UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM N-CSR

Investment Company Act file number: 811-00043

Deutsche DWS Investment Trust

(Exact Name of Registrant as Specified in Charter)

875 Third Avenue

New York, NY 10022-6225

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (212) 454-4500

Diane Kenneally

100 Summer Street

Boston, MA 02110

(Name and Address of Agent for Service)

| Date of fiscal year end: | 7/31 |

| Date of reporting period: | 7/31/2022 |

| ITEM 1. | REPORT TO STOCKHOLDERS |

| (a) |

| 2 |

| |

DWS Large Cap Focus Growth Fund |

| DWS

Large Cap Focus Growth Fund |

| |

3 |

| 4 |

| |

DWS Large Cap Focus Growth Fund |

| DWS

Large Cap Focus Growth Fund |

| |

5 |

| 6 |

| |

DWS Large Cap Focus Growth Fund |

| DWS

Large Cap Focus Growth Fund |

| |

7 |

| 8 |

| |

DWS Large Cap Focus Growth Fund |

| Class A |

1-Year |

5-Year |

10-Year |

| Average Annual Total Returns as of 7/31/22 | |||

| Unadjusted for Sales Charge |

–17.75% |

13.51% |

14.14% |

| Adjusted for the Maximum Sales Charge (max 5.75% load) |

–22.48% |

12.17% |

13.47% |

| Russell 1000® Growth Index†

|

–11.93% |

16.30% |

15.95% |

| Class C |

1-Year |

5-Year |

10-Year |

| Average Annual Total Returns as of 7/31/22 | |||

| Unadjusted for Sales Charge |

–18.38% |

12.66% |

13.29% |

| Adjusted for the Maximum Sales Charge (max 1.00% CDSC) |

–18.38% |

12.66% |

13.29% |

| Russell 1000® Growth Index†

|

–11.93% |

16.30% |

15.95% |

| Class S |

1-Year |

5-Year |

10-Year |

| Average Annual Total Returns as of 7/31/22 | |||

| No Sales Charges |

–17.55% |

13.79% |

14.43% |

| Russell 1000® Growth Index†

|

–11.93% |

16.30% |

15.95% |

| Institutional Class |

1-Year |

5-Year |

10-Year |

| Average Annual Total Returns as of 7/31/22 | |||

| No Sales Charges |

–17.55% |

13.80% |

14.44% |

| Russell 1000® Growth Index†

|

–11.93% |

16.30% |

15.95% |

| DWS

Large Cap Focus Growth Fund |

| |

9 |

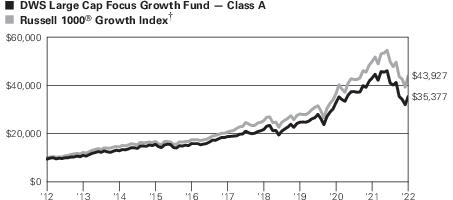

Yearly periods ended July 31

Yearly periods ended July 31| † |

The Russell 1000® Growth Index is an unmanaged index that consists of those stocks in the Russell 1000® Index that have higher price-to-book ratios and higher forecasted growth values. The Russell 1000® Index is an unmanaged price-only index of the 1,000 largest capitalized companies that are domiciled in the U.S. and whose common stocks are traded. |

| |

Class A |

Class C |

Class S |

Institutional Class |

| Net Asset Value | ||||

| 7/31/22 |

$60.10 |

$46.44 |

$63.98 |

$65.07 |

| 7/31/21 |

$79.81 |

$63.65 |

$84.33 |

$85.64 |

| Distribution Information as of 7/31/22 | ||||

| Capital Gain Distributions |

$7.10

|

$7.10 |

$7.10 |

$7.10 |

| 10 |

| |

DWS Large Cap Focus Growth Fund |

| Asset Allocation (As a % of Investment Portfolio excluding Securities Lending Collateral) |

7/31/22 |

7/31/21 |

| Common Stocks |

95% |

99% |

| Cash Equivalents |

5% |

1% |

| |

100% |

100% |

| Sector Diversification (As a % of Investment Portfolio excluding Securities Lending Collateral and Cash Equivalents) |

7/31/22 |

7/31/21 |

| Information Technology |

47% |

41% |

| Health Care |

16% |

16% |

| Consumer Discretionary |

12% |

15% |

| Communication Services |

10% |

11% |

| Industrials |

6% |

7% |

| Financials |

6% |

4% |

| Consumer Staples |

3% |

2% |

| Real Estate |

— |

2% |

| Materials |

— |

2% |

| |

100% |

100% |

| DWS

Large Cap Focus Growth Fund |

| |

11 |

| Ten Largest Equity Holdings at July 31,

2022 (56.4% of Net Assets) |

|

| 1Apple, Inc. |

12.1% |

| Designs, manufactures and markets personal computers and related computing and mobile-communication devices |

|

| 2Microsoft Corp. |

10.6% |

| Develops, manufactures, licenses, sells and supports software products |

|

| 3Alphabet, Inc. |

6.4% |

| Holding company with subsidiaries that provide Web-based search, maps, hardware products and various software applications |

|

| 4Amazon.com, Inc. |

6.2% |

| Online retailer offering a wide range of products |

|

| 5Thermo Fisher Scientific, Inc.

|

4.8% |

| Manufacturer of measurement instruments that monitor, collect and analyze information for various industries |

|

| 6Visa, Inc. |

4.3% |

| Operates a retail electronic payments network and manages global financial services |

|

| 7Progressive Corp. |

3.5% |

| Provider of property and casualty insurance |

|

| 8Costco Wholesale Corp. |

3.1% |

| Operator of wholesale warehouse stores |

|

| 9ServiceNow, Inc. |

2.8% |

| Designs, develops and produces prepackaged computer software, cloud services and IT service management platform |

|

| 10Zoetis, Inc. |

2.6% |

| Developer and manufacturer of animal health medicines |

|

| 12 |

| |

DWS Large Cap Focus Growth Fund |

| |

Shares |

Value ($) | |

| Common Stocks 94.2% |

| ||

| Communication Services 9.8% |

| ||

| Interactive Media & Services 7.4% |

| ||

| Alphabet, Inc. “A” * |

|

164,400 |

19,123,008 |

| Match Group, Inc.* |

|

43,214 |

3,168,018

|

| |

|

|

22,291,026 |

| Wireless Telecommunication Services 2.4% |

| ||

| T-Mobile U.S., Inc.* |

|

50,000 |

7,153,000 |

| Consumer Discretionary 11.3% |

| ||

| Internet & Direct Marketing Retail 6.6% |

| ||

| Amazon.com, Inc.* |

|

137,660 |

18,577,217 |

| Chewy, Inc. “A” * (a) |

|

33,000 |

1,280,730

|

| |

|

|

19,857,947 |

| Leisure Products 1.2% |

| ||

| YETI Holdings, Inc.* |

|

70,458 |

3,577,153 |

| Specialty Retail 2.8% |

| ||

| CarMax, Inc.* |

|

21,000 |

2,090,340 |

| Home Depot, Inc. |

|

20,668 |

6,219,828

|

| |

|

|

8,310,168 |

| Textiles, Apparel & Luxury Goods 0.7% |

| ||

| Lululemon Athletica, Inc.* |

|

6,752 |

2,096,563 |

| Consumer Staples 3.1% |

| ||

| Food & Staples Retailing |

| ||

| Costco Wholesale Corp. |

|

17,286 |

9,356,912 |

| Financials 5.2% |

| ||

| Capital Markets 1.7% |

| ||

| Intercontinental Exchange, Inc. |

|

48,851 |

4,982,313 |

| Insurance 3.5% |

| ||

| Progressive Corp. |

|

90,562 |

10,420,064 |

| Health Care 15.2% |

| ||

| Biotechnology 0.5% |

| ||

| Exact Sciences Corp.* |

|

34,195 |

1,542,194 |

| Health Care Equipment & Supplies 5.1% |

| ||

| DexCom, Inc.* |

|

80,272 |

6,588,726 |

| Hologic, Inc.* |

|

41,003 |

2,926,794 |

| DWS

Large Cap Focus Growth Fund |

| |

13 |

| |

Shares |

Value ($) | |

| Intuitive Surgical, Inc.* |

|

19,306 |

4,443,662 |

| iRhythm Technologies, Inc.* |

|

8,000 |

1,237,040

|

| |

|

|

15,196,222 |

| Health Care Providers & Services 1.2% |

| ||

| agilon health, Inc.* |

|

142,000 |

3,554,260 |

| Health Care Technology 0.5% |

| ||

| Certara, Inc.* |

|

70,928 |

1,630,635 |

| Life Sciences Tools & Services 5.3% |

| ||

| Azenta, Inc. |

|

22,000 |

1,501,720 |

| Thermo Fisher Scientific, Inc. |

|

23,956 |

14,335,510

|

| |

|

|

15,837,230 |

| Pharmaceuticals 2.6% |

| ||

| Zoetis, Inc. |

|

42,604 |

7,777,360 |

| Industrials 5.7% |

| ||

| Aerospace & Defense 0.6% |

| ||

| Axon Enterprise, Inc.* |

|

15,200 |

1,674,888 |

| Building Products 0.4% |

| ||

| AZEK Co., Inc.* |

|

52,609 |

1,087,954 |

| Electrical Equipment 3.4% |

| ||

| AMETEK, Inc. |

|

50,072 |

6,183,892 |

| Generac Holdings, Inc.* |

|

15,500 |

4,158,650

|

| |

|

|

10,342,542 |

| Professional Services 1.3% |

| ||

| TransUnion |

|

51,106 |

4,049,129 |

| Information Technology 43.9% |

| ||

| IT Services 7.3% |

| ||

| Fiserv, Inc.* |

|

15,891 |

1,679,361 |

| Globant SA* |

|

37,000 |

7,371,880 |

| Visa, Inc. “A” |

|

60,361 |

12,803,172

|

| |

|

|

21,854,413 |

| Semiconductors & Semiconductor Equipment 5.0% |

| ||

| Advanced Micro Devices, Inc.* |

|

47,100 |

4,449,537 |

| Applied Materials, Inc. |

|

43,000 |

4,557,140 |

| NVIDIA Corp. |

|

32,500 |

5,902,975

|

| |

|

|

14,909,652 |

| Software 19.5% |

| ||

| Atlassian Corp. PLC “A” * |

|

15,000 |

3,139,800 |

| Confluent, Inc. “A” * (a) |

|

23,500 |

598,075 |

| 14 |

| |

DWS Large Cap Focus Growth Fund |

| |

Shares |

Value ($) | |

| Datadog, Inc. “A” * |

|

16,440 |

1,677,044 |

| Microsoft Corp. |

|

113,223 |

31,786,225 |

| Paylocity Holding Corp.* |

|

5,500 |

1,132,615 |

| Roper Technologies, Inc. |

|

12,213 |

5,333,051 |

| Salesforce, Inc.* |

|

34,008 |

6,258,152 |

| ServiceNow, Inc.* |

|

18,789 |

8,392,295

|

| |

|

|

58,317,257 |

| Technology Hardware, Storage & Peripherals 12.1% |

| ||

| Apple, Inc. |

|

222,930 |

36,228,354 |

| Total Common Stocks (Cost $114,542,561) |

282,047,236 | ||

| Securities Lending Collateral 0.9% | |||

| DWS Government & Agency Securities Portfolio “DWS Government Cash Institutional Shares” , 1.55% (b) (c) (Cost $2,617,268) |

|

2,617,268 |

2,617,268 |

| Cash Equivalents 5.4% | |||

| DWS Central Cash Management Government Fund, 1.62% (b) (Cost $16,280,493) |

|

16,280,493 |

16,280,493 |

| |

|

% of

Net Assets |

Value ($) |

| Total Investment Portfolio (Cost $133,440,322) |

|

100.5 |

300,944,997 |

| Other Assets and Liabilities, Net |

|

(0.5) |

(1,612,638) |

| Net Assets |

|

100.0 |

299,332,359 |

| DWS

Large Cap Focus Growth Fund |

| |

15 |

| Value ($)

at 7/31/2021 |

Pur-

chases

Cost

($) |

Sales

Proceeds

($) |

Net

Real-

ized

Gain/

(Loss)

($) |

Net

Change

in

Unreal-

ized

Appreci-

ation

(Depreci-

ation)

($) |

Income

($) |

Capital

Gain

Distri-

butions

($) |

Number of

Shares at

7/31/2022 |

Value ($)

at 7/31/2022 |

| Securities Lending Collateral 0.9% | ||||||||

| DWS Government & Agency Securities Portfolio “DWS Government Cash Institutional Shares” , 1.55% (b) (c) | ||||||||

| 26,692,663 |

— |

24,075,395 (d) |

— |

— |

18,820 |

— |

2,617,268 |

2,617,268 |

| Cash Equivalents 5.4% | ||||||||

| DWS Central Cash Management Government Fund, 1.62% (b) | ||||||||

| 4,519,877 |

60,756,725 |

48,996,109 |

— |

— |

13,016 |

— |

16,280,493 |

16,280,493 |

| 31,212,540 |

60,756,725 |

73,071,504 |

— |

— |

31,836 |

— |

18,897,761 |

18,897,761 |

| * |

Non-income producing security. |

| (a) |

All or a portion of these securities were on loan. In addition, “Other Assets and Liabilities, Net” may include pending sales that are also on loan. The value of securities loaned at July 31, 2022 amounted to $1,620,399, which is 0.5% of net assets. |

| (b) |

Affiliated fund managed by DWS Investment Management Americas, Inc. The rate shown is the annualized seven-day yield at period end. |

| (c) |

Represents cash collateral held in connection with securities lending. Income earned by the Fund is net of borrower rebates. |

| (d) |

Represents the net increase (purchase cost) or decrease (sales proceeds) in the amount invested in cash collateral for the year ended July 31, 2022. |

| Assets |

Level 1 |

Level 2 |

Level 3 |

Total |

| Common Stocks (a) |

$282,047,236

|

$—

|

$—

|

$282,047,236 |

| Short-Term Investments (a) |

18,897,761 |

— |

— |

18,897,761 |

| Total |

$300,944,997 |

$—

|

$—

|

$300,944,997 |

| (a) |

See

Investment Portfolio for additional detailed categorizations. |

| 16 |

| |

DWS Large Cap Focus Growth Fund |

| Assets |

|

| Investments in non-affiliated securities, at value (cost $114,542,561) —

including $1,620,399 of securities loaned |

$ 282,047,236 |

| Investment in DWS Government & Agency Securities Portfolio (cost $2,617,268)* |

2,617,268 |

| Investment in DWS Central Cash Management Government Fund (cost $16,280,493) |

16,280,493 |

| Cash |

10,020 |

| Foreign currency, at value (cost $527) |

473 |

| Receivable for investments sold |

4,483,472 |

| Receivable for Fund shares sold |

6,432 |

| Dividends receivable |

29,404 |

| Interest receivable |

2,232 |

| Other assets |

23,117 |

| Total assets |

305,500,147 |

| Liabilities |

|

| Payable upon return of securities loaned |

2,617,268 |

| Payable for investments purchased |

2,958,203 |

| Payable for Fund shares redeemed |

255,954 |

| Accrued management fee |

132,621 |

| Accrued Trustees' fees |

3,967 |

| Other accrued expenses and payables |

199,775 |

| Total liabilities |

6,167,788 |

| Net assets, at value |

$299,332,359 |

| Net Assets Consist of |

|

| Distributable earnings (loss) |

175,771,090 |

| Paid-in capital |

123,561,269 |

| Net assets, at value |

$299,332,359 |

| DWS

Large Cap Focus Growth Fund |

| |

17 |

Net

Asset Value |

|

Class

A |

|

Net

Asset Value and

redemption price per share

($34,685,912

÷ 577,140 outstanding shares of beneficial interest,

$.01

par value, unlimited number of shares authorized) |

$ 60.10 |

Maximum

offering price per share (100 ÷ 94.25 of $60.10) |

$ 63.77 |

Class

C |

|

Net

Asset Value, offering

and redemption price

(subject

to contingent deferred sales charge) per share

($3,603,596

÷ 77,597 outstanding shares of beneficial interest,

$.01

par value, unlimited number of shares authorized) |

$ 46.44 |

Class

S |

|

Net

Asset Value, offering

and redemption price per share ($245,475,896

÷ 3,836,816 outstanding shares of beneficial interest,

$.01

par value, unlimited number of shares authorized) |

$ 63.98 |

Institutional

Class |

|

Net

Asset Value, offering

and redemption price per share ($15,566,955

÷ 239,246 outstanding shares of beneficial interest,

$.01

par value, unlimited number of shares authorized) |

$ 65.07 |

| 18 |

| |

DWS Large Cap Focus Growth Fund |

| Investment Income |

|

| Income: |

|

| Dividends |

$ 1,424,149 |

| Interest |

527 |

| Income distributions — DWS Central Cash Management Government Fund |

13,016 |

| Securities lending income, net of borrower rebates |

18,820 |

| Total income |

1,456,512 |

| Expenses: |

|

| Management fee |

2,208,606 |

| Administration fee |

348,349 |

| Services to shareholders |

379,169 |

| Distribution and service fees |

146,345 |

| Custodian fee |

4,997 |

| Professional fees |

88,101 |

| Reports to shareholders |

37,532 |

| Registration fees |

63,473 |

| Trustees' fees and expenses |

16,540 |

| Other |

21,106 |

| Total expenses before expense reductions |

3,314,218 |

| Expense reductions |

(177,079) |

| Total expenses after expense reductions |

3,137,139 |

| Net investment income (loss) |

(1,680,627) |

| Realized and Unrealized Gain (Loss) |

|

| Net realized gain (loss) from investments |

13,917,804 |

| Change in net unrealized appreciation (depreciation) on: |

|

| Investments |

(77,970,357) |

| Foreign currency |

(54) |

| |

(77,970,411) |

| Net gain (loss) |

(64,052,607) |

| Net increase (decrease) in net assets resulting from operations |

$ (65,733,234) |

| DWS

Large Cap Focus Growth Fund |

| |

19 |

| |

Years Ended July 31, | |

| Increase (Decrease) in Net Assets |

2022 |

2021 |

| Operations: |

|

|

| Net investment income (loss) |

$ (1,680,627) |

$ (839,469) |

| Net realized gain (loss) |

13,917,804 |

28,914,987 |

| Change in net unrealized appreciation (depreciation) |

(77,970,411) |

68,651,005 |

| Net increase (decrease) in net assets resulting from operations |

(65,733,234) |

96,726,523 |

| Distributions to shareholders: |

|

|

| Class A |

(3,883,975) |

(1,747,910) |

| Class C |

(583,005) |

(352,844) |

| Class S |

(26,825,912) |

(11,377,035) |

| Institutional Class |

(1,971,351) |

(604,553) |

| Total distributions |

(33,264,243) |

(14,082,342) |

| Fund share transactions: |

|

|

| Proceeds from shares sold |

25,457,267 |

41,823,945 |

| Reinvestment of distributions |

31,745,554 |

13,459,071 |

| Payments for shares redeemed |

(59,231,209) |

(51,599,581) |

| Net increase (decrease) in net assets from Fund share transactions |

(2,028,388) |

3,683,435 |

| Increase (decrease) in net assets |

(101,025,865) |

86,327,616 |

| Net assets at beginning of period |

400,358,224 |

314,030,608 |

| Net assets at end of period |

$299,332,359 |

$400,358,224

|

| 20 |

| |

DWS Large Cap Focus Growth Fund |

| DWS Large Cap Focus Growth Fund — Class A | |||||

| |

Years Ended July 31, | ||||

| |

2022 |

2021 |

2020 |

2019 |

2018 |

| Selected Per Share Data | |||||

| Net asset value, beginning of period |

$79.81 |

$63.63 |

$50.70 |

$47.19 |

$42.39 |

| Income (loss) from investment operations: |

|

|

|

|

|

| Net investment income (loss)a

|

(.48) |

(.30) |

(.12) |

(.04) |

(.06) |

| Net realized and unrealized gain (loss) |

(12.13) |

19.48 |

16.01 |

6.07 |

6.46 |

| Total from investment operations |

(12.61) |

19.18 |

15.89 |

6.03 |

6.40 |

| Less distributions from: |

|

|

|

|

|

| Net realized gains |

(7.10) |

(3.00) |

(2.96) |

(2.52) |

(1.60) |

| Net asset value, end of period |

$60.10 |

$79.81 |

$63.63 |

$50.70 |

$47.19 |

| Total Return (%)b,c |

(17.75) |

31.03 |

32.91 |

13.92 |

15.47 |

| Ratios to Average Net Assets and Supplemental Data | |||||

| Net assets, end of period ($ millions) |

35 |

44 |

36 |

29 |

26 |

| Ratio of expenses before expense reductions (%) |

1.15 |

1.14 |

1.18 |

1.22 |

1.22 |

| Ratio of expenses after expense reductions (%) |

1.08 |

1.09 |

1.12 |

1.15 |

1.22 |

| Ratio of net investment income (loss) (%) |

(.68) |

(.43) |

(.23) |

(.08) |

(.15) |

| Portfolio turnover rate (%) |

13 |

20 |

21 |

26 |

36 |

| a |

Based on average shares outstanding during the period. |

| b |

Total return does not reflect the effect of any sales charges. |

| c |

Total return would have been lower had certain expenses not been reduced. |

| DWS

Large Cap Focus Growth Fund |

| |

21 |

| DWS Large Cap Focus Growth Fund — Class C | |||||

| |

Years Ended July 31, | ||||

| |

2022 |

2021 |

2020 |

2019 |

2018 |

| Selected Per Share Data | |||||

| Net asset value, beginning of period |

$63.65 |

$51.67 |

$42.00 |

$39.84 |

$36.29 |

| Income (loss) from investment operations: |

|

|

|

|

|

| Net investment income (loss)a

|

(.79) |

(.66) |

(.42) |

(.32) |

(.33) |

| Net realized and unrealized gain (loss) |

(9.32) |

15.64 |

13.05 |

5.00 |

5.48 |

| Total from investment operations |

(10.11) |

14.98 |

12.63 |

4.68 |

5.15 |

| Less distributions from: |

|

|

|

|

|

| Net realized gains |

(7.10) |

(3.00) |

(2.96) |

(2.52) |

(1.60) |

| Net asset value, end of period |

$46.44 |

$63.65 |

$51.67 |

$42.00 |

$39.84 |

| Total Return (%)b,c |

(18.38) |

30.05 |

31.92 |

13.07 |

14.60 |

| Ratios to Average Net Assets and Supplemental Data | |||||

| Net assets, end of period ($ millions) |

4 |

6 |

6 |

5 |

6 |

| Ratio of expenses before expense reductions (%) |

1.92 |

1.91 |

1.93 |

1.96 |

1.97 |

| Ratio of expenses after expense reductions (%) |

1.83 |

1.84 |

1.87 |

1.90 |

1.97 |

| Ratio of net investment income (loss) (%) |

(1.43) |

(1.16) |

(.97) |

(.82) |

(.89) |

| Portfolio turnover rate (%) |

13 |

20 |

21 |

26 |

36 |

| a |

Based on average shares outstanding during the period. |

| b |

Total return does not reflect the effect of any sales charges. |

| c |

Total return would have been lower had certain expenses not been reduced. |

| 22 |

| |

DWS Large Cap Focus Growth Fund |

| DWS Large Cap Focus Growth Fund — Class S | |||||

| |

Years Ended July 31, | ||||

| |

2022 |

2021 |

2020 |

2019 |

2018 |

| Selected Per Share Data | |||||

| Net asset value, beginning of period |

$84.33 |

$66.92 |

$53.11 |

$49.22 |

$44.09 |

| Income (loss) from investment operations: |

|

|

|

|

|

| Net investment income (loss)a

|

(.32) |

(.14) |

.01 |

.08 |

.06 |

| Net realized and unrealized gain (loss) |

(12.93) |

20.55 |

16.82 |

6.37 |

6.72 |

| Total from investment operations |

(13.25) |

20.41 |

16.83 |

6.45 |

6.78 |

| Less distributions from: |

|

|

|

|

|

| Net investment income |

— |

— |

(.06) |

(.04) |

(.05) |

| Net realized gains |

(7.10) |

(3.00) |

(2.96) |

(2.52) |

(1.60) |

| Total distributions |

(7.10) |

(3.00) |

(3.02) |

(2.56) |

(1.65) |

| Net asset value, end of period |

$63.98 |

$84.33 |

$66.92 |

$53.11 |

$49.22 |

| Total Return (%) |

(17.55)b |

31.35b |

33.23b |

14.24b |

15.75 |

| Ratios to Average Net Assets and Supplemental Data | |||||

| Net assets, end of period ($ millions) |

245 |

325 |

260 |

223 |

209 |

| Ratio of expenses before expense reductions (%) |

.88 |

.87 |

.91 |

.94 |

.95 |

| Ratio of expenses after expense reductions (%) |

.83 |

.84 |

.87 |

.90 |

.95 |

| Ratio of net investment income (loss) (%) |

(.43) |

(.19) |

.02 |

.16 |

.12 |

| Portfolio turnover rate (%) |

13 |

20 |

21 |

26 |

36 |

| a |

Based on average shares outstanding during the period. |

| b |

Total return would have been lower had certain expenses not been reduced. |

| DWS

Large Cap Focus Growth Fund |

| |

23 |

| DWS Large Cap Focus Growth Fund — Institutional Class | |||||

| |

Years Ended July 31, | ||||

| |

2022 |

2021 |

2020 |

2019 |

2018 |

| Selected Per Share Data | |||||

| Net asset value, beginning of period |

$85.64 |

$67.92 |

$53.83 |

$49.88 |

$44.65 |

| Income (loss) from investment operations: |

|

|

|

|

|

| Net investment income (loss)a

|

(.33) |

(.17) |

.01 |

.03 |

.06 |

| Net realized and unrealized gain (loss) |

(13.14) |

20.89 |

17.10 |

6.49 |

6.82 |

| Total from investment operations |

(13.47) |

20.72 |

17.11 |

6.52 |

6.88 |

| Less distributions from: |

|

|

|

|

|

| Net investment income |

— |

— |

(.06) |

(.05) |

(.05) |

| Net realized gains |

(7.10) |

(3.00) |

(2.96) |

(2.52) |

(1.60) |

| Total distributions |

(7.10) |

(3.00) |

(3.02) |

(2.57) |

(1.65) |

| Net asset value, end of period |

$65.07 |

$85.64 |

$67.92 |

$53.83 |

$49.88 |

| Total Return (%) |

(17.55)b |

31.36b |

33.31 |

14.18b |

15.78 |

| Ratios to Average Net Assets and Supplemental Data | |||||

| Net assets, end of period ($ millions) |

16 |

26 |

13 |

2 |

10 |

| Ratio of expenses before expense reductions (%) |

.91 |

.89 |

.86 |

1.01 |

.94 |

| Ratio of expenses after expense reductions (%) |

.83 |

.84 |

.86 |

.90 |

.94 |

| Ratio of net investment income (loss) (%) |

(.42) |

(.23) |

.01 |

.06 |

.13 |

| Portfolio turnover rate (%) |

13 |

20 |

21 |

26 |

36 |

| a |

Based on average shares outstanding during the period. |

| b |

Total return would have been lower had certain expenses not been reduced. |

| 24 |

| |

DWS Large Cap Focus Growth Fund |

| DWS

Large Cap Focus Growth Fund |

| |

25 |

| 26 |

| |

DWS Large Cap Focus Growth Fund |

| DWS

Large Cap Focus Growth Fund |

| |

27 |

| Undistributed long-term capital gains |

$ 8,397,946 |

| Net unrealized appreciation (depreciation) on investments |

$ 167,373,198 |

| |

Years Ended July 31, | |

| |

2022 |

2021 |

| Distributions from ordinary income* |

$ 7,357,033 |

$ — |

| Distributions from long-term capital gains |

$

25,907,210 |

$ 14,082,342 |

| * |

For tax purposes, short-term capital gain distributions are considered ordinary income distributions. |

| 28 |

| |

DWS Large Cap Focus Growth Fund |

| DWS

Large Cap Focus Growth Fund |

| |

29 |

| First $1.5 billion of the Fund’s average daily net assets |

.615% |

| Next $500 million of such net assets |

.565% |

| Over $2.0 billion of such net assets |

.515% |

| Class A |

1.09% |

| Class C |

1.84% |

| Class S |

.84% |

| Institutional Class |

.84% |

| Class A |

|

1.08% |

| Class C |

|

1.83% |

| Class S |

|

.83% |

| Institutional Class |

|

.83% |

| 30 |

| |

DWS Large Cap Focus Growth Fund |

| Class A |

$ 26,216

|

| Class C |

4,153 |

| Class S |

131,849 |

| Institutional Class |

14,861 |

| |

$ 177,079 |

| Services to Shareholders |

Total

Aggregated |

Unpaid at

July 31, 2022 |

| Class A |

$ 12,025 |

$

1,981 |

| Class C |

649 |

108 |

| Class S |

132,456 |

21,751 |

| Institutional Class |

298 |

51 |

| |

$ 145,428 |

$ 23,891 |

| DWS

Large Cap Focus Growth Fund |

| |

31 |

| Sub-Recordkeeping |

Total

Aggregated |

| Class A |

$

35,209 |

| Class C |

5,821 |

| Class S |

130,984 |

| Institutional Class |

23,882 |

| |

$ 195,896 |

| Distribution Fee |

Total

Aggregated |

Unpaid at

July 31, 2022 |

| Class C |

$

36,198 |

$ 2,192 |

| Service Fee |

Total

Aggregated |

Unpaid at

July 31, 2022 |

Annual

Rate |

| Class A |

$ 98,214 |

$

13,699 |

.24% |

| Class C |

11,933 |

1,491 |

.25% |

| |

$ 110,147 |

$ 15,190 |

|

| 32 |

| |

DWS Large Cap Focus Growth Fund |

| DWS

Large Cap Focus Growth Fund |

| |

33 |

| |

Year Ended

July 31, 2022 |

Year Ended

July 31, 2021 | ||

| |

Shares |

Dollars |

Shares |

Dollars |

| Shares sold | ||||

| Class A |

58,939 |

$ 4,296,343 |

95,406 |

$ 6,627,061 |

| Class C |

7,744 |

442,851 |

29,858 |

1,646,994 |

| Class S |

149,092 |

11,038,454 |

302,750 |

22,152,179 |

| Institutional Class |

140,926 |

9,679,619 |

153,516 |

11,397,711 |

| |

|

$ 25,457,267 |

|

$ 41,823,945 |

| Shares issued to shareholders in reinvestment of distributions | ||||

| Class A |

47,270 |

$ 3,638,823 |

24,494 |

$ 1,646,726 |

| Class C |

9,748 |

582,624 |

6,505 |

350,387 |

| Class S |

312,304 |

25,552,756 |

153,094 |

10,857,405 |

| Institutional Class |

23,691 |

1,971,351 |

8,393 |

604,553 |

| |

|

$ 31,745,554 |

|

$ 13,459,071 |

| Shares redeemed | ||||

| Class A |

(77,508) |

$ (5,442,960) |

(138,155) |

$ (9,680,002) |

| Class C |

(30,531) |

(1,673,108) |

(53,987) |

(3,032,633) |

| Class S |

(481,644) |

(35,567,029) |

(476,741) |

(34,893,377) |

| Institutional Class |

(223,817) |

(16,548,112) |

(52,765) |

(3,993,569) |

| |

|

$ (59,231,209) |

|

$ (51,599,581) |

| Net increase (decrease) | ||||

| Class A |

28,701 |

$ 2,492,206 |

(18,255) |

$ (1,406,215) |

| Class C |

(13,039) |

(647,633) |

(17,624) |

(1,035,252) |

| Class S |

(20,248) |

1,024,181 |

(20,897) |

(1,883,793) |

| Institutional Class |

(59,200) |

(4,897,142) |

109,144 |

8,008,695 |

| |

|

$ (2,028,388)

|

|

$ 3,683,435 |

| 34 |

| |

DWS Large Cap Focus Growth Fund |

| DWS

Large Cap Focus Growth Fund |

| |

35 |

| 36 |

| |

DWS Large Cap Focus Growth Fund |

| DWS

Large Cap Focus Growth Fund |

| |

37 |

| 38 |

| |

DWS Large Cap Focus Growth Fund |

| Actual Fund Return |

Class A |

Class C |

Class S |

Institutional

Class |

| Beginning Account Value 2/1/22 |

$1,000.00

|

$1,000.00

|

$1,000.00

|

$1,000.00 |

| Ending Account Value 7/31/22 |

$863.10

|

$859.80

|

$864.10

|

$864.30 |

| Expenses Paid per $1,000* |

$4.99

|

$8.44

|

$3.84

|

$3.84 |

| Hypothetical 5% Fund Return |

Class A |

Class C |

Class S |

Institutional

Class |

| Beginning Account Value 2/1/22 |

$1,000.00

|

$1,000.00

|

$1,000.00

|

$1,000.00 |

| Ending Account Value 7/31/22 |

$1,019.44

|

$1,015.72

|

$1,020.68

|

$1,020.68 |

| Expenses Paid per $1,000* |

$5.41

|

$9.15

|

$4.16

|

$4.16 |

| * |

Expenses are equal to the Fund’s annualized expense ratio for each share class, multiplied by the average account value over the period, multiplied by 181 (the number of days in the most recent six-month period), then divided by 365. |

| Annualized Expense Ratios |

Class A |

Class C |

Class S |

Institutional

Class |

| DWS Large Cap Focus Growth Fund |

1.08% |

1.83% |

.83% |

.83% |

| DWS

Large Cap Focus Growth Fund |

| |

39 |

| 40 |

| |

DWS Large Cap Focus Growth Fund |

| DWS

Large Cap Focus Growth Fund |

| |

41 |

| 42 |

| |

DWS Large Cap Focus Growth Fund |

| DWS

Large Cap Focus Growth Fund |

| |

43 |

| 44 |

| |

DWS Large Cap Focus Growth Fund |

| Name, Year of Birth, Position with the Trust/ Corporation and Length of Time Served1

|

Business Experience and Directorships During the Past Five Years |

Number of Funds in DWS Fund Complex Overseen |

Other Directorships Held by Board Member |

| Keith R. Fox,

CFA (1954) Chairperson

since 2017, and Board Member

since 1996 |

Managing General Partner, Exeter Capital Partners (a series of private investment funds) (since 1986). Directorships: Progressive International Corporation (kitchen goods designer and distributor); former Chairman, National Association of Small Business Investment Companies; Former Directorships: ICI Mutual Insurance Company; BoxTop Media Inc. (advertising); Sun Capital Advisers Trust (mutual funds) |

70 |

— |

| DWS

Large Cap Focus Growth Fund |

| |

45 |

| Name, Year of Birth, Position with the Trust/ Corporation and Length of Time Served1

|

Business Experience and Directorships During the Past Five Years |

Number of Funds in DWS Fund Complex Overseen |

Other Directorships Held by Board Member |

| John W.

Ballantine (1946) Board

Member since 1999 |

Retired; formerly, Executive Vice President and Chief Risk Management Officer, First Chicago NBD Corporation/The First National Bank of Chicago (1996–1998); Executive Vice President and Head of International Banking (1995–1996); Not-for-Profit Directorships: Window to the World Communications (public media); Life Director of Harris Theater for Music and Dance (Chicago); Life Director of Hubbard Street Dance Chicago; Former Directorships: Director and Chairman of the Board, Healthways, Inc.2 (population wellbeing and wellness services) (2003–2014); Stockwell Capital Investments PLC (private equity); Enron Corporation; FNB Corporation; Tokheim Corporation; First Oak Brook Bancshares, Inc.; Oak Brook Bank; Portland General Electric2 (utility company (2003–2021); and Prisma Energy International; Former Not-for-Profit Directorships: Public Radio International; Palm Beach Civic Assn. |

70 |

— |

| Dawn-Marie

Driscoll (1946) Board Member

since 1987 |

Advisory Board and former Executive Fellow, Hoffman Center for Business Ethics, Bentley University; formerly: Partner, Palmer & Dodge (law firm) (1988–1990); Vice President of Corporate Affairs and General Counsel, Filene’s (retail) (1978–1988); Directorships: Trustee and former Chairman of the Board, Southwest Florida Community Foundation (charitable organization); Former Directorships: ICI Mutual Insurance Company (2007–2015); Sun Capital Advisers Trust (mutual funds) (2007–2012), Investment Company Institute (audit, executive, nominating committees) and Independent Directors Council (governance, executive committees) |

70 |

— |

| 46 |

| |

DWS Large Cap Focus Growth Fund |

| Name, Year of Birth, Position with the Trust/ Corporation and Length of Time Served1

|

Business Experience and Directorships During the Past Five Years |

Number of Funds in DWS Fund Complex Overseen |

Other Directorships Held by Board Member |

| Richard J.

Herring (1946) Board Member

since 1990 |

Jacob Safra Professor of International Banking and Professor of Finance, The Wharton School, University of Pennsylvania (since July 1972); formerly: Director, The Wharton Financial Institutions Center (1994–2020); Vice Dean and Director, Wharton Undergraduate Division (1995–2000) and Director, The Lauder Institute of International Management Studies (2000–2006); Member FDIC Systemic Risk Advisory Committee since 2011, member Systemic Risk Council since 2012 and member of the Advisory Board at the Yale Program on Financial Stability since 2013; Former Directorships: Co-Chair of the Shadow Financial Regulatory Committee (2003–2015), Executive Director of The Financial Economists Roundtable (2008–2015), Director of The Thai Capital Fund (2007–2013), Director of The Aberdeen Singapore Fund (2007–2018), Director, The Aberdeen Japan Fund (2007-2021) and Nonexecutive Director of Barclays Bank DE (2010–2018) |

70 |

— |

| William

McClayton (1944) Board

Member since 2004 |

Private equity investor (since October 2009);

formerly: Managing Director, Diamond

Management & Technology Consultants, Inc.

(global consulting firm) (2001–2009); Senior

Partner, Arthur Andersen LLP (accounting)

(1966–2001); Former Directorships: Board of

Managers, YMCA of Metropolitan Chicago;

Trustee, Ravinia Festival |

70 |

— |

| Chad D. Perry

(1972) Board Member or

Advisory Board Member

since 20213 |

Executive Vice President, General Counsel and Secretary, Tanger Factory Outlet Centers, Inc.2 (since 2011); formerly Executive Vice President and Deputy General Counsel, LPL Financial Holdings Inc.2 (2006–2011); Senior Corporate Counsel, EMC Corporation (2005–2006); Associate, Ropes & Gray LLP (1997–2005) |

214 |

Director - Great

Elm Capital Corp. (business

development company) (since

2022) |

| DWS

Large Cap Focus Growth Fund |

| |

47 |

| Name, Year of Birth, Position with the Trust/ Corporation and Length of Time Served1

|

Business Experience and Directorships During the Past Five Years |

Number of Funds in DWS Fund Complex Overseen |

Other Directorships Held by Board Member |

| Rebecca W.

Rimel (1951) Board Member

since 1995 |

Director, The Bridgespan Group (nonprofit organization) (since October 2020); formerly: Executive Vice President, The Glenmede Trust Company (investment trust and wealth management) (1983–2004); Board Member, Investor Education (charitable organization) (2004–2005); Former Directorships: Trustee, Executive Committee, Philadelphia Chamber of Commerce (2001–2007); Director, Viasys Health Care2 (January 2007–June 2007); Trustee, Thomas Jefferson Foundation (charitable organization) (1994–2012); President, Chief Executive Officer and Director (1994–2020) and Senior Advisor (2020-2021), The Pew Charitable Trusts (charitable organization); Director, BioTelemetry Inc.2 (acquired by Royal Philips in 2021) (healthcare) (2009–2021); Director, Becton Dickinson and Company2 (medical technology company) (2012-2022) |

70 |

— |

| Catherine

Schrand (1964) Board Member or

Advisory Board Member

since 20213 |

Celia Z. Moh Professor of Accounting (since

2016) and Professor of Accounting (since

1994), The Wharton School, University of

Pennsylvania; formerly Vice Dean, Wharton

Doctoral Programs (2016–2019) |

214 |

— |

| William N.

Searcy, Jr. (1946) Board

Member since 1993 |

Private investor since October 2003; formerly: Pension & Savings Trust Officer, Sprint Corporation2 (telecommunications) (November 1989–September 2003); Former Directorships: Trustee, Sun Capital Advisers Trust (mutual funds) (1998–2012) |

70 |

— |

| 48 |

| |

DWS Large Cap Focus Growth Fund |

| Name, Year of Birth, Position with the Trust/Corporation and Length of Time

Served6 |

Business Experience and Directorships During the Past Five Years |

| Hepsen Uzcan7 (1974) President

and Chief Executive Officer, 2017–present |

Fund Administration (Head since 2017), DWS; Secretary, DWS USA Corporation (2018–present); Assistant Secretary, DWS Distributors, Inc. (2018–present); Director and Vice President, DWS Service Company (2018–present); Assistant Secretary, DWS Investment Management Americas, Inc. (2018–present); Director and President, DB Investment Managers, Inc. (2018–present); President and Chief Executive Officer, The European Equity Fund, Inc., The New Germany Fund, Inc. and The Central and Eastern Europe Fund, Inc. (2017–present); formerly: Vice President for the Deutsche funds (2016–2017); Assistant Secretary for the DWS funds (2013–2019); Assistant Secretary, The European Equity Fund, Inc., The New Germany Fund, Inc. and The Central and Eastern Europe Fund, Inc. (2013–2020); Directorships: Interested Director, The European Equity Fund, Inc., The New Germany Fund, Inc. and The Central and Eastern Europe Fund, Inc. (since June 25, 2020); ICI Mutual Insurance Company (since October 16, 2020); and Episcopalian Charities of New York (2018–present) |

| John Millette8 (1962) Vice

President and Secretary, 1999–present |

Legal (Associate General Counsel), DWS; Chief Legal Officer, DWS Investment Management Americas, Inc. (2015–present); Director and Vice President, DWS Trust Company (2016–present); Secretary, DBX ETF Trust (2020–present); Vice President, DBX Advisors LLC (2021–present); Secretary, The European Equity Fund, Inc., The New Germany Fund, Inc. and The Central and Eastern Europe Fund, Inc. 2011–present); formerly: Secretary, Deutsche Investment Management Americas Inc. (2015–2017); and Assistant Secretary, DBX ETF Trust (2019–2020) |

| Ciara Crawford9 (1984) Assistant

Secretary, (2019–present) |

Fund Administration (Specialist), DWS (2015–present); formerly, Legal Assistant at Accelerated Tax Solutions |

| Diane Kenneally8 (1966) Chief

Financial Officer and Treasurer, 2018–present |

Fund Administration Treasurer’s Office (Co-Head since 2018), DWS; Treasurer, Chief Financial Officer and Controller, DBX ETF Trust (2019–present); Treasurer and Chief Financial Officer, The European Equity Fund, Inc., The New Germany Fund, Inc. and The Central and Eastern Europe Fund, Inc. (2018–present); formerly: Assistant Treasurer for the DWS funds (2007–2018) |

| Paul Antosca8 (1957) Assistant

Treasurer, 2007–present |

Fund Administration Tax (Head), DWS; and Assistant Treasurer, DBX ETF Trust (2019–present) |

| Sheila Cadogan8 (1966) Assistant

Treasurer, 2017–present |

Fund Administration Treasurer’s Office (Co-Head since 2018), DWS; Director and Vice President, DWS Trust Company (2018–present); Assistant Treasurer, DBX ETF Trust (2019–present); Assistant Treasurer, The European Equity Fund, Inc., The New Germany Fund, Inc. and The Central and Eastern Europe Fund, Inc. (2018–present) |

| Scott D. Hogan8 (1970) Chief

Compliance Officer, 2016–present |

Anti-Financial Crime & Compliance US (Senior Team Lead), DWS; Chief Compliance Officer, The European Equity Fund, Inc., The New Germany Fund, Inc. and The Central and Eastern Europe Fund, Inc. (2016–present) |

| DWS

Large Cap Focus Growth Fund |

| |

49 |

| Name, Year of Birth, Position with the Trust/Corporation and Length of Time

Served6 |

Business Experience and Directorships During the Past Five Years |

| Caroline Pearson8 (1962) Chief

Legal Officer, 2010–present |

Legal (Senior Team Lead), DWS; Assistant Secretary, DBX ETF Trust (2020–present); Chief Legal Officer, DBX Advisors LLC (2020–present); Chief Legal Officer, The European Equity Fund, Inc., The New Germany Fund, Inc. and The Central and Eastern Europe Fund, Inc. (2012–present); formerly: Secretary, Deutsche AM Distributors, Inc. (2002–2017); Secretary, Deutsche AM Service Company (2010–2017); and Chief Legal Officer, DBX Strategic Advisors LLC (2020–2021) |

| Christian Rijs7 (1980) Anti-Money

Laundering Compliance Officer,

since October 6, 2021 |

Senior Team Lead Anti-Financial Crime and Compliance, DWS; AML Officer, DWS Trust Company (since November 2, 2021); AML Officer, DBX ETF Trust (since October 21, 2021); AML Officer, The European Equity Fund, Inc., The New Germany Fund, Inc. and The Central and Eastern Europe Fund, Inc. (since November 12, 2021); formerly: DWS UK & Ireland Head of Anti-Financial Crime and MLRO |

| 1 |

The length of time served represents the year in which the Board Member joined the board of one or more DWS funds currently overseen by the Board. |

| 2 |

A publicly held company with securities registered pursuant to Section 12 of the Securities Exchange Act of 1934. |

| 3 |

Mr. Perry and Ms. Schrand are Advisory Board Members of Deutsche DWS Asset Allocation Trust, Deutsche DWS Equity 500 Index Portfolio, Deutsche DWS Global/International Fund, Inc., Deutsche DWS Income Trust, Deutsche DWS Institutional Funds, Deutsche DWS International Fund, Inc., Deutsche DWS Investment Trust, Deutsche DWS Investments VIT Funds, Deutsche DWS Money Market Trust, Deutsche DWS Municipal Trust, Deutsche DWS Portfolio Trust, Deutsche DWS Securities Trust, Deutsche DWS Tax Free Trust, Deutsche DWS Variable Series I and Government Cash Management Portfolio. Mr. Perry and Ms. Schrand are Board Members of each other Trust. |

| 4 |

Mr. Perry and Ms. Schrand oversee 21 funds in the DWS Fund Complex as Board Members of various Trusts. Mr. Perry and Ms. Schrand are Advisory Board Members of various Trusts/Corporations comprised of 49 funds in the DWS Fund Complex. |

| 5 |

As a result of their respective positions held with the Advisor or its affiliates, these individuals are considered “interested persons” of the Advisor within the meaning of the 1940 Act. Interested persons receive no compensation from the Fund. |

| 6 |

The length of time served represents the year in which the officer was first elected in such capacity for one or more DWS funds. |

| 7 |

Address: 875 Third Avenue, New York, NY 10022. |

| 8 |

Address: 100 Summer Street, Boston, MA 02110. |

| 9 |

Address: 5201 Gate Parkway, Jacksonville, FL 32256. |

| 50 |

| |

DWS Large Cap Focus Growth Fund |

| For More

Information |

The automated telephone system allows you to access personalized account information and obtain information on other DWS funds using either your voice or your telephone keypad. Certain account types within Classes A, C and S also have the ability to purchase, exchange or redeem shares using this system. |

| For more information, contact your financial representative. You may also access our automated telephone system or speak with a Shareholder Service representative by calling: (800) 728-3337 | |

| Web Site |

dws.com View your account transactions and balances, trade shares, monitor your asset allocation, subscribe to fund and account updates by e-mail, and change your address, 24 hours a day. |

| Obtain prospectuses and applications, news about DWS funds,

insight from DWS economists and investment specialists and access

to DWS fund account information. | |

| Written

Correspondence |

DWS

PO Box 219151 Kansas City, MO 64121-9151 |

| Proxy Voting |

The Fund’s policies and procedures for voting proxies for portfolio securities and information about how the Fund voted proxies related to its portfolio securities during the most recent 12-month period ended June 30 are available on our Web site —

dws.com/en-us/resources/proxy-voting — or on the SEC’s Web site

— sec.gov. To

obtain a written copy of the Fund’s policies and procedures without charge, upon

request, call us toll free at (800) 728-3337. |

| Portfolio Holdings |

Following the Fund’s fiscal first and third quarter-end, a complete portfolio holdings listing is posted on dws.com, and is available free of charge by contacting your financial intermediary, or if you are a direct investor, by calling (800) 728-3337. In addition, the portfolio holdings listing is filed with SEC on the Fund’s Form N-PORT and will be available on the SEC’s Web site at sec.gov. Additional portfolio holdings for the Fund are also posted on dws.com from time to time. Please see the Fund’s current prospectus for more information. |

| Principal

Underwriter |

If you have questions, comments or complaints, contact: DWS Distributors, Inc. 222 South Riverside Plaza Chicago, IL 60606-5808 (800) 621-1148 |

| DWS

Large Cap Focus Growth Fund |

| |

51 |

| Investment

Management |

DWS Investment Management Americas, Inc. (“DIMA” or the

“Advisor”

), which is part of the DWS Group GmbH & Co. KGaA (“DWS Group” ), is the investment advisor for the Fund. DIMA and its predecessors have more than 90 years of experience managing mutual funds and DIMA provides a full range of investment advisory services to both institutional and retail clients. DIMA is an indirect, wholly owned subsidiary of DWS Group. |

| |

DWS Group is a global organization that offers a wide range of investing expertise and resources, including hundreds of portfolio managers and analysts and an office network that reaches the world’s major investment centers. This well-resourced global investment platform brings together a wide variety of experience and investment insight across industries, regions, asset classes and investing styles. |

| |

Class A |

Class C |

Class S |

Institutional Class |

| Nasdaq Symbol |

SGGAX |

SGGCX |

SCQGX |

SGGIX |

| CUSIP Number |

25157M 695 |

25157M 737 |

25157M 745 |

25157M 752 |

| Fund Number |

469 |

769 |

2060 |

1469 |

| 52 |

| |

DWS Large Cap Focus Growth Fund |

| (b) Not applicable | |

| ITEM 2. | CODE OF ETHICS |

|

As of the end of the period covered by this report, the registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR that applies to its Principal Executive Officer and Principal Financial Officer.

There have been no amendments to, or waivers from, a provision of the code of ethics during the period covered by this report that would require disclosure under Item 2.

A copy of the code of ethics is filed as an exhibit to this Form N-CSR. | |

| ITEM 3. | AUDIT COMMITTEE FINANCIAL EXPERT |

| The fund’s audit committee is comprised solely of trustees who are "independent" (as such term has been defined by the Securities and Exchange Commission ("SEC") in regulations implementing Section 407 of the Sarbanes-Oxley Act (the "Regulations")). The fund’s Board of Trustees has determined that there are several "audit committee financial experts" (as such term has been defined by the Regulations) serving on the fund’s audit committee including Mr. William McClayton, the chair of the fund’s audit committee. An “audit committee financial expert” is not an “expert” for any purpose, including for purposes of Section 11 of the Securities Act of 1933 and the designation or identification of a person as an “audit committee financial expert” does not impose on such person any duties, obligations or liability that are greater than the duties, obligations and liability imposed on such person as a member of the audit committee and board of directors in the absence of such designation or identification. | |

| ITEM 4. | PRINCIPAL ACCOUNTANT FEES AND SERVICES |

DWS Large Cap Focus Growth Fund

form n-csr disclosure re: AUDIT FEES

The following table shows the amount of fees that Ernst & Young LLP (“EY”), the Fund’s Independent Registered Public Accounting Firm, billed to the Fund during the Fund’s last two fiscal years. The Audit Committee approved in advance all audit services and non-audit services that EY provided to the Fund.

Services that the Fund’s Independent Registered Public Accounting Firm Billed to the Fund

| Fiscal Year Ended July 31, |

Audit Fees Billed to Fund | Audit-Related Fees Billed to Fund |

Tax Fees Billed to Fund | All Other Fees Billed to Fund |

| 2022 | $51,236 | $0 | $7,880 | $0 |

| 2021 | $53,933 | $0 | $7,880 | $0 |

The above “Tax Fees” were billed for professional services rendered for tax preparation.

Services that the Fund’s Independent Registered Public Accounting Firm Billed to the Adviser and Affiliated Fund Service Providers

The following table shows the amount of fees billed by EY to DWS Investment Management Americas, Inc. (“DIMA” or the “Adviser”), and any entity controlling, controlled by or under common control with DIMA (“Control Affiliate”) that provides ongoing services to the Fund (“Affiliated Fund Service Provider”), for engagements directly related to the Fund’s operations and financial reporting, during the Fund’s last two fiscal years.

| Fiscal Year Ended July 31, |

Audit-Related Fees Billed to Adviser and Affiliated Fund Service Providers |

Tax Fees Billed to Adviser and Affiliated Fund Service Providers | All Other Fees Billed to Adviser and Affiliated Fund Service Providers |

| 2022 | $0 | $427,005 | $0 |

| 2021 | $0 | $92,492 | $0 |

The above “Tax Fees” were billed in connection with tax compliance services and agreed upon procedures.

Non-Audit Services

The following table shows the amount of fees that EY billed during the Fund’s last two fiscal years for non-audit services. The Audit Committee pre-approved all non-audit services that EY provided to the Adviser and any Affiliated Fund Service Provider that related directly to the Fund’s operations and financial reporting. The Audit Committee requested and received information from EY about any non-audit services that EY rendered during the Fund’s last fiscal year to the Adviser and any Affiliated Fund Service Provider. The Committee considered this information in evaluating EY’s independence.

| Fiscal Year Ended July 31, |

Total Non-Audit Fees Billed to Fund (A) |

Total Non-Audit Fees billed to Adviser and Affiliated Fund Service Providers (engagements related directly to the operations and financial reporting of the Fund) (B) |

Total Non-Audit Fees billed to Adviser and Affiliated Fund Service Providers (all other engagements) (C) |

Total of (A), (B) and (C) |

| 2022 | $7,880 | $427,005 | $0 | $434,885 |

| 2021 | $7,880 | $92,492 | $0 | $100,372 |

All other engagement fees were billed for services in connection with agreed upon procedures and tax compliance for DIMA and other related entities.

Audit Committee Pre-Approval Policies and Procedures. Generally, each Fund’s Audit Committee must pre approve (i) all services to be performed for a Fund by a Fund’s Independent Registered Public Accounting Firm and (ii) all non-audit services to be performed by a Fund’s Independent Registered Public Accounting Firm for the DIMA Entities with respect to operations and financial reporting of the Fund, except that the Chairperson or Vice Chairperson of each Fund’s Audit Committee may grant the pre-approval for non-audit services described in items (i) and (ii) above for non-prohibited services for engagements of less than $100,000. All such delegated pre approvals shall be presented to each Fund’s Audit Committee no later than the next Audit Committee meeting.

There were no amounts that were approved by the Audit Committee pursuant to the de minimis exception under Rule 2-01 of Regulation S-X.

According to the registrant’s principal Independent Registered Public Accounting Firm, substantially all of the principal Independent Registered Public Accounting Firm's hours spent on auditing the registrant's financial statements were attributed to work performed by full-time permanent employees of the principal Independent Registered Public Accounting Firm.

***

In connection with the audit of the 2021 and 2022 financial statements, the Fund entered into an engagement letter with EY. The terms of the engagement letter required by EY, and agreed to by the Audit Committee, include a provision mandating the use of mediation and arbitration to resolve any controversy or claim between the parties arising out of or relating to the engagement letter or services provided thereunder.

***

Pursuant to PCAOB Rule 3526, EY is required to describe in writing to the Fund’s Audit Committee, on at least an annual basis, all relationships between EY, or any of its affiliates, and the DWS Funds, including the Fund, or persons in financial reporting oversight roles at the DWS Funds that, as of the date of the communication, may reasonably be thought to bear on EY’s independence. Pursuant to PCAOB Rule 3526, EY has reported the matters set forth below that may reasonably be thought to bear on EY’s independence. With respect to each reported matter in the aggregate, EY advised the Audit Committee that, after careful consideration of the facts and circumstances and the applicable independence rules, it concluded that the matters do not and will not impair EY’s ability to exercise objective and impartial judgement in connection with the audits of the financial statements for the Fund and a reasonable investor with knowledge of all relevant facts and circumstances would conclude that EY has been and is capable of exercising objective and impartial judgment on all issues encompassed within EY’s audit engagements. EY also confirmed to the Audit Committee that it can continue to act as the Independent Registered Public Accounting Firm for the Fund.

| · | EY advised the Fund’s Audit Committee that various covered persons within EY and EY’s affiliates held investments in, or had other financial relationships with, entities within the DWS Funds “investment company complex” (as defined in Regulation S-X) (the “DWS Funds Complex”). EY informed the Audit Committee that these investments and financial relationships were inconsistent with Rule 2-01(c)(1) of Regulation S-X. EY reported that all breaches have been resolved and that none of the breaches involved any professionals who were part of the audit engagement team for the Fund or in the position to influence the audit engagement team for the Fund. |

| ITEM 5. | AUDIT COMMITTEE OF LISTED REGISTRANTS | |

| Not applicable | ||

| ITEM 6. | SCHEDULE OF INVESTMENTS | |

| Not applicable | ||

| ITEM 7. | DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES | |

| Not applicable | ||

| ITEM 8. | PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES | |

| Not applicable | ||

| ITEM 9. | PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS | |

| Not applicable | ||

| ITEM 10. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS | |

| There were no material changes to the procedures by which shareholders may recommend nominees to the Fund’s Board. The primary function of the Nominating and Governance Committee is to identify and recommend individuals for membership on the Board and oversee the administration of the Board Governance Guidelines. Shareholders may recommend candidates for Board positions by forwarding their correspondence by U.S. mail or courier service to Keith R. Fox, DWS Funds Board Chair, c/o Thomas R. Hiller, Ropes & Gray LLP, Prudential Tower, 800 Boylston Street, Boston, MA 02199-3600. | ||

| ITEM 11. | CONTROLS AND PROCEDURES | |

| (a) | The Chief Executive and Financial Officers concluded that the Registrant’s Disclosure Controls and Procedures are effective based on the evaluation of the Disclosure Controls and Procedures as of a date within 90 days of the filing date of this report. | |

| (b) | There have been no changes in the registrant’s internal control over financial reporting that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal controls over financial reporting. | |

| ITEM 12. | Disclosure of Securities Lending Activities for Closed-End Management Investment Companies | |

| Not applicable | ||

| ITEM 13. | EXHIBITS | |

| (a)(1) | Code of Ethics pursuant to Item 2 of Form N-CSR is filed and attached hereto as EX-99.CODE ETH. | |

| (a)(2) | Certification pursuant to Rule 30a-2(a) under the Investment Company Act of 1940 (17 CFR 270.30a-2(a)) is filed and attached hereto as Exhibit 99.CERT. | |

| (b) | Certification pursuant to Rule 30a-2(b) under the Investment Company Act of 1940 (17 CFR 270.30a-2(b)) is furnished and attached hereto as Exhibit 99.906CERT. | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Registrant: | DWS Large Cap Focus Growth Fund, a series of Deutsche DWS Investment Trust |

| By: |

/s/Hepsen Uzcan Hepsen Uzcan President |

| Date: | 9/29/2022 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By: |

/s/Hepsen Uzcan Hepsen Uzcan President |

| Date: | 9/29/2022 |

| By: |

/s/Diane Kenneally Diane Kenneally Chief Financial Officer and Treasurer |

| Date: | 9/29/2022 |