Exhibit 99.3

Management’s Discussion and Analysis

This management’s discussion and analysis (“MD&A”) of operations and financial condition for the year ended October 31, 2022, dated December 6, 2022, should be read in conjunction with VersaBank’s Audited Consolidated Financial Statements for the year ended October 31, 2022, which have been prepared in accordance with International Financial Reporting Standards (“IFRS”) and is available on VersaBank’s website at www.versabank.com, SEDAR at www.sedar.com and EDGAR at www.sec.gov/edgar.shtml. All currency amounts in this document are in Canadian dollars unless otherwise indicated.

|

Cautionary Note Regarding Forward-Looking Statements |

2 |

|

About VersaBank |

3 |

|

Strategy |

3 |

|

Overview of Performance |

4 |

|

Selected Financial Highlights |

8 |

|

Business Outlook |

9 |

|

Financial Review - Earnings |

13 |

|

Financial Review - Balance Sheet |

17 |

|

Off-Balance Sheet Arrangements |

30 |

|

Related Party Transactions |

31 |

|

Results of Operating Segments |

32 |

|

Capital Management and Capital Resources |

33 |

|

Summary of Quarterly Results |

38 |

|

Fourth Quarter Review |

39 |

|

Critical Accounting Policies and Estimates |

40 |

|

Enterprise Risk Management |

47 |

|

Non-GAAP and Other Financial Measures |

59 |

Cautionary Note Regarding Forward-Looking Statements

VersaBank’s public communications often include written or oral forward-looking statements. Statements of this type are included in this document, and may be included in other filings and with Canadian securities regulators or the US Securities and Exchange Commission, or in other communications. All such statements are made pursuant to the “safe harbor” provisions of, and are intended to be forward-looking statements under, the United States Private Securities Litigation Reform Act of 1995 and any applicable Canadian securities legislation. The statements in this management’s discussion and analysis that relate to the future are forward-looking statements. By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, many of which are out of VersaBank’s control. Risks exist that predictions, forecasts, projections and other forward-looking statements will not be achieved. Readers are cautioned not to place undue reliance on these forward-looking statements as a number of important factors could cause actual results to differ materially from the plans, objectives, expectations, estimates and intentions expressed in such forward-looking statements. These factors include, but are not limited to, the strength of the Canadian and US economy in general and the strength of the local economies within Canada and the US in which VersaBank conducts operations; the effects of changes in monetary and fiscal policy, including changes in interest rate policies of the Bank of Canada and the US Federal Reserve; global commodity prices; the effects of competition in the markets in which VersaBank operates; inflation; capital market fluctuations; the timely development and introduction of new products in receptive markets; the impact of changes in the laws and regulations pertaining to financial services; changes in tax laws; technological changes; unexpected judicial or regulatory proceedings; unexpected changes in consumer spending and savings habits; the impact of wars or conflicts including the crisis in Ukraine and the impact of the crisis on global supply chains; the impact of new variants of COVID-19; and VersaBank’s anticipation of and success in managing the risks implicated by the foregoing.

The foregoing list of important factors is not exhaustive. When relying on forward-looking statements to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. The forward-looking information contained in the management’s discussion and analysis is presented to assist VersaBank shareholders and others in understanding VersaBank’s financial position and may not be appropriate for any other purposes. Except as required by securities law, VersaBank does not undertake to update any forward-looking statement that is contained in this management’s discussion and analysis or made from time to time by VersaBank or on its behalf.

About VersaBank

VersaBank (the “Bank”) adopted an electronic branchless model in 1993, becoming the world’s first branchless financial institution and obtains its deposits and the majority of its loans and leases digitally. It holds a Canadian Schedule 1 chartered bank licence and is regulated by the Office of the Superintendent of Financial Institutions (“OSFI”). In addition to its core Digital Banking operations, VersaBank has established cybersecurity services and banking and financial technology development operations through its wholly owned subsidiary, DRT Cyber Inc. (“DRTC”). VersaBank’s Common Shares trade on the Toronto Stock Exchange and Nasdaq under the symbol VBNK. Its Series 1 Preferred Shares trade on the Toronto Stock Exchange under the symbol VBNK.PR.A.

VersaBank is focused on increasing earnings by concentrating on underserved markets that support more attractive pricing for its products, leveraging existing distribution channels to deliver its financial products to these chosen markets and expanding its diverse deposit gathering network that provides efficient access to a range of low-cost deposit sources in order to maintain a low cost of funds.

The underlying drivers of VersaBank’s performance trends for the current and comparative periods are set out in the following sections of this MD&A.

Strategy

VersaBank’s strategy is to utilize proprietary software and established non-branch financial product distribution channels to deliver innovative commercial and consumer lending and deposit products to select clients operating in underserved markets in Canada and the United States (“US”). VersaBank is also leveraging its proprietary technology in cybersecurity and innovative solutions that address the growing volume of cyber threats challenging financial institutions, multi-national corporations and government entities on a daily basis.

Overview of Performance

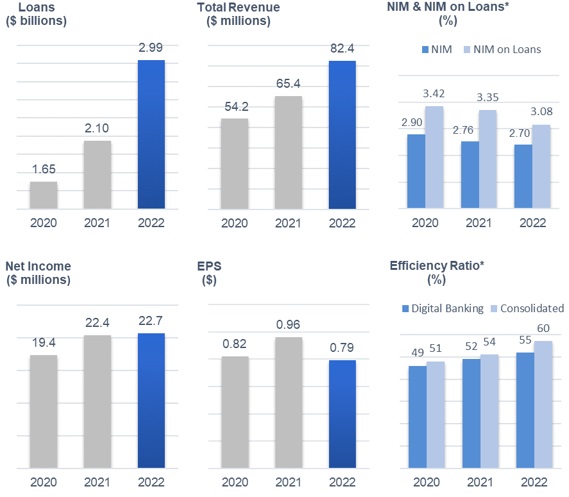

* This is a non-GAAP measure. See definition in “Non-GAAP and Other Financial Measures”.

FY 2022 vs FY 2021

|

Loans increased 42% to $2.99 billion, driven primarily by outsized growth in the Bank’s Point-of-Sale (“POS”) loan and lease receivable portfolio, which increased 74%; |

|

Total revenue increased 26% to $82.4 million, composed of net interest income of $76.7 million and non-interest income of $5.7 million, the latter derived primarily from the Bank’s technology and cybersecurity business, attributable specifically to the operations of Digital Boundary Group (“DBG”), which generated services revenue and gross profit of $9.8 million and $5.6 million, respectively, (an increase of 14% and 8%, respectively), (See Acquisition of DBG in the Financial Review – Balance Sheet); |

|

Net interest margin (“NIM”) decreased 6 bps to 2.70% and NIM on loans decreased 27 bps to 3.08% as a function primarily of higher cost of funds attributable to changes in the Bank’s funding mix, offset substantially by higher yields earned on the Bank’s lending portfolio and securities purchased in the current year; |

|

Provision for credit losses (“PCL”) and the resulting PCL ratio were $451,000 and 0.02%, respectively, compared with a recovery of credit losses and resulting PCL ratio of $438,000 and -0.02%, respectively, last year. The recovery recorded last year was attributable primarily to changes in the Bank’s lending asset portfolio mix, a partial recovery of a previously impaired asset in the amount of $116,000 and changes in the forward-looking information used in the Bank’s credit risk models in the period. The current year over year trend was due primarily to lending asset growth and changes in the forward-looking information used by the Bank in its credit risk models; |

|

Net income increased 1% to a record of $22.7 million, driven by higher revenue, which was substantially offset by higher non-interest expense attributable to $5.2 million in transitory investments in several business development initiatives, including the planned acquisition of a US national bank, development and initial launch of the US Receivable Purchase Program (“RPP”), and the ongoing development of the Canadian-dollar version of VersaBank’s Digital Deposit Receipts. These transitory investments are expected to be substantially completed in the first quarter of fiscal 2023 and expected to contribute to revenue and net income growth beginning in 2023. Higher non-interest expense was also the result of higher salary and benefits expense due to higher staffing levels to support expanded revenue-generating business activity across the Bank and higher costs associated with employee retention amidst the current challenging labour market. In addition, net income was dampened by temporarily elevated corporate income taxes resulting in the Bank’s tax provision increasing incrementally by approximately $1.1 million, which was attributable to a higher effective income tax rate, which management anticipates will be reduced in the coming fiscal year; |

|

Earnings per share (“EPS”) decreased 18% to $0.79, primarily due to the impact of the issuance of 6.3 million common shares concurrent with the Bank’s listing on Nasdaq in September 2021. EPS was also impacted by higher non-interest expense of $0.16 (on an after tax basis) related to transitory investment in multiple business development initiatives described above and the higher effective tax rate of $0.04 (on an after tax basis); and, |

|

Efficiency ratio for Digital Banking operations (excluding DRTC) increased 6% to 55% and was elevated as a function primarily of VersaBank’s investments in the business development initiatives described above. Efficiency ratio for Digital Banking operations adjusted for the Bank’s investments in the business development initiatives described above was 49% (see definition in “Non-GAAP and Other Financial Measures”). |

Items of note

FY 2022

|

On August 5, 2022, the Bank received approval from the Toronto Stock Exchange (“TSX”) to proceed with a Normal Course Issuer Bid (“NCIB”) for its common shares. On September 21, 2022, the Bank received approval from the Nasdaq to proceed with a NCIB for its common shares. Pursuant to the NCIB, VersaBank may purchase for cancellation up to 1,700,000 of its common shares representing approximately 9.54% of its public float. VersaBank’s directors and management believe that the market price of VersaBank’s common shares does not reflect the value of the business and the future prospects of same, and further, reflects a material discount to book value and as such the purchase of common shares for cancellation at such time is a prudent corporate measure and represents an attractive investment for the Bank. The Bank had repurchased 195,300 shares under the NCIB as at October 31, 2022; |

|

On June 14, 2022, the Bank signed a definitive agreement to acquire Minnesota-based Stearns Bank Holdingford, N.A. (“SBH”), a privately held, wholly-owned subsidiary of Stearns Financial Services Inc. (“SFSI”) based in St. Cloud, Minnesota, for an estimated US $13.5 million (CA $18.4 million), subject to adjustment at closing. SBH is a fully operational OCC (Office of the Comptroller of the Currency)-chartered national bank, focused on small business lending, which is expected to add approximately US $60 million in total assets to VersaBank’s balance sheet. The acquisition is intended to provide VersaBank with access to US denominated deposits to expand the growth of its RPP business, which VersaBank launched in the US early in the second quarter of fiscal 2022. Subject to customary closing conditions, including regulatory approval by both the OCC and OSFI, the transaction is anticipated to close in early calendar 2023; |

|

On May 9, 2022, the Bank announced the appointment of Rick Jankura to the Bank’s Board of Directors. Mr. Jankura brings to the VersaBank board more than four decades of experience as a finance and accounting executive with a broad range of senior management and board of director roles with both private and public companies in a diverse range of industries, including financial services, manufacturing, services and software; |

|

On March 31, 2022, VersaBank announced that it had entered into an agreement with its first RPP partner in the US, a large, North American, commercial transportation financing business focused on independent owner/operators; and, |

|

On March 28, 2022, VersaBank announced the successful completion of the independent third-party System and Organization Controls (“SOC2”) – Type I audit of its VersaVault®, VersaBank’s proprietary security technology for blockchain-based assets, which underpins VersaBank’s revolutionary Digital Deposit Receipts. |

FY 2021

|

On September 21, 2021 the Bank completed a treasury offering of 5,500,000 common shares at a price of USD $10.00 per share, the equivalent of CAD $12.68 per share, for gross proceeds of USD $55.0 million and on September 29, 2021, the underwriters of the aforementioned offering exercised their full over-allotment option to purchase an additional 825,000 shares (15% of the 5,500,000 common shares issued via the base offering referenced above) at a price of USD $10.00 per share, or CAD $12.74 per share, for gross proceeds of USD $8.3 million, collectively (“the Common Share Offering”). Total net cash proceeds from the Common Share Offering was CAD $73.2 million. However, the Bank’s share capital increased by CAD $75.1 million as a function of the Common Share Offering and tax effected issue costs of $5.4 million. The Bank listed on the Nasdaq under the symbol VBNK concurrent with the Common Share Offering on September 21, 2021; |

|

On April 30, 2021, the Bank completed a private placement with US institutional investors of non-viability contingent capital (“NVCC”) compliant fixed to floating rate subordinated notes payable (“the Notes”), in the principal amount of USD $75.0 million, equivalent to CAD $92.1 million as at April 30, 2021. Interest will be paid on the Notes semi-annually in arrears on May 1 and November 1 of each year, commencing on November 1, 2021, at a fixed rate of 5.00% per year, until May 1, 2026. Thereafter, if not redeemed by VersaBank, the Notes will have a floating interest rate payable at the 3-month Bankers’ Acceptance Rate plus 361 basis points, payable quarterly in arrears, on February 1, May 1, August 1 and November 1 of each year, commencing August 1, 2026, until maturity in May 2031. Egan-Jones Ratings Company assigned the Notes and the Bank an “A-” and “A” rating respectively, at the time of the private placement; |

|

On April 30, 2021, the Bank redeemed all of its outstanding Non-Cumulative Series 3 preferred shares (NVCC) using cash on hand. The amount paid on redemption for each share was $10.00, and in aggregate $16.8 million; |

|

On January 4, 2021, the Bank announced the appointment of Peter Irwin to the Bank’s Board of Directors, filling the vacant position left by the sudden passing of Colin E. Litton in December 2020. Mr. Irwin brings to the VersaBank Board more than 30 years of leadership experience in the Canadian financial services industry. His extensive background includes investment banking, capital markets, corporate development, merchant banking and private equity; and, |

|

On November 30, 2020, the Bank’s wholly owned subsidiary DRTC acquired 100% of the shares of 2021945 Ontario Inc., operating as Digital Boundary Group (“DBG”), in exchange for $8.5 million in cash and a deferred payment obligation of $1.4 million, for total consideration of $9.9 million. DBG is an information technology (IT) security assurance services firm with offices in London, Ontario and Dallas, Texas. DBG provides corporate and government clients with a suite of IT security assurance services, that range from external network, web and mobile application penetration testing through to physical social engineering engagements along with supervisory control and data acquisition (SCADA) system assessments, as well as various aspects of IT security training. |

Selected Financial Highlights

|

(unaudited) |

||||||||||||

|

October 31 |

October 31 |

October 31 |

||||||||||

|

($CDN thousands except per share amounts) |

2022 |

2021 |

2020 |

|||||||||

|

Results of operations |

||||||||||||

|

Interest income |

$ | 126,817 | $ | 89,488 | $ | 86,094 | ||||||

|

Net interest income |

76,666 | 60,157 | 54,125 | |||||||||

|

Non-interest income |

5,726 | 5,200 | 60 | |||||||||

|

Total revenue |

82,392 | 65,357 | 54,185 | |||||||||

|

Provision for (recovery of) credit losses |

451 | (438 | ) | (344 | ) | |||||||

|

Non-interest expenses |

49,393 | 35,006 | 27,777 | |||||||||

|

Digital banking |

42,392 | 31,046 | 26,758 | |||||||||

|

DRTC |

7,166 | 4,111 | 1,019 | |||||||||

|

Net income |

22,658 | 22,380 | 19,405 | |||||||||

|

Income per common share: |

||||||||||||

|

Basic |

$ | 0.79 | $ | 0.96 | $ | 0.82 | ||||||

|

Diluted |

$ | 0.79 | $ | 0.96 | $ | 0.82 | ||||||

|

Dividends paid on preferred shares |

$ | 988 | $ | 1,578 | $ | 2,168 | ||||||

|

Dividends paid on common shares |

$ | 2,741 | $ | 2,268 | $ | 2,112 | ||||||

|

Yield* |

4.47 | % | 4.11 | % | 4.62 | % | ||||||

|

Cost of funds* |

1.77 | % | 1.35 | % | 1.71 | % | ||||||

|

Net interest margin* |

2.70 | % | 2.76 | % | 2.90 | % | ||||||

|

Net interest margin on loans* |

3.08 | % | 3.35 | % | 3.42 | % | ||||||

|

Return on average common equity* |

6.61 | % | 8.45 | % | 7.89 | % | ||||||

|

Book value per common share* |

$ | 12.37 | $ | 11.61 | $ | 10.70 | ||||||

|

Efficiency ratio* |

60 | % | 54 | % | 51 | % | ||||||

|

Efficiency ratio - Digital banking* |

55 | % | 52 | % | 49 | % | ||||||

|

Return on average total assets* |

0.76 | % | 0.95 | % | 0.92 | % | ||||||

|

Gross impaired loans to total loans* |

0.01 | % | 0.00 | % | 0.00 | % | ||||||

|

Provision for (recovery of) credit losses as a % of average loans* |

0.02 | % | (0.02% | ) | (0.02% | ) | ||||||

|

as at |

||||||||||||

|

Balance Sheet Summary |

||||||||||||

|

Cash |

$ | 88,581 | $ | 271,523 | $ | 257,644 | ||||||

|

Securities |

141,564 | - | - | |||||||||

|

Loans, net of allowance for credit losses |

2,992,678 | 2,103,050 | 1,654,910 | |||||||||

|

Average loans* |

2,547,864 | 1,878,980 | 1,624,599 | |||||||||

|

Total assets |

3,265,998 | 2,415,086 | 1,943,885 | |||||||||

|

Deposits |

2,657,540 | 1,853,204 | 1,567,570 | |||||||||

|

Subordinated notes payable |

104,951 | 95,272 | 4,889 | |||||||||

|

Shareholders' equity |

350,675 | 332,106 | 255,288 | |||||||||

|

Capital ratios** |

||||||||||||

|

Risk-weighted assets |

$ | 2,714,902 | $ | 2,013,544 | $ | 1,580,939 | ||||||

|

Common Equity Tier 1 capital |

325,657 | 305,708 | 219,359 | |||||||||

|

Total regulatory capital |

448,575 | 418,718 | 255,471 | |||||||||

|

Common Equity Tier 1 (CET1) capital ratio |

12.00 | % | 15.18 | % | 13.88 | % | ||||||

|

Tier 1 capital ratio |

12.50 | % | 15.86 | % | 15.73 | % | ||||||

|

Total capital ratio |

16.52 | % | 20.80 | % | 16.16 | % | ||||||

|

Leverage ratio |

9.84 | % | 12.60 | % | 12.19 | % | ||||||

|

* See definition in "Non-GAAP and Other Financial Measures". |

|

** Capital management and leverage measures are in accordance with OSFI's Capital Adequacy Requirements |

|

and Basel III Accord. |

Business Outlook

VersaBank is active in underserved banking markets in Canada and the US that support more attractive pricing for its lending products, and further, continues to develop and expand its diverse deposit gathering network that provides efficient access to a range of low-cost deposit sources. In addition, VersaBank remains highly committed to, and focused on further developing and enhancing its technology advantage, a key component of its value proposition that not only provides efficient access to VersaBank’s chosen underserved lending and deposit markets, but also delivers superior financial products and better customer service to its clients.

Management continues to monitor the geo-political, economic and financial market risk precipitated by the conflict in Ukraine and its potential impact on VersaBank’s business. At this time, management has not identified any material direct or indirect risk exposure to VersaBank resulting from the conflict and will continue to assess available information and evaluate the situation as it evolves.

While VersaBank does not provide guidance on specific performance metrics, the commentary provided below discusses aspects of VersaBank’s business and certain expected trends related to same that, in management’s view, could potentially impact future performance.

Lending Assets

|

Canadian Point-of-Sale Financing: Consumer spending and business investment in Canada are expected to slow over the remainder of calendar 2022 and into 2023 as a function primarily of rising interest rates combined with persistent inflation. Notwithstanding the above, management anticipates that consumers will continue to spend, albeit at a tempered rate relative to 2022 in the various sectors to which the Bank provides POS financing supported to some extent by residual savings accumulated over the course of the pandemic. This consumer behaviour, combined with the anticipated addition of new origination partners in Canada, is expected to contribute to continued strong growth in the Bank’s POS Financing portfolio in fiscal 2023 that is more consistent with pre-fiscal 2022 levels, however, lower than the outsized growth experienced in fiscal 2022; |

|

US Receivable Purchase Program: Despite elevated inflation, higher gas prices and supply chain disruptions in the US, continued momentum in the job market and higher wages are expected to mitigate material declines in consumer spending, which in turn will support stable demand for durable goods and agricultural products which is expected to continue to stimulate transportation equipment purchases. Additionally, despite a cooling of the residential home market in the US, overall construction activity is expected to continue to expand modestly in the coming year, including residential homes, rental apartments, commercial properties, and public infrastructure which is anticipated to support demand for construction equipment in the near term. Moreover, despite higher borrowing costs and inflation, pent-up demand is anticipated to be sufficient to support manufacturers continuing to invest in process and equipment productivity initiatives in order to fulfil the current pipeline of orders in several end-use markets, including industrial machinery, materials handling equipment, and construction equipment. Management is of the view that the anticipated US macroeconomic and industry trends set out above will be supportive of healthy balance sheet growth in the US over the course of fiscal 2023 via the Bank’s RPP, which will be focused on the provision of commercial equipment financing over the course of the same period. The Bank’s RPP launched in a limited manner in the second quarter of fiscal 2022 with a large, North American, commercial transportation financing business focused on independent owner/operators; and, |

|

Commercial Real Estate: Management anticipates modest growth in the commercial mortgage sector specifically related to financing for residential housing properties over the course of fiscal 2023. Notwithstanding the highly effective risk mitigation strategies that are employed in managing this portfolio, including working with well-established, well-capitalized partners and maintaining modest loan-to-value ratios on individual transactions, management has taken a cautionary stance with respect to the CRE portfolio due to the anticipation of volatility in CRE asset valuations in a rising interest rate environment and the potential impact of same on borrowers’ ability to service debt, as well as due to concerns related to inflation and higher input costs, which continue to have the potential to drive higher construction costs. Additionally, management anticipates more meaningful participation in the B-20 compliant conventional, uninsured mortgage financing space, however, does not expect this lending activity to impact the Bank’s balance sheet until early fiscal 2023. |

Credit Quality

|

VersaBank lends to underserved markets that support more attractive pricing for its lending products but typically exhibit a lower-than-average risk profile generally as a function of the lower inherent risk associated with the underlying collateral assets and/or the structure of VersaBank’s offered financing arrangements; |

|

As at October 31, 2022, the Bank held one impaired loan totalling $279,000, which was subsequently fully repaid on November 1, 2022, and no delinquent loans on the balance sheet. The Bank continues to closely monitor its lending portfolio and origination partners, as well as the underlying borrowers, to ensure that management has good visibility on any credit trends that could provide an early warning indication of the emergence of any elevated risk in the lending portfolio; |

|

Available forward-looking macroeconomic and industry data are biased towards the negative. As a result, management anticipates that credit risk in its portfolio may increase modestly over the course of fiscal 2023 as a function primarily of continued, anticipated tightening of monetary policy in both Canada and the US and the ability of consumers and businesses to service debt at higher interest rates, the impact of elevated inflation and the effectiveness of strong labour markets and higher wages on mitigating same as well as geo-political risk derived from the continued crisis in Ukraine and the residual impact of the crisis on global supply chains. Notwithstanding the above, management also expects that the lower risk profile of VersaBank’s lending portfolio, which is a function of VersaBank’s prudent underwriting practices, structured lending products and focus on underserved financing markets within which it has a wealth of experience, will mitigate any escalation in forward credit risk in Bank’s lending portfolio; and, |

|

VersaBank has sourced credit risk modeling systems and forecast macroeconomic scenario data from Moody’s Analytics, a third-party service provider, for the purpose of computing forward-looking credit risk parameters under multiple macroeconomic scenarios that consider both market-wide and idiosyncratic factors and influences. These credit risk modeling systems are used in conjunction with VersaBank’s internally developed expected credit loss (“ECL”) models. Given that the Bank has experienced very limited historical losses and, therefore, does not have available statistically significant loss data inventory for use in developing internal, forward looking expected credit loss trends, the use of unbiased, third party forward-looking credit risk parameter modeling systems is particularly important for the Bank in the context of the estimation of expected credit losses. As discussed, management notes moderately deteriorating trends in the macroeconomic data currently being used as forward-looking information in VersaBank’s credit risk models and, depending on the growth trajectory and composition of the lending portfolio, these trends could result in higher ECL amounts and the Bank recognizing higher provisions for credit losses in the coming quarters. |

Funding and Liquidity

|

Management expects that commercial deposit volumes raised via VersaBank’s Trustee Integrated Banking (“TIB”) program will grow moderately over the course of fiscal 2023 as a function of an increase in the volume of consumer and commercial bankruptcy and proposal restructuring proceedings over the same timeframe, attributable primarily to a more challenging current and forecasted economic environment. Further, VersaBank continues to grow and expand its well-established, diverse deposit broker network through which it sources personal deposits, consisting primarily of guaranteed investment certificates; and, |

|

Management anticipates that liquidity levels will remain reasonably consistent over the course of fiscal 2023 as VersaBank continues to fund anticipated balance sheet growth across each of its lines of business. Further, management will continue to deploy cash into low risk, liquid securities with the objective of earning a more favourable yield on its available liquidity. |

Earnings and Capital

|

Earnings growth in fiscal 2023 is expected to be a function primarily of anticipated organic balance sheet growth from Digital Banking operations, specifically attributable to the Bank’s POS Financing and RPP businesses in Canada and the US, respectively, as well as incremental earnings contributions from DRTC, offset partially by elevated non-interest expenses early in the 2023 fiscal period attributable to costs related to transitory investment in the Bank’s business development initiatives, including the acquisition and integration of a US national bank, and the ongoing development of the Canadian-dollar version of VersaBank’s Digital Deposit Receipts, which are expected to be substantially completed in the first quarter of fiscal 2023. Additionally, management expects to incur higher costs associated with the recruitment and retention of staff in what remains a highly competitive labour market; |

|

Net interest income growth for fiscal 2023 is expected to be a function primarily of growth in VersaBank’s POS and RPP businesses in Canada and the US, respectively, disciplined liquidity management and the expectation that growth in the TIB program and further expansion of its diverse deposit broker network will have a favourable impact on VersaBank’s cost of funds; |

|

Non-interest income growth for fiscal 2023 is expected to be a function primarily of DRTC growing revenue from its suite of cybersecurity services; |

|

VersaBank’s capital ratios remain comfortably in excess of regulatory minimums. Management is of the view that VersaBank’s current capital levels are sufficient to accommodate balance sheet growth contemplated for fiscal 2023. Management will continue to closely monitor the capital markets to identify opportunities for VersaBank to raise additional regulatory capital on attractive terms in order to position VersaBank to support a potentially more robust growth profile in the future; |

|

Management does not anticipate increasing VersaBank’s dividend rate during fiscal 2023 to ensure that it continues to have adequate regulatory capital available to support contemplated balance sheet growth, as well as specific business development initiatives for earnings growth currently contemplated over the same timeframe and remain in compliance with its established regulatory capital ratio targets and thresholds; and, |

|

During the fourth quarter of fiscal 2022, VersaBank received approval from the TSX and Nasdaq to proceed with a NCIB for its common shares through which the Bank may purchase for cancellation up to 1,700,000 of its common shares, representing approximately 9.54% of its public float. If fully executed, the impact of the NCIB will not have a material impact on the Bank’s regulatory capital levels and ratios. The Bank had repurchased 195,300 shares under the NCIB as at October 31, 2022. |

There is potential that VersaBank may not realize or achieve the anticipated performance trends set out above as a function of a number of factors and variables including, but not limited to, the strength of the Canadian and US economies in general and the strength of the local economies in which VersaBank conducts operations; the effects of changes in monetary and fiscal policy, including changes in the interest rate policies of the Bank of Canada and the US Federal Reserve; global commodity prices; the effects of competition in the markets in which VersaBank operates; inflation; capital market fluctuations; the timely development and introduction of new products in receptive markets; the ability of VersaBank to grow its business and execute its strategy in the US market; the impact of changes in the laws and regulations regulating financial services; the impact of wars or conflicts including the crisis in Ukraine; and the impact of new variants of COVID-19 on the economy. Please see “Cautionary Note Regarding Forward-Looking Statements” on page 2 of this MD&A.

Financial Review - Earnings

Total Revenue

Total revenue, consisting of net interest income and non-interest income, increased 26% to $82.4 million compared to last year.

|

(thousands of Canadian dollars) |

||||||||||||

|

October 31 |

October 31 |

|||||||||||

|

For the year ended: |

2022 |

2021 |

Change |

|||||||||

|

Interest income |

||||||||||||

|

Point-of-sale loans and leases |

$ | 78,231 | $ | 48,215 | 62 | % | ||||||

|

Commercial real estate mortgages |

43,571 | 37,950 | 15 | % | ||||||||

|

Commercial real estate loans |

730 | 1,384 | (47 | %) | ||||||||

|

Public sector and other financing |

658 | 506 | 30 | % | ||||||||

|

Other |

3,627 | 1,433 | 153 | % | ||||||||

|

Interest income |

$ | 126,817 | $ | 89,488 | 42 | % | ||||||

|

Interest expense |

||||||||||||

|

Deposit and other |

$ | 44,600 | $ | 26,446 | 69 | % | ||||||

|

Subordinated notes |

5,551 | 2,885 | 92 | % | ||||||||

|

Interest expense |

$ | 50,151 | $ | 29,331 | 71 | % | ||||||

|

Net interest income |

$ | 76,666 | $ | 60,157 | 27 | % | ||||||

|

Non-interest income |

$ | 5,726 | $ | 5,200 | 10 | % | ||||||

|

Total revenue |

$ | 82,392 | $ | 65,357 | 26 | % | ||||||

Net Interest Income

FY 2022 vs FY 2021

Net interest income increased 27% to $76.7 million as a function primarily of:

|

Higher interest income earned on strong lending asset growth, attributable primarily to growth in the Bank’s POS Financing business; |

|

Higher yields earned on floating rate lending assets attributable to rising interest rates; and, |

|

Redeployment of available cash into higher yielding, low risk securities. |

Offset partially by:

|

Higher interest expense attributable to a shift in mix to higher personal deposit balances and rising interest rates; and, |

|

Higher interest expense attributable to the Notes issued in April 2021. |

Net Interest Margin

|

(thousands of Canadian dollars) |

||||||||||||

|

October 31 |

October 31 |

|||||||||||

|

For the year ended: |

2022 |

2021 |

Change |

|||||||||

|

Interest income |

$ | 126,817 | $ | 89,488 | 42 | % | ||||||

|

Interest expense |

50,151 | 29,331 | 71 | % | ||||||||

|

Net interest income |

76,666 | 60,157 | 27 | % | ||||||||

|

Average assets |

$ | 2,840,542 | $ | 2,179,486 | 30 | % | ||||||

|

Yield* |

4.47 | % | 4.11 | % | 9 | % | ||||||

|

Cost of funds* |

1.77 | % | 1.35 | % | 31 | % | ||||||

|

Net interest margin* |

2.70 | % | 2.76 | % | (2% | ) | ||||||

|

Average gross loans |

$ | 2,538,094 | $ | 1,873,227 | 35 | % | ||||||

|

Net interest margin on loans* |

3.08 | % | 3.35 | % | (8% | ) | ||||||

|

* See definition in "Non-GAAP and Other Financial Measures" section below. |

FY 2022 vs FY 2021

Net interest margin decreased 6 bps to 2.70% due primarily to:

|

Higher cost of funds attributable to a shift in the Bank’s funding mix and rising interest rates; |

|

A full year of interest expense attributable to the Notes issued in April 2021; and, |

|

The Bank successfully executing on its strategy to grow its POS Financing portfolio. |

Offset partially by:

|

Higher yields earned on the Bank’s lending portfolio, generally as a function of rising interest rates over the reporting period; |

|

Management adjusting the Bank’s liquidity management strategy to optimize average liquid/total asset ratios; and, |

|

Redeployment of available cash into higher yielding, low-risk securities. |

Non-Interest Income

Non-interest income is comprised of the consolidated gross profit generated by DRTC’s cybersecurity services business, or more specifically the gross profit of DBG as well as income derived from miscellaneous transaction fees not directly attributable to lending assets.

Non-interest income for the year ended October 31, 2022 was $5.7 million compared with $5.2 million a year ago and was comprised substantially of the consolidated gross profit of DBG of $5.6 million realized on service revenues of $9.8 million which were up 8% and 14% year over year respectively. The year over year trend was a function primarily of higher client engagement at DBG and the comparative period including only eleven months of operations due to the timing of the acquisition of DBG on November 30, 2020.

Provision for Credit Losses

|

(thousands of Canadian dollars) |

||||||||

|

October 31 |

October 31 |

|||||||

|

For the year ended: |

2022 |

2021 |

||||||

|

Provision for (recovery of) credit losses by lending asset: |

||||||||

|

Point-of-sale loans and leases |

$ | 270 | $ | 60 | ||||

|

Commercial real estate mortgages |

173 | (252 | ) | |||||

|

Commercial real estate loans |

9 | (92 | ) | |||||

|

Public sector and other financing |

(1 | ) | (154 | ) | ||||

|

Total provision for (recovery of) credit losses |

$ | 451 | $ | (438 | ) | |||

FY 2022 vs FY 2021

Provision for credit losses and the resulting PCL ratio were $451,000 and 0.02%, respectively, compared with a recovery of credit losses and PCL ratio of $438,000 and -0.02%, respectively, last year. The recovery recorded last year was attributable primarily to changes in the Bank’s lending asset portfolio mix, a partial recovery of a previously impaired asset in the amount of $116,000 and changes in the forward-looking information used in the Bank’s credit risk models in the period. The current year over year trend was a function primarily of:

|

Higher lending asset balances in the current period; and, |

|

Changes in the forward-looking information used by the Bank in its credit risk models in the current period. |

Non-Interest Expenses

|

(thousands of Canadian dollars) |

||||||||||||

|

October 31 |

October 31 |

|||||||||||

|

For the year ended: |

2022 |

2021 |

Change |

|||||||||

|

Salaries and benefits |

$ | 26,796 | $ | 20,243 | 32 | % | ||||||

|

General and administrative |

18,732 | 11,110 | 69 | % | ||||||||

|

Premises and equipment |

3,865 | 3,653 | 6 | % | ||||||||

|

Total non-interest expenses |

$ | 49,393 | $ | 35,006 | 41 | % | ||||||

|

Efficiency Ratio* |

59.95 | % | 53.56 | % | 12 | % | ||||||

|

* See definition in "Non-GAAP and Other Financial Measures". |

FY 2022 vs FY 2021

Non-interest expenses were up 41% to $49.4 million as a function primarily of:

|

Costs related to transitory investment in certain business development initiatives including, but not limited to, the planned acquisition of a US national bank, the development and initial launch of the US RPP, which will be offered broadly through the Bank’s US subsidiary on closing, and the ongoing development of the Canadian-dollar version of VersaBank’s Digital Deposit Receipts totaling $5.2 million, ($0.16 per share on an after tax basis). Investments associated with the acquisition and integration of the operations of the US national bank, including development of the RPP, are anticipated to be substantially completed by the end of the first quarter of fiscal 2023; |

|

Higher insurance premiums attributable to VersaBank’s listing on the Nasdaq in September 2021, which will reduce by 56% in 2023 as a result of management establishing the same comprehensive coverage through a new relationship with a financial institution-focused US insurance broker; |

|

Higher salary and benefits expense attributable to higher staffing levels to support expanded revenue-generating business activity across VersaBank and higher costs associated with employee retention totaling $2.6 million; and, |

|

Higher office and facility related costs attributable to the implementation of VersaBank’s return-to-work strategy. |

Tax Provision

The Bank’s effective tax rate for the current year was approximately 30% compared with approximately 27% in the prior year. The incremental increase in the Bank’s effective tax rate in the current year was attributable primarily to higher non-deductible expenses associated with employee stock options, which were issued as part of the Bank’s employee retention program early in the current year, and unrecognized non-capital losses, as well as temporary, incremental tax associated with initial limited launch of the Bank’s RPP in the US ahead of the planned acquisition of a US national bank. Provision for income taxes for fiscal 2022 was $9.9 million compared with $8.4 million last year. Management anticipates that the effective tax rate experienced in the current year will be reduced in fiscal 2023.

Comprehensive Income

Comprehensive income is comprised of net income for the period and other comprehensive income which consists of unrealized gains and losses on fair value through other comprehensive income associated with the foreign exchange gain or loss on translation of foreign operations. Comprehensive income for the year was $22.8 million compared to $22.4 million last year.

Financial Review – Balance Sheet

|

(thousands of Canadian dollars) |

||||||||||||

|

October 31 |

October 31 |

|||||||||||

|

2022 |

2021 |

Change |

||||||||||

|

Total assets |

$ | 3,265,998 | $ | 2,415,086 | 35 | % | ||||||

|

Cash and securities |

230,145 | 271,523 | (15 | %) | ||||||||

|

Loans, net of allowance for credit losses |

2,992,678 | 2,103,050 | 42 | % | ||||||||

|

Deposits |

2,657,540 | 1,853,204 | 43 | % | ||||||||

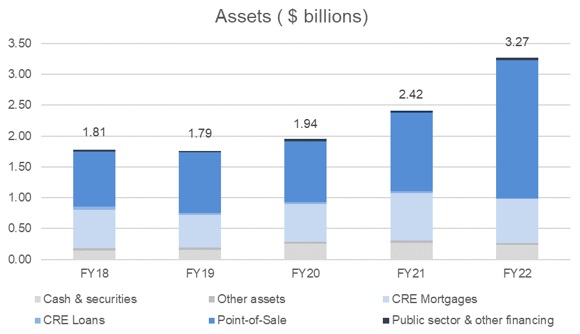

Total Assets

Total assets were up 35% to $3.27 billion at October 31, 2022 attributable primarily to strong growth in the Bank’s POS Financing portfolio, which was up 74% year over year offset partially by a modest decline in the Bank’s Commercial Real Estate portfolio.

Cash and securities

Cash and securities, which are held primarily for liquidity purposes, at October 31, 2022 was $230.1 million, or 7% of total assets, compared with $271.5 million, or 11% of total assets a year ago. The year over year decrease was a function primarily of the deployment of cash into higher yielding lending assets over the course of the 2022 fiscal year.

As at October 31, 2022, the Bank held securities totalling $141.6 million (2021 - $nil), comprised of a series of Government of Canada Treasury Bills and a US Government Treasury Bill. The series of Government of Canada Treasury Bills were purchased for $116.5 million with a face value totaling $117.5 million, resulting in a weighted average yield of 3.10% on the instruments, and with maturities ranging from November 8, 2022 to May 25, 2023. The US Government Treasury Bill was purchased for USD $17.99 million ($24.5 million) with a face value of USD $18.0 million ($24.6 million), resulting in a yield of 2.64% and maturing on November 8, 2022.

Loans

|

(thousands of Canadian dollars) |

||||||||||||

|

October 31 |

October 31 |

|||||||||||

|

2022 |

2021 |

Change |

||||||||||

|

Point-of-sale loans and leases |

$ | 2,220,894 | $ | 1,279,576 | 74 | % | ||||||

|

Commercial real estate mortgages |

710,369 | 757,576 | (6 | %) | ||||||||

|

Commercial real estate loans |

13,165 | 26,569 | (50 | %) | ||||||||

|

Public sector and other financing |

35,452 | 32,587 | 9 | % | ||||||||

| $ | 2,979,880 | $ | 2,096,308 | 42 | % | |||||||

VersaBank organizes its lending portfolio into the following four broad asset categories: Point-of-Sale Loans & Leases, Commercial Real Estate Mortgages, Commercial Real Estate Loans, and Public Sector and Other Financing. These categories have been established in VersaBank’s proprietary, internally developed asset management system and have been designed to catalogue individual lending assets as a function primarily of their key risk drivers, the nature of the underlying collateral, and the applicable market segment.

The Point-of-Sale Loans and Leases (“POS Financing”) asset category is composed of Point-of-Sale Loan and Lease Receivables acquired from VersaBank’s broad network of origination and servicing partners as well as Warehouse Loans that provide bridge financing to VersaBank’s origination and servicing partners for the purpose of accumulating and seasoning practical volumes of individual loans and leases prior to VersaBank purchasing the cashflow receivables derived from same.

The Commercial Real Estate Mortgages (“CRE Mortgages”) asset category is comprised of Commercial and Residential Construction Mortgages, Commercial Term Mortgages, Commercial Insured Mortgages and Land Mortgages. While all of these loans would be considered commercial loans or business-to-business loans, the underlying credit risk exposure is diversified across both the commercial and retail market segments, and further, the portfolio benefits from diversity in its underlying security in the form of a broad range of collateral properties.

The Commercial Real Estate Loans (“CRE Loans”) asset category is comprised primarily of Condominium Corporation Financing loans.

The Public Sector and Other Financing (“PSOF”) asset category is comprised primarily of Public Sector Loans and Leases, a small balance of Corporate Loans and Leases and Single Family Residential Conventional and Insured Mortgages. VersaBank has de-emphasized Corporate lending and continues to monitor the public sector space in anticipation of more robust demand for Federal, Provincial and Municipal infrastructure and other project financings.

FY 2022 vs FY 2021

Loans increased 42% to $2.99 billion as a function primarily of:

|

Higher POS Financing balances, which increased 74% year over year as a function primarily of continued strong demand for home finance, and home improvement/HVAC receivable financing. |

Offset partially by:

|

Lower CRE balances attributable primarily to scheduled repayments and a more conservative loan origination strategy in light of the evolving, challenging macroeconomic environment. |

Residential Mortgage Exposures

In accordance with the Office of the Superintendent of Financial Institutions (“OSFI”) Guideline B-20 – Residential Mortgage Underwriting Practices and Procedures, additional information is provided regarding the Bank’s residential mortgage exposure. For the purposes of the Guideline, a residential mortgage is defined as a loan to an individual that is secured by residential property (one-to-four-unit dwellings) and includes home equity lines of credit (“HELOCs”). This differs from the classification of residential mortgages used by the Bank which also includes multi-family residential mortgages.

Under OSFI’s definition, the Bank’s exposure to residential mortgages at October 31, 2022, was $4.0 million compared to $2.7 million a year ago. The Bank did not have any HELOCs outstanding at October 31, 2022, or a year ago.

Credit Quality and Allowance for Credit Losses

As discussed previously, at October 31, 2022, the Bank had one impaired loan on its balance sheet totalling $279,000 (October 31, 2021 - $nil). The impaired loan was fully repaid on November 1, 2022. Despite this impeccable credit performance we continue to monitor our lending assets, as well as the underlying borrowers and our origination partners closely to ensure that we have good visibility on any credit trends that could provide an early warning indication of the emergence of any elevated risk in our lending portfolio.

Allowance for Credit Losses

The Bank must maintain an allowance for expected credit losses or ECL allowance that is adequate, in management’s opinion, to absorb all credit related losses in the Bank’s lending and treasury portfolios. Under IFRS 9 the Bank’s ECL allowance is estimated using the expected credit loss methodology and is comprised of expected credit losses recognized on both performing loans, and non-performing, or impaired loans even if no actual loss event has occurred.

|

(thousands of Canadian dollars) |

||||||||||||

|

October 31 |

October 31 |

|||||||||||

|

2022 |

2021 |

Change |

||||||||||

|

ECL allowance by lending asset: |

||||||||||||

|

Point-of-sale loans and leases |

$ | 545 | $ | 275 | 98 | % | ||||||

|

Commercial real estate mortgages |

1,287 | 1,114 | 16 | % | ||||||||

|

Commercial real estate loans |

54 | 45 | 20 | % | ||||||||

|

Public sector and other financing |

18 | 19 | (5 | %) | ||||||||

|

Total ECL allowance |

$ | 1,904 | $ | 1,453 | 31 | % | ||||||

|

(thousands of Canadian dollars) |

||||||||||||

|

October 31 |

October 31 |

|||||||||||

|

2022 |

2021 |

Change |

||||||||||

|

ECL allowance by stage: |

||||||||||||

|

ECL allowance stage 1 |

$ | 1,766 | $ | 1,316 | 34 | % | ||||||

|

ECL allowance stage 2 |

138 | 137 | 1 | % | ||||||||

|

ECL allowance stage 3 |

- | - | ||||||||||

|

Total ECL allowance |

$ | 1,904 | $ | 1,453 | 31 | % | ||||||

The Bank’s ECL allowance at October 31, 2022 was $1.9 million compared to $1.5 million a year ago. The year over year trend was a function primarily of:

|

Higher lending asset balances; and, |

|

Changes in the forward-looking information used by VersaBank in its credit risk models. |

Offset partially by:

|

Changes in VersaBank’s lending asset portfolio mix. |

The Bank’s gross impaired loans at October 31, 2022 were $279,000 (October 31, 2021 – $nil).

Assessment of significant increase in credit risk (“SICR”)

At each reporting date, the Bank assesses whether or not there has been a SICR for loans since initial recognition by comparing, at the reporting date, the risk of default occurring over the remaining expected life against the risk of default at initial recognition.

SICR is a function of the loan’s internal risk rating assignment, internal watchlist status, loan review status and delinquency status which are updated as necessary in response to changes including, but not limited to, changes in macroeconomic and/or market conditions, changes in a borrower’s credit risk profile, and changes in the strength of the underlying security, including guarantor status, if a guarantor exists.

Quantitative models may not always be able to capture all reasonable and supportable information that may indicate a SICR. As a result, qualitative factors may be considered to supplement such a gap. Examples include changes in adjudication criteria for a particular group of borrowers or asset categories or changes in portfolio composition as well as changes in Canadian and US macroeconomic trends attributable to changes in monetary policy, inflation, employment rates, consumer behaviour and geo-political risks.

Expected credit loss model – Estimation of expected credit losses

Expected credit losses are an estimate of a loan’s expected cash shortfalls discounted at the effective interest rate, where a cash shortfall is the difference between the contractual cash flows that are due to the Bank and the cash flows that the Bank actually expects to receive.

Forward-Looking Information

The Bank incorporates the impact of future economic conditions, or more specifically forward-looking information into the estimation of expected credit losses at the credit risk parameter level. This is accomplished via the credit risk parameter models and proxy datasets that the Bank utilizes to develop probability of default, (“PD”) and loss given default, (“LGD”) term structure forecasts for its loans. The Bank has sourced credit risk modeling systems and forecast macroeconomic scenario data from Moody’s Analytics, a third party service provider for the purpose of computing forward-looking credit risk parameters under multiple macroeconomic scenarios that consider both market-wide and idiosyncratic factors and influences. These systems are used in conjunction with the Bank’s internally developed ECL models. Given that the Bank has experienced very limited historical losses and, therefore, does not have available statistically significant loss data inventory for use in developing internal, forward looking expected credit loss trends, the use of unbiased, third party forward-looking credit risk parameter modeling systems is particularly important for the Bank in the context of the estimation of expected credit losses.

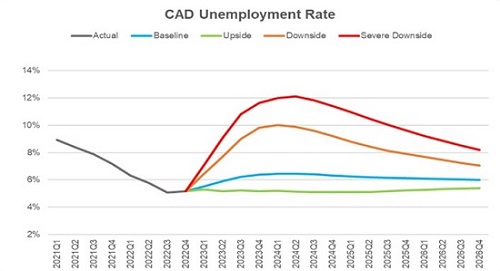

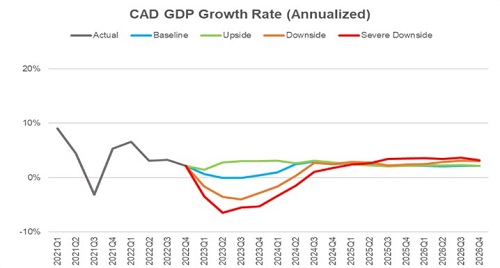

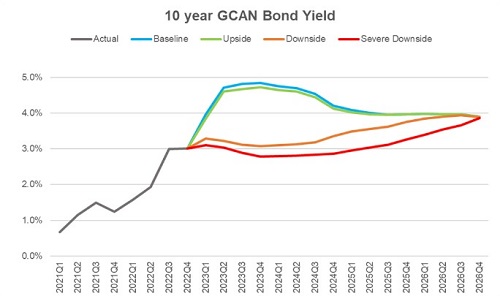

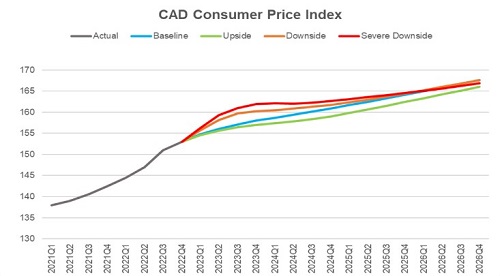

The Bank utilizes macroeconomic indicator data derived from multiple macroeconomic scenarios in order to mitigate volatility in the estimation of expected credit losses, as well as to satisfy the IFRS 9 requirement that future economic conditions are to be based on an unbiased, probability-weighted assessment of possible future outcomes. More specifically, the macroeconomic indicators set out in the macroeconomic scenarios are used as inputs for the credit risk parameter models utilized by the Bank to sensitize the individual PD and LGD term structure forecasts to the respective macroeconomic trajectory set out in each of the scenarios (see Expected Credit Loss Sensitivity below). Currently the Bank utilizes upside, downside and baseline forecast macroeconomic scenarios, and assigns discrete weights to each for use in the estimation of its reported ECL. The Bank has also applied expert credit judgement, where appropriate, to reflect, amongst other items, uncertainty in the Canadian and US macroeconomic environments.

The macroeconomic indicator data utilized by the Bank for the purpose of sensitizing PD and LGD term structure data to forward economic conditions include, but are not limited to: GDP, the national unemployment rate, long term interest rates, the consumer price index, the S&P/TSX Index and the price of oil. These specific macroeconomic indicators were selected in an attempt to ensure that the spectrum of fundamental macroeconomic influences on the key drivers of the credit risk profile of the Bank’s balance sheet, including: corporate, consumer and real estate market dynamics; corporate, consumer and SME borrower performance; geography; as well as collateral value volatility, are appropriately captured and incorporated into the Bank’s forward macroeconomic sensitivity analysis.

Key assumptions driving the base case macroeconomic forecast trends this quarter include: the Bank of Canada, (“BoC”) continuing to tighten monetary policy with the overnight rate reaching 4.5% in early 2023; consumer spending declines and business investment slows as a function primarily of higher rates and persistent inflation; inflation beings to decelerate consistently in early 2023, in line with the anticipated end of the current monetary policy tightening cycle; the housing market continues to cool attributable to higher interest rates which dampen demand, causing home values to continue to decline; a mild technical recession emerges along with rising unemployment in early 2023 as consumption slows and firms dial back their growth plans; public health restrictions do not return even as new COVID-19 case counts occasionally spike through the winter; and, supply-chain stress continues to ease as global vaccination rates improve and good demand softens.

Management developed ECL estimates using credit risk parameter term structure forecasts sensitized to individual baseline, upside and downside forecast macroeconomic scenarios, each weighted at 100%, and subsequently computed the variance of each to VersaBank’s reported ECL as at October 31, 2022 in order to assess the alignment of VersaBank’s reported ECL with VersaBank’s credit risk profile, and further, to assess the scope, depth and ultimate effectiveness of the credit risk mitigation strategies that VersaBank has applied to its lending portfolios (see Expected Credit Loss Sensitivity below).

A summary of the key forecast macroeconomic indicator data trends utilized by VersaBank for the purpose of sensitizing lending asset credit risk parameter term structure forecasts to forward looking information, which in turn are used in the estimation of VersaBank’s reported ECL, as well as in the assessment of same are presented in the charts below.

|

|

|

|

Expected Credit Loss Sensitivity:

The following table presents the sensitivity of the Bank’s estimated ECL to a range of individual forecast macroeconomic scenarios, that in isolation may not reflect the Bank’s actual expected ECL exposure, as well as the variance of each to the Bank’s reported ECL as at October 31, 2022:

| (thousands of Canadian dollars) | ||||||||||||||||

| Reported | 100% | 100% | 100% | |||||||||||||

| ECL | ||||||||||||||||

| Upside | Baseline | Downside | ||||||||||||||

| Allowance for expected credit losses | $ | 1,904 | $ | 1,350 | $ | 1,786 | $ | 2,474 | ||||||||

| Variance from reported ECL | (554 | ) | (118 | ) | 570 | |||||||||||

| Variance from reported ECL (%) | (29 | %) | (6 | %) | 30 | % | ||||||||||

Management is of the view that forward industry and macroeconomic trends will be biased slightly to the downside as a function of management’s expectation that higher interest rates will continue to pressure consumer and corporate balance sheets in the medium term and supply chain disruptions, albeit diminished will persist into 2023 precipitating continued, elevated inflation levels despite anticipated monetary policy trends. As a result management anticipates that VersaBank’s estimated ECL amounts will exhibit some volatility over the course of fiscal 2023 which may result in the Bank recognizing higher provisions for credit losses in the coming quarters.

Considering the analysis set out above and based on management’s review of the loan and credit data comprising VersaBank’s lending portfolio, combined with management’s interpretation of the available forecast macroeconomic and industry data, management is of the view that its reported ECL allowance represents a reasonable proxy for potential, future losses.

Deposits

VersaBank has established three core funding channels, those being personal deposits, commercial deposits, and cash reserves retained from VersaBank’s POS Financing origination partners that are classified as other liabilities, which are discussed in the Other Assets and Liabilities section below.

|

(thousands of Canadian dollars) |

||||||||||||

|

October 31 |

October 31 |

|||||||||||

|

2022 |

2021 |

Change |

||||||||||

|

Commercial deposits |

$ | 598,413 | $ | 606,143 | (1 | %) | ||||||

|

Personal deposits |

2,059,127 | 1,247,061 | 65 | % | ||||||||

|

Total deposits |

$ | 2,657,540 | $ | 1,853,204 | 43 | % | ||||||

Personal deposits, consisting principally of guaranteed investment certificates, are sourced primarily through a well-established and well-diversified deposit broker network that the Bank continues to grow and expand across Canada.

Commercial deposits are sourced primarily via specialized operating accounts made available to insolvency professionals (“Trustees”) in the Canadian insolvency industry. The Bank developed customized banking software for use by Trustees that integrates banking services with the market-leading software platform used in the administration of consumer bankruptcy and proposal restructuring proceedings.

FY 2022 vs FY 2021

Deposits increased 43% to $2.7 billion as a function primarily of:

|

Higher personal deposits attributable to VersaBank increasing activity in its broker market network to fund balance sheet growth. |

Offset partially by:

|

Modestly lower commercial deposits attributable to withdrawals made by Trustees to fund normal course disbursements associated with insolvency restructurings. |

Notwithstanding the year over year commercial deposit trend management expects commercial deposit volumes to grow measurably over the course of fiscal 2023 as a function of an anticipated increase in the volume of consumer bankruptcy and proposal restructuring proceedings over the same timeframe, attributable primarily to a more challenging current and forecasted economic environment.

The table below presents a summary of the Bank’s deposit portfolio by maturity, excluding accrued interest at October 31, 2022 as well as for 2021:

|

2022 |

||||||||||||||||||||||||

|

Within 3 |

3 months to |

1 year to |

2 years to |

Over |

||||||||||||||||||||

|

(thousands of Canadian dollars) |

months |

1 year |

2 years |

5 years |

5 years |

Total |

||||||||||||||||||

|

Commercial deposits |

$ | 598,413 | $ | - | $ | - | $ | - | $ | - | $ | 598,413 | ||||||||||||

|

Personal deposits |

184,686 | 904,664 | 529,806 | 412,739 | 331 | 2,032,226 | ||||||||||||||||||

| $ | 783,099 | $ | 904,664 | $ | 529,806 | $ | 412,739 | $ | 331 | $ | 2,630,639 | |||||||||||||

|

2021 |

||||||||||||||||||||||||

|

Within 3 |

3 months to |

1 year to |

2 years to |

Over |

||||||||||||||||||||

|

(thousands of Canadian dollars) |

months |

1 year |

2 years |

5 years |

5 years |

Total |

||||||||||||||||||

|

Commercial deposits |

$ | 606,143 | $ | - | $ | - | $ | - | $ | - | $ | 606,143 | ||||||||||||

|

Personal deposits |

150,323 | 399,376 | 272,782 | 411,649 | - | 1,234,130 | ||||||||||||||||||

| $ | 756,466 | $ | 399,376 | $ | 272,782 | $ | 411,649 | $ | - | $ | 1,840,273 | |||||||||||||

Subordinated Notes Payable

|

(thousands of Canadian dollars) |

||||||||

|

October 31 |

October 31 |

|||||||

|

2022 |

2021 |

|||||||

|

Ten year term, unsecured, non-viability contingent capital compliant, subordinated notes payable, principal amount of $5.0 million, effective interest rate of 10.41%, maturing March 2029. |

$ | 4,908 | $ | 4,898 | ||||

|

Ten year term, unsecured, non-viability contingent capital compliant, subordinated notes payable, principal amount of USD $75.0 million, effective interest rate of 5.38%, maturing May 2031. |

100,043 | 90,374 | ||||||

| $ | 104,951 | $ | 95,272 | |||||

Subordinated notes payable, net of issue costs, were $105.0 million at October 31, 2022, compared to $95.3 million a year ago. The year over year trends was a function primarily of changes in the USD/CAD foreign exchange spot rate.

On April 30, 2021, the Bank completed a private placement with US institutional investors of NVCC compliant fixed to floating rate subordinated notes payable in the principal amount of USD $75.0 million, equivalent to CAD $92.1 million as at April 30, 2021. Interest will be paid on the Notes semi-annually in arrears on May 1 and November 1 of each year, commencing on November 1, 2021, at a fixed rate of 5.00% per year, until May 1, 2026. Thereafter, if not redeemed by the Bank, the Notes will have a floating interest rate payable at the 3-month Bankers’ Acceptance Rate plus 361 basis points, payable quarterly in arrears, on February 1, May 1, August 1 and November 1 of each year, commencing August 1, 2026, until the maturity date. The Notes will mature on May 1, 2031, unless earlier repurchased or redeemed in accordance with their terms. On or after May 1, 2026, the Bank may, at its option, with the prior approval of the Superintendent of Financial Institutions (Canada), redeem the Notes, in whole at any time or in part from time to time on not less than 30 nor more than 60 days’ prior notice, at a redemption price which is equal to par, plus accrued and unpaid interest. Issue costs associated with the Notes were approximately CAD $2.6 million.. Egan-Jones Ratings Company assigned the Notes and the Bank an “A-” and “A” rating respectively, at the time of the private placement.

$500,000 of the Bank’s $5.0 million subordinated notes payable, issued in March 2019, are held by a related party (see note 19 to the Consolidated Financial Statements for additional information on related party transactions and balances).

Other Assets and Liabilities

Other Assets

|

(thousands of Canadian dollars) |

||||||||||||

|

October 31 |

October 31 |

|||||||||||

|

2022 |

2021 |

Change |

||||||||||

|

Accounts receivable |

$ | 3,774 | $ | 2,643 | 43 | % | ||||||

|

Prepaid expenses and other |

16,391 | 12,699 | 29 | % | ||||||||

|

Property and equipment |

6,868 | 7,075 | (3 | %) | ||||||||

|

Right-of-use assets |

4,122 | 4,817 | (14 | %) | ||||||||

|

Deferred income tax asset |

2,128 | 2,931 | (27 | %) | ||||||||

|

Investment |

953 | 953 | 0 | % | ||||||||

|

Goodwill |

5,754 | 5,754 | 0 | % | ||||||||

|

Intangible assets |

3,185 | 3,641 | (13 | %) | ||||||||

|

Total other assets |

$ | 43,175 | $ | 40,513 | 7 | % | ||||||

FY 2022 vs FY 2021

Other assets were up 7% to $43.2 million as a function primarily of:

|

Higher prepaid expenses and other attributable primarily to the capitalization of compensation costs and various costs relating to business development initiatives; and, |

|

Higher accounts receivable attributable primarily to the normal course timing of general corporate receivables. |

Offset partially by:

|

Lower capitalized assets due to amortization; and, |

|

Lower deferred income tax asset primarily attributable to timing differences in the recognition of certain deferred income tax amounts. |

Other Liabilities

|

(thousands of Canadian dollars) |

||||||||||||

|

October 31 |

October 31 |

|||||||||||

|

2022 |

2021 |

Change |

||||||||||

|

Accounts payable and other |

$ | 7,662 | $ | 6,893 | 11 | % | ||||||

|

Current income tax liability |

5,797 | 2,949 | 97 | % | ||||||||

|

Deferred income tax liability |

786 | 898 | (12 | %) | ||||||||

|

Lease obligations |

4,471 | 5,113 | (13 | %) | ||||||||

|

Cash collateral and amounts held in escrow |

8,006 | 7,887 | 2 | % | ||||||||

|

Cash reserves on loan and lease receivables |

126,110 | 110,764 | 14 | % | ||||||||

|

Total other liabilities |

$ | 152,832 | $ | 134,504 | 14 | % | ||||||

FY 2022 vs FY 2021

Other liabilities were up 14% to $152.8 million as a function primarily of:

|

VersaBank recognizing higher current income taxes payable in current fiscal year after utilizing the bulk of the Bank’s available income tax loss carryforwards in the prior fiscal year; |

|

Higher cash reserve balances attributable to higher POS Financing portfolio balances; and, |

|

General increase in accounts payable attributable to increased earning activity. |

Shareholders’ Equity

Shareholders’ equity was $350.7 million at October 31, 2022 compared to $332.1 million a year ago. The year over year trend was a function primarily of:

|

Higher retained earnings attributable to net income earned over the course of the year; and, |

|

Higher contributed surplus attributable to the fair value of the stock-based compensation. |

Offset partially by:

|

The purchase and cancellation of common shares pursuant to the Bank’s NCIB; and, |

|

Payment of dividends. |

The summary of the Banks’ issued and outstanding share capital is as follows:

| (thousands of Canadian dollars) | ||||||||||||||||

| 2022 | 2021 | |||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||

| Common shares: | ||||||||||||||||

| Balance, beginning of the year | 27,441,082 | $ | 227,674 | 21,123,559 | $ | 152,612 | ||||||||||

| Issued during the year | - | - | 6,325,000 | 75,101 | ||||||||||||

| Cancelled during the year | (195,300 | ) | (1,692 | ) | (7,477 | ) | (39 | ) | ||||||||

| Outstanding, end of year | 27,245,782 | $ | 225,982 | 27,441,082 | $ | 227,674 | ||||||||||

| Series 1 preferred shares: | ||||||||||||||||

| Outstanding, beginning and end of year | 1,461,460 | $ | 13,647 | 1,461,460 | $ | 13,647 | ||||||||||

| Series 3 perferred shares: | ||||||||||||||||

| Balance, beginning of the year | - | $ | - | 1,681,320 | $ | 15,690 | ||||||||||

| Redemption of preferred shares | - | - | (1,681,320 | ) | (15,690 | ) | ||||||||||

| Outstanding, end of year | - | $ | - | - | $ | - | ||||||||||

| Total share capital | 0 | $ | 239,629 | 0 | $ | 241,321 | ||||||||||

On August 5, 2022, the Bank received approval from the TSX to proceed with a NCIB for its common shares. On September 21, 2022, the Bank received approval from the Nasdaq to proceed with a NCIB for its common shares. Pursuant to the NCIB, VersaBank may purchase for cancellation up to 1,700,000 of its common shares representing approximately 9.54% of its public float. VersaBank’s directors and management believe that the market price of VersaBank’s common shares does not reflect the value of the business and the future prospects of same, and further, reflects a material discount to book value and as such the purchase of common shares for cancellation at such time is a prudent corporate measure and represents an attractive investment for the Bank.

The Bank was eligible to makes purchases commencing on August 17, 2022 and will terminate on August 16, 2023, or such earlier date as VersaBank may complete its purchases pursuant to the NCIB. The purchases will be made by VersaBank through the facilities of the TSX and alternate trading systems and in accordance with the rules of the TSX or such alternate trading systems, as applicable, and the prices that VersaBank will pay for any Common Shares will be the market price of such shares at the time of acquisition. VersaBank will make no purchases of Common Shares other than open market purchases. All shares purchased under the NCIB will be cancelled.

For the year ended October 31, 2022, the Bank purchased and cancelled 195,300 Common Shares at an aggregate cost of $1.9 million, reducing the Bank’s Common Share value by $1.7 million and retained earnings by $238,000.

On October 7, 2021, the Bank cancelled, and returned to treasury, 7,477 common shares with a value of $39,000 or $5.24 per common share. The cancelled shares represent predecessor share classes which had not been deposited and exchanged for VersaBank common shares in connection with the Bank’s amalgamation with PWC Capital Inc. on January 31, 2017.

On September 21, 2021 the Bank completed a treasury offering of 5,500,000 common shares at a price of USD $10.00 per share, the equivalent of CAD $12.68 per share for gross proceeds of USD $55.0 million. On September 29, 2021, the underwriters of the aforementioned offering exercised their full over-allotment option to purchase an additional 825,000 shares (15% of the 5,500,000 common shares issued via the base offering referenced above) at a price of USD $10.00 per share, or CAD $12.74 per share for gross proceeds of USD $8.3 million. Total net cash proceeds from the Common Share Offering was CAD $73.2 million. However, the Bank’s share capital increased by CAD $75.1 million as a function of the Common Share Offering and tax effected issue costs of CAD $5.4 million. The Bank’s issue costs are subject to current and future tax deductions and as such the Bank has recognized a deferred tax asset corresponding to same.

On April 30, 2021, the Bank redeemed all of its 1,681,320 outstanding, Non-Cumulative Series 3 preferred shares (NVCC) using cash on hand. The amount paid on redemption for each share was $10.00, and in aggregate $16.8 million. The initial capitalized transaction costs of $1.1 million were applied against retained earnings.

The Bank’s book value per common share at October 31, 2022 was $12.37 compared to $11.61 a year ago. The year over year trend was a function primarily of higher retained earnings attributable to net income earned in each of the periods and the purchase and cancellation of common shares pursuant to the Bank’s NCIB, offset partially by the payment of dividends over the respective periods.

See note 12 to the Consolidated Financial Statements for additional information relating to share capital.

Stock-Based Compensation

The Bank has a stock option plan for its employees and officers. Options are granted at an exercise price set at the closing market price of the Bank’s common shares on the day preceding the date on which the option is granted and are exercisable within five years of issue. Options are usually granted with graded vesting terms. One third vests on the first anniversary of the grant date, one third vests on the second anniversary of the grant date and one third vests on the third anniversary of the grant date.

|

2022 |

2021 |

|||||||||||||||

|

Weighted |

Weighted |

|||||||||||||||

|

Number of |

average |

Number of |

average |

|||||||||||||

|

options |

exercise price |

options |

exercise price |

|||||||||||||

|

Outstanding, beginning of period |

40,000 | $ | 7.00 | 42,017 | $ | 10.73 | ||||||||||

|

Granted |

971,707 | 15.90 | - | - | ||||||||||||

|

Exercised |

- | - | - | - | ||||||||||||

|

Forfeited/cancelled |

(45,941 | ) | 15.90 | - | - | |||||||||||

|

Expired |

- | - | (2,017 | ) | 10.73 | |||||||||||

|

Outstanding, end of period |

965,766 | $ | 15.53 | 40,000 | $ | 7.00 | ||||||||||

For the year ended October 31, 2022, the Bank recognized stock-based compensation expense of $1.5 million (2021 - $nil) related to the estimated fair value of options granted. The fair value of the 971,707 stock options granted over the course of the current fiscal year and was estimated at the grant dates using the Black-Scholes valuation model and the following input assumptions: risk-free rate of 1.39%, expected option life of 3.5 years, expected volatility of 29.5%, expected annual dividends of 0.64% and a forfeiture rate of 2.0%. The fair value of each stock options granted were estimated at $3.10 per share. As at October 31, 2022, 40,000 common share stock options were fully vested and exercisable at $7.00 per share and expire in October 2023.

Updated Share Information

Subsequent to October 31, 2022, the Bank purchased and cancelled 17,600 common shares and as at December 6, 2022, the number of common shares outstanding totalled 27,228,182. There were no changes in the number of Series 1 preferred shares and common share options outstanding compared to October 31, 2022.

Off-Balance Sheet Arrangements

As at October 31, 2022, VersaBank did not have any significant off-balance sheet arrangements other than loan commitments and letters of credit attributable to normal course business activities. See note 20 to the Consolidated Financial Statements for more information.

Commitments and Contingencies

The amount of credit related commitments represents the maximum amount of additional credit that the Bank could be obliged to extend. Under certain circumstances, the Bank may cancel loan commitments at its option. Letters of credit amounts are not necessarily indicative of the associated credit risk exposure as many of these secured arrangements are contracted for a limited period of time and will expire or terminate without being drawn upon.

|

(thousands of Canadian dollars) |

2022 |

2021 |

||||||

|

Loan commitments |

$ | 382,851 | $ | 296,248 | ||||

|