| December 6, 2022Commercial Opportunity Deep Dive for Milestone PharmaceuticalsJoe OlivetoLorenz MullerChief Executive OfficerChief Commercial Officer |

| Forward Looking Statement2Milestone Commercial Deep-Dive December 6, 2022

ThePresentationcontainsforward-lookingstatementswithinthemeaningofthesafeharborprovisionsofthePrivateSecuritiesLitigationReformActof1995,asamend |

| Commercial Deep-Dive Agenda•Introduction and Overview of Milestone Pharmaceuticals•PSVT Disease Burden –The Problem•Etripamil –Value Proposition•Where Do We Play –Market Size•How Do We Engage –Commercial Strategy3Milestone Commercial Deep-Dive December 6, 2022 |

| Commercial Deep-Dive Agenda•Introduction and Overview of Milestone Pharmaceuticals•PSVT Disease Burden –The Problem•Etripamil –Value Proposition•Where Do We Play –Market Size•How Do We Engage –Commercial Strategy4Milestone Commercial Deep-Dive December 6, 2022 |

| Joseph OlivetoChief Executive OfficerAmit HasijaChief Financial Officer David Bharucha, MD, PhDChief Medical Officer Francis Plat, MD Chief Scientific OfficerLorenz MullerChief Commercial OfficerJeff NelsonChief Operating OfficerManagement Team5 Milestone Commercial Deep-Dive December 6, 2022 |

| Investment Highlights1.Etripamilpotentially offers patients with PVST control over their condition through rapid resolution of episodes when and wherever they occur2.PSVT is a large untapped market with high unmet need for Patients and Health Care Providers 3.Experienced team with deep understanding of the market from 5+ years of stakeholder engagement4.Phase 3 clinical trials in PSVT deliver clear statistical efficacy and safety appropriate for patient self-use5.NDA submission expected mid-2023 enables clear path to market6.Development in AFib with Rapid Ventricular Rate (AFib-RVR) represents potential to drive future growthMilestone Commercial Deep-Dive December 6, 20226 |

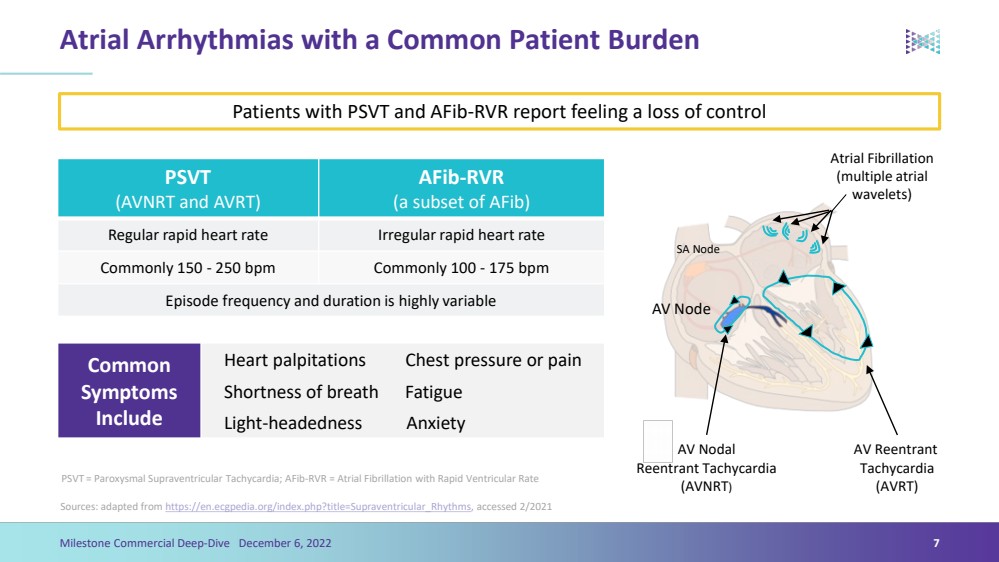

| Atrial Arrhythmias with a Common Patient BurdenSources: adapted from https://en.ecgpedia.org/index.php?title=Supraventricular_Rhythms , accessed 2/20217Milestone Commercial Deep-Dive December 6, 2022 PSVT(AVNRT and AVRT)AFib-RVR (a subset of AFib)Regular rapid heart rateIrregular rapid heart rateCommonly 150 -250 bpmCommonly 100 -175 bpmEpisode frequency and duration is highly variable AV NodeSA Node Atrial Fibrillation (multiple atrial wavelets) AV ReentrantTachycardia (AVRT) AV Nodal ReentrantTachycardia (AVNRT) Patients with PSVT and AFib-RVR report feeling a loss of controlPSVT = Paroxysmal Supraventricular Tachycardia; AFib-RVR = Atrial Fibrillation with Rapid Ventricular Rate Common Symptoms IncludeHeart palpitations Chest pressure or painShortness of breath FatigueLight-headedness Anxiety |

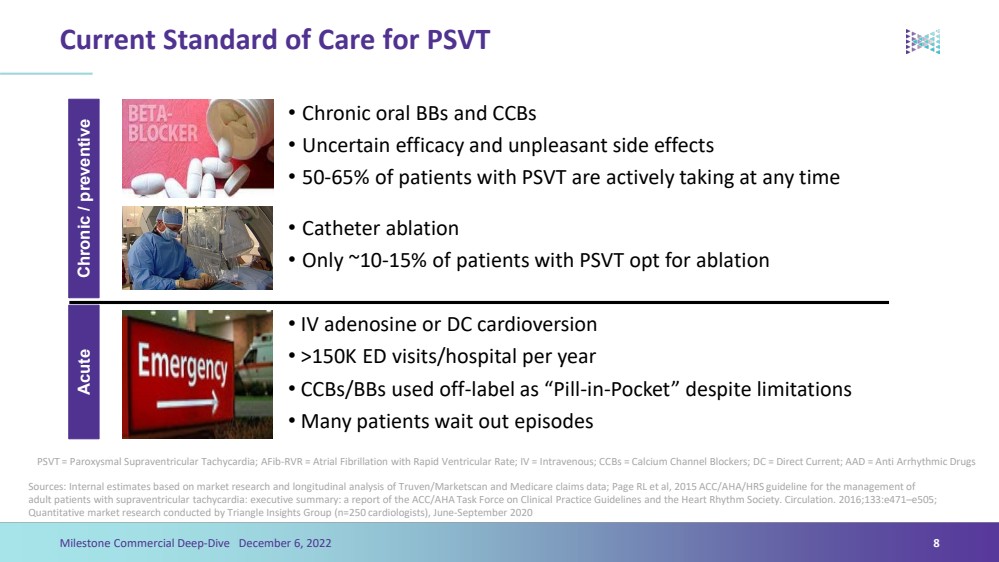

| Current Standard of Care for PSVTSources: Internal estimates based on market research and longitudinal analysis of Truven/Marketscanand Medicare claims data; Page RL et al, 2015 ACC/AHA/HRS guideline for the management of adult patients with supraventricular tachycardia: executive summary: a report of the ACC/AHA Task Force on Clinical Practice Guidelines and the Heart Rhythm Society. Circulation. 2016;133:e471–e505; Quantitative market research conducted by Triangle Insights Group (n=250 cardiologists), June-September 2020 8PSVT = Paroxysmal Supraventricular Tachycardia; AFib-RVR = Atrial Fibrillation with Rapid Ventricular Rate; IV = Intravenous; CCBs = Calcium Channel Blockers; DC = Direct Current; AAD = Anti Arrhythmic Drugs Chronic / preventive Acute •IV adenosine or DC cardioversion•>150K ED visits/hospital per year•CCBs/BBs used off-label as “Pill-in-Pocket” despite limitations•Many patients wait out episodes•Chronic oral BBs and CCBs•Uncertain efficacy and unpleasant side effects•50-65% of patients with PSVT are actively taking at any time •Catheter ablation•Only ~10-15% of patients with PSVT opt for ablation Milestone Commercial Deep-Dive December 6, 2022 |

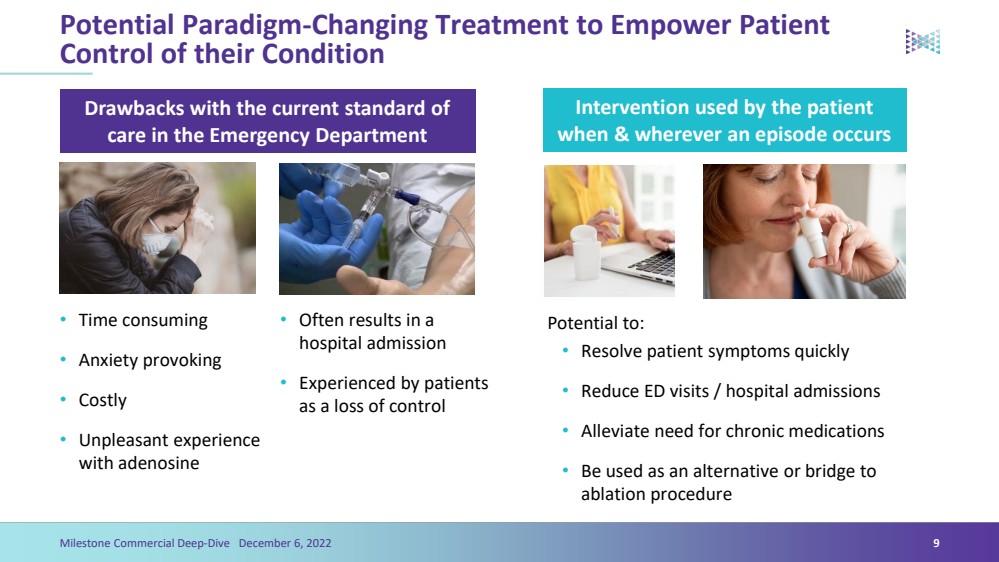

| Potential Paradigm-Changing Treatment to Empower Patient Control of their Condition•Time consuming•Anxiety provoking •Costly•Unpleasant experience with adenosine 9Milestone Commercial Deep-Dive December 6, 2022 Drawbacks with the current standard of care in the Emergency Department•Often results in a hospital admission•Experienced by patients as a loss of control Intervention used by the patient when & wherever an episode occurs •Resolve patient symptoms quickly•Reduce ED visits / hospital admissions•Alleviate need for chronic medications•Be used as an alternative or bridge to ablation procedure Potential to: |

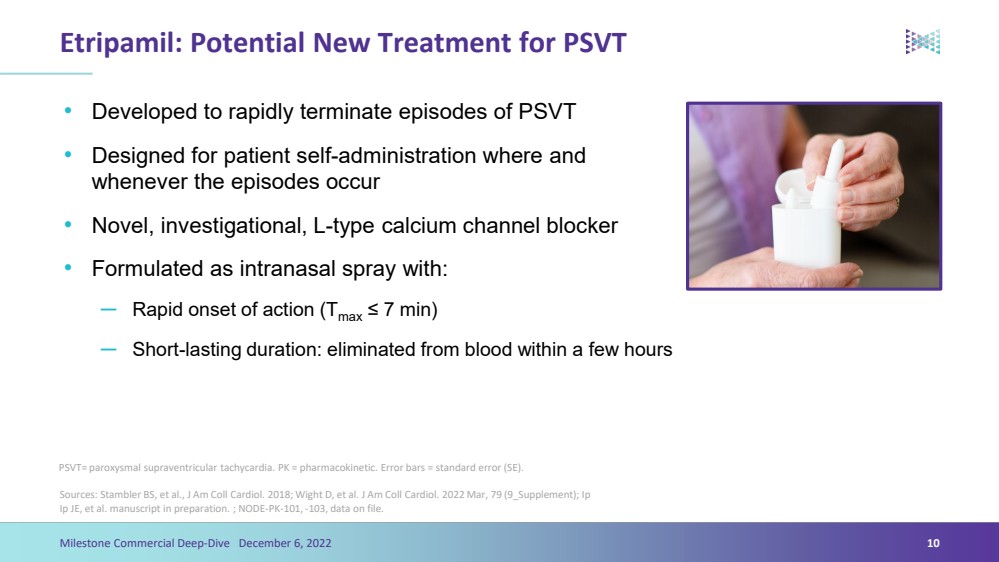

| Etripamil: PotentialNew Treatment for PSVTSources: Stambler BS, et al., J Am Coll Cardiol. 2018; Wight D,et al.J Am Coll Cardiol.2022 Mar, 79 (9_Supplement); Ip IpJE, et al. manuscript in preparation.; NODE-PK-101, -103, data on file.10Milestone Commercial Deep-Dive December 6, 2022•Developed to rapidly terminate episodes of PSVT•Designed for patient self-administration where and whenever the episodes occur•Novel, investigational, L-type calcium channel blocker•Formulated as intranasal spray with:─Rapidonsetof action (Tmax≤ 7 min)─Short-lasting duration: eliminated from blood within a few hoursPSVT= paroxysmal supraventricular tachycardia. PK = pharmacokinetic. Error bars = standard error (SE). |

| Commercial Deep-Dive Agenda•Introduction and Overview of Milestone Pharmaceuticals•PSVT Disease Burden –The Problem•Etripamil –Value Proposition•Where Do We Play –Market Size•How Do We Engage –Commercial Strategy11Milestone Commercial Deep-Dive December 6, 2022 |

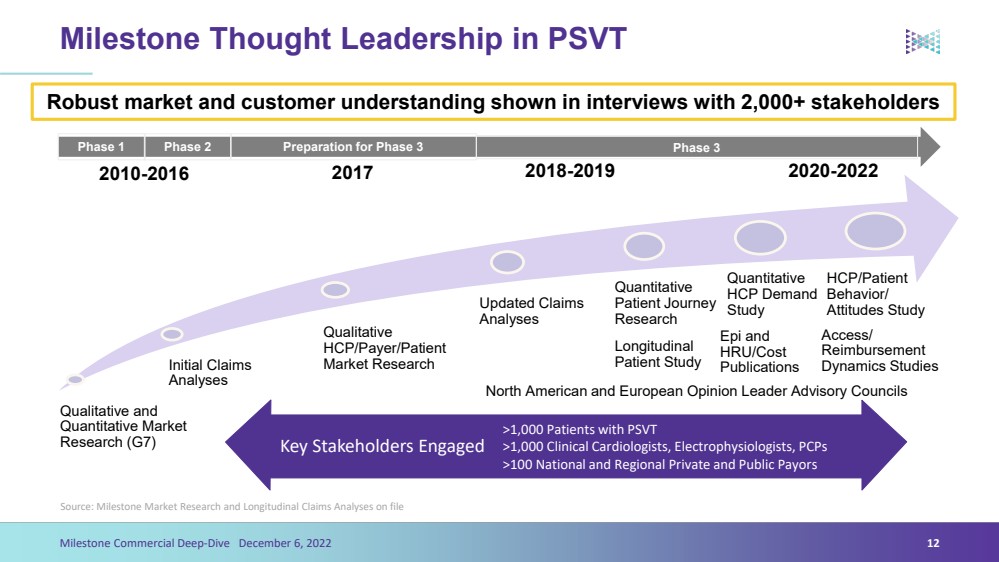

| Initial Claims Analyses Qualitative HCP/Payer/Patient Market Research Updated Claims Analyses Qualitative and Quantitative Market Research (G7) Phase 2 Preparation for Phase 3 Phase 3 Phase 1 Robust market and customer understanding shown in interviews with 2,000+ stakeholders2018-2019 Quantitative Patient Journey Research2017 2010-2016Milestone Thought Leadership in PSVTSource: Milestone Market Research and Longitudinal Claims Analyses on file12Milestone Commercial Deep-Dive December 6, 2022 >1,000 Patients with PSVT>1,000 Clinical Cardiologists, Electrophysiologists, PCPs >100 National and Regional Private and Public Payors2020-2022 Epi and HRU/Cost PublicationsQuantitative HCP Demand StudyLongitudinal Patient Study HCP/Patient Behavior/ Attitudes StudyAccess/ Reimbursement Dynamics StudiesNorth American and European Opinion Leader Advisory CouncilsKey Stakeholders Engaged |

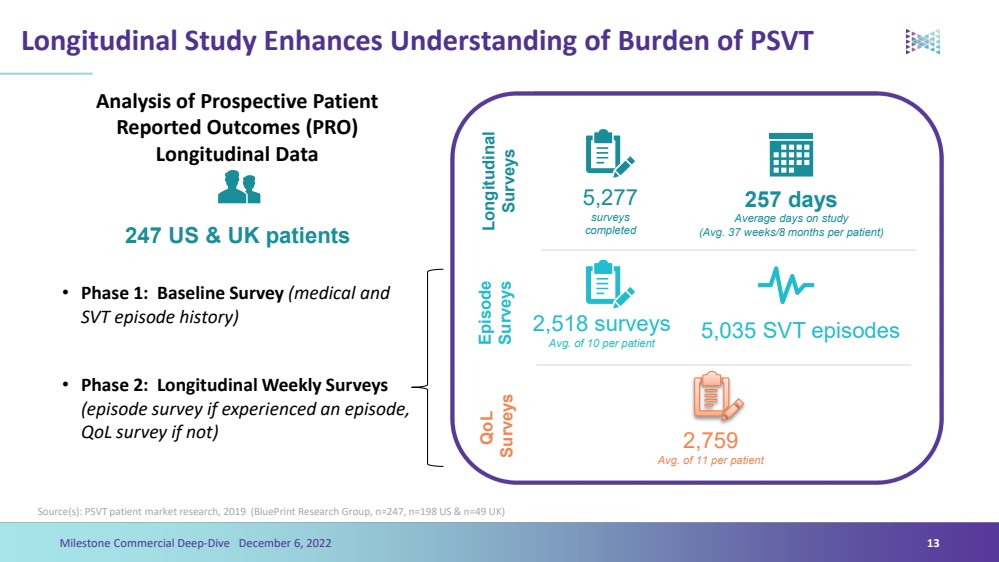

| Longitudinal Study Enhances Understanding of Burden of PSVT Analysis of Prospective Patient Reported Outcomes (PRO) Longitudinal Data•Phase 1: Baseline Survey (medical and SVT episode history)•Phase 2: Longitudinal Weekly Surveys (episode survey if experienced an episode, QoL survey if not)5,277surveys completed 257 daysAverage days on study (Avg. 37 weeks/8 months per patient) Longitudinal SurveysEpisode Surveys2,518 surveysAvg. of 10 per patient 5,035 SVT episodesQoLSurveys 2,759Avg. of 11 per patient 247 US & UK patients Milestone Commercial Deep-Dive December 6, 2022 13Source(s): PSVT patient market research, 2019 (BluePrintResearch Group, n=247, n=198 US & n=49 UK) |

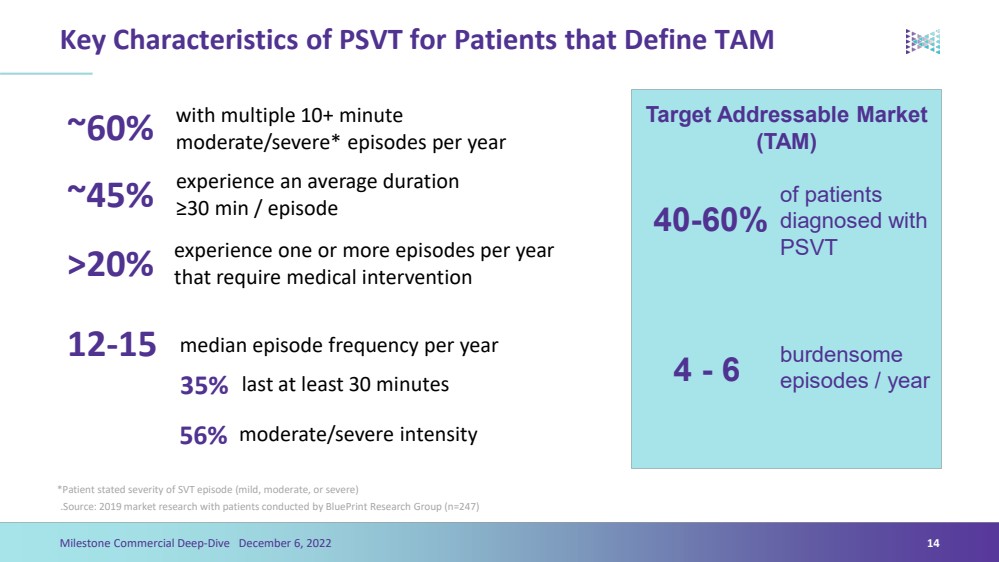

| Key Characteristics of PSVT for Patients that Define TAM.Source: 2019 market research with patients conducted by BluePrintResearch Group (n=247) 14 Milestone Commercial Deep-Dive December 6, 2022~60%~45%with multiple 10+ minute moderate/severe* episodes per yearexperience an average duration ≥30 min / episode *Patient stated severity of SVT episode (mild, moderate, or severe) >20%experience one or more episodes per year that require medical intervention12-15median episode frequency per year35%last at least 30 minutes56%moderate/severe intensity Target Addressable Market (TAM)of patients diagnosed with PSVTburdensome episodes / year40-60%4 -6 |

| Palpitations / rapidheart rateDifficulty breathingDizzinessChest pain 89%18%15%8% 87%43%34%19% 96%80%58%45%PRO Study Episode Burden –# Symptoms Correlate with Episode Severity 15Mild Episodes Moderate EpisodesSevere Episodes n=1113 (44%)n=1182 (47%)n=223 (9%)Symptoms by Episode Severity* % of EpisodesSource: PSVT patient market research, 2019 (BluePrintResearch Group, n=247, n=198 US & n=49 UK)*Severity as self-reported by patient (mild, moderate, severe) Average Number of Symptoms per Episode2.13.56.015Milestone Commercial Deep-Dive December 6, 2022 |

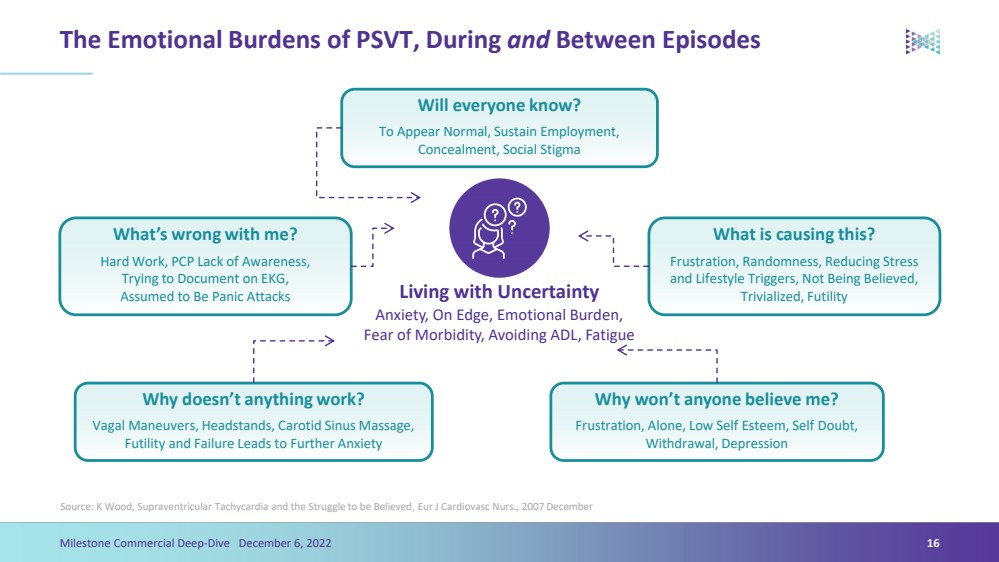

| The Emotional Burdens of PSVT, During andBetween Episodes Source: K Wood, Supraventricular Tachycardia and the Struggle to be Believed, EurJ Cardiovasc Nurs., 2007 December Will everyone know?To Appear Normal, Sustain Employment, Concealment, Social Stigma What is causing this?Frustration, Randomness, Reducing Stress and Lifestyle Triggers, Not Being Believed, Trivialized, Futility What’s wrong with me?Hard Work, PCP Lack of Awareness, Trying to Document on EKG, Assumed to Be Panic Attacks Why doesn’t anything work?Vagal Maneuvers, Headstands, Carotid Sinus Massage, Futility and Failure Leads to Further Anxiety Why won’t anyone believe me?Frustration, Alone, Low Self Esteem, Self Doubt, Withdrawal, Depression16 Living with UncertaintyAnxiety, On Edge, Emotional Burden, Fear of Morbidity, Avoiding ADL, Fatigue Milestone Commercial Deep-Dive December 6, 2022 |

| Commercial Deep-Dive Agenda•Introduction and Overview of Milestone Pharmaceuticals•PSVT Disease Burden –The Problem•Etripamil –Value Proposition•Where Do We Play –Market Size•How Do We Engage –Commercial Strategy17Milestone Commercial Deep-Dive December 6, 2022 |

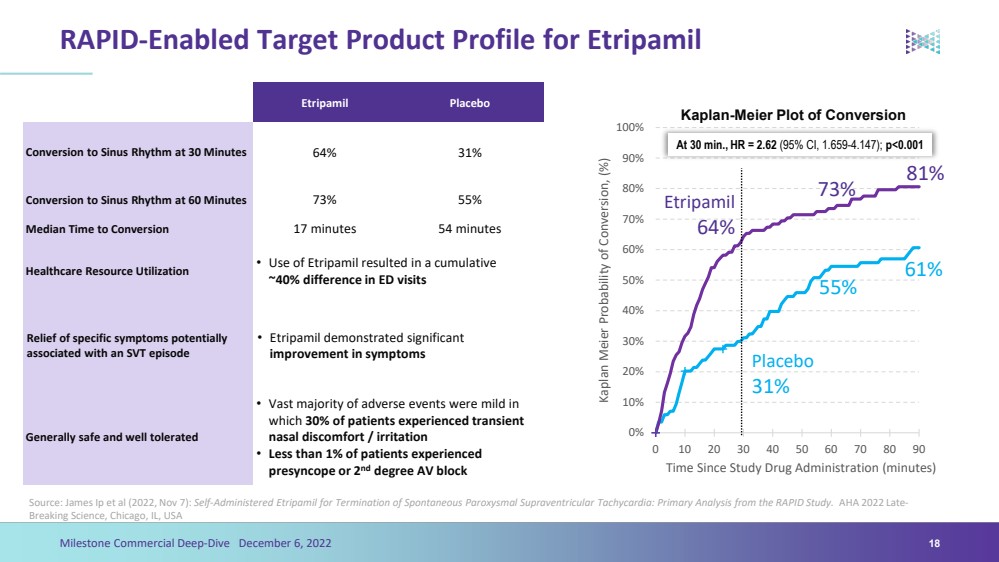

| RAPID-Enabled Target Product Profile for Etripamil18 EtripamilPlaceboConversion to Sinus Rhythm at 30 Minutes64% 31%Conversion to Sinus Rhythm at 60 Minutes73%55%Median Time to Conversion17 minutes54 minutesHealthcare Resource Utilization•Use of Etripamil resulted in a cumulative ~40% difference in ED visitsRelief of specific symptoms potentially associated with an SVT episode•Etripamil demonstrated significant improvement in symptomsGenerally safe and well tolerated •Vast majority of adverse events were mild in which 30% of patients experienced transient nasal discomfort / irritation•Less than 1% of patients experienced presyncope or 2nddegree AV blockKaplan-Meier Plot of Conversion 0%10%20%30% 40% 50% 60% 70% 80%90%100%0102030405060708090 Kaplan Meier Probability of Conversion, (%) Time Since Study Drug Administration (minutes) Placebo31%Etripamil64% At 30 min., HR = 2.62(95% CI, 1.659-4.147); p<0.00155%73%61%81%Milestone Commercial Deep-Dive December 6, 2022Source: James Ip et al (2022, Nov 7): Self-Administered Etripamilfor Termination of Spontaneous Paroxysmal Supraventricular Tachycardia: Primary Analysis from the RAPID Study.AHA 2022 Late-Breaking Science, Chicago, IL, USA |

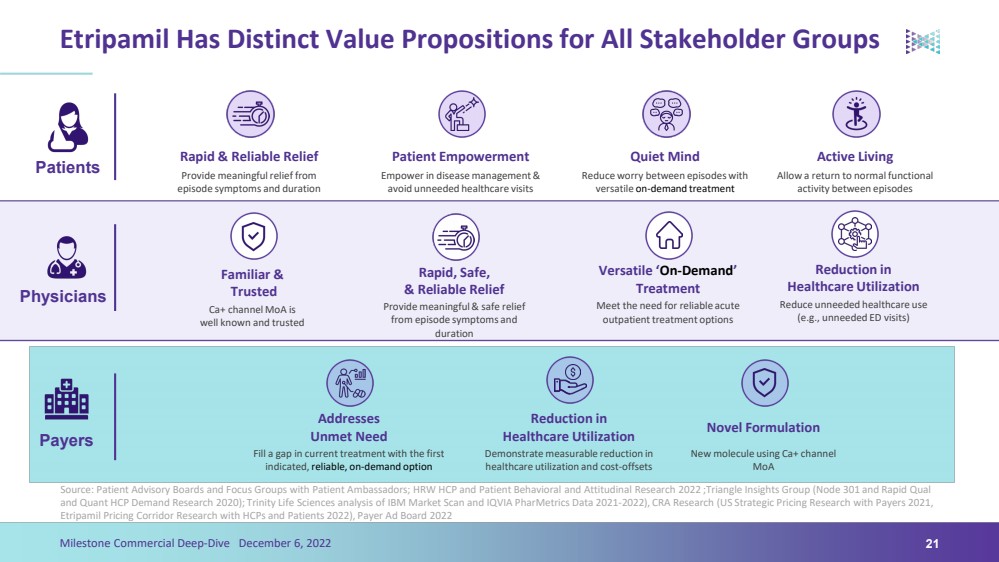

| Etripamil Has Distinct Value Propositions For PatientsSource: Patient Advisory Boards and Focus Groups with Patient Ambassadors, HRW HCP and Patient Behavioral and Attitudinal Research 202219Milestone Commercial Deep-Dive December 6, 2022Patients Rapid & Reliable Relief Patient Empowerment Quiet Mind Active Living Provide meaningful relief from episode symptoms and duration Empower in disease management & avoid unneeded healthcare visits Reduce worry between episodes with versatile on-demand treatment Allow a return to normal functional activity between episodes |

| Etripamil Has Distinct Value Propositions for Patients and PhysiciansSource: Patient Advisory Boards and Focus Groups with Patient Ambassadors; HRW HCP and Patient Behavioral and Attitudinal Research 2022 ;Triangle Insights Group (Node 301 and Rapid Qual and Quant HCP Demand Research 2020)20Milestone Commercial Deep-Dive December 6, 2022Patients Physicians Rapid & Reliable Relief Patient Empowerment Quiet Mind Active Living Versatile ‘On-Demand’ Treatment Rapid, Safe, & Reliable Relief Reduction in Healthcare Utilization Provide meaningful relief from episode symptoms and duration Empower in disease management & avoid unneeded healthcare visits Reduce worry between episodes with versatile on-demand treatment Allow a return to normal functional activity between episodes Provide meaningful & safe relief from episode symptoms and duration Meet the need for reliable acute outpatient treatment options Reduce unneeded healthcare use (e.g., unneeded ED visits) Familiar &Trusted Ca+ channel MoA is well known and trusted |

| Etripamil Has Distinct Value Propositions for All Stakeholder GroupsSource: Patient Advisory Boards and Focus Groups with Patient Ambassadors; HRW HCP and Patient Behavioral and Attitudinal Research 2022 ;Triangle Insights Group (Node 301 and Rapid Qual and Quant HCP Demand Research 2020); Trinity Life Sciences analysis of IBM Market Scan and IQVIA PharMetricsData 2021-2022), CRA Research (US Strategic Pricing Research with Payers 2021, Etripamil Pricing Corridor Research with HCPs and Patients 2022), Payer Ad Board 202221Milestone Commercial Deep-Dive December 6, 2022Patients Payers Physicians Rapid & Reliable Relief Patient Empowerment Quiet Mind Active Living Reduction in Healthcare Utilization Addresses Unmet Need Provide meaningful relief from episode symptoms and duration Empower in disease management & avoid unneeded healthcare visits Reduce worry between episodes with versatile on-demand treatment Allow a return to normal functional activity between episodes Demonstrate measurable reduction in healthcare utilization and cost-offsets Fill a gap in current treatment with the first indicated, reliable, on-demand option Novel Formulation New molecule using Ca+ channel MoA Versatile ‘On-Demand’ Treatment Rapid, Safe, & Reliable Relief Reduction in Healthcare Utilization Provide meaningful & safe relief from episode symptoms and duration Meet the need for reliable acute outpatient treatment options Reduce unneeded healthcare use (e.g., unneeded ED visits) Familiar &Trusted Ca+ channel MoA is well known and trusted |

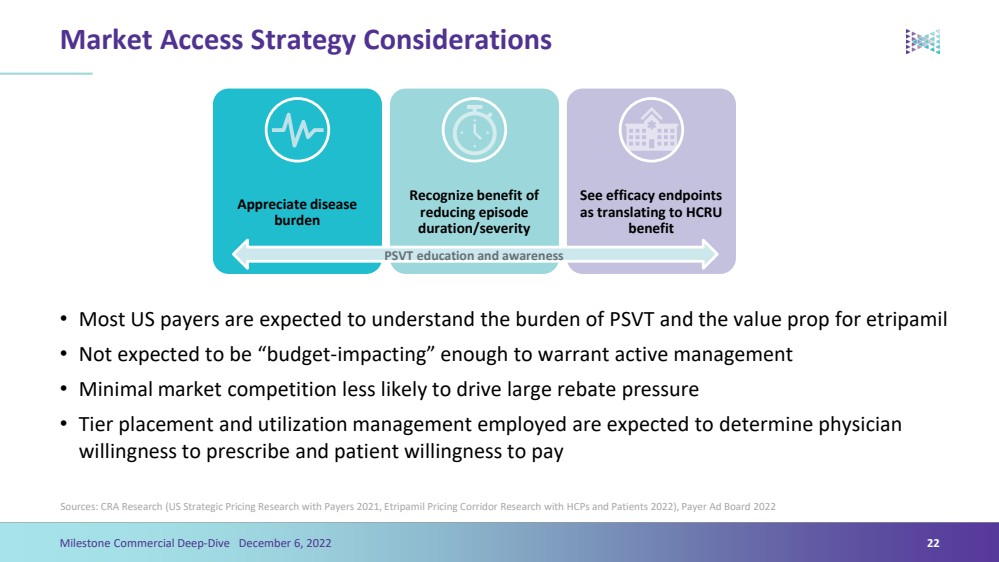

| Market Access Strategy Considerations•Most US payers are expected to understand the burden of PSVT and the value prop for etripamil•Not expected to be “budget-impacting” enough to warrant active management•Minimal market competition less likely to drive large rebate pressure•Tier placement and utilization management employed are expected to determine physician willingness to prescribe and patient willingness to paySources: CRA Research (US Strategic Pricing Research with Payers 2021, Etripamil Pricing Corridor Research with HCPs and Patients 2022), Payer Ad Board 202222Milestone Commercial Deep-Dive December 6, 2022 Appreciate disease burden Recognize benefit of reducing episode duration/severity See efficacy endpoints as translating to HCRU benefit PSVT education and awareness |

| Commercial Deep-Dive Agenda•Introduction and Overview of Milestone Pharmaceuticals•PSVT Disease Burden –The Problem•Etripamil –Value Proposition•Where Do We Play –Market Size•How Do We Engage –Commercial Strategy23Milestone Commercial Deep-Dive December 6, 2022 |

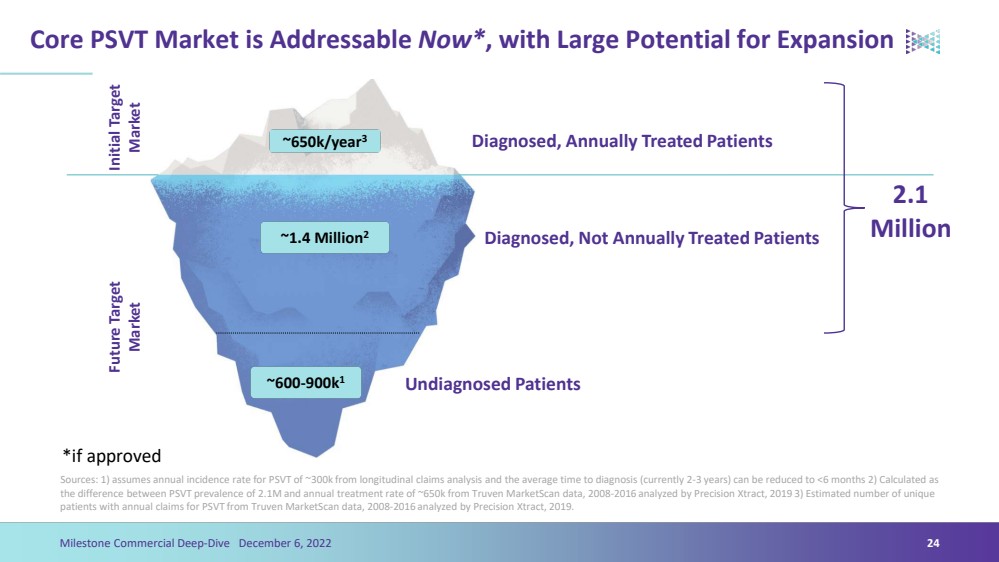

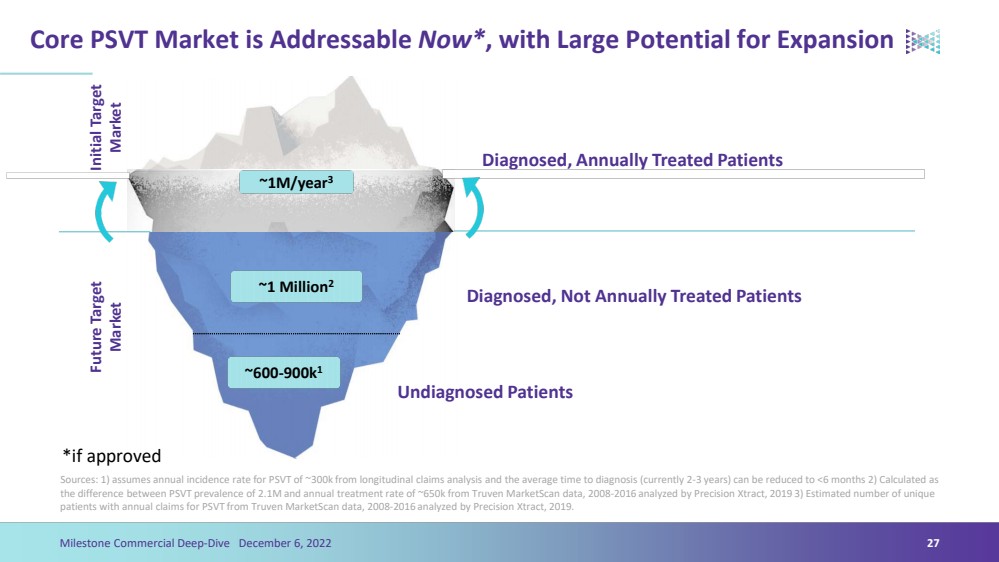

| Core PSVT Market is Addressable Now*, with Large Potential for ExpansionSources: 1) assumes annual incidence rate for PSVT of ~300k from longitudinal claims analysis and the average time to diagnosis (currently 2-3 years) can be reduced to <6 months 2) Calculated as the difference between PSVT prevalence of 2.1M and annual treatment rate of ~650k from Truven MarketScandata, 2008-2016 analyzed by Precision Xtract, 2019 3) Estimated number of unique patients with annual claims for PSVT from Truven MarketScandata, 2008-2016 analyzed by Precision Xtract, 2019.24Milestone Commercial Deep-Dive December 6, 2022 ~650k/year3 ~1.4 Million2 ~600-900k1Initial Target MarketFuture Target MarketDiagnosed, Annually Treated PatientsDiagnosed, Not Annually Treated PatientsUndiagnosed Patients 2.1 Million*if approved |

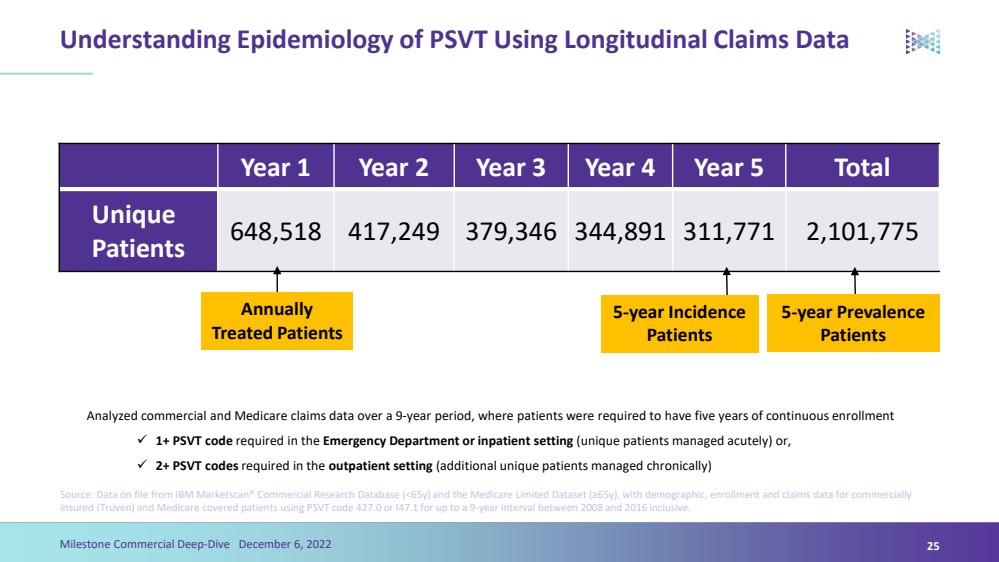

| Understanding Epidemiology of PSVT Using Longitudinal Claims Data Source: Data on file from IBM Marketscan® Commercial Research Database (<65y) and the Medicare Limited Dataset (≥65y), with demographic, enrollment and claims data for commercially insured (Truven) and Medicare covered patients using PSVT code 427.0 or I47.1 for up to a 9-year interval between 2008 and 2016 inclusive. Year 1Year 2Year 3Year 4Year5TotalUnique Patients648,518 417,249 379,346 344,891 311,771 2,101,775 Annually Treated Patients 5-year Incidence Patients Analyzed commercial and Medicare claims data over a 9-year period, where patients were required to have five years of continuousenrollment 1+ PSVT code required in the Emergency Department or inpatient setting (unique patients managed acutely) or,2+ PSVT codes required in the outpatient setting (additional unique patients managed chronically)Milestone Commercial Deep-Dive December 6, 202225 5-year Prevalence Patients |

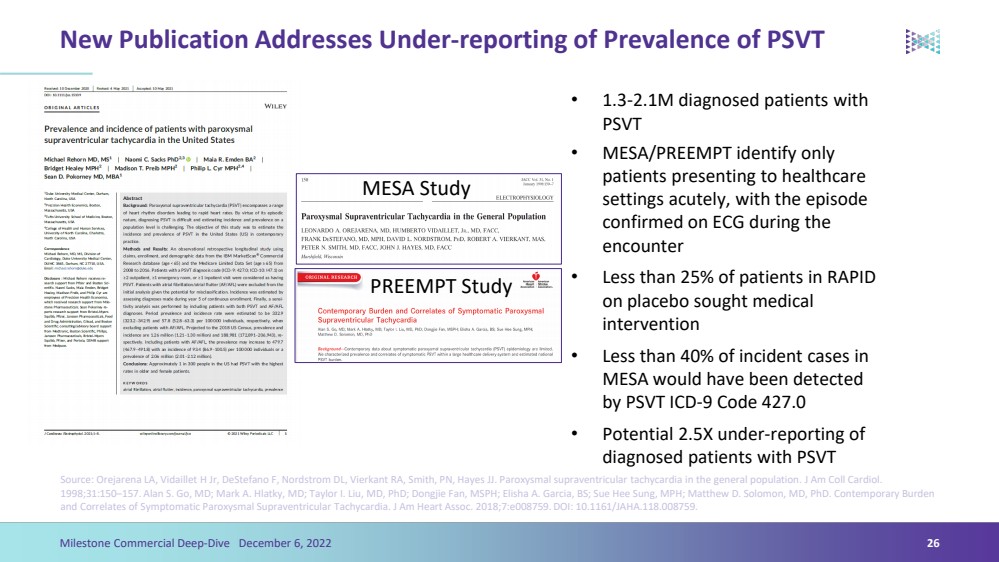

| New Publication Addresses Under-reporting of Prevalence of PSVT•MESA/PREEMPT identify only patients presenting to healthcare settings acutely, with the episode confirmed on ECG during the encounter•Less than 25% of patients in RAPID on placebo sought medical intervention•Less than 40% of incident cases in MESA would have been detected by PSVT ICD-9 Code 427.0•Potential 2.5X under-reporting of diagnosed patients with PSVTSource: OrejarenaLA, VidailletH Jr, DeStefano F, Nordstrom DL, VierkantRA, Smith, PN, Hayes JJ. Paroxysmal supraventricular tachycardia in the general population. J Am Coll Cardiol. 1998;31:150–157. Alan S. Go, MD; Mark A. Hlatky, MD; Taylor I. Liu, MD, PhD; DongjieFan, MSPH; Elisha A. Garcia, BS; Sue HeeSung, MPH; Matthew D. Solomon, MD, PhD. Contemporary Burden and Correlates of Symptomatic Paroxysmal Supraventricular Tachycardia. J Am Heart Assoc. 2018;7:e008759. DOI: 10.1161/JAHA.118.008759.26Milestone Commercial Deep-Dive December 6, 2022 •1.3-2.1M diagnosed patients with PSVT PREEMPT Study MESA Study |

| Core PSVT Market is Addressable Now*, with Large Potential for ExpansionSources: 1) assumes annual incidence rate for PSVT of ~300k from longitudinal claims analysis and the average time to diagnosis (currently 2-3 years) can be reduced to <6 months 2) Calculated as the difference between PSVT prevalence of 2.1M and annual treatment rate of ~650k from Truven MarketScandata, 2008-2016 analyzed by Precision Xtract, 2019 3) Estimated number of unique patients with annual claims for PSVT from Truven MarketScandata, 2008-2016 analyzed by Precision Xtract, 2019.27Milestone Commercial Deep-Dive December 6, 2022Initial Target MarketFuture Target MarketDiagnosed, Annually Treated PatientsDiagnosed, Not Annually Treated Patients ~650k/year3 ~1.4 Million2 ~600-900k1 ~1M/year3 ~1 Million2 ~600-900k1 Undiagnosed Patients *if approved |

| Commercial Deep-Dive Agenda•Introduction and Overview of Milestone Pharmaceuticals•PSVT Disease Burden –The Problem•Etripamil –Value Proposition•Where Do We Play –Market Size•How Do We Engage –Commercial Strategy28Milestone Commercial Deep-Dive December 6, 2022 |

| Core PSVT Market is Addressable Now*, with Large Potential for ExpansionSource: 1) assumes annual incidence rate for PSVT of ~300k from longitudinal claims analysis and the average time to diagnosis (currently 2-3 years) can be reduced to <6 months 2) Calculated as the difference between PSVT prevalence of 2.1M and annual treatment rate of ~650k from Truven MarketScandata, 2008-2016 analyzed by Precision Xtract, 2019 3) Estimated number of unique patients with annual claims for PSVT from Truven MarketScandata, 2008-2016 analyzed by Precision Xtract, 2019.29Milestone Commercial Deep-Dive December 6, 2022 ~650k/year3 ~1.4 Million2 ~600-900k1Initial Target MarketFuture Target MarketDiagnosed, Annually Treated PatientsDiagnosed, Not Annually Treated PatientsUndiagnosed Patients Strategy to Address •Hyperfocus on Early Adopters (Cardiologists)•Quality Reimbursement/Co-Pay Support•Omnichannel Patient Activation•Expanded Access•PCP Market Development/Expansion•Institutional & Urgent Care Market Expansion •Market Development Through Digital Diagnostics•Targeted DTC –TV*if approved |

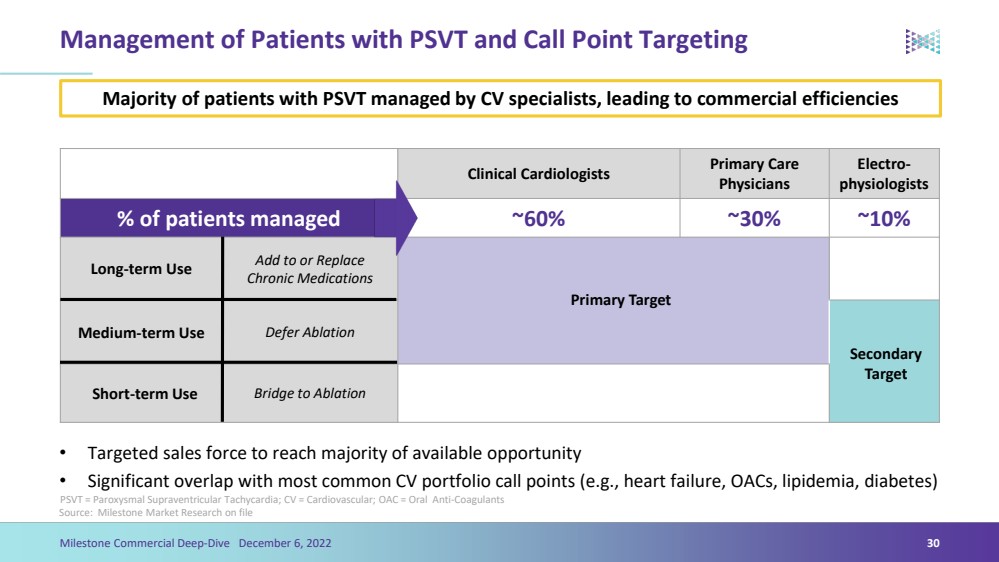

| Management of Patients with PSVT and Call Point Targeting•Targeted sales force to reach majority of available opportunity•Significant overlap with most common CV portfolio call points (e.g., heart failure, OACs, lipidemia, diabetes)Source: Milestone Market Research on file30 Clinical CardiologistsPrimary Care PhysiciansElectro-physiologists% of patients managed ~60%~30%~10%Long-term UseAdd to or Replace Chronic MedicationsMedium-term UseDefer AblationShort-term UseBridge to Ablation Primary Target Secondary Target Majority of patients with PSVT managed by CV specialists, leading to commercial efficienciesMilestone Commercial Deep-Dive December 6, 2022 PSVT = Paroxysmal Supraventricular Tachycardia; CV = Cardiovascular; OAC = Oral Anti-Coagulants |

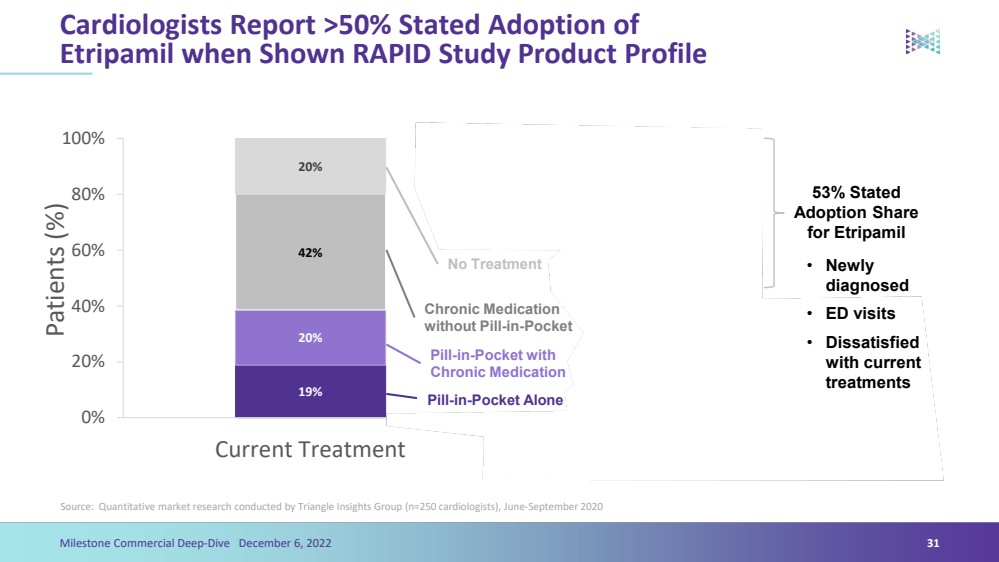

| Cardiologists Report >50% Stated Adoption of Etripamil when Shown RAPID Study Product ProfileSource: Quantitative market research conducted by Triangle Insights Group (n=250 cardiologists), June-September 2020 19%6%20%8%42%24%20%9%29%25%0%20%40% 60% 80%100%Current TreatmentTreatment with Etripamil Available Patients (%) 53% StatedAdoption Share for Etripamil 31Etripamil AloneEtripamil with Chronic MedicationPill-in-Pocket AlonePill-in-Pocket with Chronic MedicationChronic Medication without Pill-in-PocketNo Treatment Milestone Commercial Deep-Dive December 6, 2022 •Newly diagnosed•ED visits•Dissatisfied with current treatments |

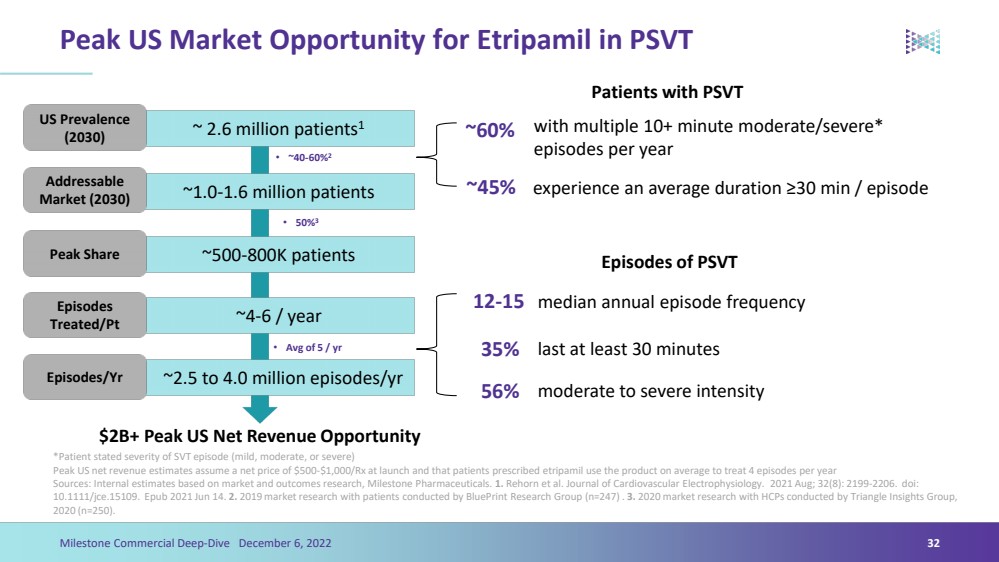

| Peak US Market Opportunity for Etripamilin PSVTPatients with PSVT*Patient stated severity of SVT episode (mild, moderate, or severe) Peak US net revenue estimates assume a net price of $500-$1,000/Rx at launch and that patients prescribed etripamil use the product on average to treat 4 episodes per yearSources: Internal estimates based on market and outcomes research, Milestone Pharmaceuticals. 1.Rehornet al. Journal of Cardiovascular Electrophysiology. 2021 Aug; 32(8): 2199-2206. doi: 10.1111/jce.15109. Epub2021 Jun 14. 2. 2019 market research with patients conducted by BluePrintResearch Group (n=247) . 3. 2020 market research with HCPs conducted by Triangle Insights Group, 2020 (n=250).32 Milestone Commercial Deep-Dive December 6, 2022 ~ 2.6 million patients1 US Prevalence (2030) ~1.0-1.6 million patients Addressable Market (2030) ~500-800K patients Peak Share ~4-6 / year Episodes Treated/Pt ~2.5 to 4.0 million episodes/yr Episodes/Yr$2B+ Peak US Net Revenue Opportunity•~40-60%2•50%3•Avg of 5 / yr12-15~60%35%~45% with multiple 10+ minute moderate/severe* episodes per yearexperience an average duration ≥30 min / episode median annual episode frequencylast at least 30 minutesEpisodes of PSVT 56%moderate to severe intensity |

| Commercial Deep-Dive: Key Takeaways•PSVT represents a large and actionable population in the US with significant potential for expansion•Most patients with PSVT experience episodes that could benefit from etripamil•RAPID study results enable a target product profile that appeals to physicians and patients while not overly burdening payers•PSVT market dynamics allow for early success and substantial room to expand•Milestone has the foundational market understanding and commercialization expertise to successfully launch etripamil in the US33Milestone Commercial Deep-Dive December 6, 2022 |

| Thank you |