MANAGEMENT'S DISCUSSION AND ANALYSIS

OF FINANCIAL POSITION AND RESULTS OF OPERATIONS

Third Quarter Ended September 30, 2022

INDEX

| | | | | |

| Introduction | |

About IAMGOLD | |

| Highlights — Third Quarter 2022 | |

| Operating and Financial Results | |

| Outlook | |

| Environmental, Social and Governance | |

| |

| Quarterly Updates | |

| |

| Operating and Financial Performance | |

| West Africa | |

| North America | |

| South America | |

| |

| |

| |

| Exploration | |

| |

| Financial Condition | |

| |

| Liquidity and Capital Resources | |

| Cash Flow | |

| Market Trends | |

| Market Risk | |

| |

| Shareholders’ Equity | |

| Quarterly Financial Review | |

| Disclosure Controls and Procedures and Internal Control over Financial Reporting | |

| Critical Judgments, Estimates and Assumptions | |

| |

| New Accounting Standards | |

| Risks and Uncertainties | |

| Non-GAAP Financial Measures | |

| Cautionary Statement on Forward-Looking Information | |

| | | | | |

IAMGOLD CORPORATION Third Quarter 2022 Management’s Discussion and Analysis | 1 |

INTRODUCTION

The following Management’s Discussion and Analysis (“MD&A”) of IAMGOLD Corporation (“IAMGOLD” or the “Company”), dated November 8, 2022, is intended to supplement and complement the unaudited condensed consolidated interim financial statements and notes thereto as at and for the three and nine months ended September 30, 2022 ("consolidated interim financial statements"). This MD&A should be read in conjunction with IAMGOLD's audited annual consolidated financial statements and related notes as at and for the fiscal year ended December 31, 2021 and the related MD&A included in the 2021 annual report. All figures in this MD&A are in U.S. dollars and tabular dollar amounts are in millions, unless stated otherwise. Additional information on IAMGOLD can be found at www.iamgold.com. The information on the website is not in any way incorporated in or made a part of this MD&A.

ABOUT IAMGOLD

IAMGOLD is a mid-tier gold mining company operating in North America, South America and West Africa. The Company has three operating mines: Essakane (Burkina Faso), Rosebel (Suriname) and Westwood (Canada) and is building the large-scale, long life Côté Gold project (“Côté Gold”) (Canada) which is expected to start production in the beginning of 2024. In addition, the Company has a robust development and exploration portfolio within high potential mining districts in the Americas and West Africa. On October 18, 2022, IAMGOLD entered into a definitive agreement to sell its interests in Rosebel (see below for further details).

IAMGOLD employs approximately 5,000 people and is committed to maintaining its culture of accountable mining through high standards of Environmental, Social and Governance ("ESG") practices, including its commitment to Zero Harm®, in every aspect of its business. IAMGOLD is listed on the New York Stock Exchange (NYSE:IAG) and the Toronto Stock Exchange (TSX:IMG) and is one of the companies on the JSI index1.

HIGHLIGHTS - THIRD QUARTER 2022

•Attributable gold production of 184,000 ounces in the third quarter and 528,000 ounces year-to-date (“YTD”) as a result of continued strong performance from Essakane and improvements at Rosebel.

•The Company expects that annual production will exceed the top end of the previous guidance range of 570,000 to 640,000 ounces and is revising guidance upwards to 650,000 to 705,000 ounces.

•Cost of sales per ounce sold of $1,140 ($1,102 YTD), cash cost2 per ounce sold of $1,126 ($1,087 YTD) and all-in sustaining costs2 ("AISC") of $1,559 ($1,550 YTD).

•The Company expects AISC2 to be below the bottom end of guidance range of $1,650 to $1,690 and revised guidance downwards to between $1,600 and $1,650 per ounce sold. Cash costs2 guidance for 2022 is revised downwards to be between $1,100 and $1,130 per ounce sold from the previous guidance range of $1,100 to $1,150 per ounce.

•Gold revenues of $343.3 million in the third quarter from sales of 203,000 ounces (187,000 ounces on an attributable basis) at an average realized gold price of $1,690 per ounce and $1,033.9 million YTD from sales of 584,000 ounces (538,000 ounces on an attributable basis) at an average realized gold price of $1,766 per ounce.

•Earnings before interest, income taxes, depreciation and amortization (“EBITDA”)2 of $(41.3) million ($195.0 million YTD) and adjusted EBITDA2 of $103.1 million ($350.6 million YTD).

•Mine-site free cash flow2 of $59.2 million ($189.3 million YTD).

•Net loss and adjusted net loss per share attributable to equity holders2 of $(0.23) and $(0.03), respectively; YTD net earnings (loss) and adjusted net earnings (loss) per share attributable to equity holders2 of $(0.20) and $0.01, respectively.

•Cash, cash equivalents and short-term investments of $536.1 million and liquidity2 of $636.8 million at September 30, 2022.

•As of September 30, 2022, the Côté Gold project was approximately 64.2% complete, with detailed engineering fully complete and construction in line with the updated technical report. The Company's share of remaining project spend to bring Côté Gold into production is estimated to be between $1.0 and $1.1 billion from October 1, 2022, net of leases and working capital.

•On October 18, 2022, the Company announced that it had entered into a definitive agreement with Zijin Mining Group Co. Ltd. to sell its interests in the Rosebel mine for cash consideration of $360 million plus working capital adjustments, as well as the release of approximately $41 million of IAMGOLD obligations related to equipment leases, on closing. The transaction is expected to close in the first quarter 2023 or earlier. It is subject to certain regulatory approvals, including approvals from the relevant authorities of the People’s Republic of China, the Government of Suriname, and other customary closing conditions. An after-tax non-cash impairment charge of $74.0 million ($115.8 million before tax) was recorded to align the carrying value of the Rosebel cash generating unit with the purchase price.

•The Company is actively pursuing various alternatives to increase its liquidity and capital resources to advance and complete construction of the Côté Gold project on the updated schedule. See “Liquidity and Capital Resources - Liquidity Outlook”.

______________________________

1.Jantzi Social Index (“JSI”). The JSI is a socially screened market capitalization-weighted common stock index modeled on the S&P/TSX 60. It consists of companies which meet a set of broadly based environmental, social and governance rating criteria.

2.This is a non-GAAP financial measure. See "Non-GAAP Financial Measures".

| | | | | |

IAMGOLD CORPORATION Third Quarter 2022 Management’s Discussion and Analysis | 2 |

OPERATING AND FINANCIAL RESULTS For more details and the Company's overall outlook for 2022, see "Outlook", and for individual mines and projects performance, see "Quarterly Updates". The following table summarizes certain operating and financial results for the three months ended September 30, 2022 (Q3 2022), June 30, 2022 (Q2 2022) and September 30, 2021 (Q3 2021) and the nine months ended September 30 (or YTD), 2022 and 2021 and certain measures of the Company's financial position as at September 30, 2022, June 30, 2022 and December 31, 2021.

| | | | | | | | | | | | | | | | | | |

| | | |

| | | | | | |

| Q3 2022 | Q2 2022 | Q3 2021 | YTD 2022 | YTD 2021 | |

| Key Operating Statistics | | | | | | |

| Gold production – attributable (000s oz) | 184 | | 170 | | 153 | | 528 | | 448 | | |

| Gold sales – attributable (000s oz) | 187 | | 170 | | 150 | | 538 | | 438 | | |

| | | | | | |

| | | | | | |

Average realized gold price1 ($/oz) | $ | 1,690 | | $ | 1,799 | | $ | 1,787 | | $ | 1,766 | | $ | 1,788 | | |

Cost of sales2 ($/oz sold) – attributable | $ | 1,140 | | $ | 1,130 | | $ | 1,247 | | $ | 1,102 | | $ | 1,157 | | |

Cash costs3 ($/oz sold) – attributable | $ | 1,126 | | $ | 1,119 | | $ | 1,245 | | $ | 1,087 | | $ | 1,155 | | |

AISC3 ($/oz sold) – attributable | $ | 1,559 | | $ | 1,604 | | $ | 1,508 | | $ | 1,550 | | $ | 1,387 | | |

| | | | | | |

Financial Results ($ millions, except where noted) | | | | | | |

| Revenues | $ | 343.3 | | $ | 334.0 | | $ | 294.1 | | $ | 1,033.9 | | $ | 857.1 | | |

| Gross profit | $ | 29.7 | | $ | 49.4 | | $ | 6.9 | | $ | 160.1 | | $ | 79.0 | | |

| | | | | | |

| | | | | | |

EBITDA3 | $ | (41.3) | | $ | 101.4 | | $ | 19.6 | | $ | 195.0 | | $ | 220.5 | | |

Adjusted EBITDA3 | $ | 103.1 | | $ | 110.0 | | $ | 82.5 | | $ | 350.6 | | $ | 265.7 | | |

| Net loss attributable to equity holders | $ | (108.3) | | $ | (9.6) | | $ | (75.3) | | $ | (94.1) | | $ | (60.3) | | |

Adjusted net earnings (loss) attributable to equity holders3 | $ | (13.7) | | $ | (6.3) | | $ | (20.1) | | $ | 6.1 | | $ | (17.5) | | |

| Net loss per share attributable to equity holders | $ | (0.23) | | $ | (0.02) | | $ | (0.16) | | $ | (0.20) | | $ | (0.13) | | |

| | | | | | |

| | | | | | |

| | | | | | |

Adjusted net earnings (loss) per share attributable to equity holders3 | $ | (0.03) | | $ | (0.01) | | $ | (0.04) | | $ | 0.01 | | $ | (0.04) | | |

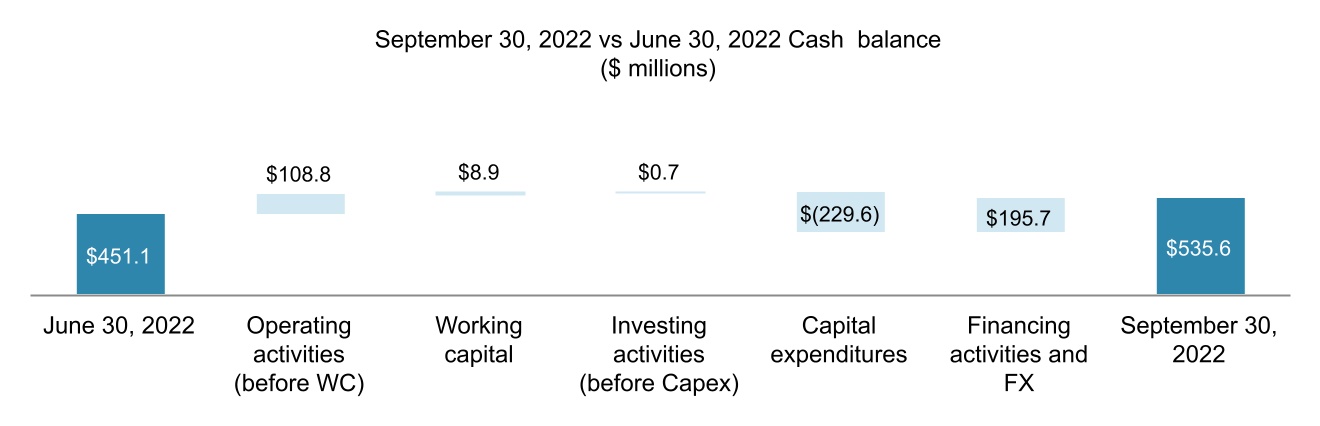

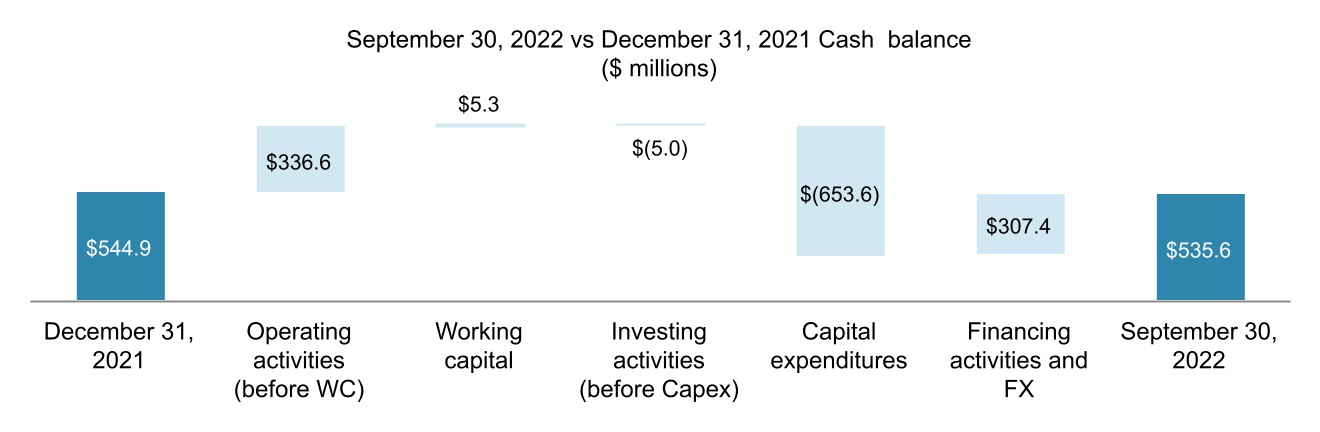

Net cash from operating activities before changes in working capital3 | $ | 108.8 | | $ | 93.9 | | $ | 79.6 | | $ | 336.6 | | $ | 217.0 | | |

| Net cash from operating activities | $ | 117.7 | | $ | 81.9 | | $ | 78.5 | | $ | 341.9 | | $ | 217.5 | | |

| | | | | | |

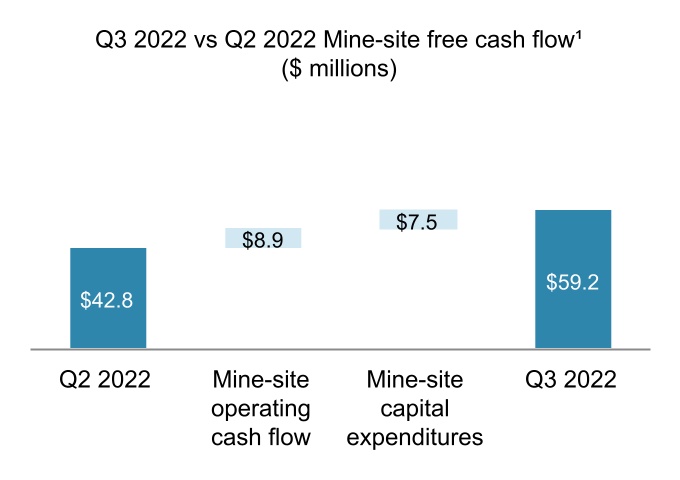

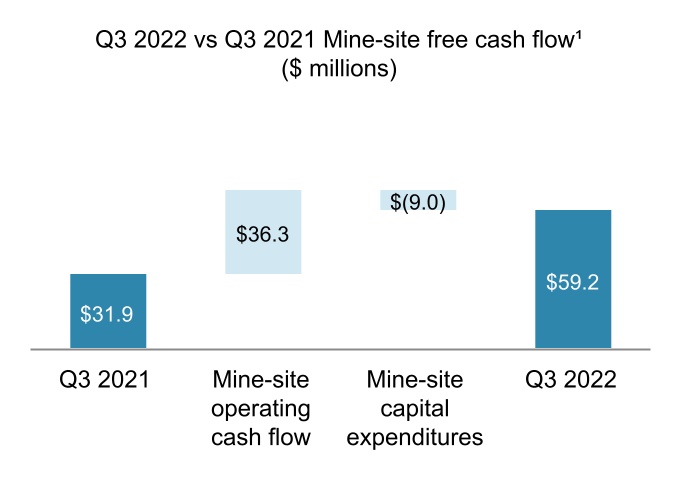

Mine-site free cash flow3 | $ | 59.2 | | $ | 42.8 | | $ | 31.9 | | $ | 189.3 | | $ | 121.6 | | |

Capital expenditures3,4,5 – sustaining | $ | 71.1 | | $ | 67.1 | | $ | 26.4 | | $ | 214.8 | | $ | 64.0 | | |

Capital expenditures3,4,5 – expansion | $ | 158.9 | | $ | 189.0 | | $ | 113.0 | | $ | 440.0 | | $ | 330.2 | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| September 30 | June 30 | December 31 | September 30 | December 31 | |

| 2022 | 2022 | 2021 | 2022 | 2021 | |

| Financial Position ($ millions) | | | | | | |

| Cash, cash equivalents and short-term investments | $ | 536.1 | | $ | 452.9 | | $ | 552.5 | | $ | 536.1 | | $ | 552.5 | | |

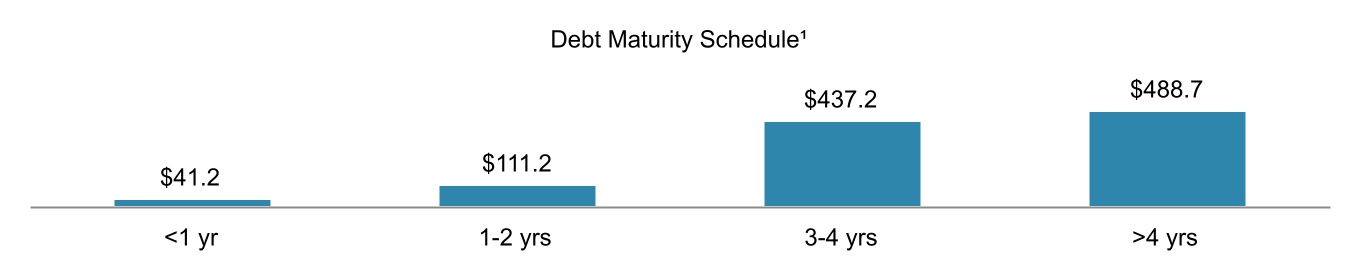

| Long-term debt | $ | 844.6 | | $ | 612.0 | | $ | 464.4 | | $ | 844.6 | | $ | 464.4 | | |

Net cash (debt)3 | $ | (409.3) | | $ | (225.1) | | $ | 16.3 | | $ | (409.3) | | $ | 16.3 | | |

| Available credit facility | $ | 100.7 | | $ | 348.7 | | $ | 498.3 | | $ | 100.7 | | $ | 498.3 | | |

| | | | | | |

| | | | | | |

| | | | | | |

1.The average realized gold price in the third quarter 2022 excluding the impact of the 2019 Prepay Arrangement (as defined below) was $1,735, (second quarter 2022 - $1,873) and YTD 2022 $1,829.

2.Throughout this MD&A, cost of sales, excluding depreciation, is disclosed in the cost of sales note in the consolidated interim financial statements.

3.Throughout this MD&A, the Company uses the terms average realized gold price per ounce sold, cash costs, cash costs per ounce sold, AISC, AISC per ounce sold, net cash from operating activities before changes in working capital, mine-site free cash flow, liquidity, net cash (debt), EBITDA, adjusted EBITDA, adjusted net earnings (loss) attributable to equity holders and adjusted net earnings (loss) per share attributable to equity holders, sustaining capital expenditures and expansion capital expenditures all of which are non-GAAP financial measures with no standard meaning under International Financial Reporting Standards ("IFRS") and are further discussed in the "Non-GAAP Financial Measures" section.

4.Throughout this MD&A, capital expenditures represent cash expenditures for property, plant and equipment and exploration and evaluation assets.

5.Starting in 2022, a higher portion of stripping costs are categorized as sustaining capital versus expansion capital, due to the particular areas that are scheduled to be mined and the stage of the life of mine aligning with World Gold Council guidelines. See "Non-GAAP Financial Measures" section.

| | | | | |

IAMGOLD CORPORATION Third Quarter 2022 Management’s Discussion and Analysis | 3 |

Summary of Financial and Operating Results

| | | | | | | | |

| Contributors to Change | | Q3 2022 vs. Q2 2022 |

| Financial | | |

| Revenues | r | $343.3 million, up $9.3 million or 3%, primarily due to higher sales volumes at Essakane and Westwood as a result of higher production and timing of sales ($32.7 million and $6.9 million, respectively), partially offset by a lower average realized gold price ($23.6 million or $109 per ounce sold) and lower sales volume at Rosebel as a result of timing of sales ($6.3 million). Included in the quarter is the impact of the lower revenues recognized from the $1,500 per ounce collar included in the 2019 Prepay Arrangement ($9.1 million or $45 per ounce sold). |

| Cost of sales | r | $313.6 million, up $29.0 million or 10%. Excluding the non-cash net realizable value (“NRV”) write-down of ore stockpile and finished goods inventories, cost of sales is higher, primarily due to higher operating costs, as a result of higher operating waste stripping volumes, ongoing cost pressures and higher depreciation (see below) and an increase in ounces produced and sold. The NRV write-down during the quarter was $4.0 million (second quarter 2022 - $5.2 million) and is associated with Rosebel and Westwood. |

| | |

Depreciation expense (included in cost of sales) | r | $84.3 million, up $6.2 million or 8%, primarily due to higher depreciation at Essakane ($7.0 million), partially offset by lower depreciation at Westwood ($0.6 million). |

| General and administrative expenses | s | $11.8 million, down $5.4 million or 31%, primarily due to lower severance and salaries costs ($2.8 million), legal and consulting costs associated with changes in the Company's board of directors ($2.4 million) and other consulting costs ($0.4 million) occurring in the second quarter, partially offset by higher share-based payments ($0.2 million). |

| Exploration expenses | s | $5.6 million, down $3.7 million, primarily due to reductions in drilling activity. |

| Other income (expense) | r | $2.3 million, up $0.9 million. |

| Income tax (recovery) expense | s | ($19.2) million, down $44.3 million, comprised of current income tax expense of $14.6 million (second quarter 2022 - $27.7 million) and deferred income tax recovery of $33.8 million (second quarter 2022 - recovery of $2.6 million). The higher current income tax expense in the second quarter primarily reflected withholding taxes paid in respect of dividends from Essakane and other foreign subsidiaries during that quarter. |

| | |

| | |

| | |

| Net cash from operating activities before changes in working capital | r | $108.8 million, up $14.9 million, primarily due to the factors noted below. |

| Net cash from operating activities | r | $117.7 million, up $35.8 million, primarily due to a decrease in income taxes paid ($22.4 million) and a net inflow in non-cash working capital movements ($20.9 million), partially offset by lower net cash earnings ($5.2 million) and lower settlement of derivatives ($1.7 million).

|

| Mine-site free cash flow | r | $59.2 million, up $16.4 million, from the prior quarter, primarily due to higher free cash flow at Essakane ($20.2 million) and Westwood ($9.2 million) due to higher sales volume, partially offset by lower free cash flow at Rosebel ($13.0 million) primarily due to changes in working capital and lower average realized gold price. |

| | |

| Cash, cash equivalents, short-term investments and restricted cash | r | $583.3 million comprised of cash and cash equivalents of $535.6 million, short-term investments of $0.5 million and restricted cash of $47.2 million, up $91.5 million from June 30, 2022, and down $11.4 million from December 31, 2021. |

| Operating | | |

| Attributable gold production | r | 184,000 ounces, up 14,000 ounces or 8%, primarily due to higher production at Essakane (8,000 ounces) due to higher throughput, and Westwood (5,000 ounces) due to higher grade from the underground mine. |

| Attributable gold sales | r | 187,000 ounces, up 17,000 ounces or 10%, due to higher production and timing of sales at Essakane (16,000 ounces) and higher production at Westwood (4,000 ounces), partially offset by timing of sales at Rosebel (3,000 ounces). |

Capital expenditures – capitalized stripping (included in capital expenditures – sustaining and expansion) | r | $38.0 million, up $2.2 million or 6%, primarily due to higher capitalized stripping activities at Essakane. In the third quarter 2022, $34.2 million of capitalized stripping expenditures were categorized as sustaining capital (second quarter 2022 - $24.5 million) and $3.8 million were categorized as expansion capital (second quarter 2022 - $11.3 million). |

| | |

| | | | | |

IAMGOLD CORPORATION Third Quarter 2022 Management’s Discussion and Analysis | 4 |

| | | | | | | | |

| Contributors to Change | | Q3 2022 vs. Q2 2022 |

| Operating | | |

| | |

| | | | | | | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Capital expenditures – sustaining | r | $71.1 million, up $4.0 million or 6%. Sustaining capitalized stripping expenditures were higher by $9.7 million and other sustaining capital expenditures were lower by $5.7 million, primarily due to lower spending at Rosebel ($9.2 million) related to timing of capital projects, partially offset by higher spending at Essakane ($5.1 million) due to the commissioning of replacement equipment in the quarter. |

| Capital expenditures – expansion | s | $158.9 million, down $30.1 million or 16%. Expansion capitalized stripping expenditures were lower by $7.5 million and other expansion capital expenditures were lower by $22.6 million, primarily due to lower expenditures at Côté Gold which includes $14.6 million of sale-leaseback proceeds, and Rosebel of $4.5 million. |

Cost of sales (excluding depreciation) per ounce sold | r | $1,140, up $10 or 1%, from $1,130 per ounce sold. Production costs per ounce sold were in line with the prior quarter with higher costs being offset by higher production. Included was the positive impact of realized derivative gains of $40 per ounce sold (second quarter 2022 - gains of $64 per ounce sold). |

| Cash costs per ounce sold | r | $1,126, up $7 or 1% from $1,119 per ounce sold. Cash costs per ounce sold were higher due to higher cost of sales per ounce, partially offset by the exclusion of the long term NRV adjustment that is included in cost of sales. |

| AISC per ounce sold | s | $1,559, down $45 or 3%, from $1,604 per ounce sold, primarily due higher sales volume and a decrease in general administrative expenses as described above. |

| Contributors to change | | Q3 2022 vs. Q3 2021 |

| Financial | | |

| Revenues | r | $343.3 million, up $49.2 million or 17%, primarily due to higher sales volume at Rosebel ($27.4 million) and higher production at Essakane ($21.7 million) and Westwood ($19.5 million), partially offset by a lower realized gold price ($19.6 million or $98 per ounce sold). Included in the third quarter 2022 is the impact of lower revenues recognized from the $1,500 per ounce collar included in the 2019 Prepay Arrangement ($9.1 million or $45 per ounce sold) |

| Cost of sales | r | $313.6 million, up $26.4 million or 9%. Cost of sales is higher primarily due to higher operating costs, production and sales volume. The NRV write-down this quarter was $4.0 million as noted above (third quarter 2021 - $16.2 million). |

| | |

| | |

Depreciation expense (included in cost of sales) | s | $84.3 million, down $0.8 million, primarily due to lower depreciation at Rosebel resulting from the 2021 impairment charge ($5.0 million), partially offset by higher depreciation of capitalized stripping assets at Essakane ($4.1 million). |

| General and administrative expenses | s | $11.8 million, down $1.8 million or 13%, primarily due to lower salaries ($0.8 million), consulting costs ($0.7 million) and share-based payments ($0.5 million), partially offset by lower realized gains on cash flow hedges ($0.5 million). |

| Exploration expenses | s | $5.6 million, down $4.4 million due to a reduction in planned exploration expenditures during 2022. |

| Other income (expense) | r | $2.3 million, up $48.3 million, primarily due to changes in the Doyon asset retirement obligation ($43.9 million). |

| Income tax (recovery) expense | s | ($19.2) million, down $21.6 million, comprised of current income tax expense of $14.6 million (third quarter 2021 - $12.3 million) and deferred income tax recovery of $33.8 million (third quarter 2021 - recovery of $9.9 million). |

| Net cash from operating activities before changes in working capital | r | $108.8 million, up $29.2 million, primarily due to the factors noted below. |

| Net cash from operating activities | r | $117.7 million, up $39.2 million, primarily due to proceeds from the 2022 Prepay Arrangements ($59.0 million), and an increase in movements in non-cash working capital items and non-current ore stockpiles ($10.0 million), partially offset by a lower net cash earnings ($24.7 million) and lower proceeds from insurance claim ($7.7 million). |

| Mine-site free cash flow | r | $59.2 million, up $27.3 million, primarily due to higher free cash flow at Essakane ($18.7 million) and Westwood ($7.9 million) due to higher sales volume and changes in working capital, partially offset by lower average realized gold price and the impact of inflation. Free cash flow at Rosebel ($0.7 million) was in line with the same prior year period. |

| | |

| | |

| | |

| | |

| | |

| | | | | |

IAMGOLD CORPORATION Third Quarter 2022 Management’s Discussion and Analysis | 5 |

| | | | | | | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Contributors to change | | Q3 2022 vs. Q3 2021 |

| Operating | | |

| Attributable gold production | r | 184,000 ounces, up 31,000 ounces or 20%, due to higher production at Westwood (12,000 ounces) as the underground operations continue ramping up after being in care and maintenance in the first half of 2021, Rosebel (10,000 ounces) and Essakane (9,000 ounces) both resulting from higher head grade and recoveries, partially offset by lower throughput. |

| Attributable gold sales | r | 187,000 ounces, up 37,000 ounces or 25%, due to higher production and timing of sales at Rosebel (15,000 ounces) and Essakane (11,000 ounces) and higher production at Westwood (11,000 ounces). |

Capital expenditures – capitalized stripping (included in capital expenditures – sustaining and expansion) | r | $38.0 million, up $6.8 million or 22%, due to higher capitalized stripping activities at Rosebel ($11.0 million) to support future production plans, partially offset by lower capitalized stripping at Essakane ($4.2 million). In the third quarter 2022, $34.2 million of capitalized stripping expenditures were categorized as sustaining capital (third quarter 2021 - $1.0 million) and $3.8 million were categorized as expansion capital (third quarter 2021 - $30.2 million). |

| Capital expenditures – sustaining | r | $71.1 million, up $44.7 million or 169%. Sustaining capitalized stripping activities were higher by $33.2 million and other sustaining capital expenditures were higher by $11.5 million, primarily due to higher spending at Essakane ($8.4 million) related to timing of capital projects and Westwood ($2.6 million) as underground operations were ramping after being in care and maintenance in the first half of 2021. |

| Capital expenditures – expansion | r | $158.9 million, up $45.9 million or 41%. Expansion capitalized stripping expenditures were lower by $26.4 million and other expansion capital expenditures were higher by $72.3 million, primarily due to higher spending at Côté Gold resulting from an increase in construction activities ($84.2 million), partially offset by lower spending at Rosebel ($5.5 million), Essakane ($4.4 million) and Boto Gold ($2.7 million). |

| | |

Cost of sales (excluding depreciation) per ounce sold

| s | $1,140, down $107 or 9%, from $1,247 per ounce sold. Excluding depreciation, cost of sales per ounce sold was lower primarily due to higher production and sales volume at Essakane, Rosebel and Westwood and a lower NRV write-down, partially offset by higher production costs. |

| | |

| | |

| Cash costs per ounce sold | s | $1,126, down $119 or 10%, from $1,245 per ounce sold. Cash costs per ounce sold were lower due to lower cost of sales per ounce sold noted above and a lower NRV write-down, partially offset by higher production costs. |

| AISC per ounce sold | r | $1,559, up $51 or 3%, from $1,508, primarily due to higher sustaining capital expenditures, partially offset by lower cash costs per ounce sold noted above. |

Global COVID-19 PandemicThe global COVID-19 pandemic continues to evolve and the management thereof remains a focus for the business. See "Operational Updates" for more information on each site. The Company continues to closely monitor developments and is taking necessary measures to manage the impact of the COVID-19 pandemic on its personnel, operations, construction and development projects and exploration activities. COVID-19 detection and mitigation protocols at our sites are reviewed on an ongoing basis to adapt to the evolving situation.

OUTLOOK

Operating Performance

| | | | | | | | | | | | |

| | | | |

| Actual YTD 2022 | Updated Full Year Guidance 20221 | Previous Full Year Guidance 20222 | |

| Essakane (000s oz) | 334 | | 410 – 430 | 360 – 385 | |

| Rosebel (000s oz) | 145 | | 175 – 200 | 155 – 180 | |

| Westwood (000s oz) | 49 | | 65 – 75 | 55 – 75 | |

| | | | |

| | | | |

Total attributable production (000s oz)3 | 528 | | 650 – 705 | 570 – 640 | |

| | | | |

Cost of sales3 ($/oz sold) | $ | 1,102 | | $1,100 – $1,130 | $1,100 – $1,150 | |

| | | | |

Cash costs3,4 ($/oz sold) | $ | 1,087 | | $1,100 – $1,130 | $1,100 – $1,150 | |

| | | | |

AISC3,4 ($/oz sold) | $ | 1,550 | | $1,600 – $1,650 | $1,650 – $1,690 | |

Depreciation expense5 ($ millions) | $ | 237.4 | | $305 – $315 | $280 – $290 | |

| Income taxes paid | $ | 59.0 | | $69 – $79 | $69 – $79 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

1.The updated full year guidance is based on the following 2022 full year assumptions, before the impact of hedging: average realized gold price of $1,792 per ounce, USDCAD exchange rate of 1.30, EURUSD exchange rate of 1.04 and average crude oil price of $100 per barrel.

2.The previous full year guidance is based on the following 2022 full year assumptions, before the impact of hedging: average realized gold price of $1,700 per ounce, USDCAD exchange rate of 1.25, EURUSD exchange rate of 1.20 and average crude oil price of $70 per barrel.

3.Consists of Essakane, Rosebel and Westwood on an attributable basis of 90%, 95% and 100%, respectively.

4.This is a non-GAAP financial measure. See "Non-GAAP Financial Measures".

5.The updated full year depreciation expense guidance includes an estimated $12 million of depreciation in the fourth quarter at Rosebel. Effective October 18, 2022, the Rosebel mine will be accounted for as held for sale, and its operating results will be reported as discontinued operations.

| | | | | |

IAMGOLD CORPORATION Third Quarter 2022 Management’s Discussion and Analysis | 6 |

Production Outlook

The Company expects that annual attributable production will exceed the top end of the previous guidance range of 570,000 to 640,000 ounces due to stronger operating performance, particularly at Essakane, and is revising guidance upwards to 650,000 to 705,000 ounces.

Costs Outlook

Cash costs guidance for 2022 has been revised downwards to $1,100 and $1,130 per ounce sold and AISC guidance is revised downwards with costs expected to be between $1,600 and $1,650 per ounce sold, largely reflecting the higher sales expected for the full year, partially offset with higher costs from inflation. The estimates issued in January 2022 included an inflation assumption of 5% to 7% on key consumables, translating to an increase of 1% to 2% in cash costs and AISC (reflected in the previous guidance figures). During the first nine months of the year, higher production offset the additional cost pressures from systemic inflation, constrained global supply chains and the sanctions on trade with Russia that increased the average cost of key consumables such as oil, ammonium nitrate, grinding media, lime and cyanide. The impact of the above-mentioned cost pressures stabilized during the third quarter of 2022 when compared to the first six months of the year. The Company continues to work with its supply chain and seek alternatives to mitigate ongoing costs pressures, including the sourcing of appropriate alternatives as well as progressing productivity initiatives at its operations through the IAMALLIN operational improvement program. Increases in oil prices have been partially mitigated by the existing oil hedge program, see “Market Risk”. For reference, excluding the impact of the Company’s hedging program, a $10/bbl increase in the oil price would translate to a $15 per ounce increase in cash costs; however, with current hedges in place, the same movement would equate to a $6 per ounce increase in cash costs. The Company notes that continued external cost pressures may result in an increase in costs and capital expenditures.

Income Taxes Paid

Income taxes paid guidance for 2022 is reaffirmed between $69 and $79 million.

Depreciation Expense

Depreciation expense guidance for 2022 is expected to be in the range of $305 and $315 million, reflecting higher YTD 2022 production and sales at Essakane. The updated full year depreciation expense guidance includes an estimated $12 million of depreciation in the fourth quarter at Rosebel. Effective October 18, 2022, the Rosebel mine will be accounted for as held for sale, and its operating results will be reported as discontinued operations.

Capital Expenditures1

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| Actual YTD 2022 | Updated Full Year Guidance 2022 | Previous Full Year Guidance 2022 |

| ($ millions) | Sustaining2 | Expansion3 | Total | Sustaining2 | Expansion3 | Total | Sustaining2 | Expansion3 | Total | | |

| | | | | | | | | | | |

| Essakane | $ | 116.4 | | $ | 2.5 | | $ | 118.9 | | $ | 175 | | $ | 5 | | $ | 180 | | $ | 165 | | $ | 5 | | $ | 170 | | | |

Rosebel4 | 75.0 | | 23.4 | | 98.4 | | 105 | | 30 | | 135 | | 105 | | 35 | | 140 | | | |

| Westwood | 22.5 | | 2.7 | | 25.2 | | 30 | | 5 | | 35 | | 40 | | 10 | | 50 | | | |

| 213.9 | | 28.6 | | 242.5 | | 310 | | 40 | | 350 | | 310 | | 50 | | 360 | | | |

| | | | | | | | | | | |

| Boto Gold | — | | 11.8 | | 11.8 | | — | | 20 | | 20 | | — | | 20 | | 20 | | | |

| | | | | | | | | | | |

| Corporate | 0.9 | | — | | 0.9 | | — | | — | | — | | — | | — | | — | | | |

Total5,6,7,8 (±5%) | $ | 214.8 | | $ | 40.4 | | $ | 255.2 | | $ | 310 | | $ | 60 | | $ | 370 | | $ | 310 | | $ | 70 | | $ | 380 | | | |

1.100% basis, unless otherwise stated.

2.Sustaining capital includes capitalized stripping of (i) $18.6 million for Essakane and $15.6 million for Rosebel in Q3 2022 (ii) $65.7 million for Essakane and $35.4 million for Rosebel YTD 2022 and (iii) $110 million for Essakane and $45 million for Rosebel for both the revised and previous full year guidance. See "Outlook" sections below.

3.Expansion capital includes capitalized stripping of (i) $nil million for Essakane and $3.8 million for Rosebel in Q3 2022 (ii) $nil for Essakane and $18.6 million for Rosebel YTD 2022 and (iii) $nil for Essakane and $20 million for Rosebel for the both the revised and previous full year 2022 guidance. See "Outlook" sections below.

4.Rosebel includes Saramacca at 70%.

5.Includes $10 million of capitalized exploration and evaluation expenditures also included in the Exploration Outlook guidance table.

6.Capitalized borrowing costs are not included.

7.In addition to the above capital expenditures, $22 million in total principal lease payments are expected.

8.See "Costs Outlook" section above.

Exploration

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Actual YTD 2022 | Full Year Guidance 2022 |

| ($ millions) | Capitalized | Expensed | Total | Capitalized | Expensed | Total |

| Exploration projects – greenfield | $ | — | | $ | 19.5 | | $ | 19.5 | | $ | — | | $ | 21 | | $ | 21 | |

Exploration projects – brownfield1 | 5.2 | | 3.4 | | 8.6 | | 10 | | 4 | | 14 | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| $ | 5.2 | | $ | 22.9 | | $ | 28.1 | | $ | 10 | | $ | 25 | | $ | 35 | |

1.Exploration projects - brownfield includes planned near-mine exploration and resource development of (i) $5.2 million YTD 2022, and (ii) $10 million for the full

year 2022 guidance.

| | | | | |

IAMGOLD CORPORATION Third Quarter 2022 Management’s Discussion and Analysis | 7 |

ENVIRONMENTAL, SOCIAL AND GOVERNANCE

The Company is committed to:

•Maintaining its culture of accountable mining through high standards of ESG practices; and

•The principle of Zero Harm®, in every aspect of its business, with particular emphasis on respecting the natural environment, building strong community partnerships and putting the health and safety of the Company's employees first.

The Company has implemented the Mining Association of Canada's Toward Sustainable Mining ("TSM") framework at all its operations and is working towards the implementation of the World Gold Council’s Responsible Gold Mining Principles with the year two annual report relating to this implementation released by the Company. ESG policies, systems and practices are embedded throughout the business and the Company reports annually on its ESG performance via its Global Reporting Initiative compliant Sustainability Report. As part of its accountability and reporting framework, the Company has also committed to report in accordance with the Task Force on Climate-Related Financial Disclosures ("TCFD") guidelines and expects to release its initial TCFD report by the end of 2022.

Environmental

The Company recognizes that mining activities are energy intensive and generate significant greenhouse gas emissions (“GHG”). In September 2021, the Company announced that it had set a global target of reaching net negative GHG emissions by no later than 2050. The Company also announced a target of achieving net positive biodiversity. Medium term targets will be set as part of the Company’s roadmap to achieve these global targets and will be issued by the end of 2022. An external review of the Company’s GHG emissions profile across all sites has been completed and a draft action plan of the Company’s global commitments is currently being reviewed by the Executive Leadership and the Board. The details of the roadmap will be published in the inaugural TCFD report in Q4 2022.

At Côté Gold, the Company received the Ontario Minister of the Environment, Conservation and Parks for a site visit. The Annual Federal and Provincial compliance reports have been filed with the relevant authorities.

At Rosebel, the Tailings Storage Facility 3 ("TSF3") Expansion Environmental and Social Impact Assessment ("ESIA") was completed and submitted to the authorities. A public disclosure meeting was conducted and comments from authorities received to update the ESIA. As part of TSM Water Stewardship protocol requirements, the study watershed and water use by Communities of Interest started in September. The site-wide water balance study is also ongoing and expected to be complete by the end of 2022. The Company also started analyzing a de-carbonization roadmap for the mine.

At Essakane, the Company continued working on the various studies and action plans required to gather all the information that will feed the mine’s knowledge base, which will be used to develop the integrated mine closure plan.

Social

Health and Safety

Health and safety is core to the Company’s relentless pursuit of its Zero Harm® vision. Through various programs, the Company continuously promotes a safe work environment and a wellness program at all sites. The DARTFR (days away, restricted, transferred duty frequency rate) was 0.27 (on YTD basis) at the end of the third quarter of 2022, tracking below the global annual target of 0.42, with a decreasing trend. The TRIFR (total recordable injuries frequency rate) was 0.72 (on YTD basis) at the end of the third quarter of 2022, tracking below the global annual target of 0.73, with a decreasing trend. Côté Gold has surpassed over 6.9 million hours with no lost time injuries to date. The operations have been increasing focus on situational awareness and preventative activities related to work tasks.

Social and Economic Development

The Company is continuously exploring opportunities for investing and partnering with communities impacted by its operations. At both Essakane and Rosebel, the Company has committed to establishing and seeding community funds. The bulk of the Company’s funding for community investment initiatives at these sites will flow through these dedicated community funds to ensure consistent funding on a year-to-year basis.

At Rosebel, the Company has committed to making an annual contribution of 0.25% of annual revenues to the Rosebel Community Fund, in addition to its existing in-kind royalty of 0.25% of gold and silver monthly production it contributes to the Suriname Environmental & Mining Foundation. In 2021, Rosebel contributed $0.9 million to the Rosebel Community Fund complementing the initial endowment of $2.5 million made by the Company in 2020. Rosebel updated its community investment strategy to further support the social and economic development of its local communities. The priority areas identified up to 2025 are public health, education, livelihood development and basic infrastructure. In Q3 2022, the construction of a Mourning Facility was completed in one of Rosebel's Communities of Interest. An agreement was signed with the traditional authority and entrepreneurs of the region to start a large-scale agricultural project and the Company committed $200,000 for this project: $100,000 will be invested in Q4 2022 and $100,000 in Q1 2023. Rosebel strongly believes in socio-economic development of the region to ensure a self-sustaining livelihood post mine closure. Rosebel completed the ESIA for the TSF3 expansion. As part of that process the public disclosure meeting was successfully completed with alignment and consent of the host communities for the project.

| | | | | |

IAMGOLD CORPORATION Third Quarter 2022 Management’s Discussion and Analysis | 8 |

At Essakane, the Company continued its participation in the Mining Fund for Local Development in Burkina Faso, a program established by the government, pursuant to which the Company committed to contribute 1% of its annual revenues. The contribution for the third quarter 2022 is estimated at $5.9 million and $7.9 million year-to-date from the mine. A session of the communal committee for Falagountou was held in September and concluded with the adoption of 17 projects for a total budget of $2.5 million. In parallel, Essakane continued its direct community investment initiatives, focusing on agricultural programs as well as the fight against malaria, tuberculosis and malnutrition, income generating activities supported through the mine’s Iron Fund and small business support through the mine’s local content strategy. Consultations with stakeholders are ongoing for the official launch in Q4 of the implementation of the 2-year partnership program with the United Nations Development Programme for the implementation of a local development initiative in favor of the communities of Falagountou, Markoye, Gorom-Gorom and Dori, fostering youth employment, reducing poverty, strengthening local infrastructure, and supporting capacity building in local governance.

The Company has continued to advance work on its previously announced partnership with Giants of Africa, a non-governmental organization founded by Masai Ujiri, President of the Toronto Raptors. After the first phase in 2021, two additional courts have been constructed this year by Giants of Africa in Burkina Faso and Senegal.

At Boto Gold, the construction of new houses for the resettlement of the Kouliminde village is progressing and expected to be completed in the first half of 2023. The Company also continued with its community development projects, focusing on health with the fight against malaria, access to water and income generating activities through agriculture and vegetable production.

At Côté Gold, several successful site visits were organized with various stakeholders and Indigenous groups including Fisheries and Oceans Canada, Impact Assessment Agency of Canada, Ministry of Natural Resources and Forestry, Ministry of the Environment, Conservation and Parks, Métis Nation of Ontario, Flying Post First Nation, and members of the local cottagers association.

Diversity, Equity and Inclusion

The Company unequivocally condemns inequity, discrimination and hatred in all its forms. One of the Company's values is to conduct itself with respect and to embrace diversity. The Company has established a Diversity, Equity and Inclusion ("DEI") Steering Committee and Employee Council groups to further enhance the Company's strong commitment to these important values through data collection, education, awareness and action planning at the enterprise level. The Company completed a diagnostic evaluation of its DEI status and the resulting findings and recommendations (global and site specific) are being rolled out across the Company to develop action plans. The Company is a sponsor of the Artemis Project, which aims to promote female business owners and entrepreneurs in the mining sector. The Company is also an active contributor of the TSM protocol on DEI and is working closely with Mining HR Canada on various initiatives.

Governance

The Board of Directors of IAMGOLD (the “Board”) adopted new diversity and renewal guidelines in 2021, reflecting governance best practices. In terms of diversity, the Board agreed that its membership should comprise, at a minimum, the greater of (i) two and (ii) 30%, female directors. With respect to Board membership renewal, it was decided that the average tenure of the Board should not exceed ten years and that no director should serve as the chair of the Board or the chair of any committee for more than ten consecutive years. Currently, women represent approximately 43% of the directors and the average tenure of directors on the Board is less than one year.

Recent Developments and Acknowledgments

•Corporate Knights released its Best 50 list on June 29, 2022, which identifies the top 50 Canadian corporate citizens across all sectors evaluated based on ESG and economic key performance indicators. From a pool of 332 firms, the Company placed in 37th place, an improvement of seven places over the prior year.

•In a recent ESG assessment by Moody’s ESG Solutions, IAMGOLD was ranked 5th out of 52 sector peers, with notable strengths in social and economic development, environmental strategy, health & safety and governance.

•The Company obtained the ECOLOGO® certification for its mineral exploration activities carried out in Quebec and is the first producing mining company to achieve such certification.

•On September 16, 2022, the Company announced the departure of Daniella Dimitrov, Chief Financial Officer ("CFO") and Executive Vice president, Strategy & Corporate Development. Maarten Theunissen, the Company's current Vice President of Finance, was appointed interim CFO.

•On September 30, 2022, Deborah Starkman resigned from the Board. Ms. Starkman's decision to resign was to focus on her other professional commitments.

| | | | | |

IAMGOLD CORPORATION Third Quarter 2022 Management’s Discussion and Analysis | 9 |

QUARTERLY UPDATES

West Africa

Essakane District, Burkina Faso

The Essakane District is located in north-eastern Burkina Faso, West Africa approximately 330 km northeast of the capital, Ouagadougou. The Essakane District includes the Essakane Mine and the surrounding mining lease and exploration concessions totaling approximately 650 square kilometres. The Company owns a 90% interest in the Essakane mine with the remaining 10% held by the government of Burkina Faso.

Essakane Mine (IAMGOLD interest – 90%)1

| | | | | | | | | | | | | | | | | |

| | |

| | | | | |

| Q3 2022 | Q2 2022 | Q3 2021 | YTD 2022 | YTD 2021 |

| Key Operating Statistics | | | | | |

| Ore mined (000s t) | 3,259 | | 3,803 | | 3,908 | | 10,894 | | 11,902 | |

| Waste mined (000s t) | 9,357 | | 7,602 | | 11,335 | | 28,305 | | 33,502 | |

| Material mined (000s t) – total | 12,616 | | 11,405 | | 15,243 | | 39,199 | | 45,404 | |

Strip ratio2 | 2.9 | | 2.0 | | 2.9 | | 2.6 | | 2.8 | |

| Ore milled (000s t) | 2,978 | | 2,704 | | 3,298 | | 8,844 | | 9,656 | |

| Head grade (g/t) | 1.50 | | 1.52 | | 1.33 | | 1.47 | | 1.37 | |

| Recovery (%) | 90 | | 90 | | 83 | | 89 | | 82 | |

| Gold production (000s oz) – 100% | 129 | | 119 | | 118 | | 372 | | 349 | |

| Gold production (000s oz) – attributable 90% | 115 | | 107 | | 106 | | 334 | | 314 | |

| Gold sales (000s oz) – 100% | 133 | | 117 | | 122 | | 381 | | 351 | |

Average realized gold price3 ($/oz) | $ | 1,739 | | $ | 1,882 | | $ | 1,790 | | $ | 1,833 | | $ | 1,794 | |

Financial Results ($ millions)1 | | | | | |

Revenues4 | $ | 232.2 | | $ | 218.8 | | $ | 217.4 | | $ | 699.2 | | $ | 629.7 | |

| Operating costs | (115.7) | | (86.4) | | (101.1) | | (292.5) | | (303.3) | |

| Royalties | (11.4) | | (10.6) | | (10.9) | | (34.3) | | (31.5) | |

| | | | | |

Cash costs3 | $ | (127.1) | | $ | (97.0) | | $ | (112.0) | | $ | (326.8) | | $ | (334.8) | |

Other mine costs5 | (0.3) | | (0.3) | | (0.3) | | (1.0) | | (0.7) | |

Cost of sales4 | $ | (127.4) | | $ | (97.3) | | $ | (112.3) | | $ | (327.8) | | $ | (335.5) | |

Sustaining capital expenditures3,6 | (37.6) | | (31.1) | | (11.6) | | (116.4) | | (28.3) | |

| | | | | |

Other costs and adjustments7 | (1.5) | | (2.0) | | (1.5) | | (1.8) | | (4.9) | |

AISC3 | $ | (166.5) | | $ | (130.4) | | $ | (125.4) | | $ | (446.0) | | $ | (368.7) | |

Expansion capital expenditures3,8 | $ | (1.0) | | $ | (0.5) | | $ | (27.2) | | $ | (2.5) | | $ | (60.3) | |

Performance Measures9 | | | | | |

| Cost of sales excluding depreciation ($/oz sold) | $ | 954 | | $ | 838 | | $ | 925 | | $ | 860 | | $ | 956 | |

Cash costs3 ($/oz sold) | $ | 952 | | $ | 836 | | $ | 923 | | $ | 858 | | $ | 955 | |

AISC3 ($/oz sold) | $ | 1,248 | | $ | 1,124 | | $ | 1,033 | | $ | 1,171 | | $ | 1,051 | |

1.100% basis, unless otherwise stated.

2.Strip ratio is calculated as waste mined divided by ore mined.

3.This is a non-GAAP financial measure. See "Non-GAAP Financial Measures".

4.As per note 27 of the consolidated interim financial statements for revenues and cost of sales. Cost of sales is net of depreciation expense.

5.Other mine costs exclude by-product credits.

6.Includes sustaining capitalized stripping for the third quarter 2022 of $18.6 million (second quarter 2022 - $17.2 million; third quarter 2021 - $1.0 million) and YTD 2022 of $65.7 million (YTD 2021 - $1.0 million).

7.Other costs and adjustments include sustaining lease principal payments, environmental rehabilitation accretion and depletion and prior period operating costs, partially offset by by-product credits.

8.Includes expansion capitalized stripping for the third quarter 2022 of $nil (second quarter 2022 - $nil; third quarter 2021 - $21.8 million) and YTD 2022 of $nil (YTD 2021 - $43.9 million).

9.Cost of sales, cash costs and AISC per ounce sold may not be calculated based on amounts presented in this table due to rounding.

Operational Insights

•Essakane continued to deliver strong results and achieved attributable gold production of 115,000 ounces in the third quarter of 2022, higher by 8,000 ounces or 7% compared to the prior quarter and 9,000 ounces or 8% compared to the same quarter of the prior year. Higher production is attributed mainly to higher mill throughput when compared with the prior quarter and better head grade at higher recovery rates when compared to the same prior year period.

| | | | | |

IAMGOLD CORPORATION Third Quarter 2022 Management’s Discussion and Analysis | 10 |

•Mining activity of 12.6 million tonnes in the third quarter was higher compared to the prior quarter mainly due to the return of mining operations to full capacity during September as a result of mitigation efforts and an easing of supply chain challenges in the country.

•Mill throughput of 3.0 million tonnes in the third quarter, at an average head grade of 1.50 g/t Au and plant availability of 93%, was higher compared to the prior quarter due to improved grind size and mill availability. Mill recovery of 90% in the third quarter was similar to the prior quarter.

•The Company reported on certain political developments in Burkina Faso in the third quarter (see news release dated October 3, 2022). All IAMGOLD personnel continue to be safe and Essakane continues to operate as per the business plan.

•The security situation in Burkina Faso continues at elevated risk levels and the Company continues to take proactive measures to ensure the safety and security of in-country personnel and is constantly adjusting its protocols and the activity levels at the site according to the security environment. The Company is furthering certain additional investments in security and supply chain infrastructure in the region and at the mine site, with the support of the government. The security situation continues to apply pressures to the in-country supply chain, however mitigation measures minimized impacts in the third quarter.

•The COVID-19 situation remained stable during the third quarter with a few isolated cases recorded.

•The IAMALLIN improvement project has continued the execution phase in the third quarter, with the focus continuing on improving mine productivity, mill feed optimization and supplies inventory management including lead time optimization.

Financial Performance - Q3 2022 Compared to Q2 2022 and Q3 2021

•Cost of sales, excluding depreciation, of $127.4 million was (i) higher by $30.1 million or 31% compared with the prior quarter, primarily due to higher operating costs resulting from higher mill throughput as described above and an increase in operational waste stripping volumes, and (ii) higher by $15.1 million or 13% compared to the same prior year period, primarily due to higher operational waste stripping volumes and inflationary impacts, partially offset by lower mill throughput and higher realized derivative gains.

•Compared to the second quarter 2022, cost of sales, excluding depreciation, and cash costs per ounce sold of $954 and $952, respectively, were higher by 14%, primarily due to higher operating costs partially offset by higher production and sales. AISC per ounce sold of $1,248 was higher by $124 or 11% due to higher cash costs per ounce and higher sustaining capital expenditures.

•Compared to the third quarter 2021, cost of sales, excluding depreciation, and cash costs per ounce sold, were higher by 3%, primarily due to higher operating costs resulting from inflation, partially offset by higher production and sales. AISC per ounce sold was higher by $215 or 21%, compared with the same prior year period primarily due to higher sustaining capital expenditures.

•Total capitalized stripping (sustaining and expansion) in the third quarter of $18.6 million was higher by $1.4 million or 8% and lower by $4.2 million or 18% compared to the prior quarter and same prior year period, respectively. Capitalized stripping was higher than the prior quarter as the impact of supply chain issues were mitigated towards the end of the quarter, while lower than the same prior year period due to the timing of stripping activities and the impact of the supply chain issues experienced in 2022.

•Sustaining capital expenditures, excluding capitalized stripping, of $19.0 million included mobile and mill equipment of $8.0 million, capital spares of $4.4 million, tailings management of $1.9 million, airstrip extension of $1.6 million and other sustaining projects of $3.1 million. Expansion capital expenditures, excluding capitalized stripping, of $1.0 million, primarily included capital projects associated with the community village resettlement project.

Financial Performance – YTD 2022 Compared to YTD 2021

•Cost of sales, excluding depreciation, of $327.8 million for YTD 2022, was lower by $7.7 million or 2% compared with the same prior year period, primarily due to a higher ratio of stripping costs capitalized and the positive impact of realized derivative gains, partially offset by higher operating costs due to inflation.

•Cost of sales, excluding depreciation, and cash costs per ounce sold of $860 and $858, respectively, for YTD 2022 was lower by 10% compared to the same prior year period, due to lower cost of sales noted above combined with the impact of higher production and sales volume.

•AISC per ounce sold of $1,171 for YTD 2022 was higher by $120 or 11%, compared to the same prior year period, primarily due to higher sustaining capital expenditures, partially offset by lower cash costs per ounce.

•Sustaining capital expenditures, excluding capitalized stripping, of $50.7 million for YTD 2022 included mobile and mill equipment of $16.8, capital spares of $14.4 million, tailings management of $6.2 million, airstrip extension of $4.4 million, and other sustaining projects of $8.9 million. Expansion capital expenditures, excluding capitalized stripping, of $2.5 million for YTD 2022 included capital projects associated with community village resettlement, tailings management, tailings management plant upgrade and other expansion projects.

| | | | | |

IAMGOLD CORPORATION Third Quarter 2022 Management’s Discussion and Analysis | 11 |

Outlook

The guidance range for 2022 attributable gold production at Essakane has been increased to 410,000 to 430,000 ounces, reflecting the continued trend of positive grade reconciliation. The Company is investigating whether the updated block model may be underestimating grade as the complexity of mineralization has increased in the lower portions of the pit with higher amounts of coarse gold. The operation continues to execute on targeted operational improvements including improving mill throughput optimizing blast fragmentation and enhanced gravity circuit recoveries through the planned addition of a double deck screen. In the fourth quarter, Essakane's capital stripping program is expected to increase from current levels in order to secure the 2023 and 2024 production plan, assuming no significant disruptions in the supply chain resulting from the security situation described above.

Cash costs continue to be under pressure due to systemic inflation and constrained global supply chains, although these pressures have been partially offset through increased sales volumes and the weakening of the EURUSD exchange rate which lowers the cost of certain inputs, including labour. The Company continues to actively work with authorities and suppliers to mitigate potential impacts and manage continuity of supply due to the security situation noted above while also investing in additional security infrastructure.

Brownfield Exploration

During the first three quarters of 2022, approximately 9,000 metres of diamond drilling were completed as part of a planned 10,000-metre infill program in 2022 to improve resource confidence within selected areas of the EMZ and the Lao satellite deposit. Exploration activities on concessions surrounding the mine lease continue to be suspended due to the impacts of regional security constraints.

Bambouk District

The Bambouk District includes the Boto Gold project and the Karita and the Diakha-Siribaya Gold projects located within 15 kilometres of the Boto Gold project in adjacent countries. The Company is undertaking a delineation drilling program to support an initial resource estimate at the Karita discovery in Guinea and the completion of an updated mineral resource estimate aiming to convert mineral resources to a higher confidence level at the Diakha deposit in Mali. The Company continues to progress its strategic alternatives with respect to these development and exploration assets in West Africa that may include the disposition of all or an interest in one or more of such assets. See “Liquidity and Capital Resources - Liquidity Outlook”.

Boto Gold Project, Senegal

The Boto Gold project is a shovel ready development project located in southeastern Senegal along the border with Mali. The project is owned 90% by the Company, with the Republic of Senegal owning a 10% free carried interest. The project is located on an exploitation permit granted in late 2019 for an initial 20-year period and is currently undergoing various de-risking activities.

The 2022 scope includes the completion of preliminary works started in 2021. During the third quarter 2022, both geotechnical drilling to further de-risk the Malikoundi pit design, as well as on-site hydrogeological testing to further understand and model water flow, were competed. The data acquired are being processed and final reports are expected by year-end 2022. The Company is progressing with the work related to the Kouliminde village resettlement action plan and continues to evaluate the scope of the overall project, associated capital expenditures and timing, as well as potential alternatives to enhance the value of the project in general. Capital expenditures totaled $11.8 million for the first three quarters of 2022.

Karita Gold Project, Guinea

The Karita Gold project is wholly-owned by the Company and was acquired in 2017 as a granted exploration permit that covers approximately 100 square kilometres located in Guinea between the Company's Boto Gold project in Senegal to the north and its Diakha-Siribaya Gold project in Mali to the south. During 2019, a first pass RC drilling program confirmed the discovery of mineralization along this portion of the Senegal-Mali Shear Zone.

In 2022, the Company is completing a 24,000-metre drilling program to support a future initial mineral resource estimate, of which approximately 21,000 metres were completed in the first three quarters of 2022. During the third quarter, the Company reported assay results with highlights including: 34.0 metres grading 5.81 g/t Au, 25.0 metres grading 5.32 g/t Au and 12.0 metres grading 9.49 g/t Au (see news release dated July 6, 2022).

Diakha-Siribaya Gold Project, Mali

The Diakha-Siribaya project is wholly-owned by the Company and consists of eight contiguous exploration permits which cover a total area of approximately 600 square kilometres, located approximately 10 kilometres south of the Boto Gold project, in the Kédougou-Kéniéba inlier of the West African Craton region of western Mali along the borders with Senegal and Guinea. The results of a revised mineral resource estimate incorporating the drill results from the 2021 drilling program completed at the Diakha deposit are expected to be reported in Company's annual year end Mineral Resource and Reserve statement.

| | | | | |

IAMGOLD CORPORATION Third Quarter 2022 Management’s Discussion and Analysis | 12 |

North America

Abitibi District, Canada

The Company is developing a “hub-and-spoke" model in the Abitibi District to exploit the available mill capacity at the Westwood complex, located 35 kilometres northeast of Rouyn-Noranda and 80 kilometres west of Val d'Or in southwestern Québec, Canada. In addition to feed from the Westwood underground mine and the Grand Duc open pit mine, the Company is evaluating potential future supplemental feed from assets such as the Fayolle exploration property and the optioned Rouyn Gold project.

Westwood Mine (IAMGOLD interest – 100%)

| | | | | | | | | | | | | | | | | |

| | |

| | | | | |

| Q3 2022 | Q2 2022 | Q3 2021 | YTD 2022 | YTD 2021 |

| Key Operating Statistics | | | | | |

| Underground lateral development (metres) | 951 | | 1,207 | | 401 | 3,006 | | 549 | |

| Ore mined (000s t) – underground | 61 | | 53 | | 31 | | 177 | | 45 | |

| Ore mined (000s t) – other sources | 243 | | 218 | | 171 | | 620 | | 690 | |

| Ore mined (000s t) – total | 304 | | 271 | | 202 | | 797 | | 735 | |

| Ore milled (000s t) | 284 | | 284 | 220 | | 818 | | 711 | |

| Head grade (g/t) – underground | 6.82 | | 4.01 | | 4.17 | | 5.68 | | 4.26 | |

| Head grade (g/t) – other sources | 0.94 | | 1.04 | | 0.59 | | 0.98 | | 0.82 | |

| Head grade (g/t) – total | 2.23 | | 1.62 | | 1.11 | | 2.00 | | 1.03 | |

| Recovery (%) | 94 | | 93 | | 92 | | 93 | | 93 | |

| Gold production (000s oz) – 100% | 19 | | 14 | | 7 | | 49 | | 22 | |

| Gold sales (000s oz) – 100% | 18 | | 14 | | 7 | | 48 | | 22 | |

Average realized gold price1 ($/oz) | $ | 1,730 | | $ | 1,854 | | $ | 1,779 | | $ | 1,814 | | $ | 1,790 | |

| Financial Results ($ millions) | | | | | |

Revenues2 | $ | 31.4 | | $ | 27.1 | | $ | 12.7 | | $ | 89.3 | | $ | 39.4 | |

| | | | | |

| | | | | |

Cash costs1 | $ | (32.4) | | $ | (34.8) | | $ | (24.7) | | $ | (97.7) | | $ | (47.8) | |

Other mine costs3 | (0.3) | | (0.6) | | — | | (1.4) | | (0.3) | |

Cost of sales2 | $ | (32.7) | | $ | (35.4) | | $ | (24.7) | | $ | (99.1) | | $ | (48.1) | |

Sustaining capital expenditures1 | (6.4) | | (8.8) | | (3.8) | | (22.5) | | (6.3) | |

Other costs and adjustments4 | (0.7) | | (0.9) | | (0.4) | | (1.7) | | (0.2) | |

AISC1 | $ | (39.8) | | $ | (45.1) | | $ | (28.9) | | $ | (123.3) | | $ | (54.6) | |

Expansion capital expenditures1 | $ | (1.5) | | $ | (0.7) | | $ | (0.8) | | $ | (2.7) | | $ | (2.6) | |

Performance Measures5 | | | | | |

Cost of sales excluding depreciation6 ($/oz sold) | $ | 1,817 | | $ | 2,463 | | $ | 3,512 | | $ | 2,043 | | $ | 2,205 | |

Cash costs1 ($/oz sold) | $ | 1,803 | | $ | 2,427 | | $ | 3,500 | | $ | 2,015 | | $ | 2,192 | |

AISC1 ($/oz sold) | $ | 2,208 | | $ | 3,147 | | $ | 4,087 | | $ | 2,541 | | $ | 2,501 | |

1.This is a non-GAAP financial measure. See "Non-GAAP Financial Measures".

2.As per note 27 of the consolidated interim financial statements for revenues and cost of sales. Cost of sales is net of depreciation expense.

3.Other mine costs exclude by-product credits.

4.Other costs and adjustments include sustaining lease principal payments and environmental rehabilitation accretion and depletion, partially offset by by-product credits.

5.Cost of sales, cash costs and AISC per ounce sold may not be calculated based on amounts presented in this table due to rounding.

6.Includes non-cash ore stockpile and finished goods inventories NRV write-down of $1.1 million for the third quarter 2022 (second quarter 2022 - $3.3 million; third quarter 2021 - $4.8 million) and $6.1 million for YTD 2022 (YTD 2021 - $7.8 million), which had an impact on cost of sales, excluding depreciation, per ounce sold of $61 for third quarter 2022 (second quarter 2022 - $232; third quarter 2021 - $681) and $126 for YTD 2022 (YTD 2021 - $358).

Operational Insights

•Westwood achieved gold production of 19,000 ounces in the third quarter, higher by 5,000 ounces or 36% compared to the prior quarter, as a result of higher volumes of underground ore at a higher grade. Underground production was on care and maintenance for the majority of the first half of 2021 with the ramp up of underground mining activities beginning in the third quarter of 2021.

•Mining activities totaled 304,000 tonnes in the third quarter, with underground mining activities contributing 61,000 tonnes and the open pit mining at Grand Duc contributing 243,000 tonnes. Mining volumes were 12% higher than the prior quarter due to improved underground mine performance and supplemental tonnes from Grand Duc.

| | | | | |

IAMGOLD CORPORATION Third Quarter 2022 Management’s Discussion and Analysis | 13 |

•Underground development in the third quarter achieved 951 metres of lateral development, 21% lower than the prior quarter due to labour constraints and lower mechanical availability of underground equipment. Development of vertical escape ways and underground rehabilitation progressed in line with planned levels despite challenging ground conditions and impacts from supply chain challenges. Underground mining activity in the third quarter focused on accessing additional stope sequences in the eastern zones in order to secure multiple ore faces to allow for simultaneous exploitation in support of the production plan. Mining activities in the higher-grade western and central underground zones commenced in June 2022.

•Mill throughput was 284,000 tonnes in the third quarter at a head grade of 2.23 g/t Au with average recovery of 94% and plant availability of 91%. Mill throughput was in line with the prior quarter and continues to benefit from successfully executing mill maintenance strategies for improved availability as well as management of highly abrasive material from Grand Duc.

•The COVID-19 situation at site and in the Abitibi District remained stable in the third quarter.

Financial Performance - Q3 2022 Compared to Q2 2022 and Q3 2021

•Cost of sales, excluding depreciation, of $32.7 million was (i) lower by $2.7 million or 8% compared with the prior quarter, primarily due to a lower NRV write-down, and (ii) higher by $8.0 million or 32% compared to the same prior year period as underground mining was ramping up having resumed in June 2021.

•Compared to the second quarter 2022, cost of sales excluding depreciation and cash costs per ounce sold of $1,817 and $1,803, were lower by 26%, respectively, primarily due to higher production volume and sales. AISC per ounce sold of $2,208 was lower by $939 or 30% due to lower cash costs and sustaining capital expenditures.

•Compared to the third quarter 2021, cost of sales, excluding depreciation, cash costs and AISC per ounce sold were lower by 48%, 48% and 46%, respectively, as underground mining was ramping up having resumed in June 2021.

•Sustaining capital expenditures in the third quarter of $6.4 million included underground development and diamond drilling of $4.7 million and other sustaining capital projects of $1.7 million. Expansion capital expenditures of $1.5 million relate to the relocation of certain infrastructure allowing for the expansion of the Grand Duc open pit.

Financial Performance – YTD 2022 Compared to YTD 2021

•Cost of sales, excluding depreciation, of $99.1 million for YTD 2022, was higher by $51.0 million or 106% compared with the same prior year period, as a result of the operations being in care and maintenance until June 2021.

•Cost of sales, excluding depreciation, cash costs and AISC per ounce sold of $2,043, $2,015, and $2,541 for YTD 2022, were lower by 7%, 8% and higher by 2%, respectively, compared to the same prior year period, as a result of the underground mining ramping up after operations being in care and maintenance until June 2021. Sustaining capital was higher as the underground development program also resumed with underground mining.

•Sustaining capital expenditures of $22.5 million for YTD 2022 included underground development and diamond drilling of $19.1 million and other sustaining projects of $3.4 million. Expansion capital expenditures of $2.7 million for YTD 2022 primarily related to advancing Fayolle property activities and supporting the expansion of the Grand Duc open pit.

Outlook

Gold production at the Westwood complex in 2022 is expected to be in the range of 65,000 to 75,000 ounces. Production levels are expected to continue to increase in the fourth quarter based on the underground mine delivering higher volumes of ore in the fourth quarter, in addition to an increase in the grade of the ore sourced from the Grand Duc open pit. The revised guidance range reflects the expectation that development rates will continue ramping up month-over-month. Underground mining activity is expected to continue to open access to new stope sequences in support of the 2023 production plan.

Year-to-date, additional cost pressures emerged as discussed above. Despite these impacts, cash costs per ounce sold are expected to continue to decrease in the fourth quarter 2022 with anticipated increases in production and sales. The current collective bargaining agreement with the Westwood union ends in November and negotiations are underway.

Brownfield Exploration - Westwood Area

Approximately 34,000 metres of underground and surface diamond drilling are planned in 2022. Surface drilling will focus on evaluating the resource potential between and adjacent to the Grand Duc and Doyon pits, while underground infill drilling will focus on supporting the continued ramp up of underground mining operations. Approximately 28,600 metres were completed in the first three quarters of 2022 including approximately 3,200 metres in geotechnical drilling.

Fayolle Property

The Company is evaluating the potential development of the Fayolle deposit located 29 kilometres northwest of the Westwood complex. Detailed engineering, permitting, and environmental studies are ongoing.

Rouyn Gold Project

The Company holds a purchase option with Yorbeau Resources Inc. (“Yorbeau”) for the Rouyn Gold project, located near Rouyn-Noranda. Approximately 5,700 metres of diamond drilling were completed in the first three quarters of 2022 to further delineate the Lac Gamble zone extensions and other selected targets to evaluate their resource potential and to support an initial mineral resource estimate expected to be completed in the first quarter of 2023.

| | | | | |

IAMGOLD CORPORATION Third Quarter 2022 Management’s Discussion and Analysis | 14 |

Côté District, Canada

The Côté District located 125 kilometres southwest of Timmins and 175 kilometres north of Sudbury, Ontario, Canada includes the Côté Gold construction project and the adjacent Gosselin deposit. The project is being developed by a 70:30 joint venture (the "Côté Gold UJV") between IAMGOLD, as the operator, and Sumitomo Metal Mining Co. Ltd. (“SMM”) with the Company effectively owning a 64.75% interest in the associated land package. In July 2020, the Company, together with SMM, announced the decision to proceed with the construction of the project.

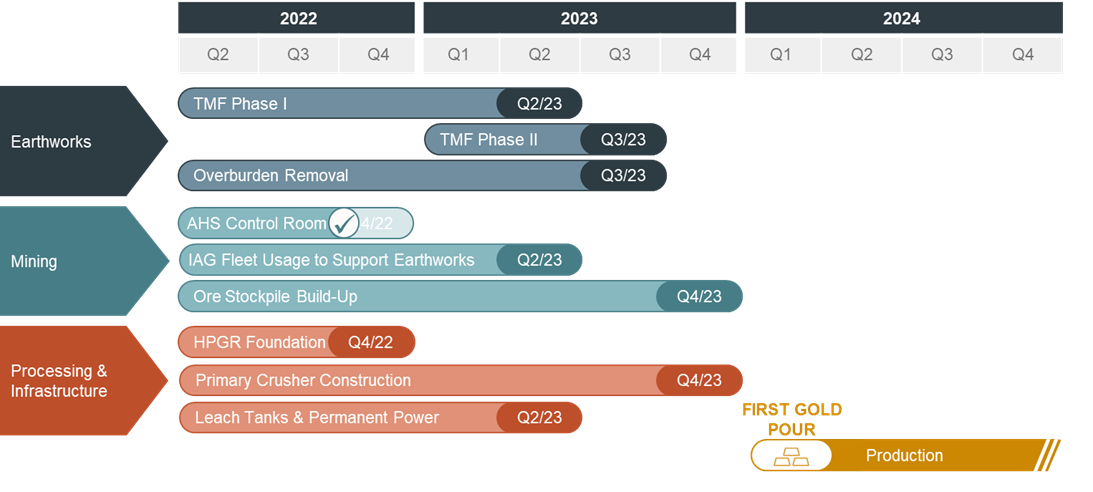

Upcoming Milestones and Schedule Summary

Côté Gold is expected to commence production in early 2024. Construction of the project commenced in the third quarter 2020 and major earthworks commenced in the first quarter 2021. Remaining milestones of note are as follows:

The Company cautions that potential further disruptions, including, without limitation caused by COVID-19, the Ukraine war, inflation, other global supply chain disturbances, weather, labour disputes and the tight labour market could continue to impact the timing of activities, availability of workforce, productivity and supply chain and logistics and, consequently, could further impact the timing of actual commercial production and, consequently, project costs.

Third Quarter Activities Update

As of September 30, 2022, overall, the project was approximately 64.2% complete, with detailed engineering fully complete and shifting to construction field engineering. The following provides an update on project activities:

| | | | | |

| Project Activity | Update |

Health and safety | The project has surpassed 6.9 million hours of no lost time injuries. The project is operating at near peak manpower capacity. COVID-19 impacts have been limited but remain closely monitored and controlled on a case-by-case basis. |

Labour and workforce | Current manpower on site reached approximately 1,500 workers and is nearing peak capacity levels. A temporary camp providing an additional 220 rooms capacity to meet anticipated peak camp load was completed in August and is currently in service. |

| | | | | |

IAMGOLD CORPORATION Third Quarter 2022 Management’s Discussion and Analysis | 15 |

| | | | | |

Earthworks activities | Earthworks activities advanced with several work fronts providing significant progress over the summer months, including the tailings management facility, water realignment channels, polishing pond dam and other water management infrastructure dams. •Côté Lake Dam, Polishing Pond Dam, Dam 4, and Emulsion Plant Pads are complete and work on the East Seepage collection Pond Dam, TMF West Dam and Water Realignment Channel 2 is advancing. • The 2022 fish relocation program progressed with the Polishing Pond fish out completed in September. Smaller water bodies in the West Overburden Expansion areas are expected to be completed by year-end. • Following the installation of water treatment systems in the second quarter to redress higher amounts of freshet water experienced in the spring, the water level in the pit remained at low levels, allowing for overburden excavation to progress. A site water management study to assess current dewatering systems in preparation for the 2023 freshet is underway. Overburden material removal from the pit and access to fresh rock remain a priority. •TMF East Starter Dam work advanced to the north and south plinth, including cleaning and doweling activities of the north plinth, the completion of concrete placement on the south plinth, placement of a geomembrane liner and appropriate granular material, including run of mine material on the dam.

|

Procurement | Heavy mobile equipment continues to arrive on site including CAT 793F haul trucks (11 delivered), 994 loaders (2 delivered) and D10 dozers (4 delivered) at the end of September. The handover and assembly of the Autonomous Control Room was completed in mid September in line with the update project schedule. Equipment delivery is ongoing with inventory being held on site laydown and off-site at warehouses. Some equipment is being held at North American based suppliers to reduce load onsite and off-site storage facilities. Equipment preservation is being executed at present prior to the winter season to align with the required on site schedule requirements. At present there is no material impact on schedule related to supply chain or logistics. |

Processing plant | Processing plant civil works have progressed with the continued placement of pre-cast and cast-in-place concrete, with a number of selected areas well positioned for handover to advance mechanical installation. The primary crusher concrete is complete to the 409 elevation with one more vertical lift remaining to be formed and poured. Work is ongoing at the secondary crusher, HPGR and screening building. SMP work activities in the processing plant are well underway, with the first sections of the ball mill mounted on erection cradles and the pump box set in place. Structural steel and steel deck activities are progressing, including piping. The wet end of the plant has begun SMP work, while the focus remains on exterior building works at the leach tanks, thickeners, and structural steel. Concrete foundations for the HPGR/Secondary Crusher, screening buildings, and fine ore bins have been handed over to SMPEI contractors. |

Infrastructure | The overhead power line has been completed, with the exception of connection to Hydro and the main electrical substation, which is under construction. Stringing and installation of the 13.8 kV network has continued to advance. Hydro One electrical upgrade work has been completed. Erection of tower bases for the autonomous system progressed with 11 out of 13 bases complete. The assay lab structure and cladding has been complete with activities shifting to interior works. Truck shop foundations are 95% complete and structural steel erection is well advanced. The truck wash and warehouse building interior works are well underway. Buried piping installation works continued, although at lower productivity rates, resulting in the addition of a night shift and an increase in crew size to mitigate planned activities, while prioritizing excavation required to complete before the onset of winter. The administration building and offices have been erected and are commissioning. |