Nov. 28, 2022 |

|---|

| Donoghue Forlines Risk Managed Innovation ETF

|

| Donoghue Forlines Risk Managed Innovation ETF

|

| Investment Objective

|

| The Donoghue Forlines Risk Managed Innovation ETF (the “Fund”) seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the FCF Risk Managed Quality Innovation Index (the “Underlying Index”).

|

| Fees and Expenses

|

| This table describes the fees and expenses that you may pay if you buy, hold and sell Shares. You may also pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table or example below.

|

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment):

|

| | | | | | | | | | | | Management Fee1 | | 0.69% | | | Other Expenses | | 0.00% | | | | | | | Total Annual Fund Operating Expenses | | 0.69% | |

|

| Example

|

| The following example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The example assumes that you invest $10,000 for the time periods indicated and then redeem all of your Shares at the end of those periods. The example also assumes that the Fund provides a return of 5% per year and that operating expenses remain the same. The example does not reflect any brokerage commissions that you may pay on purchases and sales of Shares.

|

| Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

| | | | | | | | | | | | | One Year | Three Years | Five Years | Ten Years | | $70 | $221 | $384 | $859 |

|

| Portfolio Turnover

|

| The Fund may pay transaction costs, including commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Shares are held in a taxable account. These costs, which are not reflected in the annual fund operating expenses or in the example, affect the Fund’s performance. For the fiscal year ended July 31, 2022, the Fund’s portfolio turnover rate was 82% of the average value of its portfolio.

|

| Principal Investment Strategies

|

To pursue its investment objective, the Fund invests, under normal market circumstances, at least 80% of its net assets (plus any borrowings for investment purposes) in component securities of the Underlying Index. The Underlying Index is sponsored and maintained by FCF Indexes LLC (the "Index Provider"), an affiliate of FCF Advisors LLC, the Fund’s investment adviser (the “Adviser”). The Underlying Index is designed to track the performance of a strategy that seeks to provide risk-managed exposure to U.S. publicly traded companies with strong free cash flow and strong research and development (“R&D”) investment. The Fund intends to maintain a portfolio of securities that generally replicates the holdings of the Underlying Index. To be eligible for inclusion in the Underlying Index, an equity security must: (i) be a U.S. listed common stock; (ii) have a minimum total market capitalization larger than the 97th percentile of the cumulative market capitalization of all U.S.-listed companies; (iii) have an average monthly trading volume of greater than $75 million over the last six months; and (iv) have been issued by a company that has reported over the past 12 months certain characteristics of its expenses, including free cash flow and positive R&D expense. Each security eligible for inclusion is then scored based on the following components of the company issuing the security (the “FCF Innovation Score”), which is intended to be representative of a company’s free cash flow and innovation: (i) quality of earnings (i.e., a metric that determines the proportion of income attributable to the cash flow activities of a company); (ii) profits generated from R&D; (iii) degree of R&D investment relative to total assets; (iv) assets turnover; and (v) financial leverage. Only companies with an FCF Innovation Score within the top 25% of all eligible securities are candidates for inclusion in the Underlying Index. A target weighting is then assigned to each security based on a combination of its FCF Innovation Score and free-float market capitalization. Companies are then ranked based on their target weighting and sequentially included in the Underlying Index until either 120 securities have been included or 90% of the cumulative security weight has been included, whichever occurs first. These securities comprise the “Equity Portfolio” of the Underlying Index. The Underlying Index utilizes a proprietary, rules-based methodology that employs a downside protection model that is intended to manage risk in the Equity Portfolio during certain bear market environments. The downside protection model will provide either a “buy signal” or a “sell signal,” which are used to determine whether the Underlying Index will be in a bullish (i.e., fully invested long position) or defensive posture, respectively. When a “buy signal” is triggered, the Underlying Index will be comprised entirely of the Equity Portfolio. When a “sell signal” is triggered, the Underlying Index will eliminate 50% of the Equity Portfolio allocations in exchange for short-term U.S. Treasury securities and/or other cash equivalents (“Short-Term Treasury Securities”). The Short-Term Treasury Securities comprise the “U.S. Treasury Portfolio” of the Underlying Index. The downside protection model will provide buy or sell signals on a daily basis. Sell signals are typically only triggered during prolonged bear markets and downside protection will not be provided during all declining or bear market environments. The sell signal was most recently triggered in September 2022, in connection with the recent bear market environment. Please review the portfolio holdings information on the Fund's website at www.donoghueforlinesetfs.com/dfnv to determine whether the Fund is in a bullish or defensive posture prior to making an investment in the Fund. Allocations to the Equity Portfolio are rebalanced and reconstituted quarterly. The composition of the U.S. Treasury Portfolio is also rebalanced and reconstituted quarterly. The Fund is generally rebalanced and reconstituted in accordance with the Underlying Index. Allocations implemented pursuant to the downside protection model are determined at the close of trading on each business day, based on the signal triggered, and become effective at the close of trading on the following business day. The Fund will generally implement downside protection allocations in accordance with the Underlying Index. The Fund can use derivative instruments, including exchange-traded futures contracts, to gain exposure to component securities of the Underlying Index. Donoghue Forlines LLC, the Fund’s sub-adviser (the "Sub-Adviser"), may engage in active and frequent trading of the Fund’s portfolio securities to achieve the Fund’s investment objective. The Fund will concentrate its investments (i.e., invest more than 25% of its total assets) in a particular industry or group of industries to approximately the same extent that the Underlying Index is concentrated. As of September 30, 2022, the Fund is concentrated in the technology sector.

|

| Principal Risks

|

An investment in the Fund involves risk, including those described below. There is no assurance that the Fund will achieve its investment objective. An investor may lose money by investing in the Fund. Equity Investing Risk. An investment in the Fund involves risks similar to those of investing in any fund holding equity securities, such as market fluctuations, changes in interest rates and perceived trends in stock prices. The values of equity securities could decline generally or could underperform other investments. In addition, securities may decline in value due to factors affecting a specific issuer, market or securities markets generally. Small and Medium Capitalization Company Risk. Investing in securities of small and medium capitalization companies involves greater risk than customarily is associated with investing in larger, more established companies. These companies’ securities may be more volatile and less liquid than those of more established companies. Often, small and medium capitalization companies and the industries in which they focus are still evolving and, as a result, they may be more sensitive to changing market conditions. Small and medium capitalization companies may be particularly affected by interest rate increases, as they may find it more difficult to borrow money to continue or expand operations or may have difficulty in repaying any loans which are floating rate. U.S. Treasury Securities Risk. U.S. Treasury securities may differ from other securities in their interest rates, maturities, times of issuance and other characteristics and may provide relatively lower returns than those of other securities. Similar to other issuers, changes to the financial condition or credit rating of a government may cause the value of Short-Term Treasury Securities to decline. Index-Based Strategy Risk. The Fund is managed as an index-based fund that seeks to track the performance of the Underlying Index. This differs from an actively managed fund, which typically seeks to outperform a benchmark index. As a result, the Fund may hold the component securities of the Underlying Index regardless of the current or projected performance of a specific security or the relevant market as a whole. Maintaining investments in securities regardless of market conditions or the performance of individual securities could cause the Fund’s returns to be lower than if the Fund employed an active strategy. The Fund will seek to track the Underlying Index in all market conditions, including during adverse market conditions when other funds may seek to take temporary defensive measures (such as investing significantly in cash or cash equivalents). Accordingly, unless the Underlying Index allocates significant portions of its assets to cash and/or cash equivalents during times of adverse market or economic conditions, the Fund may be subject to a higher level of market risk during such times than other funds. Additionally, the Fund generally rebalances and reconstitutes its portfolio, and implements downside protection allocations, in accordance with the Underlying Index and, therefore, any changes to the Underlying Index’s rebalance, reconstitution or downside protection trigger schedule will typically result in corresponding changes to the Fund’s rebalance, reconstitution or downside protection trigger schedule. Downside Protection Model Risk. Neither the Adviser nor the Sub-Adviser can offer assurances that the downside protection model employed by the Underlying Index methodology will achieve its intended results, or that downside protection will be provided during periods of time when the Equity Portfolio is declining or during any period of time deemed to be a bear market. For example, the Underlying Index methodology would not have triggered a signal to employ the downside protection model during the market volatility experienced in March 2020. While significant dips occurred in the market at that time, the bear market environment was short lived, and markets began recovering relatively quickly. As discussed above, signals are typically only triggered during prolonged bear markets, meaning that the signal is triggered based on the duration of the decline not the amount of the decline. Accordingly, while the signal would not have triggered in March 2020, it would have triggered during the financial crisis of 2007-2008, during which a prolonged bear market occurred. The sell signal was also most recently triggered in September 2022, in connection with the recent bear market environment. Investment in a fund that utilizes a downside protection model that seeks to minimize risk only during certain prolonged bear market environments may not be appropriate for every investor seeking a particular risk profile. Please review the portfolio holdings information on the Fund's website at www.donoghueforlinesetfs.com/dfnv to determine whether the Fund is in a bullish or defensive posture prior to making an investment in the Fund.

Market Events Risk. The value of securities in the Fund’s portfolio may decline due to daily fluctuations in the securities markets that are generally beyond the Fund’s control, including the quality of the Fund’s investments, economic conditions, adverse investor sentiment, lower demand for a company’s goods or services, and general market conditions. In a declining market, the prices for all securities (including those in the Fund’s portfolio) may decline, regardless of their long-term prospects. Security values tend to move in cycles, with periods when securities markets generally rise and periods when they generally decline. In addition, local, regional or global events such as war, acts of terrorism, the spread of infectious illness or other public health issue, recessions, or other events could have a significant impact on the Fund, its investments and the trading of its Shares. For example, an outbreak of an infectious respiratory illness, COVID-19, has caused adverse effects on many companies, sectors, nations, regions and the markets in general. The ongoing effects of COVID-19 are unpredictable and may adversely impact the value and performance of the Fund and its ability to buy and sell investments at appropriate valuations and/or achieve its investment objective. Concentration Risk. A fund concentrated in an industry or group of industries is likely to present more risks than a fund that is broadly diversified over several industries or groups of industries. Compared to the broad market, an individual industry or group of related industries may be more strongly affected by changes in the economic climate, broad market shifts, moves in a particular dominant stock or regulatory changes. Derivatives Risk. A derivative instrument derives its value from an underlying security, currency, commodity, interest rate, index or other asset (collectively, “underlying asset”). The Fund’s investments in derivatives may pose risks in addition to and greater than those associated with investing directly in the underlying assets, including counterparty, leverage and liquidity risks. Derivatives may also be harder to value, less tax efficient and subject to changing government regulation that could impact the Fund’s ability to use certain derivatives or their cost. Derivatives strategies may not always be successful. •Futures Contracts Risk. Exchange-traded futures contracts are a type of derivative, which call for the future delivery of an asset, or cash settlement, at a certain stated price on a specified future date. Futures contracts involve the risk of imperfect correlation between movements in the price of the instruments and the price of the underlying assets. In addition, there is the risk that the Fund may not be able to enter into a closing transaction because of an illiquid market. Exchanges can limit the number of positions that can be held or controlled by the Fund or the Sub-Adviser, thus limiting the ability to implement the Fund’s strategies. Futures markets are highly volatile, and the use of futures may increase the volatility of the Fund’s NAV.

Active and Frequent Trading Risk. Active and frequent trading of portfolio securities may result in increased transaction costs to the Fund, including brokerage commissions, dealer mark-ups and other transaction costs on the sale of the securities and on reinvestment in other securities, and may also result in higher taxes if Shares are held in a taxable account.

Index Correlation Risk. While the Sub-Adviser seeks to track the performance of the Underlying Index closely (i.e., to achieve a high degree of correlation with the Underlying Index), the Fund’s returns may not match or achieve a high degree of correlation with the returns of the Underlying Index due to operating expenses, transaction costs, cash flows, regulatory requirements and/or operational inefficiencies. Index Calculation Risk. The Underlying Index relies on various sources of information to assess the criteria of issuers included in the Underlying Index and to determine whether a “buy” or “sell” trigger should be issued, including information that may be based on assumptions and estimates. The Fund, the Index Provider, the Adviser, the Sub-Adviser, the Underlying Index calculation agent and any of their respective affiliates cannot offer assurances that the Underlying Index’s calculation methodology or sources of information will provide an accurate assessment of included issuers or the appropriate trigger at any particular time. ETF Risk. As an exchange-traded fund (“ETF”), the Fund is subject to the following risks: •Authorized Participants Concentration Risk. The Fund may have a limited number of financial institutions that may act as Authorized Participants (“APs”). To the extent that those APs exit the business or are unable to process creation and/or redemption orders, Shares may trade at a discount to NAV and possibly face delisting. •Flash Crash Risk. Sharp price declines in securities owned by the Fund may trigger trading halts, which may result in Shares trading in the market at an increasingly large discount to NAV during part (or all) of a trading day. Shareholders could suffer significant losses to the extent that they sell Shares at these temporarily low market prices. •Large Shareholder Risk. Certain shareholders, including the Adviser, the Sub-Adviser or their respective affiliates, or groups of related shareholders, such as those investing through one or more model portfolios, may own a substantial amount of the Shares. The disposition of Shares by large shareholders, resulting in redemptions through or by APs, could have a significant negative impact on the Fund. In addition, transactions by large shareholders may account for a large percentage of the trading volume on the Exchange and may, therefore, have a material upward or downward effect on the market price of the Shares. •Premium-Discount Risk. Shares may trade above or below their NAV. Accordingly, investors may pay more than NAV when purchasing Shares or receive less than NAV when selling Shares. The market prices of Shares will generally fluctuate in accordance with changes in NAV, changes in the relative supply of, and demand for, Shares, and changes in the liquidity, or the perceived liquidity, of the Fund’s holdings. •Secondary Market Trading Risk. Investors buying or selling Shares in the secondary market may pay brokerage commissions or other charges, which may be a significant proportional cost for investors seeking to buy or sell relatively small amounts of Shares. Although the Shares are listed on the Exchange, there can be no assurance that an active or liquid trading market for them will develop or be maintained. In addition, trading in Shares on the Exchange may be halted.

|

| Performance

|

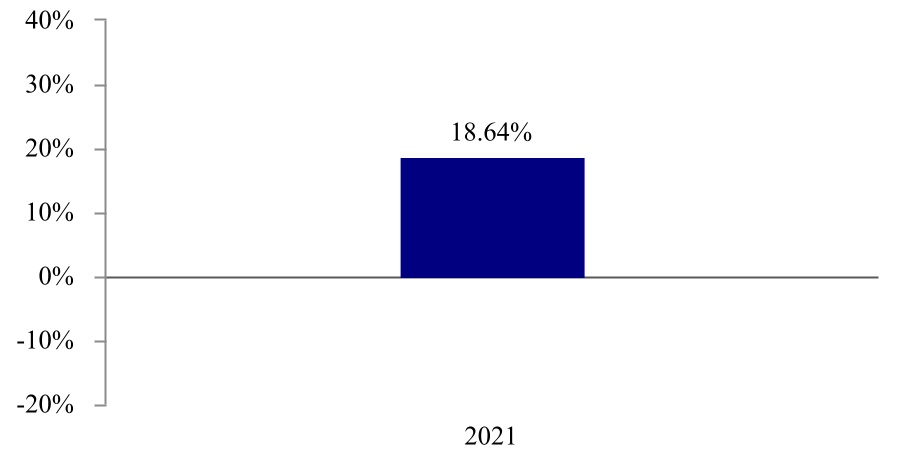

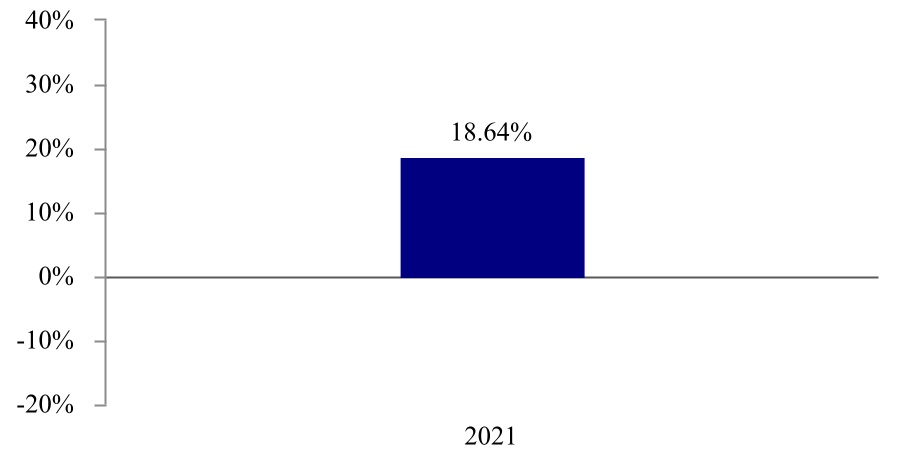

| The following performance information indicates some of the risks of investing in the Fund. The bar chart shows the Fund’s performance as of December 31. The table illustrates how the Fund’s average annual returns for the 1-year and since inception periods compare with those of a broad measure of market performance. The Fund’s past performance, before and after taxes, does not necessarily indicate how it will perform in the future. Updated performance information is also available on the Fund’s website at www.donoghueforlinesetfs.com.

|

| Calendar Year Total Returns

|

|

| For the year-to-date period ended September 30, 2022, the Fund’s total return was -25.83% During the period of time shown in the bar chart, the Fund’s highest quarterly return was 9.66% for the quarter ended June 30, 2021, and the lowest quarterly return was 0.17% for the quarter ended September 30, 2021.

|

| Average Annual Total Returns For the Period Ended December 31, 2021

|

| | | | | | | | | | Donoghue Forlines Risk Managed Innovation ETF | 1 Year | Since Inception (12/07/2020) | | Return Before Taxes | 18.64% | 21.62% | | Return After Taxes on Distributions | 16.60% | 19.65% | | Return After Taxes on Distributions and Sale of Shares | 11.19% | 15.77% | FCF Risk Managed Quality Innovation Index (reflects no deduction for fees, expenses, or taxes) | 19.20% | 22.22% | Russell 1000® Total Return (reflects no deduction for fees, expenses or taxes) | 26.45% | 27.02% |

|

| Donoghue Forlines Tactical High Yield ETF

|

| Donoghue Forlines Tactical High Yield ETF

|

| Investment Objective

|

| The Donoghue Forlines Tactical High Yield ETF (the “Fund”) seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the FCF Tactical High Yield Index (the “Underlying Index”).

|

| Fees and Expenses

|

| This table describes the fees and expenses that you may pay if you buy, hold and sell Shares. You may also pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table or example below.

|

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment):

|

| | | | | | | | | | | | Management Fee1 | | 0.69% | | | Other Expenses | | 0.00% | | | | | | | Acquired Fund Fees and Expenses | | 0.18% | | Total Annual Fund Operating Expenses2 | | 0.87% | |

|

| Example

|

| The following example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The example assumes that you invest $10,000 for the time periods indicated and then redeem all of your Shares at the end of those periods. The example also assumes that the Fund provides a return of 5% per year and that operating expenses remain the same. The example does not reflect any brokerage commissions that you may pay on purchases and sales of Shares.

|

| Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

| | | | | | | | | | | | | One Year | Three Years | Five Years | Ten Years | | $89 | $278 | $482 | $1,073 |

|

| Portfolio Turnover

|

| The Fund may pay transaction costs, including commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Shares are held in a taxable account. These costs, which are not reflected in the annual fund operating expenses or in the example, affect the Fund’s performance. For the fiscal year ended July 31, 2022, the Fund’s portfolio turnover rate was 1,029% of the average value of its portfolio. The index experienced tactical signals during the fiscal year resulting in the Fund moving partially into short-term treasury exposures and back to high yield exposures.

|

| Principal Investment Strategies

|

To pursue its investment objective, the Fund invests, under normal market circumstances, at least 80% of its net assets (plus any borrowings for investment purposes) in component securities of the Underlying Index. The Underlying Index is sponsored and maintained by FCF Indexes LLC (the "Index Provider"), an affiliate of FCF Advisors LLC, the Fund's investment adviser (the "Adviser"). The Underlying Index is designed to track the performance of a strategy that seeks to provide risk-managed exposure to exchange-traded funds (“ETFs”) that investment primarily in high yield debt instruments (also known as “junk bonds”) (“High Yield Bond ETFs”). The Fund intends to maintain a portfolio of securities that generally replicates the holdings of the Underlying Index. To be eligible for inclusion in the Underlying Index, a High Yield Bond ETF must: (i) be U.S. listed; (ii) invest primarily in U.S. high yield debt instruments; (iii) have more than $1 billion in assets under management (“AUM”); (iv) have an expense ratio of less than 0.50%; and (v) have an investment process that excludes factors, hedges and long/short strategies. Eligible High Yield Bond ETFs are weighted based on their expenses (lower expenses increase weighting) and AUM (greater AUM increases weighting). These securities comprise the “High Yield Bond Portfolio” of the Underlying Index.

The types of high yield debt instruments in which a High Yield Bond ETF may invest include corporate bonds or other bonds or debt instruments that are generally rated below investment grade, which are those rated lower than Baa3 by Moody’s Investors Service, Inc. (“Moody’s”) or lower than BBB- by S&P Global Ratings ("S&P"). High Yield Bond ETFs may invest up to 100% of their respective assets in instruments generally rated below Caa3 by Moody’s or CCC- by S&P. The Underlying Index utilizes a proprietary, rules-based methodology that employs a tactical overlay that is intended to provide downside protection to the High Yield Bond ETF allocations. The tactical overlay will provide either a “buy signal” or a “sell signal,” which are used to determine whether the Underlying Index will be in a bullish (i.e., fully invested long position) or defensive posture, respectively. When a “buy signal” is triggered, the Underlying Index will be comprised entirely of High Yield Bond ETFs. When a “sell signal” is triggered, the Underlying Index will eliminate 80% of its High Yield Bond ETF allocations in exchange for ETFs that invest primarily in intermediate-term U.S. Treasury securities and/or other cash equivalents (“Intermediate-Term Treasury ETFs”). The tactical overlay will provide buy or sell signals on a daily basis. Please review the portfolio holdings information on the Fund's website at www.donoghueforlinesetfs.com/dfhy to determine whether the Fund is in a bullish or defensive posture prior to making an investment in the Fund. To be eligible for inclusion in the Underlying Index, an Intermediate-Term Treasury ETF must: (i) be U.S. listed; (ii) invest primarily in intermediate-term U.S. Treasury securities (i.e., those with durations typically between 3.5 and 6 years) and/or other cash equivalents; (iii) have more than $1 billion in AUM; (iv) have an expense ratio of 0.15% or less; and (v) have an investment process that excludes factors, hedges and long/short strategies. Eligible Intermediate-Term Treasury ETFs are weighted and ranked based on their expenses (lower expenses increase weighting) and AUM (greater AUM increases weighting). These securities comprise the “U.S. Treasury Portfolio” of the Underlying Index.

Allocations to the High Yield Bond Portfolio are rebalanced quarterly and reconstituted annually. The composition of the U.S. Treasury Portfolio is also rebalanced quarterly and reconstituted annually. The Fund is generally rebalanced and reconstituted in accordance with the Underlying Index. Allocations implemented pursuant to the tactical overlay are determined at the close of trading on each business day, based on the signal triggered, and become effective at the close of trading on the following business day. The Fund will generally implement tactical overlay allocations in accordance with the Underlying Index. The Fund can use derivative instruments, including exchange-traded futures contracts, to gain exposure to component securities of the Underlying Index. Donoghue Forlines LLC, the Fund’s sub-adviser (the “Sub-Adviser”), may engage in active and frequent trading of the Fund’s portfolio securities to achieve the Fund’s investment objective.

The Fund will concentrate its investments (i.e., invest more than 25% of its total assets) in a particular industry or group of industries to approximately the same extent that the Underlying Index is concentrated.

|

| Principal Risks

|

An investment in the Fund involves risk, including those described below. There is no assurance that the Fund will achieve its investment objective. An investor may lose money by investing in the Fund. Underlying ETFs Risk. In seeking to track the Underlying Index, the Fund invests substantially all of its assets in High Yield Bond ETFs and/or Intermediate-Term Treasury ETFs (together, the “Underlying ETFs”). Accordingly, the Fund’s investment performance is directly related to the performance of the Underlying ETFs. The Fund’s net asset value (or “NAV”) will change with changes in the value of the Underlying ETFs based on their market valuations. An investment in the Fund will entail more costs and expenses than a direct investment in the Underlying ETFs. As the Underlying ETFs, or the Fund’s allocations among the Underlying ETFs, change from time to time, or to the extent that the total annual fund operating expenses of any Underlying ETF changes, the weighted average operating expenses borne by the Fund may increase or decrease. High Yield (Junk Bond) Securities Risk. High yield securities and unrated securities of similar credit quality are considered to be speculative with respect to the issuer’s continuing ability to make principal and interest payments and are generally subject to greater levels of credit quality risk than investment grade securities. High yield securities are usually issued by companies, including smaller and medium capitalization companies, without long track records of sales and earnings, or with questionable credit strength. These companies may be particularly affected by interest rate increases, as they may find it more difficult to borrow money to continue or expand operations, or may have difficulty in repaying floating rate loans. These fixed-income securities are considered below “investment-grade.” The retail secondary market for these “junk bonds” may be less liquid than that of higher-rated fixed income securities, and adverse conditions could make it difficult at times to sell these securities or could result in lower prices than higher-rated fixed income securities. These risks can reduce the value of the shares of a High Yield Bond ETF and the income it earns. Liquidity Risk. Liquidity risk exists when a particular investment is difficult to purchase or sell. If a High Yield Bond ETF invests in illiquid securities or its portfolio securities otherwise become illiquid, it may reduce the returns of the High Yield Bond ETF because the High Yield Bond ETF may be unable to sell the illiquid securities at an advantageous time or price. In the event that a High Yield Bond ETF voluntarily or involuntarily liquidates its portfolio assets during periods of infrequent trading of its securities, the High Yield Bond ETF may not receive full value for those assets, which will reduce the value of the High Yield Bond ETF’s shares, and in turn, the value of the Fund’s investment in such shares. U.S. Treasury Securities Risk. U.S. Treasury securities may differ from other securities in their interest rates, maturities, times of issuance and other characteristics and may provide relatively lower returns than those of other securities. Similar to other issuers, changes to the financial condition or credit rating of a government may cause the value of an Intermediate-Term Treasury ETF’s investments to decline. Index-Based Strategy Risk. The Fund is managed as an index-based fund that seeks to track the performance of the Underlying Index. This differs from an actively managed fund, which typically seeks to outperform a benchmark index. As a result, the Fund may hold the component securities of the Underlying Index regardless of the current or projected performance of a specific security or the relevant market as a whole. Maintaining investments in securities regardless of market conditions or the performance of individual securities could cause the Fund’s returns to be lower than if the Fund employed an active strategy. The Fund will seek to track the Underlying Index in all market conditions, including during adverse market conditions when other funds may seek to take temporary defensive measures (such as investing significantly in cash or cash equivalents). Accordingly, unless the Underlying Index allocates significant portions of its assets to cash and/or cash equivalents during times of adverse market or economic conditions, the Fund may be subject to a higher level of market risk during such times than other funds. Additionally, the Fund generally rebalances and reconstitutes its portfolio, and implements tactical overlay allocations, in accordance with the Underlying Index and, therefore, any changes to the Underlying Index’s rebalance, reconstitution or tactical overlay trigger schedule will typically result in corresponding changes to the Fund’s rebalance, reconstitution or tactical overlay trigger schedule. Tactical Overlay Risk. Neither the Adviser nor the Sub-Adviser can offer assurances that the tactical overlay process employed by the Underlying Index methodology will achieve its intended results. Investment in a fund that utilizes a tactical overlay that seeks to minimize risk may not be appropriate for every investor seeking a particular risk profile. Please review the portfolio holdings information on the Fund's website at www.donoghueforlinesetfs.com/dfhy to determine whether the Fund is in a bullish or defensive posture prior to making an investment in the Fund. Market Events Risk. The value of securities in the Fund’s portfolio may decline due to daily fluctuations in the securities markets that are generally beyond the Fund’s control, including the quality of the Fund’s investments, economic conditions, adverse investor sentiment, lower demand for a company’s goods or services, and general market conditions. In a declining market, the prices for all securities (including those in the Fund’s portfolio) may decline, regardless of their long-term prospects. Security values tend to move in cycles, with periods when securities markets generally rise and periods when they generally decline. In addition, local, regional or global events such as war, acts of terrorism, the spread of infectious illness or other public health issue, recessions, or other events could have a significant impact on the Fund, its investments and the trading of its Shares. For example, an outbreak of an infectious respiratory illness, COVID-19, has caused adverse effects on many companies, sectors, nations, regions and the markets in general. The ongoing effects of COVID-19 are unpredictable and may adversely impact the value and performance of the Fund and its ability to buy and sell investments at appropriate valuations and/or achieve its investment objective. Concentration Risk. A fund concentrated in an industry or group of industries is likely to present more risks than a fund that is broadly diversified over several industries or groups of industries. Compared to the broad market, an individual industry or group of related industries may be more strongly affected by changes in the economic climate, broad market shifts, moves in a particular dominant stock or regulatory changes. Derivatives Risk. A derivative instrument derives its value from an underlying security, currency, commodity, interest rate, index or other asset (collectively, “underlying asset”). The Fund’s investments in derivatives may pose risks in addition to and greater than those associated with investing directly in the underlying assets, including counterparty, leverage and liquidity risks. Derivatives may also be harder to value, less tax efficient and subject to changing government regulation that could impact the Fund’s ability to use certain derivatives or their cost. Derivatives strategies may not always be successful.

•Futures Contracts Risk. Exchange-traded futures contracts are a type of derivative, which call for the future delivery of an asset, or cash settlement, at a certain stated price on a specified future date. Futures contracts involve the risk of imperfect correlation between movements in the price of the instruments and the price of the underlying assets. In addition, there is the risk that the Fund may not be able to enter into a closing transaction because of an illiquid market. Exchanges can limit the number of positions that can be held or controlled by the Fund or the Sub-Adviser, thus limiting the ability to implement the Fund’s strategies. Futures markets are highly volatile, and the use of futures may increase the volatility of the Fund’s NAV.

Active and Frequent Trading Risk. Active and frequent trading of portfolio securities may result in increased transaction costs to the Fund, including brokerage commissions, dealer mark-ups and other transaction costs on the sale of the securities and on reinvestment in other securities, and may also result in higher taxes if Shares are held in a taxable account. Index Correlation Risk. While the Sub-Adviser seeks to track the performance of the Underlying Index closely (i.e., to achieve a high degree of correlation with the Underlying Index), the Fund’s returns may not match or achieve a high degree of correlation with the returns of the Underlying Index due to operating expenses, transaction costs, cash flows, regulatory requirements and/or operational inefficiencies. Index Calculation Risk. The Underlying Index relies on various sources of information to assess the criteria of issuers included in the Underlying Index and to determine whether a “buy” or “sell” trigger should be issued, including information that may be based on assumptions and estimates. The Fund, the Index Provider, the Adviser, the Sub-Adviser, the Underlying Index calculation agent and any of their respective affiliates cannot offer assurances that the Underlying Index’s calculation methodology or sources of information will provide an accurate assessment of included issuers or the appropriate trigger at any particular time. ETF Risk. As an ETF, the Fund is subject to the following risks: •Authorized Participants Concentration Risk. The Fund may have a limited number of financial institutions that may act as Authorized Participants (“APs”). To the extent that those APs exit the business or are unable to process creation and/or redemption orders, Shares may trade at a discount to NAV and possibly face delisting. •Flash Crash Risk. Sharp price declines in securities owned by the Fund may trigger trading halts, which may result in Shares trading in the market at an increasingly large discount to NAV during part (or all) of a trading day. Shareholders could suffer significant losses to the extent that they sell Shares at these temporarily low market prices. •Large Shareholder Risk. Certain shareholders, including the Adviser, the Sub-Adviser or their respective affiliates, or groups of related shareholders, such as those investing through one or more model portfolios, may own a substantial amount of the Shares. The disposition of Shares by large shareholders resulting in redemptions through or by APs could have a significant negative impact on the Fund. In addition, transactions by large shareholders may account for a large percentage of the trading volume on the Exchange and may, therefore, have a material upward or downward effect on the market price of the Shares. •Premium-Discount Risk. Shares may trade above or below their NAV. Accordingly, investors may pay more than NAV when purchasing Shares or receive less than NAV when selling Shares. The market prices of Shares will generally fluctuate in accordance with changes in NAV, changes in the relative supply of, and demand for, Shares, and changes in the liquidity, or the perceived liquidity, of the Fund’s holdings. •Secondary Market Trading Risk. Investors buying or selling Shares in the secondary market may pay brokerage commissions or other charges, which may be a significant proportional cost for investors seeking to buy or sell relatively small amounts of Shares. Although the Shares are listed on the Exchange, there can be no assurance that an active or liquid trading market for them will develop or be maintained. In addition, trading in Shares on the Exchange may be halted.

|

| Performance

|

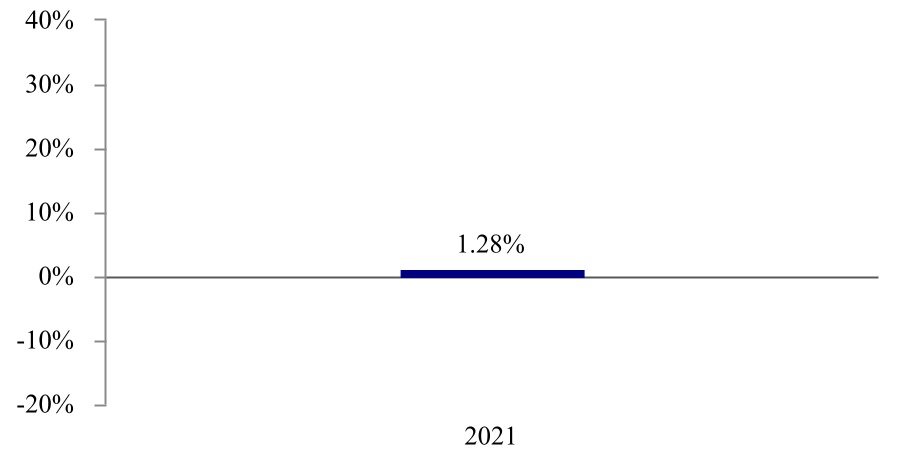

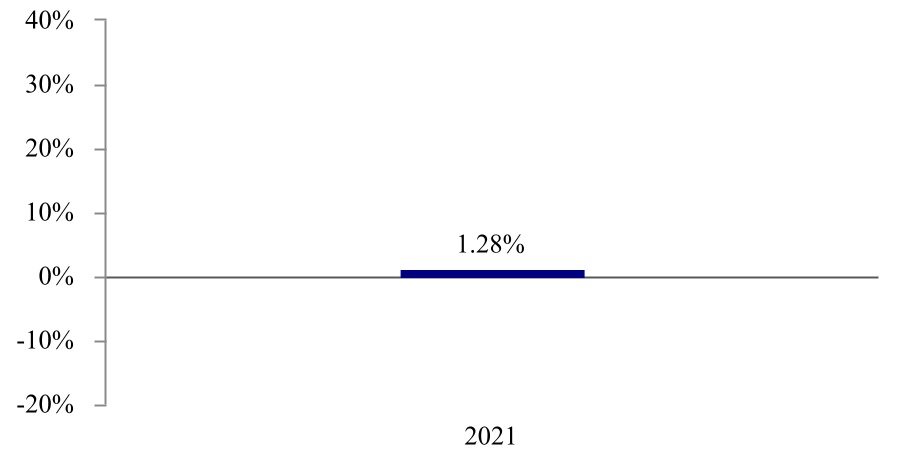

| The following performance information indicates some of the risks of investing in the Fund. The bar chart shows the Fund’s performance as of December 31. The table illustrates how the Fund’s average annual returns for the 1-year and since inception periods compare with those of a broad measure of market performance. The Fund’s past performance, before and after taxes, does not necessarily indicate how it will perform in the future. Updated performance information is also available on the Fund’s website at www.donoghueforlinesetfs.com.

|

| Calendar Year Total Returns

|

|

| For the year-to-date period ended September 30, 2022, the Fund’s total return was -14.06% During the period of time shown in the bar chart, the Fund’s highest quarterly return was 1.91% for the quarter ended June 30, 2021, and the lowest quarterly return was -0.35% for the quarter ended September 30, 2021.

|

| Average Annual Total Returns For the Period Ended December 31, 2021

|

| | | | | | | | | | Donoghue Forlines Tactical High Yield ETF | 1 Year | Since Inception (12/07/2020) | | Return Before Taxes | 1.28% | 2.16% | | Return After Taxes on Distributions | -0.09% | 0.72% | | Return After Taxes on Distributions and Sale of Shares | 0.76% | 1.05% | Bloomberg US Aggregate Bond Index (reflects no deduction for fees, expenses, or taxes) | -1.54% | -1.06% | FCF Tactical High Yield Index (reflects no deduction for fees, expenses or taxes)1 | 0.88% | 1.61% |

|

| Donoghue Forlines Yield Enhanced Real Asset ETF

|

| Donoghue Forlines Yield Enhanced Real Asset ETF

|

| Investment Objective

|

| The Donoghue Forlines Yield Enhanced Real Asset ETF (the “Fund”) seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the FCF Yield Enhanced Real Asset Index (the “Underlying Index”).

|

| Fees and Expenses

|

| This table describes the fees and expenses that you may pay if you buy, hold and sell Shares. You may also pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table or example below.

|

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment):

|

| | | | | | | | | Management Fee1 | | 0.69% | Other Expenses | | 0.00% | Total Annual Fund Operating Expenses | | 0.69% |

|

| Example

|

| The following example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The example assumes that you invest $10,000 for the time periods indicated and then redeem all of your Shares at the end of those periods. The example also assumes that the Fund provides a return of 5% per year and that operating expenses remain the same. The example does not reflect any brokerage commissions that you may pay on purchases and sales of Shares.

|

| Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

| | | | | | | | | | | | | One Year | Three Years | Five Years | Ten Years | | $70 | $221 | $384 | $859 |

|

| Portfolio Turnover

|

| The Fund may pay transaction costs, including commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Shares are held in a taxable account. These costs, which are not reflected in the annual fund operating expenses or in the example, affect the Fund’s performance. For the period from December 13, 2021 (commencement of operations) through July 31, 2022, the Fund’s portfolio turnover rate was 48% of the average value of its portfolio.

|

| Principal Investment Strategies

|

To pursue its investment objective, the Fund invests, under normal market circumstances, at least 80% of its net assets (plus any borrowings for investment purposes) in component securities of the Underlying Index. The Underlying Index is sponsored and maintained by FCF Indexes LLC (the “Index Provider”), an affiliate of FCF Advisors LLC, the Fund’s investment adviser. The Underlying Index is designed to track the investment results of a rules-based strategy that aims to provide exposure to “real assets” equities based on the Adviser’s proprietary research. The Fund intends to maintain a portfolio of securities that generally replicates the holdings of the Underlying Index. The Adviser currently defines “real assets” equities as common stock, real estate investment trusts (“REITs”), master limited partnerships (“MLPs”), and American Depositary Receipts (“ADRs”) included in the “Real Assets Industry Group,” as defined by the Index Provider. The Index Provider currently classifies the following sectors as within the Real Assets Industry Group, each as defined by a third-party industry classification system: real-estate related sectors, including diversified, equity and mortgage REITs; infrastructure-related sectors, including industrial manufacturing and services; commodities related sectors, including chemical, plastic and rubber materials, manufactured products, and food and tobacco production; and natural resources related sectors, including upstream energy, downstream and midstream energy, integrated oil and gas exploration and production, waste management, and mining and mineral products. To be eligible for inclusion in the Underlying Index, an equity security must: (i) be included in the Real Assets Industry Group; (ii) be U.S. listed; (iii) have a 6-month monthly average price volume in the top 45 percentile of the global equity universe; (iv) have a trading lot size, multiplied by the 6-month average closing price, of less than $100,000; (v) have reported the following financial statement items within the past 12 months, based on its most recent financial reports: (a) free cash flow, (b) net income, (c) dividends, (d) total revenue, (e) total assets, and (f) total equity; (vi) have reported positive free cash flow in the past 12 months; and (vii) not be a target company in any pending or completed mergers and/or acquisitions within the past 12 months. The Underlying Index may include securities of issuers of all capitalization sizes. Each security eligible for inclusion is then scored based on the following components of the company issuing the security (the “FCF Quality Dividend Score”), which is intended to be representative of a company’s ability to generate profits and pay dividends: (i) free cash flow profitability; (ii) quality of earnings (i.e., a metric that determines the proportion of income attributable to the cash flow activities of a company); and (iii) dividend yield. Only companies with an FCF Quality Dividend Score within the top 25% of all eligible securities are candidates for inclusion in the Underlying Index. A target weighting is then assigned to each security based on a combination of its FCF Quality Dividend Score and free-float market capitalization. Companies are then ranked based on their target weighting and sequentially included in the Underlying Index until either 75 securities have been included or 90% of the cumulative security weight has been included, whichever occurs first. The Underlying Index is rebalanced and reconstituted quarterly. The Fund’s portfolio is generally rebalanced and reconstituted quarterly, in accordance with the Underlying Index. The Fund can use derivative instruments, including exchange-traded futures contracts, to gain exposure to component securities of the Underlying Index. Donoghue Forlines LLC, the Fund’s sub-adviser (the “Sub-Adviser”), may engage in active and frequent trading of the Fund’s portfolio securities to achieve the Fund’s investment objective. The Fund will concentrate its investments (i.e., invest more than 25% of its total assets) in a particular industry or group of industries to approximately the same extent that the Underlying Index is concentrated. As of September 30, 2022, the Underlying Index is concentrated in the Real Assets Industry Group, as described above.

|

| Principal Risks

|

An investment in the Fund involves risk, including those described below. There is no assurance that the Fund will achieve its investment objective. An investor may lose money by investing in the Fund. Equity Investing Risk. An investment in the Fund involves risks similar to those of investing in any fund holding equity securities, such as market fluctuations, changes in interest rates and perceived trends in stock prices. The values of equity securities could decline generally or could underperform other investments. In addition, securities may decline in value due to factors affecting a specific issuer, market or securities markets generally. REITs Risk. A REIT is a company that pools investor funds to invest primarily in income producing real estate or real estate related loans or interests. The Fund may be subject to certain risks associated with direct investments in REITs. REITs may be affected by changes in their underlying properties and by defaults by borrowers or tenants. Mortgage REITs may be affected by the quality of the credit extended. Furthermore, REITs are dependent on specialized management skills. Some REITs may have limited diversification and may be subject to risks inherent in financing a limited number of properties. REITs depend generally on their ability to generate cash flow to make distributions to shareholders or unitholders and may be subject to defaults by borrowers and to self-liquidations. Depositary Receipts Risk. The risks of investments in depositary receipts are substantially similar to a direct investment in a foreign security. Returns on investments in foreign securities could be more volatile than, or trail the returns on, investments in U.S. securities. Exposures to foreign securities entail special risks, including due to: differences in information available about foreign issuers; differences in investor protection standards in other jurisdictions; capital controls risks, including the risk of a foreign jurisdiction imposing restrictions on the ability to repatriate or transfer currency or other assets; political, diplomatic and economic risks; regulatory risks; and foreign market and trading risks, including the costs of trading and risks of settlement in foreign jurisdictions. In addition, depositary receipts may not track the price of the underlying foreign securities, and their value may change materially at times when the U.S. markets are not open for trading. MLP Risk. An MLP is a publicly traded partnership primarily engaged in the transportation, storage, processing, refining, marketing, exploration, production, and mining of minerals and natural resources. MLP common units, like other equity securities, can be affected by macroeconomic and other factors affecting the stock market in general, expectations of interest rates, investor sentiment towards an issuer or certain market sector, changes in a particular issuer’s financial condition, or unfavorable or unanticipated poor performance of a particular issuer (in the case of MLPs, generally measured in terms of distributable cash flow). Prices of common units of individual MLPs, like the prices of other equity securities, also can be affected by fundamentals unique to the partnership or company, including earnings power and coverage ratios. MLP Tax Risk. MLPs taxed as partnerships, subject to the application of certain partnership audit rules, generally do not pay U.S. federal income tax at the partnership level. Rather, each partner is allocated a share of the MLP’s income, gains, losses, deductions and expenses. A change in current tax law, or a change in the underlying business mix of a given MLP, could result in an MLP being treated as a corporation for U.S. federal income tax purposes, which would result in such MLP being required to pay U.S. federal income tax on its taxable income. The classification of an MLP as a corporation for U.S. federal income tax purposes would have the effect of reducing the amount of cash available for distribution by the MLP. Thus, if any of the MLPs owned by the Fund were treated as corporations for U.S. federal income tax purposes, it could result in a reduction in the value of your investment in the Fund and lower income. Small and Medium Capitalization Company Risk. Investing in securities of small and medium capitalization companies involves greater risk than customarily is associated with investing in larger, more established companies. These companies’ securities may be more volatile and less liquid than those of more established companies. Often, small and medium capitalization companies and the industries in which they focus are still evolving and, as a result, they may be more sensitive to changing market conditions. Small and medium capitalization companies may be particularly affected by interest rate increases, as they may find it more difficult to borrow money to continue or expand operations or may have difficulty in repaying any loans which are floating rate. Index-Based Strategy Risk. The Fund is managed as an index-based fund that seeks to track the performance of the Underlying Index. This differs from an actively managed fund, which typically seeks to outperform a benchmark index. As a result, the Fund may hold the component securities of the Underlying Index regardless of the current or projected performance of a specific security or the relevant market as a whole. Maintaining investments in securities regardless of market conditions or the performance of individual securities could cause the Fund’s returns to be lower than if the Fund employed an active strategy. The Fund will seek to track the Underlying Index in all market conditions, including during adverse market conditions when other funds may seek to take temporary defensive measures (such as investing significantly in cash or cash equivalents). Accordingly, unless the Underlying Index allocates significant portions of its assets to cash and/or cash equivalents during times of adverse market or economic conditions, the Fund may be subject to a higher level of market risk during such times than other funds. Additionally, the Fund generally rebalances and reconstitutes its portfolio in accordance with the Underlying Index and, therefore, any changes to the Underlying Index’s rebalance or reconstitution schedule will typically result in corresponding changes to the Fund’s rebalance or reconstitution schedule. Market Events Risk. The value of securities in the Fund’s portfolio may decline due to daily fluctuations in the securities markets that are generally beyond the Fund’s control, including the quality of the Fund’s investments, economic conditions, adverse investor sentiment, lower demand for a company’s goods or services, and general market conditions. In a declining market, the prices for all securities (including those in the Fund’s portfolio) may decline, regardless of their long-term prospects. Security values tend to move in cycles, with periods when securities markets generally rise and periods when they generally decline. In addition, local, regional or global events such as war, acts of terrorism, the spread of infectious illness or other public health issue, recessions, or other events could have a significant impact on the Fund, its investments and the trading of its Shares. For example, an outbreak of an infectious respiratory illness, COVID-19, has caused adverse effects on many companies, sectors, nations, regions and the markets in general. The ongoing effects of COVID-19 are unpredictable and may adversely impact the value and performance of the Fund and its ability to buy and sell investments at appropriate valuations and/or achieve its investment objective. Concentration Risk. A fund concentrated in an industry or group of industries is likely to present more risks than a fund that is broadly diversified over several industries or groups of industries. Compared to the broad market, an individual industry or group of related industries may be more strongly affected by changes in the economic climate, broad market shifts, moves in a particular dominant stock or regulatory changes. Real Assets Industry Group Risk. The risks of investing in the Real Assets Industry Group include the risks of focusing investments in the real estate, infrastructure, commodities and natural resources related sectors, and adverse developments in these sectors may significantly affect the value of the Shares. Accordingly, the Fund is more susceptible to adverse developments affecting one or more of these sectors than a fund that invests more broadly, and the Fund may perform poorly during a downturn affecting issuers in those sectors. Companies involved in activities related to the Real Assets Industry Group can be adversely affected by, among other things, government regulation or deregulation, global political and economic developments, energy and commodity prices, the overall supply and demand for oil and gas, changes in tax zoning laws, environmental issues, and low inflation.

Derivatives Risk. A derivative instrument derives its value from an underlying security, currency, commodity, interest rate, index or other asset (collectively, “underlying asset”). The Fund’s investments in derivatives may pose risks in addition to and greater than those associated with investing directly in the underlying assets, including counterparty, leverage and liquidity risks. Derivatives may also be harder to value, less tax efficient and subject to changing government regulation that could impact the Fund’s ability to use certain derivatives or their cost. Derivatives strategies may not always be successful.

•Futures Contracts Risk. Exchange-traded futures contracts are a type of derivative, which call for the future delivery of an asset, or cash settlement, at a certain stated price on a specified future date. Futures contracts involve the risk of imperfect correlation between movements in the price of the instruments and the price of the underlying assets. In addition, there is the risk that the Fund may not be able to enter into a closing transaction because of an illiquid market. Exchanges can limit the number of positions that can be held or controlled by the Fund or the Sub-Adviser, thus limiting the ability to implement the Fund’s strategies. Futures markets are highly volatile, and the use of futures may increase the volatility of the Fund’s NAV.

Active and Frequent Trading Risk. Active and frequent trading of portfolio securities may result in increased transaction costs to the Fund, including brokerage commissions, dealer mark-ups and other transaction costs on the sale of the securities and on reinvestment in other securities, and may also result in higher taxes if Shares are held in a taxable account.

Index Correlation Risk. While the Sub-Adviser seeks to track the performance of the Underlying Index closely (i.e., to achieve a high degree of correlation with the Underlying Index), the Fund’s returns may not match or achieve a high degree of correlation with the returns of the Underlying Index due to operating expenses, transaction costs, cash flows, regulatory requirements and/or operational inefficiencies. Index Calculation Risk. The Underlying Index relies on various sources of information to assess the criteria of issuers included in the Underlying Index, including information that may be based on assumptions and estimates. The Fund, the Index Provider, the Adviser, the Sub-Adviser, the Underlying Index calculation agent and any of their respective affiliates cannot offer assurances that the Underlying Index’s calculation methodology or sources of information will provide an accurate assessment of included issuers. ETF Risk. As an exchange-traded fund (“ETF”), the Fund is subject to the following risks: •Authorized Participants Concentration Risk. The Fund may have a limited number of financial institutions that may act as Authorized Participants (“APs”). To the extent that those APs exit the business or are unable to process creation and/or redemption orders, Shares may trade at a discount to NAV and possibly face delisting. •Flash Crash Risk. Sharp price declines in securities owned by the Fund may trigger trading halts, which may result in Shares trading in the market at an increasingly large discount to NAV during part (or all) of a trading day. Shareholders could suffer significant losses to the extent that they sell Shares at these temporarily low market prices. •Large Shareholder Risk. Certain shareholders, including the Adviser, the Sub-Adviser or their respective affiliates, or groups of related shareholders, such as those investing through one or more model portfolios, may own a substantial amount of the Shares. The disposition of Shares by large shareholders resulting in redemptions through or by APs could have a significant negative impact on the Fund. In addition, transactions by large shareholders may account for a large percentage of the trading volume on the Exchange and may, therefore, have a material upward or downward effect on the market price of the Shares. •Premium-Discount Risk. Shares may trade above or below their NAV. Accordingly, investors may pay more than NAV when purchasing Shares or receive less than NAV when selling Shares. The market prices of Shares will generally fluctuate in accordance with changes in NAV, changes in the relative supply of, and demand for, Shares, and changes in the liquidity, or the perceived liquidity, of the Fund’s holdings. •Secondary Market Trading Risk. Investors buying or selling Shares in the secondary market may pay brokerage commissions or other charges, which may be a significant proportional cost for investors seeking to buy or sell relatively small amounts of Shares. Although the Shares are listed on the Exchange, there can be no assurance that an active or liquid trading market for them will develop or be maintained. In addition, trading in Shares on the Exchange may be halted.

|

| Performance

|

| The Fund is new and therefore does not have a performance history for a full calendar year. Performance information for the Fund will be provided once it has annual returns for a full calendar year. The Fund’s past performance, before and after taxes, does not necessarily indicate how it will perform in the future.

|