An offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation, or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Offering Circular was filed may be obtained.

Preliminary Offering Circular

December 8, 2022

Subject to Completion

RED OAK CAPITAL FUND VI, LLC

625 Kenmoor Avenue SE, Suite 200

Grand Rapids, Michigan 49546

(616) 324-0590

8.0% Series A Unsecured Bonds (A Bonds)

8.65% Series Ra Unsecured Bonds (Ra Bonds)

$35,000,000 Maximum Offering Amount (35,000 Bonds)

$10,000 Minimum Purchase Amount (10 Bonds)

Red Oak Capital Fund VI, LLC, a Delaware limited liability company, or the “Company,” is offering $35,000,000 in the aggregate, its 8.00% Series A Unsecured Bonds, or the “A Bonds,”, and its 8.65% Series Ra Unsecured Bonds, or the “Ra Bonds,” and collectively, the “Bonds,” pursuant to this offering circular. The purchase price per Bond is $1,000, with a minimum purchase amount of $10,000, or the “minimum purchase”; however, the Company, in the Manager’s sole discretion, reserves the right to accept smaller purchase amounts. The A Bonds and the Ra Bonds will bear interest at a rate equal to 8.00% and 8.65% per year, respectively, payable to the record holders of the Bonds quarterly in arrears on January 25th, April 25th, July 25th and October 25th of each year, beginning on the first such date that corresponds to the first full quarter after the initial closing in the offering. The Bonds will mature on December 31, 2028.

The Bondholders will have the right to have their Bonds redeemed (i) beginning January 1, 2027, and (ii) in the case of a holder’s death, bankruptcy or total permanent disability, each subject to notice, discounts and other provisions contained in this offering circular. See “Description of Bonds – Redemption Upon Death, Disability or Bankruptcy” and “Description of Bonds – Bondholder Redemption” for more information.

The Bonds will be offered to prospective investors on a best efforts basis by Crescent Securities Group, Inc., or our “managing broker-dealer,” a Texas corporation and a member of the Financial Industry Regulatory Authority, or “FINRA.” “Best efforts” means that our managing broker-dealer is not obligated to purchase any specific number or dollar amount of Bonds, but it will use its best efforts to sell the Bonds. Our managing broker-dealer may engage additional broker-dealers, or “selling group members,” who are members of FINRA to assist in the sale of the Bonds. At each closing date, the proceeds for such closing will be disbursed to our company and Bonds relating to such proceeds will be issued to their respective investors. We expect to commence the sale of the Bonds as of the date on which the offering statement is declared qualified by the United States Securities and Exchange Commission, or the “SEC” and terminate the offering on December 31, 2023 or the date upon which our Manager determines to terminate the offering, in its sole discretion. Notwithstanding the previous sentence, our Manager has the right to extend this offering beyond December 31, 2023 for two consecutive six-month periods.

|

|

| Price to Investors |

|

| Managing Broker- Dealer Fee, Commissions, and Expense Reimbursements(1) (2) |

|

| Proceeds to Company |

|

| Proceeds to Other Persons |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

| Per Series A Bond |

| $ | 1,000 |

|

| $ | 82.50 |

|

| $ | 917.50 |

|

| $ | 0 |

|

| Per Series Ra Bond |

| $ | 1,000 |

|

| $ | 32.50 |

|

| $ | 967.50 |

|

| $ | 0 |

|

| Maximum Offering Amount A Bonds(3) |

| $ | 35,000,000 |

|

| $ | 2,887,500 |

|

| $ | 32,112,500 |

|

| $ | 0 |

|

| Maximum Offering Amount Ra Bonds(4) |

| $ | 35,000,000 |

|

| $ | 1,137,500 |

|

| $ | 33,862,500 |

|

| $ | 0 |

|

_________

(1) This includes (a) selling commissions of 5.00% of gross offering proceeds on the sale of A Bonds, (b) a managing broker-dealer fee of up to 1.00% of the gross proceeds of the offering, (c) a wholesaling fee of up to 1.00% of gross proceeds from the certain sales of the Bonds, and (d) a nonaccountable expense reimbursement of up to 1.25% of gross offering proceeds on the sale of the Bonds. Kevin Kennedy, an officer and member of the board of managers of our Sponsor, and Raymond Davis, an officer of our Manager, are registered as associated persons of our managing broker-dealer. As a result, they may be paid all or a part of any selling commission resulting from Bonds sold directly by them or through certain selling group members. See ”Use of Proceeds” and “Plan of Distribution” for more information.

The Series Ra Bonds will be sold solely to certain purchasers, including those purchasing through a registered investment advisor. See “Plan of Distribution – Eligibility to Purchase Series Ra Bonds.” We will not pay selling commissions on the sale of Series Ra Bonds; however, we may pay a managing broker-dealer fee and a wholesaling fee and may pay nonaccountable expense reimbursements of up to 1.25% on such sales. All such amounts will be paid to our managing broker-dealer, who may reallow up to the entire amount of selling commissions and the wholesaling fee to selling group members.

(2) The table above does not include an organizational and offering fee, or O&O Fee of 2.00% of offering proceeds ($700,000 at the maximum offering amount) payable to our Manager. Our Manager will be entitled to retain as compensation any amount by which the O&O Fee exceeds actual organization and offering expenses. To the extent organizational and offering expenses exceed 2.00% of the gross proceeds raised in the offering, our Manager will pay such amounts without reimbursement from us. In no event will the O&O Fee payable to our Manager exceed 2.00% of the offering proceeds.

(3) The table above shows amounts payable to our managing broker-dealer if we sell the maximum offering amount comprised solely of Series A Bonds.

(4) The table above shows amounts payable to our managing broker-dealer if we sell the maximum offering amount comprised solely of Series Ra Bonds.

Generally, no sale may be made to you in the offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

An investment in the Bonds is subject to certain risks and should be made only by persons or entities able to bear the risk of and to withstand the total loss of their investment. Currently, there is no market for the Bonds being offered, nor does our Company anticipate one developing. Prospective investors should carefully consider and review that risk as well as the RISK FACTORS beginning on Page 7 of this offering circular. We are not an investment company and are not required to register under the Investment Company Act of 1940; therefore, investors will not receive the protections of such act.

THE SEC DOES NOT PASS UPON THE MERITS OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SELLING LITERATURE. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE SEC; HOWEVER, THE COMMISION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

FORM 1-A DISCLOSURE FORMAT IS BEING FOLLOWED.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

| 2 |

| 3 |

| Table of Contents |

ABOUT THIS OFFERING CIRCULAR

The information in this offering circular may not contain all of the information that is important to you. You should read this entire offering circular and the exhibits carefully before deciding whether to invest in the Bonds. See “Where You Can Find Additional Information” in this offering circular.

Unless the context otherwise indicates, references in this prospectus supplement to the terms “company,” “we,” “us,” and “our,” refer to Red Oak Capital Fund VI, LLC, a Delaware limited liability company; our “Manager” refers to Red Oak Capital GP, LLC, a Delaware limited liability company, our sole member and manager; and our “Sponsor” refers to Red Oak Capital Holdings, LLC, a Delaware limited liability company, and its subsidiaries.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

| 4 |

| Table of Contents |

This summary highlights information contained elsewhere in this offering circular. This summary does not contain all of the information that you should consider before deciding whether to invest in the Series A Units. You should carefully read this entire offering circular, including the information under the heading “Risk Factors.”

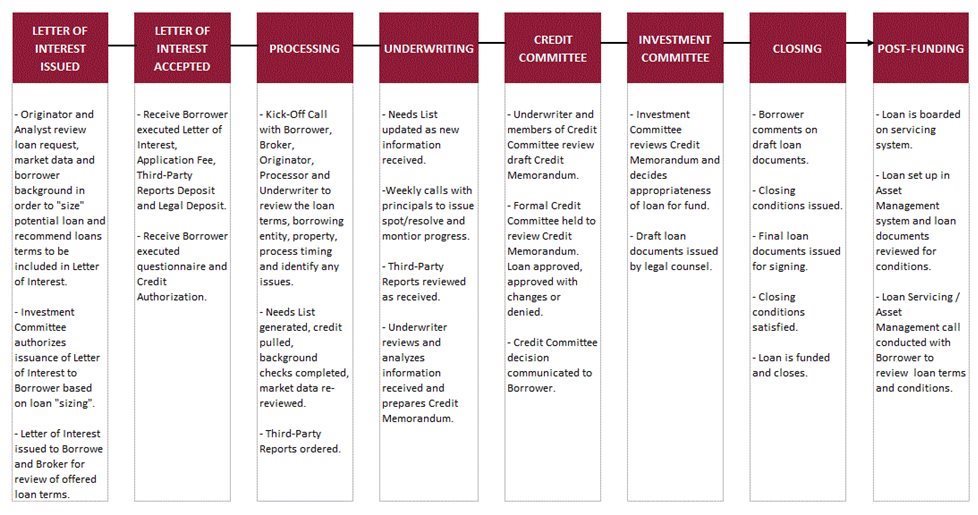

Our Company. Red Oak Capital Fund VI, LLC, a Delaware limited liability company, was formed on June 10, 2021 to originate and acquire senior loans collateralized by commercial real estate in the U.S. Our business plan is to originate, acquire, and manage commercial real estate loans and other commercial real estate-related debt instruments. While the commercial real estate debt markets are complex and continually evolving, we believe they offer compelling opportunities when approached with the capabilities and expertise of our Manager, a wholly owned subsidiary of our Sponsor. Our Manager intends to actively participate in the servicing and operational oversight of our assets rather than subrogate those responsibilities to a third party.

Our investment objective is to preserve and protect our capital while producing attractive risk-adjusted returns generated from current income on our portfolio. Our investment strategy is to originate loans and invest in debt and related instruments supported by commercial real estate in the U.S. Through our Manager, we draw on our Sponsor’s and its affiliates’ established sourcing, underwriting and structuring capabilities in order to execute our investment strategy.

The Company does not intend to act as a land or real estate developer and currently has no intent to invest in, acquire, own, hold, lease, operate, manage, maintain, redevelop, sell, or otherwise use any undeveloped real property or developed real property, unless such actions are necessary or prudent based upon borrower default in accordance with the terms of the debt instruments held by the Company.

Our principal executive office is located at 625 Kenmoor Avenue SE, Suite 200, Grand Rapids, Michigan 49546, and our telephone number is (616) 324-0590. For more information on our Sponsor, its website is www.redoakcapitalholdings.com. The information on, or otherwise accessible through, our Sponsor’s website does not constitute a part of this offering circular.

Our Sponsor and Management. Our Sponsor is a Grand Rapids, Michigan based commercial real estate finance company specializing in the acquisition, origination, processing, underwriting, operational management, and servicing of commercial real estate debt instruments. Our Sponsor is the sole member and manager of our Manager, and our Manager will rely on our Sponsor, its management and its affiliates to manage our operations and acquire and manage our portfolio of real estate loans and other debt instruments. The principals of our Sponsor and its affiliates have extensive transaction analysis and structuring experience, in fact when combined, they have over 130 years of cumulative commercial real estate lending, management and workout experience, with in excess of $30B of funded. There is a dedicated staff of originators, processors, underwriters and analysts who have field experience in the origination, closing and servicing of loans as well as implementing tactical strategies at the asset level to create maximum value.

| 5 |

| Table of Contents |

The Offering. We are offering to investors the opportunity to purchase up to an aggregate of $35,000,000 of Bonds. See “Plan of Distribution - Who May Invest” for further information. The offering will continue through December 31, 2023 or the date upon which our Manager terminates the offering, in its sole discretion, or the “offering termination.” Notwithstanding the previous sentence, our Manager has the right to extend this offering beyond December 31, 2023 for two consecutive six-month periods. Our company will conduct closings in this offering on the 20th of each month or, if the 20th is not a business day, the next succeeding business day, assuming there are funds to close, or the “closing dates,” and each, a “closing date,” until the offering termination. Once a subscription has been submitted and accepted by the Company, an investor will not have the right to request the return of its subscription payment prior to the next closing date. If subscriptions are received on a closing date and accepted by the Company prior to such closing, any such subscriptions will be closed on that closing date. If subscriptions are received on a closing date but not accepted by the Company prior to such closing, any such subscriptions will be closed on the next closing date. It is expected that settlement will occur on the same day as each closing date. On each closing date, offering proceeds for that closing will be disbursed to us and Bonds will be issued to investors, or the “Bondholders.” If the Company is dissolved or liquidated after the acceptance of a subscription, the respective subscription payment will be returned to the subscriber. The offering is being made on a best-efforts basis through Crescent Securities Group, Inc., or our managing broker-dealer.

| Issuer |

| Red Oak Capital Fund VI, LLC, a Delaware limited liability company. |

|

|

|

|

| Securities Offered |

| Maximum – $35,000,000, aggregate principal amount of the Bonds. |

|

|

|

|

| Sponsor Contribution | The Sponsor has committed to contribute $1.5 million in exchange for 6,000 Common Units in the Company (“Capital Commitment”), which may be called at time and in amounts in the discretion of the Manager. | |

|

|

|

|

| Maturity Date |

| December 31, 2028. See “Description of Bonds – Maturity” for more information. |

|

|

|

|

| Interest Rate |

| Series A Bonds – 8.00% per annum computed on the basis of a 360-day year. Series Ra Bonds – 8.65% per annum on the basis of a 360-day year. |

|

|

|

|

| Interest Payments |

| Paid to the record holders of the Bonds quarterly in arrears, each January 25th, April 25th, July 25th and October 25th, for the preceding fiscal quarter ending March 31st, June 30th, September 30th and December 31st, respectively, beginning on such payment date immediately following the first full fiscal quarter after the initial closing in the offering and continuing until the Maturity Date. Interest will accrue and be paid on the basis of a 360-day year consisting of twelve 30-day months. Interest on each Bond will accrue and be cumulative from the end of the most recent interest period for which interest has been paid on such Bond, or if no interest has paid, from the date of issuance. |

|

|

|

|

| Offering Price |

| $1,000 per Bond. |

|

|

|

|

| Ranking |

| The Bonds will be unsecured obligations and will rank junior to our senior secured indebted-ness from time to time outstanding, pari passu with our unsecured indebtedness, if any, from time to time outstanding unless such debt is expressly to the Bonds and structurally subordinate to all debt of our subsidiaries. |

|

|

|

|

| No Security |

| The Bonds will be unsecured. |

|

|

|

|

| Use of Proceeds |

| We estimate that the net proceeds we will receive from this offering, without taking into account sales of Ra Bonds, will be approximately $31,412,500 if we sell the maximum offering amount, after deducting selling commissions and fees payable to our managing broker-dealer and selling group members, and payment of the O&O Fee to our Manager.

We plan to use substantially all of the net proceeds from this offering to originate and make commercial mortgage loans and acquire other senior secured real estate debt investments consistent with our investment strategies. We may also use a portion of the net proceeds to pay fees to our Manager, or its affiliates, for working capital and for other general corporate purposes. See “Use of Proceeds” for additional information. |

|

|

|

|

| Change of Control - Offer to Purchase |

| If a Change of Control Repurchase Event as defined under “Description of Bonds – Certain Covenants” in this offering circular, occurs, we must offer to repurchase the Bonds at a price that is equal to all accrued and unpaid interest, to but not including the date on which the Bonds are redeemed, plus (i) 1.02 times the then outstanding principal amount of the Bonds if such Bonds are at least four years from maturity; (ii) 1.015 times the then outstanding principal amount of the Bonds if such Bonds are at least three years, but no more than four years, from maturity; (iii) 1.01 times the then outstanding principal amount of the Bonds if such Bonds are at least two years, but no more than three years, from maturity; and (iv) the then outstanding principal amount of the Bonds if no more than two years from maturity. |

| 6 |

| Table of Contents |

| Bondholder Redemption |

| The Bonds will be redeemable at the election of the Bondholder beginning January 1, 2027. In order to be redeemed, the Bondholder must provide written notice to us at our principal place of business. We will have 120 days from the date such notice is provided to redeem the Bondholder’s Bonds at a price per Bond equal to: (i) $800 plus any accrued but unpaid interest on the Bond. Our obligation to redeem Bonds in any given year pursuant to this Redemption is limited to 15% of the outstanding principal balance of the Bonds, in the aggregate, on January 1st of the applicable year. In addition, we have the right to reserve up to one-third of this 15% limit for Bonds redeemed as a result of a Bondholder’s right upon death, disability or bankruptcy which may reduce the number of Bonds to be redeemed pursuant to the Bondholder Redemption. Bond redemptions pursuant to the Bondholder Redemption will occur in the order that notices are received. |

|

|

|

|

| Redemption Upon Death, Disability or Bankruptcy |

| Within 60 days of the death, total permanent disability or bankruptcy of a Bondholder who is a natural person (or the beneficiary of an irrevocable trust that holds Bonds who is a natural person), the estate of such Bondholder, such Bondholder, or legal representative of such Bondholder may request that we repurchase, in whole, but not in part, the Bonds held by such Bondholder by delivering to us a written notice requesting such Bonds be redeemed. Any such request shall specify the particular event giving rise to the right of the holder or beneficial holder to have his or her Bonds redeemed. If a Bond held jointly by natural persons who are legally married, then such request may be made by (i) the surviving Bondholder upon the death of the spouse, or (ii) the disabled or bankrupt Bondholder (or a legal representative) upon total permanent disability or bankruptcy of the spouse. In the event a Bond is held together by two or more natural persons that are not legally married, neither of these persons shall have the right to request that the Company repurchase such Bond unless each Bondholder has been affected by such an event.

Upon receipt of redemption request in the event of death, total permanent disability or bankruptcy of a Bondholder, we will designate a date for the redemption of such Bonds, which date shall not be later than after 120 days we receive facts or certifications establishing to the reasonable satisfaction of the Company supporting the right to be redeemed. On the designated date, we will redeem such Bonds at a price per Bond of (i) $920 if requested prior to the third anniversary of the first issuance of Bonds to the holder, or (ii) $1,000 thereafter, plus any accrued and unpaid interest, to but not including the date on which the Bonds are redeemed. |

| Optional Redemption |

| The Bonds may be redeemed, in whole or part, at our option at any time prior to maturity. We may extend maturity on the Bonds for six months in order to facilitate redemption of the Bonds in our sole discretion. Any redemption will be at a price that is equal to all accrued and unpaid interest, to but not including the date on which the Bonds are redeemed, plus 1.01 times the then outstanding principal amount of the Bonds. In the event of a Change of Control Repurchase Event occurs during the pendency of an optional redemption by the Company, the terms of the Change of Control Repurchase covenant will apply. For the specific terms of the Optional Redemption, please see “Description of Bonds – Optional Redemption” for more information. |

|

|

|

|

| Default |

| The indenture governing the Bonds will contain events of default, the occurrence of which may result in the acceleration of our obligations under the Bonds in certain circumstances. Events of default, other than payment defaults, will be subject to our company’s right to cure within a certain number of days of such event of default. Our company will have the right to cure any payment default within 60 days before the trustee may declare a default and exercise the remedies under the indenture. See “Description of Bonds - Event of Default” for more information. |

| 7 |

| Table of Contents |

| Form |

| The Bonds will be evidenced by global bond certificates deposited with a nominee holder or directly on the books and records of UMB Bank, N.A., or UMB Bank. It is anticipated that the nominee holder will be the Depository Trust Company, or DTC, or its nominee, Cede & Co., for those purchasers purchasing through a DTC participant subsequent to the Bonds gaining DTC eligibility. See “Description of Bonds - Book-Entry, Delivery and Form” for more information. |

|

|

|

|

| Bond Service Reserve |

| Our company will be required to keep 3.75% of gross offering proceeds in a reserve account with the trustee for a period of one (1) year following the first closing date, which reserve may be used to pay our company’s Bond Service Obligations, as defined herein, during such time, and the remainder of which, if any, will be released to our company on the first anniversary of the first closing date if our company is otherwise in compliance with all terms of the Bonds. |

|

|

|

|

| Denominations |

| We will issue the Bonds only in denominations of $1,000. |

| Payment of Principal and Interest |

| Principal and interest on the Bonds will be payable in U.S. dollars or other legal tender, coin or currency of the U.S. |

|

|

|

|

| Future Issuances |

| We may, from time to time, without notice to or consent of the Bondholders, increase the aggregate principal amount of the Bonds outstanding by issuing additional bonds in the future with the same terms of the Bonds, except for the issue date and offering price, and such additional bonds shall be consolidated with the of Bonds and form a single series. |

|

|

|

|

| Securities Laws Matters: |

| The Bonds being offered are not being registered under the Securities Act in reliance upon exemptions from the registration requirements of the Securities Act and such state securities laws and may not be transferred or resold except as permitted under the Securities Act and applicable state securities laws pursuant to registration or exemption therefrom. In addition, the Company does not intend to be registered as an investment company under the Investment Company Act of 1940 nor does the Manager plan to register as an investment adviser under the Investment Advisers Act of 1940, as amended. |

|

|

|

|

| Trustee, Registrar and Paying Agent |

| We have designated UMB Bank as paying agent and registrar for the Bonds held in global form by DTC, and Phoenix American Financial Services, Inc. (“Phoenix American”) as paying agent and registrar for Bonds held in any other name. UMB Bank will act also as trustee under the indenture. The Bonds will be issued in book-entry form only, evidenced by global certificates for these Bonds held through DTC, and on the books and records of UMB Bank for those Bonds which are direct registered. As such, UMB Bank will make payments to DTC or its nominee, and Phoenix American will make payments directly to Bondholders, as the case may be. |

|

|

|

|

| Governing Law |

| The indenture and the Bonds will be governed by the laws of the State of Delaware. |

|

|

|

|

| Material Tax Considerations |

| You should consult your tax advisors concerning the U.S. federal income tax consequences of owning the Bonds in light of your own specific situation, as well as consequences arising under the laws of any other taxing jurisdiction. |

|

|

|

|

| Risk Factors |

| An investment in the Bonds involves certain risks. You should carefully consider the risks above, as well as the other risks described under “Risk Factors” beginning on page of this offering circular before making an investment decision. |

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

| 8 |

| Table of Contents |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This offering circular contains certain forward-looking statements that are subject to various risks and uncertainties. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “outlook,” “seek,” “anticipate,” “estimate,” “approximately,” “believe,” “could,” “project,” “predict,” or other similar words or expressions. Forward-looking statements are based on certain assumptions, discuss future expectations, describe future plans and strategies, contain financial and operating projections or state other forward-looking information. Our ability to predict results or the actual effect of future events, actions, plans, or strategies is inherently uncertain. Although we believe that the expectations reflected in our forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth or anticipated in our forward-looking statements. Factors that could have a material adverse effect on our forward-looking statements and upon our business, results of operations, financial condition, funds derived from operations, cash flows, liquidity and prospects include, but are not limited to, the factors referenced in this offering circular, including those set forth below.

When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements in this offering circular. Readers are cautioned not to place undue reliance on any of these forward-looking statements, which reflect our views as of the date of this offering circular. The matters summarized below and elsewhere in this offering circular could cause our actual results and performance to differ materially from those set forth or anticipated in forward-looking statements. Accordingly, we cannot guarantee future results or performance. Furthermore, except as required by law, we are under no duty to, and we do not intend to, update any of our forward-looking statements after the date of this offering circular, whether as a result of new information, future events or otherwise.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

| 9 |

| Table of Contents |

An investment in the Bonds is highly speculative and is suitable only for persons or entities that are able to evaluate the risks of the investment. An investment in the Bonds should be made only by persons or entities able to bear the risk of and to withstand the total loss of their investment. Prospective investors should consider the following risks before making a decision to purchase the Bonds. To the best of our knowledge, we have included all material risks to investors in this section.

Risks Related to the Bonds and to this Offering

The Bonds are unsecured and may be subordinated.

The indenture governing the Bonds does not prevent our incurring additional indebtedness, both unsecured and secured by liens on the assets of our company, including additional Bonds under the indenture. The Bonds will be subordinate in right of payment to secured debt we may incur, meaning that future secured indebtedness of our company will have priority of payment over the Bonds. As a result, Bondholders rights could be diluted by any increase in indebtedness, in particular indebtedness secured by our assets and/or to which the Bonds are subordinated.

The Bonds are not obligations of our subsidiaries and will be effectively subordinated to any future obligations of our company’s subsidiaries, if any. Structural subordination increases the risk that we will be unable to meet our obligations on the Bonds.

The Bonds are our obligations exclusively and not of any of our subsidiaries. We do not currently have any subsidiaries, but we are not precluded from acquiring or forming subsidiaries by the indenture or otherwise. If acquired or formed, our company’s subsidiaries are not expected to be guarantors of the Bonds and the Bonds are not required to be guaranteed by any subsidiaries our company may acquire or form in the future. The Bonds are also effectively subordinated to all of the liabilities of our company’s subsidiaries, to the extent of their assets, since they are separate and distinct legal entities with no obligation to pay any amounts due under our company’s indebtedness, including the Bonds, or to make any funds available to make payments on the Bonds. Our company’s right to receive any assets of any subsidiary in the event of a bankruptcy or liquidation of the subsidiary, and therefore the right of our company’s creditors to participate in those assets, will be effectively subordinated to the claims of that subsidiary’s creditors, including trade creditors, in each case to the extent that our company is not recognized as a creditor of such subsidiary. In addition, even where our company is recognized as a creditor of a subsidiary, our company’s rights as a creditor with respect to certain amounts are subordinated to other indebtedness of that subsidiary, including secured indebtedness to the extent of the assets securing such indebtedness.

The Bonds will not limit our company’s or its subsidiaries’ ability to incur additional debt or take other action that could negatively impact Bondholders.

The indenture does not contain provisions that would limit our company’s ability or the ability of its subsidiaries to incur indebtedness, including indebtedness that would be senior to the Bonds.

The Bonds will be protected by limited restrictive covenants, which in turn may allow us to engage in a variety of transactions that may impair our ability to fulfill our obligations under the Bonds.

The indenture governing the Bonds will contain limited financial covenants and will not restrict us from paying dividends, incurring debt, directly or indirectly (including debt of our subsidiaries) or issuing other securities. Because the indenture will contain limited covenants or other provisions designed to afford the Bondholders protection in the event of a highly leveraged transaction involving us including as a result of a takeover, recapitalization, highly leveraged transaction, or similar restructuring involving us, except to the extent described under “Description of Bonds – Certain Covenants,” we may engage in transactions that may impair our ability to fulfill our obligations under the Bonds.

| 10 |

| Table of Contents |

Some significant restructuring transactions that may adversely affect you may not constitute a “Change of Control/Repurchase Event” under the indenture, in which case we would not be obligated to offer to repurchase the Bonds.

Some restructuring transactions that result in a change in control may not qualify as a repurchase event under the Indenture; therefore, Bondholders will not have the right to repurchase their Bonds, even though the Company is under new management. These transactions are limited to those which cause a non-affiliate of the Company to gain voting control. For example, if our sole member determined to cause the Company to become Manager-Managed by a third-party, the change in control would not qualify as a repurchase event under the Indenture. Upon the occurrence of a transaction which results in a change in control of the company, Bondholders will have no voting rights with respect to such a transaction. In the event of any such transaction, Bondholders would not have the right to require us to repurchase their Bonds, even though such a transaction could increase the amount of our indebtedness, or otherwise adversely affect the Bondholders.

Our investment objectives may become more difficult to reach depending on the amount of funds raised in this offering.

While we believe we will be able to reach our investment objectives regardless of the amount of the raise, it may be more difficult to do so if we sell less Bonds than we anticipate. Such a result may negatively impact our liquidity. In that event, our investment costs may increase, which may decrease our ability to make payments to Bondholders.

Our trustee shall be under no obligation to exercise any of the rights or powers vested in it by the indenture at the request, order or direction of any of the Bondholders, pursuant to the provisions of the indenture, unless such Bondholders shall have offered to the trustee reasonable security or indemnity against the costs, expenses and liabilities that may be incurred therein or thereby.

The indenture governing the Bonds provides that in case an event of default occurs and not be cured, the trustee will be required, in the exercise of its power, to use the degree of care of a reasonable person in the conduct of his own affairs. Subject to such provisions, the trustee will be under no obligation to exercise any of its rights or powers under the indenture at the request of any Bondholder, unless the Bondholder has offered to the trustee security and indemnity satisfactory to it against any loss, liability, or expense.

The Bonds will have limited transferability and liquidity.

Prior to this offering, there was no active market for the Bonds. Although we may apply for quotation of the Bonds on an alternative trading system or over the counter market, even if we obtain that quotation, we do not know the extent to which investor interest will lead to the development and maintenance of a liquid trading market. Further, the Bonds will not be quoted on an alternative trading system or over the counter market until after the termination of this offering, if at all. Therefore, investors will be required to wait until at least after the final termination date of this offering for such quotation. The initial public offering price for the Bonds has been determined by us. You may not be able to sell the Bonds you purchase at or above the initial offering price.

Alternative trading systems and over the counter markets, as with other public markets, may from time-to-time experience significant price and volume fluctuations. As a result, the market price of the Bonds may be similarly volatile, and Bondholders may from time to time experience a decrease in the value of their Bonds, including decreases unrelated to our operating performance or prospects. The price of the Bonds could be subject to wide fluctuations in response to a number of factors, including those listed in this “Risk Factors” section of this offering circular.

No assurance can be given that the market price of the Bonds will not fluctuate or decline significantly in the future or that Bondholders will be able to sell their Bonds when desired on favorable terms, or at all. Further, the sale of the Bonds may have adverse federal income tax consequences.

Our lack of operating history makes it difficult for you to evaluate this investment.

We are a recently formed entity with no operating history and may not be able to successfully operate our business or achieve our investment objectives. We may not be able to conduct our business as described in our plan of operation.

| 11 |

| Table of Contents |

You will not have the opportunity to evaluate our investments before we make them, and we may make investments that would have changed your decision as to whether to invest in the Bonds.

As of the date of this offering circular, we own no assets. We are not able to provide you with information to evaluate our future investments. We will seek to invest substantially all of the offering proceeds available for investment, after the payment of commissions, fees, and expenses, in the origination of loans and investing in debt and related instruments supported by commercial real estate in the U.S. We have established criteria for evaluating potential investments. However, you will be unable to evaluate the transaction terms or data concerning the investments before we make investments. You will be relying entirely on the ability of our Manager, through our Sponsor and its management team, to identify suitable investments and propose transactions for our Manager to oversee and approve. These factors increase the risk that we may not generate the returns that you seek by investing in the Bonds.

The inability to retain or obtain key personnel could delay or hinder implementation of our investment strategies, which could impair our ability to honor our obligations under the terms of Bonds and could reduce the value of your investment.

Our success depends to a significant degree upon the contributions of our Sponsor’s management team. We do not have employment agreements with any of these individuals nor do we currently have key man life insurance on any of these individuals. If any of them were to cease their affiliation with us, our Manager or our Sponsor, our Sponsor may be unable to find suitable replacements, and our operating results could suffer. Competition for highly skilled personnel is intense, and our Sponsor may be unsuccessful in attracting and retaining such skilled personnel. If our Sponsor loses or is unable to obtain the services of highly skilled personnel, our ability to implement our investment strategies could be delayed or hindered, and our ability to pay obligations on the Bonds may be materially and adversely affected.

We rely on Crescent Securities Group, Inc., our managing broker-dealer, to sell the Bonds pursuant to this offering. If our managing broker-dealer is not able to market the Bonds effectively, we may be unable to raise sufficient proceeds to meet our business objectives.

We have engaged Crescent Securities Group, Inc., to act as our managing broker-dealer for this offering, and we rely on our managing broker-dealer to use its best efforts to sell the Bonds offered hereby. It would also be challenging and disruptive to locate an alternative managing broker-dealer for this offering. Without improved capital raising, our portfolio will be smaller relative to our general and administrative costs and less diversified than it otherwise would be, which could adversely affect the value of your investment in us.

We may redeem the Bonds before maturity, and you may be unable to reinvest the proceeds at the same or a higher rate of return.

We may redeem all or a portion of the Bonds. See “Description of Bonds - Optional Redemption” for more information. If redeemed, you may be unable to reinvest the money you receive in the redemption at a rate that is equal to or higher than the rate of return on the Bonds.

We may have to liquidate some of our investments at inopportune times to redeem Bonds in the event of the death, disability or bankruptcy of a Bondholder and redeem Bonds pursuant to the Optional Redemption.

The Bonds carry an early redemption right and a redemption right in the event of death, disability, or bankruptcy of the Bondholder. As a result, one or more Bondholders may elect to have their Bonds redeemed prior to maturity. In such an event, we may not have access to the necessary cash to redeem such Bonds, and we may be required to liquidate certain assets in order to make such redemptions. Our investments are not intended to liquid, and as a result any such liquidation may be at a price that represent a discount to the actual value of such investment.

| 12 |

| Table of Contents |

Risks Related to Our Corporate Structure

Because we are dependent upon our Sponsor and its affiliates to conduct our operations, any adverse changes in the financial health of our Sponsor or its affiliates or our relationship with them could hinder our operating performance and our ability to meet our financial obligations.

We are dependent on our Sponsor, as the sole owner of our Manager, and its affiliates to manage our operations and acquire and manage our portfolio of real estate assets. Our Manager, a wholly owned and controlled subsidiary of our Sponsor, makes all decisions with respect to our management. Our Manager and our Sponsor depend upon the fees and other compensation that it receives from us in connection with the purchase, management, and sale of our properties to conduct its operations. Any adverse changes in the financial condition of our Manager or our Sponsor or our relationship with our Manager or our Sponsor could hinder its ability to successfully manage our operations and our portfolio of investments.

You will have no control over changes in our policies and day-to-day operations, which lack of control increases the uncertainty and risks you face as an investor in the Bonds. In addition, our Sponsor, through our Manager, may change our major operational policies without your approval.

Our Sponsor, as the sole owner of our Manager, determines our major policies, including our policies regarding financing, growth, debt capitalization, and distributions. Our Sponsor, as the sole owner of our Manager, may amend or revise these and other policies without your approval. As a Bondholder, you will have no rights under the limited liability company agreement of our company, or our “operating agreement.” See “General Information as to Our Company – Operating Agreement” herein for a detailed summary of our operating agreement.

Our Sponsor, as the sole owner of our Manager, is responsible for the day-to-day operations of our company and the selection and management of investments and has broad discretion over the use of proceeds from this offering. Accordingly, you should not purchase Bonds unless you are willing to entrust all aspects of the day-to-day management and the selection and management of investments to our Sponsor. Specifically, our Sponsor is controlled by ROHM, which is controlled by its board of managers consisting of Gary Bechtel, Joseph Elias, Kevin Kennedy, Jason Anderson and Ray Davis, and as a result, they will be able to exert significant control over our operations. ROHM’s board of managers has exclusive control over the operations of our Sponsor, our Manager and us. As a result, we are dependent on ROHM’s board of managers to properly choose investments and manage our company. Our Manager has appointed an Investment Committee composed of three members who are nominated, appointed, and removed by the Manager, and all loan origination decisions require the unanimous approval of the Investment Committee members. The Investment Committee’s members are Gary Bechtel, Joe Elias, and Jason Anderson. You will have no control over the Investment Committee and the Manager may choose to alter the composition of, or eliminate, the Investment Committee in its sole discretion. In addition, our Sponsor may, or may cause our Manager to, retain independent contractors to provide various services for us, and you should note that such contractors will have no fiduciary duty to you and may not perform as expected or desired.

Bondholders will have no right to remove our Manager or otherwise change our management, even if we are underperforming and not attaining our investment objectives.

Only the members of our company will have the right to remove our Manager, and currently our Manager is our sole member. Bondholders will have no rights in our management and will have no ability to remove our Manager.

Our Manager and its executive officers will have limited liability for, and will be indemnified and held harmless from, the losses of our company.

Our Manager, our Sponsor and its executive officers and their agents and assigns, will not be liable for, and will be indemnified and held harmless (to the extent of our company’s assets) from any loss or damage incurred by them, our company, or the members in connection with the business of our company resulting from any act or omission performed or omitted in good faith, which does not constitute fraud, willful misconduct, gross negligence, or breach of fiduciary duty. A successful claim for such indemnification could deplete our company’s assets by the amount paid. See “General Information as to Our Company - Operating Agreement - Indemnification” below for a detailed summary of the terms of our operating agreement. Our operating agreement is filed as an exhibit this offering circular.

| 13 |

| Table of Contents |

Risks Related to Conflicts of Interest

Our Manager and our Sponsor, its executive officers and its affiliates face conflicts of interest relating to the making of investments, and such conflicts may not be resolved in our favor, which could limit our investment opportunities, impair our ability to make distributions and reduce the value of your investment.

We rely on our Sponsor, its executive officers, and its affiliates to identify suitable investment opportunities. We may be making investments at the same time as other entities that are affiliated with our Sponsor. Such programs also rely on our Sponsor, its executive officers, and its affiliates for investment opportunities. Our Sponsor has sponsored similar privately offered programs and may in the future, or concurrently, sponsor similar private and public programs that have investment objectives similar to ours. Therefore, our Sponsor, its executive officers and its affiliates could be subject to conflicts of interest between our company and other programs. Many investment opportunities would be suitable for us as well as other programs. Our Sponsor could direct attractive investment opportunities to other entities. Although we are subject to the Sponsor’s allocation policy, which is described further below and which specifically addresses some of these conflicts, there is no assurance that this policy will be adequate to address all of the conflicts that may arise or will address such conflicts in a manner that results in the allocation of a particular investment opportunity to us or is otherwise favorable to us. Such events could result in our investing in assets that provide less attractive returns, impairing our ability to honor our obligations under the terms of the Bonds and the value of your investment. See “Investment Policies of Our Company – Investment Allocation Policy” for more information.

Payment of fees to our Manager will reduce cash available for investment and fulfillment of our obligations with respect to the Bonds.

Our Manager performs services for us in connection with the selection, acquisition, and disposition of our investments. It is paid fees for these services, which reduces the amount of cash available for investment and for payment of our obligations with respect to the Bonds. Although customary in the industry, the fees to be paid to our Manager were not determined in an arm’s-length negotiation. We cannot assure you that a third party unaffiliated with our Sponsor would not be willing to provide such services to us at a lower price. We will pay our Manager management fees, calculated quarterly and paid in advance of the applicable quarter, equal to 1.00% of (i) all capital contributions of the Members, net of any amounts invested at that time in loans or debt instruments, plus (ii) the outstanding principal amount of each loan or real estate debt instrument we then hold, including loans secured by real estate we then own as a result of borrower default. The Manager will also receive 0.50% of the proceeds received from the repayment of the principal amount of any of our debt investments or any other disposition of the underlying real estate.

In addition to this, our Manager will receive the O&O Fee of 2.00% of offering proceeds ($700,000 at the maximum offering amount), from which the Manager will pay organizational and offering expenses. In no event will the O&O Fee payable to our Manager exceed 2.00% of the offering proceeds. See “Compensation of our Manager and its Affiliates” for more information.

Our Manager will receive certain fees regardless of the performance of our company or an investment in the Series A Units.

Our Manager will receive management fees, calculated quarterly and paid in advance of the applicable quarter, equal to 1.00% of (i) all capital contributions of the Members, net of any amounts invested at that time in loans or debt instruments, plus (ii) the outstanding principal amount of each loan or real estate debt instrument we then hold, including loans secured by real estate we then own as a result of borrower default. The Manager will also receive 0.50% of the proceeds received from the repayment of the principal amount of any of our debt investments or any other disposition of the underlying real estate. These fees will be paid regardless of our success and the performance of the Bonds.

| 14 |

| Table of Contents |

If the competing demands for the time of our Manager and our Sponsor, its affiliates, and its officers result in them spending insufficient time on our business, we may miss investment opportunities or have less efficient operations, which could reduce our profitability and impair our ability to honor our obligations under the Bonds.

We do not have any employees. We rely on the employees of our Sponsor, as the sole owner of our Manager, and its affiliates for the day-to-day operation of our business. The amount of time that our Sponsor and its affiliates spend on our business will vary from time to time and is expected to be greater while we are raising money and acquiring properties. Our Sponsor and its affiliates, including its officers, have interests in other programs and engage in other business activities. As a result, they will have conflicts of interest in allocating their time between us and other programs and activities in which they are involved. Because these persons have competing interests on their time and resources, they may have conflicts of interest in allocating their time between our business and these other activities. During times of intense activity in other programs and ventures, they may devote less time and fewer resources to our business than are necessary or appropriate to manage our business. We expect that as our activities expand, our Sponsor will attempt to hire additional employees who would devote substantially all of their time to our business. There is no assurance that our Sponsor or our Manager will devote adequate time to our business. If our Sponsor suffers or is distracted by adverse financial or operational problems in connection with its operations unrelated to us, it may allocate less time and resources to our operations. If any of these things occur, our ability to honor obligations under the Bonds may be adversely affected.

Our Sponsor will source all of our investments, and existing or future entities or programs sponsored and managed by our Sponsor may compete with us for, or may participate in, some of those investments, which could result in conflicts of interest.

Although we are subject to the Sponsor’s allocation policy which specifically addresses some of the conflicts relating to our investment opportunities described above, there is no assurance that this policy will be adequate to address all of the conflicts that may arise or will address such conflicts in a manner that results in the allocation of a particular investment opportunity to us or is otherwise favorable to us. The Sponsor’s allocation policy provides that in the event a lending opportunity becomes available that is suitable for multiple funds managed by the Sponsor, the Investment Committee, after consultation with counsel, may allocate participation in the lending opportunity to the various funds managed by the Sponsor based on an examination of a variety of factors. The Sponsor may determine that a lending opportunity is appropriate for a particular fund, but not for another. In addition, the Sponsor or its employees may engage in a lending opportunity that our Manager, through the Sponsor, has determined to be unsuitable for us. The investment allocation policy may be amended by the Sponsor at any time without our consent. As the investment programs of the various entities managed by the Sponsor change and develop over time, additional issues and considerations may affect the Sponsor’s allocation policy and its expectations with respect to the allocation of lending opportunities. For more information on the Sponsor’s investment allocation policy, please see “Investment Policies of Our Company – Investment Allocation Policy.”

An affiliate of our Sponsor may acquire property in connection with the foreclosure of any of our loans.

An affiliate of our Sponsor will have the ability to acquire property from our company following a foreclosure of any of our loans. In the case of a purchase by an affiliate of our Sponsor following a foreclosure, the affiliate would purchase the property at a price equal to the amounts due under the foreclosed loan. The Sponsor cannot guarantee this price is the highest price it could receive for the sale of the foreclosed property. As a result, the Sponsor, through its affiliate, may acquire these properties at a discount to fair market value.

We may from time to time acquire loans from existing or future entities or programs sponsored and managed by our Sponsor and its affiliates.

Part of our business strategy will likely include the purchase of existing and performing first mortgage loans, which could include loans held by entities or programs sponsored and managed by our Sponsor. In such an instance, we would anticipate that we would purchase the loan for the face amount of the principal then outstanding on the loan. The Sponsor cannot guarantee that this is the lowest price for which the loan could be purchased. As a result, we may acquire these loans for a premium to fair market value.

| 15 |

| Table of Contents |

Risks Related to Our Lending and Investment Activities

Our loans and investments expose us to risks associated with debt-oriented real estate investments generally.

We seek to invest primarily in debt instruments relating to real estate-related assets. As such, we are subject to, among other things, risk of defaults by borrowers in paying debt service on outstanding indebtedness and to other impairments of our loans and investments. Any deterioration of real estate fundamentals generally, and in the U.S. in particular, could negatively impact our performance by making it more difficult for borrowers of our mortgage loans, or borrower entities, to satisfy their debt payment obligations, increasing the default risk applicable to borrower entities, and/or making it more difficult for us to generate attractive risk-adjusted returns. Changes in general economic conditions will affect the creditworthiness of borrower entities and/or the value of underlying real estate collateral relating to our investments and may include economic and/or market fluctuations, changes in environmental, zoning and other laws, casualty or condemnation losses, regulatory limitations on rents, decreases in property values, changes in the appeal of properties to tenants, changes in supply and demand, fluctuations in real estate fundamentals, the financial resources of borrower entities, energy supply shortages, various uninsured or uninsurable risks, natural disasters, political events, terrorism and acts of war, changes in government regulations, changes in real property tax rates and/or tax credits, changes in operating expenses, changes in interest rates, changes in inflation rates, changes in the availability of debt financing and/or mortgage funds which may render the sale or refinancing of properties difficult or impracticable, increased mortgage defaults, increases in borrowing rates, negative developments in the economy and/or adverse changes in real estate values generally and other factors that are beyond our control.

We cannot predict the degree to which economic conditions generally, and the conditions for real estate debt investing in particular, will improve or decline. Any declines in the performance of the U.S. and global economies or in the real estate debt markets could have a material adverse effect on our business, financial condition, and results of operations.

Commercial real estate-related investments that are secured by real property are subject to delinquency, foreclosure, and loss, which could result in losses to us.

Commercial real estate debt instruments (e.g., mortgages) that are secured by commercial property are subject to risks of delinquency and foreclosure and risks of loss that are greater than similar risks associated with loans made on the security of single-family residential property. The ability of a borrower to repay a loan secured by an income-producing property typically is dependent primarily upon the successful operation of the property rather than upon the existence of independent income or assets of the borrower. If the net operating income of the property is reduced, the borrower’s ability to repay the loan may be impaired. Net operating income of an income-producing property can be affected by, among other things:

|

| · | tenant mix and tenant bankruptcies; |

|

|

|

|

|

| · | success of tenant businesses; |

|

|

|

|

|

| · | property management decisions, including with respect to capital improvements, particularly in older building structures; |

|

|

|

|

|

| · | property location and condition; |

|

|

|

|

|

| · | competition from other properties offering the same or similar services; |

|

|

|

|

|

| · | changes in laws that increase operating expenses or limit rents that may be charged; |

|

|

|

|

|

| · | any need to address environmental contamination at the property; |

|

|

|

|

|

| · | changes in global, national, regional, or local economic conditions and/or specific industry segments; |

|

|

|

|

|

| · | declines in global, national, regional, or local real estate values; |

|

|

|

|

|

| · | declines in global, national, regional, or local rental or occupancy rates; |

| 16 |

| Table of Contents |

|

| · | changes in interest rates, foreign exchange rates, and in the state of the credit and securitization markets and debt and equity capital markets, including diminished availability or lack of debt financing for commercial real estate; |

|

|

|

|

|

| · | changes in real estate tax rates, tax credits and other operating expenses; |

|

|

|

|

|

| · | changes in governmental rules, regulations, and fiscal policies, including income tax regulations and environmental legislation; |

|

|

|

|

|

| · | acts of God, terrorism, social unrest, and civil disturbances, which may decrease the availability of or increase the cost of insurance or result in uninsured losses; and |

|

|

|

|

|

| · | adverse changes in zoning laws. |

Specifically, changes in federal, state, and local laws and regulations may affect certain income producing properties more than others. Any change to the federal, state, and local regulations applicable to this industry may negatively affect the ability of the property owner to produce income and materially diminish the value of the property used to secure the loan. In addition, we are exposed to the risk of judicial proceedings with our borrowers and entities we invest in, including bankruptcy or other litigation, as a strategy to avoid foreclosure or enforcement of other rights by us as a lender or investor.

In the event that any of the properties or entities underlying or collateralizing our loans or investments experiences any of the foregoing events or occurrences, the value of, and return on, such investments could be reduced, which would adversely affect our results of operations and financial condition.

Our business could be adversely affected by unfavorable economic and political conditions, which in turn, can negatively impact our ability to generate returns to you.

The Company’s future business and operations are sensitive to general business and economic conditions in the United States. Factors beyond the Company’s control could cause fluctuations resulting in adverse conditions, such as heightened inflation. Sustained inflationary pressures have already resulted in the Federal Reserve Board increasing interest rates by 3% to date during 2022, signaling its intention to continue to raise interest rates over the remainder of 2023. To the extent such conditions worsen, inflation may make it more difficult for our borrowers to repay loans, and may increase the risk of default by them, which in turn, can negatively impact our ability to generate returns to you.

In additional, national and regional economies and financial markets have become increasingly interconnected, which increases the possibilities that conditions in one country, region, or market might adversely impact issuers in a different country, region, or market. Major economic or political disruptions, such as the slowing economy in China, the war in Ukraine and sanctions on Russia, and a potential economic slowdown in the United Kingdom and Europe, may have global negative economic and market repercussions. While the Company does not intend to make loans to borrowers located in those countries, such disruptions may nevertheless impact its operations.

The continuing spread of a coronavirus and its variants (also known as the COVID-19 virus) may adversely affect our investments and operations.

The World Health Organization has declared the spread of the COVID-19 virus a global pandemic, and the President of the United States has declared a national state of emergency in the United States in response to the outbreak. Considerable uncertainty still surrounds the COVID-19 virus, including new variants of the virus, and its potential effects, and the extent of and effectiveness of any responses taken on a national and local level. However, measures taken to limit the impact of this coronavirus, including social distancing and other restrictions on travel, congregation and business operation have resulted in significant negative short term economic impacts over the past year. The long-term impact of this coronavirus on the U.S. and world economies remains uncertain but may continue to result in long term infrastructure and supply chain disruption, as well as dislocation and uncertainty in the financial markets that could significantly and negatively impact the global, national, and regional economies, the length and breadth of which cannot currently be predicted. Our investments include commercial mortgage loans secured by hospitality properties which depend, in part, on tourism. If tourism were to not recover as anticipated, it could have a significant effect on these properties. Tourism could not recover as anticipated as a result of a variety of factors related to the COVID-19 virus, including restrictions on travel by corporations or governmental entities and any additional restrictions imposed due to increased health risks from variants of the virus. In addition, hospitality properties that depend on revenue from conferences or business travel may continue to be particularly affected.

| 17 |

| Table of Contents |

Our investments also include commercial mortgage loans secured by retail properties. In the event of a large-scale quarantine in the United States or specific areas within the United States as a result of the COVID-19 virus, or its variants, individual stores and shopping malls may be closed for an extended period of time or consumers may move to more on-line shopping.

To the extent the COVID-19 virus results in a world-wide economic downturn, there may be widespread corporate downsizing and an increase in unemployment. This could negatively impact our commercial mortgage loans secured by office, multifamily and industrial properties, and our ability to make distributions to our unitholders. Further, increased shutdowns and economic turmoil may result in delays in the deployment of funds raised in this offering.

Fluctuations in interest rates and credit spreads could reduce our ability to generate income on our loans and other investments, which could lead to a significant decrease in our results of operations, cash flows and the market value of our investments.

Our primary interest rate exposures relate to the yield on our loans and other investments and the financing cost of our debt. Changes in interest rates and credit spreads may affect our net income from loans and other investments, which is the difference between the interest and related income we earn on our interest-earning investments and the interest and related expense we incur in financing these investments. Interest rate and credit spread fluctuations resulting in our interest and related expense exceeding interest and related income would result in operating losses for us. Changes in the level of interest rates and credit spreads also may affect our ability to make loans or investments, the value of our loans and investments and our ability to realize gains from the disposition of assets. Increases in interest rates and credit spreads may also negatively affect demand for loans and could result in higher borrower default rates.

Our operating results depend, in part, on differences between the income earned on our investments, net of credit losses, and our financing costs. The yields we earn on our floating-rate assets and our borrowing costs tend to move in the same direction in response to changes in interest rates. However, one can rise or fall faster than the other, causing our net interest margin to expand or contract. In addition, we could experience reductions in the yield on our investments and an increase in the cost of our financing. Although we seek to match the terms of our liabilities to the expected lives of loans that we acquire or originate, circumstances may arise in which our liabilities are shorter in duration than our assets, resulting in their adjusting faster in response to changes in interest rates. For any period during which our investments are not match-funded, the income earned on such investments may respond more slowly to interest rate fluctuations than the cost of our borrowings. Consequently, changes in interest rates, particularly short-term interest rates, may immediately and significantly decrease our results of operations and cash flows and the market value of our investments. In addition, unless we enter into hedging or similar transactions with respect to the portion of our assets that we fund using our balance sheet, returns we achieve on such assets will generally increase as interest rates for those assets rise and decrease as interest rates for those assets decline.

We operate in a competitive market for lending and investment opportunities which may intensify, and competition may limit our ability to originate or acquire desirable loans and investments or dispose of assets we target and could also affect the yields of these assets and have a material adverse effect on our business, financial condition, and results of operations.

We operate in a competitive market for lending and investment opportunities, which may intensify. Our profitability depends, in large part, on our ability to originate or acquire our target assets on attractive terms. In originating or acquiring our target assets, we compete for opportunities with a variety of lenders and investors, including REITs, specialty finance companies, public and private funds (including funds managed by affiliates of our Sponsor), commercial and investment banks, commercial finance and insurance companies and other financial institutions. Some competitors may have a lower cost of funds and access to funding sources that are not available to us, such as the U.S. Government. Many of our competitors are not subject to the operating constraints associated with maintaining an exclusion from regulation under the Investment Company Act. In addition, some of our competitors may have higher risk tolerances or different risk assessments, which could allow them to consider a wider variety of loans and investments, offer more attractive pricing or other terms and establish more relationships than us. Furthermore, competition for originations of and investments in our target assets may lead to decreasing yields, which may further limit our ability to generate desired returns. Also, as a result of this competition, desirable loans and investments in our target assets may be limited in the future and we may not be able to take advantage of attractive lending and investment opportunities from time to time, thereby limiting our ability to identify and originate or acquire loans or make investments that are consistent with our investment objectives. We cannot assure you that the competitive pressures we face will not have a material adverse effect on our business, financial condition, and results of operations.

| 18 |

| Table of Contents |

Prepayment rates may adversely affect our financial performance and the value of certain of our assets.

Our business is currently focused on originating mortgage loans or other debt instruments secured by commercial real estate assets. Our borrowers may be able to repay their loans prior to their stated maturities. In periods of declining interest rates and/or credit spreads, prepayment rates on loans generally increase. If general interest rates or credit spreads decline at the same time, the proceeds of such prepayments received during such periods may not be reinvested for some period of time or may be reinvested by us in assets yielding less than the yields on the assets that were prepaid.

Prepayment rates on loans may be affected by a number of factors including, but not limited to, the then-current level of interest rates and credit spreads, the availability of mortgage credit, the relative economic vitality of the area in which the related properties are located, the servicing of the loans, possible changes in tax laws, other opportunities for investment, and other economic, social, geographic, demographic, and legal factors beyond our control. Consequently, such prepayment rates cannot be predicted with certainty and no strategy can completely insulate us from prepayment or other such risks.

Difficulty in redeploying the proceeds from repayments of our existing loans and investments may cause our financial performance and our ability to fulfill our obligations relative to the Series A Units.

As our loans and investments are repaid, we will look to redeploy the proceeds we receive into new loans and investments, repay borrowings, pay interest on the Series A Units, or redeem outstanding Series A Units. It is possible that we will fail to identify reinvestment options that would provide returns or a risk profile that is comparable to the asset that was repaid. If we fail to redeploy the proceeds we receive from repayment of a loan in equivalent or better alternatives, our financial performance, and our ability to fulfill our obligations related to the Series A Units will suffer.

Difficulty in redeploying the proceeds from repayments of our existing loans and investments may cause our financial performance and our ability to fulfill our obligations relative to the Bonds.

As our loans and investments are repaid, we will look to redeploy the proceeds we receive into new loans and investments, repay borrowings, pay interest on the Bonds, or redeem outstanding Bonds. It is possible that we will fail to identify reinvestment options that would provide returns or a risk profile that is comparable to the asset that was repaid. If we fail to redeploy the proceeds we receive from repayment of a loan in equivalent or better alternatives, our financial performance, and our ability to fulfill our obligations related to the Bonds will suffer.

The lack of liquidity in certain of our assets may adversely affect our business.

The illiquidity of certain of our assets may make it difficult for us to sell such investments if the need or desire arises. Certain assets such as mortgages and other loans are relatively illiquid investments due to their short life, their potential unsuitability for securitization and the greater difficulty of recovery in the event of a borrower’s default. In addition, certain of our investments may become less liquid after our investment as a result of periods of delinquencies or defaults or turbulent market conditions, which may make it more difficult for us to dispose of such assets at advantageous times or in a timely manner. Moreover, many of the loans and securities we invest in are not registered under the relevant securities laws, resulting in limitations or prohibitions against their transfer, sale, pledge, or their disposition except in transactions that are exempt from registration requirements or are otherwise in accordance with such laws. As a result, many of our investments are illiquid, and if we are required to liquidate all or a portion of our portfolio quickly, for example as a result of margin calls, we may realize significantly less than the value at which we have previously recorded our investments. Further, we may face other restrictions on our ability to liquidate an investment to the extent that we or our Manager (and/or its affiliates) has or could be attributed as having material, non-public information regarding the borrower entity. As a result, our ability to vary our portfolio in response to changes in economic and other conditions may be relatively limited, which could adversely affect our results of operations, financial condition, and ability to fulfill our obligations related to the Bonds.

| 19 |

| Table of Contents |

We are subject to additional risks associated with priority loan participations.

Some of our loans may be participation interests in which we share the rights, obligations, and benefits of the loan with other lenders. From time to time these participations may be structured so that other participants have a priority to payments of interest and principal over us, or, in other words, our rights to payments of interest and principal will be subordinate to the satisfaction of the priority rights of those participants. In such cases, if a borrower defaults on a participation loan, or if the borrower is in bankruptcy, our interest in the participation loan will be satisfied only after the interests of the other lenders in the participation loan are satisfied. In those instances, our risk of loss is greater than the risk associated with those participants with priority over our other loans. If the underlying collateral is insufficient to pay-off the other participating lenders, then we may experience losses that would have a material adverse effect on our operations.

Any distressed loans or investments we make, or loans and investments that later become distressed, may subject us to losses and other risks relating to bankruptcy proceedings.