______________________________________________

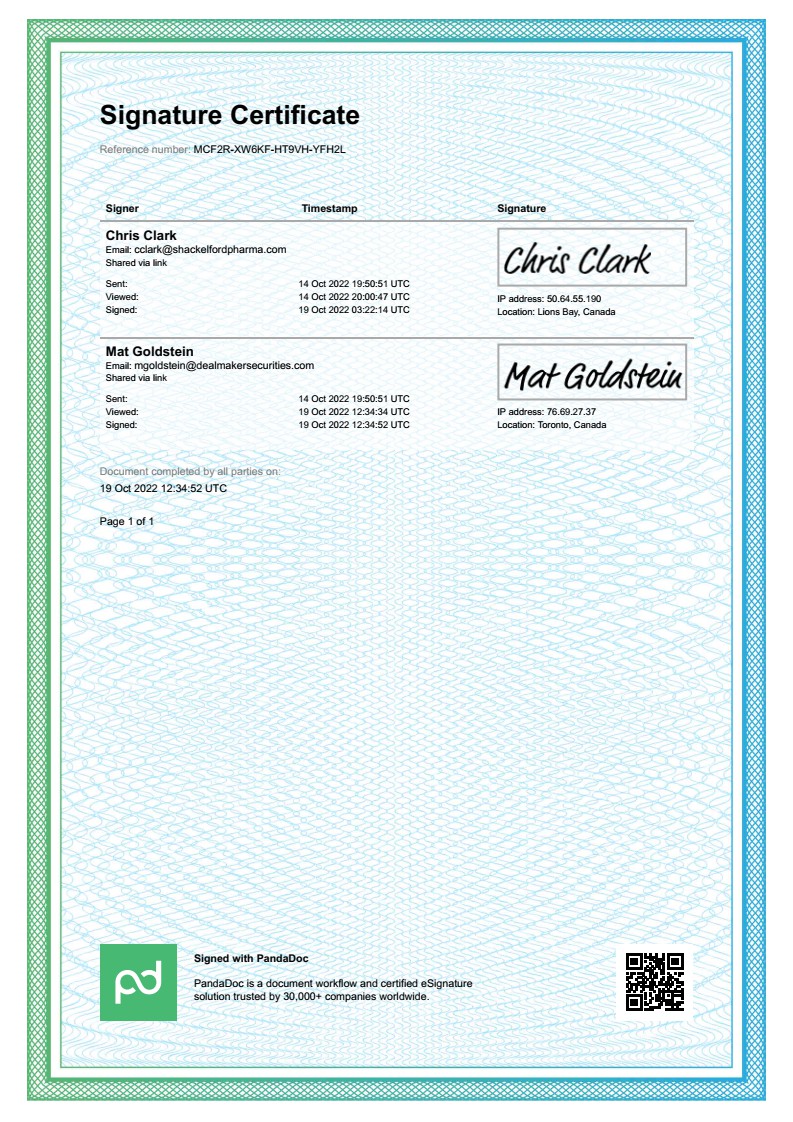

Authorized Representative

______________________________________________

Authorized Representative

AMENDED AND RESTATED DEALMAKER SECURITIES LLC ORDER FORM

| Customer: Shackelford Pharma Inc. | Contact: Chris Clark |

| Address: PO Box 10026 Pacific Centre South, 25th Floor, 700 West Georgia Street, Vancouver, B.C. V7Y1B3 |

Phone: 888-377-4225 |

| Commencement Date: 2022-10-19 | E-Mail: cclark@shackelfordpharma.com |

By its signature below in the applicable section, Customer hereby engages and retains DealMaker Securities LLC, a registered Broker-Dealer, to provide the applicable services described in Schedule A. Referenced within this Order Form are third party services provided by affiliates of DealMaker Securities LLC, subject to the Terms of Service applicable thereto (each such affiliates, a "Company").

Customer confirms that it understands the terms of this Order Form and the applicable Terms of Services, and by preceding with its order, agrees to be bound contractually with each respective Company. The Applicable Terms of Service include and contain, among other things, warranty disclaimers, liability limitations and use limitations.

There shall be no force or effect to any different terms other than as described or referenced herein (including all terms included or incorporated by reference) except as entered into by a Company and Customer in writing. This amended and restated order form supersedes the order form dated 08/17/2022 and replaces it in its entirety.

CUSTOMER ______________________________________________ Authorized Representative |

DEALMAKER SECURITIES LLC ______________________________________________ Authorized Representative |

Schedule A

Regulation A+ Offering Fees

Fees related to the Offering are set forth in the categories below and are denominated in USD. Total expenses for the offering, including fees payable to DealMaker Securities and its affiliates as well as fees payable to third parties may vary depending on the amount of capital raised, and are anticipated as follows.

| Total Offering Amount | Expected Total Fees (To DealMaker Securities, Affiliates and Third-Parties) |

Maximum Compensation |

| $3,000,000.00 | $408,940.00 (13.64%) | 10% |

| $6,000,000.00 | $553,880.00 (9.24%) | 9% |

| $9,000,000.00 | $698,820.00 (7.77%) | 8.5% |

| $12,000,000.00 | $843,760.00 (7.04%) | 8% |

To ensure adherence to fair compensation guidelines, DealMaker Securities will ensure that, in any scenario, the aggregate fees payable to DealMaker Securities and its affiliates (but excluding third-party expenses) shall never exceed the amounts set forth in the column entitled "Maximum".

and any Participating Members as defined

in FINRA Rule 5110 (j)(15)

If the Offering is fully subscribed, the maximum fees will be $960,000

DealMaker Securities LLC (and affiliate) Fees:

A. Advisory and Consulting Services Prior to Launch

a. $55,000 Advance (an advance against accountable expenses anticipated to be incurred, and refunded to extent not actually incurred, reimbursable to the issuer regardless of the termination of the offering or the receipt of the No Objection Letter, in compliance with FINRA Rule 5110(g)(4)).

b. This Advance fee includes:

i. $25,000 prepaid to DMS for Due Diligence Review

ii. $5,000 prepaid to Novation Solutions Inc. O/A DealMaker for consulting on Infrastructure for Self-Directed Electronic Road Show

iii. $25,000 prepaid to DealMaker Reach LLC for consulting on Marketing for Self-Directed Electronic Road Show.

Services may include:

Due Diligence Review

● Reviewing and performing due diligence on Issuer and Principals and consulting with Issuer regarding

same

Consulting on Infrastructure for Self-Directed Electronic Road Show

● Consulting with Issuer on best business practices regarding raise in light of current market conditions and prior self-directed capital raises

● White-labeled platform customization to capture investor acquisition through the platform's analytic and communication tools

● Consulting with Issuer on question customization for investor questionnaire

● Consulting with Issuer on selection of webhosting services

● Consulting with Issuer on completing template for campaign page

● Advising Issuer on compliance of marketing material and other communications with the public with applicable legal standards and requirements

● Providing advice to Issuer on content of Form 1A and Revisions

● Advising Issuer on how to configure platform and link between prospective investors and the Issuer

● Provide extensive, review, training, and advice to Issuer and Issuer personnel on how to configure and use electronic platform powered by DealMaker.tech

● Assisting in the preparation of state, SEC and FINRA filings

● Working with the Client's SEC counsel in providing information to the extent necessary Consulting on Marketing for Self-Directed Electronic Road Show

● Assign an experienced designer to assist the Issuer on messaging

● Providing expertise on pre-existing Issuer created assets

● Providing direction on the creation of additional Issuer assets

● Consulting with Issuer on the creation of assets for all paid media and email campaigns (i.e Google Ads, Advertising Partners, Social Platform advertising)

● Advising Issuer on website design and implementation

In the event that the Financial Industry Regulatory Authority ("FINRA") Department of Corporate Finance does not issue a no objection letter for the Offering, the entirety of the advance fee is fully refundable other than services actually rendered in accordance with DMS (and affiliates) standard hourly rates.

B. Regulatory Corporate Filing Fees

a. $2,300 for reimbursement of actual out of pocket costs and expenses related to regulatory

Pass-through fee payable to DMS, from the Customer, who will then forward it to appropriate regulatory agencies in payment for the filing. These fees are due and payable prior to any submission by DMS to such agencies.

C. Transaction Fees During the Offering:

a. Advisory, Compliance and Consulting Services During the Offering: 1% cash (calculated monthly)

● Reviewing investor information, including identity verification, performing AML (Anti-Money Laundering) and other compliance background checks, and providing issuer with information on an investor in order for issuer to determine whether to accept such investor into the Offering;

● If necessary, discussions with the issuer regarding additional information or clarification on an issuer-invited investor;

● Coordinating with third party agents and vendors in connection with performance of services;

● Reviewing each investor's subscription agreement to confirm such investor's participation in the offering and provide a recommendation to the company whether or not to accept the subscription agreement for the investor's participation;

● Contacting and/or notifying the company, if needed, to gather additional information or clarification on an investor;

● Providing a dedicated account manager;

● Providing ongoing advice to Issuer on compliance of marketing material and other communications with the public, including with respect to applicable legal standards and requirements;

● Consulting with Issuer regarding any material changes to the Form 1A which may require an amended filing; and

● Reviewing third party provider work-product with respect to compliance with applicable rules and regulations.

Fees are calculated as follows:

● One hundred (100) basis points on the aggregate amount accepted in the Offering, calculated based on the amount accepted into the Offering during the immediately preceding month.

D. Private Placement of Securities:

a. Four percent (4.0%) Cash (payable monthly)

● DMS may enter into Broker-Dealer Fee Sharing Arrangements to accept or distribute compensation attributable to a Broker-Dealer source and direct potential investors to the Customer's Invest Now Landing Page.

● Customer acknowledges that DMS has no control or authority over the decision of BDs sourcing or directing potential investors to Customer's Invest Now Landing Page. DMS will not make nor will be deemed to make any representations or warranties as to the Participants' publishing or sourcing and directing decisions.

Fees are calculated as follows:

● Four hundred (400) basis points on the aggregate amount accepted into the Offering originating from a BD providing evidence of directing potential investors to the Customer's Invest Now Landing Page.

DealMaker Technology Fees:*

A. Monthly Platform Hosting and Maintenance Fees: $1,000 per month

Includes:

● Deal portal powered by DealMaker.tech software with fully-automated tracking, signing, and reconciliation of investment transactions

● Full Analytics suite to track all aspects of the offering and manage the conversion of prospective investors into actual investors.

● Seats for up to 10 users (including legal, compliance, broker-dealer and transfer agent)

Fees are payable at the beginning of each month

B. Transaction Fees Includes:

a. General

i. $15 per electronic signature executed on DealMaker platform

ii. $15 per payment reconciled via DealMaker platform

b. Payment Processing Fees

i. Secure Bank-to-Bank Payments (USD) - 2.00%

ii. Credit Card Processing - 4.50%

iii. Express Wires - 1.00%

iv. Per Investor Refund Fee - $50.00

v. Failed Payment Fee -- $5.00

vi. Reconciliation Report - $250

c. AML Searches (required for Reg A offerings)

i. AML Search (individual) - $2.50

ii. AML Search (corporate) - $25.00

*DealMaker Technology is provided by Novation Solutions Inc. O/A DealMaker. Customer hereby agrees to the terms set forth in the DealMaker Terms of Service outlined in Schedule "B"

Authorized Representative

DealMaker Reach Fees (Marketing)*

A. Self-Hosted Electronic Road Show Marketing Advisory and Consulting Services

As per the Marketing Service Agreement, defined below, DealMaker Reach's efforts and terms of service include, but are not limited to:

● Fixed Fees - $15,000 per month during the Campaign (accrued and owing but payment may be

deferred until Client receives first distribution from the Platform; thereafter, on a monthly basis) to a maximum of $180,000

● Assisting the Issuer to implement conversion events and campaign tracking

● Consulting on landing page tests for conversion rate improvement

● Coordinate with Campaign Platform Provider to develop and optimize campaign page(s)

● Assisting the Issuer to integrate DealMaker webhooks to build investor funnel and tracking of investor progress/status

● Providing status reports on the individual campaign vehicles (e-mail, paid social, etc.)

● Ongoing monthly communication for updates, strategic planning, implementations, and execution of marketing budget.

*Marketing Services are provided by DealMaker Reach LLC. Customer hereby agrees to the terms set forth in the Service Agreement outlined in Schedule "C"

Authorized Representative

| Services DO NOT include providing any investment advice nor any investment recommendations to any investor. |

Issuers may elect to levy an administrative fee for online purchasers in an amount to be determined by the issuer.

Schedule "A"

DealMaker Securities Terms

Broker-Dealer Agreement

These terms and conditions create a binding agreement by and between the customer who has signed the Order Form ("Client"), and DealMaker Securities LLC, a FINRA-registered Broker-Dealer ("DMS")(the "Agreement"). DMS is a registered broker-dealer providing services in the equity and debt securities market, including offerings conducted via SEC approved exemptions such as Reg D 506(b), 506(c), Regulation A+, Reg CF and others.

Client is offering securities directly to the public in an offering exempt from registration under either Regulation A or Regulation CF (the " Offering"). Client recognizes the benefit of having DMS provide advisory and other services as described herein, on the terms hereof. These terms are the same as the terms linked to the Agreement signed by Customer on 2022-07-14 (the "Original"). In case of discrepancy, the terms in the Original shall govern.

1. Appointment, Term, and Termination

a. Client hereby engages and retains DMS to provide consulting, operations and compliance services at Client's discretion.

b. If Client elects to carry out a Regulation CF Offering, Client retains DMS to act as the Client's Intermediary for the Offering, as defined by 17 C.F.R. Part 227.

c. The Agreement will remain in effect for a period of the earlier of: 1) twelve (12) months from the signing of the Order Form ("Term") and will renew automatically for successive renewal terms of sixty (60) days prior to the expiration of the current term or 2) the closing of the Offering. If Client defaults in performing the obligations under this Agreement, the Agreement may be terminated (i) upon sixty (60) days written notice if Clients fails to perform or observe any material term, covenant, or condition to be performed or observed by it under this Agreement and such failure continues to be unremedied, (ii) upon written notice if any material representation or warranty made by Client proves to be incorrect at any time in any material respect, (iii) upon written notice, in order to comply with a legal requirement, if compliance cannot be timely achieved using commercially reasonable efforts, after providing as much notice as practicable, or, (iv) without limiting the foregoing, at any time if, after the commencement of DMS's due diligence of the Client, DMS believes that is not advisable to proceed with the contemplated Offering. If Client or DMS commences a voluntary proceeding seeking liquidation, reorganization or other relief, or is adjudged bankrupt or insolvent or has entered against it a final and unappealable order for relief, under any bankruptcy, insolvency, or other similar law, or either party executes and delivers a general assignment for the benefit of its creditors, the Agreement may be terminated upon thirty (30) days' written notice.

d. The termination of this Agreement as described herein shall not exclude the availability of any other remedies. Any delay or failure by either party to exercise, in whole or in part, any right, power, remedy or privilege shall not be construed as a waiver or limitation to exercise, in whole or in part, such right, power, remedy or privilege.

e. All terms of the Agreement, which should reasonably survive termination, shall survive, including, without limitation, confidentiality, limitations of liability and indemnities, arbitration and the obligation to pay Fees relating to Services provided prior to termination.

2. Services. DMS will perform the services listed on the Order Form in connection with the Offering (the "Services").

3. Fees. As payment for the Services, Client shall pay to DMS such fees as described in the Order Form. Client authorizes DMS to deduct any fees owing directly from the Client's bank account or third-party escrow account (if applicable).

4. Regulatory Compliance

a. Client and all its third-party providers shall at all times (i) comply with direct requests of DMS: (ii) maintain all required registrations and licenses, including foreign qualification, if necessary; and (iii) pay all related fees and expenses (including the FINRA Corporate Filing Fee) in each case that are necessary or appropriate to perform their respective obligations under this Agreement. Client shall comply with and adhere to all DMS policies and procedures which shall be provided to Client.

b. Client and DMS will have shared responsibility for the review of all documentation related to the Offering but the ultimate discretion about accepting an Investor will be the sole decision of the Client. Each Investor will be considered to be that of the Client's and NOT DMS.

c. Client and DMS shall each supervise and train their respective employees, agents, representatives and independent contractors in the performance of functions allocated to them pursuant to the terms of this Agreement.

d. If either Client orDMS receives material communications (orally or in writing) from any Governmental Authority or Self-Regulatory Organization with respect to this Agreement or the performance of either party's obligations thereunder, the receiving party shall promptly provide said communications to the opposite party, unless such notification is expressly prohibited by the applicable Governmental Authority.

5. Role of DMS. Client acknowledges and agrees that Client relies on Client's own judgement in engaging DMS Services. Client understands and agrees that DMS (i) is not assuming any responsibility for the Client''s underlying business decision to pursue any business strategy or effect any Offering; (ii) makes no representations with respect to the quality of any investment opportunity in connection with the Offering (iii) does not guarantee the performance to or of any Investor in the Offering, (iv) does not guarantee the performance of any third party which provides services to DMS or Client with respect to the Offering, ) (v) will make commercially reasonable efforts to perform the Services pursuant to this Agreement (vi) is not an investment adviser, does not provide investment advice and does not recommend securities transactions and any display of data or other information about the Offering, does not constitute a recommendation as to the appropriateness, suitability, legality, validity, or profitability of any Offering, (vii) Services in connection with this Agreement should not be construed as creating a partnership, joint venture, or employer-employee relationship of any kind, (ix) Services in connection with this Agreement that require registration as a FINRA/SEC registered broker-dealer shall be performed exclusively by DMS or an associated person of DMS , (x) is not providing any accounting, legal or tax advice, and (xi) will use "commercially reasonably efforts" to perform Services pursuant to this Agreement but that this shall not give rise to any express or implied commitment by DMS to purchase or place any of the Client's securities. Client explicitly acknowledges that DMS shall not and is under no duty to recommend Client's security and DMS is not selling Client's security to retail investors.

6. Indemnification

a. Indemnification by Client. Client shall indemnify and hold DMS, its affiliates and their respective members, officers, directors and agents harmless from any and all actual or direct losses, liabilities, claims, demands, judgements, arbitrations awards, settlements, damages, and costs (collectively "Losses"), resulting from or arising out of any third party suits, actions, claims, demands, investigations or similar proceedings (collectively "Claim") to the extent they are based upon (i) a breach of this Agreement by Client, (ii) the wrongful acts or omissions of Client, or (iii) the Offering.

b. Indemnification by DMS. DMS shall indemnify and hold Client, Client's affiliates and Client's representatives and agents harmless from any Losses resulting from or arising out of Proceedings to the extent they are based upon (i) a breach of this Agreement by DMS or (ii) the wrongful acts or omissions of DMS or its failure to comply with any applicable federal, state, or local laws, regulations, or codes in the performance of its obligations under this Agreement.

c. Indemnification Procedure. If any Proceeding is commenced against a party entitled to indemnification under this section, prompt notice of the Proceeding shall be given to the party obligated to provide such indemnification. The indemnifying party shall be entitled to take control of the defense, investigation or settlement of the Proceedings and the indemnified party agrees to reasonably cooperate, at the indemnifying party's cost in ensuing investigations, defense or settlement. The indemnifying party shall reimburse the indemnified party for all expenses (including reasonable fees, disbursements and other charges of counsel) as they are incurred in connection with investigating, preparing, pursuing, defending, or settling a Claim (including without limitation any shareholder or derivative action); provided, however, that indemnifying party will not be liable to indemnify and hold harmless or reimburse an indemnified party pursuant to this paragraph to the extent that an arbitrator (or panel of arbitrators) or court of competent jurisdiction will have determined by a final non-appealable judgment that such Claim resulted from the gross negligence or willful misconduct of such indemnified party. The indemnifying party will not settle, compromise or consent to the entry of a judgment in any pending or threatened Claim unless such settlement, compromise or consent includes a release of the indemnified parties satisfactory to the indemnified parties.

d. Indemnified Party Limitation Of Liability. No indemnified party shall have any liability (whether direct or indirect, in contract, tort or otherwise) to the indemnifying party arising from or related to the Agreement or the Offering or any actions or inactions allegedly taken by the indemnified party in connection with the Agreement, except to the extent that an arbitrator (or panel of arbitrators) or a court of competent jurisdiction determines by a final non-appealable judgment that Losses resulted from the gross negligence or willful misconduct of such indemnified party. In no event shall the indemnified party be liable or obligated in any manner for any consequential, exemplary or punitive damages or lost profits incurred by the Client arising from or relating to the Agreement, an Offering, or any actions or inactions taken by an indemnified party in connection with the Agreement, and the Client agrees not to seek or claim any such damages under any circumstances.

e. Insufficient Funding For A Claim. If the foregoing indemnification or reimbursement is judicially determined to be unavailable or insufficient to fully indemnify and hold harmless DMS as an indemnified party against a Claim, the Client will contribute to the amount paid or payable by an indemnified party as

a result of such Claim in such proportion as is appropriate to reflect the relative financial benefits of the Offering to the Company, on the one hand, and the indemnified party, on the other hand; or if such allocation is not permitted by applicable law, in such proportion as is appropriate to reflect not only therelative benefits but also the relative fault of the Client on the one hand and the indemnified party on the other hand with respect to such Claim as well as any other relevant equitable considerations. Notwithstanding the preceding paragraphs, in no event will the aggregate amount to be contributed by all indemnified parties towards all Claims and Client losses, exceed the actual fees received by DMS pursuant to the Agreement.

5. Witness Reimbursement. In the event that DMS or any of its employees, officers, directors, affiliates or agents are requested or required to appear as a witness or subpoenaed to produce documents in any action in which the Client or any of its affiliates is a party to and DMS is not, the Client will reimburse DMS for all expenses incurred by its employees, officers, directors, affiliates or agents in preparing for and appearing as a witness or producing documents, including the reasonable fees and disbursements of legal counsel.

7. Notices. Any notices required by the agreement shall be in writing and shall be addressed, and delivered via email at the email address included in the Order Form.

8. Confidentiality and Mutual Non-Disclosure:

a) Included Information. For purpose of this Agreement, the term "Confidential Information" means all non-public, confidential and/or proprietary information disclosed by one party to this Agreement ("Disclosing Party") to the other party ("Receiving Party"), including but not limited to (i) financial information, (ii) business and marketing plans, (iii) the names of employees and owners, (iv) the names and other personally identifiable information of customers (v) intellectual property, and (vi) all documentation provided by investors in the Offering.

b) Excluded information. For purposes of this Agreement, the term "Confidential nformation" shall not include (i) information already known to the Receiving Party prior to disclosure by the Disclosing Party, (ii) information independently developed by the Receiving Party without the use of any confidential and proprietary information, (iii) information known to the public through no wrongful act of the Receiving Party, (iv) information that becomes known to the Receiving Party from a third party not bound by a confidentiality obligation to the Disclosing Party.

c) Confidentiality Obligations. During the Term and at all times thereafter, Receiving Party shall not disclose Confidential Information of the Disclosing Party or use such Confidential Information for any purpose without the prior written consent of Disclosing Party. Each party shall use at least the same degree of care in safeguarding the other party's Confidential Information as it uses to safeguard its own Confidential Information. Notwithstanding the forgoing, a Receiving Party may disclose Confidential Information (i) if required to do by order of a court of competent jurisdiction, provided that Receiving Oarty shall notify the Disclsoing Oarty in writing promptly upon receipt of knowledge of such order so that Receiving Party may attempt to prevent such disclosure or seek a protective order, or (ii) as required by applicable law. Nothing contained herein shall be construed to prohibit the SEC, FINRA, or other government entities from obtaining, reviewing, and auditing any information, records, or data of either party containing Confidential Information.

d) Disclosure and Retention Of Confidential Information. DMS is hereby expressly permitted by Client to disclose Confidential Information to third parties involved in the Offering contemplated herein, provided that Client has been informed of such disclosure in advance and has approved such disclosure (either orally or in writing). DMS may retain one copy of the Client's Confidential Information to the extent necessary to comply with industry-specific document retention rules and other regulations, and in an archived computer backup system stored as a result of automated backup procedures for compliancepurposes. Client acknowledges that regulatory record-keeping requirements, as well as securities industry best practices, require DMS to maintain copies of practically all data and communications, even after this Agreement is terminatedAgreement.

e) Logo Display. The Parties agree that the display of a Party's name or logo on a website or in connection with any marketing materials shall not be considered a disclosure of Confidential Information.

9. Miscellaneous

a. These terms are non-exclusive and shall not be construed to prevent either party from engaging in any other business activities.

b. This Agreement shall be binding upon the parties hereto and their respective heirs, administrators, successors, and assigns. This Agreement may be modified or amended only by a written consent executed by the other party.

c. Either party may assign this Agreement to any person or entity that acquires all or substantially all of its business or assets, in which case the other party's consent shall not be unreasonably withheld. This includes an assignment to a subsidiary that an entity party may create or to a company affiliated with or controlled directly or indirectly by an entity party .

d. When Offering closes, Client agrees that:

(i) DMS, may prepare media materials of its choosing, at its own expense and in compliance with applicable regulations, describing DMS' Services in the Offering as described in this Agreement; and

(ii) If the Client issues a press release regarding the Offering, it shall include reference to DMS as the broker-dealer on the Offering.

With respect to the preparation of any other marketing or media materials either before or after Offering closes, Client and DMS will work together to authorize and approve in writing any additional co-branded notifications. press releases and/or Client facing communication materials regarding the representations in this Agreement.

e. This Agreement shall be construed in accordance with the laws of the State of New York without regard to conflict of laws principles. The parties submit to the jurisdiction of and venue in the federal courts located in the state of New York with respect to any dispute related to this Agreement and any

Offering contemplated herein and waive their right to a jury trial (whether such disputes are based on contract, tort or otherwise.) Notwithstanding the above, the parties agree that ANY DISPUTE, CONTROVERSY, CLAIM OR CAUSE OF ACTION BETWEEN THE CLIENT AND DMS DIRECTLY OR INDIRECTLY RELATING TO OR ARISING OUT OF THIS AGREEMENT, OR BREACH THEREOF required or allowed to be conducted by the Financial Industry Regulatory Authority's ("FINRA") rules (including the FINRA Code of Arbitration Procedure for Industry Disputes) shall be arbitrated in accordance with such rules. Any arbitration shall be before a neutral arbitrator or panel of arbitrators selected under the FINRA Neutral List Selection System (or any successor system) and in a forum designated by the Director of FINRA Dispute Resolution or any member of FINRA Staff to whom such Director has delegated authority. In general accordance with FINRA Rule 2268, by signing an arbitration agreement the parties agree as follows:

(i) This Agreement contains a pre-dispute arbitration clause.

(ii) Except as otherwise provided in this Agreement, all parties to this Agreement are giving up the right to sue each other in court, including the right to a trial by jury, except as provided by the rules of the arbitration forum in which a claim is filed.

(iii) Arbitration awards are generally final and binding; a party's ability to have a court reverse or modify an arbitration award is very limited.

(iv) The ability of the parties to obtain documents, witness statements and other discovery is generally more limited in arbitration than in court proceedings.

(v) The arbitrators do not have to explain the reason(s) for their award unless, in an eligible case, a joint request for an explained decision has been submitted by all parties to the panel at least 20 days prior to the first scheduled hearing date.

(vi) Any panel of arbitrators may include a minority of arbitrators who were or are affiliated with the securities industry.

(vii) The rules of some arbitration forums may impose time limits for bringing a claim in arbitration. In some cases, a claim that is ineligible for arbitration may be brought in court.

(ix) The rules of the arbitration forum in which the claim is filed, and any amendments thereto, shall be incorporated into this Agreement.

(x) As provided in FINRA Rule 2268, no person shall bring a putative or certified class action to arbitration, nor seek to enforce any pre-dispute arbitration agreement against any person who has initiated in court a putative class action; or who is a member of a putative class who has not opted out of the class with respect to any claims encompassed by the putative class action until: (i) the class certification is denied; or (ii) the class is decertified; or (iii) the customer is excluded from the class by the court. Such forbearance to enforce an agreement to arbitrate shall not constitute a waiver of any rights under this Agreement except to the extent stated herein.

f. The language used in this Agreement shall be deemed to be the language chosen by the parties to express their mutual intent, and no rule of strict construction will be applied against any party. Headings are inserted for the convenience of the parties only and are not to be considered when interpreting this Agreement.

g. If any provision, term or condition of this Agreement is invalid, void or unenforceable by a court of competent jurisdiction, or a regulatory or self-regulatory agency or body by order or judgment not subject to review, the remaining provisions, terms and conditions shall not be affected and shall remain in full force and effect, and this Agreement shall be carried out as if any such invalid, void or unenforceable provisions, terms or conditions were not included in the Agreement.

h. This Agreement, along with the Order Form and applicable schedule of DMS fees, contains the entire agreement between the parties and supersedes any prior and collateral agreements, communications, understandings and negotiations relating to the subject matter herein. The Agreement may not be modified or amended except by written agreement executed by both parties.

i. Pursuant to the requirements of Title III of Pub. L. 107-56 (the USA Patriot Act), as amended (the "Patriot Act") and other applicable laws, rules and regulations, DMS is required to obtain, verify and record information that identifies the Client which information includes the name and address of the Client and other information that that allows DMS to identify the Client in accordance with the Patriot Act and other such laws, rules and regulations.

Schedule "B"

DealMaker.tech Terms of Service

DEALMAKER.TECH TERMS AND CONDITIONS

These terms and conditions are part of the agreement between you, as customer, and DealMaker, as vendor, and apply to your use of an online portal created via http://dealmaker.tech, and any services related thereto ("DealMaker Services"). These Terms have legal implications. It is important that you read these terms carefully, and consult legal counsel if you determine that is appropriate, in order to understand this agreement. This agreement incorporates the Order Form from which this page was linked, the DealMaker Terms of Service applicable to use of the Services available online at www.dealmaker.tech/terms and contains, among other things, warranty disclaimers, liability limitations and use limitations. This agreement also contains an arbitration provision which is enforceable against the parties and may impact your rights and obligations. By signing the Order Form and using the DealMaker Services, you accept and agree to be bound by these terms. These terms are the same as the terms linked to the Agreement signed by Customer on 2022-07-14 (the "Original"). In case of discrepancy, the terms in the Original shall govern.

1) Payment & Billing

Customer will be billed for fees incurred on a monthly basis. Payment will be automatically debited from the Customer's bank account or credit card on file, with a receipt to be automatically delivered. Invoices will be available for the customer to review upon request.

2) Term & Termination

Term and Renewal. Unless otherwise specified in your Order, your Monthly Subscription Fee and subsequently, DM Engage Fee, will automatically renew each month. DM Engage can be cancelled within any month upon written notice, effective the month following cancellation.

Early Cancellation. You may choose to cancel your subscription early at your convenience provided that, we will not provide any refunds of prepaid fees or unused Subscription Fees, and you will promptly pay all unpaid fees due through the end of the Subscription term, or ninety (90) days, whichever is less.

Termination for Cause. Either party may terminate this Agreement immediately for cause, as to any or all Subscription Services. Otherwise, the Agreement may be terminated (i) upon thirty (30) days' notice to the other party of a material breach if such breach remains uncured at the expiration of such period, or (ii) immediately, if the other party becomes the subject of a petition in bankruptcy or any other proceeding relating to insolvency, cessation of business, liquidation or assignment for the benefit of creditors, in the event of Company insolvency, all of the Customer's assets are immediately released.

"Cause" includes a determination that a party is acting, or have acted, in a way that has or may negatively reflect on or impact the other party, its prospects, or its customers, including without limitation in a way that violates or causes a violation of applicable law or regulation.

This Agreement may not otherwise be terminated prior to the end of the Subscription Term.

3) Confidential Information

a. This Agreement, the terms contained hereunder and certain information related to the Customer transaction contemplated hereunder is "Confidential Information" such that it does not include information that: (i) is or has become generally known to the public; (ii) was known by either party prior to entering into the Agreement: or (iii) was independently determined by either party. All work product, pricing, deal terms and process information of either party exchanged with the other party to perform the terms of the Agreement is agreed to be Confidential Information, except any logos or marketing references are not Confidential Information.

b. Neither party may disclose Confidential Information without the express written consent of the other party.

c. By executing this Agreement, the Customer is providing written consent for DealMaker to disclose Confidential Information as required to carry out the terms of this Agreement. Customer's investors will be required to sign-in to the DealMaker portal and agree to the DealMaker terms and conditions. The parties agree that this process shall not constitute a disclosure of "Confidential Information" as described in this section.

4) DealMaker template library and forms. Customer may request access to DealMaker's documents and resources to help organize and set up the offering. These resources may include educational packages, resources for the management of administrative and collaborative tasks, and best practices observed from other offerings and industries. Customer acknowledges and agrees that, by providing access to any documents, training, or resources, DealMaker is not rendering and shall not be deemed to have rendered any legal, tax, investment, or financial planning advice. Customer shall, as it deems necessary or advisable, consult its own legal, tax, investment, or financial planning advisers.

5) Customized Support and Training. Customer may request additional support and training for team members and third party service providers, up to 4 unique sessions.

6) Third-Party Payment Processing

For the processing of electronic payments (including bank-to-bank payments, credit card, etc.), the Company may submit material(s) and or application(s) to partner third-party payment processors on behalf of the Customer. Upon approval, the Company will enable the partner processors' intake form/system within the Customer's subscription portal.

Customer acknowledges that Company makes no guarantee Customer will be approved by any third party, and approval is subject to each third party's sole discretion, including, to the extent applicable, its due diligence and compliance policies and procedures. Use of payment processing service(s) is further contingent on the mutual acceptance by Company and Customer of each third party's respective fees, to be included as an addendum to this agreement and/or presented to Customer for acceptance from time to time (including fees for merchant processing account and ongoing maintenance, which may be applied on a per-issuer basis). Note holdback periods may apply for electronic payment transfer methods, as enforced by processors. Company shall not be deemed responsible for delivery or any interruption or cessation of any services provided by any third party.

All Transactions must clear prior to being made available to Customer. US Federal regulations provide investors with 60 days to recall funds. Customer remains liable to immediately and without protestation or delay return to Company any funds recalled by investors for whatever reason.

Company reserves the right to deny, suspend or terminate participation in the offering of any investor to the extent Company, in its sole discretion, deems it advisable or necessary to comply with applicable laws or to eliminate practices that are not consistent with laws, rules, regulations, best practices, or the protection of its reputation.

7) Integration with Third Party Service Providers

Customer may request introductions to DealMaker's network of partner and vendors for the purpose of sourcing additional services (call centre, transfer agent, marketing support, investment relations). Unless otherwise specified in writing, all engagements with third parties in this respect are to be made directly between the Customer and the vendor at the Customer's discretion. Customer acknowledges and agrees that, by making such introductions, DealMaker is not recommending and shall not be deemed to have recommended any partner or vendor's products or services or to have assumed any responsibility for Customer's selection of any partner or vendor or procurement of such products or services.

Without limiting any other protection of Company under this agreement and notwithstanding anything to the contrary, DealMaker shall bear no responsibility or liability whatsoever in connection with any third party services provided by a vendor engaged by Customer, the decision to engage such vendors rests solely with the management of the Customer on the terms contracted between the Customer and such parties.

8) AML compliance and "clearing"

DealMaker's integrated AML searches are tools provided to Customer to assist Customer (or one of its agents) incomplying with applicable obligations related to KYC/AML. DealMaker is not engaged to perform and will not perform, and shall not be deemed responsible for performing, any services related to reviewing or analyzing search results, sources of funds or wealth, or making any determination as to whether Customer has complied with its obligations under applicable anti-money laundering legislation and regulations or as to whether any prospective investor poses any risk of money laundering, terrorist financing, or other criminal or suspicious activity. Customer and/or its agents (including counsel or broker dealer as applicable) shall bear primary responsibility to determine compliance with applicable AML legislation and regulation and shall assist in the clearing of any AML exceptions. Customer's KYC/AML clearing obligations may require Customer to undertake efforts to ensure that individual and corporate investors provide applicable identity verification, explanations of adverse regulatory/disciplinary/bankruptcy history or media reports, confirmation of false positive results, or other documents or information required for AML purposes. DealMaker's AML searches are limited by capabilities and design of products and services of the third parties Dealmaker engages to perform such searches, including by limitations on the search methodology, matching logic, data sources, and information accuracy used by such third parties.

9) Additional Services: Regulation D, 506(c) Accredited Investor Verification

Customer may engage either DealMaker or a third party (each a "Reviewer") to assist Customer in complying with applicable obligations related to accredited investor verification pursuant to Regulation D, 506(c) of the Securities Act. If Reviewer is DealMaker, DealMaker shall review investor submissions and uploaded documentation on the DealMaker portal and make a determination as to whether Customer has complied with its obligations to verify accredited investors (as defined by Rule 501 of Regulation D of the Securities Act) ("DM Verification"). If Reviewer is a third party, DealMaker will not perform, and shall not be deemed responsible for performing, any services related to reviewing or analyzing search results, sources of funds or wealth, or making any determination as to whether Customer has complied with its obligations to verify accredited investors (as defined by Rule 501 of Regulation D of the Securities Act).

DealMaker does not make and hereby disclaims any warranty, expressed or implied with respect to the information provided through DM Verification. DealMaker does not guarantee or warrant the correctness, merchantability, or fitness for a particular purpose of the information provided through DM Verification. Customer acknowledges that:

(a) DM Verification is conducted using a variety of third party database searches, public record services and user submissions. DealMaker cannot represent or warrant that the data provided will be 100% accurate, complete or up to date. The data is time sensitive and DealMaker provides the information as is. Public records may be incomplete, out of date or have errors and that DealMaker verification cannot be relied upon as definitively accurate.

(b) The results of a DM Verification search for any type of personal verification should be interpreted cautiously. Criminal and civil record search results may not provide a complete or accurate representation of a person's criminal background or civil judgment history. Records are available for the majority, but not all, of states and counties. Records can be incomplete, contain inaccuracies or false matches.

(c) DealMaker is not a consumer reporting agency as defined in the Fair Credit Reporting Act ("FCRA"), and the information in DealMaker's databases has not been collected in whole or in part for the purpose of furnishing consumer reports, as defined in the FCRA. CUSTOMER SHALL NOT USE DM VERIFICATION SERVICES AS A FACTOR IN (1) ESTABLISHING AN INDIVIDUAL'S ELIGIBILITY

FOR PERSONAL CREDIT OR INSURANCE OR ASSESSING RISKS ASSOCIATED WITH EXISTING CONSUMER CREDIT OBLIGATIONS, (2) EVALUATING AN INDIVIDUAL FOR EMPLOYMENT, PROMOTION, REASSIGNMENT OR RETENTION, OR (3) ANY OTHER PERSONAL BUSINESS TRANSACTION WITH ANOTHER INDIVIDUAL.

(d) Customer assumes all risks arising from its use or disclosure of DM Verification information DealMaker provides to Customer.

(e) Notwithstanding anything in the DealMaker Terms of Service, Customer agrees that it shall indemnify, defend and hold harmless DealMaker, its officers, directors, employees and agents, and the entities that have contributed information to or provided services for DM Verification against any and all direct or indirect losses, claims, demands, expenses (including attorneys' fees and cost) or liabilities of whatever nature or kind arising out of Customer's use of the information provided by DM Verification and Customer's use or distribution of any information obtained therefrom.

THE DM VERIFICATION SERVICES AND INFORMATION ARE PROVIDED "AS-IS" AND "AS AVAILABLE" AND NEITHER DEALMAKER NOR ANY OF ITS DATA SUPPLIERS REPRESENTS OR WARRANTS THAT THE INFORMATION IS CURRENT, COMPLETE OR ACCURATE. DEALMAKER HEREBY DISCLAIMS ALLREPRESENTATIONS AND WARRANTIES REGARDING THE PERFORMANCE OF THE WEBSITE OR OUR SERVICES, AND THE ACCURACY, CURRENCY, OR COMPLETENESS OF THE INFORMATION, INCLUDING (WITHOUT LIMITATION) ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE. Customer acknowledges that these disclaimers are an integral part of this Agreement and that DealMaker would not provide DM Verification services if Customer did not agree to these disclaimers.

10) Payment Processing Terms

1. Indemnification. Customer agrees to indemnify Company and hold Company harmless from any and all Losses incurred by Company in connection with its role as platform account for payment processing. "Losses" includes, but is not limited to, losses arising from chargebacks, clawbacks, payment reversals, fraudulent charges, insufficient credit, unauthorized charges, claims of Customer or third parties, and any other problems relating to card or ACH payments.

2. Pre-Closing Hold. Customer agrees that investment funds deposited in Customer's account with a financial institution ("Account") by (i) investors directly, funding via wire or cheque or (ii) by DealMaker or any third party payment processor, prior to the Closing of any transaction involving such investments (each, a "Transaction") shall remain in Customer's Account and shall not be withdrawn by Customer, or a person authorized by Customer, from the Customer's Account prior to the Closing. "Closing" includes the resolution of all applicable AML-related exceptions or discrepancies identified through any searches provided by third parties through Company or otherwise identified by or to Company for all Transactions associated with an investment and the acceptance by the Company of the investment associated with such Transactions. Customer grants Company the right, prior to any Closing, in Company's sole discretion and without prior notice, to deduct funds from Customer's Account via Pre-Authorized Debit in respect of any funds that have been deposited in Customer's Account.

3. Holdbacks. The Customer hereby acknowledges that certain terms apply in respect of electronic or credit card payment to cover against charge-backs and/or rescission. Chargeback windows can vary in duration and amount. For this reason, a holdback is applied to all funds processed online. Company shall have the right, in its sole discretion, to revise the amount and duration of any holdback. Ordinarily, the holdback is 5.00% of payments processed, for a ninety day period.

4. Post-Closing Retention. After the Closing Date, Customer agrees to retain in Customer's Account twenty percent (20%) of the funds processed online in respect of each Transaction for a period of ninety (90) days following the Closing Date (the "Retention Period") to mitigate the risk of any Losses. Company shall notify Customer prior to amending the Retention. Customer acknowledges that chargeback windows applied by credit card processors are beyond Company's control. The parties hereby agree to work together collaboratively and in good faith in order to oppose or reduce any chargebacks.

5. Loss Recovery. Upon giving Customer prior written notice of no less than three business days, Company shall have the right, in its sole discretion, to deduct funds from Customer's Account to reimburse Company for any Losses. Customer acknowledges and agrees that recovery of Losses from Customer's Account will not serve as any limitation on the indemnification obligations of Customer under this Agreement or any remedy or claim that Company may be entitled to pursue against Customer in respect of such Losses.

Schedule "C"

Marketing Service Agreement with DealMaker Reach, LLC

AMENDED AND RESTATED SERVICE

AGREEMENT

This Amended and Restatd Service Agreement ("Agreement") replaces the agreement made between DEALMAKER REACH, LLC, a Delaware limited liability company, with its principal place of business at 115 Havana Street, Austin, TX 78704 ("Service Provider"), and Shackelford Pharma Inc. with its principal place of business at PO Box 10026, Pacific Centre South, 25th Floor, 700 West Georgia Street, Vancouver BC, Canada V7Y 1B3 ("Client") on July 8, 2022 (the "Effective Date"). Service Provider and Client may be referred to individually as a "party" or collectively as the "parties".

1. THE SERVICES

1.1. Overview. Service Provider shall provide certain digital marketing services described herein (collectively, the "Services") for Client's capital raise marketing campaign (the "Campaign") hosted and / or powered by DealMaker.tech (http://dealmaker.tech) ("DealMaker" or, the "Platform") subject to the terms and conditions of this Agreement.

1.2. Description of the Services. Service Provider shall provide to Client the following Services:

● Website design and development:

○ Copywriting, wireframing, and website design

○ Website development in Webflow

○ Integration of tracking, analytics, and pixels

○ Ongoing upkeep and management of website content

● Conversion rate optimization:

○ Continuous website content testing to improve conversion rate

● Email marketing:

○ Audience building via email capture on landing page

○ Copywriting and design for investor educational series (4 to 6-part email series delivered to emails are captured on the website)

○ Ongoing email list nurturing via updates repurposed from the Client's campaign-wide announcements, other relevant news, and webinars

○ Design and implement email capture in Klaviyo

○ Integrate DealMaker webhooks to build investor funnel and tracking of investor progress/status

● Google Ads:

○ Search, Display, Google Discovery, and YouTube

○ Creation of ad designs, copy, and audience targeting across Google Ads platform

○ Ongoing testing of ad copy and creative

● Paid Social:

○ Facebook and Instagram prospecting and retargeting

○ Creation of ad designs, copy, and audience targeting

○ Ongoing testing of ad copy and creative

● Partnerships:

○ Source and negotiate private ad placements with relevant publishers and email newsletters

● Campaign forecasting:

○ Advertising spend and campaign timeline projections based on client goals and campaign metrics

● Reporting:

○ Regular calls weekly for month one after launch and 2/month thereafter

○ Strategic planning, implementation, and execution of marketing budget ("Budget")

1.3. Client Assets. Client shall provide Service Provider with all reasonably necessary materials, such as: company history, financial statements, business and market description, bios of principals and key employees, customers, products, services, tax returns, financial models, systems, pricing, intellectual property, technical specifications, access to social media channels, and other materials necessary for providing the Services (the "Information").

The parties acknowledge and agree that all such Information comes from Client and that Service Provider does not create such Information and relies on its accuracy, ownership and property. Client represents and warrants to the Service Provider that all such Information is accurate, true and correct and that, in the event Information changes during the term of this Agreement, Client shall provide updated Information to Service Provider. Client further acknowledges that Service Provider bases its Services on such Information.

2. COMPENSATION AND PAYMENT

2.1. Fixed Fees. For the first seventy (70) day period in which Service Provider develops the assets listed in Services (the "Kickoff Phase"), Client shall pay to Service Provider a fixed fee in the amount of $25,000.00 (USD) (the "Launch Fees"). Thereafter, for the Services rendered under this Agreement, Client shall pay to Service Provider a fixed fee in the amount of $15,000.00 (USD) per month during the Term (the "Monthly Fees"), which shall be prorated for any partial month and shall not exceed $180,000. The Launch Fees and the Monthly Fees are collectively, the "Fixed Fees."

2.2. Expenses. Client is responsible for all costs and expenses incurred on Client's behalf in connection with the provision of the Services ("Expenses"). Any Expenses outside of the agreed budget are subject to Client's prior written approval. Client is also responsible for its own costs and expenses incurred in connection with the Campaign on the Platform, and Client acknowledges and agrees that the Platform charges fees related to the Campaign as set forth in the Platform's terms and conditions. These Platform fees are completely unrelated to Service provider's compensation as set forth herein this Agreement.

2.3. Budget and Marketing Spend. In consultation with Client, Service Provider shall use its discretion and experience in allocating the marketing and advertising costs expended during the Campaign ("Marketing Spend") and report all expended marketing and advertising costs to Client at least once per month. Service Provider shall reasonably cooperate with Client to adjust its strategy in allocating the Marketing Spend in response to Client feedback based on analytics reporting. Service Provider may request additional budget and authority for Marketing Spend with Client's prior written consent. All Marketing Spend up to the agreed budget amount will be charged directly to Client's provided payment method.

2.4. Payment. Client agrees that 50% of the Launch Fees shall be payable on the Effective Date and the remaining 50% of the Launch Fees shall be payable 30 days after the Effective Date. Thereafter, Client shall remit payment to Service Provider on a monthly basis within fifteen (15) calendar days following receipt of an invoice. Except for the Deferment, late payments on an invoice may be subject to a late fee equal to the lesser of 1.5% per month (18% per annum) or the maximum amount permitted under applicable law.

3. RELATIONSHIP. Service Provider and Client are independent contractors in all matters relating to this Agreement. Nothing in this Agreement shall be construed to create any partnership, joint venture, agency, employment, or any other relationship between the parties. Except for Service Provider's provision of Services to Client in connection with the Marketing Spend, neither party has the authority to act on behalf of or to enter into any contract, incur any liability, or make any representation on behalf of the other party, unless otherwise expressly agreed to in writing signed by both parties. Service Provider has exclusive control over its employees, representatives, agents, contractors and subcontractors, and none of the foregoing shall be deemed to be employees of Client or eligible to participate in any employment benefit plans or other benefits available to Client employees. Client shall exercise no immediate control over the actual means and manner of Service Provider's performance under this Agreement, except to the extent that Client expects the satisfactory completion of the Services under this Agreement. Each party is responsible for its respective employees, representatives, agents, contractors and subcontractors, and the foregoing's compliance with the terms of this Agreement. Service Provider is not and shall not be deemed to be a dealer, broker, finder, intermediary or otherwise entitled to any brokerage, finder's, or other fee or commission in connection with any purchase or sale of securities resulting from Service Provider's general marketing services. Service Provider shall be solely responsible for all local, state and federal tax liabilities arising from any income received under this Agreement, whether cash or stock.

4. TERM AND TERMINATION

4.1. Term. The initial term of this Agreement commences on the Effective Date and, unless earlier terminated in accordance with the terms of this Agreement, shall continue in full force and effect for a period of three (3) months (the "Initial Term"), provided that such the Initial Term shall continue thereafter for consecutive one (1) month periods (each a "Renewal Term") unless either party notifies the other party of its intention not to renew this Agreement at least thirty (30) days before the expiration of the then-current Initial

Term or Renewal Term, as applicable. The Initial Term and any Renewal Term(s) are collectively referred to as the "Term". Service Provider will receive additional compensation for any additional Renewal Term on the same terms and conditions of this Agreement. Any additional Renewal Term does not provide Service Provider authorization for additional budget and Marketing Spend, unless expressly agreed in writing by Client.

4.2. Termination for Cause. Either party may terminate this Agreement based on a material breach of this Agreement by the other party, provided that if such material breach is curable, the terminating party shall first give the breaching party written notice specifying the circumstances of the material breach and provide such breaching party with fifteen

(15) calendar days to cure such breach as provided herein. Termination shall become effective after the lapse of such cure period, unless the events or circumstances specified in the notice have been remedied or a plan for remedying them in a prompt and effective manner has been proposed to and accepted by the terminating party and the other party has proceeded diligently to cure. This Agreement will terminate immediately upon written notice to the other party if either party becomes insolvent, makes a general assignment for the benefit of creditors, files a voluntary petition of bankruptcy, suffers or permits the appointment of a receiver for its business or assets, becomes subject to any proceedings under any bankruptcy or insolvency law, whether domestic or foreign, or has wound up or liquidated its business voluntarily or otherwise, and same has not been discharged or terminated within ninety (90) days.

4.3. Termination for Convenience. Following the Initial Term, either party may, at any time after thirty (30) calendar days from the Effective Date, terminate this Agreement, in its sole discretion, without cause, by providing the other party with at least thirty (30) calendar days' prior written notice of such termination ("Early Termination"). In the event of Early Termination, Client is solely responsible for the Marketing Spend that has already been expended and the compensation to Service Provider accrued prior to such Early Termination date.

4.4. Effect of Termination. Upon the expiration or termination of this Agreement, unless otherwise agreed by the parties in writing, (a) Client shall promptly pay the prorated amount of any Fixed Fees and Expenses for Services rendered under this Agreement on or before the effective date of termination; (b) Service Provider will cease the provision of all Services and expenditure of the Marketing Spend and return to Client any unused prepaid budget and Marketing Spend less outstanding Fixed Fees and Expenses; and (c) all legal obligations, rights, and duties arising out of this Agreement shall terminate except for such legal obligations, rights, and duties that have accrued prior to the effective date of termination and except as otherwise expressly provided in this Agreement.

5. WORK PRODUCT OWNERSHIP. Any copyrightable works, ideas, discoveries, inventions, patents, products, or other information developed in whole or in part by Service Provider in connection with the Services provided to Client (collectively the "Work Product") will be work made for hire and the exclusive property of the Client. To the extent deemed not to be work made for hire, Service Provider hereby assigns all Work Product and any and all intellectual property rights related thereto to Client. Upon request, Service Provider will execute all documents necessary to confirm or perfect Client's exclusive ownership of the Work Product. Without limiting the generality of the foregoing, all assets and other creative works created by Service Provider in the provision of the Services and all data and analytics in connection with the Services shall be the exclusive property of the Client. Notwithstanding any provision in this Agreement to the contrary, Work Product shall not include, and Service Provider shall be allowed to use, any and all audience data whatsoever including, without limitation, lookalike data, investor data and digital footprints, targeted investors and their data and digital footprints, and the like.

6. CONFIDENTIALITY. Service Provider and Client may, during the course of this Agreement, have access to or acquire knowledge from discussions with one another's personnel and from material, data, systems and other information with respect to the other which may not be accessible or known to the general public, including, but not limited to, financial, business, scientific, technical, economic, or engineering information or other proprietary or confidential information of a party ("Confidential Information"). Confidential Information does not include information which: (a) is or becomes generally available to the public other than as a result of disclosure by the receiving party (or any person to whom the receiving party disclosed such information); (b) was known by the receiving party prior to its disclosure by the disclosing party; (c) was independently developed by receiving party without use of the Confidential Information; (d) is authorized, in writing, by the disclosing party to be disclosed; or (e) becomes available to the receiving party on a non- confidential basis from a source other than the disclosing party, provided that such source is not bound by a confidentiality agreement, confidentiality obligation, or fiduciary duty which prohibits disclosure and the receiving party has no reason to believe that such source may be restricted from making such disclosure. Disclosing party shall retain all right, title, and interest in and to its Confidential Information, and nothing in this Agreement shall be construed as granting to receiving party either expressly, by implication, estoppel, or otherwise, any rights in or to disclosing party's Confidential Information, except to fulfill the purpose of this Agreement. Receiving party shall not use disclosing party's Confidential Information for any purpose other than to exercise or perform its rights or obligations under this Agreement. Receiving party shall not, without the prior written consent of disclosing party, disclose, disseminate, or otherwise communicate, in whole or in part, disclosing party's Confidential Information to any third party except to the receiving party's employees, agents, or representatives with a need to know the Confidential Information and are bound by confidentiality obligations at least as restrictive as those contained herein. Receiving party agrees to protect disclosing party's Confidential Information from disclosure with the same degree of care used to protect the confidentiality of its own Confidential Information, but in no event less than reasonable care. In the event that receiving party becomes compelled by law or order of court or administrative body to disclose any of disclosing party's Confidential Information, receiving party shall be entitled to disclose such Confidential Information, provided that: (a) receiving party provides disclosing party with prompt prior written notice to allow disclosing party the opportunity to safeguard the Confidential Information including but not limited to seeking a protective order or other appropriate legal remedy and (b) if such protective order or other appropriate remedy is not obtained, receiving party shall furnish only that portion of disclosing party's Confidential Information which is legally required to be disclosed. Receiving party shall return or destroy (in disclosing party's discretion) disclosing party's Confidential Information upon written demand by disclosing party or expiration or termination of this Agreement.

7. INDEMNIFICATION. Each party shall indemnify, defend (at its own cost and expense) and hold other party and its officers, employees, and agents harmless from and against any and all third party claims, suits, demands, damages, losses and expenses (including reasonable attorneys' fees) ("Claims") arising from such party's breach of this Agreement or such party's negligence, fraud or willful misconduct, provided that the Claims do not result from the other party's negligence or willful misconduct. If a party entitled to indemnification ("Indemnified Party") becomes aware of any Claims it believes is indemnifiable hereunder, the Indemnified Party shall give the other party ("Indemnifying Party") prompt written notice of such Claims. Notice shall (a) describe the basis on which indemnification is being asserted and (b) be accompanied by copies of all relevant pleadings, demands, and other papers related to the Claims in the possession of Indemnified Party. Indemnifying Party shall assume the defense of any such Claims. Indemnified Party shall cooperate, at the expense of Indemnifying Party, with Indemnifying Party and its counsel in the defense. Indemnified Party shall have the right to participate fully, at its own expense, in the defense of such Claims. Any compromise or settlement of such Claims shall require the prior written consent of both parties hereunder, such consent not to be unreasonably withheld or delayed. The foregoing indemnities will be in addition to, not in lieu of, all other legal rights and remedies that each party may have.

8. REPRESENTATIONS AND WARRANTIES

8.1. Mutual Representations. Each party represents and warrants that (a) it has the right to enter into this Agreement and to fully perform its obligations hereunder; (b) by entering into this Agreement, it does not violate any agreement existing between it and any other person or entity; and (c) it will comply with all applicable laws, rules, and regulations of any jurisdiction in which it conducts business.

8.2. Service Provider Representations. Service Provider represents and warrants that (a) the Services under this Agreement will be performed in a timely and workmanlike manner in accordance with generally acceptable standards in the community used by service providers providing similar services, and (b) the Work Product, and the intended use thereof in accordance with the terms of this Agreement, will not infringe, violate, or misappropriate any third party rights, including without limitation, any copyrights, trademarks, trade secrets, privacy, publicity, or other proprietary or intellectual property rights.

8.3. Client Representations. In addition to the terms of Section 1.3, Client represents and warrants that any Client assets or materials provided pursuant to Section 1.3, and the intended use thereof in accordance with the terms of this Agreement, will not infringe, violate, or misappropriate any third party rights, including without limitation, any copyrights, trademarks, trade secrets, privacy, publicity, or other proprietary or intellectual property rights

8.4. No Guarantees. Client understands that Service Provider does not and cannot make any guarantees about Client's Campaign. No language or provision in this Agreement or any related proposal shall be construed as a guarantee or warranty of any type by Service Provider, including, without limitation, the

success of this Campaign, the amount of funds raised on this Campaign, or anything relating to the scope of work or quality of work by Service Provider on this Campaign.

8.5. Disclaimers. Except as expressly set forth in this Agreement, the Services are provided on an "as is" and "as available" basis without any warranties, express or implied, including, without limitation, implied warranties of merchantability or fitness for a particular purpose, and Service Provider expressly disclaims all warranties. Client agrees and understands that Service Provider has no fiduciary duty to Client.

9. LIMITATION OF LIABILITY. EXCEPT FOR LIABILITY ARISING UNDER INDEMNIFICATION, IN NO EVENT SHALL EITHER PARTY BE LIABLE TO THE OTHER PARTY IN ANY MANNER, UNDER ANY THEORY OF LIABILITY, WHETHER IN CONTRACT, TORT (INCLUDING NEGLIGENCE), BREACH OF WARRANTY OR OTHER THEORY, FOR ANY INDIRECT, CONSEQUENTIAL, INCIDENTAL, EXEMPLARY, PUNITIVE OR SPECIAL DAMAGES, INCLUDING, WITHOUT LIMITATION, LOST PROFITS AND LOSS OF DATA, REGARDLESS OF WHETHER SUCH PARTY WAS ADVISED OF OR WAS AWARE OF THE POSSIBILITY OF SUCH DAMAGES. EXCEPT FOR AMOUNT OWED AND LIABILITY ARISING UNDER INDEMNIFICATION, IN NO EVENT SHALL EITHER PARTY'S AGGREGATE LIABILITY TO THE OTHER PARTY OR ANY THIRD PARTY ARISING OUT OF OR IN CONNECTION WITH THIS AGREEMENT FROM ALL CAUSES OF ACTION AND ALL THEORIES OF LIABILITY EXCEED COMPENSATION PAID TO SERVICE PROVIDER UNDER THIS AGREEMENT. THE LIMITATIONS SET FORTH IN THIS PARAGRAPH SHALL BE DEEMED TO APPLY TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW AND NOTWITHSTANDING THE FAILURE OF THE ESSENTIAL PURPOSE OF ANY LIMITED REMEDIES SET FORTH IN THIS AGREEMENT. THE PARTIES ACKNOWLEDGE AND AGREE THAT THEY HAVE FULLY CONSIDERED THE FOREGOING ALLOCATION OF RISK AND FIND IT REASONABLE, AND THAT THE FOREGOING LIMITATIONS IN THIS SECTION ARE AN ESSENTIAL BASIS OF THE BARGAIN BETWEEN THE PARTIES.

10. GENERAL

10.1. Force Majeure. Excluding any obligations of a party to pay monies due hereunder, neither party will be responsible for any delay or failure in its performance or obligations under this Agreement due to causes beyond its reasonable control, including, without limitation, labor disputes, strikes, civil disturbances, government actions, fire, floods, acts of God, war, terrorism, or other similar occurrences (each, a "Force Majeure Event"); provided that the party affected by such Force Majeure Event (a) is without fault in causing such delay or failure, (b) notifies the other party of the circumstances causing the Force Majeure Event, and (c) takes commercially reasonable steps to eliminate the delay or failure and resume performance as soon as practicable.

10.2. No Waiver. A party does not waive any right under this Agreement by failing to insist on compliance with any of the terms of this Agreement or by failing to exercise any right hereunder. Any waivers granted hereunder are effective only if recorded in a writing signed by the party granting such waiver.

10.3. Entire Agreement. This Agreement contains the entire agreement of the parties hereto with respect to the subject matter herein, and supersedes all prior discussions, negotiations, understanding, and written and oral agreements between the parties concerning this subject matter.

10.4. Severability. If one or more provisions of this Agreement are held to be invalid, illegal, or unenforceable, under present or future law, such provision shall be deemed modified to the least degree necessary to remedy such invalidity, illegality, or unenforceability while retaining the original intent of the parties, and the remainder of this Agreement shall continue in full force and effect.

10.5. Amendments. This Agreement may be modified or amended only in writing, if the writing is signed by the party obligated under the amendment.

10.6. Governing Law; Arbitration. This Agreement shall be governed by and construed in accordance with the laws of the State of New York without regard to its conflicts of law rules. Any and all controversies, claims, or disputes arising out of or relating to this Agreement, or the interpretation, performance, or breach thereof, including the scope or applicability of this provision to arbitrate ("Dispute") shall be referred to senior management of the parties for good faith discussion and resolution. In the event the parties cannot resolve any Dispute informally, then such Dispute shall be submitted to confidential, final, and binding arbitration administered by Judicial Arbitration and Mediation Services Inc. ("JAMS") pursuant to its then-prevailing Comprehensive Arbitration Rules and Procedures. The arbitration shall take place in New York. The arbitration shall be before a single, neutral arbitrator who is a former or retired New York state or federal court judge. The arbitration may be initiated by any party by giving to the other party written notice requesting arbitration, which notice shall also include a statement of the claims asserted and the facts upon which the claims are based. The arbitrator shall not have any power to alter, amend, modify or change any of the terms or provisions of this Agreement. Except as prohibited in this Agreement, the arbitrator shall have the authority to award any remedy or relief otherwise available in a court of law. The arbitrator's award shall be accompanied by a reasoned written opinion, will be binding on the parties, and may be entered as a judgment in any court of competent jurisdiction. Any party may bring an action in any court of competent jurisdiction to compel arbitration under this Agreement and to enforce an arbitration award. Notwithstanding this arbitration provision, either party shall be entitled to seek injunctive relief (unless otherwise precluded by any other provision of this Agreement) from any court of competent jurisdiction. If for any reason an action proceeds in court rather than in arbitration, it shall be brought exclusively in a state or federal court of competent jurisdiction located in New York and the parties expressly consent to personal jurisdiction and venue therein and expressly waive any right to trial by jury.

10.7. Notice. Any notice or communication required or permitted under this Agreement shall be sufficiently given if delivered in person or by email or certified mail, return receipt requested, to the address set forth in the opening paragraph or to such other address as one party may have furnished to the other in writing.

10.8. Assignment. Neither party may assign or transfer this Agreement without the prior written consent of the other party, which approval shall not be unreasonably withheld. Notwithstanding the foregoing, either party may assign this Agreement in its entirety, upon written notice without the other party's consent, to an affiliate or to its successor or acquirer, as the case may be, in connection with a merger, acquisition, corporate reorganization, or sale of all or substantially all of such party's assets or substantially similar transaction. Subject to the foregoing, this Agreement will bind and inure to the benefit of the parties and their respective successors and permitted assigns.

10.9. Counterparts and Electronic Signatures. This Agreement may be executed in any number of counterparts, each of which shall be deemed an original and all of which together shall constitute one and the same document. The parties agree that the electronic signatures appearing on this Agreement are the same as handwritten signatures for the purpose of validity, enforceability, and admissibility.

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be executed by their respective duly authorized representatives as of the Effective Date.

|

DEALMAKER REACH, LLC ("Service Provider") |

Shackelford Pharma Inc. ("Client") |

|

|

By: |

By: |

|

|

Name: Jonathan Stidd |

|

Name: Chris Clark, CFO |

|

Date: |

|

Date: |