EXHIBIT 96.1

|

| Technical Report Summary For The Golden Chest Mine, Idaho, USA SK-1300 Report |

Idaho Strategic Resources, Inc.

Prepared By:

Grant A. Brackebusch, P.E.

Robert J. Morgan PG, PLS

For

Idaho Strategic Resources, Inc.

201 North 3rd St.

Coeur d’Alene, ID 83814

Effective Date: December 31, 2021

Signature Date: December 8, 2022

| 1-0 |

Contents

| Contents |

| 1-1 | ||

| Tables |

| 1-6 | ||

| Figures |

| 1-7 | ||

| 1.0 | EXECUTIVE SUMMARY |

| 1-8 |

|

| 1.1 | Summary |

| 1-8 |

|

| 1.1.1 | Conclusions |

| 1-8 |

|

| 1.1.2 | Recommendations |

| 1-10 |

|

| 1.2 | Economic Analysis |

| 1-11 |

|

| 1.2.1 | Economic Criteria |

| 1-11 |

|

| 1.2.2 | Physical Parameters |

| 1-11 |

|

| 1.2.3 | Revenue Parameters |

| 1-12 |

|

| 1.2.4 | Operating and Capital Costs |

| 1-12 |

|

| 1.2.5 | Taxes and Royalties |

| 1-12 |

|

| 1.2.6 | Cash Flow |

| 1-12 |

|

| 1.2.7 | Sensitivity |

| 1-12 |

|

| 1.3 | Technical Summary |

| 1-13 |

|

| 1.3.1 | Property Description |

| 1-13 |

|

| 1.3.2 | Land Tenure |

| 1-13 |

|

| 1.3.3 | History |

| 1-13 |

|

| 1.3.4 | Geologic Setting, Mineralization, and Deposit |

| 1-13 |

|

| 1.3.5 | Exploration |

| 1-13 |

|

| 1.3.6 | Mineral Resource Estimate |

| 1-13 |

|

| 1.3.7 | Mineral Reserve Estimate |

| 1-13 |

|

| 1.3.8 | Mining Methods |

| 1-13 |

|

| 1.3.9 | Mineral Processing |

| 1-14 |

|

| 1.3.10 | Infrastructure |

| 1-14 |

|

| 1.3.11 | Market Studies |

| 1-14 |

|

| 1.3.12 | Environmental Permitting |

| 1-14 |

|

| 2.0 | INTRODUCTION |

| 2-1 |

|

| 2.1 | Site Visit |

| 2-1 |

|

| 2.2 | Sources of Information |

| 2-1 |

|

| 2.3 | List of Abbreviations |

| 2-2 |

|

| 1-1 |

| 3.0 | PROPERTY DESCRIPTION |

| 3-1 |

|

| 3.1 | Location |

| 3-1 |

|

| 3.2 | Ownership and Holdings |

| 3-1 |

|

| 3.3 | Royalty |

| 3-5 |

|

| 3.4 | Permit Requirements |

| 3-5 |

|

| 3.5 | Encumbrances and Other Risks |

| 3-5 |

|

| 4.0 | ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHSYIOGRAPHY |

| 4-1 |

|

| 4.1 | Accessibility |

| 4-1 |

|

| 4.2 | Climate |

| 4-1 |

|

| 4.3 | Local Resources and Infrastructure |

| 4-1 |

|

| 4.4 | Physiography and Environment |

| 4-2 |

|

| 5.0 | HISTORY |

| 5-1 |

|

| 5.1 | Location of District |

| 5-1 |

|

| 5.2 | Historic Gold Mining |

| 5-1 |

|

| 5.3 | Historical Mineral Resource Estimates |

| 5-2 |

|

| 5.4 | New Jersey Mining Company (IDR 2003-2012) |

| 5-2 |

|

| 5.5 | Golden Chest LLC (2010-2015) |

| 5-2 |

|

| 5.6 | Micon NI 43-101 (2011 and 2012) |

| 5-2 |

|

| 5.7 | Juniper Mining Company (2013) |

| 5-2 |

|

| 5.8 | Idaho Strategic Resources (2016-Present) |

| 5-3 |

|

| 6.0 | GEOLOGICAL SETTING, MINERALIZATION, AND DEPOSIT |

| 6-1 |

|

| 6.1 | Regional Geology |

| 6-1 |

|

| 6.1.1 | Belt Supergroup |

| 6-1 |

|

| 6.2 | Local Geology |

| 6-3 |

|

| 6.2.1 | Lithology |

| 6-3 |

|

| 6.2.2 | Structure |

| 6-5 |

|

| 6.3 | Property Geology |

| 6-6 |

|

| 6.3.1 | Lithology |

| 6-6 |

|

| 6.3.2 | Structure |

| 6-8 |

|

| 6.4 | Mineralization and Alteration |

| 6-9 |

|

| 6.4.1 | Vein Types |

| 6-9 |

|

| 6.4.2 | Vein Names and Locations |

| 6-11 |

|

| 6.4.3 | Lithologic Control of Veins |

| 6-12 |

|

| 6.4.4 | Vein Mineralization |

| 6-13 |

|

| 6.4.5 | Wall Rock Alteration |

| 6-14 |

|

| 6.5 | Deposit Type |

| 6-14 |

|

| 6.5.1 | Orogenic |

| 6-14 |

|

| 6.5.2 | Age and Genesis |

| 6-15 |

|

| 1-2 |

| 7.0 | EXPLORATION |

| 7-1 |

|

| 7.1 | Drilling |

| 7-2 |

|

| 7.1.1 | Vertical Continuity |

| 7-2 |

|

| 7.1.2 | Drill Hole Surveys |

| 7-2 |

|

| 7.1.3 | Drill Hole Sampling |

| 7-3 |

|

| 7.3 | Hydrogeology Data |

| 7-3 |

|

| 8.0 | SAMPLE PREPARATION, ANALYSES, AND SECURITY |

| 8-1 |

|

| 8.1 | Laboratory Accreditation and Certification |

| 8-1 |

|

| 8.2 | Sample Quality Assurance and Quality Control (QA/QC) |

| 8-1 |

|

| 8.2.1 | Blanks |

| 8-1 |

|

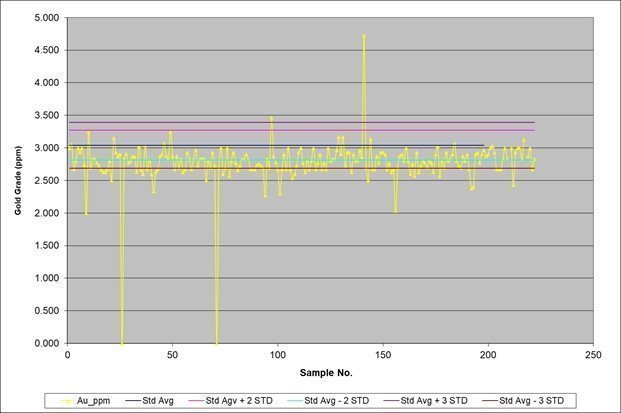

| 8.2.2 | Standard – 3 gpt |

| 8-1 |

|

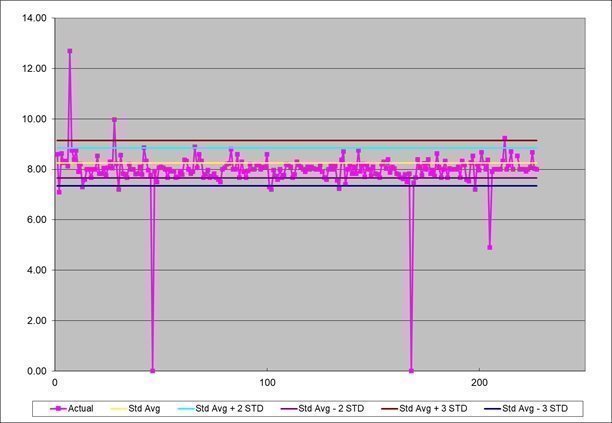

| 8.2.3 | Standard – 8 gpt |

| 8-2 |

|

| 8.3 | Sample Preparation |

| 8-3 |

|

| 8.4 | Sample Analysis |

| 8-3 |

|

| 8.5 | Security |

| 8-4 |

|

| 8.6 | QP Comments on Sample Collection, Preparation, QA/QC, Analysis and Security |

| 8-4 |

|

| 9.0 | DATA VERIFICATION |

| 9-1 |

|

| 9.1 | Database Procedures |

| 9-1 |

|

| 9.2 | Validation Procedures |

| 9-1 |

|

| 9.2.1 | Micon Historic Database Validation |

| 9-2 |

|

| 9.3 | Validation Limitations and QP Comments |

| 9-2 |

|

| 10.0 | MINERAL PROCESSING AND METALLURGICAL TESTING |

| 10-1 |

|

| 10.1 | New Jersey Mill 100 TPD Metallurgical Testing |

| 10-1 |

|

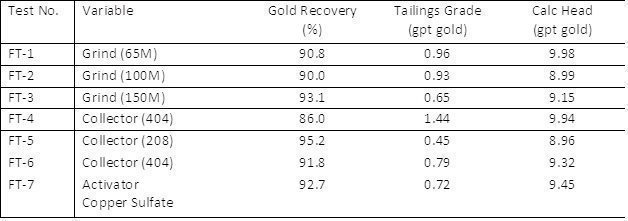

| 10.2 | Resource Development Inc. Metallurgical Testing |

| 10-2 |

|

| 11.0 | MINERAL RESOURCE ESTIMATES |

| 11-1 |

|

| 11.1 | Summary |

| 11-1 |

|

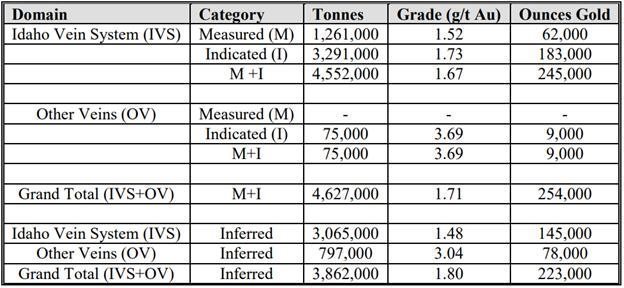

| 11.2 | 2012 Resource (Historic NI 43-101) |

| 11-1 |

|

| 1-3 |

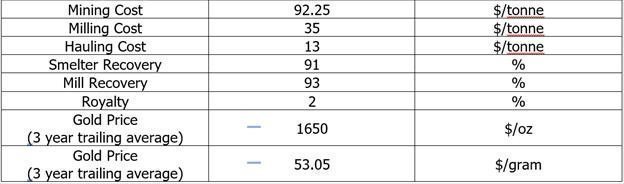

| 12.0 | MINERAL RESERVE ESTIMATES |

| 12-1 |

|

| 12.1 | Summary |

| 12-1 |

|

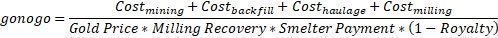

| 12.2 | Conversion to Mineral Reserves |

| 12-1 |

|

| 12.3 | Cut-Off Grade |

| 12-2 |

|

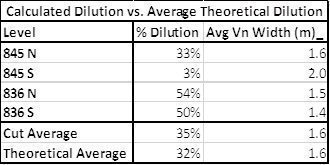

| 12.4 | Dilution |

| 12-2 |

|

| 12.5 | Extraction |

| 12-3 |

|

| 12.6 | Reconciliation |

| 12-3 |

|

| 13.0 | MINING METHODS |

| 13-1 |

|

| 13.1 | Mining Operations – Underground |

| 13-1 |

|

| 13.1.1 | Cut and Fill Method, Skookum Shoot |

| 13-2 |

|

| 13.1.2 | Skookum Shoot Area |

| 13-2 |

|

| 13.2 | Ground Stability |

| 13-3 |

|

| 13.2.1 | Operating Practices |

| 13-4 |

|

| 13.3 | Underground Development |

| 13-4 |

|

| 13.3.1 | Ground Support |

| 13-4 |

|

| 13.3.2 | Development Performance |

| 13-4 |

|

| 13.4 | Backfill |

| 13-5 |

|

| 13.5 | Mine Equipment |

| 13-5 |

|

| 13.6 | Mine Infrastructure |

| 13-5 |

|

| 13.7 | Open Pit Mining Operations |

| 13-6 |

|

| 14.0 | PROCESSING AND RECOVERY METHODS |

| 14-1 |

|

| 14.1 | Crushing Circuit |

| 14-1 |

|

| 14.2 | Grinding Circuit |

| 14-1 |

|

| 14.3 | Flotation Circuit |

| 14-1 |

|

| 14.4 | Tailings Circuit |

| 14-1 |

|

| 14.5 | Mill Production |

| 14-2 |

|

| 14.6 | Mill Workforce |

| 14-3 |

|

| 15.0 | INFRASTRUCTURE |

| 15-1 |

|

| 15.1 | Roads and Logistics |

| 15-1 |

|

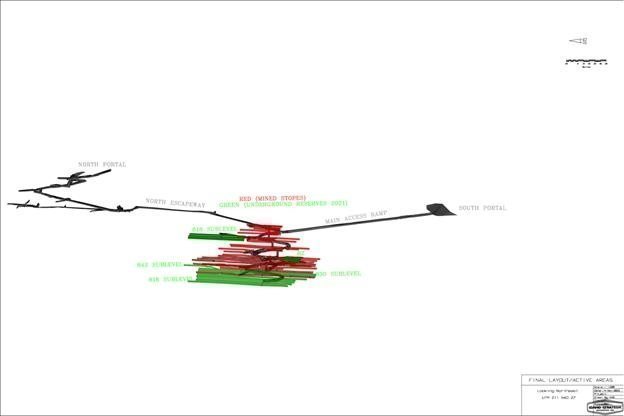

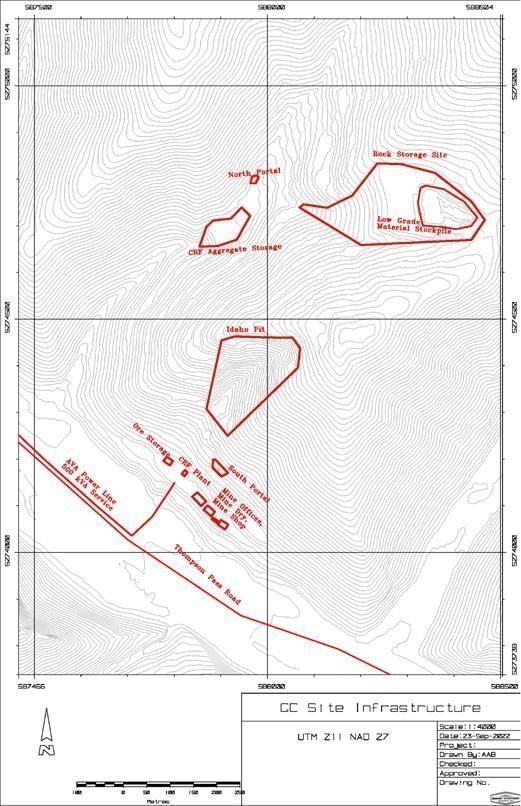

| 15.2 | Mine Layout |

| 15-2 |

|

| 15.2.1 | Waste Rock Storage |

| 15-3 |

|

| 15.2.2 | Tailings Disposal |

| 15-3 |

|

| 15.2.3 | Power |

| 15-3 |

|

| 16.0 | MARKET STUDIES |

| 16-1 |

|

| 16.1 | Market Overview |

| 16-1 |

|

| 16.2 | Commodity Price Projections |

| 16-1 |

|

| 16.3 | Contracts |

| 16-1 |

|

|

|

| 1-4 |

| 17.0 | ENVIRONMENTAL STUDIES, PERMITTING, AND PLANS, NEGOTIATIONS, OR AGREEMENTS WITH LOCAL INDIVIDUALS OR GROUPS |

| 17-1 |

|

| 17.1 | Environmental Studies and Permitting |

| 17-1 |

|

| 17.2 | Surface Mine Permit |

| 17-1 |

|

| 17.3 | Tailings Storage Facility (TSF) Permit |

| 17-2 |

|

| 17.4 | Cyanidation Permit |

| 17-2 |

|

| 17.5 | Stormwater Permits |

| 17-2 |

|

| 17.6 | Community and Social Aspects |

| 17-2 |

|

| 17.7 | Comments on Environmental Permitting and Monitoring |

| 17-2 |

|

| 18.0 | CAPITAL AND OPERATING COSTS |

| 18-1 |

|

| 18.1 | Capital Costs |

| 18-1 |

|

| 18.2 | Operating Costs |

| 18-1 |

|

| 19.0 | ECONOMIC ANALYSIS |

| 19-1 |

|

| 19.1 | Economic Criteria |

| 19-1 |

|

| 19.1.1 | Physicals |

| 19-1 |

|

| 19.1.2 | Estimation Parameters |

| 19-1 |

|

| 19.1.3 | Taxation and Royalties |

| 19-1 |

|

| 19.2 | Cash Flow Analysis |

| 19-2 |

|

| 19.3 | Sensitivity Analysis |

| 19-2 |

|

| 20.0 | ADJACENT PROPERTIES |

| 20-1 |

|

| 21.0 | OTHER RELEVANT DATA AND INFORMATION |

| 21-1 |

|

| 22.0 | INTERPRETATION AND CONCLUSIONS |

| 22-1 |

|

| 22.1 | Geology and Mineral Resources |

| 22-1 |

|

| 22.2 | Mining and Mineral Reserves |

| 22-1 |

|

| 22.3 | Mineral Processing |

| 22-2 |

|

| 22.4 | Infrastructure |

| 22-2 |

|

| 22.5 | Environment |

| 22-2 |

|

| 23.0 | RECOMMENDATIONS |

| 23-1 |

|

| 23.1 | Geology and Mineral Resources |

| 23-1 |

|

| 23.2 | Mining and Mineral Reserves |

| 23-1 |

|

| 23.3 | Mineral Processing |

| 23-1 |

|

| 23.4 | Environmental |

| 23-1 |

|

| 24.0 | REFERENCES |

| 24-1 |

|

| 25.0 | RELIANCE ON INFORMATION PROVIDED BY THE REGISTRANT |

| 25-1 |

|

| 26.0 | DATE AND SIGNATURE PAGE |

| 26-1 |

|

| 1-5 |

Tables

| Table 1‑1 Golden Chest Projected Production for One Year |

| 1-12 |

|

| Table 2‑1 - List of Abbreviations |

| 2-2 |

|

| Table 3‑1 List of patented claims at the Golden Chest Mine, as of December 31, 2021 |

| 3-1 |

|

| Table 3‑2 List of Unpatented Claims at the Golden Chest Property |

| 3-4 |

|

| Table 3‑3 Permit Descriptions |

| 3-5 |

|

| Table 4‑1 Average Climate for Burke, ID 10km South of Golden Chest |

| 4-1 |

|

| Table 6‑1 Belt Supergroup Stratigraphy in the Mine Region (modified after Gott 1980) |

| 6-2 |

|

| Table 10‑1 RDI Flotation Test Results |

| 10-3 |

|

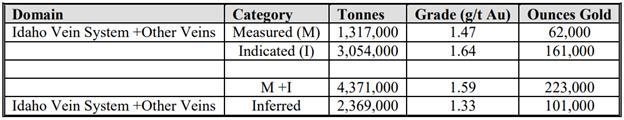

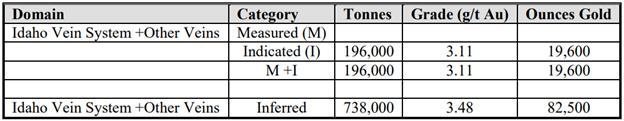

| Table 11‑1 Golden Chest Overall Mineral Resource @ 0.4 g/t Gold Cut-off as at 31 December 2012 |

| 11-2 |

|

| Table 11‑2 Golden Chest In-pit Mineral Resources @ 0.3 g/t Gold Cut-off as at 31 December, 2012 |

| 11-2 |

|

| Table 11‑3 Golden Chest Underground Potential Resource @ 2.0 g/t Gold Cut-off as at December 31, 2012 |

| 11-2 |

|

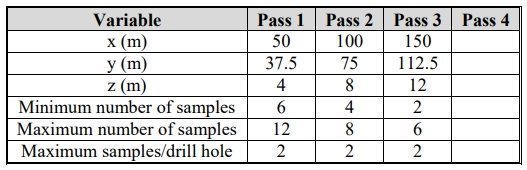

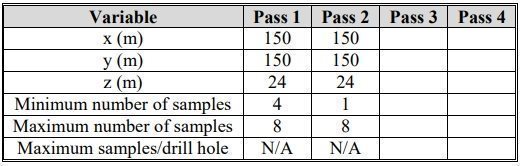

| Table 11‑4 Summary of Search/Interpolation Parameters for the Idaho Vein System |

| 11-3 |

|

| Table 11‑5 Summary of Search/Interpolation Parameters for the H Vein |

| 11-3 |

|

| Table 12‑1 Golden Chest Underground Proven Reserves at December 31st, 2021 |

| 12-1 |

|

| Table 12‑2 Go/No-Go Cut-off Parameters |

| 12-2 |

|

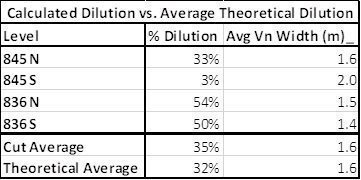

| Table 12‑3 Calculated Dilution vs. Average Theoretical Dilution |

| 12-3 |

|

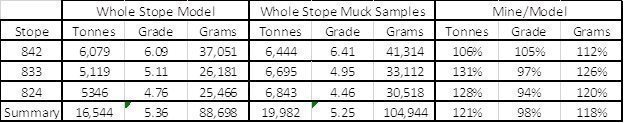

| Table 12‑4 Planned vs. actual for stopes that were a part of the 2020 reserve and have been mined out. |

| 12-3 |

|

| Table 13‑1 Calculated Vs. Theoretical Dilution Factors |

| 13-3 |

|

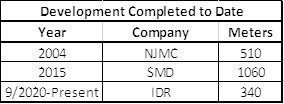

| Table 13‑2 Development by year and Company |

| 13-5 |

|

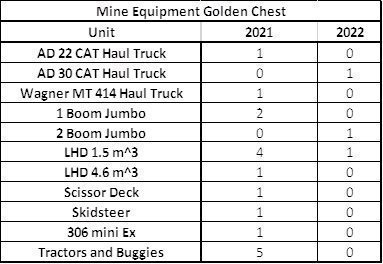

| Table 13‑3 Underground Mine Equipment List, Idaho Strategic Resources— |

| 13-5 |

|

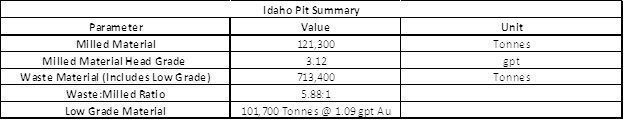

| Table 13‑4 Idaho Pit Summary (August 2016-June 2020) |

| 13-6 |

|

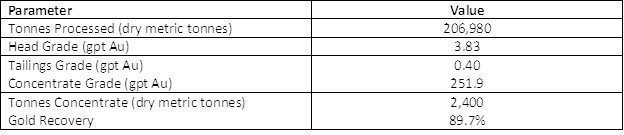

| Table 14‑1 Mill Production Summary |

| 14-2 |

|

| Table 17‑1 Environmental Permits |

| 17-1 |

|

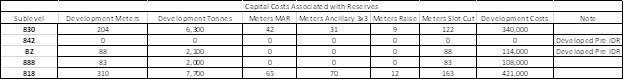

| Table 18‑1 Capital Cost Estimates Associated with Reserves |

| 18-1 |

|

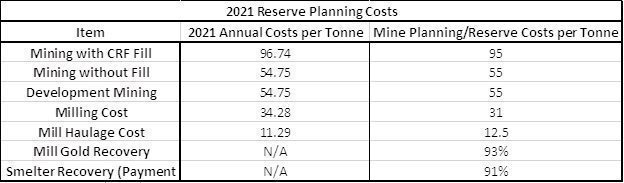

| Table 18‑2 2021 Annual costs per tonne and mine planning/reserve costs used |

| 18-2 |

|

| Table 19‑1 Underground reserve scenario production summary. |

| 19-1 |

|

| Table 19‑2 Table of Golden Chest underground reserve cash flows. |

| 19-2 |

|

| Table 19‑3 Summary of Golden Chest underground reserve sensitivity analysis |

| 19-4 |

|

| 1-6 |

Figures

| Figure 3‑1 and New Jersey Mill Location Map |

| 3-1 |

|

| Figure 3‑2 Patented and unpatented claim locations |

| 3-2 |

|

| Figure 6‑1 Geologic Provinces of Idaho (Idaho State University 2017) |

| 6-1 |

|

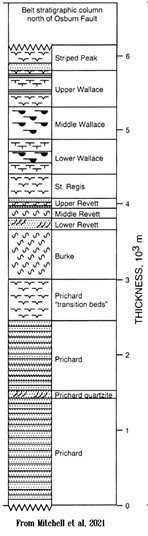

| Figure 6‑2 Belt Stratigraphy in the Mine Region |

| 6-3 |

|

| Figure 6‑3 Prichard Formation (Green), Gem Stocks (Pink), Major Fault Lineaments (Blue) and Trout Creek Anticline (Black). |

| 6-4 |

|

| Figure 6‑4 Regional Geologic Map |

| 6-6 |

|

| Figure 6‑5 Mine Geologic Map |

| 6-8 |

|

| Figure 6‑6 Banded Vein Example |

| 6-10 |

|

| Figure 6‑7 Brecciated Vein Example |

| 6-10 |

|

| Figure 6‑8 Massive Vein Example |

| 6-11 |

|

| Figure 6‑9 Vertical Cross-Section of Vein Location |

| 6-12 |

|

| Figure 6‑10 Gold-Sphalerite-Galena-Pyrite-Quartz Vein from the 941 Level |

| 6-13 |

|

| Figure 6‑11 Intrusive Related Orogenic Model (modified after Groves et al. 1998) |

| 6-16 |

|

| Figure 7‑1 Planview of Golden Chest Drill Traces |

| 7-1 |

|

| Figure 8‑1 Drill Sampling 3 gpt Standard QA/QC Tracking |

| 8-2 |

|

| Figure 8‑2 Drill Sampling 8 gpt Standards QA/QC Tracking |

| 8-3 |

|

| Figure 8‑3 Mine Office/Core Shed Building |

| 8-4 |

|

| Figure 10‑1 Aerial View of New Jersey Mill |

| 10-1 |

|

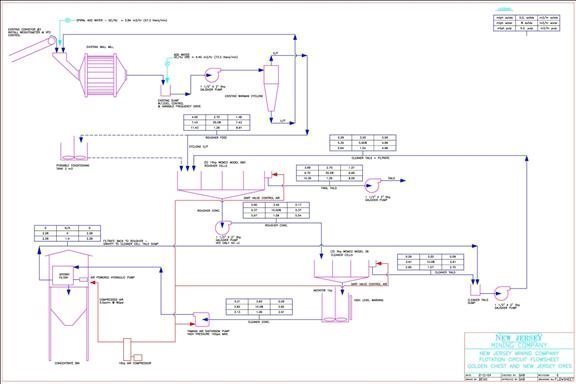

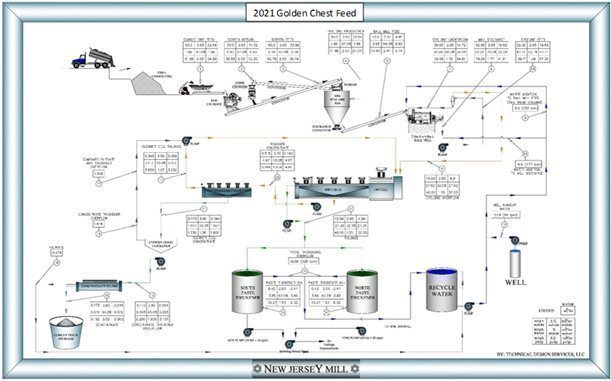

| Figure 10‑2 New Jersey Mill 100 TPD Flowsheet |

| 10-2 |

|

| Figure 13‑1 Map showing outline |

| 13-1 |

|

| Figure 14‑1 New Jersey Mill Flowsheet |

| 14-2 |

|

| Figure 15‑1 Infrastructure Layout. |

| 15-2 |

|

| Figure 19‑1 Sensitivity analysis of Golden Chest underground reserves |

| 19-3 |

|

| Figure 20‑1 Map of Adjacent Properties |

| 20-1 |

|

| 1-7 |

1.0 EXECUTIVE SUMMARY

1.1 Summary

This Technical Report Summary (TRS) on the Golden Chest Mine, Idaho (Golden Chest, property, or mine) has been prepared for Idaho Strategic Resources, Inc. (IDR) by the Qualified Persons (QP’s) Grant A. Brackebusch, P.E. and Robert J. Morgan, PG, PLS. Both are employees of IDR. Brackebusch is the Vice President of Operations and Morgan is the Vice President of Exploration.

The purpose of this report is to disclose Mineral Reserves at the Golden Chest Mine as of December 31, 2021.

IDR is listed on the NYSE and currently reports Mineral Reserves in its Annual Report on Form 10K with the United States Securities and Exchange Commission (SEC). This TRS conforms to SEC’s Modernized Property Disclosure Requirements for Mining Registrants as described in Subpart 229.1300 of Regulation S-K, Disclosure by Registrants Engaged in Mining Operations (S-K 1300) and Item 601 (b)(96) Technical Report Summary.

The Golden Chest mine is narrow vein underground gold mine located in Murray, Idaho, which produces approximately 40,000 tonnes of ore annually to feed the New Jersey Mill (NJ Mill) in Kellogg, Idaho. The Golden Chest has operated continually since 2016. The NJ Mill produces a bulk sulfide flotation concentrate which is shipped to overseas smelters.

1.1.1 Conclusions

The QP’s offer the following interpretations and conclusions by area.

Geology and Mineral Resources

|

| · | The Company has not completed a Mineral Resource Estimate for the year ending December 31, 2021, but is planning to complete one for the year ending December 31, 2022. In 2012, an historic resource estimate was completed as a part of a Canadian NI 43-101 by a third party. A summary of the historic 2012 NI 43-101 is provided for background only and does not represent a current SK 1300-compliant resource. |

|

|

|

|

|

| · | Core sampling is supervised by professional geologist and sampling procedures meet industry best practices. |

|

|

|

|

|

| · | The sample preparation, security, and analytical procedures for core samples were consistent with generally accepted industry best practices. |

|

|

|

|

|

| · | The QA/QC procedures for core samples are consistent with generally accepted industry standards. However, a persistent, low bias in assay results was found in the 3 gpt standard. |

|

|

|

|

|

| · | Blanks and standards are not currently included with muck samples from the stope rounds. Blanks and standards should be included with muck samples on a weekly basis. |

|

|

|

|

|

| · | The QP’s review of database validation yielded no deficient procedures or data. The sample database is valid for reserve and resource calculations. |

| 1-8 |

Mining and Mineral Reserves

|

| · | The Mineral Reserve estimate of has been reviewed by the QP’s and found to be in accordance with the definitions for Mineral Reserves in S-K 1300. Mineral Reserves at December 31, 2021 are 38,700 tonnes at an average grade of 4.87 gpt gold using a gold price of $1,650 per troy ounce. |

|

|

|

|

|

| · | The Mineral Reserves are all within the Skookum Shoot area near existing infrastructure and near previously mined areas where sample data is dense enough for Proven classification. |

|

|

|

|

|

| · | Open pit ore reserves were not calculated for the year ending December 31, 2021. The Klondike open pit is an area with a low density of core drilling and extensive, unmapped stopes (mined-out voids) from historic mining that make it difficult to produce an accurate reserve estimate. The open pit is mined on a drill-as-you-go basis where each bench is economically evaluated based on the blastholes assays to determine whether enough revenue will be available to generate a profit for the bench. These factors combine to make the outlook for continued open pit mining relatively uncertain. |

|

|

|

|

|

| · | Mineral Reserves are prepared by qualified personnel with appropriate supervision using industry-standard mining software. |

|

|

|

|

|

| · | The QP’s believe the use of a trailing three-year average gold price is appropriate and consistent with generally accepted practices within the mining industry. |

|

|

|

|

|

| · | The mining method at the Golden Chest is underhand cut-and-fill utilizing cemented rock fill (CRF) in the stopes. |

|

|

|

|

|

| · | The mining method is appropriate for this type of vein deposit and the ground conditions with minimum widths of 2.5 m and an average stope width of 3.0 m. |

|

|

|

|

|

| · | The Mineral Reserve is based on the underhand cut-and-fill mining method. |

|

|

|

|

|

| · | Block model versus muck sample reconciliation shows the block model accurately predicts gold grade within 2%. A reconciliation of the block model and mine versus the mill feed should completed. |

|

|

|

|

|

| · | Dilution is accounted for in the Mineral Reserve estimate and extraction is assumed to be 100%. |

|

|

|

|

|

| · | The ground support plan with the use of Swellex-bolts in conjunction with CRF has improved geotechnical stope stability. |

|

|

|

|

|

| · | The mine uses 1.5 m3 rubber-tired LHDs along with diesel-hydraulic drill jumbos and a 22-tonne underground dump truck. |

|

|

|

|

|

| · | Life-of-mine (LOM) plans should be completed once an updated Mineral Resource estimate is completed. Mining equipment, infrastructure, and mineral processing requirements could be determined once an LOM plan is completed. |

| 1-9 |

Mineral Processing

|

| · | Material is shipped from the Golden Chest Mine in Murray, Idaho to the New Jersey Mill in Kellogg, Idaho for processing using highway dump trucks with pups. |

|

|

|

|

|

| · | The New Jersey Mill operates as a bulk flotation plant at a rate of approximately 40,000 tonnes per year to produce a bulk-sulfide concentrate for sale to copper smelters in Asia. |

|

|

|

|

|

| · | The mill has processed nearly 207,000 tonnes of material from the Golden Chest open pit and underground and achieved gold recovery of 89.7% with an average concentrate grade of 252 gpt gold. |

|

|

|

|

|

| · | The mill has achieved higher gold recovery of 93% for straight underground material. This is appropriate gold recovery to use for underground Mineral Reserve estimates. |

|

|

|

|

|

| · | Previous campaigns of processing material from the Golden Chest at the 100 tpd New Jersey Mill from 2005 to 2009 provided metallurgical testing information at a bulk-sample scale. |

|

|

|

|

|

| · | RDI performed metallurgical testing evaluating gravity, flotation, and cyanidation processes using core samples from the Skookum Shoot. |

|

|

|

|

|

| · | The New Jersey Mill utilizes the novel process of paste tailings disposal and recycles process water to minimize its impact on the environment. |

Infrastructure

|

| · | The Golden Chest Mine is accessible all year round via a paved highway known as Forest Highway 9 and has all the necessary infrastructure to mine at the current rate. |

|

|

|

|

|

| · | An increase in the current mining rate would require an upgrade to the electrical power line to the mine. |

|

|

|

|

Environment

|

| · | The Golden Chest Mine and New Jersey Mill have all the necessary environmental permits to operate. |

|

|

|

|

|

| · | The Company has posted bonds to cover the cost of reclamation at both the Golden Chest and New Jersey Mill. |

|

|

|

|

|

| · | The Company promotes a “We Live Here” philosophy which encourages a commitment to the environment because employees and management all live and recreate in the local area. Local hiring and buying are also encouraged under this philosophy. |

1.1.2 Recommendations

The QP’s offer the following recommendations by area.

| 1-10 |

Geology and Mineral Resources

|

| 1. | An updated Mineral Resource compliant with SK 1300 should be calculated for the year ending December 31, 2022, as there has been significant additional core drilling since the historic Micon 2012 Resource and some depletion from mining. |

|

|

|

|

|

| 2. | Inferred Mineral Resource classification should observe the spacing requirement of two drill holes within 75 meters instead of 100 meters as used in the historic Micon 2012 Resource. |

|

|

|

|

|

| 3. | The 3 gpt standard assays should be investigated to determine if a cause for the low bias can be found. |

|

|

|

|

|

| 4. | Blanks and standards should be included with the muck samples on a weekly basis. |

|

|

|

|

|

| 5. | Follow-up or closeout assays around a vein intercept should be checked on a regular basis that they have been added to the sample database to avoid inaccuracies in compositing. |

Mining and Mineral Reserves

|

| 1. | Add the reconciliation of mill tonnes and grade to the block model reconciliation exercise. |

|

|

|

|

|

| 2. | The use of the mechanical bolter in the stopes should be implemented into the stope design to pursue increased efficiency and safety in the installation of ground support. |

|

|

|

|

|

| 3. | Study the addition of a paste backfill system for the potential to reduce operating costs. |

|

|

|

|

|

| 4. | Commission double-boom jumbo to increase rate of development. |

|

|

|

|

Mineral Processing

|

| 1. | Hire a metallurgical consultant to perform a plant audit of the mill to help optimize operational parameters to maximize net smelter return. |

|

|

|

|

|

| 2. | Complete mineralogic study of concentrate to define mineralogic components of concentrate. |

Environment

|

| 1. | Consider hiring a full-time environmental professional or environmental contractor as the scope of operations has increased. |

|

|

|

|

|

| 2. | Make plans to drill three groundwater monitoring wells at the Golden Chest Mine. |

1.2 Economic Analysis

1.2.1 Economic Criteria

IDR completed a one-year cash flow analysis for the Mineral Reserve estimation as it prefers to use sample information from mining previous levels to increase the confidence in grade estimation which produces a more accurate estimate in a narrow vein gold deposit.

1.2.2 Physical Parameters

|

| · | Total mill feed processed: 38,700 tonnes |

|

|

|

|

|

| · | Average processing rate: 185 metric tonnes per shift |

| 1-11 |

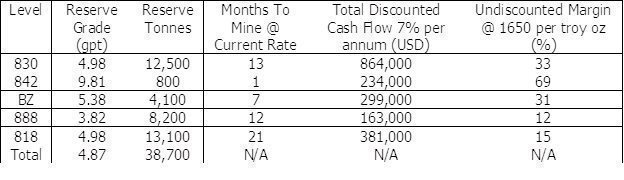

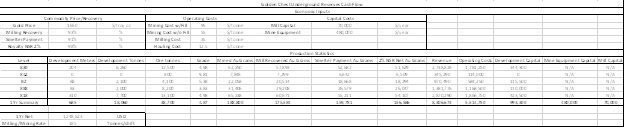

Table 1‑1 Golden Chest Projected Production for One Year

| Commodity

| Head Grade

| Mill % Recovery

| Mill Recovered Au Grams

| Year’s Mill Au Grams

|

| Au

| 4.87

| 93

| 175,580

| 175,580

|

1.2.3 Revenue Parameters

|

| · | Gold price used in the economic analysis is a constant $1650 per troy ounce representing a 3-year trailing average (2019, 2020, 2021). |

|

|

|

|

|

| · | Constant smelter payment factor of 91% |

|

|

|

|

|

| · | Constant Net of Smelter Royalty (NSR) of 2% |

|

|

|

|

1.2.4 Operating and Capital Costs

| · | Constant Net of Smelter Royalty (NSR) of 2% |

|

|

|

| · | Constant Ore haulage cost of $12.50 per tonne |

|

|

|

| · | Constant milling cost of $35.00 per tonne |

|

|

|

| · | Constant ore mining with fill of $95 per tonne |

|

|

|

| · | Constant development cost of $55 per tonne |

|

|

|

| · | Sustaining capital of $480,000 for mine equipment and $70,000 for mill infrastructure |

|

|

|

| · | Mine life of one year |

1.2.5 Taxes and Royalties

Idaho Strategic resources pays property tax in Shoshone County and occasionally a Net Profit Tax to Shoshone county. No income tax is anticipated to be payable in the next year as IDR has a substantial corporate tax loss carryforward.

The current production zone is subject to a 2% NSR royalty payable to Marathon Gold Corp. which is included in the estimate. Property taxes and net profit tax paid to Shoshone County are minor compared to the 2% NSR and are neglected in the analysis.

1.2.6 Cash Flow

The results of this analysis indicate a positive cash flow of approximately $1,250,000 at the base case. Capital requirements are paid within the year and the positive cash flow indicates economic viability at the base case $1650 per troy ounce gold price. See Table 19-2 for more detail.

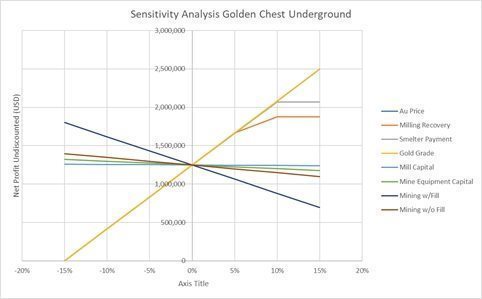

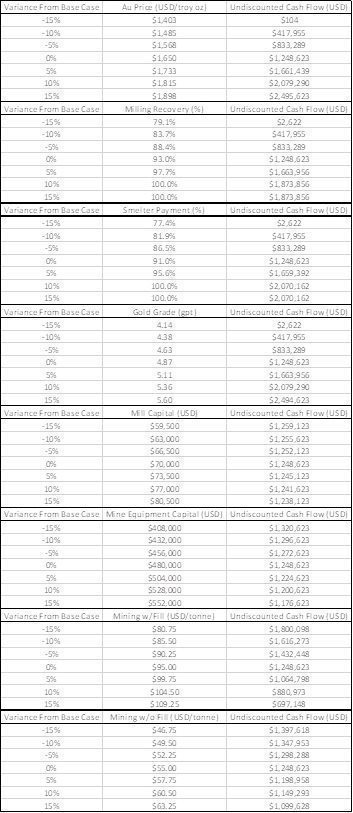

1.2.7 Sensitivity

The sensitivity analysis found that gold mill recovery, smelter payment factor, gold grade, and gold price are the most sensitive variables in the estimate.

| 1-12 |

1.3 Technical Summary

1.3.1 Property Description

The Golden Chest Mine is located 2.4 km east of Murray, Idaho along Forest Highway 9. The mine is an underground cut and fill gold property exploiting a narrow, quartz vein system. The Golden Chest produces about 40,000 tonnes of ore annually utilizing underhand cut and fill. The ore is processed at the New Jersey Mill in Kellogg, Idaho to produce a bulk sulfide concentrate for sale to smelters in Asia.

1.3.2 Land Tenure

The Company owns 100% of the Golden Chest mine and the land position is comprised of both patented (319 acres) and unpatented claims (1,390 acres) subject to a 2% Net Smelter Royalty (NSR).

1.3.3 History

The Golden Chest Mine is the oldest lode gold mine in the Coeur d’Alene District. Historic reports peg the estimated production of the Golden Chest at 65,000 ounces of gold produced before 1940. Since 1940 gold production is estimated to be approximately 30,000 ounces with this production occurring after 2004.

1.3.4 Geologic Setting, Mineralization, and Deposit

The Golden Chest is considered an orogenic gold deposit with gold mineralization hosted in a quartz vein near a major local fault. The primary geological control to mineralization at the Golden Chest is the Idaho Fault and gold mineralization usually occurs within 50 meters of the fault. The deposit is hosted by the Prichard Formation which is the oldest member of the Belt Supergroup.

1.3.5 Exploration

Currently IDR is conducting exploratory core drilling on the property with the aim to increase the Mineral Resource and help define the Mineral Reserve.

1.3.6 Mineral Resource Estimate

The Company has not completed a Mineral Resource Estimate for the year ending December 31, 2021, but is planning to complete one for the year ending December 31, 2022.

In 2012, an historic resource estimate was completed as a part of a Canadian NI 43-101 by a third party. A summary of the historic 2012 NI 43-101 is provided for background only and does not represent a current SK 1300 compliant resource. See Section 11.0 for more information.

1.3.7 Mineral Reserve Estimate

Mineral Reserve estimates, prepared by IDR and reviewed and accepted by the QP’s, have been classified in accordance with the definitions for Mineral Reserves in S-K 1300 and are estimated to be as 38,700 tonnes at a grade of 4.87 gpt gold.

1.3.8 Mining Methods

The Golden Chest Mine is accessed by a decline ramp 4.5 m by 4.0 m in cross-section. A northern ramp provides for an escapeway and secondary escape. The vein is mined by underhand cut and fill utilizing cemented rock fill (CRF) as backfill. Ore and waste are transported to the surface via the main ramp with a 22-tonne haul truck.

| 1-13 |

1.3.9 Mineral Processing

The New Jersey Mill located 3 km east of Kellogg, Idaho has processed material from the Golden Chest since 2017 from both open pit and underground sources at a rate of about 300 tpd for 3.5 days per week. The New Jersey Mill uses a conventional bulk sulfide flotation flowsheet utilizing crushing, grinding, flotation, and paste tailings disposal. Concentrate is shipped to copper smelters in Asia.

1.3.10 Infrastructure

The Golden Chest mining operations have been ongoing since 2012 and infrastructure at the site includes 1,000 meters of underground ramp, electrical service, a core shed, a mine dry, and a shop building. Year-round access to the mine is provided by Forest Highway 9 which is maintained by Shoshone County.

1.3.11 Market Studies

The Golden Chest produces a bulk sulfide concentrate sold to copper smelters in Asia through a concentrate broker and has sold concentrate in this fashion since 2016.

1.3.12 Environmental Permitting

The Golden Chest Mine and New Jersey Mill have all the necessary environmental permits to operate. The NJ Mill utilizes a unique tailings disposal method known as paste tailings disposal that allows process water recycling and prevents the discharge of process water to surface waters of the US.

| 1-14 |

2.0 INTRODUCTION

This Technical Report Summary (TRS) on the Golden Chest Mine (Golden Chest, property, or mine) has been prepared for Idaho Strategic Resources, Inc. (IDR) by the Qualified Persons (QP’s) Grant A. Brackebusch, P.E. and Robert J. Morgan, PG, PLS. Both are employees of IDR. Brackebusch is the Vice President of Operations and Morgan is the Vice President of Exploration.

The purpose of this report is to disclose Mineral Reserves at the Golden Chest Mine as of December 31, 2021. This is the initial TRS completed for the Golden Chest Mine.

Idaho Strategic Resources, Inc. (IDR) is listed on the NYSE and currently reports Mineral Reserves in its Annual Report on Form 10K with the United States Securities and Exchange Commission (SEC). This TRS conforms to SEC’s Modernized Property Disclosure Requirements for Mining Registrants as described in Subpart 229.1300 of Regulation S-K, Disclosure by Registrants Engaged in Mining Operations (S-K 1300) and Item 601 (b)(96) Technical Report Summary.

2.1 Site Visit

Both QP’s are employees of IDR and spend a significant portion of their time at the mine and the mill so a site visit is unnecessary.

2.2 Sources of Information

During preparation of this report discussions were held with the following personnel.

| Rick Alexander | Mill Lead Operator, IDR |

|

|

|

| Andrew Brackebusch, EIT | Golden Chest Mine Engineer, IDR |

|

|

|

| John Etienne | Chief Geologist, IDR |

|

|

|

| John Ferguson | Company Accountant, IDR |

|

|

|

| Kelly Gallogly | Golden Chest Mine Geologist, IDR |

|

|

|

| Rebecca Goddard | Exploration Geologist, IDR |

|

|

|

| Chandler Harris | Contract Geologist, Tamarack Geologic Services |

|

|

|

| Matt Williams | Golden Chest Mine Foreman, IDR |

|

|

|

| Jared Williams | Golden Chest Mine Foreman, IDR |

Other sources of information can be found in Section 24.0 References.

| 2-1 |

2.3 List of Abbreviations

Table 2‑1 - List of Abbreviations

| Term | Abbreviation |

| Acres | ac |

| Ammonium Nitrate/Fuel Oil | ANFO |

| Bureau of Land Management | BLM |

| Canadian National Instrument 43-101 | NI 43-101 |

| Centimeter | cm |

| Concentrate Leach Plant | CLP |

| Cemented Rock Fill | CRF |

| Cubic meter(s) | m3 |

| Cubic meters per hour | m3/hr |

| Cyanide | CN |

| Meters | m |

| Degrees Celsius | oC |

| Direct Current | DC |

| Environmental Protection Agency | EPA |

| Fire assay | FA |

| Diameter | dia. |

| Global positioning system | GPS |

| Gram(s) | g |

| Grams per tonne | gpt, g/t |

| Grams per tonne of gold | g/t Au |

| Gold | Au |

| Golden Chest Limited Liability Company | GCLLC |

| Hectare(s) | ha |

| Hour | hr |

| Idaho Department of Environmental Quality | IDEQ |

| Idaho Strategic Resources, Inc. | IDR |

| Juniper Mining Company | JMC |

| Kilogram | kg |

| Kilograms per tonne | kg/tonne |

| Kilometer(s) | km |

| Kilowatt | kW |

| Kilowatt Hour | kWh |

| Load-Haul-Dump loader | LHD |

| Main Access Ramp | MAR |

| Meter(s) | m |

| Meters above sea level | masl |

| Micron(s) | μm |

| Millimetre(s) | mm |

| Million | M |

| Million years old | Ma |

| Minute(s) | min |

| Net Smelter Royalty | NSR |

| North American Datum | NAD |

| 2-2 |

| Term | Abbreviation |

| Ounces per tonne | opt |

| Parts per million | ppm |

| Professional Geologist | PG |

| Professional Land Surveyor | PLS |

| Professional Engineer | PE |

| Quality Assurance | QA |

| Quality Assurance/Quality Control | QA/QC |

| Quality Control | QC |

| Qualified Person | QP |

| Reduced Intrusion-Related Gold System | RIRGS |

| Second | s |

| Small Mine Development | SMD |

| Sodium cyanide | NaCN |

| Tonne(s) | t |

| Tonnes per Day | tpd |

| Tonnes per hour | t/h |

| United States | US |

| United States Dollars | USD$ |

| Universal Transverse Mercator | UTM |

| 2-3 |

3.0 PROPERTY DESCRIPTION

3.1 Location

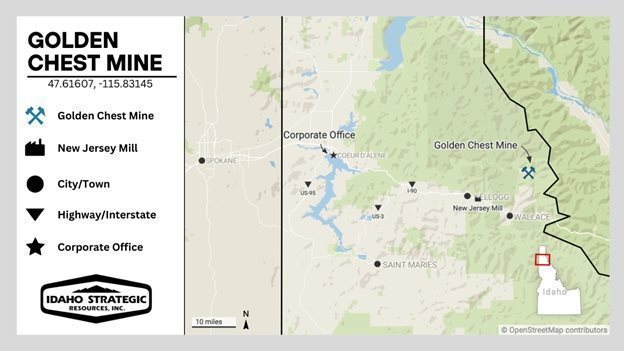

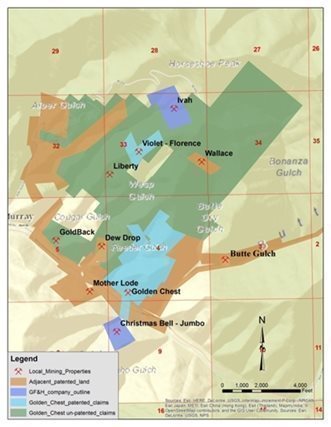

The Golden Chest Mine (mine) has an area of 554.9 hectares (ha) and is located in Shoshone County, Idaho, United States. The mine is approximately centered at Latitude 47o37’14” North and Longitude 115o49’43” West (Figure 3-1). The mine is approximately 2.4 kilometers (km) east of the small town of Murray, Idaho and 115 km east of the city of Coeur d’ Alene, Idaho.

The New Jersey Mill (Mill) is located in Shoshone County, Idaho, United States approximately at Latitude 47o31’50” North and Longitude 116o04’38” West (Figure 3-1). The Mill is located approximately 21 km south of the town of Murray, Idaho and 3 km east of the city of Kellogg, Idaho.

Figure 3‑1 and New Jersey Mill Location Map

3.2 Ownership and Holdings

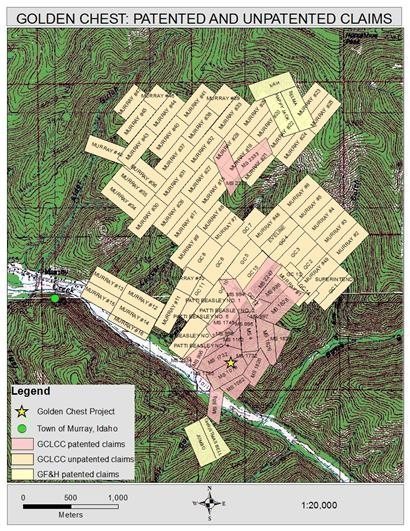

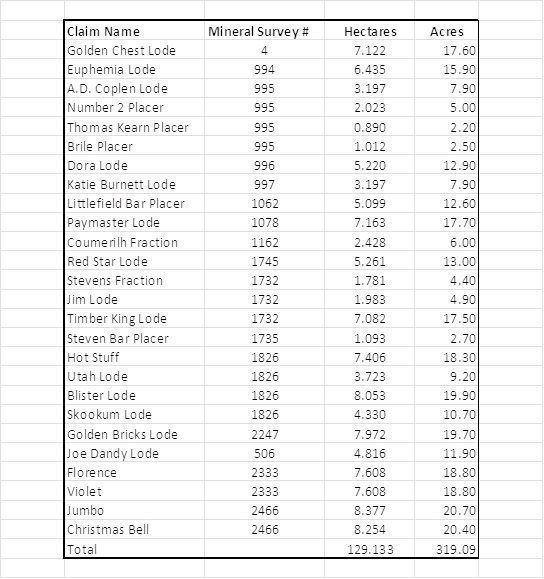

The Golden Chest Mine is composed of patented and unpatented claims (Figure 3-2). The land position consists of 26 patented mining claims (Table 3-1) covering approximately 129.1 hectares (ha) (319 acres) and 70 unpatented claims covering a total of approximately 562.5 ha (1,390 acres).

| 3-1 |

Figure 3‑2 Patented and unpatented claim locations

The core of the Golden Chest Mine is a contiguous group of 26 patented claims where all modern mining has taken place to date. The Company owns the rights to both the surface and subsurface mineral on all patented claims directly and through it’s 100% held subsidiary Golden Chest LLC (GCLLC), excluding the Joe Dandy Claim where IDR owns only the subsurface mineral rights. As these patented claims are considered private lots, legal access is allowed. Property taxes on patented claims are assessed by Shoshone County each year and IDR has paid the taxes in full. Table 3-1 below lists the patented claims at the Golden Chest Mine.

| 3-2 |

Table 3‑1 List of patented claims at the Golden Chest Mine, as of December 31, 2021

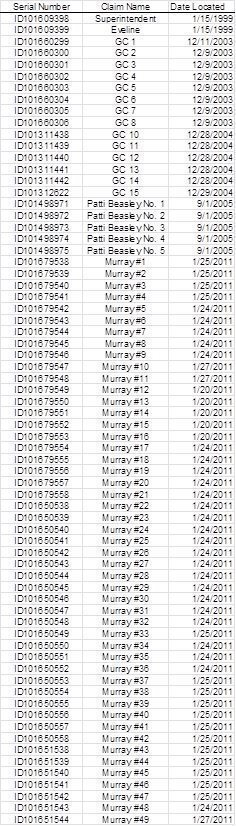

IDR currently maintains 70 unpatented mining claims covering 562.5 ha (1,390 acres). The claims have been filed with the United States Bureau of Land Management (BLM) agency and at the Shoshone County Courthouse. Annual maintenance fees are paid to the BLM by September 1, and the Golden Chest unpatented claim fees have been paid and are in good standing. The unpatented mining claims are located on parcels of public land from which the claimant owns the mineral rights, however, no surface land ownership is conveyed.

| 3-3 |

Table 3‑2 List of Unpatented Claims at the Golden Chest Property

| 3-4 |

3.3 Royalty

The Golden Chest Mine patented and unpatented claims are subject to a 2% Net Smelter Royalty (NSR) payable to Marathon Gold Corp. on a quarterly basis.

3.4 Permit Requirements

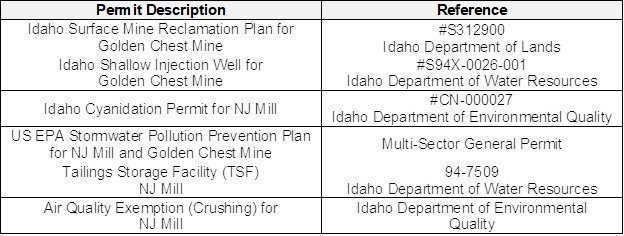

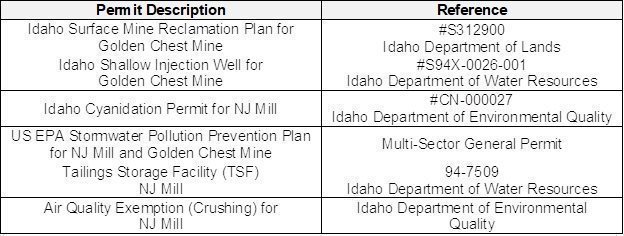

The Golden Chest Mine and New Jersey Mill have all the required environmental permits to operate currently and into the foreseeable. Some permits may require modification if operating conditions change, but typically these changes can be completed without impeding the mining operation. A summary of the permits held by the Company are found in Table 3-3.

Table 3‑3 Permit Descriptions

3.5 Encumbrances and Other Risks

As mentioned earlier, IDR does not own the surface of the Joe Dandy claim, however the deed for the claim contains language granting the owner of the mineral rights the ability to work and operate on the claim to mine the quartz lode. The Company is not aware of any significant factors or risks that may affect access, title, or the right or ability to perform work on the property.

| 3-5 |

4.0 ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHSYIOGRAPHY

4.1 Accessibility

The Golden Chest Mine is accessible year-round via a paved road known as Forest Highway 9 - a distance of 56 kilometers (35 miles) from Kingston, Idaho. At Kingston, Forest Highway 9 merges with US Interstate 90 for easy access to the local communities of Kellogg, Wallace, and Coeur d’Alene.

4.2 Climate

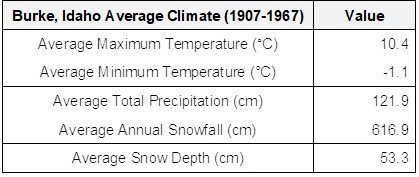

The Golden Chest is located in northern Idaho, which has a mountain climate typical for temperate regions in the mid-latitudes that are influenced by both polar and tropical air masses typified by wet, cold winters and short, dry summers.

The nearest climate records are found from Burke, Idaho (1907-1967) which is located approximately 10 km south of the mine at a slightly higher elevation.

Table 4‑1 Average Climate for Burke, ID 10km South of Golden Chest

Average annual precipitation is 121.9 cm, falling mainly in winter. Average annual snowfall is 616.9 cm and may occur in spring and fall as well as in winter.

During the winter, IDR is able to operate all season by plowing snow from the mine roads and utilizing tire chains on equipment when necessary. Forest Highway 9 is maintained all winter by Shoshone County.

4.3 Local Resources and Infrastructure

The Golden Chest Mine benefits from local human resources and services in the towns of Murray, Wallace, and Kellogg, Idaho which are located 2.4 km west, 18 km south, and 24 km southwest respectively of the mine. Wallace, with a population of 1076 people at the 2020 census, is the county seat of Shoshone County.

The area has a long mining heritage as gold was discovered in Murray in 1882 and mining has continued to the present – mostly south of the Golden Chest in the Silver Valley. Current underground mining in the area is conducted by Hecla at the Lucky Friday Mine and Americas Gold and Silver Corporation at the Galena Mine. These historic and modern mining operations have resulted in an area that is familiar with and is equipped to support the mining industry. Experienced mining personnel and small business support are available.

| 4-1 |

4.4 Physiography and Environment

The topography of the mine area consists mainly of steep, mountainous terrain, which is primarily covered in mixed coniferous forest, except where recently burned. The mine is characterized by high relief, with elevations ranging from 880 meters above sea level (masl) at the Prichard Creek valley bottom to 1,220 masl on the ridges at the north end of the mine’s patented claim group.

The drainage pattern around the mine consists of dendritic perennial and intermittent watercourses that drain generally southwest. The dominant watercourses of the area are the North Fork of the Coeur d’ Alene River and Prichard Creek. The area is characterized by incised streams bounded by long steep ridges.

Timber consists mostly of pine, fir, cedar, and hemlock. Elk, deer and moose are the most common large mammals in the area. Other reported mammals in the surrounding area are black bear, wolf, and mountain lion. There are no known protected species within the mine area.

| 4-2 |

5.0 HISTORY

5.1 Location of District

The Golden Chest Mine is the oldest lode gold mine in the Coeur d’Alene District. The area commonly known as the Coeur d'Alene Mining District, has been subdivided for purposes of record and administration into a number of local mining districts. All of these subdivided local mining districts are in Shoshone County, Idaho. The Golden Chest Mine is more specifically located in the Summit Mining District within the Murray Gold Belt region of the greater Coeur d’Alene Mining District.

5.2 Historic Gold Mining

The first discovery of gold in the Coeur d’Alene District was made along the South Fork of the Coeur d’Alene River by Thomas Irwin in 1879. A.J. Prichard initiated the first active mining in 1882 when he staked out a number of placer claims for himself and his friends near the present site of Murray. The first lode claim in the district, the Paymaster, was located in September of 1883 and is now part of the Golden Chest.

By the end of 1883 and early in 1884, several mines were developed along Prichard Creek; the Mother Lode, Daddy, and Treasure Box mines on the creek’s south side, and the Golden Chest on the north side. By 1885, Murray had a population of about 1,500 with the Golden Chest and its 20-stamp mill employing 25 to 30 men. However, by 1886, with the discovery of the enormous lead-silver deposits at Bunker Hill, the scene of most mining activity had shifted to the South Fork of the Coeur d’Alene River near Kellogg. The mining of lode quartz-gold veins had essentially ceased by 1900.

Prior to 1910, the Katie-Dora and Klondike Ore Shoots were accessed from the Katie #2, Katie #3, Martin, and Pettit Levels. After consolidation of the properties in 1910, the Idaho #3 level was completed at a lower elevation to access the deeper levels of the Katie-Dora and Klondike zones. Starting in late 1915, the Golden Chest was reopened as a source of tungsten (scheelite) for high-speed steels used in cutting tools designed for armament production in the First World War.

During the Depression, placer mining was considerably revived, and in 1933 and 1934 the Golden Chest was again active. Only a small amount of work was in progress and most of the historic underground gold mining was complete when P. Shenon, of the Idaho Bureau of Mines and Geology, visited the Golden Chest in 1935. Shenon reported that underground maps displayed over 4,000 m of drifts and crosscuts.

Historic reports peg the estimated production of the Golden Chest at 65,000 ounces of gold produced before 1940. The first documented drilling program on the Golden Chest Mine was conducted between 1969 and 1973 by Golden Chest Incorporated (GCI). Drill tests by GCI included four underground holes and one surface diamond drill hole totaling 385 m. The surface hole intersected an 18 m zone containing multiple, low-grade gold-bearing quartz veins.

Newmont Exploration Limited (NEL) conducted exploration activities including mapping, sampling and drilling between 1987 and 1990. In 1987 and 1988, Newmont completed six core drill holes with depths to 175 m. In 1988 and 1989, an additional 29 reverse-circulation holes, with depths up to 130 m, were completed on the property. Newmont dropped the property in 1990, due to the property not fulfilling their requirements for an open pit resource.

| 5-1 |

5.3 Historical Mineral Resource Estimates

Newmont Exploration Limited (NEL) evaluated the Golden Chest for bulk mineable potential between 1987 and 1990. Newmont drilled six core holes totaling 734 total meters; and 29 reverse-circulation holes totaling 2,659 total meters. This work resulted in a mineral resource estimate as follows:

· Potential Open Pit Resource: 4,758,852 short tons grading 0.049 ounces per ton (opt) Au for 230,278 ounces of gold at cut-off grade of 0.02 opt Au.

Since these “resources” are historical in nature, they cannot be relied upon. It is unlikely that these resource numbers conform to current SK 1300 criteria or to Society of Mining Metallurgy and Exploration (SME) standards, and most importantly they have not been verified to determine their relevance or reliability. However, they have been included into this section for illustrative purposes only and should not be disclosed out of context.

5.4 New Jersey Mining Company (IDR 2003-2012)

IDR leased the Golden Chest in 2003 and began a core drilling program to confirm several of Newmont’s favorable drill intercepts. Confirmatory core drilling results led to enough validation to begin a new portal (North Portal) in late 2004. Between 2004 and 2008, a 440 m spiral ramp was developed from the surface down to the historic Idaho #3 Level.

Between 2004 and 2012, small-scale mining by IDR from the North Portal access extracted a total of 8,400 tonnes of material grading 6.90 gpt Au and 1,705 ounces (oz) of gold recovered.

5.5 Golden Chest LLC (2010-2015)

The Golden Chest Limited Liability Company (GCLLC) was formed in December 2010 by a joint venture agreement between IDR and Marathon Gold USA. GCLLC began an intense surface drilling program; drilling 106 core holes in 2011 and 45 core holes in 2012 totaling over 18,000 meters.

5.6 Micon NI 43-101 (2011 and 2012)

Marathon Gold Corporation, a Canadian company and parent company to Marathon Gold USA required an independent NI 43-101 Technical Report in order to support regulatory disclosures leading to the “Micon Technical Report on the Initial Resource Estimate at the Golden Chest Property, Idaho, United States, effective date December 31, 2011”. Continued work the next year led to the development of an updated, second technical report by Micon in 2012. The updated 2012 NI 43-101 technical report included an overall mineral resource 254,000 oz gold in the Measured and Indicated categories and 223,000 oz gold in the Inferred category @ 0.4 gpt gold cut-off. The Micon 2012 report also included an open pit resource estimate with 4.63-million tonnes grading 1.71 grams per ton (gpt) gold and totaling 223,000 ounces (oz) of gold in the “Measured” and “Indicated” categories.

5.7 Juniper Mining Company (2013)

In September of 2013, Juniper Mining Company leased from GCLLC a section along the Idaho Fault known as the Skookum Shoot. Juniper conducted confirmation drilling, consisting of 16 surface core holes, to verify previous drilling results and by 2014 started construction of the South Portal and associated access ramp. Underground mining, using underhand cut and fill method was conducted from November 2014 through September 2015. Juniper accomplished about 1,000 meters of underground development after investing approximately $7 to $9 million. Other work included 889 face chip samples, 2,457 muck samples, and 734 jackleg probe hole cuttings samples. IDR processed the Golden Chest material at its New Jersey Mill during the Juniper Lease, earning cash from milling fees and its share of a 2% net smelter return (NSR) royalty on gold production. Juniper mined 40,840 dry metric tonnes of ore at an average grade of 6.70 gpt gold, resulting in production of approximately 8,000 oz of gold.

| 5-2 |

In September 2015, Juniper ceased operations and terminated their lease, forfeiting the remaining mineralized material and mine infrastructure returning the property to GCLLC.

5.8 Idaho Strategic Resources (2016-Present)

In August 2016, Idaho Strategic Resources (IDR), formerly known as New Jersey Mining Company, began to re-open the mine, starting with open pit mining on the Idaho Vein (Idaho Pit) and de-watering of the underground workings. Through June 2022, open pit mining was coincident with underground mining.

6.0 GEOLOGICAL SETTING, MINERALIZATION, AND DEPOSIT

6.1 Regional Geology

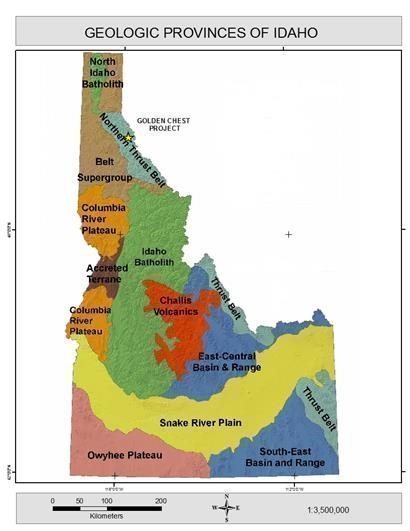

The Golden Chest Mine lies within the Northern Thrust Belt geologic province of Idaho (Figure 6-1). The Northern Thrust Belt is characterized by a set of north-west trending thrust faults which cut through the Mesoproterozoic metamorphic and sedimentary rocks of the Belt Supergroup.

Figure 6‑1 Geologic Provinces of Idaho (Idaho State University 2017)

6.1.1 Belt Supergroup

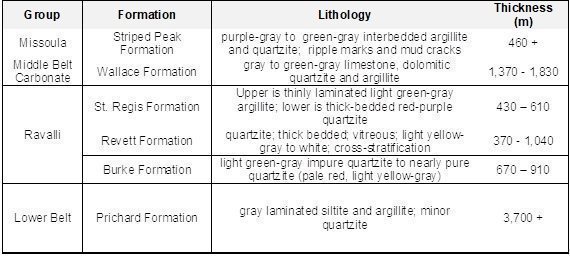

The Belt Supergroup consists of a thick sequence of marine basin sediments that were deposited 1470-1400 million years ago (Ma). In the mine region, the Belt Supergroup is comprised of four major groups, from oldest to youngest:

1) The Lower Belt Group, which is composed of a single formation (Prichard) with eight members, and is composed of thin to thick bedded argillite, siltite, and quartzite.

2) The Ravalli Group, which is composed of three formations and is dominated by quartzite lithologies.

| 6-1 |

3) The Middle Belt Carbonate Group (in the mine area, consists of the Wallace Formation) which is dominated by limestone and dolomitic quartzites.

4) The Missoula Group which consisting of interbedded quartzite and argillite (Table 6-1).

Table 6‑1 Belt Supergroup Stratigraphy in the Mine Region (modified after Gott 1980)

| 6-2 |

Figure 6‑2 Belt Stratigraphy in the Mine Region

Most of historic production in the Coeur d’Alene Mining District has been from the Ravalli and Lower Belt Groups. The host rock lithology at the Golden Chest is the Prichard Formation of the Lower Belt Group.

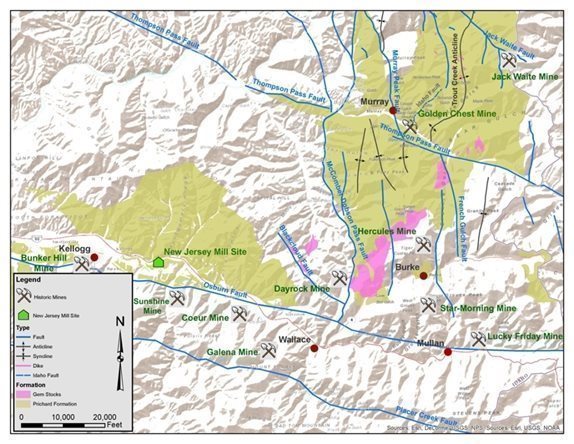

6.2 Local Geology

6.2.1 Lithology

Prichard Formation

The area surrounding Murray, Idaho is dominated by the lithologies of the Prichard Formation (Figure 7--3) which comprises the Lower Belt Group of the Belt Supergroup. The Prichard Formation is made up of a series of weakly metamorphosed, marine basin sediments consisting of siltite, argillite and quartzite. The sediments were deposited by underwater landslides in an active shelf environment creating turbidite sequences. The turbidites are composed of graded couplets consisting of a dark argillite layer and a light siltite layer. The quartzite beds are often discontinuous lenses that suggest deposition in narrow sub-marine channels. In the Murray area, the total thickness of the Prichard Formation is greater than 2740 m (Hosterman 1956). The entire Prichard Formation has been weakly metamorphosed to lower greenschist facies, which is manifested by the presence of low temperature minerals such as chlorite and a weak schistose texture.

| 6-3 |

Gem Stocks

Locally, the largest group of named igneous intrusives is called the Gem Stocks (Figure 6-3). The Murray Stocks, discussed in Section 6.3, are a smaller associated subset of the Gem Stocks. The Gem Stocks are zoned, monzonitic to syenitic intrusions. Base and precious metals were mined from veins at stock margins in the late 1800’s to mid-1900. The intrusions are small in areal extent but are known from mining to become larger with depth. Age dates for the Gem Stocks vary, but most range in age between 94 to 118 Ma, with a suggested emplacement age of 100 Ma.

The Gem and Murray stocks precede the emplacement of the Idaho Batholith and represent numerous intrusive events along their northeast-southwest trend. This is evidenced by the most mafic portion of the stocks being at the southwestern end of the string of intrusions, while the most felsic portion is at the northeastern end near Murray. The Bitterroot lobe of the Idaho Batholith was intruded during regional compression in Cretaceous time; 95 to 70 Ma.

Figure 6‑3 Prichard Formation (Green), Gem Stocks (Pink), Major Fault Lineaments (Blue) and Trout Creek Anticline (Black).

| 6-4 |

6.2.2 Structure

Thompson Pass Fault

The Thompson Pass Fault is the largest geologic structure in the Murray area (Figure 7.3). This fault is the northernmost fault structure of the three faults that define the Lewis and Clark Line in the region. The Lewis and Clark Line is a zone of nearly vertical normal, reverse and strike-slip faults that represents a fundamental break in the crust along which intermittent movement has occurred from Proterozoic time (2,500 Ma) to the present. The Lewis and Clark Line includes the Thompson Pass Fault as the north boundary, the Osburn Fault in the center, and the Placer Creek Fault as the south boundary. Near the mine, the Thompson Pass Fault strikes northwesterly, has a near vertical dip and strong right-lateral, strike-slip displacement.

Trout Creek Anticline

The Trout Creek Anticline is the next largest structural feature in the Murray area after the Thompson Pass Fault. The northerly-trending Trout Creek Anticline is truncated on its southern end by the Thompson Pass Fault. The Trout Creek Anticline is an asymmetric upright fold, with the eastern limb dipping more steeply than the western limb. The western limb dips west at about 45 degrees. The Golden Chest mine is located on the western limb of the Trout Creek Anticline (Figure 7.3). The Idaho Fault is the major fault in the mine workings and is conformable to the western limb and has the same dip.

Murray Peak Fault

Another major structural feature in the local area is the Murray Peak Fault (Figure 7.3). This fault is a northerly trending, high-angle reverse fault which primarily dips steeply to the west at 70° to 85°. Like the Trout Creek Anticline, the Murray Peak Fault is truncated at its southern end by the Thompson Pass Fault.

| 6-5 |

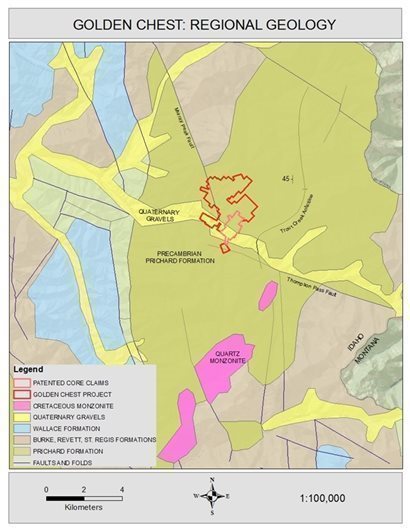

Figure 6‑4 Regional Geologic Map

6.3 Property Geology

6.3.1 Lithology

The Golden Chest mine has five fundamental rock types; three are sedimentary in origin and two are igneous. The sedimentary rocks are composed of siltite, argillite and quartzite; or any combination of these three rock types. The two types of igneous rocks are both intrusive; quartz monzonite and lamprophyre.

Siltite, Argillite and Quartzite

The mine host rocks are composed of siltite, argillite and quartzite, which belong to the Prichard Formation in the Lower Belt Group. The nomenclature for the Prichard Formation as used by IDR has been adapted from Cressman (1989). This adaptation of the Prichard describes and divides the rock units into informal members of the formation starting from older to younger, and these members are identified with nomenclatures of A through H (eight members in total). On the mine, the two youngest members of the Prichard are represented, Members G and H (Figure 6-5).

| 6-6 |

Member G is characterized by lenses of quartzite interbedded with siltite and argillite. This rock unit forms the footwall of the Idaho Fault. The thickness of Member G can range in thickness from 10 to more than 1000 m.

Member H, which lies stratigraphically above Member G, is dominated by dark gray argillites and light gray siltites with minor quartzites. This rock unit forms the hanging wall of the Idaho Fault. Bedding is dominantly planar. The thickness of Member H is from 600 to 750 m.

Quartz Monzonite

The intrusive rocks on the mine are dominantly quartz monzonite, which belong to the Murray Stocks. The Murray Stocks are a subset to the Gem Stocks and share the same Cretaceous age. Surface exposures of quartz monzonite are limited to the southern end of the mine. The quartz monzonite is more often seen in drill core as either a sill occupying the Idaho Fault or as a dike in its hanging wall.

The quartz monzonite is composed of approximately 40% quartz, 40% potassium feldspar and 20% plagioclase. It is mostly observed as grey-colored and equigranular, although porphyritic phases are also found in drill core at the southern end of the mine. When porphyritic, the quartz monzonite contains abundant, light pink potassium feldspar phenocrysts. Minor purple fluorite in thin quartz veinlets has been observed in some drill core.

Lamprophyres

There are several generations of lamprophyre dikes and sills. The lamprophyre dikes or sills are usually narrow with widths less than 1 m and are composed of a fine-grained groundmass with visible phenocrysts of black hornblende, biotite, or pyroxene.

| 6-7 |

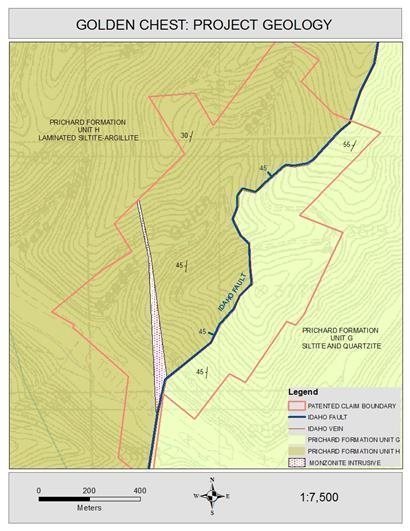

Figure 6‑5 Mine Geologic Map

Lamprophyre dikes can contain xenoliths of gold-bearing quartz vein material, indicating that at least some of these dikes and sills postdate mineralization. Marvin et al (1984) indicate ages of 68.8 ± 2.0 Ma to 58.8 ± 1.5 Ma for lamprophyre dikes in the area.

6.3.2 Structure

The mine lies at or near the intersection of several structural features including the Thompson Pass Fault, Trout Creek Anticline, the Murray Peak Fault and the Idaho Fault. This complexity forms a structural knot that has prepared the ground by providing channels for the hydrothermal fluids required to form the quartz-gold veins.

Idaho Fault

The primary structure at the Golden Chest Mine is the Idaho Fault. The Idaho Fault is interpreted as a moderate-angle, reverse fault that has exploited a lithologic boundary in the Prichard Formation.

| 6-8 |

The Idaho Fault occurs in the west limb of the Trout Creek Anticline, on a smaller scale secondary (parasitic) fold that plunges to the north-northwest. The strike of the Idaho Fault and the fold axis of the Trout Creek Anticline are sub-parallel (Figure 7.2). Bedding above and below the Idaho Fault may be parallel to it or intersecting at angles, dependent on location along the secondary fold.

Locally the Idaho Fault displays both cataclastic and mylonitic textures, indicating the fault has been active more than once. Fault slickensides can show dip-slip, strike-slip and oblique-slip movement.

Minor Faults (North West Striking)

Since IDR re-started the mine in 2016, a series of northwest striking, steeply south dipping faults have been identified in both the hanging and footwalls of the Idaho Fault. Relative movement along these faults has been difficult to determine as there are no readily identifiable marker units in the Prichard Formation. These faults have been noted to offset or terminate veins.

6.4 Mineralization and Alteration

The primary geological control to mineralization at the Golden Chest is the Idaho Fault. The Idaho Fault separates the hanging wall (Prichard Formation-Member H) from its footwall (Prichard Formation-Member G).

The Idaho Fault acted as the conduit for the mineralizing fluids that produced most of the veins at the Golden Chest Mine. The veins are generally stratiform and conformable to the Idaho Fault and are centered along the Idaho Fault to form a sub-parallel, stacked vein set.

The Minor Faults (Northwest Striking) have been seen to influence grade and tonnage in individual veins as they have been mined. The exact mechanism of control has yet to be determined.

6.4.1 Vein Types

There are three main types of quartz-gold veins found at the mine; banded, brecciated and massive. Most of the gold production and best grades come from the banded quartz veins. The banded veins consist of thin, sub-parallel shear surfaces that result from compression. The bands are composed of quartz, fine sulfides and phyllosilicate septa (derived from wall rock). A banded vein example is shown in Figure 6-6 where gold grains are circled.

| 6-9 |

Figure 6‑6 Banded Vein Example

Many of the veins at the mine are brecciated. Both the breccia clasts and matrix can be mineralized in this vein type. Brecciation events have modified or destroyed the textures of both the banded and massive vein types. A brecciated vein example is shown in Figure 6-7.

Figure 6‑7 Brecciated Vein Example

Massive quartz veins are characterized by a lack of banding or brecciation. They are also distinguished by a general lack of sulfides. The massive veins can have good gold values, but usually not as rich as the banded or brecciated veins. A massive vein example is shown in Figure 6-8.

| 6-10 |

Figure 6‑8 Massive Vein Example

6.4.2 Vein Names and Locations

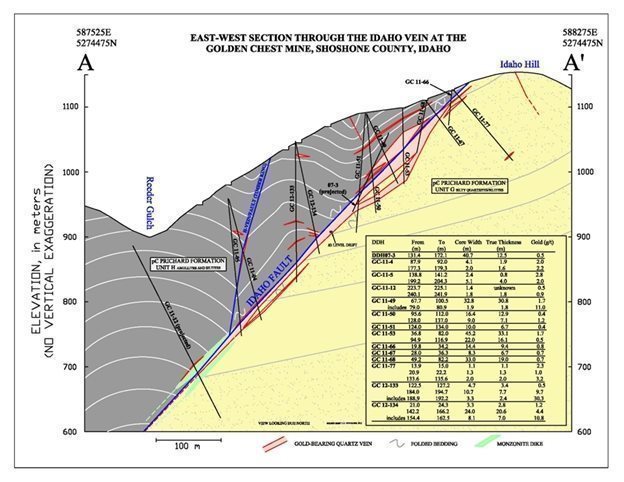

Most of the veins recognized at the mine are along or near the Idaho Fault. Both the veins and fault dip moderately to the west at approximately 45 degrees. An example vertical cross-section is shown in Figure 6-9 below.

Veins are found in both the hanging wall and the footwall of the Idaho Fault, and they are concentrated within 100 meters of the fault. Vein density increases with proximity to the Idaho Fault with the most abundant veining occurring within 50 meters of the fault. The historical workings at the mine appear to target veins that are generally within 25 meters of the Idaho Fault.

The “Idaho Vein” is the name given to the quartz vein found in the immediate footwall of the Idaho Fault.

There have been discrepancies in identifying the different veins throughout the years, because the veins pinch, swell, and split along strike. Because of this, the correlating of veins between mining levels or even along strike is difficult.

| 6-11 |

Figure 6‑9 Vertical Cross-Section of Vein Location

6.4.3 Lithologic Control of Veins

The two main lithological controls for veining at the Golden Chest are:

• Rheological: brittle-ductile contrast

• Permeability and porosity

Most of the veins at the mine are preferentially found in areas of rheological contrast. Vein development is at its strongest when brittle units, like quartzite and blocky siltite, are in contact with the more ductile laminated siltite-argillite beds.

The permeability and porosity of the lithologic units at the Golden Chest is largely related to grain size. The fine-grained units act as aquitards to hydrothermal fluids while the coarser, more permeable units accommodate and hold the hydrothermal fluids. The quartzite units of the Prichard Formation are more permeable and porous than the surrounding siltite-argillites and are more susceptible to hosting widespread silica-flooding and silicification.

At the mine, the hanging wall to the Idaho Fault is mainly composed of thinly laminated siltite-argillite, with almost no quartzite beds, and these rocks are not as susceptible to silicification. However, the footwall lithologies of the Idaho Fault are primarily light grey, fine-grained quartzites and blocky siltites and these units are very susceptible to pervasive silicification.

| 6-12 |

6.4.4 Vein Mineralization

Gold mineralization at the Golden Chest is mostly associated with the sulfide minerals pyrite, galena, sphalerite, and chalcopyrite. Less commonly, gold can be found adjacent to arsenopyrite or scheelite. Both the mineralogy of ore and gangue is shown below.

• Ore mineralogy: pyrite, galena, chalcopyrite, sphalerite, arsenopyrite, gold, scheelite

• Gangue mineralogy: quartz, chlorite, carbonates, sericite, muscovite

Commonly, native gold is seen as intergrowths associated with pyrite, galena, sphalerite, and chalcopyrite. Gold mineralization occurs along the grain boundaries or inside clusters of these sulfides (Figure 6-10).

Figure 6‑10 Gold-Sphalerite-Galena-Pyrite-Quartz Vein from the 941 Level

Four petrologists have examined vein samples from the Golden Chest Mine. The vein samples in each study were from different locations and do not show the same features. Hausen (1987) was contracted by Newmont to examine some samples of banded quartz vein material. He concluded the sulfides and quartz were epigenetic, or the mineralization is of a later age than the enclosing rocks.

Twenty-two years later, Gammons (2009) concluded the gold mineralization was late and associated with galena and chalcopyrite, but not sphalerite. Gammons determined the ore minerals as pyrite, galena, sphalerite (with chalcopyrite rims), chalcopyrite, and gold; in order of decreasing abundance. Additionally, he noted that most of the gold grains are in the 50 micron size range, and should be easy to mill or leach since they mostly occur on cracks in pyrite.

A petrographic analysis done by Ross (2010) determined the vein material at the Golden Chest is well-banded due to a combination of multi-phase mineralogical and tectonic layering. She described the banded vein quartz mineralogy as consisting of white to pale grey semi-translucent quartz, with dark septa of altered wall rock and thin sulfide-rich bands. The tectonic layering was described as hairline slip surfaces and stylolitic bands of pyrite and phyllosilicates.

| 6-13 |

Juniper Mining Company also conducted a mineralogical investigation as part of their metallurgical testing. The study showed the gold to be mostly found in association with pyrite and galena and the majority of gold grain sizes are in the 2 to 10 micron range.

Scheelite

Scheelite is found in many areas of the mine and the Golden Chest was a producer of tungsten during World War I. Frequently scheelite can be found with gold as a common subordinate mineral in orogenic gold systems. At the Golden Chest, scheelite is typically found in relatively pure masses within quartz veins.

6.4.5 Wall Rock Alteration

The wall rocks at the Golden Chest display weak alteration, which is usually confined to the area proximal to the gold-quartz veins. The alteration is in part dictated by the permeability/porosity of the lithologies. Within the gold-bearing quartz veins, the alteration minerals are primarily chlorite, sericite, and muscovite. Sometimes earthy hematite is observed.

Generally, the hanging wall rocks of the Idaho Fault display a lack of widespread alteration, due to the tight impermeable mineralogy of the siltite-argillite units. In most cases, hanging wall alteration is chloritic and is localized within 10 meters (33 feet) of Idaho Fault or the veins.

Footwall rocks, on the other hand, can display three types of alteration: sericitic, chloritic and silicification. Alteration within the footwall can be widespread and is related to rock permeability and porosity. Areas containing quartzite lithologies are particularly susceptible, and are often subject to pervasive, passive silica flooding.

The intrusive rocks may show substantial argillic and sericite alteration, especially near faults. Some propylitic alteration has been noted, characterized by veinlets of epidote in the monzonite.

6.5 Deposit Type

The Golden Chest deposit is recognized as an “intrusive related” orogenic gold-quartz vein system by IDR geologists. However, recently there has been the suggestion that the Golden Chest deposit type could be a Reduced Intrusion-Related Gold System (RIRGS). The RIRGS deposit classification is already mired in confusion over nomenclature. It should be remembered that each ore deposit has its own specific and unique characteristics and not all deposits exhibit all characteristics of any particular classification. Deposit models are sets of guidelines, not absolute parameters. No one model will describe multiple deposits, one model describes one deposit. That being said, there is considerable overlap between the two deposit model types and the Golden Chest deposit has characteristics of both orogenic and RIRGS model types. This report will continue to use the orogenic deposit classification for the Golden Chest.

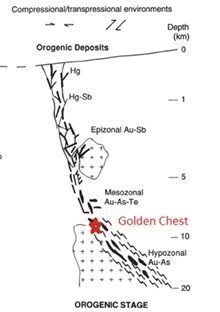

6.5.1 Orogenic

Before 1998, the term mesothermal was used for orogenic gold-quartz vein systems. Other synonyms for this type of vein are shear-hosted lode gold, low-sulfide gold-quartz veins and California Mother Lode veins. These “mesothermal” or orogenic deposits are associated with regionally metamorphosed terranes of all ages. Some of the largest gold deposits in the world are associated with orogenic vein systems. World class orebodies are generally 2 to 10 kilometers (km) long, 1 km wide, and are mined down-dip to depths of 2 to 3 km. This deposit type is responsible for a significant portion of the world’s gold production.

| 6-14 |

Orogenic vein deposits usually form within fault systems produced by regional compression or transpression (strike-slip movement). These compressional events are often associated with the collision, docking and subduction of exotic terranes. The majority of orogenic gold deposits are located within second- and third-order structures near first-order, deep-crustal fault zones. Ore forms as vein fill along second- and third-order shears and fault structures. Fluid migration along these fault structures is driven by episodes of major pressure fluctuations during seismic events. Gold is usually deposited at crustal levels within and near the brittle-ductile transition zone at depths of 6-12 kilometers, pressures between 1 to 3 kilobars and temperatures from 200° to 400° Celsius.

6.5.2 Age and Genesis

The genesis of the gold mineralization at the Golden Chest is interpreted to be related to the movement of mineralizing fluids, derived from cooling plutons, up shear zones. Hershey (1916) also believed that gold mineralization was related to the intrusive events, while the Ag-Pb-Zn mineralization was remobilized and leached from the Prichard Formation. regional

The North America Cordillera gold veins are often post-Middle Jurassic and appear to form immediately after accretion of oceanic terranes to the continental margin. The Golden Chest may be related to similar gold vein systems in British Columbia where deposits are mainly Middle Jurassic, ~ 165-170 Ma and Late Cretaceous ~ 95 Ma.

Mineralization age estimates are debatable, but it is possible that there was more than one gold mineralizing event. This Report suggests an age of 94 Ma for the gold mineralizing event at the Golden Chest. This age estimate is based on cross-cutting relationships with the quartz monzonite intrusive and coincides with the end of the Murray Stock emplacement and predates the Idaho Batholith activity.

Intrusive-related orogenic systems are characterized by intrusive rocks emplaced along a fault structure. Figure 6-11 below, displays the position of the Golden Chest Mine in relation to the intrusive and the Idaho Fault. In the case of the Golden Chest, the gold mineralization is interpreted to be primary mineralization resulting from the felsic igneous intrusive. The Thompson Pass Fault is considered to represent the first-order deep crustal fault with the Idaho Fault being a second-order fault. This association is indicative of intrusive related orogenic systems because the first-order fault provides the deep plumbing, and the second-order faults provide the extensional setting.

Other similarities between intrusive related orogenic deposits and the Golden Chest Mine:

| 1) | Precambrian turbidite host rocks |

|

|

|

| 2) | compressional geologic environments with reverse fault movement; |

|

|

|

| 3) | strong structural control |

|

|

|

| 4) | epigenetic banded veins |

|

|

|

| 5) | quartz-dominant vein system with ≤ 3-5% sulfide minerals |

|

|

|

| 6) | a general lack of widespread alteration |

| 6-15 |

| 7) | continuity at depth |

Figure 6‑11 Intrusive Related Orogenic Model (modified after Groves et al. 1998)

| 6-16 |

7.0 EXPLORATION

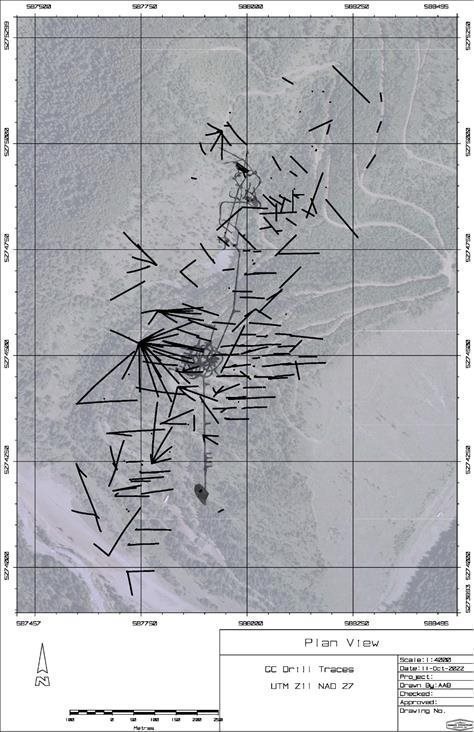

For the year 2021, the sole form of exploration work completed on the property was diamond core drilling.

Figure 7‑1 Planview of Golden Chest Drill Traces

| 7-1 |

7.1 Drilling

7.1.1 Vertical Continuity

Exploration drill holes are those designed to test specific geological targets more distant from the active workings. All 27 diamond core holes, totaling 6935 m, were drilled from the surface. The geologic targets for the drilling were the Klondike, Paymaster, and Deep Skookum mineral regions. These areas are distant from the active mine workings and currently do not contain any calculated resources or reserves.

The drilling was carried out by IDR’s in-house drill rig using a Hagby 1000 machine, and a contractor, Ruen Drilling, of Clark Fork, Idaho, using a Boart Longyear LF70 and LF90 drills. Core sizes drilled were NQ2 (5.08 cm) and HQ (6.36 cm). Drilling was fanned from prepared drill pads.

All holes are cemented from the bottom of the hole to 30 m above any important mineralized zones. Above the cement, the holes are grouted.

The drillers place the core in waxed cardboard boxes which are then stacked on pallets and strapped down prior to transport, by either drillers or geologic staff, to the logging facility, which is located near the mine offices.

Upon receipt of the core at the logging facility, the boxes are laid out in order on the benches. They are then examined to ensure correct block meterages and core orientation. Zones of core loss are noted, and geotechnical logging is conducted. This includes measurement of recovery and rock quality designation (RQD).

Logging is conducted by IDR geologists. Data is digitally captured on notebook computers using Microsoft Excel.

The core is then logged for lithology and mineralogy, as well as sedimentary structures, veins, faults, and other structural features. Following this, a third logging pass is made noting type, style, and intensity of alteration. During the logging process, features of note are marked with colored pencil so as to be visible in the core photos.

The core is then wetted and photographed using a camera and lighting which provides uniform digital images. In addition to the notations on the core for geological information, the sample boundaries and numbers are also marked to allow for easier validation of the assay results using the core photos.

7.1.2 Drill Hole Surveys

Hole locations and orientations are marked for the drillers by the supervising geologist. Once the drill is on site and ready to begin drilling, a double check of the rig orientation is made by the supervising geologist. The hole is surveyed using a Flexit Single-Shot downhole survey tool. The first measurement is made at 30 m depth and every 30 m increment in depth as the hole is drilled.