Exhibit (a)(1)(iii)

Letter of Transmittal

Regarding Shares in Carlyle Credit Solutions, Inc.

Tendered Pursuant to the Offer to Purchase

Dated September 29, 2022

The Offer and withdrawal rights will expire on October 27, 2022

and this Letter of Transmittal must be received by

the Company’s Transfer Agent, either by mail, overnight delivery or by fax, by 11:59 p.m.,

Eastern Time, on October 27, 2022, unless the Offer is extended

Complete this Letter of Transmittal and follow the

instructions included herein

NOTE: SIGNATURES MUST BE PROVIDED BELOW.

PLEASE READ THIS LETTER OF TRANSMITTAL CAREFULLY.

Ladies and Gentlemen:

The undersigned hereby tenders to Carlyle Credit Solutions, Inc., a closed-end management investment company that has elected to be regulated as a business development company under the Investment Company Act of 1940, as amended (the “1940 Act”), and is organized as a Maryland corporation (the “Company”), the shares of common stock of the Company, par value $0.01 per share (the “Shares”), or portion thereof held by the undersigned, described and specified below, on the terms and conditions set forth in the Offer to Purchase dated September 29, 2022 (the “Offer to Purchase”), receipt of which is hereby acknowledged, and in this Letter of Transmittal (which together with the Offer to Purchase constitute the “Offer”). The Offer and this Letter of Transmittal are subject to all the terms and conditions set forth in the Offer to Purchase, including, but not limited to, the absolute right of the Company to reject any and all tenders determined by it, in its sole discretion, not to be in the appropriate form.

IMPORTANT: If you hold Shares registered in the name of a broker, dealer, commercial bank, trust company or other nominee, you must contact that institution in order to tender your Shares and request that your broker, dealer, commercial bank, trust company or other nominee effect the tender for you.

The undersigned hereby sells to the Company the Shares or portion thereof tendered hereby pursuant to the Offer.

The undersigned hereby warrants that the undersigned has full authority to sell the Shares or portion thereof tendered hereby and that the Company will acquire good title thereto, free and clear of all liens, charges, encumbrances, conditional sales agreements or other obligations relating to the sale thereof, and not subject to any adverse claim, when and to the extent the same are purchased by it. Upon request, the undersigned will execute and deliver any additional documents necessary to complete the sale in accordance with the terms of the Offer.

The undersigned name(s) on this Letter of Transmittal must correspond exactly with the name(s) on the books and records of the Company maintained by State Street Bank and Trust Company, the Company’s transfer agent (the “Transfer Agent”). The undersigned recognizes that, under certain circumstances as set forth in the Offer to Purchase, the Company may amend, extend or terminate the Offer or may not be required to purchase any of the Shares tendered hereby. In any such event, the undersigned understands that the Shares not purchased, if any, will continue to be held by the undersigned and will not be tendered.

The undersigned understands that acceptance of Shares by the Company for payment will constitute a binding agreement between the undersigned and the Company upon the terms and subject to the conditions of the Offer. The undersigned understands that a non-transferrable, non-interest bearing and non-negotiable promissory note (a “Note”) will be issued to the undersigned if the Company accepts any of the undersigned’s Shares for purchase promptly following the expiration of the Offer. The undersigned acknowledges that the Transfer Agent will hold the Note on behalf of the undersigned. Following the determination of the purchase price, cash payment of the purchase price for the Shares or portion thereof of the undersigned, as described in Section 6 “Purchases and Payment” of the Offer to Purchase, will be made on behalf of the Company by check or wire transfer to the account identified by the undersigned below or, if no instructions are indicated, to the account on record with the Transfer Agent for the payment of dividends.

No alternative, conditional or contingent tenders will be accepted. All tendering stockholders, by execution of this Letter of Transmittal, waive any right to receive any notice of the acceptance of their Shares for payment.

All questions as to validity, form and eligibility (including time of receipt), including questions as to the proper completion or execution of any Letter of Transmittal or other required documents will be determined by the Company in its sole and absolute discretion (which may delegate power in whole or in part to the Transfer Agent) which determination will be final and binding. The Company reserves the absolute right to reject any or all tenders (i) determined by it not to be in appropriate form or (ii) for which the acceptance of, or payment for, would, in the opinion of counsel for the Company, be unlawful. The Company also reserves the absolute right to waive any defect or irregularity in the surrender of any Shares whether or not similar defects or irregularities are waived in the case of any other stockholder. A surrender will not be deemed to have been validly made until all defects and irregularities have been cured or waived. The Company and the Transfer Agent shall make reasonable efforts to notify any person of any defect in any Letter of Transmittal submitted to the Transfer Agent.

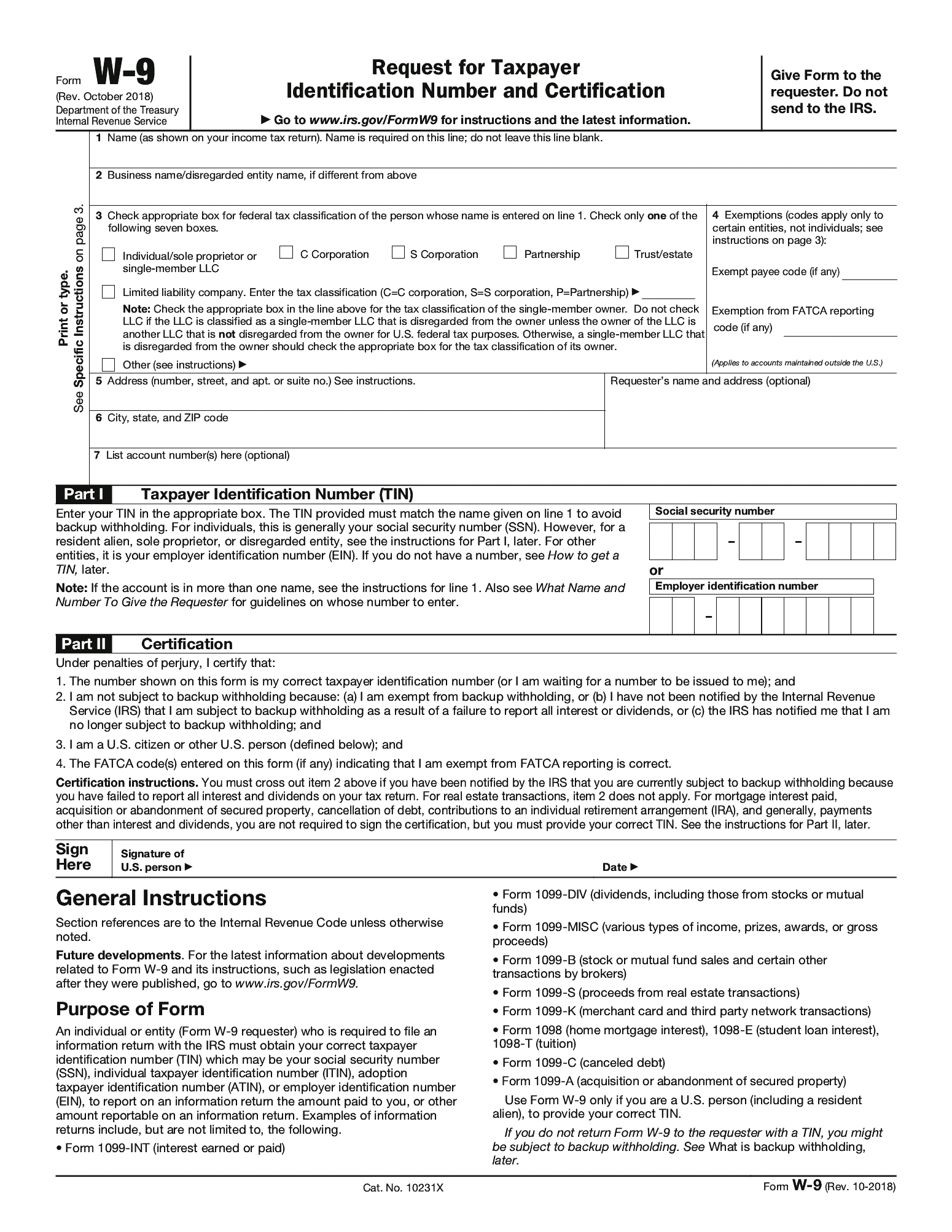

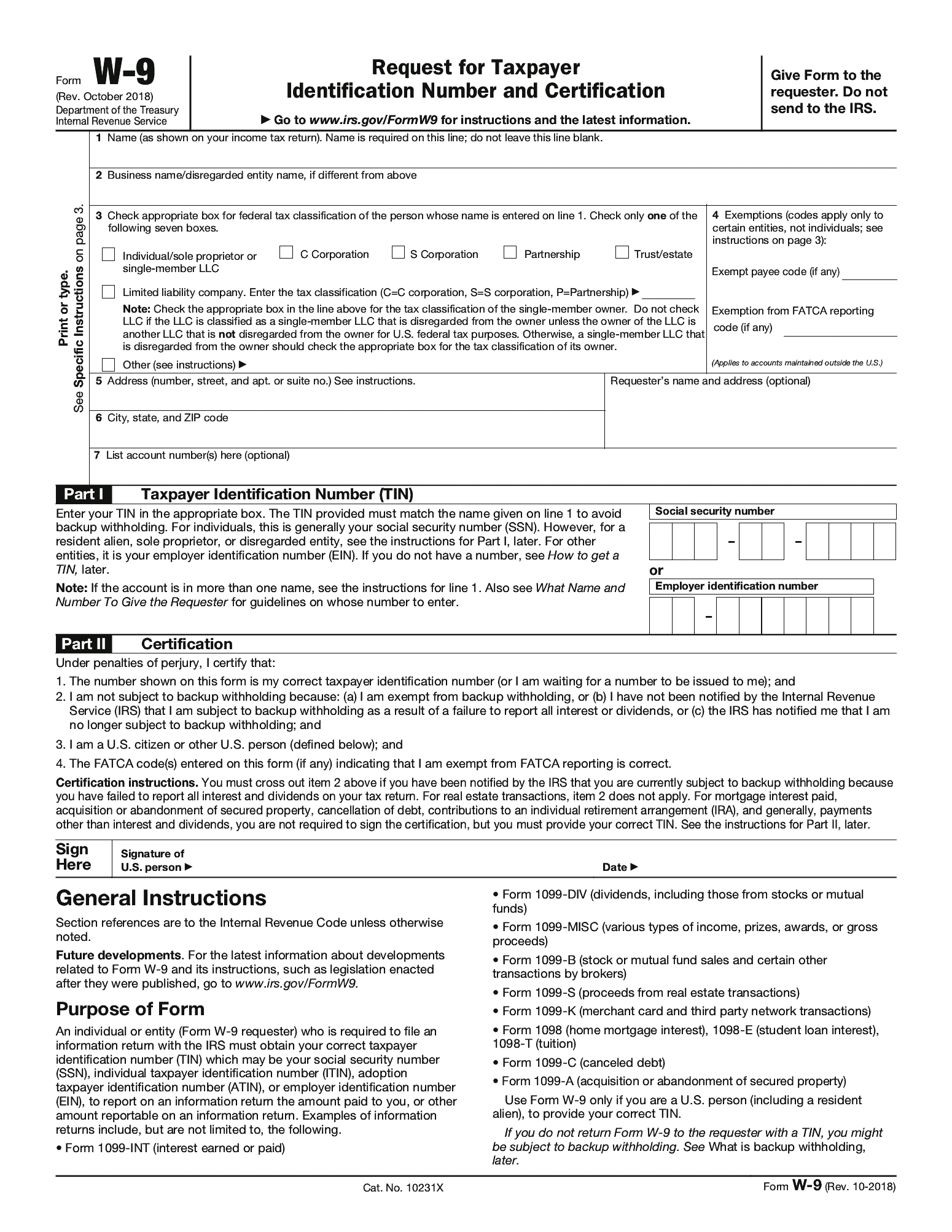

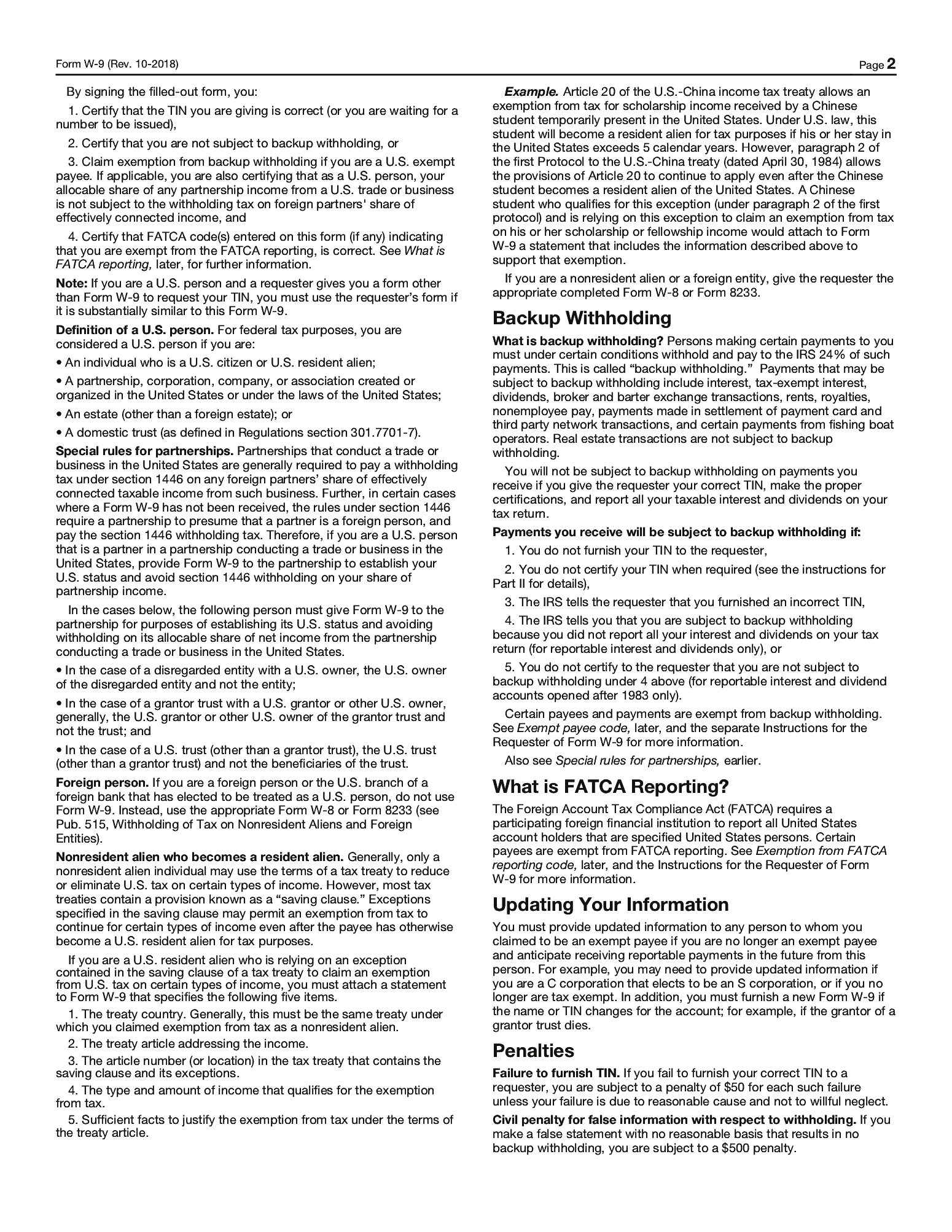

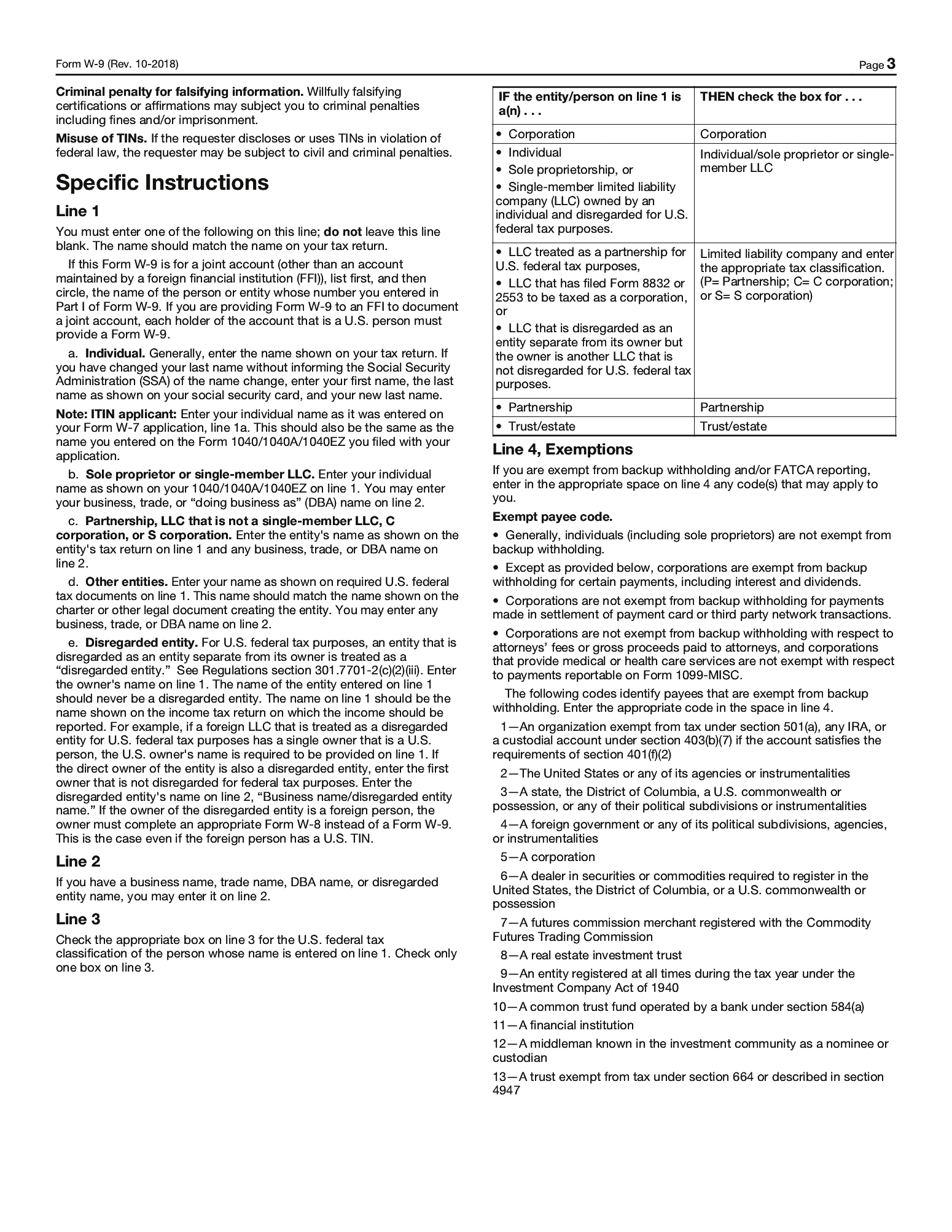

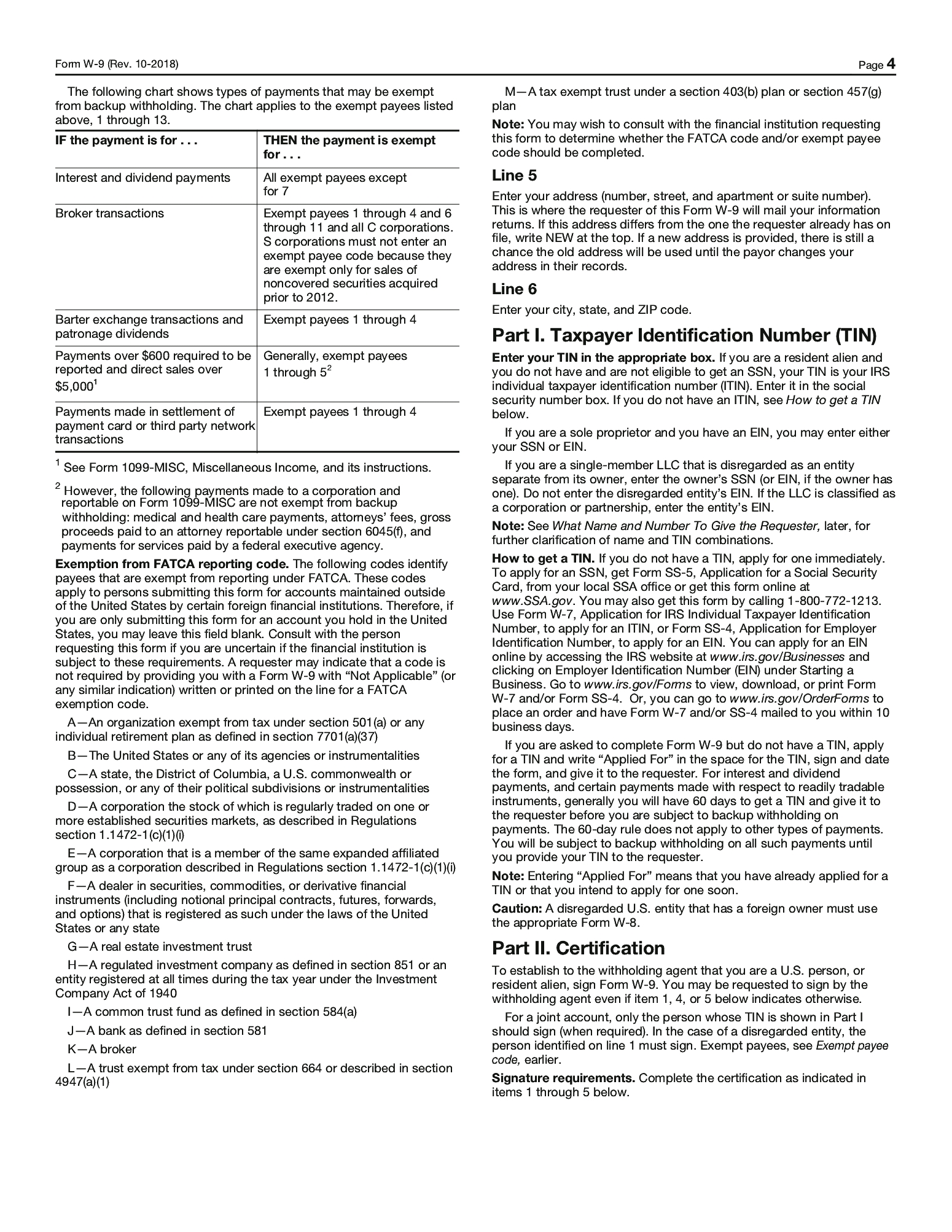

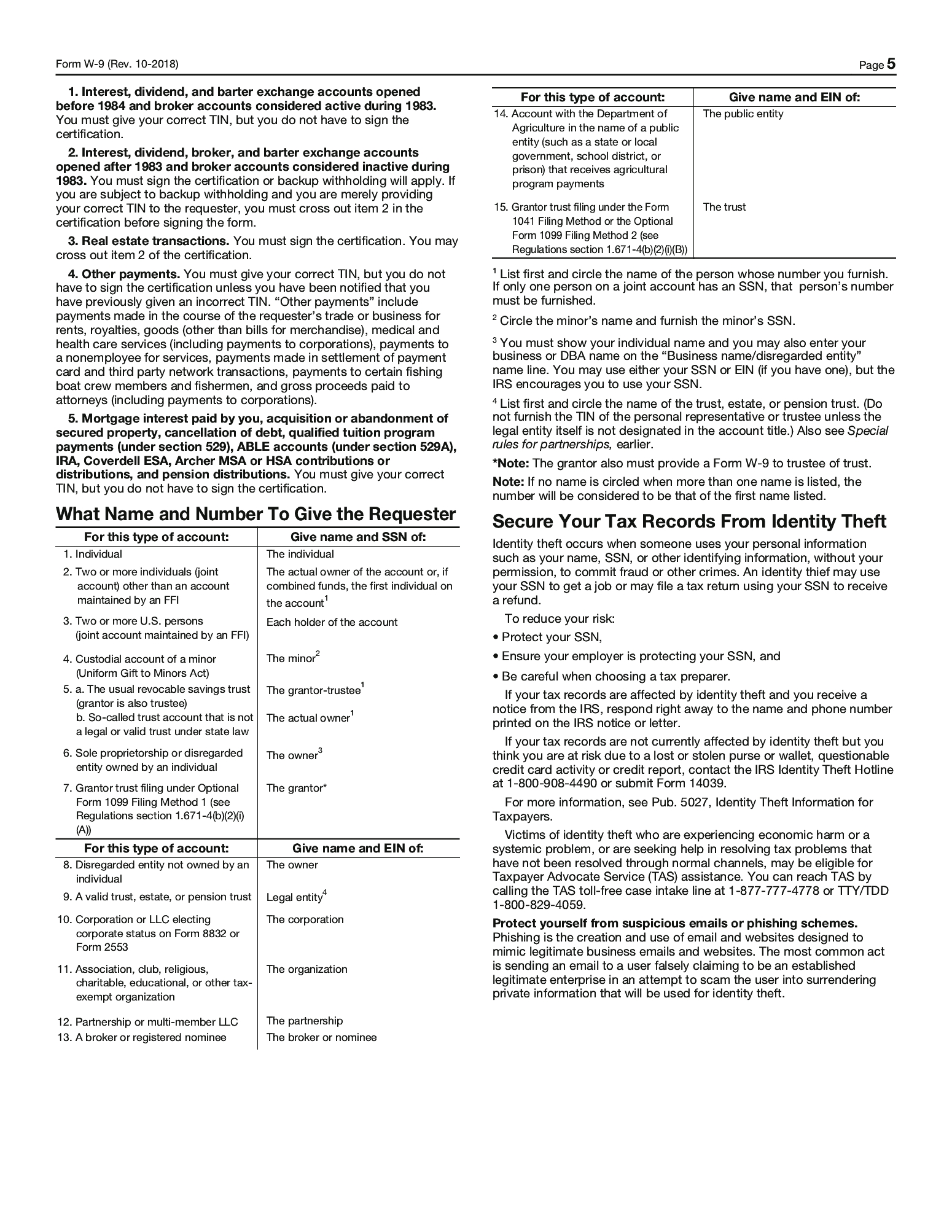

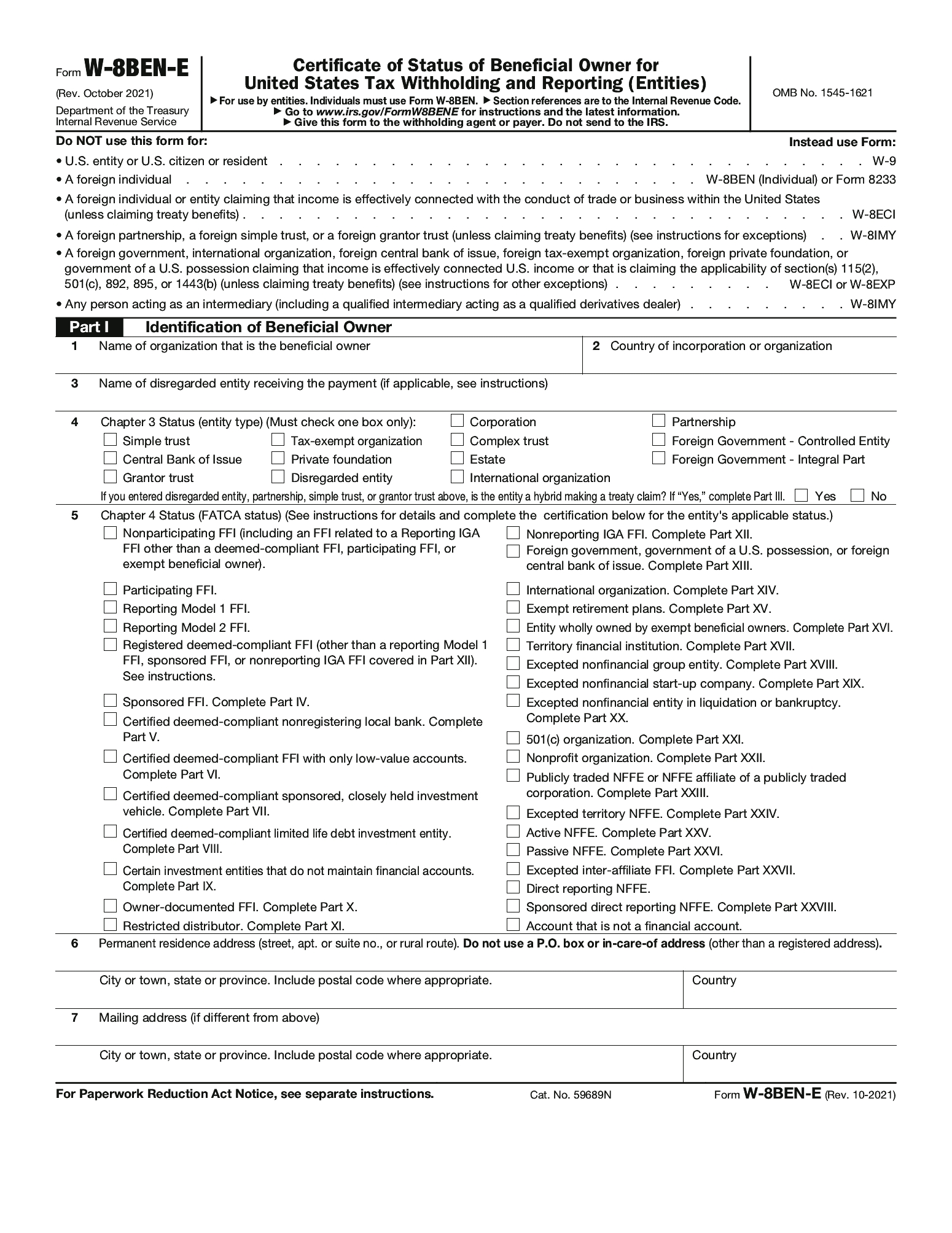

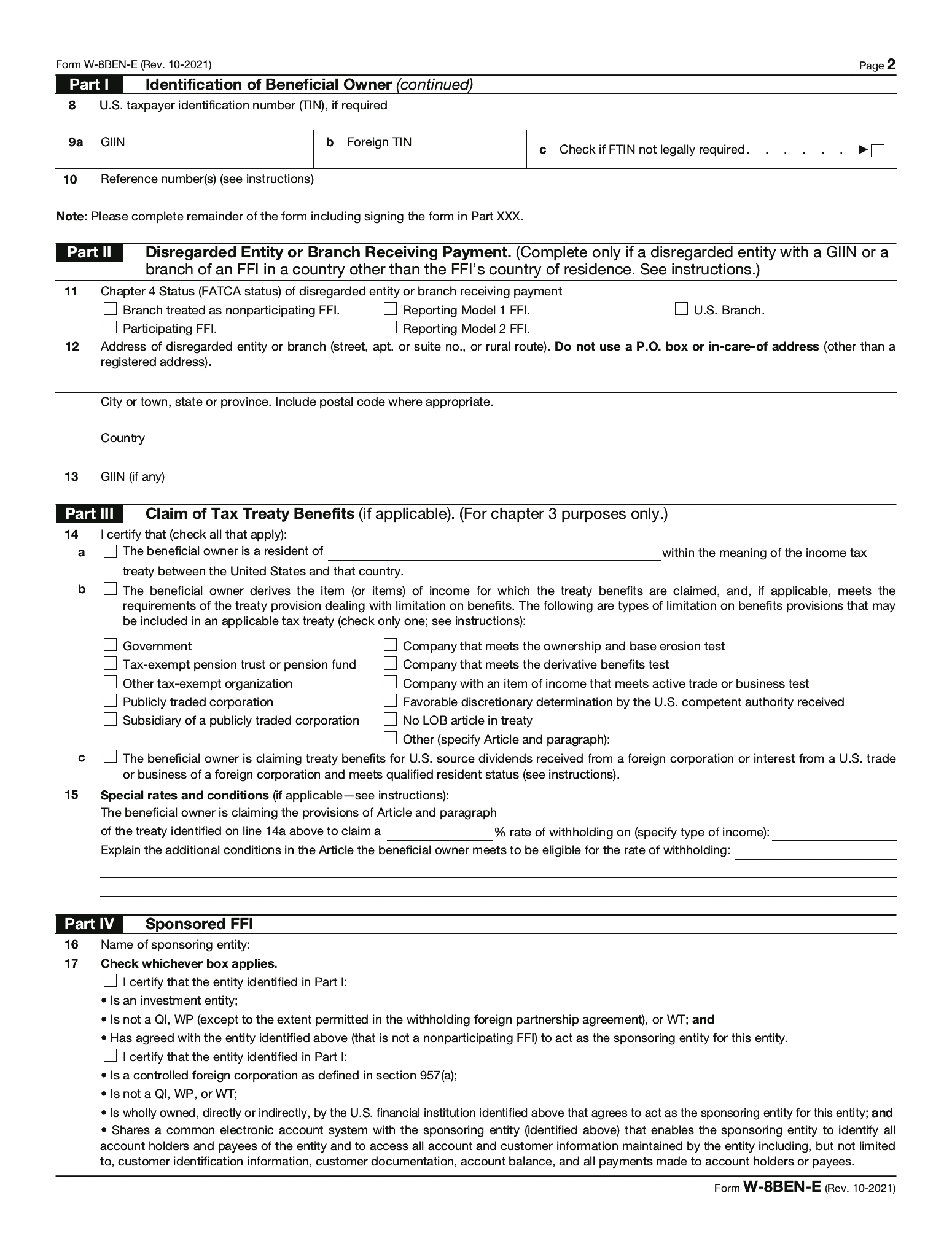

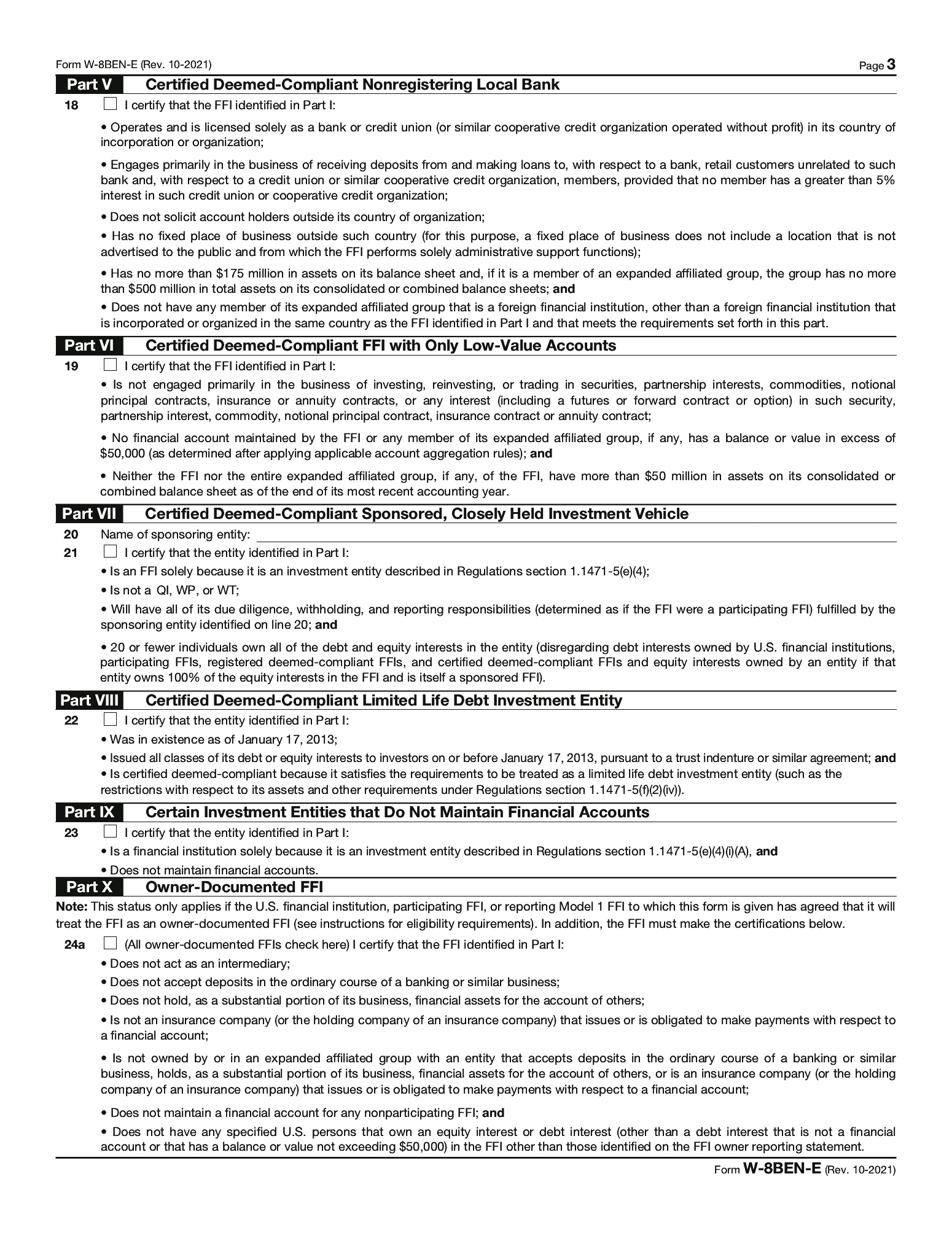

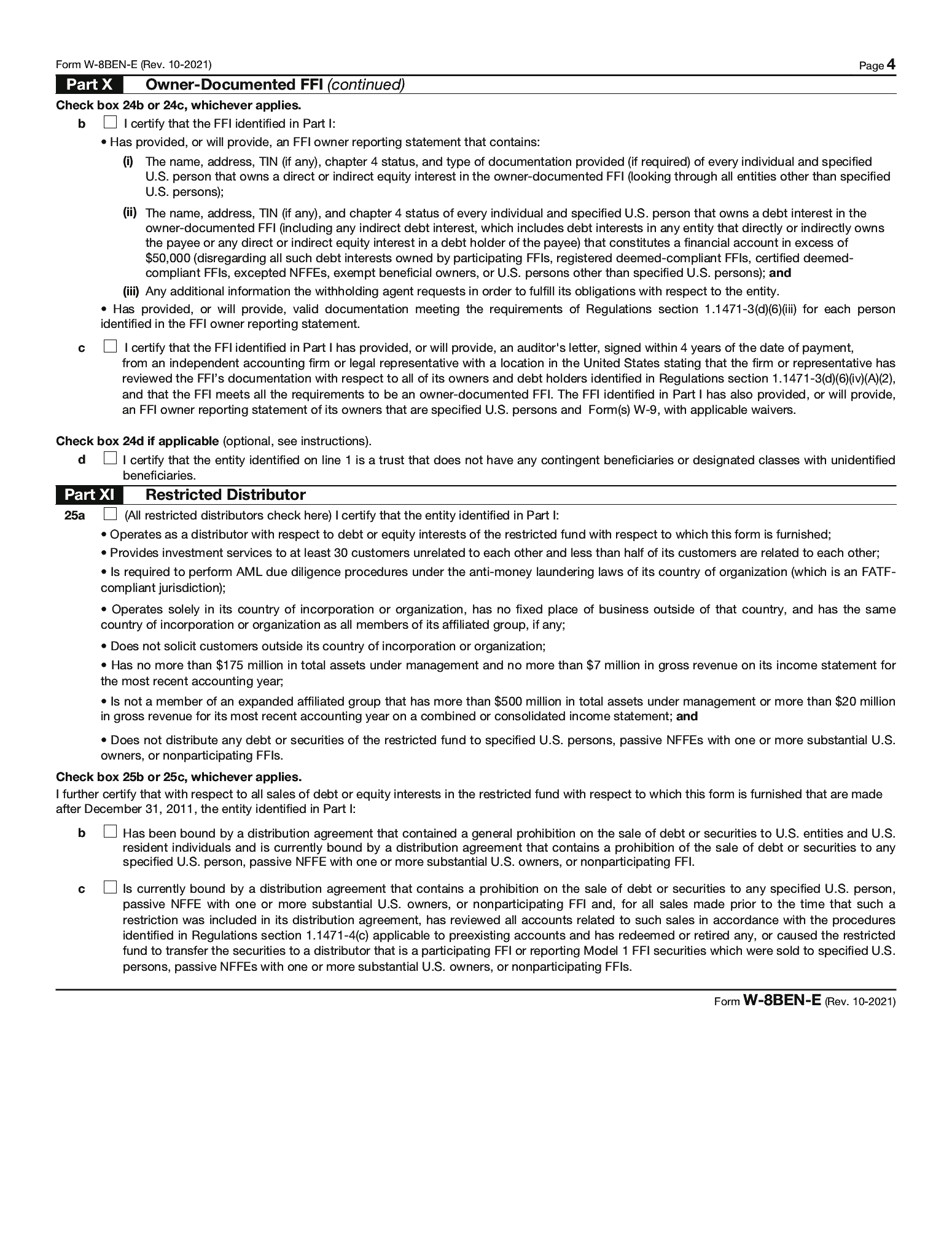

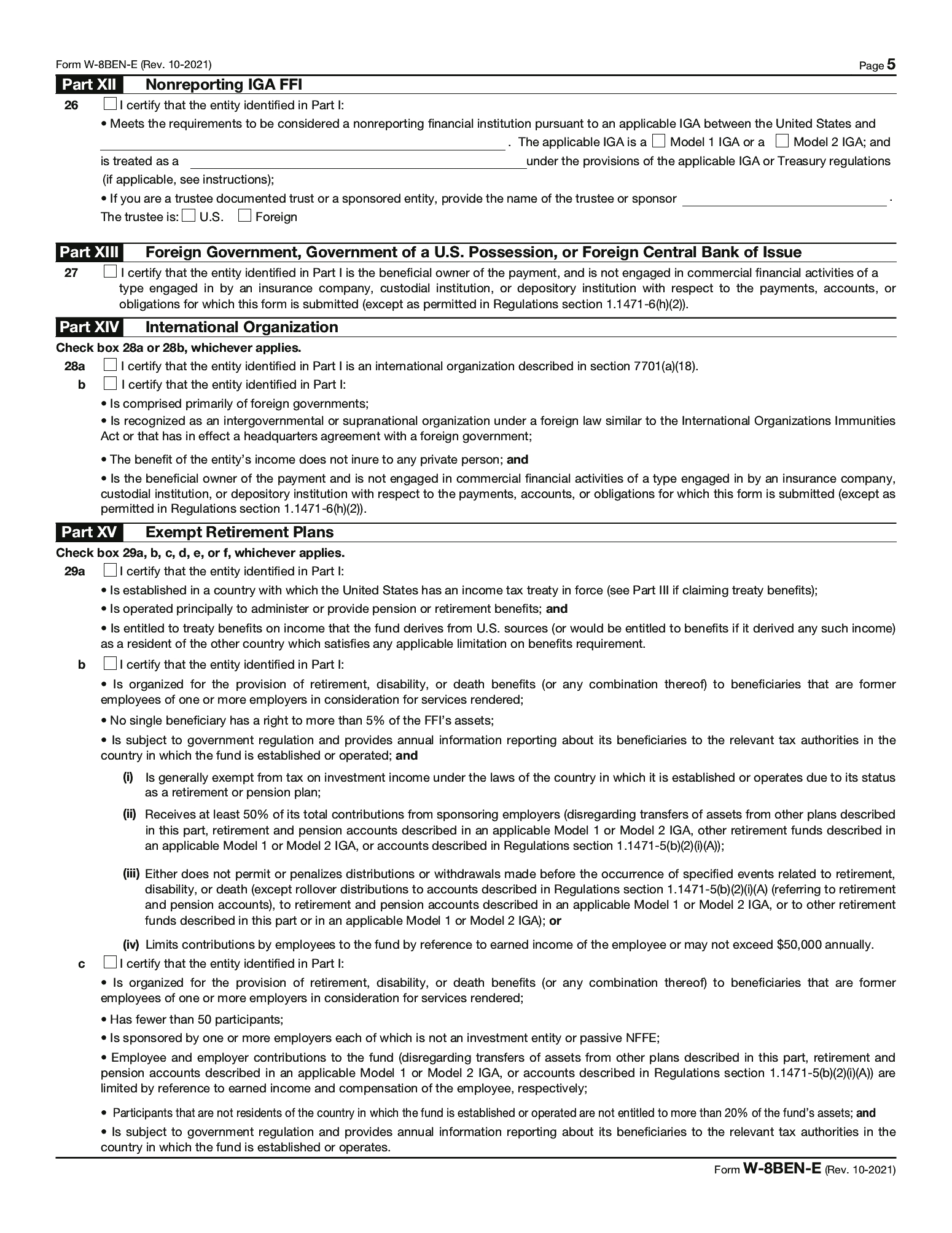

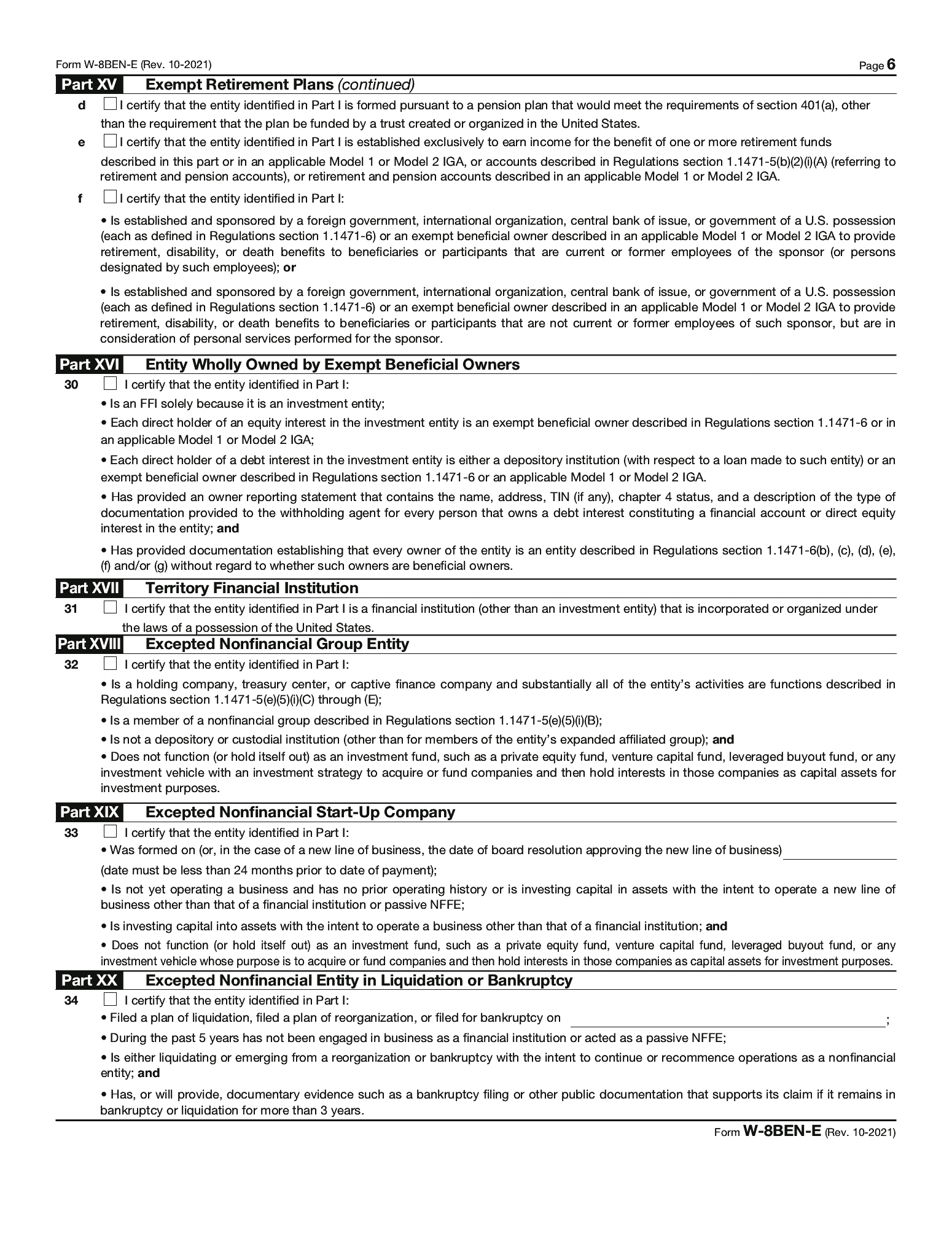

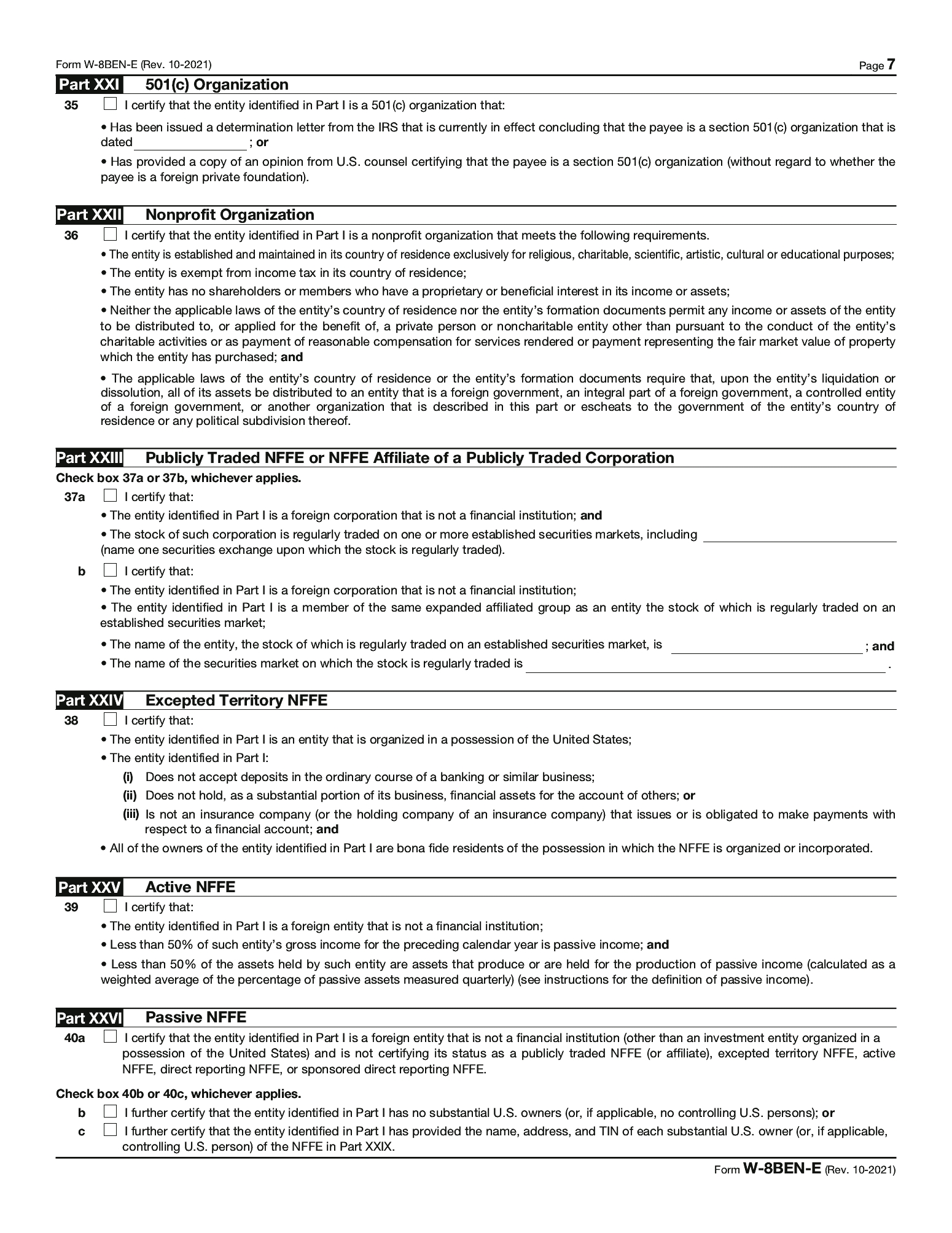

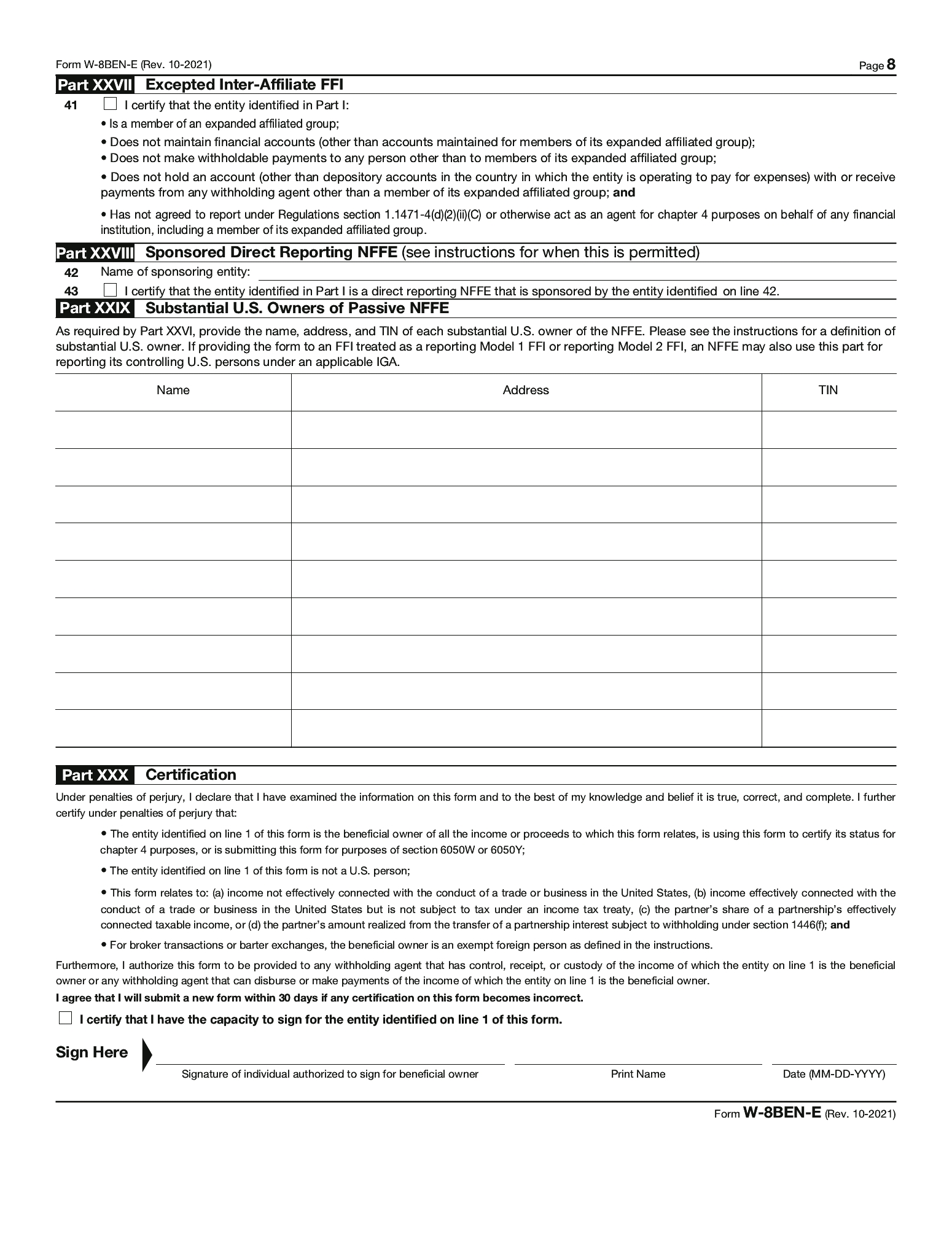

Backup Withholding. Under U.S. federal income tax laws, the Transfer Agent will be required to withhold a portion of the amount of any payments made to certain stockholders pursuant to the Offer. In order to avoid such backup withholding, each tendering stockholder or payee that is a United States person (for U.S. federal income tax purposes) who has not previously submitted to the Transfer Agent a correct, completed and signed Internal Revenue Service (“IRS”) Form W-9, should provide the Transfer Agent with such stockholder’s or payee’s correct taxpayer identification number (“TIN”) and certify that such stockholder or payee is not subject to such backup withholding by completing the attached Form W-9. A tendering stockholder who is a foreign individual or a foreign entity and who has not previously submitted to the Transfer Agent a correct, completed and signed version of the appropriate IRS tax form should complete, sign, and submit to the Transfer Agent the appropriate Form W-8 (generally Form W-8BEN for foreign individuals; or Form W-8BEN-E for foreign entities (corporations or partnerships)). Copies of such forms are attached to this Letter of Transmittal, and may also be obtained from the Transfer Agent or downloaded from the Internal Revenue Service’s website at the following address: http://www.irs.gov. Certain stockholders or payees (including, among others, corporations, non-resident foreign individuals and foreign entities) are not subject to these backup withholding and reporting requirements, but should certify their exemption by completing the applicable Form W-9 or W-8 if they have not previously submitted to the Transfer Agent a correct, completed and signed version of the appropriate IRS tax form. Failure to complete the applicable Form W-9 or W-8 will not, by itself, cause Shares to be deemed invalidly tendered, but may require the Transfer Agent to withhold a portion of the amount of any payments made of the purchase price pursuant to the Offer.

NOTE: FAILURE TO COMPLETE AND RETURN THE APPLICABLE FORM W-9 OR FORM W-8 MAY RESULT IN BACKUP WITHHOLDING OF A PORTION OF ANY PAYMENTS MADE TO YOU PURSUANT TO THE OFFER IF THE TRANSFER AGENT DOES NOT HAVE A CORRECT, COMPLETED AND SIGNED VERSION OF THE APPROPRIATE IRS TAX FORM ON FILE. PLEASE REVIEW THE “ADDITIONAL IMPORTANT TAX INFORMATION” SECTION BELOW.

ADDITIONAL IMPORTANT TAX INFORMATION

Under United States federal income tax law, a stockholder that is a non-exempt United States person (for U.S. federal income tax purposes) whose tendered Shares are accepted for payment is required by law to provide the Transfer Agent (as payer) with such stockholder’s correct TIN on the Form W-9 below. If such stockholder is an individual, the TIN is such stockholder’s social security number. If the Transfer Agent is not provided with the correct TIN, the stockholder may be subject to penalties imposed by the IRS and payments that are made to such stockholder with respect to Shares purchased pursuant to the Offer may be subject to backup withholding. If backup withholding applies with respect to such non-exempt United States person, the Transfer Agent is required to withhold 24% of any payments of the purchase price made to the stockholder. Backup withholding is not an additional tax. Rather, the tax liability of persons subject to backup withholding will be reduced by the amount of tax withheld. If withholding results in an overpayment of taxes, a refund or credit may be obtained from the IRS provided that the required information is furnished to the IRS in a timely manner.

In order to avoid backup withholding, a foreign stockholder who has not previously submitted to the Transfer Agent a correct, completed and signed version of the appropriate IRS tax form should submit a properly completed applicable IRS Form W-8 (IRS Form W-8BEN for foreign individuals; or IRS Form W-8BEN-E for foreign entities such as foreign corporations or foreign partnerships; or other applicable IRS forms), including certification of such stockholder’s foreign status, signed under penalties of perjury. IRS Form W-8BEN, IRS Form W-8BEN-E, and the related instructions are attached below, and can also be obtained from the Transfer Agent or at http://www.irs.gov.

Form W-9

To prevent backup withholding on payments that are made to a United States stockholder with respect to Shares purchased pursuant to the Offer, any stockholder who has not previously submitted to the Transfer Agent a correct, completed and signed IRS Form W-9 is required to notify the Transfer Agent of such stockholder’s correct TIN by completing a Form W-9 certifying, under penalties of perjury, (i) that the TIN provided on the Form W-9 is correct (or that such stockholder is awaiting a TIN), (ii) that such stockholder is not subject to backup withholding because (a) such stockholder has not been notified by the IRS that such stockholder is subject to backup withholding as a result of a failure to report all interest or dividends, (b) the IRS has notified such stockholder that such stockholder is no longer subject to backup withholding or (c) such stockholder is exempt from backup withholding, and (iii) that such stockholder is a U.S. person.

What Number to Give the Transfer Agent

Each United States stockholder is generally required to give the Transfer Agent its social security number or employer identification number. If the tendering stockholder has not been issued a TIN and has applied for a number or intends to apply for a number in the near future, the stockholder should write “Applied For” in Part I, sign and date the Form W-9. Notwithstanding that “Applied For” is written in Part I, the Transfer Agent will withhold 24% of all payments of the purchase price to such stockholder until a TIN is provided to the Transfer Agent. Such amounts will be refunded to such surrendering stockholder if a TIN is provided to the Transfer Agent within 60 days. Please consult your own accountant or tax advisor for further guidance regarding the completion of IRS Form W-9, IRS Form W-8BEN, IRS Form W-8BEN-E, or another version of IRS Form W-8 to claim exemption from backup withholding, or contact the Transfer Agent.

All authority herein conferred or agreed to be conferred shall survive the death or incapacity of the undersigned and the obligation of the undersigned hereunder shall be binding on the heirs, personal representatives, successors and assigns of the undersigned. Except as stated in Section 5 “Withdrawal Rights” of the Offer to Purchase, this tender is irrevocable.

Method of delivery of this Letter of Transmittal is at the option and risk of the owner thereof. If delivering via USPS, UPS or FedEx, please deliver this Letter of Transmittal in its entirety to the Transfer Agent:

STATE STREET BANK AND TRUST COMPANY

Attention: Carlyle Credit Solutions, Inc.

1 Heritage Drive, Mailstop OHD0100

North Quincy, MA 02171

A STOCKHOLDER CHOOSING TO FAX A LETTER OF TRANSMITTAL MUST ALSO MAIL

THE ORIGINAL COMPLETED AND EXECUTED LETTER OF TRANSMITTAL (OR AN ORIGNALLY SIGNED PHOTCOPY THEREOF) PROMPTLY THEREAFTER.

If delivering an originally signed photocopy via fax:

Attn: Carlyle Credit Solutions, Inc.

Fax number: (617) 937-3051

If delivering via fax, please include “Tender Offer for Carlyle Credit Solutions Shares” on the fax cover page or in the subject line, as applicable.

DELIVERY OF THIS LETTER OF TRANSMITTAL TO AN ADDRESS OTHER THAN AS SET

FORTH ABOVE WILL NOT CONSTITUTE A VALID DELIVERY TO THE TRANSFER AGENT.

IF YOU WOULD LIKE ADDITIONAL COPIES OF THE OFFER TO PURCHASE, THIS LETTER OF TRANSMITTAL OR ANY OF THE OTHER DOCUMENTS RELATED TO THE OFFER TO PURCHASE, YOU SHOULD CONTACT THE TRANSFER AGENT TOLL-FREE AT (888) 207-9542 OR THE COMPANY BY EMAIL AT DIRECT.LENDING@CARLYLE.COM.

IT IS UNDERSTOOD THAT THE METHOD OF DELIVERY OF THIS LETTER OF TRANSMITTAL AND ALL OTHER REQUIRED DOCUMENTS IS AT THE OPTION AND RISK OF THE UNDERSIGNED AND THAT THE RISK OF LOSS OF THIS LETTER OF TRANSMITTAL AND OTHER DOCUMENTS SHALL PASS ONLY AFTER THE TRANSFER AGENT HAS ACTUALLY RECEIVED THE LETTER OF TRANSMITTAL. IF DELIVERY IS BY MAIL, IT IS RECOMMENDED THAT ALL SUCH DOCUMENTS BE SENT BY PROPERLY INSURED REGISTERED MAIL WITH

RETURN RECEIPT REQUESTED. IN ALL CASES, SUFFICIENT TIME SHOULD BE ALLOWED TO ENSURE TIMELY DELIVERY.

Questions and requests for assistance regarding the Offer may be directed to the Company by email at direct.lending@carlyle.com.

Confirmation of receipt of this Letter of Transmittal may be directed to the Transfer Agent by phone at (888) 207-9542 or by mail at the following address: State Street Bank and Trust Company, Attention: Carlyle Credit Solutions, Inc., 1 Heritage Drive, Mailstop OHD0100, North Quincy, MA 02171. The Company strongly recommends that you confirm receipt of your Letter of Transmittal with the Transfer Agent by calling (888) 207-9542, Monday through Friday, except holidays, during normal business hours of 9:00 a.m. to 5:00 p.m. (Eastern Time).

You may also contact your broker, dealer, commercial bank or trust company or other nominee for assistance concerning the Offer.

[Remainder of Page Intentionally Left Blank]

VALUATION DATE: September 30, 2022

TENDER OFFER EXPIRATION DATE: 11:59 p.m. (Eastern Time), October 27, 2022

PARTS 1, 2, 3, AND 4 MUST BE COMPLETED AND IN GOOD ORDER IN ORDER TO PROCESS YOUR REQUEST

If You Invest In The Company Through A Financial Intermediary Through Whom You Expect To Have Your Tender Offer Request Submitted, Please Allow For Additional Processing Time As The Letter of Transmittal Must Ultimately Be Received By The Company’s Transfer Agent No Later Than 11:59 p.m. (Eastern Time) On The Expiration Date.

PLEASE SEND COMPLETED FORMS TO STATE STREET BANK AND TRUST COMPANY: 1 Heritage Drive, Mailstop OH0100, North Quincey, MA 02171

PART 1 – NAME AND CONTACT INFORMATION

| | | | | |

| Company Name: | |

| Company Account #: | |

| Investor Name/Registration: | |

| Address: | |

| City, State, Zip Telephone Number: | |

| Email Address: | |

| Financial Intermediary Firm Name (if applicable): | |

| Financial Intermediary Account #: | |

| Financial Advisor Name: | |

| Financial Advisor Telephone #: | |

PART 2 – REQUESTED TENDER AMOUNT

Please select repurchase type by checking one of the boxes below. If you are requesting a partial repurchase, please provide a number of Shares.

☐ Full Repurchase

☐ Partial Repurchase* of Shares (please only provide a number of Shares, not a dollar amount)

* If the requested partial repurchase would put the account balance below the required minimum balance, the Company may reduce the amount to be repurchased such that the required minimum balance is maintained, unless you indicate otherwise by checking the following box:

☐ Change request to Full Repurchase if amount requested to be repurchased would need to be reduced to maintain minimum account balance

PART 3 – PAYMENT

PAYMENT INSTRUCTIONS (Select only one)

Indicate how you wish to receive your payment for tendered and accepted Shares below. If an option is not selected, the proceeds for tendered and accepted Shares will be transmitted according to the wire instructions on record with the Transfer Agent (i.e., the same account to which cash dividends are paid, if any). Proceeds for qualified accounts, including IRAs and other custodial accounts, and certain broker-controlled accounts as required by your broker dealer of record, will automatically be issued to the custodian or broker dealer of record, as applicable. All custodial and broker-controlled accounts must include the custodian and/or broker dealer signature.

| | | | | |

☐ | Wire Transmittal to the Account on Record |

| | | | | |

☐ | Cash/Check Mailed to Address of Record |

| | | | | |

☐ | Cash/Check Mailed to Third Party/Custodian (Signature Guarantee required) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name / Entity Name / Financial Institution | | | Mailing Address | |

| | | | | | | | | | | |

| City | | | State | | | Zip Code | | | Account Number | |

| | | | | | | | | | | |

| | | | | |

☐ | Cash/Direct Deposit Attach a pre-printed voided check. |

(Signature Guarantee required) (Non-Custodial Investors Only)

I authorize the Company or its agent, including the Transfer Agent, to deposit my proceeds into my checking or savings account. In the event that the Company or its agent deposits funds erroneously into my account, they are authorized to debit my account for an amount not to exceed the amount of the erroneous deposit.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Bank / Financial Institution | | | Mailing Address | |

| | | | | | | | |

| City | | | State | | | Zip Code | |

| | | | | | | | |

| Your Bank's ABA Routing Number | | | Your Bank Account Number | | | ☐ Checking Account ☐ Savings Account | |

| | | | | | | | |

Please attach a pre-printed voided check.

NOTE: The average cost basis method will be the default method for calculating cost basis for any Shares tendered and accepted in the Offer. If you wish to change your cost basis method, please contact the Company prior to the Expiration Date at direct.lending@carlyle.com.

PART 4 – SIGNATURE(S)

(U.S. Holders — Please Also Complete the Enclosed IRS Form W-9 If the Transfer Agent Does Not Have a

Correct, Completed and Signed Version on File)

(Non-U.S. Holders — Please Obtain and Complete IRS Form W-8BEN or W-8BEN-E (or Other Applicable

IRS Form), as Appropriate, If the Transfer Agent Does Not Have a Correct, Completed and Signed Version of the Appropriate IRS Tax Form on File)

The undersigned acknowledges that this request is subject to all the terms and conditions set forth in the Offer to Purchase and all capitalized terms used and not defined herein have the meaning as defined in the Offer to Purchase. This request is irrevocable except as described in the Offer to Purchase. The undersigned represents that the undersigned is the beneficial owner of the Shares to which this repurchase request relates, or that the person signing this request is an authorized representative of the tendering stockholder.

In the case of joint accounts, each joint holder must sign this repurchase request. Requests on behalf of a foundation, partnership or any other entity should be accompanied by evidence of the authority of the person(s) signing.

Must be signed by registered owner(s) exactly as name(s) appear(s) in the books and records of Carlyle Credit Solutions, Inc. If any Shares tendered hereby are owned of record by two or more joint owners, all such owners must sign this Letter of Transmittal. If any tendered Shares are registered in the names of different holder(s), it will be necessary to complete, sign and submit as many separate Letters of Transmittal as there are different registrations of such Shares. If this Letter of Transmittal or any certificates or stock powers are signed by trustees, executors, administrators, guardians, attorneys-in-fact, officers of corporations or others acting in a fiduciary or representative capacity, such persons should so indicate when signing, and proper evidence satisfactory to the Company of their authority so to act must be submitted.

| | |

Name: ______________________________________________________________________________________ |

| (Please Print) |

| |

Capacity (full title): ____________________________________________________________________________ |

| |

Address: ____________________________________________________________________________________ |

| ______________________________________________________________________________________ |

| ______________________________________________________________________________________ |

|

| (Include Zip Code) |

| |

Area Code and Telephone Number: _______________________________________________________________ |

| |

Tax Identification or Social Security No.: __________________________________________________________ |

PAYER’S NAME: STATE STREET BANK AND TRUST COMPANY

THE IRS FORM W-9, IRS FORM W-8BEN AND IRS FORM W-8BEN-E ARE INCLUDED ON THE FOLLOWING PAGES.

IMPORTANT: THIS LETTER OF TRANSMITTAL, TOGETHER WITH BOOK-ENTRY CONFIRMATION AND ALL OTHER REQUIRED DOCUMENTS, MUST BE RECEIVED BY THE TRANSFER AGENT ON OR PRIOR TO THE EXPIRATION DATE.