As filed with the Securities and Exchange Commission on January 26, 2023

Investment Company Act Registration No. 811-22538

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM N-1A

REGISTRATION STATEMENT

UNDER

THE INVESTMENT COMPANY ACT OF 1940

Amendment No. 114

(Check appropriate box or boxes)

ADVISERS INVESTMENT TRUST

(Exact name of registrant as specified in charter)

50 S. LaSalle Street

Chicago, Illinois 60603

(Address of principal executive offices) (Zip code)

Registrant’s Telephone Number, including Area Code: 866-638-5859

Barbara J. Nelligan

50 S. LaSalle Street

Chicago, Illinois 60603

With copy to:

Michael V. Wible

Thompson Hine LLP

41 South High Street, Suite 1700

Columbus, OH 43215-6101

This Amendment No. 114 to the Registration Statement on Form N-1A has been filed by the Registrant pursuant to Section 8(b) of the Investment Company Act of 1940, as amended (the “1940 Act”), with respect to shares of beneficial interest in its NTAM Treasury Assets Fund. Shares of beneficial interest in this Fund are not registered under the Securities Act of 1933 (the “1933 Act”), in accordance with Regulation D under the 1933 Act, as amended.

NTAM TREASURY ASSETS FUND

(TICKER: TAFXX)

PROSPECTUS

Dated January 28, 2023

You could lose money by investing in the Fund. Although the Fund seeks to preserve the value of your investment at $1.00 per share, the Fund cannot guarantee it will do so. An investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (“FDIC”), any other government agency, or The Northern Trust Company, its affiliates, subsidiaries or any other bank. The Fund’s sponsor has no legal obligation to provide financial support to the Fund, and you should not expect that the sponsor will provide financial support to the Fund at any time.

THE SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES OR PASSED UPON THE ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

NOTICE TO INVESTORS

THE FUND IS A SERIES OF ADVISERS INVESTMENT TRUST, WHICH IS REGISTERED AS AN INVESTMENT COMPANY UNDER THE INVESTMENT COMPANY ACT OF 1940, AS AMENDED (“1940 ACT”). THE SHARES OF THE NTAM TREASURY ASSETS FUND WHICH ARE DESCRIBED IN THIS PROSPECTUS HAVE NOT BEEN AND WILL NOT BE REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (“1933 ACT”), OR THE SECURITIES LAWS OF ANY OF THE STATES OF THE UNITED STATES. THE OFFERINGS CONTEMPLATED BY THIS PROSPECTUS WILL BE MADE IN RELIANCE UPON AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE 1933 ACT FOR OFFERS AND SALES OF SECURITIES WHICH DO NOT INVOLVE ANY PUBLIC OFFERING, AND ANALOGOUS EXEMPTIONS UNDER STATE SECURITIES LAWS. INVESTMENT IN THE FUND MAY BE MADE ONLY BY INDIVIDUALS OR ENTITIES THAT ARE “ACCREDITED INVESTORS” WITHIN THE MEANING OF REGULATION D UNDER THE 1933 ACT UPON THE TERMS AND CONDITIONS SPECIFIED IN THE FUND’S PROSPECTUS. THIS PROSPECTUS DOES NOT CONSTITUTE AN OFFER TO SELL, OR THE SOLICITATION OF AN OFFER TO BUY, ANY INTEREST IN THE FUND.

THIS PROSPECTUS SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR SHALL THERE BE ANY SALE OF SHARES OF THE NTAM TREASURY ASSETS FUND IN ANY JURISDICTION IN WHICH SUCH OFFER, SOLICITATION, OR SALE IS NOT AUTHORIZED OR TO ANY PERSON TO WHOM IT IS UNLAWFUL TO MAKE SUCH OFFER, SOLICITATION OR SALE. NO PERSON HAS BEEN AUTHORIZED TO MAKE ANY REPRESENTATIONS CONCERNING THE NTAM TREASURY ASSETS FUND THAT ARE INCONSISTENT WITH THOSE CONTAINED IN THIS PROSPECTUS. PROSPECTIVE INVESTORS SHOULD NOT RELY ON ANY INFORMATION NOT CONTAINED IN THIS PROSPECTUS.

THIS PROSPECTUS IS INTENDED SOLELY FOR THE USE OF THE PERSON TO WHOM IT HAS BEEN DELIVERED FOR THE PURPOSE OF EVALUATING A POSSIBLE INVESTMENT BY THE RECIPIENT IN THE SHARES OF THE NTAM TREASURY ASSETS FUND DESCRIBED HEREIN, AND IS NOT TO BE REPRODUCED OR DISTRIBUTED TO ANY OTHER PERSONS (OTHER THAN PROFESSIONAL ADVISERS OF THE PROSPECTIVE INVESTOR RECEIVING THIS DOCUMENT).

PROSPECTIVE INVESTORS SHOULD NOT CONSTRUE THE CONTENTS OF THIS PROSPECTUS AS LEGAL, TAX, OR FINANCIAL ADVICE. EACH PROSPECTIVE INVESTOR SHOULD CONSULT HIS OR HER OWN PROFES- SIONAL ADVISERS AS TO THE LEGAL, TAX, FINANCIAL, OR OTHER MATTERS RELEVANT TO THE SUITABILITY OF AN INVESTMENT IN THE NTAM TREASURY ASSETS FUND FOR SUCH INVESTOR.

IN MAKING AN INVESTMENT DECISION INVESTORS MUST RELY ON THEIR OWN EXAMINATION OF THE ISSUER AND THE TERMS OF THE OFFERING, INCLUDING THE MERITS AND RISKS INVOLVED. THESE SECURITIES HAVE NOT BEEN RECOMMENDED BY ANY FEDERAL OR STATE SECURITIES COMMISSION OR REGULATORY AUTHORITY. FURTHERMORE, THE FOREGOING AUTHORITIES HAVE NOT CONFIRMED THE ACCURACY OR DETERMINED THE ADEQUACY OF THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

THESE SECURITIES ARE SUBJECT TO SUBSTANTIAL RESTRICTIONS ON TRANSFERABILITY AND RESALE AND MAY NOT BE TRANSFERRED OR RESOLD EXCEPT AS PERMITTED UNDER THE DECLARATION OF TRUST OF ADVISERS INVESTMENT TRUST, THE 1933 ACT AND APPLICABLE STATE SECURITIES LAWS, PURSUANT TO REGISTRATION OR EXEMPTION THEREFROM.

PROSPECTIVE INVESTORS ARE URGED TO READ THIS PROSPECTUS CAREFULLY BEFORE INVESTING.

i

| 1 | ||||

| Additional Information on the Fund’s Investment Objective, Strategy, and Risks |

5 | |||

| 5 | ||||

| 5 | ||||

| 6 | ||||

| 8 | ||||

| 8 | ||||

| 8 | ||||

| 8 | ||||

| Administrator, Fund Accounting Agent, Transfer Agent, Custodian and Placement Agent |

9 | |||

| 9 | ||||

| 9 | ||||

| 10 | ||||

| 11 | ||||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| 15 | ||||

| 15 |

| Back Cover |

ii

Investment Objective

The NTAM Treasury Assets Fund (the “Fund”) seeks to maximize current income to the extent consistent with the preservation of capital and maintenance of liquidity by investing its net assets, under normal market conditions, exclusively in United States (“U.S.”) Treasury securities and related repurchase agreements and other securities that limit their investments to, or are backed by, U.S. Treasury securities.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy, hold, and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

Annual Fund Operating Expenses (Expenses that you pay each year as a percentage of the value of your investment)

| NTAM Treasury Assets Fund | ||||

| Management Fee |

0.11 | % | ||

| Other Expenses |

0.02 | % | ||

| Total Annual Fund Operating Expenses |

0.13 | % | ||

| Fee Waivers and Reimbursements1 |

(0.03 | )% | ||

| Total Annual Fund Operating Expenses After Fee Waivers and Reimbursement |

0.10 | % | ||

| 1 | Northern Trust Investments, Inc. (“NTI” or the “Adviser”) has contractually agreed to waive fees and/or reimburse expenses to limit Total Annual Fund Operating Expenses (excluding the compensation paid to each Independent Trustee of Advisers Investment Trust (the “Trust”), expenses associated with each Independent Trustee’s attendance at Board of Trustees meetings and other Trust related travel, expenses of third party consultants engaged by the Board of Trustees, membership dues paid to the Investment Company Institute and Mutual Fund Directors Forum, brokerage costs, interest, taxes, dividends, litigation and indemnification expenses, expenses associated with investments in underlying investment companies, and extraordinary expenses) to 0.10% of the average daily net assets of the Fund until January 28, 2024. If it becomes unnecessary for the Adviser to waive fees or make reimbursements, the Adviser may recapture any of its prior waivers or reimbursements for a period not to exceed three years from the date on which the waiver or reimbursement was made to the extent that such a recapture does not cause the Total Annual Fund Operating Expenses (excluding the compensation paid to each Independent Trustee of the Trust, expenses associated with each Independent Trustee’s attendance at Board of Trustees meetings and other Trust related travel, expenses of third party consultants engaged by the Board of Trustees, membership dues paid to the Investment Company Institute and Mutual Fund Directors Forum, brokerage costs, interest, taxes, dividends, litigation and indemnification expenses, expenses associated with investments in underlying investment companies, and extraordinary expenses) to exceed the current expense limitation or the applicable expense limitation that was in effect at the time of the waiver or reimbursement. The agreement to waive fees and/or reimburse expenses automatically renews annually from year to year on the effective date of each subsequent annual update to the Fund’s registration statement, until such time as the Adviser provide written notice of non-renewal and will terminate automatically upon termination of the investment advisory agreement. |

Principal Investment Strategy

The Fund seeks to achieve its investment objective by investing, under normal circumstances, its total assets exclusively (and at least 99.5%) in:

| • | Cash; |

| • | Short-term bills, notes, including floating rate notes, and other obligations issued or guaranteed by the U.S. Treasury (“Treasury Obligations”); and |

| • | Repurchase agreements collateralized fully by cash or Treasury Obligations. |

The Fund, under normal circumstances, will invest at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in Treasury Obligations and repurchase agreements collateralized solely by Treasury Obligations.

The Fund operates as a “government money market fund” pursuant to Rule 2a-7 under the Investment Company Act of 1940, as amended (the “1940 Act”). As a “government money market fund” under Rule 2a-7, the Fund (i) is permitted to use the amortized cost method of valuation to seek to maintain a stable net asset value (“NAV”) of $1.00 share price, and (ii) is not

1

required to impose a liquidity fee and/or a redemption gate on fund redemptions that might apply to other types of money market funds should certain triggering events specified in Rule 2a-7 occur.

The U.S. Securities and Exchange Commission (the “SEC”) imposes strict requirements on the investment quality, maturity, diversification, and liquidity of the Fund’s investments. Accordingly, the Fund’s investments must have a remaining maturity of no more than 397 days and present minimal credit risks to the Fund. The Fund’s Adviser may consider, among other things, credit, interest rate, and payment risks as well as general market conditions when deciding whether to buy or sell investments for the Fund.

Principal Investment Risks

All investments carry a certain amount of risk, and the Fund cannot guarantee that it will achieve its investment objective. You could lose money by investing in the Fund. Although the Fund seeks to preserve the value of your investment at $1.00 per share, the Fund cannot guarantee it will do so. An investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (the “FDIC”), any other government agency, or The Northern Trust Company, its affiliates, subsidiaries or any other bank. The Fund’s sponsor has no legal obligation to provide financial support to the Fund, and you should not expect that the sponsor will provide financial support to the Fund at any time. Below are the main risks of investing in the Fund. All of the risks listed below are material to the Fund, regardless of the order in which they appear.

U.S. Government Securities Risk. U.S. government securities are subject to market risk, interest rate risk, and credit risk. Securities backed by the full faith and credit of the U.S. are guaranteed only as to the timely payment of interest and principal when held to maturity and the market prices for such securities may fluctuate. Notwithstanding that these securities are backed by the full faith and credit of the U.S., circumstances could arise that would prevent the payment of interest or principal, which could result in losses to the Fund.

Credit (Or Default) Risk. The risk that the inability or unwillingness of an issuer or guarantor of a fixed-income security, or a counterparty to a repurchase or other transaction, to meet its payment or other financial obligations will adversely affect the value of the Fund’s investments and its returns. Changes in the credit rating of a debt security or of the issuer of a debt security held by the Fund could have a similar effect. The Fund could also be delayed or hindered in its enforcement of rights against an issuer, guarantor, or counterparty.

Floating Rate Notes Risk. The risk that securities with variable or floating rates can be less sensitive to interest rate changes than securities with fixed interest rates, but may decline in value and negatively impact the Fund, particularly if changes in prevailing interest rates are more frequent or sudden than the rate changes for the variable or floating rate securities, which only occur periodically. Although variable and floating rate securities are less sensitive to interest rate risk than fixed-rate securities, they are subject to greater liquidity risk, credit risk and default risk, which could impede their value.

Income Risk. The risk that the Fund’s ability to distribute income to shareholders depends on the yield available from the Fund’s investments. Falling interest rates will cause the Fund’s income to decline. Income risk is generally higher for short-term debt securities.

Interest Rate Risk. The risk that during periods of rising interest rates, the Fund’s yield (and the market value of its securities) will tend to be lower than prevailing market rates; in periods of falling interest rates, the Fund’s yield (and the market value of its securities) will tend to be higher. If interest rates rise, the Fund’s yield may not increase proportionately. Changing interest rates may have unpredictable effects on the markets and the Fund’s investments. A low or negative interest rate environment could cause the Fund’s earnings to fall below the Fund’s expense ratio, resulting in in a low or negative yield and a decline in the Fund’s share price. A general rise in interest rates may cause investors to move out of fixed income securities on a large scale, which would adversely affect the price and liquidity of fixed income securities and could also result in increased redemptions for the Fund. Fluctuations in interest rates may also affect the liquidity of fixed income securities and instruments held by the Fund.

Large Shareholder Risk. The risk that the Fund may experience adverse effects when certain large shareholders purchase or redeem large amounts of shares of the Fund. Such large shareholder redemptions, which may occur rapidly and unexpectedly, may negatively impact its liquidity and/or net asset value, lead to an increase in the Fund’s expense ratio due to expenses being allocated over a smaller asset base, and adversely affect the Fund’s performance to the extent that the Fund is delayed in investing new cash and is required to maintain a larger cash position than it ordinarily would.

Management Risk. The Adviser’s judgments about the attractiveness, value, and potential appreciation of a particular asset class or individual security in which the Fund invests may prove to be incorrect, and there is no guarantee that individual securities will perform as anticipated.

2

Market Risk. The risk that general market conditions, such as real or perceived adverse economic or political conditions, inflation, changes in interest rates, lack of liquidity in the bond markets, disruptions to business operations and supply chains, staffing shortages, or adverse investor sentiment could cause the value of your investment in the Fund, or its yield, to decline. The market value of the securities in which the Fund invests may go up or down in response to the prospects of particular sectors or governments, general economic conditions, and/or other events (such as pandemics, terrorism, etc.) throughout the world due to increasingly interconnected global economies and financial markets. Political events, including armed conflict, tariffs and economic sanctions also contribute to market volatility.

Regulatory Risk. Changes in the laws or regulations of the United States or other countries, including any changes to applicable tax laws and regulations, could impair the ability of the Fund to achieve its investment objective and could increase the operating expenses of the Fund.

Repurchase Agreement Risk. A repurchase agreement is subject to the risk that the seller may fail to repurchase the security. In the event of a bankruptcy or other default by the seller of a repurchase agreement, the Fund could experience delays in liquidating the underlying security and losses in the event of a decline in the value of the underlying security while the Fund is seeking to enforce its rights under the repurchase agreement.

Stable NAV Risk. The risk that the Fund will not be able to maintain a NAV per share of $1.00 at all times. A significant enough market disruption or drop in market prices of securities held by the Fund, especially at a time when the Fund needs to sell securities to meet shareholder redemption requests, could cause the value of the Fund’s shares to decrease to a price less than $1.00 per share. If the Fund fails to maintain a stable NAV (or if there is a perceived threat of such a failure), the Fund could be subject to increased redemption activity, which could adversely affect the Fund’s NAV.

Performance Information

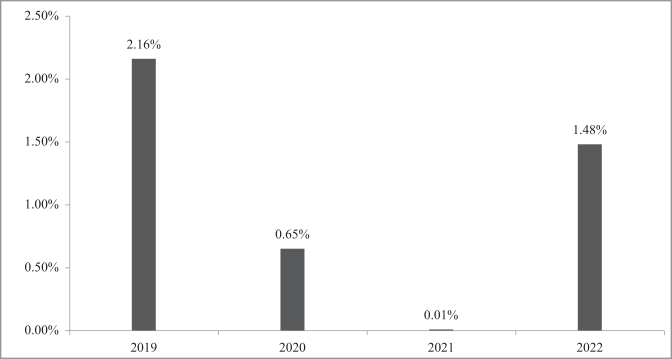

The following bar chart and table show the performance of the Fund and provide some indication of the risks of an investment in the Fund by comparing the Fund’s performance with a broad measure of market performance. Of course, the Fund’s past performance is not necessarily an indication of its future performance. Updated performance information is available by visiting www.northerntrust.com/ntam-treasury-assets-fund or by calling 855-351-4583 (toll free).

Annual Total Return year ended December 31

| Best Quarter: |

4Q 2022 | 0.81 | % | |||||

| Worst Quarter: |

2Q 2021 | 0.00 | % |

The Fund’s fiscal year end is September 30. The Fund’s most recent quarterly return (since the end of the last fiscal year) through December 31, 2022 was 0.81%.

3

Average Annual Total Returns for the Period Ended December 31, 2022

| 1 Year | Since Inception* |

|||||||

| Return Before Taxes |

1.48% | 1.21% | ||||||

| * | The Fund commenced operations on April 4, 2018. |

The 7-day yield of the Fund as of December 31, 2022 was 3.87%.

Portfolio Management

Investment Adviser

Northern Trust Investments, Inc. (“NTI” or the “Adviser”), a subsidiary of Northern Trust Corporation, serves as the investment adviser to the Fund. The Northern Trust Company, an affiliate of NTI, serves as administrator and fund accounting agent, transfer agent, and custodian to the Fund.

Buying and Selling Fund Shares

Shares of the Fund are offered by the Trust on a private placement basis in accordance with Regulation D under the 1933 Act only to certain Northern Trust Corporate and Institutional Services clients and their affiliated entities, all of whom qualify as “Accredited Investors,” as defined in Rule 501 of Regulation D. “Accredited Investors” include, but are not limited to, certain banks, broker-dealers, insurance companies, investment companies, governmental plans, employee benefit plans, corporations, partnerships, and business trusts (“Institutions”).

Institutions who are Northern Trust Corporate and Institutional Services clients may purchase or sell (redeem) Fund shares by phone or by contacting your Northern Trust account representative.

Minimum Initial Investment

The Fund’s minimum investment requirement is $5 billion. Such investment requirement may be determined by aggregating an Institution’s related or affiliated accounts invested in the Fund. The Trust reserves the right to waive the Fund’s minimum investment requirement. There is no minimum for additional investments in the Fund.

To Buy or Sell Shares:

NTAM Treasury Assets Fund

c/o The Northern Trust Company

P.O. Box 4766

Chicago, IL 60680-4766

Telephone: 855-351-4583 (toll free)

You can buy or sell shares of the Fund on any day that the Federal Reserve Bank of New York (the “New York Fed”) is open for business that is not a day the Securities Industry and Financial Markets Association (“SIFMA”) recommends the bond market be closed (individually, a “Business Day”, and collectively “Business Days”). SIFMA may recommend that the bond market be closed on additional days as determined by market events, but the current SIFMA recommended holiday schedule is as follows: New Year’s Day, Martin Luther King, Jr. Day, Presidents’ Day, Good Friday, Memorial Day, Juneteenth National Independence Day, Independence Day, Labor Day, Columbus Day, Veterans Day, Thanksgiving Day and Christmas Day. In the event that the New York Fed is not open or SIFMA does not recommend that the bond market be open because of an emergency or unusual event, the Trust may, but is not required to, open the Fund for purchase and redemption transactions if the Federal Reserve wire payment system is open. To learn whether the Fund is open for business during an emergency situation or unusual event, please call 855-351-4583.

Dividends, Capital Gains, and Taxes

The Fund’s distributions are generally taxable to you as ordinary income, capital gains, or a combination of the two, unless you are investing through a tax-exempt or tax-deferred arrangement, such as a 401(k) plan or an individual retirement account. Distributions may be taxable upon withdrawal from tax-deferred accounts.

4

Additional Information on the Fund’s Investment Objective, Strategy, and Risks

The Fund seeks to maximize current income to the extent consistent with the preservation of capital and maintenance of liquidity by investing its net assets, under normal market conditions, exclusively in U.S. Treasury securities and related repurchase agreements and other securities that limit their investments to, or are backed by, U.S. Treasury securities.

The investment objective of the Fund may be changed by the Trust’s Board of Trustees without shareholder approval. Shareholders will, however, be notified of any changes. Any such change may result in the Fund having an investment objective different from the objective that the shareholder considered appropriate at the time of investment in the Fund.

During extraordinary market conditions and interest rate environments, all or any portion of the assets of the Fund may be uninvested. Uninvested assets do not generate income. The Fund may not achieve its investment objective during this time.

All investments carry some degree of risk that will affect the value of the Fund, its yield, and investment performance and the price of its shares. An investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the FDIC, any other government agency or Northern Trust, its affiliates, subsidiaries, or any other bank.

Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund.

This section takes a closer look at some of the Fund’s principal investment strategies and related risks as well as information about additional risks and techniques that the Fund may employ in pursuing its investment objective.

The Fund:

| • | Limits its dollar-weighted average portfolio maturity to 60 days or less; |

| • | Limits its dollar-weighted average portfolio maturity without regard to maturity shortening provisions applicable to variable and floating rate securities (also known as dollar-weighted average portfolio life) to 120 days or less; |

| • | Buys securities with remaining maturities of 397 days or less or securities otherwise permitted to be purchased because of maturity shortening provisions under Rule 2a-7; and |

| • | Invests only in U.S. dollar-denominated securities that represent minimal credit risks. |

The Fund is required to comply with SEC requirements with respect to the liquidity of the Fund’s investments. Specifically, the Fund will not acquire any security other than a daily liquid asset unless, immediately following such purchase, at least 10% of its total assets would be invested in “daily liquid assets”. The Fund will not acquire any security other than a weekly liquid asset unless, immediately following such purchase, at least 30% of its total assets would be invested in “weekly liquid assets.”

For these purposes, daily and weekly liquid assets are calculated as of the end of each Business Day. Daily liquid assets include: cash; direct obligations of the U.S. government; securities that will mature or are subject to a demand feature that is exercisable and payable within one Business Day; and amounts receivable and due unconditionally within one Business Day on pending sales of Fund securities. Weekly liquid assets include: cash; direct obligations of the U.S. government; certain U.S. government agency discount notes without provision for the payment of interest with remaining maturities of 60 days or less; securities that will mature or are subject to a demand feature that is exercisable and payable within five Business Days; and amounts receivable and due unconditionally within five Business Days on pending sales of Fund securities.

In addition, the Fund limits its investments to “Eligible Securities”, which are defined in Rule 2a-7 as securities that have a remaining maturity of no more than 397 calendar days (unless otherwise permitted under Rule 2a-7), and which (i) have been determined by the Fund’s Board of Trustees (or the Adviser if the Board of Trustees delegates such power to the Adviser) to present minimal credit risks to the Fund; (ii) are issued by other investment companies that are money market funds; or (iii) are U.S. government securities. In making this determination, the Adviser considers several factors including the capacity of each security’s issuer or guarantor to meet its financial obligations.

In accordance with current SEC regulations, the Fund generally will not invest more than: (i) 5% of the value of its total assets at the time of purchase in the securities of any single issuer (and certain affiliates of that issuer); and (ii) 10% of the value of its total assets at the time of purchase in the securities subject to demand features or guarantees of any single

5

institution. The Fund may, however, invest up to 25% of its total assets in the securities of a single issuer for up to three Business Days. These limitations do not apply to cash, certain repurchase agreements, U.S. government securities or securities of other investment companies that are money market funds. In addition, securities subject to demand features and guarantees as defined by the SEC are subject to different diversification requirements as described in the Statement of Additional Information (“SAI”).

Securities in which the Fund may invest may not earn as high a level of income as long-term or lower quality securities, which generally have greater market risk and more fluctuation in market value.

Any investment in the Fund is subject to investment risks, including the possible loss of the principal amount invested. Below is a more detailed discussion of the principal risks outlined in the Fund Summary Section of this Prospectus as well as information about additional investment strategies, risks, and techniques that the Fund may employ in pursuing its investment objective.

U.S Government Securities Risk. The Fund invests in short-term bills, notes and other obligations issued or guaranteed by the U.S. Treasury. U.S. government securities are subject to market risk, interest rate risk and credit risk. Securities, such as those issued or guaranteed by the Government National Mortgage Association (Ginnie Mae) or the U.S. Treasury, that are backed by the full faith and credit of the United States, are guaranteed only as to the timely payment of interest and principal when held to maturity and the market prices for such securities will fluctuate. Notwithstanding that these securities are backed by the full faith and credit of the United States, circumstances could arise that would prevent the payment of interest or principal. This would result in losses to the Fund.

To the extent the Fund invests in debt instruments or securities of non-U.S. government entities that are backed by the full faith and credit of the United States, pursuant to the FDIC Debt Guarantee Program or other similar programs, there is a possibility that the guarantee provided under the Debt Guarantee Program or other similar programs may be discontinued or modified at a later date.

Floating rate public obligations of the U.S. Treasury (“Floating Rate Notes” or “FRNs”) have interest rates that adjust periodically. FRNs’ floating interest rates may be higher or lower than the interest rates of fixed-rate bonds of comparable quality with similar maturities. Securities with floating rates can be less sensitive to interest rate changes than securities with fixed interest rates, but may decline in value and negatively impact the Fund, particularly if changes in prevailing interest rates are more frequent or sudden than the rate changes for the FRNs, which only occur periodically.

Credit (or Default) Risk. The risk that an issuer of fixed-income securities held by the Fund may default on its obligation to pay interest and repay principal. Lower quality securities generally have a greater the risk that the issuer of the security will default on its obligation. High quality securities are generally believed to have relatively low degrees of credit risk. The Fund intends to enter into financial transactions with counterparties that are creditworthy at the time of the transactions. There is always the risk that the Adviser’s analysis of creditworthiness is incorrect or may change due to market conditions. To the extent that the Fund focuses its transactions with a limited number of counterparties, it will be more susceptible to the risks associated with one or more counterparties.

Floating Rate Notes Risk. The risk that securities with floating rates can be less sensitive to interest rate changes than securities with fixed interest rates, but may decline in value and negatively impact the Fund, particularly if changes in prevailing interest rates are more frequent or sudden than the rate changes for the floating rate notes, which only occur periodically. Although floating rate notes are less sensitive to interest rate risk than fixed-rate securities, they are subject to credit risk and default risk, which could impede their value.

Income Risk. The risk that falling interest rates will cause the Fund’s income to decline. Income risk is generally higher for short-term debt securities.

Interest Rate Risk. The Fund’s yield will vary with changes in interest rates. During periods of rising interest rates, the Fund’s yield (and the market value of its securities) will tend to be lower than prevailing market rates; in periods of falling interest rates, the Fund’s yield (and the market value of its securities) will tend to be higher. In a period of rising interest rates, the Fund’s yield may not rise as quickly as the yields of certain other short-term investments. Investments held by the Fund with longer maturities will tend to be more sensitive to interest rate changes than investments with shorter maturities. If interest rates rise, the Fund’s yields may not increase proportionately. The risks associated with increasing interest rates are heightened given that interest rates recently were at historic lows and are expected to increase in the future with unpredictable effects on the markets and the Fund’s investments. A low interest rate environment may prevent the Fund from providing a positive yield or paying Fund expenses out of Fund assets and could lead to a decline in the Fund’s share price.

6

Additionally, securities issued or guaranteed by the U.S. government, its instrumentalities and sponsored enterprises have historically involved little risk of loss of principal if held to maturity. However, due to fluctuations in interest rates, the market value of such securities held by the Fund may vary.

Large Shareholder Transactions Risk. The Fund may experience adverse effects when certain large shareholders purchase or redeem large amounts of shares of the Fund. Such large shareholder redemptions may cause the Fund to sell its securities at times when it would not otherwise do so, which may negatively impact the Fund’s liquidity. In addition, a large redemption could result in the Fund’s current expenses being allocated over a smaller asset base, leading to an increase in the Fund’s expense ratio. Similarly, large share purchases may adversely affect the Fund’s performance to the extent that the Fund is delayed in investing new cash and is required to maintain a larger cash position than it ordinarily would.

Management Risk. The Adviser’s reliance on its strategy and its judgments about the value and potential appreciation securities in which the Fund invests may prove to be incorrect, including the Adviser’s tactical allocation of the Fund’s portfolio among its investments. The ability of the Fund to meet its investment objective is directly related to the Adviser’s proprietary investment process. The Adviser’s assessment of the relative value of securities, their attractiveness and potential appreciation of particular investments in which the Fund invests may prove to be incorrect and there is no guarantee that the Adviser’s investment strategy will produce the desired results.

Market Risk. The risk that general market conditions, such as real or perceived adverse economic or political conditions, inflation, changes in interest rates, lack of liquidity in the bond markets or adverse investor sentiment could cause the value of your investment in the Fund, or its yield, to decline. The market value of the securities in which the Fund invests may go up or down in response to the prospects of particular sectors or governments, natural disasters, pandemics (including COVID-19), epidemics, terrorism, climate change or climate-related events, regulatory events, governmental or quasi-governmental actions, and/or general economic conditions throughout the world due to increasingly interconnected global economies and financial markets.

Regulatory Risk. Regulatory authorities in the U.S. or other countries may restrict the ability of the Fund to fully implement its strategy and could increase the operating expenses of the Fund. Policy and legislative changes in the United States and in other countries may also contribute to decreased liquidity and increased volatility in the financial markets.

Repurchase Agreements. Agreements by the Fund to purchase securities subject to the seller’s agreement to repurchase them at a mutually agreed upon date and price are known as “repurchase agreements”. Repurchase agreements may be considered to be loans under the 1940 Act. The Fund may enter into repurchase agreements with domestic and foreign financial institutions such as banks and broker-dealers that are deemed to be creditworthy by the Adviser. Although the securities subject to a repurchase agreement may have maturities exceeding one year, settlement of the agreement generally will not be more than one year after the Fund acquires the securities and normally will be within a shorter period of time. In the event of a default, the Fund will suffer a loss to the extent that the proceeds from the sale of the underlying securities and other collateral, due to adverse market action or delays in selling underlying securities, are less than the repurchase price. The Fund also will the bear costs associated with delay and enforcement of the repurchase agreement. In addition, in the event of bankruptcy or insolvency, the Fund could suffer additional losses if a court determines that the Fund’s interest in the collateral is unenforceable by the Fund. The Fund intends to enter into transactions with counterparties that are creditworthy at the time of the transactions. There is always the risk that the Adviser’s analysis of creditworthiness is incorrect or may change due to market conditions. To the extent that the Fund focuses its transactions with a limited number of counterparties, it will be more susceptible to the risks associated with one or more counterparties. If the Fund allows the seller to assign its repurchase obligations to a central clearing organization, the Fund will be subject to that organization’s rule, which may limit the Fund’s rights and remedies, and may be exposed to the risk of that organization’s insolvency.

If the Fund enters into a repurchase agreement with a foreign financial institution, it may be subject to the same risks associated with foreign investments. Unlike repurchase agreements with domestic financial institutions, in the event of default by the counterparty in a foreign repurchase agreement, the Fund may be unable to successfully assert a claim to the collateral under foreign laws. As a result, foreign repurchase agreements may involve higher credit risks than repurchase agreements with domestic financial institutions. Moreover, certain countries have less developed and less regulated banking and auditing, accounting and financial reporting systems than the United States. In addition, repurchase agreements with foreign financial institutions, particularly those located in emerging markets, may involve foreign financial institutions or counterparties with lower credit ratings than domestic financial institutions.

Stable NAV Risk. The risk that the Fund will not be able to maintain a NAV per share of $1.00 at all times. A significant enough market disruption or drop in market prices of securities held by the Fund, especially at a time when the Fund needs to sell securities to meet shareholder redemption requests, could cause the value of the Fund’s shares to decrease to a price less than $1.00 per share. The U.S. government may take numerous steps to alleviate these market concerns, including without

7

limitation, acquiring ownership interests in distressed institutions. However, there is no assurance that such actions will be successful. Continuing market problems and government intervention in the economy may adversely affect the Fund.

A description of the Fund’s policies and procedures with respect to the disclosure of the portfolio holdings is available in the SAI.

With the increased use of the Internet and because information technology (“IT”) systems and digital data underlie most of the Fund’s operations, the Fund and its Adviser, custodian, transfer agent, placement agent, and other service providers and the financial intermediaries of each (collectively “Service Providers”) are exposed to the risk that their operations and data may be compromised as a result of internal and external cyber-failures, breaches or attacks (“Cyber Risk”). This could occur as a result of malicious or criminal cyber-attacks. Cyber-attacks include actions taken to: (i) steal or corrupt data maintained online or digitally, (ii) gain unauthorized access to or release confidential information, (iii) shut down the Fund or Service Provider website through denial-of-service attacks, or (iv) otherwise disrupt normal business operations. However, events arising from human error, faulty or inadequately implemented policies and procedures or other systems failures unrelated to any external cyber-threat may have effects similar to those caused by deliberate cyber-attacks.

Successful cyber-attacks or other cyber-failures or events affecting the Fund or its Service Providers may adversely impact the Fund or its shareholders. For instance, such attacks, failures or other events may interfere with the processing of shareholder transactions, impact the Fund’s ability to calculate its NAV, cause the release of private shareholder information or confidential Fund information, impede trading, or cause reputational damage. Such attacks, failures or other events could also subject the Fund or its Service Providers to regulatory fines, penalties or financial losses, reimbursement or other compensation costs, and/or additional compliance costs. Insurance protection and contractual indemnification provisions may be insufficient to cover these losses. The Fund or its Service Providers may also incur significant costs to manage and control Cyber Risk. While the Fund and its Service Providers have established IT and data security programs and have in place business continuity plans and other systems designed to prevent losses and mitigate Cyber Risk, there are inherent limitations in such plans and systems, including the possibility that certain risks have not been identified or that cyber-attacks may be highly sophisticated.

Cyber Risks are also present for issuers of securities or other instruments in which the Fund invests, which could result in material adverse consequences for such issuers, and may cause the Fund’s investment in such issuers to lose value.

NTI, a subsidiary of Northern Trust Corporation, serves as the Adviser to the Fund. NTI is located at 50 South LaSalle Street, Chicago, Illinois 60603. NTI is an Illinois State Banking Corporation and an investment adviser registered under the Investment Advisers Act of 1940, as amended. It primarily manages assets for institutional and individual separately managed accounts, investment companies, and bank common and collective funds. Northern Trust Corporation is regulated by the Board of Governors of the Federal Reserve System as a financial holding company under the U.S. Bank Holding Company Act of 1956, as amended.

Under the Investment Advisory Agreement with the Trust, the Adviser, subject to the general supervision of the Trust’s Board of Trustees, is responsible for making investment decisions for the Fund and for placing purchase and sale orders for portfolio securities.

As of December 31, 2022, Northern Trust Corporation, through its affiliates, had assets under custody of $10.6 trillion, and assets under investment management of $1.2 trillion.

Under the Fund’s Investment Advisory Agreement, the Adviser receives an advisory fee from the Fund based on the following annual rate of the average daily net assets of the Fund:

| Fund |

Management Fee (as % of average daily net assets) |

|||

| NTAM Treasury Assets Fund |

0.11 | % | ||

8

The Adviser has contractually agreed to waive fees and/or reimburse expenses to the extent necessary to limit total annual operating expenses of the Fund (other than certain fees and expenses shown in the table under the caption “Fees and Expenses of the Fund” in the Fund Summary) so that “Total Annual Fund Operating Expenses After Expense Reimbursement” to the amount shown in the table under the caption “Fees and Expenses of the Fund” in the Fund Summary. The “Total Annual Fund Operating Expenses After Expense Reimbursement” for the Fund may be higher than the contractual limitation for the Fund as a result of certain excepted expenses that are not reimbursed. The contractual expense reimbursement arrangement is expected to continue until January 28, 2024. If it becomes unnecessary for the Adviser to waive fees or make reimbursements, the Adviser may recapture any of its prior waivers or reimbursements for a period not to exceed three years from the date on which the waiver or reimbursement was made to the extent that such a recapture does not cause the Total Annual Fund Operating Expenses to exceed the current expense limitation or the applicable expense limitation that was in effect at the time of the waiver or reimbursement. The agreement to waive fees and/or reimburse expenses automatically renews annually from year to year on the effective date of each subsequent annual update to the Fund’s registration statement, until such time as the Adviser provides written notice of non-renewal, and will terminate automatically upon termination of the investment advisory agreement. The Board of Trustees may terminate the arrangement at any time with respect to the Fund if it determines that it is in the best interest of the Fund and its shareholders.

The Adviser may reimburse additional expenses or waive all or a portion of the management fees of the Fund from time to time, including to avoid a negative yield. Any such additional expense reimbursement or fee waiver would be voluntary and could be implemented, increased or decreased, or discontinued at any time. There is no guarantee that the Fund will be able to avoid a negative yield.

Disclosure regarding the basis for the Board of Trustees’ approval of the Investment Advisory Agreement between the Adviser and the Fund is available in the Fund’s semi-annual report to shareholders for the period ended March 31, 2022.

Administrator, Fund Accounting Agent, Transfer Agent, Custodian and Placement Agent

The Northern Trust Company, 50 South LaSalle Street, Chicago, Illinois 60603, an affiliate of NTI, serves as the Fund’s Administrator and Fund Accounting Agent, Transfer Agent, and Custodian. Foreside Fund Officer Services, LLC, a wholly owned subsidiary of Foreside Financial Group, LLC (d/b/a ACA Group), 3 Canal Plaza, Suite 100, Portland, ME 04101, provides compliance services and financial controls services for the Fund. Foreside Financial Services, LLC, a wholly owned subsidiary of Foreside Financial Group, LLC (d/b/a ACA Group) (the “Placement Agent”), is located at 3 Canal Plaza, Suite 100, Portland, Maine 04101 and serves as placement agent to the Fund.

When you buy and sell shares of the Fund, the price of the shares is based on the Fund’s NAV per share next determined after the order is received by the Fund.

Calculating the Fund’s NAV

The Trust issues shares and redeems shares at NAV. The NAV for the shares of the Fund is calculated by dividing the value of the Fund’s net assets by the number of the Fund’s outstanding shares. The NAV is calculated at 2:00 p.m. Eastern Time (“ET”)/1:00 p.m. Central Time (“CT”), on each Business Day. The NAV used in determining the price of your shares is the one calculated after your purchase or redemption order is timely received and in good order as described below.

The Fund seeks to maintain a stable NAV of $1.00 per share by valuing the obligations held by it at amortized cost in accordance with SEC regulations. Amortized cost will normally approximate fair value. A purchase or redemption request is considered to be “in good order” when all necessary information is provided and all required documents are properly completed, signed and delivered. Requests must include the following:

| • | The account number (if issued) and Fund name; |

| • | The amount of the transaction, in dollar amount or number of shares; |

| • | For redemptions (other than telephone or wire redemptions), the signature of all account owners exactly as they are registered on the account; |

| • | Required signature guarantees, if applicable; and |

9

| • | Other supporting legal documents and certified resolutions that might be required in the case of estates, corporations, trusts and other entities or forms of ownership. Call 855-351-4583 (toll free) for more information about documentation that may be required of these entities. |

Additionally, a purchase order initiating the opening of an account is not considered to be in “good order” unless you have provided all information required by the Fund’s “Customer Identification Program” as described below.

Telephone Transactions

All calls may be recorded or monitored. The Transfer Agent has adopted procedures in an effort to establish reasonable safeguards against fraudulent telephone transactions. If reasonable measures are taken to verify that telephone instructions are genuine, the Fund and its Service Providers will not be responsible for any loss resulting from fraudulent or unauthorized instructions received over the telephone. In these circumstances, shareholders will bear the risk of loss. During periods of unusual market activity, you may have trouble placing a request by telephone. In this event, consider sending your request in writing to your Northern Trust account representative.

The proceeds of redemption orders received by telephone will be sent by wire according to proper instructions. The Fund reserves the right to refuse a telephone redemption, subject to applicable law.

Shares of the Fund are not registered under the 1933 Act or any of the securities laws of any state and are sold in reliance upon an exemption from registration. Shares may not be transferred or resold without registration under the 1933 Act, except pursuant to an exemption from registration. Shares may, however, be redeemed from the Trust as described below under “How to Redeem Shares.” Shares of the Fund are sold without a sales load or redemption fee. Assets of the Fund are not subject to a Rule 12b-1 fee.

Any non-U.S. shareholders generally would be subject to U.S. tax withholding on distributions by the Fund. This Prospectus does not address in detail the tax consequences affecting any shareholder who is a nonresident alien individual or a non-U.S. trust or estate, corporation or partnership. Investment in the Fund by non-U.S. investors may be permitted on a case-by-case basis, at the sole discretion of the Fund.

You may purchase Fund shares by contacting your Northern Trust account representative. Purchase requests received in good order by the Fund before 2:00 p.m. ET/1:00 p.m. CT (or before the close of the New York Fed if it closes before 2:00 p.m. ET/1:00 p.m. CT) will be effective at that day’s share price. Purchase requests received in good order by the Fund after 2:00 p.m. ET/1:00 p.m. CT (or after the close of the New York Fed if it closes before 2:00 p.m. ET/1:00 p.m. CT) are processed at the share price determined on the following Business Day. Payment in federal or other immediately available funds must be received by the Transfer Agent by the close of the Federal Reserve wire transfer system (normally, 6:00 p.m. ET) the same Business Day of the purchase. In the event that payment is not received by the Transfer Agent by the close of the Federal Reserve wire transfer system, the Fund reserves the right to cancel your purchase order and you may be responsible for any loss incurred by the Fund. After you have made your minimum initial investment, you may invest any amount you choose, as often as you wish. Purchase requests received in good order by the Transfer Agent on a non-Business Day or after the deadlines described above on a Business Day will be executed on the next Business Day, at that day’s closing share price for the Fund, provided that payment is made as noted above.

Investors

Shares of the Fund are offered on a private placement basis in accordance with Regulation D under the 1933 Act only to certain Northern Trust Corporate and Institutional Services clients and their affiliated entities, all of whom qualify as “Accredited Investors,” as defined in Rule 501 of Regulation D. “Accredited Investors” include, but are not limited to, certain banks, broker-dealers, insurance companies, investment companies, governmental plans, pension employee benefit plans, corporations, partnerships and business trusts (“Institutions”).

Institutions that are Northern Trust Corporate and Institutional Services clients may purchase or sell (redeem) Fund shares by phone or by contacting your Northern Trust account representative. The Fund’s investment requirement is $5 billion. Such investment requirement may be determined by aggregating an Institution’s related or affiliated accounts invested in the Fund. The Trust reserves the right to waive the Fund’s investment requirement.

10

Customer Identification Program: Important Information About Procedures for Opening an Account

Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. When you open an account, the Fund may ask for identifying information which may include but is not limited to the name, residential or business address, taxpayer identification number, or other identifying information for each account opened or reopened. For legal entity customers, we will also ask that any individual(s) who, directly or indirectly, owns 25% or more of the entity and one individual who has significant responsibility to control, manage, or direct the legal entity be identified.

If we do not receive the required information, there may be a delay in processing your investment request, which could subject your investment to market risk. If we are unable to immediately verify your identity, the Fund may restrict further investment until your identity is verified. Once the Fund is able to verify your identity, your investment will be accepted and processed at the next determined NAV. However, if we are unable to verify your identity, the Fund reserves the right to close your account without notice and return your investment to you at the NAV determined on the day in which your account is liquidated. If we close your account because we are unable to verify your identity, your investment will be subject to market fluctuation, which could result in a loss of a portion of your principal investment. The Fund and its agents will not be responsible for any loss in your account resulting from a delay in providing all required identifying information or from closing an account and redeeming shares when your identity is not verified. If your account is closed at the request of governmental or law enforcement authorities, the Fund may be required by the authorities to withhold the proceeds.

Fund Direct Purchases

You may purchase shares of the Fund by contacting your Northern Trust account representative at 855-351-4583 (toll free). Your Northern Trust account representative will be able to assist you with all phases of the investment.

By Directed Reinvestment

Your dividend and capital gain distributions will be automatically reinvested unless you indicate otherwise on your application.

| • | Complete the “Dividend and Capital Gain Distributions” section on the New Account Application. |

| • | Reinvestments can only be directed to an existing Fund account. |

Other Purchase Information

The Fund reserves the right to limit the amount of purchases and to refuse to sell to any person, Institution, or intermediary. If your wire does not clear, you may be responsible for any loss incurred by the Fund. If you are already a Fund shareholder, the Fund reserves the right to redeem shares from any identically registered account in the Fund as reimbursement for any loss incurred or money owed to the Fund. You also may be prohibited or restricted from making future purchases in the Fund. In certain circumstances, the Trust may advance the time by which purchase orders must be received. The Fund reserves the right to advance the time for accepting purchase or redemption orders for same Business Day credit when SIFMA recommends the bond market close early, trading on the bond market is restricted, an emergency arises or as otherwise permitted by the SEC. In addition, on any Business Day when SIFMA recommends that the bond markets close early, the Fund reserves the right to close at or prior to the SIFMA recommended closing time. If the Fund does so, it will cease granting same Business Day credit for purchase and redemption orders received at the Fund’s closing time and credit will be given on the next Business Day. In addition, the Board of Trustees of the Fund also may, for any Business Day, decide to change the time as of which the Fund’s NAV is calculated in response to new developments such as altered trading hours, or as otherwise permitted by the SEC.

You may redeem all or part of your investment in the Fund on any Business Day, subject to certain restrictions described below. Redemption requests received by the Fund before 2:00 p.m. ET/1:00 p.m. CT (or before the New York Fed closes, if it closes before 2:00 p.m. ET/1:00 p.m. CT) will be effective that day. Redemption requests received by the Fund after 2:00 p.m. ET/1:00 p.m. CT (or after the New York Fed closes, if it closes before 2:00 p.m. ET/1:00 p.m. CT) are processed at the NAV determined on the following Business Day.

The price you will receive when you redeem your shares will be the NAV next determined after the Fund receives your properly completed order to sell. You may receive proceeds from the sale by bank wire transfer or direct deposit into your bank account and in certain cases, payment may be made in securities of the Fund as described in “Additional Information

11

About Redemptions.” The Fund typically expects that it will pay out or credit redemption proceeds on a daily basis following receipt of a redemption request in good order. While not expected, payment of redemption proceeds may take up to seven days or ten days, if paid by electronic transfer. The proceeds may be more or less than the purchase price of your shares, depending on the market value of the Fund’s securities at the time your redemption request is received. The Fund typically expects to hold cash or cash equivalents to meet redemption requests. The Fund also may use the proceeds from the sale of portfolio securities to meet redemption requests if consistent with the management of the Fund. These redemption methods will be used regularly and may also be used in stressed market conditions.

Redeeming Directly from the Fund

On any Business Day, you may sell (redeem) Fund shares by contacting your Northern Trust account representative at 855-351-4583 (toll free). Your Northern Trust account representative will be able to assist you with all phases of the investment.

The redemption request must include:

| • | The number of shares or the dollar amount to be redeemed; |

| • | The Fund account number; and |

| • | The signatures of all account owners signed in the exact name(s) and any special capacity in which they are registered. |

Additional Information About Redemptions

It is expected that payment of redemption proceeds will normally be made from uninvested cash or short-term investments, proceeds from the sale of portfolio securities. The Fund reserves the right to defer crediting, sending or wiring redemption proceeds for up to 7 days (or such longer period permitted by the SEC) after receiving the redemption order if, in its judgment, an earlier payment could adversely affect the Fund. The Fund may hold proceeds from redemptions for shares purchased by electronic transaction, including ACH, until the purchase amount has been collected, which may be as long as ten Business Days. To eliminate this delay, you may purchase shares of the Fund by wire. Also, when the New York Fed is closed (or when trading is restricted) for any reason other than its customary weekend or holiday closing or under any emergency circumstances, as determined by the SEC, the Fund may suspend redemptions or postpone payment of redemption proceeds.

At the discretion of the Fund or the Transfer Agent, corporate investors, and other associations may be required to furnish an appropriate certification authorizing redemptions to ensure proper authorization.

Generally, all redemptions will be for cash. However, the Fund reserves the right to pay part or all of your redemption proceeds in readily marketable securities instead of cash at the discretion of the Fund. Redemptions in-kind are typically used to meet redemption requests that represent a large percentage of a fund’s net assets in order to minimize the effect of large redemptions on the fund and its remaining shareholders. Redemptions in-kind may be used regularly in circumstances as described above, and may also be used in stressed market conditions. Redemption-in-kind proceeds are limited to securities that are traded on a public securities market or are limited to securities for which quoted bid and ask prices are available. They are distributed based on a weighted-average pro-rata basis of the Fund’s holdings to the redeeming shareholder. Shareholders may incur brokerage charges on the sale of any securities distributed in lieu of cash. If payment is made in securities, the Fund will value the securities selected in the same manner in which it computes its NAV. This process minimizes the effect of large redemptions on the Fund and its remaining shareholders.

If you are redeeming recently purchased shares by electronic transaction, your redemption request may not be paid until your electronic transaction has cleared. This may delay your payment for up to 10 days. Subject to applicable law, the Trust and the Transfer Agent reserve the right to redeem shares held by any shareholder who provides incorrect or incomplete account information or when such involuntary redemptions are necessary to avoid adverse consequences to the Trust and its shareholders or the Transfer Agent. Subject to applicable law, the Trust, Northern Trust and their agents reserve the right to involuntarily redeem an account at the Fund’s then current NAV, in cases of disruptive conduct, suspected fraudulent or illegal activity, inability to verify the identity of an investor, or other circumstances determined to be in the best interest of the Trust and its shareholders. The Trust, Northern Trust and their agents reserve the right, without notice, to freeze any account and/or suspend account services when: (i) notice has been received of a dispute regarding the assets in an account, or a legal claim against an account or (ii) if there is reason to believe a fraudulent transaction may occur or has occurred. The Trust may require any information from the shareholder reasonably necessary to ensure that a redemption request has been duly authorized. The Trust reserves the right to change or discontinue any of its redemption procedures. The Trust does not permit redemption proceeds to be sent by outgoing International ACH Transaction (“IAT”). An IAT is a payment transaction involving a financial institution’s office located outside U.S. territorial jurisdiction.

12

Advanced Notification of Large Transactions

The Trust requests that an Institution give advance notice to the Transfer Agent by noon ET if it intends to place a purchase or redemption order of $50 million or more on a Business Day.

Excessive Trading in Fund Shares

The Board of Trustees of the Trust has adopted, on behalf of the Fund, policies and procedures with respect to frequent purchases and redemptions of Fund shares in light of the nature and high quality of the Fund’s investments. The Fund reserves the right to refuse a purchase order if management of the Fund determines that the purchase may not be in the best interests of the Fund.

Dividends from net income are declared daily and paid monthly by the Fund to its shareholders. Net income includes the interest accrued on the Fund’s assets less estimated expenses. The Fund’s net realized short-term capital gains, if any, are distributed at least annually. The Fund does not expect to realize net long-term capital gains. Dividends are paid as soon as practicable following the end of each month, except in the case of a total redemption in an account that is not subject to a standing order for the purchase of additional shares. In that event, dividends will be paid promptly along with the redemption proceeds.

All distributions are reinvested automatically (without any sales charge) in additional shares of the Fund, unless you elect to receive distributions in cash by notifying the Transfer Agent in writing. You may make arrangements to credit these distributions to your account with Northern Trust or its affiliates. There are no fees or sales charges on reinvestments.

The following information is provided to help you understand the U.S. federal income tax you may have to pay on income dividends and capital gains distributions from the Fund, as well as on gains realized from your redemption of Fund shares. This discussion is not intended or written to be used as tax advice. Because everyone’s tax situation is unique, you should consult your tax professional about federal, state, local, or foreign tax consequences before making an investment in the Fund.

The Fund intends to qualify each year as a “regulated investment company” under Subchapter M of the Internal Revenue Code of 1986, as amended. By so qualifying, the Fund will not be subject to Federal income taxes to the extent that it distributes substantially all of its net investment income and any net realized capital gains. Except as otherwise noted below, you will generally be subject to federal income tax at ordinary rates on the Fund’s distributions to you, regardless of whether they are paid in cash or reinvested. U.S. individuals with “modified adjusted gross income” exceeding $200,000 ($250,000 if married and filing jointly) and trusts and estates with income above certain thresholds also are subject to a Medicare contribution tax on their “net investment income,” which includes non-exempt interest, dividends, and capital gains at a rate of 3.8%.

The Fund generally will be invested in debt instruments and not in shares of stock on which dividend income will be received. As a result, the Fund does not expect to pay dividends that may be eligible for the reduced tax rate on corporate dividends or that may qualify for the dividends-received deduction for corporations.

Distributions from the Fund (both taxable income dividends and capital gains) are normally taxable to you as ordinary income or long-term capital gains, regardless of whether you reinvest these distributions or receive them in cash (unless you hold shares in a qualified tax- deferred plan or account or are otherwise not subject to U.S. federal income tax). Due to the nature of the investment strategies used, distributions by the Fund generally are expected to consist primarily of income dividends and net realized capital gains; however, the nature of the Fund’s distributions could vary in any given year. The Fund will mail to each shareholder after the close of the calendar year an Internal Revenue Service Form 1099 setting forth the federal income tax status of distributions made during the year. Income dividends and capital gains distributions also may be subject to state and local taxes.

13

For federal income tax purposes, distributions of net investment income generally are taxable generally as ordinary income although certain distributions of qualified dividend income paid to a non-corporate U.S. shareholder may be subject to income tax at the applicable rate for long-term capital gain.

Distributions of net realized capital gains (that is, the excess of the net realized gains from the sale of investments that the Fund owned for more than one year over the net realized losses from investments that the Fund owned for one year or less) that are properly designated by the Fund as capital gains generally will be taxable as long-term capital gain regardless of how long you have held your shares in the Fund.

Distributions of net realized short-term capital gain (that is, the excess of any net short-term capital gain over net long-term capital loss), if any, will be taxable to shareholders at ordinary income tax rates. Capital gains distributed to a corporate shareholder (whether short-term or long-term) are taxed at the same rate as ordinary income.

If you are a taxable investor and invest in the Fund shortly before it makes a capital gain distribution, some of your investment may be returned to you in the form of a taxable distribution. Fund distributions will reduce the NAV per share. Therefore, if you buy shares after the Fund has experienced capital appreciation but before the record date of a distribution of those gains, you may pay the full price for the shares and then effectively receive a portion of the purchase price back as a taxable distribution. This is commonly known as “buying a dividend.”

Selling Shares

Dividends on shares are earned through and including the day prior to the day on which they are redeemed. Redemptions are treated as sales for tax purposes and generally are taxable events for shareholders. In general, if Fund shares are sold, a shareholder will recognize gain or loss equal to the difference between the amount realized on the sale and the shareholder’s adjusted tax basis in the shares. As long as the Fund maintains a constant NAV of $1.00 per share, generally no gain or loss should be recognized upon the sale of Fund shares. Realized capital gains are subject to federal income tax and capital losses may be deductible, subject to various limitations under applicable law. For individuals, long-term capital gains you realize from selling Fund shares generally are taxed at preferential income tax rates. Short-term capital gains are taxed at ordinary income tax rates. Any loss realized upon the redemption of Fund shares within six months from the date of their purchase will be treated as a long-term capital loss to the extent of any distributions from the Fund treated as capital gain dividends during that six-month period. In addition, all or a portion of any loss realized upon the redemption of Fund shares may be disallowed to the extent Fund shares are purchased (including by means of reinvested dividends) within 30 days before or after such redemption.

Backup Withholding

By law, you may be subject to backup withholding (currently at a rate of 24%) on a portion of your taxable distributions and redemption proceeds unless you provide your correct Social Security or taxpayer identification number and certify that (i) this number is correct, (ii) you are not subject to backup withholding, and (iii) you are a US person (including a US resident alien). You also may be subject to withholding if the Internal Revenue Service instructs the Fund to withhold a portion of your distributions or proceeds. You should be aware that the Fund may be fined by the Internal Revenue Service for each account for which a certified taxpayer identification number is not provided. In the event that such a fine is imposed with respect to a specific account in any year, the Fund may make a corresponding charge against the account.

U.S. Tax Treatment of Foreign Shareholders

Fund distributions attributable to certain Fund income such as interest generally will be subject to a 30% withholding tax when paid to foreign shareholders. The withholding tax may, however be reduced (and in some cases eliminated) under an applicable tax treaty between the United States and a shareholder’s country of residence or incorporation, provided that the shareholder furnishes the Fund with a properly completed Form W-8BEN or W-8BEN-E, as applicable, to establish entitlement for these treaty benefits. Dividends reported as short-term capital gain dividends or interest-related dividends generally are not subject to this U.S. withholding tax. The exemption may not apply, however, if the recipient’s investment in the Fund is connected to a trade or business of the recipient in the United States or if the recipient is present in the United States for 183 days or more in a year and certain other conditions are met. Payments to a Fund shareholder that is either a foreign financial institution (“FFI”) or a non-financial foreign entity (“NFFE”) within the meaning of the Foreign Account Tax Compliance Act (“FATCA”) may be subject to a generally nonrefundable 30% withholding tax on: (a) income dividends paid by the Fund, and (b) certain capital gain distributions and the proceeds arising from the redemption of Fund shares after December 31, 2018. FATCA withholding tax generally can be avoided: (a) by an FFI, subject to any applicable intergovernmental agreement or other exemption, if it enters into a valid agreement with the Internal Revenue Service (“IRS”) to, among other requirements, report required information about certain direct and indirect ownership of foreign

14

financial accounts held by U.S. persons with the FFI and (b) by an NFFE, if it: (i) certifies that it has no substantial U.S. persons as owners or (ii) if it does have such owners, reports information relating to them. The Fund may disclose the information that it receives from its shareholders to the IRS, non-U.S. taxing authorities or other parties as necessary to comply with FATCA. Withholding also may be required if a foreign entity that is a shareholder of the Fund fails to provide the Fund with appropriate certifications or other documentation concerning its status under FATCA.

All foreign investors should consult their own tax professionals regarding the tax consequences in their country of residence of an investment in the Fund.

Tax Status for Retirement Plans and Other Tax-Deferred Accounts

When you invest in the Fund through a qualified employee benefit plan, retirement plan or some other tax-deferred account, dividend and capital gain distributions generally are not subject to current federal income taxes. In general, these plans or accounts are governed by complex tax rules. You should ask your tax adviser or plan administrator for more information about your tax situation, including possible state or local taxes.

Medicare Tax

An additional 3.8% Medicare tax may be imposed on distributions you receive from a Fund and gains from selling, redeeming or exchanging your shares.

Shareholder Reports and Other Information

Shareholders of record will be provided each year with a semi-annual report showing the Fund’s investments and other information as of March 31 and with an annual report containing audited financial statements as of September 30. If we have received appropriate written consent, we send a single copy of all materials, including, prospectuses, financial reports, proxy statements or information statements to all shareholders who share the same mailing address, even if more than one person in a household holds shares of the Fund. If you do not want your mailings combined with those of other members of your household, you may opt-out at any time by contacting the NTAM Treasury Assets Fund Center by telephone at 855-351-4583. You also may send an e-mail to: ntamtreasury@ntrs.com. The Fund will begin sending individual copies to you within 30 days after receipt of your opt-out notice.

The Trust may reproduce this Prospectus in electronic format that may be available on the Internet. If you have received this Prospectus in electronic format you, or your representative, may contact the Transfer Agent for a free paper copy of this Prospectus by calling 855- 351-4583 or by sending an e-mail to: ntamtreasury@ntrs.com. The Adviser publishes on its website at www.northerntrust.com/ntam-treasury-assets-fund, no later than the fifth Business Day of each month and for a period of not less than six months, a complete schedule of the Fund’s holdings and certain other information regarding Fund holdings of the Fund as of the last Business Day of the prior month. Certain Fund information concerning the Fund will be provided in monthly holdings reports to the SEC on Form N-MFP2. Form N-MFP2 will be made available to the public on the SEC’s EDGAR database immediately upon filing after the end of the month to which the information pertains, and a link to each of the most recent 12 months of filings on Form N-MFP2 will be provided on the Adviser’s website. A further description of the Trust’s Policy on Disclosure of Fund Holdings is available in the SAI.

The financial information about the Fund below is intended to help you understand the Fund’s financial performance since its inception on April 4, 2018. The total return in the table represents the rate that an investor would have earned or lost on an investment in the Fund (assuming reinvestment of all dividends and distributions and excludes redemption fees). The information has been audited by Deloitte & Touche LLP, whose report, along with the Fund’s financial statements, is included in the Fund’s Annual Report for the fiscal year ended September 30, 2022, which is available upon request.

15

Advisers Investment Trust

NTAM Treasury Assets Fund

Financial Highlights

For the fiscal years ended September 30, 2022, September 30, 2021, September 30, 2020, September 30, 2019 and the fiscal period from April 4, 2018, commencement of operations, to September 30, 2018

| NTAM Treasury Assets Fund | ||||||||||||||||||||

| Year Ended September 30, 2022 |

Year Ended September 30, 2021 |

Year Ended September 30, 2020 |

Year Ended September 30, 2019 |

Period Ended September 30, 2018(a) |

||||||||||||||||

| Net asset value, beginning of period |

$ | 1.00 | $ | 1.00 | $ | 1.00 | $ | 1.00 | $ | 1.00 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) from operations: |

||||||||||||||||||||

| Net investment income |

0.01 | — | (b) | 0.01 | 0.02 | 0.01 | ||||||||||||||

| Net realized gains from investments(b) |

— | — | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total from investment operations |

0.01 | — | 0.01 | 0.02 | 0.01 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Less distributions paid: |

||||||||||||||||||||

| From net investment income |

(0.01 | ) | (— | )(b) | (0.01 | ) | (0.02 | ) | (0.01 | ) | ||||||||||

| From net realized gains on investments |

— | (b) | (— | )(b) | (— | )(b) | (— | )(b) | — | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total distributions paid |