| AT THE FOREFRONT OF THERAPIES FOR RARE DISEASES 41STAnnual J.P. Morgan Healthcare ConferenceJanuary 9, 2023 |

| 2

Forward-Looking Statements

Thispresentationcontains"forward-lookingstatements" |

| Definition: \əˈmēkəs(noun) LatinFriend Our Passion is for PatientsOur Mission: We seek to deliver the highest quality therapies for people living with rare diseasesOur Vision: Be a leader in rare disease drug development and commercialization leveraging our global capabilities in bringing life-changing therapies to patients 3 |

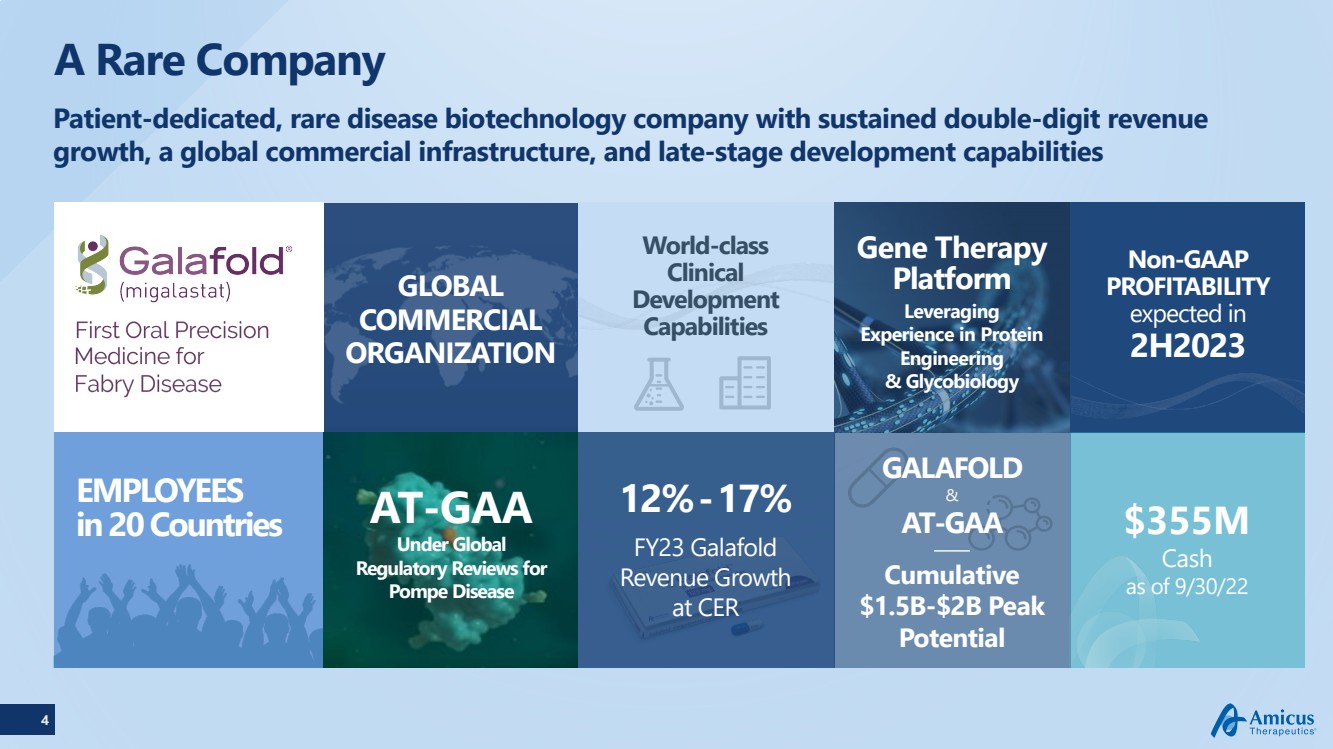

| 4 A Rare CompanyPatient-dedicated, rare disease biotechnology company with sustained double-digit revenue growth, a global commercial infrastructure, and late-stage development capabilities GLOBAL COMMERCIAL ORGANIZATIONEMPLOYEESin 20 Countries GALAFOLD&AT-GAA Gene TherapyPlatformLeveraging Experience in Protein Engineering & Glycobiology 12%-17%FY23 Galafold Revenue Growth at CER Non-GAAP PROFITABILITY expected in 2H2023 Cumulative $1.5B-$2B Peak Potential AT-GAAUnder Global Regulatory Reviews forPompe Disease $355MCashas of 9/30/22 World-class Clinical Development Capabilities |

| 5 2022: A Year in Headlines Positive Long-Term Data from Phase 1/2 Study of AT-GAA in Pompe Disease |

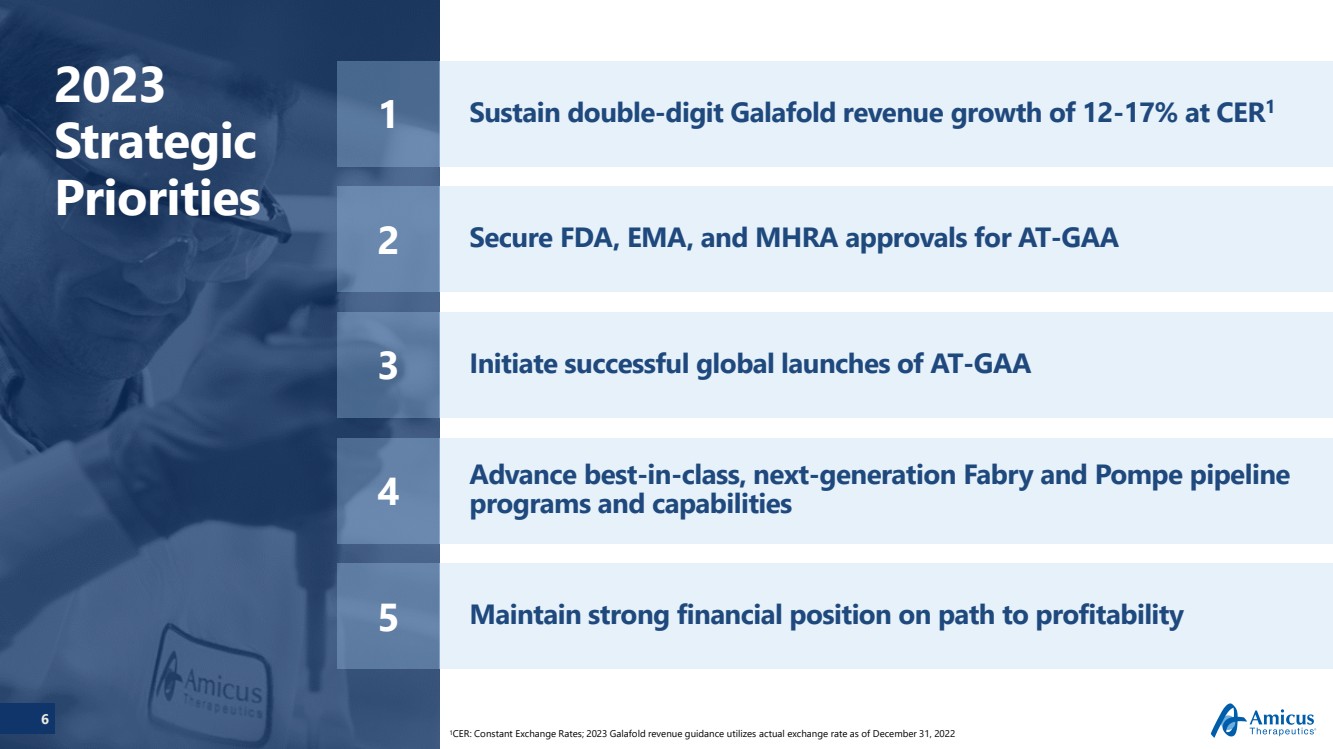

| 2023 Strategic Priorities Sustain double-digit Galafold revenue growth of 12-17% at CER1 Secure FDA, EMA, and MHRA approvals for AT-GAA Initiate successful global launches of AT-GAA Advance best-in-class, next-generation Fabry and Pompe pipeline programs and capabilities Maintain strong financial position on path to profitability 6 1 2 3 4 5 1CER: Constant Exchange Rates;2023 Galafold revenue guidance utilizes actual exchange rate as of December 31, 2022 |

| 7 Galafold® (migalastat)Continued GrowthBuilding a leadership position in the treatment of Fabry disease |

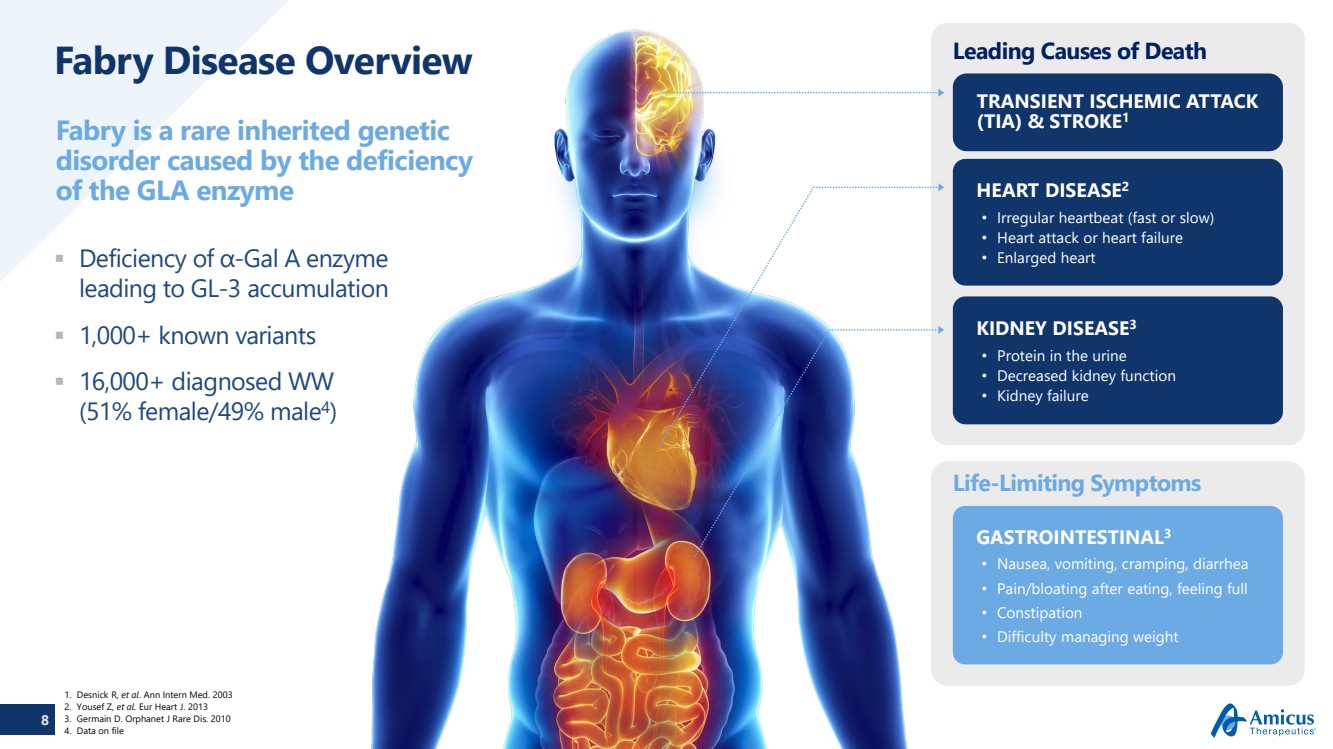

| 8 Fabry Disease Overview Deficiency of α-Gal A enzyme leading to GL-3 accumulation 1,000+ known variants 16,000+ diagnosed WW (51% female/49% male4)Fabry is a rare inherited genetic disorder caused by the deficiency of the GLA enzyme Leading Causes of DeathLife-Limiting Symptoms TRANSIENT ISCHEMIC ATTACK (TIA) & STROKE1 KIDNEY DISEASE3•Protein in the urine•Decreased kidney function•Kidney failure HEART DISEASE2•Irregular heartbeat (fast or slow)•Heart attack or heart failure•Enlarged heart GASTROINTESTINAL3•Nausea, vomiting, cramping, diarrhea•Pain/bloating after eating, feeling full •Constipation•Difficulty managing weight1.DesnickR, et al. Ann Intern Med. 2003 2.Yousef Z, et al. EurHeart J. 2013 3.Germain D. OrphanetJ Rare Dis. 2010 4.Data on file |

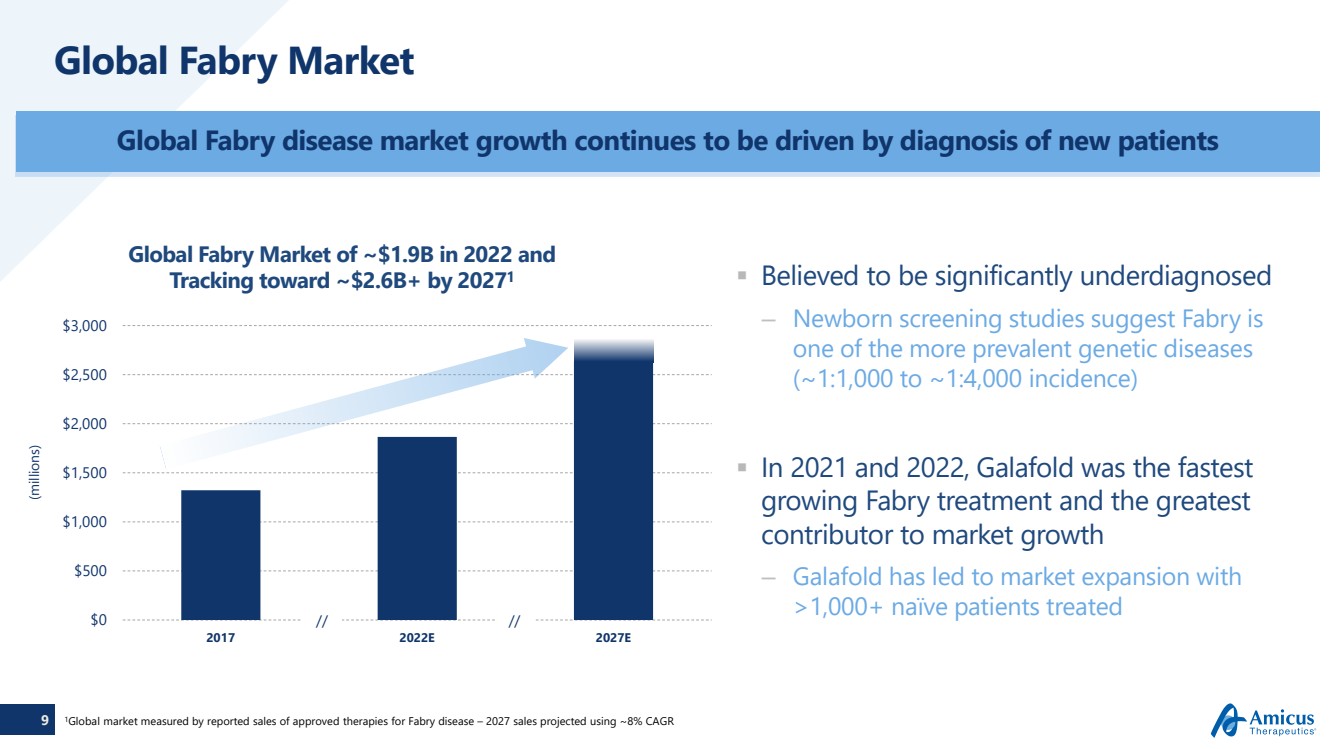

| 9 Global Fabry Market Believed to be significantly underdiagnosed–Newborn screening studies suggest Fabry is one of the more prevalent genetic diseases (~1:1,000 to ~1:4,000 incidence) In 2021 and 2022, Galafold was the fastest growing Fabry treatment and the greatest contributor to market growth–Galafold has led to market expansion with >1,000+ naïve patients treated Global Fabry disease market growth continues to be driven by diagnosis of new patients(millions)1Global market measured by reported sales of approved therapies for Fabry disease –2027 sales projected using ~8% CAGR $0$500$1,000$1,500$2,000$2,500 $3,00020172022E2027EGlobal Fabry Marketof ~$1.9B in 2022 and Tracking toward ~$2.6B+ by 20271 // // |

| 10 2022 Galafold Success (as of December 31, 2022) Building on Galafold’s success and leveragingleadership position to drive continued growth Galafold is indicated for adults with a confirmed diagnosis of Fabry diseaseand an amenable variant. The most common adverse reactions reported with Galafold (≥10%) were headache, nasopharyngitis, urinary tract infection, nausea, and pyrexia. For additional information about Galafold, including the full U.S. Prescribing Information, please visithttps://www.amicusrx.com/pi/Galafold.pdf .. For further important safety information for Galafold, including posology and method of administration, special warnings, drug interactions, and adverse drug reactions, please see the European SmPC for Galafold available from the EMA website atwww.ema.europa.eu ..Galafold is the first and only approved oral treatment option with a unique mechanism of action for Fabry patients with amenable variants 350Amenable Variants in U.S. Label45Countries with Regulatory Approvals 35Countries withReimbursed Sales$329M2022 Galafold Revenue116%Operational Growth1,386Amenable Mutations in EU Label1 Preliminary and unaudited |

| 11 Galafold Global Launch Momentum (as of December 31, 2022) Global 3-month net new patients trend highest in 2 years ~50% share of treated amenable patients Healthy mix of switch (55%) and previously untreated patients (45%)1 Compliance and adherence >90% Growing prescriber base Continued penetration into existing marketsFurther uptake in diagnosed untreated populationContinued geographic expansionMaintaining compliance and adherenceDriving reimbursement and access FY22 Strength Reflects Increasing Demand with >2,000 Individuals TreatedSustained Growth in 2023 Driven by: Strong patient demand with 2,000+ individuals treated with Galafold and performance against key metrics lay the foundation for continued double-digit growth in 20231Data on file 11 |

| 12 Galafold Studies and Real-World Evidence Growing body of evidence for Galafold on compliance, impacts on quality of life, long-term efficacy and importance of early treatment 12 |

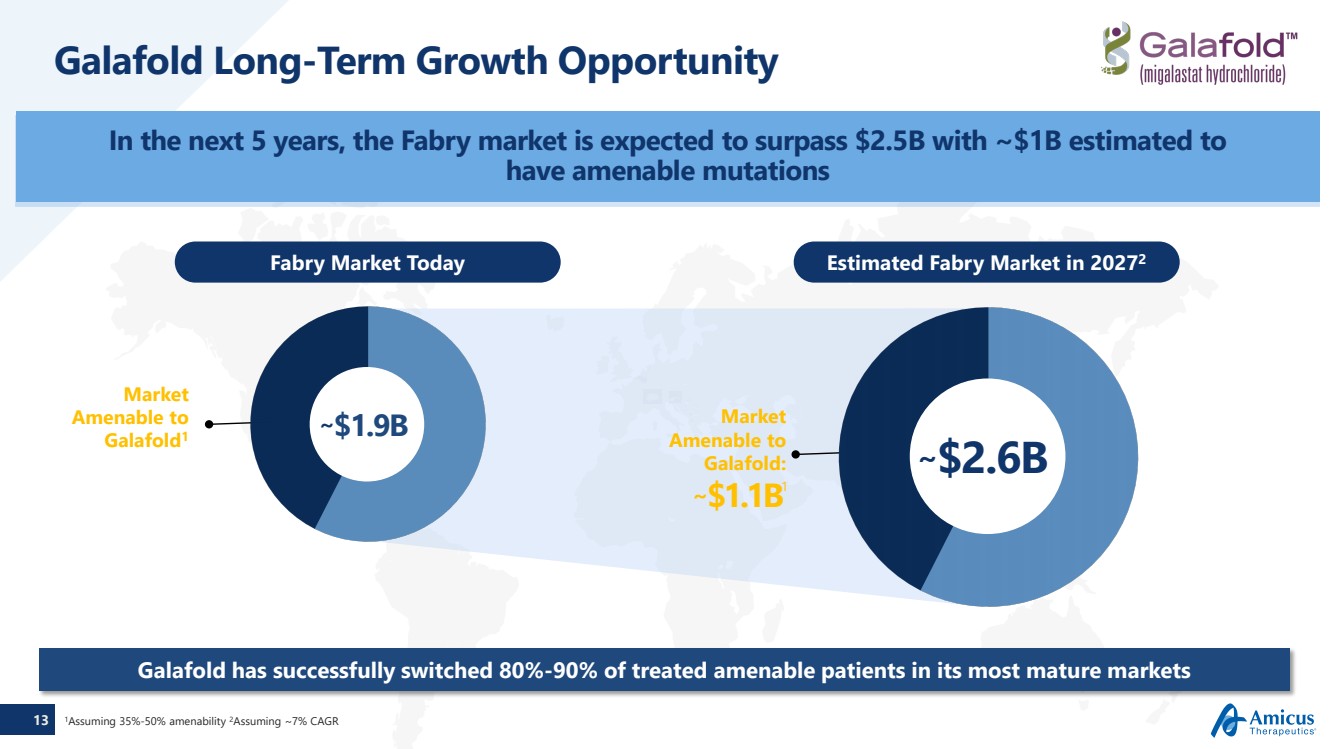

| 13 Galafold Long-Term Growth Opportunity In the next 5 years, the Fabry market is expected to surpass $2.5B with ~$1B estimated to have amenable mutations Galafold has successfully switched 80%-90% of treated amenable patients in its most mature markets1Assuming 35%-50% amenability 2Assuming ~7% CAGR Market Amenable to Galafold1Market Amenable to Galafold:~$1.1B1 Fabry Market Today Estimated Fabry Market in 20272 ~$1.9B ~$2.6B |

| 14 AT-GAA (cipaglucosidase alfa + miglustat)Potential to establish a new standard of care for people living with Pompe disease |

| 15 Deficiency of GAA leading to lysosomal glycogen accumulation and cellular dysfunction NBS studies shows higher incidence than medical literature suggests (~1:10,000 to ~1:30,000) Symptoms include muscle weakness, respiratory failure, and cardiomyopathy Majority of patients on current standard of care decline after ~2 years Estimated incidence of ~1:28,000; Significant underdiagnosis Respiratory and cardiac failure are leading causes of morbidity and mortality Age of onset ranges from infancy to adulthoodPompe Disease Overview NBS: Newborn ScreeningPompe is a severe and fatal neuromusculardisease causedby the deficiency of lysosomal enzymeGAA |

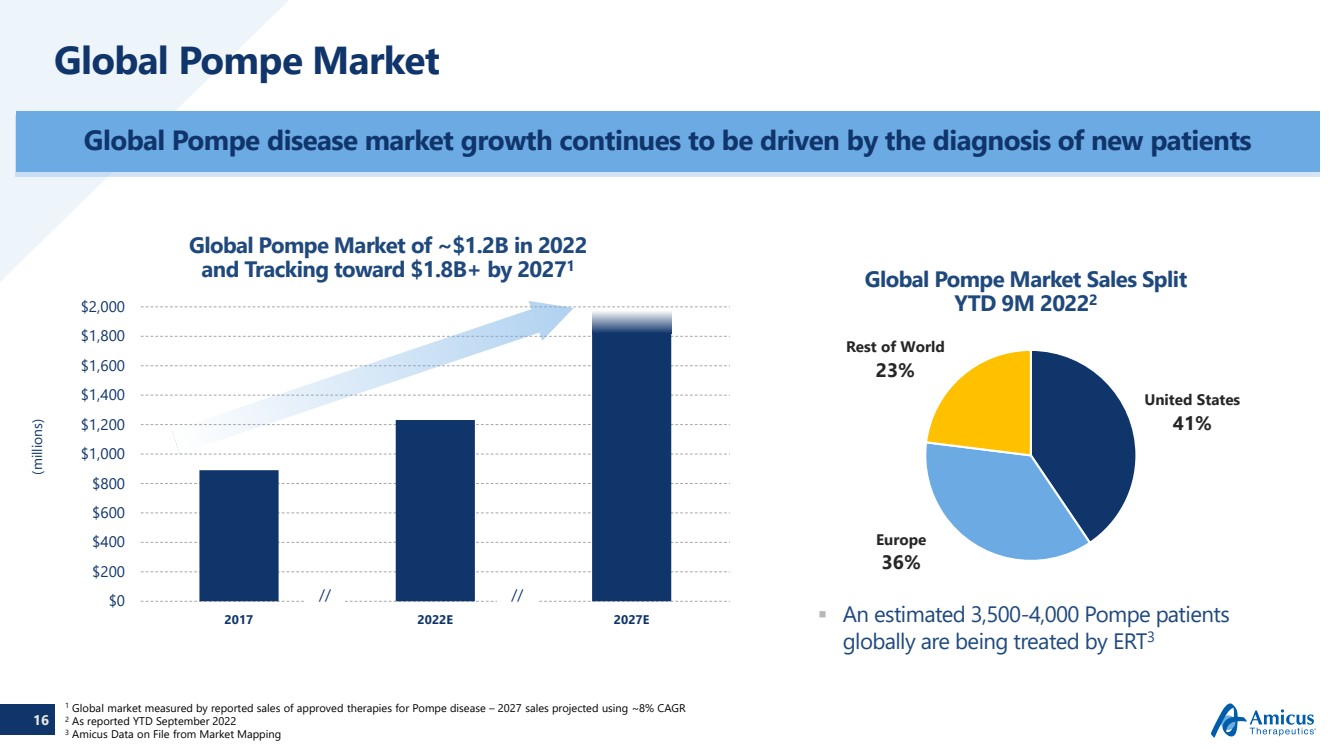

| 16 Global Pompe Market Global Pompe disease market growth continues to be driven by the diagnosis of new patients An estimated 3,500-4,000 Pompe patients globally are being treated by ERT3Global Pompe Market of ~$1.2B in 2022and Tracking toward $1.8B+ by 20271(millions) $0$200$400 $600 $800$1,000 $1,200 $1,400 $1,600 $1,800 $2,000 2017 2022E 2027E 1Global market measured by reported sales of approved therapies for Pompe disease –2027 sales projected using ~8% CAGR2As reported YTD September 2022 3Amicus Data on File from Market Mapping // // United States 41% Europe 36% Rest of World 23% Global Pompe Market Sales SplitYTD 9M 20222 |

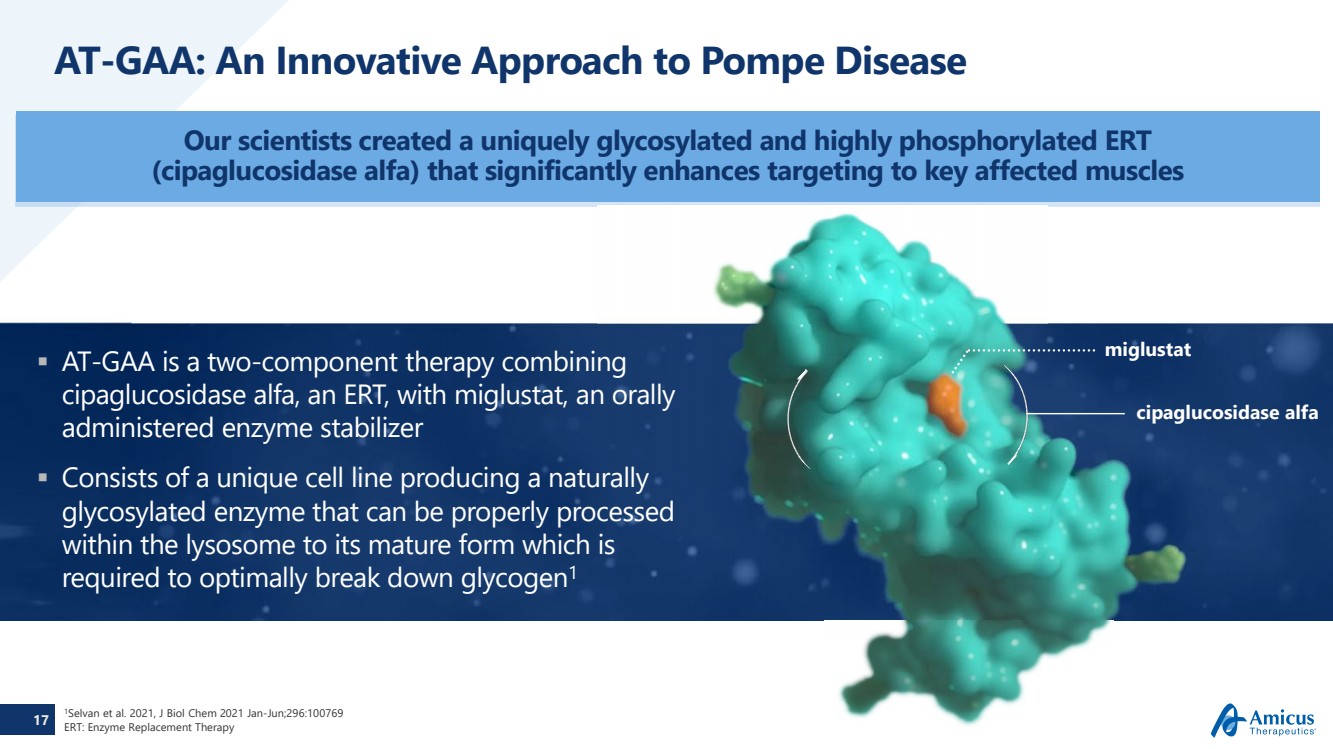

| 17 AT-GAA: An Innovative Approach to Pompe Disease Our scientists created a uniquely glycosylated and highly phosphorylated ERT (cipaglucosidase alfa) that significantly enhances targeting to key affected muscles AT-GAA is a two-component therapy combining cipaglucosidase alfa, an ERT, with miglustat, an orally administered enzyme stabilizer Consists of a unique cell line producing a naturally glycosylated enzyme that can be properly processed within the lysosome to its mature form which is required to optimally break down glycogen1 cipaglucosidase alfamiglustat 1Selvan et al. 2021, J Biol Chem 2021 Jan-Jun;296:100769ERT: Enzyme Replacement Therapy |

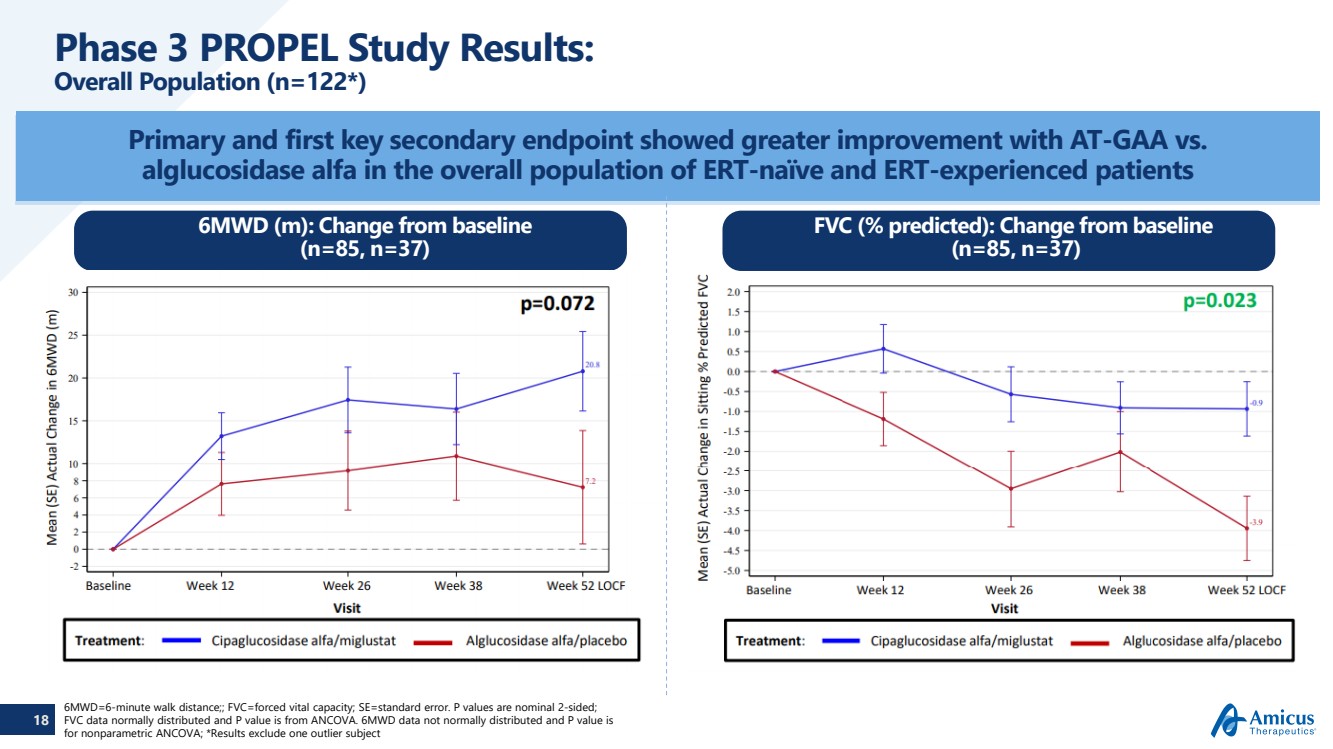

| 18 Phase 3 PROPEL Study Results:Overall Population (n=122*) Primary and first key secondary endpoint showed greater improvement with AT-GAA vs. alglucosidase alfa in the overall population of ERT-naïve and ERT-experienced patients6MWD=6-minute walk distance;; FVC=forced vital capacity; SE=standard error. P values are nominal 2-sided; FVC data normally distributedand P value is from ANCOVA. 6MWD data not normally distributed and P value is for nonparametric ANCOVA; *Results exclude one outlier subject 6MWD (m): Change from baseline (n=85, n=37) FVC (% predicted): Change from baseline(n=85, n=37) |

| 19 Phase 3 PROPEL Topline Results:ERT Experienced Population (n=95)NOTE: Baseline is Mean (STDEV); CFBL is Mean (SE); P-values are nominal 2-sided; FVC data normally distributed and p–values are from ANCOVA6MWD data not normally distributed and 6MWD p-value is for non-parametric ANCOVA; 6MWD parametric MMRM p-value was p=0.078 ERT-experienced patients treated with AT-GAA demonstrated improvements over time in 6MWD and stabilization over time in FVC versus alglucosidase alfa 6MWD (m): Change from baseline (n=65, n=30) FVC (% predicted): Change from baseline(n=65, n=30) |

| 20 1Data on file 20 AT-GAA: Global Regulatory Status Anticipate regulatory approvals and launch into the three largest Pompe markets in 2023 1 FDA has not provided anticipated action dates as they continue to monitor the public health situation and travel restrictionsinChina; The Company expects the FDA to approve the NDA and BLA applications together Pombiliti™(cipaglucosidase alfa) received a positive CHMP opinion in December 2022 Miglustat CHMP opinion is expected in 2Q 2023 PDUFA action deferred due to inability to conduct pre-approval manufacturing inspection1 In discussion with the FDA to develop plans and logistics for inspection U.K. MAA submitted via recognition procedure based on CHMP opinion 20 |

| 21 AT-GAA: EU Opportunity Strong indication statement:–Pombiliti™(cipaglucosidase alfa) is a long-term enzyme replacement therapy used in combination with the enzyme stabilisermiglustat for the treatment of adults with late-onset Pompe disease (acid α glucosidase [GAA] deficiency) >1,300 patients are estimated to be treated in Europe1 Broad experience with AT-GAA from a wide set of KOLs through clinical trials and early access programs EU regulatory outcome and label to be leveraged in other ex-U.S. geographies1 Amicus Data on File from Market Mapping EU Pompe market currently represents a sizeable market opportunity of $450M+ |

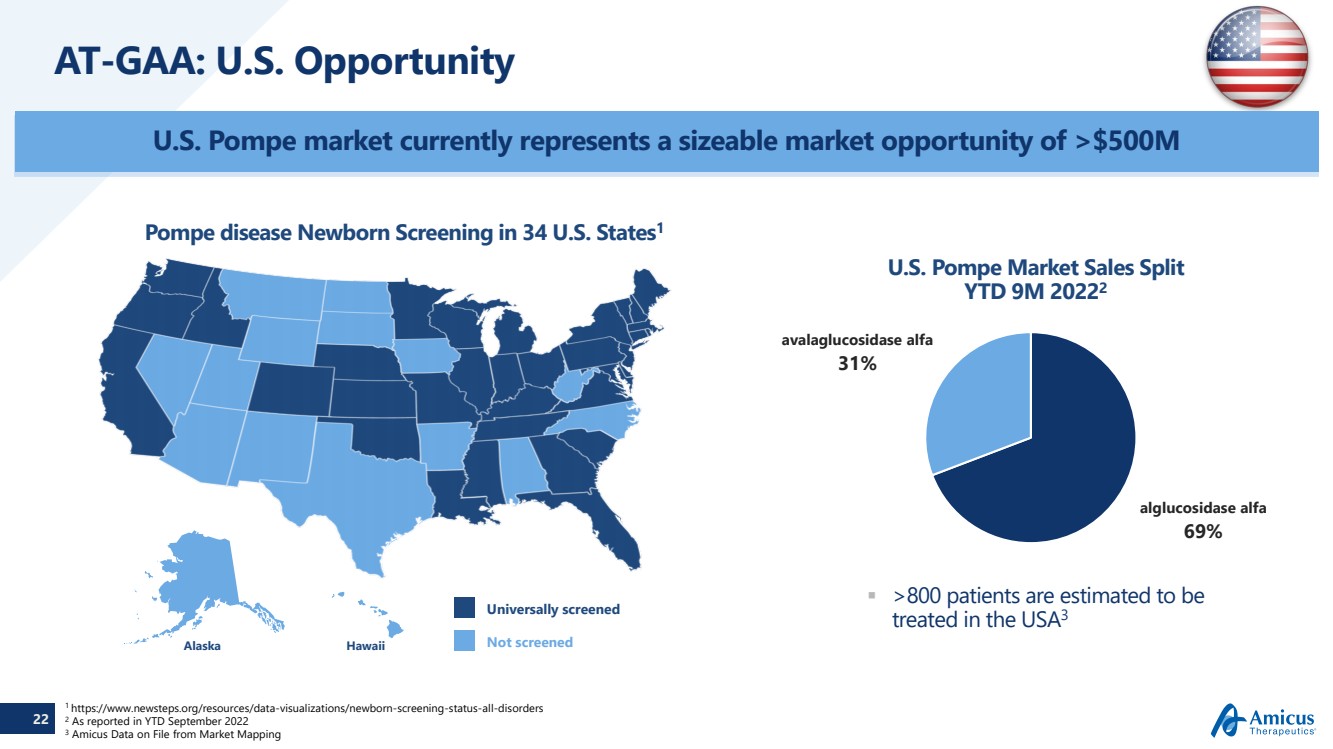

| 22 AT-GAA: U.S. Opportunity AlaskaHawaiiUniversally screenedNot screened Pompe disease Newborn Screening in 34 U.S. States1U.S. Pompe Market Sales SplitYTD 9M 20222 >800 patients are estimated to be treated in the USA3 alglucosidase alfa 69% avalaglucosidase alfa 31% 1 https://www.newsteps.org/resources/data-visualizations/newborn-screening-status-all-disorders2As reported in YTD September 20223Amicus Data on File from Market Mapping U.S. Pompe market currently represents a sizeable market opportunity of >$500M 22 |

| 23 AT-GAA: U.K. Opportunity U.K. submission via recognition procedure based on CHMP opinion Significant demand through EAMS underscores unmet need:–Dozens of patients on treatment today–All leading centers have requested access–Requests for additional patients being received every month >200 people with Pompe disease are estimated to be treated in the U.K.11Amicus Data on File from Market Mapping U.K. represents the third largest Pompe disease market 23 |

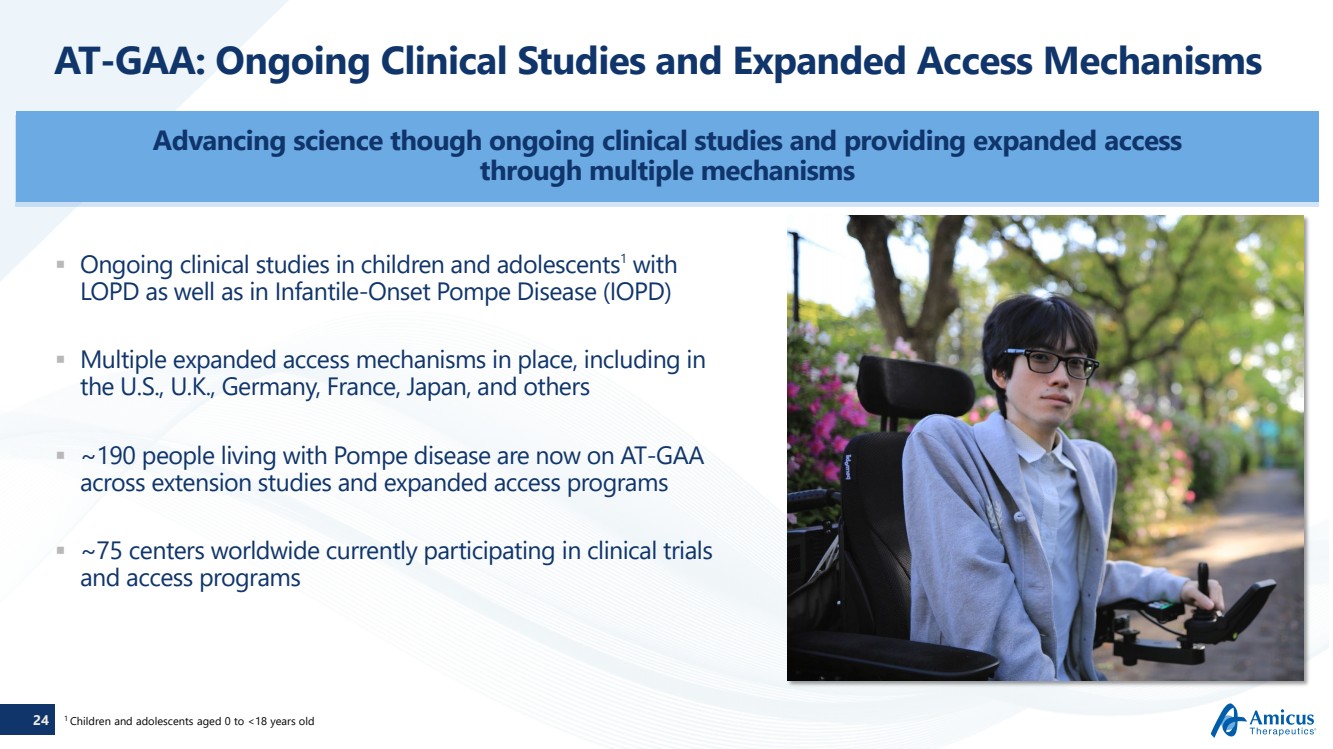

| 24 AT-GAA: Ongoing Clinical Studies and Expanded Access Mechanisms Ongoing clinical studies in children and adolescents1with LOPD as well as in Infantile-Onset Pompe Disease (IOPD) Multiple expanded access mechanisms in place, including in the U.S., U.K., Germany, France, Japan, and others ~190 people living with Pompe disease are now on AT-GAA across extension studies and expanded access programs ~75 centers worldwide currently participating in clinical trials and access programs Advancing science though ongoing clinical studies and providing expanded accessthrough multiple mechanisms1 Children and adolescents aged 0 to <18 years old |

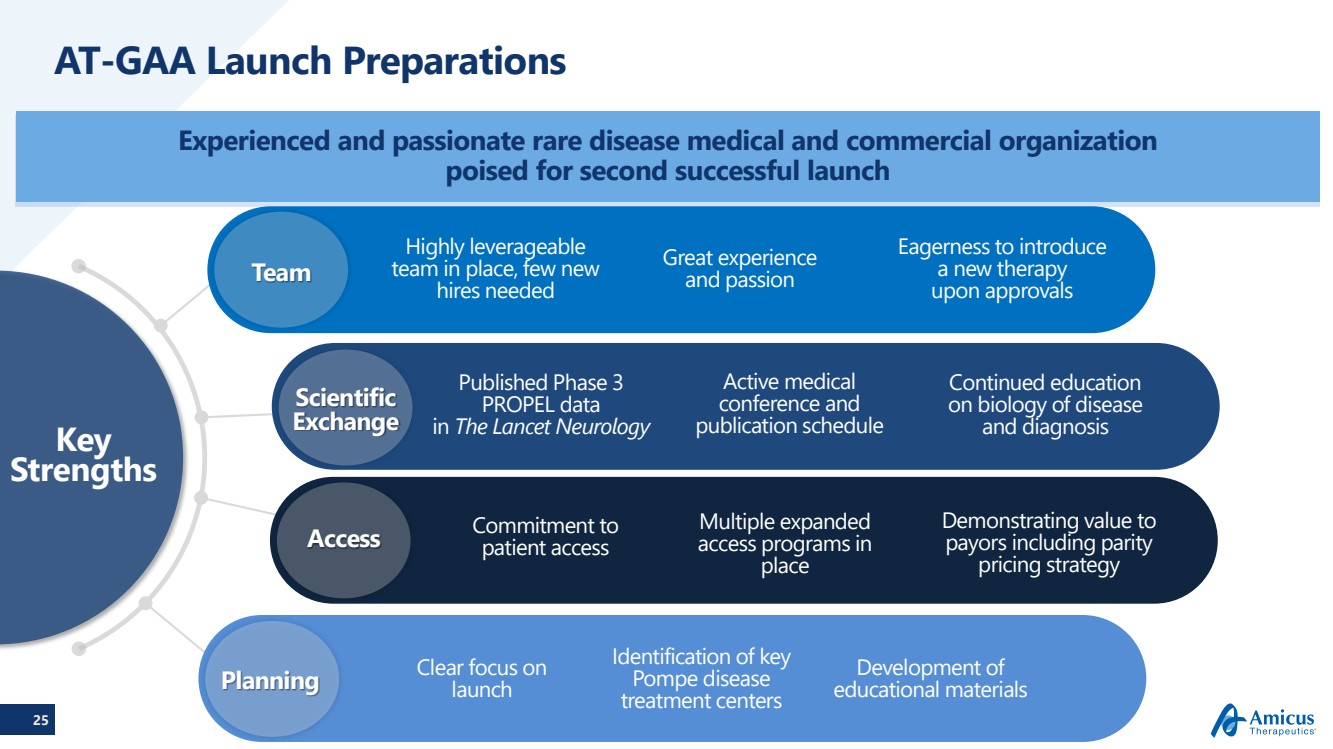

| 25 AT-GAA Launch Preparations Experienced and passionate rare disease medical and commercial organization poised for secondsuccessful launch Key Strengths Commitment to patient accessClear focus on launchIdentification of key Pompe disease treatment centersDevelopment of educational materials Planning Access Scientific Exchange Team Great experience and passionEagerness to introduce a new therapy upon approvalsHighly leverageable team in place, few new hires neededPublished Phase 3 PROPEL data in The Lancet NeurologyActive medical conference and publication scheduleMultiple expanded accessprograms in placeContinued education on biology of disease and diagnosisDemonstrating value to payors including parity pricing strategy |

| 26 Corporate OutlookDelivering on our mission for patients and shareholders |

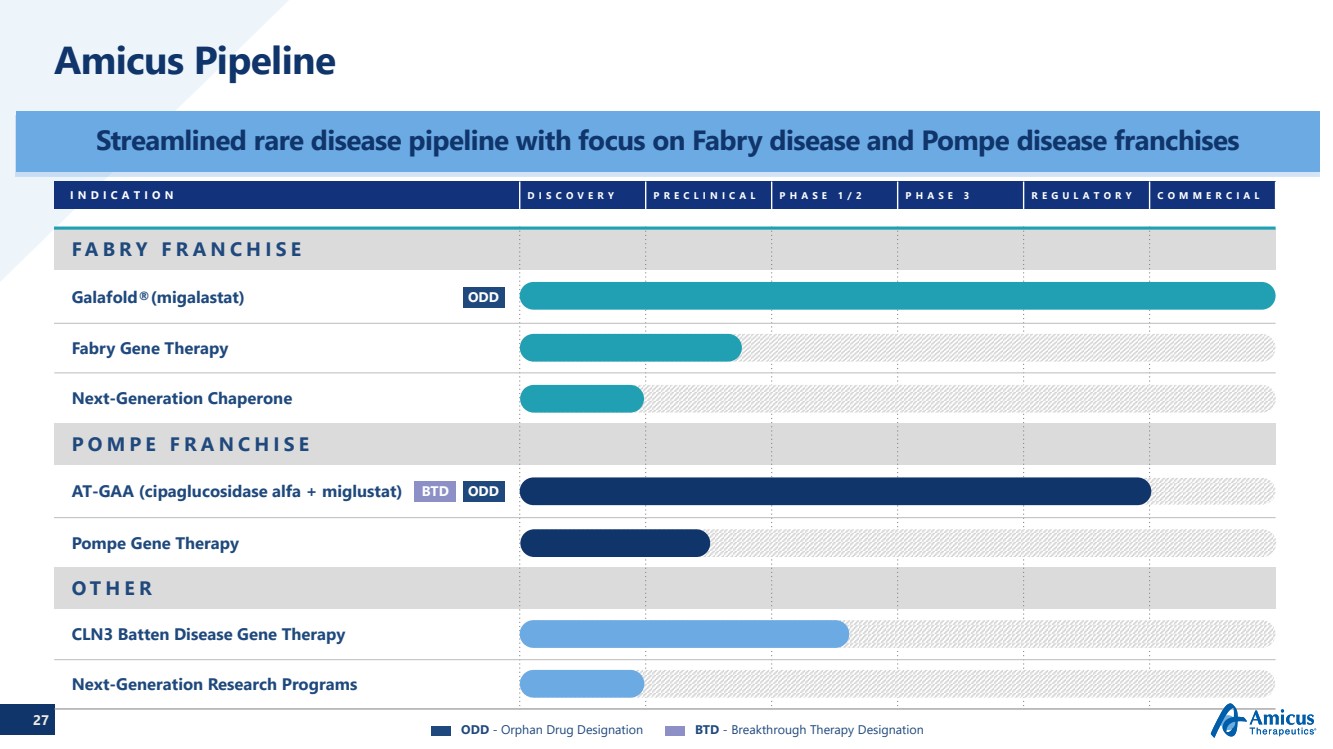

| 27 INDICATIONDISCOVERYPRECLINICALPHASE 1/2PHASE 3REGULATORYCOMMERCIALFABRY FRANCHISEGalafold®(migalastat) Fabry Gene TherapyNext-Generation ChaperonePOMPE FRANCHISEAT-GAA (cipaglucosidase alfa + miglustat)Pompe Gene TherapyOTHERCLN3 Batten Disease Gene Therapy Next-Generation Research ProgramsAmicus Pipeline Streamlined rare disease pipeline with focus on Fabry disease and Pompe disease franchises ODD ODD BTDODD-Orphan Drug Designation BTD -Breakthrough Therapy Designation |

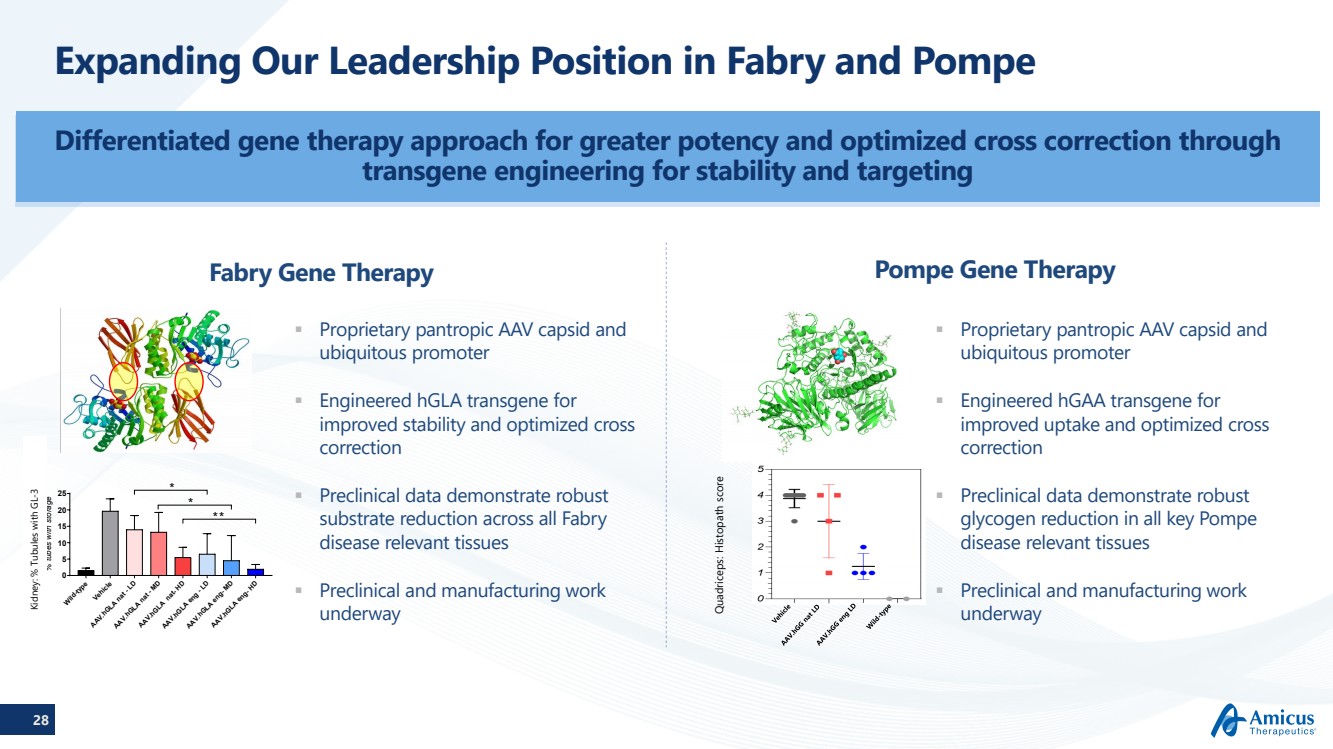

| 28 Expanding Our Leadership Position in Fabry and Pompe Differentiated gene therapy approach for greater potency and optimized cross correction through transgene engineering for stability and targeting Fabry Gene TherapyPompe Gene Therapy Proprietary pantropic AAV capsid and ubiquitous promoter Engineered hGLAtransgene for improved stability and optimized cross correction Preclinical data demonstrate robust substrate reduction across all Fabry disease relevant tissues Preclinical and manufacturing work underway Proprietary pantropic AAV capsid and ubiquitous promoter Engineered hGAA transgene for improved uptake and optimized cross correction Preclinical data demonstrate robust glycogen reduction in all key Pompe disease relevant tissues Preclinical and manufacturing work underway Wild-typeVehicleAAV.hGLA nat - LDAAV.hGLA nat - MDAAV.hGLA nat- HDAAV.hGLA eng - LDAAV.hGLA eng- MDAAV.hGLA eng- HD 0510152025 % tubes with storage **** *-3 Quadriceps: Histopathscore |

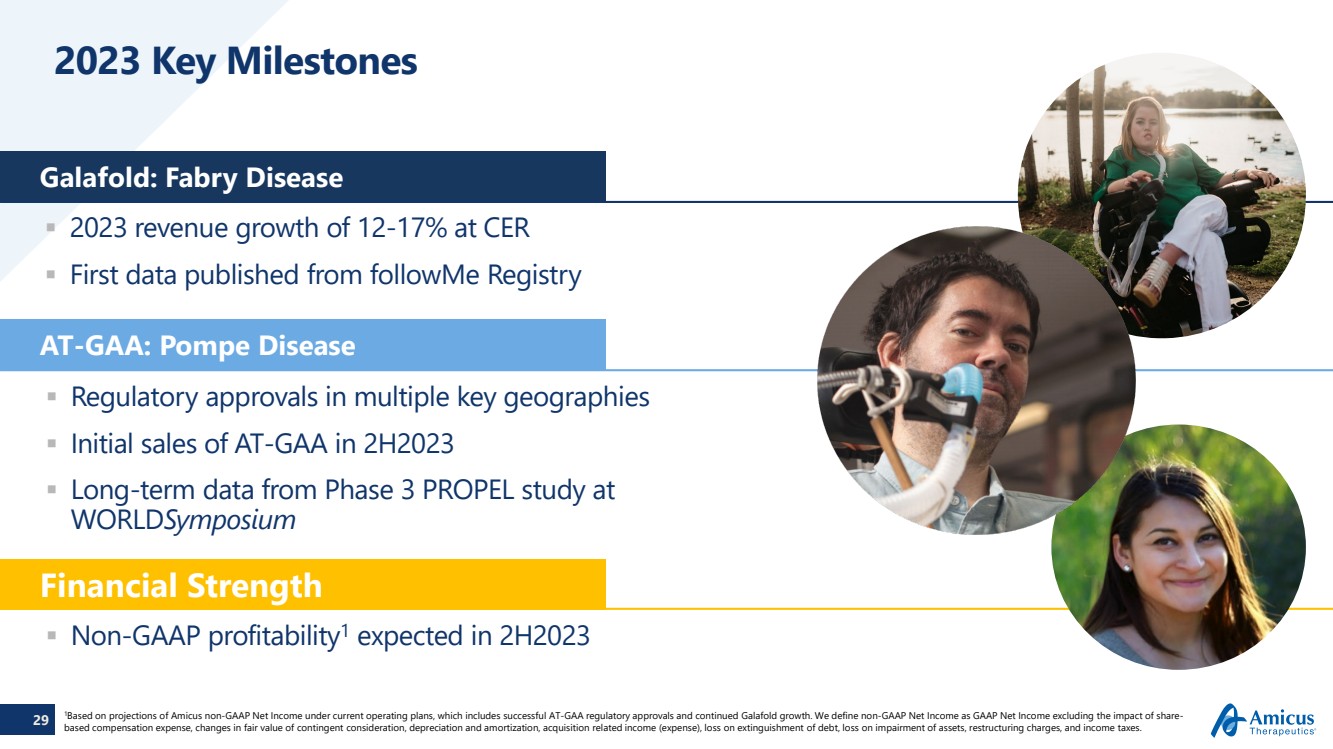

| 29 2023 Key Milestones Galafold: Fabry Disease AT-GAA: Pompe Disease Financial Strength 2023 revenue growth of 12-17% at CER First data published from followMeRegistry Regulatory approvals in multiple key geographies Initial sales of AT-GAA in 2H2023 Long-term data from Phase 3 PROPEL study at WORLDSymposium Non-GAAP profitability1expected in 2H20231Based on projections of Amicus non-GAAP Net Income under current operating plans, which includes successful AT-GAA regulatory approvals and continued Galafold growth. We define non-GAAP Net Income as GAAP Net Income excluding the impact of share-based compensation expense, changes in fair value of contingent consideration, depreciation and amortization, acquisition related income (expense), loss on extinguishment of debt, loss on impairment of assets, restructuring charges, and income taxes. |

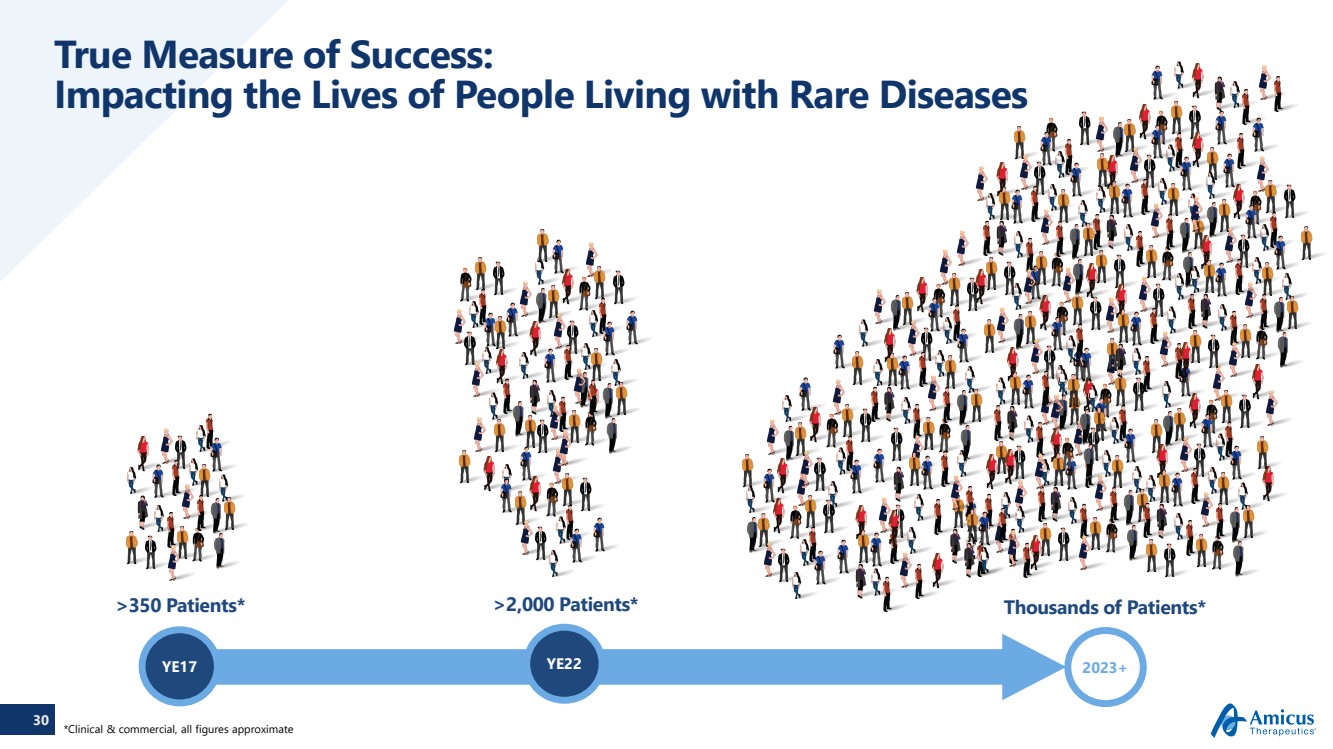

| 30 True Measure of Success: Impacting the Lives of People Living with Rare Diseases YE17 2023+Thousands of Patients*>2,000 Patients* YE22 >350 Patients* *Clinical & commercial, all figures approximate |

| Thank You |

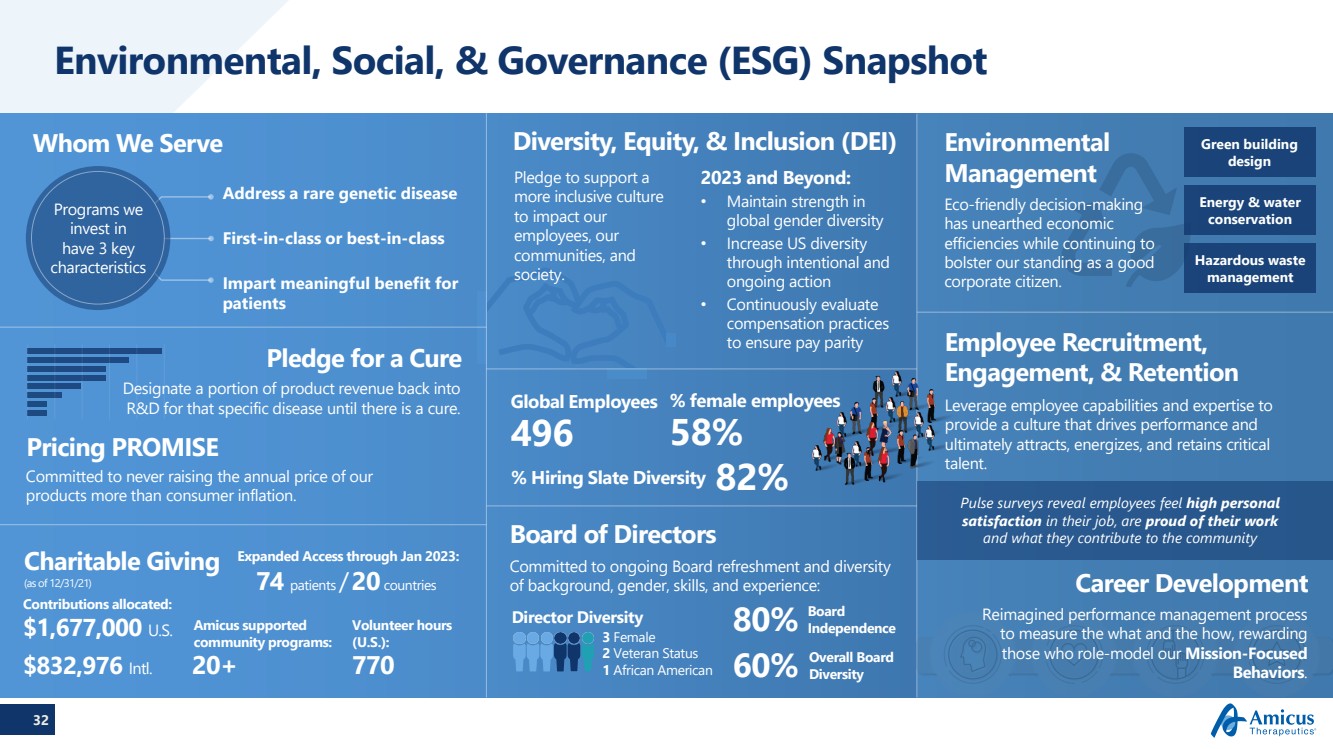

| 32 Environmental, Social, & Governance (ESG) Snapshot Board of Directors Eco-friendly decision-making has unearthed economic efficiencies while continuing to bolster our standing as a good corporate citizen.Committed to ongoing Board refreshment and diversity of background, gender, skills, and experience:Contributions allocated:$1,677,000 U.S.$832,976 Intl.770Volunteer hours (U.S.):20+Amicus supported community programs: 80%Board Independence60%Overall Board DiversityAddress a rare genetic disease First-in-class or best-in-classImpart meaningful benefit for patients 496Global Employees58%% female employees Whom We ServeEnvironmental Management Green building design Energy & water conservation Hazardous waste management Pledge for a CureDesignate a portion of product revenue back into R&D for that specific disease until there is a cure.Pricing PROMISE Programs we invest in have 3 key characteristicsCommitted to never raising the annual price of our products more than consumer inflation.Diversity, Equity, & Inclusion (DEI) 2023 and Beyond:•Maintain strength in global gender diversity•Increase US diversity through intentional and ongoing action•Continuously evaluate compensation practices to ensure pay parity Pledge to support a more inclusive culture to impact our employees, our communities, and society. 3 Female2 Veteran Status1 African AmericanDirector Diversity % Hiring Slate Diversity 82% Leverage employee capabilities and expertise to provide a culture that drives performance and ultimately attracts, energizes, and retains critical talent.Employee Recruitment, Engagement, & Retention Pulse surveys reveal employees feel high personal satisfaction in their job, are proud of their work and what they contribute to the communityCharitable Giving(as of 12/31/21)74 patients /20countriesExpanded Access through Jan 2023: Career DevelopmentReimagined performance management process to measure the what and the how, rewarding those who role-model our Mission-Focused Behaviors. |

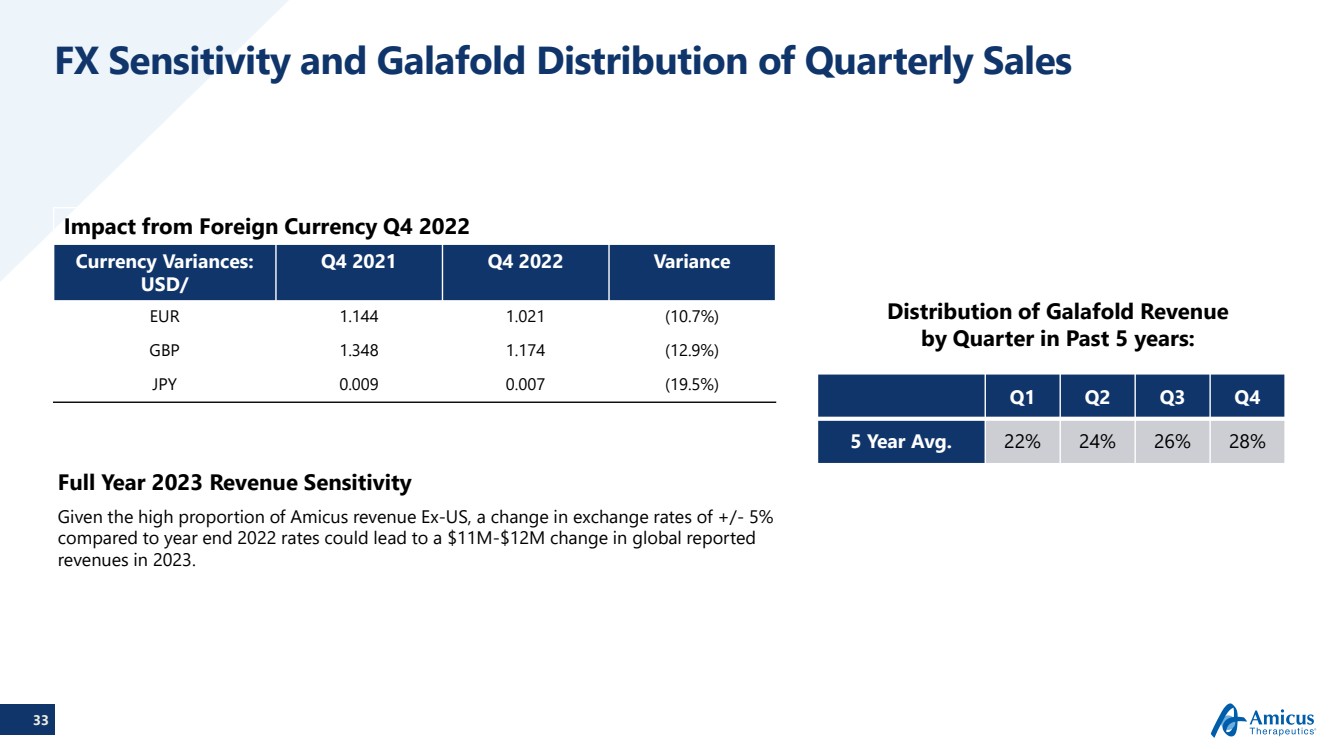

| 33 FX Sensitivity and Galafold Distribution of Quarterly Sales Impact from Foreign Currency Q4 2022Currency Variances: USD/Q4 2021Q4 2022VarianceEUR1.1441.021(10.7%)GBP1.3481.174(12.9%)JPY0.0090.007(19.5%) Full Year 2023 Revenue SensitivityGiven the high proportion of Amicus revenue Ex-US, a change in exchange rates of +/-5% compared to year end 2022 rates could lead to a $11M-$12M change in global reported revenues in 2023.Distribution of Galafold Revenue by Quarter in Past 5 years: Q1 Q2Q3Q45 Year Avg.22%24%26%28% |

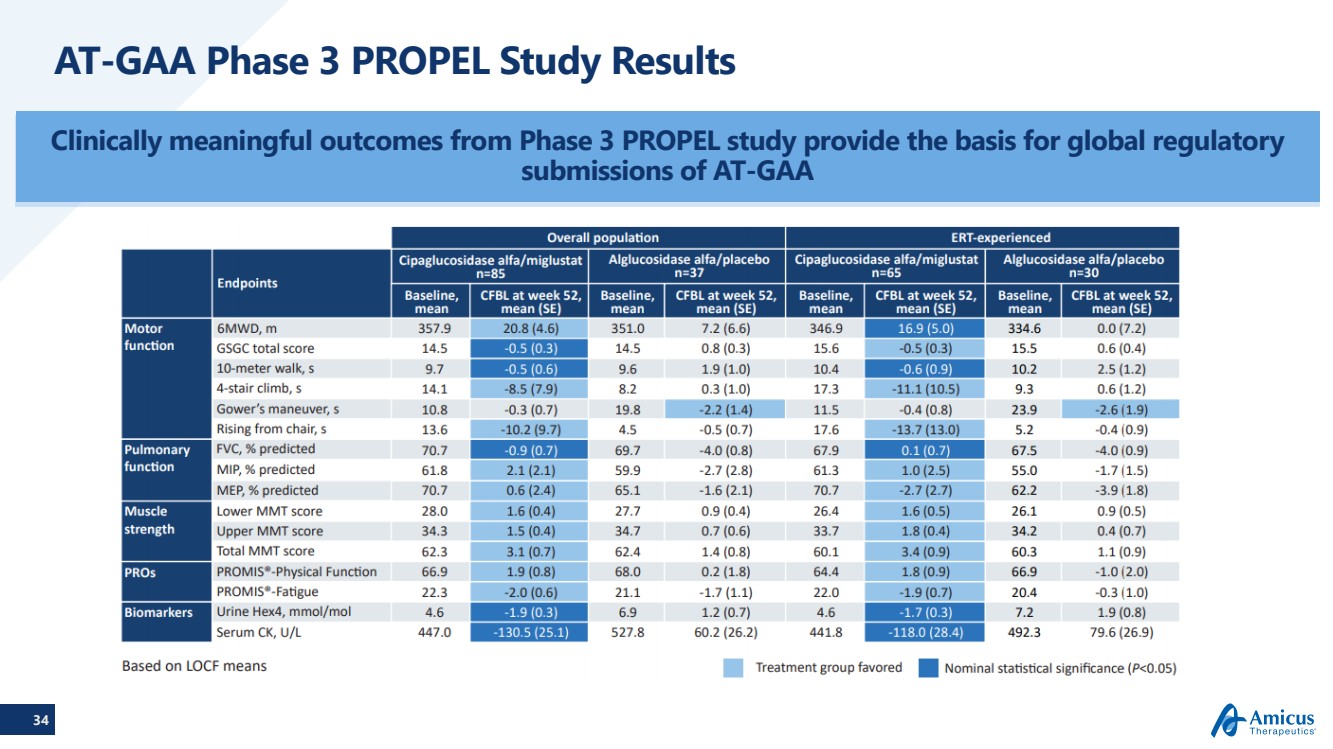

| 34 AT-GAA Phase 3 PROPEL Study Results Clinically meaningful outcomes from Phase 3 PROPEL study provide the basis for global regulatory submissions of AT-GAA |