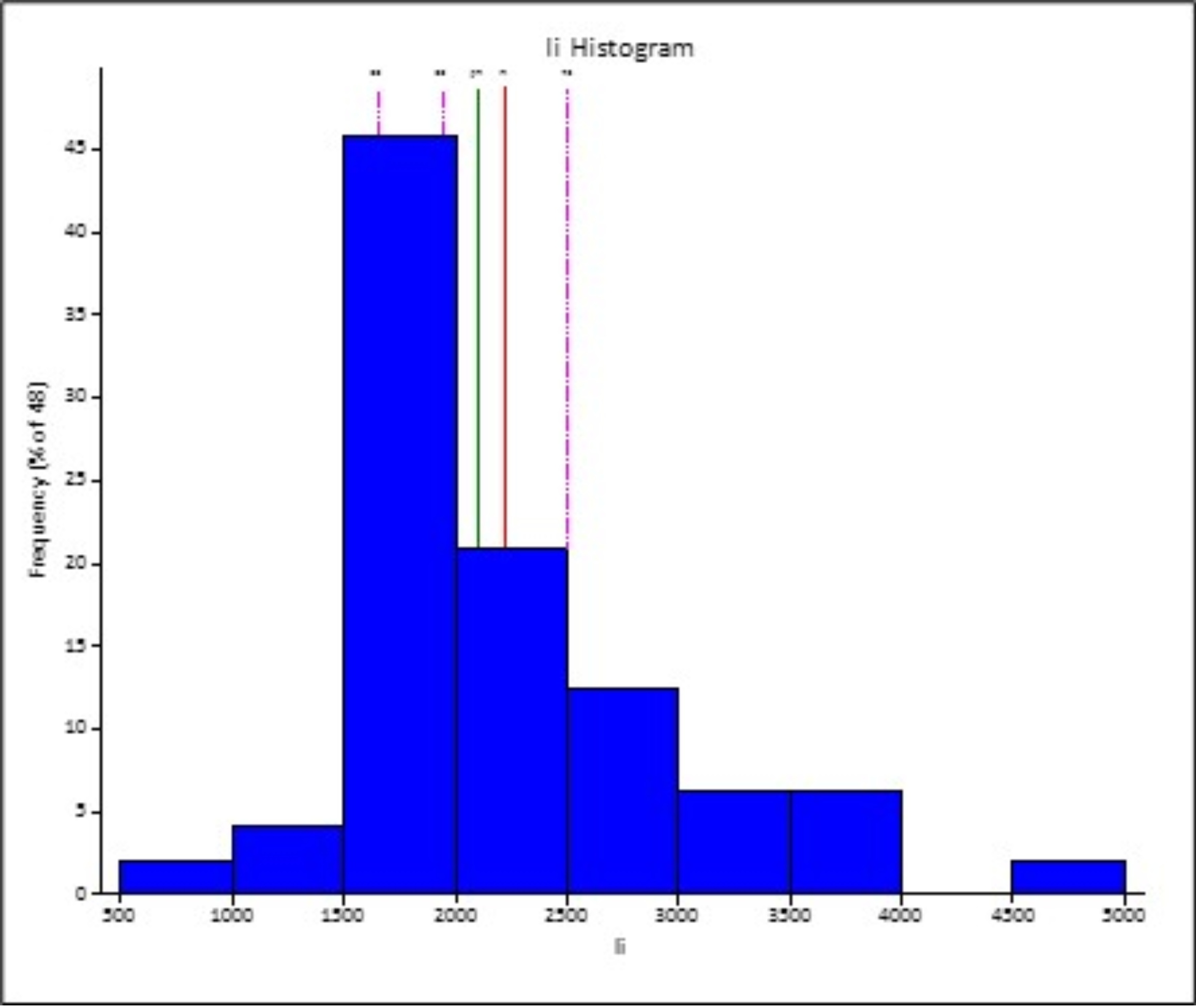

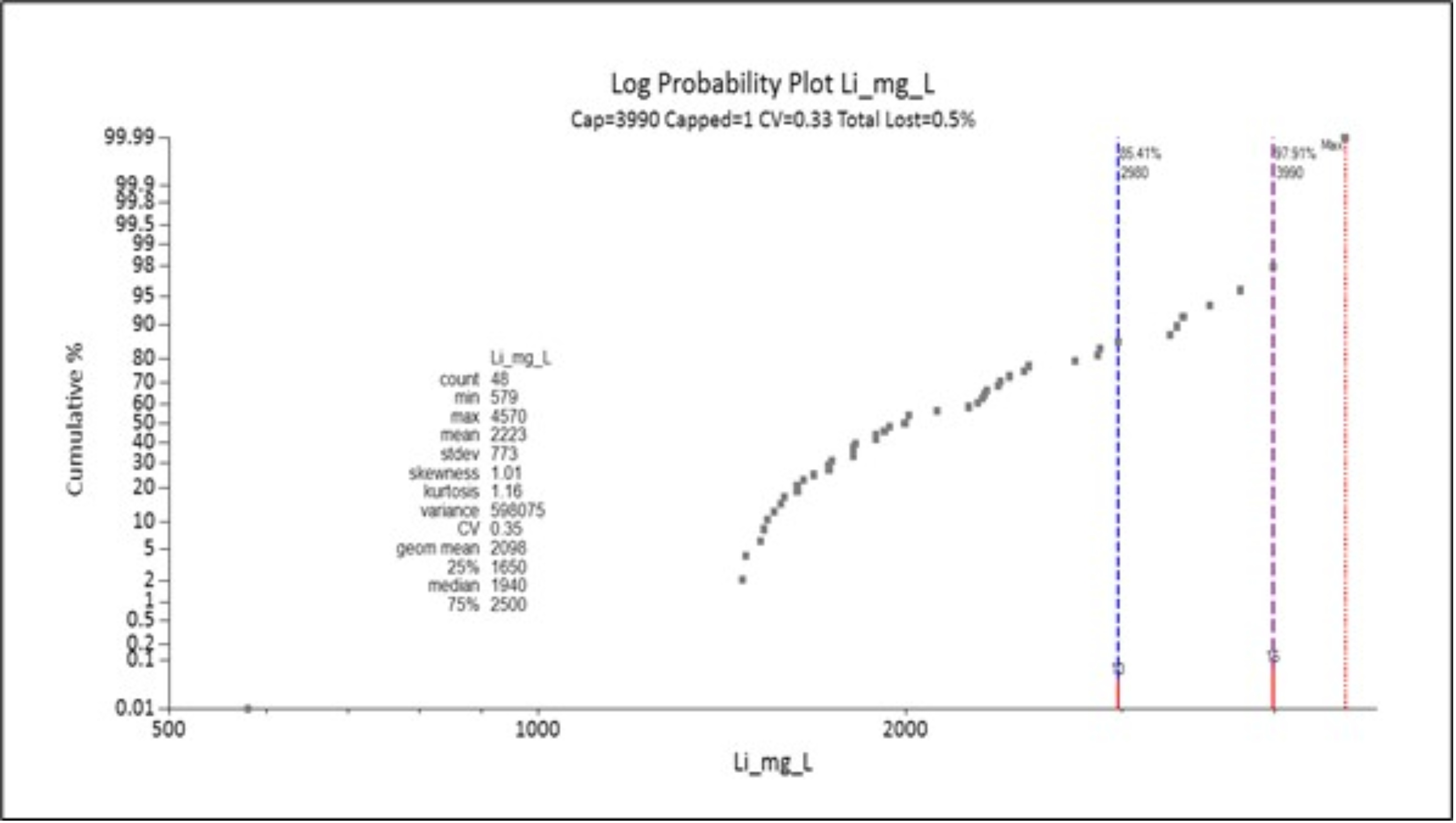

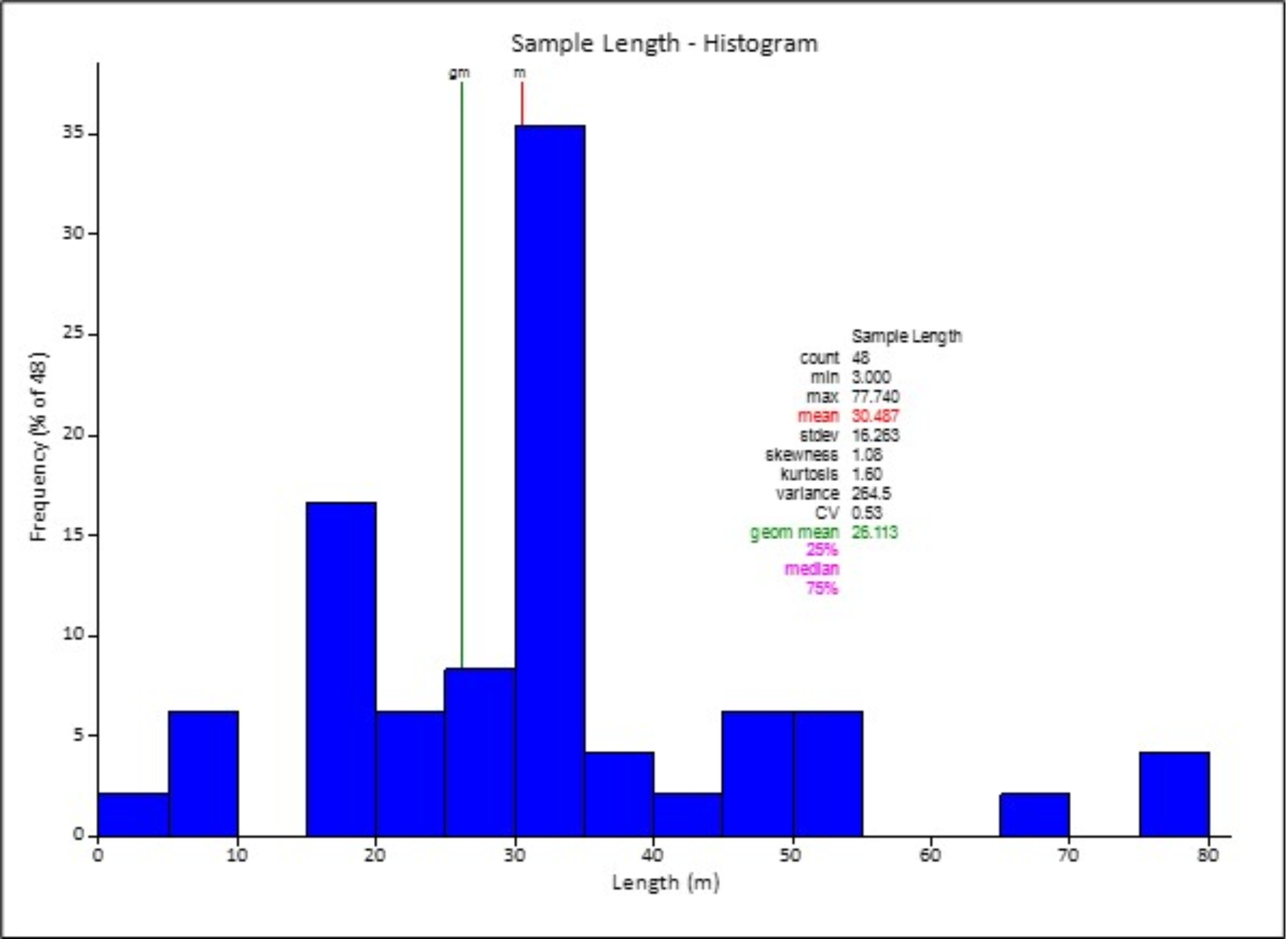

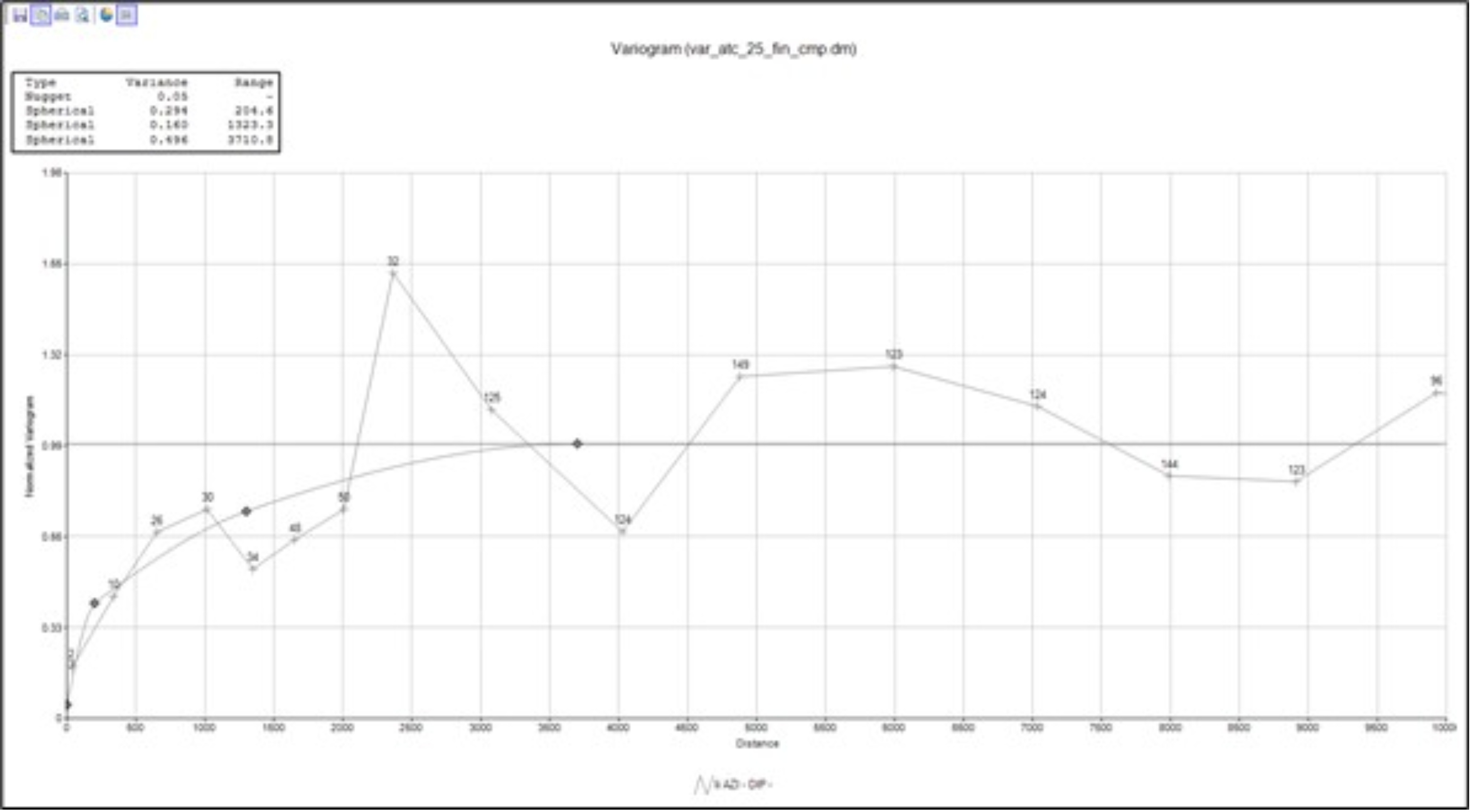

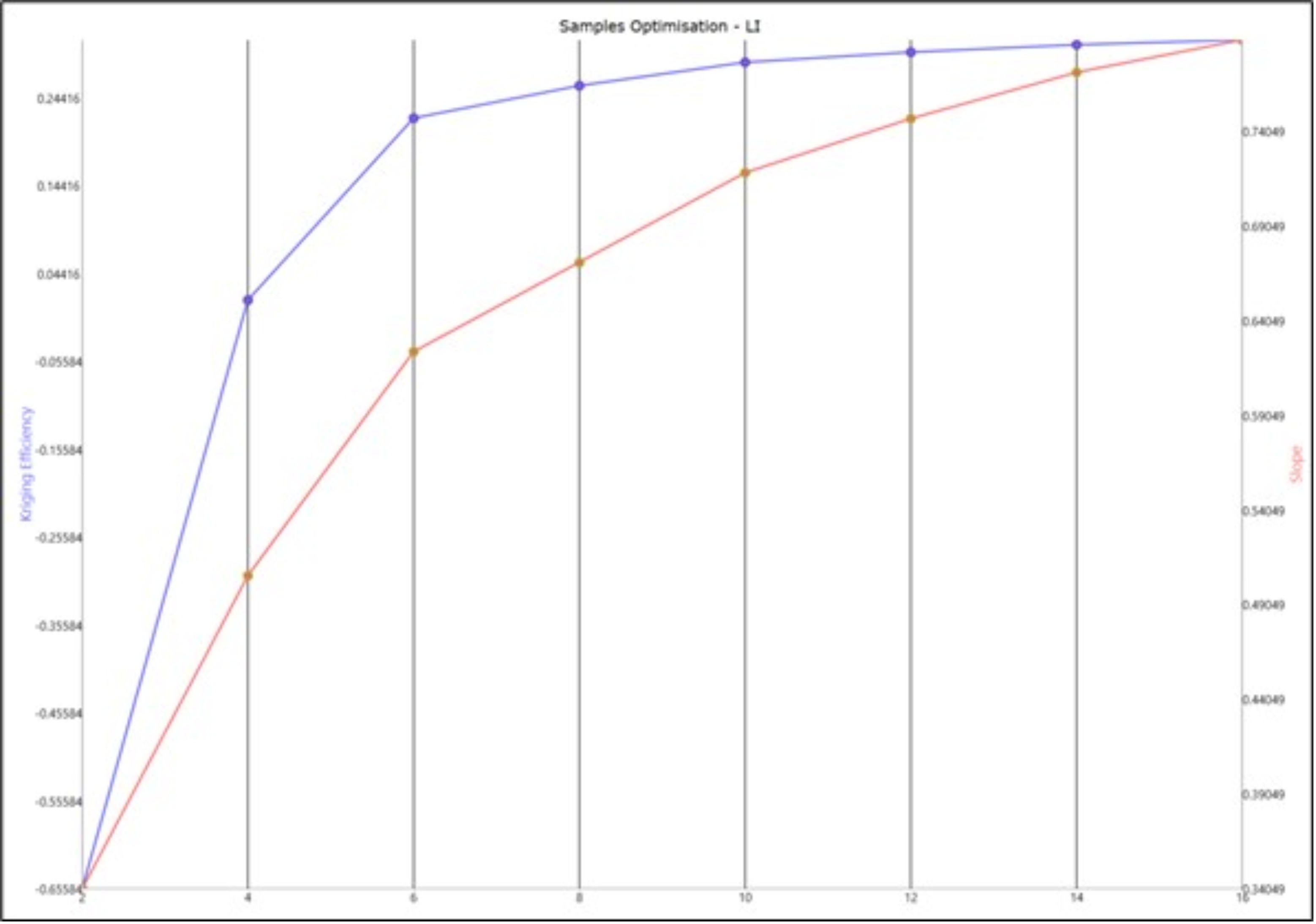

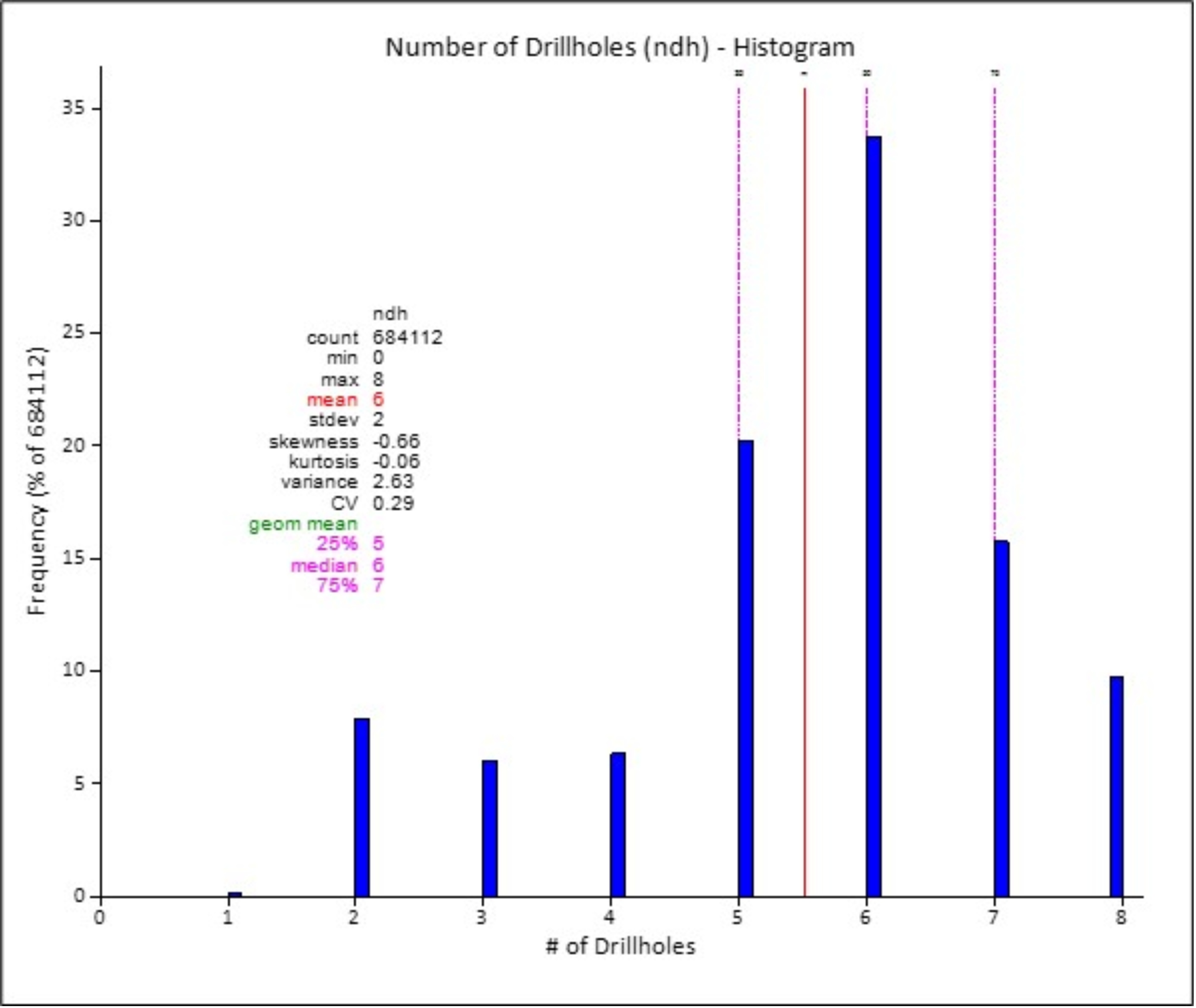

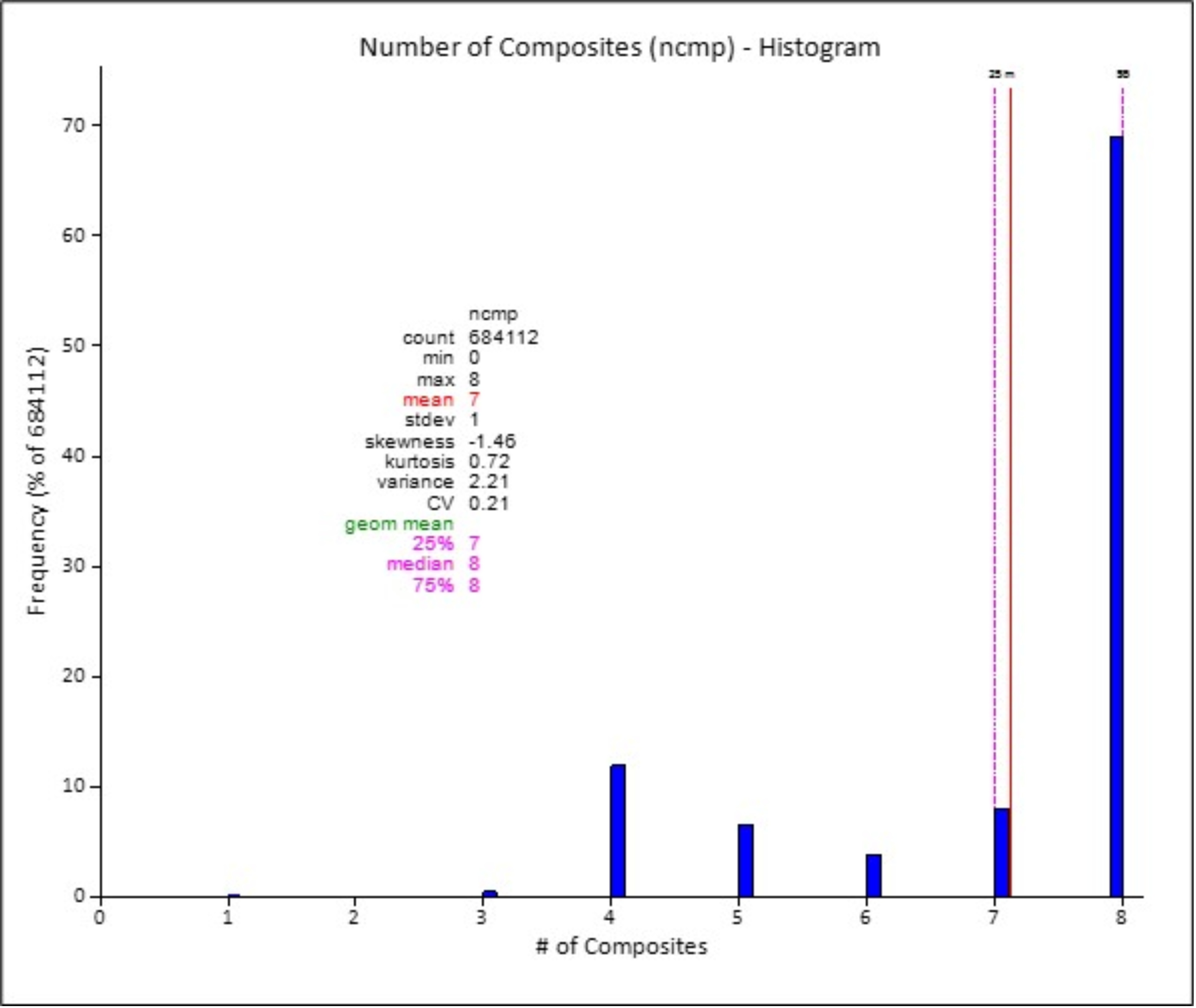

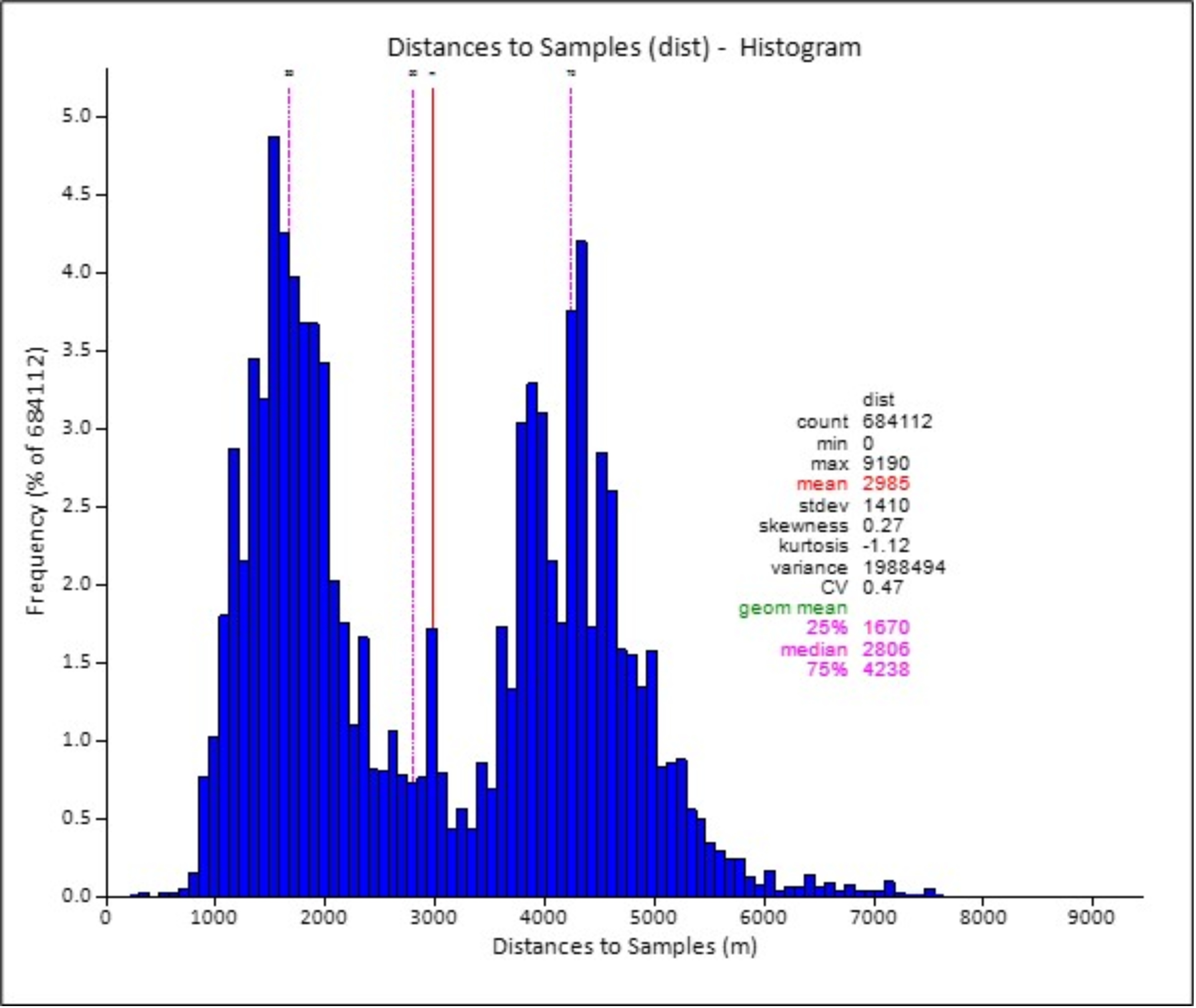

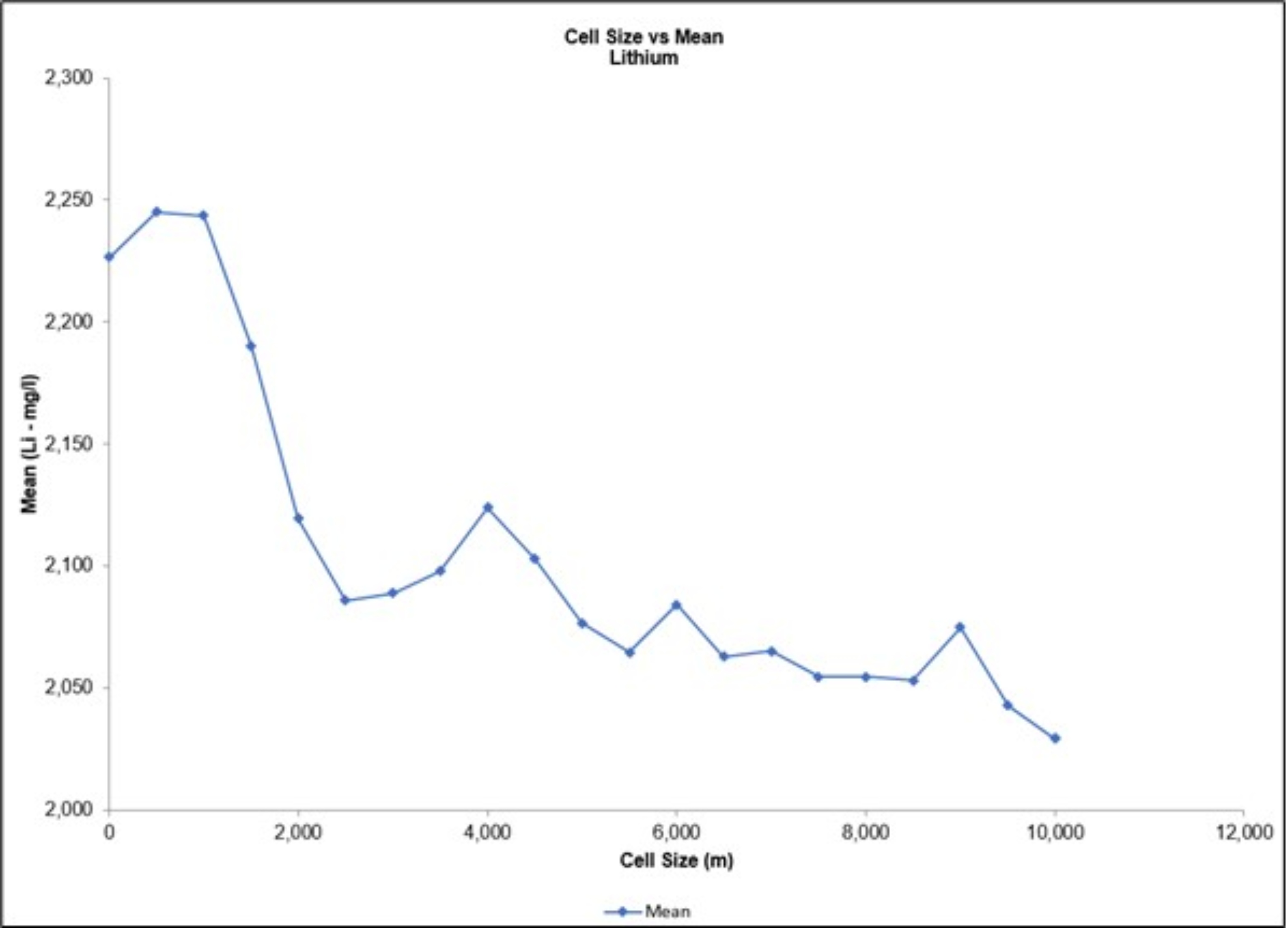

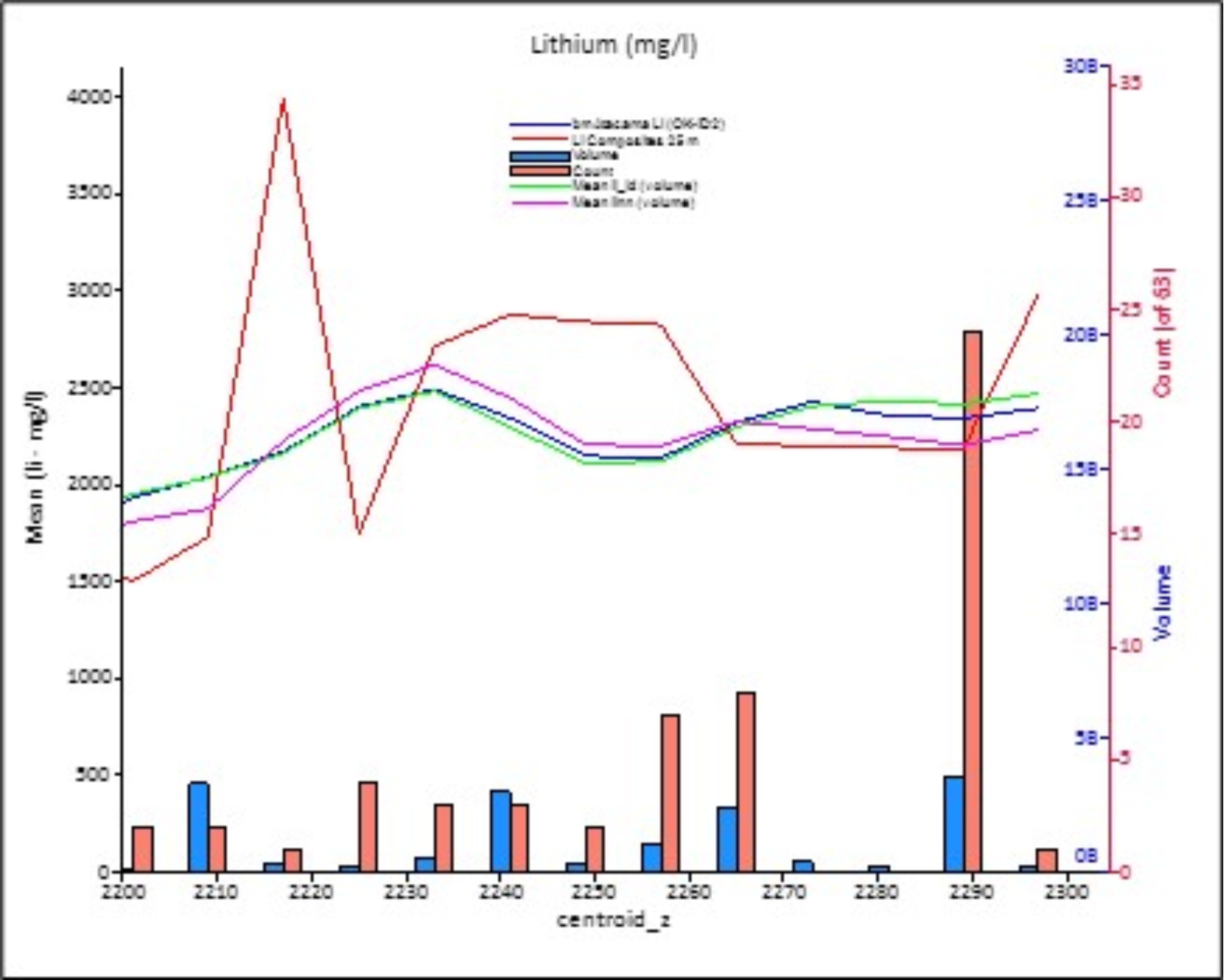

Lithium concentration data from the brine sampling exploration data set was regularized to equal lengths, when was possible, for constant sample volume (Compositing). Lithium grades were interpolated into a block model using ordinary kriging (OK) and inverse distance weighting (IDW)

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page 18 |

methods. Results were validated visually and via various statistical comparisons. The estimate was depleted for current production, categorized in a manner consistent with industry standards and statistical parameters. Mineral resources have been reported above a cutoff grade (CoG) supporting reasonable potential for eventual economic extraction of the resource. Mineral resources, as of August 31, 2021, exclusive of reserves, are summarized in Table 1-1. Mineral resources, as of August 31, 2021, inclusive of reserves, are summarized in Table 1-2.

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page 19 |

Table 1-1: Salar de Atacama Mineral Resource Estimate, Exclusive of Mineral Reserves (Effective August 31, 2021)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Measured Resource | Indicated Resource | Measured + Indicated Resource | Inferred Resource |

| Contained Li (Tonnes x 1000) | Brine Concentration (mg/L Li) | Contained Li (Tonnes x 1000) | Brine Concentration (mg/L Li) | Contained Li (Tonnes x 1000) | Brine Concentration (mg/L Li) | Contained Li (Tonnes x 1000) | Brine Concentration (mg/L Li) |

| Total | 717 | 2,211 | 687 | 1,747 | 1,404 | 1,959 | 131 | 1,593 |

Source: SRK, 2021

•Mineral resources are reported exclusive of mineral reserves. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

•Given the dynamic reserve versus the static resource, a direct measurement of resources post-reserve extraction is not practical. Therefore, as a simplification, to calculate mineral resources, exclusive of reserves, the quantity of lithium pumped in the life of mine plan was subtracted from the overall resource without modification to lithium concentration. Measured and indicated resource were deducted proportionate to their contribution to the overall mineral resource.

•Resources are reported on an in-situ basis.

•Resources are reported between the elevations of 2,299 masl and 2,200 masl. Resources are reported as lithium metal

•Resources have been categorized subject to the opinion of a QP based on the amount/robustness of informing data for the estimate, consistency of geological/grade distribution, survey information.

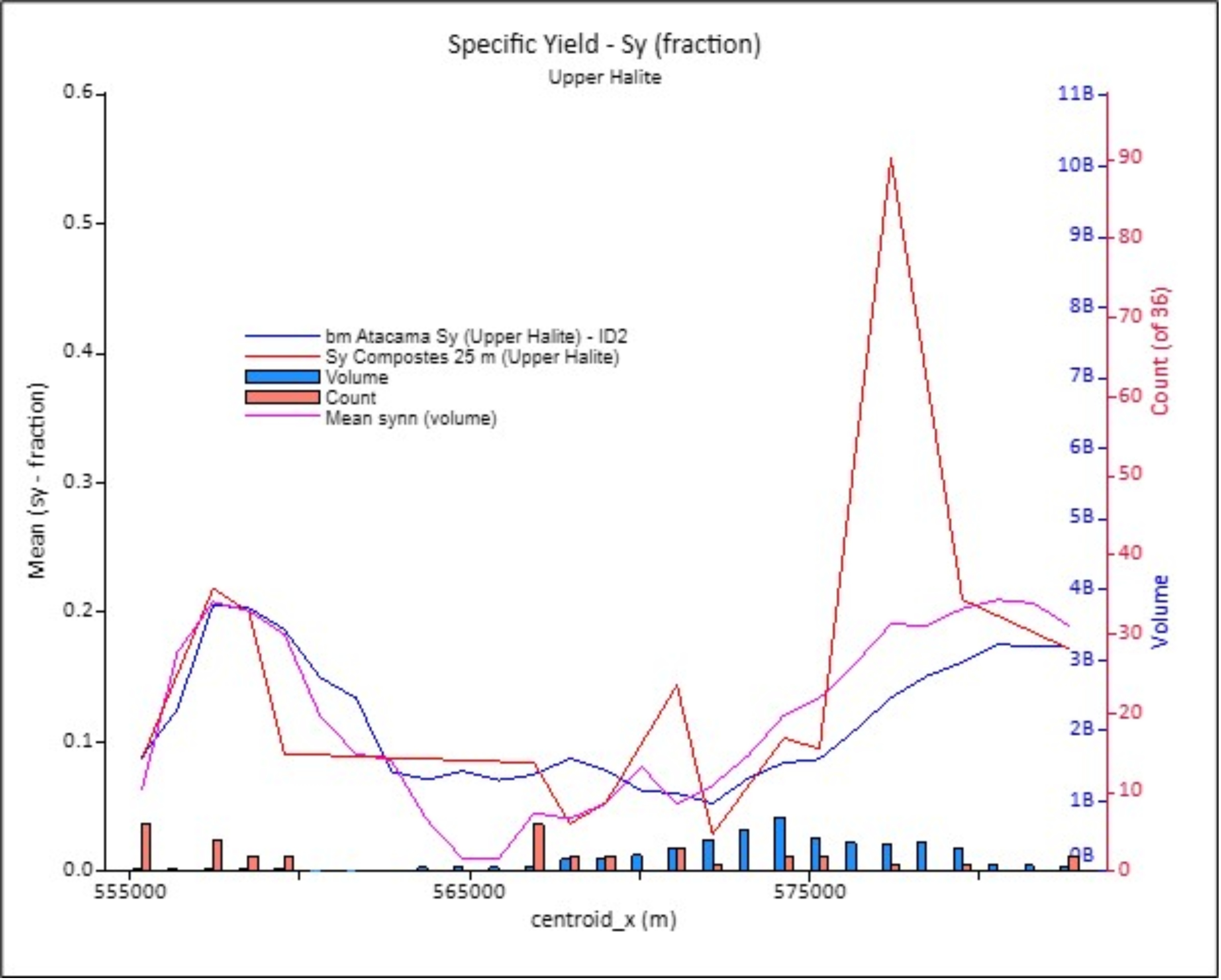

•Resources have been calculated using drainable porosity estimated from measured values in Upper Halite and VGC units, and bibliographical values based on the lithology and QP’s experience in similar deposits

•The estimated economic cutoff grade utilized for resource reporting purposes is 670 mg/l lithium, based on the following assumptions:

◦A technical grade lithium carbonate price of US$11,000 / metric tonne CIF La Negra. This is a 10% premium to the price utilized for reserve reporting purposes. The 10% premium applied to the resource versus the reserve was selected to generate a resource larger than the reserve, ensuring the resource fully encompassed the reserve while still maintaining reasonable prospect for eventual economic extraction.

◦Recovery factors for the salar operation increase gradually over the span of four years, from the current 40% to the proposed SYIP 65% recovery in 2025. After that point, evaporation pond recovery is assumed constant at 65%, considering the installation of a liming plant is assumed in 2027. An additional recovery factor of 80% lithium recovery is applied to the La Negra lithium carbonate plant.

◦A fixed average annual brine pumping rate of 442 l/s is assumed, consistent with Albemarle’s permit conditions.

◦Operating cost estimates are based on a combination of fixed brine extraction, G&A and plant costs and variable costs associated with raw brine pumping rate or lithium production rate. Average life of mine operating cost is calculated at approximately $3,000/metric tonne CIF Asia.

◦Sustaining capital costs are included in the cutoff grade calculation and post the SYIP installation, average around US$54M per year.

◦Government royalties are excluded from the cutoff grade calculation as these costs are variable, depending upon price. A 3.5% community royalty is included in the cutoff grade as this royalty is fixed.

•Mineral Resources tonnage and contained metal have been rounded to reflect the accuracy of the estimate, and numbers may not add due to rounding.

•SRK Consulting (U.S.) Inc. is responsible for the Mineral Resources with an effective date: August 31, 2021. The geologic block model is incorporating all relevant exploration data as of June 30, 2020 and there is no additional data since that date. The resource has been depleted to August 31, 2021.

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page 20 |

Table 1-2: Salar de Atacama Mineral Resource Estimate, Inclusive of Mineral Reserves (Effective August 31, 2021)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Measured Resource | Indicated Resource | Measured + Indicated Resource | Inferred Resource |

| Contained Li (Tonnes x 1000) | Brine Concentration (mg/L Li) | Contained Li (Tonnes x 1000) | Brine Concentration (mg/L Li) | Contained Li (Tonnes x 1000) | Brine Concentration (mg/L Li) | Contained Li (Tonnes x 1000) | Brine Concentration (mg/L Li) |

| In Situ | 1,029 | 2,211 | 966 | 1,747 | 1,995 | 1,959 | 131 | 1,593 |

| In Process | 24 | 2,685 | 0 | 0 | 24 | 2,685 | - | - |

Source: SRK, 2021

•Mineral resources are reported inclusive of mineral reserves. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

•Resources are reported as in situ and in process. In process resources quantify the prior 24 months of pumping data and reflect the raw brine, at the time of pumping.

•In situ resources are reported between the elevations of 2,299 masl and 2,200 masl.

•Resources are reported as lithium metal

•Resources have been categorized subject to the opinion of a QP based on the amount/robustness of informing data for the estimate, consistency of geological/grade distribution, survey information.

•Resources have been calculated using drainable porosity estimated from measured values in Upper Halite and VGC units, and bibliographical values based on the lithology and QP’s experience in similar deposits

•The estimated economic cutoff grade utilized for resource reporting purposes is 670 mg/l lithium, based on the following assumptions:

◦A technical grade lithium carbonate price of US$11,000 / metric tonne CIF La Negra. This is a 10% premium to the price utilized for reserve reporting purposes. The 10% premium applied to the resource versus the reserve was selected to generate a resource larger than the reserve, ensuring the resource fully encompassed the reserve while still maintaining reasonable prospect for eventual economic extraction.

◦Recovery factors for the salar operation increase gradually over the span of 4 years, from the current 40% to the proposed SYIP 65% recovery in 2025. After that point, evaporation pond recovery is assumed constant at 65%, considering the installation of a liming plant is assumed in 2027. An additional recovery factor of 80% lithium recovery is applied to the La Negra lithium carbonate plant.

◦A fixed average annual brine pumping rate of 442 l/s is assumed, consistent with Albemarle’s permit conditions.

◦Operating cost estimates are based on a combination of fixed brine extraction, G&A and plant costs and variable costs associated with raw brine pumping rate or lithium production rate. Average life of mine operating cost is calculated at approximately $3,000/metric tonne CIF Asia.

◦Sustaining capital costs are included in the cutoff grade calculation and post the SYIP installation, average around US$54M per year.

◦Government royalties are excluded from the cutoff grade calculation as these costs are variable, depending upon price. A 3.5% community royalty is included in the cutoff grade as this royalty is fixed.

•Mineral Resources tonnage and contained metal have been rounded to reflect the accuracy of the estimate, and numbers may not add due to rounding.

•SRK Consulting (U.S.) Inc. is responsible for the Mineral Resources with an effective date: August 31, 2021. The geologic block model is incorporating all relevant exploration data as of June 30, 2020 and there is no additional data since that date. The resource has been depleted to August 31, 2021.

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page 21 |

1.4Mining Methods and Mineral Reserve Estimates

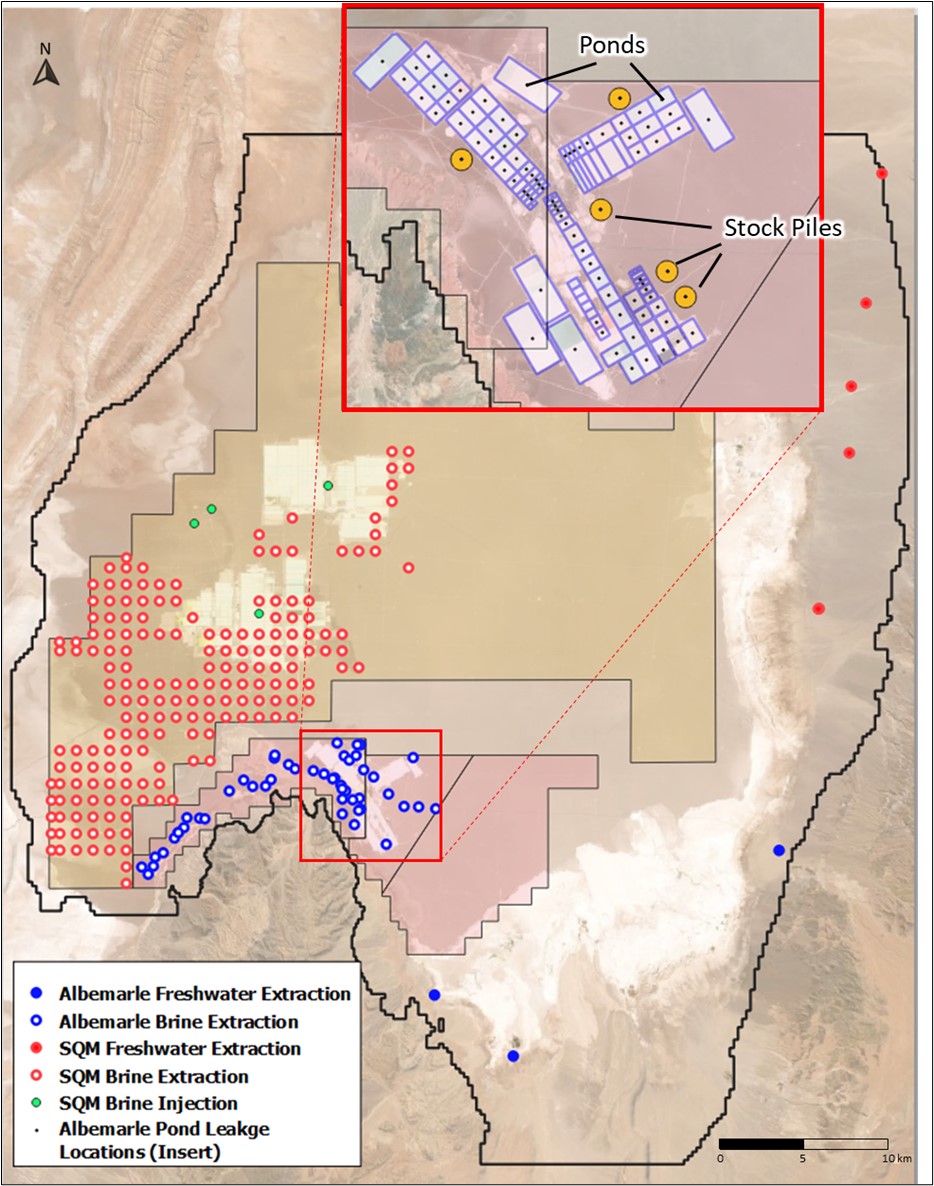

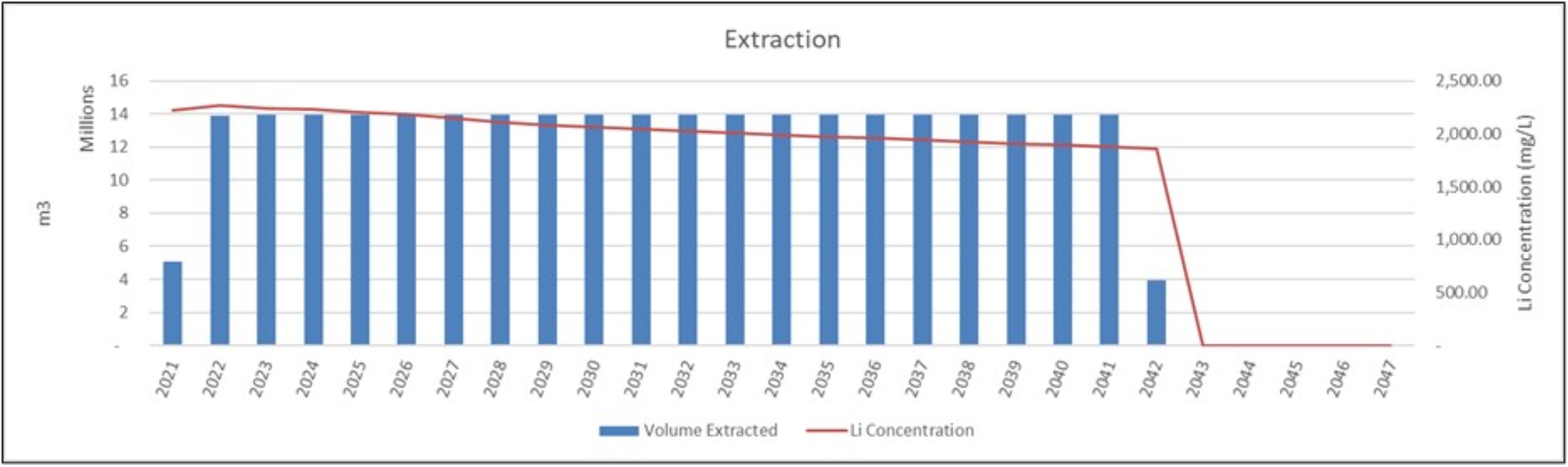

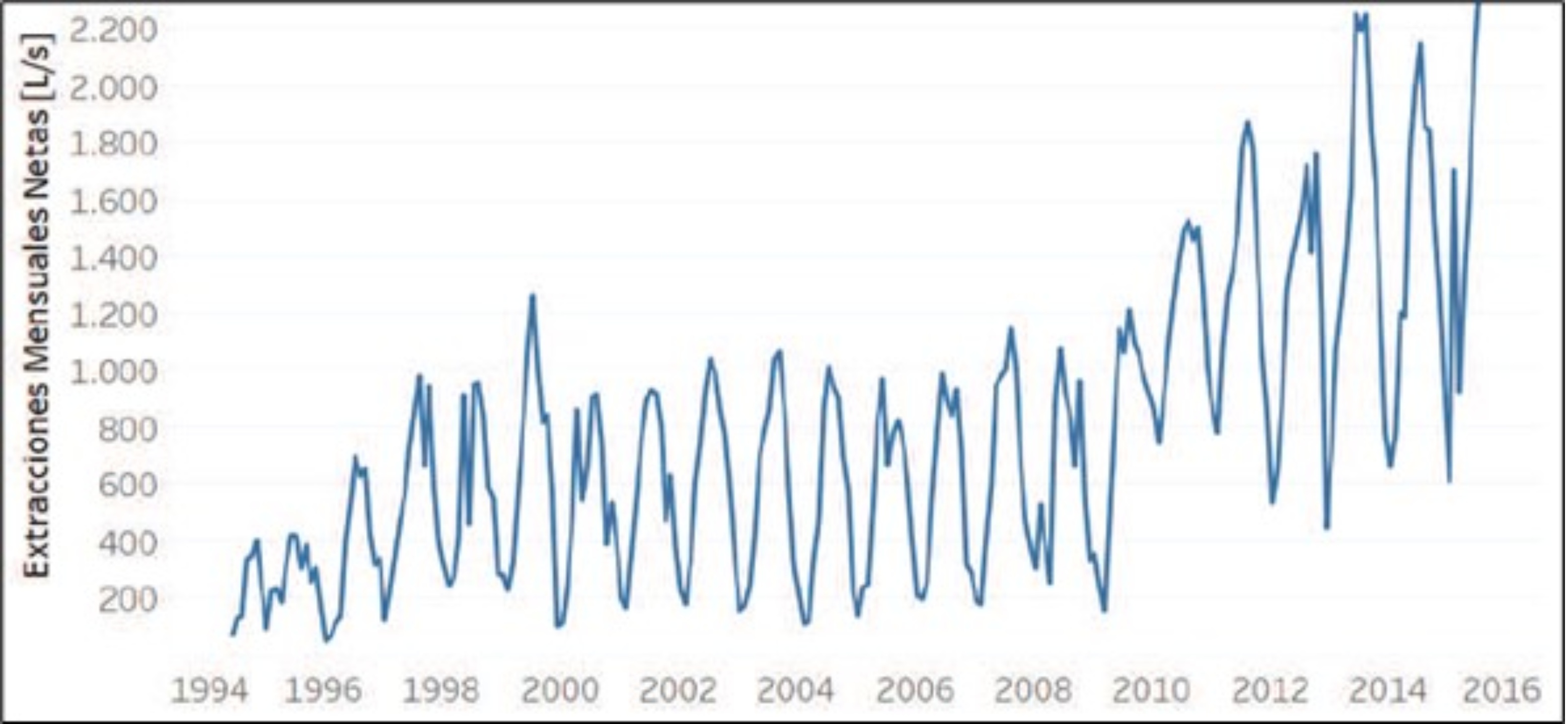

The brine reserve is extracted at the Salar de Atacama by pumping the raw brine from the aquifer utilizing a network of wells and trenches. This method of brine extraction has been used at the operation since 1983. The extracted brine is transferred to a series of evaporation ponds for initial processing (i.e., concentration with solar evaporation).

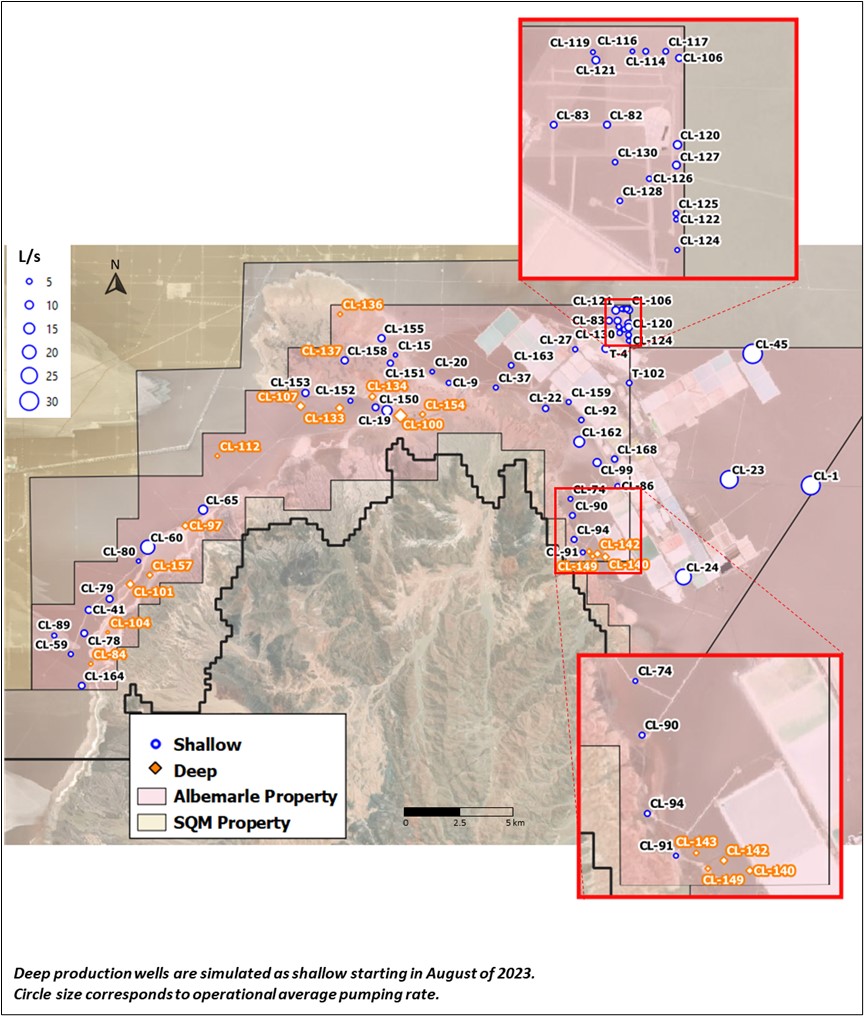

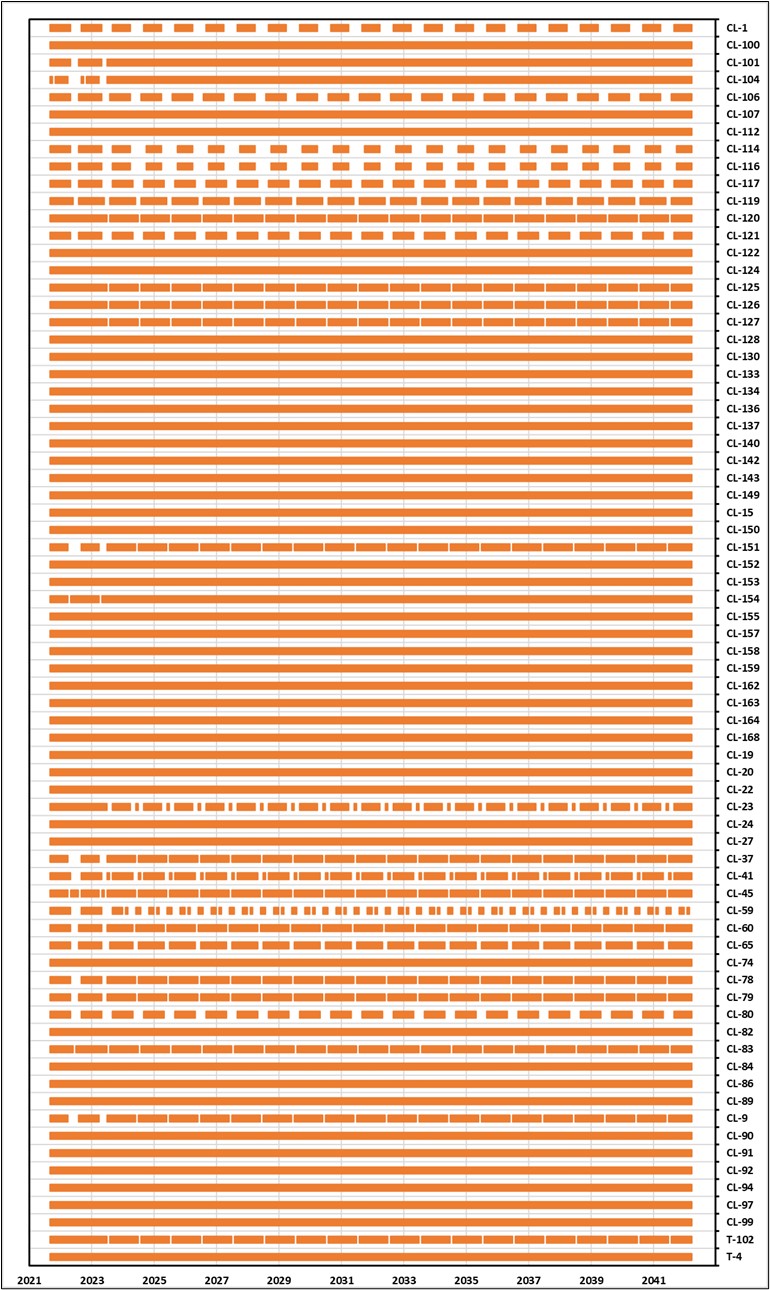

There are currently approximately 75 active brine extraction wells, and, over the life of mine, this number of wells is forecast to gradually reduce to a steady state of 72 extraction wells. There are both shallow and deep wells in place with depths of between 25 meters (m) and 40 m for the shallow wells and 70 m to 90 m for deep wells. Brine extraction rates from the aquifer are restricted by permit conditions to a combined maximum average annual rate of 442 liters per second (l/s). Extraction wells are located to maximize lithium grades as well as balance calcium and sulphate-rich brines to benefit process recovery rates.

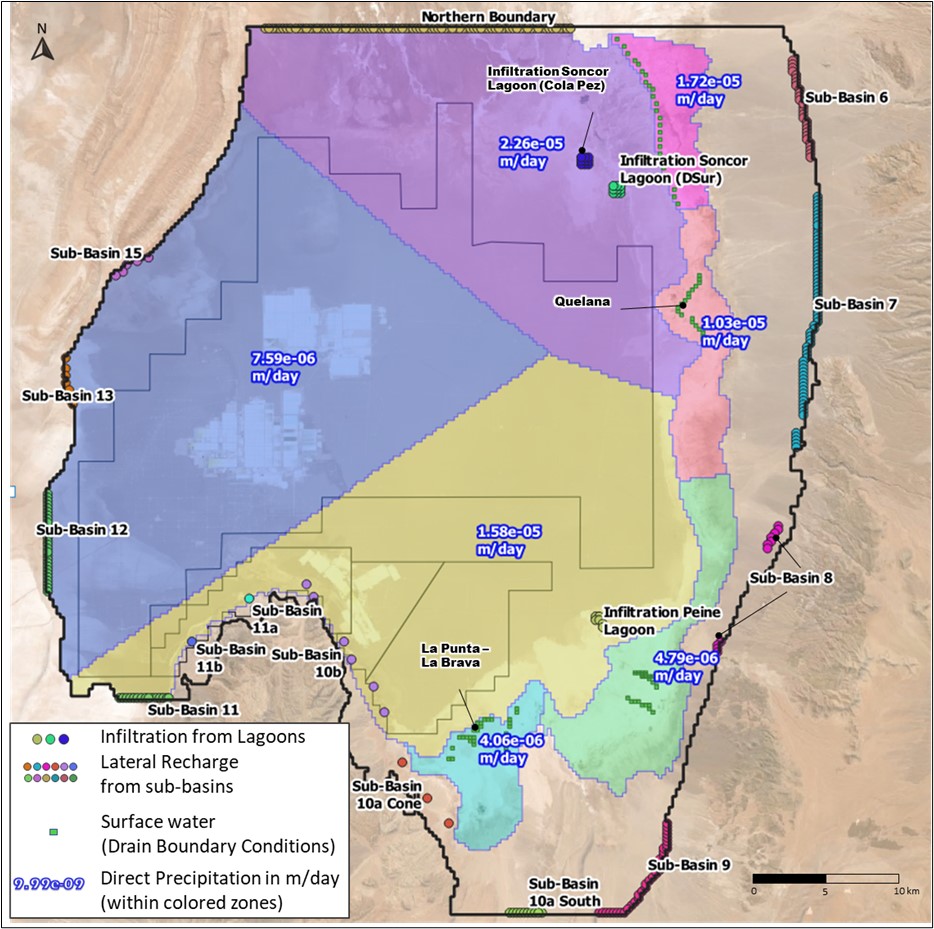

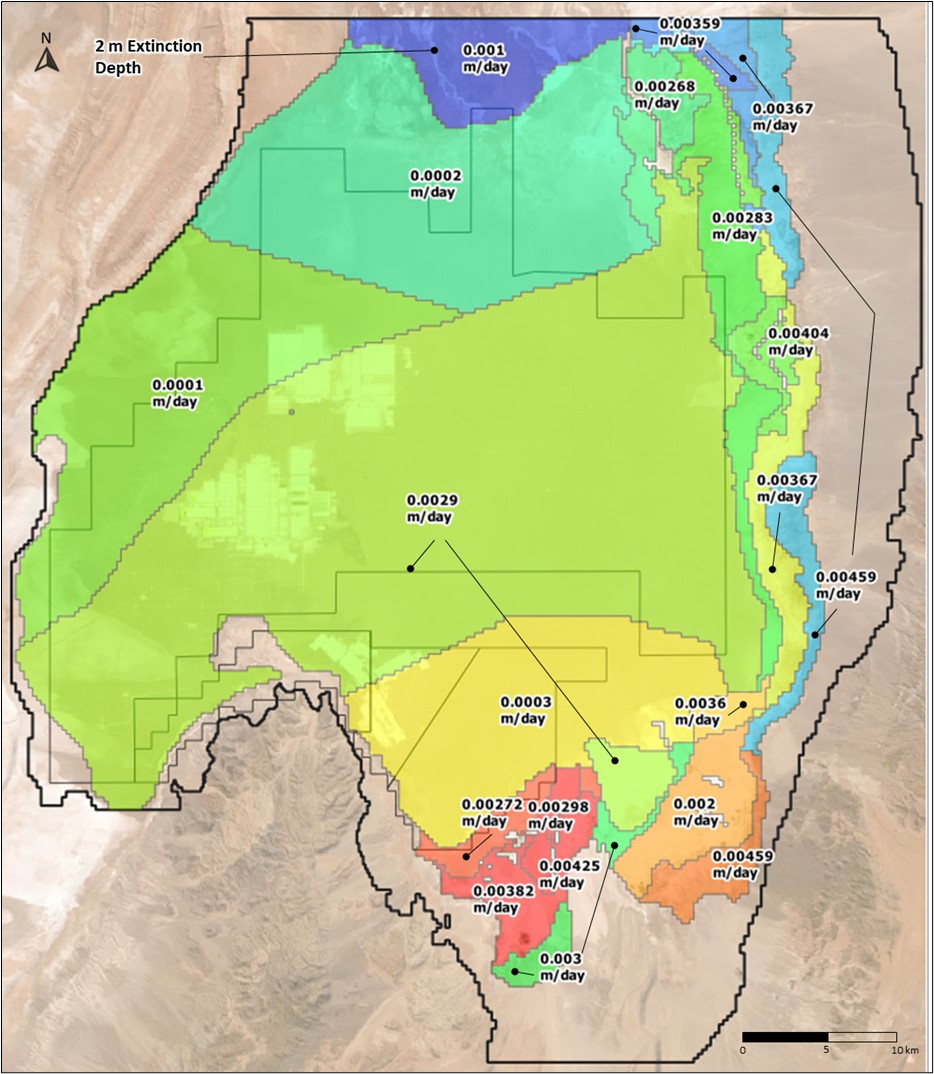

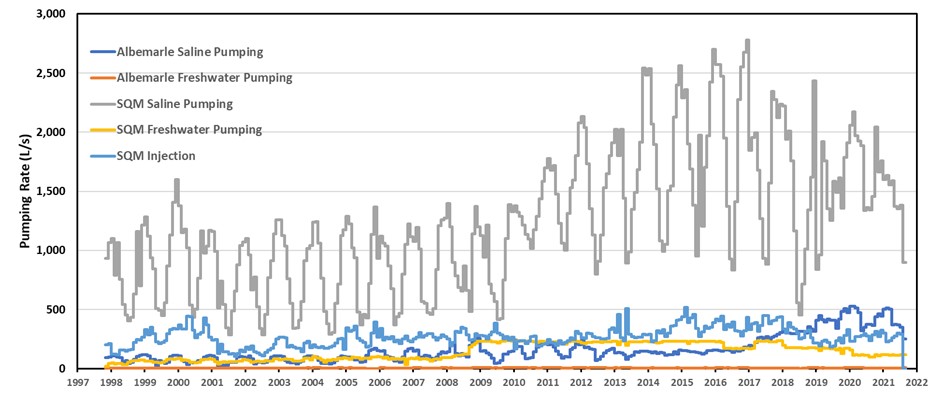

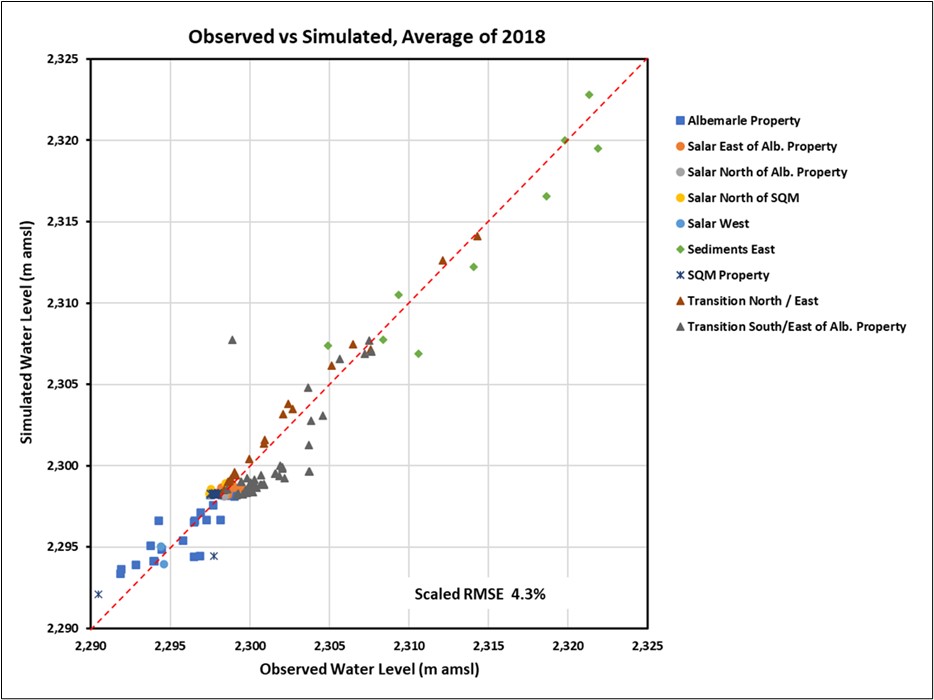

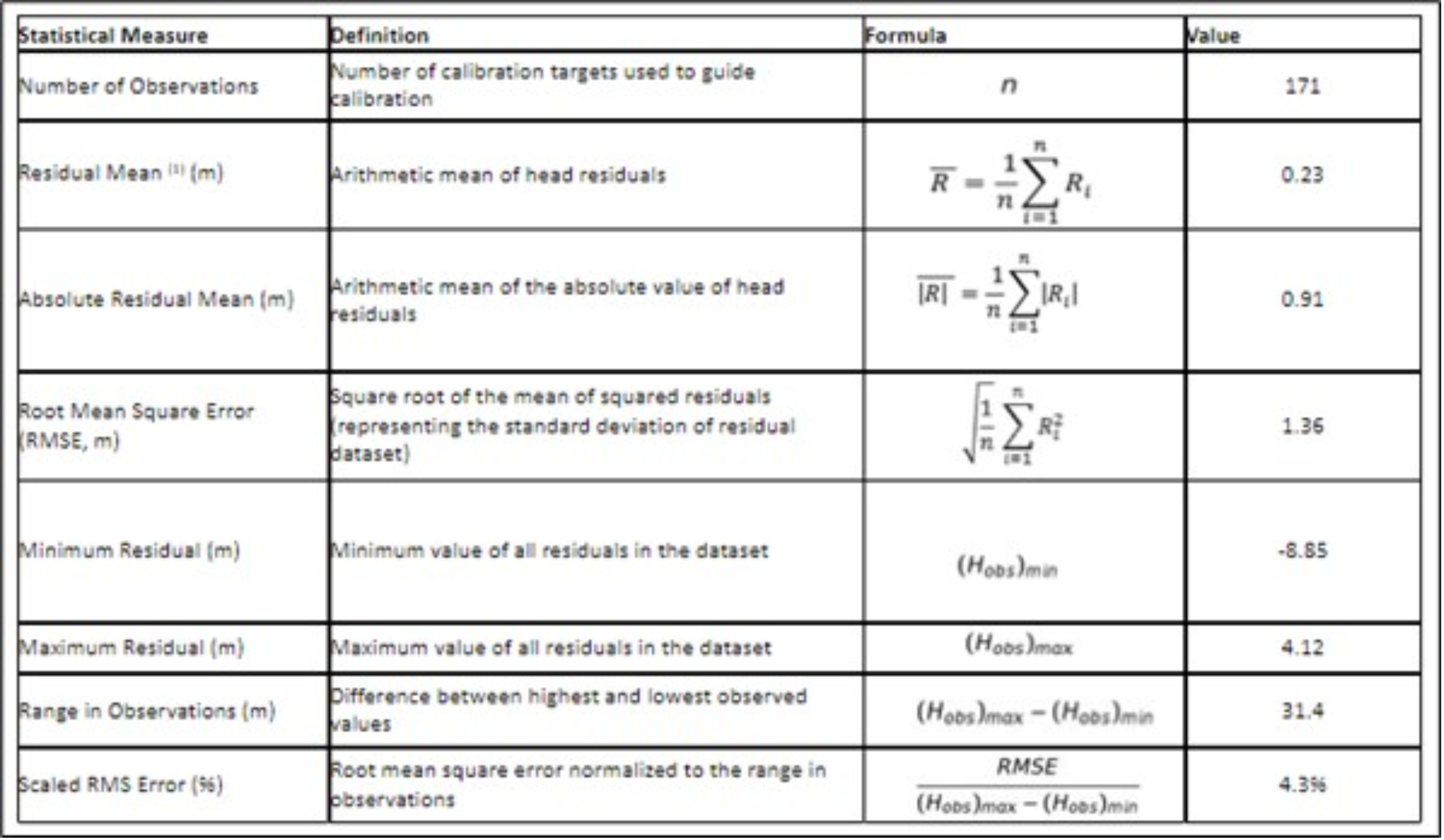

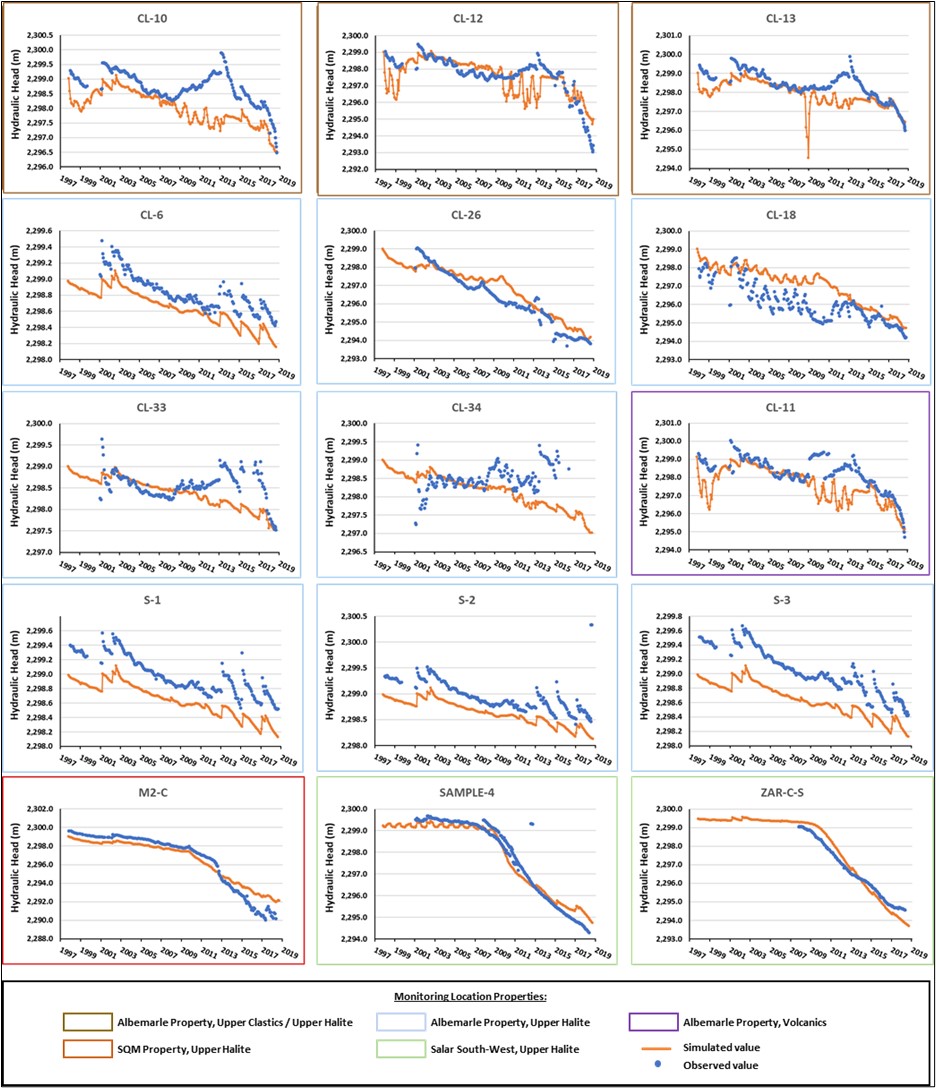

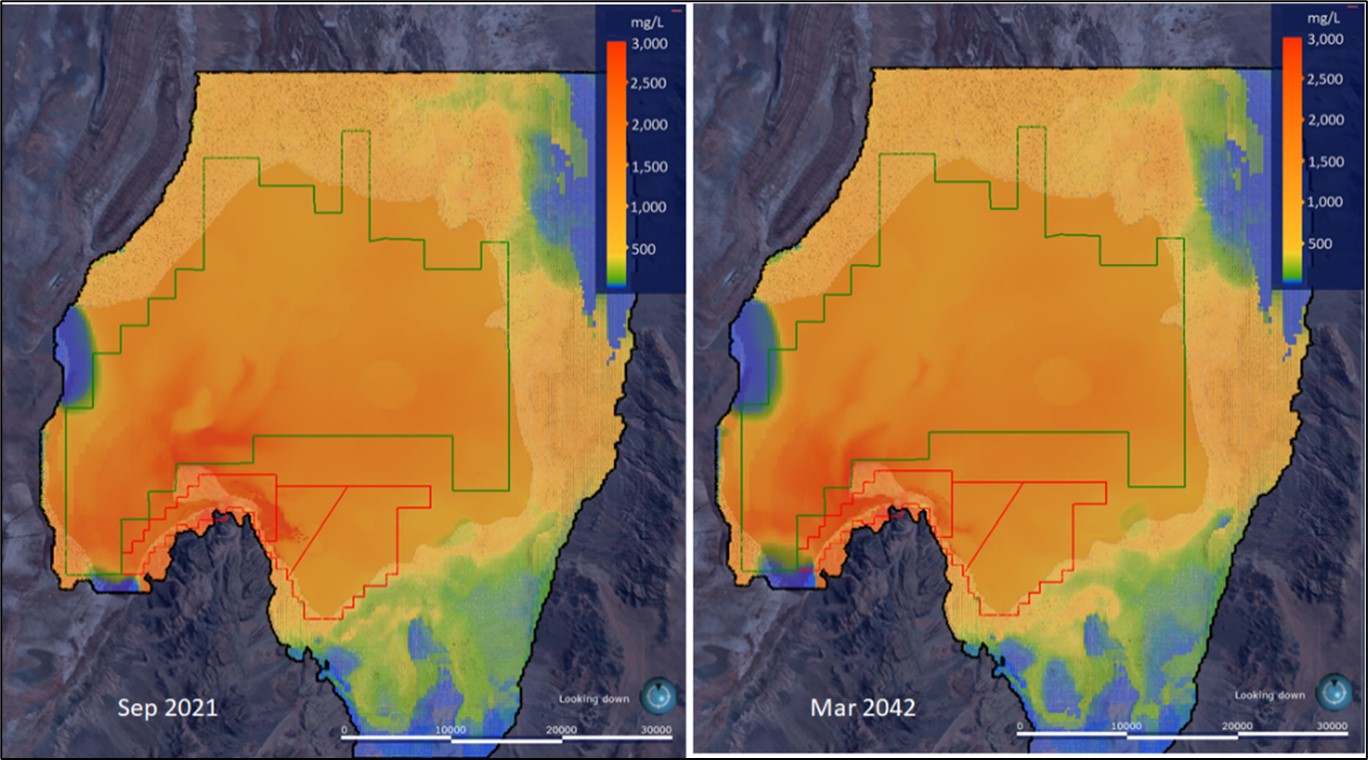

A geologically-based, 3D, numerical groundwater-flow and solute transport model was developed to evaluate the extractability of brine from the salar and develop the life of mine (LoM) pumping plan that underpins the reserve estimate. The model construction is based on an analysis of historical hydrogeologic data conducted by Albemarle and SRK.

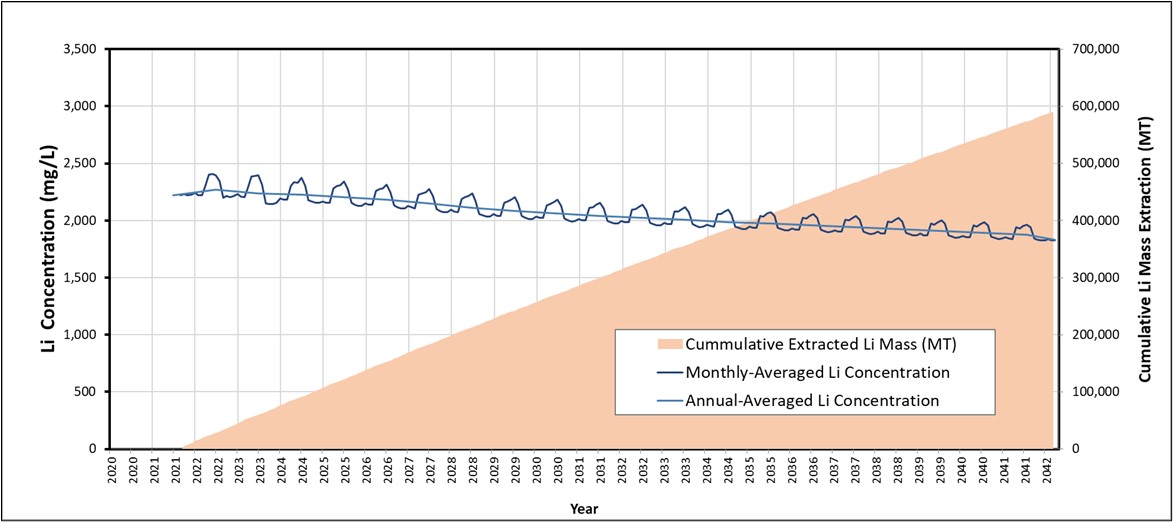

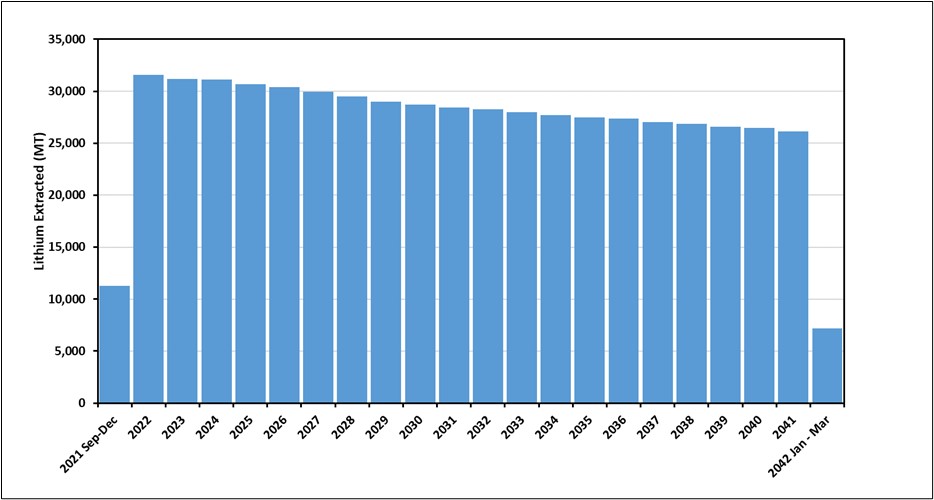

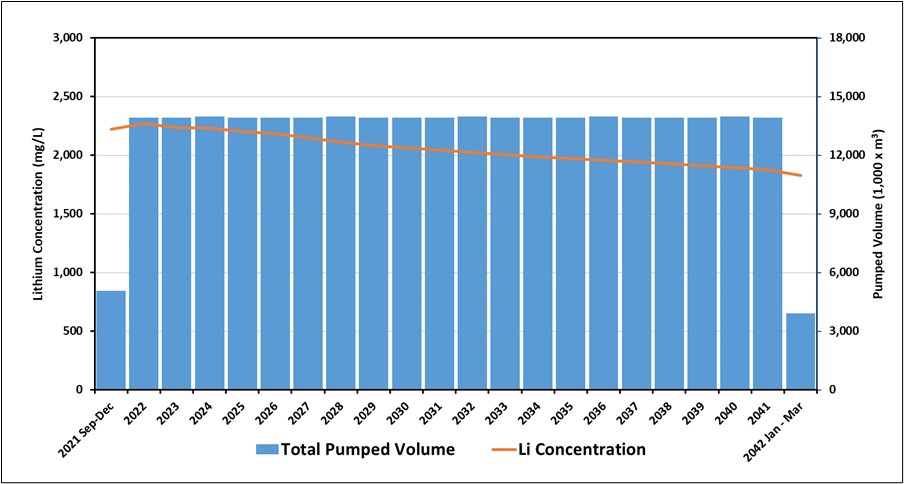

Using these hydrogeologic properties of the salar combined with the wellfield design parameters, the rate and volume of lithium projected as extracted from the Project area was simulated using this predictive model. The predictive model output generated a brine production profile appropriate for the salar based upon the wellfield design assumptions with a maximum pumping rate of 442 L/s (i.e., maximum authorized extraction rate) over a period of 21 years. The use of a 21-year period reflects the timing required to extract the full, authorized quota of lithium production. Given the approximately two year offset in timing from pumping to final production, this also is the last year that extraction from the salar can be reasonably expected to still result in lithium produced by the 2043 expiry of Albemarle’s production quota.

When estimating brine resources and reserves, different models are utilized to define those resources and reserves. The resource model presents a static, in situ measurement of potentially extractable brine volume whereas the reserve model (i.e., the predictive model) presents a dynamic simulation of brine that can potentially be pumped through extraction wells. As such, the predictive model does not discriminate between brine derived from inferred, measured, or indicated resources. Further, a brine resource is dynamic and is constantly influenced by water inflows (e.g., precipitation, groundwater inflows, pond leakage, etc.) and pumping activities which cause varying levels of mixing and dilution. Therefore, direct conversion of measured and indicated classification to proven and probable reserves is not practical. As the direct conversion is not practical, in the QP’s opinion, the most defensible approach to classification of reserves (e.g., proven versus probable) is to utilize a time-dependent approach as the QP has the highest confidence in the early years of the predictive model results, with a steady erosion of that confidence over time.

Therefore, in the context of time-dependent risk, in the QP’s opinion, the production plan through the end of 2031 approximately 10.3 years of pumping) is reasonably classified as a proven reserve with the remainder [10.3 years]) of production classified as probable. Notably, this results in approximately 49% of the reserve being classified as proven and 51% of the reserve being classified as probable. For comparison, the measured resource comprises approximately 52% of the total

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page 22 |

measured and indicated resource. In the QP’s opinion, this is reasonable as the overall geological and technical uncertainty for the Salar de Atacama resource and reserve are similar.

Table 1-3 presents the Salar de Atacama mineral reserves as of August 31, 2021.

Table 1-3: Salar de Atacama Mineral Reserves, Effective August 31, 2021

| | | | | | | | | | | | | | | | | | | | |

| Proven Reserve | Probable Reserve | Proven and Probable Reserve |

| Contained Li (Metric Tonnes x 1000) | Li Concentration (mg/L) | Contained Li (Metric Tonnes x 1000) | Li Concentration (mg/L) | Contained Li (Metric Tonnes Li x 1000) | Li Concentration (mg/L) |

| In Situ | 312 | 2,162 | 279 | 1,948 | 591 | 2,061 |

| In Process | 24 | 2,685 | 0 | 0 | 24 | 2,685 |

Source: SRK, 2021

•In process reserves quantify the prior 24 months of pumping data and reflect the raw brine, at the time of pumping. These reserves represent the first 24 months of feed to the lithium process plant in the economic model.

•Proven reserves have been estimated as the lithium mass pumped during Years 2020 through 2030 of the proposed Life of Mine plan

•Probable reserves have been estimated as the lithium mass pumped from 2030 until the end of the proposed Life of Mine plan (2041)

•Reserves are reported as lithium metal

•This mineral reserve estimate was derived based on a production pumping plan truncated in March 2042 (i.e., approximately 21 years). This plan was truncated to reflect the projected depletion of Albemarle’s authorized lithium production quota.

•The estimated economic cutoff grade for the Project is 783 mg/l lithium, based on the assumptions discussed below. The truncated production pumping plan remained well above the economic cutoff grade (i.e., the economic cutoff grade did not result in a limiting factor to the estimation of the reserve).

◦A technical grade lithium carbonate price of US$10,000 / metric tonne CIF Asia.

◦Recovery factors for the salar operation increase gradually over the span of 4 years, from the current 40% to the proposed SYIP 65% recovery in 2025. After that point, evaporation pond recovery is assumed constant at 65%, considering the installation of a liming plant is assumed in 2027. An additional recovery factor of 80% lithium recovery is applied to the La Negra lithium carbonate plant.

◦A fixed average annual brine pumping rate of 442 l/s is assumed, consistent with Albemarle’s permit conditions.

◦Operating cost estimates are based on a combination of fixed brine extraction, G&A and plant costs and variable costs associated with raw brine pumping rate or lithium production rate. Average life of mine operating cost is calculated at approximately $3,000/metric tonne CIF Asia.

◦Sustaining capital costs are included in the cutoff grade calculation and post the SYIP installation, average around US$54M per year.

◦Government royalties are excluded from the cutoff grade calculation as these costs are variable, depending upon price. A 3.5% community royalty is included in the cutoff grade as this royalty is fixed.

•Mineral reserve tonnage, grade and mass yield have been rounded to reflect the accuracy of the estimate and numbers may not add due to rounding.

•SRK Consulting (U.S.) Inc. is responsible for the mineral reserves with an effective date: August 31, 2021. The geologic block model is incorporating all relevant exploration data as of June 30, 2020 and there is no additional data since that date. The resource has been depleted to August 31, 2021.

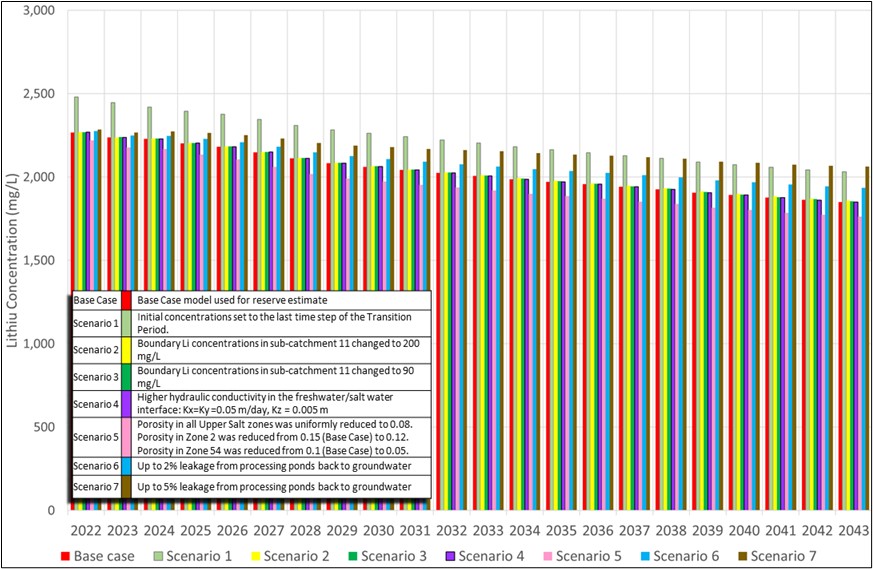

In the QP’s opinion, key points of uncertainty associated with the modifying factors in this reserve estimate that could have a material impact on the reserve include the following:

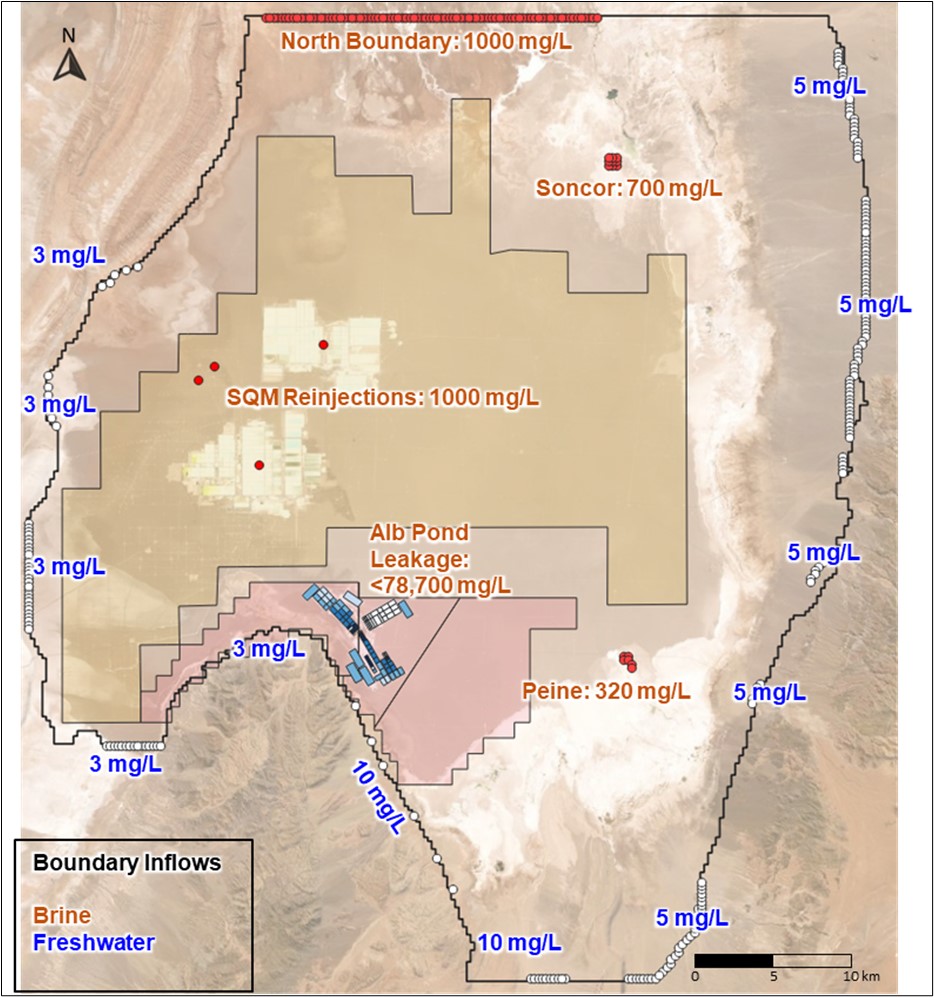

•Resource dilution: the reserve estimate included in this report assumes that the salar brine is replenished at its boundaries at certain rates and with certain chemical composition. Changes in the rate of inflows, versus those assumed, will impact the reserve. For example, an increase in the magnitude of lateral flows into the salar could act to dilute the brine and reduce lithium concentrations in extraction wells, primarily in the southwest area of the Albemarle property.

•Initial lithium concentration: The current initial concentration was estimated based on the best data available by space distribution and date (2018 to 2019 sampling campaign), which was assigned to the year 1999 as initial condition for calibration purposes. This assumption underestimates the lithium concentration at the beginning of the production. In order to illustrate this effect of the initial lithium concentration, the lithium distribution mentioned above was set up at the end of the transition model (August 2021). As a result, the average lithium concentrations increase by 9%.

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page 23 |

•Seepage from processing ponds: the predictive simulations did not consider potential seepage of concentrated brine from the processing pond. Such seepage may have two opposing effects: on one hand, loss of lithium mass between extraction from groundwater and production of lithium carbonate at the end of the concentration process, and on the other hand replenishing groundwater with lithium that could be captured by extraction wells. SRK completed a sensitivity simulation that predicts that pond seepage would result in average lithium concentrations increase of approximately 10% at the end of production as compared to the base case (for the conditions evaluated in the sensitivity analysis).

•Freshwater/brine mixing: the numerical model implicitly simulated the density separation of lateral freshwater recharge and salar brine by imposing a low-conductivity zone at the brine-freshwater interface. It is possible that lateral recharge of freshwater into the salar may increase without this restriction, as the water table declines as a result of pumping and reducing the amount of freshwater lost to evaporation at the periphery of the salar. SRK completed a sensitivity analysis where the hydraulic conductivity at the freshwater/brine interface was increased by half an order of magnitude (dashed green line). This scenario resulted in no material change compared to the base case.

•Hydrogeological assumptions: factors such as specific yield and hydraulic conductivity play a key role in estimating the volume of brine available for extraction in the wellfield and the rate it can be extracted. Actual contacts between hydrogeological units may not be exactly as represented in the numerical model. These factors are variable through the salar and are difficult to directly measure. Hydraulic conductivities and specific yields lower than assumed in the numerical model would result in reduced pumpability and reduced lithium mass extraction. Specific yields and porosities lower than assumed in the model would lead to faster migration of fresh / brackish water from the edges of the salar and dilution of lithium concentrations in extraction wells. SRK completed a sensitivity where effective porosities in the upper part of the salar were reduced by 20%. This scenario resulted in average lithium concentrations reduction of approximately 5% at the end of production as compared to the base case.

•Lithium carbonate price: although the pumping plan remains above the economic cutoff grade, commodity prices, can have significant volatility which could result in a shortened reserve life.

•Change to SQM pumping plan: the numerical model makes certain assumptions regarding the SQM pumping plan (which terminates at the end of 2030). Overall, SQM has extracted – and is expected to extract – brines at greater rates than Albemarle. SQM pumping has resulted in drawdowns at the salar of up to approximately 14 m in the southwest region of the salar. Enhanced pumping by SQM, or lengthening of the pumping period, may have two effects: reduce available resource in the salar, and draw freshwater at greater rate from the periphery of the salar (dilution effect). Conversely, reduced extraction by SQM would increase available resources and reduce dilution.

•Process recovery: the ability to extract the full lithium production quota within the defined production period relies upon the ability to increase recovery rates of lithium in the evaporation ponds from current levels of approximately 40% to a target of approximately 65%. This will require updating the process flow sheet at the salar to reduce lithium losses to precipitated salts. In the QP’s opinion, the assumed recovery rates are reasonable; however, there remains uncertainty in performance of the new process and any material

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page 24 |

underperformance to these targets could limit Albemarle’s ability to extract its full lithium quota prior to expiry of the quota.

•Lithium production quota: the current production quota acts as a hard stop on the estimated reserve. It is important to note that the expiry date for production of this lithium is 2043. If raw brine grades, pumping rates or process recoveries underperform forecasts and Albemarle cannot produce the full quota by 2043, this potential reserve will be lost (i.e., Albemarle cannot recover lost production in later years and cannot pump faster than the regulatory limit of 442 l/s to offset any underperformance). Conversely, with lithium grades well above economic cutoff and approximately 30% of the estimated mineral resource converting to reserve, the potential to negotiate an additional production quota with the government of Chile presents an opportunity to increase the current reserve, which is artificially constrained by the current quota.

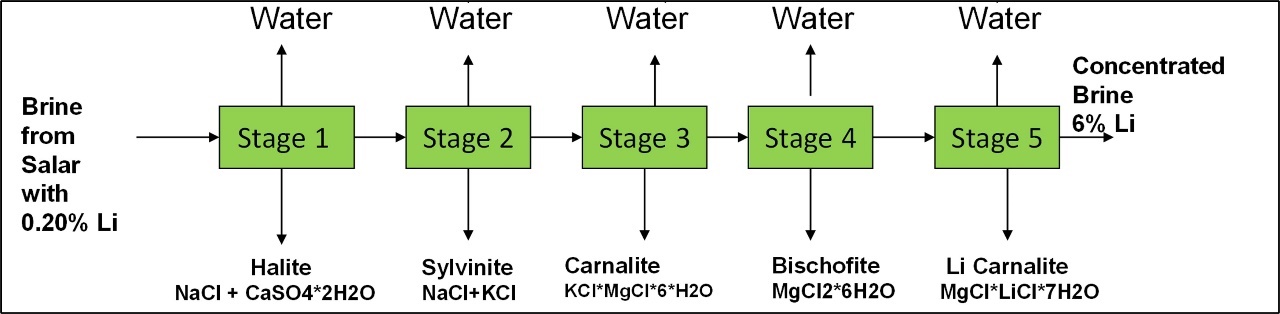

1.5Mineral Processing and Metallurgical Testing

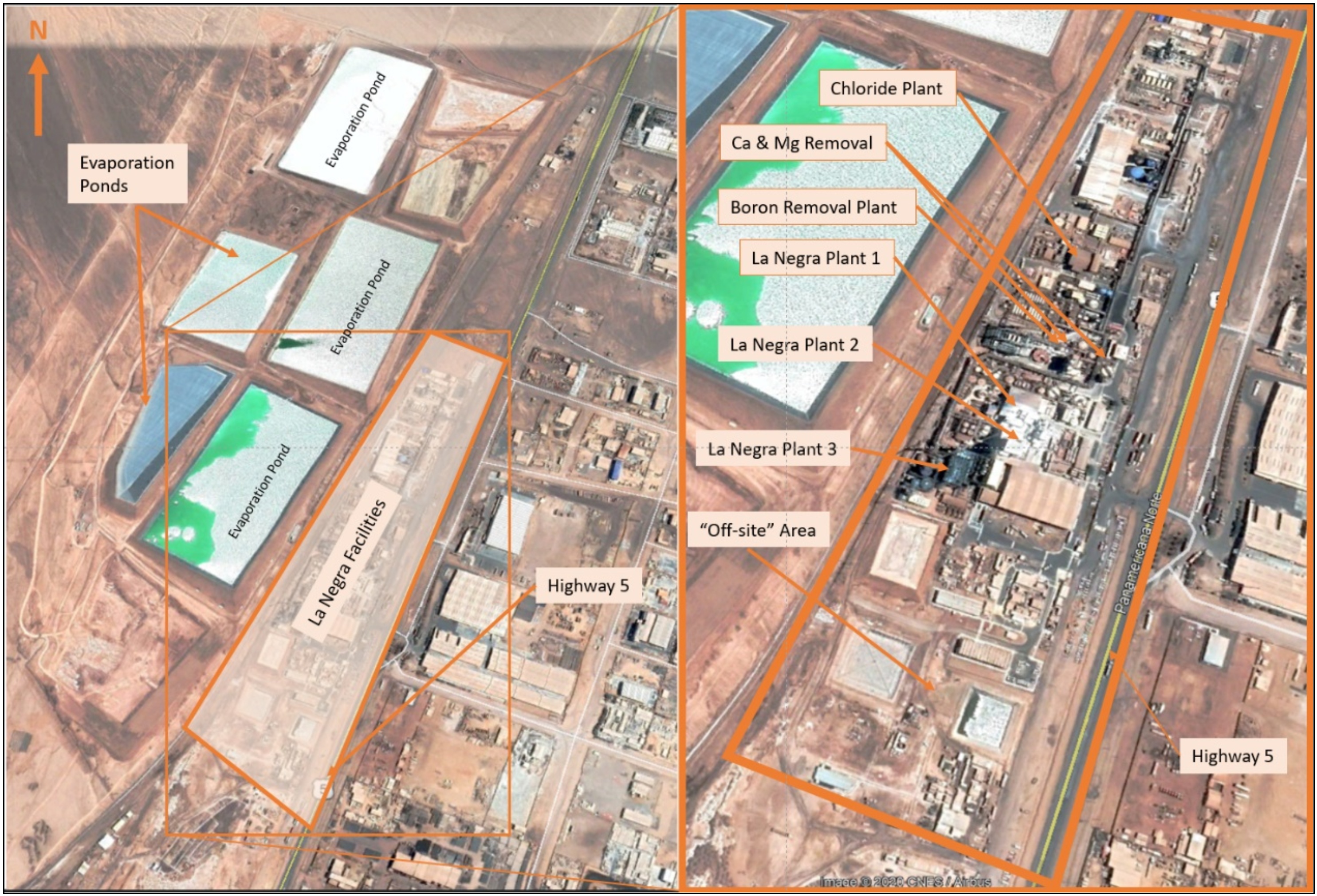

Albemarle's operations in Chile are developed in two areas, the Salar de Atacama and La Negra.

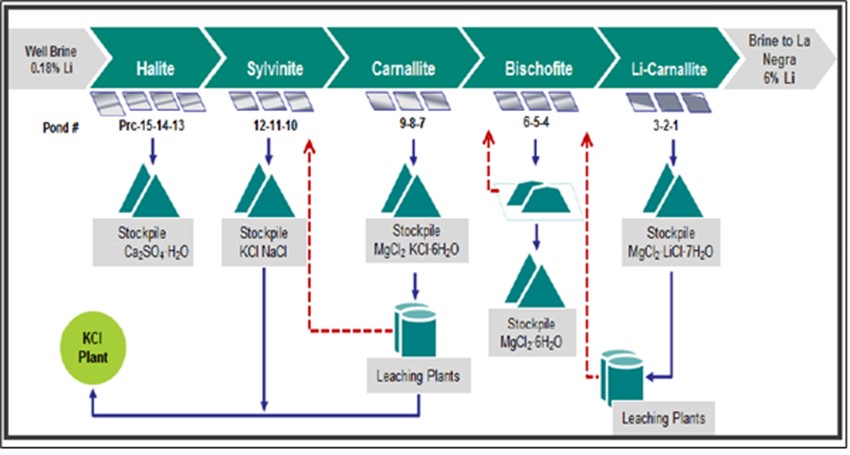

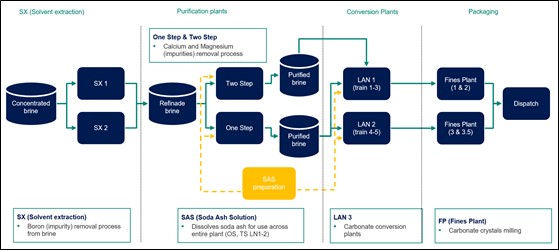

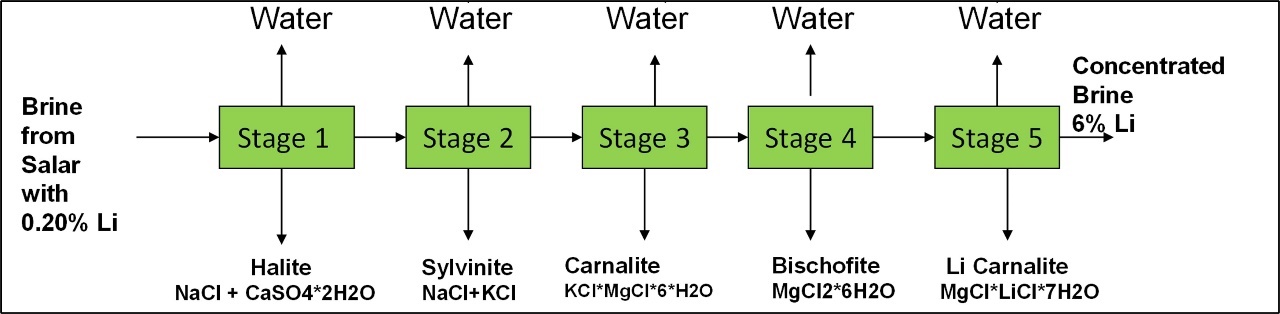

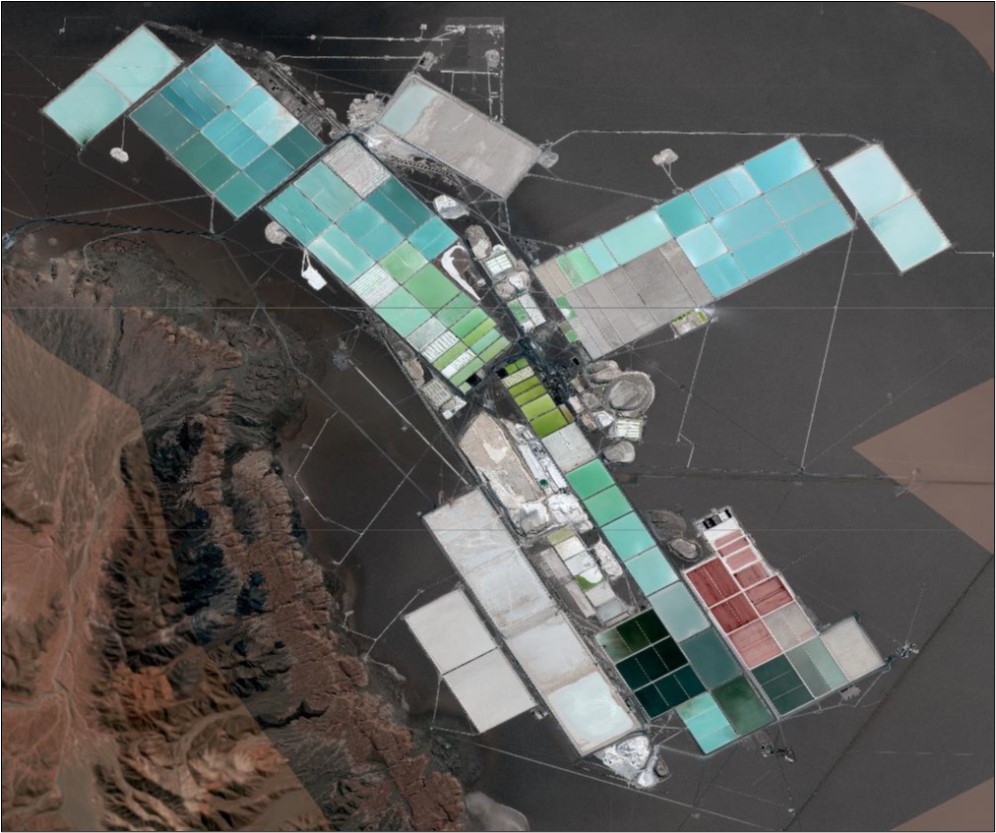

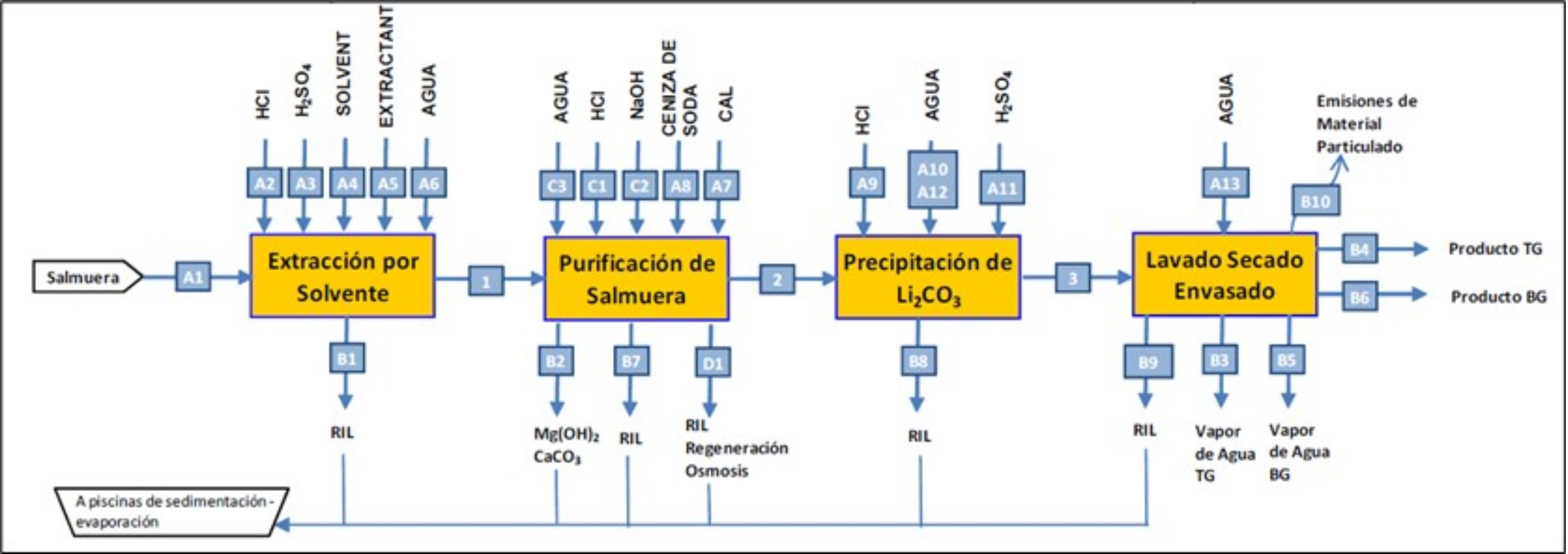

At the salar, a lithium-rich chloride brine is extracted from production wells. This brine is pumped to ponds where it goes through a concentration process utilizing solar evaporation. The objective of the concentration process is to obtain a concentrated lithium chloride brine of around 6% lithium that is largely depleted of impurities such as sulfate, sodium, calcium, potassium and magnesium. This concentrated brine is transported to the La Negra chemical plant for further processing. There is also a potash (KCl) plant for byproduct potash production at the salar. Albemarle also harvests halite and bischofite salts from the evaporation ponds as byproduct production for third party sales.

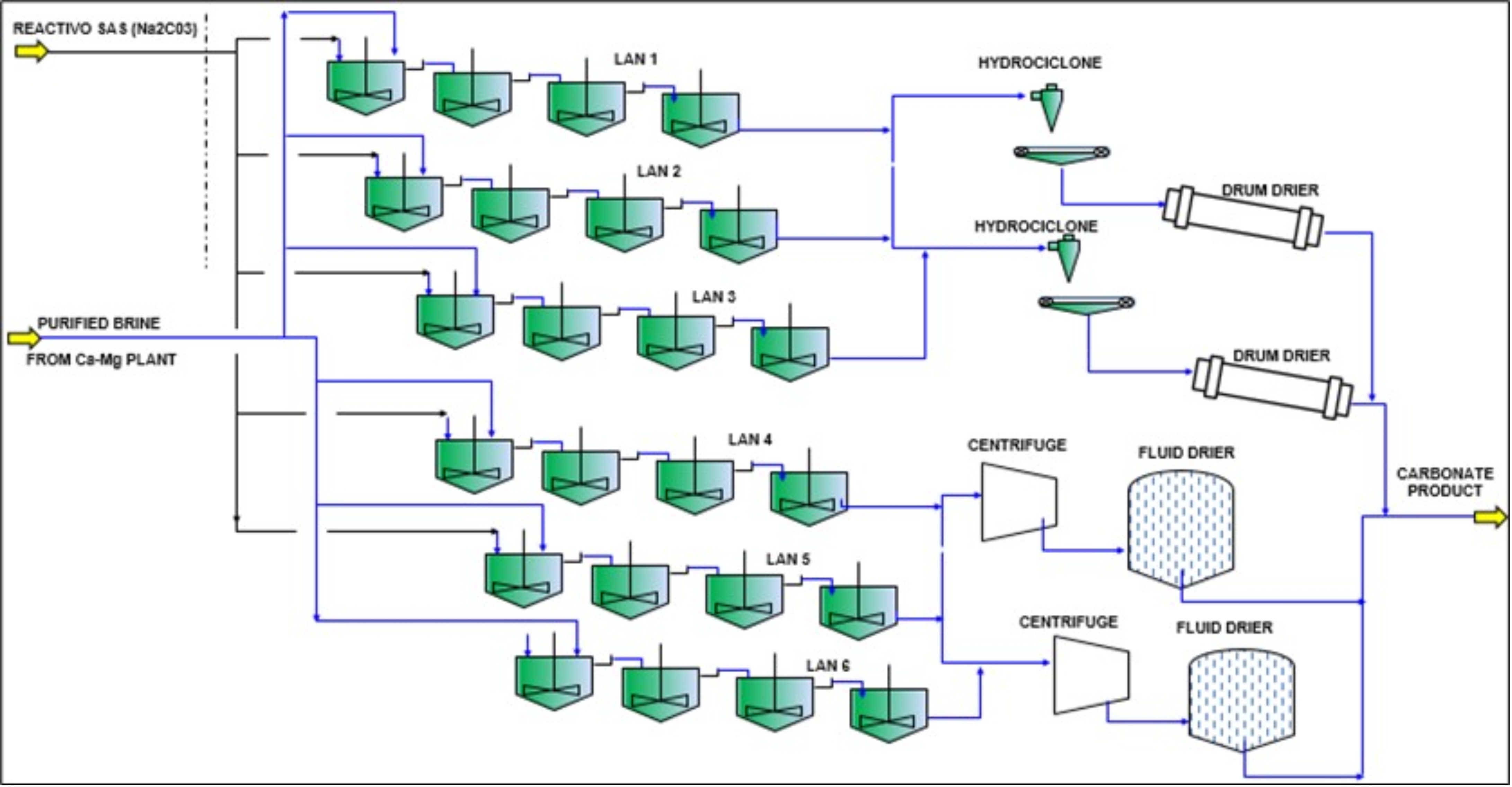

The La Negra plant receives the concentrated brine from the salar, and the brine is further processed with several purification steps followed by the conversion of the lithium from a chloride to a lithium carbonate. The La Negra plant produces both technical and battery grade lithium carbonate. Albemarle has also historically produced lithium chloride product at La Negra.

These operations have been in production for approximately 40 years and most of the data relied upon to forecast operational performance relies upon experience with historic production. However, Albemarle is proposing a modification to its flow sheet at the salar to improve lithium process yields in the evaporation ponds. Albemarle refers to this process as the Salar Yield Improvement Program (SYIP). The SYIP aims to improve this process recovery through mechanical grinding and washing of by-product salts in two new plants, the Li-Carnalite Plant and Bischofite Plant.

Based on testwork performed in 2017 by K-UTEC on the proposed SYIP flowsheet, Albemarle has assumed evaporation pond yield improves up to an average of around 65%. Current operations have a 40% recovery and is increasing. SRK has generally accepted this assumption although has modified the yield to be variable based on lithium concentration in the raw brine. Over time, SRK’s pumping plan predicts that the ratio of sulfate to calcium will increase in the raw brine, potentially reducing evaporation pond yields. To offset this potential future imbalance, SRK has assumed addition of a liming plant to increase calcium levels in the ponds and reduce lithium losses which could be solved in the future by optimizing the annual pumping plan. Post the installation of this liming plant, SRK has assumed a fixed 65% evaporation pond yield.

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page 25 |

1.6Infrastructure

The Project is a mature functioning operation with two separate sites that contain key facilities. Access is fully developed, with the majority accessible by paved major highway and local improved roadways on site. There is an air strip at the salar operations. The Antofagasta airport is the nearest major commercial airport servicing the La Negra operation (the Calama airport is the closet major commercial airport to the salar). The infrastructure is in place, operating and provides all necessary support for ongoing operations as summarized in this report.

The Salar site contains the brine well fields, brine supply water pipelines to evaporation ponds, primary processing facilities to create a concentrated brine, a phosphate plant that creates a potassium chloride product, camps; including a new camp that is partially constructed and functional with a second phase planned, airfield, access and internal roads, diesel power generated supply and distribution, water supply and distribution, shop and warehouse facilities, administrative offices, change houses, waste salt storage areas, fuel storage systems, security and communications systems. The concentrated brine product is trucked approximately 260 km to the La Negra facility. Future additions to the infrastructure include substation and powerline additions to connect to the local Chilean power system in 2021.

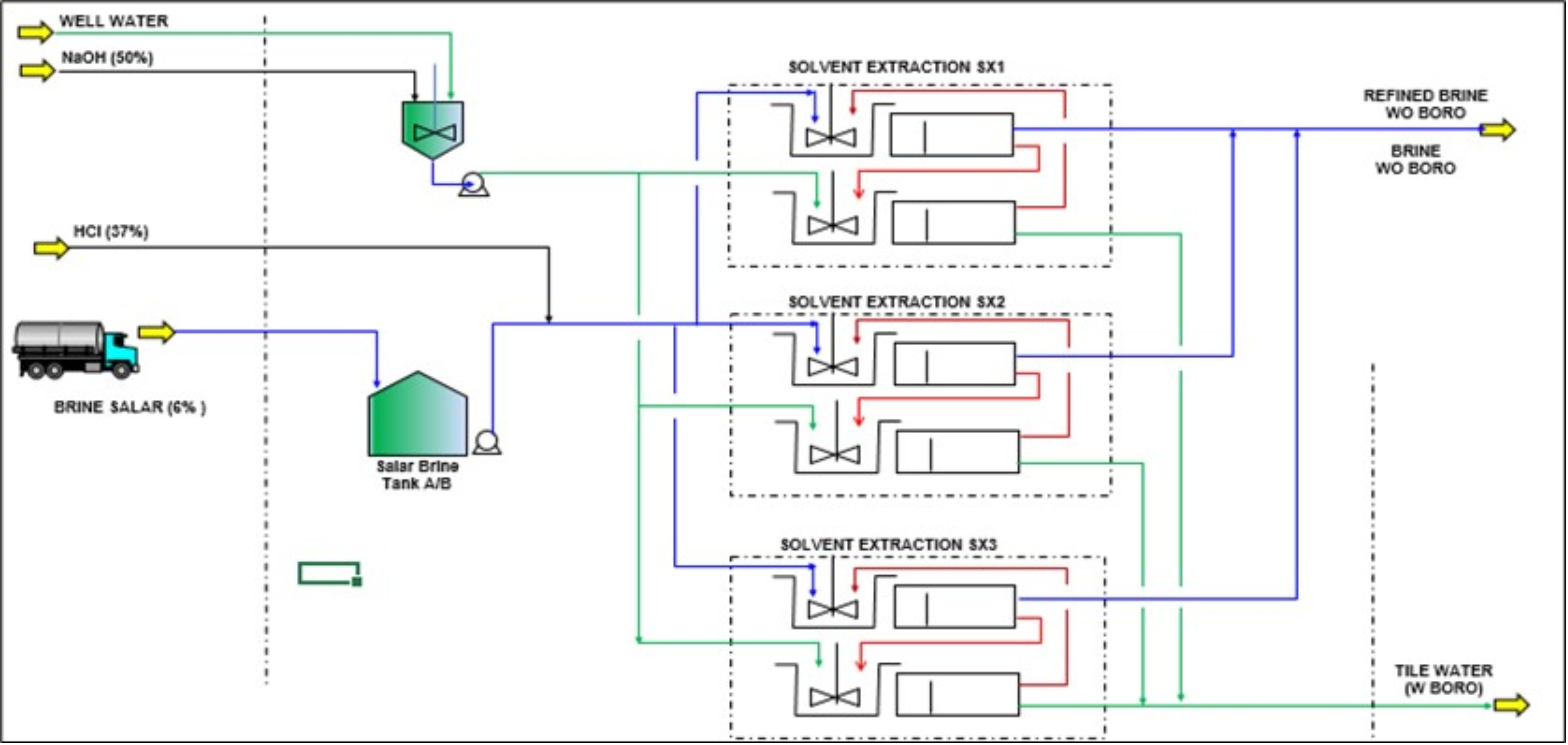

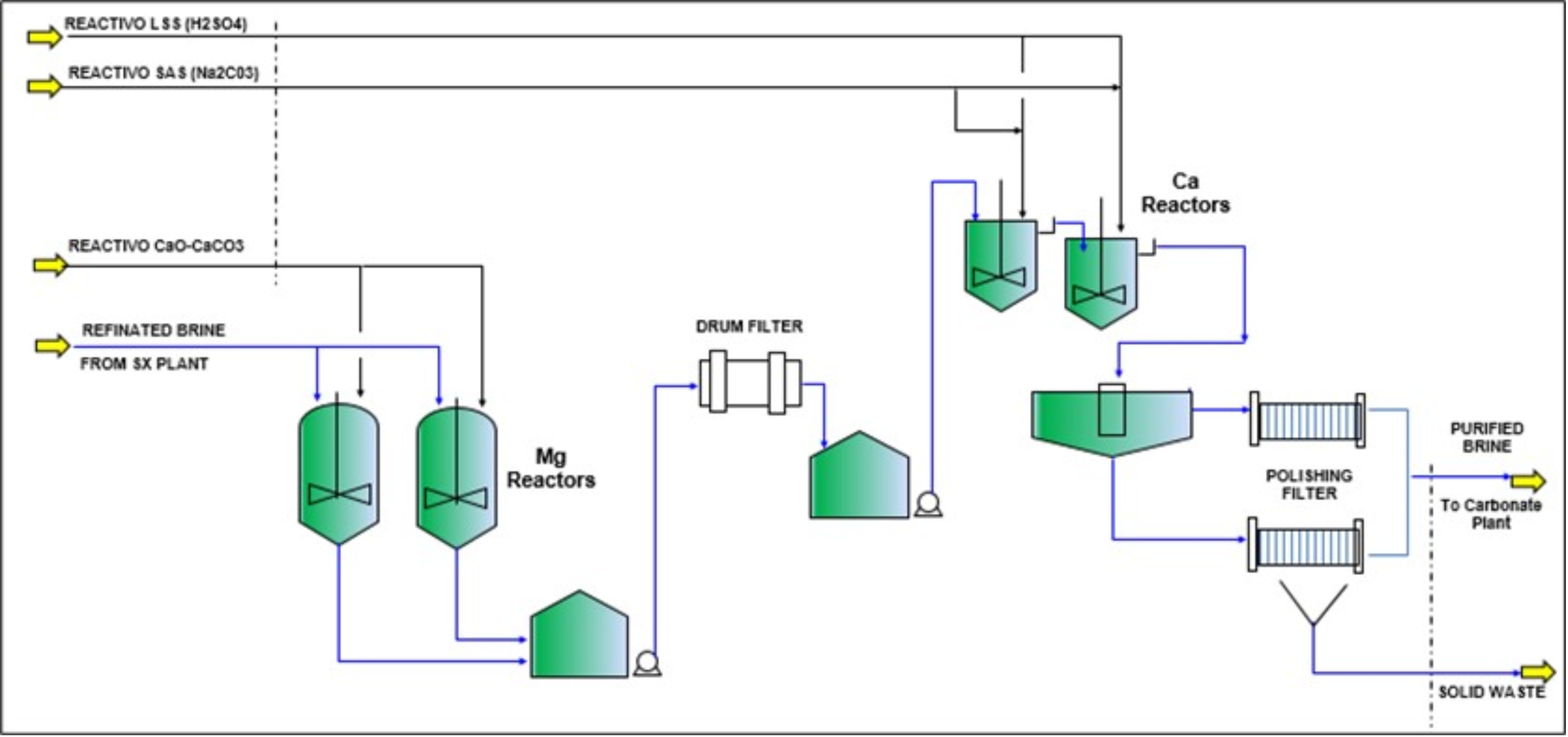

The La Negra plant purifies the lithium brine from the Salar Plant and converts the brine into lithium carbonate and lithium chloride. Facilities at the site include the boron removal plant, calcium and magnesium removal plant, lithium carbonate conversion plants, lithium chloride plant, evaporation sedimentation ponds and an “offsite” area where raw materials are warehoused and combined as needed in the processing facilities. Power to the facility is provided by the regional power company via a 110 kV transmission line and distributed throughout the plant to load centers. Piped natural gas provides the energy for heating and steam needs at the facilities. The project is security protected and has a full communication system installed.

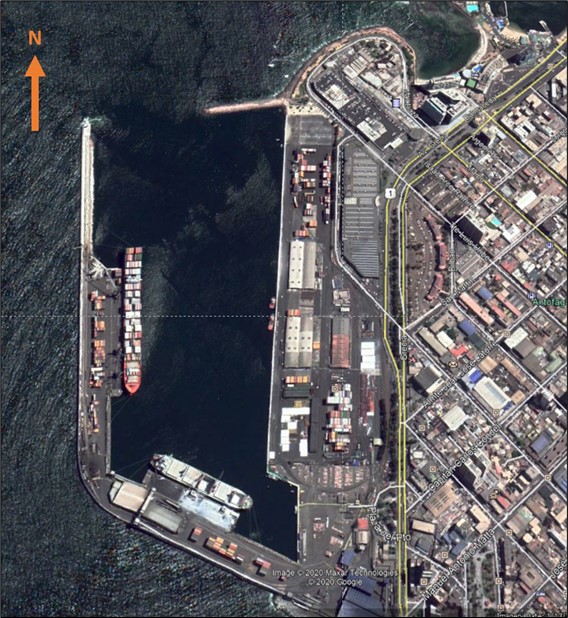

Final products from the La Negra plant are delivered to clients by truck, rail, or through two port facilities near the plant.

1.7Environmental, Social, and Closure

Baseline studies, in both operational areas, have been developed since the first environmental studies for permitting were submitted; 1998 in La Negra, and 2000 at Salar de Atacama. With the ongoing monitoring programs in both locations, environmental studies, such as hydrogeology and biodiversity, are regularly updated.

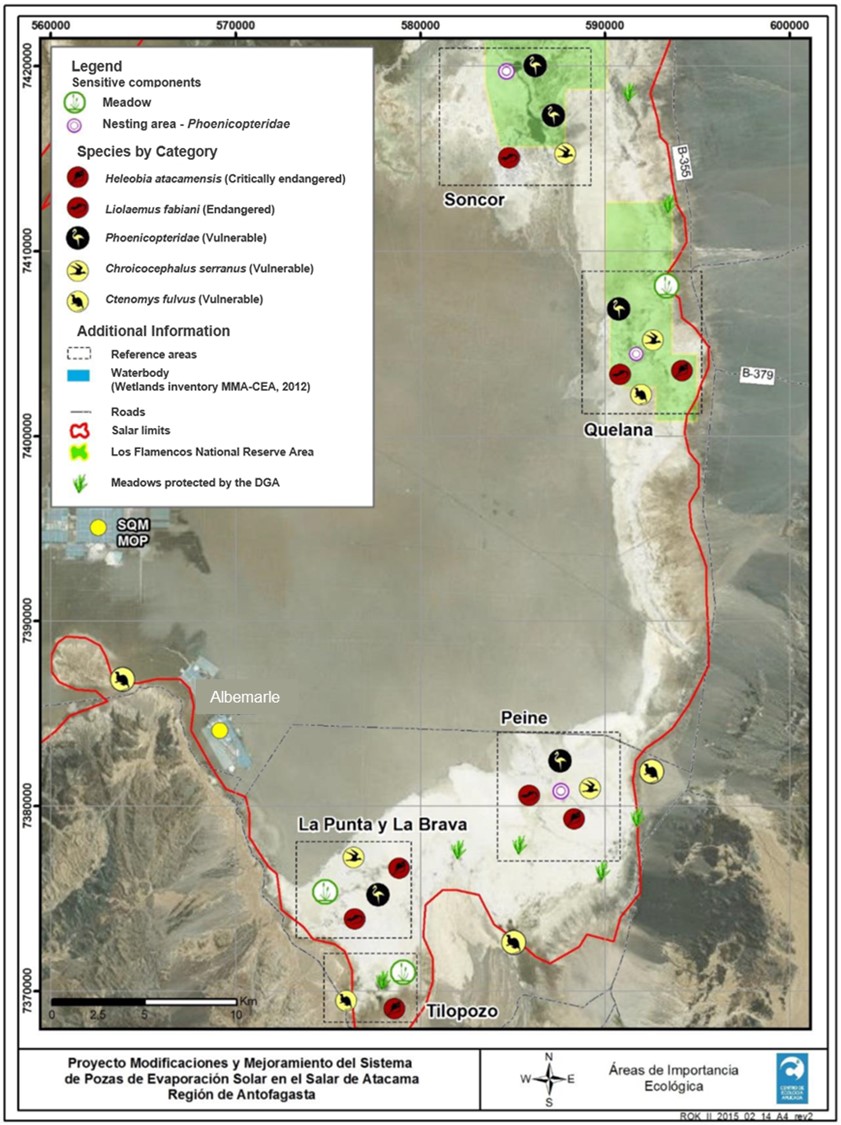

The Salar de Atacama basin presents a unique system due to the biodiversity associated with lake and wetland systems that depend on the hydrogeological conditions of the area. There are also indigenous areas and communities in the sector. As such, the key environmental issues at Salar de Atacama include biodiversity, hydrogeology, and socioeconomics.

La Negra is located within an industrial area which is in saturation conditions for the daily and annual standard of inhalable particulate matter (PM10). Although there are no surface water courses, there is an aquifer that could be affected by potential infiltrations from the plant facilities. As such, a water quality monitoring program is in place. Air quality, hydrogeology, and water quality have been deemed as key environmental characteristics of the La Negra area.

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page 26 |

The operations of Albemarle have adequate plans to address and follow-up the most sensitive and relevant environmental issues, such as hydrogeological/biodiversity issues, and those associated with the indigenous communities in the Salar de Atacama area.

Albemarle adequately follows up on issues related to water quality in the Negra and fluctuations in the water table and potential effects on the sensitive ecosystems around the Salar de Atacama, including analysis of possible cumulative effects given the multiplicity of actors that extract brine and freshwater in the area. The aim of the Early Warning Plan is to promptly detect any deviation from what was indicated in the initial environmental assessment, preventing unforeseen impacts from occurring. Notwithstanding the above, the Salar de Atacama is a complex system and requires constant updating of management tools based on the results of the monitoring programs, and also be attentive to requirements or new tools that the authority may incorporate.

Albemarle has the environmental permits for an operation with an average brine extraction rate of 442 L/s, a production of 250,000 cubic meters per year (m3/y) of brine concentrated in solar evaporation ponds with an approximate surface area of 1,043 ha, for a production of 94,000 t/year of lithium carbonate equivalent (LCE). Brine exploitation is authorized until 2043. Any modification of the production and/or extraction, or to any approved conditions, will require a new environmental permit.

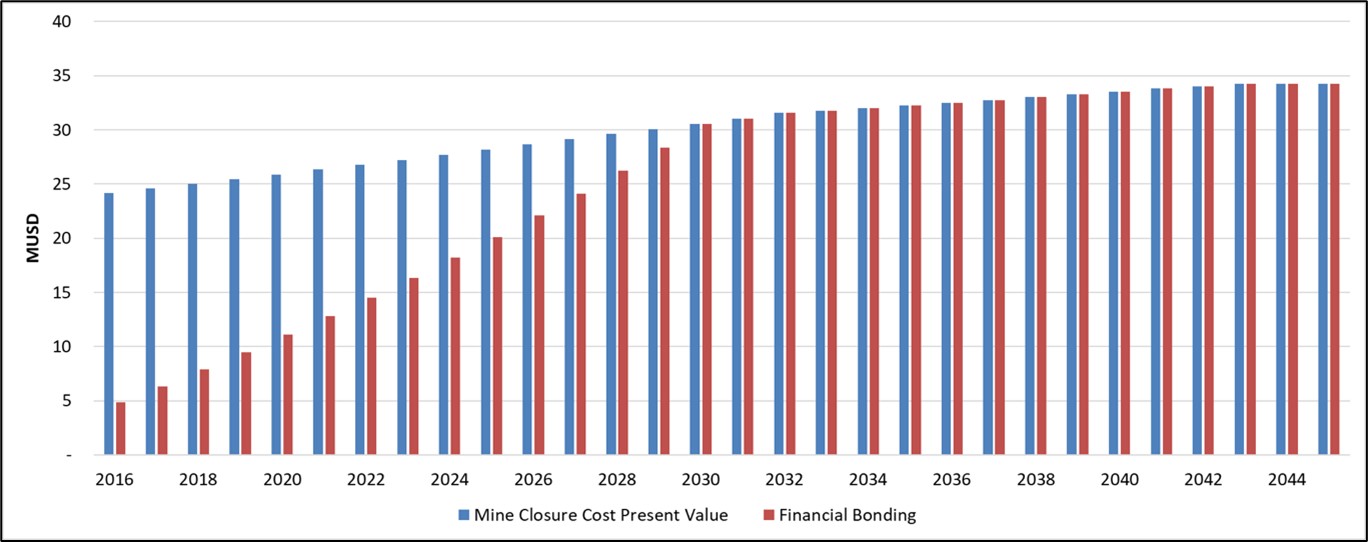

Albemarle has an approved closure plan (Res. Ex. N°287/2019), which includes all environmental projects approved until 2016, including EIA “Modification and improvement solar evaporation system” (RCA N°021/2016).This closure plan considers a life of mine until 2043, estimated by the authority’s methodology, which response to financial assurance purposes and it does not define the definitive closure date.

In terms of closure activities, the approved closure plan considers 17 month period of execution, which includes backfilling of the ponds, and dismantling and demolish of all infrastructure, including final disposal.

Post-closure activities comprise monitoring of 221 monitoring wells for water quality, evaporation and flux monitoring of groundwater and surficial waters on site. This monitoring program will continue for three years after closure, on a quarterly basis.

The closure cost has been estimated based on the approved closure plan plus a conceptual estimate of all environmental projects reviewed in this document, and that were not included in the closure plan. The total closure costs of La Negra and Salar de Atacama Plants are US$40.89 million, considering direct and indirect costs, and contingencies.

However, the purpose of this estimate is only to provide the Chilean government an assessment of the closure liabilities at the site and form the basis of financial assurance. This type of estimate typically reflects the cost that the government agency responsible for closing the site in the event that an operator fails to meet their obligation. If Albemarle, rather than the government, closes the site in accordance with their current mine plan and approved closure plan, the cost of closure is likely to be different from the financial assurance cost estimate approved by the government.

Furthermore, because closure of the site is not expected until 2043, the closure cost estimate represents future costs based on current expectations of site conditions at that date. In all probability, site conditions at closure will be different than currently expected and, therefore, the current estimate of closure costs is unlikely to reflect the actual closure cost that will be incurred in the future.

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page 27 |

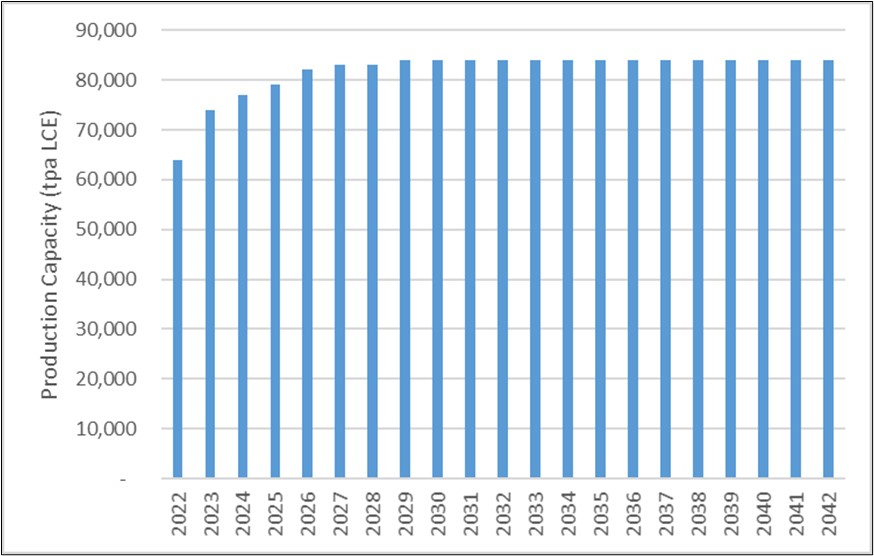

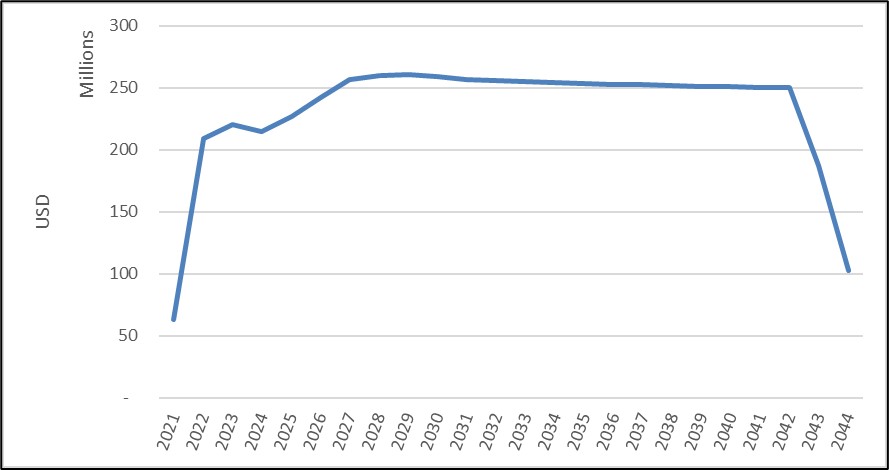

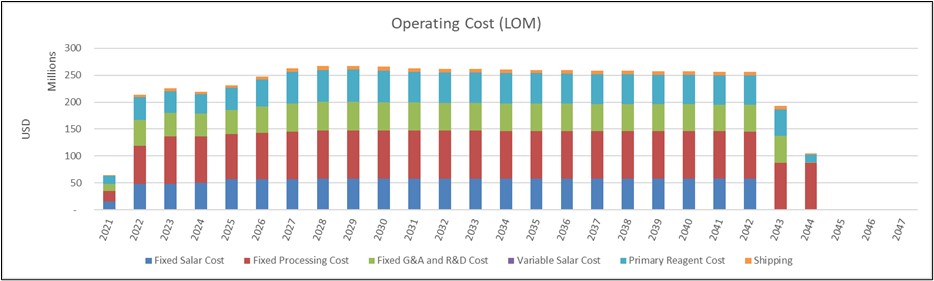

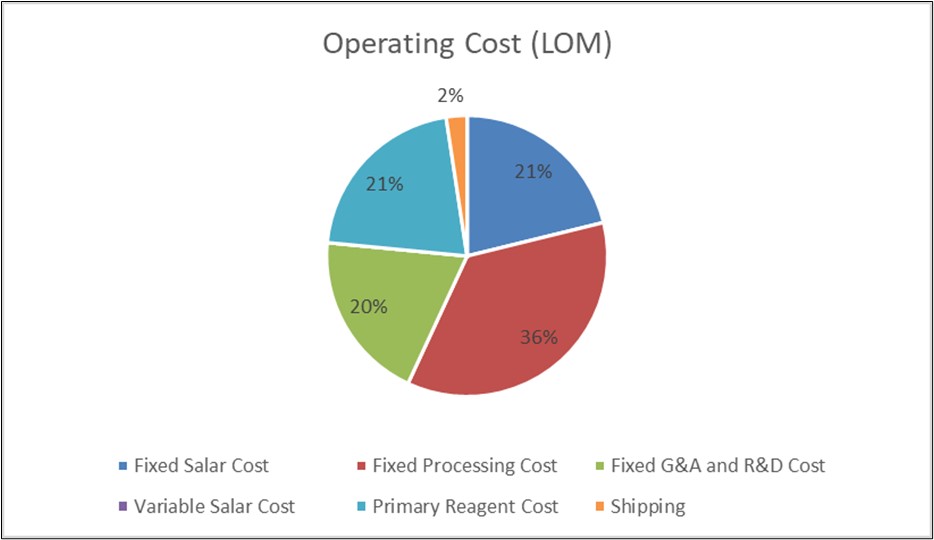

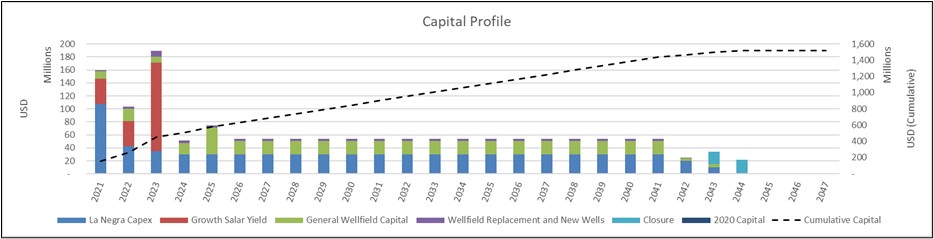

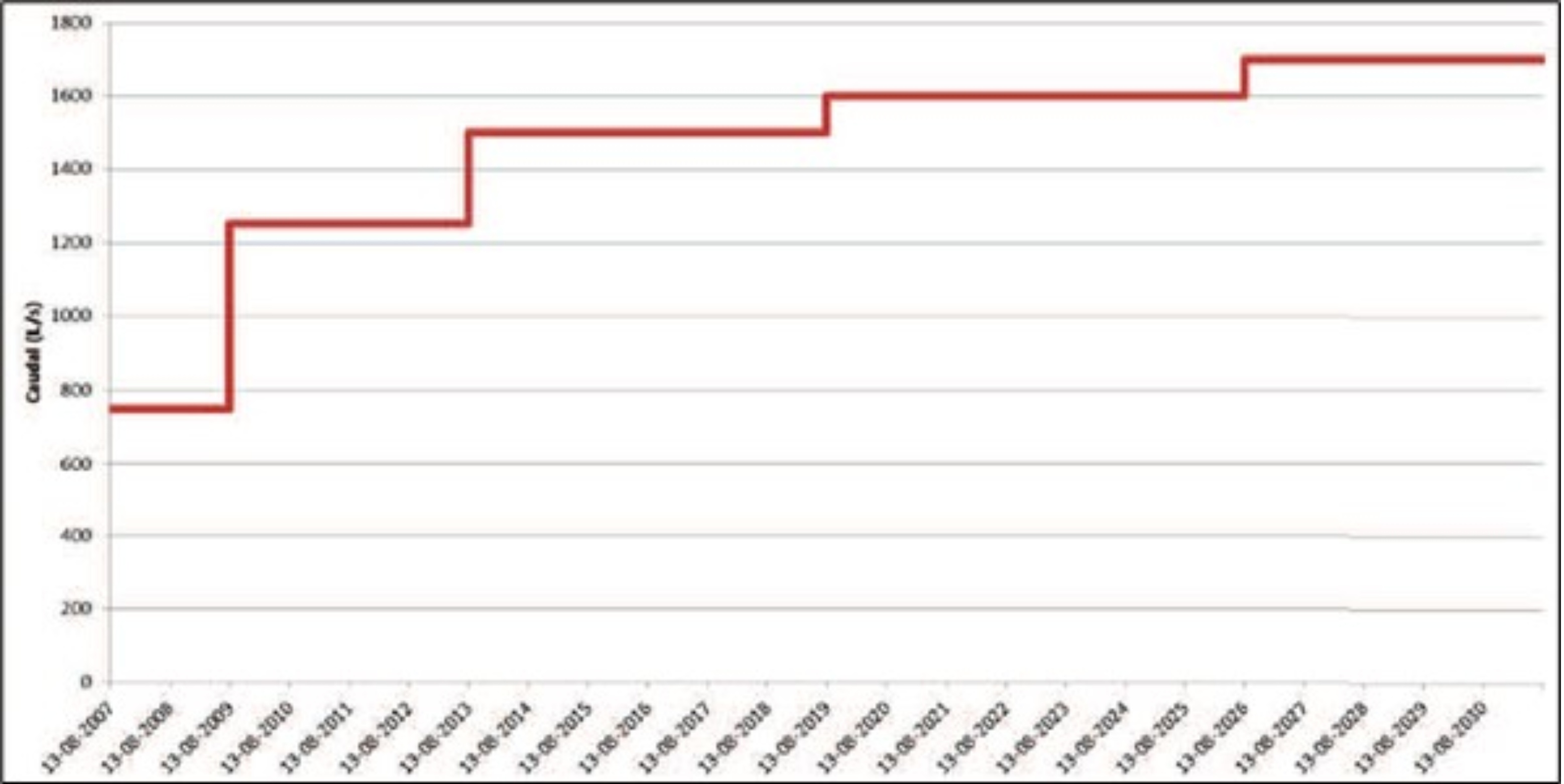

1.8Capital and Operating Costs

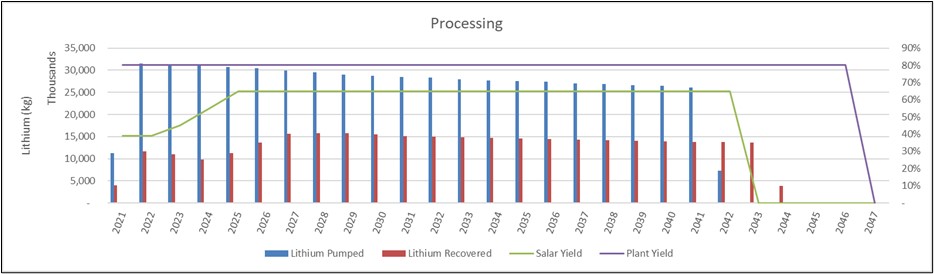

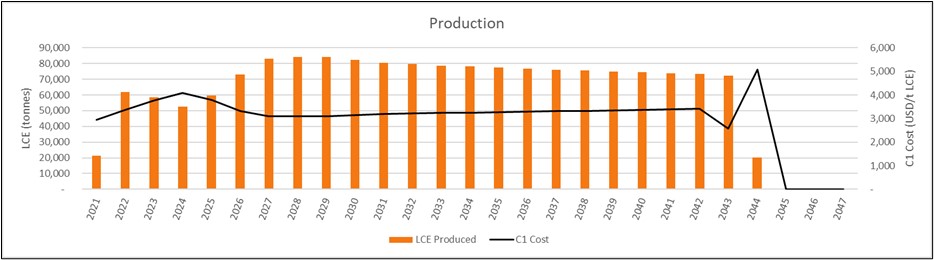

The Salar de Atacama and La Negra facilities are currently operating. Capital and operating costs are forecast as a normal course of operational planning with a primary focus on short term budgets (i.e., subsequent year). The operations currently utilizes mid (e.g., five year plan) and less detailed long-term (i.e., LoM) planning. Given the limited official mid and long-term planning completed at the operation, SRK developed a long-term forecast for the operation based on Albemarle forecasts, combined with historic operating results, adjusted for assumed changes in operating conditions and planned strategic changes to operations (the most significant changes being completion of the La Negra 3 expansion and the installation of the SYIP). SRK’s capital expenditure forecast is provided in Table 1-4 and its operating cost forecast is provided in Figure 1-1.

Table 1-4: Capital Cost Forecast ($M Real 2020)

| | | | | | | | | | | |

| Period | Total Sustaining Capex | Total Expansion Projects | Capital Expenditure (US$M Real 2020) |

| 2020 | 12.9 | 64.8 | 77.7 |

| 2021 | 37.5 | 64.9 | 96.1 |

| 2022 | 43.2 | 88.0 | 125.5 |

| 2023 | 51.0 | 47.0 | 90.2 |

| 2024 | 52.4 | - | 51.0 |

| 2025 | 75.8 | - | 74.4 |

| 2026 | 53.8 | - | 53.8 |

| 2027 | 53.8 | - | 53.8 |

| 2028 | 53.8 | - | 53.8 |

| 2029 | 53.8 | - | 53.8 |

Remaining LOM (2031 – 2043) | 685.6 | -- | 685.6 |

Note: 2020 capex is July – December only, assumed at 50% of total 2020 spend

Source: SRK, 2021

Note 2020 costs reflect a partial year (September – December)

Source: SRK

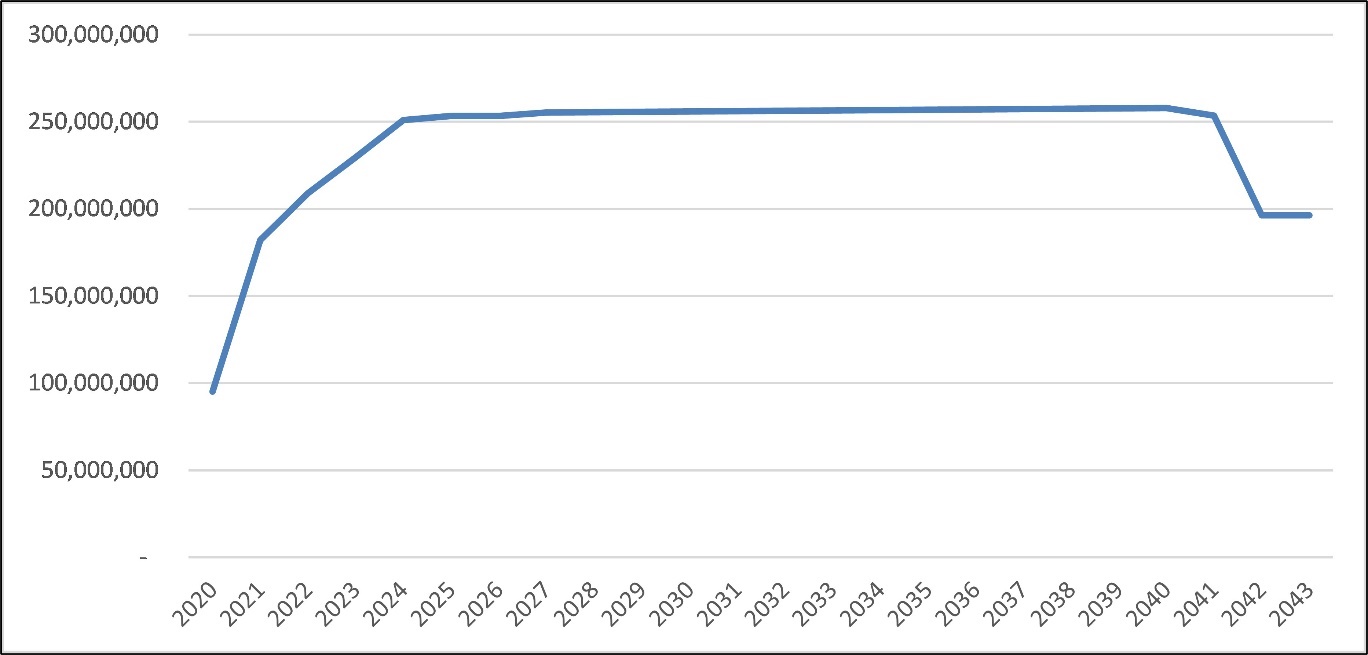

Figure 1-1: Total Forecast Operating Expenditure (Real 2020 Basis) (Tabular Data shown in Table 19-9)

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page 28 |

Estimation of capital and operating costs is inherently a forward-looking exercise. These estimates rely upon a range of assumptions and forecasts that are subject to change depending upon macroeconomic conditions, operating strategy and new data collected through future operations. For this report, capital and operating costs are estimated to a PFS-level, as defined by S-K 1300, with a targeted accuracy of +/-25%. However, this accuracy level is only applicable to the base case operating scenario and forward-looking assumptions outlined in this report. Therefore, changes in these forward-looking assumptions can result in capital and operating costs that deviate more than 25% from the costs forecast herein.

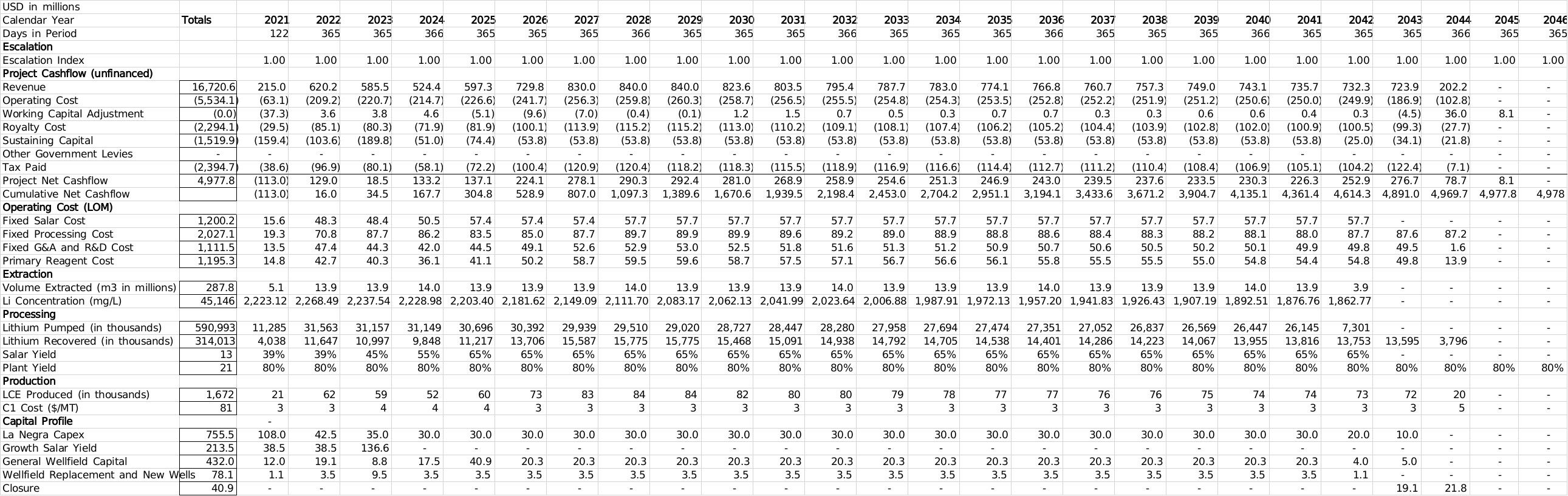

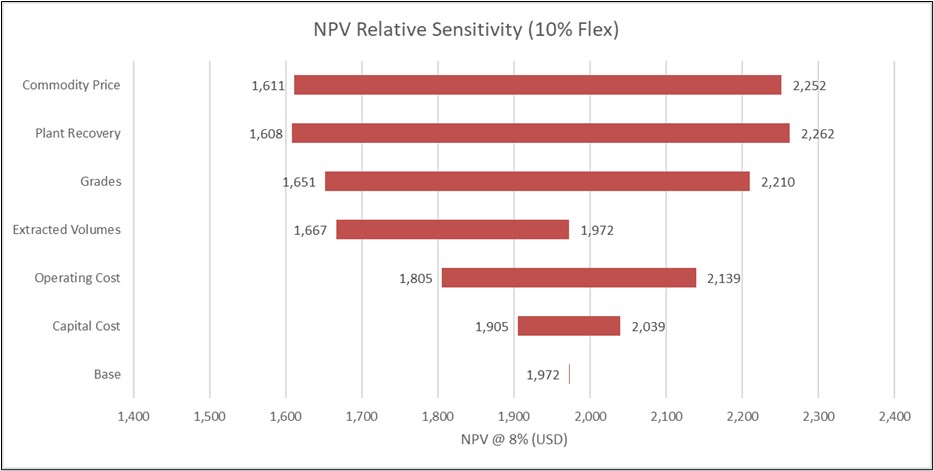

1.9Economics

As with the capital and operating cost forecasts, the economic analysis is inherently a forward-looking exercise. These estimates rely upon a range of assumptions and forecasts that are subject to change depending upon macroeconomic conditions, operating strategy and new data collected through future operations.

The operation is forecast to have a 24-year life with the first modeled year of operation being a partial year to align with the effective date of the reserves.

The economic analysis metrics are prepared on annual after-tax basis in US$. The results of the analysis are presented in Table 1-5. At a technical grade lithium carbonate price of US$10,000/t, the net present value, using an 8% discount rate (NPV 8%), of the modeled after-tax free cash flow is US$1,972 million. Note that because Salar de Atacama is in operation and is modeled on a go-forward basis from the date of the reserve, historic capital expenditures are treated as sunk costs (i.e., not modeled) and therefore, IRR and payback period analysis are not relevant metrics.

Table 1-5: Indicative Economic Results

| | | | | | | | |

| LoM Cash Flow (Unfinanced) | Units | Value |

| Total Revenue | US$ | 16,720,589,734 |

| Total Opex | US$ | (5,534,107,988) |

| Royalties | US$ | (2,294,064,911) |

| Operating Margin | US$ | 8,892,416,835 |

| Operating Margin Ratio | % | 53% |

| Taxes Paid | US$ | (2,394,685,717) |

| Free Cashflow | US$ | 4,977,836,374 |

| Before Tax |

| Free Cash Flow | US$ | 7,372,522,091 |

| NPV @ 8% | US$ | 3,027,458,930 |

| NPV @ 10% | US$ | 2,518,956,354 |

| NPV @ 15% | US$ | 1,679,104,360 |

| After Tax |

| Free Cash Flow | US$ | 4,977,836,374 |

| NPV @ 8% | US$ | 1,972,048,082 |

| NPV @ 10% | US$ | 1,622,066,434 |

| NPV @ 15% | US$ | 1,045,940,855 |

Source: SRK, 2021

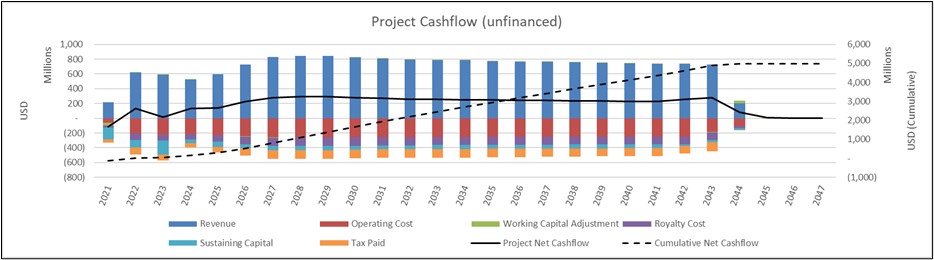

A summary of the cashflow on an annual basis is presented in Figure 1-2.

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page 29 |

Source: SRK, 2021

Figure 1-2: Annual Cashflow Summary (Tabular Data shown in Table 19-9)

1.10 Recommendations and Conclusions

1.10.1Geology

The property is well known in terms of descriptive factors and ownership. Geology and mineralization are well-understood through decades of active mining. The status of exploration, development, and operations is very advanced and active. Assuming that exploration and mining continue at Salar de Atacama in the way that they are currently being done, there are no additional recommendations at this time.

1.10.2Mineral Resource Estimate

SRK has reported a mineral resource estimation (MRE) which is appropriate for public disclosure and long-term considerations of mining viability. The mineral resource estimation could be improved with additional infill program (drilling and brine sampling).

1.10.3Mineral Reserves

Mining operations have been established at the Salar de Atacama over its more than 35-year history of production. Reserve estimates have been developed based on a predictive hydrogeological model that estimates brine production rates and associated lithium concentrations over time. In the QP’s opinion, the mining methods and predictive approach for reserve development are appropriate for the Salar de Atacama.

However, in the QP’s opinion, there remains opportunity to further refine the production schedule. This optimization should focus on the balance between calcium and sulfate concentration in the production brine. Maintaining an optimum blend of calcium-rich and sulfate-rich brine improves process recovery in the evaporation ponds. SRK’s current assumption is an optimum balance in these contaminants is lost in 2027 and has assumed the additional capital and operating cost expenditure associated with installation and operation of a liming plant is required. However, if additional calcium-rich brine can be sourced in the pumping plan, these assumed expenses could potentially be delayed or avoided altogether.

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page 30 |

1.10.4Infrastructure

The project is a mature functioning operation with two separate sites that contain key facilities. The infrastructure is in place, operating and provides all necessary support for ongoing operations as summarized in this report. No significant risks associated with the Project are identified in this report.

1.10.5Environmental, Social, and Closure

The operations of Albemarle have adequate plans to address and follow-up the most sensitive and relevant environmental issues, such as hydrogeological/biodiversity issues, and those associated with the indigenous communities in the Salar de Atacama area.

Albemarle adequately follows up on issues related to water quality in the Negra and fluctuations in the water table and potential effects on the sensitive ecosystems around the Salar de Atacama, including analysis of possible cumulative effects given the multiplicity of actors that extract brine and freshwater in the area. Notwithstanding the above, the Salar de Atacama is a complex system and requires constant updating of management tools based on the results of the monitoring programs, and also be attentive to requirements or new tools that the authority may incorporate.

In relation with the indigenous communities, Albemarle maintains relations with all the communities and indigenous groups in the area and has achieved and maintained unprecedented agreements in Chile with these communities. Any future development or modification of the current conditions of the operation will be subject to an Indigenous Consultation Process; therefore, it is of high importance to maintain this adequate management strategy with these communities.

Currently, there are no known environmental issues that could materially affect Albemarle's capacity to extract the resources or reserves of the Salar de Atacama, as long as the brine extraction is kept at the values approved by the environmental authority. Any requirement of a brine extraction greater than the one approved (442 L/s) has an uncertain approval success, considering the multi-user conditions in the Salar de Atacama, the sensitivity of the ecosystem and the synergistic impacts on this ecosystem which concern the environmental and water authorities

There is an operational issue that could generate regulatory risk, related with infrastructure requirements to adequately manage the liquid solutions that are generated in La Negra's process, which is not possible to manage with the current facilities. Any spill or overflow from the ponds can lead to an environmental non-compliance that can be sanctioned by the Superintendence of the Environment. This issue is being addressed as a priority action by the company to seek a definitive solution in the long term, and also one that allows them to solve the issue in the short term.

Albemarle has also an approved closure plan (Res. Ex. N°287/2019), which includes all environmental projects approved until 2016, including EIA “Modification and improvement solar evaporation system” (RCA N°021/2016).This closure plan considers a life of mine until 2043, estimated by the authority’s methodology, which response to financial assurance purposes and it does not define the definitive closure date.

Albemarle does not currently have an internal closure cost estimate other than for financial assurances. Therefore, other costs would likely be incurred by Albemarle during closure of the site. Then, the actual closure cost could be greater or less than the financial assurance estimate.

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page 31 |

Due to new environmental approvals not included in the approved closure plan, it is required that Albemarle update its closure plan in order to be able to operate some of these projects, as they need the closure plan approval for execution.

Therefore, it is highly recommended to develop an internal closure plan, where other costs could be determined, such as head office costs, human resources costs, taxes, operator-specific-costs, and social costs. Also, closure provision should be determined in this document.

1.10.6Mineral Processing and Metallurgical Testing

In the QP’s opinion, the long operating history and associated knowledge and information provide appropriate support for development of operating predictions for this reserve estimate. The notable deviation from historic practice is the SYIP.

Albemarle is currently planning on developing the SYIP in the next few years. Historic testwork associated with this project has gaps in sample representivity and support for projected mass balances. SRK recommends updating these test results with more representative samples and a more thorough evaluation of associated mass balances with the potential to further optimize the SYIP performance and reduce risk in ramp up and performance. Nonetheless, in the QP’s opinion, the projected performance for the SYIP is reasonable.

SRK has assumed that a liming plant will be required starting in 2027 to offset a reduction in calcium-rich brine available for blending. If further optimization of the life of mine pumping plan is not possible (i.e., the sulfate to calcium ratio cannot be reduced by alternative pumping strategy), Albemarle will need to add calcium to the evaporation pond system to avoid additional lithium losses in the ponds. Albemarle should start conceptual evaluation of this calcium addition (whether through liming as assumed by SRK or alternative options) so that if/when this plant is required, Albemarle will have an appropriate design developed for installation.

1.10.7Capital and Operating Costs

The capital and operating costs for the Salar de Atacama operation have been developed based on actual project costs. In the opinion of the QP, the cost development is acceptable for declaration of mineral reserves. However, the operation itself lacks detailed life of operation planning and costing. As such, the forward looking costs incorporated here are inherently strongly correlated to current market conditions. Due to the ongoing COVID-19 pandemic, the currently global economic environment can charitably be described as ‘somewhat chaotic’, and any forward looking forecast based on such an environment carries increased risk.

The QP strongly recommends continued development and refinement of a robust life of operation cost model. In additional to further refinement of the cost model, the QP also recommends that close watch be kept on the economic environment with an eye toward continuous updates as the market environment continues to evolve.

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page 32 |

1.10.8Economics

The operation is forecast to generate positive cashflow during every year of the LoM plan in which it is pumping, or processing brine based on the production schedule, costs and process performance outlined in this report.

An economic sensitivity analysis indicates that the operation’s NPV is most sensitive to variations in commodity price, plant recovery and lithium grade.

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page 33 |

2Introduction

This TRS was prepared in accordance with the SEC S-K regulations (Title 17, Part 229, Items 601 and 1300 through 1305) for Albemarle by SRK on the Salar de Atacama. Associated lithium processing facilities at the La Negra operation are included in this report as they are critical to the production of a final, commercially salable product. Albemarle is 100% owner of the Salar de Atacama and La Negra operations.

2.1Terms of Reference and Purpose

The quality of information, conclusions, and estimates contained herein are consistent with the level of effort involved in SRK’s services, based on i) information available at the time of preparation and ii) the assumptions, conditions, and qualifications set forth in this report. This report is intended for use by Albemarle subject to the terms and conditions of its contract with SRK and relevant securities legislation. The contract permits Albemarle to file this report as a TRS pursuant to the SEC S-K regulations, more specifically Title 17, Subpart 229.600, item 601(b)(96) - TRS and Title 17, Subpart 229.1300 - Disclosure by Registrants Engaged in Mining Operations. Any other uses of this report by any third party is at that party’s sole risk. The responsibility for this disclosure remains with Albemarle.

The purpose of this TRS is to report mineral resources and mineral reserves for Salar de Atacama. This report is prepared to a pre-feasibility standard, as defined by S-K 1300.

The effective date of this report is August 31, 2021.

The report was amended to include additional clarifying information in December 2022. The basis of the report is unchanged. The changes and location in document are summarized as follows:

•Amended date added to title page

•Addition of historic price curve (16.1.4)

•Addition of notes on figures referencing tabular source data (Chapter 1.8, 1.9, 19.1.3, 19.1.4)

•Modified Summary Table for clarity (Chapter 19.2)

2.2Sources of Information

This report is based in part on internal Company technical reports, previous feasibility studies, maps, published government reports, Company letters and memoranda, and public information as cited throughout this report and listed in Section 24.

Reliance upon information provided by the registrant is listed in Section 25 where applicable.

2.3Details of Inspection

Table 2-1 summarizes the details of the personal inspections on the property by each qualified person or, if applicable, the reason why a personal inspection has not been completed.

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page 34 |

Table 2-1: Site Visits

| | | | | | | | | | | |

| Expertise | Date(s) of Visit | Details of Inspection | Reason Why a Personal Inspection Has Not Been Completed |

| Process | Several, most recent March 2017 | Site visit with inspection of evaporation ponds, and La Negra plant and packaging area. | |

| Resource and Mining | November 12&13 2021 | Site visit with inspection of drillholes, production wells, packer testing, evaporation ponds, site facilities, laboratory, trucking facilities at the salar. | |

Source: SRK, 2021

2.4Report Version Update

The user of this document should ensure that this is the most recent TRS for the property.

This TRS is not an update of a previously filed TRS.

2.5Qualified Person

This report was prepared by SRK Consulting (U.S.), Inc., a third-party firm comprising mining experts in accordance with § 229.1302(b)(1). Albemarle has determined that SRK meets the qualifications specified under the definition of qualified person in § 229.1300. References to the Qualified Person or QP in this report are references to SRK Consulting (U.S.), Inc. and not to any individual employed at SRK.

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page 35 |

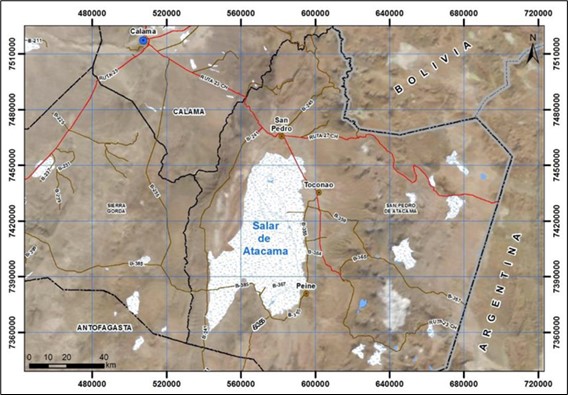

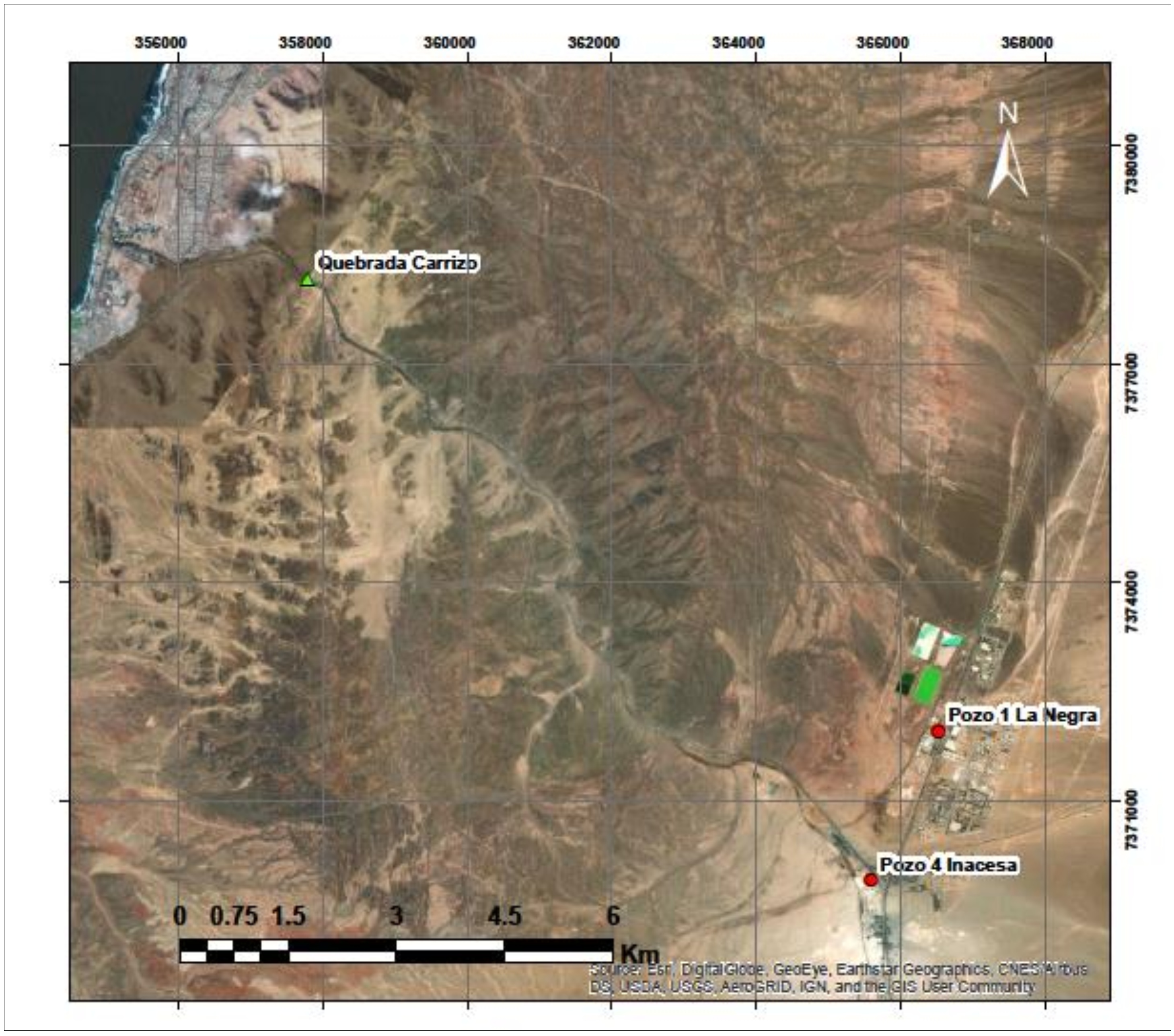

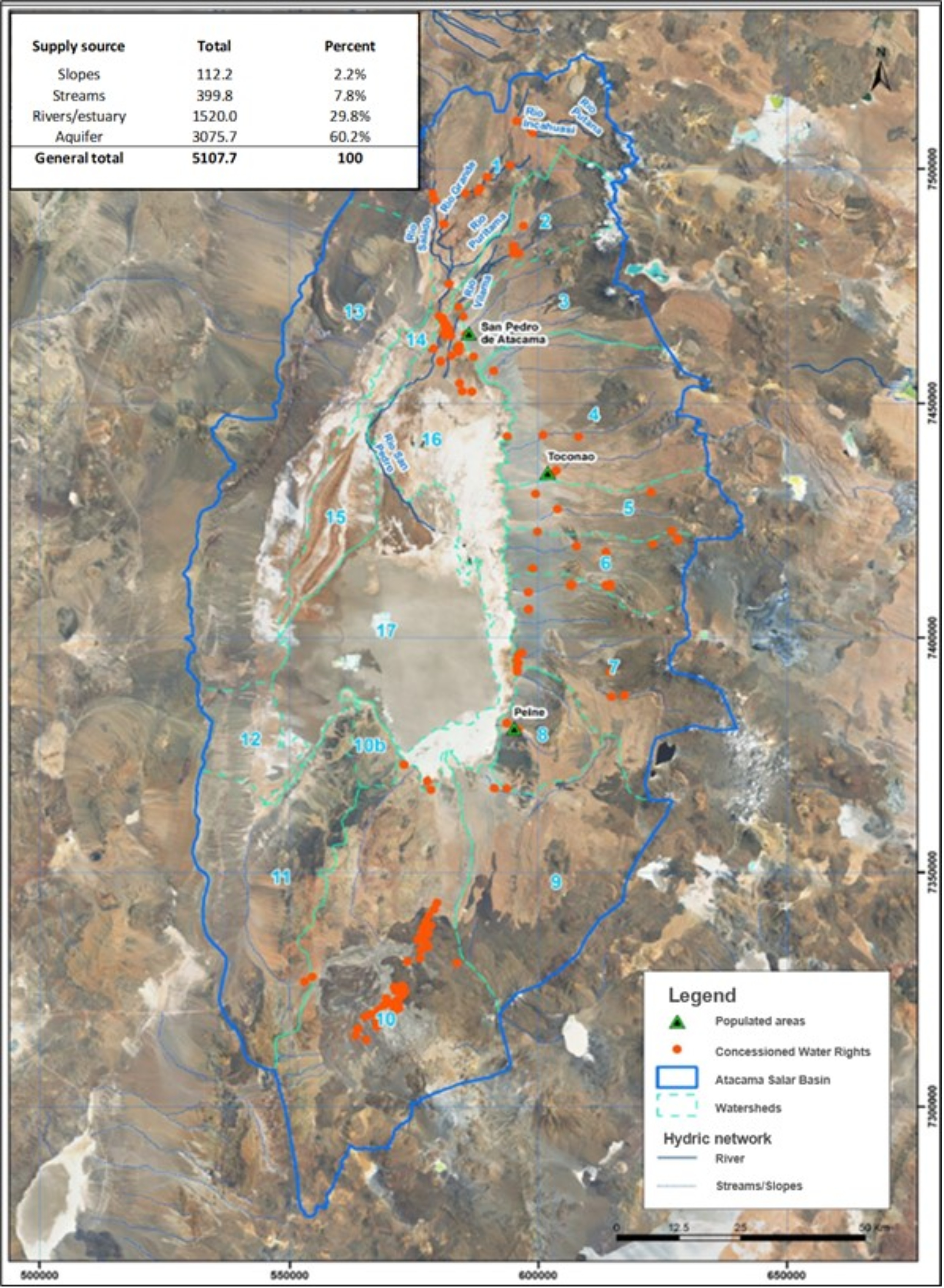

3Property Description

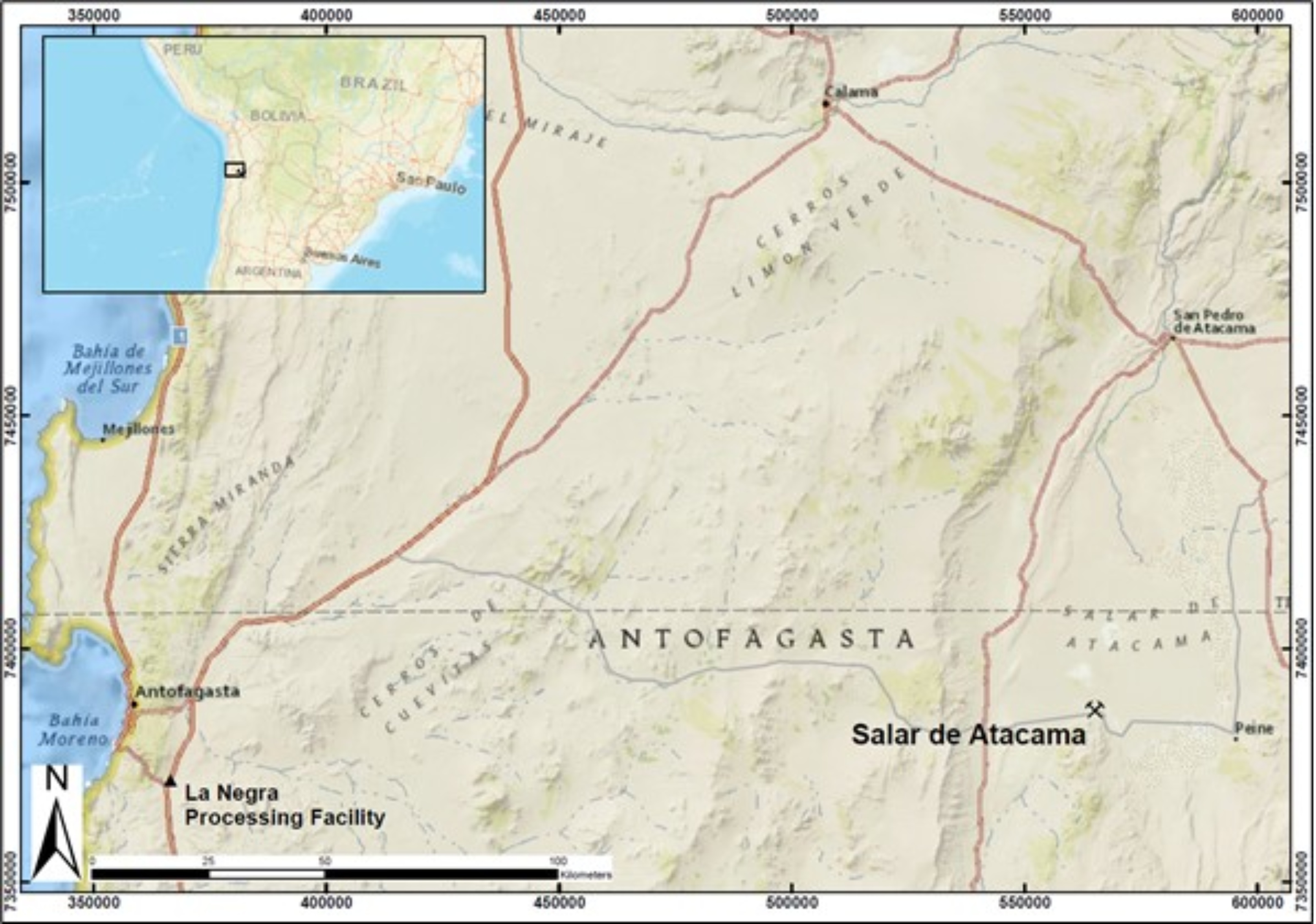

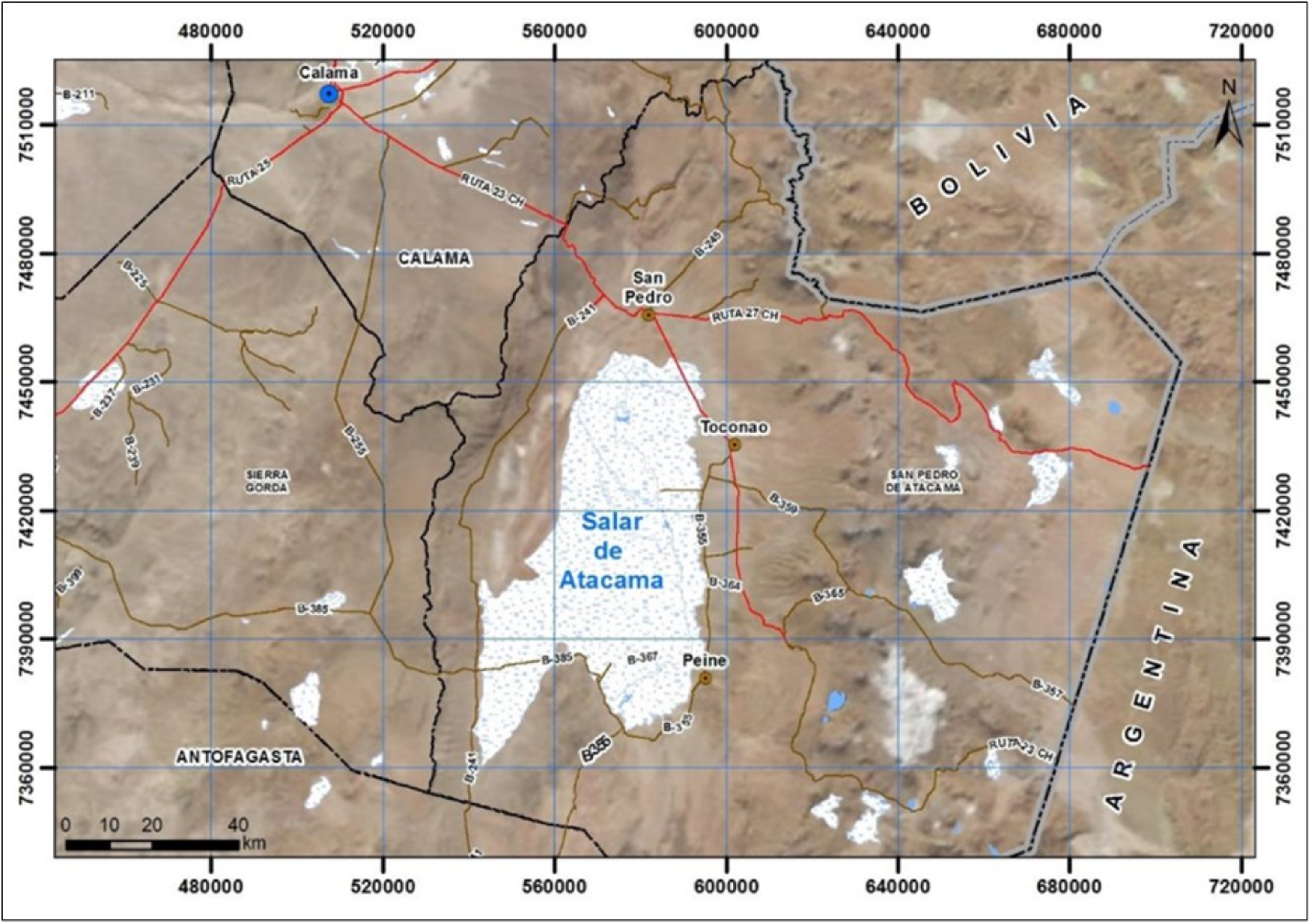

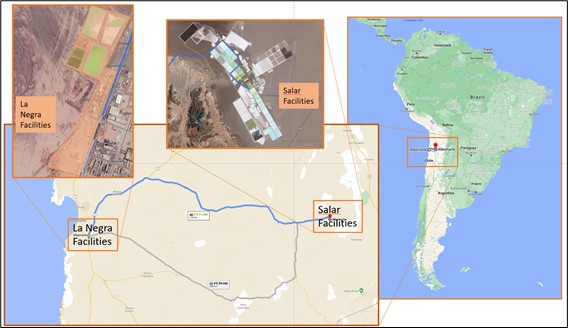

The Salar de Atacama Basin is located in the commune of San Pedro de Atacama, with the Albemarle operations approximately 100 km to the south of this commune, in the extreme east of the Antofagasta Region and close to the border with the republics of Argentina and Bolivia, as shown in Figure 3-1. The communal area is 23,439 square kilometers (km2) and has an approximate population of 10,000 inhabitants, which are mainly distributed in the populated areas of San Pedro de Atacama, Toconao, Socaire and Peine.

Source: SRK, 2021

Figure 3-1: Location Map

In a regional context, the salar is located in a remote area with the nearest city, Calama, approximately 190 km by road to the northwest. The regional capital, Antofagasta, which also is located near the La Negra processing facilities, is located approximately 250 km, by road to the west.

3.1Property Area

Albemarle's mining properties within the Salar de Atacama include two groups of exploitation concessions, CASEME (Carlos Sáez – Eduardo Morales Echeverría) and OMA, which cover a total of 5,227 mining properties. They comprise of approximately 25 km at the widest zone in the East-West direction and 12 km in the widest North-South zone. For the purpose of the reserve estimate, the OMA concessions are those that are relevant.

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page 36 |

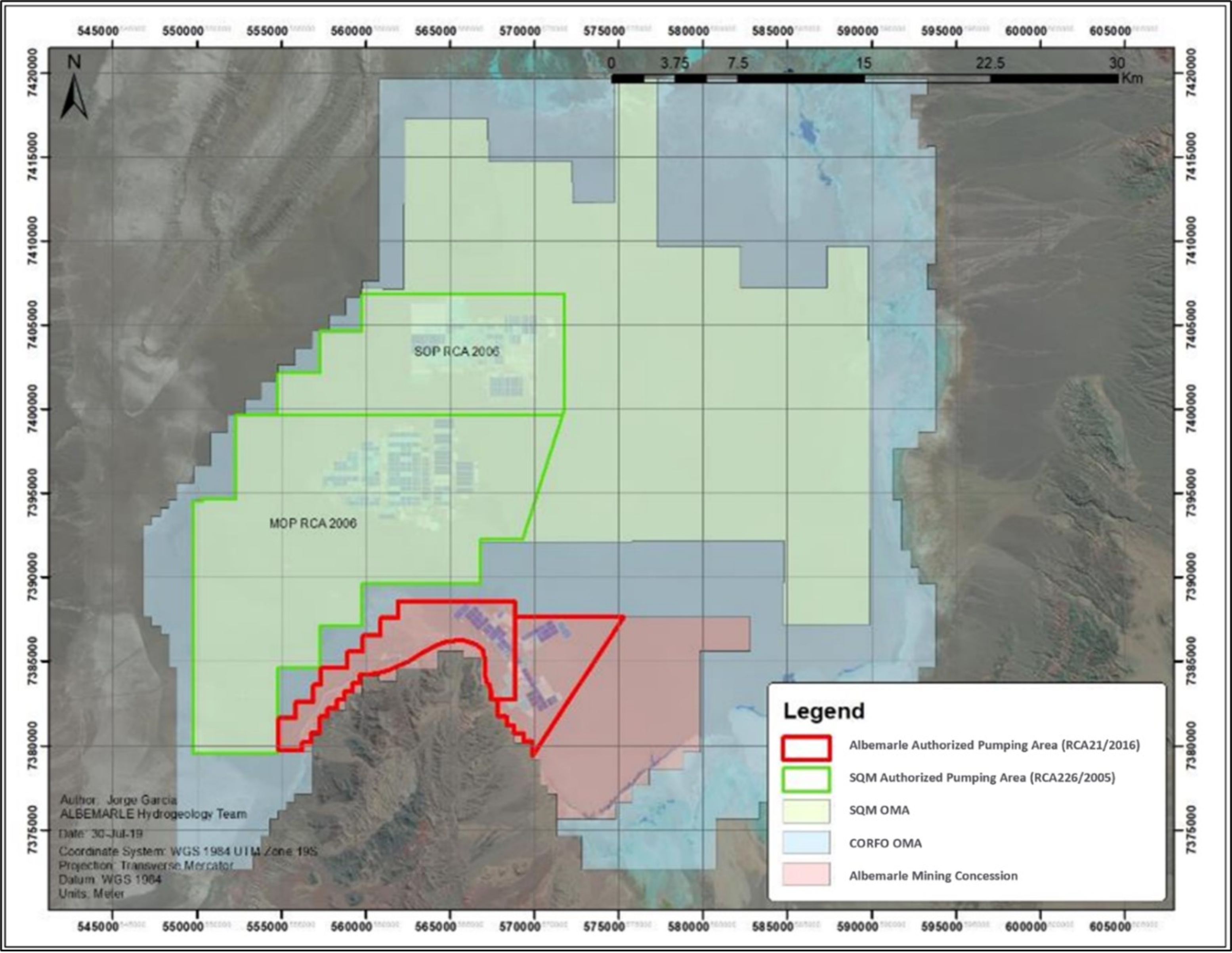

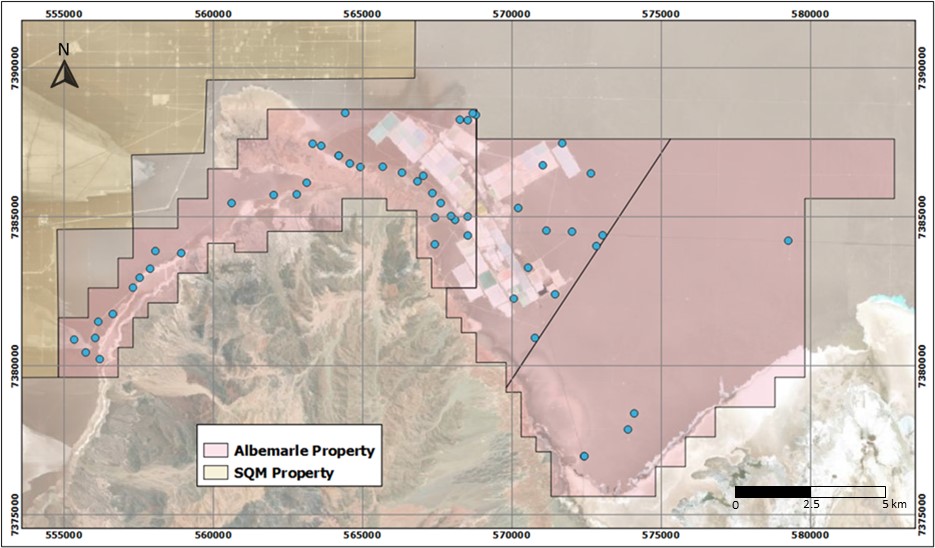

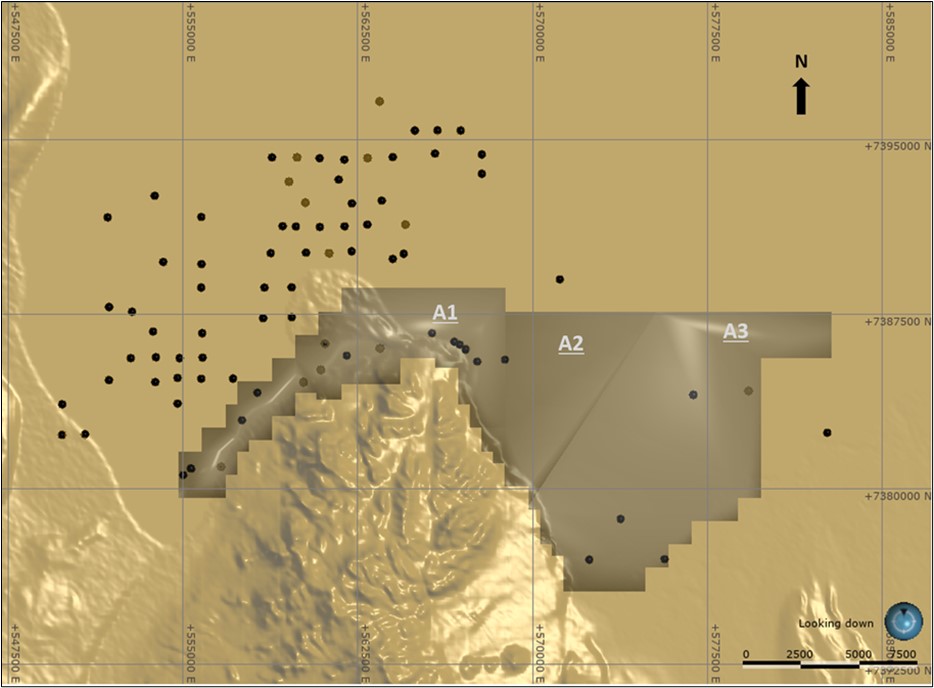

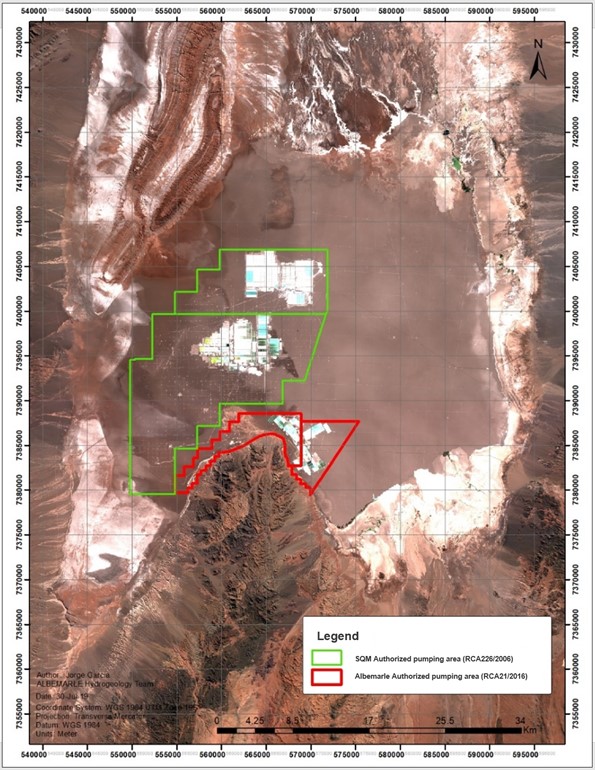

The CASEME concessions include 1,883 properties and the same number of hectares. The OMA concessions include 3,344 mining properties of 5 ha each, which corresponds to 16,720 ha. Figure 3-2 shows the location of the Albemarle concessions at the southern end of the Salar de Atacama (in pink), the rest of the OMA properties belonging to CORFO (in light blue) and the location of SQM's properties (in green) in the Salar.

Source: GWI, 2019

Figure 3-2: Albemarle Mining Claims in the Salar de Atacama

3.2Mineral Title

Albemarle’s mineral rights at the Salar de Atacama in Chile consist of the right to extract lithium brine, pursuant to a long-term contract with the Chilean government, originally entered into in 1980 by Foote Minerals, a predecessor of Albemarle. This contract has been subsequently amended and restated. This agreement is discussed in more detail in Section 16.3.1 although key details follow.

Albemarle’s predecessor’s initial contract with the Chilean government will remain in effect until the date on which it has produced and sold 200,000 t of LME, although the lithium can be produced in any of its forms, from the Salar de Atacama. As of August 31, 2021, the remaining amount of lithium from the initial contract equals approximately 78,038 t of LME. On November 25, 2016, CORFO and Albemarle entered into an annex to the initial agreement adding an additional 262,132 t LME to the total quota and setting an expiry for production of the quota of January 1, 2044 (i.e., any remaining

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page 37 |

quota after this date will be forfeited). As of August 31, 2021, the remaining amount of lithium from the second quota equals 262,132 t. Combined, as of the effective date of this TRS, August 31, 2021, Albemarle has a remaining quota of 340,170 t of LME, expiring January 1, 2044.

The size of the area at the Salar de Atacama covered by Albemarle’s OMA mining concessions (those relevant to the current reserve estimate) is approximately 16,700 ha. Table 3-1 describes these OMA concessions. Albemarle also currently owns the land on which the extraction facility at the Salar de Atacama and the processing facility at La Negra operate. However, the ownership of the land at the Salar de Atacama will revert to the Chilean government once all amounts of lithium remaining under Albemarle’s contract with the Chilean government are sold (the ownership of the land and fixed assets at La Negra will remain unchanged).

Section 17 of this report provides a summary of the existing environmental permits and under which Albemarle operates. The rights to use existing water and the agreements with the communities are also summarized.

Table 3-1: OMA Mining Concessions

| | | | | | | | | | | | | | | | | |

| Property of SCL |

| Page Number 07 | Concession Name | National Role | Number | Properties | Hectares |

| 230300007-3 | Oma 1 Al 59820 | 2303-0007-0 | 11 | 3,344 | 16,720 |

| Property of CORFO |

| Page Number 07 | Concession Name | Pages | Number | Properties | Hectares |

| 023011965-1 | Oma 1 Al 59820 | 408 | 11 | 1,370 | 6,850 |

Source: GWI, 2019

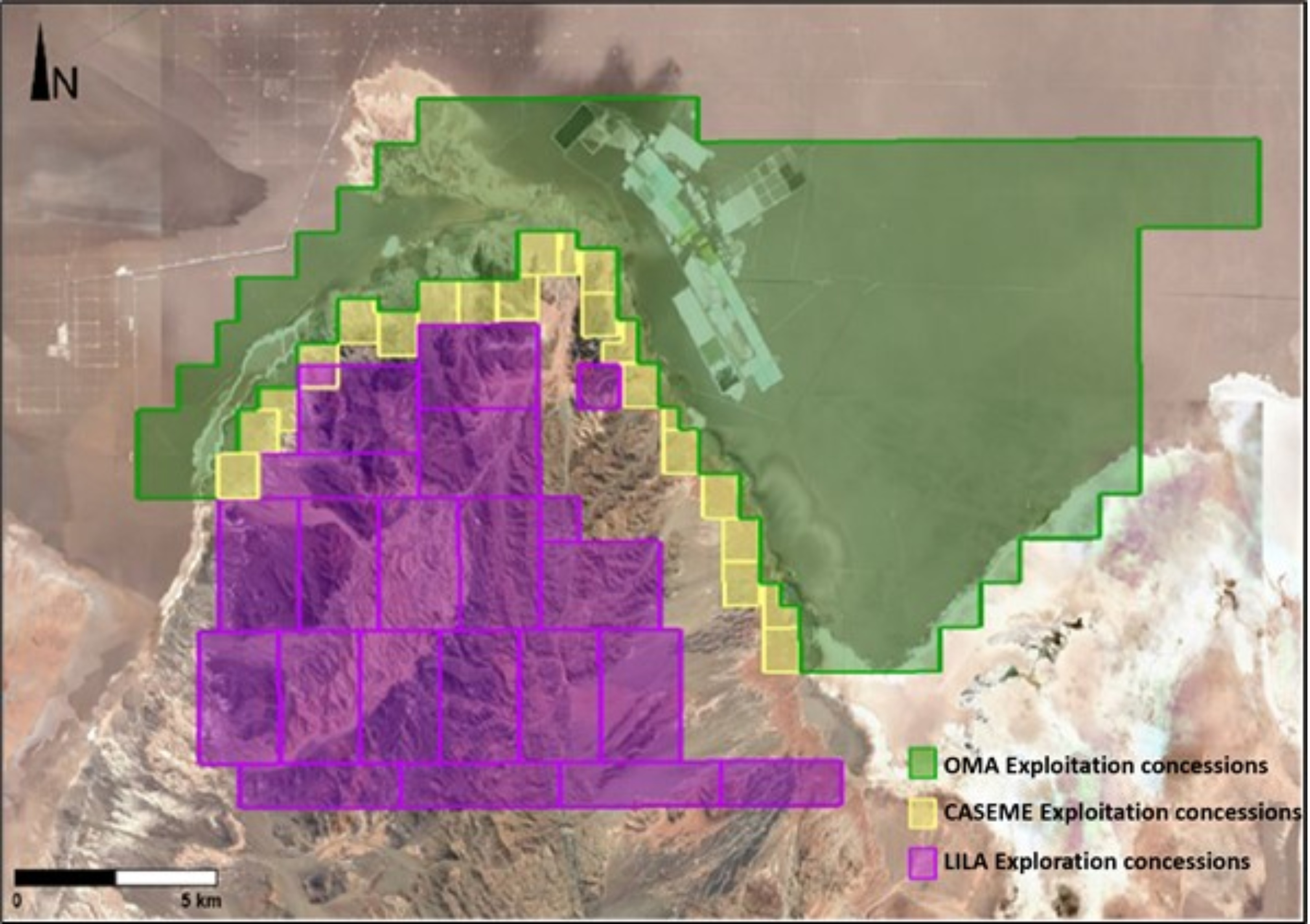

In addition, to the mining properties located in the core of the Salar de Atacama, although not covering the area relevant to the resource and reserve reported herein, Albemarle has mining properties located in the extreme north of the Cordón de Lila called CASEME and LILA as shown in Table 3-2 and Figure 3-3.

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page 38 |

Table 3-2: Albemarle Mining Concessions

| | | | | | | | | | | | | | | | | | | | |

| CASEME Mining Concessions |

| Property of SCL |

| Role Number | Concession name | Pages | Number | Properties | Hectares |

| 023030381-9 | Caseme uno 1 to 100 | 1464 | 1212 | 100 | 100 |

| 023030382-7 | Caseme dos 1 al 100 | 1466 | 1213 | 100 | 100 |

| 023030383-5 | Caseme tres 1 al 75 | 1468 | 1214 | 75 | 75 |

| 023030384-3 | Caseme cuatro 1 al 100 | 1470 | 1215 | 100 | 100 |

| 023030385-1 | Caseme cinco 1 al 97 | 1472 | 1216 | 97 | 97 |

| 023030386-K | Caseme seis 1 al 100 | 1474 | 1217 | 100 | 100 |

| 023030401-7 | Caseme siete 1 al 100 | 1476 | 1218 | 100 | 100 |

| 023030402-5 | Caseme ocho 1 al 100 | 1478 | 1219 | 100 | 100 |

| 023030388-6 | Caseme nueve 1 al 95 | 1480 | 1220 | 95 | 95 |

| 023030389-4 | Caseme diez 1 al 100 | 1482 | 1221 | 100 | 100 |

| 023030387-8 | Caseme once 1 al 46 | 1484 | 1222 | 46 | 46 |

| 023030390-8 | Caseme doce 1 al 90 | 1486 | 1223 | 90 | 90 |

| 023030391-6 | Caseme trece 1 al 90 | 1488 | 1224 | 90 | 90 |

| 023030392-4 | Caseme catorce 1 al 65 | 1490 | 1225 | 65 | 65 |

| 023030393-2 | Caseme quince 1 al 90 | 1492 | 1226 | 90 | 90 |

| 023030394-0 | Caseme dieciseis 1 al 20 | 1494 | 1227 | 20 | 20 |

| 023030395-9 | Caseme diecisiete 1 al 90 | 1496 | 1228 | 90 | 90 |

| 023030396-7 | Caseme dieciocho 1 al 90 | 1498 | 1229 | 90 | 90 |

| 023030397-5 | Caseme diecinueve 1 al 90 | 1500 | 1230 | 90 | 90 |

| 023030398-3 | Caseme veinte 1 al 90 | 1502 | 1231 | 90 | 90 |

| 023030399-1 | Caseme veintiuno 1 al 65 | 1504 | 1232 | 65 | 65 |

| 023030400-9 | Caseme veintidos 1 al 90 | 1506 | 1233 | 90 | 90 |

| Totals | 1,883 | 1,883 |

| LILA Mining Concessions |

| Property of Albemarle LTDA |

| Role Number | Concession name | Pages | Number | Hectares |

| 02303-B222-7 | Lila 1 | 3146 | 2236 | 400 |

| 02303-B247-2 | Lila 2 | 3148 | 2237 | 400 |

| 02303-B4998 | Lila 3 | 3718 | 2579 | 400 |

| 02303-B241-3 | Lila 4 | 3150 | 2238 | 300 |

| 02303-B5005 | Lila 5 | 3720 | 2580 | 600 |

| 02303-B5013 | Lila 6 | 3722 | 2581 | 600 |

| 02303-B243k | Lila 7 | 3152 | 2239 | 600 |

| 02303-B503k | Lila 8 | 3724 | 2582 | 600 |

| 02303-B225-1 | Lila 9 | 3154 | 2240 | 600 |

| 02303-B245-6 | Lila 10 | 3156 | 2241 | 600 |

| 02303-B5021 | Lila 11 | 3726 | 2583 | 600 |

| 02303-B220-0 | Lila 12 | 3158 | 2242 | 600 |

| 02303-B246-4 | Lila 13 | 3160 | 2243 | 600 |

| 02303-B505-6 | Lila 14 | 3728 | 2584 | 600 |

| 02303-B224-3 | Lila 15 | 3162 | 2244 | 600 |

| 02303-B244-8 | Lila 16 | 3164 | 2245 | 100 |

| 02303-B5048 | Lila 17 | 3730 | 2585 | 400 |

| 02303-B221-9 | Lila 18 | 3166 | 2246 | 600 |

| 02303-B248-0 | Lila 19 | 3168 | 2247 | 600 |

| 02303-B5072 | Lila 20 | 5311 | 3566 | 600 |

| 02303-B223-5 | Lila 21 | 3170 | 2248 | 100 |

Source: GWI, 2019

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page 39 |

Source: Albemarle, 2019

Figure 3-3: Albemarle Mining Concessions

Section 17 of this report provides a summary of the existing environmental permits and under which Albemarle operates. The rights to use existing water and the agreements with the communities are also summarized.

Since 2000 to date, numerous Environmental Impact Declarations and Environmental Impact Studies have been approved by the Environmental Assessment Service (SEA) for both the La Negra Plant and the El Salar Plant. In addition, 10 Pertinence Queries to the SEA have been entered. Albemarle has two wells located in the Tilopozo and Tucúcaro areas, both of which have groundwater rights.

3.3Royalties

As described above, CORFO owned the concessions in the Salar de Atacama prior to 1979, which are currently operated by Albemarle and SQM, under specific contracts with limits to lithium extraction in time and/or quantity. The role of the corporation in is to safeguard its rights in contracts and collect agreed payments, which it exercises through the Sistema de Empresas (SEP). In the case of ALB, only one royalty payment for potassium is contemplated since the usage of the concessions granted by CORFO was recognized as a contribution to the constitution of the initial company.

| | | | | |

SalardeAtacama_SEC_Report_515800.040 | December 2022 |

SRK Consulting (U.S.), Inc.

| | | | | |

SEC Technical Report Summary – Salar de Atacama | Page 40 |

The new agreement of Albemarle with CORFO adds an additional royalty payment to the state development agency, according to the sales price for both carbonate and lithium hydroxide. Table 3-3 presents this royalty schedule.

Table 3-3: CORFO Royalty Scheme for Albemarle in Atacama

| | | | | | | | | | | |

| Lithium Carbonate | Lithium Hydroxide |

| Price Range (USD/ton) | Progressive Commission Rate (%) | Price Range (USD/ton) | Progressive Commission Rate (%) |

| 0-4,000 | 6.8% | 0-4,000 | 6.8% |

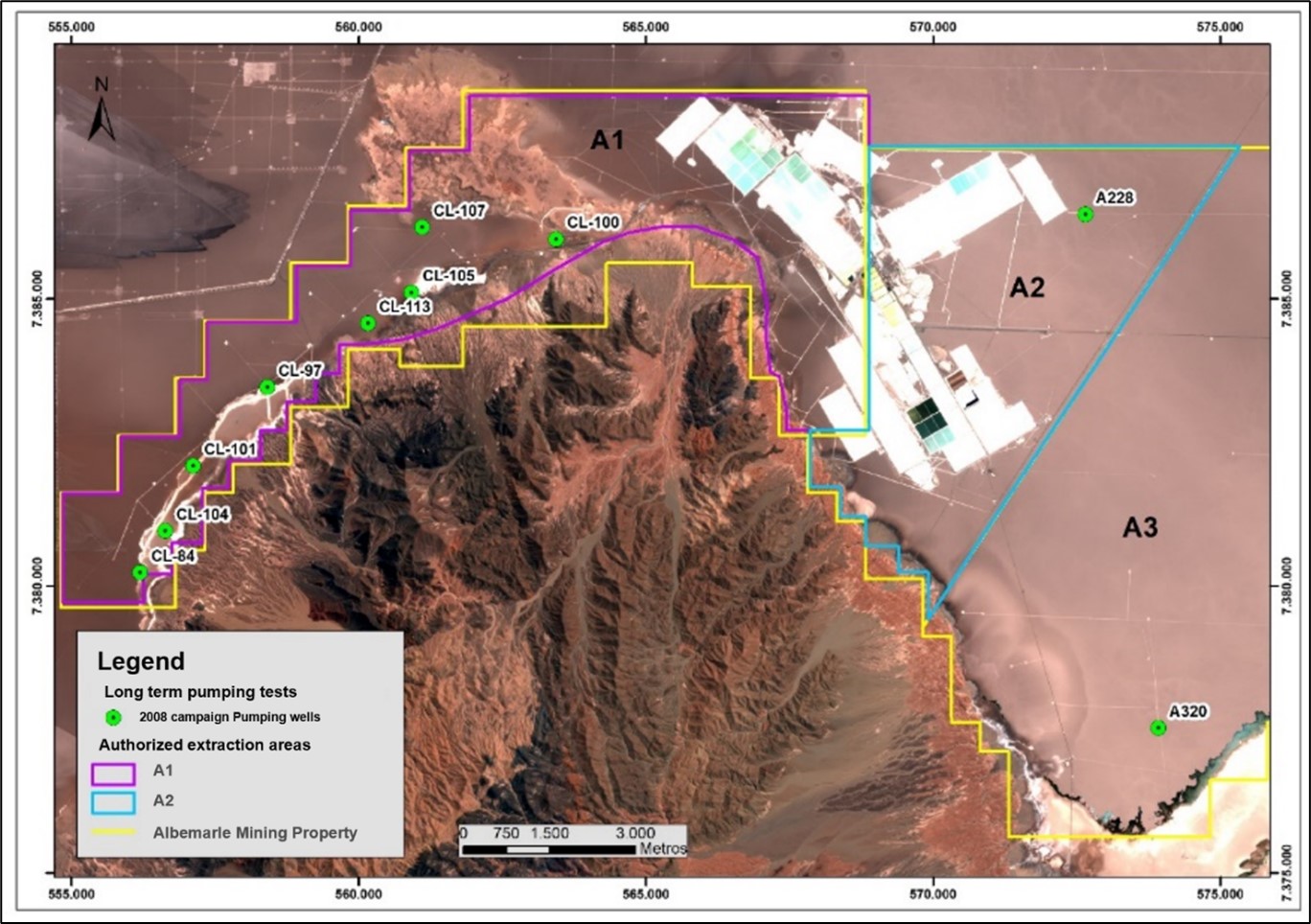

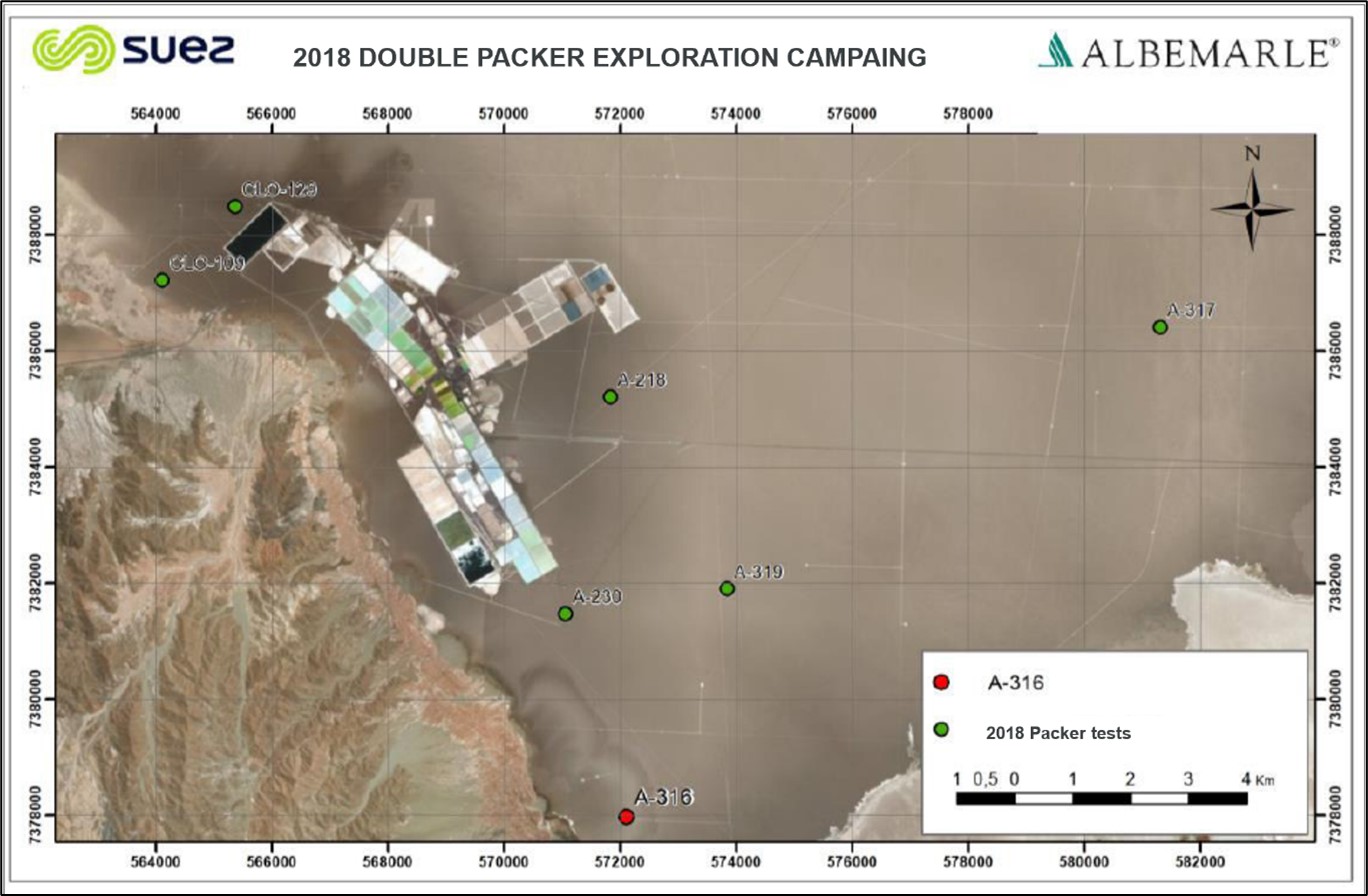

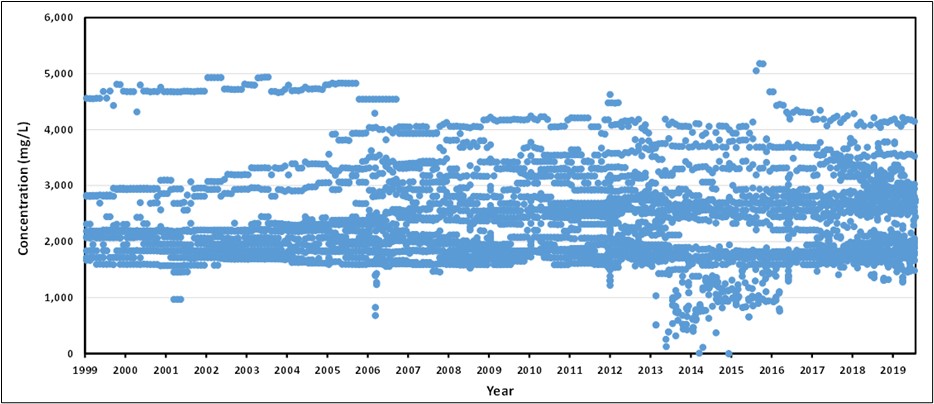

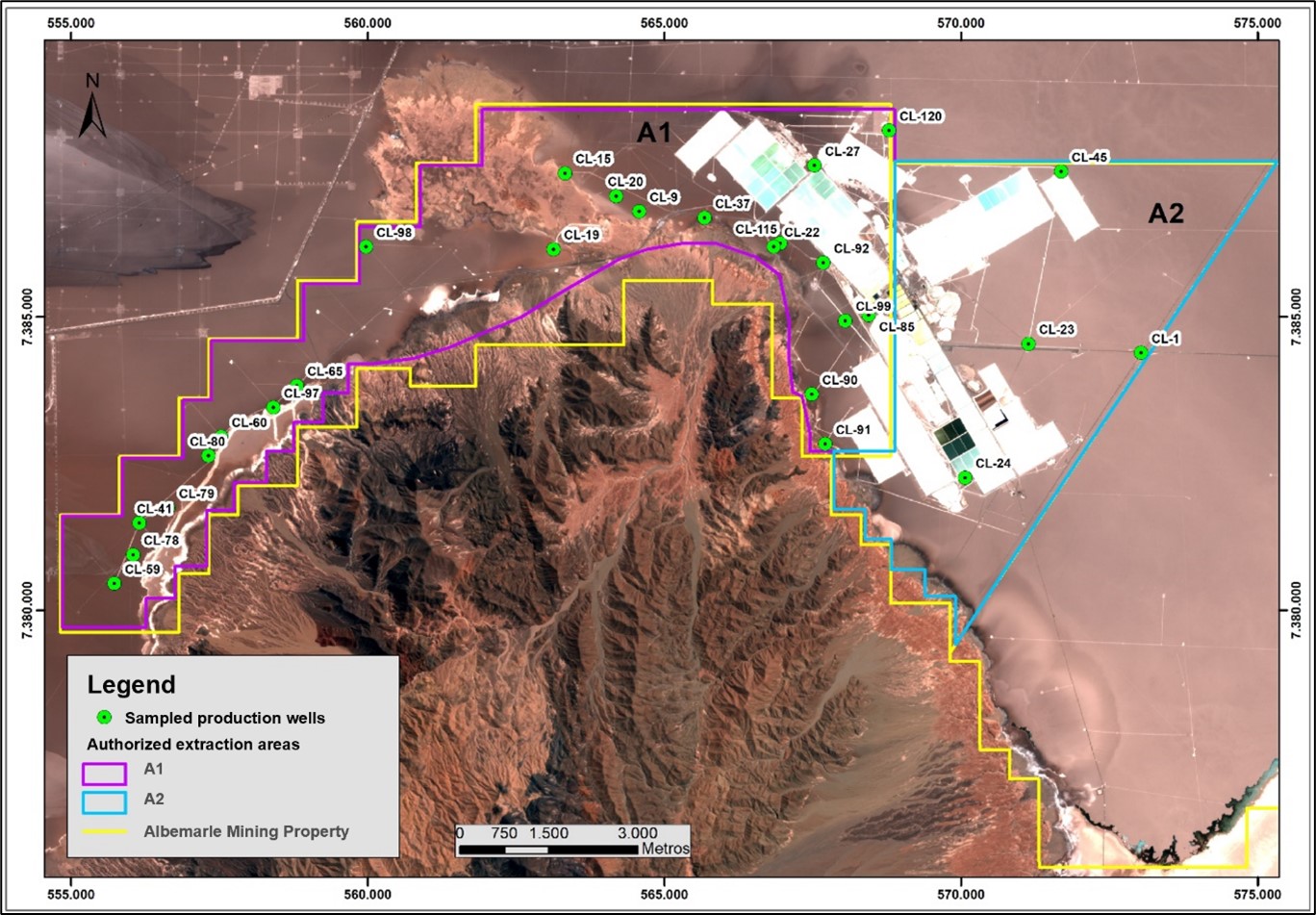

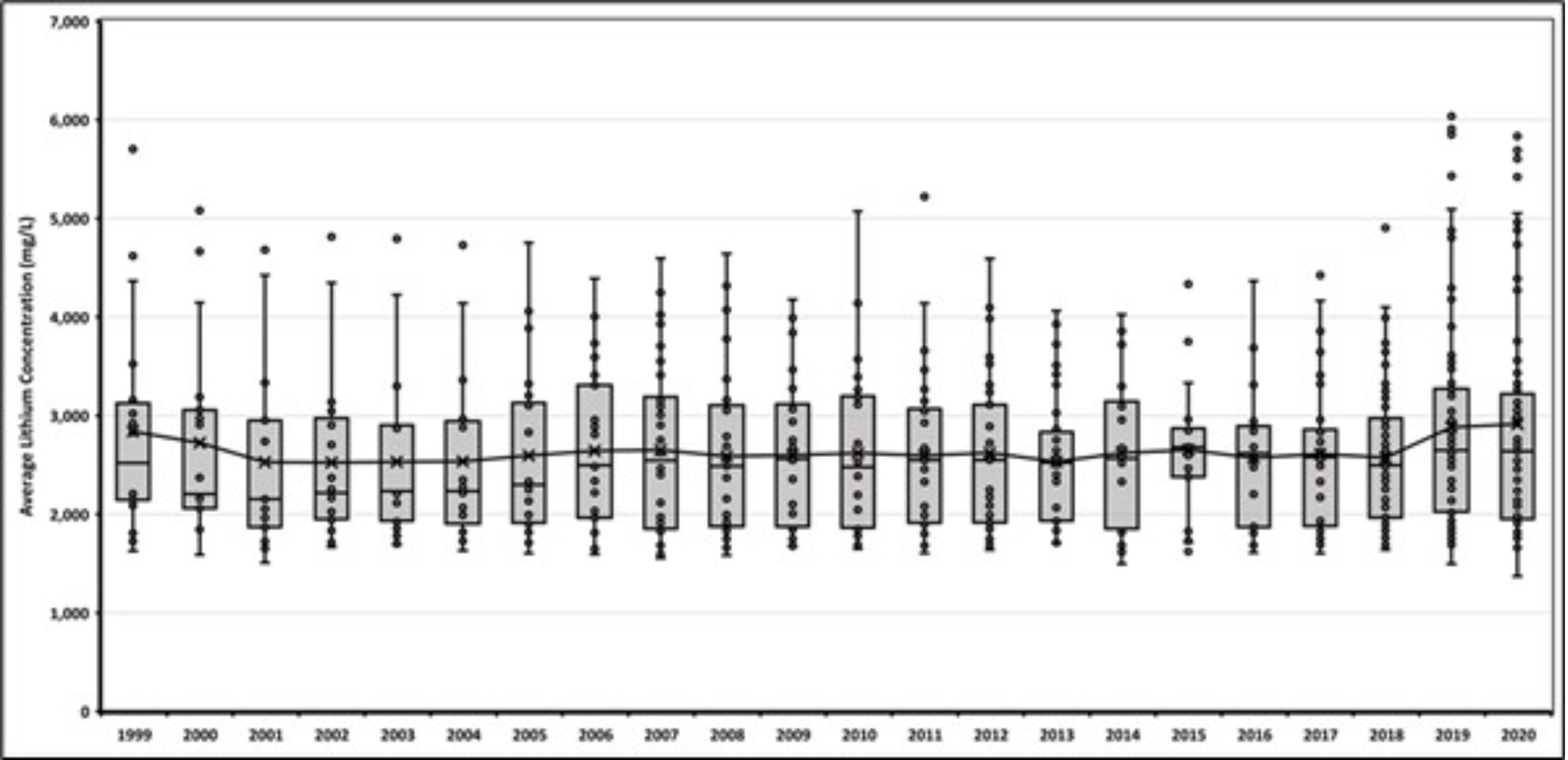

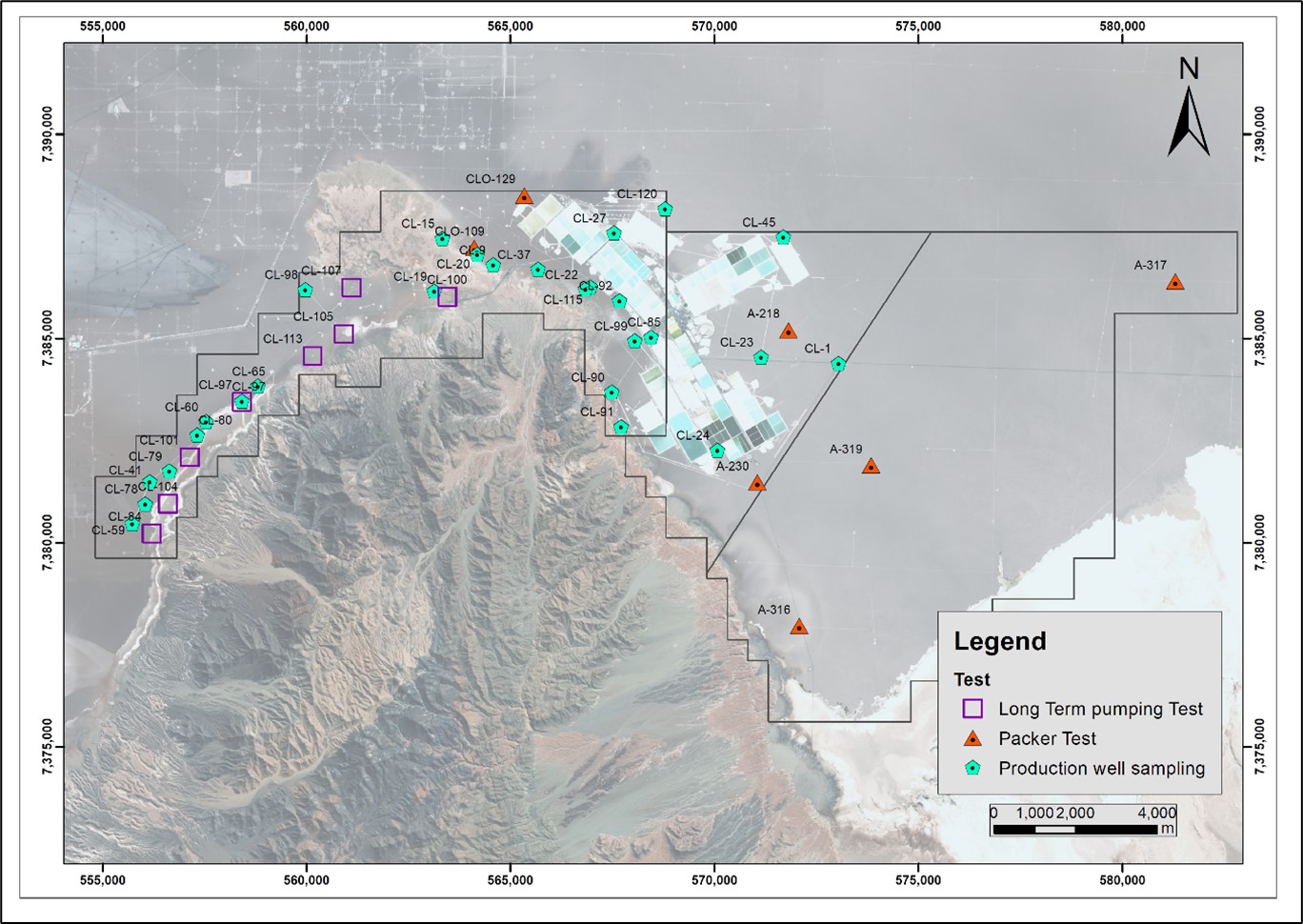

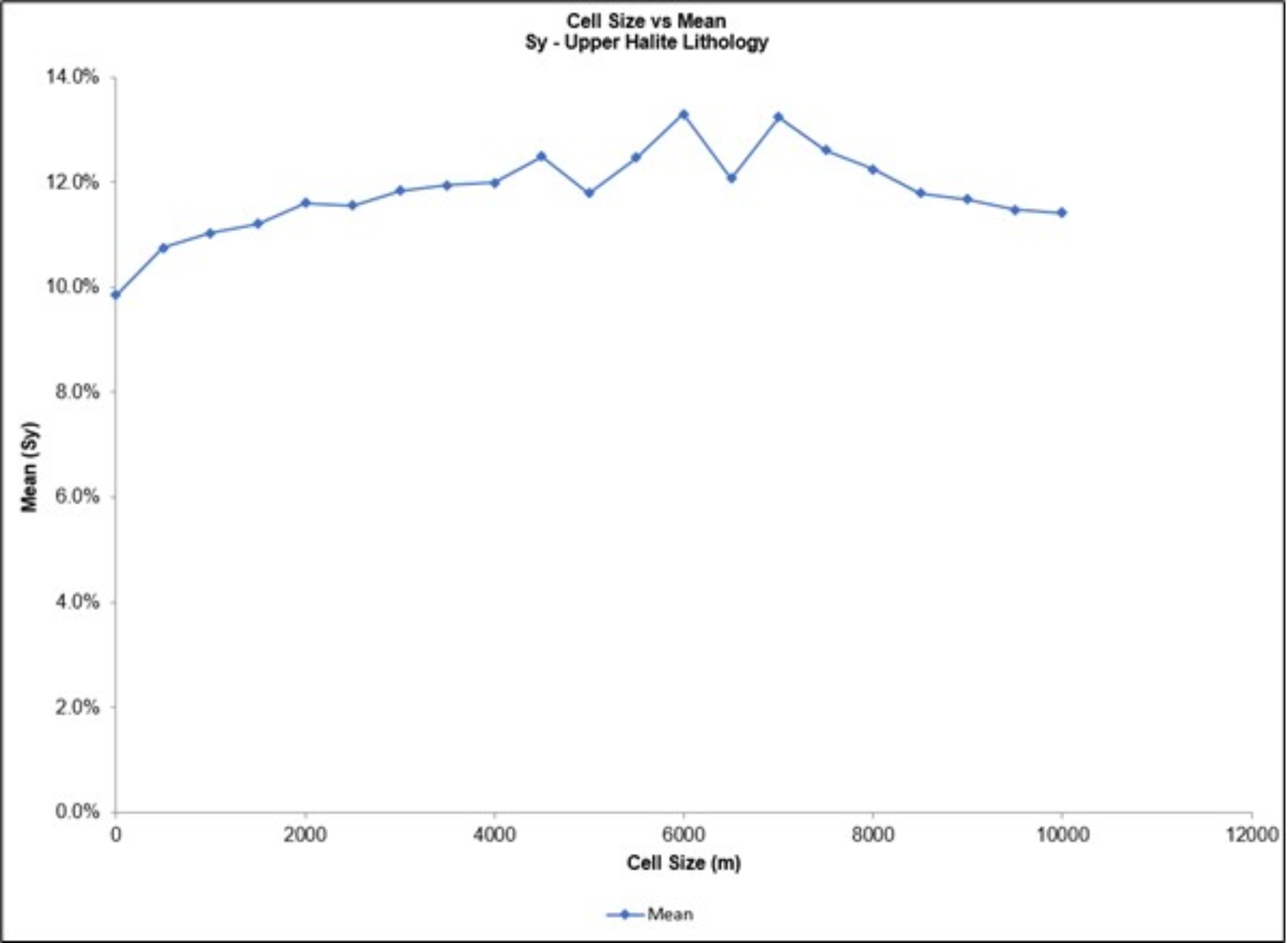

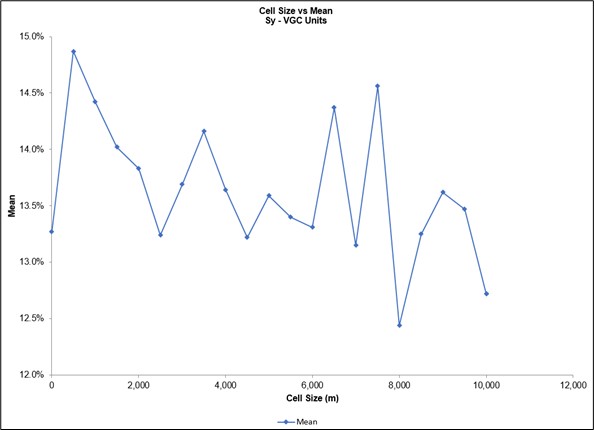

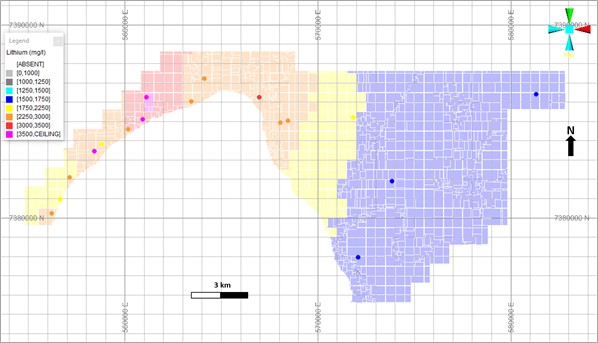

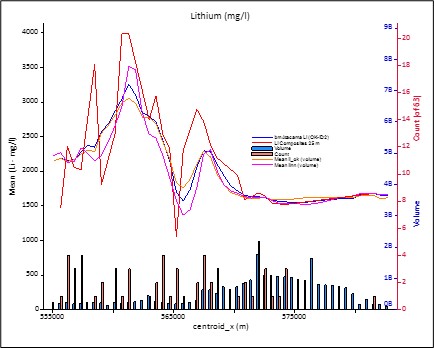

| 4,000-5,000 | 8% | 4,000-5,000 | 8% |