Strategy and Governance Update Fall 2022 M. Christian Mitchell Lead Independent Director cmitchell@marshall-stevens.com 213-233-1532 Steve Gardner Chairman, President & Chief Executive Officer sgardner@ppbi.com 949-864-8000

2© 2021 Pacific Premier Bancorp, Inc. | All rights reserved FORWARD LOOKING STATEMENTS AND WHERE TO FIND MORE INFORMATION Forward Looking Statements This investor presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 regarding the financial condition, results of operations, business plans and the future performance of Pacific Premier Bancorp, Inc. (“PPBI” or the “Company”), including its wholly-owned subsidiary Pacific Premier Bank (“Pacific Premier” or the “Bank”). Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “projects,” “could,” “may,” “should,” “will” or other similar words and expressions are intended to identify these forward-looking statements. These forward-looking statements are based on PPBI’s current expectations and beliefs concerning future developments and their potential effects on the Company including, without limitation, plans, strategies and goals, and statements about the Company’s expectations regarding revenue and asset growth, financial performance and profitability, loan and deposit growth, yields and returns, sources and liquidity, loan diversification and credit management, stockholder value creation, capital management, tax rates and acquisitions we have made or may make. Because forward-looking statements relate to future results and occurrences, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict. Many possible events or factors could affect PPBI’s future financial results and performance and could cause actual results or performance to differ materially from anticipated results or performance. These risks and uncertainties include, but are not limited to, the following: the strength of the United States economy in general and the strength of the local economies in which we conduct operations; the effects of, and changes in, our ability to attract and retain deposits and access to other sources of liquidity, trade, monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System; inflation/deflation, interest rate, market and monetary fluctuations; the effect of acquisitions we have made or may make, including, without limitation, the failure to achieve the expected revenue growth and/or expense savings from such acquisitions, and/or the failure to effectively integrate an acquisition target into our operations; the timely development of competitive new products and services and the acceptance of these products and services by new and existing customers; the impact of changes in financial services policies, laws and regulations, including those concerning taxes, banking, securities and insurance, and the application thereof by regulatory bodies; the effectiveness of our risk management framework and quantitative models; changes in the level of our nonperforming assets and charge-offs; risks and uncertainties related to our adoption of the SOFR family of interest rates to replace LIBOR; the effect of changes in accounting policies and practices or accounting standards, as may be adopted from time-to-time by bank regulatory agencies, the U.S. Securities and Exchange Commission (“SEC”), the Public Company Accounting Oversight Board, the Financial Accounting Standards Board or other accounting standards setters, including ASU 2016-13 (Topic 326), “Measurement of Credit Losses on Financial Instruments,” commonly referenced as the CECL model, which has changed how we estimate credit losses and may further increase the required level of our allowance for credit losses in future periods; possible credit related impairments of securities held by us; possible impairment charges to goodwill, including any impairment that may result from increasing volatility in our stock price; the impact of governmental efforts to restructure the U.S. financial regulatory system, including any amendments to the Dodd-Frank Wall Street Reform and Consumer Protection Act; changes in consumer spending, borrowing and savings habits; the effects of our lack of a diversified loan portfolio, including the risks of geographic and industry concentrations; the possibility that we may reduce or discontinue the payments of dividends on our common stock; changes in the financial performance and/or condition of our borrowers; changes in the competitive environment among financial and bank holding companies and other financial service providers; geopolitical conditions, including acts or threats of terrorism, actions taken by the United States or other governments in response to acts or threats of terrorism and/or military conflicts, including the war between Russia and Ukraine, which could impact business and economic conditions in the United States and abroad; public health crises and pandemics, including the COVID-19 pandemic, and their effects on the economic and business environments in which we operate, including on our credit quality and business operations, as well as the impact on general economic and financial market conditions; climate change, including regulatory, compliance and credit risks; cybersecurity threats and the cost of defending against them, including the costs of compliance with potential legislation to combat cybersecurity at a state, national or global level; unanticipated regulatory or legal proceedings; and our ability to manage the risks involved in the foregoing. Additional factors that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in the Company's 2021 Annual Report on Form 10-K and other filings filed with the SEC and available at the SEC’s Internet site (http://www.sec.gov). The Company undertakes no obligation to revise or publicly release any revision or update to these forward-looking statements to reflect events or circumstances that occur after the date on which such statements were made. Non-U.S. GAAP Financial Measures This presentation contains non-U.S. GAAP financial measures. For purposes of Regulation G promulgated by the SEC, a non-U.S. GAAP financial measure is a numerical measure of the registrant’s historical or future financial performance, financial position or cash flows that excludes amounts or is subject to adjustments that have the effect of excluding amounts that are included in the most directly comparable measure calculated and presented in accordance with U.S. GAAP in the statement of income, statement of financial condition or statement of cash flows (or equivalent statements) of the issuer; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented in this regard. U.S. GAAP refers to generally accepted accounting principles in the United States. Pursuant to the requirements of Regulation G, PPBI has provided reconciliations within this presentation, as necessary, of the non-U.S GAAP financial measures to the most directly comparable U.S. GAAP financial measures. For more details on PPBI’s non-U.S. GAAP measures, refer to the Appendix in this presentation.

3© 2022 Pacific Premier Bancorp, Inc. | All rights reserved PPBI 2022 RELEVANT UPDATES AND DISCLOSURES Links to Key Disclosures and Updates: Investor website - https://investors.ppbi.com/corporate-profile/default.aspx 2021 Corporate Social Responsibility Report - https://investors.ppbi.com/corporate-social-responsibility/2021-csr- report/default.aspx Links to various ESG relevant policies and documents - https://investors.ppbi.com/corporate-social-responsibility/policies-and- documents/default.aspx Link to additional Corporate Governance Documents - https://investors.ppbi.com/corporate-overview/documents/default.aspx Certain SEC filings include additional relevant ESG information in the proxy statement and Form 10-Ks - https://investors.ppbi.com/sec-filings/documents/default.aspx Most Recent SEC Filings and Key Disclosures 3Q22 10-Q (11/4/22) – https://investors.ppbi.com/sec-filings/documents/sec-filings-details/default.aspx?FilingId=16178566 3Q22 Earnings Call Transcript (8-K filing, 10/24/22) - https://investors.ppbi.com/sec-filings/documents/sec-filings- details/default.aspx?FilingId=16147334 3Q22 Earnings Release (8-K filing, 10/20/22) - https://investors.ppbi.com/news-webcast/press-releases/news-details/2022/Pacific- Premier-Bancorp-Inc.-Announces-Third-Quarter-2022-Financial-Results-and-a-Quarterly-Cash-Dividend-of-0.33-Per- Share/default.aspx 3Q22 Investor Presentation (8-K filing, 10/20/22), for certain updates to ESG-related disclosures – refer to PPBI Culture & ESG on pages 34–38 in the pdf version found here https://s25.q4cdn.com/825120303/files/doc_presentations/2022/10/Pacific- Premier-Bancorp-Q3-2022-10..20.22-v.dist.pdf New ESG related disclosure topics in Investor Presentation (8-K filing) for 3Q22 include: Materiality Assessment, Relevancy Assessment of Scope 3 emissions, Establishment of Climate-Related Credit Risk Working Group, and Partnership with Gallup to facilitate Premier Perspective, an employee engagement survey Additional Corporate Responsibility pages on the Bank’s website - https://www.ppbi.com/corporate-responsibility/index.html • PPBI published inaugural Corporate Social Responsibility Report in 2022 which provided detailed ESG information

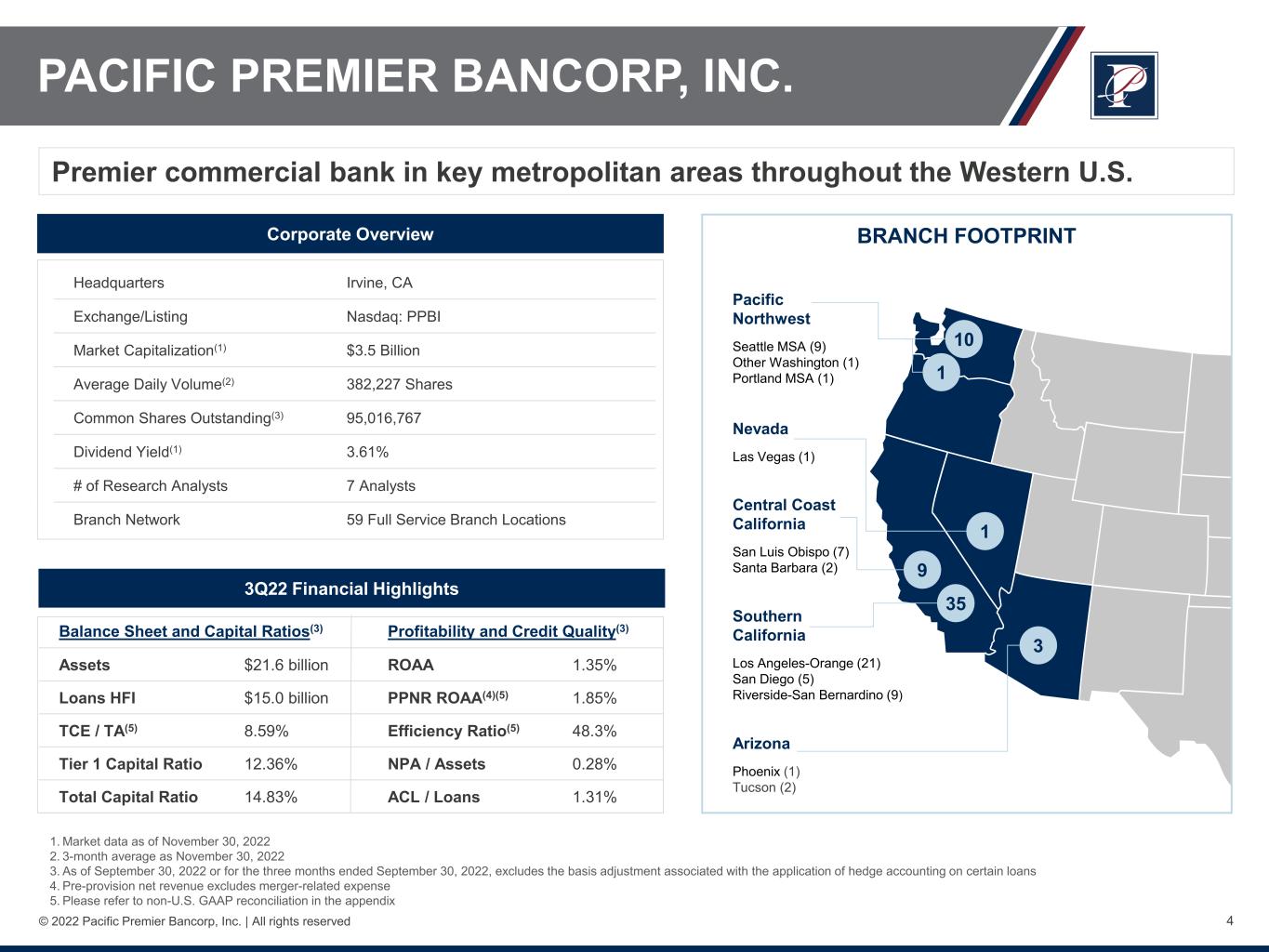

4© 2022 Pacific Premier Bancorp, Inc. | All rights reserved Balance Sheet and Capital Ratios(3) Profitability and Credit Quality(3) Assets $21.6 billion ROAA 1.35% Loans HFI $15.0 billion PPNR ROAA(4)(5) 1.85% TCE / TA(5) 8.59% Efficiency Ratio(5) 48.3% Tier 1 Capital Ratio 12.36% NPA / Assets 0.28% Total Capital Ratio 14.83% ACL / Loans 1.31% Premier commercial bank in key metropolitan areas throughout the Western U.S. Headquarters Irvine, CA Exchange/Listing Nasdaq: PPBI Market Capitalization(1) $3.5 Billion Average Daily Volume(2) 382,227 Shares Common Shares Outstanding(3) 95,016,767 Dividend Yield(1) 3.61% # of Research Analysts 7 Analysts Branch Network 59 Full Service Branch Locations Corporate Overview 1. Market data as of November 30, 2022 2. 3-month average as November 30, 2022 3. As of September 30, 2022 or for the three months ended September 30, 2022, excludes the basis adjustment associated with the application of hedge accounting on certain loans 4. Pre-provision net revenue excludes merger-related expense 5. Please refer to non-U.S. GAAP reconciliation in the appendix 3Q22 Financial Highlights BRANCH FOOTPRINT 10 1 Arizona Phoenix (1) Tucson (2) 3 Nevada Las Vegas (1) 1 Southern California Los Angeles-Orange (21) San Diego (5) Riverside-San Bernardino (9) 35 Central Coast California San Luis Obispo (7) Santa Barbara (2) 9 Pacific Northwest Seattle MSA (9) Other Washington (1) Portland MSA (1) PACIFIC PREMIER BANCORP, INC.

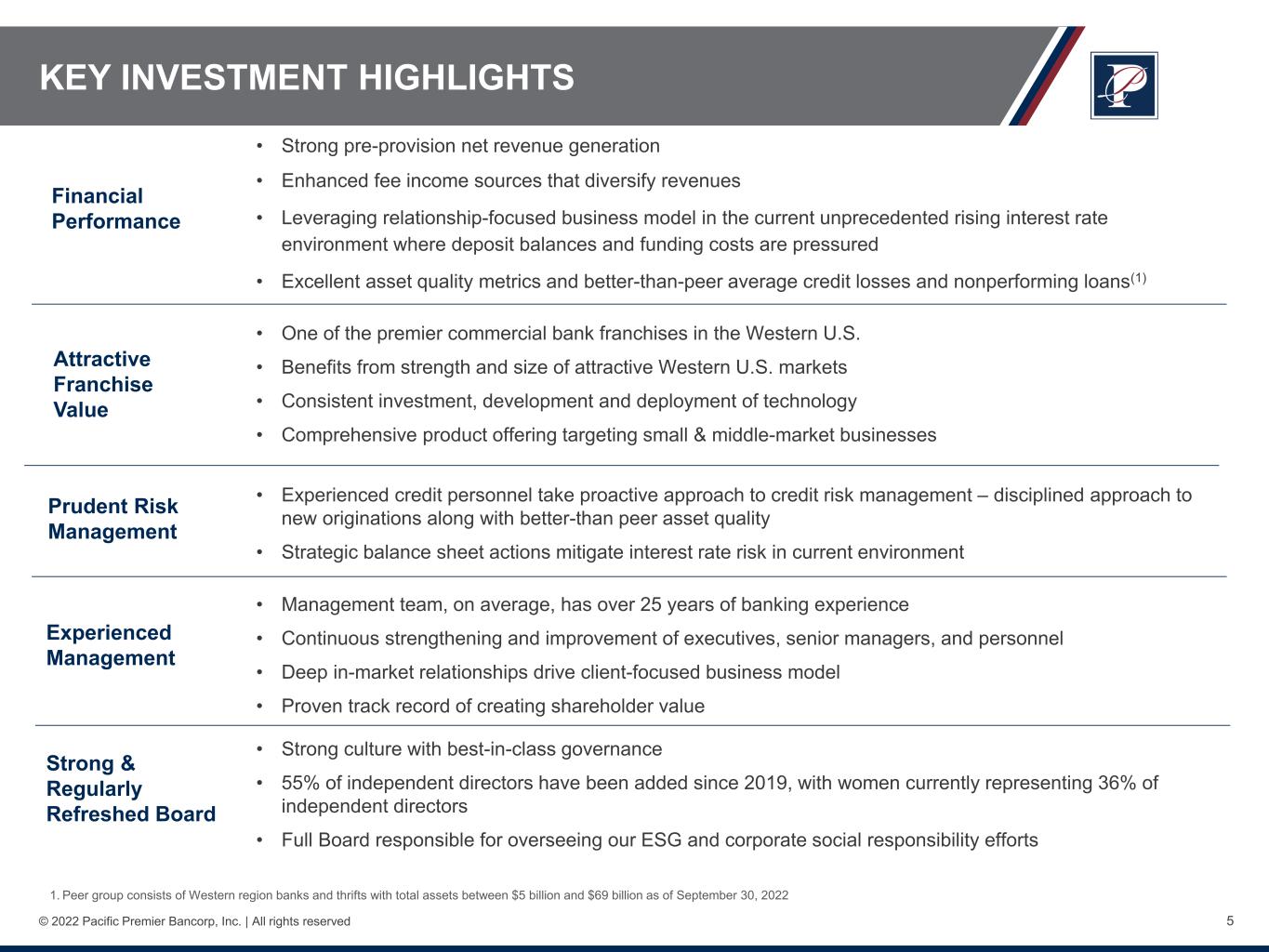

5© 2022 Pacific Premier Bancorp, Inc. | All rights reserved • One of the premier commercial bank franchises in the Western U.S. • Benefits from strength and size of attractive Western U.S. markets • Consistent investment, development and deployment of technology • Comprehensive product offering targeting small & middle-market businesses Attractive Franchise Value • Experienced credit personnel take proactive approach to credit risk management – disciplined approach to new originations along with better-than peer asset quality • Strategic balance sheet actions mitigate interest rate risk in current environment Prudent Risk Management • Strong pre-provision net revenue generation • Enhanced fee income sources that diversify revenues • Leveraging relationship-focused business model in the current unprecedented rising interest rate environment where deposit balances and funding costs are pressured • Excellent asset quality metrics and better-than-peer average credit losses and nonperforming loans(1) Financial Performance • Management team, on average, has over 25 years of banking experience • Continuous strengthening and improvement of executives, senior managers, and personnel • Deep in-market relationships drive client-focused business model • Proven track record of creating shareholder value Experienced Management KEY INVESTMENT HIGHLIGHTS 1. Peer group consists of Western region banks and thrifts with total assets between $5 billion and $69 billion as of September 30, 2022 Strong & Regularly Refreshed Board • Strong culture with best-in-class governance • 55% of independent directors have been added since 2019, with women currently representing 36% of independent directors • Full Board responsible for overseeing our ESG and corporate social responsibility efforts

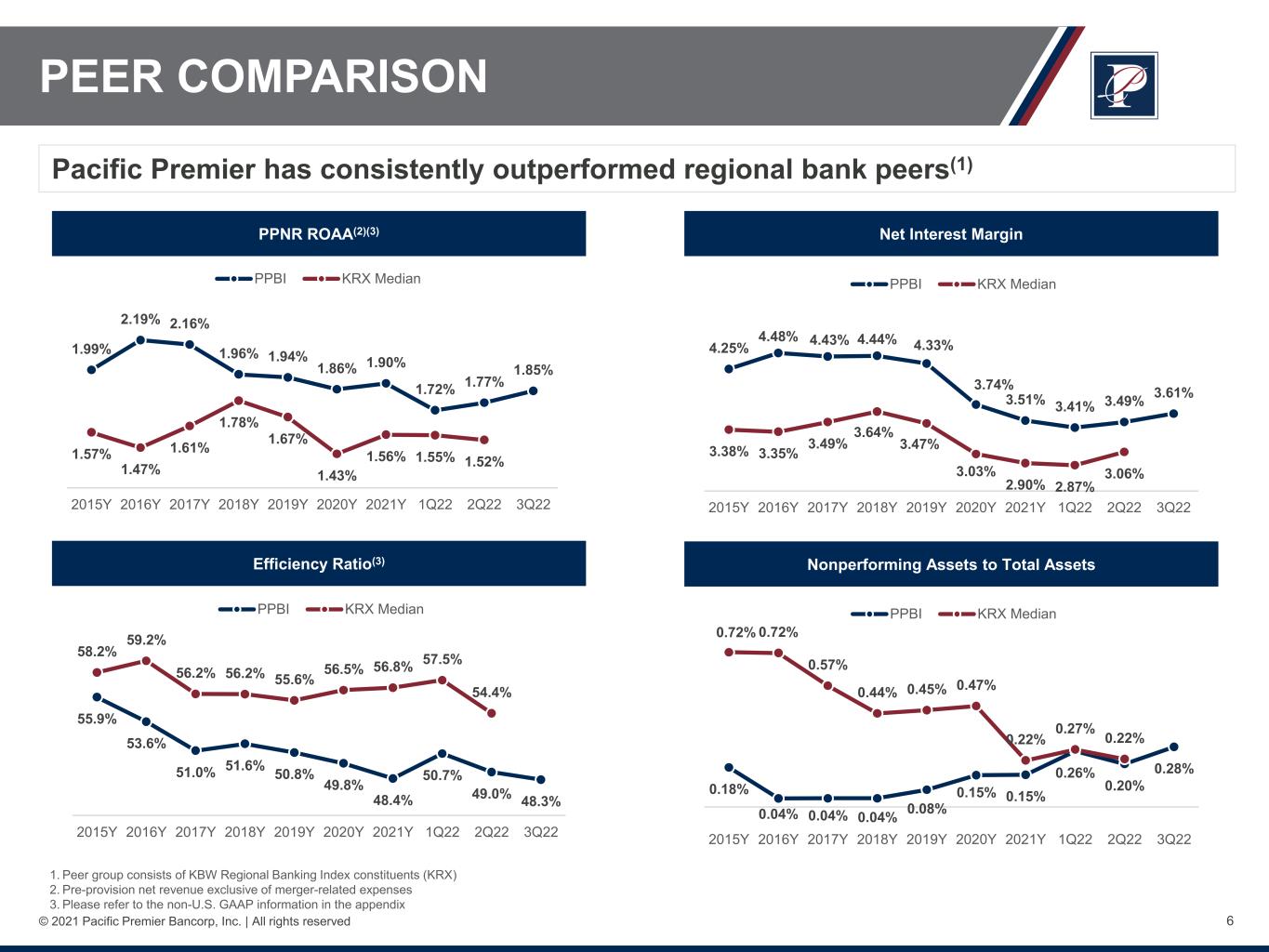

6© 2021 Pacific Premier Bancorp, Inc. | All rights reserved PEER COMPARISON PPNR ROAA(2)(3) Pacific Premier has consistently outperformed regional bank peers(1) Net Interest Margin Efficiency Ratio(3) Nonperforming Assets to Total Assets 1. Peer group consists of KBW Regional Banking Index constituents (KRX) 2. Pre-provision net revenue exclusive of merger-related expenses 3. Please refer to the non-U.S. GAAP information in the appendix 4.25% 4.48% 4.43% 4.44% 4.33% 3.74% 3.51% 3.41% 3.49% 3.61% 3.38% 3.35% 3.49% 3.64% 3.47% 3.03% 2.90% 2.87% 3.06% 2015Y 2016Y 2017Y 2018Y 2019Y 2020Y 2021Y 1Q22 2Q22 3Q22 PPBI KRX Median 0.18% 0.04% 0.04% 0.04% 0.08% 0.15% 0.15% 0.26% 0.20% 0.28% 0.72% 0.72% 0.57% 0.44% 0.45% 0.47% 0.22% 0.27% 0.22% 2015Y 2016Y 2017Y 2018Y 2019Y 2020Y 2021Y 1Q22 2Q22 3Q22 PPBI KRX Median 55.9% 53.6% 51.0% 51.6% 50.8% 49.8% 48.4% 50.7% 49.0% 48.3% 58.2% 59.2% 56.2% 56.2% 55.6% 56.5% 56.8% 57.5% 54.4% 2015Y 2016Y 2017Y 2018Y 2019Y 2020Y 2021Y 1Q22 2Q22 3Q22 PPBI KRX Median 1.99% 2.19% 2.16% 1.96% 1.94% 1.86% 1.90% 1.72% 1.77% 1.85% 1.57% 1.47% 1.61% 1.78% 1.67% 1.43% 1.56% 1.55% 1.52% 2015Y 2016Y 2017Y 2018Y 2019Y 2020Y 2021Y 1Q22 2Q22 3Q22 PPBI KRX Median

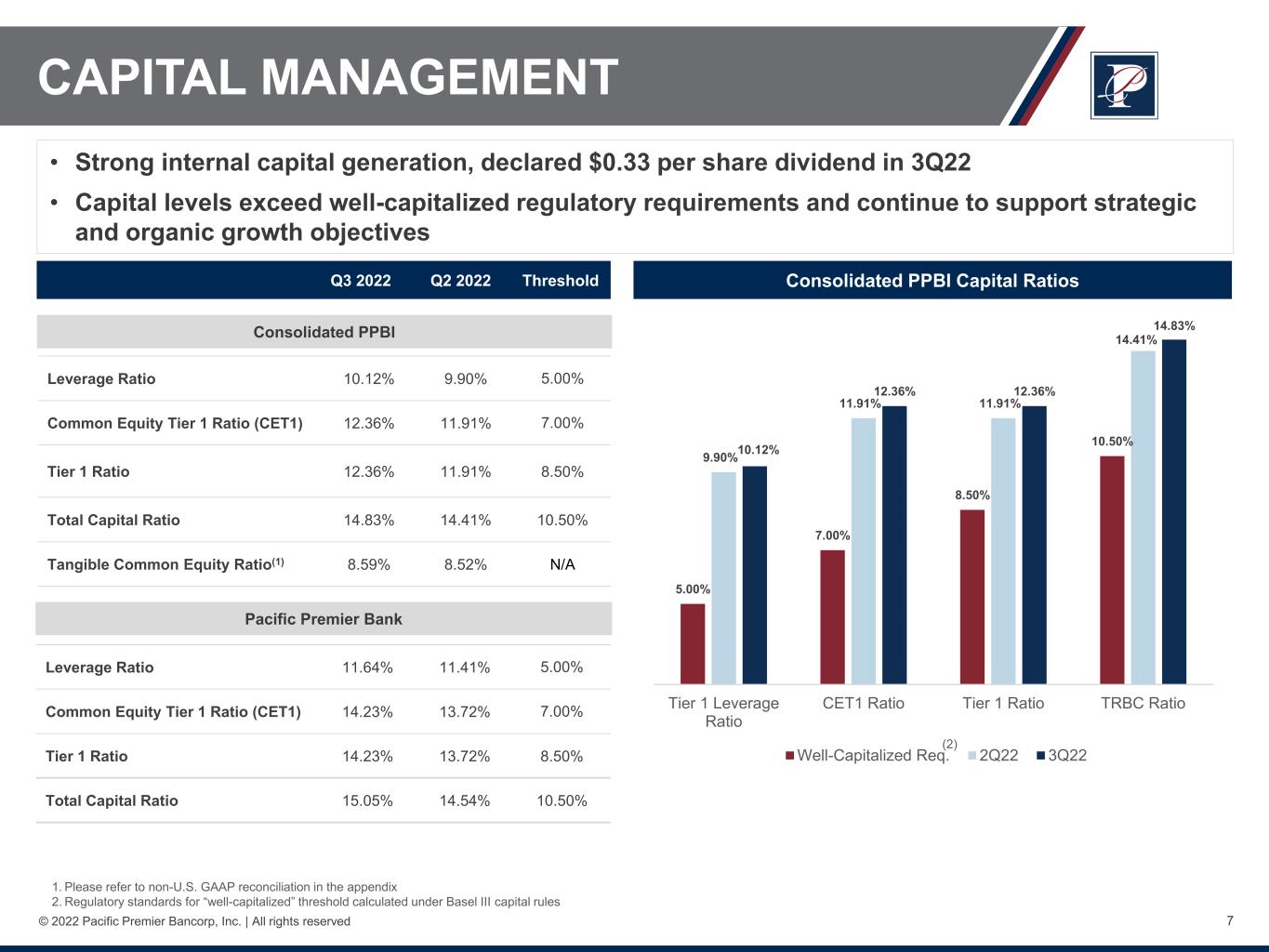

7© 2022 Pacific Premier Bancorp, Inc. | All rights reserved CAPITAL MANAGEMENT Consolidated PPBI Capital Ratios • Strong internal capital generation, declared $0.33 per share dividend in 3Q22 • Capital levels exceed well-capitalized regulatory requirements and continue to support strategic and organic growth objectives 1. Please refer to non-U.S. GAAP reconciliation in the appendix 2. Regulatory standards for “well-capitalized” threshold calculated under Basel III capital rules Consolidated PPBI Pacific Premier Bank Leverage Ratio 10.12% 9.90% 5.00% Common Equity Tier 1 Ratio (CET1) 12.36% 11.91% 7.00% Tier 1 Ratio 12.36% 11.91% 8.50% Total Capital Ratio 14.83% 14.41% 10.50% Tangible Common Equity Ratio(1) 8.59% 8.52% N/A Leverage Ratio 11.64% 11.41% 5.00% Common Equity Tier 1 Ratio (CET1) 14.23% 13.72% 7.00% Tier 1 Ratio 14.23% 13.72% 8.50% Total Capital Ratio 15.05% 14.54% 10.50% Q3 2022 Q2 2022 Threshold 5.00% 7.00% 8.50% 10.50% 9.90% 11.91% 11.91% 14.41% 10.12% 12.36% 12.36% 14.83% Tier 1 Leverage Ratio CET1 Ratio Tier 1 Ratio TRBC Ratio Well-Capitalized Req. 2Q22 3Q22 (2)

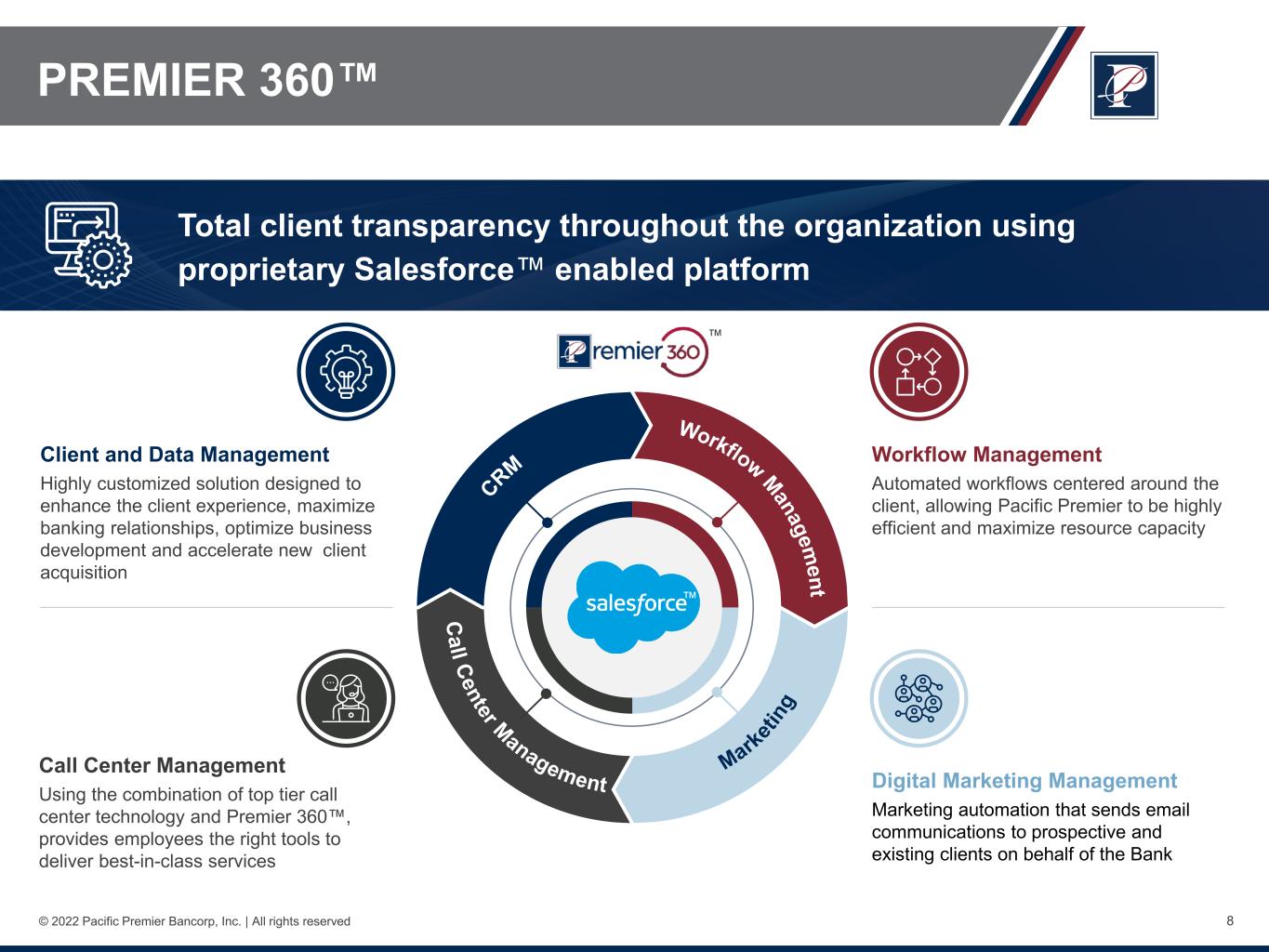

8© 2022 Pacific Premier Bancorp, Inc. | All rights reserved PREMIER 360™ Total client transparency throughout the organization using proprietary Salesforce™ enabled platform ™ Client and Data Management Highly customized solution designed to enhance the client experience, maximize banking relationships, optimize business development and accelerate new client acquisition Workflow Management Automated workflows centered around the client, allowing Pacific Premier to be highly efficient and maximize resource capacity Call Center Management Using the combination of top tier call center technology and Premier 360™, provides employees the right tools to deliver best-in-class services Digital Marketing Management Marketing automation that sends email communications to prospective and existing clients on behalf of the Bank ™

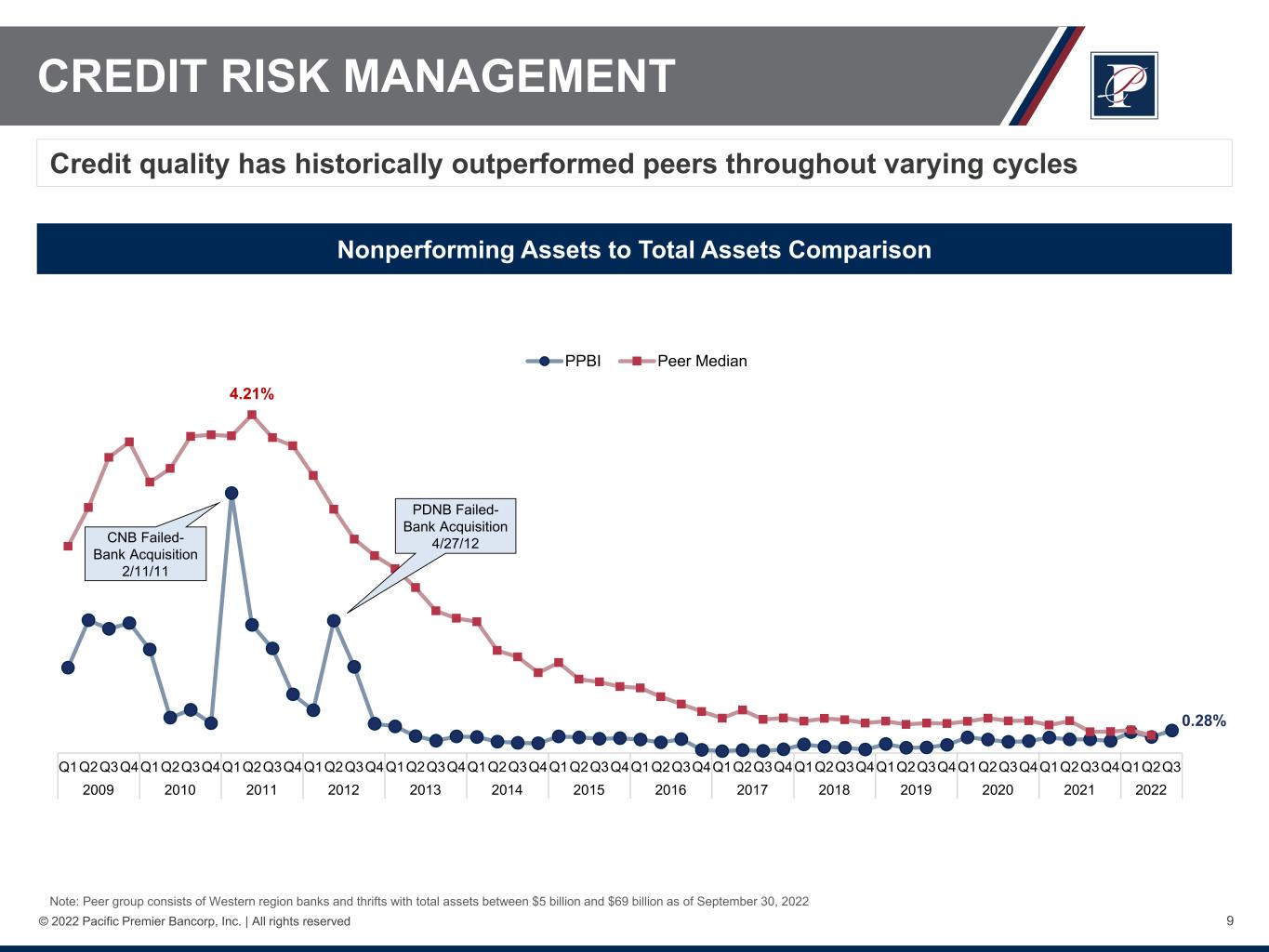

9© 2022 Pacific Premier Bancorp, Inc. | All rights reserved 0.28% 4.21% Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 PPBI Peer Median PDNB Failed- Bank Acquisition 4/27/12 CREDIT RISK MANAGEMENT Credit quality has historically outperformed peers throughout varying cycles Nonperforming Assets to Total Assets Comparison CNB Failed- Bank Acquisition 2/11/11 Note: Peer group consists of Western region banks and thrifts with total assets between $5 billion and $69 billion as of September 30, 2022

PPBI Culture and Governance

11© 2022 Pacific Premier Bancorp, Inc. | All rights reserved CULTURE AT PACIFIC PREMIER Our culture is defined by our Success Attributes and they are the foundation of our “one bank, one culture” approach Organizational Culture Integrity • Do the right thing, every time. • Conduct business with the highest ethical standards. • Take responsibility for your actions. Improve • Improvement is incremental. Small changes over time have a significant impact. • Mistakes happen. Learn from them and don’t repeat them • Be responsible for your personal and professional development Communicate • Over-communicate. • Provide timely and complete information to all stakeholders. • Collaborate to make better decisions. Achieve • Results matter • Be open to achieving results in new ways • A winning attitude is contagious Urgency • Operate with a sense of urgency. • Be thoughtful, making decisions in a timely manner. • Act today, not tomorrow.

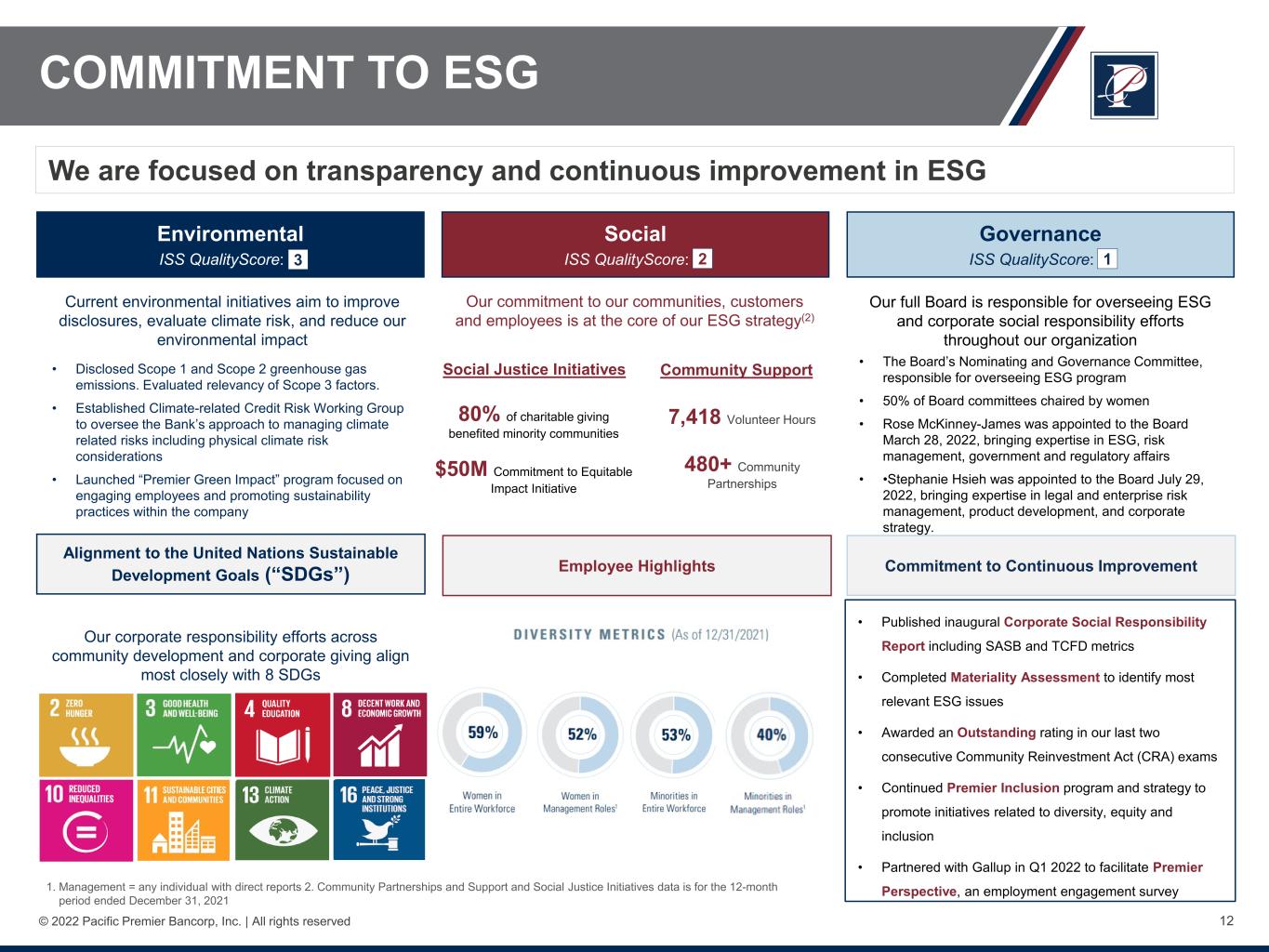

12© 2022 Pacific Premier Bancorp, Inc. | All rights reserved We are focused on transparency and continuous improvement in ESG Environmental ISS QualityScore: 4 Social ISS QualityScore: 3 Governance ISS QualityScore: 1 • Published inaugural Corporate Social Responsibility Report including SASB and TCFD metrics • Completed Materiality Assessment to identify most relevant ESG issues • Awarded an Outstanding rating in our last two consecutive Community Reinvestment Act (CRA) exams • Continued Premier Inclusion program and strategy to promote initiatives related to diversity, equity and inclusion • Partnered with Gallup in Q1 2022 to facilitate Premier Perspective, an employment engagement survey Alignment to the United Nations Sustainable Development Goals (“SDGs”) Our corporate responsibility efforts across community development and corporate giving align most closely with 8 SDGs Current environmental initiatives aim to improve disclosures, evaluate climate risk, and reduce our environmental impact Our commitment to our communities, customers and employees is at the core of our ESG strategy(2) Community Support 7,418 Volunteer Hours 480+ Community Partnerships Our full Board is responsible for overseeing ESG and corporate social responsibility efforts throughout our organization 80% of charitable giving benefited minority communities $50M Commitment to Equitable Impact Initiative • Disclosed Scope 1 and Scope 2 greenhouse gas emissions. Evaluated relevancy of Scope 3 factors. • Established Climate-related Credit Risk Working Group to oversee the Bank’s approach to managing climate related risks including physical climate risk considerations • Launched “Premier Green Impact” program focused on engaging employees and promoting sustainability practices within the company 1. Management = any individual with direct reports 2. Community Partnerships and Support and Social Justice Initiatives data is for the 12-month period ended December 31, 2021 Social Justice Initiatives COMMITMENT TO ESG • The Board’s Nominating and Governance Committee, responsible for overseeing ESG program • 50% of Board committees chaired by women • Rose McKinney-James was appointed to the Board March 28, 2022, bringing expertise in ESG, risk management, government and regulatory affairs • •Stephanie Hsieh was appointed to the Board July 29, 2022, bringing expertise in legal and enterprise risk management, product development, and corporate strategy. 3 2 Employee HighlightsEmployee Highlights Commitment to Continuous Improvement

13© 2022 Pacific Premier Bancorp, Inc. | All rights reserved ESG RISK INTEGRATION Educate business units about relevant ESG risks Identify relevant ESG risk drivers and incorporate into existing risk management framework Map and align ESG risks to RCSA Establish ESG disclosure documentation requirements Identify and review adequacy of internal controls Leverage solutions to facilitate tracking, data collection and reporting

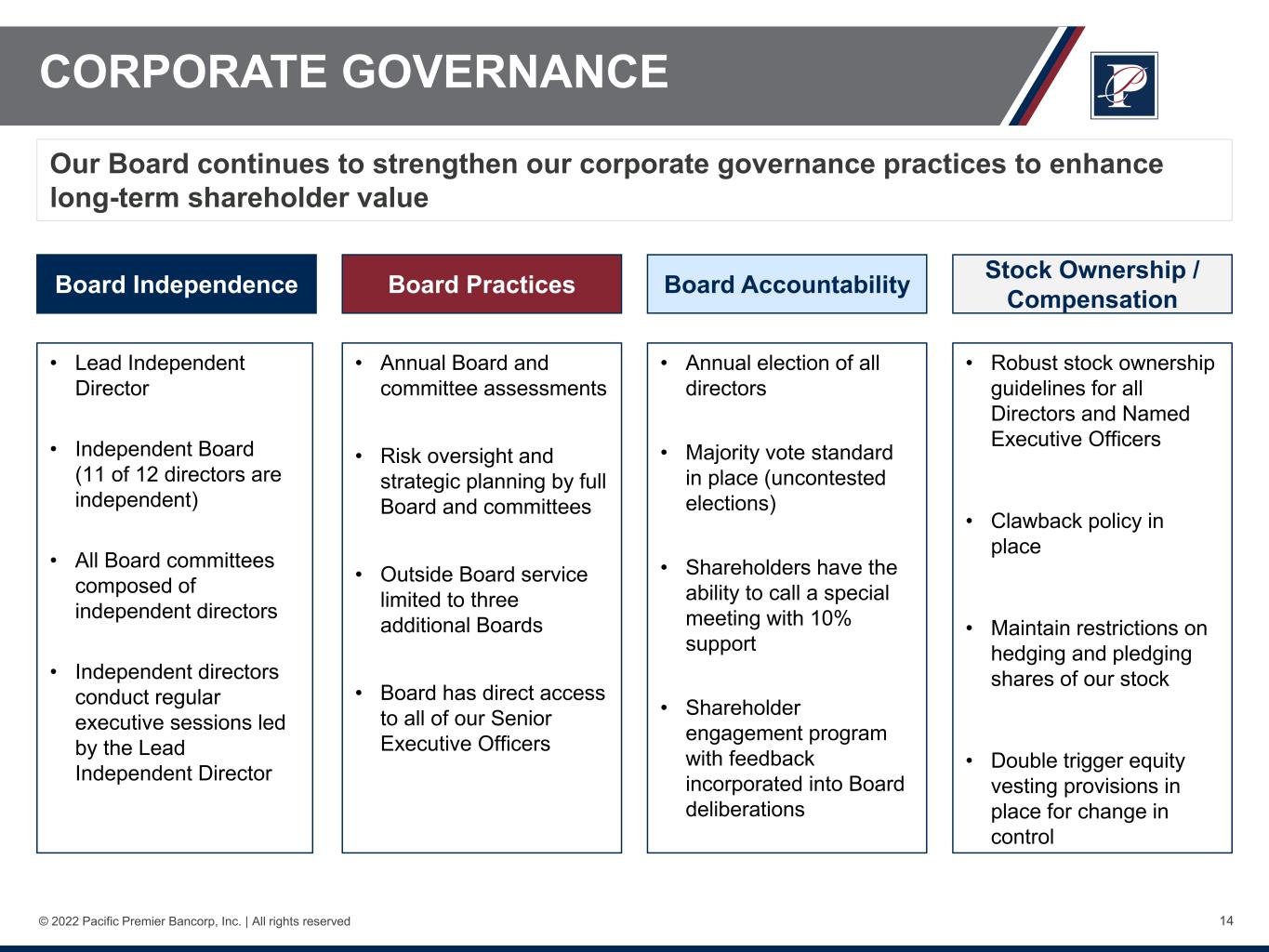

14© 2022 Pacific Premier Bancorp, Inc. | All rights reserved Our Board continues to strengthen our corporate governance practices to enhance long-term shareholder value Board Independence • Lead Independent Director • Independent Board (11 of 12 directors are independent) • All Board committees composed of independent directors • Independent directors conduct regular executive sessions led by the Lead Independent Director Board Practices • Annual Board and committee assessments • Risk oversight and strategic planning by full Board and committees • Outside Board service limited to three additional Boards • Board has direct access to all of our Senior Executive Officers Board Accountability • Annual election of all directors • Majority vote standard in place (uncontested elections) • Shareholders have the ability to call a special meeting with 10% support • Shareholder engagement program with feedback incorporated into Board deliberations Stock Ownership / Compensation • Robust stock ownership guidelines for all Directors and Named Executive Officers • Clawback policy in place • Maintain restrictions on hedging and pledging shares of our stock • Double trigger equity vesting provisions in place for change in control CORPORATE GOVERNANCE

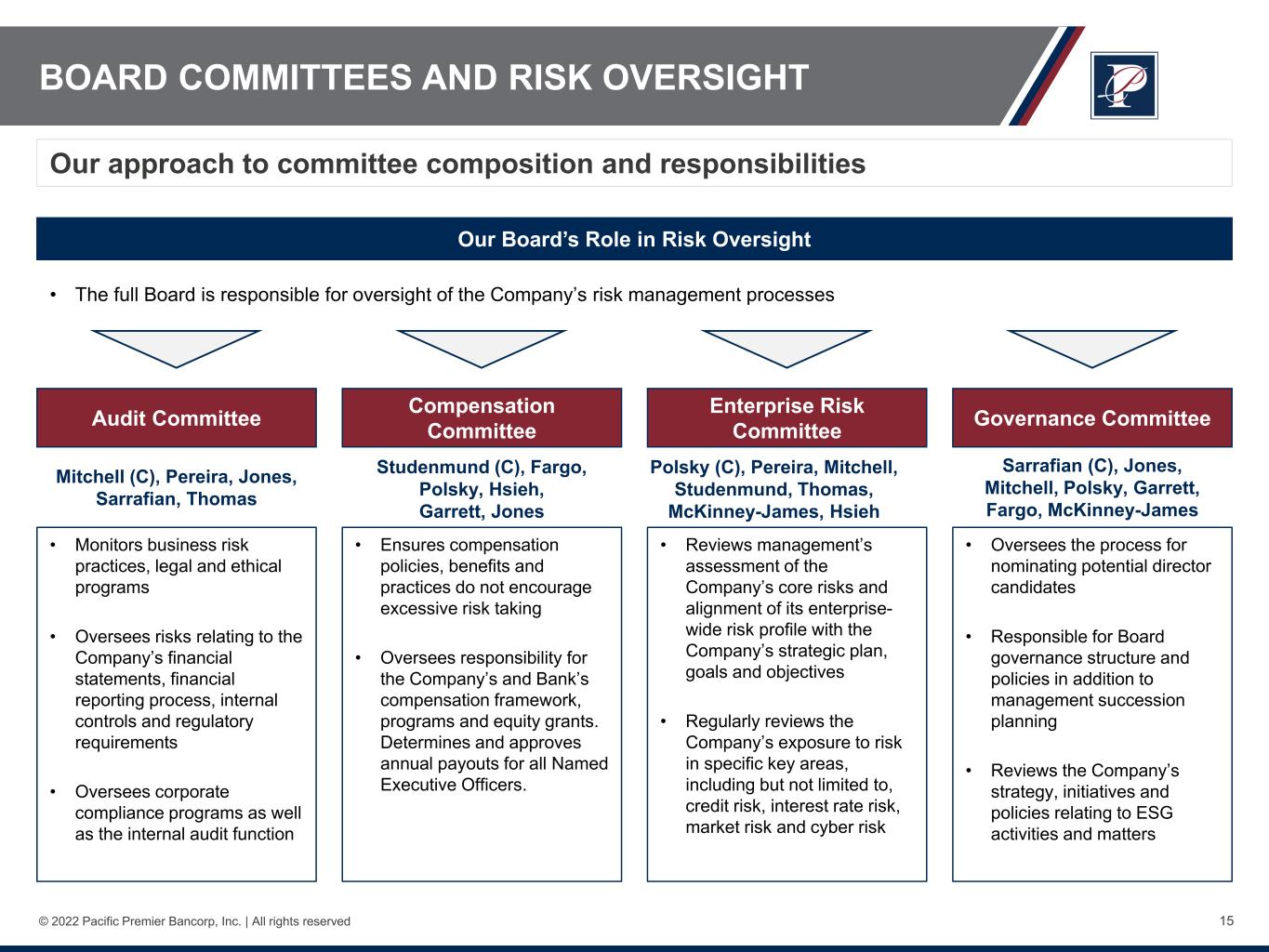

15© 2022 Pacific Premier Bancorp, Inc. | All rights reserved Our approach to committee composition and responsibilities Our Board’s Role in Risk Oversight • The full Board is responsible for oversight of the Company’s risk management processes Audit Committee • Monitors business risk practices, legal and ethical programs • Oversees risks relating to the Company’s financial statements, financial reporting process, internal controls and regulatory requirements • Oversees corporate compliance programs as well as the internal audit function Compensation Committee • Ensures compensation policies, benefits and practices do not encourage excessive risk taking • Oversees responsibility for the Company’s and Bank’s compensation framework, programs and equity grants. Determines and approves annual payouts for all Named Executive Officers. Enterprise Risk Committee • Reviews management’s assessment of the Company’s core risks and alignment of its enterprise- wide risk profile with the Company’s strategic plan, goals and objectives • Regularly reviews the Company’s exposure to risk in specific key areas, including but not limited to, credit risk, interest rate risk, market risk and cyber risk Governance Committee • Oversees the process for nominating potential director candidates • Responsible for Board governance structure and policies in addition to management succession planning • Reviews the Company’s strategy, initiatives and policies relating to ESG activities and matters Mitchell (C), Pereira, Jones, Sarrafian, Thomas Polsky (C), Pereira, Mitchell, Studenmund, Thomas, McKinney-James, Hsieh Studenmund (C), Fargo, Polsky, Hsieh, Garrett, Jones Sarrafian (C), Jones, Mitchell, Polsky, Garrett, Fargo, McKinney-James BOARD COMMITTEES AND RISK OVERSIGHT

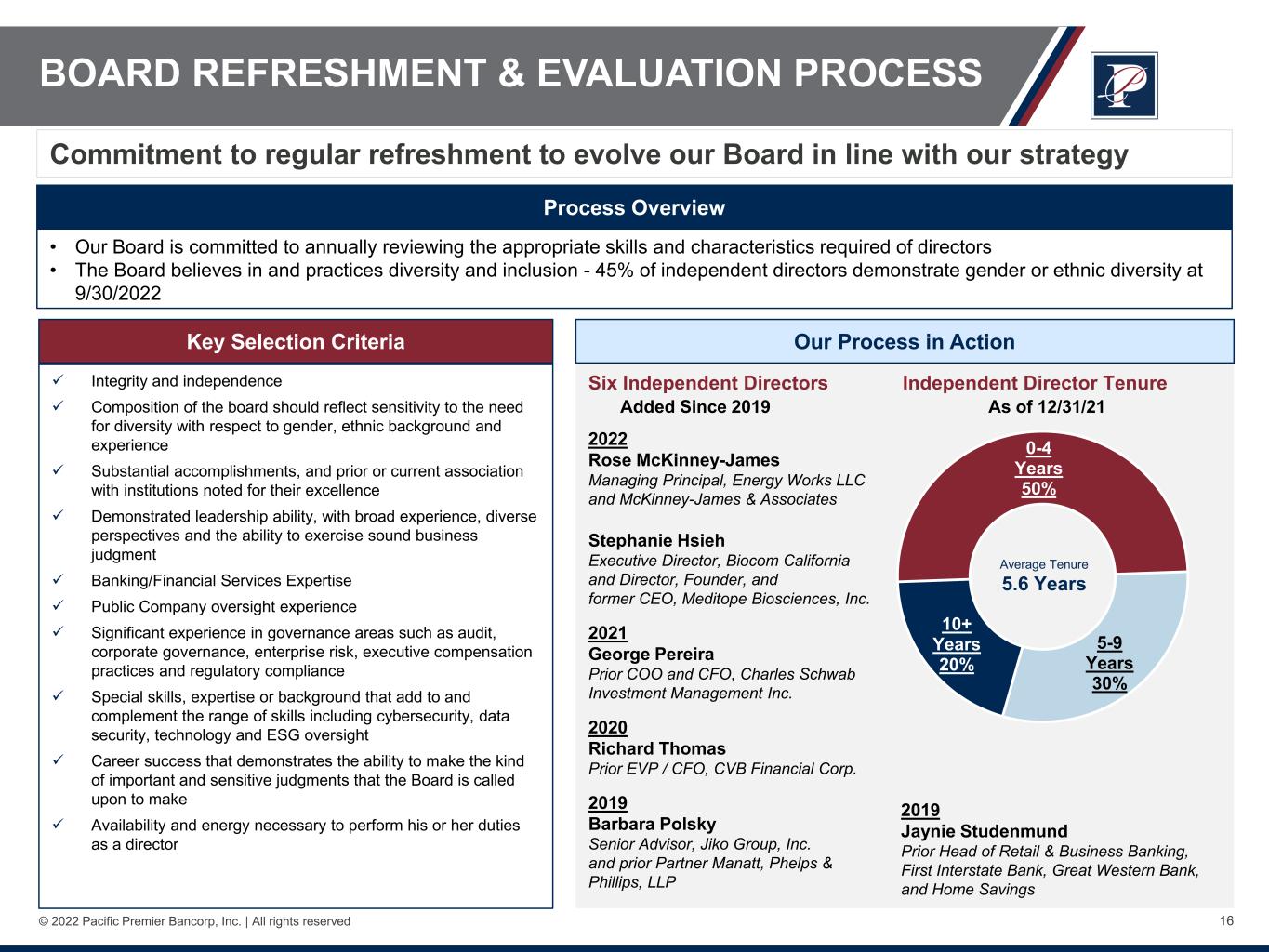

16© 2022 Pacific Premier Bancorp, Inc. | All rights reserved Six Independent Directors Independent Director Tenure Added Since 2019 As of 12/31/21 2022 Rose McKinney-James Managing Principal, Energy Works LLC and McKinney-James & Associates Stephanie Hsieh Executive Director, Biocom California and Director, Founder, and former CEO, Meditope Biosciences, Inc. 2021 George Pereira Prior COO and CFO, Charles Schwab Investment Management Inc. 2020 Richard Thomas Prior EVP / CFO, CVB Financial Corp. 2019 Barbara Polsky Senior Advisor, Jiko Group, Inc. and prior Partner Manatt, Phelps & Phillips, LLP 10+ Years 20% 0-4 Years 50% 5-9 Years 30% Commitment to regular refreshment to evolve our Board in line with our strategy Process Overview • Our Board is committed to annually reviewing the appropriate skills and characteristics required of directors • The Board believes in and practices diversity and inclusion - 45% of independent directors demonstrate gender or ethnic diversity at 9/30/2022 Key Selection Criteria Integrity and independence Composition of the board should reflect sensitivity to the need for diversity with respect to gender, ethnic background and experience Substantial accomplishments, and prior or current association with institutions noted for their excellence Demonstrated leadership ability, with broad experience, diverse perspectives and the ability to exercise sound business judgment Banking/Financial Services Expertise Public Company oversight experience Significant experience in governance areas such as audit, corporate governance, enterprise risk, executive compensation practices and regulatory compliance Special skills, expertise or background that add to and complement the range of skills including cybersecurity, data security, technology and ESG oversight Career success that demonstrates the ability to make the kind of important and sensitive judgments that the Board is called upon to make Availability and energy necessary to perform his or her duties as a director Our Process in Action Average Tenure 5.6 Years BOARD REFRESHMENT & EVALUATION PROCESS 2019 Jaynie Studenmund Prior Head of Retail & Business Banking, First Interstate Bank, Great Western Bank, and Home Savings

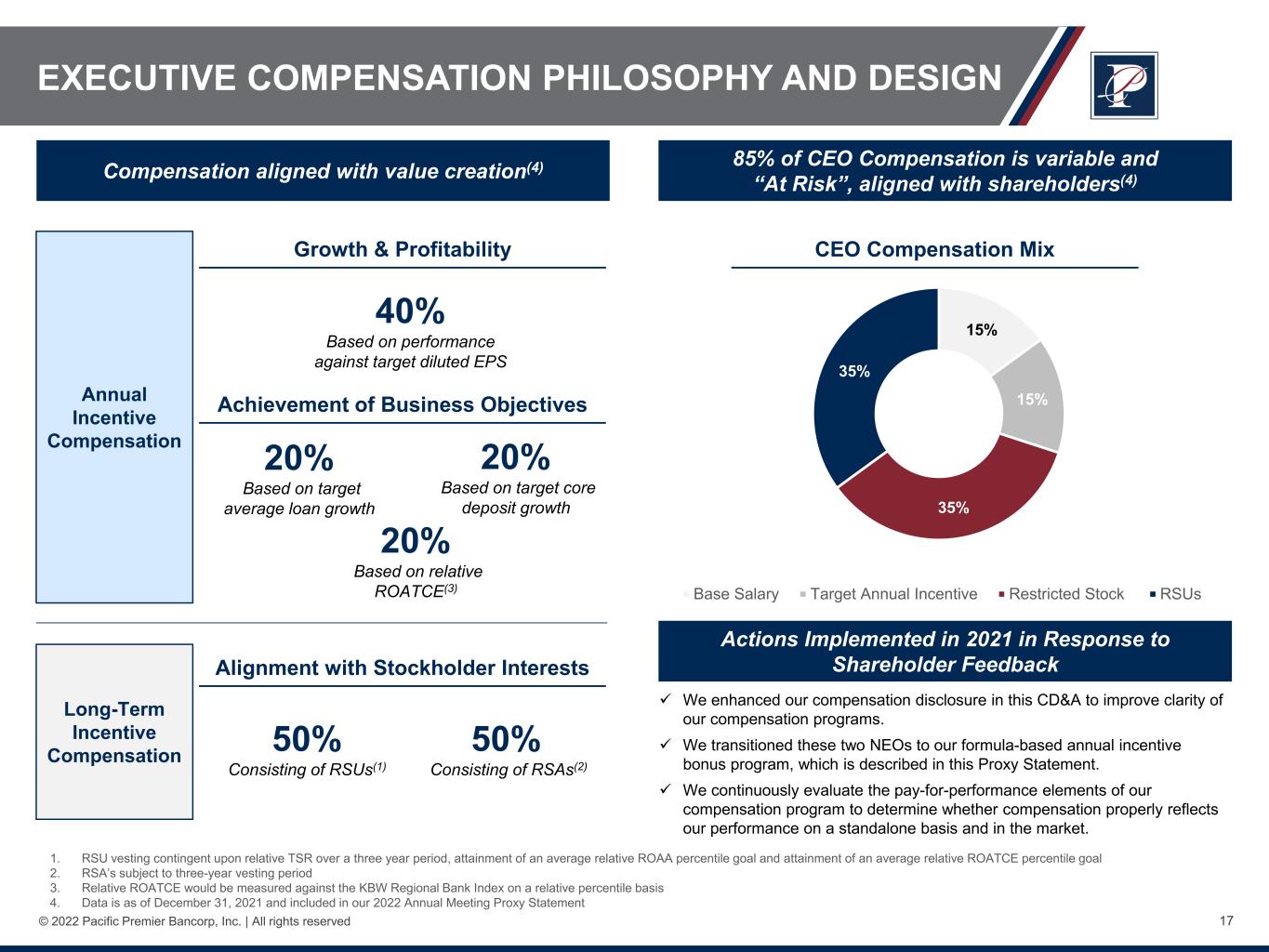

17© 2022 Pacific Premier Bancorp, Inc. | All rights reserved EXECUTIVE COMPENSATION PHILOSOPHY AND DESIGN 85% of CEO Compensation is variable and “At Risk”, aligned with shareholders(4) 40% Based on performance against target diluted EPS 20% Based on target average loan growth 20% Based on target core deposit growth 20% Based on relative ROATCE(3) 50% Consisting of RSUs(1) 50% Consisting of RSAs(2) 1. RSU vesting contingent upon relative TSR over a three year period, attainment of an average relative ROAA percentile goal and attainment of an average relative ROATCE percentile goal 2. RSA’s subject to three-year vesting period 3. Relative ROATCE would be measured against the KBW Regional Bank Index on a relative percentile basis 4. Data is as of December 31, 2021 and included in our 2022 Annual Meeting Proxy Statement Long-Term Incentive Compensation Annual Incentive Compensation Growth & Profitability Achievement of Business Objectives Alignment with Stockholder Interests 15% 15% 35% 35% Base Salary Target Annual Incentive Restricted Stock RSUs Compensation aligned with value creation(4) CEO Compensation Mix Actions Implemented in 2021 in Response to Shareholder Feedback We enhanced our compensation disclosure in this CD&A to improve clarity of our compensation programs. We transitioned these two NEOs to our formula-based annual incentive bonus program, which is described in this Proxy Statement. We continuously evaluate the pay-for-performance elements of our compensation program to determine whether compensation properly reflects our performance on a standalone basis and in the market.

18© 2022 Pacific Premier Bancorp, Inc. | All rights reserved PPBI INVESTMENT THESIS We have maintained a strong credit culture in both good times and bad Emphasis on risk management has been and continues to be a key strength of our organization Highly experienced and respected bank acquirer – 11 successful acquisitions since 2011 Financial results remain solid – strong capital ratios and core earnings Our culture differentiates us and drives fundamentals for all stakeholders We believe we are well-positioned to take advantage of opportunities that arise from this economic environment Shareholder value is our key focus – building long-term value for our owners Diverse Board advising on strategy, overseeing risk and ESG, and supporting long-term value creation

Appendix: Information - Non-GAAP Reconciliation

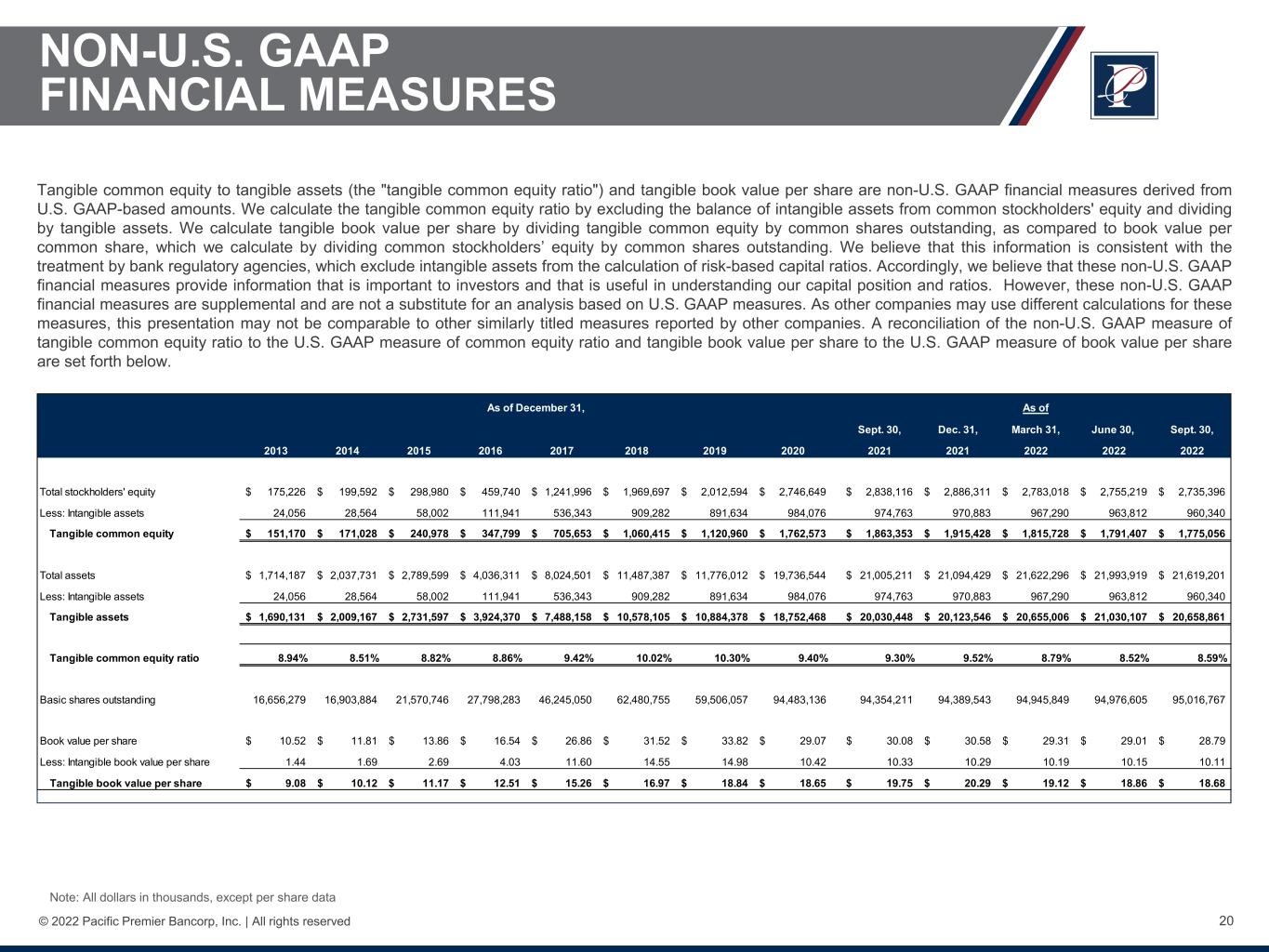

20© 2022 Pacific Premier Bancorp, Inc. | All rights reserved NON-U.S. GAAP FINANCIAL MEASURES Note: All dollars in thousands, except per share data Tangible common equity to tangible assets (the "tangible common equity ratio") and tangible book value per share are non-U.S. GAAP financial measures derived from U.S. GAAP-based amounts. We calculate the tangible common equity ratio by excluding the balance of intangible assets from common stockholders' equity and dividing by tangible assets. We calculate tangible book value per share by dividing tangible common equity by common shares outstanding, as compared to book value per common share, which we calculate by dividing common stockholders’ equity by common shares outstanding. We believe that this information is consistent with the treatment by bank regulatory agencies, which exclude intangible assets from the calculation of risk-based capital ratios. Accordingly, we believe that these non-U.S. GAAP financial measures provide information that is important to investors and that is useful in understanding our capital position and ratios. However, these non-U.S. GAAP financial measures are supplemental and are not a substitute for an analysis based on U.S. GAAP measures. As other companies may use different calculations for these measures, this presentation may not be comparable to other similarly titled measures reported by other companies. A reconciliation of the non-U.S. GAAP measure of tangible common equity ratio to the U.S. GAAP measure of common equity ratio and tangible book value per share to the U.S. GAAP measure of book value per share are set forth below. Sept. 30, Dec. 31, March 31, June 30, Sept. 30, 2013 2014 2015 2016 2017 2018 2019 2020 2021 2021 2022 2022 2022 Total stockholders' equity 175,226$ 199,592$ 298,980$ 459,740$ 1,241,996$ 1,969,697$ 2,012,594$ 2,746,649$ 2,838,116$ 2,886,311$ 2,783,018$ 2,755,219$ 2,735,396$ Less: Intangible assets 24,056 28,564 58,002 111,941 536,343 909,282 891,634 984,076 974,763 970,883 967,290 963,812 960,340 Tangible common equity 151,170$ 171,028$ 240,978$ 347,799$ 705,653$ 1,060,415$ 1,120,960$ 1,762,573$ 1,863,353$ 1,915,428$ 1,815,728$ 1,791,407$ 1,775,056$ Total assets 1,714,187$ 2,037,731$ 2,789,599$ 4,036,311$ 8,024,501$ 11,487,387$ 11,776,012$ 19,736,544$ 21,005,211$ 21,094,429$ 21,622,296$ 21,993,919$ 21,619,201$ Less: Intangible assets 24,056 28,564 58,002 111,941 536,343 909,282 891,634 984,076 974,763 970,883 967,290 963,812 960,340 Tangible assets 1,690,131$ 2,009,167$ 2,731,597$ 3,924,370$ 7,488,158$ 10,578,105$ 10,884,378$ 18,752,468$ 20,030,448$ 20,123,546$ 20,655,006$ 21,030,107$ 20,658,861$ Tangible common equity ratio 8.94% 8.51% 8.82% 8.86% 9.42% 10.02% 10.30% 9.40% 9.30% 9.52% 8.79% 8.52% 8.59% Basic shares outstanding 16,656,279 16,903,884 21,570,746 27,798,283 46,245,050 62,480,755 59,506,057 94,483,136 94,354,211 94,389,543 94,945,849 94,976,605 95,016,767 Book value per share 10.52$ 11.81$ 13.86$ 16.54$ 26.86$ 31.52$ 33.82$ 29.07$ 30.08$ 30.58$ 29.31$ 29.01$ 28.79$ Less: Intangible book value per share 1.44 1.69 2.69 4.03 11.60 14.55 14.98 10.42 10.33 10.29 10.19 10.15 10.11 Tangible book value per share 9.08$ 10.12$ 11.17$ 12.51$ 15.26$ 16.97$ 18.84$ 18.65$ 19.75$ 20.29$ 19.12$ 18.86$ 18.68$ As of December 31, As of

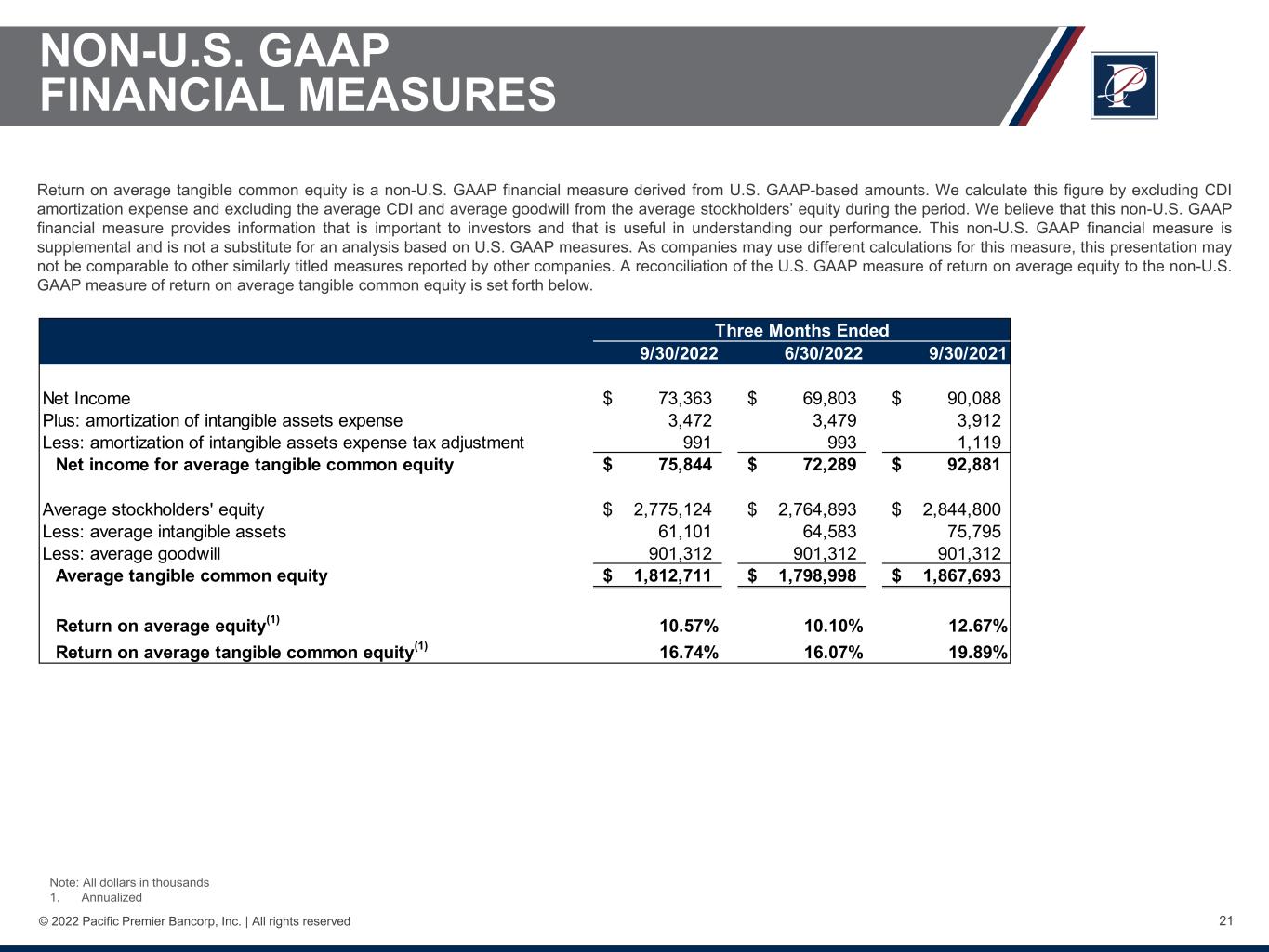

21© 2022 Pacific Premier Bancorp, Inc. | All rights reserved NON-U.S. GAAP FINANCIAL MEASURES Note: All dollars in thousands 1. Annualized Return on average tangible common equity is a non-U.S. GAAP financial measure derived from U.S. GAAP-based amounts. We calculate this figure by excluding CDI amortization expense and excluding the average CDI and average goodwill from the average stockholders’ equity during the period. We believe that this non-U.S. GAAP financial measure provides information that is important to investors and that is useful in understanding our performance. This non-U.S. GAAP financial measure is supplemental and is not a substitute for an analysis based on U.S. GAAP measures. As companies may use different calculations for this measure, this presentation may not be comparable to other similarly titled measures reported by other companies. A reconciliation of the U.S. GAAP measure of return on average equity to the non-U.S. GAAP measure of return on average tangible common equity is set forth below. 9/30/2022 6/30/2022 9/30/2021 Net Income 73,363$ 69,803$ 90,088$ Plus: amortization of intangible assets expense 3,472 3,479 3,912 Less: amortization of intangible assets expense tax adjustment 991 993 1,119 Net income for average tangible common equity 75,844$ 72,289$ 92,881$ Average stockholders' equity 2,775,124$ 2,764,893$ 2,844,800$ Less: average intangible assets 61,101 64,583 75,795 Less: average goodwill 901,312 901,312 901,312 Average tangible common equity 1,812,711$ 1,798,998$ 1,867,693$ Return on average equity(1) 10.57% 10.10% 12.67% Return on average tangible common equity(1) 16.74% 16.07% 19.89% Three Months Ended

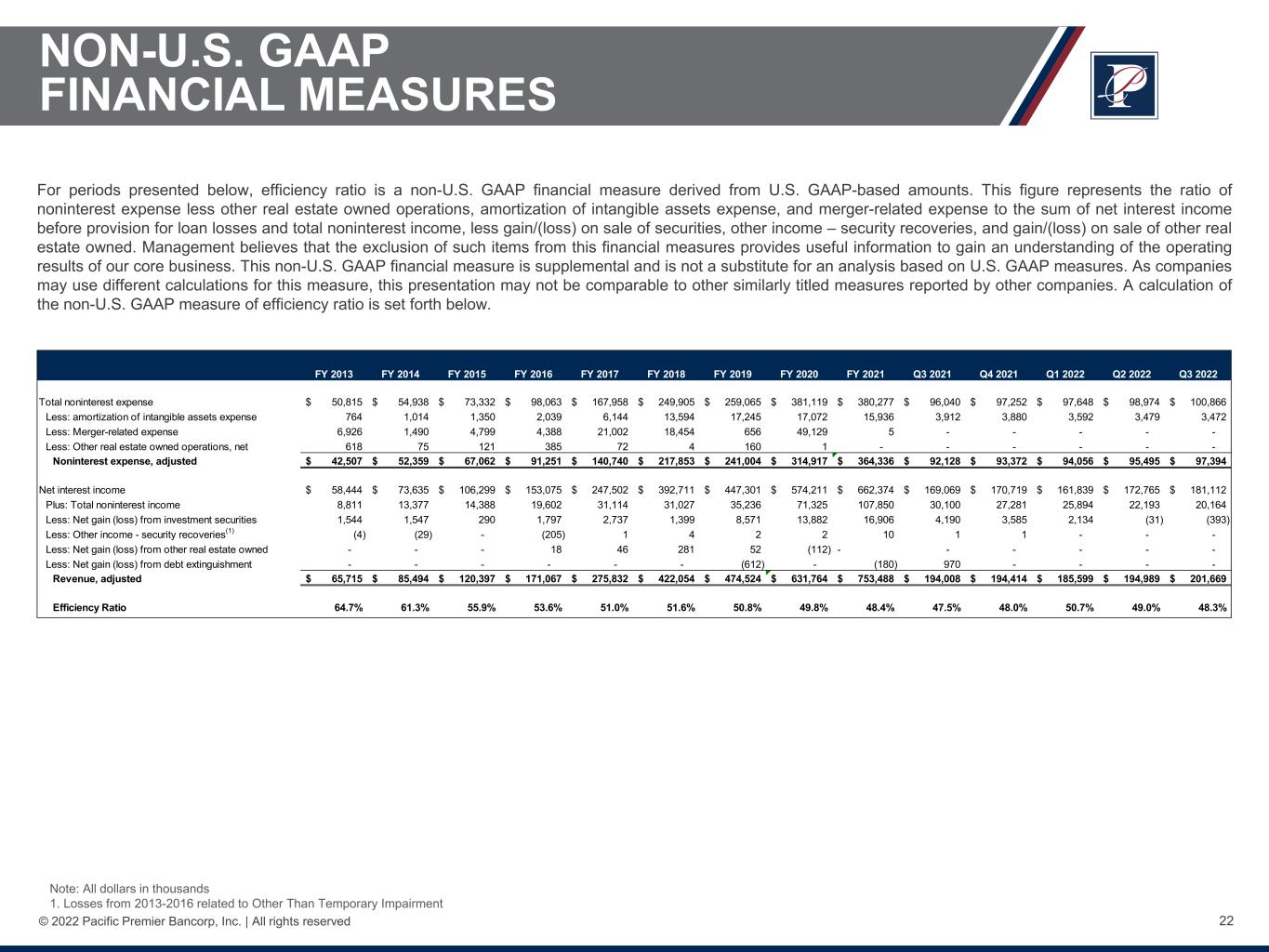

22© 2022 Pacific Premier Bancorp, Inc. | All rights reserved NON-U.S. GAAP FINANCIAL MEASURES Note: All dollars in thousands 1. Losses from 2013-2016 related to Other Than Temporary Impairment For periods presented below, efficiency ratio is a non-U.S. GAAP financial measure derived from U.S. GAAP-based amounts. This figure represents the ratio of noninterest expense less other real estate owned operations, amortization of intangible assets expense, and merger-related expense to the sum of net interest income before provision for loan losses and total noninterest income, less gain/(loss) on sale of securities, other income – security recoveries, and gain/(loss) on sale of other real estate owned. Management believes that the exclusion of such items from this financial measures provides useful information to gain an understanding of the operating results of our core business. This non-U.S. GAAP financial measure is supplemental and is not a substitute for an analysis based on U.S. GAAP measures. As companies may use different calculations for this measure, this presentation may not be comparable to other similarly titled measures reported by other companies. A calculation of the non-U.S. GAAP measure of efficiency ratio is set forth below. FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Total noninterest expense 50,815$ 54,938$ 73,332$ 98,063$ 167,958$ 249,905$ 259,065$ 381,119$ 380,277$ 96,040$ 97,252$ 97,648$ 98,974$ 100,866$ Less: amortization of intangible assets expense 764 1,014 1,350 2,039 6,144 13,594 17,245 17,072 15,936 3,912 3,880 3,592 3,479 3,472 Less: Merger-related expense 6,926 1,490 4,799 4,388 21,002 18,454 656 49,129 5 - - - - - Less: Other real estate owned operations, net 618 75 121 385 72 4 160 1 - - - - - - Noninterest expense, adjusted 42,507$ 52,359$ 67,062$ 91,251$ 140,740$ 217,853$ 241,004$ 314,917$ 364,336$ 92,128$ 93,372$ 94,056$ 95,495$ 97,394$ Net interest income 58,444$ 73,635$ 106,299$ 153,075$ 247,502$ 392,711$ 447,301$ 574,211$ 662,374$ 169,069$ 170,719$ 161,839$ 172,765$ 181,112$ Plus: Total noninterest income 8,811 13,377 14,388 19,602 31,114 31,027 35,236 71,325 107,850 30,100 27,281 25,894 22,193 20,164 Less: Net gain (loss) from investment securities 1,544 1,547 290 1,797 2,737 1,399 8,571 13,882 16,906 4,190 3,585 2,134 (31) (393) Less: Other income - security recoveries(1) (4) (29) - (205) 1 4 2 2 10 1 1 - - - Less: Net gain (loss) from other real estate owned - - - 18 46 281 52 (112) - - - - - - Less: Net gain (loss) from debt extinguishment - - - - - - (612) - (180) 970 - - - - Revenue, adjusted 65,715$ 85,494$ 120,397$ 171,067$ 275,832$ 422,054$ 474,524$ 631,764$ 753,488$ 194,008$ 194,414$ 185,599$ 194,989$ 201,669$ Efficiency Ratio 64.7% 61.3% 55.9% 53.6% 51.0% 51.6% 50.8% 49.8% 48.4% 47.5% 48.0% 50.7% 49.0% 48.3%

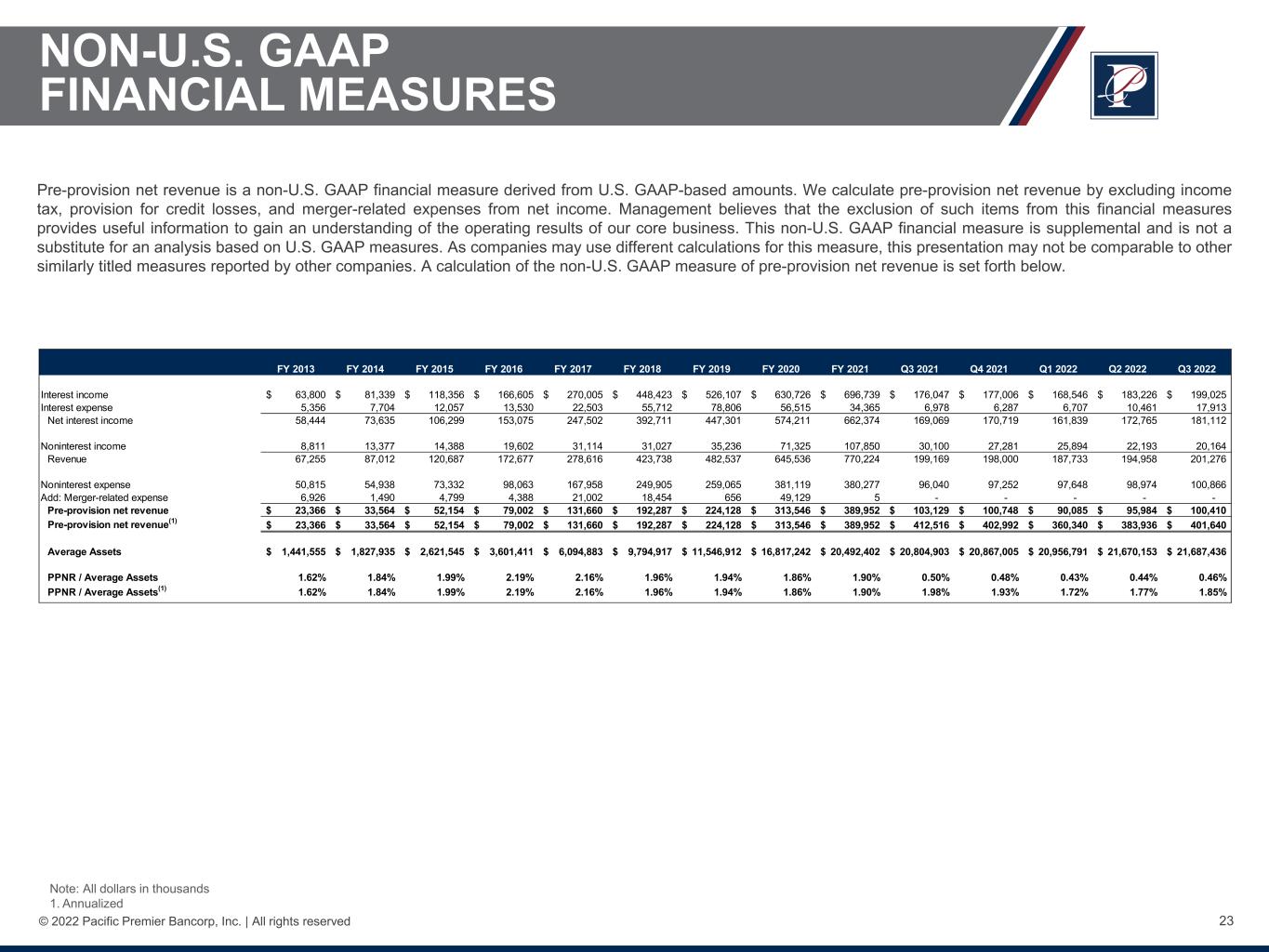

23© 2022 Pacific Premier Bancorp, Inc. | All rights reserved NON-U.S. GAAP FINANCIAL MEASURES Note: All dollars in thousands 1. Annualized Pre-provision net revenue is a non-U.S. GAAP financial measure derived from U.S. GAAP-based amounts. We calculate pre-provision net revenue by excluding income tax, provision for credit losses, and merger-related expenses from net income. Management believes that the exclusion of such items from this financial measures provides useful information to gain an understanding of the operating results of our core business. This non-U.S. GAAP financial measure is supplemental and is not a substitute for an analysis based on U.S. GAAP measures. As companies may use different calculations for this measure, this presentation may not be comparable to other similarly titled measures reported by other companies. A calculation of the non-U.S. GAAP measure of pre-provision net revenue is set forth below. FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Interest income 63,800$ 81,339$ 118,356$ 166,605$ 270,005$ 448,423$ 526,107$ 630,726$ 696,739$ 176,047$ 177,006$ 168,546$ 183,226$ 199,025$ Interest expense 5,356 7,704 12,057 13,530 22,503 55,712 78,806 56,515 34,365 6,978 6,287 6,707 10,461 17,913 Net interest income 58,444 73,635 106,299 153,075 247,502 392,711 447,301 574,211 662,374 169,069 170,719 161,839 172,765 181,112 Noninterest income 8,811 13,377 14,388 19,602 31,114 31,027 35,236 71,325 107,850 30,100 27,281 25,894 22,193 20,164 Revenue 67,255 87,012 120,687 172,677 278,616 423,738 482,537 645,536 770,224 199,169 198,000 187,733 194,958 201,276 Noninterest expense 50,815 54,938 73,332 98,063 167,958 249,905 259,065 381,119 380,277 96,040 97,252 97,648 98,974 100,866 Add: Merger-related expense 6,926 1,490 4,799 4,388 21,002 18,454 656 49,129 5 - - - - - Pre-provision net revenue 23,366$ 33,564$ 52,154$ 79,002$ 131,660$ 192,287$ 224,128$ 313,546$ 389,952$ 103,129$ 100,748$ 90,085$ 95,984$ 100,410$ Pre-provision net revenue(1) 23,366$ 33,564$ 52,154$ 79,002$ 131,660$ 192,287$ 224,128$ 313,546$ 389,952$ 412,516$ 402,992$ 360,340$ 383,936$ 401,640$ Average Assets 1,441,555$ 1,827,935$ 2,621,545$ 3,601,411$ 6,094,883$ 9,794,917$ 11,546,912$ 16,817,242$ 20,492,402$ 20,804,903$ 20,867,005$ 20,956,791$ 21,670,153$ 21,687,436$ PPNR / Average Assets 1.62% 1.84% 1.99% 2.19% 2.16% 1.96% 1.94% 1.86% 1.90% 0.50% 0.48% 0.43% 0.44% 0.46% PPNR / Average Assets(1) 1.62% 1.84% 1.99% 2.19% 2.16% 1.96% 1.94% 1.86% 1.90% 1.98% 1.93% 1.72% 1.77% 1.85%

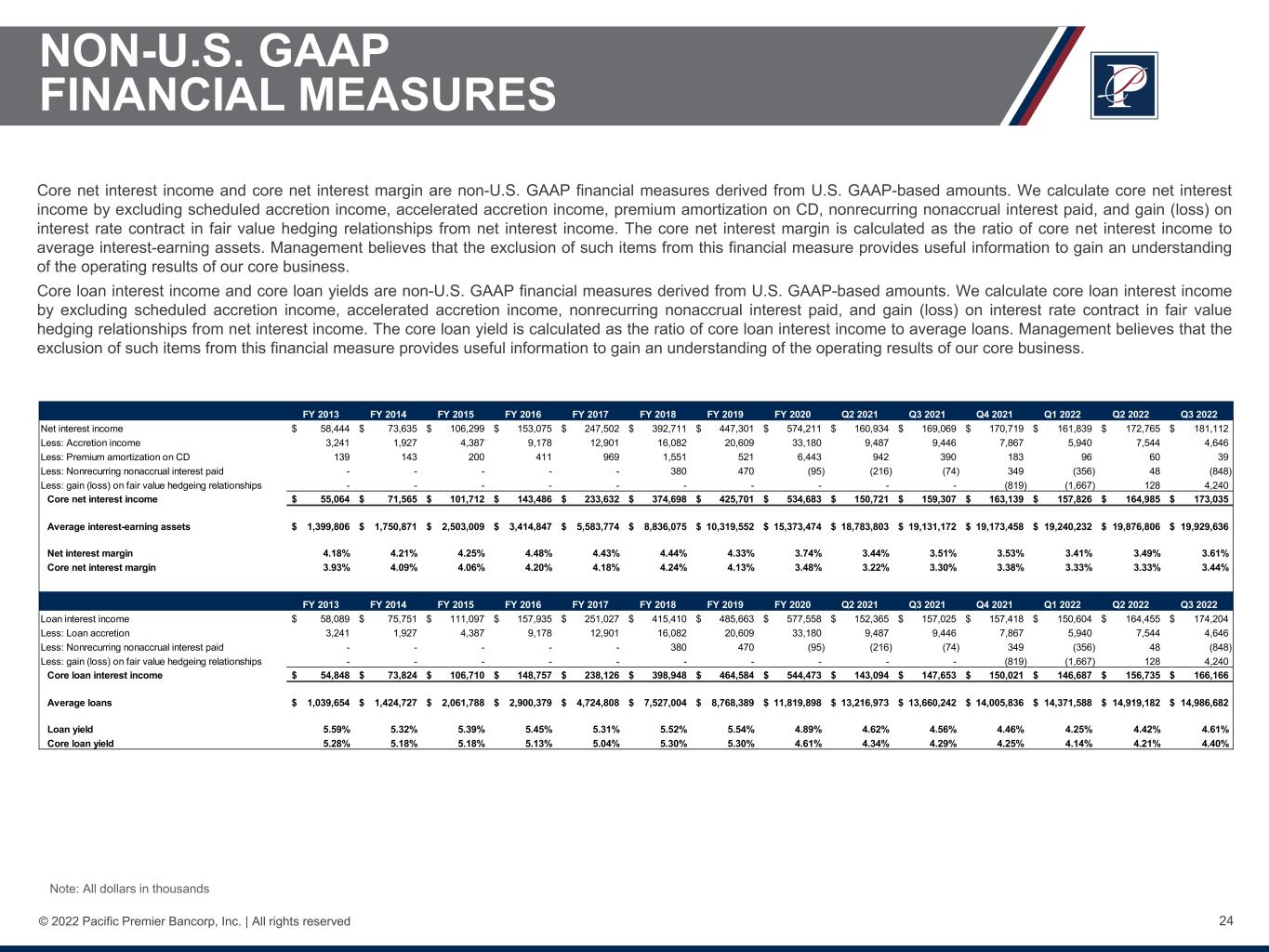

24© 2022 Pacific Premier Bancorp, Inc. | All rights reserved NON-U.S. GAAP FINANCIAL MEASURES Core net interest income and core net interest margin are non-U.S. GAAP financial measures derived from U.S. GAAP-based amounts. We calculate core net interest income by excluding scheduled accretion income, accelerated accretion income, premium amortization on CD, nonrecurring nonaccrual interest paid, and gain (loss) on interest rate contract in fair value hedging relationships from net interest income. The core net interest margin is calculated as the ratio of core net interest income to average interest-earning assets. Management believes that the exclusion of such items from this financial measure provides useful information to gain an understanding of the operating results of our core business. Core loan interest income and core loan yields are non-U.S. GAAP financial measures derived from U.S. GAAP-based amounts. We calculate core loan interest income by excluding scheduled accretion income, accelerated accretion income, nonrecurring nonaccrual interest paid, and gain (loss) on interest rate contract in fair value hedging relationships from net interest income. The core loan yield is calculated as the ratio of core loan interest income to average loans. Management believes that the exclusion of such items from this financial measure provides useful information to gain an understanding of the operating results of our core business. Note: All dollars in thousands FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 FY 2020 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Net interest income 58,444$ 73,635$ 106,299$ 153,075$ 247,502$ 392,711$ 447,301$ 574,211$ 160,934$ 169,069$ 170,719$ 161,839$ 172,765$ 181,112$ Less: Accretion income 3,241 1,927 4,387 9,178 12,901 16,082 20,609 33,180 9,487 9,446 7,867 5,940 7,544 4,646 Less: Premium amortization on CD 139 143 200 411 969 1,551 521 6,443 942 390 183 96 60 39 Less: Nonrecurring nonaccrual interest paid - - - - - 380 470 (95) (216) (74) 349 (356) 48 (848) Less: gain (loss) on fair value hedgeing relationships - - - - - - - - - - (819) (1,667) 128 4,240 Core net interest income 55,064$ 71,565$ 101,712$ 143,486$ 233,632$ 374,698$ 425,701$ 534,683$ 150,721$ 159,307$ 163,139$ 157,826$ 164,985$ 173,035$ Average interest-earning assets 1,399,806$ 1,750,871$ 2,503,009$ 3,414,847$ 5,583,774$ 8,836,075$ 10,319,552$ 15,373,474$ 18,783,803$ 19,131,172$ 19,173,458$ 19,240,232$ 19,876,806$ 19,929,636$ Net interest margin 4.18% 4.21% 4.25% 4.48% 4.43% 4.44% 4.33% 3.74% 3.44% 3.51% 3.53% 3.41% 3.49% 3.61% Core net interest margin 3.93% 4.09% 4.06% 4.20% 4.18% 4.24% 4.13% 3.48% 3.22% 3.30% 3.38% 3.33% 3.33% 3.44% FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 FY 2020 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Loan interest income 58,089$ 75,751$ 111,097$ 157,935$ 251,027$ 415,410$ 485,663$ 577,558$ 152,365$ 157,025$ 157,418$ 150,604$ 164,455$ 174,204$ Less: Loan accretion 3,241 1,927 4,387 9,178 12,901 16,082 20,609 33,180 9,487 9,446 7,867 5,940 7,544 4,646 Less: Nonrecurring nonaccrual interest paid - - - - - 380 470 (95) (216) (74) 349 (356) 48 (848) Less: gain (loss) on fair value hedgeing relationships - - - - - - - - - - (819) (1,667) 128 4,240 Core loan interest income 54,848$ 73,824$ 106,710$ 148,757$ 238,126$ 398,948$ 464,584$ 544,473$ 143,094$ 147,653$ 150,021$ 146,687$ 156,735$ 166,166$ Average loans 1,039,654$ 1,424,727$ 2,061,788$ 2,900,379$ 4,724,808$ 7,527,004$ 8,768,389$ 11,819,898$ 13,216,973$ 13,660,242$ 14,005,836$ 14,371,588$ 14,919,182$ 14,986,682$ Loan yield 5.59% 5.32% 5.39% 5.45% 5.31% 5.52% 5.54% 4.89% 4.62% 4.56% 4.46% 4.25% 4.42% 4.61% Core loan yield 5.28% 5.18% 5.18% 5.13% 5.04% 5.30% 5.30% 4.61% 4.34% 4.29% 4.25% 4.14% 4.21% 4.40%

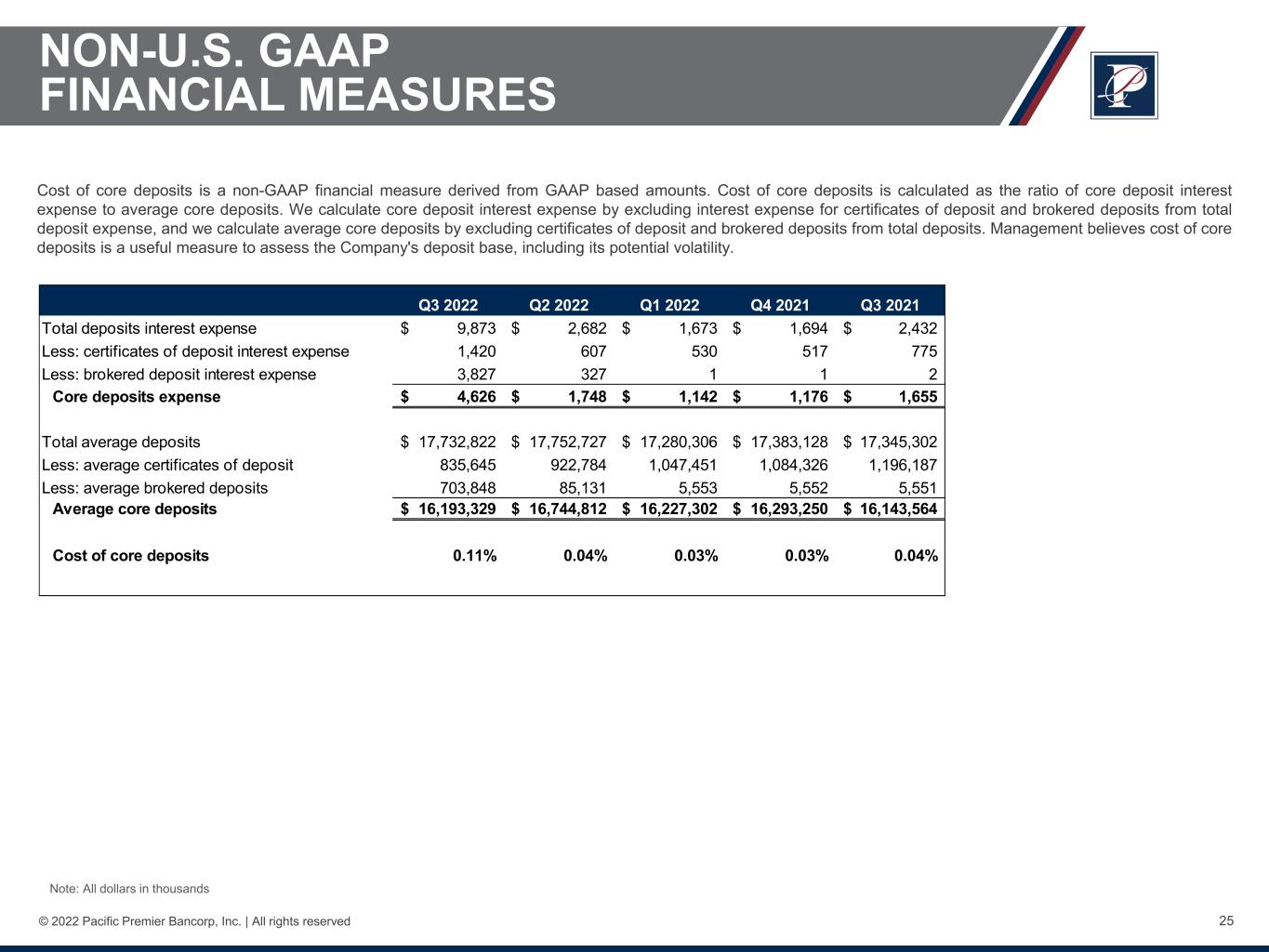

25© 2022 Pacific Premier Bancorp, Inc. | All rights reserved NON-U.S. GAAP FINANCIAL MEASURES Cost of core deposits is a non-GAAP financial measure derived from GAAP based amounts. Cost of core deposits is calculated as the ratio of core deposit interest expense to average core deposits. We calculate core deposit interest expense by excluding interest expense for certificates of deposit and brokered deposits from total deposit expense, and we calculate average core deposits by excluding certificates of deposit and brokered deposits from total deposits. Management believes cost of core deposits is a useful measure to assess the Company's deposit base, including its potential volatility. Note: All dollars in thousands Q3 2022 Q2 2022 Q1 2022 Q4 2021 Q3 2021 Total deposits interest expense 9,873$ 2,682$ 1,673$ 1,694$ 2,432$ Less: certificates of deposit interest expense 1,420 607 530 517 775 Less: brokered deposit interest expense 3,827 327 1 1 2 Core deposits expense 4,626$ 1,748$ 1,142$ 1,176$ 1,655$ Total average deposits 17,732,822$ 17,752,727$ 17,280,306$ 17,383,128$ 17,345,302$ Less: average certificates of deposit 835,645 922,784 1,047,451 1,084,326 1,196,187 Less: average brokered deposits 703,848 85,131 5,553 5,552 5,551 Average core deposits 16,193,329$ 16,744,812$ 16,227,302$ 16,293,250$ 16,143,564$ Cost of core deposits 0.11% 0.04% 0.03% 0.03% 0.04%