| Pioneering A Cell Therapy Powerhouse ©2022 Sigilon Therapeutics, Inc. October 2022 |

| Disclaimer This presentation has been prepared by Sigilon Therapeutics, Inc. (“we,” “us,” “our,” “Sigilon” or the “Company”) and is made fo r informational purposes only and not for any other purpose. Certain information contained in this presentation and statements made orally during this presentation relate to or are based on studies, publications, surveys and other data obtained from third - party sources and the Company’s own internal estimates and research. The Company has not inde pendently verified, and Sigilon makes no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from third - party sources. The Company’s internal research has not been verified by any independent source. This presentation contains forward - looking statements. All statements other than statements of historical facts contained in thi s presentation are forward - looking statements. In some cases, you can identify forward - looking statements by terms such as “may,” “will,” “should,” “expect,” “plan,” “anticipa te,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these terms or other similar ex pre ssions, although not all forward - looking statements contain these words. Forward - looking statements include, but are not limited to, statements concerning: our current c ash runway; our plans to withdraw our IND and CTAs and to close out activities for our Hemophilia Type A program in the second half of 2022; our expectations related t o o ur manufacturing strategy and expansion strategy; the initiation, timing, progress and results of our research and development programs, preclinical studies and clin ica l trials, including the submission of INDs or CTAs for SIG - 005 and our other product candidates; our ability to advance any product candidates that we may develop and successfully complete any clinical studies, including the manufacture of any such product candidates; our ability to leverage our initial programs to develop additional product candid ate s using our SLTx platform; and our ability to successfully scale our manufacturing capabilities. Any forward - looking statements represent the Company’s views only as of today and should not be relied upon as representing its views as of any subsequent date. The Company explicitly disclaims any obligation to update any forward - looking statements, except as required by law. The Company’s business is subject to substantial risks and uncertainties that could cause these statements to be inaccurate. Appl ica ble risks and uncertainties include, among others, that we have incurred significant losses since inception and our need for additional funding; if we fail to achieve t he expected financial and operational benefits of our corporate restructuring, the results of our investigation of our Phase 1/2 clinical trial in Hemophilia A or failure in clini cal development of our diabetes or MPS - 1 programs could adversely effect our business and may require us to discontinue or delay development of other product candidates, which ar e all based on the same SLTx platform; there may be SAEs in addition to the SAE reported in our Phase 1/2 clinical trial of SIG - 001 in Hemophilia A, other undesirable side e ffects related to our product candidates or clinical studies, or limited efficacy of product candidates arising from our SLTx platform; the SLTx platform consists of nov el technologies that are not yet clinically validated for human therapeutic use; that we do not have any results from the testing of any of our product candidates in clinical trials o the r than SIG - 001 and any favorable preclinical results are not predictive of results that may be observed in clinical trials; the FDA or other regulators may request additi ona l preclinical studies or clinical trials beyond those that we currently anticipate for our product candidates; and other risks and uncertainties identified under the heading “Risk Fa ctors” and in our Quarterly Report on Form 10 - Q for the quarter ended June 30, 2022 and in any subsequent filings with the Securities and Exchange Commission. Investors, po ten tial investors, and others should give careful consideration to these risks and uncertainties. 2 Non - Confidential |

| MISSION: We aim to deliver functional cures to patients by harnessing the power of the human cell Non - Confidential 3 |

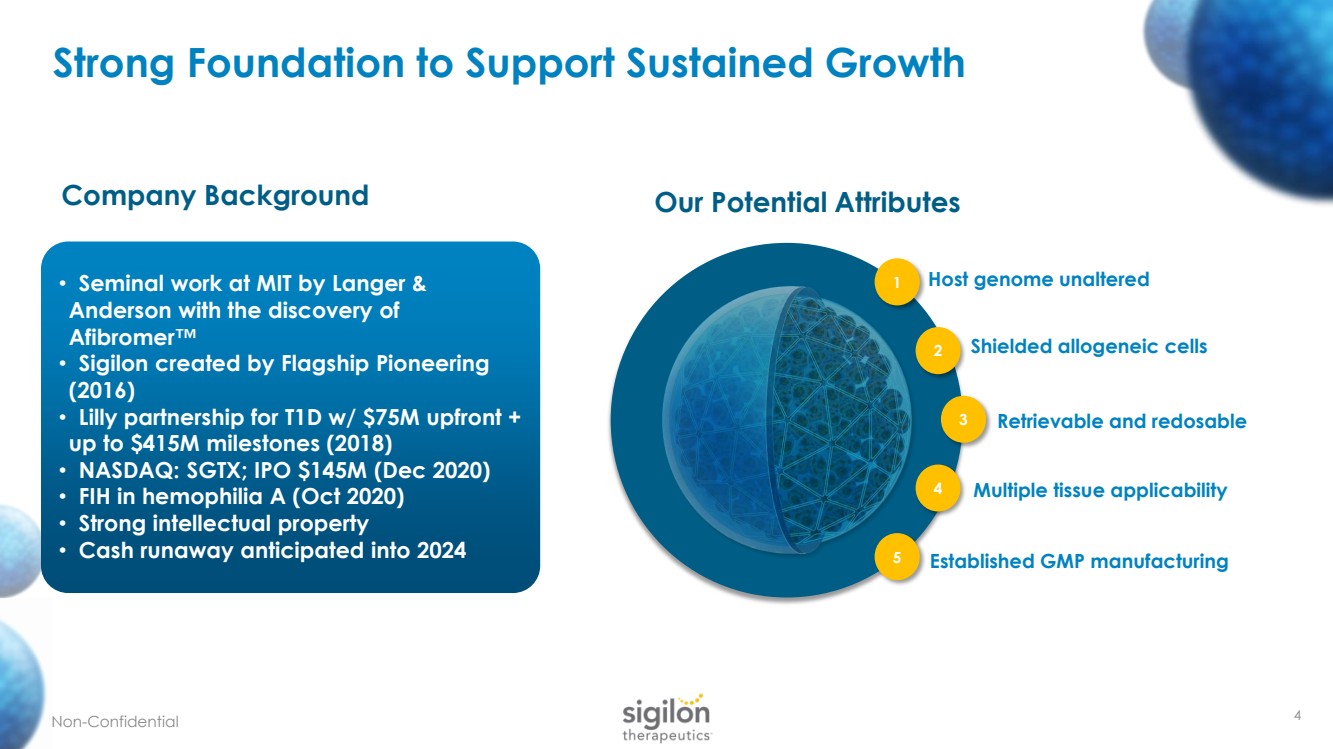

| Strong Foundation to Support Sustained Growth • Seminal work at MIT by Langer & Anderson with the discovery of Afibromer ™ • Sigilon created by Flagship Pioneering (2016) • Lilly partnership for T1D w/ $75M upfront + up to $415M milestones (2018) • NASDAQ: SGTX; IPO $145M (Dec 2020) • FIH in hemophilia A (Oct 2020) • Strong intellectual property • Cash runaway anticipated into 2024 Non - Confidential 4 Company Background Our Potential Attributes Host genome unaltered 1 Shielded allogeneic cells 2 Retrievable and redosable 3 Multiple tissue applicability 4 Established GMP manufacturing 5 |

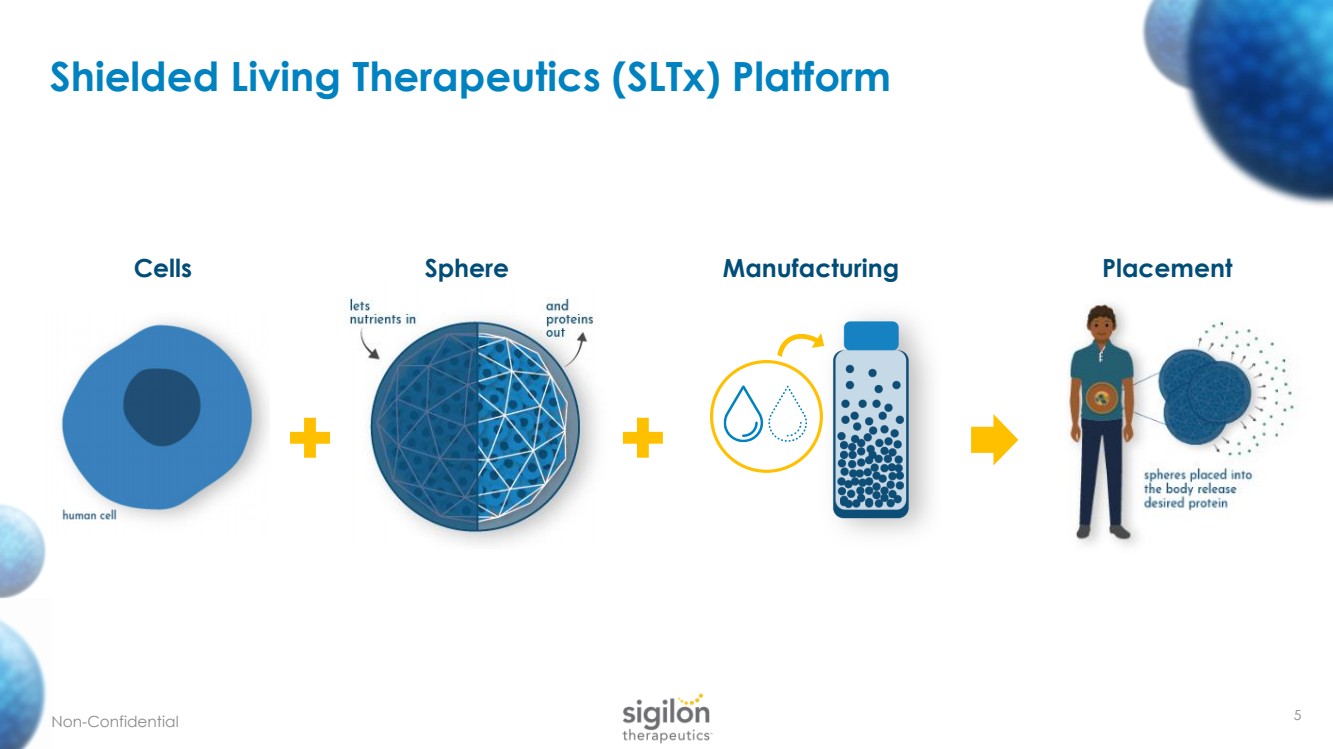

| 5 Shielded Living Therapeutics ( SLTx ) Platform + + Manufacturing Placement Cells Sphere Non - Confidential |

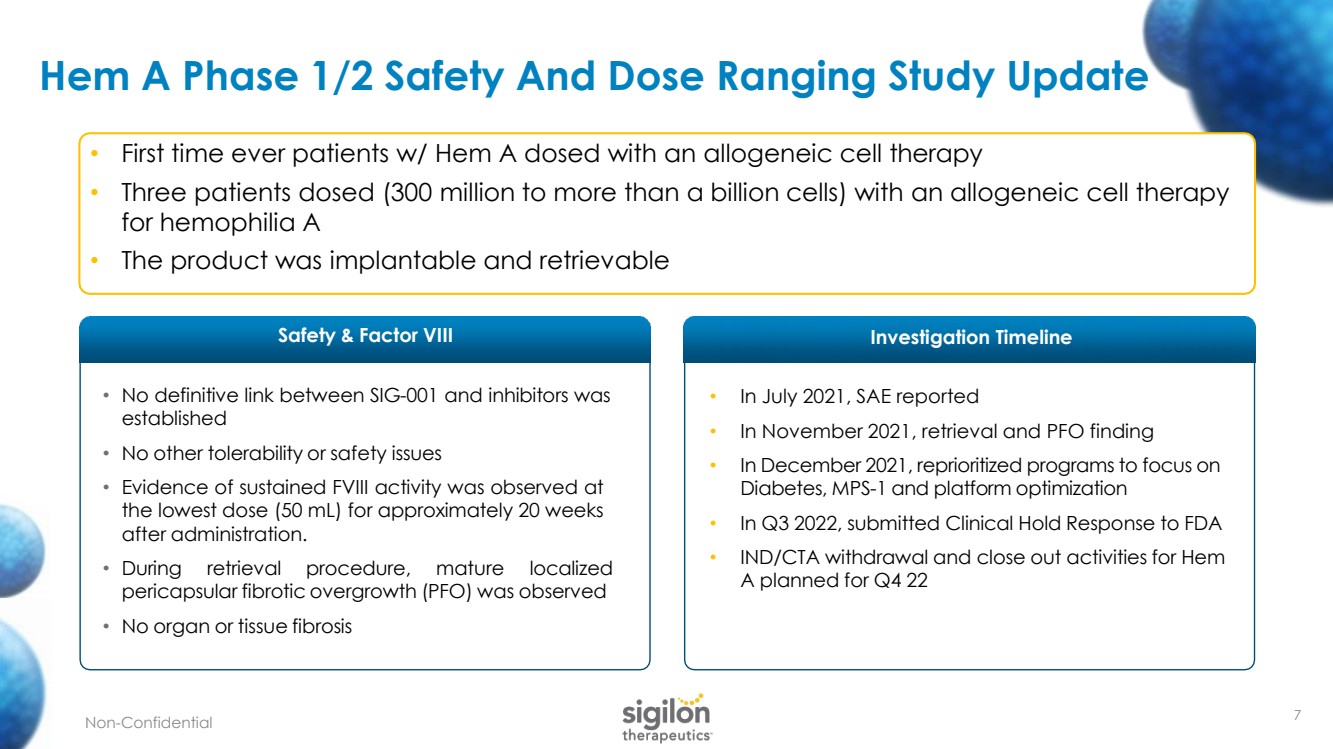

| • No definitive link between SIG - 001 and inhibitors was established • No other tolerability or safety issues • Evidence of sustained FVIII activity was observed at the lowest dose ( 50 mL) for approximately 20 weeks after administration .. • During retrieval procedure, mature localized pericapsular fibrotic overgrowth (PFO) was observed • No organ or tissue fibrosis Hem A Phase 1/2 Safety And Dose Ranging Study Update • In July 2021, SAE reported • In November 2021, retrieval and PFO finding • In December 2021, reprioritized programs to focus on Diabetes, MPS - 1 and platform optimization • In Q3 2022, submitted Clinical Hold Response to FDA • IND/CTA withdrawal and close out activities for Hem A planned for Q4 22 • First time ever patients w/ Hem A dosed with an allogeneic cell therapy • Three patients dosed (300 million to more than a billion cells) with an allogeneic cell therapy for hemophilia A • The product was implantable and retrievable Safety & Factor VIII Investigation Timeline 7 Non - Confidential |

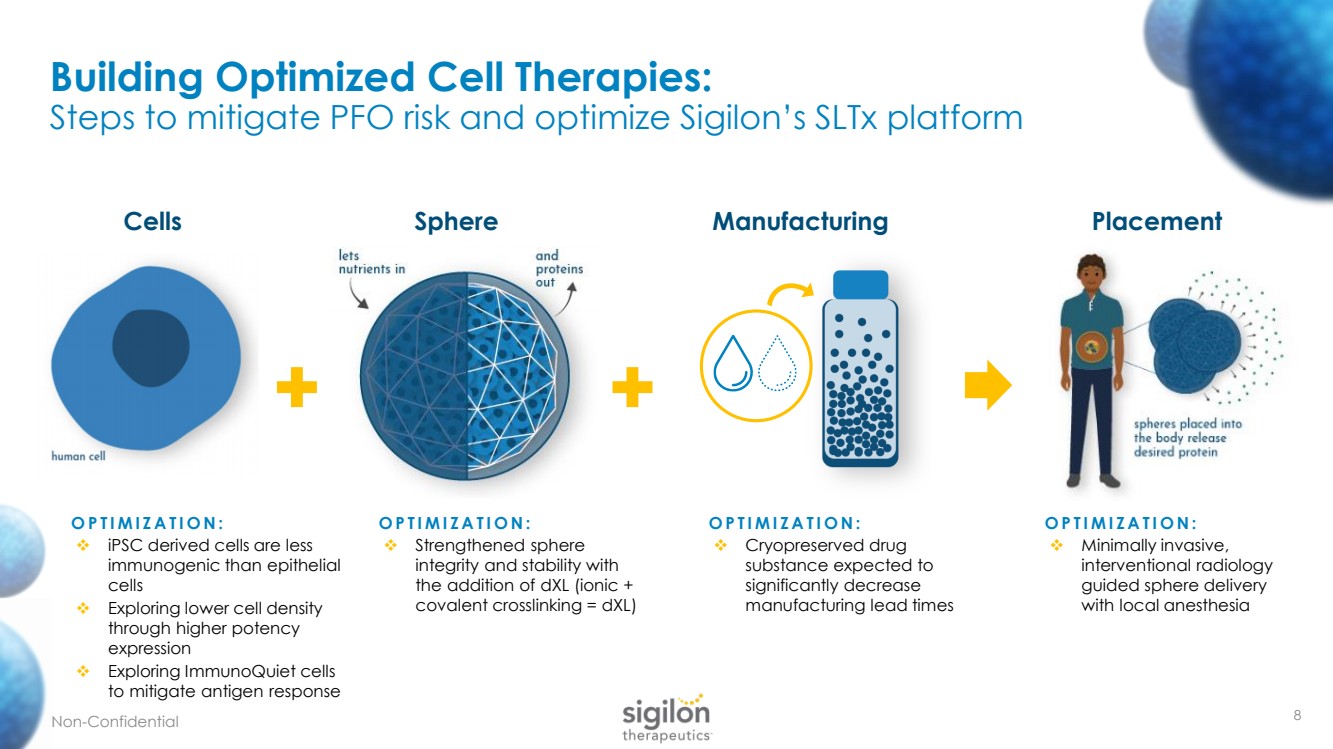

| 8 Building Optimized Cell Therapies: Steps to mitigate PFO risk and optimize Sigilon’s SLTx platform + + Manufacturing Placement Cells Sphere OPTIMIZATION: ❖ iPSC derived cells are less immunogenic than epithelial cells ❖ Exploring lower cell density through higher potency expression ❖ Exploring ImmunoQuiet cells to mitigate antigen response OPTIMIZATION: ❖ Cryopreserved drug substance expected to significantly decrease manufacturing lead times OPTIMIZATION: ❖ Minimally invasive, interventional radiology guided sphere delivery with local anesthesia OPTIMIZATION: ❖ Strengthened sphere integrity and stability with the addition of dXL (ionic + covalent crosslinking = dXL ) Non - Confidential |

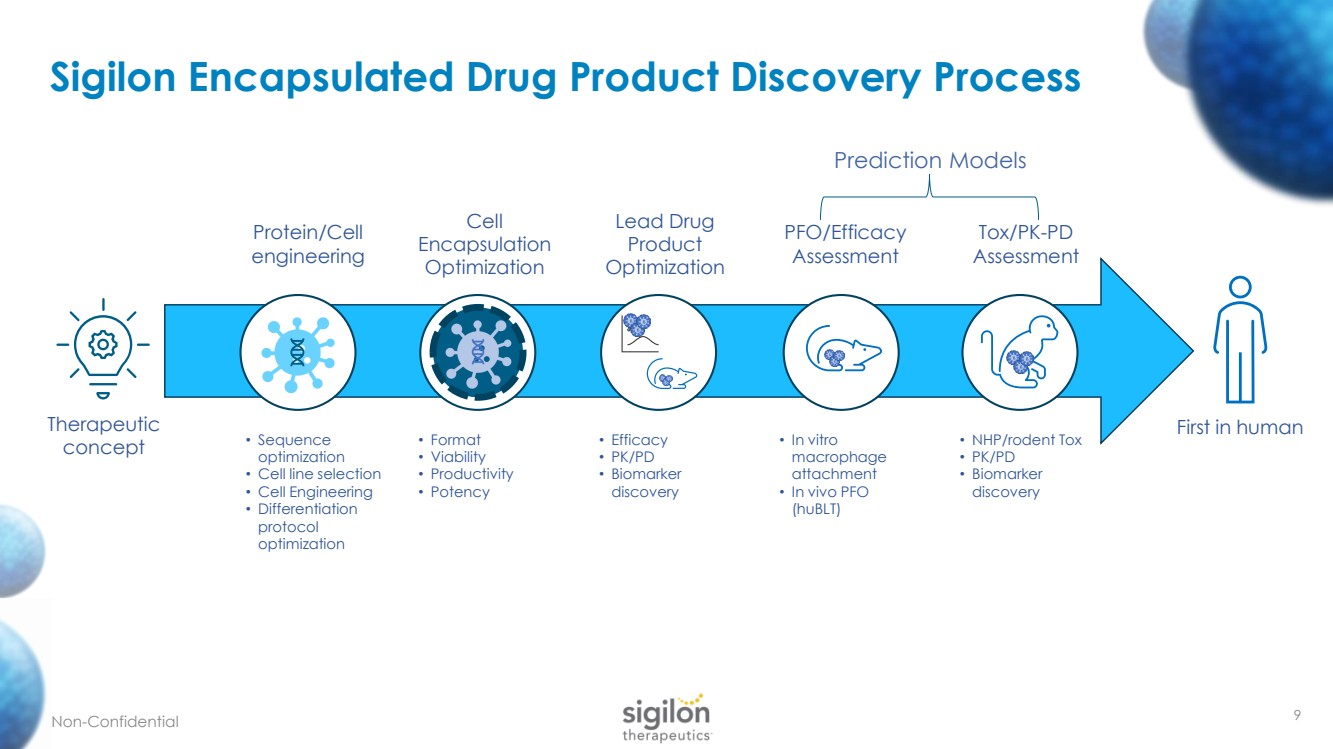

| Sigilon Encapsulated Drug Product Discovery Process Therapeutic concept Protein/Cell engineering Cell Encapsulation Optimization Lead Drug Product Optimization PFO/Efficacy Assessment Tox/PK - PD Assessment First in human • Sequence optimization • Cell line selection • Cell Engineering • Differentiation protocol optimization • Format • Viability • Productivity • Potency • Efficacy • PK/PD • Biomarker discovery • In vitro macrophage attachment • In vivo PFO ( huBLT ) • NHP/rodent Tox • PK/PD • Biomarker discovery Non - Confidential Prediction Models 9 |

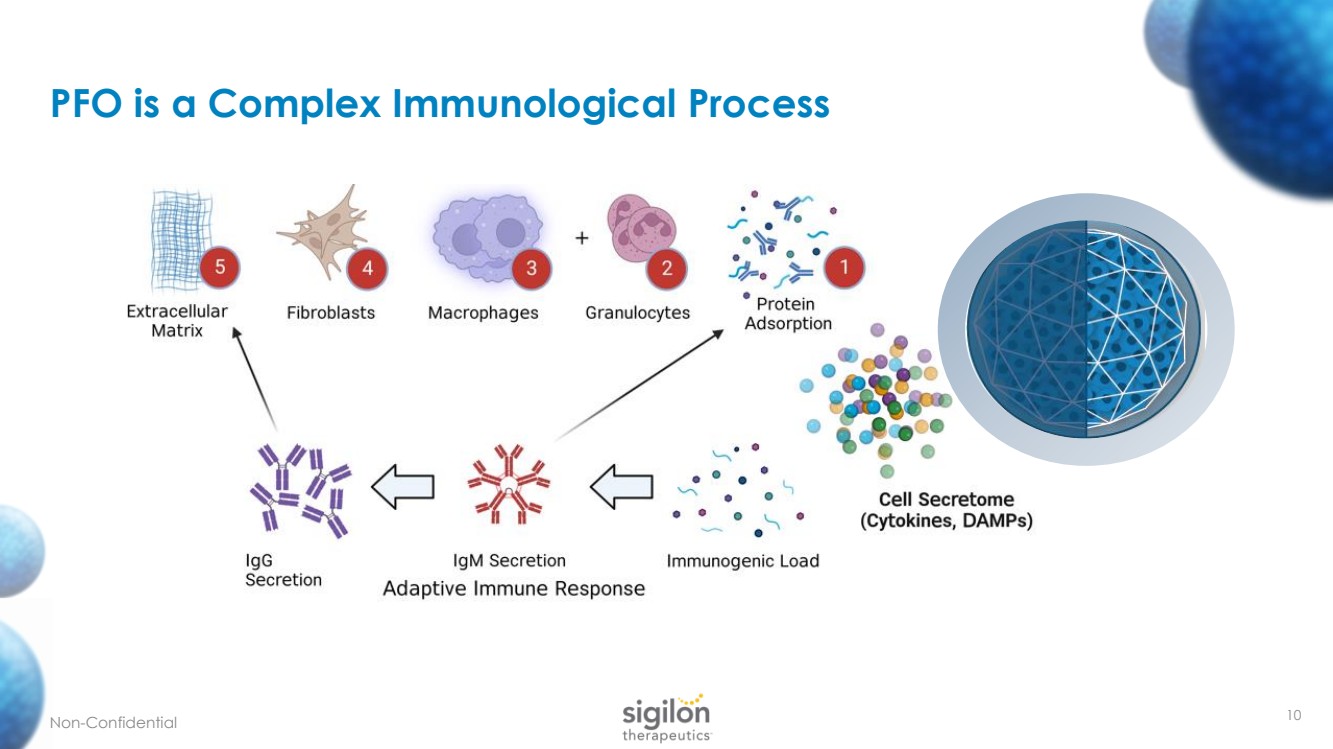

| 10 PFO is a Complex Immunological Process N on - Confidential |

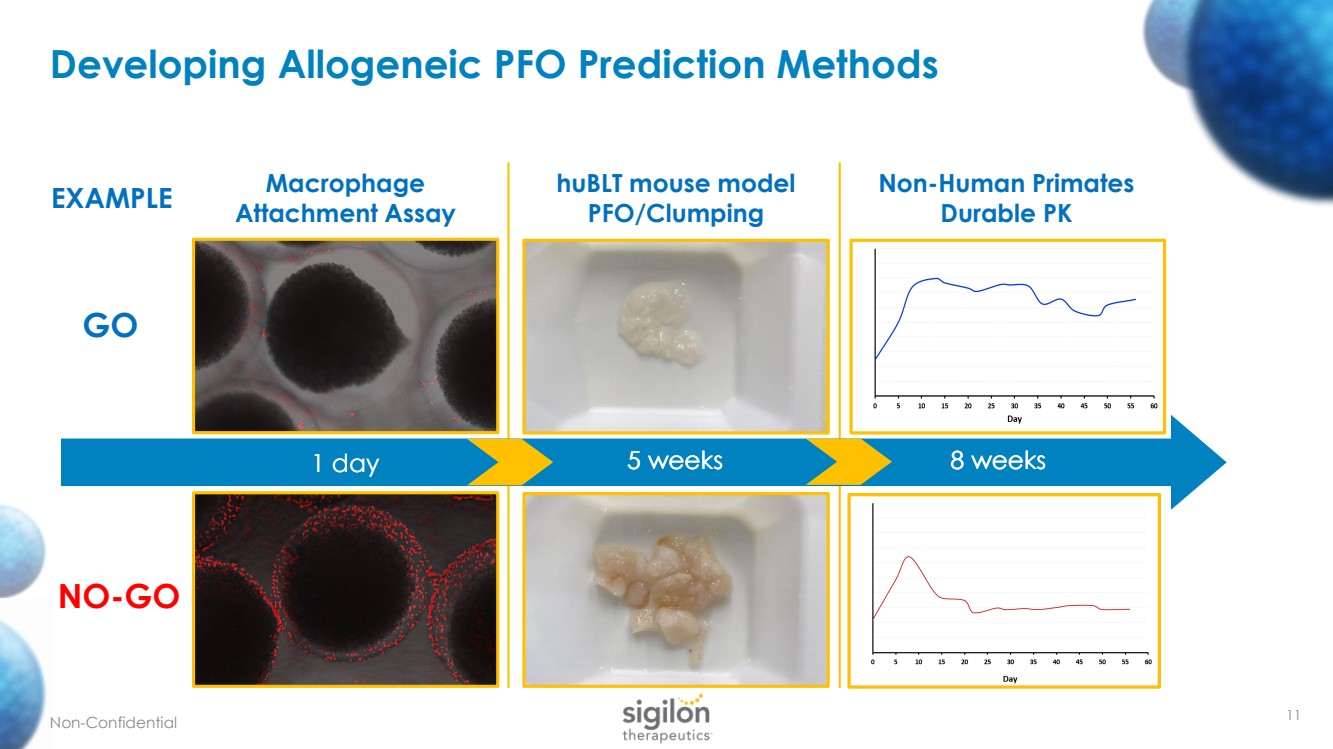

| 11 Developing Allogeneic PFO Prediction Methods Non - Confidential Macrophage Attachment Assay GO NO - GO huBLT mouse model PFO/Clumping Non - Human Primates Durable PK EXAMPLE 1 day 5 weeks 8 weeks 5 weeks 8 weeks 1 day 5 weeks 8 weeks |

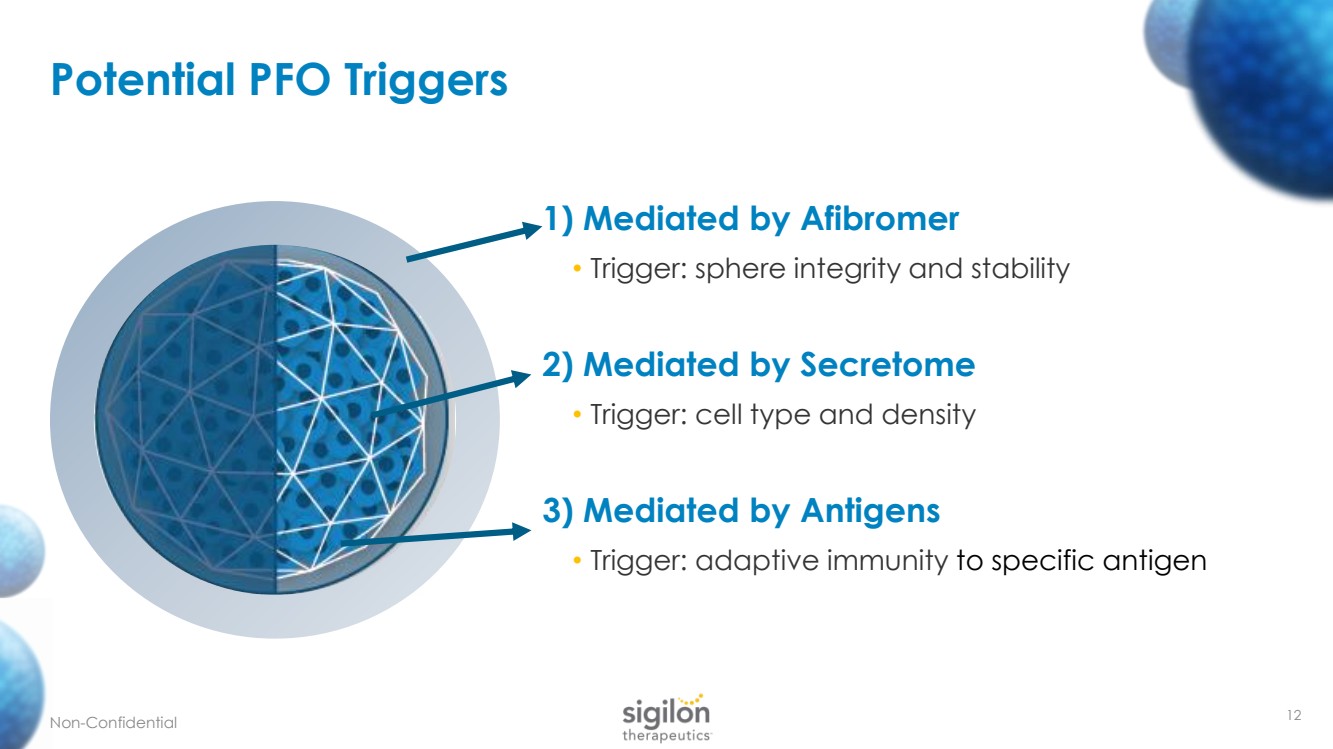

| 1) Mediated by Afibromer • Trigger: sphere integrity and stability 2) Mediated by Secretome • Trigger: cell type and density 3) Mediated by Antigens • Trigger: adaptive immunity to specific antigen 12 Potential PFO Triggers Non - Confidential |

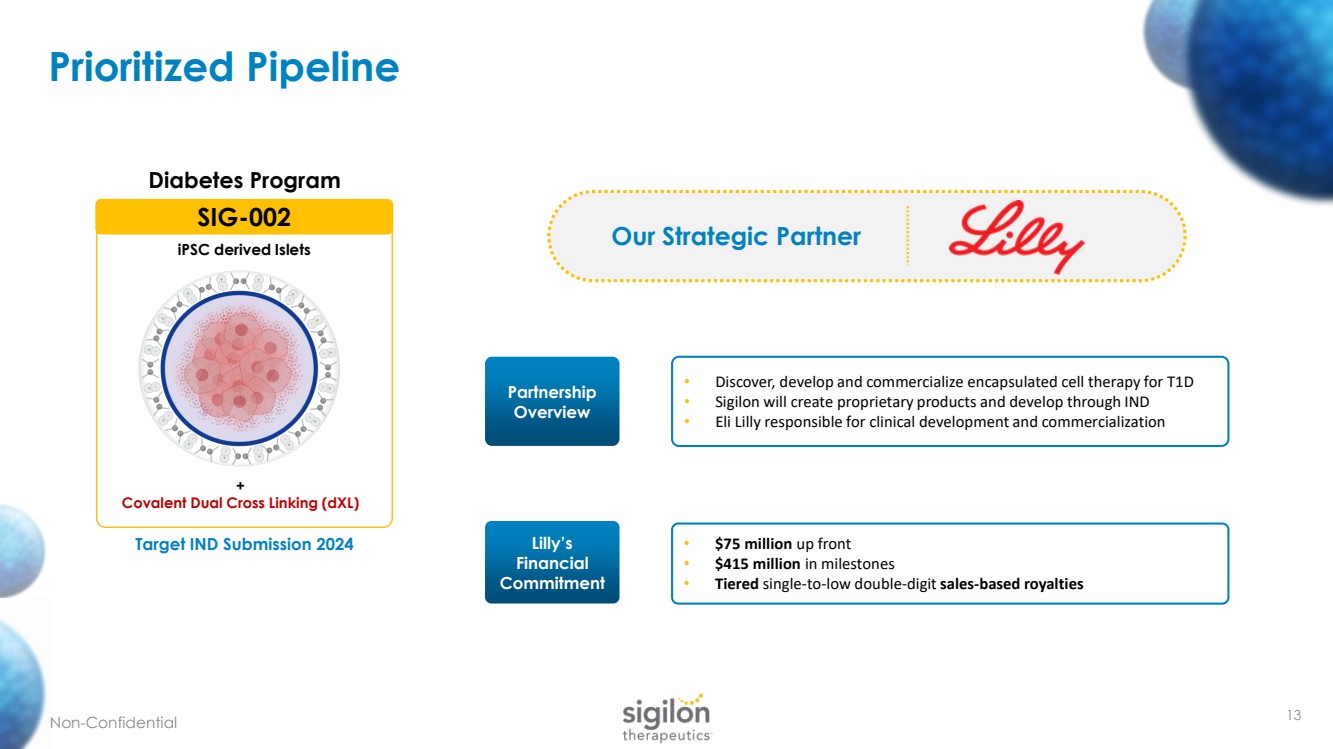

| Prioritized Pipeline 13 + Covalent Dual Cross Linking ( dXL ) SIG - 002 iPSC derived Islets Target IND Submission 2024 Diabetes Program Non - Confidential Our Strategic Partner Partnership Overview Lilly’s Financial Commitment • Discover, develop and commercialize encapsulated cell therapy for T1D • Sigilon will create proprietary products and develop through IND • Eli Lilly responsible for clinical development and commercialization • $75 million up front • $415 million in milestones • Tiered single - to - low double - digit sales - based royalties |

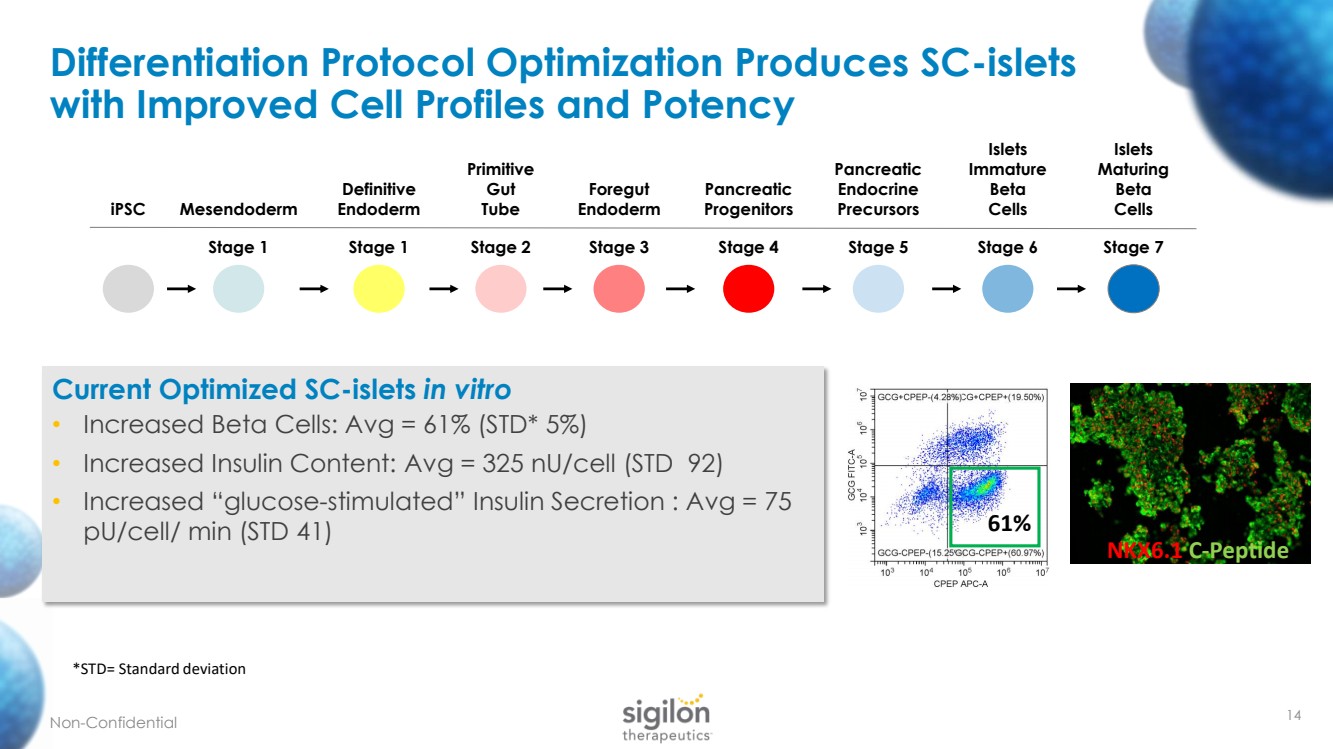

| 14 Differentiation Protocol Optimization Produces SC - islets with Improved Cell Profiles and Potency iPSC Mesendoderm Stage 1 Definitive Endoderm Stage 1 Primitive Gut Tube Stage 2 Foregut Endoderm Stage 3 Pancreatic Progenitors Stage 4 Pancreatic Endocrine Precursors Stage 5 Islets Immature Beta Cells Stage 6 Islets Maturing Beta Cells Stage 7 61% NKX6.1 C - Peptide Current Optimized SC - islets in vitro • Increased Beta Cells: Avg = 61 % (STD* 5%) • Increased Insulin Content: Avg = 325 nU /cell (STD 92) • Increased “glucose - stimulated” Insulin Secretion : Avg = 75 pU /cell/ min (STD 41) Non - Confidential *STD= Standard deviation |

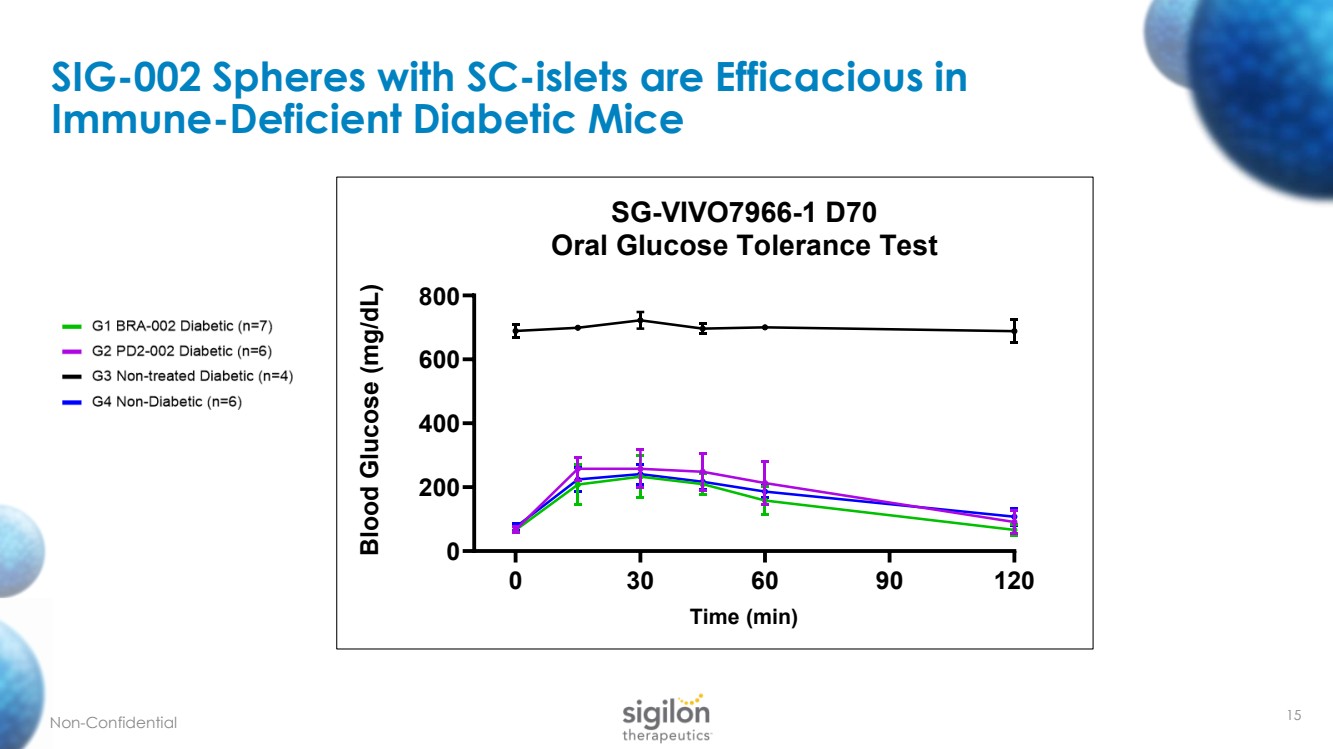

| 15 SIG - 002 Spheres with SC - islets are Efficacious in Immune - Deficient Diabetic Mice Non - Confidential 0 30 60 90 120 0 200 400 600 800 SG-VIVO7966-1 D70 Oral Glucose Tolerance Test Time (min) Blood Glucose (mg/dL) |

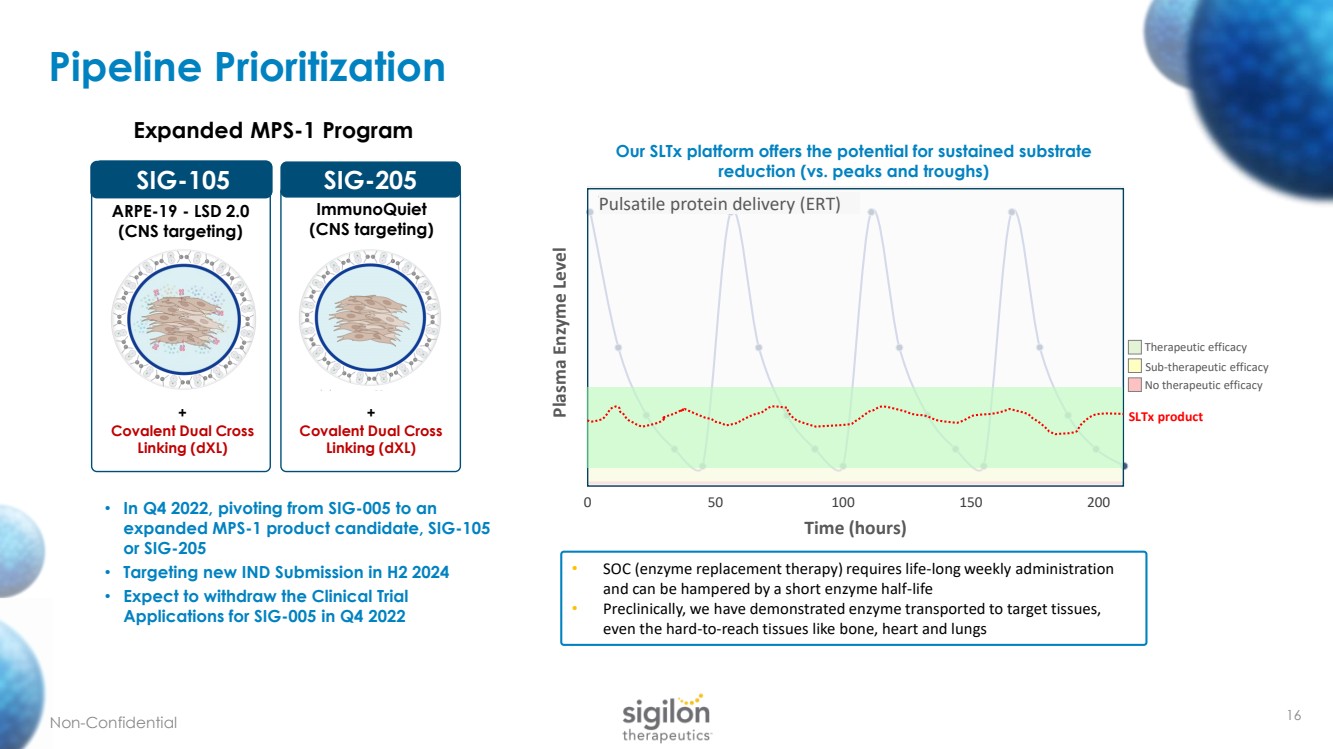

| Pipeline Prioritization 16 SIG - 105 Expanded MPS - 1 Program SIG - 105 ARPE - 19 - LSD 2.0 (CNS targeting) + Covalent Dual Cross Linking ( dXL ) ImmunoQuiet * ARPE - 19 LSD 2.0 SIG - 205 + Covalent Dual Cross Linking ( dXL ) ImmunoQuiet (CNS targeting) Non - Confidential • SOC (enzyme replacement therapy) requires life - long weekly administration and can be hampered by a short enzyme half - life • Preclinically, we have demonstrated enzyme transported to target tissues, even the hard - to - reach tissues like bone, heart and lungs Therapeutic efficacy Sub - therapeutic efficacy No therapeutic efficacy 0 50 100 150 200 Plasma Enzyme Level Time (hours) Traditional Therapies Pulsatile protein delivery (ERT) SLTx product • In Q4 2022, pivoting from SIG - 005 to an expanded MPS - 1 product candidate, SIG - 105 or SIG - 205 • Targeting new IND Submission in H2 2024 • Expect to withdraw the Clinical Trial Applications for SIG - 005 in Q4 2022 Our SLTx platform offers the potential for sustained substrate reduction (vs. peaks and troughs) |

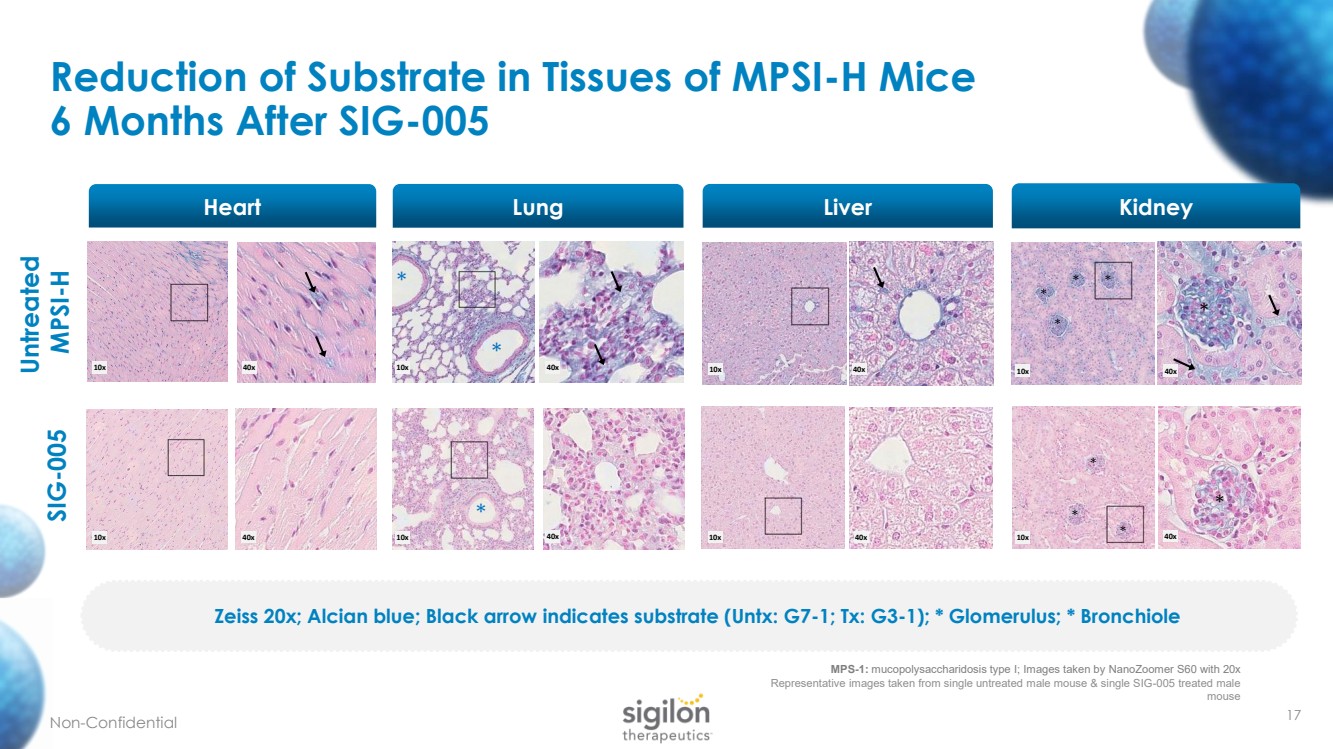

| Reduction of Substrate in Tissues of MPSI - H Mice 6 Months After SIG - 005 17 Untreated MPSI - H SIG - 005 * * * * * * * * * * * * 10x 10x 10x 10x 10x 10x 10x 10x 40x 40x 40x 40x 40x 40x 40x 40x MPS - 1: mucopolysaccharidosis type I; Images taken by NanoZoomer S60 with 20x Representative images taken from single untreated male mouse & single SIG - 005 treated male mouse Heart Lung Liver Kidney Zeiss 20x; Alcian blue; Black arrow indicates substrate ( Untx : G7 - 1; Tx: G3 - 1); * Glomerulus; * Bronchiole Non - Confidential |

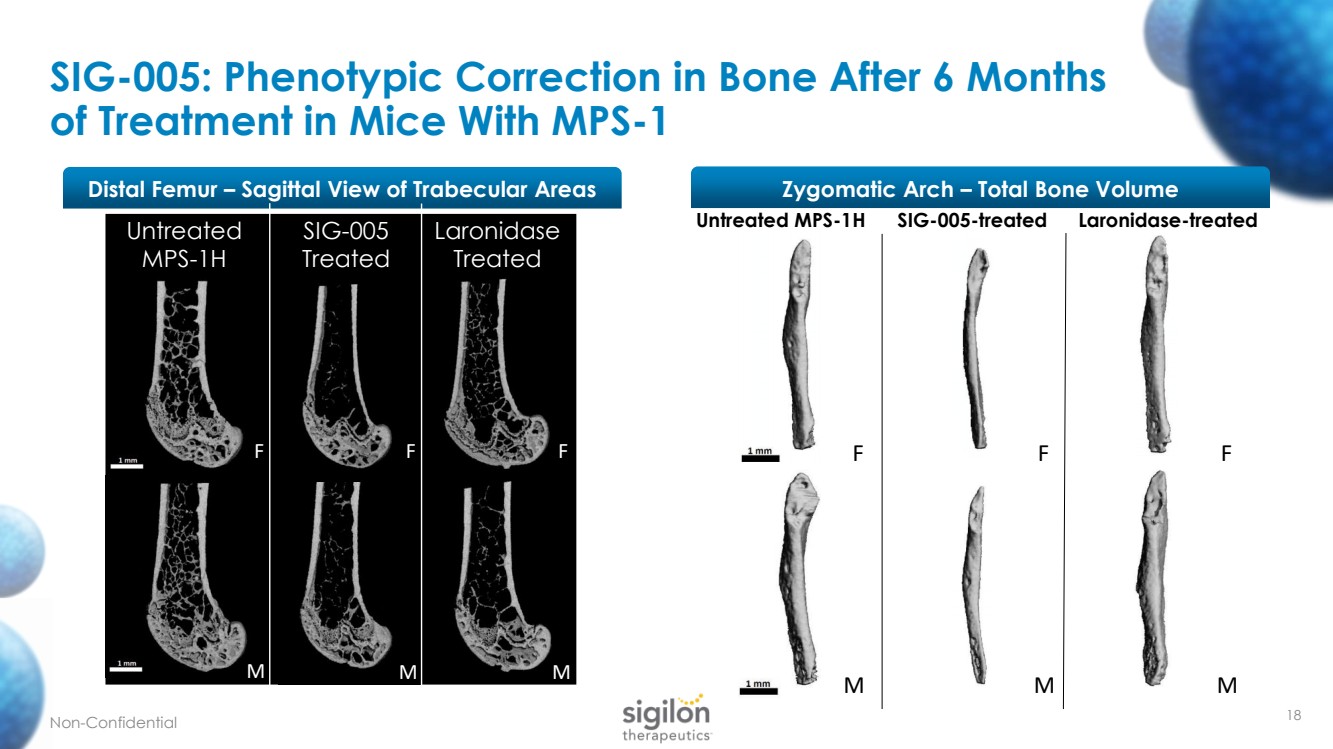

| 18 SIG - 005: Phenotypic Correction in Bone After 6 Months of Treatment in Mice With MPS - 1 Distal Femur – Sagittal View of Trabecular Areas Untreated MPS - 1H SIG - 005 Treated M F M F Untreated MPS - 1H SIG - 005 - treated Laronidase - treated F M F M F M Laronidase Treated M F Zygomatic Arch – Total Bone Volume Non - Confidential |

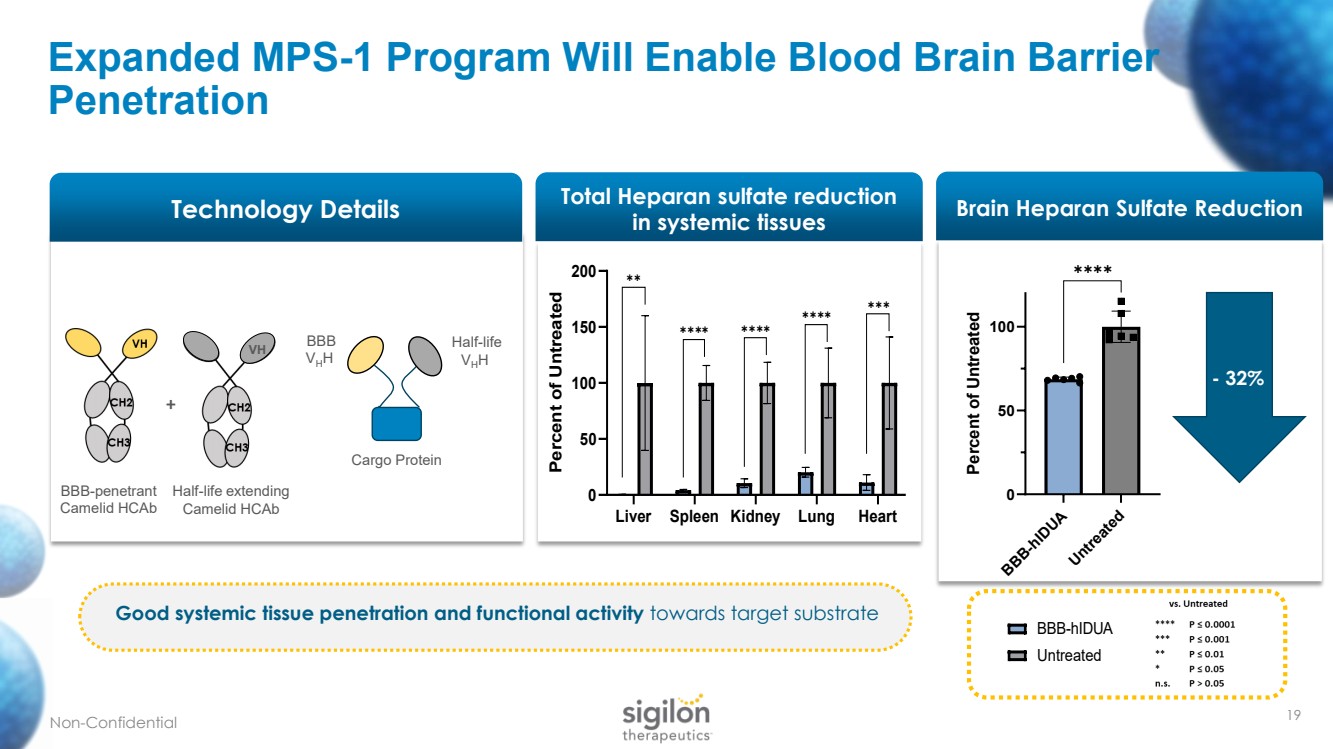

| Expanded MPS - 1 Program Will Enable Blood Brain Barrier Penetration BBB - penetrant Camelid HCAb BBB V H H Cargo Protein Half - life V H H Half - life extending Camelid HCAb VH + - 32% Technology Details Good systemic tissue penetration and functional activity towards target substrate Total Heparan sulfate reduction in systemic tissues 19 Liver Spleen Kidney Lung Heart 0 50 100 150 200 Total Heparan sulfate reduction in systemic tissues Percent of Untreated BBB-hIDUA Untreated ✱✱ ✱✱✱✱ ✱✱✱✱ ✱✱✱✱ ✱✱✱ Brain Heparan Sulfate Reduction BBB-hIDUA Untreated 0 50 100 Brain heparan sulfate reduction Percent of Untreated ✱✱✱✱ Liver Spleen Kidney Lung Heart 0 50 100 150 200 Total Heparan sulfate reduction in systemic tissues Percent of Untreated BBB-hIDUA Untreated ✱✱ ✱✱✱✱ ✱✱✱✱ ✱✱✱✱ ✱✱✱ Non - Confidential |

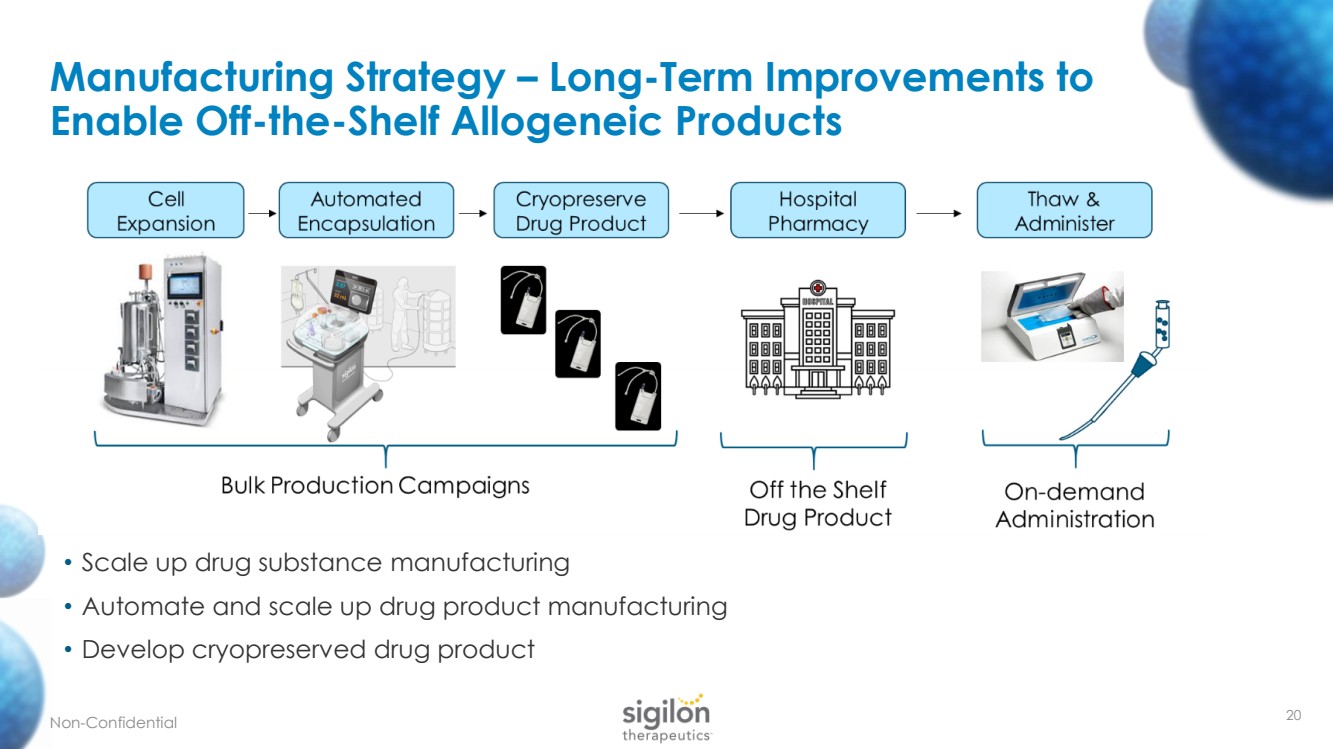

| 20 Manufacturing Strategy – Long - Term Improvements to Enable Off - the - Shelf Allogeneic Products Non - Confidential • Scale up drug substance manufacturing • Automate and scale up drug product manufacturing • Develop cryopreserved drug product |

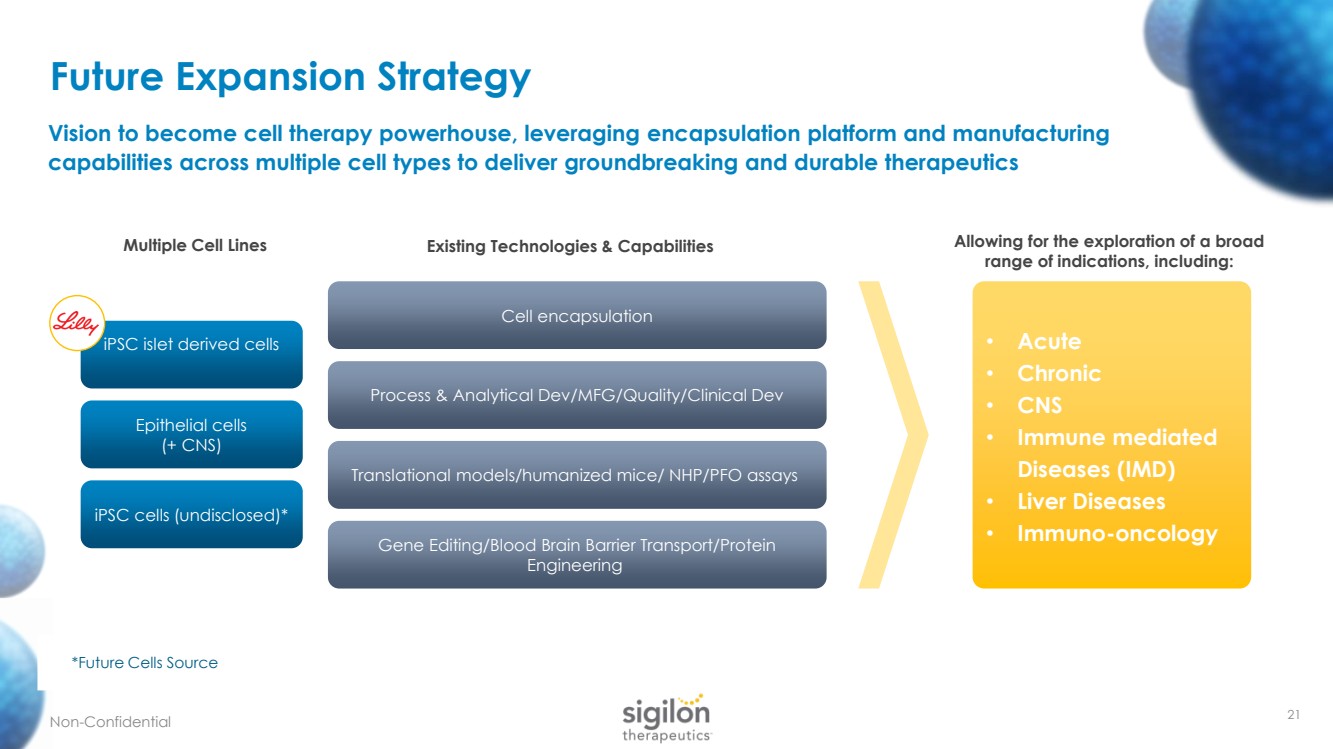

| • Acute • Chronic • CNS • Immune mediated Diseases (IMD) • Liver Diseases • Immuno - oncology Multiple Cell Lines Existing Technologies & Capabilities Allowing for the exploration of a broad range of indications, including: *Future Cells Source Future Expansion Strategy Non - Confidential Vision to become cell therapy powerhouse, leveraging encapsulation platform and manufacturing capabilities across multiple cell types to deliver groundbreaking and durable therapeutics 21 Epithelial cells (+ CNS) iPSC cells (undisclosed)* Process & Analytical Dev/MFG/Quality/Clinical Dev Cell encapsulation Translational models/humanized mice/ NHP/PFO assays Gene Editing/Blood Brain Barrier Transport/Protein Engineering iPSC islet derived cells |

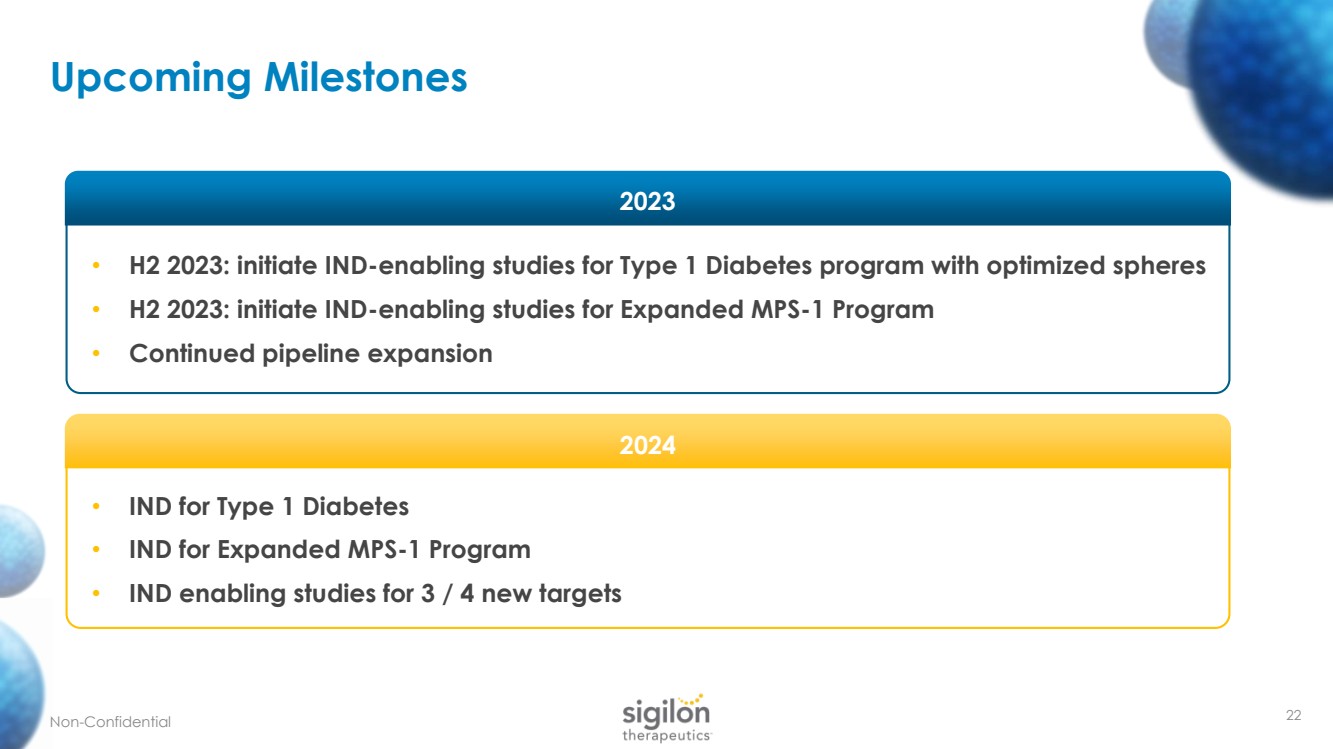

| 22 Upcoming Milestones • H2 2023: initiate IND - enabling studies for Type 1 Diabetes program with optimized spheres • H2 2023: initiate IND - enabling studies for Expanded MPS - 1 Program • Continued pipeline expansion • IND for Type 1 Diabetes • IND for Expanded MPS - 1 Program • IND enabling studies for 3 / 4 new targets 2023 2024 Non - Confidential |