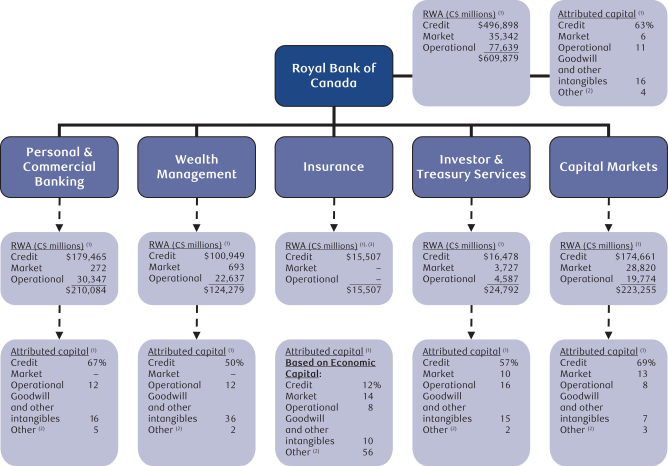

Personal & Commercial Banking |

Personal & Commercial Banking provides a broad suite of financial products and services to individuals and businesses for their banking, investing and financing needs. We are focused on building deep and meaningful relationships with our clients, underscored by the delivery of exceptional client experiences, the breadth of our product suite, our depth of expertise, and the features of our digital solutions.

day-to-day

> 14 million |

#1 or #2 |

38,450 | ||||||

Number of Canadian Banking clients |

Ranking in market share for all key retail and business products |

Employees | ||||||

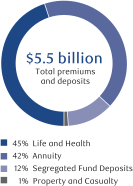

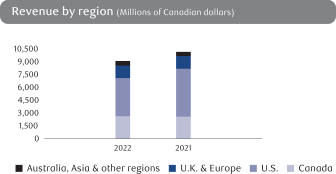

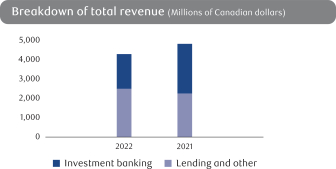

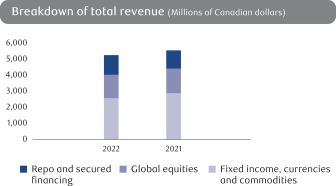

Revenue by business lines |

We operate through two businesses – Canadian Banking and Caribbean & U.S. Banking. Canadian Banking serves our home market in Canada. We have the largest branch network, the most ATMs, one of the largest mobile sales forces across Canada along with market-leading digital capabilities. In Caribbean & U.S. Banking, we offer a broad range of financial products and services in targeted markets. In Canada, we compete with other Schedule 1 banks, independent trust companies, foreign banks, credit unions, caisses populaires, auto financing companies, as well as emerging entrants to the financial services industry. In the Caribbean, our competition includes banks, trust companies and investment management companies serving retail and corporate clients, as well as public institutions. In the U.S., we compete primarily with other Canadian banking institutions that have U.S. operations. | |||||||

|

||||||||

2022 Operating environment

› |

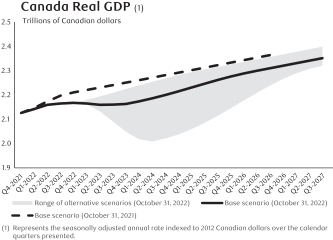

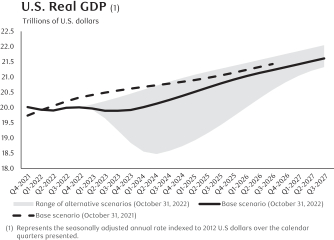

In the early part of the fiscal year, the operating environment continued to be impacted by COVID-19 related restrictions; however, it was buffered in part by low unemployment levels, sustained GDP growth and government support. As restrictions eased during the year, client activity improved, driving solid revenue growth in fiscal 2022. |

› |

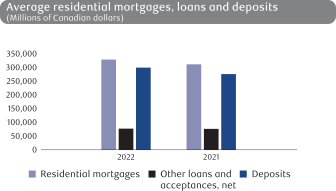

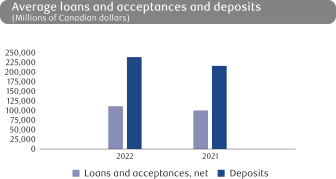

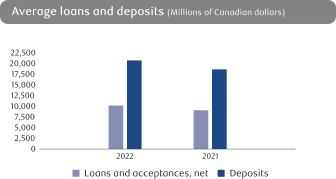

In response to rising inflation, the BoC raised the benchmark interest rate by 350 basis points from March 2022 to October 2022. As a result of the rising interest rate environment, we saw NIM expansion in fiscal 2022, reversing the decline in the prior year. The combination of strong volumes and higher NIM translated to significant growth in net interest income. |

› |

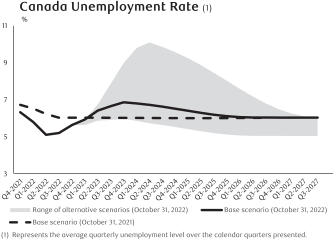

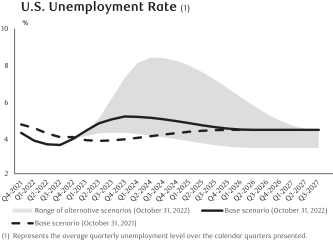

While the credit environment in fiscal 2022 reflected a recovery from the COVID-19 pandemic, it also reflected unfavourable changes in our economic outlook towards the latter half of the year, including the impact of slowing economic growth as well as rising inflation and interest rates. PCL on impaired loans remained well below pre-pandemic levels. |

› |

As a result of the rising rate environment, housing activity has slowed and household debt servicing costs increased. In the latter half of the year, we saw mortgage originations below prior year levels. |

› |

Personal and business deposits continued to see significant growth in the first half of the year as COVID-19 related disruptions persisted; however, as a result of the economy re-opening and robust client activity, as well as the impact from Bank of Canada’s monetary policy, deposit growth decelerated in the latter half of the fiscal year but remained well above pre-pandemic levels. |

› |

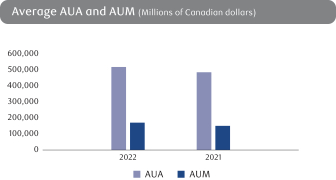

In fiscal 2022, we saw unfavourable market conditions driving mutual fund balances lower from both market depreciation and net redemptions. We also saw a decline in client activity in our Direct Investing business from elevated levels in the previous year. |

› |

Client preferences for digital offerings are evolving and we continue to invest in digital solutions to improve the client experience and deliver personalized advice. |

› |

Our Caribbean Banking business was favourably impacted by the recovery from the COVID-19 pandemic, reflecting higher client activity. We also saw releases of provisions on performing and impaired loans. |

› |

In the U.S., earnings were favourably impacted by the rising interest rate environment and the increase in cross-border travel, as most restrictions related to COVID-19 were lifted. |

32 Royal Bank of Canada: Annual Report 2022 Management’s Discussion and Analysis